Gold prices continued their upward momentum in Asian trading on Tuesday, building on strong overnight gains as markets increasingly bet that the Federal Reserve will lower interest rates at its December policy meeting.

Growing investor caution ahead of several high-impact U.S. economic releases also supported safe-haven flows, allowing gold to climb even as the dollar held steady. Most major metals traded higher as well.

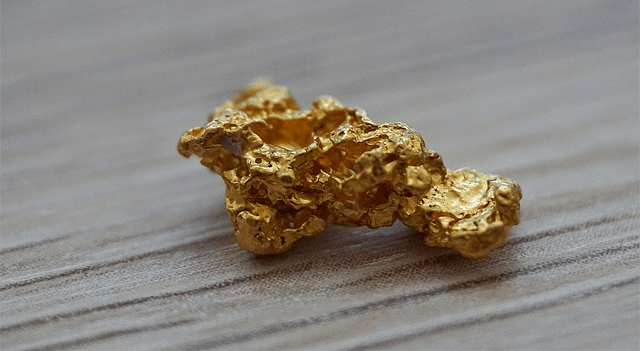

Spot gold rose 0.3% to $4,145.57 per ounce, while February gold futures added 0.2% to $4,180.0/oz by 23:46 ET (04:46 GMT).

Expectations for a December rate cut have risen sharply after recent comments from two Federal Reserve officials hinted at support for further easing.

According to CME’s FedWatch tool, markets now assign a 77.2% probability of a 25-basis-point cut at the December 9–10 meeting—up significantly from 41.8% just a week earlier.

Lower rates tend to strengthen the appeal of non-yielding assets like gold by reducing the opportunity cost of holding them. The metal notched multiple all-time highs this year as the Fed delivered cuts at its last two meetings.

Safe-haven interest was also boosted by rising geopolitical friction between China and Japan, as well as ongoing concerns over ballooning fiscal deficits across advanced economies.

Among other precious metals, spot platinum climbed 0.5% to $1,570.65/oz, while spot silver gained 0.8% to $51.5555/oz.

Copper also advanced, with benchmark London Metal Exchange futures rising 1.2% to $10,887.0 per tonne.

The broader metals market saw muted moves as traders awaited a slate of key U.S. data due in the coming days.

Although the readings pertain to September, they will likely be the last economic indicators available to the Fed before the December meeting.

Later on Tuesday, producer price inflation and retail sales figures are scheduled for release, followed by Wednesday’s PCE price index—the Fed’s preferred inflation measure.

Officials have indicated that October’s inflation and labor data will probably never be published due to the extended government shutdown, a factor that previously led markets to anticipate a potential rate hold in December given the Fed’s limited visibility heading into its final meeting of the year.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.