UBS reaffirmed its positive long-term stance on platinum, even as the bank warned that short-term volatility could create more attractive buying opportunities for investors, according to a research note published Wednesday.

The bank highlighted increasingly tight market dynamics that continue to support upward price risks for platinum — particularly if supply disruptions occur or investment flows pick up. Still, UBS cautioned that near-term uncertainty in China and soft jewelry demand may restrain upward momentum for now.

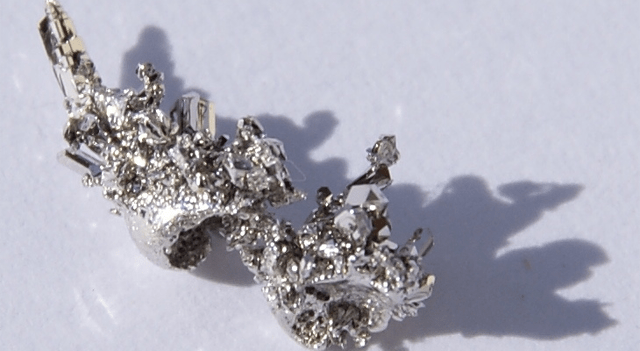

On palladium, UBS noted that the metal entered a bottoming phase in 2024, with that process extending into the first half of 2025. The bank said palladium has traded in a higher but more volatile range during the latter half of 2025 as supply-demand conditions reset.

UBS does see potential upside in palladium prices over the next year, but stressed that these moves do not alter its broader outlook, which remains defined by structurally rising surpluses. The bank believes the steepest part of palladium’s decline is now in the past.

According to the note, palladium’s recent price behavior reflects a market adjusting to new fundamentals after years of chronic deficits, alongside evolving expectations around vehicle electrification — a critical driver of demand for the metal.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.