Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Level check out HIIT.

Pulled in nearly $2 Million in revenue in Q4 2012!!

HIIT @ $.16

2 new business divisions on line in 2013!

43,667,483 shares of common stock were issued and outstanding.

Good management team looking to build a real company in oil and gas fracing.

Check TEVE out as well buddy..

Overall, I don't know if I've mentioned this to traders but I think it is best to avoid otc no information stocks. There are occasional notable exceptions, but SEC continues to be cracking down in that area, so be prepared for increased suspension potential on them. On the positive side, a suspension often can reveal of there is really any plans for them or not. If company proceeds then to file necessary filings to get up to date and out of suspension, we know there is a potential plan for them.

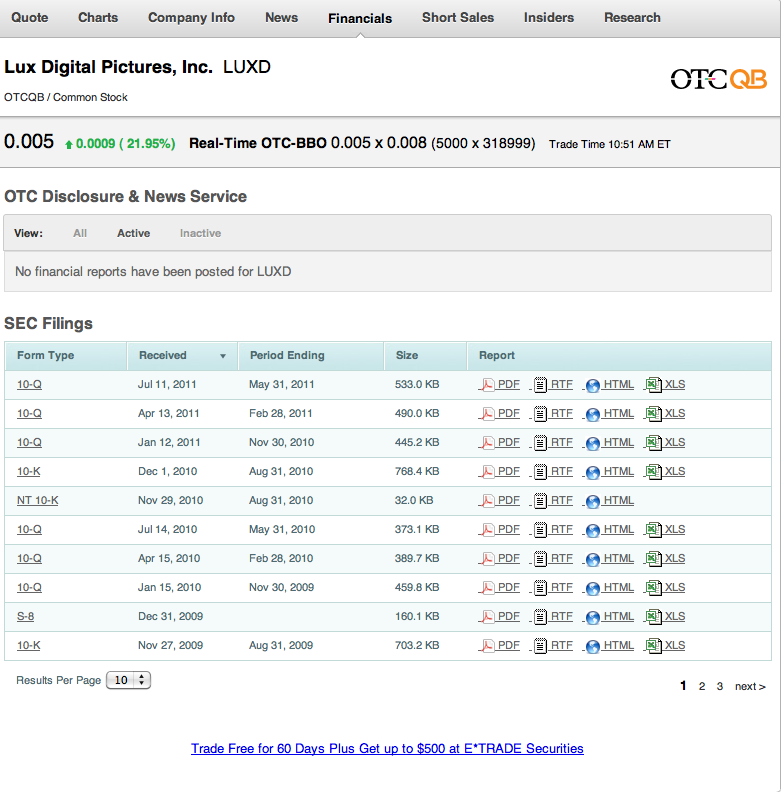

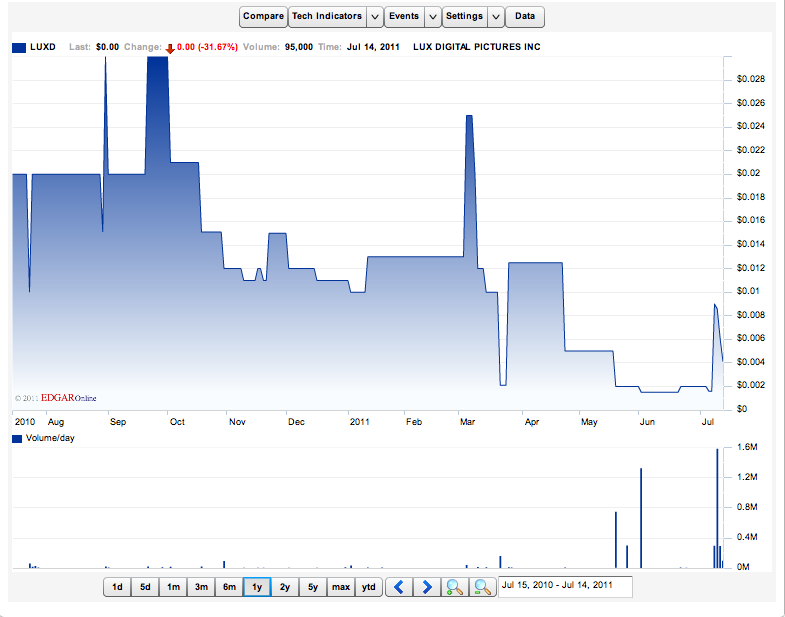

LUXD some more generic info

We were formed to develop businesses, assets and opportunities, some acquired and contributed from third parties and our founding shareholders, in the motion picture production and distribution industry and some related fields. Lux Digital Pictures, Inc. (“Lux” or the “Company”) operates its businesses under several names and divisions (“brands”) and the Company believes it will be able to compete in today’s entertainment industry marketplace by controlling production costs and by limiting its distribution expenses using, primarily, online marketing tools to promote its products and to further develop its digital strategies. The Company has not been able to raise any new capital, at this point, to grow and expand its businesses and has been actively seeking opportunities to capitalize, re-capitalize the Company or combine or sell the Company in a manner that will be beneficial to shareholders. As of July 8, 2011 the Company is in active negations with a party to do a reverse merger which will result in a change of control of the Company with a new, different and considerably larger business being vended into the Company, which shall result in substantial dilution to shareholders.

Results of Operations for the Quarter ending May 31, 2011

Assets

As of the three months ending May 31, 2011 the Company had Total Assets of $582,281, Total Current Liabilities of $163,217 and Total Stockholders’ Equity of $419,064 compared with Total Assets of $779,014, Total Current Liabilities of $156,682 and Total Stockholders’ Equity of $622,332 for the Company’s prior fiscal year ending August 31, 2010. The decrease in Company assets in the current three month period is, principally, attributable to the Company’s write off of an impaired asset and increased amortization of capitalized production expenses.

Revenue and Operating Expense and Net Income

For the three months ending May 31, 2011 the Company had a Net Loss of $210,319, Gross Revenues of $44,340, and Total Operating Expenses of $100,012 compared with a Net Loss of $6,366, Gross Revenues of $42,087 and Total operating Expenses of $48,394 for the Company’s three month period ending May 31, 2010. The increase in Net Loss from the prior year’s Quarter is, primarily, attributable to the write off of an impaired asset and increased amortization of capitalized production expenses.

Level any opinions on

LU_XD

Interesting info. Could see an R/M according to the 10-Q

At July 8, 2011, there were 51,539,223 shares outstanding of the Company's common stock

Plan of Operation and Liquidity

As of May 31, 2011 the Company believes it has sufficient cash resources available to fund its primary operations for the next twelve (12) months absent any extraordinary events. The Company is engaged in negotiations to do a reverse merger with a larger Company operating in a different field. If successfully completed the transaction would create greater liquidity for the new Company. The Company has no current off balance sheet arrangements and no agreements with its shareholders, officer or director to provide funds for operations in the future.

Level was wondering if you ever heard of AL_SC last week on Friday there were 3 blocks of shares worth about 1.4 million.

Some info found on the MM RILY who showed up on the ask.

RILY the lead ask on ALSC

Bryant R. Riley is founder and Chairman of B. Riley & Co., Inc.; a Southern California based brokerage firm providing research and trading ideas primarily to institutional investors. Mr. Riley is also the founder and Chairman of Riley Investment Management, LLC, an investment adviser which provides investment management services. Prior to 1997, Mr. Riley held a variety of positions in the brokerage industry, primarily as an institutional salesman and trader. From October 1993-January 1997 he was a co-head of Equity at Dabney-Resnick, Inc., a Los Angeles based brokerage firm. From 1991-1993 he was a co-founder of Huberman-Riley, a Texas based brokerage firm. Mr. Riley graduated from Lehigh University in 1989 with a B.S. in finance. He also serves on the board of directors of Aldila, Inc., Alliance Semiconductor Corporation, DDi Corp., and lcc International, Transmeta, and Silicon Storage. Mr. Riley?s tenure in investment banking and private equity, as well as his management experience and significant experience on other public company boards, brings extensive knowledge to our Board in executive management and finance matters including mergers and acquisitions, securities and debt offerings.

The Anatomy of a Lightsquared Smear Campaign - (How to convince people that a start-up will lead to Armageddon?)

**This is an opinion piece and not like many of the typical DD pieces I do. I have watched the Lightsquared story for the last year and a half, and have seen the pieces fall in place, both with regards to the company and it's opponents. This is my take.

DISASTER!!

Planes are crashing, ambulances can't make it to your dying mother, crops are destroyed, the woman on your GPS tells you to turn right into a lake, and the economy plummets. Yes, only weeks after Armageddon was supposed to arrive according to Harold Camping and crew, you would think that fears of the end times would fade away. Not so fast, according to some business and industry big wigs. And, if you think the end times would be brought about by some other worldly forces, you'd be sorely mistaken. Apparently, where so many others failed over the years in stoking the end times, one start-up Lightsquared might succeed. The little engine that could. Lest you think this is all just wide eyed imagination, take note of the year they expect to start full scale service, 2012. Coincidence? Or a harbinger of doom?

I know this all sounds like a fantasy, and yes I'm guilty of overdramatizing, but if one read the news feed of Lightsquared you would think you had just entered Wall Street's version of "Days of our Lives". It's about as dramatic and juicy of a story as one can find. Before you judge me for my facetiousness, just take a peak at this sampling of recent news articles and blog entries about Lightsquared, the company in question. Ask yourself am I really over-dramatizing what is being alluded to by various media outlets.

http://www.bloomberg.com/news/2011-06-01/deere-says-falcone-s-lightsquared-to-cause-massive-interference-.html

http://www.gpsworld.com/survey/lightsquared-its-worse-you-think-11646

http://gisforum.org/2011/04/gps-threatened-with-widespread-interference/

http://urgentcomm.com/networks_and_systems/commentary/lightsquared-money-vs-interference-20110601/

http://www.amerisurv.com/content/view/8715/

http://www.pobonline.com/Articles/Industry_News/BNP_GUID_9-5-2006_A_10000000000001056213

http://www.aviationdynamix.com/?page_id=36

http://www.techeye.net/mobile/lightsquareds-wireless-broadband-could-kill-gps#ixzz1O8ytyxTy

And there are dozens and dozens of more articles like this out there. Here are just a few choice tidbits, quotes and kernels of wisdom from a few of these articles:

“There are major economic consequences,” said Deere, the world’s largest maker of farm equipment. “Deere customers in agriculture, construction, and other applications will lose high accuracy navigation in and near areas served by LightSquared.”

“The potential impact of GPS interference is so vast, it’s hard to get your head around,” said Jim Kirkland, vice president and general counsel of Trimble Navigation Ltd., which makes GPS systems. “Think 40,000 GPS dead spots covering millions of square miles in cities and towns throughout the U.S.”

With GPS interference, a pilot “may go off course and not even realize it,” said Chris Dancy, a spokesman for the Aircraft Owners and Pilots Association.

Manufacturers have warned that if the network sends signals that are too strong it could jam existing navigation systems and bring down aircraft.

LightSquared’s network could also undermine the Federal Aviation Administration’s multi-billion-dollar program to upgrade the nation’s air-traffic control system, which is based on World War II-era radar technology.

Many 911 systems also use GPS to help locate people. Disruptions could delay responses to emergencies, said Harlin McEwen, an official with the International Association of Chiefs of Police.

“Our military is heavily reliant on an uninterrupted GPS capability to do their jobs. The risk to our forces of the widespread denial of GPS was too great and required action. I am glad that my amendment ensuring that the Department of Defense’s concerns are addressed before LightSquared moves ahead passed overwhelming in the House today,” said Turner.

In January 2011, the FCC granted a conditional waiver to a single commercial communications company, called LightSquared, to build tens of thousands of ground stations that may cause widespread interference to neighboring GPS signals. The Commander of Air Force Space Command, General William Shelton, told Turner in March 2011 that, based on analysis he had seen to-date, “that virtually every GPS receiver out there would be affected.”

Turner further stated, “It is unacceptable for our armed forces to be put at greater risk or made less effective as a result of LightSquared’s operations. Congress and the Defense Department must have assurances from the FCC and this Administration that it will fully resolve the harmful interference issue prior to granting LightSquared final authorization to provide service. Our troops are depending on our government, and the FCC, to do the right thing.”

alrighty bud just missed seeing you around. You know sooner or later I am going to harass you!

Hey Immie, I'm around just been so busy with some other non stock related projects that I haven't been able to chat with people as much. Once things clear up I shall return. Until then, just trying to stick with a few DD stocks and the SOS changes as best I can.

Best, level

Just a heads up for those who haven't seen this yet, will change the penny game in some respects. An important rule change. Explains the L2 from the last couple of days.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=62789694

Hey Level,

This is completely unrelated to your post, just dont have PM.

Not sure if CVCP has come across your screen or not but figured it was right up the R/M alley

recent nevada SOS change reactivated the shell with a name change

the name is pointing to what seems to be a sucessful Natural Dog food manufactuer that appears to have a good following

recent related domains have been registered but pointing to an international entity. It is the consensus that they are looking to grow beyond there current market and being Canandian based

the US would be the first obvious choice.

Anywho would love your take on it.

CVCP last reported

OS 42mil

19 Float

back in 08

little activity between now and then

was dormant shell.

New speculated company is Paw4mance pet products

check out the board when you have a sec.

PDOS could be good for some incredible gains this summer. They have licensed two films from their Intellectual Property that are playing this summer. One, has an opportunity to be a summer blockbuster.

Dylan Dog - Dead of Night - Starring Brandon Routh (Superman Returns)

you can tell the pack...just not very much...GO BUCS!

Too bad for those who can't read between the lines :) Personally, I don't think it will hurt at all, it may help us. Keeping away those who can't understand what's really going on and probably shouldn't be in the stock to begin with isn't necessarily a bad thing. I'm much more for educated traders who can read the tea leaves.

As for INVX, it is bankruptcy related, but I personally think it's better than a Q, because INVX itself is not in bankruptcy. The benefits of a successful restructuring for their subsidiary is the great part and it's minus the pitfalls that most Q stocks because the commons aren't at risk of being cancelled (as the parent is not in bankruptcy). The bankruptcy filing and other filings pretty much spell this out, that the subsidiary is going through the bankruptcy court at the moment not the parent:

On March 30, 2010, Innovex (Thailand) Limited, (“Innovex Thailand”) a subsidiary of Innovex, Inc. (the “Company”), filed with the Central Bankruptcy Court in Thailand, a voluntary rehabilitation petition under the Bankruptcy Act for Business Rehabilitation in accordance with Thailand Law. The petition, dated March 30, 2010, was formally accepted by the Thai Court on April 2, 2010 and the decision on the final acceptance and approval to reorganize the business in accordance with the petition is expected to be provided in June 2010. The petition filing pertains to the restructuring plans of the Company’s subsidiary, Innovex Thailand and does not extent to cover its parent, Innovex, Inc.

On January 22 2010, Innovex (Thailand) Limited (the "Borrower") received a letter dated January 14, 2010 (the "Letter") from TMB Bank Public Company Limited ("TMB") relating to debt obligations to TMB. The Borrower is a subsidiary of Innovex, Inc. (the "Company")

As previously reported by a Current Report on Form 8-K filed January 7, 2010, the Company entered into a mandate letter on January 4, 2010 with Standard Chartered Bank (Hong Kong) Limited ("SCB"). The mandate letter relates to, among other things, SCB's possible purchase from BAY and TMB of the outstanding debt owed by the Borrower at a discount from the total value outstanding. SCB is currently in discussions with TMB and BAY to reach an agreement on a purchase price of the debt.

I think it actually may hurt INVX that there is no "Q" on it, newcomers probably dont realize its bankrupt and just think its a shell/POS.

On the bankruptcy madness of the last week, in the end people will start to come to their senses and not just pile all their money into any stock with a Q next to it. IMO, the money will flow towards the plays with true DD that backs up the move they have made. Three bankruptcy related stocks that I currently see in this category are INVX, PFOB & BUTLQ.

Me either... I already said this was my long term one for developments

Yeah, watching that as well, no one really posting on it at the moment, but certainly could see it making a move if it were to get attention. I personally hope it will stay down here a little bit longer.

When you see a flurry of buying right after being posted on certain boards, those are the momo boys piling in. They sometimes don't hold very long and can tank the stock afterwards. I don't care for them much.

Ok, good. Just checking, since I'm new to the stock and have recently been accused of everything under the sun!!!!

Not sure what you are talking about, post was not directed to you.

Who is? I am not pumping INVX is you are referring to me as a "momo boy"

Momo boys on it now, might move.

Have an eye on INVX after finding some new information. Watching it closely.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=61009380

Very interesting! Looks like a long term winner, sometime in 2012

CBTEQ 8-K thought it was interesting. Any thoughts Level?

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 03/09/2011

Commonwealth Biotechnologies, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-13467

Virginia

54-1641133

(State or other jurisdiction of

(IRS Employer

incorporation)

Identification No.)

718 Grove Road

Midlothian, VA 23114

(Address of principal executive offices, including zip code)

(804) 464-1601

(Registrant’s telephone number, including area code)

601 Biotech Drive

Richmond, VA 23235

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events

On March 9, 2011, Chairman of the Registrant, Bill Guo calls for an annual shareholder meeting in the end of March 2011, to elect a new Board of Directors, consisting only of one member, and submits his proposal of how to reorganize Commonwealth Biotechnologies Inc., from bankruptcy status, as showed in the attachment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Co Commonwealth Biotechnologies, Inc.

D Date: March 9, 2011

By:

/s/ /s/ Bill Guo __________

Ri Bill Guo, Chaiman

Attachment:

CBI’s Chairman Calls for Annual Shareholder Meeting

Dear Shareholders of Commonwealth Biotechnologies Inc Common Stock:

(Forward-Looking Statements: No statement made in this public letter should be interpreted as an offer to purchase any security. Such an offer can only be made in accordance with the Securities Act of 1933, as amended and applicable state securities laws. Any statements contained in this release that relate to future plans, events or performance are forward-looking statements that involve a number of risks and uncertainties. There can be no assurance that such statements will prove to be accurate and the actual results and future events could differ materially from management's current expectations. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.)

Commonwealth Biotechnologies Inc (“CBI”) filed Bankruptcy on January 20, 2011. As a result of this development, almost all values of your shares of CBI have lost. Is there any possibility that the company will continue as a going concern and get out of Bankruptcy quickly? Yes, it is possible. This is why I distribute this letter to call the annual shareholder meeting, and ask your support to elect the board of directors and adapt my plan of reorganization.

(1) Higher administrative expenses caused bankruptcy:

The long-time practice of CBI’s failure to generate profits, forced CBI sold its main operations of USA: CBI Services and Fairfax Identity Laboratories (“FIL”), to Bostwick Laboratories, Inc. (“Bostwick”) effective November 2, 2009. After the sale, the only income of CBI in USA’s operation is the limited rental minus the mortgage. However, CBI still kept very higher administrative expenses including the high salary payment to the Chief Operating Officer, and the high maintaining costs of a big size (seven members) of the Board of Directors.

Every member of the directors of CBI should be an expert of the business management. The elementary (ABC) knowledge as a business manager is that the administrative costs should manage at the level of the company’s affordability. Unfortunately, the CBI’s only executive officer has violated the affordability rule, breached the Shareholders’ fiduciary duty, and caused the bankruptcy.

(2) Currently CBI’s financial condition:

CBI has two main assets left: one building with 09/2009’s appraisal value of $5.9 million, located in 601 Biotech Drive, Richmond, Virginia, rented to Bostwick with monthly income of $49,498. This building is pledged to several creditors with a total secured claim of $3,081,195; among them BB&T has the highest mortgage value of $2,438,487, at a fix interests rate of 5.5% before; and the interests rate jumped to 21% after the bankruptcy filing; and another is the stock of the subsidiary of Mimotopes Pty Limited, an Austria operation, with approximate market value around $1 million, which was collateral to creditors for loans of over $480,000.

In addition, there are over $1.5 million of unsecured creditors’ claims; among them over $ 344,000 are the claims of the unpaid compensation of CEO and other directors.

(3) My reorganization plan:

I have the following CBI reorganization plan to rescue some value of CBI’s shareholders; this plan is to delay the fire sale of CBI’s building considering that the real-estate market weak:

·

To eliminate CBI officers and directors’ claims against CBI’s visible property; and these claims should be resolved by voluntarily abandon, donation or issuance of common stock;

·

To pay remaining unsecured debt partially with common stock and partially with remaining cash left after the sale of Mimotopes.

·

To refinance mortgage at a lower fixed mortgage rate.

·

To close Richmond operation, and keep all administrative expenses no more than $7,500 per month.

If we can reach these goals, we will get positive cash flow, then to look for a real growth business to merger. Our positive cash flow, NASDAQ listing history, and carry forward operating loss will bring real economy value to a growth, profitable and seeking public entity. After these steps, our shareholders will have some value recovered.

(4) Why should we eliminate CBI officers and directors’ claims against CBI’s visible property?

Following two tables listed the claims copied from CBI’s bankruptcy court filings on February 3, 2011, entitled “Summary of Schedules” made by Dr. Richard Freer; there was no Board meeting to examine the filing. It is possible that some Directors’ claims haven’t been confirmed personally.

The tables showed the Officer and Directors aggregately have over $ 344,000 value claims against CBI. Most of them are the compensation expenses happened after the operations of CBI Services and Fairfax Identity Laboratories being sold.

Table 1. Dr. Richard Freer Claims (Unsecured)

No.

Item

Amount

1

Director annual fee (Priority)

$ 11,725.00

2

Restricted Stock Earned but not Issued

$ 52,500.00

3

Wages Earned but not Paid

$ 94,294.02

4

No explanation

$ 52,500.00

Total

$ 211,019.02

Table 2. Other Directors' Claims (Unsecured)

Name

Mark Hober

Annual fee (Priority)

$ 11,725.00

Mark Hober

Annual fee

$ 16,794.00

Mikio Taniguchi

Annual fee (Priority)

$ 11,725.00

Eric Tao

Annual fee

$ 17,000.00

James Brennan

Contract Buyout

$ 25,000.00

James D. Cuausey

Annual fee

$ 17,000.00

Marie Song

Annual fee

$ 17,000.00

S. P. Sears Jr.

Annual fee

$ 17,000.00

Total

$ 133,244.00

When a corporation officer or director made claim against the company, we not only should examine the time which the officer or director spent for the company, but also examine the executive results of his service because the officer or director of CBI has fiducially duty, and should be loyal to CBI, and put the company’s and shareholders’ interests above his own, and should take the administrative liabilities for the failure of business operation.

In the 10-K filings for the period ended December 31, 2009, Dr. Freer reminded public of his severance package valued about $0.5 million in his employment contract with CBI. However he missed two important criteria of that contract, first that contract signed when he was acting as a Chairman which ended in September 2008; secondly, the contract mentioned financial performance standard which he didn’t achieve. Because CBI consistently has operating loss, and the corporation operating scale became small, smaller and much smaller, a lot of old regulations including the officer and director compensations have failed to revise, and became unfair, unreasonable, and unaffordable.

The officers and directors can’t claim the company based on the obsolete terms of the contracts, and their claims should base on the high ethics standard as a top officer or director, and their fiducially duties, and company’s affordability. It is time for them to revise or abandon voluntarily the claims against the company which he had served proudly. The shareholders will keep in mind forever for their great help and positive contribution in the financial crisis of the company.

(5) Why Dr. Freer is not qualified as a CEO and director of CBI.

(i) CBI has accumulated deficits over $25 million, and Mr. Freer doesn’t ever show that he has the capability to run CBI with profits despite that, he is a co-founding CBI in 1992, and has served as a director of CBI and, as the Chairman of the Board of CBI until September 2008. He assumed the role of Chief Operating Officer in 2002.

(ii) Richard J. Freer’s professional background is a Doctor in life-science, not a stock broker, and he doesn’t have much experience in engaging the business merger. Any of his existing business plans will carry an unaffordable high administrative costs of CBI. We can hire outside counsel to engage in the business merger without any front costs.

(iii) I asked Dr. Freer to resign in November 2010, he rejected. Dr. Freer controlled details of financial activities of CBI, but he never submitted any plan of how to avoid the bankruptcy to the board of directors.

(iv) Dr. Freer’s plans for assets sales haven’t been approved by the Board of Directors. He hired and will hire, lawyers, counsel, special consultant, accounting firm, real-estate broker to expedite assets sale, which is not the best interests of CBI shareholders and unsecured debtors.

(6) Annual Shareholder meeting will be scheduled in the end of March of 2011 for determining following items:

·

To revise Article of CBI and accept minimum member of the board of directors is one;

·

To revise By-laws of CBI and accept minimum member of the board of directors is one;

To nominate and elect Bill Guo as the director of CBI of 2011;

The salary and compensation of new Director will be $1 (one dollar) per year, without any insurance coverage by CBI.

The above proposals determined by you, the shareholders, are to make the organization structure leaner, and to cut the administrative costs to the minimum. I believe that I am competitive as a director candidate for year 2011, in experience, loyalty and financial supporting to CBI and CBI’s shareholders. Anyone who wants to compete for the position is welcome as he (she) can show us the capabilities in which he (she) can bring CBI the real economy value of shareholders.

Since CBI has the financial difficulty to pay the costs of shareholder meeting, I will cover costs of this meeting. Any shareholder or ex-director has any proposal including dissent opinion with mine, may submit his (her) proposal before March 15, 2011. For costs control purpose, any other proposal is limited to 200 words, and the proposal with over 200 words will be rejected. If anyone will pay the costs by itself, the proposal may be allowed with unlimited words at my discretion.

(7) Other Miscellaneous issues:

(i) Andrew Chien, CEO of USChina Channel LLC was hired as a representative to manage the shareholder meeting. His e-mail address is uschien@uschinachnnel.net; mail address: 665 Ellsworth Avenue, New Haven, CT 06511, telephone no.: 203-5628899.

(ii) We may hire Broadridge to manage the vote process.

(8) Where you can find public information of CBI in the future:

CBI has no financial auditing since fiscal year 2009, and CBI is no longer qualified as a SEC reporting company due to Section 13 or 15(d) of the Exchange Act of 1934, as amendment. I hired Andrew Chien to file Form 8-k and Form 15 to report this public letter, and suspend our status as a SEC reporting company.

We will submit our company’s information regularly in the www.otcmarkets.com (former name: www.pinksheet.com), which is a paid service. I also will cover the expenses for public our information.

Sincerely yours,

Bill Guo

Chairman of CBI

Address: Venturepharm Towers

No. 3 Jinzhuang, Sijiqing, Haidian District

Beijing, China PC 100089

Tel: 86-1088500088

So do you want to set one up together here? In the free zone?

Mike,

No problem, you and the others are doing great work. I think keeping it broad always works and gets more people to participate on a board. Just having an Energy Storage board would be a place that allows the experts and people who have questions to interact. It is a huge swath of terrority to attack, but much needed on Ihub IMO.

With all the great posters that just joined AXPW board, would be a shame not to see all that expertise put towards analyzing the sector as a whole. Nothing more enlightening that getting a whole bunch of knowledgable people in one room together, or in this case board. Anyhow was just a thought, either way nice posting.

I got your PM, thanks for the compliments! Nice idea on an energy storage alt energy board. Not sure how to go about it, how to limit it properly. Not sure it could be limited to the grid only, maybe overall power back ups, but that covers a huge swath of territory. Also might be hard to separate storage from production in some cases like integrated thermal solar units that collect sunlight heat and store it as molten salt to make steam for steam turbines overnight! One of my favorite underdogs, but no players I know of to play in puplic stocks.

I do not have PMs, I use the free account.

Great discussion on AXPW board regarding battery and energy storage technology from people in the know and involved in industry, if you want to know more from guys with professional expertise check it out. Like what I'm seeing with professionals jumping in.

AXPW continues to make a nice move up. Definitely continued potential with the oil price spike. Any more positive company news and this could make a much bigger move.

TDGI

NEWS:

Hannover House Corporate Financing Venture to Fuel Enhanced Theatrical and Video Release Slate

http://ih.advfn.com/p.php?pid=nmona&article=46532335

"Turtle" Sets Incredible Journey to America With Hannover House Summer Theatrical Release

http://ih.advfn.com/p.php?pid=nmona&article=46424945

High Profile Video Release Slate for 2011 Helps Hannover House Sign New Wholesale Accounts

http://ih.advfn.com/p.php?pid=nmona&article=46380183

DD

http://tinyurl.com/TDGI-DD

all imho

thanks level, your "green company" speculation did come through and there's still that stan larson(TRDY) connection.

Hey buy2 been a long time since I really DD'd PYBX and back when I did it was under a different owner. Thanks for the kind words on the old DD. Either way, I'll look at it, if I see anything new and interesting I'll let you know.

level, did you see pybx today? i see that you had some great DD early last year, maybe you could get involved again? some great DD could really keep the momo going.

Yup, they ran up the bid from around 3.00 yesterday to 3.80 today, there was a buy in the 3.80 range and that thinned out to the ask at 15, someone then hit the ask for 200. Interesting movement and ask thinned out, seen it heating up lately. Probably due to the Mobile World Congress and all the releases by Airspan. Either way I would expect there should be shares available back down in the lower range, someone wanted to spike it today though.

only 200 shares traded at 15 the rest a lot lower;

http://otcbb.com/asp/Info_Center.asp

That move was absolutely amazing, a once in a decade kind of move.

Been super busy with developing tools, that I have had to back off on DD and stock picks. Once I'm done with tools which should continue to help DD process I will be back in full force DD'ing stocks.

Something about this AIRO stock, way higher than I normally play and had two R/S's. All of that says stay away from usually and incredibly risky. However, I posted this on AIRO board, it is a very intriguing stock with A/S 2,000,000, at last report O/S at ~200,000, with a float close to 150,000 shares. And tons of news and momentum as of late. Last week new updated website popped up as well. I actually took a very small position in the $3.50 area just in case, not a bad one to accumulate a few in $2-$4 range if you like tremendous risk and uncertainty. But with 200,000 O/S and last reported revenue in the $70 million range for EOY 2008 this is going to stay on my radar. Today, also some interesting MM activity with AUTO and UBSS pushing bid up and then the $15 hitting near end of day. Quickly ask retraced back down. Just depends on if they can get current after the reincorporation and how quickly things will happen. Found it during my digging on Lightsquared and ZPCM. Another interesting story there. Either way, highly risky one, one of those ones I am not very confident with, but I see the potential for nice things.

Interline brands : http://www.google.com/finance?q=NYSE%3AIBI

Interline Brands Announces Pending Departure of Founding Board Member

GlobeNewswireInterline Brands, Inc. (NYSE:IBI) ("Interline" or the "Company"), a leading distributor and direct marketer of maintenance, repair and operations products, today announced that one of its directors, Ernest Jacquet, has informed the Company that he will not seek re-election to the Board of Directors following the expiration of his current term, which expires at the conclusion of the 2011 Annual Meeting of Stockholders in May. Mr. Jacquet stated that his decision would allow him more time to focus on his role as Chairman of the Board of Directors of Passport Brands, Inc., a designer, merchandiser and marketer of upper-end niche branded apparel and accessories. Michael Grebe, Interline's Chairman and Chief Executive Officer, stated: "Ernest is a founding member of the Company's Board of Directors. He has served as a director for Interline and our corporate predecessor since 1995, including serving as Chairman from June 2004 to December 2006. Throughout his more than 15 years of service to the Company, Ernest has made innumerable and important contributions. In particular, he was instrumental in bringing Interline public and helping shape the Company's growth and acquisition strategies. Although his presence will be missed, he leaves a legacy of passion and commitment to creating shareholder value that will carry forward in all of us that have had the pleasure and honor to work with him."

Mr. Grebe continued, "On behalf of the Board of Directors and the entire Company, we would like to express our deepest gratitude to Ernest for his many years of dedicated service to Interline Brands. We thank Ernest for his leadership, counsel, and commitment to our Board and Interline, and we wish him all the best with his new business endeavor."

Mr. Jacquet currently serves as a member of the Nominating and Governance Committee of Interline's Board of Directors, and will continue in that role until his term as a director expires.

About Interline

Interline Brands is a leading distributor and direct marketer with headquarters in Jacksonville, Florida. Interline Brands provides maintenance, repair and operations products to a diversified customer base made up of facilities maintenance professionals, professional contractors, and specialty distributors primarily throughout North America, Central America and the Caribbean. For more information, visit the Company's website at Interline Brands.

This news release was distributed by GlobeNewswire, GlobeNewswire - Press Release Distribution - EDGAR Filings - Video News Releases

SOURCE: Interline Brands, Inc.

CONTACT: Lev Cela 904-421-1441

GWAY holy god what a move, guy that acquired CKXE back in 2004 just did the same.

Robert F.X. Sillerman Agrees To Acquire Control Of Gateway Industries, Inc.

By Business Wire 02/08/11 - 10:54 AM EST

Leading media entrepreneur Robert F.X. Sillerman announced that he has reached an agreement to acquire control of Gateway Industries, Inc. (GWAY.PK) to serve as the vehicle for his new venture. Upon closing of the transaction, Gateway Industries, Inc. will be recapitalized and renamed Function (X), Inc. with the ticker symbol (FNCX).

Sillerman has a proven track record of pioneering some of the most successful and profitable businesses in television, radio, promotion, marketing and live entertainment. With the sales of SFX Entertainment and SFX Broadcasting, Sillerman has driven some of the largest transactions in the history of live entertainment and radio.

Berenson & Company, LLC is the exclusive financial advisor to Function (X) Inc. on this transaction, which is expected to close shortly. Further details about Function (X) will be announced in the coming weeks.

About Robert F.X. Sillerman

In February 2005, Sillerman formed CKx (NASDAQ: CKXE) to engage in the ownership, development and commercial utilization of entertainment content including American Idol. Sillerman announced his resignation as the Chairman and Chief Executive Officer of CKx in May 2010, to bid to acquire the company and to pursue other ventures. He remains CKx’s largest shareholder. Sillerman is also the Chairman and Chief Executive Officer of Circle Entertainment Inc. (CEXE).

Sillerman was the founder, Executive Chairman and a major shareholder of SFX Entertainment, the world’s largest presenter, promoter and producer of live entertainment, from 1997 until its sale to Clear Channel Communications in August 2000. Previously, he was a founder, major stakeholder and served as Executive Chairman of SFX Broadcasting, a leading owner and operator of radio stations, from 1992 to 1998, when he sold the company to an affiliate of buyout firm Hicks, Muse, Tate & Furst.

As I said in previous posts here and elsewhere I like the story and potential based on DD, there is something intriguing about it. There are certainly many question marks however and I'm sure people might come in and try and push the stock up on the good DD. Personally I am never one to buy more after a 300% run. The day unfolding should tell us more, whether more sellers start showing up. Chart may need a breather, hard to know.

Do you think its legitimate?

ACTT, now +300% since last week.

|

Followers

|

27

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

480

|

|

Created

|

11/20/09

|

Type

|

Free

|

| Moderator levelnever | |||

| Assistants prado | |||

JUMP, JUMP LIL' LEMMINGS

THE BOARD'S PHILOSOPHY: Do the DD, find the stocks with good stories and good fundamentals, get in them and wait for the crowd to catch up.

| Rules of the Game: We will tend to focus on DD'ing stocks under .20 and keep in mind we are only featuring stocks that we believe in. With all that said, we don't always get the stocks right, we are after all DD'ing stocks in penny land. Anything is possible. However, if we do have concerns we will drop a stock from our DD list, and they will stay off the DD list unless our concerns are ameliorated. We will also note this in the Ibox with the reason we are dropping it. Of course if a penny stock does address our concerns we will consider putting it back on the DD list.

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |