Friday, January 28, 2022 8:26:06 AM

Morning Markets....

.

.

.

.

Neurotic Futures Tumble Despite Record Apple Quarter

by Tyler Durden

Friday, Jan 28, 2022 - 08:07 AM

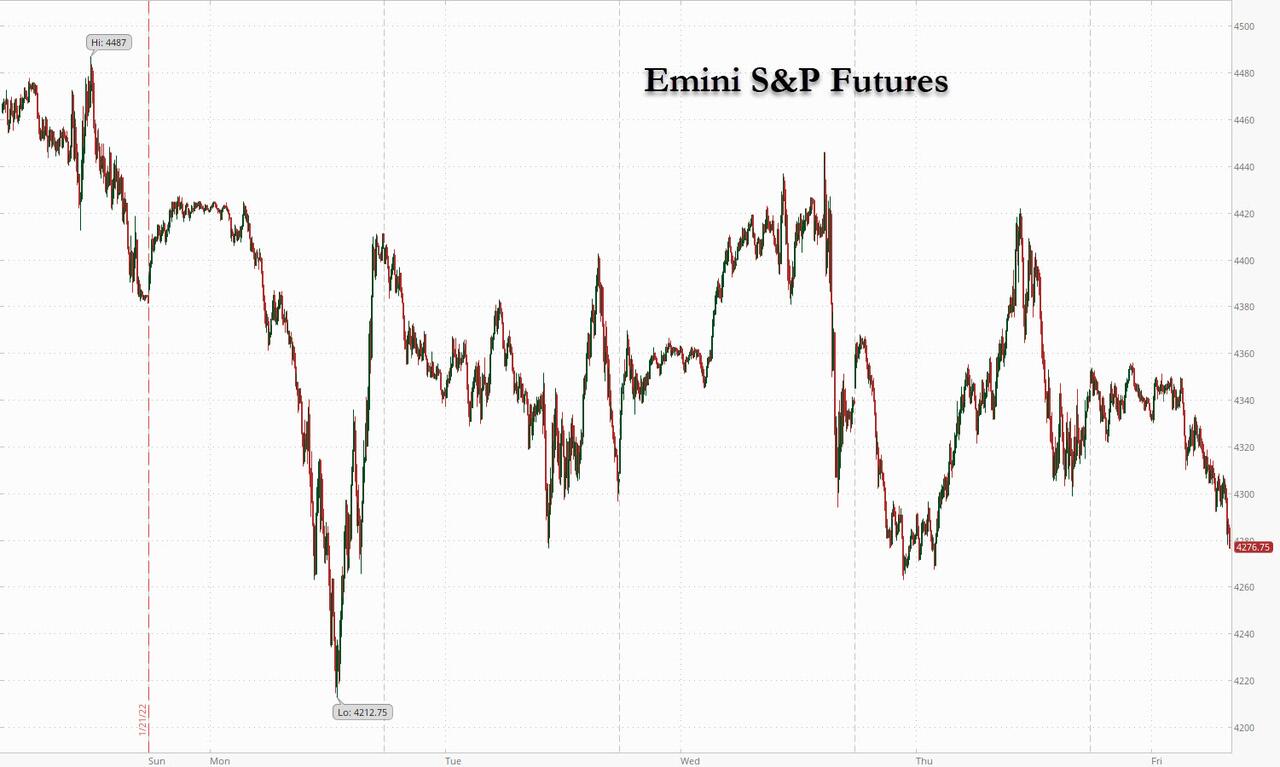

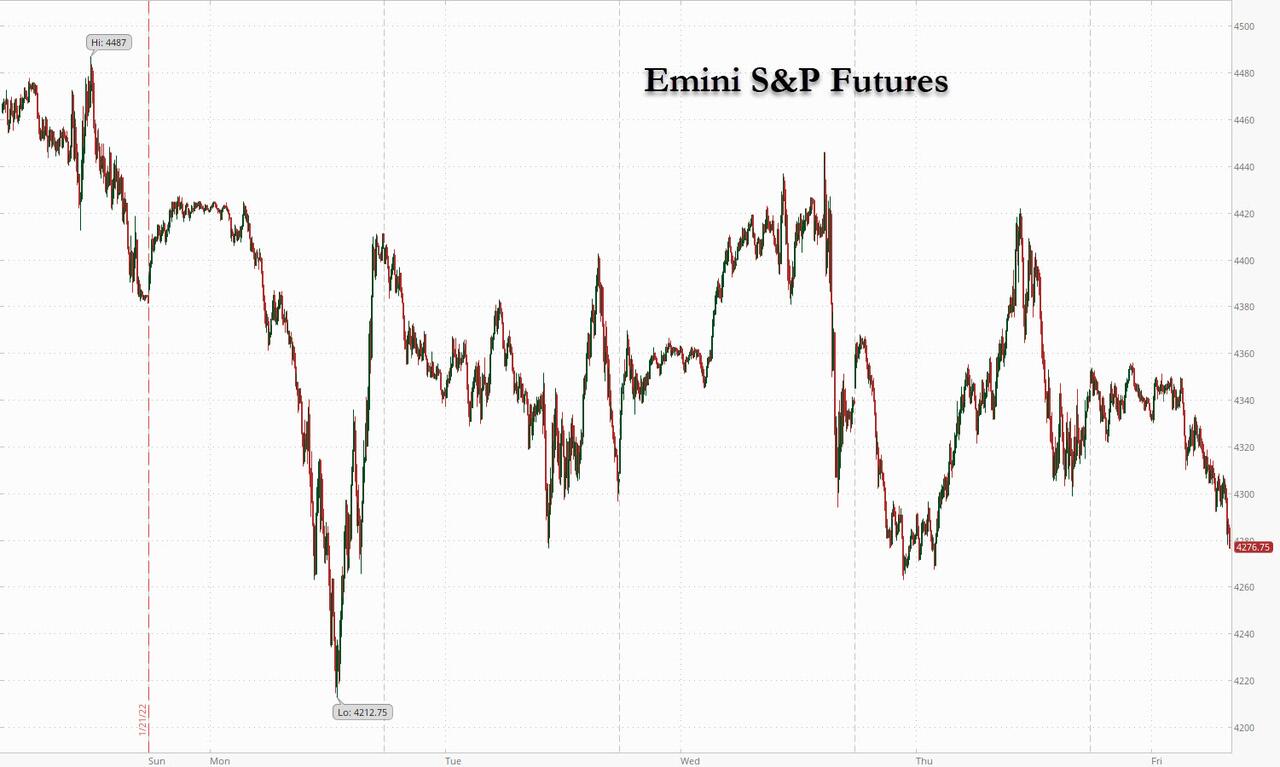

If you thought that yesterday's blowout, record earnings from Apple would be enough to put in at least a brief bottom to stocks and stop the ongoing collapse in risk assets, we have some bad news for you: after staging a feeble bounce overnight, S&P futures erased earlier gains as traders ignored the solid results from Apple and instead focused on the risk of higher interest rates hurting economic growth. Contracts in S&P 500 dropped as negative sentiment continued to prevail, while Nasdaq 100 futures erased earlier gains after strong Apple earnings. As of 730am, Emini futures were down 48 points or 1.12% to 4,269, Dow futures were down 335 points or 0.99% and Nasdaq futs were down 77 or 0.6%. The dollar was set for a fifth straight day of gains, the longest streak since November, 19Y TSY yields were up 3bps to 1.83%, gold and bitcoin both dropped.

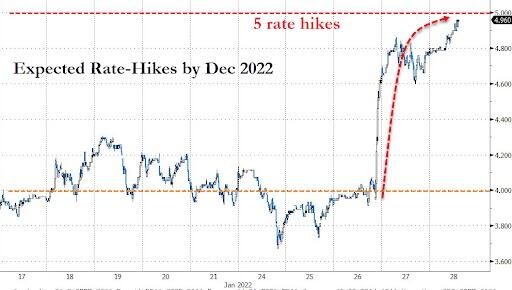

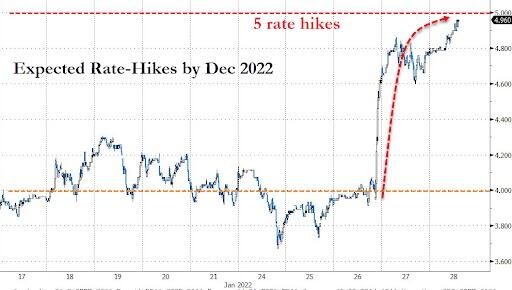

Markets have been whiplashed by volatility this week as the Federal Reserve signaled aggressive tightening, adding to investor concerns about geopolitical tensions and an uneven earnings season. Also sapping sentiment on Friday were weak data on the German economy and euro-area confidence. Meanwhile, geopolitical tensions were still on the agenda with a potential conflict in Ukraine not yet defused.

“Market expectations for four to five rate hikes this year will not derail growth or the equity rally,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “We expect an eventual relaxation of tensions between Russia and Ukraine,” he added. Expected data on Friday include personal income and spending data, as well as University of Michigan Sentiment, while Caterpillar, Chevron, Colgate-Palmolive, VF Corp and Weyerhaeuser are among companies reporting earnings.

Money markets are now pricing in nearly five Fed hikes this year after a hawkish stance from Chair Jerome Powell. That’s up from three expected as recently as December.

“Tighter liquidity and weaker growth mean higher volatility,” Barclays Plc strategists led by Emmanuel Cau wrote in a note. The “current growth scare looks like a classic mid-cycle phase to us, while a lot of hawkishness is priced in.”

In premarket trading, Apple shares rose 4.5% as analysts rose their targets to some of the most bullish on the Street, after the iPhone maker reported EPS and revenue for the fiscal first quarter that beat the average analyst estimates. Watch Apple’s U.S. suppliers after the iPhone maker posted record quarterly sales that beat analyst estimates, a sign it was able to work through the supply-chain crunch. Peers in Asia rose, while European suppliers are active in early trading. Tesla shares also rise as much as 2% in premarket, set to rebound from yesterday’s 12% slump following a disappointing set of earnings and outlook. Other notable premarket movers:

Visa (V US) shares gain 5% premarket after company reported adjusted earnings per share for the first quarter that beat the average analyst estimate.

Cryptocurrency-exposed stocks gain as Bitcoin and other digital tokens rise. Riot Blockchain (RIOT US) +3.7%, Marathon Digital (MARA US) +3.3%, Bit Digital (BTBT US) +1.6%, Coinbase (COIN US) +0.5%.

Robinhood (HOOD US) shares tumbled 14% in premarket after the online brokerage’s fourth-quarter revenue and first-quarter outlook missed estimates. Some analysts cut their price targets.

Atlassian (TEAM US) shares jump 10% in extended trading on Thursday, after the software company reported second-quarter results that beat expectations and gave a third-quarter revenue forecast that was ahead of the analyst consensus.

U.S. Steel (X US) shares fall as much as 2.4% aftermarket following the steelmaker’s earnings release, which showed adjusted earnings per share results missed the average analyst estimate.

The U.S. stock market is priced “quite aggressively” versus other developed nations as well as emerging markets, and valuations in the latter can be a tailwind rather than a headwind as in the U.S., Feifei Li, partner and CIO of equity strategies at Research Affiliates, said on Bloomberg Television.

European equity indexes are again under pressure, rounding off a miserable week, and set for the worst monthly decline since October 2020 as corporate earnings failed to lift the mood except in the retail sector. The Euro Stoxx 50 dropped over 1.5%, DAX underperforming at the margin. Autos, tech and banks are the weakest Stoxx 600 sectors; only retailers are in the green. Hennes & Mauritz shares climbed on a profit beat, while technology stocks continued to underperform. Here are some of the biggest European movers today:

LVMH shares rise as much as 5.8% after analysts praised the French conglomerate’s full-year results, with several noting improved performance at even minor brands such as Celine.

Signify gains as much as 15% after saying it expects to grow in 2022 even as the supply chain problems that caused its “worst ever” quarter continue.

H&M climbs as much as 7.4% after posting a strong margin in 4Q which impressed analysts. Analysts also lauded the Swedish retailer’s buyback announcement and target to double sales by 2030.

Stora Enso rises as much as 6.2% on 4Q earnings with the CEO noting paper capacity closures have helped boost its pricing power, contributing to a turnaround in the unprofitable business.

SCA gains as much as 5.5% in Stockholm, the most since May 2020, after reporting better-than-expected Ebitda earnings and announcing a SEK3.25/share dividend -- higher than analysts had estimated.

AutoStore rises as much as 18% after a German court halts Ocado’s case against the company. Ocado drops as much as 8.1%.

Henkel slides as much as 10% after the company’s forecast for organic revenue growth of 2% to 4% in 2022 was seen as cautious.

Wartsila falls as much as 9% after posting 4Q earnings that analysts say showed strong order intake overshadowed by lagging margins.

Alstom drops as much as 7.3% after Exane BNP Paribas downgrades to neutral, citing risk that the company might resort to raising equity financing to forestall a possible credit-rating cut.

Earlier in the session, Asian stocks rose after slumping to their lowest since November 2020, with Japan and Australia leading the rebound as turbulence over the highly anticipated U.S. monetary tightening eased. The MSCI Asia Pacific Index climbed as much as 1% on Friday following a 2.7% slide the day before. Industrials and consumer-discretionary names provided the biggest boosts to the measure. Japan’s Nikkei 225 Stock Average was among the best performers in the region after enduring its worst daily drop in seven months. “It’s undeniable that stock markets last year -- as well as the real economy -- were supported by continued monetary easing, considering which, more share-price correction could be anticipated,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management in Tokyo. Even so, “stocks fell too much yesterday.” The Asian benchmark is down almost 5% this week, and set to cap its biggest such drop since February last year. Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle inflation, triggering a broad selloff in global equities Thursday. Japan’s Topix and Australia’s S&P/ASX 200 gained after slipping into technical correction earlier this week. South Korea’s Kospi also added almost 2% after sliding into a bear market Thursday. Meanwhile, Chinese shares extended a rout of nearly $1.2 trillion this month.

Japanese equities rose, trimming their worst weekly loss in two months, as some observers saw the selloff on concerns over higher U.S. interest rates as having gone too far. Electronics and auto makers were the biggest boosts to the Topix, which rose 1.9%, paring its weekly decline to 2.6%. Fast Retailing and Shin-Etsu Chemical were the largest contributors to a 2.1% rise in the Nikkei 225. The yen was little changed after weakening 1.3% against the dollar over the previous two sessions. “Looking at the technical indicators like RSI, you can see that Japanese equities have been oversold,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities. “Shares have fallen too much considering the not-bad corporate earnings and also when compared with U.S. equities.” U.S. futures rallied in Asian trading hours, after a volatile cash session that ended in losses as investors continued to reprice assets on the Fed’s pivot to tighter policy. Apple provided a post-market lift with record quarterly sales that sailed past Wall Street estimates.

In Australia, the S&P/ASX 200 index rose 2.2% to 6,988.10 at the close in Sydney, bouncing back after slipping into a technical correction on Thursday. The benchmark gained for its first session in five as miners and banks rallied, trimming its weekly slide to 2.6%. Champion Iron was a top performer after its 3Q results. Newcrest was one of the worst performers after its 2Q production report, and as gold extended declines. In New Zealand, the S&P/NZX 50 index fell 1.6% to 11,852.15.

India’s benchmark index edged lower on Friday to extend its decline to a second consecutive week as investors grapple with volatility created by the U.S. Federal Reserve’s rate-hike plan. The S&P BSE Sensex fell 0.1% to 57,200.23 in Mumbai on Friday, erasing gains of as much as 1.4% earlier in the session. The NSE Nifty 50 Index ended flat. For the week, the key gauges ended with declines of 3.1% and 2.9%, respectively. All but five of the 19 sector sub-indexes compiled by BSE Ltd. climbed on Friday, led by a measure of health-care companies. BSE’s mid- and small-sized companies’ indexes outperformed the benchmark by rising 1% and 1.1%. “Selling pressure has now cooled off, markets will now focus on local triggers such as expectations from the budget,” said Prashant Tapse, an analyst with Mumbai-based Mehta Equities. Investors will also monitor corporate-earnings reports for the December quarter to gauge demand and inflation outlook. Of the 21 Nifty 50 companies that have announced results so far, 12 either met or exceeded expectations, eight missed, while one can’t be compared. Kotak Mahindra Bank continued the strong earnings run by lenders, reporting fiscal third-quarter profit ahead of the consensus view, while Dr. Reddy’s Laboratories missed the consensus estimate. ICICI Bank contributed the most to the Sensex’s decline, falling 1.6%. Out of 30 shares in the Sensex index, 14 rose and 16 fell.

In rates, bonds trade poorly again with gilts and USTs bear steepening, cheapening 3-3.5bps across the back end. Treasuries are weaker, same as most European bond markets, with stock markets under pressure globally and S&P 500 futures lower but inside weekly range. Treasury yields are cheaper by 4bp-5bp from intermediate to long-end sectors, 10-year around 1.84%, inside weekly range; though front-end outperforms, 2-year yield reaches YTD high 1.22%, steepening 2s10s by ~1bp. Gilts underperformed as traders price in a more aggressive path of rate hikes from the BOE. Treasury curve is steeper for first day in four, lifting spreads from multimonth lows. Globally in 10-year sector, gilts lag Treasuries by 0.5bp while bunds outperform slightly. Bunds bear flatten with 5s30s near 52bps after two block trades but subsequently recover above 54bps. IG dollar issuance slate empty so far; Procter & Gamble priced a $1.85b two-tranche offering Thursday, the first since Wednesday’s Fed meeting.

In FX, Bloomberg Dollar Spot pushes to best levels for the week. Scandies and commodity currencies suffer the most. The Bloomberg Dollar Spot Index was set for a fifth straight day of gains, the longest streak since November, and near its strongest level in 17 months as the greenback was steady or higher against all of its Group-of-10 peers. The euro steadied near a European session low of $1.1121 while risk-sensitive Australian and Scandinavian currencies led the decline. Sweden’s krona sank, despite data showing the Nordic nation’s economy grew more than expected in the final quarter of 2021, fueling speculation that the central bank could soon start to take its foot off the stimulus pedal. Australia’s dollar dropped to the lowest level in 18 months as the Reserve Bank of Australia lags behind many of its peers in signaling monetary tightening. Treasuries sold off, led by the belly; Bunds also traded lower, yet outperformed Treasuries, and Germany’s 5s30s curve flattened to 52bps after two futures blocks traded. Italian government bonds underperformed with the nation’s parliament voting twice on Friday to elect a new president, as the lack of progress after four days of inconclusive ballots adds to pressure to end a process that’s left the country in limbo.

In commodities, Crude futures hold a narrow range, just shy of Asia’s best levels. WTI trades either side of $87, Brent just shy of a $90-handle. Spot gold drops near Thursday’s lows, close to $1,791/oz. Base metals are under pressure; LME copper underperforms peers, dropping over 1.5%.

Crypto markets were rangebound in which Bitcoin traded both sides of the 37,000 level. Russia's government drafted a roadmap for cryptocurrency regulation, according to RBC.

To the day ahead now, and data releases include Germany’s Q4 GDP, US personal income and personal spending for December, as well as the Q4 employment cost index and the University of Michigan’s final consumer sentiment index for January. Earnings releases include Chevron and Caterpillar.

Market Snapshot

S&P 500 futures up 0.1% to 4,323.75

STOXX Europe 600 down 1.0% to 465.51

MXAP up 0.5% to 182.48

MXAPJ little changed at 597.31

Nikkei up 2.1% to 26,717.34

Topix up 1.9% to 1,876.89

Hang Seng Index down 1.1% to 23,550.08

Shanghai Composite down 1.0% to 3,361.44

Sensex down 0.1% to 57,197.94

Australia S&P/ASX 200 up 2.2% to 6,988.14

Kospi up 1.9% to 2,663.34

Brent Futures up 0.4% to $89.71/bbl

Gold spot down 0.3% to $1,792.52

U.S. Dollar Index up 0.13% to 97.38

German 10Y yield little changed at -0.05%

Euro down 0.1% to $1.1132

Top Overnight News from Bloomberg

The euro-area economy kicked off 2022 on a weak footing, with pandemic restrictions taking a toll on confidence and growing fears that Germany may be on the brink of a recession for the second time since the crisis began. A sentiment gauge by the European Commission fell to 112.7 in January, the lowest in nine months, driven by declines in most sectors and among consumers. Employment expectations dropped for a second month

Germany’s economy shrank 0.7% in the fourth quarter with consumers spooked by another wave of Covid-19 infections and factories reeling from supply-chain problems.

Governor Haruhiko Kuroda said the Bank of Japan won’t be switching its bond yield target until inflation rises high enough to warrant exit talks

Seven straight jumps in the so- called “fear gauge” for the S&P 500 is a signal that it may be time to wager against volatility, if history is any guide. Only 10 times in the past two decades has the Cboe Volatility Index - - better known as the VIX -- risen for that many trading sessions in a row

A more detailed look at global markets courtesy of Newsquawk

Asian stocks eventually traded mixed although China lagged ahead of holiday closures next week. ASX 200 (+2.2%) was lifted back up from correction territory. Nikkei 225 (+2.1%) gained on a weaker currency and with corporate results driving the biggest movers. KOSPI (+1.9%) was boosted by earnings including from the world's second-largest memory chipmaker SK Hynix. Hang Seng (-1.1%%) and Shanghai Comp. (-0.9%) lagged with a non-committal tone in the mainland ahead of the Lunar New Year holiday closures and with Hong Kong pressured by losses in blue chip tech and health care

Top Asian News

Asia Stocks Rise, Still Head for Worst Week Since February

Kuroda Hints No Chance of Switching Yield Target Until Exit

China Fintech PingPong Said to Mull $1 Billion Hong Kong IPO

Biogen Sells Bioepis Stake for $2.3 Billion to Samsung Biologics

European bourses have conformed to the downbeat APAC handover with losses in the region extending following the cash open, Euro Stoxx 50 -1.7%. Sectors were mixed with Tech and Banking names the laggards while Personal/Household Goods and Retail outperformer following LVMH and H&M respectively; since then, performance has deteriorated though the above skew remains intact. US futures are moving in tandem with European-peers; however, magnitudes are more contained as the ES is only modestly negative and NQ continues to cling onto positive territory following Apple earnings. Apple Inc (AAPL) Q1 2022 (USD): EPS 2.10 (exp. 1.89), Revenue 123.95bln (exp. 118.66bln), iPhone: 71.63 bln (exp. 68.34bln), iPad: 7.25bln (exp. 8.18bln), Mac: 10.85bln (exp. 9.51bln), Services: 19.52bln (exp. 18.61 bln), according to Businesswire. +3.5% in the pre-market, trimming from gains in excess of 5.0% earlier

Top European News

German Economy Contracted Amid Tighter Virus Curbs, Supply Snags

H&M CEO Sets Target to Double Retailer’s Sales by 2030

Telia Sells Tower Stake for $582 Million, Cuts Costs

U.K. ‘Partygate’ Probe May Be Watered Down at Police Request

In FX, buck bull run continues as DXY takes out another July 2020 high to leave just 97.500 in front of key Fib resistance. Aussie feels the heat of Greenback strength more than others amidst risk-off positioning and caution ahead of next week’s RBA policy meeting. Kiwi also lagging and Loonie losing crude support after the BoC’s hawkish hold midweek. Euro and Yen reliant on some hefty option expiry interest to provide protection from Dollar domination. BoJ Governor Kurdoa if times come to debate the exit of policy, then targeting shorter maturity JGBs could become an option; at this stage its premature to raise yield target or take steps to steepen yield curve.

In commodities, WTI and Brent are consolidating somewhat after yesterday's choppy price action, but remain towards the lowend

of a circa. USD 1.00/bbl range. Focus remains firmly on geopols as Russia is set to speak with French and German officials on Friday, though rhetoric, remains relatively familiar. Spot gold and silver are pressured as the yellow metal loses the 100-DMA, and drops to circa. USD 1780/oz as the USD rallies, and ahead of inflation data while LME copper follows the equity downside.

US Event Calendar

8:30am: 4Q Employment Cost Index, est. 1.2%, prior 1.3%

8:30am: Dec. Personal Income, est. 0.5%, prior 0.4%

Dec. PCE Core Deflator YoY, est. 4.8%, prior 4.7%; PCE Core Deflator MoM, est. 0.5%, prior 0.5%

Dec. PCE Deflator YoY, est. 5.8%, prior 5.7%; PCE Deflator MoM, est. 0.4%, prior 0.6%

8:30am: Dec. Personal Spending, est. -0.6%, prior 0.6%; Real Personal Spending, est. -1.1%, prior 0%

10am: Jan. U. of Mich. Sentiment, est. 68.8, prior 68.8

Current Conditions, est. 73.2, prior 73.2; Expectations, est. 65.9, prior 65.9

1 Yr Inflation, est. 4.9%, prior 4.9%; U. of Mich. 5-10 Yr Inflation, prior 3.1%

......................

Have a Nice Weekend

Irregularities in the Pension Fund (Window Scene)

.

.

.

.

.

.

. . . .

.

.

.

.

Neurotic Futures Tumble Despite Record Apple Quarter

by Tyler Durden

Friday, Jan 28, 2022 - 08:07 AM

If you thought that yesterday's blowout, record earnings from Apple would be enough to put in at least a brief bottom to stocks and stop the ongoing collapse in risk assets, we have some bad news for you: after staging a feeble bounce overnight, S&P futures erased earlier gains as traders ignored the solid results from Apple and instead focused on the risk of higher interest rates hurting economic growth. Contracts in S&P 500 dropped as negative sentiment continued to prevail, while Nasdaq 100 futures erased earlier gains after strong Apple earnings. As of 730am, Emini futures were down 48 points or 1.12% to 4,269, Dow futures were down 335 points or 0.99% and Nasdaq futs were down 77 or 0.6%. The dollar was set for a fifth straight day of gains, the longest streak since November, 19Y TSY yields were up 3bps to 1.83%, gold and bitcoin both dropped.

Markets have been whiplashed by volatility this week as the Federal Reserve signaled aggressive tightening, adding to investor concerns about geopolitical tensions and an uneven earnings season. Also sapping sentiment on Friday were weak data on the German economy and euro-area confidence. Meanwhile, geopolitical tensions were still on the agenda with a potential conflict in Ukraine not yet defused.

“Market expectations for four to five rate hikes this year will not derail growth or the equity rally,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “We expect an eventual relaxation of tensions between Russia and Ukraine,” he added. Expected data on Friday include personal income and spending data, as well as University of Michigan Sentiment, while Caterpillar, Chevron, Colgate-Palmolive, VF Corp and Weyerhaeuser are among companies reporting earnings.

Money markets are now pricing in nearly five Fed hikes this year after a hawkish stance from Chair Jerome Powell. That’s up from three expected as recently as December.

“Tighter liquidity and weaker growth mean higher volatility,” Barclays Plc strategists led by Emmanuel Cau wrote in a note. The “current growth scare looks like a classic mid-cycle phase to us, while a lot of hawkishness is priced in.”

In premarket trading, Apple shares rose 4.5% as analysts rose their targets to some of the most bullish on the Street, after the iPhone maker reported EPS and revenue for the fiscal first quarter that beat the average analyst estimates. Watch Apple’s U.S. suppliers after the iPhone maker posted record quarterly sales that beat analyst estimates, a sign it was able to work through the supply-chain crunch. Peers in Asia rose, while European suppliers are active in early trading. Tesla shares also rise as much as 2% in premarket, set to rebound from yesterday’s 12% slump following a disappointing set of earnings and outlook. Other notable premarket movers:

Visa (V US) shares gain 5% premarket after company reported adjusted earnings per share for the first quarter that beat the average analyst estimate.

Cryptocurrency-exposed stocks gain as Bitcoin and other digital tokens rise. Riot Blockchain (RIOT US) +3.7%, Marathon Digital (MARA US) +3.3%, Bit Digital (BTBT US) +1.6%, Coinbase (COIN US) +0.5%.

Robinhood (HOOD US) shares tumbled 14% in premarket after the online brokerage’s fourth-quarter revenue and first-quarter outlook missed estimates. Some analysts cut their price targets.

Atlassian (TEAM US) shares jump 10% in extended trading on Thursday, after the software company reported second-quarter results that beat expectations and gave a third-quarter revenue forecast that was ahead of the analyst consensus.

U.S. Steel (X US) shares fall as much as 2.4% aftermarket following the steelmaker’s earnings release, which showed adjusted earnings per share results missed the average analyst estimate.

The U.S. stock market is priced “quite aggressively” versus other developed nations as well as emerging markets, and valuations in the latter can be a tailwind rather than a headwind as in the U.S., Feifei Li, partner and CIO of equity strategies at Research Affiliates, said on Bloomberg Television.

European equity indexes are again under pressure, rounding off a miserable week, and set for the worst monthly decline since October 2020 as corporate earnings failed to lift the mood except in the retail sector. The Euro Stoxx 50 dropped over 1.5%, DAX underperforming at the margin. Autos, tech and banks are the weakest Stoxx 600 sectors; only retailers are in the green. Hennes & Mauritz shares climbed on a profit beat, while technology stocks continued to underperform. Here are some of the biggest European movers today:

LVMH shares rise as much as 5.8% after analysts praised the French conglomerate’s full-year results, with several noting improved performance at even minor brands such as Celine.

Signify gains as much as 15% after saying it expects to grow in 2022 even as the supply chain problems that caused its “worst ever” quarter continue.

H&M climbs as much as 7.4% after posting a strong margin in 4Q which impressed analysts. Analysts also lauded the Swedish retailer’s buyback announcement and target to double sales by 2030.

Stora Enso rises as much as 6.2% on 4Q earnings with the CEO noting paper capacity closures have helped boost its pricing power, contributing to a turnaround in the unprofitable business.

SCA gains as much as 5.5% in Stockholm, the most since May 2020, after reporting better-than-expected Ebitda earnings and announcing a SEK3.25/share dividend -- higher than analysts had estimated.

AutoStore rises as much as 18% after a German court halts Ocado’s case against the company. Ocado drops as much as 8.1%.

Henkel slides as much as 10% after the company’s forecast for organic revenue growth of 2% to 4% in 2022 was seen as cautious.

Wartsila falls as much as 9% after posting 4Q earnings that analysts say showed strong order intake overshadowed by lagging margins.

Alstom drops as much as 7.3% after Exane BNP Paribas downgrades to neutral, citing risk that the company might resort to raising equity financing to forestall a possible credit-rating cut.

Earlier in the session, Asian stocks rose after slumping to their lowest since November 2020, with Japan and Australia leading the rebound as turbulence over the highly anticipated U.S. monetary tightening eased. The MSCI Asia Pacific Index climbed as much as 1% on Friday following a 2.7% slide the day before. Industrials and consumer-discretionary names provided the biggest boosts to the measure. Japan’s Nikkei 225 Stock Average was among the best performers in the region after enduring its worst daily drop in seven months. “It’s undeniable that stock markets last year -- as well as the real economy -- were supported by continued monetary easing, considering which, more share-price correction could be anticipated,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management in Tokyo. Even so, “stocks fell too much yesterday.” The Asian benchmark is down almost 5% this week, and set to cap its biggest such drop since February last year. Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle inflation, triggering a broad selloff in global equities Thursday. Japan’s Topix and Australia’s S&P/ASX 200 gained after slipping into technical correction earlier this week. South Korea’s Kospi also added almost 2% after sliding into a bear market Thursday. Meanwhile, Chinese shares extended a rout of nearly $1.2 trillion this month.

Japanese equities rose, trimming their worst weekly loss in two months, as some observers saw the selloff on concerns over higher U.S. interest rates as having gone too far. Electronics and auto makers were the biggest boosts to the Topix, which rose 1.9%, paring its weekly decline to 2.6%. Fast Retailing and Shin-Etsu Chemical were the largest contributors to a 2.1% rise in the Nikkei 225. The yen was little changed after weakening 1.3% against the dollar over the previous two sessions. “Looking at the technical indicators like RSI, you can see that Japanese equities have been oversold,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities. “Shares have fallen too much considering the not-bad corporate earnings and also when compared with U.S. equities.” U.S. futures rallied in Asian trading hours, after a volatile cash session that ended in losses as investors continued to reprice assets on the Fed’s pivot to tighter policy. Apple provided a post-market lift with record quarterly sales that sailed past Wall Street estimates.

In Australia, the S&P/ASX 200 index rose 2.2% to 6,988.10 at the close in Sydney, bouncing back after slipping into a technical correction on Thursday. The benchmark gained for its first session in five as miners and banks rallied, trimming its weekly slide to 2.6%. Champion Iron was a top performer after its 3Q results. Newcrest was one of the worst performers after its 2Q production report, and as gold extended declines. In New Zealand, the S&P/NZX 50 index fell 1.6% to 11,852.15.

India’s benchmark index edged lower on Friday to extend its decline to a second consecutive week as investors grapple with volatility created by the U.S. Federal Reserve’s rate-hike plan. The S&P BSE Sensex fell 0.1% to 57,200.23 in Mumbai on Friday, erasing gains of as much as 1.4% earlier in the session. The NSE Nifty 50 Index ended flat. For the week, the key gauges ended with declines of 3.1% and 2.9%, respectively. All but five of the 19 sector sub-indexes compiled by BSE Ltd. climbed on Friday, led by a measure of health-care companies. BSE’s mid- and small-sized companies’ indexes outperformed the benchmark by rising 1% and 1.1%. “Selling pressure has now cooled off, markets will now focus on local triggers such as expectations from the budget,” said Prashant Tapse, an analyst with Mumbai-based Mehta Equities. Investors will also monitor corporate-earnings reports for the December quarter to gauge demand and inflation outlook. Of the 21 Nifty 50 companies that have announced results so far, 12 either met or exceeded expectations, eight missed, while one can’t be compared. Kotak Mahindra Bank continued the strong earnings run by lenders, reporting fiscal third-quarter profit ahead of the consensus view, while Dr. Reddy’s Laboratories missed the consensus estimate. ICICI Bank contributed the most to the Sensex’s decline, falling 1.6%. Out of 30 shares in the Sensex index, 14 rose and 16 fell.

In rates, bonds trade poorly again with gilts and USTs bear steepening, cheapening 3-3.5bps across the back end. Treasuries are weaker, same as most European bond markets, with stock markets under pressure globally and S&P 500 futures lower but inside weekly range. Treasury yields are cheaper by 4bp-5bp from intermediate to long-end sectors, 10-year around 1.84%, inside weekly range; though front-end outperforms, 2-year yield reaches YTD high 1.22%, steepening 2s10s by ~1bp. Gilts underperformed as traders price in a more aggressive path of rate hikes from the BOE. Treasury curve is steeper for first day in four, lifting spreads from multimonth lows. Globally in 10-year sector, gilts lag Treasuries by 0.5bp while bunds outperform slightly. Bunds bear flatten with 5s30s near 52bps after two block trades but subsequently recover above 54bps. IG dollar issuance slate empty so far; Procter & Gamble priced a $1.85b two-tranche offering Thursday, the first since Wednesday’s Fed meeting.

In FX, Bloomberg Dollar Spot pushes to best levels for the week. Scandies and commodity currencies suffer the most. The Bloomberg Dollar Spot Index was set for a fifth straight day of gains, the longest streak since November, and near its strongest level in 17 months as the greenback was steady or higher against all of its Group-of-10 peers. The euro steadied near a European session low of $1.1121 while risk-sensitive Australian and Scandinavian currencies led the decline. Sweden’s krona sank, despite data showing the Nordic nation’s economy grew more than expected in the final quarter of 2021, fueling speculation that the central bank could soon start to take its foot off the stimulus pedal. Australia’s dollar dropped to the lowest level in 18 months as the Reserve Bank of Australia lags behind many of its peers in signaling monetary tightening. Treasuries sold off, led by the belly; Bunds also traded lower, yet outperformed Treasuries, and Germany’s 5s30s curve flattened to 52bps after two futures blocks traded. Italian government bonds underperformed with the nation’s parliament voting twice on Friday to elect a new president, as the lack of progress after four days of inconclusive ballots adds to pressure to end a process that’s left the country in limbo.

In commodities, Crude futures hold a narrow range, just shy of Asia’s best levels. WTI trades either side of $87, Brent just shy of a $90-handle. Spot gold drops near Thursday’s lows, close to $1,791/oz. Base metals are under pressure; LME copper underperforms peers, dropping over 1.5%.

Crypto markets were rangebound in which Bitcoin traded both sides of the 37,000 level. Russia's government drafted a roadmap for cryptocurrency regulation, according to RBC.

To the day ahead now, and data releases include Germany’s Q4 GDP, US personal income and personal spending for December, as well as the Q4 employment cost index and the University of Michigan’s final consumer sentiment index for January. Earnings releases include Chevron and Caterpillar.

Market Snapshot

S&P 500 futures up 0.1% to 4,323.75

STOXX Europe 600 down 1.0% to 465.51

MXAP up 0.5% to 182.48

MXAPJ little changed at 597.31

Nikkei up 2.1% to 26,717.34

Topix up 1.9% to 1,876.89

Hang Seng Index down 1.1% to 23,550.08

Shanghai Composite down 1.0% to 3,361.44

Sensex down 0.1% to 57,197.94

Australia S&P/ASX 200 up 2.2% to 6,988.14

Kospi up 1.9% to 2,663.34

Brent Futures up 0.4% to $89.71/bbl

Gold spot down 0.3% to $1,792.52

U.S. Dollar Index up 0.13% to 97.38

German 10Y yield little changed at -0.05%

Euro down 0.1% to $1.1132

Top Overnight News from Bloomberg

The euro-area economy kicked off 2022 on a weak footing, with pandemic restrictions taking a toll on confidence and growing fears that Germany may be on the brink of a recession for the second time since the crisis began. A sentiment gauge by the European Commission fell to 112.7 in January, the lowest in nine months, driven by declines in most sectors and among consumers. Employment expectations dropped for a second month

Germany’s economy shrank 0.7% in the fourth quarter with consumers spooked by another wave of Covid-19 infections and factories reeling from supply-chain problems.

Governor Haruhiko Kuroda said the Bank of Japan won’t be switching its bond yield target until inflation rises high enough to warrant exit talks

Seven straight jumps in the so- called “fear gauge” for the S&P 500 is a signal that it may be time to wager against volatility, if history is any guide. Only 10 times in the past two decades has the Cboe Volatility Index - - better known as the VIX -- risen for that many trading sessions in a row

A more detailed look at global markets courtesy of Newsquawk

Asian stocks eventually traded mixed although China lagged ahead of holiday closures next week. ASX 200 (+2.2%) was lifted back up from correction territory. Nikkei 225 (+2.1%) gained on a weaker currency and with corporate results driving the biggest movers. KOSPI (+1.9%) was boosted by earnings including from the world's second-largest memory chipmaker SK Hynix. Hang Seng (-1.1%%) and Shanghai Comp. (-0.9%) lagged with a non-committal tone in the mainland ahead of the Lunar New Year holiday closures and with Hong Kong pressured by losses in blue chip tech and health care

Top Asian News

Asia Stocks Rise, Still Head for Worst Week Since February

Kuroda Hints No Chance of Switching Yield Target Until Exit

China Fintech PingPong Said to Mull $1 Billion Hong Kong IPO

Biogen Sells Bioepis Stake for $2.3 Billion to Samsung Biologics

European bourses have conformed to the downbeat APAC handover with losses in the region extending following the cash open, Euro Stoxx 50 -1.7%. Sectors were mixed with Tech and Banking names the laggards while Personal/Household Goods and Retail outperformer following LVMH and H&M respectively; since then, performance has deteriorated though the above skew remains intact. US futures are moving in tandem with European-peers; however, magnitudes are more contained as the ES is only modestly negative and NQ continues to cling onto positive territory following Apple earnings. Apple Inc (AAPL) Q1 2022 (USD): EPS 2.10 (exp. 1.89), Revenue 123.95bln (exp. 118.66bln), iPhone: 71.63 bln (exp. 68.34bln), iPad: 7.25bln (exp. 8.18bln), Mac: 10.85bln (exp. 9.51bln), Services: 19.52bln (exp. 18.61 bln), according to Businesswire. +3.5% in the pre-market, trimming from gains in excess of 5.0% earlier

Top European News

German Economy Contracted Amid Tighter Virus Curbs, Supply Snags

H&M CEO Sets Target to Double Retailer’s Sales by 2030

Telia Sells Tower Stake for $582 Million, Cuts Costs

U.K. ‘Partygate’ Probe May Be Watered Down at Police Request

In FX, buck bull run continues as DXY takes out another July 2020 high to leave just 97.500 in front of key Fib resistance. Aussie feels the heat of Greenback strength more than others amidst risk-off positioning and caution ahead of next week’s RBA policy meeting. Kiwi also lagging and Loonie losing crude support after the BoC’s hawkish hold midweek. Euro and Yen reliant on some hefty option expiry interest to provide protection from Dollar domination. BoJ Governor Kurdoa if times come to debate the exit of policy, then targeting shorter maturity JGBs could become an option; at this stage its premature to raise yield target or take steps to steepen yield curve.

In commodities, WTI and Brent are consolidating somewhat after yesterday's choppy price action, but remain towards the lowend

of a circa. USD 1.00/bbl range. Focus remains firmly on geopols as Russia is set to speak with French and German officials on Friday, though rhetoric, remains relatively familiar. Spot gold and silver are pressured as the yellow metal loses the 100-DMA, and drops to circa. USD 1780/oz as the USD rallies, and ahead of inflation data while LME copper follows the equity downside.

US Event Calendar

8:30am: 4Q Employment Cost Index, est. 1.2%, prior 1.3%

8:30am: Dec. Personal Income, est. 0.5%, prior 0.4%

Dec. PCE Core Deflator YoY, est. 4.8%, prior 4.7%; PCE Core Deflator MoM, est. 0.5%, prior 0.5%

Dec. PCE Deflator YoY, est. 5.8%, prior 5.7%; PCE Deflator MoM, est. 0.4%, prior 0.6%

8:30am: Dec. Personal Spending, est. -0.6%, prior 0.6%; Real Personal Spending, est. -1.1%, prior 0%

10am: Jan. U. of Mich. Sentiment, est. 68.8, prior 68.8

Current Conditions, est. 73.2, prior 73.2; Expectations, est. 65.9, prior 65.9

1 Yr Inflation, est. 4.9%, prior 4.9%; U. of Mich. 5-10 Yr Inflation, prior 3.1%

......................

Have a Nice Weekend

Irregularities in the Pension Fund (Window Scene)

.

.

.

.

.

.

. . . .

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.