T.NCU

YERINGTON, Nev., Sept. 21, 2021 (GLOBE NEWSWIRE) -

- $Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the “Company”) today provided an update on management team additions and execution of its productivity improvement plan.

Highlights

Accelerated stope turnover rates:

The pace of stope mining continues to accelerate at the Company’s underground mine at its Pumpkin Hollow Project (the “Underground Mine”), with mining from the second stope already complete, and blasting of the third stope commenced. Further improved visibility on stoping inventory and additional stopes is planned in the coming weeks.

Team strengthened in key positions:

Following Mike Brown assuming the role of Interim President and Chief Executive Officer, a number of key positions have been swiftly filled, adding key mining skills and building out the execution team. Key positions include GM Underground Projects, Interim Chief Operating Officer, Underground Production Manager, Process Manager, Senior Electrical Engineer, and Director of Financial Reporting.

Productivity improvement plan generating positive results:

Management, including new team additions, have initiated a productivity improvement plan aimed at addressing the operational challenges at the Underground Mine encountered during Q2 2021, including improved planning, monitoring and contractor management systems. In the weeks since initiated, substantial improvements in productivity have been demonstrated in development rates.

Processing: Ore from stope mining averaging approximately 1.5% Cu is being delivered to the mill with recoveries as planned and production of concentrate meeting offtake specifications while batch processing ore.

Mike Brown, Interim President and Chief Executive Officer, commented: “I am very pleased to welcome the new additions to our team. Along with strengthened leadership and the addition of key skills, we are already seeing improvements in operational execution and productivity, resulting in increased stope turnover rates. These results are encouraging as we embed operational improvements and continue with the ramp-up of copper production”.

Further Details

Team Strengthening

During August and September, a number of key additions to the Pumpkin Hollow operating team have been made. These additions address prior limitations in availability of mining and geotechnical technical skills within the management team. Key among these additions are:

GM Underground Projects: Robert Booth will oversee all underground mining activities, including contractor management and infrastructure. Mr. Booth has substantial underground mining and contractor management experience in the Americas, including as Project Director for Hudbay Minerals since 2018, as Project Director and Mine Manager across Vale’s Canadian operations between 1990 and 2017, and prior to that at Inco Limited.

Interim Chief Operating Officer

Underground Production Manager

Process Manager

Senior electrical engineer

Director, financial reporting

Productivity Improvement Plan

Over recent weeks, management has undertaken a detailed review of the constraints encountered during Q2 2021 at the Underground Mine and reviewed planning for the remaining ramp-up and steady-state operations. As a result, a number of measures have been implemented to address operational constraints encountered in Q2, including:

Stronger contractor management procedures combined with revised contractor key performance indicators and aligned incentive systems to drive improved mining productivity.

Planning focus on accelerated stope delivery and prioritization of certain underground infrastructure items key to delivering higher production volumes.

Implementation of enhanced inventory management systems and supply chain optimization to ensure critical consumables and spares are available to service mining activities.

Optimization of equipment utilization, including revisions to the mobile equipment maintenance program.

The above measures are delivering operational improvements and providing greater visibility on stoping inventory. An increased rate of stope mining is underway with the second stopes mined, the blasting of the third stope having commenced and further stopes planned in the coming weeks.

The surface ventilation fans for the Underground Mine remain on schedule for commissioning in Q4 2021. The Company will provide further updates on operating performance metrics in due course.

Credit Facility Amendments

Discussions are progressing positively with KfW-IPEX Bank (“KfW”), in-line with the expectations previously reported in the Company’s August 31, 2021 news release. The Company expects to finalize amendments to its senior facility with KfW in the coming weeks in order to, among other things, extend the project completion longstop date under the facility. However, there can be no assurance that such amendments and extensions will be obtained.

Completion of Share Consolidation

The Company has completed the previously announced consolidation of its issued and outstanding common shares on the basis of one (1) post-consolidation common share for every ten (10) pre-consolidation common shares (the “Share Consolidation”). The common shares will begin trading on a post-consolidation basis at the market open on September 21, 2021. See the Company’s September 3, 2021 press release for additional details on the Share Consolidation.

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., and Norm Bisson, P.Eng., for Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

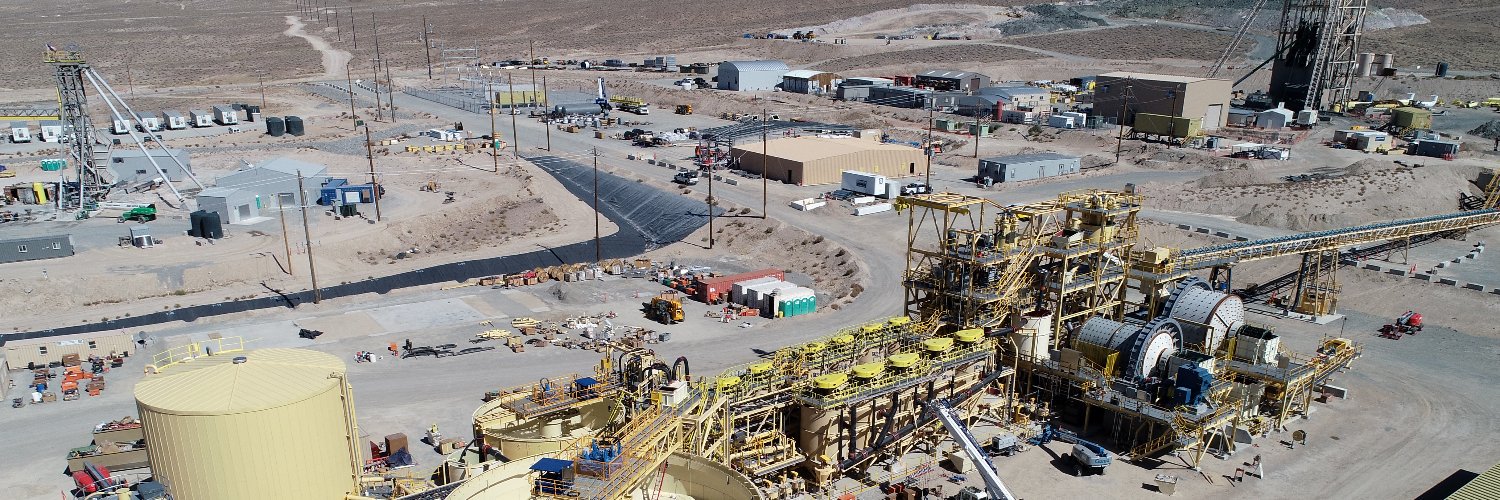

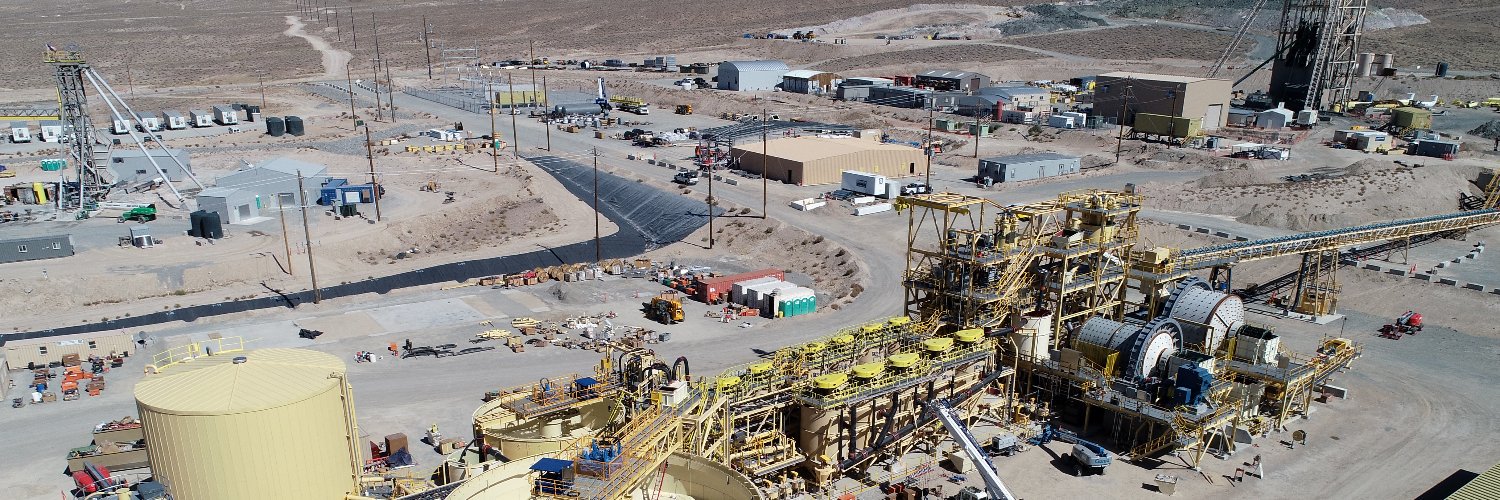

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Brown, Interim President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Cautionary Language

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to mine development plans, production and ramp-up plans and the expected timing and results thereof, equipment installation, and amendments to the Company’s amended and restated senior credit facility with KfW.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Such risks and uncertainties include, without limitation, those relating to: the ability of the Company to complete the ramp-up of the Underground Mine within the expected cost estimates and timeframe; requirements for additional capital and no assurance can be given regarding the availability thereof; the impact of the COVID-19 pandemic on the business and operations of the Company; the state of financial markets; history of losses; dilution; adverse events relating to milling operations, construction, development and ramp-up, including the ability of the Company to address underground development and process plant issues; failure to obtain extensions under and amendments to the Company’s amended and restated senior credit facility with KfW; ground conditions; cost overruns relating to development, construction and ramp-up of the Underground Mine; loss of material properties; interest rates increase; global economy; limited history of production; future metals price fluctuations; speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labor disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates from management’s expectations and the difference may be material; legal and regulatory proceedings and community actions; accidents; title matters; regulatory approvals and restrictions; increased costs and physical risks relating to climate change, including extreme weather events, and new or revised regulations relating to climate change; permitting and licensing; volatility of the market price of the Company’s securities; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those risks discussed in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2020 and in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 18, 2021. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements and information. The forward-looking information and statements are stated as of the date hereof. Nevada Copper disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the additional information regarding Nevada Copper’s business contained in Nevada Copper’s reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on Nevada Copper and the risks and challenges of its business, investors should review Nevada Copper’s filings that are available at www.sedar.com.

Nevada Copper provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

$Nevada Copper Provides Operations and Financing Updates

T.NCU

YERINGTON, Nev., Aug. 31, 2021 (GLOBE NEWSWIRE) --

Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the

“Company”) today provided an update regarding operations at the

underground mine at its Pumpkin Hollow project (the “Underground

Mine”), as well as an update on financing matters. All amounts below

are stated in US dollars.

Operations Update

Stoping and Lateral Development: Development and penetration through the water bearing dike has now been completed on the first crossing. Lateral development beyond this crossing is now into solid ground at a pace consistent with mine plan rates focused on establishing production from the East-North deposit. In addition, with steel support beams recently installed, a second crossing is expected in the coming weeks, further enhancing development rates.

Stoping: The Company has mined the second stope in the Alphabet Zone at a CuEq grade of 1.45% with backfilling scheduled to start in the coming week.

Surface Ventilation Fans: Delivery of the surface fans remains on schedule with installation and commissioning expected to be completed in Q4 2021 with sustainable hoisting rates of 3,000 tpd expected to follow.

“We are pleased to have completed our first crossing of the water dikeenabling our development rates to increase in line with our mine plan expectations,” stated Mike Brown, Interim Chief Executive Officer of Nevada Copper. “We look forward to continued production rate increases in Q3 and Q4 of this year.”

Financing Update

KfW Credit Facility Amendment Discussions: On August 31, 2021, the Company received an extension of the waiver from KfW IPEX-Bank (“KfW”), the Company’s senior project lender, to September 30, 2021 to complete the project completion test (the “Project Longstop Date”) under the amended and restated credit agreement (“Amended KfW Facility”). The Company is in discussions with KfW regarding a longer-term extension of the Project Longstop Date into 2023; deferral of debt servicing by up to twenty-four months; and the deferral of certain financial covenants under the Amended KfW Facility to further support the ramp-up of the Underground Mine. The Company expects to have the proposed extension and amendments finalized in the next month. However, there can be no assurance that such extension and amendments will be finalized by such times or at all. Failure to finalize the extension would result in the Company being in default under the Amended KfW Facility.

Additional $13M of liquidity: The existing Promissory Note provided by Pala Investments Limited, the Company’s largest shareholder (“2021 Promissory Note”) has been amended (subject to regulatory approval) to allow total borrowings of up to $55 million, providing an additional $13 million of liquidity to the Company. Further draws by the Company are subject to agreed use of proceeds. The 2021 Promissory Note has a maturity date of June 30, 2022, and bears interest at 8% per annum on amounts drawn. Pursuant to the amendment, the 2021 Promissory Note now provides for an arrangement fee of 6% on the full commitment amount of $55 million, which will be capitalized. The proceeds will be used to fund the development and ramp-up of the Underground Mine and related working capital needs. The amendment was reviewed and approved by a committee of independent directors of the Company.

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., and Norm Bisson, P.Eng., for Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade underground mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Brown, Interim President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

$B-H; Last Time This Happened Gold Price Soared 25X And Silver Skyrocketed

38X, But Here Is Another Bullish Surprise

July 27, 2021

The last time this happened the price of gold soared 25X and silver

skyrocketed 38X, but here is another bullish surprise.

A Copper Bullish Surprise

July 27 (King World News) –

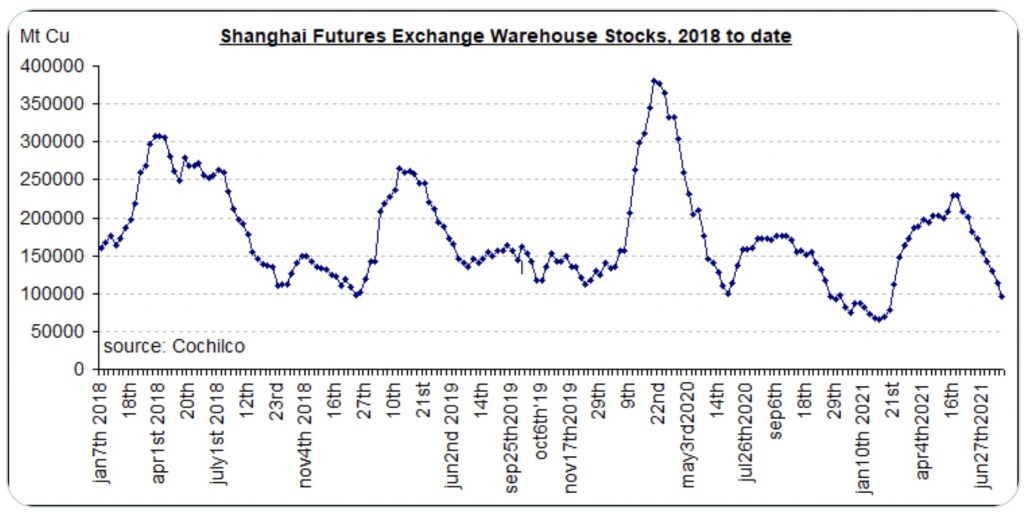

Gianni Kovacevic: Copper warehouse levels Shanghai Futures Exchange:

January 2018 to Summer 2021 (see chart below).

Copper Warehouse Levels Plummeted In Shanghai!

Copper Getting Ready To Takeoff

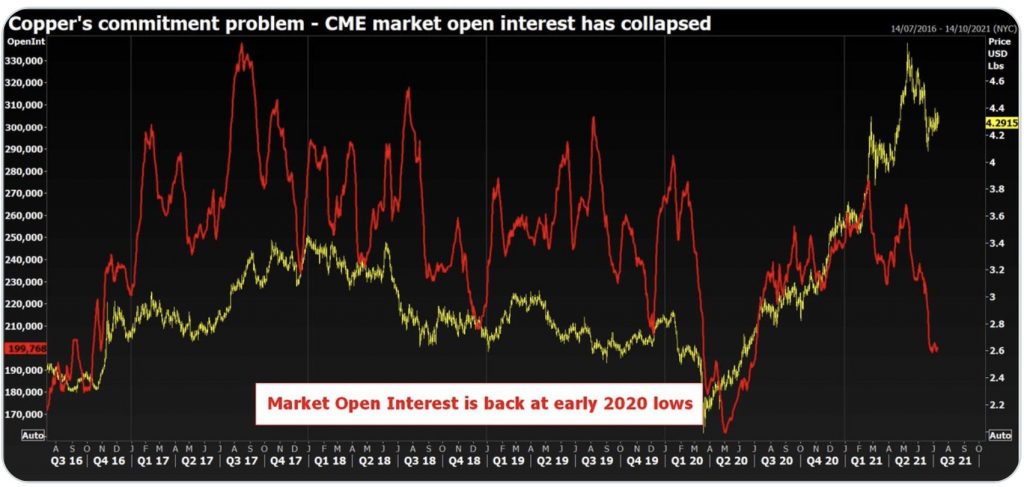

Meanwhile… the past few months speculators lost interest in the red

metal… but the price stayed well above $4 bucks. What happens next?

Stay tuned for the next exciting episode of copper decoupling from oil

(see chart below).

Copper Long Positions (RED) Have Been Liquidated

https://kingworldnews.com/last-time-this-happened-gold-price-soared-25x-and-silver-skyrocketed-38x/

$NEWS RELEASE Nevada Copper Announces Further Progress with Underground Operations and Strategic Project Development

July 12, 2021

https://nevadacopper.com/news/nevada-copper-announces-further-progress-with-underground-operations-and-strategic-project-development/

Yerington, NV – July 12, 2021 –

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the

“Company”) is pleased to provide an update regarding the ramp-up of the

Underground Mine and development activities for the Open Pit project at

its 100%-owned, fully-permitted Pumpkin Hollow Project in Nevada.

Production Ramp-Up Update

$Nevada Copper Corp (NEVDF) discussing Minerals Processing & Tailings Management

266 viewsJun 9, 2021

https://www.youtube.com/watch?v=gm6aNh5mY6k

$Like folding fiat notes, physical gold in possession has no interest

rate, but as money it is routinely loaned, leased and swapped for

fiat.

This would not happen if gold, silver & copper was not the real money.

Because of its innate stability, gold’s interest rate is low.

Figure 4 illustrates why.

RE: I definitely think copper should be part of everyone's portfolio.

I appreciate your DD, NYBob.

https://www.kitco.com/commentaries/2021-06-08/Is-copper-the-new-golden-child-of-the-metals-group.html

Silver, Copper and Gold...

Note...Ex. This IVN vs. NCU

"Kamoa-Kakula Copper Mine is powered by clean, renewable hydro-generated electricity."

Climate change is causing Kariba to dry up

The world’s largest man-made reservoir, that of the Kariba Dam –

which has provided electricity to Zambia and Zimbabwe for over five

decades – hasn’t been spared by the droughts.

According to the Zambezi River Authority (ZRA), in recent months the

inflows of water from the Zambezi River that feed it have dwindled

to a third compared to a year ago.

Renewable IF climate change drought doesn't disrupt food production or

cyclones destroy transportation infrastructure

February 11, 2011 - Cyclone Bingiza emerged into the Mozambique Channel after crossing northern Madagascar.

January 17, 2012 - Subtropical Depression Dando struck southern Mozambique

January 21, 2012 - Cyclone Funso

March 2012 - Tropical Storm Irina

February 2013 - Cyclone Haruna

January 2014 -

March 26, 2014 - Cyclone Hellen formed near the northeast coast of Mozambique, bringing rainfall to the region.

April 27, 2016 - The remnants of Cyclone Fantala produced flooding in Tanzania that killed eight people.

February 15, 2017 - Cyclone Dineo struck central Mozambique, causing flooding that extended into Zimbabwe and Malawi. Dineo killed 271 people and caused over US$200 million in damage.

January 14, 2018 - A tropical depression formed over Mozambique.

January 17, 2019 - A tropical low formed over Mozambique and later intensified into Tropical Storm Desmond in the Mozambique Channel.

March 4, 2019 - A tropical depression moved ashore Mozambique, and later moved into the Mozambique Channel, strengthening into Cyclone Idai. The intense tropical cyclone made landfall near Beira. The cyclone killed 1,000 people.

April 25, 2019 - Cyclone Kenneth became the strongest tropical cyclone on record to strike Mozambique, when it moved ashore just north of Pemba. The JTWC estimated landfall winds of 220 km/h (140 mph). Kenneth killed 45 people in Mozambique, less than two months after Idai's deadly trek through the region.[12][13][14]Climate change is causing Kariba to dry up

by bogfit

----

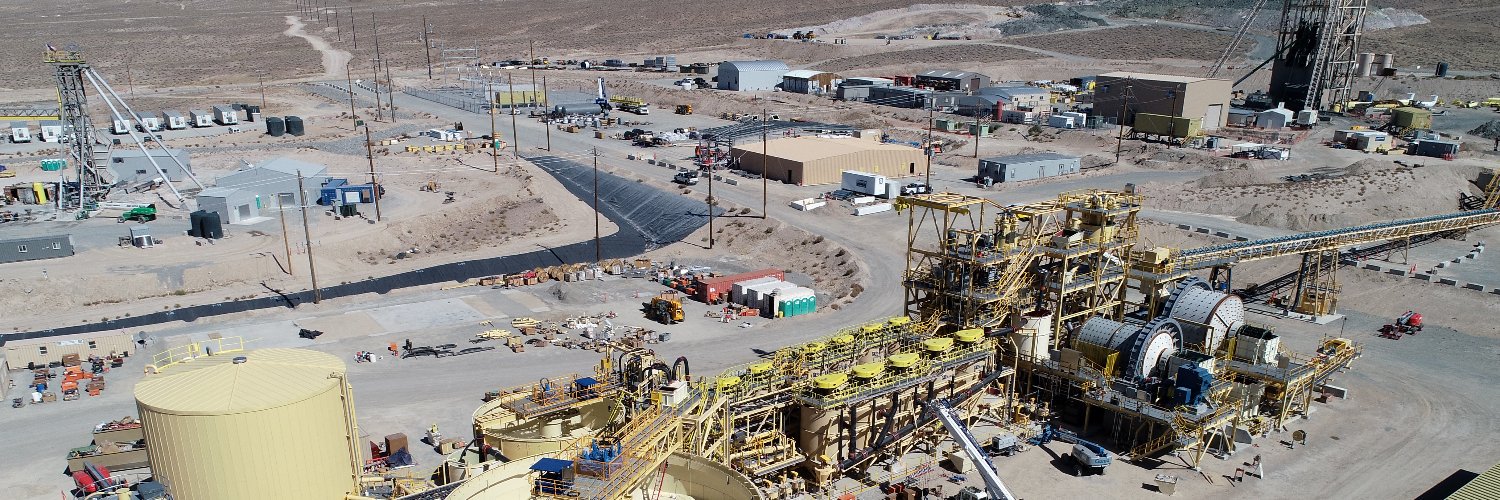

$NEVADA COPPER | Pumpkin Hollow, 2 Mines Loaded with Copper

712 views•Premiered May 26, 2021

BUILDING THE NEXT MID-TIER COPPER PRODUCER

Nevada Copper (TSX:NCU) is a US copper producer and owner of

Pumpkin Hollow, which hosts an underground project that is

now in production, and an open pit development.

The property is located in Nevada (USA) – rated by

The Fraser Institute as the World #1 mining jurisdiction.

The processing facility commenced production in December, 2019,

using development ore stockpiled during construction of

the underground mine.

The project benefits from a straightforward approach to production,

together with a desert climate and local topography that

facilitates efficient, eco-friendly mining techniques.

In addition, the local district of Yerington is a former copper-

producing region with superb infrastructure and

a skilled workforce.

The project’s substantial reserves and resources include copper, gold

and silver and there is clear potential for deposit expansion and

greenfield exploration.

https://www.youtube.com/watch?v=vIEmMHVZefA&t=62s

Nevada Copper: (TSX: NCU | OTC: NEVDF)

Website:

http://www.nevadacopper.com

Corporate Presentation:

https://nevadacopper.com/investors/presentations/

$Nevada Copper Corp (NEVDF) Building A New US Copper District -

https://investors.nevadacopper.com/alerts/?utm_campaign=core_ld_remark&utm_source=google&utm_medium=display&utm_content=r1&gclid=EAIaIQobChMIrrnh_e7o8AIVpOdbCh25JQRJEAEYASAAEgIIpfD_BwE

$Nevada Copper mines first stope at Pumpkin Hollow

Posted by Paul Moore on 18th May 2021

There were significant improvements made to the processing plant

performance and recoveries during the quarter.

The company achieved a weekly average of 4,700 t/d and a maximum

daily milling throughput of 5,000 t/d during March, while batch

processing ore.

119,000 t of ore were processed through the concentrator in Q1.

Approximately 3,173 t of concentrate was produced at a 24% average

copper grade for Q1 and reaching 26% average copper grade in March.

Recoveries improved from 82% in Q4 2020, to recovery levels above 90%

in 2021.

“I am pleased with the progress achieved in Q1 at our underground mine

and the dedication of our team,” stated Mike Ciricillo, Chief Executive

Officer of Nevada Copper.

“The operation made significant progress through the ramp-up during the

first quarter, and we look forward to the interim milestone of

production rates of 3,000 tpd expected in June, 2021 and continuing our

ramp-up to steady state production.”

https://im-mining.com/2021/05/18/nevada-copper-mines-first-stope-pumpkin-hollow/

Copper rebounds despite China trying to control

https://www.mining.com/copper-price-rebounds-demand-signals-are-still-firing-on-all-cylinders-td-securities/

Nevada Copper Corp (NCU)(NEVDF) NCU.C Analysis -

http://www.stockta.com/cgi-bin/analysis.pl?symb=NCU.C&cobrand=&mode=stock

silver_bars thanks; NvCu might start seeing a premium build up soon ...

as Chile is the #1 Copper producer in the world ....

https://www.zerohedge.com/commodities/worlds-largest-lithium-producer-crashes-10-chilean-political-storm

Growing uncertainty in Chile/Peru make Nevada Copper strategically more

important ... a hard left turn from the govts of Chile/Peru should be

very good for NvCu ....

https://www.gata.org/node/21160

https://www.reuters.com/world/americas/worlds-top-copper-region-political-risk-rises-2021-05-17/

$Nevada Copper Corp (NCU.TO)

BARCHART OPINION

https://www.barchart.com/stocks/quotes/NCU.TO/opinion

$Nevada Copper Corp. starting Cu-Bull Run has just started but

it's a long hike back UP, imo!

NvCu might start seeing a premium build up soon ... as Chile is the #1 Copper producer in the world ....

https://www.zerohedge.com/commodities/worlds-largest-lithium-producer-crashes-10-chilean-political-storm

Quote:

Growing uncertainty in Chile/Peru make Nevada Copper strategically more important ... a hard left turn from the govts of Chile/Peru should be very good for NvCu ....

https://www.gata.org/node/21160

https://www.reuters.com/world/americas/worlds-top-copper-region-political-risk-rises-2021-05-17/

$bigone thanks; Copper expected to rise to record highs later this year

433 views•May 7, 2021

https://www.youtube.com/watch?v=BWkn07W7G1M

$Is there a buyers on the horizon

It’s a perfect setup...

The reality is that the future looks pretty bright for

Nevada Copper Corp (NEVDF) or Hudbay with large copper properties

beside each other =

Likely profitable going forward and holding some excellent properties

in stable jurisdictions.

It is a perfect time for Barrick or ? to make a play for Nevada Copper

or/and Hudbay.

Ex...

Barrick has publicly stated that they are looking for a copper play.

Maybe soon to moon

Russia elite billionaire taken large position with great future

foresight -

$China, Peru, and the copper bull market

12,351 views•May 8, 2021

https://www.youtube.com/watch?v=NGDmrKktevg

$Lucky NCU is only now bringing up High-Grade ore

We will now be selling high grade at these kind of prices

instead of the $2.75 or something that the original hedging

was done at.

$4.7570 +0.0398 +0.84%

21:44:03 - Real-time derived data. Currency in USD ( Disclaimer )

$Remember 65,000,000 pounds of copper per year soon to be burbing up

from the underground mine alone... U can do the math.

by Notgnu

$What’s Behind Surging Copper Prices?

3,186 views•May 11, 2021

https://www.youtube.com/watch?v=Uc9KfIPzp5A

Record High Metal Prices - Copper and Steel Demand Surge

417 views•May 9, 2021

https://www.youtube.com/watch?v=7qXSHwcUYQc

$Nevada Copper Corp (NEVDF) Analyst; Copper to surge at

least seven-fold before this bull market is

over .....

https://www.kitco.com/news/2021-05-11/Copper-to-surge-at-least-seven-fold-before-this-bull-market-is-over-Goehring-Rozencwajg.html

$Copper price hits 10-year highs; where is it headed from here? –

Gary Wagner

21,717 views•Apr 26, 2021

https://www.youtube.com/watch?v=VOhe4hQmGrE

$Nevada Copper Corp (NEVDF) First New Source of Copper Supply in the US in a Decade Comes Online

Contributed Opinion - New Mill 5000 t/d it would take 10-20yrs for

someone else to get permits , construction development etc. -

NCU got it, made it and its a Mother Lode Cu-Au-Ag bargain today -

for fiat peanuts- slave currency IMO!

$nowwhat2 thanks; Copper outlook just became even stronger >>> maybe $20,000 !

https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

$Copper's supply crunch will drive prices to $13,000 or even $20K - Bank of America

https://www.kitco.com/news/2021-05-05/Copper-s-supply-crunch-will-drive-prices-to-13-000-or-even-20K-Bank-of-America.html

$nw2 well it's long overdue for NEVDF to move to the Cu-BULL TOP -

to Ccpycat Ex...EXMGF's BULL-RUN - NEVDF MOVE UP ROCKET TO GOOOOOO

$Nevada Copper Corp. starting Cu-Bull Run - We want it ROCKET Back UP

$6/sh++++ let's Move IT FLY NCU

$Why has silver price not yet spiked from demand, but copper has? Lobo Tiggre

65,199 views•Apr 28, 2021

https://www.youtube.com/watch?v=6mgOPnZ1Vbc

$Nevada Copper Corp (NEVDF) RE: Converted to Canadian = $1.66 to $3.30 per share......

At $4.50 copper, 2.3 billion fully diluted shares and 70,000 TPD open

pit:

70,000 tpd X .005 copper equivalent X 88% recovery X 2000 pounds per ton

X 365 days per year = 225 million pounds plus 65 million pounds from

underground = 290 million pounds X ~ $2.50 profit = $725,000,000 free

cash-flow per year.

$0.725 billion p/year cash flow X5 multiple = $3.63 billion / 2.3 billion shares = $1.58 USD p/s

$0.725 billion p/year cash flow X6 multiple = $4.35 billion / 2.3 billion shares = $1.89 USD p/s

$0.725 billion p/year cash flow X7 multiple = $5.08 billion / 2.3 billion shares = $2.21 USD p/s

$0.725 billion p/year cash flow X8 multiple = $5.80 billion / 2.3 billion shares = $2.52 USD p/s

$0.725 billion p/year cash flow X9 multiple = $6.53 billion / 2.3 billion shares = $2.84 USD p/s

$0.725 billion p/year cash flow X10multiple =$7.25 billion / 2.3 billion shares = $3.15 USD p/s

$1.96 CAD to $3.91 CAD per share

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

$At $5.00 copper, 2.3 billion fully diluted shares and 70,000 TPD

70,000 tpd X .005 copper equivalent X 88% recovery X 2000 pounds per ton

X 365 days per year = 225 million pounds, plus 65 million pounds from

underground = 290 million pounds X ~ $3.00 profit = $870,000,000 free

cash-flow per year.

$0.87 billion p/year cash flow X5 multiple = $4.35 billion / 2.3 billion shares = $1.89 USD p/s

$0.87 billion p/year cash flow X6 multiple = $5.22 billion / 2.3 billion shares = $2.27 USD p/s

$0.87 billion p/year cash flow X7 multiple = $6.09 billion / 2.3 billion shares = $2.65 USD p/s

$0.87 billion p/year cash flow X8 multiple = $6.96 billion / 2.3 billion shares = $3.03 USD p/s

$0.87 billion p/year cash flow X9 multiple = $7.83 billion / 2.3 billion shares = $3.40 USD p/s

$0.87 billion p/year cash flow X10multiple =$8.70 billion / 2.3 billion shares = $3.78 USD p/s

$2.36 CAD to $4.72 CAD per share

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

$Current underground mine as a stand alone after ramp up:

65 million pounds per year x $2.44 ($4.30 - $1.86 = $2.44)

Free cash-flow of about $159 million USD per year at a conservative, low 5 X cash-flow multiple =

$793 million, divided by 1.8 billion shares = $0.44 USD = $0.55 CAD

by nozzpack

$Joecanada13 EnjoY Nevada Copper Mine; Ya big block buys going through - The new golden oil - Looks primed for another bull run ^^^^^

https://www.msn.com/en-us/money/markets/copper-is-the-new-oil-and-could-reach-15000-by-2025-as-the-world-transitions-to-clean-energy-goldman-sachs-says/ar-BB1fE8bx

https://www.cnbc.com/2021/04/14/goldman-says-copper-is-the-new-oil-raises-price-forecast.html

$Nevada Copper - Pumpkin Hollow Project Extract - will be the great new

copper, silver, gold mine -

$Nevada Copper Provides Operations Update

April 21, 2021

View PDF

April 21, 2021 –

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF)

(“Nevada Copper” or the “Company”) provides a project update for the

underground mine at its Pumpkin Hollow project (the “Underground

Project”).

https://nevadacopper.com/news/nevada-copper-provides-operations-update/

Performance Highlights

First Stopes to Be Mined

The first stope will be mined in the East South Alphabets zone this week.

$The Alphabets zone is expected to carry copper equivalent grade of

approximately 2.5%.

Ventilation Expansion

The electrical upgrades have been completed and the fan bulkhead is in

the final stages of construction for installation of the remaining

underground ventilation fans.

Two additional underground ventilation fans, as previously announced,

are on schedule for installation in May, which should enable further

increases in underground development rates.

The surface ventilation fans remain on schedule for installation in the

third quarter of 2021.

Lateral Development

Lateral development in March increased 69% from February after the

previously announced electrical upgrades were completed.

Lateral development early in the first quarter 2021 was slower than

anticipated due to cautious progress through a water bearing dike.

Progress continues with penetration through the dike.

$Continuing to Increase Mill Throughput Rates

While we are still batch processing ore through the mill, we achieved a

weekly average of 4,700 tons per day (“tpd”) and maximum daily milling

throughput of 5,000 tpd during March.

Concentrate grade continues to be achieved that comply with off-take

specifications.

Concentrate grade has continued to rise, with an average grade of 26%

achieved in March compared to 24% during January and February.

The Company is on schedule to reach steady-state production of

approximately 5,000 tpd in the third quarter of 2021.

“We are pleased with the progress achieved in Q1 despite the challenges

with lateral development and we look forward to the imminent blasting

of our first high grade stopes,” stated Mike Ciricillo, Chief Executive

Officer of Nevada Copper.

“As well as advancing our stope development, we look forward to further

increases in underground development rates as we move closer to steady-

state production in Q3 this year.”

Qualified Persons

The information and data in this news release was reviewed by

Greg French, C.P.G., and Norm Bisson, P. Eng.,

for Nevada Copper, who are non-independent Qualified Persons

within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of

The Pumpkin Hollow Copper Mine project -

Located in Nevada, USA,

$Pumpkin Hollow Mine has substantial reserves and

resources including copper, gold and silver.

Its two fully permitted projects include the high-grade underground mine

and processing facility, which is now in the production stage, and

a large-scale open pit project, which is advancing towards

feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Ciricillo, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

https://nevadacopper.com/news/nevada-copper-provides-operations-update/

https://nevadacopper.com/

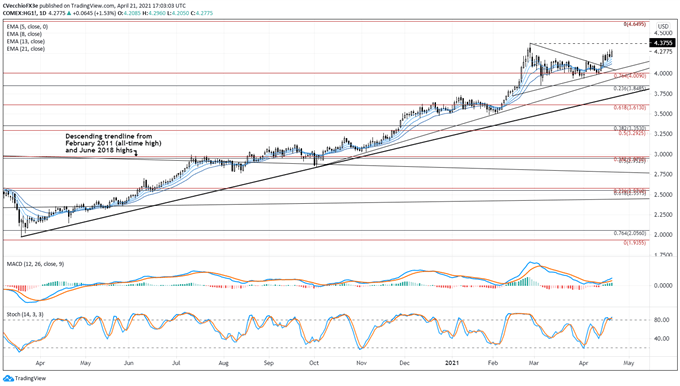

$COPPER PRICE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO APRIL 2021) (CHART 1)

$Copper prices have indeed found bullish resolution, with copper prices in

the past two days rising to their highest level since February 25 –

the day that the yearly high was established.

With a strong fundamental backdrop, the technical picture looks promising

as well.

Copper prices are above their daily 5-, 8-, 13-, and 21-EMA envelope,

which is in bullish sequential order. Daily MACD

$Nevada copper very Undervalued, oversold @ a bargain -

the Cu investors have not discovered Nevada Copper yet -

its a great opportunity, imo!

Ex....

$Interview with Stephen Gill, chairman of Nevada Copper

Maurice Jackson of Proven and Probable talks with

Stephen Gill, chairman

of Nevada Copper, who discusses his company's copper project,

where the underground mine is ramping up production and

the open pit is fully permitted.

https://www.streetwisereports.com/article/2021/04/13/first-new-source-of-copper-supply-in-a-decade-comes-online-in-us.html

https://www.mining.com/goldman-doubles-down-record-high-copper-price-within-a-year/

https://nevadacopper.com/news

https://investorshub.advfn.com/Nevada-Copper-Corp-NEVDF-32771/

http://ow.ly/Ir5Z50EnREY

Iorich, Vladimir

Ex...

https://www.celebritynetworth.com/richest-businessmen/richest-billionaires/vladimir-iorich-net-worth/

Ex. Iorich Vladimir bought in NCU for a much higher price and I am sure

he still will be doing very well on the LT longer term

Imo!

$Nevada Copper - Pumpkin Hollow Project Extract -

https://www.youtube.com/watch?v=fMZC65A7GPk

https://www.youtube.com/watch?v=rFw0OFaTHKs

https://nevadacopper.com/news

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

FEATURED Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • Sep 24, 2024 8:50 AM

FEATURED Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM