***CAUTION... Many of the stocks listed here are easily subjected to manipulation... http://sharesleuth.com/investigations/2018/03/pretenders-and-ghosts-stealth-promotion-network-exploits-financial-sites-to-tout-stocks

John Maynard Keynes once wrote, “It is safer to be a speculator than an investor in the sense that a speculator is one who runs risks of which he is aware and an investor is one who runs risks of which he is unaware.”

Don't forget to vote...something needs to change in this picture...We need change... for starters we do not need career politicians (aka brown noseing lap dogs that only vote the party line out of fear of not getting re-elected)...we need senators and congressman elected that are willing to represent their State and their people and know how to compromise... Congress needs to stop allllllllllllllllllllllllll these endless wars and take responsibility=vote if troops are needed ... Congress needs to stop letting the lobyist write 1000 page bills that they vote on before they read the bill (infact they sometimes aren't allowed to read the new bill unless they pass it). Pensions and health care need to be take away from Congress and Cabinet Members because they haven't been doing their job in the first place.

Your life and finances have been hijacked. Sold to the highest bidder. Your rights and ability to save and earn have been slowly eroded, picked apart by bankers, lobbyists, politicians and inflation. I've seen the slow decay firsthand. Since the turn of the century, the world has been changing...

International bankers have taken over the world's finances. They print as much paper currency as they want, conspire to manipulate global interest rates, launder money for rogue entities, and generally operate above the law.

Pensions are gone. Social Security will soon be gone. Costs keep rising for food, energy, health care, and other essentials.

But wages barely grow. If you can afford to save at all, investment fees, wild market swings, poor yield, and ever-increasing taxes eat away at what should be your nest egg...

Millions of people are starting to realize that the American Dream is a myth. That it's not those who work hard and obey the rules that get ahead, but rather those who make the rules, and change them as they see fit.

Debt is out of control. We fight trillion-dollar, multi-year wars the majority of people are against.

And now, they're treating citizens like criminals... The Patriot Act has erased your privacy and liberties. There are millions of cameras watching you — on every street corner and traffic light, in every airport, and silently from up in the sky. Your calls are monitored, your Internet traffic observed.

Those truly in charge — the banking elite who control the currency and exercise their will by pulling the strings of puppet politicians — continue to compound their wealth.

They placate a third of the country with handouts: nearly 50 million people are on food stamps, 10 million are on disability, and millions more are taking drugs prescribed for “depression.” The rest of us pay for it all with our hard-earned money and freedoms. We're the Outsiders. Nick Hodge... the OutSider Club

122 Things Everyone Should Know About Investing

The inflation pipeline has three stages. The first stage is the price of raw materials. The second stage is the price companies pay for raw materials (producer price inflation). The third stage is what companies charge consumers for their products (CPI inflation). It all starts with the direction of commodity prices. Strangely, that's the part that economists (and the Fed) pay no attention to. How can economists expect to predict the final stage of CPI inflation, if they ignore the first stage which is the direction of commodity prices? ...John Murphy StockCharts.com

https://wallmine.com/

http://www.stock1010.com/

http://www.valuewalk.com/stock-watchlists/

2018...Incredible Change Is Coming to the Business World

Now, there are opportunities like this unfolding in every sector of our economy right now.

In finance, it’s the emergence of blockchain and mobile payments.

In energy, it’s a shift to natural, sustainable, renewable energy that is local, storable and portable.

In transportation, it’s a shift to electric motors and self-driving cars, trucks, ships and planes.

In food, it’s a shift to local, organic and natural food and meal kits.

For retailers, it’s a shift to online shopping and brands that cater to the millennial generation’s preferences.

In building, it’s the coming use of building blocks and modules and 3-D printing.

Incredible change is coming all at once.

For investors who are open to investing in these changes in the business world, and who are in the right stocks, it’s a time of incredible opportunity. For those who stay invested in the old ways, and the companies whose technologies and products are based on the old ways, they’re going to lose their money as these companies are wiped out. https://banyanhill.com/business-world-revolutionary-change/

The Game in Wall Street and How to Play it Successfully ...by Hoyle...this is a tiny book copyright 1898. The sections on PANICS and Systems/Speculation are very good. Try to find some time to read it...

https://babel.hathitrust.org/cgi/pt?id="hvd.hb1j3s;view=1up;seq=48"

"...we shall adhere to our opinion that 95% of the business (trading) in Wall Street is part of a game.

We will show later that it is NOT A Game of Chance, but a GAME of SKILL."

"There is no business in the world that, win or lose, is so sure to wreck soul, mind and body, as is Wall Street speculation."

"...it seems to be the general opinion that anyone can rush into stock speculation and make a fortune. If this theory were true, if the amateurs could win as a rule ... If the public should take away more money from the Street than it brought, who would pay the expenses of the game? Someone must lose, and if it were the brokers and the pools they would shut up shop after a season or two."

(...I came to this same conclusion (see below) about 10 years ago..about Systems and opinions... kiy)

\

Markets are complicated. Market analysis is complicated. Developing a trading system certainly can be complicated. But trading cannot be complicated. The act of placing trades and evaluating results must be as streamlined and simplified as possible. Here are a few suggestions for things you can do today, without investing an enormous amount of time and energy, to improve your trading or investing. Chances are that you are already doing some of these things, but can you do them better?

1. Make sure you have an edge. I hate to keep coming back to this, but it matters. Furthermore, most things most people do don't actually work. Are you certain your methodology has a statistical edge in the long run? You will make two piles of money from your trades: money you win and money you lose. Are you certain the “money you will win” pile will be bigger? If not, develop and test a methodology until you have confidence in it.

2. Keep good records. Your broker statement is not adequate. You need good records of why you took a trade, what you saw when you took it (or what conditions triggered an entry), how the P&L developed, what decisions you made once you were in a trade, etc. Don’t make this a daunting task; if you create a system that is onerous you will not follow it, so you have to strike a balance.

3. Work on your process. Do you have an established process for finding new trades? What markets to look at, when, how, and what will trigger an entry? How about for evaluating existing trades? When to take partial profits, when to tighten stops, when to exit, when to add, etc.? You can’t be consistent unless you have a defined process you follow each and every time.

4. Think about how you evaluate your results. The conventional wisdom is that we should evaluate our winning trades, but that might not be right. Do you know how to tease out the impact of luck in your results? Do you know how to evaluate the stability of your edge? These things matter far more than looking at charts of winning and losing trades you made.

5. Work on yourself. Though I’m often critical of trading psychology (believing that correct trading has a much clearer impact on psychology than vice versa), there is no doubt that regular exercise, living from a conviction in the abundant bounty of the universe, working on impulse control, being connected to friends and family, and practicing conscious gratitude lead to a happier and healthier you. Consider adding some of these to your daily process, and always work to get better.

5 ways to improve your trading today was originally published on Adam H Grimes http://adamhgrimes.com/blog/

You are only as good as your next trade...Kiy

DAY TRADING IS HARD, an exceptionally difficult undertaking that requires diligence, skill, insight, discipline, flexibility, adaptability . . . . Please note: Kiy is a swingtrader and there is a very big difference between daytrading and swing trading and yes; daytrading is... and all trading is hard.

With Swing Trading you have velocity on your side & compounding... this blows buy and hold returns away... this is FACT. Consider the swings that have taken place. Thousands of points of potential opportunity... but you have to work for it.

Subjective vs. Objective....The truth is... we need to wait for an actual signal instead of jumping the gun and projecting our emotions/opinion into the data. You can then swing trade trying to capture +10-15% from oversold levels and if you catch a good trend you can get more...FAD-fanatics...Either you learn to be very objective (able to look at both sides in your assessment or you remain a member of the FAD-fanatics... A good way to break this addiction of the Fad-fanatic is practice= you argue for the BEAR when you're Bullish...argue for the Bull when you're Bearish...and objectivity starts to show...If you can't point to it on the PRICE Chart for everyone to see; you are being too subjective. Your Subjective feelings and emotions and egothinking have no place in trading...you are the weakest link if you bring these traits into your trading.

........................................................................................................................................................................................

5 simple rules:

-- Don't risk more than you can lose (I'm talking 100%, not some arbitrary stop)

-- Take half off if it doubles (so you can play with the house's money)

-- Don't be afraid to take a loss

-- Don't buy a falling knife

-- Don't fall in love

A key to trading is to wait patiently for a stock to pullback to a key technical or price support level. This will allow you to set a tight stop

while minimizing losses in case a trade goes against you.

***As a reminder, it is estimated that roughly 60%-70% of a stock’s movement over a 12-month period can be attributed to its post-earnings moves. From a trading perspective, this spells opportunity, particularly if one looks to position trade once the earnings report has come out.

Some RULES for this I-Hub Board...........You are totally responsible for your trades...

This board will be used for analysis of charts ranging in different time periods to determine signals for trading of various instruments=individual stocks and options. Please direct your comments towards technical indicators that everyone can see on a price chart: we are talking about signals and technical indicators here, not opinions or predictions or forecasts of when the next grand slam will be... share technical signals and charts with the group and if you have an active position...... Rather than being opinionated and letting your subjective bias determine which side of the market to be on, try to maintain objectivity based on technical analysis and the fundamental story of the stock. Intellect is the capacity for understanding, thinking, and reasoning, as distinct from feeling or wishing. The faculty of reasoning and understanding objectively, especially with regard to abstract or academic matters will serve you best.

One of the key items to remember as investors/traders is that the market doesn't always reflect reality. Oftentimes it reflects belief. And belief can prove to be a delusion. "A belief held without objective examples that everyone can see is a delusion."

“Opinion is that exercise of the human will which 'lets' us make a decision without objective information and objective examples.” And is not a choice that promotes a healthy process.

“Discussion is an exchange of knowledge; an argument an exchange of ignorance.”

If you don't know yourself; the Stock Market is an expensive place to find out...

It is no disgrace to be wrong... disgrace happens when you choose to stay wrong...

YES Symphonic...And You and I

Anticipation vs. Rewards: Is it in the Stock or in the Brain?

If you feel you must GAMBLE and encourage gambling from the 5 minute or lower time frames you will be asked to take your message to the "gamblers board"...If you feel you "must offer an opinion or off topic comment; please do it after trading hours. Charts and signals at signal lines is what we want...and If you feel you do not need to answer questions on this board ...then why are you here.

I-Hub's rules state: It is the burden of each poster to ensure that their posts do not contain content that qualifies them for removal. It doesn't matter if your post contains the cure to the common cold or the best stock tip since (fill in your favorite ticker here), if it contains other content that is a violation of the site's rules of conduct, then it qualifies for removal. ...

Thank You... Kiy...ki...theMatrix You are only as good as your next trade...Kiy

This release may contain "forward-looking statements" that are within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by certain words or phrases such as "may", "will", "aim", "will likely result", "believe", "expect", "will continue", "anticipate", "estimate", "intend", "plan", "contemplate", "seek to", "future", "objective", "goal", "project", "should", "will pursue" and similar expressions or variations of such expressions. ...

"I am tempted to say that stupid and drunk is another bad combination, but that would be disingenuous. It is after all one of the great combos that humanity has brought forth upon this big blue marble, right up there with high crimes and misdemeanors, drawing and quartering, and the biathlon (frozen snot rules). But stupid, drunk and posting? That's a losing trifecta, always has been and always will be." (...LOL...I won't say who posted this; found it on the "JailHouse Board...I've never been sent there...yet...)

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

RISK not... want not...

The key to trading anything is the recognition that you can control risk. Once you embrace that idea, the wild moves in stocks don't seem so random and unpredictable. You can handle them because you will cut your exposure when they don't cooperate. ....Nothing to it...right...?...

... it has been well said, humans think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." Extraordinary Popular Delusions and the Madness of Crowds ...Charles Mackay 1841

...as with anything in a market, anything can be real as long as enough people believe in it....(...comment from SeekingAlpha ...

(...next few links are for the bubble heads that don't understand Market psychology or their own psychology...

If you don't know yourself; the Stock Market is an expensive place to find out...

Argumentation theory...Argument from ignorance...Confirmation bias

Psycho-Therapy

Look What They Done to My Song

( ...and so...its a certainty that you can be fooled...its easy to be fooled...and it is even easier to FOOL yourself...kiy... Is it in the Stock or in the Brain?

Still a man hears what he wants to hear and disregards the rest

Fear, Uncertainty and Doubt (often shortened to FUD) is a disinformation strategy used in sales, marketing, public relations, talk radio, politics, religious organizations, and propaganda. FUD is generally a strategy to influence perception by disseminating negative and dubious or false information and a manifestation of the appeal to fear. While the phrase dates to at least the early 20th century, the present common usage of disinformation related to software, hardware and technology industries generally appeared in the 1970s to describe disinformation in the computer hardware industry, and has since been used more broadly.

... the fact is that quite frequently we behave as if controlled by little green men from outer space. We are the only species on the planet that is always at odds with each other, with practically all other species, and with the planet itself. We are the only species with wars, jails, ghettos and mental institutions, where we act and live worse than animals would anywhere. What have we done to ourselves as a species? What is the force that binds us to selfish deeds?

“Just look at us. Everything is backwards, everything is upside down. Doctors destroy health, lawyers destroy justice, psychiatrists destroy minds, scientists destroy truth, major media destroys information, religions destroy spirituality and governments destroy freedom.” -Michael Ellner It holds true that Humans aren't complicated they just complicate everything...it also holds true that Humans seem to have to go to extremes with everything before concensus asks to draw it in a bit to the middle road = seek some "balance" here people ...to an outside observer humans really do appear to be a bunch of YoYos...(Concensus in government seems to have come to a standstill...gridlock and laws come in packages of thousands of pages...perpetuates the insanity of the people in power ...and they think they're "Normal"...this isn't normal...why aren't there more humanitarians in congress...more mothers in congress...can't just have a bunch of people with law degrees that says they can argue any point about anything to absurdity...just look at who's running for president...just look at who's president 2017...more of the same or outright insanity...that's some great choices YOU PEOPLE have made... isn't it...so don't forget to vote... In philosophy, "the Absurd" refers to the conflict between (1) the human tendency to seek inherent value and meaning in life and (2) the human inability to find any. In this context absurd does not mean "logically impossible", but rather "humanly impossible". ===============================================================================================================================

Bubbles

According to Grantham, "Investment bubbles and high animal spirits do not materialize out of thin air. They need extremely favorable economic fundamentals together with free and easy cheap credit, and they need it for at least two or three years. Importantly, they also need serial pleasant surprises in such critical variables as global GNP growth."

If BUBBLES, Fads, and Mania are a human characteristic (mass hysteria collective obsessive behavior)...Humans be very flawed...Kiy...

\

What would a panic sell of Bitcoin look like...?... A bunch of people trying to get their money back from nowhere. BitCoin...?...Sh!tCoin...?...

"I may be a little bit over exposed, I am using a little bit of spidey sense, instincts etc. and I do not like doing that with the math based monkey brain attatched in my head..." (LOL...:) ...from The 2-1/2 Minute Warning

Some comments from ZeroHedge: Crypto Currency...

Oh, you mean that so called currency based on nothing more than some electricity-wasting calculations? Now that's a real storage of value "=) Seriously... whatever it is you buy, make sure it's something tangible and has actual worth. When this illusion we're living under finally collapses, necessity will demand real things... not empty promises. SPEAKING of RAGING BULLS

Risk management has been completely thrown out the window. Big money is doing this. Retail traders can't drive markets like this. Absolutely stunning. The only way to participate is to chase. Laggards aren't worth buying. That which under performs bull markets will over perform in a bear market to the downside. The decade of easy money is finally exploding the bubble. It is truly a sight to behold. The eventual implosion will end empires. ...Circlem Jan. 2018

Gold/Silver Ratio When empires are about to fail, war looks like a great alternative to fool the masses as to what is really going on. Currency Wars, Trade Wars and Shooting Wars...

On the Madness of Crowds..."Once the crowd gains momentum in the direction of stupid, there is no stopping it." not so famous quote by some guy...Circlem

Bitcoin is going up in price, not in value.

Goldman’s Sharmin Mossavar-Rahmani and Brett Nelson write. They note cryptocurrencies already dwarf both the dot-com bubble and the notorious Dutch “Tulipmania,” a period where tulip bulbs became a prized commodity between 1634 and 1637 and prices went haywire.

Goldman’s Sharmin Mossavar-Rahmani and Brett Nelson write. They note cryptocurrencies already dwarf both the dot-com bubble and the notorious Dutch “Tulipmania,” a period where tulip bulbs became a prized commodity between 1634 and 1637 and prices went haywire. The bubble logic driving tulipomania has since acquired a name: “the greater fool theory.” Although by any conventional measure it is folly to pay thousands for a tulip bulb (or for that matter an Internet stock, ...a BitCoin), as long as there is an even greater fool out there willing to pay even more, doing so is the most logical thing in the world.

– Michael Pollan, The Botany of Desire: A Plant’s-Eye View of the World (2001)

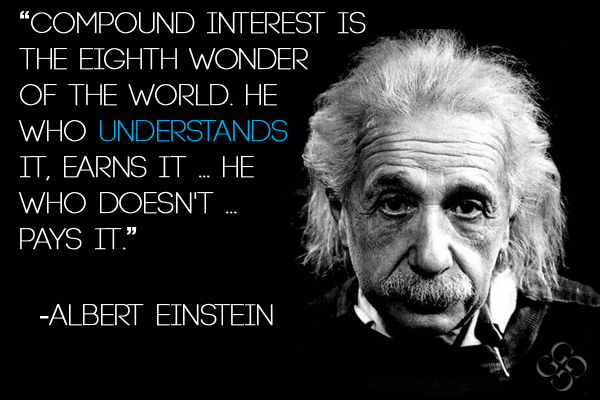

Albert Einstein http://quoteinvestigator.com/2011/10/31/compound-interest/

Create Half a Million $ With $5 a day

https://medium.com/mcubedblog/create-half-a-million-with-5-a-day-ec73d56f7055

Literally everyone can build wealth the tried and true way.

The S&P500 Index, one of many indicator of stock market performance (by tracking big US businesses), averaged 9.5% annual returns from 1928 to 2015

Now let’s take our $5 a day, which adds up to to $1,825 a year, and put it into an S&P500 or total stock market index or mutual fund. Which just means it should have similar performance, over the long term, as the S&P500’s 9.5% annual returns. We contribute this $5 a day in weekly or monthly chunks (this is important).

You start to accrue both the money you contributed, that $5 a day, and the 9.5% a year returns. Then those contributions and the returns, plus the second year’s contributions, earn another 9.5%. And so on and so fourth. This won’t be the exact case for the year 1 and year 2, because the stock market is SUPER unpredictable in the short term. But in the long term, you can expect decent returns.

After 25 years, we can reach over $180,000 dollars. Your contributions of $5 a day, only make up 1/4 of that total sum. 75% of that is JUST EARNINGS.

After 35 years, we can reach half a million dollars. Can you spare $5 a day for a $500,000 payday? 87% of that is purely earnings!

(There are more examples like these on the S&P board Intro page...)

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Henry David Thoreau famously stated in Walden that “the mass of men lead lives of quiet desperation.” He thinks misplaced value is the cause: We feel a void in our lives, and we attempt to fill it with things like money, possessions, and accolades.

Henry David Thoreau famously stated in Walden that “the mass of men lead lives of quiet desperation.” He thinks misplaced value is the cause: We feel a void in ourlives, and we attempt to fill it with things like money, possessions, and accolades.

Art isn’t all fairytale photoshoots and landscape shots – it can also act as catalyst of change. And Steve Cutts thinks that many things in the world should be different. Work shouldn’t be a grinding, soul-crushing rat race for the almighty dollar. Consumerism shouldn’t hold a vice-like grip on our lives. And social media, well, we need to throw-off the shackles we so eagerly put on ourselves. Wouldn’t life be better then?

Wish You Were Here ...Comfortably Numb .... Hey You

.... Brain Damage "There's someone in my head, but its not me"...(Recall what was said about ego) ..... Us and Them....

WE Are Borg...you will be assimilated...

Elon Musk and AI experts urge U.N. to ban artificial intelligence in weapons

Earlier this year, Elon Musk unveiled details about his new venture Neuralink, a California company that plans to develop a device that can be implanted into the brain and help people who have certain brain injuries, such as strokes. The device would enable a person’s brain to connect wirelessly with the cloud, as well as with computers and with other brains that have the implant.

The end goal of the device, Musk said, is to fight potentially dangerous applications of artificial intelligence.

“We’re going to have the choice of either being left behind and being effectively useless or like a pet — you know, like a house cat or something — or eventually figuring out some way to be symbiotic and merge with AI,” Musk said in a story on the website Wait But Why.

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Trading Notes

Swing trades= Always trade in the direction of the daily bias even for short term trades...if you really feel you must trade against the daily bias...you need a hair trigger...get out quick if the position moves against you.

Remember...What you're looking at on an intraday chart is a daily candle or OHLC price bar "uncompressed" from the daily chart. Kind of a "micro" view of the Macro daily chart...and daily chart would be a micro view of the weekly chart's price bar...

Front Running a Daily chart signal (...The 60 minute chart will lead daily chart signals when daily CCI is getting ready to come out of oversold/overbought levels...it just takes patience to get the timing..) This way; rather than only trade the intraday cycle you can use the intraday charts to front run a daily CCI signal. When the Daily CCI is ready to move out of oversold or overbought... your goal eventually is to catch a trade from intraday that carries over onto the daily chart. It just takes some practice and patience becoming comfortable with the CCI cycles= Intraday/Daily/(Weekly) and as these cycles sometimes line up together= synchronized you may consider a larger position. Best trades will be trades that are trading in the same direction as the daily chart's bias...=Commodity Channel Index CCI 20 points the way...

There is a "Method to the Madness of Crowds" and you can find it and define it on the charts...Technical Charting takes away some of the fear/doubt in trading... and then all you need is patience while waiting for the chart to tell you when the bias/momentum/sentiment turns...listen to signals at signal lines(simple enough...yes?...)...

MOMENTUM...looking at the price chart below; the technical indicators above the price bars are momentum indicators...buy low/sell high...oversold/overbought "relative" to what = CCI 20...%B...Stochastics...and ULT are all about "PRICE" MOMENTUM. Technical indicators "indicate"... "point direction" they are best read when the indicator is at one of it's "signal" lines and when price is at certain price levels such as Support/Resistance lines.

Stochastics is an important indicator, learn all you can about this one. Developed by George C. Lane in the late 1950s, the Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. According to an interview with Lane, the Stochastic Oscillator “doesn't follow price, it doesn't follow volume or anything like that. It follows the speed or the momentum of price. As a rule, the momentum changes direction before price.” As such, bullish and bearish divergences in the Stochastic Oscillator can be used to foreshadow reversals. This was the first and most important, signal that Lane identified. Lane also used this oscillator to identify bull and bear set-ups to anticipate a future reversal. Because the Stochastic Oscillator is range bound, it is also useful for identifying overbought and oversold levels. (StockCharts.com)

Regression to the Mean/Mean Reversion is the most powerful law in financial physics

Talking about PRICE here... Mean reversions out of extremes are the most powerful and profitable forces in all the financial markets. Riding one has enormous benefits for your wealth. Financial-market prices and sentiment are like a giant pendulum. The farther they are pulled to one extreme by excessive greed or fear, the farther they necessarily swing to the opposite extreme in the subsequent mean reversion. Like pendulums, these reversions don’t magically stop right in the middle at normal again. Their kinetic momentum carries them through to the opposite ends of their arcs. But overshot extremes don’t last for long, as the universal greed necessary to fuel them quickly burns itself out.

The Market is a giant feedback loop, showing traders (and anyone who views the market) a thermometer reading of the social mood under which traders, and by extension society, are operating. Most traders seem to think of the market as something that has some external value outside of the price attributed to it by traders. I prefer to think of it as a real-time gauge of a society’s view of their own productive capacity…or more simply put–social mood. When Markets are understood, the idea that everyone can make money is not only inaccurate but impossible and laughable. Everyone making money means there is no market, because who would be willing to take the other side of the trade? In addition, most traders feel they can move with the crowd to make a (paper) profit, and then get out before the crowd, turning that trade into a real profit. In theory this is sound, but remember everyone else is setting out to do the same thing. It is this crowd movement which allows traders to make money at times. Without a large portion of traders coming to the same decision markets simply would not move. It takes conviction by many traders to create a trend, then it takes euphoric acceptance that “this is the new norm” to end it and “bend it. ” It then takes mass disillusionment to crash it the other way. (vantagepointtrading.com)

Note how important the 50 day average is as the 10day average is trying to decide to move above or below the 50 day average... It can be this easy... maybe now you are an expert, but don't know it. Test it... You can look back at a chart from 5years ago or look at this chart 5years from now...I will not have to change any parameters on this chart and all the definitions above will remain the same... (please note: these colored price bars are part of the Elder's Impulse System which is based on two indicators, a 13-day exponential moving average and the MACD-Histogram. The moving average identifies the trend, while the MACD-Histogram measures momentum. As a result, the Impulse System combines trend following and momentum to identify tradable impulses. This unique indicator combination is color coded into the price bars for easy reference. I (Kiy) have added some speed to it with the use of the 10day moving average (also the 10day average relates to the Grail averages and it just so happens the colored price bars work very good with the 10day average also.) And (Kiy) does not use MACD for momentum, I like Stochastics....I leave it to you to use the link above to see how Dr. Elder interprets the colored price bars.) (...Any way you look at the colored price bars; they are very helpful...better than Candlesticks ; you can test it and learn.) Next...Note the last graph on the above chart, below the On Balanced Volume indicator... Note how the price bars change color when price closes above or below the 10 day average. Maybe a green price bar is telling you to buy because a potential trend may form; maybe a green price bar is saying don't sell...maybe = its saying both buy-don't sell ... Maybe a red price bar says sell or maybe its saying don't buy... maybe both... Maybe a blue price bar is neutral about Direction/Trend; maybe its saying to listen to the last green or red price bar on the price chart...?... The stickie note "Sectors" ...Daily charts... has a long list of charts based on the technical indicators noted above: https://investorshub.advfn.com/boards/read_msg.aspx?message_id=141247347 "Trader's Sentiment Indicators" *$*$*$*$*Markets are not about beliefs, but about sentiment. And, if you can track sentiment, If you can measure sentiment... then you are in a position to make your investment account grow without the need for excuses. (...this really is all you need to know about the Markets; ... SENTIMENT On the above chart...look at the indicators starting with VOLUME... I use these indicators as SENTIMENT INDICATORS... ...Volume=volume speaks volumes...Accumulation/Distribution... Money Flow Index (MFI) is also both a momentum and sentiment indicator...On Balanced Volume (OBV)...(and on an intraday chart VWAP=Volume Weighted Average Price which I consider both a MOMETUM and SENTIMENT indicator ...from Wikipedia The VWAP can be used similar to moving averages, where prices above the VWAP reflect a bullish sentiment and prices below the VWAP reflect a bearish sentiment. Traders may initiate short positions as a stock price moves below VWAP for a given time period or initiate long position as the price moves above VWAP. Institutional buyers and algorithms will often use VWAP to plan entries and initiate larger positions without disturbing the stock price.) The crowd is always taking action...The sentiment indicators are telling you what the "crowd" is doing/thinking... These Sentiment Indicators "indicate"... "point direction" (it really is ALLLL about UP/Sideways/DOWN...) Sentiment indicators are best read when price is at certain price levels like Support/Resistance Lines or at certain Moving Average Lines like the 10day, 20day and 50day moving average. Markets are not about beliefs/opinions, but about sentiment. And, If you can measure sentiment... then you are in a position to make your investment account grow without the need for excuses. (...this really is all you need to know about the Markets... and it should be carved in stone...kiy) (https://seekingalpha.com/article/1719142-how-should-you-trade-silver-with-all-the-manipulation) (note Kiy; does not advocate Elliot Wave) Investors focus on a wide range of measures to gauge the current state of the stock market. Financial analysts generate elaborate financial models. Technical analysts interpret charts and complex indicators. Quant investors design intricate algorithms.

Each of these approaches is legitimate in its own right. But each ignores the elephant in the room: market sentiment.

Maybe that's because market sentiment is hard to quantify, making it the red-headed stepchild of market analysis.

But in the real world, market sentiment often matters more than a market's fundamentals. https://www.investmentu.com/article/detail/58940/end-of-bull-market-does-not-feel-like-this?src=email#.WuAAJhvRWUs |

...You are now an expert... Enjoy good trades...And always...Give a little back to a good cause. ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

https://wallmine.com/ http://www.stock1010.com/ https://scan.alpaca.ai/symbol/SLV/

http://www.stockta.com/

http://www.buyupside.com/sample_portfolios/lithium.php

**** https://www.biopharmcatalyst.com/calendars/fda-calendar FDA Calender

https://www.tipranks.com/stocks/fcx Price Target

https://finbox.io/fcx fair value

https://swingtradebot.com/equities/FCX

https://www.google.com/finance?q=FCX&ei=6p84WZm8E9aMjAHSlLTYDg

Fair Value (fv) estimates are from https://financhill.com/search/valuation/GG

http://oracledispatch.com/

http://wealthyventurecapitalist.com/

www.insidercow.com What is a Pump-and-Dump Scam

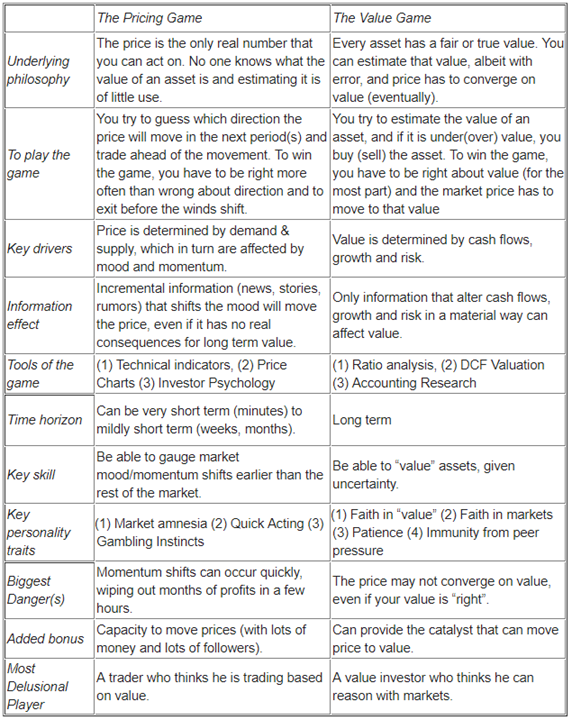

Speculation Stocks ...just KNOW that you're Speculating and not investing... and you just don't buy a stock because you think it will go up in price; buy it because it's worth more than the price at the time, based on fundamentals and growth prospects

https://swingtradebot.com/equities/most-tracked

There isn't a day that goes by on Wall Street when certain stocks trading for under $10 a share don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and solid risk management are banking ridiculous coin on a regular basis. Roberto Pedone... Street.com

Color Code of stock symbols/letters....MVIS (T/$3.50H-4.50) example MVIS letter colors "red" indicate the stock price is moving down and all the letters are boxed in with green= oversold oversold MVIS=MVIS and you should be looking/considering a long position...(T/$3.50H-4.50) and someone has put a $4.50 price target on it. (..."T"=target price...the "H" indicates the target price has been hit...

Colors are based on reading the CCI 20 (Commodity Channel Index signal lines) ... if "letters" are colored =Green =UP...Red=down...lighter colors = less confident in direction...if letters/stock symbols are Boxed in=Green =oversold=anticipate an "UP" cycle for the CCI 20 indicator or a mean reversion price bounces = at least to centerline within the Bollinger Bands 20,2= the 20 day moving average... and if the box is red=Red=overbought=anticipate a "DOWN" cycle...

§=Reverse of a Signal line(focus is mainly the CCI centerline...overbought line +100 and oversold line -100)(The CCI signal lines))... ¥= first stock to turn UP/Down after the Group/Sector has been overbought/oversold. Stocks that have a "Target" price are the better choice for a trade...example...MVIS (T/$3.50H-4.50) a target price with an "H" behind it says the target was "hit" since the target price was added...here MVIS has a second target price of $4.50...so if you find MVIS oversold you can consider a long position if you are comfortable with the width of the Bollinger Bands and the target price will give you 10% or more profit... remember this; PRICE= %B and CCI they indicate very much the same and they represent price within the parameters of the Bollinger Bands (box Price in, inside these Bollinger Bands. The %B tends to lead the CCI signals (a little)... ***BAC (T/$24H-26H-30H-35) light blue color is 2017 price targets that where hit=H A few of the more interesting ETFs/Sectors http://www.direxioninvestments.com/products/direxion-daily-sp-500-bull-3x-etf?gclid=CPPB6bX5-s0CFRSUfgodGfQGMA ...Candle Glance Charts= click on the ETF's symbol and you'll get a set of the largest holdings 10-12 stocks in that ETF. FINANCIAL Rising bond yields are good for financials like banks and insurers, but are bad for bond proxies like utilities (and REITs). 03/15... The Fed hiked rates today as expected, with expectations for two more hikes this year. Judging from immediate market reactions, the Fed announcement is being viewed as somewhat dovish. For one thing, bond yields are dropping. With yields falling, bond prices are having a strong day. Junk bonds, which have been correcting lately, are especially strong. That's also positive for stocks. Rate sensitive stock groups like utilities and REITs are leading a strong market response. Falling yields, however, are weighing on bank stocks. The dollar is also dropping. XLF CandleGlance BRK.B,*JPM,WFC, ,C ,SPG,USB,CB,*AIG,*GS,*BAC  XLK CandleXGlance AAPL,MSFT,FB,T,GOOGL,GOOG,VZ,INTC,***CSCO(T/$ 40H-43H-45H-48-52)... ***HDP (T/$21H-24) .. SGH (T/$21H-33H-40H 40H-50H-55H-75 ) ...V ...REW ...2xBear... TECS ...3xBear

XLK CandleXGlance AAPL,MSFT,FB,T,GOOGL,GOOG,VZ,INTC,***CSCO(T/$ 40H-43H-45H-48-52)... ***HDP (T/$21H-24) .. SGH (T/$21H-33H-40H 40H-50H-55H-75 ) ...V ...REW ...2xBear... TECS ...3xBear Short Technolgy

Short Semiconductors

SMH CandleGlance Semiconductor ...AMD 04/2018 ***AMD(T/$11H-13H-15H-17H),MVDA,CY(T/$15H-18H-20-23),IDTI,IPHI,MPWR,MU,MXIM,TXN,

SMH CandleGlance Semiconductor ...AMD 04/2018 ***AMD(T/$11H-13H-15H-17H),MVDA,CY(T/$15H-18H-20-23),IDTI,IPHI,MPWR,MU,MXIM,TXN,

http://www.buyupside.com/sample_portfolios/semiconductorsmems.php SMH

10-12

*STM (T/$18H-26H)...INTC (T/$40H-47H-55H-62)...AMD 04/2018 ***AMD (T/$11H H-13-15-17) ... ***MRAM (T/$14H-18H-1013-15)Potential Double ... ***RESN (T/$8H-6 -8)...... **ICHR (T/$24H-28H-30H-35-38-40-42)... UCTT... ***IOTS (T/$10-12) ...LSCC (T/$7-9) COHU (T/$24H-28-31) ... CY (T/$14H-15H-18-20) .***AXTI (T/$10H-8-10-12)...AMSC (T/$6H-7.50) ...

*ASYS (T/$

8H-12H-13.50H -8H-10H-13-15-18) equip...

A.I. ***XLNX (T/$ 70H-75H-80)... INTC (T/$54H-57-60-64) ... QUIK (T/$2.5)...

07/25****

07/25****AMD 04/04/2018 Target $13...(T/$11-13.50)

*SKYY CandleGlance Cloud Computing ...AKAM,*ORCL(T/$55-60),EQIX,NTAP,AMZN,CSCO,OTEX,JNPR,FB ...  ***AMBR (T/$10H-12-14)...

***AMBR (T/$10H-12-14)...June 21, 2018...There’s a lot to be optimistic about in the Technology sector an analyst just weighed in on Amber Road (NYSE: AMBR) . Stifel Nicolaus analyst Tom Roderick maintained a Buy rating on Amber Road (NYSE: AMBR) today and set a price target of $14. The company’s shares closed yesterday at $9.80, close to its 52-week high of $10.29. According to TipRanks.com, Roderick is a 5-star analyst with an average return of 18.7% and a 72.0% success rate. Roderick covers the Technology sector, focusing on stocks such as Nuance Communications, Salesforce.com, and Everbridge Inc.

Amber Road has an analyst consensus of Moderate Buy, with a price target consensus of $14. Amber Road, Inc. provides cloud-based global trade management (GTM) solutions in the United States and internationally. The company's GTM solutions include modules for logistics contract and rate management; supply chain visibility and event management; international trade compliance; and global knowledge trade content database, supply chain collaboration with overseas factories and vendors, and duty management solutions to importers and exporters, nonvessel owning common carriers (resellers), and ocean carriers. It provides its solution to various industries, including chemical/pharmaceutical, high technology/electronics, industrial/manufacturing, logistics, oil and gas, and retail/apparel through a software-as-a-service model.

\

DTRM (T/$3.50H - 1.50-3.00) ****YEXT (T/$14H-14H-16H-18H-21H) 4 brokers like this stock....Yext, the company only held its initial public offering in April2017. However, Yext could be one of the best up-and-coming AI stocks around. Yext's key product is a knowledge engine platform that lets businesses manage their digital knowledge in the cloud and sync that knowledge to over 100 services, including Bing, Cortana, Google, Google Maps, and Siri. The company calls this "digital knowledge management" and touts its ability to enable businesses to facilitate face-to-face and digital interactions with customers that boost brand awareness and lead to higher sales. Mar. 8th https://seekingalpha.com/article/4155001-yext-still-giving

DTRM (T/$3.50H - 1.50-3.00) ****YEXT (T/$14H-14H-16H-18H-21H) 4 brokers like this stock....Yext, the company only held its initial public offering in April2017. However, Yext could be one of the best up-and-coming AI stocks around. Yext's key product is a knowledge engine platform that lets businesses manage their digital knowledge in the cloud and sync that knowledge to over 100 services, including Bing, Cortana, Google, Google Maps, and Siri. The company calls this "digital knowledge management" and touts its ability to enable businesses to facilitate face-to-face and digital interactions with customers that boost brand awareness and lead to higher sales. Mar. 8th https://seekingalpha.com/article/4155001-yext-still-giving  HACK Cyber Security... IMPV,QLYS,JNPR (T/$24H-28H),SAIC,FTNT,CSCO, CHKP... *** FEYE (T/$16H-18H-20-23) http://www.buyupside.com/sample_portfolios/cybersecurity.php *CYBR(T/$42H-48H-55H),TMICF,PFPT,AVG...

HACK Cyber Security... IMPV,QLYS,JNPR (T/$24H-28H),SAIC,FTNT,CSCO, CHKP... *** FEYE (T/$16H-18H-20-23) http://www.buyupside.com/sample_portfolios/cybersecurity.php *CYBR(T/$42H-48H-55H),TMICF,PFPT,AVG...

Posted

July 20, 2018 at 8:00PM ...

Jason Simpkins There’s been a lot of talk about hacking this week. America was once again reminded that Russia launched a dangerous cyberattack on our democracy in 2016. But I’m not here to talk politics. I’m here to talk

profits.

Last week, the special counsel appointed to investigate election interference indicted 12 Russian spies, accusing them of hacking into two Democratic Party computer systems.

These Russian spies are part of GRU — Russia’s military intelligence agency. And to achieve their goal, they set up an entire company that employed hundreds of people. It had a budget of $1.25 million per month. It used information (Social Security numbers and birth dates) stolen from U.S. citizens to create fake online personas, like Guccifer 2.0. And it used a virtual private network to disguise its location. This “cyberarmy” infiltrated computer networks at the DCCC and DNC, where it secretly monitored the activity of dozens of employees. It also planted hundreds of files containing malicious computer code to steal passwords and data. That is how sophisticated, how complex, and how well-funded these operations are. And there’s dozens more just like it.

China has a cyberarmy, too. It’s called ‘Unit 61398’. Beijing uses it to spy on political rivals (the United States) and steal trade secrets and technology from companies like Apple and Samsung. In fact, in June, Chinese hackers gained access to U.S. submarine plans after hacking a U.S. Navy contractor’s computer.

But now, here’s the really scary thing: You don’t even have to be a professional to be an effective hacker. Earlier this month, it was revealed that an

amateur hacker stole U.S. military information about combat drones…

and they weren’t even trying. They simply used what

Wired magazine called a “dumb security flaw.” Yet they were able to access top-secret documents stored on Air Force computers and then put that information up for sale on the dark web for a couple hundred dollars. If this person had been targeting this information, or had known what it was they found, they would have charged way more for U.S. military secrets!

When you consider all that, it can’t come as a surprise that

cybersecurity stocks are going gangbusters — doubling the return of the overall market. Indeed, cybersecurity stocks (as tracked by the ETFMG Prime Cyber Security ETF) have returned 30% over the past year —

double the return of the S&P 500. It’s also no coincidence that we’re just a few months shy of the one-year anniversary of the Equifax hack — one of the largest data breaches ever, affecting 145.5 million people.

In fact, corporate entities are even more at risk than governments.

**05/14 REPORTS SPCB (T/$5) Jan. 8th ...crypto services, allows users to load funds into their SuperWallet mobile application through a credit card and bank account or by providing cash at any supporting top-up location or agent. SuperPay's Bitcoin and cryptocurrency capabilities in development will allow users also without a bank account or credit card to load and receive funds and then use those funds to purchase Bitcoin, Ethereum and other cryptocurrencies. They will also be able to sell their cryptocurrency through the suite. https://finance.yahoo.com/news/supercom-develop-bitcoin-other-cryptocurrency-140000884.html

***NXTD NXTD (T/$5H-6H -5) SOUNDS LIKE BIG POTENTIAL HERE...BUT WHAT HAPPENED TO PRICE???Nxt-ID, Inc., a security technology company, engages in the development of products and solutions for security, healthcare, finance, and Internet of Things (IoT) markets....

***NXTD NXTD (T/$5H-6H -5) SOUNDS LIKE BIG POTENTIAL HERE...BUT WHAT HAPPENED TO PRICE???Nxt-ID, Inc., a security technology company, engages in the development of products and solutions for security, healthcare, finance, and Internet of Things (IoT) markets....NXT-ID, Inc. (

NXTD) a provider of payment, credential management, and authentication platform services and Fit Pay, Inc., its wholly owned subsidiary,...Jan. 8th, 2018 NXT-ID, Inc. and Fit Pay, Inc. will demo the FitPay Payment Platform

™, the

company's proprietary technology platform that adds contactless payment capabilities to wearable and IoT devices. FitPay recently announced that Garmin Pay™, a contactless payment capability on the Garmin vívoactive 3 smartwatch that is powered by the FitPay Platform, is now live.Management will also highlight with attending media its recently announced

strategy to extend the FitPay Payment Platform to cryptocurrency holders. On December 20

th, Fit Pay, Inc. and Cascade Financial Technology Corp announced an agreement for the joint development of a platform that gives cryptocurrency holders the ability to use the value of their currency to make purchases at millions of retail locations worldwide. The new platform will enable devices with stored value exchanged from cryptocurrency to be used for traditional payment transactions.

May 23/2018 another parent

https://finance.yahoo.com/news/nxt-id-announces-issuance-us-120000094.html  Global Internet Of Things According to researchers, the global market for IoT in 2020 is going to be worth $373 billion in terms of sales. Hardware will account for 52% of sales — devices ranging from personal wearable technology to smart homes to connected cars. The remaining 48% will pour in from the software and analytics required to turn the copious amounts of data generated by hardware into usable information. Leading market research firm IDC forecasts China to spend $128 billion on IoT by 2020. India’s spending will come in around $10 billion to $12 billion by 2020. And forecast sales for the Middle East and Africa are at $11 billion by 2019.

Global Internet Of Things According to researchers, the global market for IoT in 2020 is going to be worth $373 billion in terms of sales. Hardware will account for 52% of sales — devices ranging from personal wearable technology to smart homes to connected cars. The remaining 48% will pour in from the software and analytics required to turn the copious amounts of data generated by hardware into usable information. Leading market research firm IDC forecasts China to spend $128 billion on IoT by 2020. India’s spending will come in around $10 billion to $12 billion by 2020. And forecast sales for the Middle East and Africa are at $11 billion by 2019.

SNSR CandleGlance Global Internet Of Things...SWKS,GRMN,ST,BRCD,DXCM,JCI,SLAB,BDC,IDCC,ADI ... **OTIV (T/$ 2.50H-2.00-2.50)... cashless payment and management requirements for the Internet of Payment Things (IoPT), wearables, automated retail and petroleum markets. crypo...

SNSR CandleGlance Global Internet Of Things...SWKS,GRMN,ST,BRCD,DXCM,JCI,SLAB,BDC,IDCC,ADI ... **OTIV (T/$ 2.50H-2.00-2.50)... cashless payment and management requirements for the Internet of Payment Things (IoPT), wearables, automated retail and petroleum markets. crypo...

NDCVF ...SWIR...PTC.. SFE..

***

HDP (T/$13H-19H-21-23-25) In addition to its Hortonworks Data Platform (HDP) for processing stored data (data at rest), the company also has a relatively new product called Hortonworks DataFlow (HDF) specifically geared toward the Internet of Things. HDF collects and processes purchase, sensor, and asset data in real time and feeds this information into either a data lake for analysis or directly into streaming applications. In its most recent quarter, Hortonworks installed HDF in eight of its 10 largest new deals, showing that the platform has a lot of promise and that large enterprises are investing in IoT solutions. Hortonworks certainly looks to be in good position to capture its share of the IoT wave.  .*****IOTS (T/$5H-7H-10-12) ultra low power (flash) memory., trademark resistive RAM technology called Conductive Bridging RAM (CBRAM®). CBRAM® is a breakthrough technology platform that enables 100 times less energy consumption than today’s flash memory technologies as well as delivering enhanced performance. Visit: http://www.adestotech.com

.*****IOTS (T/$5H-7H-10-12) ultra low power (flash) memory., trademark resistive RAM technology called Conductive Bridging RAM (CBRAM®). CBRAM® is a breakthrough technology platform that enables 100 times less energy consumption than today’s flash memory technologies as well as delivering enhanced performance. Visit: http://www.adestotech.com

PRNT 3D Printing Jan 2017 International Data Corporation (IDC) Worldwide Semi-Annual 3D Printing Spending guide is predicting that the rapid expansion of the 3D printing industry is expected to continue without slowing down. According to the IDC analysts, global revenues for the 3D printing market will explode to a massive $35.4 billion by the year 2020. With 2016 revenues expected to reach $15.9 billion which means the industry could nearly double within the next five years. http://www.marketwired.com/press-release/3dx-industries-metal-printing-division-positioned-for-assertive-growth-in-2017-otcqb-dddx-2189898.htm

http://www.buyupside.com/sample_portfolios/3dprinters.php

DDD 3D Systems (T/$13H -H10H-13H-15H-18),

DDD 3D Systems (T/$13H -H10H-13H-15H-18),  SSYS (T/$24H-19H-21H-23H) Stratasys ...

SSYS (T/$24H-19H-21H-23H) Stratasys ...  XONE ..ExOne... VJET (T/$6H -6) Voxeljet ...

XONE ..ExOne... VJET (T/$6H -6) Voxeljet ...  .............MTLS Materialise Sftwre Services... **ONVO (liver tissue)(late 2019) HPQ (T/$22H-24H-26-28)sftwre ...HP introduced their new line of Multi Jet Fusion 3-D printers that are available for the public to buy; ironically enough, these printers have been used to produce a number of components to build their “regular” printers.

.............MTLS Materialise Sftwre Services... **ONVO (liver tissue)(late 2019) HPQ (T/$22H-24H-26-28)sftwre ...HP introduced their new line of Multi Jet Fusion 3-D printers that are available for the public to buy; ironically enough, these printers have been used to produce a number of components to build their “regular” printers.  PRLB A unique company in the 3-D printing industry is Proto Labs Inc. (NYSE: PRLB). What makes it unique is that it doesn’t actually make and sell printers. Its business model is making prototypes and test models of products for other companies.

PRLB A unique company in the 3-D printing industry is Proto Labs Inc. (NYSE: PRLB). What makes it unique is that it doesn’t actually make and sell printers. Its business model is making prototypes and test models of products for other companies. Proto Labs has quietly been doing very well over the past year, as its stock has generated a return of about 140% during that time. And even though 3-D printing revenue growth has slowed in the past couple years, Proto Labs has been seeing double-digit sales growth. In fact, its

sales growth for 2018 is expected to be 27%, which would be its highest growth since 2014.

The reason I bring PRLB up is that it could be used as a proxy for demand in the 3-D printing industry. If a lot of companies are making orders for 3-D printing-based models for product prototypes, it suggests that the demand for the technology is still there. The process of creating prototypes and models, what’s known as the product development stage, seems to be the sweet spot for using 3-D printing technology right now, and if the demand is there, we could be seeing a rebound in industry-wide growth starting in the next year or two. This suggestion could be backed up by comments from management of companies around the world that seem very bullish about 3-D printing. In a survey done by Sculpteo, a French 3-D printing company, about 1,000 companies from 62 countries around the world that use 3-D printing as part of their business operations gave their take on the technology. About 90% of the companies said that they consider it an advantage over their competitors that don’t use it. Even better, 72% of the companies said that they expect to spend more on the technology in 2018 than they did in 2017, even after their average budget for 3-D printing technology grew by 55% in 2017.

IYZ Telecom... The deployment of 5G connectivity It’s different than the now-common 4G connectivity that powers your smartphone in that even as fast as 4G is, only one connection per radio frequency can be made at a time. With fifth-generation signals, the network understands and manages the high-speed connections being made at any given time by a massive number of devices, allowing them to share radio frequencies with minimal degradation of their connection speed. That’s how 5G connections will effectively be up to three times faster than 4G connections are. 5G connectively is in its infancy, however, only being tested in real-world settings rather than sold as an outright feature for wireless phone subscribers. Wireless telecom carriers know, however, the real opportunity in 5G is in providing the backbone for the radio-based connections the real rise of IoT will require. It’s coming though, and soon.

IYZ Telecom... The deployment of 5G connectivity It’s different than the now-common 4G connectivity that powers your smartphone in that even as fast as 4G is, only one connection per radio frequency can be made at a time. With fifth-generation signals, the network understands and manages the high-speed connections being made at any given time by a massive number of devices, allowing them to share radio frequencies with minimal degradation of their connection speed. That’s how 5G connections will effectively be up to three times faster than 4G connections are. 5G connectively is in its infancy, however, only being tested in real-world settings rather than sold as an outright feature for wireless phone subscribers. Wireless telecom carriers know, however, the real opportunity in 5G is in providing the backbone for the radio-based connections the real rise of IoT will require. It’s coming though, and soon.  ***T (T/$36H-38H-34H-36H-40-42-44)AT&T Inc. is setting the stage for a major victory on the 5G front, though you won’t see it until next year 2018; it’s not ready for mass rollout just yet. Ditto for T-Mobile US Inc (NASDAQ:TMUS), which recently caught up with AT&T in its effort to reach 5G speeds in excess of one gigibit per second .Indeed, T-Mobile is on track to unveil the nation’s first narrowband IoT network in 2018, directly addressing and removing one of the key bottlenecks that had been holding the movement back. ***T,VZ,TMUS,CLT,SBAC,LVLT,S,FTR,SHEN ....TDS....(WIN ... RNG... ***QTNA (T/$18-20) ...

***T (T/$36H-38H-34H-36H-40-42-44)AT&T Inc. is setting the stage for a major victory on the 5G front, though you won’t see it until next year 2018; it’s not ready for mass rollout just yet. Ditto for T-Mobile US Inc (NASDAQ:TMUS), which recently caught up with AT&T in its effort to reach 5G speeds in excess of one gigibit per second .Indeed, T-Mobile is on track to unveil the nation’s first narrowband IoT network in 2018, directly addressing and removing one of the key bottlenecks that had been holding the movement back. ***T,VZ,TMUS,CLT,SBAC,LVLT,S,FTR,SHEN ....TDS....(WIN ... RNG... ***QTNA (T/$18-20) ...  ALT ENERGY GEX Global Alt. Energy...TSLA,VWSYF,ETN,GAM,ENS,FSLR,CREE,ITRI,ORA,POWI,CVA,...CLPXF,NDRBF,KTWIF,NIBE B ICLN Global Clean Energy...OEZVF,CHFFF,VWSYF,

ALT ENERGY GEX Global Alt. Energy...TSLA,VWSYF,ETN,GAM,ENS,FSLR,CREE,ITRI,ORA,POWI,CVA,...CLPXF,NDRBF,KTWIF,NIBE B ICLN Global Clean Energy...OEZVF,CHFFF,VWSYF,  PHO Water Resources WAT,ROP,ECL,DHR,HDS,IEX,TTC,AOS,RXN,AWK,VMI...TTEK,WTR, CGW Global Water Index... ...... (CDZI...Water Utility) TAN SOLAR

PHO Water Resources WAT,ROP,ECL,DHR,HDS,IEX,TTC,AOS,RXN,AWK,VMI...TTEK,WTR, CGW Global Water Index... ...... (CDZI...Water Utility) TAN SOLAR  ...FSLR,SCTY,GCPEF,TERP,TSL,SPWR,CAFD,ABY ... RUN (T/11H-12H-15) ... VSLR (T/$6H)... ***SUNW (T/$2.50H-2) ...

...FSLR,SCTY,GCPEF,TERP,TSL,SPWR,CAFD,ABY ... RUN (T/11H-12H-15) ... VSLR (T/$6H)... ***SUNW (T/$2.50H-2) ...

.....AVOID?... WNDW (T/$5H-8H-10H) ...SolarWindow Technologies, Inc. has developed transparent electricity generating coatings that can go onto any glass surface, such as windows or sunroofs. Imagine a Tesla being able to top off its batteries while on the road. And since these coatings generate electricity under natural, low and even shaded light conditions, that Tesla could be charging up all day.

.....AVOID?... WNDW (T/$5H-8H-10H) ...SolarWindow Technologies, Inc. has developed transparent electricity generating coatings that can go onto any glass surface, such as windows or sunroofs. Imagine a Tesla being able to top off its batteries while on the road. And since these coatings generate electricity under natural, low and even shaded light conditions, that Tesla could be charging up all day. 90-plus SolarWindow International and U.S. patent and trademark filings include:

- Electricity generating windows that can:

- self-tint to darker or lighter shades, based on user preferences;

power various devices such as smart sensors for delivering data to intelligent energy management systems in buildings;

Electricity-generating coatings for: - powering mission-critical systems on military and commercial aircraft;

providing emergency power to pilots;

application to various three-dimensional objects;

thin and flexible surfaces, using various application methods;

Processes and the processing of SolarWindow™ device architectures;

Enhancements to SolarWindow™ device architecture; and

Improvements to various SolarWindow™ module performance; among others.

The company’s scientists, engineers, and attorneys continually identify, develop and pursue intellectual property with the objective of providing the high commercial value and strategic position when compared to other technologies. High-value patents and trademarks are actively developed while legacy assets are either repurposed to add value, or eventually retired.

The solar cell is no longer the dominant cost of the energy it produces. The majority of the cost increasingly lies in everything else—the inverter, installation labor, permitting fees

Power inverters have become a critical component of solar power systems large and small. They're what converts the direct current (DC) generated by a solar cell into the alternating current (AC) the grid uses, inverters may be the key to unlocking value for investors. They can be the smart hubs that integrate energy production with energy storage and the grid, a critical component of any installation. Motley Fool

SEDG ...ABB

***** ENPH (T/$1H-4H-6H-8-9) Enphase’s new IQ microinverters

.....

----------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Speculation Stocks RISK...

"DILUTION RISK, DRUG FAILURE RISK, poor management decision making... risk" ...

“Promoted stocks tend to rise because of the work of the stock promoter. But, later on, usually share price declines when the promo dollars dry up. Thus, buyers beware! The share price could keep creeping up as more emails are sent out and new market participants buy shares. Some will make money. However, in a few days, weeks or months, the stock promotion will stop or the exchange will warn the market about it, and the share price may fall sharply. Just be careful... Pumps & Dumps 101

This is your brain on stocks

5 Brain Flaws that make you a lousy investor

=========================================================================================================================

RoBoSapien

*****Virtual Reality/Augmented Reality/Artificial Intelligence In the real world, Artifical Intelligence9(AI) will enter our lives in three phases and forms:

Portfolio of Artificial Intelligence (AI) Chip Stocks --- Portfolio of Artificial Intelligence (AI) Stocks

https://agorafinancial.com/2017/02/17/the-next-mega-tech-transformation-10-times-bigger-than-microsoft/

PHASE #1 Assisted Intelligence: AI that replaces repetitive and mundane tasks traditionally done by humans. A timely example would be the proliferation of robots used at Amazon to “pick” items from warehouse shelves, which we mentioned in last month’s issue. You’ll recall we’re already double-digit gains in the space (with more to come) in the

Robo Global Robotics & Automation ETF (ROBO) and

Cognex Corp. (CGNX). PHASE #2 Augmented Intelligence: AI that incorporates machine learning to supplement and support human analysis. One area where this type of AI is being implemented is legal discovery. That is, the period of time in which both legal parties gather evidence. Seventy-five percent of the costs associated with discovery are tied to human review of documents. And people are expensive. Using AI to pre-screen — and reduce the amount of relevant documents before humans even start reviewing the files — can dramatically reduce costs. We profited from this very technology when our portfolio position Epiq Systems was acquired for a 40% gain in July 2016.

PHASE #3 Autonomous Intelligence: AI that takes over for humans in a highly specific task. Self-driving cars would be the ultimate example of this in action.

AI appears on our smartphones, with personal assistants, augmented and virtual reality headsets, robots, in data centers, and in semi and fully autonomous vehicles.

AI will be dominated by the big names such as Apple, Amazon, Alphabet Google, Facebook, and Samsung; however some smaller names like Nvidia and AMD can also do well.

AI will be invisible, yet it will be everywhere. https://seekingalpha.com/article/4086169-look-artificial-intelligence-companies-top-5

AI = "machines with brains"

7/25 AMD (T/$8H-11H-13H 15H-13H-15H-18-20-23) Advanced Micro Devicesis a semiconductor manufacturer. The company's new AI chips are the Radeon Instinct series. AMD is also racing to put its chips into AI applications. AMD will release its ROCm deep-learning framework, as well as an open-source GPU-accelerated library called MIOpen. The company plans to launch three products under the new brand in 2017. ***08/04 https://www.thestreet.com/story/14256965/1/amd-falls-in-premarket-as-abu-dhabi-s-sells-part-of-stake.html?puc=yahoo&cm_ven=YAHOO&yptr=yahoo Abu Dhabi is largest share holder after recent sells still owns 13% of outstanding shares...

04/05/18

AMD...ITS WEAK...no volume...price is up more than 10% off its recent low... 300shares I'd consider selling 200...Getting a good entry you have a chance to catch a move of more than one dollar...grab some profit with 200 shares and let 100 shares do the work for now... That's where I say I don't like dead money...I take the money out and go find another stock that I can hit UP for a quick 10%...it may take AMD 3 months to get above $12...I may get in for 2-3 swing trades before that. And with the Market so volatile... I'm a trader...buy and hold is too slow...as a swing trader you're swing trading in order to own 100 shares at no cost...so you use 300 or more shares on a $10 stock and play hit and run for 10% or more... 60 minute...AMD is going to perform along with the overall MARKET and then its going to over re-act to any bad news about itself...so swing trade it...to fill time...and you just have to get some trades in to at least lower you stop... 07/25

AMD

Softbank (OTC:SFBTF)(they bought out chip designer ARM, and own 4.95% of Nvidia)

Softbank (OTC:SFBTF)(they bought out chip designer ARM, and own 4.95% of Nvidia) - AAOI (T/$32H-35H-40H)Applied Optoelectronics Inc. (NASDAQ:AAOI) - Design and manufacture high speed data and fiber-optic network products, such as transmitters and receivers. 2017 PE is 14.2, and 2018 PE is 12.6 representing excellent value for a growth stock. Analyst consensus price target is US$75.78, representing 23% upside.

Fabrinet FN (T/$30-35-37-42) Design and manufacture transceivers, transponders, optical amplifiers, lasers, and sensors. Fabrinet provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of optical communication components, modules and sub-systems, industrial lasers, medical devices, and sensors.

- NeoPhotonics (NPTN),

Lumentum LITE.

MU(T/$50H-55H-60H-65-72-76-82-86-90-95-100) memory based processing is the future.

It is no secret that Automotive makers are racing each other to mass produce the first autonomous car. To achieve fully autonomous driving, cars need to have a variety of sensors to perceive near and far fields of visions in every direction. The sensors include radar, LIDAR, ultrasonic, cameras, and night vision devices. The data collected by these sensors are fed into highly complex System on Chips (SoCs) with compute performance that is equivalent to what only supercomputers could deliver a few years ago. Complex, state of the art algorithms that are increasingly based upon artificial intelligence ensure vehicle, driver, passenger, and pedestrian safety based on factors such as traffic, weather, dangerous conditions, etc https://www.micron.com/solutions/automotive

Next level memory is an integral part of AI. I recommend you getting up to speed on the demands we're talking about in memory today. this is not about storage capacity. This is about on demand, real time access to data that has to solve a problem immediately. This is the next level of memory that only 2 or 3 companies can do. It's a workload solution not just a storage solution. Think about a car that needs to calculate what is happening around it immediately. Thats not a storage solution, thats a storage plus speed and cross referenced access in real time. Only 3 or 4 companies in the world have this capability and innovation, and Micron is one of the only american ones. This is why Nvidia and Intel are partnered with Micron.  Virtual Reality "VR"...Augmented Reality. "AR" 2018 and 2023, Markets expect the AR market to grow from $11 billion to $60 billion, and for the VR market to expand from $7.9 billion to $34 billion.

Virtual Reality "VR"...Augmented Reality. "AR" 2018 and 2023, Markets expect the AR market to grow from $11 billion to $60 billion, and for the VR market to expand from $7.9 billion to $34 billion. 02/28/17 ...

potential profits in the VR/AR industry are enormous. Goldman Sachs (GS) estimates that the market will reach $80 billion by 2025, with the potential for that figure to actually soar much higher, to more than $180 billion. Many of the companies developing VR/AR hardware and software are among the biggest names in Silicon Valley including Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), Facebook (FB) and Sony ***SNE T/$85

. Autoliv ALV Augmented reality superimposes digital images in a person's field of vision. It provides the user with information for navigation, to complete tasks and other purposes. By contrast,

virtual reality is an immersive media that places the wearer of special headsets into a completely digital world, mostly for entertainment purposes. In November,

Bloomberg reported that Apple had already ordered "small quantities of near-eye displays from one supplier for testing." It said Apple was in the exploration phase of wearable computing. The device being tested would connect wirelessly to the iPhone. Also in November, KGI analyst Ming-Chi Kuo said Apple is looking to leapfrog the competition in AR by three to five years with its offering. But Kuo said it could take Apple one to two years to come out with an AR product.

....Sony Facebook's Oculus virtual reality device Samsung, Microsoft Hololens...Google Glass

Head worn devices...ZBRA Zebra Technology... INTC Intel...FJTSY Fujitsu...

Sales of virtual reality and augmented reality headsets will surge by 2021, when 100 million a year of the devices may be sold, according to a new report by research firm IDC.

****FNSR FNSR (T/$18H-20H-22-25-29) ... AAPL's pre-paytment of $390million boost in the company's standing in the fast-growing VCSEL and 3D sensing module market, which could hit $14 billion in revenue by 2020 as compared to just $1.5 billion this year. Investors, therefore, should definitely think of capitalizing on Finisar's stock price weakness this year to ride the VCSEL gravy train. https://finance.yahoo.com/news/apple-apos-millions-could-finisar-163200140.html Finisar was rumored to be in line to supply Apple with VCSEL arrays to enable the Face ID feature in the latest iPhone X, but rival Lumentum (NASDAQ: LITE) ran away with this business as Finisar reportedly had trouble meeting Apple's requirements. Not surprisingly, Lumentum is witnessing a big boost in its business thanks to the massive uptake of its 3D sensing chips by Apple. The company's revenue in the December-ended quarter could rise around 36% year over year as it reportedly got $300 million worth of 3D sensing orders from Apple since April.

***CY(T/$18H-18H-20-23) Cypress is the market leader in Wi-Fi/Bluetooth combo chips for Internet of Things (IoT) devices, USB-C controllers, NOR flash memory chips, and auto instrument cluster microcontrollers (MCUs). All these components are being installed in new high-end vehicles. Wi-Fi/Bluetooth combo chips and USB-C controllers tether mobile devices to the dashboard, NOR flash memory is installed in advanced driver-assistance systems (ADAS) platforms, and auto instrument cluster MCUs sync all of a vehicle's data onto its dashboard. Cypress notes that newer cars require more semiconductors than ever, with "basic" models using about $300 worth of chips, and "high-end" models using about $1,000 in chips. That's why the company expects its automotive business to grow at a compound annual growth rate (CAGR) of 8%-12% between 2016 and 2021. The strength of Cypress' auto chip business, which posted 16% sales growth in 2017, complements its strength in the industrial and IoT markets.

***HIMX HIMX (T/$6H-10H-8H-10-12-15) Himax Technologies

10/06/2017 Himax could soon tap the mass-market AR opportunity on the back of its recent partnership with Qualcomm. The two companies are going to develop a 3D camera system to enable vision-based functions for different use cases such as biometric face authentication and scene perception, among others, for use in smartphones, cars, and Internet of Things applications.

Qualcomm and Himax believe that they can start manufacturing the new platform on a mass scale from the first quarter of 2018. This is a big deal for Himax, as a partnership with Qualcomm opens the doors to tapping the fast-growing AR opportunity in smartphones. Motley Fool

9/14 KOPN (T/$3.70H-5) May 31, 2018 Kopin Unveils World's First Voice Controlled Wearable Smart Screen; Weighing 1.5 Ounces. Golden-i™ Infinity smart screen, the first voice- and gesture-controlled wearable device that supports Android and Windows 10-based computing solutions. Kopin Corporation semvismicndtr...wearable technologies and display products...develops, makes and markets virtual and augmented reality gaming, training, and simulation products. Kopin’s Whisper™ Voice Chip, Solos™ smart glasses and Pupil LCD display modules will be among the Kopin products displayed on the CES show floor. Kopin has transitioned to a wearable-centric company - they have positioned themselves to be entirely levered to success in Enterprise and Consumer head-worn AR with components and licensable IP. When you combine high level AR market forecasts with Kopin's device share dominance with design wins inside 5 Industrial AR headsets, I believe it is clear this stock is the one to own if you are looking to lever your portfolio to the massive growth possible in the head-worn wearable segment. As I have noted previously and pointed out in my blog posting "The Wearables Acquisition Intel Needs To Make - And Fast!" I believe a current reasonable market capitalization value for Kopin would be $394M or north of $5.00/share based on the following: https://seekingalpha.com/article/4070837-small-private-company-disrupting-industrial-ar-market "The Wearables Acquisition Intel Needs To Make - And Fast!" I believe a current reasonable market capitalization value for Kopin would be $394M or north of $5.00/share based on the following: IP portfolio I have valued at at least $300M: Kopin holds over 300 granted & pending wearables patents; I believe they possess the strongest head-worn wearables IP portfolio in the industry.