Friday, October 20, 2017 12:31:29 AM

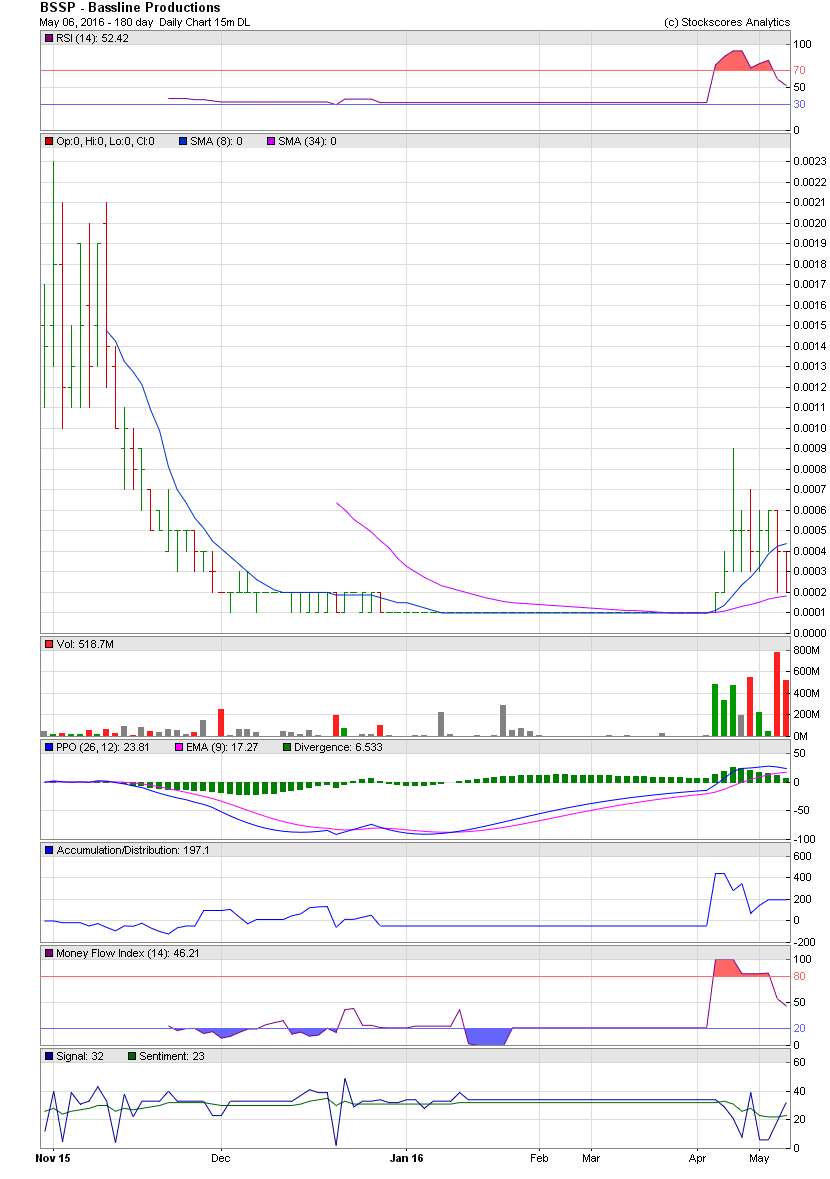

* The Market is a "Forward-Looking Mechanism"

* Traders move the Price of the stock Down

6-to-9 months in advance,

to a Price Level that is seen as,

a "Point of Maximum Opportunity"

and "Fairly Valued".

________________________________________________________________

* The insiders "pull the price down",

for the funding of their operations,

by increasing the "shares outstanding",

and the "authorized shares",

and when the price of the stock,

reaches the price level,

where the "VC"s want to "Buy",

(0.0001 and 0.0002)

the stock finally bottoms,

and you then see the accumulation.

________________________________________________________________

* The Price of the stock is - "Artificially Depressed" !

* The Price has been pulled Down Artificially,

by lack of Trader Interest,

as a result of a "temporary" lack of News.

* A Huge Price Climb - is about to happen !

_________________________________________________________________

Educational Post - Dilution

Authorized Shares,

has no bearing on the price.

The "Shares Authorized",

is not used in any fundamental of financial calculation,

to determine company value.

OTC companies only have two things,

stock for sale and stories of progress.

Dilution:

when the company moves shares from the A/S (authorized shares)

to the O/S (outstanding shares) or tradeable inventory,

for cash investments in the company.

This means there are more shares

at the same market price

and reduces the size of the EPS.

It doesn't reduce the price or value of the stock.

But many pennylanders think it does.

Dilution

doesn't change price, it changes EPS.

Creating loss in company value, not stock value.

Hardly 1 in 1000 OTC companies have an EPS to effect.

So, dilution can't effect their company value in the first place.

What's the value of no earnings, thus no EPS.

On the OTC, "dilution" is the best news one can hear !

Not only does it give the company a chance at growth,

it doesn't effect their EPS value one bit.

They have no EPS to effect.

Plus, every time VCs get there hands on large amounts of shares,

they buy a run, and we can trade for profits !

So, "dilution" is a win for the company,

a win for the Venture capital firm,

and a win for the educated pennyland trader,

on the OTC.

Stocks of many start-up companies,

bottom at the "Triple 000" price level,

before they begin their meteoric rise.

"Venture Capitalists"

like to buy the shares of these companies at these low levels.

_________________________________________________________________

The Pond-Fishing Play

They Trade at the Bid 0.00 - Ask 0.0001 Level

aka "The Patience Play"

because you have to tie your money-up,

for 3-to-6 months in some cases,

accumulating it slowly,

while you wait for the time

the stock receives the promotion,

and the "Run" from the promotion,

begins to lift the price,

out of the multi-month trading range.

Called a "pond",

because it starts

from a "dead still pond surface" in price.

This means that there is a long period of time

with no price movement at all.

There are "3-volume surges"

during this time,

to signal random accumulation at these low prices.

That one action,

of "3-volume surges" without price change,

is an OTC "tell" or, "signal" ,

that funding may be taking place.

Video

You want to accumulate

while the price is staying low.

_________________________________________________________________

* Embedded Charts

* Buy all of them at,

the Point of Maximum Financial Opportunity !

Where is that ?

At the end of an Elliott Wave 5-Wave Decline Sequence !

Elliott Wave Basics: abc corrective phase

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.