Friday, January 21, 2022 8:29:02 AM

Apparently it's Happy Friday on "Morning Markets"

Morning Markets

.

.

.

.

Markets Are "Sea Of Red" Amid "Total Meltdown In Anything Tech And Pandemic Winners"

Friday, Jan 21, 2022 - 08:03 AM

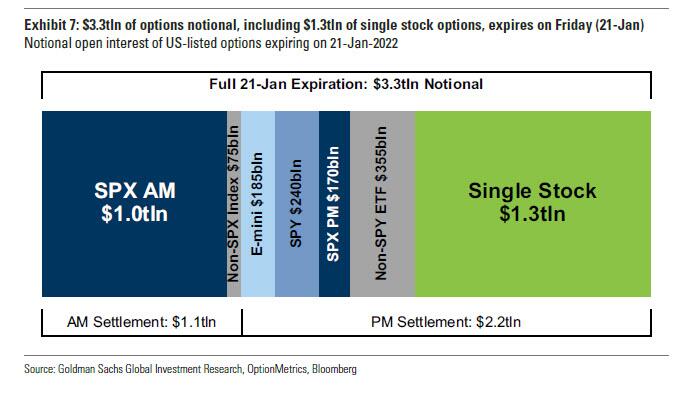

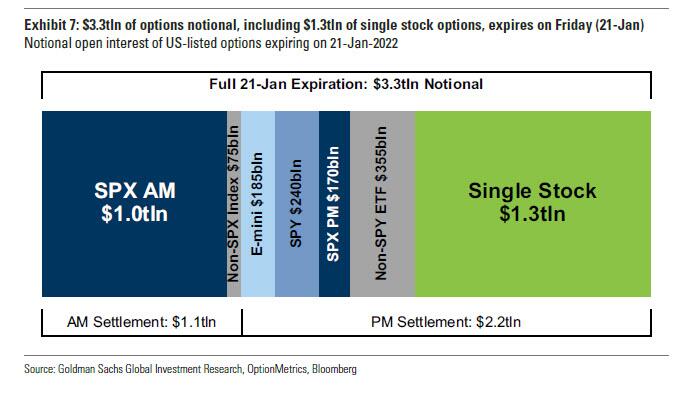

Futures, yields, oil, dollar, cryptos - everything is lower on this $3.1 trillion option expiration day...

... as US traders relocate from their bedroom to their basement on the last day of the week, discovering a sea of red in most assets and a "total meltdown" in others. Emini S&P futures are down 0.5% or 22 points to 4,452 which by the way is well off the session lows which saw the S&P plunge as low as 4,429. Nasdaq futures are down 0.8% or 122 and Dow futures are lower by 95 points or 0.25%, while European stocks touched the lowest level in a month weighed by miners, travel and leisure and automakers. 10Y TSY yields are at 1.778%, rising from 1.76% at the session lows, but down from Thuesday's close around 1.80%.

Cryptocurrencies crashed with Bitcoin trading below $38,000, the level that Mike Novogratz said is where he would be buying. Presumably he isn't doing so. Ether, the second largest cryptocurrency by market cap, extends its decline to trade at around $2,750, in its longest daily losing streak since late July. Meanwhile, oil extends declines, with Brent falling 1.7% to below $87, while WTI falls over 2% to below $84 a barrel. Spot gold -0.4% to $1,832/oz, while the dollar also slips 0.1%.

“Risk appetite is widely down, and the cautious trading mood reflects the global uncertainty investors are now facing,” said Pierre Veyret, technical analyst at ActivTrades. “Sentiment is being driven down by monetary policies, uneven corporate results, a bigger Omicron impact on economies as well as rising geopolitical tensions between the USA and Russia over Ukraine.”

Meanwhile, a report that Washington is allowing some Baltic states to send U.S.-made weapons to Ukraine stoked concerns about a standoff with Russia.

“The 2022 outlook for risky assets is likely to be more challenging as central bank accommodation is withdrawn,” said Mohit Kumar, managing director at Jefferies International. “We would wait for more clarity from the Fed before shifting our cautious stance on equities.”

Besides the huge negative gamma overhang (much of which will fade by EOD as trillions in options expire) and the prospect of rising interest rates weighing on investor sentiment, corporate earnings aren’t helping the mood with disappointing earnings from PPG Industry and CSX, while Netflix plunged 21% in premarket trading as analysts cut their ratings and slash price targets after the streaming company’s first-quarter subscriber outlook missed estimates, prompting worries over slowing growth. Alibaba Group dropped in U.S. premarket trading as market participants weigh the stock impact of a report that China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal. Expected data on Friday include Leading Index, while Huntington Bancshares, IHS Markit, Schlumberger are among companies reporting earnings. Here are all notable premarket movers:

Peloton (PTON US) shares rise 8.6% in U.S. premarket trading, set to rebound following Thursday’s 24% tumble in the wake of a CNBC report saying the company is temporarily halting production of bikes and treadmills over slow demand, which CEO John Foley later disputed in a memo to staff.

Apple’s (AAPL US) price target and estimates are raised at Wells Fargo ahead of the tech giant’s results next Thursday. The shares edge 0.1% lower in U.S. premarket trading.

Alibaba (BABA US) drops as much as 1.5% in U.S. premarket trading as market participants weigh the stock impact of FT report saying China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal.

PPG (PPG US) fell 3% postmarket after the chemicals maker forecast adjusted earnings per share for the first quarter that missed the average analyst estimate and cited “significantly higher operating costs.”

CSX (CSX US) shares dropped over 3.8% in postmarket trading as fourth-quarter profit and revenue beat was overshadowed by a miss in operating ratio, a measure of the railroad’s efficiency.

In Europe, stocks dropped to the lowest level in a month echoing Asia’s slump. Euro Stoxx 600 drops as much as 1.7% with most European cash indexes ~1% in the red. Cyclical sectors such as basic resources, autos and travel led the declines, along with tech, while defensive stocks such as food, personal care and utilities outperformed. European e-commerce stocks fall on Friday, with Markets.com chief market analyst Neil Wilson noting the “total meltdown in anything tech and pandemic winners.” There’s a “huge momentum unwind” and “no one wants to touch them now,” with investors looking for defensive cash flows and value, Wilson writes in emailed comments: Naked Wines -6%, Home24 -5.4%, Global Fashion Group -5.2%, THG -3.5%, Moonpig -3.3%, Asos -3.2%, Made.com -2.9%, Allegro 2.6%, AO World -2.5%, Zalando -2.4%, Westwing -2.1%.

Earlier in the session, Asian equities resumed declines after a one-day reprieve, as global inflation concerns and the impact on borrowing costs weighed on technology stocks. The MSCI Asia Pacific Index fell as much as 1.4%, dragged down by shares of chipmakers TSMC and Samsung, as the global tech selloff deepened. The regional benchmark was headed for a weekly drop of more than 1.7%, its steepest since late November. Read more: A Year’s Worth of Nasdaq Tumult Gets Jammed Into Three Weeks Benchmarks fell across Asia, with Australia’s main gauge sliding more than 2% and Japan’s Topix narrowly missing a technical correction. Elevated energy costs and rising prices of other goods amid supply-chain bottlenecks have added to worries about faster-than-expected monetary-policy tightening. “A world shaped by supply constraints will bring more macro volatility,” BlackRock Investment Institute strategists including Elga Bartsch wrote in a note. “Monetary policy cannot stabilize both inflation and growth: it has to choose between them.” Toyota also ranked among the biggest drags on the regional benchmark after the auto giant announced more production halts on rising Covid-19 cases. Alibaba dropped after a Financial Times report said China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal

Indian stocks completed their biggest weekly decline since November, as concerns about policy moves by the U.S. Federal Reserve and a rally in crude oil prices dented investors’ appetite for riskier emerging market assets. The S&P BSE Sensex dropped 0.7% to 59,037.18 in Mumbai, extending this week’s losses this to 3.6%. The NSE Nifty 50 Index also fell 0.8% on Friday. Technology stocks were hammered for a fourth consecutive session, with the sector gauge ending with the worst weekly performance since April 2020. Infosys Ltd., down 2.1%, was the biggest drag on the key indexes. All but one of 19 sub-indexes fell, led by a gauge of realty stocks. As the Federal Reserve looks at tackling higher inflation, investors are grappling with the prospect of reduced stimulus that had driven flows into emerging markets and bolstered riskier assets. “The likely Fed action and crude surge have been negative for sentiment after the market had a strong start to the year, and we expect this downward pressure to continue,” said A. K. Prabhakar, head of research at IDBI Capital Ltd. “In earnings, tech results have been strong, but attrition is high, while for others, higher raw material costs are a drag.” Of the 13 Nifty 50 companies that have announced results so far, six have either met or exceeded expectations, six have missed and one can’t be compared. Reliance Industries Ltd., the nation’s most-valuable company, is scheduled to announce results in the day

Australia's S&P/ASX 200 index slumped 2.3% to close at 7,175.80, its lowest level since June 1, following U.S. shares lower after the tech-heavy Nasdaq 100 slipped into a correction. The Australian benchmark shed 3% this week amid anxiety over interest rates and the outlook for corporate earnings, capping its worst weekly performance since October 2020. Paladin Energy was the worst performer on Friday, plunging 11%, and Whitehaven fell after trimming its full-year managed ROM coal production forecast. In New Zealand, the S&P/NZX 50 index fell 1.2% to 12,348.00. The gauge lost 3.5% this week in its biggest such loss in 11 months

In rates, demand for havens pushed the 10-year U.S. Treasury yield below 1.80%. Treasury futures are off session highs reached during Asia trading hours, hold modest gains from belly to long end, trimming yields by ~1bp vs Thursday’s closing levels. 10-year TSY yield around 1.775% is ~2bp richer on the day after dropping as low as 1.763% during Asia session; German 10- year outperforms by 1.2bp with Estoxx50 down 1.7%. IG dollar issuance slate empty so far; three-deal docket Thursday consisted entirely of banks for combined $5.4bn. Bunds bull flatten, richer by ~3bps at the long end; gilts bull steepen with the belly outperforming.

In FX, Bloomberg Dollar Spot dips 0.2% into the red. SEK and CHF are the best performers in G-10; NZD, AUD and GBP lag, with cable near session low of 1.3562, one tick above the 21-DMA at 1.3561. The Bloomberg dollar index slipped as the greenback traded mixed versus its Group-of-10 peers. The pound lagged most of its Group-of-10 peers, extending declines after data showed U.K. retail sales plummeted in December. BOE’s Mann to speak later. Sweden’s krona is the best G-10 performer as it retraces about half of yesterday’s deep losses that took it to an 18- month low against the greenback in the U.S. session after a triggering stop-losses and options barriers. Australian and New Zealand dollars weakened amid risk-off price action in stocks and commodities. The yen strengthened on haven demand; BOJ minutes of its December meeting showed one board member noting that policy adjustment now would be too early.

In commodities, crude futures are deep in the red, but off worst levels, after a surprise climb in U.S. crude stockpiles. The White House also said it can work to accelerate the release of strategic reserves. WTI regained a $84-handle, Brent trades back above $87. Spot gold drops ~$5 before finding support near $1,830/oz. Base metals are mostly in the green and up on the week. LME lead and tin outperform.

Looking at the day ahead, data releases included UK retail sales for December, which missed badly, and the US Conference Board’s leading index for December. Central bank speakers include ECB President Lagarde and the BoE’s Mann.

Market Snapshot

S&P 500 futures down 0.2% to 4,467.50

STOXX Europe 600 down 1.3% to 476.89

MXAP down 0.9% to 191.91

MXAPJ down 1.0% to 630.82

Nikkei down 0.9% to 27,522.26

Topix down 0.6% to 1,927.18

Hang Seng Index little changed at 24,965.55

Shanghai Composite down 0.9% to 3,522.57

Sensex down 0.8% to 58,998.67

Australia S&P/ASX 200 down 2.3% to 7,175.81

Kospi down 1.0% to 2,834.29

Brent Futures down 1.9% to $86.66/bbl

Gold spot down 0.3% to $1,832.94

U.S. Dollar Index down 0.14% to 95.60

German 10Y yield little changed at -0.05%

Euro up 0.3% to $1.1344

Brent Futures down 2.0% to $86.63/bbl

Top Overnight News from Bloomberg

Federal Reserve officials will signal next week they’ll raise interest rates in March for the first time in more than three years and shrink their balance sheet soon after, economists surveyed by Bloomberg said

The European Union is ripping up the green investing playbook with plans to allow some gas and nuclear projects to be called sustainable. The bloc is poised to include these kinds of power generation with conditions in its rulebook for sustainable activities, or taxonomy. That’s divided the fund community, as some worry their holdings will no longer be in line with the rules, while others think it’s a necessary compromise.

China is quietly urging banks to increase lending after a slow start to the year, ramping up efforts to combat the weakest economic expansion since early 2020

Italy’s papal-style vote for a new president each seven years is the culmination of Rome’s political intrigues and power games. For the first time, the process is attracting international interest as Prime Minister Mario Draghi is touted as a top contender for the job. Voting will start on Jan. 24 at 3 p.m. local time, and it is expected to last a few days

Iron ore futures climbed to the highest intraday level since October as China made it clear that it will take action to stabilize the economy, bolstering the demand outlook for the raw material

A more detailed look at global markets courtesy of Newsquawk

Asia Pacific

APAC markets traded lower amid wide-spread risk aversion after late Wall Street selling . ASX 200 (-2.3%) underperformed as miners led the broad downturn.

Nikkei 225 (-0.9%) dropped more than 500 points intraday on currency strength but finished off lows

Hang Seng (U/C) and Shanghai Comp. (-0.9%) downside was somewhat cushioned on subsequently confirmed reports of further PBoC action.

US equity futures traded with losses across the board: NQ underperformed post-Netflix earnings.

Top Asian News

Rising Cases Spark Covid Superspreader Fears in Hong Kong

Alibaba Drops in U.S. Premarket on Corruption Report Speculation

Playtech Sinks as Former F1 Boss Jordan Pulls Possible Offer

Coal Soars to $300 a Ton as Asia Scrambles for Power Plant Fuel

Europe

Major European bourses are pressured Euro Stoxx 50 -1.3%; Stoxx 600 -1 5%. as the Wall St rally faded and reverberated through APAC trade . Although, the Stoxx 600 remains -0.5% on the week.

US futures have been lifting off overnight lows, though the NO continues to lag post-Netflix.

European sectors are all in the red. but defensives are faring slightly better than cyclicals

Top European News

U.K. Retail Sales Drop as Omicron Keeps Shoppers Away

Lotus Explores Electric-Car Battery Tie-Up With Britishvolt

Amazon’s Alexa Voice Assistant Reportedly Suffers Europe Outages

Greece Is Great Place to Be in Rough January for Europe Stocks

FX

Franc finally evades SNB clutches to rally and outshine other safe-haven currencies.

Pound discounted after dire UK retail sales data and deterioration in consumer sentiment.

Buck betwixt and between as USTs rebound, but risk aversion gathers momentum.

Kiwi and Aussie lag due to unfavorable market conditions and their high beta characteristics but Yuan continues to rally as PBoC adds SLFs to the list of official rates being cut to support the Chinese economy Click here for a detailed summary.

Fixed Income

USTs extend rebound from post-20 year auction highs on amidst more pronounced risk-off positioning.

Bunds play catch up with Treasuries as demand for safe-havens picks up

Gilts also correct higher and pay some heed to downbeat UK fundamental

Commodities

WTI and Brent March contacts remain pressured by the broader risk tone, with focus on geopolitics

Morgan Stanley has increased its Q3 Brent price forecast to USD 100/bbl vs prev. viev; of around USD 90/bbl.

Spot gold looks heavy as traders booked some profits from yesterdays rally, while the yellow metal found support around the USD 1 830/oz.

LME copper re-tested USD 10k/t to the upside but failed to mount the level

.......................

Other good stuff on our MMGYS sister board

‘The Enigma.’: Giant 555.55-carat black diamond heads to auction

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582155

What A FULL-ON DEBT MARKET IMPLOSION Will Look Like For Gold, Silver, Crude, And MORE. Mannarino

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582124

Gareth Soloway reveals top stock picks for 2022, downgrades Bitcoin target to "sub-$20k"

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582076

Apparently it's Happy Friday

"Apparently" This Kid is Awesome, Steals the Show During Interview

.

.

.

.

.

.

. . . .

Morning Markets

.

.

.

.

Markets Are "Sea Of Red" Amid "Total Meltdown In Anything Tech And Pandemic Winners"

Friday, Jan 21, 2022 - 08:03 AM

Futures, yields, oil, dollar, cryptos - everything is lower on this $3.1 trillion option expiration day...

... as US traders relocate from their bedroom to their basement on the last day of the week, discovering a sea of red in most assets and a "total meltdown" in others. Emini S&P futures are down 0.5% or 22 points to 4,452 which by the way is well off the session lows which saw the S&P plunge as low as 4,429. Nasdaq futures are down 0.8% or 122 and Dow futures are lower by 95 points or 0.25%, while European stocks touched the lowest level in a month weighed by miners, travel and leisure and automakers. 10Y TSY yields are at 1.778%, rising from 1.76% at the session lows, but down from Thuesday's close around 1.80%.

Cryptocurrencies crashed with Bitcoin trading below $38,000, the level that Mike Novogratz said is where he would be buying. Presumably he isn't doing so. Ether, the second largest cryptocurrency by market cap, extends its decline to trade at around $2,750, in its longest daily losing streak since late July. Meanwhile, oil extends declines, with Brent falling 1.7% to below $87, while WTI falls over 2% to below $84 a barrel. Spot gold -0.4% to $1,832/oz, while the dollar also slips 0.1%.

“Risk appetite is widely down, and the cautious trading mood reflects the global uncertainty investors are now facing,” said Pierre Veyret, technical analyst at ActivTrades. “Sentiment is being driven down by monetary policies, uneven corporate results, a bigger Omicron impact on economies as well as rising geopolitical tensions between the USA and Russia over Ukraine.”

Meanwhile, a report that Washington is allowing some Baltic states to send U.S.-made weapons to Ukraine stoked concerns about a standoff with Russia.

“The 2022 outlook for risky assets is likely to be more challenging as central bank accommodation is withdrawn,” said Mohit Kumar, managing director at Jefferies International. “We would wait for more clarity from the Fed before shifting our cautious stance on equities.”

Besides the huge negative gamma overhang (much of which will fade by EOD as trillions in options expire) and the prospect of rising interest rates weighing on investor sentiment, corporate earnings aren’t helping the mood with disappointing earnings from PPG Industry and CSX, while Netflix plunged 21% in premarket trading as analysts cut their ratings and slash price targets after the streaming company’s first-quarter subscriber outlook missed estimates, prompting worries over slowing growth. Alibaba Group dropped in U.S. premarket trading as market participants weigh the stock impact of a report that China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal. Expected data on Friday include Leading Index, while Huntington Bancshares, IHS Markit, Schlumberger are among companies reporting earnings. Here are all notable premarket movers:

Peloton (PTON US) shares rise 8.6% in U.S. premarket trading, set to rebound following Thursday’s 24% tumble in the wake of a CNBC report saying the company is temporarily halting production of bikes and treadmills over slow demand, which CEO John Foley later disputed in a memo to staff.

Apple’s (AAPL US) price target and estimates are raised at Wells Fargo ahead of the tech giant’s results next Thursday. The shares edge 0.1% lower in U.S. premarket trading.

Alibaba (BABA US) drops as much as 1.5% in U.S. premarket trading as market participants weigh the stock impact of FT report saying China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal.

PPG (PPG US) fell 3% postmarket after the chemicals maker forecast adjusted earnings per share for the first quarter that missed the average analyst estimate and cited “significantly higher operating costs.”

CSX (CSX US) shares dropped over 3.8% in postmarket trading as fourth-quarter profit and revenue beat was overshadowed by a miss in operating ratio, a measure of the railroad’s efficiency.

In Europe, stocks dropped to the lowest level in a month echoing Asia’s slump. Euro Stoxx 600 drops as much as 1.7% with most European cash indexes ~1% in the red. Cyclical sectors such as basic resources, autos and travel led the declines, along with tech, while defensive stocks such as food, personal care and utilities outperformed. European e-commerce stocks fall on Friday, with Markets.com chief market analyst Neil Wilson noting the “total meltdown in anything tech and pandemic winners.” There’s a “huge momentum unwind” and “no one wants to touch them now,” with investors looking for defensive cash flows and value, Wilson writes in emailed comments: Naked Wines -6%, Home24 -5.4%, Global Fashion Group -5.2%, THG -3.5%, Moonpig -3.3%, Asos -3.2%, Made.com -2.9%, Allegro 2.6%, AO World -2.5%, Zalando -2.4%, Westwing -2.1%.

Earlier in the session, Asian equities resumed declines after a one-day reprieve, as global inflation concerns and the impact on borrowing costs weighed on technology stocks. The MSCI Asia Pacific Index fell as much as 1.4%, dragged down by shares of chipmakers TSMC and Samsung, as the global tech selloff deepened. The regional benchmark was headed for a weekly drop of more than 1.7%, its steepest since late November. Read more: A Year’s Worth of Nasdaq Tumult Gets Jammed Into Three Weeks Benchmarks fell across Asia, with Australia’s main gauge sliding more than 2% and Japan’s Topix narrowly missing a technical correction. Elevated energy costs and rising prices of other goods amid supply-chain bottlenecks have added to worries about faster-than-expected monetary-policy tightening. “A world shaped by supply constraints will bring more macro volatility,” BlackRock Investment Institute strategists including Elga Bartsch wrote in a note. “Monetary policy cannot stabilize both inflation and growth: it has to choose between them.” Toyota also ranked among the biggest drags on the regional benchmark after the auto giant announced more production halts on rising Covid-19 cases. Alibaba dropped after a Financial Times report said China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal

Indian stocks completed their biggest weekly decline since November, as concerns about policy moves by the U.S. Federal Reserve and a rally in crude oil prices dented investors’ appetite for riskier emerging market assets. The S&P BSE Sensex dropped 0.7% to 59,037.18 in Mumbai, extending this week’s losses this to 3.6%. The NSE Nifty 50 Index also fell 0.8% on Friday. Technology stocks were hammered for a fourth consecutive session, with the sector gauge ending with the worst weekly performance since April 2020. Infosys Ltd., down 2.1%, was the biggest drag on the key indexes. All but one of 19 sub-indexes fell, led by a gauge of realty stocks. As the Federal Reserve looks at tackling higher inflation, investors are grappling with the prospect of reduced stimulus that had driven flows into emerging markets and bolstered riskier assets. “The likely Fed action and crude surge have been negative for sentiment after the market had a strong start to the year, and we expect this downward pressure to continue,” said A. K. Prabhakar, head of research at IDBI Capital Ltd. “In earnings, tech results have been strong, but attrition is high, while for others, higher raw material costs are a drag.” Of the 13 Nifty 50 companies that have announced results so far, six have either met or exceeded expectations, six have missed and one can’t be compared. Reliance Industries Ltd., the nation’s most-valuable company, is scheduled to announce results in the day

Australia's S&P/ASX 200 index slumped 2.3% to close at 7,175.80, its lowest level since June 1, following U.S. shares lower after the tech-heavy Nasdaq 100 slipped into a correction. The Australian benchmark shed 3% this week amid anxiety over interest rates and the outlook for corporate earnings, capping its worst weekly performance since October 2020. Paladin Energy was the worst performer on Friday, plunging 11%, and Whitehaven fell after trimming its full-year managed ROM coal production forecast. In New Zealand, the S&P/NZX 50 index fell 1.2% to 12,348.00. The gauge lost 3.5% this week in its biggest such loss in 11 months

In rates, demand for havens pushed the 10-year U.S. Treasury yield below 1.80%. Treasury futures are off session highs reached during Asia trading hours, hold modest gains from belly to long end, trimming yields by ~1bp vs Thursday’s closing levels. 10-year TSY yield around 1.775% is ~2bp richer on the day after dropping as low as 1.763% during Asia session; German 10- year outperforms by 1.2bp with Estoxx50 down 1.7%. IG dollar issuance slate empty so far; three-deal docket Thursday consisted entirely of banks for combined $5.4bn. Bunds bull flatten, richer by ~3bps at the long end; gilts bull steepen with the belly outperforming.

In FX, Bloomberg Dollar Spot dips 0.2% into the red. SEK and CHF are the best performers in G-10; NZD, AUD and GBP lag, with cable near session low of 1.3562, one tick above the 21-DMA at 1.3561. The Bloomberg dollar index slipped as the greenback traded mixed versus its Group-of-10 peers. The pound lagged most of its Group-of-10 peers, extending declines after data showed U.K. retail sales plummeted in December. BOE’s Mann to speak later. Sweden’s krona is the best G-10 performer as it retraces about half of yesterday’s deep losses that took it to an 18- month low against the greenback in the U.S. session after a triggering stop-losses and options barriers. Australian and New Zealand dollars weakened amid risk-off price action in stocks and commodities. The yen strengthened on haven demand; BOJ minutes of its December meeting showed one board member noting that policy adjustment now would be too early.

In commodities, crude futures are deep in the red, but off worst levels, after a surprise climb in U.S. crude stockpiles. The White House also said it can work to accelerate the release of strategic reserves. WTI regained a $84-handle, Brent trades back above $87. Spot gold drops ~$5 before finding support near $1,830/oz. Base metals are mostly in the green and up on the week. LME lead and tin outperform.

Looking at the day ahead, data releases included UK retail sales for December, which missed badly, and the US Conference Board’s leading index for December. Central bank speakers include ECB President Lagarde and the BoE’s Mann.

Market Snapshot

S&P 500 futures down 0.2% to 4,467.50

STOXX Europe 600 down 1.3% to 476.89

MXAP down 0.9% to 191.91

MXAPJ down 1.0% to 630.82

Nikkei down 0.9% to 27,522.26

Topix down 0.6% to 1,927.18

Hang Seng Index little changed at 24,965.55

Shanghai Composite down 0.9% to 3,522.57

Sensex down 0.8% to 58,998.67

Australia S&P/ASX 200 down 2.3% to 7,175.81

Kospi down 1.0% to 2,834.29

Brent Futures down 1.9% to $86.66/bbl

Gold spot down 0.3% to $1,832.94

U.S. Dollar Index down 0.14% to 95.60

German 10Y yield little changed at -0.05%

Euro up 0.3% to $1.1344

Brent Futures down 2.0% to $86.63/bbl

Top Overnight News from Bloomberg

Federal Reserve officials will signal next week they’ll raise interest rates in March for the first time in more than three years and shrink their balance sheet soon after, economists surveyed by Bloomberg said

The European Union is ripping up the green investing playbook with plans to allow some gas and nuclear projects to be called sustainable. The bloc is poised to include these kinds of power generation with conditions in its rulebook for sustainable activities, or taxonomy. That’s divided the fund community, as some worry their holdings will no longer be in line with the rules, while others think it’s a necessary compromise.

China is quietly urging banks to increase lending after a slow start to the year, ramping up efforts to combat the weakest economic expansion since early 2020

Italy’s papal-style vote for a new president each seven years is the culmination of Rome’s political intrigues and power games. For the first time, the process is attracting international interest as Prime Minister Mario Draghi is touted as a top contender for the job. Voting will start on Jan. 24 at 3 p.m. local time, and it is expected to last a few days

Iron ore futures climbed to the highest intraday level since October as China made it clear that it will take action to stabilize the economy, bolstering the demand outlook for the raw material

A more detailed look at global markets courtesy of Newsquawk

Asia Pacific

APAC markets traded lower amid wide-spread risk aversion after late Wall Street selling . ASX 200 (-2.3%) underperformed as miners led the broad downturn.

Nikkei 225 (-0.9%) dropped more than 500 points intraday on currency strength but finished off lows

Hang Seng (U/C) and Shanghai Comp. (-0.9%) downside was somewhat cushioned on subsequently confirmed reports of further PBoC action.

US equity futures traded with losses across the board: NQ underperformed post-Netflix earnings.

Top Asian News

Rising Cases Spark Covid Superspreader Fears in Hong Kong

Alibaba Drops in U.S. Premarket on Corruption Report Speculation

Playtech Sinks as Former F1 Boss Jordan Pulls Possible Offer

Coal Soars to $300 a Ton as Asia Scrambles for Power Plant Fuel

Europe

Major European bourses are pressured Euro Stoxx 50 -1.3%; Stoxx 600 -1 5%. as the Wall St rally faded and reverberated through APAC trade . Although, the Stoxx 600 remains -0.5% on the week.

US futures have been lifting off overnight lows, though the NO continues to lag post-Netflix.

European sectors are all in the red. but defensives are faring slightly better than cyclicals

Top European News

U.K. Retail Sales Drop as Omicron Keeps Shoppers Away

Lotus Explores Electric-Car Battery Tie-Up With Britishvolt

Amazon’s Alexa Voice Assistant Reportedly Suffers Europe Outages

Greece Is Great Place to Be in Rough January for Europe Stocks

FX

Franc finally evades SNB clutches to rally and outshine other safe-haven currencies.

Pound discounted after dire UK retail sales data and deterioration in consumer sentiment.

Buck betwixt and between as USTs rebound, but risk aversion gathers momentum.

Kiwi and Aussie lag due to unfavorable market conditions and their high beta characteristics but Yuan continues to rally as PBoC adds SLFs to the list of official rates being cut to support the Chinese economy Click here for a detailed summary.

Fixed Income

USTs extend rebound from post-20 year auction highs on amidst more pronounced risk-off positioning.

Bunds play catch up with Treasuries as demand for safe-havens picks up

Gilts also correct higher and pay some heed to downbeat UK fundamental

Commodities

WTI and Brent March contacts remain pressured by the broader risk tone, with focus on geopolitics

Morgan Stanley has increased its Q3 Brent price forecast to USD 100/bbl vs prev. viev; of around USD 90/bbl.

Spot gold looks heavy as traders booked some profits from yesterdays rally, while the yellow metal found support around the USD 1 830/oz.

LME copper re-tested USD 10k/t to the upside but failed to mount the level

.......................

Other good stuff on our MMGYS sister board

‘The Enigma.’: Giant 555.55-carat black diamond heads to auction

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582155

What A FULL-ON DEBT MARKET IMPLOSION Will Look Like For Gold, Silver, Crude, And MORE. Mannarino

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582124

Gareth Soloway reveals top stock picks for 2022, downgrades Bitcoin target to "sub-$20k"

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167582076

Apparently it's Happy Friday

"Apparently" This Kid is Awesome, Steals the Show During Interview

.

.

.

.

.

.

. . . .

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.