https://www.youtube.com/watch?v=xLpfbcXTeo8

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Better send another letter to STEVE MNUNCHIN. 🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣

Your absurd posts --------> 🚽

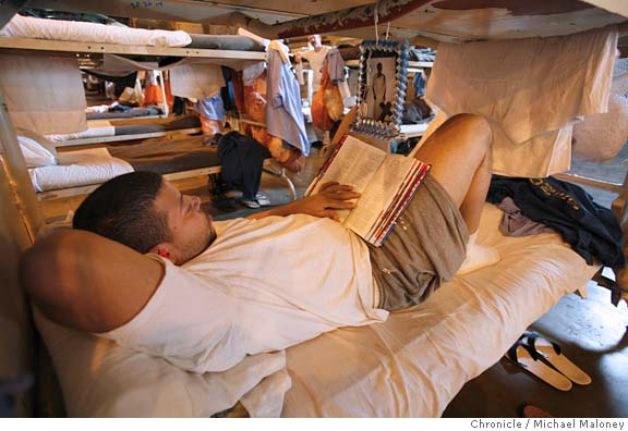

The only small island that child Brick God Sosa will be inhabiting is Terminal Island.

https://www.bop.gov/locations/institutions/trm/

A young, small-boned, lithe, effeminate kid like Shaky Jake will be very popular in prison. Moreso if he shaves his ass. And I have no doubt that Shaky Jake is destined for Federal prison, just like Justin(e) Costello, David Russell Foley, Tovy Pustovit, Jim Bolt, Rufus Paul Harris, and other pennyscammers who thought they knew more than they did.

More than tax loss selling - those trying to gett ~OUTT before the Expert Market arrives.

Nott to worry tho - CMW has been in a lott of meetings recently - with Jack Daniels, Jim Beam, George Dickel, Evan Williams, Basil Hayden, Colonel E.H. Taylor, Jr., and others.

All CMW needs is a pen to sign the deals.

"The Staff further indicated that, based upon the Company’s implementation of one or more reverse stock splits within the past two years at a cumulative ratio of 250 shares or more to one in contravention of Nasdaq Listing Rule 5810(c)(3)(A)(iv), the Company’s securities were subject to delisting unless the Company timely requests a hearing before the Nasdaq Hearings Panel (the “Panel”). The Company plans to timely request a hearing before the Panel, which request will stay any further suspension or delisting action by Nasdaq at least pending the ultimate conclusion of the hearing process."

JAY PATRICK BOOTH begging to felch STEVEN MOSKOWITZ

"The Staff further indicated that, based upon [b[color=red]]the Company’s implementation of one or more reverse stock splits within the past two years at a cumulative ratio of 250 shares or more to one in contravention of Nasdaq Listing Rule 5810(c)(3)(A)(iv), the Company’s securities were subject to delisting[/color] unless the Company timely requests a hearing before the Nasdaq Hearings Panel (the “Panel”). The Company plans to timely request a hearing before the Panel, which request will stay any further suspension or delisting action by Nasdaq at least pending the ultimate conclusion of the hearing process."

"Completion of the Transaction resulted in the sale of substantially all of the Company’s assets, and the proceeds thereof will be used entirely to satisfy a portion of the claims of the Company’s secured creditors net of transaction costs. The Company no longer has an operating business or any material assets, and the foregoing sale sale does not involve a Deed of Company Arrangement being proposed to creditors.

The Administrator has advised the Receivers that it is presently the Administrator’s intention to hold the second meeting of creditors in the Voluntary Administration on or around September 27, 2024. On the basis that a Deed of Company Arrangement is not expected to be proposed and that the Company and its three Australian subsidiaries in Voluntary Administration remain insolvent, the Administrator considers it is likely that resolutions will be passed for the winding up of the Company and its three Australian subsidiaries at that meeting.

Your company will be liquidated and will be "wound up" - meaning it will be dissolved. Tritium DCFC Ltd. will no longer exist and the shares are entirely worthless. All proceeds of the sale go to pay creditors. Common stock gets nothing and will be cancelled as part of the wind down dissolution of the corporation.

Congratulations on the total loss of your investment in the common stock of DCFCQ !

das Ende

"Completion of the Transaction resulted in the sale of substantially all of the Company’s assets, and the proceeds thereof will be used entirely to satisfy a portion of the claims of the Company’s secured creditors net of transaction costs. The Company no longer has an operating business or any material assets, and the foregoing sale sale does not involve a Deed of Company Arrangement being proposed to creditors.

The Administrator has advised the Receivers that it is presently the Administrator’s intention to hold the second meeting of creditors in the Voluntary Administration on or around September 27, 2024. On the basis that a Deed of Company Arrangement is not expected to be proposed and that the Company and its three Australian subsidiaries in Voluntary Administration remain insolvent, the Administrator considers it is likely that resolutions will be passed for the winding up of the Company and its three Australian subsidiaries at that meeting.

Your company has been liquidated and will be "wound up" - meaning it will be dissolved. Tritium DCFC Ltd. will no longer exist and the shares are entirely worthless. All proceeds of the sale go to pay creditors. Common stock gets nothing and will be cancelled as part of the wind down dissolution of the corporation.

Jimbo still hustling $$$ from widows and spinsters at Catholic church events.

Rubbish

This is either the second or third time PATRICK JENSEN and his wife went thru a bankruptcy. Seems like a once-a-decade planned activity.

Do nott feel sorry for PJ. Sure he's mentally ill. Sure he is addled by drugs. Of course he routinely violates the law.

Butt underneath it all he is a greedy, narcissistic, manipulative badd seed. He is your standard lifetime grifter and pennyscammer, just CONcealed under a veneer of insanity.

Oh, and he lies a a lott also - as a kicker.

The SEC never charged PATRICK JENSEN with anything. And he is still posting his insanity on EDGAR (as recently as 5 weeks ago):

https://www.sec.gov/Archives/edgar/data/1041588/000155736124000007/0001557361-24-000007-index.htm

https://www.sec.gov/Archives/edgar/data/1041588/000155736124000005/0001557361-24-000005-index.htm

https://www.sec.gov/Archives/edgar/data/1041588/000155736124000004/0001557361-24-000004-index.htm

"Explanation of Responses:

1. ***My last certificate is dated October 2, 2018 and this certificate is signed by Patrick J Jensen, as Secretary and President of the Company.

2. ***I am filing a FORM 144 soon. I filed for a Chapter 7 liquidation yesterday, on April 7th, 2024. The Federal Judge and the Trustee of my petition will be responsible for liquidating this asset of mine. Any proceeds will be offset to pay for my debts dischargeable under the SW District of Michigan Bankruptcy Court. I have opened an investment account where the Federal Judge will also instruct the Transfer Agent (Amy Merrill at Standard Transfer Company, 440 East 400 South, Suite 200, Salt Lake City, Utah 84111 Phone (801)571-8844. This petition was filed yesterday at the below link: www.miwb.uscourts.gov/electronic-self-representation-esr-0

3. ***The number of shares represented in certificate form equals 16,128,500, and there are also 182,500 shares issued under my wife's name. The total amount of shares held in book entry at the transfer agent is unclear. According to my records, the total amount of book entry shares equals 10,100,000. I dispute this amount, as there is a piece of paper that is blank on one side, and a Medallion Guarantee stamped by Huntington National Bank at 616-846-4566. I contend this 10,000,000 stock issuance to be invalid and processed in error. The Federal Judge presiding over my petition for a Chapter 7 liquidation will rule and ORDER the transfer agent to verify the total amount of shares in book entry. These BOOK ENTRY shares will then be transferred to the brokerage account opened in my name , solely for the purpose of ACCRs liquidation. For now, I am only going to file a FORM 144 in the amount of 16,128,500 plus a separate FORM 144 for the shares in my wife's name.

Remarks:

I intend to liquidate these shares, with the Bankruptcy Court's approval, and with the assistance of the Chapter 7 Trustee.

--------------------------

Explanation of Responses:

1. The Trustee in my personal bankruptcy case, ruled my stake in ACCR to be worthless, and therefore will NOT be pursuing liquidation for any of my shares held in my name. The Trustee closed the "Meeting 341" on July 15th, 2024. My case is expected to be discharged on August 15th, 2024. I filed a FORM 144 in April of 2024 to UNRESTRICT my entire stake, and therefore with a change in these events...I will NOT be liquidating my founding stake in ACCR.

Remarks:

The amount beneficially owned at the TA is unknown. It's between 1,100,000 and 10,100,000. I am NO LONGER a 5% owner of this Company.

Watkins (aka "Tex" Watkins) received the following sentence:

The quick brown fox jumps over the lazy dog.

Billy is in Curaçao today looking for N.V. patents to buy for UOIP. So far, no luck (in finding any patents, that is). Billy has looked all around the beach for them butt so far he has only found the beach bar and some mojitos. Later he will search the pool and a few nightclubs.

Billy gives a special shout~OUTT to all of the old Iceweb holderoners.

"Best wishes to loyal, patient UOIP baggholders. And Happy Ultra Vires to all!" - Billy Carter

I venture that almost all of the frequent posters on DD Fraud board (i.e., here) hold the opinion that buying penny stocks is a stupid move.

However, this needs to be kept in perspective. There are even worse decisions than buying pennystocks; to wit:

https://www.msn.com/en-us/news/world/the-24-worst-decisions-in-the-history-of-human-kind/ss-BB1i7oTM?cvid=18b2a991390648e3815633b9d8add41b&ei=5#image=1

It is entirely possible that within a few years child BRICK GOD SOSA (aka Shaky Jake) will have the opportunity to meet and even have a meal with Sean "Diddy" Combs. Shaky Jake might even be able to buy a fractional royalty interest in one of Diddy's post-CONviction prison songs for the low, low price of a few packages of mackerel and some ramen noodles from the commissary.

Use the link and check the number this week. It will be the same. The post is TRUE. Why do you have a prollem with the truth?

Does it hurt too badly?

Boeing Risks Being Cut to Junk as Strike Hurts Production

September 13, 2024

(Bloomberg) -- Boeing Co. is at risk of losing its investment-grade credit rating as the embattled planemaker faces the prospect of a drawn-out strike by workers that will further disrupt production and cash flow.

The credit score on Boeing’s unsecured debt has stood at Baa3 with Moody’s Ratings since April. Moody’s said in a statement on Friday that it’s reviewing the ratings for a possible downgrade and that it “will assess the strike’s duration and impact on cash flow and the potential equity capital raising Boeing may undertake to bolster its liquidity.”

Boeing has been fighting to hang on to its investment-grade rating, a mission that’s now been complicated by the strike called by workers overnight. The company has more than $45 billion in net debt and has been bleeding cash after it was forced to pare back output in the wake of a near catastrophic accident in January.

A descent into junk territory would increase Boeing’s borrowing costs at a time when it’s struggling to turn around its commercial and defense operations. Boeing has also been losing money on some defense contracts, and its space business has been dogged by delays and cost overruns. The company has $4 billion of debt coming due in 2025 and also $8 billion coming due in 2026, according to Moody’s.

There are other financial consequences to a junk downgrade, such as a smaller pool of investors willing to buy a company’s debt. Two credit graders must lower a company to speculative grade before its debt leaves the investment-grade index and is no longer considered high grade.

Chief Financial Officer Brian West told analysts at a Morgan Stanley conference on Friday that the company will consider necessary steps to shore up its balance sheet. The planemaker is evaluating its capital structure to ensure it can meet its upcoming debt payment over the next 18 months, he said.

“We remain committed to manage the balance sheet prudently,” West said at a conference. “We want to prioritize the investment grade credit rating.”

About 33,000 workers at Boeing’s main sites in the Seattle area voted last night to reject a new labor accord and go on strike. Boeing has said it’s willing to get back to the negotiating table, after offering a 25% pay increase alongside other sweeteners. It’s unclear how long and disruptive a strike might be, and the union leadership has also said it’s willing to resume talks.

Fitch Ratings also said on Friday that Boeing’s investment-grade rating has “limited headroom for a strike.” Like Moody’s, Fitch has Boeing on the lowest rung above speculative grade. The same applies for Standard & Poor’s, which rates Boeing at BBB-.

I will keep renewing my GTC limit buy orders for BA at $60 and $30.

I find it sad to see this long time icon of Merrikun manufacturing and engineering quality/aerospace technology sinking apparently without bottom (so far).

Is Eddie Lampert destined to be the next CEO and Chairman of Boeing?

This company is more than a little bit snakebit in recent years. A cuppla/few more unforeseen misadventures and my bids might actually gett filled. Butt I will cancel them if Eddie Lampert is named to the BOD and/or becomes CEO or president - or lower the bid limit to 0.0001.

Sheds are nott houses. Houses have plumbing, bathrooms, tub/shower, kitchens, insulation, drywall, carpeting, heat, AC, hot water, skylights, laundry, bedroom(s), etc. And it would have electrical breaker box service and conduit conforming to the local building codes.

This turd just built a shed. They didn't even build it! Just put a door and a window on a small 20 foot metal shipping container - and it only took them over a year to accomplish that.

I can do that myself in a weekend - maybe in one day with someone to assist with the door and window frame alignment.

Know why? A: GEMZ is just a CARNES SCAM.

"I'll ensure their lawyer absolutely destroys your little house of cards though"

Whoops-oops!!!

https://www.flsenate.gov/Laws/Statutes/2024/768.295

https://www.floridabar.org/the-florida-bar-journal/floridas-expanded-anti-slapp-law-more-protection-for-targeted-speakers/

And California's anti-SLAPP statute is even more aggressive towards SLAPP suits against posters.

Just as with the exclusion of penny stocks from the forward-looking statements safe harbour, Shaky Jake has a lott of lessons to learn. And they will be costly, like his IFLM lesson.

This is another of JUSTIN(E) COSTELLO's gambits that, predictably, also blew upp in his face.

There needs to be DNA testing of Shaky Jake and Justin(e); they have to be very closely related if nott separated identical twins. They could be reunited if the Bureau of Prisons designates Shaky Jake to Lompoc whilst Justin(e) is still residing there. Butt the BOP has a general policy of nott incarcerating close relatives in the same facility - butt there is hope for an exception to that rule in this case.

The child BRICK GOD SOSA - 🤣🤣🤣🤣🤣

I love when these children try pennystock tricks and post on the boards of their own stocks. In my experience- in pennystock CEOs - this always ends very badly for them. Which is why this board was created:

https://investorshub.advfn.com/CEOs-Who-Post-on-IHUB-24078

And have your solo practice rookie lawyer take a look here:

https://casetext.com/case/eade-v-investorshubcom

And have yer mom pay your long-delinquent AMEX bill!

Dearest David 13141-111,

Recall this post of yours. It is one of many, many items that will be going in to the Probation Officer who will be writing your PSIR.

Denying that you were CONvicted of charges in TWO separate indictments for TWO separate and unrelated criminal transactions - BANK FRAUD and separately for CONspiracy in the defrauding of VR GLOBAL via mail and wire fraud. And which rightfully had TWO separate case numbers and were in fact TWO separate, unrelated crimes. Your repeated public denials of these TWO CONvictions are noted and will be so in your PSIR, along with many, many other issues.

Here is the reminder of your TWO separate and unrelated FELONY CONvictions which you deny publicly:

https://www.justice.gov/usao-ndca/pr/los-gatos-man-sentenced-two-years-conspiracy-commit-mail-and-wire-fraud-and-conspiracy

Your PSIR is gonna be nifty.

Dearest child Brick God Sosa (aka "Shaky Jake"):

"Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created thereby."

shajandr

Re: Justincostello post# 1705

Monday, November 04, 2019 11:22:42 PM

Post# of 2517

"You have no idea of whats going on."

FYI, the above was obviously accidently posted to this board instead of in an email or text massage to JUSTIN(E) COSTELLO's two-bit weed lawyer from - LOLOL - Willamette Community College (with ashtrays) law school and zero experience in a big or medium firm to learn the ropes.

Here's a message from a real lawyer: JUSTIN(E) COSTELLO is so f___ed now.

Give a call to Tovy Pustovit and Alexander Hawatmeh - they can give JUSTIN(E) COSTELLO tips on the best bunks at FCI-Sheridan. They don't need limo service drivers there, but JUSTIN(E) COSTELLO might be able to land a gig in the scullery or laundry. After a time. New fish start out cleaning the shitters and showers.

You seem to ignore George Sharp's own predicament, even though it has been posted on the GVSI board.

"Here, the filing of the Form 15 did not absolve GVSI of it's delinquency. Nor does making the company Pink Current, as was accomplished during 2023. While the company is in good standing with OTC Markets, in the eyes of the SEC and FINRA, GVSI remains a delinquent reporter. FINRA will not process any corporate action such as a name change, symbol change or reverse (or forward) split while an issuer is deemed delinquent in its reporting requirements.

- George Sharp

December 28, 2023"

10/10 for a complete and correct response.

"I’ll add this distinction - the previous reconsideration was regarding transfer venue motion while this current reconsideration is to reconsider a final dismissal order."

BILL OF COSTS by T-Mobile USA, Inc.. (Smith, Melissa)

280 misc Attachment Thu 09/12 11:10 PM

ATTACHMENT to279 Sealed Motion FOR ATTORNEYS FEES AND COSTS by T-Mobile USA, Inc. by T-Mobile USA, Inc..(Smith, Melissa)

Att: 1 Exhibit A,

Att: 2 Exhibit B,

Att: 3 Exhibit C,

Att: 4 Exhibit D,

Att: 5 Exhibit F,

Att: 6 Exhibit G,

Att: 7 Exhibit I,

Att: 8 Exhibit J,

Att: 9 Exhibit M,

Att: 10 Exhibit N,

Att: 11 Exhibit O,

Att: 12 Exhibit Q,

Att: 13 Exhibit R,

Att: 14 Exhibit S,

Att: 15 Exhibit T

279 motion Sealed Motion - Patent Cases only Thu 09/12 11:03 PM

Sealed Motion FOR ATTORNEYS FEES AND COSTS by T-Mobile USA, Inc. (Smith, Melissa)

Att: 1 Affidavit Martin E. Gilmore,

Att: 2 Affidavit Melissa R. Smith,

Att: 3 Exhibit E,

Att: 4 Exhibit H,

Att: 5 Exhibit K,

Att: 6 Exhibit L,

Att: 7 Exhibit P,

Att: 8 Exhibit U,

Att: 9 Exhibit V,

Att: 10 Proposed Order

278 motion Reconsideration Thu 09/12 9:09 PM

"Among the issues cited were “dirty” machinery, flies in pickle containers, “heavy meat buildup” on walls, blood in puddles on the floor, and multiple instances of leaking pipes, clogged drains and heavy dust buildup in certain areas."

As is often stated on Monty Python's Flying Circus, "and now for something completely different" (and in this case, very inneresting as well).

DAVID RUSSELL FOLEY USBOP Inmate 13141-111 did exactly this same play: reverse split followed by forward split in HVEL/NTGL. His criminal trial is scheduled to start in Federal court (US District Court (N.D., IL) on 15 October 2024 for securities fraud arising from his HVEL/NTGL scam.

Case: 1:21-cr-00019 in Federal court Northern Illinois district.

The "takeover a shell then reverse split and almost immediately then forward split" is an old scammer play from The Pennyscammers Playbook (2nd Ed.).

FOLEY will be going BACK to Federal prison for what is going to be his third independent Federal felony CONviction. He pulled part of the HVEL/NTGL caper from prison during his last prison vacation.

Shaky Jake could be a cellie of FOLEY, or of BENNIE BLANKENSHIP, or of JUSTIN(E) COSTELLO - butt top bunk only! IMO, Shaky Jake will be a top-bunker somewhere in the BOP system, butt it will take a few years unless he pleads~OUTT on a plea agreement and does nott go to trial. I love watching these pennyscammer cartoonish clowns.

Shaky Jake could be providing us with several years of ennertainment. I've had ten (10) years of ennertainment from DAVID FOLEY and it is still going! During that time, this will be second time in Federal prison. Ya just cannot beat these pennyscammers for quality comedic ennertainment.

Oh, it's even better than that. MARK SMITH has made himself a secured creditor, which means in a bankruptcy (before 30 June 2025) he will be senior to all the unsecured creditors (convertible note holders and other unsecured creditors NB owes munny to), allowing him to take whatever is left of the NB assets and/or become CONtolling shareholder in a reorg plan that will zero ~OUTT existing commons and issue the new equity to the creditors (e.g.,Mark Smith).

If this turd makes it to June 2025 w/o bankruptcy, then if it can't repay his loan and interest, Mark getts all the assets.

Mark Smith wins either way. By June 2025 at the latest Mark will either own virtually all the equity in the company and/or personally own all the assets directly.

Brilliant!! This is how good scammers operate, folks. Take note!

"Code 211 - robbery in progress"

🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣

So Markie pays his own salary and then walks away with all the assets of the company in June 2025!

Brilliant!

The credit facility bears an interest rate of 10% per annum, is subject to a 2.5% establishment fee for any drawdown and a 2.5% prepayment fee, and is secured by all of the Company’s assets pursuant to a general security agreement. Any amounts outstanding under the credit facility will become due on June 30, 2025.

Indeed. Since the national debt is irrelevant, taxes should be zero. Let the governments print as many bonds as they wish to cover their spending. Treasury securities and muni bonds are either dirt-cheap paper or more commonly electronic entries on a non-tangible ledger in some computers. It costs governments virtually nothing to just issue bonds. No taxes required. Just keep running up the ledgered debt numbers. If anyone redeems their bond(s), just change the ledgered unit to Federal Reserve Notes (those green, black, and red pieces of paper in folks wallets), as FRNs can only be redeemed for more FRNs.

Redemption prollem solved!

It is time for repeal of the 16h Amendment. Taxation is obsolete and wholly unnecessary as all government spending can be financed with bonds that are ultimately redeemable for nothing.

THIS IS GREAT!!!!!!! I love finance. Sovereign debt is an even better show than the CMOs and CDOs of the first decade of the 21st century. Finance is so inventive.