Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Covered my last half about 7 sec before close at 4.765 yesterday. Don't usually trade in extended hrs unless there is some good action, but just looked in on my old favorite FCEL yesterday morning and caught it going above $5 with that classic bear trap and just had to play it. I trade BE and PLUG also and wish all of them would make it and succeed, but facts of life is that there will be winners and losers in the market and the more quality stocks will get most of business and investment money and rise above.

We might get a little bump more today on the bill getting through, and carbon credits will keep FCEL muddling along, but the whole sector is getting to exhaustion here so would expect a confirmation on yesterdays candle today or maybe next wk. FCEL has a hard time to stay above $5 sad to say and the long term trend is still down.

Open mind is good advice. FCEL is definitely overbought. Was really overbought before the bell this morning. All on really low volume and manipulation. Anyone can guess where I followed the money and shorted my 6000 shares before the bell. First red candle confirmation following a run, a very manipulated run at that on the 15m chart.

But very possible a red candle today or tomorrow on the daily. There is also two gaps to fill below, wouldn't normally pay too much attention to that, but FCEL fill gaps 100% of time in the last two yrs, so they do have validity here.

That's added to your stated history lessons.

I'll probably cover before days end, but is sure is tempting to hold short exception to my $5 rule.

Chart looks worse now than it did a few minutes ago when I snapped this one.

As Patrick Henry said, "Give me liberty or give me death". We are no longer just a church in Richmond, Virginia; we are the world.

Plus, I don't think that others around Putin wants to have that happen. Nothing but nothingness in it for them, everything or anything is in it if they stop that.

An interesting observation.

Vladimir Putin Is A Vertically Challenged Thug

A small man with a big ego like many before him.

https://medium.com/loud-updates/vladimir-putin-is-a-vertically-challenged-thug-a0e4bcdfc7dd

Like many short, midget dictators down through the centuries, Vladimir Putin attempts to make up for being vertically challenged by wanting the world to know he is the toughest guy on the block. At 170 cms or 5.577 feet, Putin is a shorty. It has long been rumoured he wears heel lifts and that is not surprising as that has been the way of many dictators throughout history.

Another wannabe dictator, one Donald Trump, claims to be 6 feet, 3 inches in height. However, Trump shamelessly lies about everything and cheats as a matter of course so it is not surprising he lies about his height and wears heel lifts. It seems he does not like being in the same room or in the same company with anyone taller than he is. That’s why he was in love with Kim Jun Un.

Napoleon Bonaparte was a little man with a big ego. He measured 168 cms of 5 foot 5 inches in his socks. He also over-compensated for his lack of height by being a belligerent little dictator with a bad temper and a fiery manner as big as he was short. His small stature and renowned temper inspired the term the “Napoleon Complex”. It translates into a popular belief that short men often compensate for their lack of height through domineering behaviour and aggression. This seems to be the case with Vlad the Putin.

Another short guy with an inferiority complex he made up for with brutality and aggression was Benito Mussolini, the World War II Italian dictator buddy of Adolph Hitler. Mussolini was a mere 5 foot 6 inches and hated being reminded of it.

Photo by William Warby on Unsplash

Another Russian with an angry demeanour and an inferiority complex about his height was Nikita Khrushchev. Barely nudging 5 foot 3 inches. Little Nikki ferociously overcompensated for his lack of height by be being very aggressive, once pounding on the podium at the United Nations with one of his shoes.

Another rolly-polly little fat guy dictator is North Korea’s Kim Jung Un. Though having lost a great deal of weight due to a rumoured illness, he measures in at a tiny 5 foot, 4 inches though he claims to be 5 foot, 7 inches. It has long been rumoured he wears special shoes whose heels and soles are covered by the long trousers with the bell bottom style he favours.

Vladimir Putin is in good company with other dictators like Kim Jung Il (1.75 metres — 5 foot 7 inches), Adolph Hitler (1.74 metres — 5 foot 7 inches) and the infamous Pol Pot of Cambodia genocide fame at (1.7 metres — 5 foot 6 inches). All bullies. All thugs.

It’s interesting that so many dictatorial thugs are short in stature but big on thuggery. It seems all these short, little creeps are short in height, short in empathy and humanness but big on killing, murder and genocide.

https://en.wikipedia.org/wiki/Trolley_problem

Sacrifices saving the rest of the free world. Saving a $1 to spend $5 more is never a very efficient business model. Neither is saving a million to continually cost a billion more down the road.

On stopping Putin: If not now, when?

Scott Benarde

OPINION

https://www.palmbeachpost.com/story/opinion/2022/03/23/commentary-world-cant-let-putin-destroy-ukraine-and-bully-humanity/7089535001/

I have been struggling for days with immense frustration, sadness, and disbelief at the senseless death and destruction the vicious tyrant and man-boy bully Vladimir Putin has unleashed on Ukraine to satisfy his delusions of Soviet empire grandeur. There is a lesson here: No individual should have this much power. I know we’re supposed to be careful about comparing war-mongering, imperialist strongmen to Hitler but Putin is clinging to “der Fuhrer’s” blood-soaked coattails. I am reminded of these lyrics from “The Last Resort,” an Eagles’ classic by Don Henley and Glenn Frey: “We satisfy our endless needs / And justify our bloody deeds / In the name of destiny…” It wasn’t written about Putin but the jackboot fits.

I feel like some kid on the playground watching the school bully slowly beat the hell out of some smaller child just because he can and being unable to stop it. I want to, but I can’t. It’s a shameful, guilt-filled feeling. I was brought up to speak out against injustice, to intervene and protect the defenseless. I am not a very religious person but there is a commandment of sorts in the Jewish book of ethics known as the Pirke Avot, The Ethics of Our Fathers, that serves as a moral guidepost: “In a place where there are no human beings, you must strive to be one.” The message being, if there is no one else available to respond to the needs of the community, then you must do it for the sake of humanity.

To me this isn’t only about individuals; it applies to groups, governments, and groups of governments. In the Pirke Avot, we are also reminded that the world stands on three things: “on justice, on truth and on peace...,” so it is imperative to “execute the judgment of truth and peace in your gates.” In my view we are failing to do that.

With all the military and humanitarian aid the free world is providing; with all the global, cumulative sanctions undertaken against Putin and Russia, we are still allowing the bully free reign. He might tire; he might slow down but he is not stopping because we have not done all we could do to end this tomorrow. Why? Because we are afraid Putin might be nuts enough to use nuclear weapons.

If that is our fear, then Putin wins and rules the world. If he takes Ukraine, as costly as that might be to him, we still have enabled and empowered the bully to continue his ruthless, power-mad onslaught. If not tomorrow, then perhaps a year or two or three from now, after he has recharged his army and restocked his arsenal. Putin will see that all he has to do is rattle his nuclear saber and the world trembles and recoils.

NATO and the rest of the free world are sending a sign of weakness. Ukraine has been warning us; they’ve been fighting this fight for a while. They know whom and what they are dealing with. And after 22 years of ruthlessly ruling Russia, the rest of the world knows who and what Putin is: an insecure bully with too much power, who had it all, and on Feb. 24, 2022, decided that wasn’t enough.

The question is, what are we finally going to do about it?

The Pirke Avot also asks this vital question: And if not now, when?

Russia faces ‘economic oblivion’ despite claims of short-term resilience, economists say

PUBLISHED TUE, AUG 2 20225:51 AM EDT

https://www.cnbc.com/2022/08/02/russia-faces-economic-oblivion-despite-short-term-resilience.html

‘Catastrophically crippling’

A Yale University study published last month, which analyzed high-frequency consumer, trade and shipping data that its author’s claim presents a truer picture than the Kremlin is presenting, argued that rumors of Russia’s economic survival had been greatly exaggerated.

The paper suggested international sanctions and an exodus of more than 1,000 global companies are “catastrophically crippling” the Russian economy.

“Russia’s strategic positioning as a commodities exporter has irrevocably deteriorated, as it now deals from a position of weakness with the loss of its erstwhile main markets, and faces steep challenges executing a ‘pivot to Asia’ with non-fungible exports such as piped gas,” the Yale economists said.

They added that despite some “lingering leakiness,” Russian imports have “largely collapsed,” with Moscow now facing challenges in securing inputs, parts and technology from increasingly jittery trade partners and as a result, seeing widespread supply shortages in its domestic economy.

“Despite Putin’s delusions of self-sufficiency and import substitution, Russian domestic production has come to a complete standstill with no capacity to replace lost businesses, products and talent; the hollowing out of Russia’s domestic innovation and production base has led to soaring prices and consumer angst,” the report said.

“As a result of the business retreat, Russia has lost companies representing ~40% of its GDP, reversing nearly all of three decades worth of foreign investment and buttressing unprecedented simultaneous capital and population flight in a mass exodus of Russia’s economic base.”

No path out of ‘economic oblivion’

The apparent resilience of the Russian economy and the resurgence of the ruble was largely attributed to soaring energy prices and strict capital control measures – implemented by the Kremlin to limit the amount of foreign currency leaving the country – along with sanctions restricting its capacity to import.

Russia is the world’s largest exporter of gas and second-largest exporter of oil, and thus the hit to GDP from the war and associated sanctions has been softened by high commodity prices and Europe’s continued dependence on Russian energy for the time being.

Russia has now relaxed some of its capital controls and cut interest rates in a bid to bring the currency down and shore up its fiscal account.

“Putin is resorting to patently unsustainable, dramatic fiscal and monetary intervention to smooth over these structural economic weaknesses, which has already sent his government budget into deficit for the first time in years and drained his foreign reserves even with high energy prices – and Kremlin finances are in much, much more dire straits than conventionally understood,” the Yale economists said.

They also noted that Russia’s domestic financial markets were the worst performing markets in the world so far this year despite the strict capital controls, with investors pricing in “sustained, persistent weakness within the economy with liquidity and credit contracting,” along with Russia’s effective ostracization from international financial markets.

“Looking ahead, there is no path out of economic oblivion for Russia as long as the allied countries remain unified in maintaining and increasing sanctions pressure against Russia,” the report concluded.

“Defeatist headlines arguing that Russia’s economy has bounced back are simply not factual – the facts are that, by any metric and on any level, the Russian economy is reeling, and now is not the time to step on the brakes.”

I can handle revolting and ridiculous. Her and the whole group is just plain dangerous and an existing major threat to our way of life and our children's and their children's lives, needless to say destruction of our so called democracy. But she and her ilk are scamming big bucks to be criminal and traitorous. No morals, no leadership values, no nothing except just being a conflictive detriment to the country. All that is needed is continuous lies and WWE theatrics, which they have plenty of. So no reason for pos like that to stop.

Rep. Greene: Uvalde students needed JR-15s

https://www.newsnationnow.com/politics/marjorie-taylor-greene-uvalde-students-jr-15s/

Greene suggested that the students attacked in the Uvalde, Texas, school shooting could have defended themselves with JR-15s, a “smaller, safer, lighter version” of the AR-15 rifle.

‘I’m just still scared’: Uvalde 3rd-grader describes surviving massacre

The Georgia Republican suggested it in a tweet, with a picture of an advertisement for the JR-15, and a photo of House Speaker Nancy Pelosi on Friday.

“The kids at Uvalde needed JR-15s to defend themselves from the evil maniac that didn’t care about laws,” Greene said in the social media post, “At least they could have defended themselves since no one else did, while their parents were held back by police.”

“Give the guns to the government & they’ll protect you,” said Green, including a “face with rolling eyes” emoji.

Greene sent this Tweet on the same day that Pelosi delivered remarks on the floor of the House of Representatives in support of H.R. 1808, the Assault Weapons Ban. She specifically mentioned the JR-15, advertised by gun-maker WEE1 Tactical.

“The manufacturer stated their goal was to develop a shooting platform that was not only sized correctly but also ‘looks, feels and operates just like mom and dad’s gun,’” said Pelosi. “‘Mom and dad’s gun,’ they use that expression.”

Read the full report on the Uvalde school shooting

The advertisement for the JR-15 includes specifications for the “.22 long rifle” and says that it was designed with a “tamper-resistant safety that puts adults in control of the firearms safety switch.”

“This gun is yet another part of the gun industry’s mission to market to children, who are more likely to die by firearms than any other cause of death,” said Shannon Watts, founder of the gun control group Moms Demand Action.

During the 2020–21 school year, there were 93 school shootings with casualties at public and private elementary and secondary schools, according to the Report on Indicators of School Crime and Safety: 2021 released in June by the National Center for Education Statistics (NCES), within the U.S. Department of Education’s Institute of Education Sciences (IES).

This statistic is the highest of any year since data collection began

Absolutely.

He is believed to be one of the main architects behind the devastating Sept. 11 terrorist attacks on the World Trade Center and the Pentagon.

The White House

@WhiteHouse

Tonight at 7:30 PM ET, President Biden will deliver remarks on a successful counterterrorism operation.

3:09 PM · Aug 1, 2022·The White House

Tonight at 7:30 PM ET, President Biden will deliver remarks on a successful counterterrorism operation.

— The White House (@WhiteHouse) August 1, 2022

It's a conundrum for sure. I'm well aware of the situations that can arise with a third party and I don't see a real third party being anything viable for maybe way past 2024, if it was any solution. Politics have changed and we can't rely on previous history to be maintained. It has been lost forever. We have a problem with the politics today, a real problem. The repugs are already going to win elections they shouldn't as of now. They are going to continue "Trumpism" which is based on violence and conflict, criminality, disinformation and lies, and just plain power mongering with brute force, control of the high judges and the counting of the votes with no vision for America, but only for their own control. And they are succeeding.

We are at the beginning of only one party now, the extreme right, and a civil war is in the cards. There is nowhere good that this is going to go with what we have going on now. The traitorous criminal, terrorists gangs (proud boys, one percenters, etc) disgracing our flag by wrapping themselves in it aren't the only ones with killing weapons, nor are all the their bullets and auto rifles the only weapons of war. Anybody can make weapons of war with what they have in their garden shed and under the sink, plus the US gun culture has saturated the entire population, all sides with those guns and ammo.

The New GOP has attacked and declared war on America, and they are the enemy of the people. They are using the criminal gangs and other criminal means to attacking our rule of law, destroying any democracy that we might be able to hold on to, war on the climate change (friends of fossil fuel), war on science, and are on a crusade of destruction with some fantasy that they can control it all like North Korea, Russia, or China.

There better be some answer for a change of path that the New GOP and Trumpism has taken us on. It's going to a dead end of nothing but bad things as it is right now.

US faces new era of political violence

https://www.theguardian.com/us-news/2022/jul/31/us-political-violence-threats-against-lawmakers

Alarm as Arizona Republicans set to nominate election deniers for top posts

https://www.theguardian.com/us-news/2022/aug/01/arizona-republicans-kari-lake-mark-finchem

America First is laying plans to perpetuate Trumpism beyond Trump

The rightwing group is planning a future more authoritarian, more extreme and more ruthless – with or without the former president

https://www.theguardian.com/us-news/2022/jul/30/america-first-trumpism-beyond-trump

Been tried before, but I think America is more ready this time and just might have a better chance of succeeding. I know I'm ready for a new political direction.

Group of Republicans and Democrats form new political party to appeal to moderates

https://www.cnn.com/2022/07/28/politics/andrew-yang-forward-party-whitman-jolly/index.html

By Brian Rokus, CNN

Updated 6:58 PM ET, Thu July 28, 2022

A group of former Republican and Democratic officials are forming a new political party called Forward, in an attempt to appeal to what they call the "moderate, common-sense majority."

"Political extremism is ripping our nation apart, and the two major parties have failed to remedy the crisis," David Jolly, Christine Todd Whitman and Andrew Yang wrote in a Washington Post op-ed published Wednesday. "Today's outdated parties have failed by catering to the fringes. As a result, most Americans feel they aren't represented."

Jolly is a former Republican congressman from Florida, Whitman a former Republican governor of New Jersey and Yang is a former Democratic presidential and New York mayoral candidate. The three will merge their political organizations into the new party, whose launch was first reported by Reuters.

The group cites issues including guns, climate change and abortion as those that could benefit from a moderate approach. The new party will also advocate ranked-choice voting and open primaries, the end of gerrymandering, and nationwide protection for voting rights.

"Sixty-two percent of Americans now want a third party, a record high, because they can see that our leaders aren't getting it done," Yang told CNN's Brianna Keilar on "New Day" on Thursday in a joint appearance with Whitman. "And when you ask about the policy goals, the fact is the majority of Americans actually agree on really even divisive issues. The most divisive issues of the day like abortion or firearms -- there's actually a commonsense coalition position on these issues and just about every other issue under the sun."

Forward is planning a national convention next summer and will soon seek ballot access to run candidates in 2024, according to the Post op-ed.

The party said in a news release that it would launch "a national building tour this fall to hear from voters and begin laying the groundwork for expanded state-by-state party registration and ballot access, relying on the combined nationwide network of the three organizations." It plans to gain legal recognition "in 15 states by the end of 2022, twice that number in 2023, and in almost all U.S. states by the end of 2024."

While Forward won't be running its own candidates in this year's midterm elections, it will "support select candidates in November who stand up for our democracy, even if they come from outside the new party," according to the news release.

Jolly, Whitman and Yang acknowledged the clear lack of success third parties have had in the United States previously, writing in their op-ed, "Most third parties in U.S. history failed to take off, either because they were ideologically too narrow or the population was uninterested." But they said that "voters are calling for a new party now more than ever," citing a Gallup poll from last year.

John Wood, former January 6 committee investigator, launches independent Senate bid in Missouri

John Wood, former January 6 committee investigator, launches independent Senate bid in Missouri

"Americans of all stripes -- Democrats, Republicans and independents -- are invited to be a part of the process, without abandoning their existing political affiliations, by joining us to discuss building an optimistic and inclusive home for the politically homeless majority," Jolly, Whitman and Yang wrote.

Asked by Keilar on Thursday why they believe their effort to create a third party would work, Whitman said, "We're in a different time."

"When you have 50% of the American people saying that they are registered independent ... people are sick and tired of what they're seeing in Washington and the fact that nothing major is getting done is frustrating them. We have big problems and we want to see them resolved," she said.

A few independent candidates have earned national attention in their races this cycle. In Utah, Evan McMullin, who ran for president in 2016 as an anti-Trump conservative, is challenging GOP Sen. Mike Lee and has the backing of the state Democratic Party. In Missouri, John Wood, a former senior investigator for the House select committee investigating the January 6, 2021, attack on the US Capitol, is running as a "commonsense alternative" to the field of Republican and Democratic candidates for the state's open US Senate seat. And in Oregon, former state Sen. Betsy Johnson, who left the Democratic Party last year, is a top contender in the open governor's race.

CORRECTION: This story has been corrected to reflect that Andrew Yang has not been elected to office.

This story has also been updated with additional reaction.

CNN's Rachel Janfaza contributed to this report.

09.59

Federal prosecutors ready for executive privilege fight

https://www.theguardian.com/us-news/live/2022/jul/29/trump-jan-6-manchin-biden-covid-boosters-us-politics-latest

Prosecutors at the justice department are gearing up for a courtroom battle to force the testimony of Donald Trump’s former White House officials, as they pursue their criminal inquiry into his insurrection, a report published Friday by CNN says.

The former president is expected to try to invoke executive privilege to prevent his closest associates telling what they know about his conduct and actions following his 2020 election defeat, and efforts to prevent Joe Biden taking office, according to the network.

But the department, which has taken a much more aggressive stance in recent weeks, is readying for that fight, CNN says, “the clearest sign yet” that the inquiry has become more narrowly focused on Trump’s conversations and interactions.

Attorney general Merrick Garland.

Attorney general Merrick Garland. Photograph: Jacquelyn Martin/AP

This week attorney general Merrick Garland promised “justice without fear or favor” for anyone caught up in insurrection efforts and would not rule out charging Trump criminally if that’s where the evidence led.

He told NBC’s Lester Holt:

We intend to hold everyone, anyone who was criminally responsible for events surrounding January 6, or any attempt to interfere with the lawful transfer of power from one administration to another, accountable.

That’s what we do. We don’t pay any attention to other issues with respect to that.

CNN’s story suggests that prosecutors are acutely aware that Trumpworld insiders who are initially reluctant to testify will be more inclined to do so with a judge’s order compelling it.

The network also says Trump’s attempt to maintain secrecy came up over recent federal grand jury testimony of two of former vice-president Mike Pence’s aides, Marc Short and Greg Jacob.

Questioning reportedly skirted around issues likely to be covered by executive privilege, with prosecutors having an expectation they could return to those subjects at a later date, CNN’s sources said.

The development is set to add more legal pressure on Trump following the announcement of an evidence-sharing “partnership” between the justice department and the parallel House January 6 inquiry, in which transcripts of testimony from at least 20 witnesses are passing to Garland’s investigation.

Civil rights lawsuit filed against Clark County sheriff after 8 women allegedly assaulted at jail

https://www.wthr.com/article/news/crime/civil-rights-lawsuit-filed-against-clark-county-sheriff-after-8-women-allegedly-assaulted-at-jail-jamey-noel-david-lowe-indiana-federal-lawsuit/531-e8d7a51a-5c84-446c-934c-ee594f66d860

Gillian Branstetter

@GBBranstetter

https://twitter.com/GBBranstetter/status/1552072325612331016

28 women held at an Indiana jail are suing after guards gave the keys to their cells to incarcerated men in exchange for a $1000 bribe, allowing the men to rape and assault the women.

The whole gang of these POS New GOPs are pretty detrimental to America, that's for sure.

Gaetz among 20 House Republicans who voted against anti-human trafficking bill

BY MYCHAEL SCHNELL - 07/27/22 11:10 AM ET

https://thehill.com/homenews/house/3576150-gaetz-among-20-house-republicans-who-voted-against-anti-human-trafficking-bill/

Rep. Matt Gaetz (R-Fla.) was among the 20 House Republicans who voted on Tuesday against a bill that seeks to combat human trafficking.

The legislation, titled the Frederick Douglass Trafficking Victims Prevention and Protection Reauthorization Act, passed in a 401-20 vote, with all opposition coming from Republicans. Eight Republicans and one Democrat did not vote.

Gaetz, who is currently under investigation by the Department of Justice for sex trafficking allegations involving a minor, was among the Republicans who opposed the bill that aims to bolster programs including shelters, mental health care, education and job training for victims of human trafficking.

Gaetz was joined by GOP Reps. Brian Babin (Texas), Andy Biggs (Ariz.), Lauren Boebert (Colo.), Mo Brooks (Ala.), Ken Buck (Colo.), Andrew Clyde (Ga.), Louie Gohmert (Texas), Paul Gosar (Ariz.), Marjorie Taylor Greene (Ga.), Andy Harris (Md.), Jody Hice (Ga.), Thomas Massie (Ky.), Tom McClintock (Calif.), Mary Miller (Ill.), Troy Nehls (Texas), Ralph Norman (S.C.), Scott Perry (Pa.), Chip Roy (Texas) and Van Taylor (Texas).

The bill calls for allocating more than $1.1 billion over five years to reapprove and bolster programs that were created under the Trafficking Victims Protection Act of 2000.

According to the measure, local educational agencies operating in a high-intensity sex trafficking area or a location with significant child labor trafficking would be prioritized for Frederick Douglass Human Trafficking Prevention Education Grants. Local educational agencies that work with nonprofit organizations focused on human trafficking prevention education and partner with law enforcement would also be prioritized, among other groups.

The legislation would also reauthorize the Department of Homeland Security’s Angel Watch Center, which is meant to prevent international sex tourism travel perpetrated by child sex offenders, and improve trafficking prevention education for children by including parents and law enforcement in child trafficking and online grooming prevention.

Additionally, it would allocate $35 million each fiscal year for housing options that would help women living with their abusers separate themselves.

News broke last year that Gaetz, who remains close to former President Trump, was under investigation by the Justice Department for allegations that he had a sexual relationship with a 17-year-old woman and financed her traveling with him. The Florida Republican has denied the assertions, claiming that he and his family “have been victims of an organized criminal extortion.”

Those allegations, however, crept back into the spotlight this week after Marc Short, who served as chief of staff to former Vice President Mike Pence, shot back at Gaetz over criticism of the ex-vice president.

Whitmer’s race moves from ‘toss up’ to ‘lean Democrat’

Watch live: President Biden delivers remarks following negative COVID-19 test

Gaetz, in delivering remarks to Turning Point USA, a conservative student group, said, “Let me just say what everyone here knows: Mike Pence will never be president. Nice guy, not a leader.”

Asked about those comments on Monday, Short told CNN, “Well, I don’t know if Mike Pence will run for president in 2024, but I don’t think Matt Gaetz will have an impact on that. In fact, I’d be surprised if he’s still voting. It’s more likely he’ll be in prison for child trafficking by 2024.”

“And I’m actually surprised the Florida law enforcement still allows him to speak to teenage conferences like that. So, I’m not too worried what Matt Gaetz thinks,” he added.

Tulsi Gabbard, Rand Paul Placed on List of Russian Propagandists by Ukraine

BY GIULIA CARBONARO ON 7/26/22 AT 4:45 AM EDT

https://www.newsweek.com/tulsi-gabbard-rand-paul-placed-list-russian-propagandists-ukraine-1727831

Kentucky Senator Rand Paul and former Hawaii Representative Tulsi Gabbard have been listed by Ukraine among a number of American politicians, academics and activists Kyiv claims have promoted "Russian propaganda."

The list was compiled by the Ukrainian Center for Countering Disinformation, founded in 2021 by Ukrainian President Volodymyr Zelensky to study the impact of Russian disinformation. The center is part of Ukraine's National Security and Defense Council.

The list—which also includes retired U.S. Army Colonel Douglas Macgregor, military strategist Edward Luttwak, political scientist John Mearsheimer and journalist Glenn Greenwald—does not explain what the consequences are for those who Ukraine clearly considers responsible for promoting the Kremlin's line. But it offers explanations for inclusion on the list.

In April, Paul said President Joe Biden provoked Russia to invade its neighbor by advocating Ukraine's entrance into NATO.

He also said: "You could also argue the countries they've attacked were part of Russia. Or part of the Soviet Union."

Paul was immediately rebuked for this by Secretary of State Antony Blinken, who said Russia was not justified in invading Ukraine.

Former Rep. Gabbard said that the U.S. had provoked Putin for many years and that there are 25 dangerous biolabs in Ukraine that could release deadly pathogens.

The former representative has been accused of of lending credibility to Russian propaganda.

The biolab claims have also been supported by Greenwald, who Ukraine says didn't want the U.S. to help Ukraine to avoid provoking Russia into a nuclear war.

Macgregor is listed as having said that the Russian army was highly skilled and "invincible," while Mearsheimer is on Ukraine's blacklist for having said NATO provoked Vladimir Putin into war.

Luttwak is listed as having given support to holding referendums in the breakaway Ukrainian regions of Luhansk and Donetsk.

A look at the fibs. Always intrigued how the calculations line up with occurrence's both in nature and in the stock market over time. When I posted a chart recently in discussion with santafe2 where for curiosity I ran the fib from the low of the last recession spanning about 15 yrs on a monthly chart. Plus some standard SMAs 9, 20, 50, 100, and 200 periods and few other studies which I will repost.

Then there is the fib from the Covid lows inserted on a weekly chart and then the daily closer views of the same. I think definitely we have some areas of interest and matching points on the charts. Given everything that is occurring, I believe we still have more downside risk than not other than a short bear market rally that might happen. Playing by ear daily I think is about all we've got to be sure on.

But as the market does, attention to sentiment is given, and there is is 50/50 bull/bear sentiment. This leaves a lot holding onto their capitol, looking for a lower bottom or just plain waiting to see how it goes or just play the bear rally presumed by any bearish outlook. This creates the situation for a flush to satisfy the bears need to see a lower bottom and put some capitol in and of course the market will take the bulls money if and when this happens. That's if it is somewhat of a bottom, if not then the market will just continue it's trend downward on it's own longer term.

Going to the shorter term fib (yellow) 50% line is not a stretch at all and seems pretty reasonable place to touch in the short term with the market conditions currently. If some forceful events happen in the future (war, inflation still heated, climate occurrences), then lower points could be in store. The best I think we could see is flat in a channel for a bit with opportunity to do some profitable trades.

Anyway, just something to look at and watch, or not.

I'll second that. It isn't just subscribing either, it's that they create, inseminate, and nourish the story that they spend their entire time on.

Only the bulk of the population grabbing a hold of their senses and human decency and saying NO MORE. Maybe out of the ashes of the vanishing few of the old GOP, a phoenix can rise, but I don't see any of it happening anytime soon enough. I see Civil War before that, we're in the beginning stages now, but it can become more recognizable real quick given everything.

Like I've said, this theater that the new GOP has chosen can only have bad endings for most. I guess we have to get to the very bottom of the gutter and wallow around in the puke before any survivors can scrape themselves out of it. The most vile word in the universe eludes me right now, so I'll just say DISGUSTING, which doesn't even begin to cover it.

Republicans are just getting worse by the day...

We are a global economy, and no matter how anyone wanting to live in the fantasy that we're not or that everything under the sun revolves around the US is just that, fantasy and an expensive waste of focus. If one thinks the oil cartels (foreign or domestic) , when given free reign to annihilate a country and its' population or pump and increase production with no environmental or safety conditions or any thought to the costs of the environmental damage, that they are just going to give all of that supply on the cheap when they can get so much more elsewhere for that supply, is just senseless stupidity. That would be like the fossil fuel companies buying the politicians and judges to do their bidding and sellers paying the fees on Ebay or auction houses not taking the highest bid and giving it to the lowest bid buyer. Not going to ever happen no matter which party is in control.

On that note, if anyone is following the global shipping industry and the dramatic changes in geopolitical and geoeconomics that are currently happening and how that will relate to costs to consumer, certain stocks, or US economy, here's some news on that front.

Tanker Market in Recovery Mode

in Hellenic Shipping News 16/07/2022

https://www.hellenicshippingnews.com/tanker-market-in-recovery-mode/

The tanker market has entered into recovery mode during the month of June. In its latest monthly report, OPEC said that dirty tanker spot freight rates in June recovered some of the losses seen the previous month. The tanker market continued to improve following the poor performance in 2021, although gains varied across sectors. Suezmax and Aframax markets have benefited from the rerouting of longstanding trade patterns, resulting in longer voyages. Suezmax rates rose 20% m-o-m, while Aframax rates increased 11% m-o-m on average. VLCCs have seen less momentum from these shifts, with lower flows on longer haul routes such as from the Americas to Asia. As a result, VLCC rates remained at comparatively soft levels, up 8% on average, with gains were seen both East and West of Suez. Product trade flows have continued to strengthen, amid a shift to longer haul routes due to trade dislocations and refinery capacity expansions in export regions. Clean rates were up 21% m-o-m on average.

Spot fixtures

The latest estimates show global spot fixtures declined in June, averaging 13.0 mb/d. Fixtures fell 1.8 mb/d, or around 13% m-o-m. Compared with the previous year, spot fixtures were down 2.5 mb/d, or about 16%. OPEC spot fixtures slipped m-o-m in June, averaging 9.1 mb/d. This represented a drop of 13%, or 1.3 mb/d. In comparison with the same month in 2021, they were about 0.3 mb/d, or 4%, lower. Middle East-to-East fixtures fell 1.2 mb/d, or 19%, to average 4.9 mb/d. Compared with the same month last year, eastward flows declined 0.3 mb/d, or almost 6%. In contrast, spot fixtures from the Middle East-to-West fell m-o-m by around 0.1 mb/d, or 8%, in June, to average 1.5 mb/d. Y-o-y, rates were 0.4 mb/d, or 37%, higher. Outside the Middle East, fixtures averaged 2.7 mb/d in June. This represents a marginal m-o-m decline of about 2%, and a decline of 0.4 mb/d, or 14%, y-o-y.

Sailings and arrivals

OPEC sailings increased m-o-m by 0.1 mb/d, or less than 1%, in June to average 22.6 mb/d. OPEC sailings were 0.9 mb/d, or 4%, higher compared with the same month a year ago. Middle East sailings edged down by 0.1 mb/d in June to average 17.0 mb/d. Y-o-y, sailings from the region rose 1.7 mb/d, or around 11%, compared with June 2021. Crude arrivals in June saw m-o-m gains across all regions except West Asia.

Arrivals in the Far East increased m-o-m by 0.5 mb/d, or about 4%, to average 14.4 mb/d. Y-o-y, arrivals were almost 1.0 mb/d, or about 7%, higher. Arrivals were marginally lower m-o-m in West Asia, edging down 1% in June to average 8.2 mb/d, representing a y-o-y increase of 2.1 mb/d, or 35%.

Meanwhile, arrivals in North America increased by 0.4 mb/d or 4% to average 9.1 mb/d, representing a y-o-y rise of 0.2 mb/d, or about 2%. European arrivals rose m-o-m by 0.2 mb/d, or about 2%, to average 13.7 mb/d. This was 0.9 mb/d, or about 7%, higher than in the same month last year.

Dirty tanker freight rates

Very large crude carriers (VLCCs)

VLCC spot rates recovered some of the previous month’s losses and were up 8% on average m-o-m. The sector has seen less momentum from recent trade dislocations, amid lower flows on longer haul routes such as from the Americas to Asia. Y-o-y, VLCC rates were up 43% on average. On the Middle East-to-East route, rates increased 10% m-o-m to average WS46 points and were 44% higher y-o-y. Rates on the Middle East-to-West route rose 8% m-o-m to average WS27 points. Y-o-y, rates on the route increased 29%. West Africa-to-East spot rates gained 9% m-o-m to average WS48 in June. Compared with the same month last year, rates were 45% higher.

Suezmax

Suezmax rates also recovered some of the previous month’s losses in June, increasing 20% m-o-m. Rates were supported by ongoing trade dislocations which have boosted demand for longer haul voyages. These include higher Russian flows to Asia and increased European imports from the Middle East and the Americas, as well as West Africa. Y-o-y, rates were almost 130% higher. Rates on the West Africa-to-US Gulf Coast (USGC) route increased by 23% m-o-m in June to average WS102. Compared with the same month last year, rates were 127% higher. Spot freight rates on the USGC-to-Europe route rose 17% over the previous month to average WS91 points. Y-o-y, rates were 133% higher.

Aframax

Aframax spot freight rates also gained back some of the previous month’s losses, which had been driven by disruptions in North African flows. On average, spot Aframax rates rose 11% m-o-m. Compared with the same month last year, rates were 100% higher. Rates on the Indonesia-to-East route built on the previous month’s gains, rising 1% m-o-m to average WS173. Y-o-y, rates on the route were up 111%. Spot rates on the Caribbean-to-US East Coast (USEC) route rose 6% m-o-m to average WS172. Y-o-y, rates were 112% higher

Cross-Med spot freight rates saw an increase in June, up 22% m-o-m to average WS169. Y-o-y, rates were 86% higher. On the Mediterranean-to-NWE route, rates rose 17% m-o-m to average WS158. Compared with the same month last year, rates were around 90% higher on both routes.

Clean tanker freight rates

Clean spot freight rates continued to show robust gains across all monitored routes, supported by trade dislocations which have boosted demand for longer haul routes particularly towards Europe. On average, rates increased 21% m-o-m in June and were up by 235% compared with the levels seen in the same month last year. Gains were seen on both sides of the Suez, amid the continuation of a globally tight product balance.

Rates on the Middle East-to-East route rose a further 4% m-o-m in June, building on the strong gains of recent months, to average WS310. Y-o-y, rates are up 248%. Freight rates on the Singapore-to-East route gained 23% m-o-m to average WS414 and were 211% higher compared with the same month last year. In the West of Suez market, rates on the Northwest Europe (NWE)-to-USEC route rose 9% m-o-m to average WS359 points. They were 209% higher y-o-y. Rates in the Cross-Med and Med-to-NWE saw gains of 34% each to average WS467 and WS477 points, respectively. Compared with the same month last year, rates were 259% higher Cross-Med and up 241% on the Med-to-NWE route.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Yeah, that Putin is a master manipulator, and a ruthless disinformation king, although the new GOP is moving up to be some competition to that criminal prowess. Political costs to the people that incur by focusing on only policies and subject matter that are good for them, that are not good for the economic and social stability of the country, but only to gain or keep power for themselves. Keeping attention on the lies, bs, and social issues instead of repairing or building up our infrastructure, developing a lot better health system, and minimizing the extreme environmental costs that are growing and are going to grow exponentially. Billions and billions of dollars out of the economy and into PACs, dark money, and the pockets of the politicians and judges on a constant basis instead of investment into the future for all (or at least most instead of the few).

The parties have been doing it forever, but since Trumpian politics came in, it has crossed the line by miles and is in an untenantable and unworkable contexture. These are all going to be translated into heavy dollar costs and difficulties for us and just more headwinds for the overall market. But so much for my rant, lets all just keep focusing on CHEAP $5 a gallon gas, give the perpetrators more power, and everybody will live happily ever after. Good luck with that.

Gas prices may surge again ahead of midterm elections

As new sanctions threaten to choke global oil supply, the White House scrambles to contain potential fallout

https://www.washingtonpost.com/business/2022/07/16/gas-price-increase-midterms/

By Evan Halper

July 16, 2022 at 6:00 a.m. EDT

Drivers relieved by the recent dip in gas prices may be in for a shock when the summer winds down, with energy analysts warning a fresh round of price surges could emerge as soon as October.

The prospect of a new gas price jolt coinciding with midterm elections has the White House and many Democrats on edge.

The price concerns are tied to the timeline for stricter sanctions on Russia that will further choke the global oil supply. J.P. Morgan has warned that in a worst-case scenario — in which Russia retaliates by shutting down its supply altogether — the price of oil could jump to $380 per barrel, more than triple what it is today.

“If you were to ask me where could oil prices go, I would say pick a number,” said Michael Tran, managing director for global energy strategy at RBC Capital, who says that while the outlook is murky, several indicators point to a price rebound. “This is the tightest oil market we have seen in a generation or more.”

The worrisome prognosis for consumers, coming as the nation is already struggling with historic levels of inflation, has the Biden administration grasping for interventions that could bring relief.

Yet U.S. political leaders are confronting the reality that even the most aggressive domestic political and policy measures often have scant impact over prices in a global oil market guided by forces out of their control.

Economists across the ideological spectrum warn that the measures the White House is promoting — allowing Russian oil into the global market at reduced prices, taxing oil company “windfall” profits, cutting the federal gas tax — could ultimately aggravate the energy crunch in the United States, rather than ease it.

“When things like this happen, we tend to focus on short-term fixes,” said Christopher Knittel, a professor of applied economics at MIT’s Sloan School of Management. “But, unfortunately, gas prices are not really something you can fix in the short term.”

The White House worries come at a moment consumers see gas prices as one of the few things in the economy trending in the right direction. The cost of a gallon has fallen from more than $5 a month ago to a national average of $4.60, according to AAA. Oil is trading for less than the price it did before Russia invaded Ukraine.

Concerns about a potential recession dampening demand have played big in the price drop.

Another key reason prices have fallen lately is that initial sanctions against Russia are far less effective than planned. The country’s oil is making its way into world markets despite the restrictions, flowing to places like China and India. It means the global supply is not as tight as forecast when the United States and Europe initially joined forces to punish Russia over its invasion.

That could change with the next round of planned sanctions. A full ban of cargo shipments of Russian oil to Europe is set to take hold on Dec. 5, with the market expected to factor in its impact much sooner.

The sanctions would be accompanied by a ban on insuring ships that carry Russian oil, preventing them from accessing international waterways. The insurance policies for most of the world’s oil cargo ships are written out of Europe.

As a result, Russia would confront steep new obstacles to moving its oil anywhere. The sanctions are intended to double the amount of Russian oil pulled from the market since the war began.

An internal U.S. Treasury analysis projects that could send the price of oil soaring 50 percent above where it is today. Some market analysts are warning of potentially steeper climbs, which could push gas prices beyond $6 a gallon.

The warnings all come with caveats. In the event of more bad economic news signaling a prolonged recession, for example, prices would likely stabilize. Less gasoline is used when the economy is in retreat.

A fresh round of coronavirus lockdowns in large Chinese cities would similarly weaken global demand and ease upward pressure on prices.

Yet the imbalance between oil and gasoline supply and demand is so pronounced right now that prices could swing back up months before new sanctions take effect, in the thick of the midterm campaign, said Kevin Book, managing director at ClearView Energy Partners, a research firm.

“People procuring oil make their bids early,” Book said. “It takes four to six weeks for it to be delivered. If they think a shortage is coming, they plan for it.”

Pump shock: why gas prices are so high

The political and economic dilemma points to the challenges of using energy as a foreign policy cudgel.

“Energy sanctions were never the silver bullet people hoped,” said Edward Chow, an energy security scholar at the Center for Strategic and International Studies who worked in the industry for decades. “Politicians are telling voters that we can do this and people don’t have to sacrifice. It only works if you are willing to make sacrifices and actually cut demand.”

American lawmakers have shown little appetite for the conservation measures that the International Energy Agency is urging be implemented as part of the effort to assist Ukraine. The 10-point plan the agency unveiled months ago — aimed at cutting oil demand by the equivalent of all the cars in China — calls on economically advanced nations to lower highway speed limits, make cities car-free one day a week and implement vehicle sharing.

The plans are seen as political losers in the United States, echoing the unpopular conservation initiatives that doomed the Carter administration when it confronted an energy crisis in the 1970s.

The White House is instead lobbying world leaders to agree on a novel price cap that would allow Russia to continue to sell its oil after Dec. 5 but at a heavily reduced price. The idea is to avoid a global shortage while also cutting the oil profits Russia uses to fund its war effort.

Although the plan has some prominent champions, energy experts are deeply skeptical. They warn that Russia has various levers it could pull to throw the market into chaos, including cutting off all shipments abroad, plunging countries like India deeper into crisis.

The J.P. Morgan warning, that oil prices could more than triple in a worst-case scenario, is premised on its finding that Russia’s economy can sustain a cut in oil production of millions of barrels per day.

“The problem is Russia gets a vote, too,” Book said. “Just because something has never been done before doesn’t necessarily mean it can’t be done. But sometimes there is a reason it has never been done.”

Chow called the effort “puzzling.” “I have not met a single person who has worked in the energy industry who believes this can work,” he said.

Other measures the Biden administration is pursuing would take aim at oil companies, heavily taxing the “windfall” profits they are earning from high prices. Leading Democrats argue that such actions are overdue.

“In my view, quite a lot of intervention is appropriate in this market,” said Sen. Sheldon Whitehouse (D-R.I.). “You are not as government interfering in the marketplace. You are counteracting the anti-competitive effects of a cartel. Even if you are a free marketeer, it is fair game to knock down anti-competitive, cartel-driven practices.”

It is a potent argument and one that resonates with voters, who blame oil companies for high prices. But the United States has a history dating back to the Nixon administration of trying to use regulations to control prices at the pump. Knittel chronicled in a detailed academic paper how those efforts backfired, leading to oil shortages and long lines at gas stations in the 1970s.

The countries right now tinkering with aggressive market interventions are facing the same dilemma all over again. Before Russia invaded Ukraine, the Hungarian government imposed price controls capping the cost of gas at $4.80 per gallon. Shortages followed. Drivers there are now prohibited from purchasing more than 13 gallons of fuel per day.

“Gas prices are set based on a world oil market, and it is tough for any one country to have an appreciable impact on that market in a short time period,” Knittel said. “The way to stop this is a rallying call for federal legislation that reduces demand for oil over the long term. So next time prices go up like this, it won’t hit us as hard.”

Home inventory has grown 28% since last year as sellers cut sales prices

CNBC’s Diana Olick reports on housing supply.

AN HOUR AGO

https://www.cnbc.com/video/2022/07/15/home-inventory-grows-28-percent-since-last-year-as-sellers-cut-sales-prices.html

Average long-term US mortgage rates bounce back up to 5.51%

YOUR MONEY

Matt Ott/AP Business Writer

Posted: JUL 15, 2022 / 06:46 AM CDT | Updated: JUL 15, 2022 / 06:46 AM CDT

WASHINGTON (AP) — Average long-term U.S. mortgage rates were back up this week, just as the latest government data shows inflation has not slowed, meaning the Federal Reserve is almost certain to raise its benchmark borrowing rate later this month.

Mortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 5.51% from 5.30% last week. One year ago the average 30-year rate was 2.88%.

The average rate on 15-year, fixed-rate mortgages, popular among those refinancing their homes, rose to 4.67% from 4.45% last week. A year ago, the rate was 2.22%.

The Federal Reserve raised its benchmark rate by a half-point in May and another three-quarters of a point last month, the biggest single hike since 1994. Fed policymakers have signaled that much higher interest rates could be needed to reign in persistent, four-decade high inflation. Most economists expect the Federal Reserve to jack up its borrowing rate another half-to-three-quarters of a point when it meets later this month.

Fed officials acknowledge that their rate hikes could weaken the economy, but suggested that such steps were necessary to slow price increases back to the Fed’s 2% annual target.

The Labor Department reported Wednesday that its consumer price index soared 9.1% over the past year, the biggest yearly increase since 1981. On Thursday, Labor released data showing that its producer price index — which measures inflation before it reaches consumers — rose by 11.3% in June compared with a year earlier.

The Fed’s benchmark short-term rate, which affects many consumer and business loans, will now be pegged to a range of 1.5% to 1.75% — and Fed policymakers forecast a doubling of that range by year’s end.

Higher borrowing rates have discouraged house hunters and cooled what was a red-hot housing market, one of the most important sectors of the economy. Sales of previously occupied U.S. homes slowed for the fourth consecutive month in May.

Home prices kept climbing in May, even as sales slowed. The national median home price jumped 14.8% in May from a year earlier to $407,600 — an all-time high according to NAR data going back to 1999.

Mortgage applications have declined 14% from last year and refinancings are down 80%, the Mortgage Bankers Association reported this week. Those numbers could retreat further with more Fed rate increases a near certainty.

Layoffs in the housing and lending sectors have already begun. On Tuesday, the online mortgage company loan Depot said it was cutting 2,000 jobs.

Last month, the online real estate broker Redfin said it was laying off 8% of its workers and Compass said it was letting go of 450 employees.

The nation’s largest bank by assets, JPMorgan Chase, is laying off hundreds from its mortgage unit and has reassigned hundreds of others to jobs elsewhere in the firm.

I don't think the end is near, but who knows. LOL. And I'm not sure how far below we could go, but I do think there is a lot of downside risk still here at this point. My estimate for the RDI was for end of July, so I guess Sept will be those numbers.

There's a lot big money manipulation recently and the action has matched across different sectors and indexes, sometimes candle by candle during the day between two unrelated stocks under two different indexes matched with the SPY. So there is a lot of orchestrated manipulation across the board happening. That said, yesterday the uptick in the markets coincided with timing when the Feds came out and indicated the .75 signal. We probably had a little short covering, I was covering and going long at the time, but doesn't mean what others were doing and I was just intraday and a small fry.

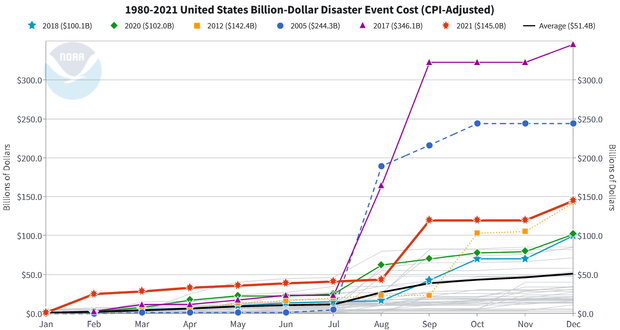

I agree that the last yr downtrend on the RDI has a lot to do with the infusion of money, but that isn't the only causes of it and I don't think one can put it all on that. We have the virus wars, supply breakdown, environmental, and war with the geopolitical and geoeconomically upheaval that has really not even shown the bulk of the economic repercussions of Putin's war yet. There's more, but those are some pretty main causes in partner with the cash infusions. Damages from the 2021 disasters totaled approximately $145 billion. (All cost estimates are adjusted based on the Consumer Price Index, 2021). The costliest 2021 events were Hurricane Ida ($75 billion), the mid-February Winter Storm / Cold Wave ($24.0 billion), and the Western wildfires ($10.9 billion). Adding the 2021 events to the record that began in 1980, the U.S. has sustained 310 weather and climate disasters where the overall damage costs reached or exceeded $1 billion. The cumulative cost for these 310 events exceeds $2.15 trillion.

As far as the two numbers that you're taking and drawing the slight upward slope I interpret as just on two sides of the peak. We can do that with probably most all of any charts (ex the SPY below). The rate of change on the chart is going at a pretty good clip to be putting the breaks on and bottoming out even in the next 6 months or so. I know the bulls are looking for a Santa run at end of yr, but I have a lot of doubts. I project when the newer numbers come out and catch up to now or the end of July we will see that number on the RDI go below 14k.

To stop the rate of decent and turn it will take some major events and major sentiment change, events that are the opposite of all the headwinds and events coming down the pike. We are going to have a world recession, and there is a good possibility of it being worse than the last one in 2009.

The war is going to be a long one and we are only in the first stages and the economic impact has not been realized and "priced in" by any means. The environmental and social costs (which most ignore) of burning fossil fuels is hard to quantify, but it's in the trillions of expense to the economy every year and it's compounding and getting worse. Medical, birth defects, cancers, poisoned water/land/air, etc, etc all on top of the price at the pump or costs to turn down your air conditioner or buy a set of tires. Hard to quantify due to the hiding of information, disinformation campaigns, and 100s of millions a year at least IMO of dark and light money from the fossil fuel industry buying the politicians and judges declaring war on any who dare to put forth the facts and good science. Political costs are very real, again hard to quantify, but just because they hide those numbers doesn't mean they are not there and they will effect our overall economy for the average joe. The rug is now just one big hump of dirt with the edges overflowing, and a big headwind is going to make a mess and the cost of cleanup or restoration is going to hurt.

Climate extremes caused by fossil fuels are going to cost our economy trillions more. The number of events, the velocity, and length of time of those events are increasing and I believe they are increasing in exponential way. The costs of those events are going to be another detriment for any recovery.

Month-by-month accumulation of estimated costs of each year's billion-dollar disasters, with colored lines showing 2021 (red) and the previous top-5 costliest years. Other years are light gray. 2021 finished the year in third place for annual costs.

https://www.climate.gov/news-features/blogs/beyond-data/2021-us-billion-dollar-weather-and-climate-disasters-historical

The gap between "rich and poor" is increasing in a detrimental manner, yes a touchy political debate, but there is no debate that there are costs to the economic stability that has to be considered in with things like the RDI slope.

After these things, there is a myriad of other forces working against us on recovery or "bottoming out" of the market. Including the debt and credit problems. Defaulting on debt, whether it's student loans, car or house payments, it dings the credit scores and does nothing but cost more in interest, rent, and just about everything including the ability to support the demand side of equations and again has to be considered in things like the RDI and the rate of change or slope or trend. Bank stocks don't do to well either the bigger the problem gets.

In conclusion (for now) is that we have a very big storm brewing and it just has a little breeze at the moment. If all things were equal and "normal" I could give credence to a "bottom" here and feel comfortable comparing to other recessions, etc, but we are not equal nor "normal" and instead of comparatively some major detrimental event, we have multiple, harder force events, and a political upheaval to boot all to make it almost impossible to do anything but a short term rally if we get that. Yes there is definitely mm manipulation and will be more of that, more volatility, great for day trading, but not so good for the average investor. I have a real hard time seeing this manipulation as any major turning point in the market.

I think the next few months will be telling and many things can happen in that amount of time. There a lot of things that are not if but when, and I think the when is sooner than a lot of folks want to admit.

Thanks for the response, I do use FRED and is one of the dozen or so pages that I have open when I open my browser. I've used it before, but at some point with posts here, I made it one of the "home" pages on my browser. I haven't been able to have the time yet to analyze and discuss the differences in the data projected between the two charts. It was from another blog and I just pasted the address of the image.

I have no argument that wages have steadily increased in general, my point is that real income or disposable income, the money to have the quality of life that each individual strives for beyond just paying the bills, is going down and with many families it isn't even paying the bills. The cost of housing and necessary living expenses is where the wages are not keeping up and the chart of that is in a horrible downtrend.

This is a big subject as well as your other valid points with a few caveats about the comparisons of certain points in time that you have made in your posts, but I have to get to my trading and will have to discuss at a later time. But I did want to respond and give thanks for your thought out response, definitely appreciate the input.

For now I will refer to the FRED chart here which is 2 1/2 months behind and is a lot worse number now and is still trending down at a very worrisome rate of decline. I believe somewhere in there is where the -4.4 number is referring to. Exact numbers can be debated, and of course depends on the data that is put in (or the data that is withheld in the charts), but the point is that there is a street reality of a too negative of number that is at play here. The causes and effects (political, social, environmental, wars, viruses, financial and more) and any solutions or how we decide to trade or invest with are all involved and I believe a very serious situation is evolving.

https://fred.stlouisfed.org/series/DSPIC96

Enjoy following the board, I have incorporated many posts into my trading and thought I throw this out there for some comment.

Lots of talk of inflation rate peaking and starting to come down in the future, but issue I'm looking at is, that even if true, the cost of living would still be going up albeit at a lower rate from peak. I don't think the wage rate increases are going to be increasing at the same rate as it has, which hasn't kept up to inflation giving a negative wage income result. I can't see this divergence getting any better even in the next yr or longer, in fact I see it getting worse. This will only increase the stress and pressures for labor to be screaming and struggling in odds with the pressure for employers to cut costs which usually looks at labor as the highest expense to cut back on. And so it goes. How is that problem going to turn the market trend anytime soon and not just continue to make lower highs and lower lows? I know main street and wall street are so disconnected in ways, but they are still connected in ways that can't be ignored.

The housing market is just beginning to tip, irrational supply and demand to the max has been going on there, who knows how far it can go back down, but it's got to go down considerably. The cost of housing vs income are just in a unsustainable level and now interest rates making that worse. Auto repos are increasing dramatically now which is not a good omen. People with $2500 a month income paying $1000 car payments, realities biting, hence the dramatic increase in auto repos. More and more middle income and even some of the higher income are feeling it and making adjustments. One can only adjust so far and the poor category is growing and is going to grow a lot more.

We're not even talking about environmental costs that are going to be increasing dramatically (food, water, utilities, material, insurance, medical, and more caused by climate extremes) coming our way real soon, some of it here right now. Or the continued war, supply problems, and a myriad of other problematic issues that cannot be fixed in any shorter or medium term time spans, some may never be fixed, just learned to live with.

Sure I've read the consensus that the market is pricing in 175 basis points now in the next few Fed meetings, and the feelings that the market has had a good correction, but those things alone don't even cut it IMO, not with all these other issues with costs not even known or can't really project how detrimental all of these things will be, but I feel that some are falling into the same irrational exuberance of years past or just hope that we're looking at the bottom. Hope and desperation is never a good strategy and never turns out well.

In my opinion, I don't think that we can hold flat, let alone a little growth, and only see a bottom a lot lower from here. There might be a soft landing, but I don't feel we have even jumped out of the plane yet and only trying to fit the parachute, and the landing is miles below.

Thoughts?

Watch for a bombshell announcement of share issuance ; thus dilution. and more and more dilution.

STEVE BANNON, 30 SECOND MAN

July 10, 2022/53 Comments/in 2020 Presidential Election, January 6 Insurrection /by emptywheel

https://www.emptywheel.net/2022/07/10/steve-bannon-30-second-man/

Predictably, multiple outlets are following the WaPo in serving as Steve Bannon’s chumps. The Guardian, CNN, and NYT reported Bannon’s false claims that the reason he blew off the January 6 Committee subpoena last year was because of Executive Privilege as if they were true.

So I’d like to point out another way in which these outlets have been manipulated by Bannon.

Back on June 29 (less than two weeks ago), Bannon moved to delay his trial until October, claiming — as many other accused January 6 criminals have — that publicity associated with the January 6 Committee makes it impossible to get a fair trial. It was a reasonable claim for the Proud Boys to make. But thus far, Bannon has no more figured in the hearings than other passing faces in the mob.

Indeed, DOJ mocked Bannon’s claim, noting that he had been mentioned just twice in more than fourteen hours of hearings, one of which was just a description that he had blown off the Committee subpoena.

To date, the Committee has held seven hearings, spanning more than 14 hours in total.1 The Defendant was not mentioned at all during five of them, and was featured only in passing in the Committee’s June 9 and June 21, 2022, hearings—for a combined total of less than 30 seconds. These are the two instances that the Defendant cites in his brief, couching them in the language of “for instance,” and “[a]nother example,” ECF No. 88 at 11, to suggest that they are just two of many more such instances, when in fact they are the only ones.

But a closer look even at these two brief mentions of the Defendant by the Committee demonstrate that they do not call prejudicial attention toward the Defendant with respect to his criminal trial, and are nothing like the dramatic cases that the Defendant attempts to marshal in support of his motion. First, in its June 9, 2022, hearing, the Committee’s ranking minority member, Rep. Liz Cheney, mentioned the Defendant’s podcast as part of her opening statement. In particular, Rep. Cheney said, “And on the evening of January 5th, the President’s close advisor, Steve Bannon, said this on his podcast.” The Committee then played a clip of the Defendant speaking three sentences on his own media program—“All Hell is going to break lose tomorrow. Just understand this. All Hell is going to break loose tomorrow”—without further commentary. See June 9, 2022, Hearing, at 51:42-52:01.2 Rep. Cheney’s neutral introduction to the Defendant’s own statement and the Defendant’s statement include no reference to the crimes for which the Defendant has been charged or commentary on the Defendant’s commission of the charged offense. And at the Committee’s hearing on June 21, 2022, as part of her concluding comments during a hearing that spanned nearly three hours on topics wholly unrelated to the Defendant, Rep. Cheney said, “Others, like Steve Bannon and Peter Navarro, simply refused to comply with lawful subpoenas. And they have been indicted.” June 21, 2022, Hearing at 2:44:30-2:44:37.3 The Defendant makes no argument about how this factual statement regarding his non-compliance and his subsequent indictment will result in the potential jury being “so aroused against” him that he will not receive a fair trial. Haldeman, 559 F.2d at 62.

In fourteen hours of hearings, Bannon merited no more than thirty seconds of attention.

Presciently, DOJ noted that no one but Steve Bannon and his lawyers are talking about Steve Bannon.

Further, while the Defendant’s motion describes media coverage of the Committee’s hearings overall, the Defendant does not cite a single media article covering the Committee’s hearing that mention the Defendant. That is because there are none. In fact, the Defendant and his attorneys have caused far more pretrial publicity about this case than the Committee hearings have by holding press conferences at the courthouse and speaking with reporters.

Bannon responded on July 6, just four days ago, presenting entirely irrelevant data that counted how many times his name has shown up in the press, then attributing all of that to the Committee, and not his own big mouth.

Then he opened his own big mouth and caused what he claims he’s trying hard to avoid: a press torrent of mostly inaccurate reporting.

Two weeks ago, Steve Bannon needed to be something more than a thirty second man in hopes of delaying his trial. And multiple outlets jumped to do his bidding.

Replies are great

I was reading about them yesterday, seen this coming miles back. Monopoly money pretending to be real.

From $10 billion to zero: How a crypto hedge fund collapsed and dragged many investors down with it

PUBLISHED MON, JUL 11 20223:30 PM EDTUPDATED TUE, JUL 12 20224:59 AM EDT

MacKenzie Sigalos

@KENZIESIGALOS

KEY POINTS

The bankruptcy filing from Three Arrows Capital (3AC) triggered a downward spiral that wrapped in many crypto investors.

The hedge fund failed to meet margin calls from its lenders.

“3AC was supposed to be the adult in the room,” said Nik Bhatia, professor of finance and business economics at the University of Southern California.

WATCH NOW

VIDEO09:02

Bitcoin dips, Saylor dubs ether a security, and what caused crypto’s crash: CNBC Crypto World

As recently as March, Three Arrows Capital managed about $10 billion in assets, making it one of the most prominent crypto hedge funds in the world.

Now the firm, also known as 3AC, is headed to bankruptcy court after the plunge in cryptocurrency prices and a particularly risky trading strategy combined to wipe out its assets and leave it unable to repay lenders.

The chain of pain may just be beginning. 3AC had a lengthy list of counterparties, or companies that had their money wrapped up in the firm’s ability to at least stay afloat. With the crypto market down by more than $1 trillion since April, led by the slide in bitcoin and ethereum, investors with concentrated bets on firms like 3AC are suffering the consequences.

Crypto exchange Blockchain.com reportedly faces a $270 million hit on loans to 3AC. Meanwhile, digital asset brokerage Voyager Digital filed for Chapter 11 bankruptcy protection after 3AC couldn’t pay back the roughly $670 million it had borrowed from the company. U.S.-based crypto lenders Genesis and BlockFi, crypto derivatives platform BitMEX and crypto exchange FTX are also being hit with losses.

“Credit is being destroyed and withdrawn, underwriting standards are being tightened, solvency is being tested, so everyone is withdrawing liquidity from crypto lenders,” said Nic Carter, a partner at Castle Island Ventures, which focuses on blockchain investments.

Three Arrows’ strategy involved borrowing money from across the industry and then turning around and investing that capital in other, often nascent, crypto projects. The firm had been around for a decade, which helped give founders Zhu Su and Kyle Davies a measure of credibility in an industry populated by newbies. Zhu also co-hosted a popular podcast on crypto.

“3AC was supposed to be the adult in the room,” said Nik Bhatia, a professor of finance and business economics at the University of Southern California.

Court documents reviewed by CNBC show that lawyers representing 3AC’s creditors claim that Zhu and Davies have not yet begun to cooperate with them “in any meaningful manner.” The filing also alleges that the liquidation process hasn’t started, meaning there’s no cash to pay back the company’s lenders.

Zhu and Davies didn’t immediately respond to requests for comment.

Tracing the falling dominoes

The fall of Three Arrows Capital can be traced to the collapse in May of terraUSD (UST), which had been one of the most popular U.S. dollar-pegged stablecoin projects.

The stability of UST relied on a complex set of code, with very little hard cash to back up the arrangement, despite the promise that it would keep its value regardless of the volatility in the broader crypto market. Investors were incentivized — on an accompanying lending platform called Anchor — with 20% annual yield on their UST holdings, a rate many analysts said was unsustainable. more......

https://www.cnbc.com/2022/07/11/how-the-fall-of-three-arrows-or-3ac-dragged-down-crypto-investors.html

America Headed for 'Real Economic Pain': Top Investment Firm

BY ZOE STROZEWSKI ON 7/11/22 AT 3:24 PM EDT

https://www.newsweek.com/america-headed-real-economic-pain-top-investment-firm-1723583

Atop investment management firm warned that the United States could see "real economic pain" before the Federal Reserve "changes course" in its efforts to combat rising inflation.

BlackRock addressed the issue of rising costs in its 2022 Midyear Global Outlook report that was issued Monday. The company wrote that "major spending shifts" and "production constraints," rather than excessive demand, have been driving inflation, citing the COVID-19 pandemic as the "root" of those constraints and Russia's war in Ukraine as a factor that worsened them.

"Major central banks are jacking up policy rates in a rush to get back to neutral levels that neither stimulate nor restrain activity," the report read. "The Fed is planning to go further, pencilling in rate hikes that go well intro restrictive territory to near 4 percent in 2023. The problem: Rate hikes don't do much against today's inflation. The Fed has to crush activity in the rate-sensitive part of the economy to bring inflation back to its 2 percent target. Yet the Fed has so far failed to acknowledge this."

Investment Firm Warns of Economic Pain

Investment management firm BlackRock warned on Monday that the United States could see “real economic pain” before the Federal Reserve “changes course” in its efforts to combat rising inflation. Above, gas prices are displayed on a sign in Washington, D.C., on June 14.

The Federal Reserve, as well as the Biden administration, have been facing pressure to take action to curb the rising costs that have become a top issue for Americans. Last month, the Fed announced its largest interest rate hike in 28 years as part of the effort to fight inflation, however the move spurred expert discussions on whether it could actually worsen the elevated costs. After it hiked up the interest rate, the Fed signaled that more increases would likely be needed in the future, the Associated Press reported.