Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Are Investment Newsletters Too Bullish?

By: Schaeffer's Investment Research | March 20, 2024

• The II saw its first reading above 60% in almost three years

• The II survey currently shows an extreme amount of optimism

A popular sentiment poll we monitor is the weekly sentiment survey published by Investors Intelligence (II). They obtain numerous published newsletters, emails, bulletins, etc. that go to clients giving stock market advice. Then they determine the percentage that are bullish or bearish or expecting a correction (short-term bearish but longer term bullish). The survey currently shows an extreme amount of optimism. This isn’t surprising given the S&P 500 Index (SPX) has been consistently hitting new all-time highs for a couple months now. But the survey has recently hit a few significant milestones, making me wonder whether similar occurrences in the past have signaled potential risks ahead.

II PERCENT BULLS AT EXTREMES

The percentage of bullish newsletters from the II poll was above 60% in the latest report. It’s the first reading above 60% since July 2021. It’s an extreme reading registering in the 95th percentile for percentage of bulls going back to 1971. The tables below compare how the S&P 500 has performed after newsletters are extremely bullish on the market or extremely bearish. The poll has been a reliable long-term contrarian indicator. When the bulls are extremely high, the S&P 500 averages a 6.8% return over the next 12 months, with 68% of the returns positive. When there’s a dearth of bullish newsletters, the index averages a return of 14% with 80% of the readings positive.

There’s not a lot of difference in the average return and percent positive when you look at the shorter-term time frames (out to six months). There is significant difference, however, in volatility. Looking at the average positive and average negative figures, our current situation shows less volatility going forward, which is reflected in low implied volatilities (IV).

For reference, the table below shows S&P 500 returns when the percentage of bulls is between extremes. Based on all these figures, I would say buy and hold investors might lower expectations a bit going forward. But for shorter-term traders, the numbers don’t mean too much.

This next table shows how the S&P 500 performed after the II bullish percentage reached 60% for the first time in at least six months. This just occurred in the latest report. These figures are more concerning. There have been 19 occurrences. The index averaged a loss of about 0.5% over the next month with less than half of the returns positive. The three-month return barely averaged breakeven. The six-month and 12-month returns are positive, but underperform typical S&P 500 returns significantly.

BEARISH NEWSLETTERS DISAPPEARING

The percentage of bearish newsletters is at an even more extreme. The recent report saw the bearish newsletters drop below 15% for the first time in over six years (February of 2018). The table below shows how the S&P 500 performed after the percentage of bearish newsletters dropped below 15% for the first time in at least six months. These 10 occurrences have tended to lead to short-term bullish returns, out to three months, but then longer-term returns that are just typical.

Finally, below, I have the dates in which the II survey showed at least 60% of newsletters bullish and less than 15% bearish, which is our current situation. It shows instances where it was the first such reading in at least six months. The last time was in 2017, in which the market was great for a few months before a pullback resulted in a one-year return of just 2.3%. Ominously, the time before that was early 1987, less than a year from the biggest one-day drop in the history of the S&P 500 (Black Monday in October of 1987). Overall, however, those short-term returns have been very bullish. So, maybe there are some gains to be made in the near future.

Read Full Story »»»

DiscoverGold

DiscoverGold

Best performing Nasdaq 100 $QQQ stocks so far in 2024

By: Savvy Trader | March 20, 2024

• Best performing NASDAQ 100 $QQQ stocks so far in 2024

Nvidia $NVDA +78.9%

Constellation Energy $CEG +49.5%

Facebook $META +40.6%

DoorDash $DASH +35.3%

Netflix $NFLX +27.3%

$ASML +26%

CrowdStrike $CRWD +26%

Paccar $PCAR +24.5%

Diamondback $FANG +24.4%

Applied Materials $AMAT +23.5%

$AMD +22.2%

Airbnb $ABNB +20.2%

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX $20+ Million OTM Call Orders These have 5200+ strikes

By: Cheddar Flow | March 20, 2024

• $SPX $20M+ OTM Call Orders

These have 5200+ strikes

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500: Active investment managers are notorious for their tendency to buy equities at tops and sell them at bottoms, revealing the challenges they face in accurately timing the market and making profitable investment decisions

By: Isabelnet | March 20, 2024

• S&P 500

Active investment managers are notorious for their tendency to buy equities at tops and sell them at bottoms, revealing the challenges they face in accurately timing the market and making profitable investment decisions.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | March 20, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NDX - Update: Both Bear 'Wedges' in-play. For now tho, still within the Cautious Band 17800-18400

By: Sahara | March 20, 2024

• $NDX - Update

Both Bear 'Wedges' in-play, bringing into view the arrowed targets. For now tho, still within the Cautious Band 17800-18400 Supported by the 2Hr Dotted-Grey/MA.

Although under its Lime 63/MA's on the chart and the ratios...

Read Full Story »»»

DiscoverGold

DiscoverGold

AI-generated Buy and Sell Daily Signals

By: Hedgeye | March 20, 2024

• This is free access to our brand-new AI-generated buy and sell signals.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lots of interest in $SPX 5100 puts and 5160 calls today. I suspect the former are related to hedging ahead of tomorrow's FOMC decision and press conference.

By: Markets & Mayhem | March 19, 2024

• Lots of interest in $SPX 5100 puts and 5160 calls today. I suspect the former are related to hedging ahead of tomorrow's FOMC decision and press conference.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | March 19, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index..

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500: The reading of 91.66 signals that the US stock market is clearly overbought, worrying investors who anticipate a potential correction in the near future

By: Isabelnet | March 19, 2024

• S&P 500

The reading of 91.66 signals that the US stock market is clearly overbought, worrying investors who anticipate a potential correction in the near future.

Read Full Story »»»

DiscoverGold

DiscoverGold

AI-generated Buy and Sell Daily Signals

By: Hedgeye | March 19, 2024

• This is free access to our brand-new AI-generated buy and sell signals.

Read Full Story »»»

DiscoverGold

DiscoverGold

Inflation Projection No Rate Cut Soon

By: Almanac Trader | March 18, 2024

Until PCE is sustained at or below 2% they are not likely to cut. Our PCE projection chart reveals the Fed is not likely to be in a rush. They are slow to cut rates & only move quickly when a real crisis is at hand, which currently is not.

The Street is overly optimistic the Fed will cut rates sooner, substantially, & start well before the election to not appear political. But last week’s higher than expected CPI (0.4% monthly 3.2% yearly) suggests otherwise as PCE tends to follow CPI’s trend.

Headline PCE index, including food and energy “is the Federal Reserve’s preferred measure of inflation.” https://fred.stlouisfed.org/series/PCEPI

PCE’s monthly change was 0.3%, which put the 12-month rate at 2.4%, above the Fed’s stated 2% target. Anything above a 0.1% monthly change will keep inflation above 2%. Any monthly change greater than 0.1% is likely to delay any Fed rate cut until after midyear if not longer.

The Fed may have engineered the goldilocks soft landing, but with inflation persistent while the economy remains resilient and unemployment stays down, there’s no need for the Fed to rush to cut rates.

Read Full Story »»»

DiscoverGold

DiscoverGold

Here's the S&P 500 stocks that bought back the most shares in Q4 2023

By: Evan | March 18, 2024

• Here's the S&P 500 stocks that bought back the most shares in Q4 2023

1 Apple $AAPL: $22.7B

2 Google $GOOGL: $16.2B

3 Raytheon $RTX: $10.3B

4 General Motors $GM: $10B

5 Broadcom $AVGO: $8.3B

6 Facebook $META: $8.2B

7 Exxon Mobil $XOM: $4.7B

8 Microsoft $MSFT: $4b

9 Visa $V: $3.8B

10 Comcast $CMCSA $3.5B

Read Full Story »»»

DiscoverGold

DiscoverGold

Major US Equity Indices On Trendline Support From Last Oct, Or In Slight Breach, Even As Bears Hit Multi-Year Low

By: Hedgopia | March 18, 2024

The major US equity indices closed last week either right on or in slight breach of trendline support from last October’s low. Bulls’ mettle is being tested, even as investor sentiment remains too giddy.

The Nasdaq 100 ended the week before on a rising trendline from last October’s low. In the early goings last week, tech bulls were clearly not in a mood to lose this support. Both Monday and Tuesday, bids were waiting at the 20-day moving average, with Tuesday ticking 18228. On the prior Friday, the tech-heavy index retreated after posting a new all-time high of 18415. Then, it was all downhill in the next three sessions, ending last week down 1.2 percent to 17808. The trendline in question is breached, albeit marginally (Chart 1). The week also produced a shooting star, coming on the heels of the prior week’s spinning top.

Further, the index closed last week under 18000, which had earlier attracted sellers for three weeks before breaking out in the prior week. Last week, bulls were unable to defend the breakout. The index is now under both the 10- and 20-day. The 50-day is at 17554, which coincides with the daily lower Bollinger band at 17538. This level is a must-save.

Tech bears have an opportunity here. Should they succeed in building on the downside momentum of the last two weeks, the S&P 500 will be the next to lose the trendline support from last October. The sector has a leading weight in the index.

Last week, the large cap index closed right on that support (Chart 2), as the bulls failed to hang on to the weekly gains of one percent as of intraday Tuesday. By Friday, the gains turned into a loss of 0.1 percent. In the prior week, the S&P 500 lost 0.3 percent, having reversed on Friday after touching 5189 – a new high.

For the second week in a row, the S&P 500 has now produced a candle with a long upper shadow. Last week’s loss is only the fourth down week in 20.

Nearest support lies at 5050s, with the index closing last week at 5117.

Small-caps are faring worse.

The large-caps lifted off last October’s low to rally to new highs this month, while the Russell 2000 remains substantially below its all-time high from November 2021. Back then, the small cap index retreated after touching 2459, subsequently bottoming at 1641 next June. That low was again tested in October that year (2022) with a low of 1642. Come last October, this level once again attracted bids at 1634. The rally that followed culminated just north of 2100 – 2116, to be precise – in the week before (Chart 3).

Horizontal resistance at 2100 goes back to January 2021. This also completed a measured-move target of a 1700-1900 range breakout on December 13th last year. After a weekly spinning top showed up at that resistance in the week before, the Russell 2000 gave back 2.1 percent last week to 2039. Thus far, 2000 is drawing buying interest. But once the trendline support from last October, which is where the index closed last week, gets breached, the door opens toward a breakout retest at 1900.

Equity bulls’ problem is that there are too many of them and that bears are too few. As of last Tuesday, Investors Intelligence bearish percent dropped 1.5 percentage points week-over-week to 14.5 percent. This was the lowest since February 2018 (Chart 4). (Bulls, in the meantime, rose 1.5 percentage points to 60.9 percent, which was the highest since July 2021.)

The sentiment boat thus is beginning to get lopsidedly bullish. At some point, there are no bears left to turn into bulls. This is when the upside momentum becomes vulnerable. As things stand, a decisive breach of the trendline mentioned above will swing the ball into the bears’ camp – duration and timing notwithstanding.

Read Full Story »»»

DiscoverGold

DiscoverGold

Sentiment: At 81.75, the current reading of the Market Greed/Fear Index indicates a significant level of market greed, which raises concerns about potential overconfidence

By: Isabelnet | March 18, 2024

• Sentiment

At 81.75, the current reading of the Market Greed/Fear Index indicates a significant level of market greed, which raises concerns about potential overconfidence.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | March 18, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | March 18, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

AI-generated Buy and Sell Daily Signals

By: Hedgeye | March 18, 2024

• This is free access to our brand-new AI-generated buy and sell signals.

Read Full Story »»»

DiscoverGold

DiscoverGold

Ignore The Naysayers, This Market Is On FIRE!!!

By: Tom Bowley | March 17, 2024

Last week was interesting for sure. Both February Core CPI (consumer price index) and February Core PPI (producer price index) came in above expectations. The headline PPI number doubled expectations. Despite that, the S&P 500 managed to close at an all-time high on Tuesday, the day the February CPI data was released.

This bull market remains extremely resilient and provides evidence of it nearly every day.

The vast majority of market analysts, in my opinion, expected that any weakness in the Magnificent 7 stocks would automatically be the end of this bull market. But they were wrong. NVIDIA Corp (NVDA) is the only stock in the Magnificent 7 that has gained any significant ground over the past month. The weakening price action for growth stocks is typical during the 2nd half of calendar quarters (except for Q4). Growth stocks tend to take a back seat to value, especially compared to what happens during the 1st half of calendar quarters as we work our way through earnings season.

Let's look at the Magnificent 7 stocks to gain a better feel of what's been transpiring there:

For each stock, the pink line represents price action, while the black line represents the 10-day rate of change (ROC). Over the past couple weeks, there's been price deterioration in a few of these names, and especially on Tesla (TSLA), which has dropped a staggering 19% over this period.

The good news, however, is that during this more "risk off" kind of market, money is not leaving the stock market. Instead, it's helping to fuel a HUGE rally in other areas of the stock market, mostly value-oriented areas. This represents widening participation in this secular bull market advance, a key ingredient of bull market sustainability.

Read Full Story »»»

DiscoverGold

DiscoverGold

Since 1954, when the S&P 500 index has risen by more than 5% on day 50, the rest of the year has been higher 96% of the time, with an average gain of 12.6%

By: Isabelnet | March 16, 2024

• S&P 500

Since 1954, when the S&P 500 index has risen by more than 5% on day 50, the rest of the year has been higher 96% of the time, with an average gain of 12.6%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Core Systems at/near Major Sell signals – with *significant* room to decline:

By: Macro Charts | March 15, 2024

• Core Systems at/near Major Sell signals – with *significant* room to decline:

• Critical shift is underway for Bond Yields (higher).

• Weakness already visible in Rate-sensitive Equities (downside leaders).

• Tech Positioning extremely crowded – vulnerable to a sharp unwind.

Read Full Story »»»

DiscoverGold

DiscoverGold

This Bull Market is Expanding!

By: Tom Bowley | March 16, 2024

We have seen just about everything we've needed to see to confirm this powerful secular bull market advance since the beginning of 2023. There was really only one thing missing and it's not missing any longer. I'll get to that in a minute.

But let's look at the most aggressive sector in the stock market and let's evaluate the growth vs. value trade that has characterized and driven a tremendous move higher in U.S. equities.

Technology (XLK):

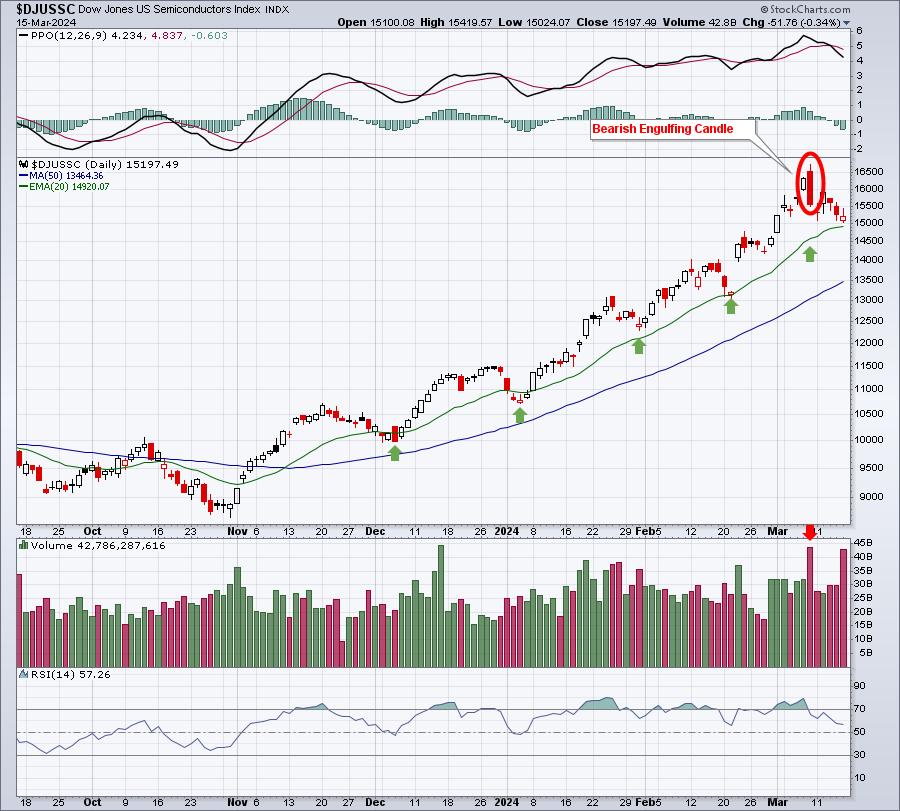

Semiconductors ($DJUSSC) have been the lifeblood of technology's leadership and technology represents nearly 30% of the S&P 500 now - thanks in large part to the huge advance in technology shares. After a remarkable 200% advance in semiconductors over 15 months, we've seen the DJUSSC cool off a bit, which began with the bearish engulfing candle I pointed out one week ago:

From the high on Friday, March 8th to the low on Friday, March 15th, the DJUSSC lost approximately 10%. That had an obvious impact on technology stocks in general, which lagged most sectors last week.

The very ugly bearish engulfing candle, together with the HUGE volume, is not to be ignored. It "could" represent a major top in this group for awhile, which isn't a bad thing. We shouldn't expect the DJUSSC to triple every 15 months, that's not sustainable. But if it pauses in the near-term, it's likely to have a significant effect as many of its component stocks are represented in both the S&P 500 ($SPX) and the NASDAQ 100 ($NDX). The group is much more heavily represented in the $NDX. Semiconductors represents nearly 22.86% and 9.76% of the $NDX and $SPX, respectively. While there's plenty of growth stocks in the S&P 500, the NASDAQ 100 is much more heavily impacted by growth stocks. That's why I like to follow the $NDX:$SPX ratio. It's a "growth vs. value" ratio that provides us one look at the risk environment that we're in. When the ratio goes up, we can typically conclude that the market environment is "risk on", which usually leads to higher stock prices. A falling ratio, however, can signal "risk off", which would mean more caution. Here's where we currently stand:

During the summer of 2023, the $NDX:$SPX ratio declined and this "risk off" signal resulted in a 10% correction as the benchmark S&P 500 followed suit to the downside. But look at the last 3 "risk off" readings in the $NDX:$SPX ratio. The S&P 500, for the most part, has kept gaining ground, especially over the past two months. What's changed?

Well, thanks for asking, because this was the missing ingredient in the secular bull market in 2024. Let me show you what's changed. It's called BULLISH ROTATION:

XLI:$SPX

XLF:$SPX

XLE:$SPX

XLB:$SPX

Over the summer months, when we turned "risk off", the proceeds from selling those aggressive sectors simply left the market, it didn't rotate to and create bullishness in other sectors in the market. You can see that by simply following all of those red directional lines for each of the 4 sectors shown above. This time is different and the above relative sector charts help us visualize the difference.

I believe technology will be fine in time, but a period of underperformance wouldn't be a bad thing at all. In fact, the rotation is creating tremendous opportunities in other areas of the market. You need to recognize this shift now, because it's increasing the likelihood that our current bull market run may only just be beginning.

Read Full Story »»»

DiscoverGold

DiscoverGold

CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | March 16, 2024

• Following futures positions of non-commercials are as of March 12, 2024.

E-mini S&P 500: Currently net short 239.8k, up 35.4k.

Equity bears further widened a slight opening they were granted last week, when a weekly spinning top formed on the S&P 500; this was after 16 up weeks in 18. Until Tuesday this week, it did not look like they would be able to make much of it, with the large cap index ticking 5180 intraday, which was less than nine points from the March 8th all-time high of 5189. Then, the bulls began to struggle, unable to take out high-5170s Tuesday through Thursday. Friday, the 10-day was lost. For the week, the index edged lower 0.1 percent, having reversed from up 1.1 percent at Tuesday’s high.

For the second week in a row, the weekly has now produced a candle with a long upper shadow. This is taking place even as investor sentiment further rose into giddy territory (more on this here).

The upside momentum is yet to decisively break, but this is as good an opportunity as any for the bears.

Amidst this, non-commercials raised their net shorts to a 34-week high.

Nasdaq (mini): Currently net long 1.4k, up 760.

The Nasdaq 100 acts like it is exhausted and wants lower prints (more on this here). This week, it gave back 1.2 percent to 17808. This follows last week’s loss of 1.6 percent, which came in a week in which the tech-heavy index posted a new intraday high of 18415 on Friday but only to then reverse to close at 18018.

This week, the index closed under 18000, where it struggled for three weeks before breaking out last week. It turns out the breakout was false.

At 17554 lies the 50-day, coinciding with the daily lower Bollinger band at 17538. This is a must-save for the bulls.

Russell 2000 mini-index: Currently net short 19.1k, down 3.7k.

Small-cap bulls’ mettle is being tested. Last Friday’s session high of 2116 set a two-year high, which also completed a measured-move target of a 1700-1900 range breakout on December 13th. The tape has weakened since.

This week, the Russell 2000 declined 2.1 percent to 2039. But before that on both Thursday and Friday, horizontal support at 2000 drew bids, with the small cap index touching 2017 and 2019 respectively. A likely breach of this support opens the door toward a breakout retest at 1900.

US Dollar Index: Currently net long 6.2k, up 3.1k.

Dollar bulls are in a mood to once again go after 103-104, which goes back to December 2016. This week, the US Dollar Index rallied 0.4 percent to 103.06, tagging 103.31 on Tuesday.

Earlier, it hit 104.88 on February 14th and retreated, bottoming at 102.30 last Friday.

Immediately ahead, the 50- and 200-day at 103.41 and 103.52 respectively can act as a magnet.

VIX: Currently net short 49.1k, up 3.2k.

Yet again, a rising trend line from December 12th when VIX bottomed at 11.81 was touched and left intact. The volatility index tagged 13.42 Thursday, piercing through the 50-day (13.79) intraday but was saved on time, ending the session at 14.40.

Come Friday, the 200-day (14.71) was reclaimed intraday but was pushed under by close, ending the week at 14.41, down 0.33 points for the week. It was one of those rare weeks when both VIX and the S&P 500 went hand in hand.

So, VIX is trapped between the 50- and 200-day, with the former rising and the latter flattish. In the current setup, it is only a matter of time before the 50-day approaches the 200-day from underneath.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500 Index (SPX) »» Weekly Summary Analysis

By: Marty Armstrong | March 16, 2024

S&P 500 Cash Index closed today at 511709 and is trading up about 7.28% for the year from last year's settlement of 476983. Presently, this market has been rising for 4 months going into March suggesting that this has been a bull market trend on the monthly time level which has been confirmed by electing all of our model's long-term Bullish Reversals from the key low. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 518926 while it has not broken last month's low so far of 485352. Nevertheless, this market is still trading above last month's high of 511106.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in S&P 500 Cash Index, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2009 and 2002. The Last turning point on the ECM cycle high to line up with this market was 2022 and 2007 and 2000.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The S&P 500 Cash Index has continued to make new historical highs over the course of the rally from 1974 moving into 2024. Noticeably, we have elected two Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the S&P 500 Cash Index, this market remains moderately bullish currently with underlying support beginning at 511454 and overhead resistance forming above at 512466. The market is trading closer to the support level at this time. An opening below this level in the next session will imply a decline is unfolding.

On the weekly level, the last important high was established the week of March 4th at 518926, which was up 19 weeks from the low made back during the week of October 23rd. Afterwards, the market bounced for 19 weeks reaching a high during the week of March 4th at 505682. Since that high, we have been generally trading down to sideways for the past week, which has been a reasonable move of 1.890% in a reactionary type decline. Nonetheless, the market still has not penetrated that previous low of 410378 as it has fallen back reaching only 9627 which still remains -97.6% above the former low.

When we look deeply into the underlying tone of this immediate market, The broader perspective, this current rally into the week of March 4th has exceeded the previous high of 479330 made back during the week of December 25th. This immediate decline has thus far held the previous low formed at 410378 made the week of October 23rd. Only a break of that low would signal a technical reversal of fortune and of course we must watch the Bearish Reversals.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend. From a pointed viewpoint, this market has been trading down for the past week.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are rising at this time with the previous low made 2022 while the last high formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2022 warning that this market remains strong at this time on a correlation perspective as it has moved higher with the Momentum Model.

Interestingly, the S&P 500 Cash Index has been in a bullish phase for the past 11 months since the low established back in March 2023.

Critical support still underlies this market at 417150 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Nasdaq Composite Index (COMP) »» Weekly Summary Analysis

By: Marty Armstrong | March 16, 2024

NASDAQ Composite Index Cash closed today at 1597317 and is trading up about 6.40% for the year from last year's settlement of 1501135. At present, this market has been rising for 4 months going into March suggesting that this has been a bull market trend on the monthly time level which has been confirmed by electing all of our model's long-term Bullish Reversals from the key low. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 1644970 while it has not broken last month's low so far of 1520888. Nevertheless, this market is currently trading below last month's close of 1609192.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NASDAQ Composite Index Cash, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2009 and 2002. The Last turning point on the ECM cycle high to line up with this market was 2007 and 2000.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NASDAQ Composite Index Cash has continued to make new historical highs over the course of the rally from 2009 moving into 2024. Distinctly, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NASDAQ Composite Index Cash, this market remains moderately bearish position at this time with the overhead resistance beginning at 1597804 and support forming below at 1586924. The market is trading closer to the resistance level at this time. An opening above this level in the next session will imply that a bounce is unfolding.

On the weekly level, the last important high was established the week of March 4th at 1644970, which was up 19 weeks from the low made back during the week of October 23rd. Afterwards, the market bounced for 19 weeks reaching a high during the week of March 4th at 1586263. Since that high, we have been generally trading down to sideways for the past week, which has been a sharp move of 3.184% in a reactionary type decline. Nonetheless, the market still has not penetrated that previous low of 1254386 as it has fallen back reaching only 23720 which still remains -98.1% above the former low.

When we look deeply into the underlying tone of this immediate market, The broader perspective, this current rally into the week of March 4th has exceeded the previous high of 1515007 made back during the week of December 25th. This immediate decline has thus far held the previous low formed at 1254386 made the week of October 23rd. Only a break of that low would signal a technical reversal of fortune and of course we must watch the Bearish Reversals. Right now, the market is neutral on our weekly Momentum Models warning we have overhead resistance forming and support in the general vacinity of 1555144. Additional support is to be found at 1470623. From a pointed viewpoint, this market has been trading down for the past week.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are rising at this time with the previous low made 2022 while the last high formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 warning that this market remains strong at this time on a correlation perspective as it has moved higher with the Momentum Model.

Interestingly, the NASDAQ Composite Index Cash has been in a bullish phase for the past 11 months since the low established back in March 2023.

Critical support still underlies this market at 1486003 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

U.S. economic growth has defied the odds

By: Raymond James Financial | March 15, 2024

Key Takeaways

• U.S. economic growth has defied the odds

• The labor market is off to a strong start to the year

• The road to 2% inflation may be bumpy, but is still intact

Happy Saint Patrick’s Day and the first day of spring – two celebrations to look forward to in the coming days. What’s not to like about good luck charms, all things green, leprechauns and the arrival of warmer weather? And just like the seasons change, the economy goes through its own variations – moving from cold to hot, with the Federal Reserve (Fed) behind the scenes trying to guide the economy somewhere in between. Whether it was luck or skill (or maybe both) the Fed has done a good job navigating this economy, despite the great challenges it has faced over the last four years. The Fed’s Tuesday/Wednesday meeting next week will include its updated economic forecasts, the potential path of interest rate cuts (the ‘dot plot’) and the Chairman’s press conference. Here’s what has changed since its December 2023 projections:

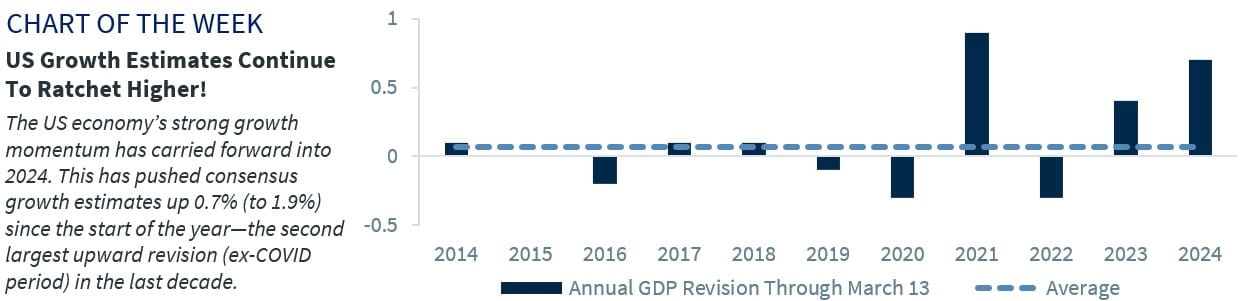

• Economic growth has defied the odds | With the U.S. economy posting two consecutive quarters of 3%+ GDP growth, recession calls have quieted down. In fact, Google searches for the term ‘recession’ have declined to the lowest level since 2004. While seasonal factors and cold weather have muddied the data to start the year, the U.S. economy remains on solid footing due to healthy consumer fundamentals (i.e., household net worth hitting a record high and personal incomes climbing at their fastest pace since July 2021 in January) and solid residential fixed investment. This has pushed consensus growth estimates up 0.7% (to 1.9%) since the start of the year, marking the second largest upward revision at this juncture of the year over the last ten years (trailing only the 2021 COVID recovery). While economic data remains strong, there have been some warning signs over the last few months that suggest growth could slow. For example, credit card debt is soaring, borrowing rates are at record high levels, credit card delinquencies, particularly those 90 days or more past due, rose to the highest level since 1Q21, and both consumer and business confidence have ticked lower since the start of the year. The upside growth surprises should see the Fed modestly increase its +1.5% 2024 GDP forecast; however, Chair Powell should reiterate the messaging in his semi-annual testimony before Congress last week – the economy is on the path for a soft landing, but it's too soon to declare mission accomplished.

• Labor market remains solid | Driving the economy has been the resilience of the labor market, especially the strong job growth to start to the year. Over the last two months, the U.S. economy has added over 500k new jobs (the best two months of gains since last April), with jobless claims remaining near cyclical lows. While the labor market is on solid footing, cracks are forming. First, announced job cuts rose to the highest level since March of last year, with cost cutting and automation being the two biggest culprits. Second, the number of job openings has declined to the lowest level since 2021, with the quits rate (a sign of consumer confidence in the labor market) easing to a 2.5 year low. Third, the percentage of small businesses planning to increase employment declined for the third consecutive month to the lowest level since 2020. More important, the same survey stated that the percentage of small businesses having difficulty attracting qualified talent fell sharply. The Fed’s updated forecasts will likely reflect a gently higher unemployment rate from the current 3.9% rate (a two-year high), but not much changed from the 4.1% year-end 2024 forecast last December. While the unemployment rate is likely to remain historically low, Chair Powell will likely stress that a healthy, but normalizing labor market should ease wage pressures, thereby giving the Fed the confidence it needs to cut rates in 2024.

• Disinflationary trend hits a snag | Inflation fell notably throughout 2023, declining from a cyclical peak of 9.1% to 3.2%. However, in the first two months of the year, inflation has ticked higher—with core consumer prices and the Fed’s preferred measure of inflation, core PCE, showing healthy month-on-month gains. No doubt, the hotter than expected prints will keep policymakers on guard in the near term given their reticence to declare victory after the progress made last year. The key culprit for the recent uptick has been elevated shelter costs but given the well-telegraphed measurement issues with this sub-component of the inflation index, Fed officials are more likely to hit the pause button rather than panic. Case in point: inflation, excluding shelter costs, came in at 1.8% in February – well below the Fed’s 2.0% target. While the road to 2.0% may hit some bumps, a sustained reacceleration appears unlikely given that global commodity prices (ex-energy) are trending lower, supply chains have normalized, and consumers are pushing back on price increases. The last two inflation prints are unlikely to materially change the Fed’s inflation forecasts, which show the core PCE measure on track to hit 2.0% by 2026.

Bottom line for the Fed | The recent economic news will likely reinforce the Fed’s near-term caution. However, with the economy expected to lose momentum, the labor market slowing, and disinflationary trends still intact, a Fed easing cycle still appears on the horizon given the Fed’s restrictive policy stance. While the Fed will want to wait for more data, the ‘dot plot’ is likely to maintain the three rate cuts penciled in for 2024, which aligns with our economist's view of three to four rate cuts this year. In addition, the Fed is expected to detail the plans to temper the pace of its recent balance sheet reduction strategy.

Read Full Story »»»

DiscoverGold

DiscoverGold

SPA "Doji" Denotes Indecision

By: Nautilus Research | March 15, 2024

• SPA "Doji" Denotes Indecision

Read Full Story »»»

DiscoverGold

DiscoverGold

Typical Ides of March Low

By: Almanac Trader | March 15, 2024

First half of March trading has been mostly in line with its seasonal pattern over the last 21 years. There has been plenty of chop with S&P 500, NASDAQ and Russell 1000 drifting higher while DJIA and Russell 2000 have moved lower. S&P 500 is up 1.06% thus far this month. NASDAQ is hanging onto an 0.23% gain, but DJIA and Russell 2000 are both in the red, down 0.23% and 1.15% respectively.

Today is the Ides of March and over the last 21-year period, the market has tended hit its March low today on the Ides and then to rally afterwards. Having avoided typical seasonal weakness in February and in early March, this upcoming period of strength could already be factored into the market, and we could experience more chop and churn.

Historically, the week after quarterly options expiration in March has been prone to weakness. Plus, the Fed is scheduled to meet next week. Even though it is widely expected that they will not be changing the Fed Fund’s Rate, everyone will still be looking for clues as to when they may begin cutting rates.

This AI-fueled bull market has enjoyed solid gains since last October and will likely continue to push higher in the near-term, but momentum does appear to be waning with the pace of gains slowing. With April and the end of DJIA’s and S&P 500’s “Best Six Months” quickly approaching we are going to begin shifting to a more cautious stance. We maintain our bullish stance for 2024, but that does not preclude the possibility of some weakness during spring and summer.

Read Full Story »»»

DiscoverGold

DiscoverGold

As the deviation of the S&P 500 index from its 50-day moving average is reaching extreme levels, speculation mounts regarding the potential for a short-term market correction

By: Isabelnet | March 15, 2024

• S&P 500

As the deviation of the S&P 500 index from its 50-day moving average is reaching extreme levels, speculation mounts regarding the potential for a short-term market correction.

Read Full Story »»»

DiscoverGold

DiscoverGold

The rising S&P 500 to M2 ratio suggests a potential overvaluation in the US stock market. This trend implies greater demand for stocks compared to the supply of money, worrying investors and analysts

By: Isabelnet | March 15, 2024

• The rising S&P 500 to M2 ratio suggests a potential overvaluation in the US stock market. This trend implies greater demand for stocks compared to the supply of money, worrying investors and analysts.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX $25+ Million Call Buyers Stepping In *Above the Ask*

By: Cheddar Flow | March 15, 2024

• $SPX $25M+ Call Buyers Stepping In

*Above the Ask*

Read Full Story »»»

DiscoverGold

DiscoverGold

The percentage of S&P 500 stocks trading within 5% of their 252-day high cycled from less than 10% to greater than 50%, with the index reaching an all-time high. Similar precedents suggest the uptrend in the world's most benchmarked index persists.

By: SentimenTrader | March 15, 2024

• The percentage of S&P 500 stocks trading within 5% of their 252-day high cycled from less than 10% to greater than 50%, with the index reaching an all-time high. Similar precedents suggest the uptrend in the world's most benchmarked index persists.

Read Full Story »»»

DiscoverGold

DiscoverGold

Election Years Are Different

By: Tom McClellan | March 15, 2024

We are now firmly into this election year, with both major parties' candidates determined. This moment is pretty early for that type of resolution. It has also been more than a century since a former president served as a major party's candidate seeking reelection (and no, Teddy Roosevelt's Bull Moose Party run in 1912 does not count).

Most of the time, election years are up years for the stock market. But there are big differences during the year depending on whether there is an incumbent first term president running for reelection, versus when a 2nd term president is term limited from running again. We are in the first circumstance this year.

I have been writing about the Presidential Cycle Pattern since 1994, using the pattern which is derived from averaging together SP500 price data in 4-year chunks of time. One difference in how I do this versus others is that I start each 4-year period as of Nov. 1 instead of Jan. 1, to better align with election day.

This week's chart looks at the differences (and similarities) in the versions of the Presidential Cycle Pattern depending on what type of president is in office. The green line reflects first term presidents from a different party than the last president, and reflects the condition we have now.

A lot of the time, the two patterns behave very similarly. But in March of the election year, there is a notable difference. When a first term president is in office and running for reelection, March is typically a sideways month, part of a larger sideways pattern lasting all the way until late May. March is different, though, when a second term president is in office (red line). I do not have a good explanation for that difference.

From April to July, the two patterns behave very much alike. But July is when the political parties typically start holding their nominating conventions, and the news coverage begins to heat up.

The stock market normally rallies from June all the way to election day when there is an incumbent running for reelection. And usually an incumbent will win reelection. That is how things normally go.

The red line veers downward starting in July, reflecting how investors start to feel more nervous about the impending certainty of getting an unknown new president from the November election. Fear of the unknown is the biggest fear for investors.

This year, we cannot necessarily set aside the message of that red line. President Biden's health issues and low approval ratings make it much more likely than normal that someone else will be named as nominee at the Aug. 19-22, 2024 convention. That throws off the normal presumption about how the incumbent 1st term president usually wins reelection.

And this year we have a challenger who is not an unknown quantity (to Wall Street), who at the moment has a slight lead in the polls. This type of condition is totally backwards from how election years usually go. Add to that the additional unknowns about how President Trump is facing multiple trials for alleged crimes, and we have an election year completely unlike any previous one. So trying to run a forecast model based on how things have gone in prior election years may just not work this year.

Tom McClellan

Editor, The McClellan Market Report

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | March 15, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | March 15, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

Ides, Schmides – March Drawdowns <2% Rather Bullish

By: Almanac Trader | March 15, 2024

While our 2024 outlook has remained decidedly bullish since our December “2024 Forecast: More New All-Time Highs Anticipated,” we’ve warned to “Beware the Ides of March.” That this overbought market is due for a pullback. That stuff happens in March, especially in election years (think 1980 Hunt Bros, 2000 Dotcom Bubble Pop and 2020 Covid Crash).

But what does it mean if this AI-driven bull powers ahead through March without a hitch? Well, it’s bullish, that’s what. Gains beget gains and when macro forces overpower weak seasonality, those forces often gather momentum when the seasonal period ends.

While there is still time left for March’s history of volatility to kick in, especially during notoriously treacherous week after Triple Witching, should the market escape the usual March retreat that would support continued robust bullish market action for the rest of 2024. When March’s drawdown is <2% the Best Six Months November-April are up 95.7% of the time, average gain 11.4%; Worst Six Months are not bad, up 69.6% of the time, 3.5% average; rest of the year is up 87% of the time, average 9.3%; and the full year is up 91.3% of the time with an average gain of 15.7%.

Read Full Story »»»

DiscoverGold

DiscoverGold

AI-generated Buy and Sell Daily Signals

By: Hedgeye | March 15, 2024

• This is free access to our brand-new AI-generated buy and sell signals.

Read Full Story »»»

DiscoverGold

DiscoverGold

Money managers Increased their exposure to the US Equity markets since last week...

DiscoverGold

DiscoverGold

NAAIM Exposure Index

March 14, 2024

The NAAIM Number

104.75

Last Quarter Average

67.81

»»» Read More…

$SPY Highly Unusual $1.1 Million OTM Put. This has a near-term expiration, far OTM strike, and is above the ask

By: Cheddar Flow | March 14, 2024

• $SPY Highly Unusual $1.1M OTM Put

This has a near-term expiration, far OTM strike, and is above the ask

This is an opening order too (Vol > OI)

Since there's no supporting flow around this order, it could be a singular hedge. Watch for similar prints to determine if it is directional or not

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX Getting squeezed tight within that 'Wedge'...

By: Sahara | March 14, 2024

• $SPX - Latest

Getting squeezed tight within that 'Wedge'...

Read Full Story »»»

DiscoverGold

DiscoverGold

$NDX - Latest: I have added Lines for a Lrgr 'Wedge'. And I see a 'Broadening' Plot developed (Black)...

By: Sahara | March 14, 2024

• $NDX - Latest

I have added Lines for a Lrgr 'Wedge'. And I see a 'Broadening' Plot developed (Black)...

Read Full Story »»»

DiscoverGold

DiscoverGold

The AAII Investor Sentiment

By: AAII | March 14, 2024

Bullish 45.9%

Neutral 32.2%

Bearish 21.9%

• Historical 1-Year High

Bullish: 52.9%

Neutral: 39.5%

Bearish: 50.3%

Read Full Story »»»

DiscoverGold

DiscoverGold

AI-generated Buy and Sell Daily Signals

By: Hedgeye | March 14, 2024

• This is free access to our brand-new AI-generated buy and sell signals.

Read Full Story »»»

DiscoverGold

DiscoverGold

It took the Nasdaq 100 a median of 86 days before falling back below its average. Only twice did it gain double-digits before doing so

By: Jason Goepfert | March 13, 2024

• Big tech just celebrated its 1-year anniversary levitating above its 200-day moving average.

It took the Nasdaq 100 a median of 86 days before falling back below its average. Only twice did it gain double-digits before doing so.

Read Full Story »»»

DiscoverGold

DiscoverGold

Will the $SPY heater continue into April? History is on the bulls side: Over the last 20 years, April has been red just 4 times, with an average return of +2.04%

By: TrendSpider | March 13, 2024

• Will the $SPY heater continue into April? History is on the bulls side:

Over the last 20 years, April has been red just 4 times, with an average return of +2.04%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Macro Factor for S&P 500 Traders to Consider

By: Schaeffer's Investment Research | March 13, 2024

• The S&P 500 has averaged about 8% per year since 1928

• Since Covid, especially, the Fed has created a huge amount of new money

In my usual analysis, I typically delve into technical indicators, sentiment gauges, or seasonal patterns. As options traders, we usually don't pay much attention to the S&P 500 Index's (SPX) price-earnings (P/E) ratio. However, this week, I'm shifting gears to explore it. Even for traders focused on shorter timeframes, considering certain macro factors can prove beneficial. It might offer insights for longer-term strategies, aid in risk management, or serve as a sentiment indicator. Specifically, I've delved into data on the Shiller S&P 500 P/E Ratio, also known as the CAPE ratio (Cyclically Adjusted Price-Earnings ratio). This metric calculates the P/E ratio of S&P 500 stocks while smoothing out earnings by examining the past 10 years and adjusting them for inflation.

I've analyzed monthly data dating back to 1928, and only a few instances have seen this ratio surpass 30. The first occurred in 1929, just before the Great Depression. The second was in 1997, reaching nearly 45 before the tech bubble crash in the early 2000's. It breached 30 again in 2017 and has hovered around that level since. Currently, it's trending upward, surpassing the 32.5 mark, the peak of this ratio just before the Great Depression. Next, I'll show what kind of returns stocks produced given the level of the CAPE Ratio.

S&P 500 RETURNS AND THE CAPE

The first table below shows the annualized returns of the S&P 500 going forward after CAPE Ratio readings above 25. For a benchmark, the S&P 500 averages about 8% per year since 1928. When the CAPE Ratio has been above 25, the one-year returns have slightly underperformed averaging about 6%. The longer-term returns are more concerning. Over the next five years, the S&P 500 averaged an annualized return of 3.4% and was positive barely half the time.

The second table shows S&P 500 returns after the CAPE Ratio reading was below 10. These low ratios have tended to lead to significant outperformance. The index gained an average of 18.5% over the next year, with 84% of the returns positive. Looking at the five-year returns, it averaged 13% on an annualized basis, with 100% of the returns positive. The CAPE Ratio has been a reliable long-term stock indicator.

For completeness, here is a table showing S&P 500 returns between these two extremes.

IMPLICATIONS OF A CAPE RATIO

The chart below highlights the disparity of average annualized returns going forward based on the CAPE Ratio. If this tendency holds up, it could be a rough go for buy-and-hold investors over the next several years. If someone believes that’s the case, it might be a good reason to shorten time horizons…maybe get into options?

I’ve heard compelling arguments against a pessimistic outlook. In 1997, after the CAPE moved above 30, there were still a few years of substantial gains. Also, the ratio has been at an elevated level since 2017. The all-time average of the CAPE is around 19. It hasn’t been to this level since 2009. So, maybe some things have changed.

Those are famous last words but hear me out. Since Covid, especially, the Fed has created a huge amount of new money. Although the earnings in the denominator of the CAPE ratio is inflation-adjusted, price inflation has not kept pace with money creation. So, the new money might have a bigger impact on the price in the numerator depending on how much of that new money is directed into the market. If that’s the case, the CAPE ratio will settle around a higher normal reading for a prolonged period before price inflation catches up. So, there are reasons to be hopeful.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500 Index (SPX): Summary Analysis

By: Marty Armstrong | March 13, 2024

S&P 500 Cash Index opened above the previous high and closed above it as well warning of a bullish posture right now. This market is above all our indicators at this time reflecting it is moving higher over recent activity. The overall oscillator position is also turning positive at this time. It closed today at 517527 and is trading up about 8.50% for the year from last year's settlement of 476983.

As of now, this market has been declining for going into 2024 reflecting that this has been only still a bearish reactionary trend. As we stand right now, this market has made a new high exceeding the previous year's high reaching thus far 518926 while it is still trading above last year's high of 479330.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The S&P 500 Cash Index has continued to make new historical highs over the course of the rally from 1974 moving into 2024. Distinctly, we have elected two Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Focusing on our perspective using the indicating ranges on the Daily level in the S&P 500 Cash Index, this market remains moderately bullish currently with underlying support beginning at 512797.

On the weekly level, the last important high was established the week of March 4th at 518926, which was up 19 weeks from the low made back during the week of October 23rd. So far, this week is trading within last week's range of 518926 to 505682. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 518926 made 0 week ago. This market has made a new historical high this past week reaching 518926. Here the market is trading positive gravitating more toward resistance than support. We have technical support lying at 510232 which we are still currently trading above for now.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend. Looking at this from a wider perspective, this market has been trading up for the past 9 weeks overall.

INTERMEDIATE-TERM OUTLOOK

Interestingly, the S&P 500 Cash Index has been in a bullish phase for the past 11 months since the low established back in March 2023.

Critical support still underlies this market at 417150 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Nasdaq Composite Index (COMP): Summary Analysis

By: Marty Armstrong | March 13, 2024

NASDAQ Composite Index Cash opened above the previous high and closed above it as well warning of a bullish posture right now. It closed today at 1626564 and is trading up about 8.35% for the year from last year's settlement of 1501135. At present, this market has been rising for going into 2024 reflecting that this has been only still a bullish reactionary trend. As we stand right now, this market has made a new high exceeding the previous year's high reaching thus far 1644970 while it is still trading above last year's high of 1515007.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NASDAQ Composite Index Cash has continued to make new historical highs over the course of the rally from 2009 moving into 2024. Distinctly, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NASDAQ Composite Index Cash, this market remains moderately bullish currently with underlying support beginning at 1612856.

On the weekly level, the last important high was established the week of March 4th at 1644970, which was up 19 weeks from the low made back during the week of October 23rd. So far, this week is trading within last week's range of 1644970 to 1586263. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 1644970 made 0 week ago. Still, this market is within our trading envelope which spans between 1473112 and 1616634. This market has made a new historical high this past week reaching 1644970. Here the market is trading positive gravitating more toward resistance than support. We have technical support lying at 1596636 which we are still currently trading above for now.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend. Looking at this from a wider perspective, this market has been trading up for the past 9 weeks overall.

INTERMEDIATE-TERM OUTLOOK

Interestingly, the NASDAQ Composite Index Cash has been in a bullish phase for the past 11 months since the low established back in March 2023.

Critical support still underlies this market at 1486003 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

$SPX Whales are moving up to 5235 & 5400c's now

By: Cheddar Flow | March 13, 2024

• $SPX Hey there

Whales are moving up to 5235 & 5400c's now

Read Full Story »»»

DiscoverGold

DiscoverGold

March Quarterly Options Expiration Week: S&P 500 and NASDAQ Up 12 of Last 16

By: Almanac Trader | March 13, 2024

March Quarterly Option Expiration Weeks have been quite bullish. S&P 500 has been up 27 times in the last 41 years while NASDAQ has advanced 25 times. More recently, S&P 500 and NASDAQ have both advanced 12 times in the last 16 weeks. But the week after is the exact opposite, S&P down 27 of the last 41 years—and frequently down sharply. In 2018, S&P fell –5.95% and NASDAQ dropped 6.54%. Notable gains during the week after for S&P of 4.30% in 2000, 3.54% in 2007, 6.17% in 2009, and 10.26% in 2020 appear to be rare exceptions to this historically poorly performing week.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

179

|

Posters

|

|

|

Posts (Today)

|

3

|

Posts (Total)

|

68674

|

|

Created

|

06/10/03

|

Type

|

Free

|

| Moderators DiscoverGold | |||

:::::::::::: Welcome to S&P 500 & Nasdaq Analysis and Trends :::::::::::::

• The purpose of this board is to help others with Short & Long term S&P 500 & Nasdaq analysis and direction.

• This is strickly an educational board helping traders to learn market direction, swing and bottom trading.

• I ask that everyone respect opinions on the board whether you agree with them or not. We are all here to make money and avoid the

minimum loss we can.

Rules of the Board

Most of this board's WATCHERS are "lurkers" who appreciate info available without the need to sift through tons of "empty" posts.

1. Respect everyone opinions on trades.

2. No Pumping of Stocks.

3. No OTCBB or PINK STOCKS

*********************************************************************************************************

To help us evaluate our performance, please "BoardMark" the board if you find it useful.

To do so, just click on "Add to Favorites" Button at Right just above the Posts Dates.

*Information Posted on this Board is not Meant to Suggest any Specific Action, But to Point Out the Technical Signs That Can Help Our Readers Make Their Own Specific Decisions. Your Due Deligence is a Must.

EXCHANGE TRADED FUNDS~ETFs COMPONENTS~RSI and I/V charts#msg-5495097 COMPONENTSFOR ^NDX / QQQQ ~ I/V charts #msg-9787995

Gold~ Silver~ HUI~ XAU~ US$~ €uro~ Crude #msg-29347660 (thanks,bob)

Cookies/Bandwidth/Security/Privacy #msg-9353921 PIEs/Cookies/Macromedia/Flash #msg-9412363 PerformanceTips for WinXP #msg-9854670

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |