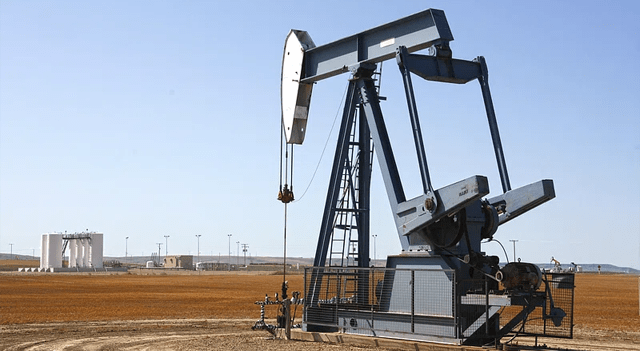

Oil prices edged higher on Thursday as fresh Ukrainian attacks on Russia’s energy infrastructure raised the risk of supply disruptions, while stalled diplomatic efforts tempered hopes for any deal that might normalize Russian crude flows. Gains, however, remained modest due to ongoing weak market fundamentals.

By 0659 GMT, Brent crude was up 41 cents, or 0.65%, at $63.08 a barrel. U.S. West Texas Intermediate rose 45 cents, or 0.76%, to $59.40.

A Ukrainian military intelligence source said Wednesday that Ukraine struck the Druzhba pipeline in Russia’s Tambov region — the fifth reported hit on the major conduit that supplies Russian oil to Hungary and Slovakia. Despite the attack, the pipeline operator and Hungary’s state-owned oil and gas firm confirmed that flows continued without disruption.

Consultancy Kpler noted in a recent report that “Ukraine’s drone campaign against Russian refining infrastructure has shifted into a more sustained and strategically coordinated phase,” explaining that repeated strikes are now aimed at preventing critical facilities from stabilizing.

Kpler added: “This has pushed Russian refining throughput down to around 5 million barrels per day between September and November, a 335,000 bpd year-on-year decline, with gasoline hit hardest and gasoil output also materially weaker.”

Oil prices also found support from renewed pessimism over peace negotiations. U.S. President Donald Trump’s representatives finished discussions with Kremlin officials without any movement toward ending the conflict, and Trump acknowledged that it was unclear how talks would proceed.

As Vandana Hari of Vanda Insights put it, “Crude will likely remain stuck in a narrow range while the Ukraine peace efforts grind on.”

Expectations of a breakthrough had previously pushed prices lower, with traders anticipating that any agreement would lift sanctions and bring more Russian supply back into an already saturated oil market.

Adding to the bearish backdrop, Fitch Ratings lowered its oil price assumptions for 2025–2027 on Thursday, citing persistent oversupply and production growth expected to outpace demand.

Brent Oil price

Crude Oil price

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.