VNET Group, Inc. (NASDAQ:VNET) saw its shares climb 5.77% in premarket trading Thursday after the Chinese data-center operator posted stronger-than-expected third-quarter revenue, even as it delivered a wider-than-anticipated loss.

For the quarter ending September 30, 2025, VNET generated RMB2.58 billion ($362.7 million) in revenue, ahead of the RMB2.4 billion analyst consensus and marking a robust 21.7% year-over-year increase. However, earnings came in at a loss of RMB1.14 per share, sharply missing expectations for RMB0.09 in positive EPS.

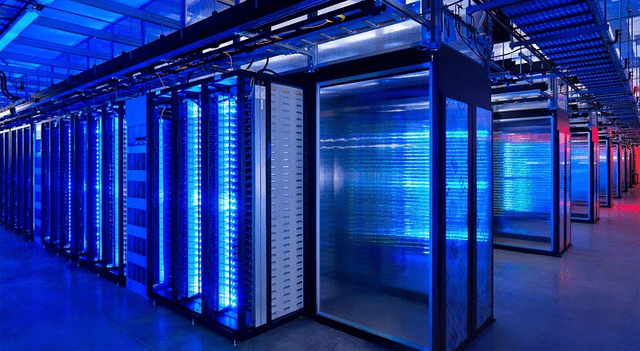

The company’s wholesale IDC segment remained the standout performer. Revenue from this division surged 82.7% year over year to RMB955.5 million, underscoring the continued strength of large-scale infrastructure demand.

Founder, Executive Chairperson, and interim CEO Josh Sheng Chen said the company’s momentum remained solid, stating, “We delivered another strong quarter, demonstrating our strategy’s effectiveness in capturing opportunities.” He added that “Our wholesale IDC business sustained its robust growth trajectory in the third quarter, driven by our rapid delivery capabilities and customers’ fast move-in pace.”

Adjusted EBITDA rose 27.5% year over year to RMB758.3 million ($106.5 million), while the adjusted EBITDA margin improved to 29.4%, up 1.3 percentage points from the prior year. Meanwhile, the retail IDC business saw a more modest increase of 2.4% to RMB999.1 million.

VNET raised its full-year 2025 revenue outlook, guiding for RMB9.55 billion to RMB9.87 billion in total net revenues — implying 16–19% year-over-year growth and topping the RMB9.56 billion consensus estimate.

During the quarter, the company booked three new wholesale orders totaling 63MW, alongside roughly 2MW of new retail capacity commitments from clients across multiple industries. Early in the fourth quarter, VNET also secured a sizable 32MW wholesale order from a customer in the internet sector.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.