Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Morning Markets. . . .

.

.

.

.

Futures Reverse Gains As Nail-biting Volatility Enters February

by Tyler Durden

Tuesday, Feb 01, 2022 - 07:50 AM

World stocks began the new month on firmer ground, after a volatile January, as reassuring comments from Federal Reserve officials helped to calm rate-hike jitters even though US futures failed to extend recent gains. After closing out January with a furious two-day, dip-buying meltup thanks to a flood of inbound month-end rebalancing, US index futures briefly traded through Monday’s highs, backed by decent rally in European equities where financials outperformed, boosted by solid UBS earnings, before dipping lower as the volatility seen in past days lingered. At 7:00am ET, emini S&P futures traded 0.23%, or 10.5 points lower, Nasdaq futures were also red, some 31 points or 0.15% lower, and Dow futures dropped 0.2% as investors weighed cautious rate-hike commentary from Fed officials and awaited earnings from firms including Alphabet and General Motors. Treasuries climbed and the dollar weakened. Oil fell, but held close to seven-year highs.

Videogame makers were in focus after Sony said it will buy Bungie, the developer behind the popular Destiny and Halo game franchises, for $3.6 billion. In another busy day ahead for earnings, AMD rose in premarket trading amid expectations its results Tuesday will show market-share gains. Other notable premarket movers:

UPS (UPS US) rose 7.3% premarket as the postal firm benefited from higher prices and rising holiday deliveries to post profit that beat analyst estimates.

Spire (SPIR US) shares gain as much as 27% in premarket trading after the satellite-imaging and data company released preliminary 4Q numbers ahead of analysts’ targets and guided toward higher 2022 revenue.

Harley-Davidson (HOG US) shares have valuation support at current levels, while the market appears to be pricing in an overly negative outlook, Morgan Stanley writes, upgrading stock to equal-weight. Shares up 0.8% premarket.

Knightscope (KSCP US) declines 14% in premarket trading, set to come down from a high reached on Monday as retail investors piled into the security-camera and robotics company, tripping two trading halts along the way.

Earnings season has provided a healthy breadth of beats so far: of the 182 companies in the S&P 500 that have reported earnings so far this season, more than 82% have beaten or met,

“Investors continue to buy the dips almost everywhere this week, with market sentiment boosted by a strong earning season so far where most companies have beaten expectations,” says Pierre Veyret, technical analyst at ActivTrades. “Technically speaking, most indices have registered solid rebounds over major support zones and are now challenging key resistance levels.”

In a jawboning fest on monday, four Fed officials said they’ll back interest-rate increases at a pace that doesn’t disrupt the economy, calming markets unnerved by previous hawkish messages from the central bank. Investors are now debating whether the rally that pared the worst monthly rout in the S&P 500 since March 2020 will continue. They are also focusing on earnings releases to gauge the strength of the economic recovery.

“Good news is that some Fed officials are finally out trying to soothe investors’ nerves saying that they still want to avoid unnecessarily disrupting the U.S. economy,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “But what will really make the difference is the quantitative tightening and given the steep rise in Fed’s balance sheet since March 2020, even halting the growth would be an abrupt change.”

In Europe, the Stoxx Europe 600 Index rose 1%, led by financial services and basic-resource stocks. UBS shares surged 6% after the lender beat estimates. Telecoms were the only industry group in red. European tech stocks rallied again, with the Stoxx Tech Index rising as much as 2.1%, among the top-performing sectoral gauge in Europe. Sector added to 3.5% gain Monday, lifted higher by overnight rally in the U.S., with the Nasdaq 100 Index +3.4%. Semiconductor makers and pandemic winners lead gains, with BE Semi +4.5%, Deliveroo +3%, ASMI +2.8%, ASML +2.6% and Just Eat Takeaway.com +2.8%. Here are some of the biggest European movers today:

UBS shares gained as much as 7.5% in early European trading, the biggest intraday gain since April 2020, after the Swiss lender posted largely better-than-expected results and analysts cheered the new financial targets.

HeidelbergCement shares rise as much as 4.7% after the company reported preliminary 4Q revenue that Stifel analyst Tobias Woerner says was “reassuring.”

Faurecia shares rise as much as 4.4% as the shares resume trading after being suspended all of Monday ahead of the closing of the Hella acquisition. The deal is a key milestone that allows the French auto parts firm to start implementing synergies, says Citi analyst Gabriel Adler (buy).

Ubisoft shares rise as much as 3.7% in positive readacross after Sony said it will buy U.S. video game developer Bungie for $3.6b. The acquisition indicates the sector is consolidating, says Citi (buy).

Hexagon shares soar as much as 23%, the most since 2009, after it signs deal with a commercial truck maker to provide battery packs for electric heavy-duty vehicles.

Shares in U.K. clothing retailer Joules plunge as much as 34%, to the lowest since April 2020, after reporting that revenue and profit before tax for the 9 weeks to Jan. 30 fell short of the board’s expectations.

Saipem falls as much as 15%, extending Monday’s 30% plunge, as brokers including Mediobanca downgrade the oil drilling specialist after it warned on 2021 earnings and said it would hold discussions with creditors and shareholders for financing.

Earlier in the session, Asian stocks rose as the latest remarks from Federal Reserve officials helped ease fears of aggressive U.S. monetary tightening. The MSCI Asia Pacific Index added as much as 0.5%, with the information-technology and financial sectors providing the biggest boosts. Japan’s Keyence and Murata Manufacturing contributed most to the advance, with both releasing quarterly earnings results after market closed in Tokyo. Equity gauges in New Zealand and India led gains, with many markets in the rest of Asia shut for holidays. China, Hong Kong, South Korea, Singapore and Taiwan were among bourses closed for the Lunar New Year break. “Now that markets are finding calm, buying is kicking into individual stocks of companies that have reported solid earnings or are expected to,” said Shogo Maekawa, a strategist at JP Morgan Asset Management in Tokyo. Asian shares may extend gains if U.S. data this week on employment and ISM manufacturing don’t rattle the market, Maekawa added. Fed officials said they want to avoid unnecessarily disrupting the economy as they prepare to start raising rates, mitigating market concern over a 50 basis-point move in March. “You always want to go gradually,” Kansas City Fed President Esther George told the Economic Club of Indiana. Asia’s stock benchmark fell 4.4% in January, its biggest such drop since July, hit by concern that faster-than-expected U.S. rate hikes will cool the global economic recovery.

Japanese stocks pared large morning gains, with the Topix finishing little changed, as automakers slid. Chemical and machinery makers also dragged on the Topix, which wiped out a gain of as much as 1.3%. The Nikkei closed 0.3% higher, paring a 1.5% advance, with TDK and Shionogi the biggest boosts. Both gauges had risen about 3% over the previous two sessions. “There’s a lot of tussle between buyers and sellers due to month-end and month-start trading,” said Hiroshi Namioka, chief strategist at T&D Asset Management. “Shares of companies with robust earnings are being bought, but those without any specific leads to go on seem to be exposed to selling pressure.”

Indian stocks rose after the annual federal budget pledged to step up spending in a bid to support a business recovery in Asia’s third-largest economy. The S&P BSE Sensex climbed 1.5%, its biggest advance in a month, to 58,862.57 in Mumbai. The NSE Nifty 50 Index rose 1.4%. Fifteen of the 19 sector indexes compiled by BSE Ltd. rose, led by a gauge of metal stocks that jumped the most in six months. Finance Minister Nirmala Sitharaman’s strong push for infrastructure-led growth and investment centered around sectors like railways, roadways, logistics and energy will benefit most metal companies, according to Priyesh Ruparelia, a vice president at ICRA Ltd. A measure of capital goods companies also jumped the most in a year. The nation plans to boost capital spending by 35% to 7.5 trillion rupees ($100 billion) in the next financial year that starts in April in a bid to sustain a recovery in growth disrupted by the pandemic. “With growth-oriented focus intact in the budget, we expect economic and capital market buoyancy to remain,” said Vijay Chandok, managing director at ICICI Securities Ltd.

Waves of volatility have swept across markets after the Fed signaled swifter monetary-policy tightening to curb inflation than many had expected. Investors need to “get used to this up and down volatility” as there’ll likely be more of it, Nancy Davis, chief investment officer at Quadratic Capital Management, said on Bloomberg Television.

In rates, Treasuries bull flattened as spreads unwound a portion of Monday’s steepening move with yields richer by up to 3.5bp across long-end of the curve. US Treasury yields were richer by 2bp to 3.5bp across the curve with 2s10s, 5s30s spreads both flatter by almost 1bp each; 10-year yields around 1.75%, with bunds lagging by 1.5bp and gilts outperforming by 1bp in the sector. In European bonds, focus remains on the front-end of the curve as rate hike premium continues to build -- German 2-year yields are cheaper by almost 4bp on the day, trading above the European Central Bank’s deposit rate for the first time since 2015. Gilts outperform in early London session. IG dollar issuance slate includes Kommuninvest $1b 2Y SOFR; two companies priced $1.8b Monday as sales activity continues to drop off in volatile backdrop.

In FX, Bloomberg Dollar Spot index falls 0.3%. NOK, CHF and SEK outperform in G-10, CAD and euro lag. The Bloomberg Dollar Spot Index slumped as the greenback weakened against all of its Group-of-10 peers. Gains were led by the Swiss franc, which advanced a second day as it rebounded after adverse month-end flows; Scandinavian currencies were also among the top gainers amid supportive risk sentiment. The euro headed for a third day of gains, boosted by an unwind of the latest rally for downside exposure through options; the common currency rose by as much as 0.3% to 1.1269, raising questions on whether its latest weakness was more down to month-end flows rather than hawkish Fed bets. French inflation rose 3.3% from a year earlier in January, a sharper gain than the 2.9% economists estimated following December’s 3.4% advance. The pound rallied against a broadly weaker dollar, with domestic focus remaining on the Bank of England’s meeting this week. Figures showed U.K. house prices registered their strongest start to the year since 2005, before mortgage data due later Tuesday. The Aussie reversed an earlier loss after the RBA said it’s ready to be patient on interest rates even as it ceased its bond-purchase program. Overnight- indexed swaps continued to price in four rate hikes by the central bank this year. The Kiwi also advanced, in part on purchases against Aussie post RBA. Japan’s bonds extended a decline to a fourth day amid growing speculation that the central bank will step in to slow a rise in yields. The yen gained for third day.

Crypto markets were varied in which Bitcoin traded sideways around 38.5k and Ethereum gained over 2%.

In commodities, crude futures fade a sharp drop. WTI finds support near $87 before recovering back on to a $88-handle. Brent trades flat near $89.20. Most base metals trade in the green; LME nickel rises 1.3%, outperforming peers, LME lead and tin lags. Spot gold rises roughly $10 to trade near $1,807/oz

U.S. economic data slate includes January Markit manufacturing PMI (9:45am), ISM manufacturing, December construction spending and JOLTS job openings (10am); while AMD, Alphabet, Electronic Arts, Exxon, General Motors, Gilead, PayPal, Stanley Black & Decker, Starbucks and UPS are among companies reporting results.

Market Snapshot

S&P 500 futures down 0.3% to 4,490.00

STOXX Europe 600 up 0.8% to 472.72

MXAP up 0.4% to 185.38

MXAPJ up 0.3% to 606.58

Nikkei up 0.3% to 27,078.48

Topix little changed at 1,896.06

Hang Seng Index up 1.1% to 23,802.26

Shanghai Composite down 1.0% to 3,361.44

Sensex up 1.3% to 58,793.71

Australia S&P/ASX 200 up 0.5% to 7,006.04

Kospi up 1.9% to 2,663.34

Brent Futures down 0.9% to $88.45/bbl

Gold spot up 0.5% to $1,805.93

U.S. Dollar Index down 0.16% to 96.38

German 10Y yield little changed at -0.01%

Euro up 0.2% to $1.1258

Brent Futures down 0.9% to $88.45/bbl

Top Overnight News from Bloomberg

Money markets are wagering on the BOE raising rates five times by 25 basis points and a move of that magnitude from the ECB by December. That spurred a renewed selloff in bonds across the continent on Monday, and challenges ECB policy makers including President Christine Lagarde who have pushed back against the idea of raising borrowing costs this year

Euro-area manufacturers are taking a more aggressive approach to price setting -- another signal that inflation won’t slow quickly after stronger- than-expected readings from the region’s biggest economies. Output prices rose at the second-fastest rate on record in January, according to a survey of purchasing managers by IHS Markit released Tuesday. While there were some signs of supply- chain problems easing, robust demand allowed firms to pass on higher costs to customers

German joblessness fell at a much faster pace than anticipated in January as the economy comes to terms with coronavirus curbs to contain surging infections. Unemployment in Europe’s largest economy declined by 48,000, pushing the jobless rate down to 5.1%. Economists had forecast a drop of just 6,000

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were positive but with upside limited amid mass holiday closures for the Lunar New Year. ASX 200 (+0.5%) rose above 7,000 with the index further underpinned as the RBA stuck to a dovish tone. Nikkei 225 (+0.3%) was kept afloat after lower unemployment although retraced gains as JPY strengthened. Nifty 50 (+1.4%) outperformed as focus in India centred on earnings and the budget announcement.

Top Asian News

Europe Is Losing Nuclear Power Just When It Really Needs Energy

Winners and Losers in India’s Budget Aiming to Bolster Growth

Widespread Bullying, Harassment Detailed in Rio Tinto Report

India Plans Record Borrowing to Fund Modi’s Growth Ambitions

European bourses are firmer taking impetus from the holiday-thinned APAC handover and Monday's US close; albeit, benchmarks are off best levels, Euro Stoxx 50 +1.0%. Sectors are all in the green though Telecom lags while Basic Resources, Banks and Tech do well amid base metals, UBS (+7.0%) earnings and the NQ/NXPI read-across respectively. Stateside, US futures are relatively contained but have moved directionally with European peers, the NQ remains the current modest outperformer.

Top European News

U.K. Mortgage Approvals Rise to 71k in Dec. Vs. Est. 66k

Slovenia Mulls Law on Swiss-Franc Loans Slammed by Lenders, ECB

Europe Is Losing Nuclear Power Just When It Really Needs Energy

Putin Meets Orban Amid Diplomatic Flurry: Ukraine Update

In FX, DXY sheds more Fed rate hike premium and month end rebalancing momentum. Franc rebounds firmly as yields recede and SNB President Jordan sets sights on keeping track of inflation. Sterling underpinned by risk appetite and firm UK macro releases. Kiwi turns table on Aussie after encouraging NZ trade data and RBA pledges patience on tightening after confirming removal of QE. Rouble on front foot ahead of call between Russia’s Foreign Minister Lavrov and US Secretary of State Blinken, but Lira lurching after Turkey’s manufacturing PMI slows to the brink of stagnation. BoJ is under less pressure to shift yield target than market thinks, sources cited by Reuters say. Sources say the central bank has many tools to combat rising yields; BoJ currently prefers market operations.

In commodities, WTI and Brent are pivoting the mid-point of ~USD 1.50/bbl ranges that have seen a test of yesterday's trough for Brent at worst thus far. Total OPEC+ production was lower by 824k/BPD than the required production in December, via JTC cited by Energy Intel's Bakr; overall compliance in December was 122%. Goldman Sachs, on OPEC+, sees growing potential for a faster ramp-up, given the pace of the recent rally and likely pressures from importing nations. Spot gold/silver are firmer picking up from the pressure seen in recent sessions. Though, gold remains near the USD 1800/oz mark and as such the 200-, 100- & 50-DMAs.

US Event Calendar

9:45am: Jan. Markit US Manufacturing PMI, est. 55.0, prior 55.0

10am: Dec. JOLTs Job Openings, est. 10.3m, prior 10.6m

10am: Dec. Construction Spending MoM, est. 0.6%, prior 0.4%

10am: Jan. ISM Manufacturing, est. 57.5, prior 58.7, revised 58.8

10am: Jan. ISM Employment, est. 53.0, prior 54.2, revised 53.9

10am: Jan. ISM New Orders, est. 58.0, prior 60.4, revised 61.0

10am: Jan. ISM Prices Paid, est. 67.0, prior 68.2

.............

Have a Great Day

Weird-looking cat Wilfred goes viral with Michael Rapaport voiceover

.

.

.

.

.

.

.

.

.

.

.

. . . .

This Night in Rock History. . . .

.

.

.

.

2004 Green Day performs a new version of the classic song "I Fought The Law" for one of a series of Pepsi commercials that air during the Super Bowl.

iTunes/Pepsi Ad On Music Downloads Featuring Green Day

This Day in Financial History. . . .

.

.

.

.

Learn what happened in business in today’s past

February 01:

2002: The Nikkei 225 Average of blue-chip Japanese stocks closes the day at 9791.43, while the Dow Jones Industrial Average finishes at 9907.26. For the first time since August, 1957, Japan's leading stock index has closed below the level of America's best-known stock index. Since it peaked on 38,915.87 on December 29, 1989, the Nikkei has lost 74.8% of its value -- a sobering reminder that bear markets start when people least expect them and can last longer than most investors could ever imagine.

The Wall Street Journal, February 4, 2002, p. C1; Financial Times, February 2-3, 2002, p. 1.

1975: Bill Gates and Paul Allen finish writing the first BASIC language program for a personal computer and license it to Micro Instrumentation and Telemetry Systems of Albuquerque, NM, the maker of the Altair 8800 PC. Unlike some of Gates' future products, "it works perfectly the very first time."

Inside Out: Microsoft -- In Our Own Words (New York, Warner Books, 2000), pp. 6, 10-11; The New York Times, August 19, 2001, p. III: 1; http://www.microsoft.com/billgates/bio.asp

1946: The U.S. venture-capital industry is born as John Hay Whitney, scion of a great family fortune, founds J.H. Whitney & Co. to finance promising new businesses. Some of Wall Street's leading figures, including Goldman, Sachs & Co. chairman Sidney Weinberg, warn him that his idea of venture-capital financing will never work. So "Jock" Whitney gets started simply by writing a $5 million personal check. The firm goes on to finance Freeport Sulphur, the Minute Maid Co., Memorex Corp. and Compaq Computer.

E.J. Kahn, Jr., "John Hay Whitney," in Charles D. Ellis and James R. Vertin, Wall Street People (John Wiley & Sons, New York, 2001), pp. 31-35; Charles D. Ellis, "Benno Schmidt," ibid, pp. 36-41; http://www.whitney.com/about_whitney_our_history.html

1869: The New York Stock Exchange requires listed companies to register their securities to prevent "watered stock," or the manipulated over-issuance of shares by insiders.

http://www.nyse.com/pdfs/historical99.pdf

1812: The Deed of Settlement is signed by a group of British brokers, establishing the formal basis for the London Stock Exchange -- even though stocks have been trading in London for roughly two centuries already.

Neil Brazil, press officer, London Stock Exchange.

Holidome & Gem Mall Tucson Gem Show 2022 Wholesale Show Part1

Great investments found here in Tucson this week

62 sunny night 40ish chilly

Welcome to the Captains Quarters Investment Board

Lots of great stuff on our board....

Thanks for all your inspirations....and thanks for flying our Love Network

The Romantics - One In A Million (Video)

It's no secret....

Do You Want To Know A Secret (Remastered 2009)

We're catching some of the best investments on the internet

enjoy the board

and Thanks

.

.

.

.

.

.

.

. . . .

One of the TUCSON GEMSHOW 2022 LIVE streams

Streamed live on Jan 28, 2022

LIVE CLASSIC CAR AUCTION - SUNDAY 30 JANUARY 2022

LIVE Today "The Sunday Slot" - 30th Jan 2022

2022 Scottsdale Car Auction Preview Show-BARRETT-JACKSON

Gerald Genta Icon of Time

It gives me great pleasure to present such priceless investments to the investors in our IHUB community,

Watch for a Brave New World of investments for investors and pleasure watchers this year on IHUB's Captains Quarters Board

Thanks for Watching

J:D

Gerald Genta Icon of Time

This Night in Rock History. . . .

.

.

.

.

1985 "We Are The World" by USA For Africa is recorded by artists including Bruce Springsteen, Bob Dylan, Ray Charles, Diana Ross, Bette Midler, Cyndi Lauper, Willie Nelson, Michael Jackson, and Stevie Wonder, among others.

Morning Markets....

.

.

.

.

Neurotic Futures Tumble Despite Record Apple Quarter

by Tyler Durden

Friday, Jan 28, 2022 - 08:07 AM

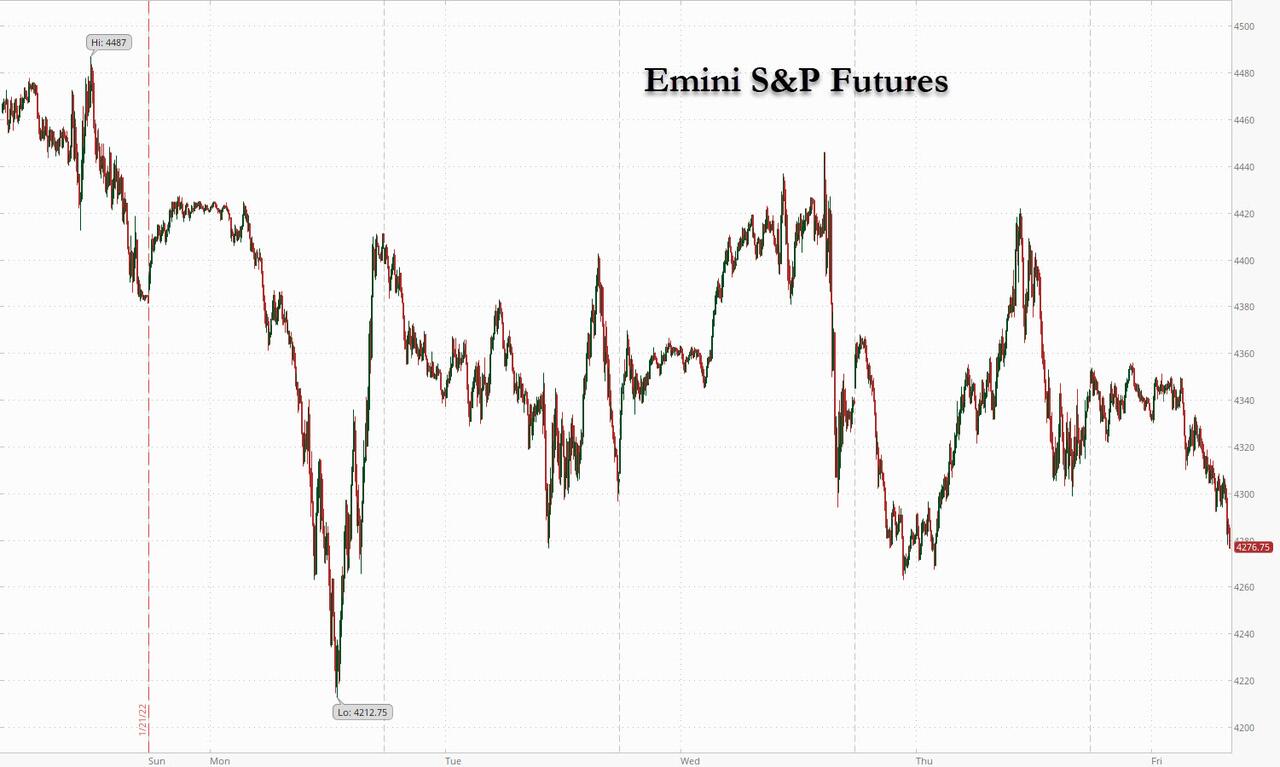

If you thought that yesterday's blowout, record earnings from Apple would be enough to put in at least a brief bottom to stocks and stop the ongoing collapse in risk assets, we have some bad news for you: after staging a feeble bounce overnight, S&P futures erased earlier gains as traders ignored the solid results from Apple and instead focused on the risk of higher interest rates hurting economic growth. Contracts in S&P 500 dropped as negative sentiment continued to prevail, while Nasdaq 100 futures erased earlier gains after strong Apple earnings. As of 730am, Emini futures were down 48 points or 1.12% to 4,269, Dow futures were down 335 points or 0.99% and Nasdaq futs were down 77 or 0.6%. The dollar was set for a fifth straight day of gains, the longest streak since November, 19Y TSY yields were up 3bps to 1.83%, gold and bitcoin both dropped.

Markets have been whiplashed by volatility this week as the Federal Reserve signaled aggressive tightening, adding to investor concerns about geopolitical tensions and an uneven earnings season. Also sapping sentiment on Friday were weak data on the German economy and euro-area confidence. Meanwhile, geopolitical tensions were still on the agenda with a potential conflict in Ukraine not yet defused.

“Market expectations for four to five rate hikes this year will not derail growth or the equity rally,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “We expect an eventual relaxation of tensions between Russia and Ukraine,” he added. Expected data on Friday include personal income and spending data, as well as University of Michigan Sentiment, while Caterpillar, Chevron, Colgate-Palmolive, VF Corp and Weyerhaeuser are among companies reporting earnings.

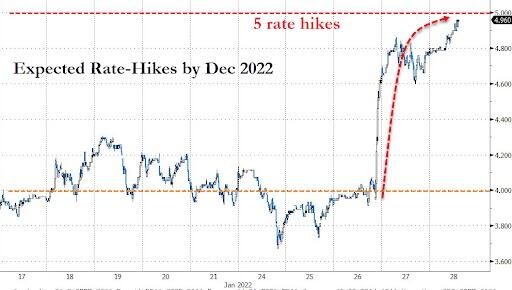

Money markets are now pricing in nearly five Fed hikes this year after a hawkish stance from Chair Jerome Powell. That’s up from three expected as recently as December.

“Tighter liquidity and weaker growth mean higher volatility,” Barclays Plc strategists led by Emmanuel Cau wrote in a note. The “current growth scare looks like a classic mid-cycle phase to us, while a lot of hawkishness is priced in.”

In premarket trading, Apple shares rose 4.5% as analysts rose their targets to some of the most bullish on the Street, after the iPhone maker reported EPS and revenue for the fiscal first quarter that beat the average analyst estimates. Watch Apple’s U.S. suppliers after the iPhone maker posted record quarterly sales that beat analyst estimates, a sign it was able to work through the supply-chain crunch. Peers in Asia rose, while European suppliers are active in early trading. Tesla shares also rise as much as 2% in premarket, set to rebound from yesterday’s 12% slump following a disappointing set of earnings and outlook. Other notable premarket movers:

Visa (V US) shares gain 5% premarket after company reported adjusted earnings per share for the first quarter that beat the average analyst estimate.

Cryptocurrency-exposed stocks gain as Bitcoin and other digital tokens rise. Riot Blockchain (RIOT US) +3.7%, Marathon Digital (MARA US) +3.3%, Bit Digital (BTBT US) +1.6%, Coinbase (COIN US) +0.5%.

Robinhood (HOOD US) shares tumbled 14% in premarket after the online brokerage’s fourth-quarter revenue and first-quarter outlook missed estimates. Some analysts cut their price targets.

Atlassian (TEAM US) shares jump 10% in extended trading on Thursday, after the software company reported second-quarter results that beat expectations and gave a third-quarter revenue forecast that was ahead of the analyst consensus.

U.S. Steel (X US) shares fall as much as 2.4% aftermarket following the steelmaker’s earnings release, which showed adjusted earnings per share results missed the average analyst estimate.

The U.S. stock market is priced “quite aggressively” versus other developed nations as well as emerging markets, and valuations in the latter can be a tailwind rather than a headwind as in the U.S., Feifei Li, partner and CIO of equity strategies at Research Affiliates, said on Bloomberg Television.

European equity indexes are again under pressure, rounding off a miserable week, and set for the worst monthly decline since October 2020 as corporate earnings failed to lift the mood except in the retail sector. The Euro Stoxx 50 dropped over 1.5%, DAX underperforming at the margin. Autos, tech and banks are the weakest Stoxx 600 sectors; only retailers are in the green. Hennes & Mauritz shares climbed on a profit beat, while technology stocks continued to underperform. Here are some of the biggest European movers today:

LVMH shares rise as much as 5.8% after analysts praised the French conglomerate’s full-year results, with several noting improved performance at even minor brands such as Celine.

Signify gains as much as 15% after saying it expects to grow in 2022 even as the supply chain problems that caused its “worst ever” quarter continue.

H&M climbs as much as 7.4% after posting a strong margin in 4Q which impressed analysts. Analysts also lauded the Swedish retailer’s buyback announcement and target to double sales by 2030.

Stora Enso rises as much as 6.2% on 4Q earnings with the CEO noting paper capacity closures have helped boost its pricing power, contributing to a turnaround in the unprofitable business.

SCA gains as much as 5.5% in Stockholm, the most since May 2020, after reporting better-than-expected Ebitda earnings and announcing a SEK3.25/share dividend -- higher than analysts had estimated.

AutoStore rises as much as 18% after a German court halts Ocado’s case against the company. Ocado drops as much as 8.1%.

Henkel slides as much as 10% after the company’s forecast for organic revenue growth of 2% to 4% in 2022 was seen as cautious.

Wartsila falls as much as 9% after posting 4Q earnings that analysts say showed strong order intake overshadowed by lagging margins.

Alstom drops as much as 7.3% after Exane BNP Paribas downgrades to neutral, citing risk that the company might resort to raising equity financing to forestall a possible credit-rating cut.

Earlier in the session, Asian stocks rose after slumping to their lowest since November 2020, with Japan and Australia leading the rebound as turbulence over the highly anticipated U.S. monetary tightening eased. The MSCI Asia Pacific Index climbed as much as 1% on Friday following a 2.7% slide the day before. Industrials and consumer-discretionary names provided the biggest boosts to the measure. Japan’s Nikkei 225 Stock Average was among the best performers in the region after enduring its worst daily drop in seven months. “It’s undeniable that stock markets last year -- as well as the real economy -- were supported by continued monetary easing, considering which, more share-price correction could be anticipated,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management in Tokyo. Even so, “stocks fell too much yesterday.” The Asian benchmark is down almost 5% this week, and set to cap its biggest such drop since February last year. Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle inflation, triggering a broad selloff in global equities Thursday. Japan’s Topix and Australia’s S&P/ASX 200 gained after slipping into technical correction earlier this week. South Korea’s Kospi also added almost 2% after sliding into a bear market Thursday. Meanwhile, Chinese shares extended a rout of nearly $1.2 trillion this month.

Japanese equities rose, trimming their worst weekly loss in two months, as some observers saw the selloff on concerns over higher U.S. interest rates as having gone too far. Electronics and auto makers were the biggest boosts to the Topix, which rose 1.9%, paring its weekly decline to 2.6%. Fast Retailing and Shin-Etsu Chemical were the largest contributors to a 2.1% rise in the Nikkei 225. The yen was little changed after weakening 1.3% against the dollar over the previous two sessions. “Looking at the technical indicators like RSI, you can see that Japanese equities have been oversold,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities. “Shares have fallen too much considering the not-bad corporate earnings and also when compared with U.S. equities.” U.S. futures rallied in Asian trading hours, after a volatile cash session that ended in losses as investors continued to reprice assets on the Fed’s pivot to tighter policy. Apple provided a post-market lift with record quarterly sales that sailed past Wall Street estimates.

In Australia, the S&P/ASX 200 index rose 2.2% to 6,988.10 at the close in Sydney, bouncing back after slipping into a technical correction on Thursday. The benchmark gained for its first session in five as miners and banks rallied, trimming its weekly slide to 2.6%. Champion Iron was a top performer after its 3Q results. Newcrest was one of the worst performers after its 2Q production report, and as gold extended declines. In New Zealand, the S&P/NZX 50 index fell 1.6% to 11,852.15.

India’s benchmark index edged lower on Friday to extend its decline to a second consecutive week as investors grapple with volatility created by the U.S. Federal Reserve’s rate-hike plan. The S&P BSE Sensex fell 0.1% to 57,200.23 in Mumbai on Friday, erasing gains of as much as 1.4% earlier in the session. The NSE Nifty 50 Index ended flat. For the week, the key gauges ended with declines of 3.1% and 2.9%, respectively. All but five of the 19 sector sub-indexes compiled by BSE Ltd. climbed on Friday, led by a measure of health-care companies. BSE’s mid- and small-sized companies’ indexes outperformed the benchmark by rising 1% and 1.1%. “Selling pressure has now cooled off, markets will now focus on local triggers such as expectations from the budget,” said Prashant Tapse, an analyst with Mumbai-based Mehta Equities. Investors will also monitor corporate-earnings reports for the December quarter to gauge demand and inflation outlook. Of the 21 Nifty 50 companies that have announced results so far, 12 either met or exceeded expectations, eight missed, while one can’t be compared. Kotak Mahindra Bank continued the strong earnings run by lenders, reporting fiscal third-quarter profit ahead of the consensus view, while Dr. Reddy’s Laboratories missed the consensus estimate. ICICI Bank contributed the most to the Sensex’s decline, falling 1.6%. Out of 30 shares in the Sensex index, 14 rose and 16 fell.

In rates, bonds trade poorly again with gilts and USTs bear steepening, cheapening 3-3.5bps across the back end. Treasuries are weaker, same as most European bond markets, with stock markets under pressure globally and S&P 500 futures lower but inside weekly range. Treasury yields are cheaper by 4bp-5bp from intermediate to long-end sectors, 10-year around 1.84%, inside weekly range; though front-end outperforms, 2-year yield reaches YTD high 1.22%, steepening 2s10s by ~1bp. Gilts underperformed as traders price in a more aggressive path of rate hikes from the BOE. Treasury curve is steeper for first day in four, lifting spreads from multimonth lows. Globally in 10-year sector, gilts lag Treasuries by 0.5bp while bunds outperform slightly. Bunds bear flatten with 5s30s near 52bps after two block trades but subsequently recover above 54bps. IG dollar issuance slate empty so far; Procter & Gamble priced a $1.85b two-tranche offering Thursday, the first since Wednesday’s Fed meeting.

In FX, Bloomberg Dollar Spot pushes to best levels for the week. Scandies and commodity currencies suffer the most. The Bloomberg Dollar Spot Index was set for a fifth straight day of gains, the longest streak since November, and near its strongest level in 17 months as the greenback was steady or higher against all of its Group-of-10 peers. The euro steadied near a European session low of $1.1121 while risk-sensitive Australian and Scandinavian currencies led the decline. Sweden’s krona sank, despite data showing the Nordic nation’s economy grew more than expected in the final quarter of 2021, fueling speculation that the central bank could soon start to take its foot off the stimulus pedal. Australia’s dollar dropped to the lowest level in 18 months as the Reserve Bank of Australia lags behind many of its peers in signaling monetary tightening. Treasuries sold off, led by the belly; Bunds also traded lower, yet outperformed Treasuries, and Germany’s 5s30s curve flattened to 52bps after two futures blocks traded. Italian government bonds underperformed with the nation’s parliament voting twice on Friday to elect a new president, as the lack of progress after four days of inconclusive ballots adds to pressure to end a process that’s left the country in limbo.

In commodities, Crude futures hold a narrow range, just shy of Asia’s best levels. WTI trades either side of $87, Brent just shy of a $90-handle. Spot gold drops near Thursday’s lows, close to $1,791/oz. Base metals are under pressure; LME copper underperforms peers, dropping over 1.5%.

Crypto markets were rangebound in which Bitcoin traded both sides of the 37,000 level. Russia's government drafted a roadmap for cryptocurrency regulation, according to RBC.

To the day ahead now, and data releases include Germany’s Q4 GDP, US personal income and personal spending for December, as well as the Q4 employment cost index and the University of Michigan’s final consumer sentiment index for January. Earnings releases include Chevron and Caterpillar.

Market Snapshot

S&P 500 futures up 0.1% to 4,323.75

STOXX Europe 600 down 1.0% to 465.51

MXAP up 0.5% to 182.48

MXAPJ little changed at 597.31

Nikkei up 2.1% to 26,717.34

Topix up 1.9% to 1,876.89

Hang Seng Index down 1.1% to 23,550.08

Shanghai Composite down 1.0% to 3,361.44

Sensex down 0.1% to 57,197.94

Australia S&P/ASX 200 up 2.2% to 6,988.14

Kospi up 1.9% to 2,663.34

Brent Futures up 0.4% to $89.71/bbl

Gold spot down 0.3% to $1,792.52

U.S. Dollar Index up 0.13% to 97.38

German 10Y yield little changed at -0.05%

Euro down 0.1% to $1.1132

Top Overnight News from Bloomberg

The euro-area economy kicked off 2022 on a weak footing, with pandemic restrictions taking a toll on confidence and growing fears that Germany may be on the brink of a recession for the second time since the crisis began. A sentiment gauge by the European Commission fell to 112.7 in January, the lowest in nine months, driven by declines in most sectors and among consumers. Employment expectations dropped for a second month

Germany’s economy shrank 0.7% in the fourth quarter with consumers spooked by another wave of Covid-19 infections and factories reeling from supply-chain problems.

Governor Haruhiko Kuroda said the Bank of Japan won’t be switching its bond yield target until inflation rises high enough to warrant exit talks

Seven straight jumps in the so- called “fear gauge” for the S&P 500 is a signal that it may be time to wager against volatility, if history is any guide. Only 10 times in the past two decades has the Cboe Volatility Index - - better known as the VIX -- risen for that many trading sessions in a row

A more detailed look at global markets courtesy of Newsquawk

Asian stocks eventually traded mixed although China lagged ahead of holiday closures next week. ASX 200 (+2.2%) was lifted back up from correction territory. Nikkei 225 (+2.1%) gained on a weaker currency and with corporate results driving the biggest movers. KOSPI (+1.9%) was boosted by earnings including from the world's second-largest memory chipmaker SK Hynix. Hang Seng (-1.1%%) and Shanghai Comp. (-0.9%) lagged with a non-committal tone in the mainland ahead of the Lunar New Year holiday closures and with Hong Kong pressured by losses in blue chip tech and health care

Top Asian News

Asia Stocks Rise, Still Head for Worst Week Since February

Kuroda Hints No Chance of Switching Yield Target Until Exit

China Fintech PingPong Said to Mull $1 Billion Hong Kong IPO

Biogen Sells Bioepis Stake for $2.3 Billion to Samsung Biologics

European bourses have conformed to the downbeat APAC handover with losses in the region extending following the cash open, Euro Stoxx 50 -1.7%. Sectors were mixed with Tech and Banking names the laggards while Personal/Household Goods and Retail outperformer following LVMH and H&M respectively; since then, performance has deteriorated though the above skew remains intact. US futures are moving in tandem with European-peers; however, magnitudes are more contained as the ES is only modestly negative and NQ continues to cling onto positive territory following Apple earnings. Apple Inc (AAPL) Q1 2022 (USD): EPS 2.10 (exp. 1.89), Revenue 123.95bln (exp. 118.66bln), iPhone: 71.63 bln (exp. 68.34bln), iPad: 7.25bln (exp. 8.18bln), Mac: 10.85bln (exp. 9.51bln), Services: 19.52bln (exp. 18.61 bln), according to Businesswire. +3.5% in the pre-market, trimming from gains in excess of 5.0% earlier

Top European News

German Economy Contracted Amid Tighter Virus Curbs, Supply Snags

H&M CEO Sets Target to Double Retailer’s Sales by 2030

Telia Sells Tower Stake for $582 Million, Cuts Costs

U.K. ‘Partygate’ Probe May Be Watered Down at Police Request

In FX, buck bull run continues as DXY takes out another July 2020 high to leave just 97.500 in front of key Fib resistance. Aussie feels the heat of Greenback strength more than others amidst risk-off positioning and caution ahead of next week’s RBA policy meeting. Kiwi also lagging and Loonie losing crude support after the BoC’s hawkish hold midweek. Euro and Yen reliant on some hefty option expiry interest to provide protection from Dollar domination. BoJ Governor Kurdoa if times come to debate the exit of policy, then targeting shorter maturity JGBs could become an option; at this stage its premature to raise yield target or take steps to steepen yield curve.

In commodities, WTI and Brent are consolidating somewhat after yesterday's choppy price action, but remain towards the lowend

of a circa. USD 1.00/bbl range. Focus remains firmly on geopols as Russia is set to speak with French and German officials on Friday, though rhetoric, remains relatively familiar. Spot gold and silver are pressured as the yellow metal loses the 100-DMA, and drops to circa. USD 1780/oz as the USD rallies, and ahead of inflation data while LME copper follows the equity downside.

US Event Calendar

8:30am: 4Q Employment Cost Index, est. 1.2%, prior 1.3%

8:30am: Dec. Personal Income, est. 0.5%, prior 0.4%

Dec. PCE Core Deflator YoY, est. 4.8%, prior 4.7%; PCE Core Deflator MoM, est. 0.5%, prior 0.5%

Dec. PCE Deflator YoY, est. 5.8%, prior 5.7%; PCE Deflator MoM, est. 0.4%, prior 0.6%

8:30am: Dec. Personal Spending, est. -0.6%, prior 0.6%; Real Personal Spending, est. -1.1%, prior 0%

10am: Jan. U. of Mich. Sentiment, est. 68.8, prior 68.8

Current Conditions, est. 73.2, prior 73.2; Expectations, est. 65.9, prior 65.9

1 Yr Inflation, est. 4.9%, prior 4.9%; U. of Mich. 5-10 Yr Inflation, prior 3.1%

......................

Have a Nice Weekend

Irregularities in the Pension Fund (Window Scene)

.

.

.

.

.

.

. . . .

Sorry TypeO "Man of Sorrows" sold for a cool_39.3Million

By far the best art auction to date on the Captains Quarters

Maybe the best in IHUB history

This Night in Rock History. . . .

.

.

.

.

1973 - Stevie Wonder

'Superstition' the lead single from Stevie Wonder's Talking Book album became his second No.1 single in the US, 10 years after his first No.1 hit. Jeff Beck created the original drum beat while in the studio with Wonder. After writing the song, Wonder offered it to Beck to record, but at the insistence of Berry Gordy, Wonder himself recorded it first. Beck was instead offered 'Cause We've Ended As Lovers', which he recorded on his Blow by Blow album in 1975.

LIVE from New York | Master Paintings and Sculpture Part I

LIVE from New York | Master to Master: The Nelson Shanks Collection

.

.

.

.

This Day in Financial History. . . .

.

.

.

.

Learn what happened in business in today’s past

January 27:

1938: After a protracted war with the new U.S. Securities and Exchange Commission, the New York Stock Exchange finally recommends an internal reorganization that will install a board of governors, a salaried independent president and a specialized administrative staff. Previously, the Exchange had functioned like a private gentleman's club, with conduct enforced mainly by unspoken codes of honor and a pro-bono president chosen from among his fellow brokers.

Joel Seligman, The Transformation of Wall Street: A History of the Securities and Exchange Commission and Modern Wall Street (Houghton Mifflin, Boston, 1982), pp. 166-167; John Brooks, Once in Golconda: A True Drama of Wall Street, 1920-1938 (Harper & Row, New York, 1969), pp. 251-252.

1850: Samuel Gompers, founding president of the American Federation of Labor, is born in London, England. He comes to the U.S. at the age of 13 and begins working in a cigar factory. In 1886 he organizes the AFL, creating a nationwide union and galvanizing the labor movement with strikes and boycotts. In the age of the "Robber Barons," Gompers helps prevent managers from taking workers for granted.

http://en.wikipedia.org/wiki/Samuel_Gompers

Morning Markets. . . .

.

.

.

.

Futures Swing Wildly In Overnight Rollercoaster Session Before Settling Flat

by Tyler Durden

Thursday, Jan 27, 2022 - 07:52 AM

After a rollercoaster overnight session, which saw S&P futures tumble as much as 2%, dropping as low as 4,260 following Powell's hawkish comments, futures have recovered and briefly traded in the green while European stocks are still red though trading near session highs as traders spooked by the Fed's comments started digging for bargains. At 7:20am ET (incredibly illiquid) emini S&P futures were flat at 4,341, Dow futures were up 0.1% or 36 points and Nasdaq futures swung the most and after dropping as much as 2.2% turned green some 0.5% higher or 75 points after Bill Ackman revealed late on Wednesday he had purchased 3.1 million Netflix shares.

The yield curve shrank to the flattest since 2020 after the meeting. Two-year Treasuries extended declines, though longer-dated ones rebounded. The dollar extended gains. Oil fluctuated as calm reigned for crypto. Expectations of Fed tightening sent the policy-sensitive U.S. two-year yield to 1.208%, levels last reached in February 2020. The benchmark 10-year yield slipped slightly to 1.835% having hit a high of 1.88% on Wednesday. The spread between the 10 and two-year bond yields fell to its narrowest since late 2020 as investors priced in a faster pace of rate rises in the medium-term. This in turn helped the dollar to its highest since June 2020 and sent the euro to its lowest in 19-months. The single currency dropped 0.5% to $1.1182 .

In U.S. premarket trading, Tesla fell after signaling supply chain troubles, while Intel slid as it warned on profit margins. Qualtrics International on the other hand, jumped after posting a better-than-expected revenue forecast. Netflix gained as much as 4.8% after hedge fund founder Bill Ackman said he has acquired more than 3.1 million shares in the online video streaming giant. Meanwhile, Teradyne plunged 18% in premarket after the chip-testing firm’s first-quarter earnings forecast fell short of estimates due to to supply constraints and a drop in demand stemming from a slow transition at one of its customers. Other notable premarket movers:

DouYu (DOYU US) shares jump 10% in U.S. premarket trading after Reuters reports that Tencent plans to take the live game streaming company private, citing people with knowledge of the matter.

Teradyne (TER US) shares plunge 18% in U.S. premarket trading after the chip-testing firm’s 1Q earnings forecast fell short of estimates due to to supply constraints and a drop in demand stemming from a slow transition at one of its customers.

Levi Strauss (LEVI US) shares surge 8.3% in premarket trading after the jeans maker gave an outlook for full-year net revenue that exceeded estimates. Analysts say momentum appears to have carried through to the start of 2022.

Qualtrics (XM US) shares gain 11% in U.S. premarket trading after the software company gave a revenue forecast for 1Q that beat estimates. Analysts were positive on the company’s organic billings growth and said guidance is strong.

U.S. stocks have swung violently this week as investors worried about the fallout from an increasingly hawkish Federal Reserve on a broader economic recovery and company earnings. Overvalued technology-related stocks have been hit particularly hard since higher interest rates mean a bigger discount for the present value of their future profits, hurting growth stocks with the highest valuations and boosting cheap or so-called value shares.

“The hawkish tone last night from the Fed has led to a renewed rotation into value names but given the magnitude of some of the moves we have now seen in growth stocks year-to-date, we believe the opportunity set is again getting more exciting for growth investors,” said Marcus Morris-Eyton, portfolio manager at Allianz Global Investors. “We expect the market to gradually return to fundamentals now the Fed meeting has passed, and the earnings season moves into full swing.”

Investors expect the speed at which the Fed tightens policy to be the major determinant of risk sentiment in the coming months, although the U.S. central bank has said how quickly it hikes will depend on economic data and especially inflation.

"Powell (is) not committing to the size or the frequency of rate hikes and also the timing of the balance sheet reduction. I think that buys him a bit of wiggle room as to how quickly and with what velocity he wants to normalise monetary policy in the U.S." said David Chao, global market strategist, Asia Pacific (ex-Japan) at Invesco.

European equities slump at the open but most indexes gradually fade losses. Euro Stoxx 50 is only down 0.6%, having traded off as much as 1.8%. Spain’s IBEX outperforms, turning an initial 1.5% drop into a gain of as much as 0.8%. Banks and autos are the best performers.

Weeks of fretting over the Fed’s plan to combat inflation with higher interest rates is coming to fruition as Asian stock markets tumble into bear markets and technical corrections: Bear Markets Show Pain Across AsiaEquities as Fed Hikes Near; China Stocks Enter Bear Market as Yuan Tumbles Most in 7 Months. Bonds tumbled across Asia after Fed Chair Jerome Powell’s latest hawkish pivot, with Australian and New Zealand benchmark yields spiking to fresh highs: Fed Fallout Sends Sovereign Yields Soaring to Highs Across Asia

China high-yield dollar bonds fell 1-3 cents on the dollar , according to credit traders, after the market notched its longest winning streak since July: China Junk Dollar Bonds Set for First Drop in More Than a Week. Chinese authorities are considering a proposal to dismantle China Evergrande Group by selling the bulk of its assets: China Weighs Dismantling Evergrande to Contain Debt Crisis. The People’s Bank of China’s newfound autonomy may prove to be an unlikely source of support for the recovery: China Rushes to Deliver Stimulus as Fed Pulls Back in New Era.

Investors globally have dumped riskier assets in 2022 and sought safety as they brace for the end of nearly two years of exceptionally cheap and plentiful cash.

"What cheap money has done is provide a safety blanket from bad news," said Jane Foley, an analyst at Rabobank. "But as this comfort blanket is pulled away, investors will be more exposed and I suspect this will create a more volatile environment for asset prices."

In rates, after extending post-FOMC drop late Wednesday, Treasuries began clawing their way back during Asia session and European morning led by long-end tenors, further flattening the curve. Ten-year Treasury yields slipped three basis points to 1.83% after surging to near a two-year high in the previous session, while the 2-year yield rose by 4bps to 1.19%. Yields are richer by ~5bp across 30-year sector, flattening 5s30s spread by ~3bp to tightest since March 2020; 2s10s spread is flatter by ~6bp and lowest since November 2020; the 10-year yield ~1.83% has retraced about half Wednesday’s surge to 1.876%. The ED market has boosted rate hike expectations to nearly 5 by December.

Treasury auction cycle concludes with $53b 7-year note sale at 1pm ET, following strong demand for 2- and 5-year sales earlier this week. Fed- dated OIS price in ~30bp of rate hikes for March meeting and 117bp by December after Wednesday’s post-FOMC front-end selloff. The hawkish central-bank pricing spills over into Europe: ECB-dated OIS briefly factor in a 20bps move and BOE OIS ~120bps of tightening by year end. Bunds and gilts drop, curves bear-flattening playing catch up to USTs, which bull-flatten away from their post-FOMC extremes. FOMC-dated OIS rates briefly factor in a full five hikes this year. Peripheral spreads tighten, short-end Italy and Spain outperform.

In FX, Bloomberg dollar spot trades close to session highs, adding 0.3%. The Bloomberg Dollar Spot Index rose for a fourth consecutive day as the greenback strengthened against all of its Group-of-10 peers. Hedging costs in major currencies remain relatively low, even as realized steepens and key risk events are captured by the front- end. The euro fell below $1.12 for the first time since November as traders increase bets on higher borrowing costs, with money markets now expecting five Federal Reserve interest-rate increases this year. Bunds extended a decline, sending the German 10-year yield to a one-week high as money markets bet on a faster pace of ECB policy tightening. The Canadian dollar and Norwegian krone held up best against the greenback as oil prices consolidated near a seven-year high and the pound was also among the better-performing G-10 currencies as markets rushed to price in another four interest-rate rises from the Bank of England. Other risk sensitive currencies, led by the New Zealand dollar, were the worst performers. Government bonds dropped in Australia and New Zealand, while the Australian dollar fell to a seven-week low and the New Zealand dollar slid for a sixth consecutive day to touch $0.6596, the lowest since November 2020. New Zealand’s debt auctions drew strong demand even after local data showed inflation quickened to the highest in more than three decades.

In commodities, crude futures drift back into the green. WTI adds 0.2%, rising back above $87; Brent reclaims $90. U.S. officials say they are in talks with major energy-producing countries and companies worldwide over a possible diversion of supplies to Europe if Russia invades Ukraine, although the White House said it faces challenges finding alternative sources of energy supplies. Spot gold trades off worst levels after finding support near $1,810/oz. Most base metals are in the green with LME tin up over 1%. Crypto markets declined amid broad weakness in risk assets during APAC hours; in-fitting with broader performance, crypto has staged a modest recovery during the European session. Bitcoin was last trading at $36,500.

Looking at the day ahead now, data releases include the US GDP reading for Q4, along with the weekly initial jobless claims, December’s pending home sales, durable goods orders, core capital goods orders, and January’s Kansas City Fed manufacturing index. Central bank speakers include the ECB’s Scicluna, whilst earnings releases include Apple, Visa, Mastercard, Comcast, Danaher and McDonald’s.

Market Snapshot

S&P 500 futures up 0.2% to 4,351.25

STOXX Europe 600 down 0.4% to 465.34

MXAP down 2.4% to 182.01

MXAPJ down 2.1% to 598.93

Nikkei down 3.1% to 26,170.30

Topix down 2.6% to 1,842.44

Hang Seng Index down 2.0% to 23,807.00

Shanghai Composite down 1.8% to 3,394.25

Sensex down 1.2% to 57,180.21

Australia S&P/ASX 200 down 1.8% to 6,838.28

Kospi down 3.5% to 2,614.49

German 10Y yield little changed at -0.03%

Euro down 0.4% to $1.1198

Brent Futures down 0.3% to $89.72/bbl

Gold spot down 0.3% to $1,814.46

U.S. Dollar Index up 0.35% to 96.81

Top Overnight News from Bloomberg

Spain’s labor market continued to improve in the fourth quarter, with the unemployment rate falling to the lowest since 2008, according to figures released by the nation’s statistics office, INE

Norway’s $1.3 trillion sovereign wealth fund, the world’s biggest, returned 14.5% in 2021, equivalent to about $176 billion, after stocks rose.

Turkey’s central bank raised its inflation projections after a collapse in the currency pushed consumer price growth to its highest in President Recep Tayyip Erdogan’s 19-year rule

A more detailed look at global markets courtesy of Newsquawk

In Asia, APAC markets sold off with risk appetite hit as the region digested the hawkish FOMC meeting. Nikkei 225 (-3.1%) suffered losses of more than 3% and with the index down more than 10% from January highs. KOSPI (-3.5%) was mired by another North Korean launch and with Samsung Electronics dwindling post- earnings. Hang Seng (-1.9%) and declined amid a slowdown in Chinese Industrial Profits andShanghai Comp. (-1.7%) with the CSI 300 Index slipping into bear market territory after falling 20% from its February 2021 peak, while developers are hit including Evergrande as investors will have to wait six months for an initial restructuring plan.

Top Asian News

China Fintech PingPong Is Said to Weigh $1 Billion Hong Kong IPO

Tencent Plans to Take U.S.-Listed DouYu Private: Reuters

China Stocks Enter Bear Market as Yuan Tumbles Most in 7 Months

Japan’s 10-Year Bond Yield Closes at Highest Level Since 2018

In Europe, major bourses in Europe are nursing the post-Fed pressure with the complex now mixed, Stoxx 600 -0.1%. In Europe, with lagging post-Intel (-3.1% pre-market) in-spite of strong numbers givensectors are mixed Tech soft guidance, with European comparables pressured post respective earnings this morning. While Financials outperform post-Fed.

Top European News

Deutsche Bank Plans to Boost Dividend After Three-Year Drought

Dutch Government Said to Resume Sale of Majority ABN Amro Stake

European Gas Fluctuates With Ukraine Tensions and Mild Weather

U.S., Other ‘Populist’ Nations Mishandled Pandemic, Study Says

In FX, hawkish Fed Powell overshadows official FOMC policy message to give a fresh boost.Greenback Franc, and underperform as Fed gets set to widen the gap between policy stances of SNB, BoJ andYen Euro ECB. Kiwi fails to benefit much from hot NZ CPI and Aussie via a poll predicting RBA tightening in November amidst the Buck’s latest bill run. Rand stands firm awaiting a SARB hike and regains some poise on technical grounds rather than anyRouble real improvement in Russian relations with the US or western nations. CBRT Minutes: the policy stance will be set taking into account the source/permanence of risks, expects the disinflation process to start on the back of measures taken. Will develop tools to support the increase of TRY assets.

In commodities, crude benchmarks have trimmed post-Fed downside in tandem with the equity recovery, as focus remains as Russia receives the US' written response.very much on geopolitics WTI and have recaptured USD 87.00/bbl and USD 90.00/bbl respectively, and are now holding nearBrent session highs. Spot gold lies near the post-Fed trough and as such the 200- & 50-DMAs are back in view at USD 1805/oz and USD 1803/oz respectively. China Gold Association said 2021 gold consumption increased 36.5% Y/Y to 1,220.9 tons and gold output rose 10.0% Y/Y to 329.0 tons, according to Bloomberg

US Event Calendar

8:30am: 4Q GDP Annualized QoQ, est. 5.5%, prior 2.3%

8:30am: 4Q GDP Price Index, est. 6.0%, prior 6.0%

8:30am: 4Q Personal Consumption, est. 3.4%, prior 2.0%

8:30am: 4Q PCE Core QoQ, est. 4.9%, prior 4.6%

8:30am: Dec. Durable Goods Orders, est. -0.6%, prior 2.6%

8:30am: Dec. -Less Transportation, est. 0.3%, prior 0.9%

8:30am: Dec. Cap Goods Ship Nondef Ex Air, est. 0.5%, prior 0.3%

8:30am: Dec. Cap Goods Orders Nondef Ex Air, est. 0.4%, prior 0%

8:30am: Jan. Initial Jobless Claims, est. 265,000, prior 286,000

8:30am: Jan. Continuing Claims, est. 1.65m, prior 1.64m

10am: Dec. Pending Home Sales YoY, est. -4.0%, prior 0.2%; MoM est. -0.4%, prior -2.2%

11am: Jan. Kansas City Fed Manf. Activity, est. 20, prior 24

..............................

Have a Great Day

Melvin capital trader talks

.

.

.

.

.

.

. . . .

Morning Markets. . . .

.

.

.

.

Futures Surge After Microsoft Reversal With All Eyes On Fed

Wednesday, Jan 26, 2022 - 08:09 AM

Yesterday, after Microsoft stock initially slumped despite beating across the board as the skeptical market latched on to even the smallest weakness to hammer the stock, dragging down both the Nasdaq and S&P futures close to session lows, we said that the reaction was premature and would reverse, as the earnings release did not include guidance and would promptly reverse once the company revealed its cloud guidance in its conference call a little over an hour later. Well, that's precisely what happened and after first tumbling as much as 5% after hours, the 2nd largest US company (MSFT has $2.2 trillion in market cap) reversed all losses and is now trading solidly in the green, sparking broader tech momentum, lifting the Nasdaq as much as 2.1% this morning and (briefly) helping traders forget that today at 2pm the Fed is expected to unveil a March rate hike and balance sheet runoff a few months later.

Indeed, contracts on the Nasdaq 100 led broad-based gains - which would have been gaping losses had MSFT failed to reverse late on Tuesday - as U.S. stock futures rallied, with investors bracing for the Federal Reserve’s decision and preparing for a slew of earnings from companies including Tesla, Intel and Boeing. Nasdaq 100 futures jumped as much as 2.1% while S&P 500 and Dow Jones futures also rallied. The VIX fell from a one-year high, snapping six days of gains. Elsewhere, the Stoxx Europe 600 rose 2% in the biggest jump in seven weeks. 10Y TSY yields rose to 1.79% with the Fed’s policy announcement in the limelight; the dollar was slightly higher, as was Bitcoin while Brent oil traded just shy of $90 on its way to triple digits.

Of course, the big event today is the Fed policy statement at 2pm ET and press conference 2:30pm, which are expected to ratify expectations for rate increases beginning in March

Short-term interest rate futures price in just 1bp of rate-hike premium for January meeting but fully price in 25bp for March

Commentary on shrinking the central bank’s balance sheet is also anticipated

We will have a detailed post on what to expect from the Fed shortly.

“We expect inflation to remain high and interest rates to rise more than investors are expecting today,” said Norbert Frey, head of portfolio management at Fuerst Fugger Privatbank. “A rising interest rate environment is leading to a revaluation of all business models and we think 2022 can be a year of value stocks.”

While equities have had had a rocky start to 2022 as bond yields rose with investors anticipate tighter policy from the Fed, while Russia-U.S. tension added to investor concerns. Now, strategists from Goldman Sachs Group Inc. to Citigroup Inc. are saying it’s time to buy the dip.

“Any further significant weakness at the index level should be seen as a buying opportunity, in our view,” Goldman strategists including Peter Oppenheimer wrote in a note on Wednesday.

In U.S. premarket trading, Microsoft Corp rose, with analysts positive on the software maker’s outlook for growth for its Azure cloud-computing services. Shares gained 4.1% in U.S. premarket trading after initially tumbling before the market heard the company's strong cloud guidance, with analysts positive on the software maker’s outlook for growth for its Azure cloud-computing services. Analysts also highlighted the company’s commercial bookings and a supportive IT spending backdrop. Texas Instruments shares also rose 4% after the chipmaker gave a first-quarter forecast that was stronger than expected, with analysts noting the company’s conservatism amid a still supportive demand backdrop. Texas Instruments also reported its fourth-quarter results. Other notable premarket movers:

Cryptocurrency-exposed stocks in Europe and the U.S. are trading higher as Bitcoin kept regaining ground ahead of the Federal Reserve decision. Marathon Digital (MARA US) +6%, (RIOT US) Riot Blockchain +5%, (COIN US) Coinbase +3.4%.

Electric vehicle stocks climb in U.S. premarket trading ahead of Tesla’s fourth-quarter results due Wednesday after the market close. Rivian (RIVN US) +3.5%; Tesla (TSLA US) +4.4%; Nikola (NKLA US) +3.6%.

Moderna’s (MRNA US) stock valuation “makes a lot more sense” after more than halving since Deutsche Bank initiated in October, prompting the broker to upgrade the vaccine maker to hold from sell. Shares gain 4.6% premarket.

Capital One (COF US) reported adjusted earnings per share for the fourth quarter that beat the average analyst estimate. Shares dropped postmarket, with higher expenses “the only wrinkle” in the bank’s quarter, according to Vital Knowledge.

Stride (LRN US) shares gained 7% postmarket Tuesday after the technology-based education company boosted its revenue forecast for the full year. The guidance beat the average

Global stocks have shed about 7% in January, on track for the worst month since the pandemic roiled markets back in 2020. Some strategists are optimistic about the outlook following the declines.

“The growth-policy trade-off may be less favourable, yet we think a lot of bad news is now priced in,” Emmanuel Cau, head of European equity strategy at Barclays Plc, wrote in a note. “Starts of policy normalisation typically bring higher volatility but rarely terminate bull markets, although higher-than-usual P/E multiples mean equities are more rates-sensitive this time.”

In the latest developments involving Russia and Ukraine, president Joe Biden said he would consider personally sanctioning Vladimir Putin if he orders an invasion of Ukraine, escalating efforts to deter the Russian leader from war. In response, Russian Foreign Minister Sergei Lavrov signaled that Moscow will respond to any “aggressive” action by the U.S. and its European allies as Germany and France pursue efforts to broker a peaceful resolution to the tensions over Ukraine.

European equities rally, brushing off geopolitical tensions, with most indexes clawing back roughly 3/4 of Monday’s sharp sell off to rise over 2%. Europe’s Stoxx 600 adds as much as 2% with travel, energy, miners and autos leading what is broad sectoral support. Here are some of the biggest European movers today:

Vestas Wind Systems shares rise as much as 6%, reversing an earlier decline, after guidance for 2022 was met with relief. Handelsbanken analysts said the guidance miss was unsurprising, and the market likely feared it would be worse.

Other European renewables stocks -- which have been hit hard in the recent selloff -- gain after Vestas’ update, rebounding after declines triggered by Siemens Gamesa’s profit warning last week.

Travel and leisure is the best-performing sector among Stoxx 600 groups on Wednesday. Airlines including Lufthansa and IAG lead gains, with the German carrier upgraded to buy at Stifel.

AutoStore advances after being raised to buy at Citi. The upgrade follows a slump of more than 50% amid uncertainty regarding patent litigation and a broader sell-off in tech stocks.

De Longhi rises as much as 8.9%, the most intraday since March 2021, after Equita upgrades to buy from hold, citing recent underperformance and more confidence in the company’s coffee business.

Essity falls the most since Oct. 2020 after the Swedish hygiene products manufacturer reported weaker-than-expected earnings and announced further price hikes in 2022.

Orpea shares continued their descent after its CEO was summoned to the French minister for elderly policy. The French nursing home operator also denied reports it had offered a journalist money to not publish a book critical of the company.

Barry Callebaut shares fell, reversing earlier gains, after reporting 1Q sales. Citi noted “some more caution” on commodities amid waning supply of cocoa beans.

Earlier in the session, stocks in Asia were mixed after slumping across the board in the previous session, as investors awaited the Federal Reserve’s policy decision. The MSCI Asia Pacific Index was down 0.1%, on track to fall for a fourth day, with advances in communication services and financials offsetting losses in technology shares. Benchmarks in China, Hong Kong and Singapore were among the gainers, while Japan’s Topix Index fell deeper into correction territory. Asian equities have tumbled this month amid heightened volatility on the prospect of U.S. monetary-policy tightening, with the Fed expected to telegraph a March interest-rate hike on Wednesday. Worries over rising rates sent a gauge of the region’s tech hardware stocks to its lowest in months on Wednesday, with chipmakers TSMC and Samsung Electronics among the biggest drags. “There’s a lot of noise in the market right now, and I don’t think anyone’s confident that this is the bottom, because we aren’t sure about Fed policy yet,” said Kyle Rodda, analyst at IG Markets. Despite the broader drop in tech shares, Tencent advanced on dip-buying, helping to boost the Hang Seng Tech Index. The CSI 300 Index whipsawed to narrowly avoid entering a bear market

Fixed income takes a back seat. Curves adopt a modest bear steepening theme with gilts underperforming both bunds and USTs by 1-2bps. Eurodollars bear flatten a touch ahead of today’s FOMC meeting. Peripheral and semi-core spreads narrow with Italy, Belgium and France outperforming.

Treasuries are under pressure in early U.S. trade with U.S. stock index futures higher by 1%-2%, European benchmarks by 2%-3%, with travel, energy, miners and autos leading a broad advance. Front-end yields cheaper by more than 2bp with most curve spreads within 1bp of Tuesday’s close; 10-year yields around 1.785%, outperforming gilts by ~1bp. Focal point of U.S. day is Fed policy decision and Chair Powell news conference. Auction cycle pauses for Fed, concluding with 7-year notes Thursday. The stellar 2Y & 5Y auctions are underwater after stopping through (the 5Y produced record-low dealer award), There is no Fed POMO today. IG dollar issuance slate empty so far and expected to remain slim; Treasury auctions resume with $53b 7-year note sale on Thursday, following strong demand for 2- and 5-year notes earlier this week.

In FX, Bloomberg Dollar Spot is little changed but mixed price action across much of G-10. USD/JPY rises through 114, EUR/USD dips back onto a 1.12-handle. Commodity currencies trade well as crude futures drift back toward Monday’s highs.

Bitcoin extended its gains for the week, trading near $38,000.

In commodities, WTI adds 0.6%, regaining a $86-handle after the latest APIR report showed a draw in U.S. stockpiles and investors tracked tensions over Ukraine for signs the conflict may disrupt supplies. Brent climbs to about $89. Spot gold trades a tight range near $1,846/oz. Most base metals are well bid, lead by LME copper and tin; aluminum underperforms.

Looking at the day ahead now, the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s subsequent press conference, whilst there’s also a policy decision from the Bank of Canada. On the data side, we’ve got US new home sales for December, along with the preliminary December reading of wholesale inventories. Meanwhile earnings releases include Tesla, Abbott Laboratories, Intel, AT&T and Boeing.

Market Snapshot

S&P 500 futures up 1.2% to 4,399.50

STOXX Europe 600 up 1.8% to 467.79

MXAP down 0.1% to 186.79

MXAPJ little changed at 612.28

Nikkei down 0.4% to 27,011.33

Topix down 0.3% to 1,891.85

Hang Seng Index up 0.2% to 24,289.90

Shanghai Composite up 0.7% to 3,455.67

Sensex up 0.6% to 57,858.15

Australia S&P/ASX 200 down 2.5% to 6,961.63

Kospi down 0.4% to 2,709.24

German 10Y yield little changed at -0.08%

Euro down 0.2% to $1.1284

Brent Futures up 0.8% to $88.92/bbl

Gold spot down 0.1% to $1,846.69

U.S. Dollar Index up 0.15% to 96.09

Top Overnight News from Bloomberg

Federal Reserve policy makers are poised to signal plans for their first interest rate hike since 2018 and discuss shrinking their bloated balance sheet as they seek to restrain the hottest inflation in nearly 40 years

The Treasury market appears more likely to respond in a logical way to Wednesday’s Federal Reserve communications because of indications that the past week’s U.S. stock-market bloodbath cleared out a crowded camp of bets on higher yields

The employment cost index, which Federal Reserve Chair Jerome Powell cited in December as a key reason for the central bank’s pivot to a more aggressive stance on inflation, is seen registering a fourth-quarter gain nearly on par with the record increase in the prior three months

Lithuanian Central Bank Governor Gediminas Simkus warned that Europe’s economy would suffer a significant blow if tensions escalate further between Russia and Ukraine, urging politicians to step up efforts to deter hostilities

OPEC and its allies are expected by delegates to stick to their plan and ratify another modest production increase next week as they try to satisfy rebounding oil demand

A more detailed look at global markets courtesy of Newsquawk

In Asian trading, APAC markets were subdued ahead of the FOMC and holiday-quietened conditions. Nikkei 225 (-0.4%) oscillated around the 27k level after record daily COVID-19 cases. KOSPI (-0.4%) faded opening gains with attention on earnings. Hang Seng (+0.2%) and Shanghai Comp. (+0.7%) were mixed as PBoC liquidity efforts and government support signals were offset as Evergrande default woes resurfaced.

Top Asian News

Foreigners Cash Out of Key Asian Emerging Markets Before Fed

China to Start Three-Year Crackdown on Money Laundering

China Criticizes U.S. Diplomats Seeking Exit Over Covid Rules

China South City Bonds Rally as Consent Given to Extend 2022s

European bourses are firmer in an extension of yesterday's upside, with the Stoxx 600 +2.0% on the session but still lower on the week. US futures are firmer across the board with the NQ, +2.0%, outpacing and benefitting from MSFT post earnings, +4.0% in pre-market. European sectors are all in the green with Travel & Leisure outperforming amid broker action while Oil & Gas is a relatively close second given crude action. EU antitrust decision against Intel (INTC) has been annulled in part by the EU General Court. Microsoft (MSFT) Q2 2022 (USD): EPS 2.48 (exp. 2.31), Revenue 51.73bln (exp. 50.88bln). Co. sees Q3 product revenue between USD 15.6bln-15.8bln and expects Azure revenue growth to increase significantly, while it guides Q3 rev. USD 48.5bln-49.3bln (implied) vs exp. USD 47.7bln. +4.0% in the pre-market.

Top European News

Inflation Outlook No Reason for ECB to Change Track: Simkus

Italy Asks Firms Not to Meet With Putin Amid Ukraine Crisis

Finland ‘Wise’ to Sell Long-Maturity Debt Ahead of ECB Tapering

Europe Travel Stocks Gain on Airlines Boost; Lufthansa Upgraded

In FX, Loonie loving risk recovery and WTI revival in run up to likely BoC hike. Aussie rebounds in absence of those away for a national holiday. Greenback stands firm awaiting something hawkish from the Fed. Kiwi hovering ahead of NZ CPI. -Pound pensive before Partygate findings are published. Rouble unable to benefit from Brent bounce as Russia begins big drills in Black Sea to keep geopolitical tensions elevated.

In commodities, WTI and Brent March futures have continued grinding higher despite quiet news flow as focus remains on geopolitics and the benchmarks also benefit from equity action. At best, WTI and Brent have surpassed USD 86.00/bbl and USD 89.00/bbl respectively thus far. Spot Gold remains contained amid relatively rangebound USD action while Silver is buoyed ahead of USD 24.00 /oz and touted resistance marks. US Private Energy Inventory Data (bbls): Crude -0.9mln (exp. -0.7mln), Gasoline +2.4mln (exp. +2.5mln),

Distillates -2.2mln (exp. -1.3mln), Cushing -1.0mln. Qatar's Emir is to meet US President Biden on Monday to discuss Afghanistan and contingency plans to supply natural gas to Europe in the event of a Russian invasion of Ukraine. Qatar Emir and US President Biden are to discuss additional Qatari gas supplies to Europe in the case of a Russian-Ukraine conflict at next week's discussions, via Reuters sources; Qatar has little spare gas for Europe as most gas is pre-sold.

Geopolitics

US State Department said the US hasn't seen the de-escalation that is necessary if diplomacy and dialogue with Russia is to prove successful, while US Department of Defense Spokesman Kirby said the US will not rule out adding further troops to the already 8,500 on alert.

Ukraine Foreign Ministers says the proposals the US will send to Russia do not raise Ukraine's objections; subsequently, Moscow says received some answers to security guarantee proposals, but not in written form - awaiting further details.

Ukrainian President Zelensky said the situation in the east is under control and they are working to establish that the meeting of Presidents of Ukraine, Russia, Germany, and France takes place as soon as possible.

Russian navy has commenced large-scale training in the Black Sea, according to Ifax.

UK Foreign Minister Truss, when question if they would sanction Russia's Putin, says they are not ruling anything out.

Ukraine envoy to Japan said that they are fully committed to a diplomatic solution to the current tensions with Russia, while the envoy also stated that a full-scale war is very difficult to expect although they may see more localised conflict.

US Event Calendar

7am: Jan. MBA Mortgage Applications, prior 2.3%

8:30am: Dec. Advance Goods Trade Balance, est. -$96b, prior -$97.8b, revised -$98b

8:30am: Dec. Retail Inventories MoM, est. 1.5%, prior 2.0%; Wholesale Inventories MoM, est. 1.2%, prior 1.4%

10am: Dec. New Home Sales MoM, est. 2.1%, prior 12.4%; New Home Sales, est. 760,000, prior 744,000

2pm: FOMC Rate Decision

.

.

.

.

Have a Great Day

“Hero’s Journey” Starring Melissa McCarthy

About this author

https://en.wikipedia.org/wiki/Zero_Hedge

.

.

.

.

.

.

.

.

. . . .

Anything Technologies Media, Inc. Gives Update Regarding Roll-Out of Cannabis & CBD Beverages

$EXMT

January 25, 2022 08:30 ET | Source: Anything Technologies Media, Inc.

...

CARSON CITY, NV, Jan. 25, 2022 (GLOBE NEWSWIRE) -- via NewMediaWire -– Anything Technologies Media Inc. (EXMT) (Alternative Wellness Health), announced today that the joint venture negotiations with a major THC Licensed and grow organization expects to be concluded soon and the joint venture should be completed by the end of January.