Wednesday, August 29, 2018 9:35:16 AM

Mark A Miller tells us he is olivertwist in the following post:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=135202503

I have solved the mystery of who is doing all these illegal hijackings that involve bogus 8K filings. It's a real person by the name of Mark A Miller that lives in Minnesota.

So far I have found 5 public Issuers linked to Mark A Miller that have done suspicious 8K filings - DIGI, ECMH, BLLB, UITA, and SMEV.

ECMH, BLLB, UITA, and SMEV all involved illegal hijackings of those shells. The jury is still out on DIGI about whether or not that was also a hijacking.

I was able to connect all the dots by tracking the SEC filing agent used to do all the suspicious 8K filings and by tracking the social media posters that were involved in pumping all of the bogus 8K hijacking plays.

Before I go on, let me explain that the CIK # for the filing agent used to submit an SEC filing can be found by looking at the first set of numbers taken from the "accession number" which is the unique code given to each filing submitted through the Edgar filing system

https://www.sec.gov/edgar/searchedgar/accessing-edgar-data.htm

You can locate the "accession number" by looking at the text version of any SEC filing from off the Issuers Edgar page.

Digitiliti, Inc (DIGI)

DIGI was the first Mark A Miller public Issuer that did an 8K filing.

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001411658

The Issuer was based out of Minnesota which is Mark A Miller's home state.

The DIGI shell went dark in 2014. The last SEC filing done by the Issuer was a Form 15 filing in 2012. The DIGI twitter page at https://twitter.com/digilibe went dead in 2013 and the DIGI website at http://digitiliti.com died in 2014.

On October 4, 2017, Mark A Miller used an SEC filing agent that reports under the CIK #0001548123 to do an 8K filing for the DIGI shell

https://www.sec.gov/Archives/edgar/data/1411658/000154812317000227/f8kcurrentreport.htm

Effective on June 15, 2017, David S. Macey resigned as President and CEO and appointed Mark A. Miller as President and CEO. Mr. Miller is also the sole director of the Company.

Mark A. Miller, age 40, has been self employed by MJ Miller Construction as the CEO and licensed general contractor for the past sixteen years. Mr. Miller is in charge of every aspect of the business including estimating, invoicing, finance, sales and marketing.

At this point I haven't been able to determine if the Issuer was revoked at the Delaware SOS before Mark A Miller swooped in our not (since the Delaware SOS charges money for information). So I'm not really sure if Miller hijacked the DIGI shell or if he acquired it legally from the previous owner. I can say that doing an 8K for an entity that stopped being an SEC filer 5 years earlier is more than a bit suspicious.

MJ Miller Construction is a real business in Minnesota run by Mark A Miller

https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=23b1c136-8cd4-e011-a886-001ec94ffe7f

Right after the 8K showed up, Mark A Miller tweeted from his personal twitter page at https://twitter.com/MJTWMiller/ (account now deleted) about the change of control and about a new twitter page for DIGI located at https://twitter.com/DigitilitiInc

Mark A Miller also launched a new website for DIGI at http://digitiliti.co which was registered on October 3, 2017.

Mark A Miller also did some updates to the OTC market page but to date has not done any OTC filings and for some odd reason no officer is listed for the entity.

https://www.otcmarkets.com/stock/DIGI/profile

On July 9, 2018, Mark A Miller put out a press release about some bogus sounding buyout proposal from some unnamed entity for the DIGI shell

https://www.accesswire.com/504668/Digitiliti-Inc-DIGI-Commences-Buy-Out-Negotiations

The DIGI price chart shows some notable volume starting at $.001 on 9/21/17 then a lot of thinly traded choppy price action between $.0015 - $.006 until DIGI got a pop coinciding with that July 9, 2018 fake buyout PR pushing the price to a new recent high at $.0125/share

To this day Mark A Miller still runs the DIGI shell.

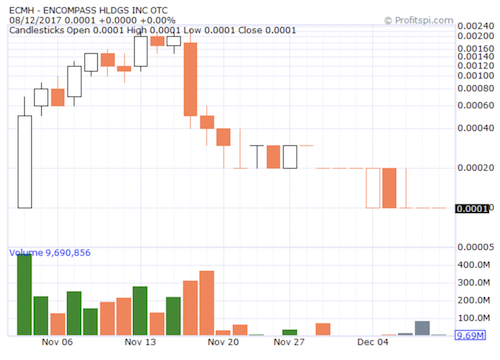

Encompass Holdings Inc (ECMH)

Mark A Miller wasted no time going after his second abandoned shell - Encompass Holdings Inc (ECMH).

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000769882

ECMH is an abandoned Nevada business entity that last filed an annual report with the state in 2011

https://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=r77zNda8XolRhvQTx0eAOA%253d%253d&nt7=0

ECMH is a delinquent SEC filer that hasn't done any of its required SEC filings since 2010.

On November 2, 2017, Mark A Miller used the same SEC filing agent from DIGI (CIK #0001548213) to submit a bogus 8K for him saying that he was now in control of the ECMH shell

https://www.sec.gov/Archives/edgar/data/769882/000154812317000230/f8kcurrentreport.htm

Effective on October 20, 2017, J. Scott Webber resigned as President and CEO and appointed Mark A. Miller as President. Mr. Miller is also the sole director of the Company.

Mark A. Miller, age 40, has been self employed by DDG Properties, LLC as the CEO for the past 8 years. Mr. Miller is the sole member of DDG Properties LLC, a real estate holdings company which was formed in 2009.

Since ECMH was never reinstated at the Nevada SOS and no active entity for ECMH exists any where it begs the question of how he got the SEC filing agent to submit the bogus 8K. Were forged documents involved?

DDG Properties LLC is a real company in Minnesota controlled by Mark A Miller.

https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=c2027ed8-97d4-e011-a886-001ec94ffe7f

Miller immediately launched a new twitter page for ECMH at https://twitter.com/ecmh44/ (now deleted)

From that twitter page Miller began to pump ECMH by tweeting about a large share cancellation and a clean balance sheet with no convertible debt

On November 9, 2017, Mark Miller did a press release through newsfilecorp touting a letter of intent to acquire DDG Properties LLC which Miller claimed in the PR was worth $6.4 million

https://www.newsfilecorp.com/release/30351/Encompass-Holdings-announces-material-event-business-change-and-6.4-Million-asset-acquisition-via-LOI

The bogus 8K, the tweets, and the press release kicked off some pretty big pump and dump type action for the stock with the price running from $.0001/share to $.0022/share on heavy volume.

But then the old CEO and control person of the ECMH shell, J Scott Weber, showed back up and submitted an 8K putting himself back in charge and foiling the ECMH pump & dump

https://www.sec.gov/Archives/edgar/data/769882/000154812317000272/f8kcurrentreport.htm

Mark A Miller immediately deleted his fake ECMH twitter page and the share price quickly fell back to where it started at $.0001/share

Bell Buckle Holdings Inc (BLLB)

Even though the ECMH hijacking ended in disaster, there is no doubt that Mark A Miller and traders close to him still probably made a lot of money off ECMH when the stock price ran up from $.0001/share to $.0022/share.

And that is probably why this group decided to continue their illegal hijacking/bogus 8K scam on more abandoned shells.

The next shell Mark A Miller hijacked was the Bell Buckle Holdings Inc (BLLB) shell

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001165876

BLLB is a Florida business entity.

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=BELLBUCKLEHOLDINGS%20P070000675390&aggregateId=domp-p07000067539-a2cc704b-9cb4-4bdd-99d3-3ec41843b40b&searchTerm=Bell%20Buckle&listNameOrder=BELLBUCKLEHOLDINGS%20P070000675390

The entity had been abandoned since 2009. It did its last SEC filing (a Form 15) in 2007 and its last filing with the Florida SOS in 2008.

On February 22, 2018, a reinstatement filing showed up for BLLB at the Florida SOS

http://search.sunbiz.org/Inquiry/CorporationSearch/GetDocument?aggregateId=domp-p07000067539-a2cc704b-9cb4-4bdd-99d3-3ec41843b40b&transactionId=p07000067539-re-4ace8636-c885-43f5-a635-4bbbff744521&formatType=PDF

It was filled out by somebody named Andre S Jaberian. The reinstatement filing used the old address for the abandoned shell from 10 years ago and used the old resident agent's name from 10 years ago - attorney Ronny Halperin.

I'm willing to bet any amount of money that Ronny Halperin (the attorney listed as the Resident Agent for the reinstatement) doesn't even know his name was used. Ronny Halperin was banned by the SEC a few years ago, banned by OTC markets, and is no longer licensed to practice law having retired in 2015 to avoid being disbarred. He hasn't been active since.

At this point it is debatable if Andre S Jaberian is a real person or just a alter ego for Mark Miller.

On February 26, 2018 a fraudulent 8K was filing for BLLB using the same SEC filing agent as DIGI and ECMH (CIK #0001548123) disclosing Andre S Jaberian as the new control person/CEO

https://www.sec.gov/Archives/edgar/data/1165876/000154812318000023/f8kcurrentreportbllb.htm

On February 27, 2018, a domain was registered at http://bellbuckleholding.com (it still shows under construction with a countdown clock to launch)

On February 28, 2018, Andre S Jaberian launched a fake twitter page for BLLB at https://twitter.com/ajaberian_bllb

The following are some of the more interesting tweets on the first day

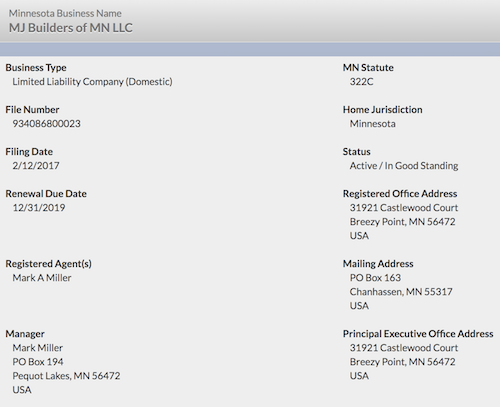

Andre S Jaberian also put out a press release on February 28, 2018 announcing the bogus change of control. Take notice who is listed as the paying party (shown at the very top) - MJ Builders of MN

https://www.pressrelease.com/news/bell-buckle-holdings-announces-shareholders-update-to-recent-120733

MJ Builders of MN LLC is a Minnesota business entity controlled by Mark A Miller

https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=3d343d5a-46f1-e611-8169-00155d01d700

That gives us our proof that BLLB was another Mark A Miller hijacking.

OTC Markets ended up slapping BLLB with the CE (skull & crossbones) right away because of the promotional type action and probably because of concerns about possible fraudulent activity. By that point BLLB had already seen its price run up from $.0001/share to $.0058/share.

By the start of April the stock was back in the triple zeros.

On June 22, 2018, Jaberian put out 2 tweets through the bogus BLLB twitter page apologizing for the long silence and saying that their attorney told him that everything is in order and all red flags have been taken care of. Jaberian also tweeted that all financial statements were completed and ready to be submitted to the OTC markets

Those tweets caused a spike the the BLLB price from $.0006 to $.0012 on June 22nd with over 173 million shares traded.

Jaberian deleted the June 22nd tweets the next day claiming that the twitter account was hacked the previous day and so those July 22nd tweets should be disregarded.

The only other tweet since then came on July 12th basically announcing that business has ceased because of the high US tariffs.

Mark A Miller through his puppet CEO (possibly ghost CEO) Andre S Jaberian is still shown in control of the illegally hijacked shell as of today.

Utilicraft Aerospace Industries Inc (UITA)

UITA is 9 years delinquent with its required SEC filings.

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001334740

In 2013 all of the officers submitted their resignations

https://www.sec.gov/Archives/edgar/data/1334740/000101054913000058/uita8k021113.htm

Somehow somebody named Kevin Williams ended up in control of the UITA shell and in 2016 he filed that he was going to be doing a reverse split then taking the shell private

https://www.sec.gov/Archives/edgar/data/1334740/000101968716005318/utilicraft_13e3.htm

The reverse split was never approved so on June 16, 2017, Williams filed that he was no longer going to do the going private transaction

https://www.sec.gov/Archives/edgar/data/1334740/000168316817001597/utilicraft_8k.htm

Instead Kevin Williams just closed down shop by having the Nevada business entity voluntarily revoked

9 months later the Mark A Miller group showed up

Miller and two fellow Minnesota natives named Richard Kilchesky and Peter Kilchesky had the UITA Nevada business entity reinstated on March 13, 2018

https://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=7VAzAcM4L%252fhIUOZ2JVAyow%253d%253d

On March 21, 2018, the Miller group did an 8K saying that Kevin Williams resigned and appointed them as the new officers of the shell

https://www.sec.gov/Archives/edgar/data/1334740/000154812318000026/f8kcurrentreport31518.htm

The super interesting thing about that 8K filing is that up until that 8K filing, UATI always used SEC filing agent CIK #0001683168, but the 8K filing announcing Miller as the new secretary used the same filing agent that Miller used for DIGI, ECMH, and BLLB (CIK #0001548123).

My understanding is that it is extremely unusual to switch filing agents when one already exists for a public Issuer. The only legitimate time that usually does happen is if a filing agent retires and is no longer able to do your filings for you.

The switching of filing agents to assist with the 8k filings gives us some clue about why the OTC Markets site has UITA labeled as a "control dispute"

https://www.otcmarkets.com/stock/UITA/profile

According to some investors that reached out to both Mark Miller and Kevin Williams there absolutely is a control dispute

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=141729887

The problem is that SOMEONE is lying, and getting paid to do it. I've talked to both Mark Miller and Kevin Williams. Mark says Richard will update shareholders in the Fall but will not provide any contact info for Richard. Kevin says someone swooped in and hijacked his insolvent, dormant company and that he's not going to give "them" the financials to get current. Then Mark says that it would have been nice to know Kevin was going to make a stink about things when they signed stuff.

Kevin Williams claims his UITA shell was hijacked without his knowledge and consent and he vows to do everything he can to prevent the scheme from moving forward. And Mark Miller wants investors to believe that his group acquired the shell legally and Kevin Williams is reneging on their deal.

Even before the UITA business entity was reinstated at the Nevada SOS on March 13, 2018, the stock was already seeing some super obvious frontloading with the price climbing from $.0004/share to $.0069/share on higher than normal volume. It sure seems obvious that people close to the Mark Miller group were in the know and were loading up ahead of what they knew was coming.

Miller put out news on March 22nd through newsfilecorp

https://www.newsfilecorp.com/release/33643/Utilicraft-Aerospace-Industries-Announces-Its-2018-Business-Plan-and-Change-in-Ownership

The price continued to climb to the $.014s by mid-April but interest died down by June. With the control dispute overshading everything else, the stock quietly sank back into the $.0014 range.

It appears that Kevin Williams stood his ground and prevented the Mark Miller group from making any more progress with the UITA shell.

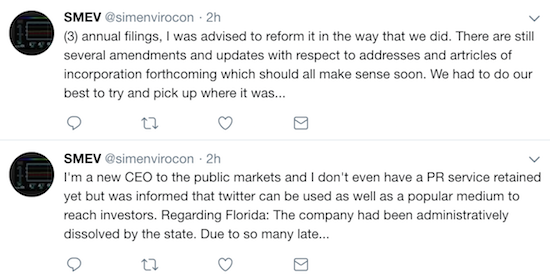

Simulated Environment Concepts Inc (SMEV)

The next shell the Mark A Miller group went after is the Simulated Environment Concepts Inc (SMEV) shell.

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000929061

The SMEV shell was abandoned in 2014. The last SEC filing done by the Issuer was in 2007 (a Form 15) when it was still known as 5th Avenue Channel Corp. The entity did its last Florida SOS filing in 2013 causing the shell to be administratively dissolved in 2014.

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=SIMULATEDENVIRONMENTCONCEPTS%20P930000336193&aggregateId=domp-p93000033619-1cda5ec3-be98-4067-a45b-8149bbd67aa1&searchTerm=Simulated%20Environment%20Concepts&listNameOrder=SIMULATEDENVIRONMENTCONCEPTS%20P000000069652

The SMEV shell had quite the interesting history. It had Ivana Trump as a shareholder in the late 1990s. The Issuer became the subject of an SEC investigation before getting abandoned in 2001.

https://nypost.com/1999/08/19/sec-probes-ivana-speak-to-an-attorney/

In 2005 Claude Eldridge (a notorious shell peddler from Texas) hijacked the shell eventually selling it to Ella Frenkel and Allen Licht in 2007.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=143157414

By 2012, the SMEV shell was getting badly abused by toxic financiers and paid promoters leading to Allen Licht filing a lawsuit against all the parties he felt were abusing the shell

https://www.scribd.com/document/112739347/Watson

The lawsuit ended up getting dismissed and Frenkel and Licht stopped keeping up with the shell allowing it to go into bad standing and opening the door for the Mark A Miller group to come and attempt to illegally hijack the shell. Before abandoning the shell, Frenkel and Licht dismissed the transfer agent leaving the shell with no transfer agent.

On August 21, 2018, the Mark A Miller group made a new Florida entity by the same name using the old address of the abandoned SMEV shell

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=SIMULATEDENVIRONMENTCONCEPTS%20P180000714930&aggregateId=domp-p18000071493-fc051825-8a30-41d1-843e-238c02dc60c6&searchTerm=Simulated%20Environment%20Concepts&listNameOrder=SIMULATEDENVIRONMENTCONCEPTS%20P000000069652

The new entity listed Brian Matthews as its sole officer/director.

On August 24, 2018, Brian Matthews filed a fraudulent 8K using the same SEC filing agent (CIK #0001548123) that was used for the DIGI, ECMH, BLLB, and UITA fraudulent 8Ks.

https://www.sec.gov/Archives/edgar/data/929061/000154812318000235/f8kcurrentreport71818.htm

Effective July 18th, 2018, Ella Frenkel resigned as President, CEO and Director; as well as all other corporate officers, including, Allen Licht, Ely Spivak and Vladimir Shats.

Effective July 18th, 2018, Brian Matthews, age 40 was appointed as the President, CEO, Secretary and sole director. Mr. Matthews has 20 years experience in Auto CAD design as well as horticulture. Mr. Matthews is a graduate of Clemson University.

Since the real SMEV Florida entity was still in bad standing it begs the question as to why the SEC filing agent would submit the bogus 8K filing. Were forged documents involved?

At this point it's still debatable if Brian Matthews is a real person or just an alter ego for Mark A Miller.

Being this group's 5th hijacked shell, they were on the ball with a new website already registered for SMEV on July 21, 2018 at http://www.enviro-gro.com/ and a new twitter page already set up on August 15, 2018 at https://twitter.com/simenvirocon

The website touts some kind of Simulated climate control AI thermostat device then goes on and on about environmental benefits to indoor grow facilities and homeopathic farming methods. Being an indoor grow related business plan they word drop marijuana into the description of the business operations.

This is the face given to Brian Matthews

When questioned about why he made a new entity instead of reinstating the old, Brian Williams said that it was because it was administratively dissolved

And when questioned about how he was able to acquire the SMEV shell when SMEV has no transfer agent, Matthews replied that the control stock was acquired as part of an MOU and no transfer agent was needed.

With the bogus 8K filing used by Matthews as his evidence that he controls the SMEV shell, Matthews tricked the OTC markets people into letting him update the OTC Markets page for SMEV

https://www.otcmarkets.com/stock/SMEV/profile

This time I was on top of the whole scheme right from the instant the Florida SOS entity hit. And when I saw the 8K I immediately reached out to Allen Licht and Ella Frenkel (the true control people of the SMEV shell) and got a response. They called the hijacking attempt on their shell a "scam" and have since been reaching out to the FBI, SEC, and FINRA to try to report the scammers.

I've continued to keep in touch with Allen Licht who said he has spoken with people at all three agencies and will be reaching out to OTC markets next.

On August 27, 2018, Brian Matthews submitted a reinstatement filing for the old SMEV Florida business entity. My guess is he the Mark Miller group realized they are going to run into problems if they don't reinstate that entity or possibly they are looking to make amendments to the articles of incorporation to create new control stock that will trump the voting rights of the 700,000 preferred control shares still owned by Ella Frenkel.

It should also be noted that Mark A Miller was posting on the SMEV forum under a new alias "WasOliverTwisted" which got booted as a multiple IHUB alias since he already had the "Olivertwisted" account

https://investorshub.advfn.com/boards/profilea.aspx?user=683797

All of Mark A Miller's posts on that forum are interesting and worth reading. But now that we know Miller's role in all of this, I find statement in particular about SMEV to be extra intriguing:

I have been in this stock for a little over a year when the concept of MJ was originally talked about. Now, I have been reading the thread as of late and to me it seems like the new management is trying to right the ship.

SMEV was used for a fake MJ merger pump & dump in June of 2017. It sounds like Miller got stuck holding the bag. So Miller's motivation might be as simple as wanting to unload that old stock for some profits and that is why he targeted the SMEV shell.

Luckily since I was on top of SMEV from the get go, it didn't get the same type of ugly pump & dump action that ECMH, BLLB, and UITA got.

Hopefully this information combined with Allen Licht and Ella Frenkel stepping up to fight against the hijacking attempt on their shell will be enough to get the SEC to step in and put an end to this string of illegal hijacking/8K frauds once and for all.

The only real question left at this point is who is the SEC filing agent the submit through edgar under the CIK #0001548123 because they have a lot of explaining to do.

------------------------

OTHER MARK A MILLER STOCKS OF INTEREST

MedX Holdings Inc (MEDH)

This one looks like it might have been a legitimate shell acquisition.

The MEDH shell used to be a Colorado business entity named Disaboom Inc. It was run by John Walpuck up until it went into bad standing in Colorado in 2012.

In December 2014 somebody named David Black came along and reinstated the entity changing its name to Cantor Group Inc.

Black sold the shell to David Schellpfeffer in 2015. Schellpfeffer changed the name to MedX Holdings Inc and moved it to Wyoming

https://wyobiz.wy.gov/business/FilingDetails.aspx?eFNum=095005198060174083219081253009120205228211135226

The shell ended up in Kathleen Roberson's control in 2017 then in last 2017 she sold her shares to Mark A Miller

Miller did two 8Ks for the event. Both 8Ks used the same filing agent as DIGI, ECMH, BLLB, UITA, and SMEV (CIK #0001548123)

https://www.sec.gov/Archives/edgar/data/1393901/000154812318000025/f8kcurrentreport12818.htm

https://www.sec.gov/Archives/edgar/data/1393901/000154812318000081/f8kcurrentreport31018.htm

Mark Miller started a MEDH twitter page at https://twitter.com/MedX_Holdings and a MEDH website at http://www.medxholdings.co/

MEDH lists Miller's two Minnesota entities - MJ Builders of MN LLC and DDG Properties LLC as subsidiaries of MEDH.

One especially interesting press release was from April 3rd announcing that Mark A Miller hired Viridian Resources as a consultant

https://www.otcmarkets.com/stock/MEDH/news/MedX-Holdings-Inc-Hires-Viridian-Resources-as-a-Consultant-for-California-Expansion-and-Operations?id=188005

Viridian touts itself as a consulting firm that does some business in the cannabis industry.

https://viridianco.com/

Since that April press release, MEDH has mostly touted itself as being involved in the cannabis industry in its press releases.

MEDH has had some interesting price action starting in late 2017

---------------------

OTHER RECENT ILLEGAL HIJACKING OF INTEREST

Trophy Resources Inc (TRSI)

This one I'm not sure if it was manipulated by the Mark A Miller group or not.

Many of the same people were involved in touting all six Mark A Miller linked shells - DIGI, ECMH, BFFB, UITA, MEDH, and SMEV.

And most of those very same people were also touting Trophy Resources Inc (TRSI) starting a few days before a fake Florida SOS entity showed up.

TRSI was abandoned by its former CEO/control person Joe Canouse in 2013 going into bad standing at the Florida SOS

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=TROPHYRESOURCES%20P970000043698&aggregateId=domp-p97000004369-554e2a2b-f994-4329-927d-b8154faca06e&searchTerm=trophy%20resources&listNameOrder=TROPHYRESOURCES%20P180000522720

On July 11, 2018 a new entity was activity using the same name as the public shell and using the same address that the abandoned public shell had previously used.

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=TROPHYRESOURCES%20P180000522720&aggregateId=domp-p18000052272-ac1ba86b-c1f3-47dd-8a60-4f9d1a27020d&searchTerm=trophy%20resources&listNameOrder=TROPHYRESOURCES%20P180000522720

That new fake entity listed Thomas L Mitchell as its sole officer/director.

The real CEO/control person eventually showed up on the TRSI message board on July 27th saying that it was fake

https://investorshub.advfn.com/boards/profilea.aspx?user=96081

No 8K ever hit for TRSI. The reason for that is probably because Trophy Resources Inc was never registered with the SEC ever in its history so there was no edgar codes for the dirty SEC filing agent that Mark A Miller used on all of his other shells to crack this time.

Before the new Florida business entity hit, TRSI got front loaded up from $.0003/share to $.001/share, but after the filing hit the stock only managed 1 more tick to $.0011/share before quickly retreating back to where it came.

There were also some other stock manipulation schemes run on TRSI.

Back on April 17, 2018, TRSI was the subject of a fake press release involved TNKE

https://finance.yahoo.com/news/tanke-inc-tnke-announces-joint-134000559.html

TNKE was without a doubt a stock being manipulated by the Carlos Reyes group because that stock manipulation scheme initiated through OTCBitcoinstocks.com which I am 100% sure was run by the Carlos Reyes group.

Then on August 22, 2018 some group launched a fake twitter page at https://twitter.com/TrophyResources and fake website was launched for TRSI https://trophyresources.com/.

The website and twitter page were so fake that it almost seemed like they were made to be identified as fakes and not to fool people. The website used fake bios and fake pictures stolen from another website for another company.

The twitter page was deleted within hours of being launched. The website had all of its content removed the next day.

The twitter/website scheme brought very little attention to the stock.

Simclar Inc (SIMC)

The SIMC shell was voluntarily dissolved by its previous owners in 2013

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=SIMCLAR%205180242&aggregateId=domp-518024-06ac2d94-3c36-432c-bb11-104d51d10670&searchTerm=Simclar%2C%20Inc&listNameOrder=SIMCLAR%205180242

The Issuer last did an SEC filing in 2008 when it filed a Form 15 to go dark

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000764039

On April 17, 2018 somebody created a new entity by the same name in Florida

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=SIMCLAR%20P180000364920&aggregateId=domp-p18000036492-ee6fde9a-b399-416a-b5ec-84f538d49cc6&searchTerm=Simclar%2C%20Inc&listNameOrder=SIMCLAR%205180242

The new Simclar Inc Florida entity listed all of the old officers from when it was abandoned in 2013 and listed the old address from that time too.

Unlike the known Mark A Miller hijacked shells that were former SEC registrants, this one did not do any bogus 8K filing.

And this one didn't have any of the usual suspects touting it that are found on all the other Mark A Miller linked plays.

SIMC saw some pretty major pump & dump action off the fake Forida SOS filing pushing from $.011/share to $.015/share

The old owners eventually became aware of the fraudulent use of their names and they wrote a letter to the Florida SOS which is now attached to the articles of corporation for the new fake entity (page 3)

http://search.sunbiz.org/Inquiry/CorporationSearch/ConvertTiffToPDF?storagePath=COR%5C2018%5C0423%5C70258437.tif&documentNumber=P18000036492

Swingplane Ventures Inc (SWVI)

SWVI was abandoned in 2016 after being abused as a paid promotion shell. It became revoked at the Nevada SOS.

https://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=9nCUlvpfyWEx9%252fXhkFccRg%253d%253d&nt7=0

On August 17, 2018 somebody created a new entity in Nevada named Swingplane Ventures Inc using the same address as the public shell and using the former CEO of the shell as the resident agent.

https://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=eQ1FWFqhm818%252bcQLoIDULA%253d%253d&nt7=0

I'd bet anything that Donald Wanner has no idea his name was used.

SWVI looks like it was the Carlos Reyes group since they were touting it early on before the Fake SOS page was made public.

The Carlos Reyes group was previously involved in fake SOS annual report filings done for TSTS and PEII.

SWVI was front loaded starting at $.0009/share on August 16th and was manipulated as high as $.011/share by August 21st before the new Nevada business entity was exposed as a fake.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.