Saturday, February 29, 2020 9:36:47 AM

Trader53's - Custodianship Plays: Explained

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

Custodianship Plays : Explained

What is a Custodianship?

There are literally thousands of penny stocks

that are publicly traded.

It isn’t uncommon

for some of those stocks

to get abandoned by their control people

for a variety of different reasons.

When a publicly

traded company gets abandoned

it doesn’t just stop publicly trading.

The abandoned shell

will continue to trade

until the day that the SEC

files an administrative order

to revoke the Issuers registration

(for SEC filers)

or until FINRA deletes the symbol

(for non-SEC filers).

That can often mean years of trading as

nothing but a zombie ticker.

As abandoned shells,

the public Issuers will fall behind

with their business license at the state level

(since nobody is around

to pay the annual fees

due to the Secretary of State).

When two years pass

without an entity paying its business taxes

at the state level,

the entity becomes revoked.

This opens the

door for control of the public Issuer to be

taken over by an interested party

(a shareholder or debt holder for example)

through a custodianship petition.

The interested party

can file a petition with the local court

requesting that the court approve a motion

to let the interested party

(or an individual of their choosing)

take over control of the abandoned shell

“in the best interest of the shareholders“.

The only real concerns the court will have

is that there is no objections to the motion

and that the custodian has a clean background.

The petitioner has to prove to the court

that they have made a legitimate effort

to contact the former control people

and they have to convince the court

that the custodian is a respectable choice

with a clean background

that will act in the best interest

of the existing shareholders.

That usually isn’t hard to do

so most custodianship petitions

will be granted by the court.

The only exception

is usually when the old control people

do show back up to object

or if the petitioner voluntarily dismisses

the petition

(this may happen if the

SEC suspends the Issuer during the proceedings

or initiates an administrative order to

revoke trading in the Issuer during the proceedings).

________________________________________________________________

What Are Custodianship Plays

Why are some Custodianship plays such big movers?

Stocks that end up being taken over

through custodianship petitions can offer

several profit opportunities for

penny stock traders for a number of reasons:

1. The share prices have often fallen on

light volume to relatively low prices

(for the share structure of the stock)

due to years of inactivity putting some

of the stocks in extremely good price ranges

and setting them up with the potential

for large gains if interest builds for the stock.

2. Most have seen very little trading activity

for many years so much of the float is

owned by non-active traders that may not even

realize the stock has become active again ….

this means the retail/active float is

often even smaller than the true float.

3. Custodianship stocks are automatically

considered reverse merger candidates.

As reverse merger plays that allows for

the type of speculation that can create

big message board/social media pumps

_________________________________________________________________

Which Custodianship Plays are the Best?

Not all custodianship stocks will turn into good custodianship plays. So which are the best?

• Stocks that are in lower price ranges

(typical under $.01/share or in the low pennies)

with relatively good share structures for the price

have the biggest potential to turn into big plays

so they usually draw the most interest.

• Interest can also depend on who the custodian

is for the shell. Some custodians are

more popular than others. The custodians

that were involved in big movers in the past

tend to get more attention when

they do new custodianships.

https://otcmarketresearch.com/understanding-custodianship-plays/

SEC Form

15-12G

https://www.investopedia.com/terms/s/sec-form-15-12g.asp

________________________________________________________________

Trader53's - Pond-Fishing Plays: Explained

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=135550937

________________________________________________________________

________________________________________________________________

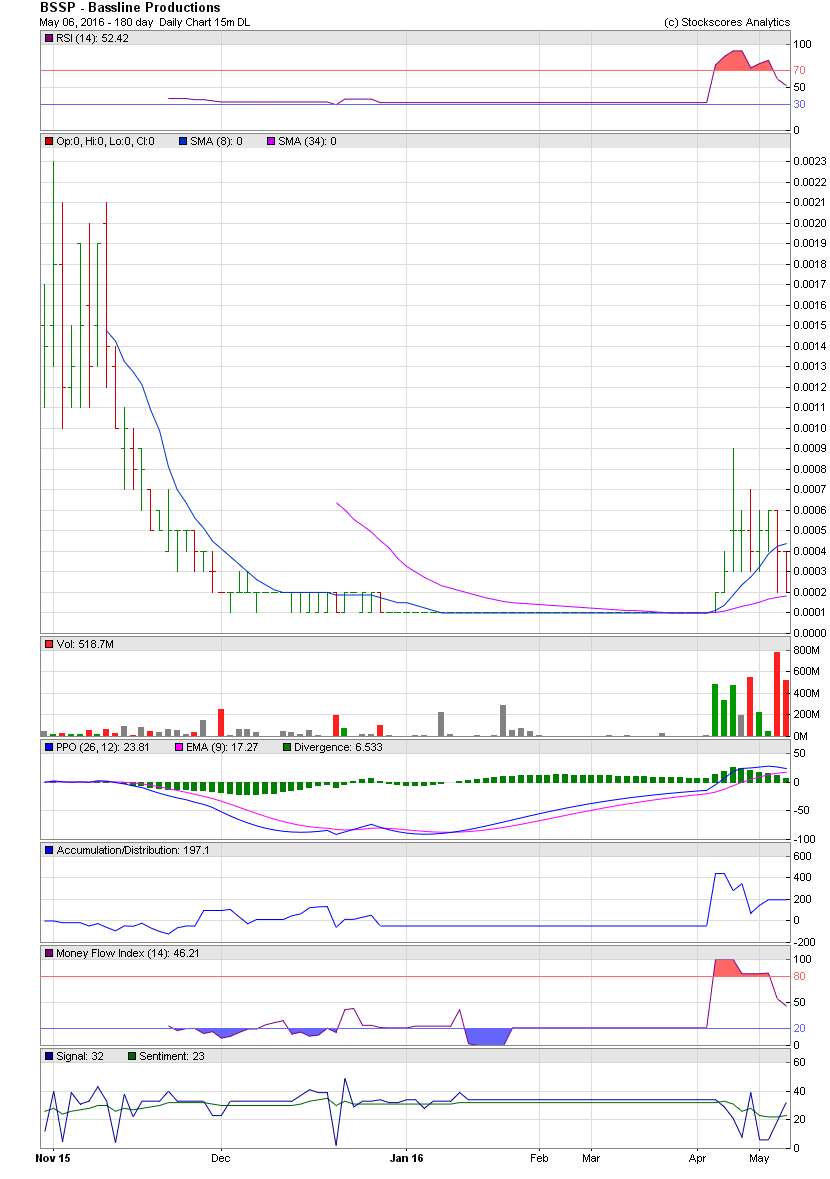

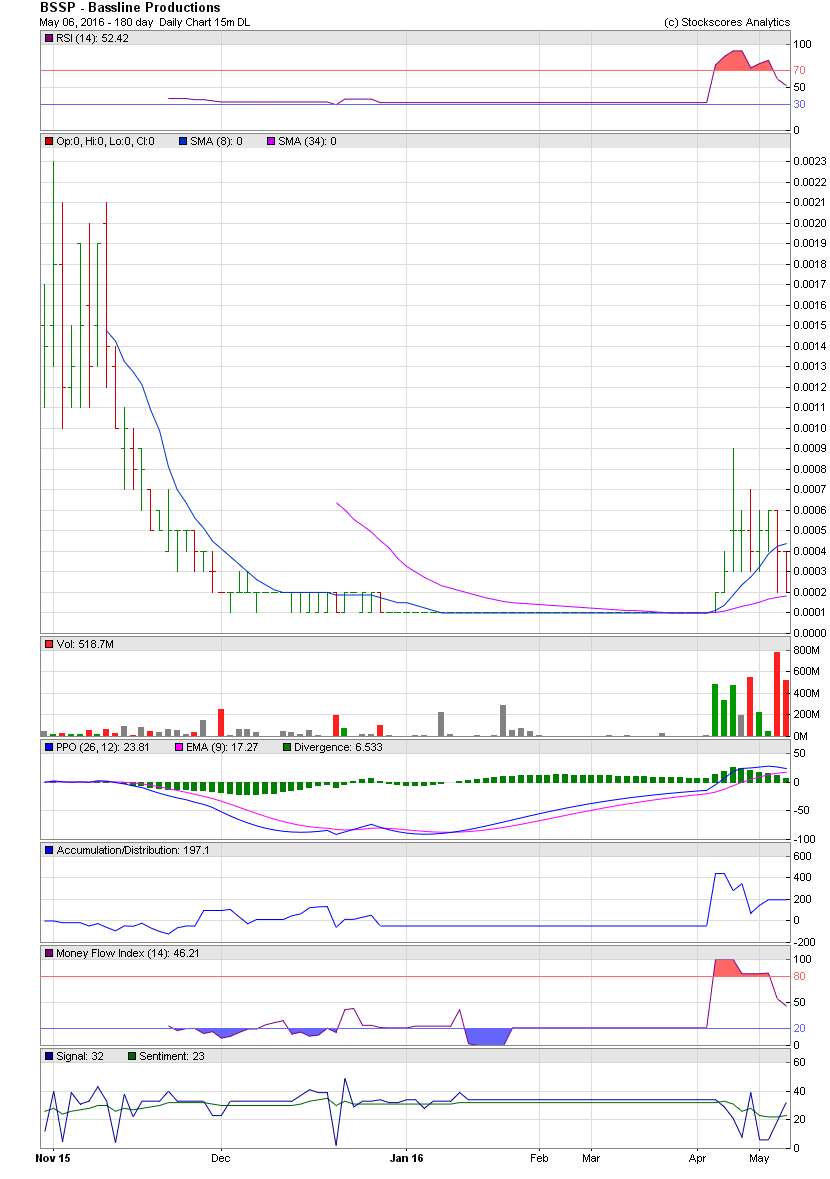

Embedded Charts

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

Custodianship Plays : Explained

What is a Custodianship?

There are literally thousands of penny stocks

that are publicly traded.

It isn’t uncommon

for some of those stocks

to get abandoned by their control people

for a variety of different reasons.

When a publicly

traded company gets abandoned

it doesn’t just stop publicly trading.

The abandoned shell

will continue to trade

until the day that the SEC

files an administrative order

to revoke the Issuers registration

(for SEC filers)

or until FINRA deletes the symbol

(for non-SEC filers).

That can often mean years of trading as

nothing but a zombie ticker.

As abandoned shells,

the public Issuers will fall behind

with their business license at the state level

(since nobody is around

to pay the annual fees

due to the Secretary of State).

When two years pass

without an entity paying its business taxes

at the state level,

the entity becomes revoked.

This opens the

door for control of the public Issuer to be

taken over by an interested party

(a shareholder or debt holder for example)

through a custodianship petition.

The interested party

can file a petition with the local court

requesting that the court approve a motion

to let the interested party

(or an individual of their choosing)

take over control of the abandoned shell

“in the best interest of the shareholders“.

The only real concerns the court will have

is that there is no objections to the motion

and that the custodian has a clean background.

The petitioner has to prove to the court

that they have made a legitimate effort

to contact the former control people

and they have to convince the court

that the custodian is a respectable choice

with a clean background

that will act in the best interest

of the existing shareholders.

That usually isn’t hard to do

so most custodianship petitions

will be granted by the court.

The only exception

is usually when the old control people

do show back up to object

or if the petitioner voluntarily dismisses

the petition

(this may happen if the

SEC suspends the Issuer during the proceedings

or initiates an administrative order to

revoke trading in the Issuer during the proceedings).

________________________________________________________________

What Are Custodianship Plays

Why are some Custodianship plays such big movers?

Stocks that end up being taken over

through custodianship petitions can offer

several profit opportunities for

penny stock traders for a number of reasons:

1. The share prices have often fallen on

light volume to relatively low prices

(for the share structure of the stock)

due to years of inactivity putting some

of the stocks in extremely good price ranges

and setting them up with the potential

for large gains if interest builds for the stock.

2. Most have seen very little trading activity

for many years so much of the float is

owned by non-active traders that may not even

realize the stock has become active again ….

this means the retail/active float is

often even smaller than the true float.

3. Custodianship stocks are automatically

considered reverse merger candidates.

As reverse merger plays that allows for

the type of speculation that can create

big message board/social media pumps

_________________________________________________________________

Which Custodianship Plays are the Best?

Not all custodianship stocks will turn into good custodianship plays. So which are the best?

• Stocks that are in lower price ranges

(typical under $.01/share or in the low pennies)

with relatively good share structures for the price

have the biggest potential to turn into big plays

so they usually draw the most interest.

• Interest can also depend on who the custodian

is for the shell. Some custodians are

more popular than others. The custodians

that were involved in big movers in the past

tend to get more attention when

they do new custodianships.

https://otcmarketresearch.com/understanding-custodianship-plays/

SEC Form

15-12G

https://www.investopedia.com/terms/s/sec-form-15-12g.asp

________________________________________________________________

Trader53's - Pond-Fishing Plays: Explained

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=135550937

________________________________________________________________

________________________________________________________________

Embedded Charts

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.