Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This Night in Rock History . . . .

.

.

.

.

1962 "The Twist" by Chubby Checker hits Number One again, over a year after it first reached the top of the chart.

This Day in Financial History. . . .

.

.

.

.

Learn what happened in business in today’s past

January 13:

2000: Federal Reserve Chairman Alan Greenspan, speaking to the Economic Club of New York, imagines an observer looking back in the year 2010. That future-dweller, he says, "might well conclude that a good deal of what we are currently experiencing was just one of the many euphoric speculative bubbles that have dotted human history." The next day, the NASDAQ Composite -- the bubble Greenspan probably had in mind -- puffs up 2.7% fatter, to 4064.27.

The Wall Street Journal, January 17, 2000, p. C1; http://www.federalreserve.gov/boarddocs/speeches/2000/200001132.htm

1967: On the first trading day after the U.S. Surgeon General reports that smoking is hazardous to human health, tobacco stocks take a deep breath...and rise. R.J. Reynolds & Co. closes up 25 cents at $42.75 on massive volume of 127,500 shares, making it the most active stock of the day. American Tobacco Co. closes unchanged at $28.50, while Liggett & Myers Tobacco Co., P. Lorillard Co. and Philip Morris, Inc. close down a hair. The solid stocks reflect "investors' belief that the Federal report?probably won't have a major impact on cigaret smoking," says The Wall Street Journal.

The Wall Street Journal, January 14, 1964, pp. 8, 24.

1937: The first shipment of gold is received at the Fort Knox Bullion Depository, the nation's official gold vault.

http://www.ustreas.gov/education/history/events/01-jan.shtml

Futures Flat Ahead Of Another Scorching PPI Print

Morning Markets

Futures Flat Ahead Of Another Scorching PPI Print

.

.

.

.

Thursday, Jan 13, 2022 - 08:00 AM

US futures were little changed on Thursday one day after the highest CPI print since 1982 and just minutes before another red hot PPI print is expected (9.8%, up from 9.6%), as investors tried to gauge the timing and pace of monetary tightening. S&P 500, Dow and Nasdaq 100 futures were up 0.1% as investors waited for the next trading signal. 10Y yields were flat around 1.74%, and the dollar edged lower as a growing tide of investors bet the world’s reserve currency has reached a peak with rate hikes largely priced-in to the market with Fed tightening likely to lead to an economic slowdown.

“Markets in 2022 have been volatile as the reality of inflation set in, and this reaction mainly reflects relief that the print did not exceed already lofty expectations,” Geir Lode, head of global equities at the international business of Federated Hermes, said in an email.

Inflation hitting 7% could force a quicker move by the Federal Reserve, with the market now pricing four rate hikes this year starting no later than March, according to technical analyst Pierre Veyret at ActivTrades in London. “Investors still struggle with one crucial question: how will the Fed manage to tackle rising price pressure without derailing the fragile post-pandemic economic recovery?”

In premarket trading, shares in Delta Air Lines rose more than 2% even though the carrier missed revenue and EPS expectations, after the company said the omicron variant won’t derail its expectation to remain profitable for the rest of the year, as it released fourth-quarter financial results. Here are some of the biggest U.S. movers today:

U.S. chip stocks are mixed in premarket trading after sector bellwether TSMC gave a 1Q sales outlook that beat estimates and raised its projected annual capex versus last year. Equipment stock Applied Materials (AMAT US) +2% premarket, while TSMC customers are mixed with Apple (AAPL US) -0.1%, Nvidia (NVDA US) +0.7% and AMD (AMD US) +0.6%.

Puma Biotechnology (PBYI US) shares surge 13% in U.S. premarket trading, after the company said that its Nerlynx treatment was included in the National Comprehensive Cancer Network’s (NCCN) clinical practice guidelines in oncology for the treatment of breast cancer.

KB Home (KBH US) shares rise 6.2% in premarket trading after the homebuilder’s 4Q EPS beat estimates, with Wells Fargo calling the results and guidance “solid.”

Planet Labs (PL US) shares rise 1.6% in U.S. premarket trading, after the satellite data provider said that it plans to launch 44 SuperDove satellites on Thursday on SpaceX’s Falcon 9 rocket.

Adagio Therapeutics (ADGI US) said ADG20 has neutralization activity against omicron and cites recent findings from three publications on ADG20. Shares jumped 30% in post-market trading.

Discussing yesterday's scorching CPI print, DB's Jim Reid writes that "if you did an MRI scan of US inflation yesterday you’d find things to support both sides of the debate which is surprising when it hit 7% YoY and the highest since 1982 when Fed Funds were more than 13% rather than close to zero as they are today. So a slightly different real rate to back then. In fact the real rate is through any level seen in the 1970s and is only comparable to WWII levels. Back to CPI and the YoY number was in line with expectations, but core and MoM figures were all a bit firmer than expected. However, the beats were small enough that the data didn’t significantly change the outlook for monetary policy, with Fed funds futures still pricing in an 89% chance of a March hike, which is roughly around where it’d been over the preceding days."

In Europe, the Stoxx Europe 600 Index paused after a two-day advance, erasing early declines of as much as 0.3% to trade little changed, with technology and automotive shares offsetting losses in consumer products and health care. CAC 40 underperforms, dropping as much as 0.6%. The Stoxx Europe 600 Technology sub-index is up 1.1%, getting a boost from chip stocks which gained after sector bellwether TSMC gave a 1Q sales outlook that beat estimates and raised its projected annual capex versus last year. Geberit dropped as much as 4.5% to a seven-month low after the Swiss producer of sanitary installations reported fourth-quarter sales.

Bloomberg Dollar Spot dips into the red pushing most majors to best levels of the session. NZD, AUD and GBP are the best G-10 performers. Crude futures maintain a relatively narrow range. WTI is flat near $82.70, Brent stalls near $84.84. Spot gold dips before finding support near $1,820/oz. Most base metals are in the red with LME zinc lagging peers.

Asian stocks were little changed after capping their biggest rally in a year, with health-care and software-technology names retreating while financials advanced. The MSCI Asia Pacific Index fluctuated between a drop of 0.3% and a gain of 0.2% on Thursday. Hong Kong’s Hang Seng Tech Index lost 1.8% after rising the most in three months in the previous session. Benchmarks in China and Japan were the day’s worst performers, while the Philippines and Australia outperformed. “The market rose a bit too much yesterday,” said Mamoru Shimode, chief strategist at Resona Asset Management in Tokyo. “Investors keep shifting back and forth from value stocks to growth names and vise versa. It’s because we don’t know yet where U.S. long-term yields will end up settling around.” The Asian stock measure jumped 1.9% Wednesday on views that the Federal Reserve’s anticipated rate hikes will help curb inflation and allow the global recovery to chug along. U.S. inflation readings overnight, at an almost four-decade high, were in line with expectations and helped investors keep previous bets

Japanese stocks fell after Tokyo raised its Covid-19 alert to the second-highest level on a four-tier system. The Topix dropped 0.7% to 2,005.58 at the 3 p.m. close in Tokyo, while the Nikkei 225 declined 1% to 28,489.13. Recruit Holdings Co. contributed the most to the Topix’s decline, decreasing 4%. Out of 2,181 shares in the index, 500 rose and 1,604 fell, while 77 were unchanged. HIS, Japan Airlines and other travel shares fell. Tokyo’s daily cases jumped more than fivefold on Wednesday to 2,198 compared with 390 a week earlier.

India’s benchmark equity index eeked out gains to complete its longest string of advances since mid-October, buoyed by the nation’s top two IT firms after their earnings reports. The S&P BSE Sensex rose for a fifth day, adding 0.1% to close at 61,235.30 in Mumbai, while the NSE Nifty 50 Index climbed 0.3%. Infosys and Tata Consultancy Services were among the biggest boosts to both measures. Of the 30 shares in the Sensex index, 19 rose and 11 fell. Thirteen of the 19 sector sub-indexes compiled by BSE Ltd. advanced, led by a gauge of metal companies. Infosys’ quarterly earnings beat and bellwether Tata Consultancy Services’s better-than-expected sales offer some hope that the rally in India’s technology sector has further room to run, according to analysts. Still, Wipro sank the most in a year after its profit missed estimates

Fixed income is relatively quiet, with changes across major curves limited to less than a basis point so far. The 10-year yield stalled around 1.75%, slightly cheaper on the day, and broadly in line with bunds and gilts. Eurodollar futures bear steepen a touch after a round of hawkish Fedspeak during Asian hours. Treasuries were steady with yields broadly within a basis point of Wednesday’s close. Eurodollars are slightly lower across green- and blue-pack contracts after Fed’s Daly and Harker sounded hawkish tones during Asia hours. Across front-end, eurodollar strip steepens out to blue-pack contracts (Mar25-Dec25), which are lower by up to 4bp. 30-year bond reopening at 1pm ET concludes this week’s coupon auction cycle.$22b 30-year reopening at 1pm ET follows 0.3bp tail in Wednesday’s 10-year auction, and large tails in last two 30-year sales. The WI 30-year yield at ~2.095% is above auction stops since June and ~20bp cheaper than last month’s, which tailed the WI by 3.2bp.

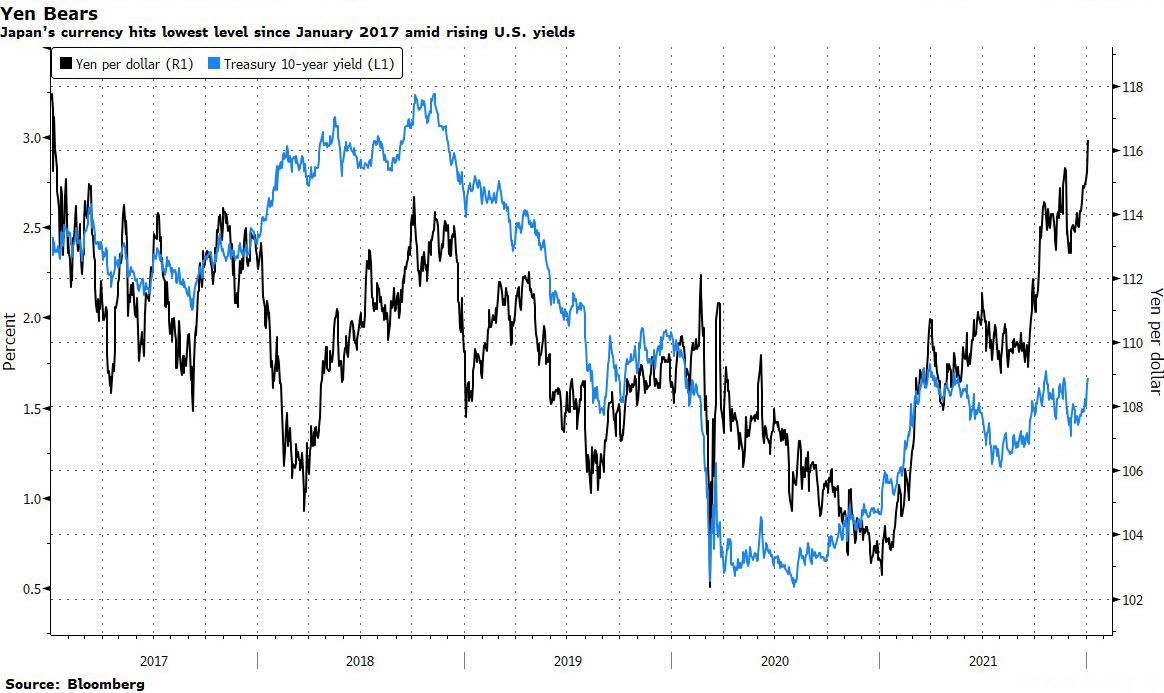

In FX, the pound advanced to its highest level since Oct. 29 amid calls for U.K. Prime Minister Boris Johnson to resign over a “bring your own bottle” party at the height of a lockdown meant to stem the first wave of coronavirus infections in 2020. The Bloomberg Dollar Spot Index held a two-month low as the greenback weakened against all of its Group-of-10 peers, and the euro rallied a third day as it approached the $1.15 handle. Implied volatility in the major currencies over the two- week tenor, that now captures the next Fed meeting, comes in line with the roll yet investors are choosing sides. The Australian dollar extended its overnight gain as the greenback declined following as-expected U.S. inflation. Iron ore supply concern also supported the currency. The yen hovered near a two-week high as long dollar positions were unwound. Japanese government bonds traded in narrow ranges.

In commodities, cude futures maintain a relatively narrow range. WTI is flat near $82.70, Brent stalls near $84.50. Spot gold dips before finding support near $1,820/oz. Most base metals are in the red with LME zinc lagging peers. Bitcoin traded around $44,000 as the inflation numbers rekindled the debate about whether the cryptocurrency is a hedge against rising consumer prices.

Expected data on Thursday include producer prices, an early indicator of inflationary trends, and unemployment claims.

Market Snapshot

S&P 500 futures little changed at 4,715.50

STOXX Europe 600 down 0.1% to 485.67

MXAP little changed at 196.79

MXAPJ up 0.1% to 643.93

Nikkei down 1.0% to 28,489.13

Topix down 0.7% to 2,005.58

Hang Seng Index up 0.1% to 24,429.77

Shanghai Composite down 1.2% to 3,555.26

Sensex up 0.1% to 61,220.38

Australia S&P/ASX 200 up 0.5% to 7,474.36

Kospi down 0.3% to 2,962.09

German 10Y yield little changed at -0.04%

Euro up 0.2% to $1.1465

Brent Futures down 0.1% to $84.58/bbl

Gold spot down 0.3% to $1,820.68

U.S. Dollar Index little changed at 94.83

Top Overnight News from Bloomberg

Federal Reserve Bank of San Francisco President Mary Daly and her Philadelphia Fed peer Patrick Harker joined the ranks of officials publicly discussing an interest-rate increase as early as March as the central bank seeks to combat the hottest inflation in a generation

Global central banks will diverge on the way they respond to inflation this year, creating risks to economies everywhere, Bank of England policy maker Catherine Mann said

Norway’s race to appoint a new central bank governor is reaching a finale mired in controversy at the prospect of a political ally and friend of Prime Minister Jonas Gahr Store getting the job

Italy’s government is working on a spending package that won’t require revising its budget to expand the deficit, people familiar with the matter said

Several of China’s largest banks have become more selective about funding real estate projects by local government financing vehicles, concerned that some are taking on too much risk after they replaced private developers as key buyers of land, people familiar with the matter said

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed following the choppy session in the US where major indices eked mild gains as markets digested CPI data in which headline annual inflation printed at 7.0%. ASX 200 (+0.5%) was underpinned as the energy and mining related sectors continued to benefit from the recent upside in underlying commodity prices, while Crown Resorts shares outperformed after Blackstone raised its cash proposal for Crown Resorts following due diligence inquiries. Nikkei 225 (-1.0%) declined with the index hampered by unfavourable currency flows and with Tokyo raising its COVID-19 alert to the second-highest level. Hang Seng (+0.1%) and Shanghai Comp. (-1.1%) were initially subdued, but did diverge later, after the slight miss on loans and aggregate financing data, while there is a slew of upcoming key releases from China in the days ahead including trade figures tomorrow, as well as GDP and activity data on Monday. In addition, the biggest movers were headline driven including developer Sunac China which dropped by a double-digit percentage after it priced a 452mln-share sale at a 15% discount to repay loans and cruise operator Genting Hong Kong wiped out around half its value on resumption of trade after it warned of defaults due to insolvency of its German shipbuilding business. Finally, 10yr JGBs traded rangebound and were stuck near the 151.00 level following the indecisive mood in T-notes which was not helped by an uninspiring 10yr auction stateside, while the lack of BoJ purchases in the market also added to the humdrum tone.

Top Asian News

Asia Stocks Steady After Best Rally in a Year; Financials Gain

Country Garden Selloff Shows Chinese Developer Worries Spreading

China Banks Curb Property Loans to Local Government Firms

China’s True Unemployment Pain Masked by Official Data

Bourses in Europe now see a mixed picture with the breadth of the price action also narrow (Euro Stoxx 50 Unch; Stoxx 600 -0.10%). The region initially opened with a modest downside bias following on from a mostly negative APAC handover after Wall Street eked mild gains. US equity futures have since been choppy within a tight range and exhibit a relatively broad-based performance with no real standout performers. Back in Europe, sectors are mixed and lack an overarching theme. Tech remains the outperformer since the morning with some follow-through seen from contract-chip manufacturer TSMC (ADR +4.3% pre-market), who beat on net and revenue whilst upping its 2022 Capex to USD 40bln-44bln from around USD 30bln the prior year, whilst the CEO expects capacity to remain tight throughout 2022. Tech is closely followed by Autos and Parts and Travel & Leisure, whilst the other end of the spectrum sees Healthcare, Oil & Gas, Retail and Personal & Household goods among the straddlers – with Tesco (-1.5%) and Marks & Spencer (-5.3%) weighing on the latter two following trading updates. In terms of other individual movers, BT (+0.5%) trades in the green amid reports DAZN is nearing a deal to buy BT Sport for around USD 800mln, a could be reached as soon as this month but has not been finalized. Turning to analyst commentary: Morgan Stanley’s clients have aligned themselves to the view that European equities will likely perform better than US counterparts. 45% of respondents see Financials as the top-performing sector this year, 14% preferred Tech which would be the lowest score in over six years.

Top European News

Johnson Buys Time With Apology But U.K. Tory Rage Simmers

U.K. Retailers Slide as Updates Show Lingering Impact of Virus

Wood Group Plans Sale of Built Environment Unit Next Quarter

Just Eat Advisers Pitching Grubhub Sale or Take-Private: Sources

In FX, the Dollar has weakened further in wake of Wednesday’s US inflation data as ‘buy rumour sell fact’ dynamics are compounded by more position paring and increasingly bearish technical impulses to outweigh fundamental factors that seem supportive, on paper or in theory. Indeed, the index only mustered enough recovery momentum to reach 95.022 on the back of hawkish Fed commentary and some short covering before retreating through the psychological level, then yesterday’s 94.903 low and another trough from late 2021 at 94.824 (November 11 base) to 94.710, thus far and leaving little bar the 100 DMA, at 94.675 today, in terms of support ahead of 94.500. However, the flagging Greenback could get a fillip via PPI and/or IJC, if not the next round of Fed speakers and final leg of this week’s auction remit in the form of Usd 22 bn long bonds.

NZD/AUD - A change in the running order down under where the Kiwi has overtaken the Aussie irrespective of bullish calls on the Aud/Nzd cross from MS, with Nzd/Usd breaching the 50 DMA around 0.6860 on the way to 0.6884 and Aud/Usd scaling the 100 DMA at 0.7288 then 0.7300 before fading at 0.7314.

GBP/EUR/CHF/CAD/JPY - Also extracting more impetus at the expense of the Buck, but to varying degrees as Sterling continues to shrug aside ongoing Tory party turmoil to attain 1.3700+ status and surpass the 200 DMA that stands at 1.3737, while the Euro has overcome Fib resistance around 1.1440, plus any semi-psychological reticence at 1.1450 to reach 1.1478 and the Franc is now closer to 0.9100 than 0.9150. Elsewhere, crude is still providing the Loonie with an incentive to climb and Usd/Cad has recoiled even further from early 2022 peaks beneath 1.2500 as a result, and the Yen is around 114.50 with scope for a stronger retracement to test the 55 DMA, at 114.22.

SCANDI/EM - Some signs of fatigue as the Nok stalls on the edge of 9.9000 against the Eur in tandem with Brent just a few cents over Usd 85/brl, but the Czk has recorded fresh decade-plus highs vs the single currency following remarks from CNB chief Rusnok on the need to keep tightening and acknowledging that this may culminate in Koruna appreciation. The Cnh and Cny are firmer vs the Usd pre-Chinese trade and GDP data either side of the weekend, but the Rub is lagging again as the Kremlin concludes that there was no progress in talks between Russia and the West, but the Try is underperforming again with headwinds from elevated oil prices and regardless of a marked pick up in Turkish ip.

In commodities, WTI and Brent front-month contracts have conformed to the indecisive mood across the markets, although the benchmarks received a mild uplift as the Dollar receded in early European hours. As it stands, the WTI Feb and Brent Mar contract both reside within USD 0.80/bbl ranges near USD 82.50/bbl and USD 84.50/bbl respectively. News flow for the complex has been quiet and participants are on the lookout for the next catalyst, potentially in the form of US jobless claims/PPI amid multiple speakers, although the rise in APAC COVID cases remains a continuous headwind on demand for now – particularly in China. On the geopolitical front, Russian-backed troops have reportedly begun pulling out of the 1.6mln BPD Kazakh territory, but Moscow’s tensions with the West do not seem to abate. Russia's Kremlin suggested talks with the West were "unsuccessful" – which comes after NATO’s Secretary-General yesterday suggested there is a real risk of a new armed conflict in Europe. Elsewhere, spot gold has drifted off best levels as the DXY found a floor, for now – with the closest support yesterday’s USD 1,813/oz low ahead of the 50 and 21 DMAs at USD 1,807/oz and USD 1,806.50/oz respectively. LME copper has also pulled back from yesterday’s best levels to levels under USD 10,000/t as the mood remains cautious, although, copper prices in Shanghai rose to over a two-month high as it played catch-up to LME yesterday.

US Event Calendar

8:30am: Dec. PPI Final Demand YoY, est. 9.8%, prior 9.6%; MoM, est. 0.4%, prior 0.8%

8:30am: Dec. PPI Ex Food and Energy YoY, est. 8.0%, prior 7.7%; MoM, est. 0.5%, prior 0.7%

8:30am: Jan. Continuing Claims, est. 1.73m, prior 1.75m

8:30am: Jan. Initial Jobless Claims, est. 200,000, prior 207,000

.......................

Today on the MMGYS sister board

The REAL Reason Gold Hasn't Gone Up and Why It Ultimately Will

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167485384

Inflation is now at 7%, the highest in 40 years, and will stay until 2024 - Steve Hanke

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167485231

Andy Schectman - Silver Inventory Delayed by Mints, Ordering Months In Advance

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167485172

I Live in Iraq America, Thanks MAGA

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167486659

Have a Great day

Stay Safe

.

.

.

.

.

.

. . . .

I Live in Iraq America, Thanks MAGA

Still facing the grips how I lost my right to Vote.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167486659

CQs...."Blue Chill Out"...tonight on.."Late-Night"

.

.

.

.

Good evening and Welcome to the Captains Quarters "Late-night"

Chill out with us tonight, Relax, Kick back and enjoy some soft blue sounds of Wednesday night on the CQs

Great to see you....

.

.

.

.

Chris Isaak - Blue Spanish Sky

.

.

.

.

.

.

.

.

.

.

.

Blue Bayou - Songwriters Roy Orbison & Joe Melson Performed By The Linda Ronstadt Experience

.

.

.

.

.

.

.

.

.

.

Shocking Blue - Venus

.

.

.

.

Thanks for being with us tonight

Hope you're enjoying your evening

J:D

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3....on IHUB

.

.

.

LOVENET Encore

Shocking Blue ~ Never Marry A Railroad Man

.

.

.

.

.

.

. . . .Good night...Stay Safe out there

This Night in Rock History. . . .

.

.

.

.

1974 "The Joker" by the Steve Miller Band hits Number One on the pop chart.

This Day in Financial History. . . .

.

.

.

.

Learn what happened in business in today’s past

January 12:

1914: Henry Ford announces that he will share the Ford Motor Co.'s profits with its workers by raising wages from $2.34 for a nine-hour day to $5.00 for an eight-hour day. He hopes his own workers will be able to afford to buy their own Fords; within two years, Ford goes on to produce its 1,000,000th car.

http://www.hfmgv.org/exhibits/hf/chrono.asp

1906: The Dow Jones Industrial Average, a few months short of its tenth birthday, closes above 100 for the first time, finishing the day at 100.25.

John A. Prestbo, ed., The Market's Measure: An Illustrated History of America Told through the Dow Jones Industrial Average (Dow Jones, New York, 1999), p. 56; http://averages.dowjones.com

Morning Markets

.

.

.

.

Futures Slightly Green Ahead Of Today's "Brutal" CPI Print

Wednesday, Jan 12, 2022 - 08:00 AM

U.S. index futures were little changed, if slightly in the green on Wednesday as investors settled into a wait-and-see mode ahead of today's "brutal" CPI report which is expected to show the highest CPI print in nearly 40 years, a time when the fed funds rate was 11% compared to 0% now...

... and gauge the pace of Federal Reserve tightening. Consensus expects December CPI to show inflation climbing to 7.0%, a result which could see front- end fully price in a March rate hike (currently priced at 85%). Helping the overnight mood in Asia, was a moderation in China’s inflation pressures, with CPI dipping to 10.3% y/y in December, giving the central bank scope to cut interest rates to cushion the economy’s downturn just as most major nations look to tighten policy. At 730am ET, S&P futures were up 0.2% of 7.50, and Nasdaq futures rose 22 points or 0.14%, recovering toward Asia’s best levels; Dow futures were up about 0.1%. The dollar was slightly lower, extending on its recent sharp drop, while Treasury yields were steady.

“All we know is that the Fed has waited too long before taking action,” said Ipek Ozkardeskaya, senior analyst at Swissquote. “If today’s inflation print is higher than expected, recent gains in equities will melt like snow in the sun,” she wrote, even though investors seemed to put aside fears that tighter policy will stifle the economic rebound and market rally after soothing words from Federal Reserve Chair Jerome Powell. His testimony Tuesday helped arrest a five-day slide in the S&P 500, just as we predicted it would.

As Deutsche writes, the highlight of the last 24 hours was Chair Powell’s renomination hearing before the Senate Banking Committee. The overall communicated stance of policy wasn’t much changed with the hawkish pivot still on. Nevertheless, there were a few incremental takeaways. Powell did nothing to push back on liftoff being on the table in March, in line with our US econ team’s call and the increasing probability implied by the market, which is currently 85%. He made it clear that QE (yes it’s still happening) would finish in March, despite speculations it may come to an abrupt halt beforehand. In line with growing consensus, he painted a picture that made the start of QT likely in 2022. Finally, on the overall stance of policy, he emphasized the Fed needs to pull back from extreme levels of accommodation, but didn’t need to rush to get to a neutral stance of policy.

“It was a masterful performance really, leaving the bowls neither too full nor too shallow, but just right from the financial market’s perspective,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific, in an email. “The music can still play in equity markets in 2022, it’s just that we’ve likely seen the best of the technology gains.”

With three and possibly four Fed rate increases now priced in, strategists are turning more sanguine about inflation and focusing on positives such as the start of the earnings season. Markets have been buffeted by volatility at the start of the year on the prospect of faster interest-rate increases to subdue price pressures.

“Hawkish Fed repricing is likely largely done for now,” and “resilient earnings should help equities rebound,” Barclays Plc strategists led by Emmanuel Cau wrote in a note to clients on Wednesday.

Looking at the CPI print, DB's Jim Reid notes that repeated upside surprises in the inflation data have sent the year-on-year numbers up to multi-decade highs, putting significant pressure on the Fed. Indeed if you look at the monthly headline CPI reading, 7 of the last 9 releases have come in above the consensus estimate on Bloomberg. In terms of what to expect this time around, economists think that year-on-year CPI will rise to +7.0%, which will be the highest annual CPI number since 1982. And if that figure is realized, it would also mean that the real Fed Funds rate in December was around -7%, which for reference is lower than at any point in the 1970s, when the lowest the fed funds rate got in real terms was around -5%.

In the premarket, Dish Network Corp. rose more than 7% on a New York Post report of merger talks with DirecTV. PayPal shares dropped 1.9% in premarket trading after Jefferies cut its recommendation for the digital payments provider to hold from buy. Here are some of the biggest U.S. movers today:

U.S.-listed Chinese stocks rally in premarket trading, as Asian listings rebound amid bargain hunting and a reassuring tone from Fed Chair Jerome Powell. Alibaba (BABA US) +2.4%, JD.com (JD US) +1.5%, Pinduoduo (PDD US) +3.3%

Biogen (BIIB US) drops 9.1% in premarket trading after the U.S. government limited Medicare coverage of the company’s Aduhelm Alzheimer’s disease treatment and similar drugs to patients enrolled in clinical trials. The highly unusual move will curb access to the controversial treatment approved last year

Wells Fargo (WFC US) advanced in premarket trading as Piper Sandler upgraded its rating to overweight from neutral; cuts Premier Financial to neutral from overweight

Bed Bath & Beyond (BBBY US) shares jump as much as 4.9% in U.S. premarket trading, boosted by disclosures of insider purchases of the retailer’s stock made on Jan. 7

Rocket Lab USA (RKLB US) started at overweight, with $17 target by Morgan Stanley, which says the company offers high-quality exposure to the space race. Stock gains 4.1% in premarket trading

Cogent Communications (CCOI US) faces a “challenging setup” on weak growth and a high multiple, Wells Fargo writes in note as downgrades to underweight from equal-weight

European equities climbed back toward opening highs after a choppy first hour of cash trading. The Euro Stoxx 50 added 0.7%, FTSE 100 outperforms at the margin. Miners, oil & gas and tech are the strongest performing sectors. In Europe, mining and technology companies led the Stoxx 600 Index up 0.5%. Philips slumped 14%, the most in two decades, after the Dutch producer of medical equipment reported lower preliminary revenue than expected. Here are some of the biggest European movers today:

Rexel jumps to an eight-year high after the French maker of electrical products said 2021 organic growth will be higher than forecast with Citi noting positive demand comments from firm.

VAT shares post their steepest gains in more than a month after the Swiss supplier of products for the semiconductor industry reported 4Q order intake that was well above expectations.

DFS Furniture shares gain as much as 6.4%, among the top advancers in the FTSE All-Share Index, after the U.K. retailer kept its FY pretax profit forecast unchanged.

Just Eat Takeaway stock rises after initially falling following an update. Citi analysts say the online food delivery firm’s 4Q results are broadly in line with an expected deceleration.

TeamViewer shares rise as much as 15% in Frankfurt after the company reported 4Q and FY billings that beat market expectations with RBC calling the results “reassuring.”

Sainsbury shares rise as much as 3.9% after the U.K. grocer boosted its outlook for the year. Profit delivery is strong, according to Jefferies.

BHP Group and European mining peers are among the biggest gainers Wednesday with UBS saying in a sector note that shares are cheap -- but valuations are not compelling.

Sweco shares fall as much as 6.8% after Danske Bank downgrades to hold from buy, noting “stalling execution” despite solid market demand for the engineering consultancy’s services.

Taylor Wimpey shares drop as much as 2.2% after a holder sold about 86m shares in the company at 163.75p apiece, representing a 3.7% discount to Tuesday’s close.

Earlier in the session, Asian stocks climbed to their highest level in almost seven weeks as Federal Reserve Chair Jerome Powell’s remarks spurred expectations that anticipated rate hikes won’t derail the global economic recovery. The MSCI Pacific Index added as much as 1.6% to its highest since Nov. 26, bolstered by gains in the consumer-discretionary and information-technology sectors. Alibaba Group and Tencent Holdings were among the biggest contributors to the measure’s rise. Benchmarks in Hong Kong and Japan led gains for the region. Powell pledged to do what’s necessary to contain an inflation surge and prolong the economic expansion at his confirmation hearing for a second term as U.S. central bank chief. Futures on the S&P 500 advanced in Asia trading after halting a five-day slide. A gauge of Chinese technology shares rallied after the Nasdaq 100 outperformed major benchmarks. “The market view is that containing inflation with early rate hikes will turn out to be good for the economy -- that we’ll be able to push back on inflation while keeping the economy strong,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management in Tokyo. “Before, the market had been reacting simply to the words ‘monetary tightening’.” Asia’s equity benchmark is attempting a rebound following last year’s 3.4% slump, when the gauge was hit by concerns over U.S. tightening, Covid-19 and a selloff in Chinese tech shares. Solid gains during Wednesday’s session will likely help spread a sense of relief, according to Fujiwara. “We think there’s more attractiveness here in Asia and EMs overall. And valuations are much more compelling given overall EM/Asia markets have underperformed compared to U.S. and Europe,” Ken Wong, Asian equity fund specialist at Eastspring Investments, told Bloomberg Television. “In 2022, there will be opportunities to be selective.”

Japanese equities posted their first gain in four sessions, following a similar rebound in U.S. peers after soothing comments from Federal Reserve Chair Jerome Powell. Electronics makers and telecoms were the biggest boosts to the Topix, which closed 1.6% higher. Tokyo Electron and SoftBank Group were the largest contributors to a 1.9% rise in the Nikkei 225. Powell pledged to do what’s necessary to contain an inflation surge and prolong the expansion, while steering clear of fresh details on the path of U.S. monetary policy. The S&P 500 rose for the first time in six sessions. “The market view is that containing inflation with early rate hikes will turn out to be good for the economy - that we’ll be able to push back on inflation while keeping the economy strong,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management in Tokyo. “Before, the market had been reacting simply to the words ‘monetary tightening’.”

Indian stocks rose along with Asian peers after Federal Reserve Chair Jerome Powell reassured investors that the U.S. central bank will tackle inflation to extend the economic expansion. The S&P BSE Sensex climbed for a fourth day, up 0.9% to 61,150.04 in Mumbai. The benchmark is 1% away from surpassing its record high touched in October. The NSE Nifty 50 Index advanced by a similar magnitude. Reliance Industries Ltd. rose 2.7% and was among the biggest boosts to the key indexes. Of the 30 shares on the Sensex, 24 gained. All but two of the 19 sector indexes compiled by BSE Ltd. rose, led by a gauge of telecom companies. IT major Wipro Ltd. reported net income for the third quarter that missed the average analyst estimate. Tata Consultancy Services Ltd. and Infosys Ltd. are also scheduled to announce Oct.-Dec. earnings in the day

Australian stocks also rebounded as mining shares hit 5-month highs. The S&P/ASX 200 index rose 0.7% to 7,438.90, with miners and health-care contributing the most to the benchmark’s gain. The materials subgauge led the rebound, hitting the highest since Aug. 17. Afterpay surged after the company said that Block, formerly known as Square, has now received approval from the Bank of Spain in respect of the acquisition by Lanai AU 2 Pty Ltd. Domino’s Pizza Enterprises dropped to its lowest since May. Official data Wednesday showed job vacancies climbed to a record in Australia, up 18.5% to almost 400,000 in the three months through November. In New Zealand, the S&P/NZX 50 index fell 0.2% to 12,804.48

In rates,Treasuries were marginally cheaper across the curve, with the front-end underperforming ahead of December CPI release at 8:30am ET. Treasury 2-year yields higher by 1.8bp vs. Tuesday close while rest of the curve is less than 1bp cheaper on the day; 10-year yields around 1.74% with both bunds and gilts outperforming by over 2bp in the sector. Cash USTs bear flatten, cheapening roughly 2bps across the short end. Session highlight also includes 10-year note auction, a $36b reopening: US auctions resume with a $36BN 10-year reopening at 1pm, followed by $22b 30-year reopening Thursday. The WI 10-year at around 1.745%, above auction stops since January 2020 and ~23bp cheaper than December stop-out which tailed 0.4bp. Elsewhere, bunds and gilts drift higher, with the 10y point outperforming. Bund futures regain 170. Peripheral spreads tighten slightly.

In FX, most G-10 currencies were confined to narrow ranges after the dollar’s drop yesterday and the Bloomberg Dollar Spot Index hovered while the Treasury curve bear-flattened as yields rose by up to 2bps, while commodity currencies outperform but trade off best levels with G-10 FX generally trading narrow ranges.

Demand for long gamma exposure into the next Federal Reserve meeting remains subdued even as realized volatility stays relatively high. The Norwegian krone was the best G-10 performer, followed by the Canadian dollar, as oil steadied above $81 barrel after posting the biggest one-day surge this year as investors embraced risk assets, commodities climbed and industry estimates pointed to another drawdown in U.S. crude stockpiles. The euro moved in a tight $1.1355-1.1378 range and Bund yields inched lower, led by the belly of the curve. The pound treaded water as investors monitored London hospital admissions for any signs of an easing in pandemic pressures and questioned how much further the currency can rise when rate hikes are already priced in.Australian dollar edged up amid iron ore hitting a three-month high as heavy rains disrupted southeastern Brazil’s iron ore industry. Japanese government bonds rallied across maturities after a smooth five-year note auction, driving down benchmark 10-year yields from a 10-month high and the yen steadied. BOJ Governor Haruhiko Kuroda said he expects the country’s underlying inflation to pick up gradually over the long-term after moderate near-term gains led by energy prices.

In commodities, crude futures fade a modest push higher. WTI stalls after a test of $82, Brent trades near $84. Spot gold drifts slightly lower near $1,817/oz. Base metals are in the green with LME nickel up 4%. Bitcoin jumped back over $43K while ether was above $3,300.

Looking at the day ahead now, and the aforementioned US CPI release for December will be the highlight. Other data releases include Euro Area industrial production for November and the US monthly budget statement for December. From central banks, the Fed will be releasing their Beige Book, and speakers include BoE Deputy Governor Cunliffe and the Fed’s Kashkari.

Market Snapshot

S&P 500 futures up 0.1% to 4,710.50

STOXX Europe 600 up 0.5% to 485.30

MXAP up 1.6% to 196.29

MXAPJ up 1.6% to 641.50

Nikkei up 1.9% to 28,765.66

Topix up 1.6% to 2,019.36

Hang Seng Index up 2.8% to 24,402.17

Shanghai Composite up 0.8% to 3,597.43

Sensex up 1.0% to 61,200.72

Australia S&P/ASX 200 up 0.7% to 7,438.90

Kospi up 1.5% to 2,972.48

German 10Y yield little changed at -0.04%

Euro little changed at $1.1370

Brent Futures up 0.5% to $84.17/bbl

Gold spot down 0.3% to $1,815.68

U.S. Dollar Index little changed at 95.59

Top Overnight News from Bloomberg

Bank of France Governor Francois Villeroy de Galhau says the European Central Bank will do what is necessary to get inflation around 2% in the medium term

Natural gas prices are likely to remain high for the next two years, with very few options to boost supplies quickly, according to the chief executive of Britain’s biggest energy supplier

China’s inflation pressures moderated to 10.3% y/y in December, giving the central bank scope to cut interest rates to cushion the economy’s downturn just as most major nations look to tighten policy

US Event Calendar

7am: Jan. MBA Mortgage Applications 1.4%, prior -5.6%

8:30am Dec. CPI data:

8:30am: Dec. CPI YoY, est. 7.0%, prior 6.8%; MoM, est. 0.4%, prior 0.8%

8:30am: Dec. CPI Ex Food and Energy YoY, est. 5.4%, prior 4.9%; MoM, est. 0.5%, prior 0.5%

8:30am: Dec. Real Avg Hourly Earning YoY, prior -1.9%, revised -1.7%

8:30am: Dec. Real Avg Weekly Earnings YoY, prior -1.9%

2pm: U.S. Federal Reserve Releases Beige Book

2pm: Dec. Monthly Budget Statement, est. -$5b, prior -$191.3b

...................

Wishing you a Great Day

Please stay safe

Donkey video bombs the white tiger with awesome smile.

.

.

.

.

.

.

. . . .

CQs...."Tuesday's Roll Out Showdown"....tonight on "Late-night"

.

.

.

.

Good evening and Welcome to the Captains Quarters "Late-night"

Join us as we lose control and cruise down Tuesday night boulevard

Please Hold your refreshment tightly and

Nice to see you. . .

.

.

.

.

Little Feat - Let It Roll

.

.

.

.

.

.

.

.

.

.

.

Jeff Lynne's ELO - Showdown (remastered 2021)

.

.

.

.

.

.

.

.

.

.

.

Queen / Roger Daltrey / Tony Iommi - I Want It All 1992 Live

.

.

.

.

Have a nice evening and

Thanks for being with us tonight

J:D

.

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3. . . .on IHUB

This Night in Rock History

.

.

.

.

1986 "I Knew The Bride (When She Used To Rock And Roll)" by Nick Lowe & His Cowboy Outfit peaks at Number 77 on the pop chart.

.

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3. . . .on IHUB

This Day in Financial History . . . .

Learn what happened in business in today’s past

January 11:

1973: The Dow Jones Industrial Average peaks at a then-record high of 1051.70. It will not close above that level again for almost a decade -- 3,583 days, to be exact.

Ned Davis Research; http://averages.dowjones.com

1964: A 10-member scientific advisory panel reports to the U.S. Surgeon General that cigarette smoking is hazardous to human health. The report finds that smoking "contributes substantially to mortality for certain specific diseases and to the overall death rate" and "is a health hazard of sufficient importance in the U.S. to warrant appropriate remedial action." More than three decades will pass, however, before the hot performance of tobacco stocks is stubbed out.

The Wall Street Journal, January 13, 1964, pp. 3, 12; The New York Times, January 13, 1964, p. 1.

1807: Ezra Cornell is born to Elijah and Eunice Cornell in Westchester Landing, New York. He works in the family's pottery business, then becomes a carpenter and self-taught mechanical engineer. In 1843, Cornell meets Samuel F. B. Morse. While helping Morse lay the transmission lines for his new telegraph, Cornell makes the key discoveries that the wires should be insulated and strung above ground. In 1855, Cornell co-founds Western Union, the greatest growth stock of the 19th Century, and in 1865 he founds Cornell University.

http://rmc.library.cornell.edu/ezra-exhibit/entrance.html

1757: Alexander Hamilton, future U.S. Secretary of the Treasury and founder of the American financial system, is born on the Caribbean island of Nevis, "the bastard brat of a Scotch pedlar," in the words of his political nemesis John Adams. [Note: Hamilton was indeed born out of wedlock, and thus his birthdate is in some dispute. But the U.S. government accepts this day as his official date of birth.]

John Steele Gordon, Hamilton's Blessing: The Extraordinary Life and Times of Our National Debt (Walker & Co., New York, 1997), p. 18;http://www.ustreas.gov/education/history/secretaries/ahamilton.shtmlhttp://www.alexanderhamiltonexhibition.org/

He's Gonna Blow

Morning Markets

.

.

.

.

Futures Rebound As Fed-Induced Rout Finally Eases

Tuesday, Jan 11, 2022 - 08:07 AM

After yesterday's miraculous tech recovery which saw gigacaps drop as much as 4% before recovering all losses and closing green, Nasdaq futures led gains among U.S. stock-index futures, hinting at further relief for technology stocks as Treasury yields retreated in early trading but have since steadied around 1.75%, unchanged from Monday. Nasdaq futures rose as much as 0.7%, while S&P 500 and Dow Jones contracts were also higher by about 0.4% ahead of Powell’s Senate confirmation hearing for second term as Fed chair which begins at 10am and where the Fed chair is expected to put on a dovish mask and walk back some of the recent hawkish commentary.

Dip-buyers rescued the Nasdaq from a fifth session of declines on Monday after Marko Kolanovic urged JPM clients to buy the dip, writing that yields aren't too high and the Fed's won't derail the economy’s rebound. “We view the recent equity volatility as an adjustment to the Fed’s incrementally more hawkish stance, rather than a sign that the Fed is about to bring the recovery and the equity rally abruptly to an end,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note. “We now expect three Fed rate hikes this year, starting as soon as March.”

“We are looking for opportunities to raise our weighting in stocks in 2022,” according to Luca Paolini, chief strategist at Pictet Asset Management, whose firm has a neutral stance on equities. “The global recovery remains resilient, thanks to a strong labor market, pent-up demand for services and healthy corporate balance sheets.”

In his second term confirmation hearing before the Senate Banking Committee at 10am ET today, Fed Chair Jerome Powell will say the central bank will keep inflation from becoming entrenched, but the post-pandemic economy may look different from previous expansions. Meanwhile, swaps indicate the Fed will implement as many as four interest-rate hikes this year, while the momentum is building for the first increase to take place as soon as March, although any economic slowdown will quickly crash these plans.

In U.S. premarket trading, technology stocks including Apple Inc. and Microsoft Corp. rose. Tesla Inc. gained following positive autos sales data from China and a price target hike at Morgan Stanley. Intel Corp. shares jumped after the chipmaker hired Micron Technology Inc.’s David Zinsner as chief financial officer. Here are some of the other big movers today:

Mega-cap U.S. technology stocks edged higher in premarket trading, hinting at a return of dip-buyers after last week’s selloff wiped $1.1 trillion from the value of the Nasdaq Composite Index. Tesla (TSLA US), Apple (AAPL US), Microsoft (MSFT US) are among the companies moving higher.

Tesla (TSLA US) shares gain 2% in U.S. premarket trading, following positive autos sales data from China and a PT hike at Morgan Stanley. Chinese EV peers also rally.

Intel (INTC US) shares gain 2.3% in U.S. premarket trading after the chipmaker hires Micron’s David Zinsner as CFO. Micron shares decline 1%.

TechnipFMC (FTI US) falls 6.6% in U.S. premarket trading after Technip Energies bought back 1.8m of its shares from TechnipFMC. TechnipFMC announced plan to delist from Euronext Paris and move to a single U.S. listing.

Rivian Automotive (RIVN US) dropped in post- market trading Monday after a Dow Jones report that its chief operating officer left the company last month as it ramped up production. Shares tumbled 5.6% in regular trading to close at a record low.

Wynn Resorts (WYNN US) fell in postmarket trading after Citi downgraded the stock to neutral from buy, citing valuation

Inari Medical Inc. jumped 10% in postmarket trading after the medical device company posted preliminary 4Q revenue that topped expectations.

Tech shares also led gains in Europe, where equities mostly reversed Monday’s sell off with the Euro Stoxx 50 rising ~1.25%. Technology, travel, consumer products and health-care stocks are among Europe’s top performing sectors Tuesday as investors rotate into sectors beaten down in recent sessions. BE Semi shares gain 4.3%, best performing tech stocks, while food delivery stocks gain on Delivery Hero’s outlook and HelloFresh introducing a new share buyback. Meanwhile banking and auto stocks -- this year’s top performing sectors - are at the bottom of the leaderboard, with banks falling for the first time this year: Deutsche Bank -1.6% and Commerzbank -2.9%, biggest decliners in Europe as Cerberus cuts stakes. Here are some of the biggest European movers today:

Technology, travel, consumer products and health-care stocks are among Europe’s top performing sectors Tuesday as investors rotate into sectors beaten down in recent sessions.

Delivery Hero +6.2% at noon CET, Sinch +8.6%, BE Semiconductor 7.2%, HelloFresh +4.2%

Pandora shares rise as much as 7.5% after publishing preliminary 4Q sales numbers, which Morgan Stanley says provide relief for investors and suggest “solid underlying momentum.”

Sika shares climb as much as 5.2%, the steepest intraday gain since November, after the Swiss construction- materials maker reported 4Q sales that beat expectations, Vontobel says.

Brunello Cucinelli shares jump as much as 8.4% after the Italian apparel maker reported 4Q sales that showed all channels and geographies accelerating from the previous quarter.

Shop Apotheke rise as much as 2.5% after reporting preliminary 4Q numbers. Citi notes sales are driven by “solid 4Q performance,” adding questions remain on e-prescriptions in Germany.

Darktrace soared the most since its trading debut after the cybersecurity company boosted its outlook, prompting an upgrade from the broker whose bearish note triggered a plunge last year.

JDE Peet’s, Reckitt fall, among the worst performers in Europe’s Stoxx 600 Index, after Exane BNP Paribas downgrades the stocks in a note that says it’s “not too enthused” about the 2022 outlook for consumer staples.

Castellum falls as much as its chief executive officer was ousted after only one month at the helm of one of Sweden’s biggest property companies, while DNB also downgraded the shares.

About You shares drop as much as 7.4% after the company reported 3Q21 sales below market consensus, in addition to higher-than-expected costs related to marketing and expansion.

Meanwhile, earlier in the session, Asian stocks were poised to halt a two-day gain as investors sold high-growth technology shares amid uncertainty over U.S. monetary policy. The MSCI Asia Pacific Index fell 0.1% after dropping as much as 0.7% as information-technology firms slid, while gains in financial shares helped limit the gauge’s loss. China’s CSI 300 and Japan’s Nikkei 225 Stock Average were among the worst performers in the region. Asia’s benchmark is struggling to pull itself from last year’s 3.4% slump amid lingering concerns over U.S. tightening, China’s weak technology shares and the possibility of new restrictions to contain the pandemic.

“It’s a bit difficult to aggressively buy up stocks,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “People are wary over the possibility of a faster-than-expected rate hike cycle.” Still, Pfizer’s remarks suggesting a vaccine for the omicron variant could be available as early as March “will somewhat alleviate concern over the virus,” Ichikawa added. Pfizer is developing a hybrid vaccine that combines its original shot with a formulation that shields against the highly transmissible omicron variant, CEO Albert Bourla said at a conference on Monday.

Japanese equities slid for a third day after the yen strengthened against the dollar and amid continued concerns over virus infections and U.S. monetary tightening. Electronics and chemical makers were the biggest drags on the Topix, which fell 0.4%. Keyence dropped 7.9% as investors sold growth stocks amid uncertainty over the Federal Reserve’s plan, Ichiyoshi Asset Management said. Tokyo Electron and Fast Retailing were the largest contributors to a 0.9% loss in the Nikkei 225. The yen slightly weakened against the dollar after gaining 0.8% in the previous four sessions. Many now expect the Fed will implement four quarter-point interest-rate hikes this year. Meanwhile, Prime Minister Fumio Kishida said Japan will extend its tightened border measures until the end of February as virus cases surge in the country

India’s benchmark equity index ended higher, after swinging between gains and losses during the day, ahead of quarterly earnings for top companies. The S&P BSE Sensex climbed 0.4% to close at 60,616.89 in Mumbai, while the NSE Nifty 50 Index added 0.3% to complete a third session of gains. Housing Development Finance Corp gave the biggest boost to the Sensex, rising 1.9%. Of the 30 shares in the Sensex, 16 rose and 14 fell. Thirteen of the 19 sector indexes compiled by BSE Ltd. gained, led by a gauge of power stocks. The S&P BSE Metal Index fell 2.8%, the most in three weeks, after Jefferies India Pvt. put out a cautious view on the metals sector in 2022. The brokerage downgraded Tata Steel Ltd. to hold and JSW Steel to underperform from buy. Analysts expect a steady growth in sales for the nation’s top software exporters, Tata Consultancy Services, Infosys and Wipro, which are scheduled to release their Oct.-Dec. earnings reports on Wednesday. “All eyes are on the earnings of the three IT majors. We reiterate our positive yet cautious view on markets and suggest focusing more on sector and stock selection,” Ajit Mishra, vice president research at Religare Broking Ltd. wrote in a note. India is ramping up its vaccination drive for younger population and booster shots for senior citizens as Covid-19 cases climb.

Australian stocks extended losses as bank, consumer staples weighed. The S&P/ASX 200 index fell 0.8% to close at 7,390.10, down for a second straight day, with banks and consumer staples among sectors weighing most on the benchmark. Ten of the 11 industry sub-gauges closed lower, while materials stocks were little changed. Inghams was among the worst performers, tumbling after the company said the spread of omicron is having a significant impact on its supply chain, operations, logistics and sales performance. Polynovo soared after the company reported U.S. sales were up 58% year on year. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,831.73.

In rates, Treasuries were cheaper across front-end of the curve while long-end outperforms with 10-year Treasury yields on either side of 1.75% giving the curve a small bull flattening bias as participants set up for first of this week’s auctions, in the form of a 3-year note sale at 1pm ET. Treasury yields are cheaper by 2.4bp in 2-year sector, flattening 2s10s spread as 10s are little changed at 1.76%; long-end yields are ~1bp richer on the day, flattening 5s30s spread by ~3bp toward last year’s low. Gilts outperformed by 1.7bp in 10-year sector, bunds by ~0.5bp. The US coupon auction cycle includes $52b 3-year new issue, $36b 10-year reopening Wednesday and $22b 30-year reopening Thursday; the WI 3-year yield at around 1.240% exceeds auction stops since February 2020; last month’s drew 1%, 0.3bp below the WI yield at the bidding deadline. IG dollar issuance slate includes five deals announced overnight; ten borrowers priced $12.2b Monday. Peripheral spreads widen slightly, books on Spain’s 10y syndication top EU58b.

In FX, Bloomberg Dollar Spot returns to flat on the session after a choppy morning, with the Bloomberg Dollar Index drifting with EUR/USD little changed at around $1.33; the 10-year Treasury yield is steady at 1.75%. Commodity currencies lead in G-10, JPY lags, fading roughly half of Monday’s strength: the Norwegian krone outperforms G-10 peers alongside the Canadian dollar as oil snaps a two-day run of declines. The Japanese yen lags, halting a four-day rally as an easing of concern over the omicron outbreak damped demand for haven assets. Australia’s dollar strengthens after retail sales beat forecasts. “The Aussie has received a bit of a boost from the strong retail-sales data, but also some bargain hunting in equities with S&P 500 futures trading a little higher,” said David Forrester, a senior foreign-exchange strategist at Credit Agricole CIB in Hong Kong.

In commodities, crude futures rise over 1%. WTI regains a $79-handle, pushing through Monday’s highs. Brent rises through $82. Spot gold adds ~$4 but struggles to make headway through $1,810/oz. Base metals are in the green after a prolonged exchange outage, with LME nickel up over 3%.

Looking at the day ahead, the main highlight will be Fed Chair Powell’s nomination hearing for a second term at the Senate Banking Committee. We’ll also hear from the Fed’s Mester, George and Bullard, along with the ECB’s Kazaks. Data releases include Italian retail sales for November, and in the US there’s the NFIB small business optimism index for December.

Market Snapshot

S&P 500 futures up 0.4% to 4,681.75

STOXX Europe 600 up 1.1% to 484.28

MXAP little changed at 193.02

MXAPJ up 0.2% to 630.48

Nikkei down 0.9% to 28,222.48

Topix down 0.4% to 1,986.82

Hang Seng Index little changed at 23,739.06

Shanghai Composite down 0.7% to 3,567.44

Sensex up 0.3% to 60,584.58

Australia S&P/ASX 200 down 0.8% to 7,390.12

Kospi little changed at 2,927.38

Brent Futures up 1.5% to $82.08/bbl

Gold spot up 0.4% to $1,809.09

U.S. Dollar Index down 0.17% to 95.83

German 10Y yield little changed at -0.06%

Euro up 0.1% to $1.1342

Top Overnight News from Bloomberg

Federal Reserve Chair Jerome Powell said the central bank will prevent higher inflation from becoming entrenched while cautioning that the post-pandemic economy might look different than the previous expansion

Asian stocks and U.S. futures fluctuated Tuesday ahead of a key American inflation reading that’s expected to strengthen the case for tighter monetary policy

Boris Johnson is facing opposition calls for his resignation over an alleged drinks party in his Downing Street office while pandemic curbs were in place, renewing a sense of crisis around the U.K. premier

President Kassym-Jomart Tokayev said Russian-led troops that helped him crush an uprising would begin to leave in two days as he denounced “oligarchic groups” that dominate Kazakhstan’s economy

Top Asian News

Asia Stocks Set to Snap 2-Day Gain as Fed Outlook Hits Tech

Japan’s Household Inflation Expectations Jump to Most Since 2008

Mizuho Set to Appoint New CEO as Technical Glitches Persist

Shimao Downgraded to B- by Fitch on Liquidity Concerns

US Event Calendar

6am: Dec. SMALL BUSINESS OPTIMISM, est. 98.7, prior 98.4

Central Banks

9:12am: Fed’s Mester speaks on Bloomberg Television

9:30am: Fed’s George Discusses the Economic and Policy Outlook

10am: Senate Banking Cmte Holds Hearing on Powell Nomination

4pm: POSTPONED - Fed’s Bullard Discusses Economy and Monetary...

......................

Have a Beautiful Day

.

.

.

.

.

.

.

. . . .

CQs...."Making Mondays Roll"....tonight on "Late-night"

.

.

.

.

Good evening and Welcome to the Captains Quarters "Late-night"

Kick back....Relax and Catch the Vibs as we Roll out and make Monday Night.

Great to see you....

Enjoy

Good Vibrations the Lost Studio Footage

.

.

.

.

.

.

.

.

.

.

.

Jeff Lynne's ELO Roll Over Beethoven

Thanks for being with us tonight

J:D

.

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3....on IHUB

This Night in Rock History . . . .

.

.

.

.

1970 Willy And The Poor Boys by Creedence Clearwater Revival peaks at Number Three on the album chart, where it spends six weeks.

This Day in Financial History

Learn what happened in business in today’s past

January 10:

2000: America Online agrees to purchase Time Warner in a stock swap valued at $156 billion, driving Time Warner stock up by 39% and sending the NASDAQ 100 index up 6% as Wall Street slobbers over the first merger between a "new media" and an "old media" company. "The opportunities are limitless," burbles Time Warner CEO Gerald Levin. Well, the opportunities for losing money are almost limitless: Time Warner stock goes on to lose 90% of its value as the supposedly glorious future of AOL goes up in smoke.

The Wall Street Journal, January 11, 2000, pp. A1, C1; http://media.aoltimewarner.com/media/press_view.cfm?release_num=15100390

1910: Joyce C. Hall, a teenage boy from Norfolk, Nebraska, opens a new business, storing his inventory in a couple of shoeboxes in a room at the YMCA in Kansas City. He begins by selling illustrated postcards by mail-order, but soon he hits on the idea of what he calls "greeting cards." He does $200 in business his first two months, and Hallmark, Inc. is born -- making bad poetry, canned emotion (and, yes, good wishes too) a part of American life.

Hallmark public relations department; http://pressroom.hallmark.com/Hmk_corp_history.html

1901: The Spindletop gusher blows its top on a hill near Beaumont, Texas, as a drill hits an oil deposit 1,006 feet below ground, sending "black gold" spouting 100 feet into the air at the astounding rate of 80,000 barrels per day. It takes nine days to get the well safely capped. Within a year, 285 competing wells have been sunk and some 600 companies have sprung up. Nearly all of them fail. The major survivors: Gulf (originally the J. M. Guffey Petroleum Co.), Mobil (Magnolia Petroleum Co.) and Texaco (the Texas Co.).

http://www.tsha.utexas.edu/handbook/online/articles/view/SS/dos3.html

1870: John D. Rockefeller, Sr. founds The Standard Oil Co. (Ohio) with $1 million in capital and control of a tenth of the nation's oil refining. "The Standard Oil Co.," he says, "will someday refine all the oil and make all the barrels."

Ron Chernow, Titan: The Life of John D. Rockefeller, Sr. (Random House, New York, 1998), p. 132.

.

.

.

.

.

.

. . . .

Andy Schectman Sees What Others Do Not, the Biggest Risk to the Dollar

George Strait - The Weight Of The Badge

Today is National Law Enforcement Appreciation Day

Message from Secretary Mayorkas on Law Enforcement Appreciation Day

January 9, 2022

12:20 pm

Alejandro Mayorkas

Secretary

Colleagues,

Today is National Law Enforcement Appreciation Day. On this day, we take time to express our gratitude, respect, and admiration for those who selflessly and bravely risk their lives to protect and serve our communities and every one of us.

Our Department is home to the greatest number of law enforcement officers in the federal government. Please join me in thanking our law enforcement colleagues for the noble work they perform in service to our nation. The families and loved ones of our law enforcement colleagues deserve our deep appreciation and respect as well. No one serves alone.

All of you who wear the badge – who give so much of yourselves to keep our communities safe – thank you. You bring honor to our Department and to our country.

Alejandro N. Mayorkas

Secretary of Homeland Security

https://www.dhs.gov/employee-resources/blog/2022/01/09/message-secretary-mayorkas-law-enforcement-appreciation-day?utm_source=hp_slideshow&utm_medium=web&utm_campaign=dhsgov

George Strait - The Weight Of The Badge

News Update on James Webb Space Telescope's Full_Deployment

NASA

Experts from the James Webb Space Telescope team discuss the successful completion of the final stage of all major spacecraft deployments to prepare for science operations.

On Sat., Jan. 8, Mission Operations Center ground control at the Space Telescope Science Institute in Baltimore began deploying the second side panel of the primary mirror at 8:53 a.m. EST. Once it extended and latched into position at 1:17 p.m. EST, the team declared all major deployments completed.

It's a dang heartache that gold doesn't finally sail up and away like the James Webb Space Telescope!

Especially when the dollar has lost most all of its purchasing power since the beginning of the last century.

Ray Price's 1959 country hit didn't get 2,294,965 views for nothing.

The plaintiveness of simple country melodies holds a charm for many.

Love the background harmony part to his lead singing.

Price worked on his last album, Last of the Breed, with fellow country music singers Willie Nelson and Merle Haggard. This album was released on March 20, 2007, by the company Lost Highway Records. The two-disc set features 20 country classics as well as a pair of new compositions. The trio toured the U.S. from March 9 until March 25 starting in Arizona and finishing in Illinois. This was Price's third album with Nelson and first album with Haggard. After the tour, Haggard remarked, "I told Willie when it was over, 'That old man gave us a goddamn singing lesson.' He really did. He just sang so good. He sat there with the mic against his chest. And me and Willie are all over the microphone trying to find it, and he found it.

CQs...."Purple Roadhouse True Love"....tonight on...."Late-night"

.

.

.

.

Good evening and Welcome to the Captains Quarters.

Kick-off your weekend with us as we let it roll all night long.

Great to see you !

OK.... grab a refreshment and....Let's Go.........

.

.

.

.

The Doors - Roadhouse Blues, BEST version (live in N.Y. 1970)

.

.

.

.

.

.

.

.

.

.

.

.

Purple Haze (Live at the Atlanta Pop Festival)

.

.

.

.

.

.

.

.

.

.

.

Depeche Mode - Policy Of Truth [Live - from "Touring The Angel: Live In Milan"] (Official Video)

.

.

.

.

.

.

.

.

.

.

.

David Bowie - Modern Love (Live Aid 1985)

.

.

Thanks for being with tonight

Wishing everyone a Great weekend

and Thanks

J:D

.

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3. . . .on IHUB

This Night in Rock History. . . .

.

.

.

.

2007 Olivia Newton-John appears on the first episode of the TV talent search Grease: You're the One That I Want.

Olivia Newton-John + John Travolta - You're the One That I Want.MPG

.

.

.

.

.

.

.

. . . .J:Ds<3LOVENET<3. . . .on IHUB

This Day in Financial History. . . .

.

.

.

.

Learn what happened in business in today’s past

January 07:

1992: Less than 15 months after closing above 500 for the first time, the NASDAQ Composite Index breaks the 600 barrier, finishing the day at 602.29.

http://www.nasdaq.com

1980: Pres. Jimmy Carter signs the Chrysler Corporation Loan Guarantee Act, which makes Uncle Sam stand behind $1.5 billion in loans to keep the desperate carmaker afloat and stave off bankruptcy. Chrysler pays off the loans in full by August, 1983.

http://jimmycarterlibrary.org/documents/diary/1980/d010780t.pdf

1973: In one of economic forecasting's finest moments, the nation's leading experts are unanimous: The bull market has only just begun. The financial editor of The New York Times, Thomas E. Mullaney, intones, "The United States is in the midst of a new economic boom that may prove to be unrivaled in scope, power and influence by any previous expansion in its history." And a renowned forecaster is passionately optimistic: "It's very rare that you can be as unqualifiedly bullish as you can now," declares Alan Greenspan, who runs the consulting firm of Townsend, Greenspan & Co. It's also very rare that anyone has ever been so unqualifiedly wrong: 1973 and 1974 turn out to be the worst years for economic growth and the stock market since the Great Depression.

The New York Times, January 7, 1973, special "Economic Survey" section, pp. 2, 19, 44.

1927: Regular commercial telephone service begins between New York City and London, England, as AT&T begins connecting transoceanic callers by radio.

http://www.research.att.com/history/29atlan.html

1914: The first commercial passage through the Panama Canal is completed, as a French ship, the Alexandre La Valley, emerges from the Pacific locks -- four decades after the canal was first proposed. The shipping distance between New York and San Francisco is now nearly 8,000 miles shorter.

David McCullough, The Path Between the Seas: The Creation of the Panama Canal, 1870-1914 (Simon & Schuster, New York, 1977), p. 607.

1825: The nation's first great nonfinancial IPO is sold, as the Delaware & Hudson Canal Co. goes public at $100 per share. The stock hits $112 that May, slides to $71 over the next three years, then goes on to be a stable growth stock for decades.

Walter Werner and Steven Smith, Wall Street (Columbia University Press, New York, 1991), pp. 88, 90, 92, 251.

1793: The United States Mint becomes a significant enough institution to hire its first security staffer, a watchdog named Nero, which it buys for $3.

http://www.ustreas.gov/education/history/events/01-jan.shtml#7

Morning Markets

.

.

.

.

Futures Rise Ahead Of Jobs Data That Could "Wreak Havoc In Markets"

Friday, Jan 07, 2022 - 08:05 AM

US index futures climbed on Friday, paring this week’s losses fractionally as investors braced for jobs data that should provide clues about the pace of Fed tightening and which is expected to come in strong (whisper number at 502k, above 447k estimate, up from 210K last month; Wednesday’s ADP print was 807k, well above 410k estimate, our full preview is here) but not too strong - remember we now live in a "good news is bad news" world - or else the market will freak out that the Fed will hike even faster than is currently expected. Nasdaq futures also showed signs of recovery after a three-day selloff even as cryptocurrencies crashed again during the Asian session. As of 730am, emini S&P futures were up 4 points or 0.1%, Nasdaq futures were 0.24% higher, or 37 points and Dow futures were unchanged.Treasuries were steady, with the two-year yield heading for the biggest weekly spike since October 2019. Crude oil headed for the longest streak of weekly gains since October on tightening supplies.

U.S. hiring likely more than doubled in December from the previous month to 447,000 new jobs, according to consensus projections for nonfarm payrolls. “A low figure, around 100,000-200,000, wouldn’t change the direction the Fed is preparing to take,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “However, a strong NFP print, and a beat on unemployment rate, have the power of boosting the Fed hawks, on the idea that the jobs market no longer needs the Fed’s support.” That “could wreak havoc in risk markets.”

A surprisingly hawkish stance from the Fed revealed in the latest Minutes roiled financial markets at the start of a new year, with investors reassessing how to price assets in an environment of rising interest rates. The removal of crisis-era accommodation marks a shift not seen in at least three years, a time that also saw a spike in volatility.

“We knew coming into 2022 that the Fed was going to be a creator of volatility within the market and we’re seeing that right out of the gate at the start of the year,” said Lindsey Bell, chief markets and money strategist at Ally. “The good news is that today things seem to be stabilizing a little bit after yesterday’s knee-jerk reaction.”

Comments by regional Fed presidents provided some additional insight Thursday as traders attempted to predict a possible schedule for tightening. St. Louis Fed President James Bullard, a more hawkish policy maker, said in a speech the central bank could raise its target interest rate as soon as March. Meanwhile, San Francisco Fed President Mary Daly said at a virtual event that trimming the Fed balance sheet would come after normalizing the Fed funds rate.

Back to markets, Among meme stocks, GameStop jumped 18% in premarket trading after a report that the gaming retailer plans to launch a marketplace for non-fungible tokens this year. AMC Entertainment gained 6.5%. Discovery Inc. rose in New York premarket trading after BofA Global Research recommended the stock. Cryptocurrency-exposed stocks slip as Bitcoin extended its decline, falling below $42,000, before recovering slightly; the largest token declined as much as 4.9% to $41,008, marking a tumble of about 40% from its record near $69,000 reached Nov. 10. Marathon Digital dropped 1.6% in U.S. premarket, Riot Blockchain -1.3%, MicroStrategy -0.4% In Europe, Safello -4%, Arcane Crypto -5.7%, Northern Data -3.1%. Other notable premarket movers:

GameStop (GME US) shares surge 19% in U.S. premarket trading after the gaming retailer was said to be planning to launch an NFT marketplace.

Kohl’s (KSS US) falls 3.8% in premarket trading after UBS downgrades it to sell and slashes price target to a Wall Street-low on the “challenging” outlook for the stock in 2022 on inflationary pressures.

Cryptocurrency-exposed stocks slip as Bitcoin extends its decline, falling below $42,000, before recovering slightly. Marathon Digital (MARA US) drops 1.6% in U.S. premarket, Riot Blockchain -1.3% (RIOT US), MicroStrategy -0.4% (MSTR US).

Thursday’s court ruling was a “clear win” for Sonos (SONO US), and provides further proof that the firm has industry-leading intellectual property that it can successfully defend, Morgan Stanley (overweight) says. Shares rose 5.7% post-market.

Marin Software (MRIN US) soars 36% in U.S. premarket trading after the marketing software firm announced an integration with Amazon Ads’ demand-side platform. Marin’s market capitalization was about $53m at Thursday’s close.

Duck Creek Technologies’ (DCT US) net new annual recurring revenue is “back to beating,” Barclays (overweight) says. The shares rose 7.7% in postmarket trading after co. boosted its full-year revenue forecast.

Quidel (QDEL US) rose 3% postmarket after the maker of Covid tests reported 4Q preliminary revenue that sailed past expectations.

Armada Hoffler Properties (AHH US) fell 4.7% in premarket after launching a share sale to help pay the cash cost of its previously announced deal for the Exelon Building in Baltimore.

Absci Corp. jumped 48% after announcing a research agreement with Merck & Co.

European equities had a choppy morning, settling flat to small lower as losses for travel and real-estate stocks outweighed gains in the mining industry, pulling the Stoxx Europe 600 Index down 0.3%. The gauge has had a bumpy first week of the year, pulling back from three consecutive record highs. In Milan, STMicroelectronics rose as much as 6.5%, the most since October, after the chipmaker reported higher-than-expected revenue. DAX lagged peers, dropping as much as 0.75%. Most indexes trade around lows for the week. Travel and real estate are the weakest sectors; miners, tech and oil & gas stocks lead to the upside. Here are some of the biggest European movers today:

STMicroelectronics shares rise as much as 6.5% in Milan, the most since Oct. 28, after the chipmaker reported 4Q21 revenue that exceeded projections.

Banca Carige soars as much as 13% amid reports that Cerberus submitted a non-binding offer for the troubled lender.

Lanxess jumps as much as 3.3% to the highest since Nov. 3 after the stock is upgraded to overweight from equal-weight at Barclays, which sees “an attractive set-up” for share outperformance this year.

Aston Martin gains as much as 3.8% after an update from the luxury car-maker that Jefferies (hold) called a “reassuring profit warning.”

Inpost falls as much as 8.6%, reversing early gains, after the firm posted a 4Q and FY operational update. Growth in 4Q parcel volumes was 1% below Jefferies’ estimates, writes analyst David Kerstens (buy).

Evolution drops as much as 6.2% after Berenberg says the market is “overly optimistic” about the Swedish online gambling giant’s top-line growth prospects, initiating with a hold rating on the stock.

M&C Saatchi falls as much as 12%, the most intraday since July 2020, erasing some of the gains since the Jan. 5 announcement that AdvancedAdvT acquired a stake. The drop came after AdvancedAdvT said it’s interested in exploring a share- exchange merger.

C&C falls as much as 5.8% after the Irish cider maker said performance was behind expectations in December due to the latest U.K. and Ireland measures to control the spread of Covid-19.

Consumer prices in the euro area jumped a record 5% from a year earlier in December, adding pressure on the ECB to join a growing legion of central banks from the Fed to the Bank of England in tightening monetary conditions.