Thursday, July 14, 2022 11:36:56 PM

As far as the two numbers that you're taking and drawing the slight upward slope I interpret as just on two sides of the peak. We can do that with probably most all of any charts (ex the SPY below). The rate of change on the chart is going at a pretty good clip to be putting the breaks on and bottoming out even in the next 6 months or so. I know the bulls are looking for a Santa run at end of yr, but I have a lot of doubts. I project when the newer numbers come out and catch up to now or the end of July we will see that number on the RDI go below 14k.

To stop the rate of decent and turn it will take some major events and major sentiment change, events that are the opposite of all the headwinds and events coming down the pike. We are going to have a world recession, and there is a good possibility of it being worse than the last one in 2009.

The war is going to be a long one and we are only in the first stages and the economic impact has not been realized and "priced in" by any means. The environmental and social costs (which most ignore) of burning fossil fuels is hard to quantify, but it's in the trillions of expense to the economy every year and it's compounding and getting worse. Medical, birth defects, cancers, poisoned water/land/air, etc, etc all on top of the price at the pump or costs to turn down your air conditioner or buy a set of tires. Hard to quantify due to the hiding of information, disinformation campaigns, and 100s of millions a year at least IMO of dark and light money from the fossil fuel industry buying the politicians and judges declaring war on any who dare to put forth the facts and good science. Political costs are very real, again hard to quantify, but just because they hide those numbers doesn't mean they are not there and they will effect our overall economy for the average joe. The rug is now just one big hump of dirt with the edges overflowing, and a big headwind is going to make a mess and the cost of cleanup or restoration is going to hurt.

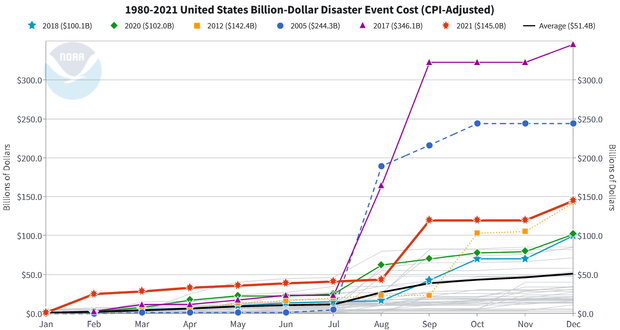

Climate extremes caused by fossil fuels are going to cost our economy trillions more. The number of events, the velocity, and length of time of those events are increasing and I believe they are increasing in exponential way. The costs of those events are going to be another detriment for any recovery.

Month-by-month accumulation of estimated costs of each year's billion-dollar disasters, with colored lines showing 2021 (red) and the previous top-5 costliest years. Other years are light gray. 2021 finished the year in third place for annual costs.

Damages from the 2021 disasters totaled approximately $145 billion. (All cost estimates are adjusted based on the Consumer Price Index, 2021). The costliest 2021 events were Hurricane Ida ($75 billion), the mid-February Winter Storm / Cold Wave ($24.0 billion), and the Western wildfires ($10.9 billion). Adding the 2021 events to the record that began in 1980, the U.S. has sustained 310 weather and climate disasters where the overall damage costs reached or exceeded $1 billion. The cumulative cost for these 310 events exceeds $2.15 trillion.

https://www.climate.gov/news-features/blogs/beyond-data/2021-us-billion-dollar-weather-and-climate-disasters-historical

The gap between "rich and poor" is increasing in a detrimental manner, yes a touchy political debate, but there is no debate that there are costs to the economic stability that has to be considered in with things like the RDI slope.

After these things, there is a myriad of other forces working against us on recovery or "bottoming out" of the market. Including the debt and credit problems. Defaulting on debt, whether it's student loans, car or house payments, it dings the credit scores and does nothing but cost more in interest, rent, and just about everything including the ability to support the demand side of equations and again has to be considered in things like the RDI and the rate of change or slope or trend. Bank stocks don't do to well either the bigger the problem gets.

In conclusion (for now) is that we have a very big storm brewing and it just has a little breeze at the moment. If all things were equal and "normal" I could give credence to a "bottom" here and feel comfortable comparing to other recessions, etc, but we are not equal nor "normal" and instead of comparatively some major detrimental event, we have multiple, harder force events, and a political upheaval to boot all to make it almost impossible to do anything but a short term rally if we get that. Yes there is definitely mm manipulation and will be more of that, more volatility, great for day trading, but not so good for the average investor. I have a real hard time seeing this manipulation as any major turning point in the market.

I think the next few months will be telling and many things can happen in that amount of time. There a lot of things that are not if but when, and I think the when is sooner than a lot of folks want to admit.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.