Metal prices advanced across the board on Tuesday, with both precious and base metals recording solid gains amid improving sentiment in the industrial sector.

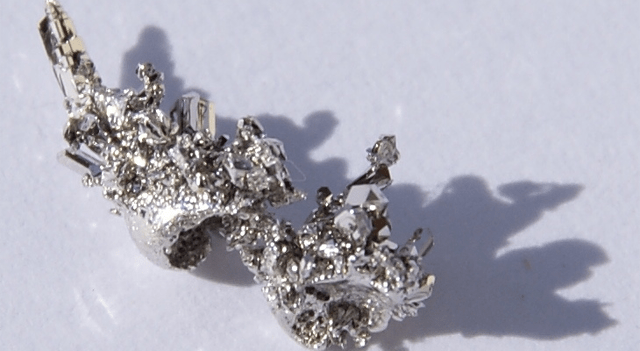

Palladium led the rally, jumping 2.11% to $1,447 per ounce, followed by platinum, which rose 1.53% to $1,598 per ounce. Silver gained 1.13% to $51.08 per ounce, while gold added 0.63%, reaching $4,142 per ounce.

Base metals also moved higher. Zinc climbed 0.80% to $1.40 per pound, aluminum rose 0.75% to $1.30 per pound, copper gained 0.74% to $4.90 per pound, lead increased 0.56% to $0.93 per pound, and nickel edged up 0.32% to $6.85 per pound.

In bulk commodities, iron ore futures on the Dalian Exchange for January 2026 delivery rose 0.3% to around 764 yuan ($107) per metric ton, while coking coal futures climbed 2.6% to 1,180 yuan per metric ton.

In the U.S., the Midwest aluminum premium slipped 0.8% to roughly $0.88 per pound on Monday, though it remains 13.2% higher month-over-month and over 300% above year-ago levels.

Steel markets also showed resilience. Nucor set its weekly Consumer Spot Price for hot-rolled coil (HRC) at $895 per short ton for the week of November 10, marking a $5 week-over-week increase and extending gains for a third straight week.

U.S. steel capacity utilization improved to 76.7% for the week ended November 8, up from 76.0% the previous week and 72.6% a year earlier. Raw steel output rose 1.0% week-over-week to 1.758 million net tons, representing a 9.1% increase year-over-year, while year-to-date production climbed 3.1% to 77.2 million metric tons.

In India, steel market trends were mixed — HRC prices fell on soft demand, while rebar prices edged higher amid firm offers. Market participants noted that ample supply and sluggish demand continue to weigh on sentiment.

Meanwhile, iron ore shipments from Australia and Brazil dropped 9% in the week of November 3–9, totaling 24.4 million metric tons from 20 ports and 17 mining companies.

On the energy front, global thermal coal prices fell modestly on Monday. API2 (Europe) contracts for December slipped 0.6% to $99 per ton, API4 (South Africa) declined 0.6% to $89 per ton, and Newcastle (Australia) dropped 0.8% to $114 per ton. Despite the daily pullback, coal prices remain higher on both weekly and monthly bases.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.