Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

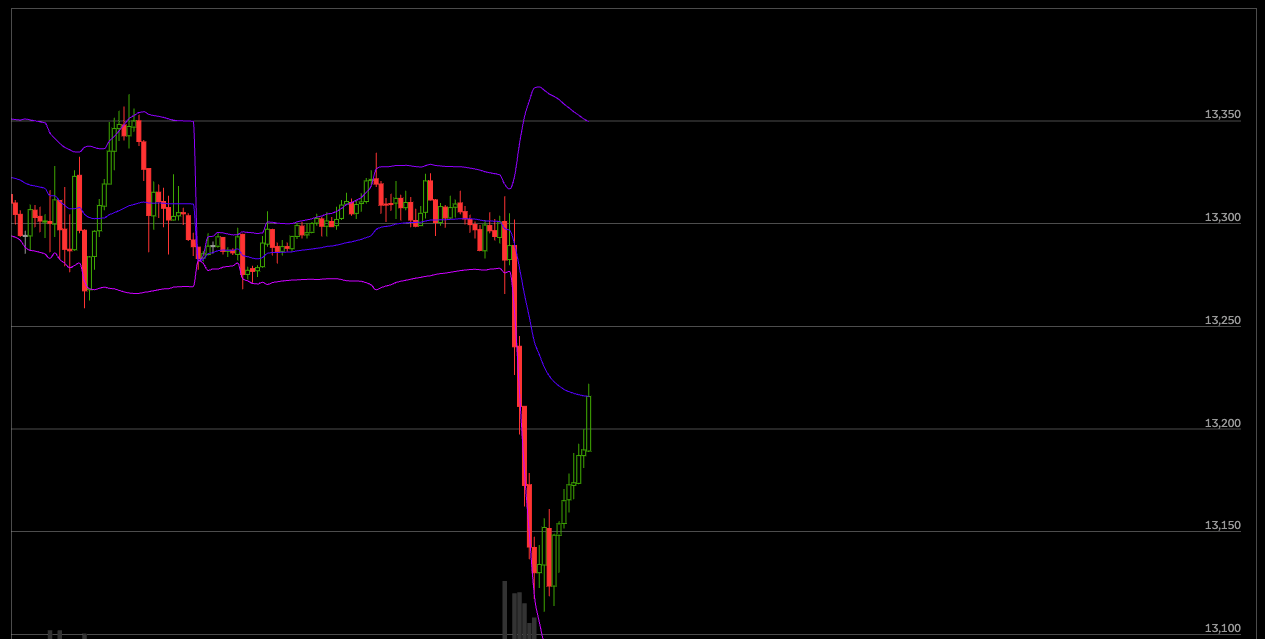

Finally a pullback! The technicals were nose bleed levels.

I played some NQ short and some QQQp, but didn't hold them anywhere near long enough.

It looks like some air is finally coming out of this bubble.

There's real rotation going on out of tech and into cyclicals/defensives and it's likely the TGA refill is kicking in now.

Next week is full of economic data + FOMC.

$KRE really going against me.

$TGT trying to find a bounce zone.

$NQ been treating me right the last two days, though.

I'm back in $PATH again with July and August 20c.

Even though tech correction may finally be happening? Maybe? Mayyyyybe?

Added to $KRE puts around the open.

Closed out a NQ short I shouldn't have done for a small profit after Apple cracked. Took all day....

Picked up some $TGT for a bounce.

QQQ/tech is now well into overbought territory on both the Daily and Weekly. That's normally a 'nothing to think about' short, but this rally has me questioning that.

I have some KRE puts for December I'm going to average down on, but that's all I am willing to risk on the short side for the moment.

Looking for a sector that will pick up the inevitable tech rotation.....

Right now, only thing bears have to latch on to is the possible TGA liquidity drain.

Everything else is currently printing good news.

Still though. These technicals on QQQ are like flies to honey right now. Hard to resist.

OUT: $PATH June 21 20c @ 1.30 (from 0.55)

OUT: $PATH July 7 20c @ 1.05 (from 0.57)

OUT: $PATH June 23 20c @ 0.65 (from .50)

I will be back in PATH. I think it's got $30+ in it. It's just gone up quite quickly, so looking for a short-term pull back. I missed the top today by a bit, but I won't be out long.

OUT: PLTR @ 2.38 (from 1.93) - sold before the convention started. Don't like holding through the events.

OUT: $NQ 14344 (from 14385)

OUT: $PATH June 16 15c @ 2.50 (from 2.30)

BOT: $PATH June 21 20c @ 0.55 (currently 0.73)

BOT: $PATH July 7 20c @ 0.57 (currently 0.93)

ADDED: $INOD Aug 18 10c , avg now @ 2.90 (getting hit on this one, but I'm betting on announcement based on latest PR)

BOT: $PLTR June 16 13c @ 1.90. - PLTR has an event tomorrow.

Lightning DD - $PATH

Need to add in one more.

$PATH

Price: $16.57 (+6% today)

Marketcap: $9B

Revenue: $1B

Float is 8% short

Enterprise AI (includes Generative)

https://ir.uipath.com/news/detail/279/how-businesses-can-win-with-generative-ai-uipath-to-unveil

Chart looks good, too

I'll be picking this up next.

Wow! $AI just kept on pushing.

I sold when the equity was around 37 around the open.

It went on to 46 after 4pm. Currently up 38% on the day.

Those calls I exited at 9.60 are now 16.

AI mania is here!

OUT: $AI @ 9.60 (from 5.70)

Missed today's top by a lot, but not a bad result for overnight/weekend. IV at 350% is off the dial on this one, tomorrow afterhours is the big day. I was going to hold some lottos, but there's no longer lottos that make sense at this point.

OUT: $BBAI @ 2.45 (from 2.37) - don't like it.

OUT: $INOD @ 11.50 (from 11.40) - swapped out for some Aug 18 10c

Lightning DD - $AI, $PLTR, $INOD, $BBAI, $AMD

$AI

Price: 32.94

Marketcap: $3.7B

Revenue: $260M

Float is 30% short

Analysts/market hates this stock

They're in all the right areas https://c3.ai/

If they deliver on 5/31, should really send this one - if not, it's getting wrecked. High stakes this week.

$PLTR

Price: 13.65

Marketcap: $29B

Revenue: $2B

Float is 9% short

Full on AI, platform + OS

WSB favorite

$INOD

Price: 11.30

Marketcap: $300M

Revenue: 80M

Deal announcements upcoming in Generative AI (likely)

https://innodata.com/generative-ai/

Float is 3% short

$BBAI

Price: 2.37

Marketcap: 335M

Revenue: $150M

Backlog with government

S-3 sitting on top of the stock, not going anywhere without big news or sellers standing down

https://ir.bigbear.ai/sec-filings/all-sec-filings##document-547-0000899243-23-013957-2

They will end up doing an offering for the company as well, they'r e burning a lot of cash, almost 1:1 with revenue

https://bigbear.ai/

$AMD

Price: 127.03

Marketcap: $200B

Revenue: $24B

Float is 2% short

They have not made a real splash into AI yet (like NVDA), I expect they will do so in the coming months

They are the assumed #2 picks and shovels play after NVDA

I was drooling at 97 after earrings, traded, should have just 'owned'. Will do so on next tech dip.

Week Ahead: May 30, 2023 - QQQ, NFP, AI

* Monday - Markets were closed for Memorial Day.

* Tuesday - Housing Index @ 9am, Consumer Confidence @ 10am, FOMC Barkin @ 1pm

* Wednesday - ADP @ 8:15am, JOLTS at 10am (!!)

* Thursday - Jobless Claims @ 8:30am, ISM @ 10am

* Friday - NFP @ 8:30am (!!!)

* All times US/Eastern

QQQ blew out my high end by a lot, pushed on to 348 on Friday. Big confidence on the back of tech and debt ceiling hope. Impressive.

Technicals - QQQ daily chart is now properly overbought and is setup for a sell the news event. Weekly says this is it at 350, so pop on Monday - then drop?

Current positions:

AAPL 170p October 20 @ 9.30 (trimmed)

KRE 38p Dec 15 @ 4.95

NQ short @ 14400 (trying one more time..)

AI 35c June 30 @ 5.70

BBAI @ 2.37 (starter on Friday) - needs research

INOD @ 11.40 (starter on Friday) - needs research

Translated: Long AI, short broad tech and banks.

Debt ceiling - they’ve reached an agreement in principle, which means it’s mostly just paperwork at this point. I don’t see it getting blocked despite some additional political theater. The terms we know so far here are https://www.reuters.com/markets/us/whats-debt-ceiling-deal-biden-mccarthy-are-negotiating-2023-05-26/

I may be wrong, but I do think this will be a sell the news event, as early as Tuesday. The technicals are hot, this optimistic event is now mostly resolved, it’s a potential liquidity drain, and we’ve got JPow looking at us with a 25bps hike (63% chance now). I thought the Fed Trade was over, but the PCE and similar are keeping it alive.

I am shifting more towards specific stocks than macro/QQQ/SPY trading. I’ve been doing well in the specific stocks I’ve traded lately - AMD, AI, etc - less so in the indices. It’s much easier for me to see bullish signs in individual than overall macro right now.

AI (stock) is most interesting at the moment since it’s got the ticker symbol, is in ‘the’ space, and has ER on 5/31. It’s also got some top-tier clients. I traded it on Friday and I plan to exit my main position prior to the ER (Wednesday AH) and let some lottos ride.

BBAI, INOD I’m researching, just have starter positions in for now. PLTR is on my radar, too.

I’ll be posting some individual due diligence on a few companies I like this week.

Aside from AI, I remain a market bear and think we just saw the final hurrah (for now) of this monster bear market rally. I think we’ll see QQQ 300 before we say QQQ 400.

Week Ahead: May 22, 2023 - QQQ 342/330 range

* All week: Fed speakers again.

* Monday - Bullard @ 8:30am, Bostic and Daily around 11am, New Home Sales at 10am

* Tuesday - PMI @ 9:45am, Home Data @ 10am

* Wednesday - Yellen @ 10am, Waller @ 12:45pm, Fed Minutes @ 2pm, NVDA earnings AH

* Thursday - GDP + Jobless Claims @ 8:30am, Barkin at 9:45am

* Friday - PCE at 8:30am, UMICH 10am

* All times US/Eastern

QQQ went over my top end estimate from last week of 330. The debt ceiling possible resolution pushed us to new recent highs (338).

Technicals - QQQ daily chart is now overbought on some indicators and is setup for a sell the news event. It may push to 342 on debt ceiling agreement reached, but I think that’s it for now. Weekly says it may have a little air left to 344 max, but then it’s going to come down or at least consolidate.

Current positions:

AAPL 170p October 20 @ 9.60

KRE 38p Dec 15 @ 4.95 (added more last week)

I’ve got some KR calls and WM equity, as well, but nothing exciting.

JPow looked uncomfortable at the last FOMC Q&A and he showed similar discomfort on the Friday panel.

I think there’s still significant risk in the regional banking sector, despite all this resilient talk. We saw some start cracking on the way to 5% and now it’s going to hold there. KRE has already been pounded, but there’s still more to go - even though we’re in the middle of a mechanical bounce (noted last Sunday likely to happen).

I played AMD a few times last week - my biggest gainer of the week. As usual, my only regret was not holding it despite the obvious move on AI excitement. It was just on fire and likely to remain so into NVDA earnings on Wednesday afternoon.

The debt ceiling was not resolved last week, as expected. They gave some hope, market blasted, yanked it on Friday and market barely backed down — it knows they will resolve it despite all this political theater. I’ve read a few tweets and watched a video from CNBC suggesting that when it is resolved, it’s likely to be a sell the news event. The charts are set up for it, for sure. The fundamental case for this is how the liquidity will be drawn out of the market with all the new debt issuance. So, double whammy.

The market indicators (DXY, TNX) are aligning back to be bad news is bad news and good news is good news - which is a lot easier to trade.

Overall, I remain a bear - despite the indices currently blasting. The market breadth is weak and not indicative of a new rally, but the final hurrah of a monster bear market rally (which, kudos to the bulls - I didn’t see it lasting this long and cost me).

Snippet on Consumer Debt

https://www.morningbrew.com/daily/issues/big-dreams

If you’ve been dropping plastic a lot and hoping it’ll take care of itself later, join the club. Yesterday, the New York Fed released its Q1 report on household debt: Findings include a record-high debt level of $17 trillion, persistent credit card debt, and rising delinquency rates.

A typical first quarter sees credit card balances decline as people pay off what they spent over the holidays while trying to out-gift their in-laws. But, for the first time since the New York Fed started tracking this 20 years ago, that isn’t the case, according to Bankrate’s senior industry analyst Ted Rossman. Instead, balances remained flat over Q1, suggesting that people aren’t cutting back and are probably using credit cards to finance daily spending due to the rising cost of…pretty much everything.

It’s not just that credit card balances are flat. Delinquency is rising, as is its intimidating older brother, serious delinquency, which is when a debt is 90+ days past due. The Fed’s report showed that 4.57% of credit card debt transitioned to serious delinquency last quarter, up from 3.04% in Q1 of 2022. And for credit card holders aged 18–29, 8.3% of balances were in serious delinquency.

Plastic isn’t the only thing to blame

In addition to causing lots of folks to check their credit card balance real quick, the report had a few key takeaways:

Auto loan delinquencies are higher than they were before the pandemic for those under 40. The average monthly car payment has jumped to $729.

Mortgage debt increased by $121 billion in the first quarter, reaching a $12.04 trillion balance even though mortgage originations were way down, likely due to the Fed’s rate increase extravaganza.

Student debt saw a slight decrease in the rate of serious delinquency, which went down to less than 1%—but that’s probably because repayment is paused for now.

Zoom out: Debt balances are almost $3 trillion higher than pre-pandemic, but Fed analysts see one bright spot: Many households are still more financially stable than they were before, thanks to the mortgage refi boom of 2020–2021 when rates were at their lowest.—CC

Week Ahead: May 15, 2023 - QQQ 330/320 range

* All week: Fed speakers - too many to list, just know they’re all over the place this week.

* Monday - Empire State Manu Index @ 8:30am

* Tuesday - Retail Sales @ 8:30am & Housing @ 10am

* Wednesday - Housing @ 8:30am - this is quietest day of the week!

* Thursday - Philly & Jobless Claims at 8:30am

* Friday - JPow in the wild at 11am - typically bullish

* All times US/Eastern

I closed out my NQ short on Friday for a loss (much less than it was the day before..) because it was clouding my thinking and stopping me from doing other trades - I’m going to make it a intraday trader only and not hold it overnight, if possible. I added to my KRE and AAPL puts. Played VWAP trade long on NQ - that felt great.

Technicals - QQQ daily chart remains slightly bullish. It’s above the middle of the regression channel I drew (see below). Weekly says the trend continues….somehow.

Current positions:

AAPL 170p October 20 @ 9.60

KRE 38p Dec 15 @ 5.20

I’ve got some KR calls and WM equity, as well, but nothing exciting.

I keep thinking about how uncomfortable JPow was at the last FOMC Q&A. This man is normally smooth as jazz music. What was on his mind that he didn’t or couldn’t tell us? I’m a bear, so it’s easy to run wild.

Financial conditions are too loose still and despite the headline CPI being under the magical 5%, it wasn’t a good print. It was OK. https://www.chicagofed.org/research/data/nfci/current-data

There’s huge risk to the banking sector. KRE has already been pounded, but there’s still more to go - even if we see a mechanical short covering bounce ( may have started on Friday afternoon). I’d actually rather go directly short a few banks instead of the ETF, so I’ll probably hold the puts I have and add a few specific banks once I identify them. This is the trade I’m most confident in right now.

As to the Fed speakers this week - there’s just too many of them. It’s hard to really get a sense of situation from them when they’re all yapping. JPow will matter on Friday though. I’ll post a link to his live talk once it’s available.

I do not expect the debt ceiling to get resolved this week. They will inevitably take it right down to the wire like always. Need that drama and press coverage. This will continue to weigh on the market and start dragging it down the closer we get and we’ll get a nice pop when it’s resolved.

Overall, I remain a bear - indexes are proving more irrational than I am willing to tolerate, so I’m going to find some specific companies to focus on. I otherwise don't see any clear trades yet this week.

Today was lowest volume since Thanksgiving 2022 half-day. <yawn>

Position Update - May 8

No change:

Short NQ @ 13215

AAPL 170p 10/20 @ 10

Trades:

KRE - sold the 35c I had right at the open for a tidy little profit that I wasn't expecting. The equity dropped about 2.50 from there.

KRE - bought 38p Dec'15 @ 5.10 avg. I meant to do this as soon as I sold the calls, but forgot. Remembered and hour later and got in there, obviously a bit more expensive.

After I get out of this NQ position (by Wednesday, I think...), I won't touch it again until AAPL breaks 160 to confirm a new dowtrend. QQQ is just not coming down and I'm tired of fighting it. There's much better individual stocks to focus on right now that I'm missing due to NQ position distraction.

There's two banking reports coming out today - one at 2pm EST (loan survey) and a big one at 4pm EST (from the Fed). There will be a reaction to the 4pm one.

Week Ahead: May 8, 2023 - QQQ 328/316 range

* Monday - Wholesale Inventories at 10am, Fed Loan Survey at 2pm (market mover)

* Tuesday - Fed Jefferson at 8:30am, Fed Williams at 12pm

* Wednesday - CPI at 8:30am (market mover)

* Thursday - PPI + Jobless Claims at 8:30am

* Friday - Consumer Sentiment at 10am

* All times US/Eastern

We ended the week just slightly below where we started. We had a 7 point drop during the week, then Friday clawed almost all of it back. It was an action packed week with Fed, Apple, and much more.

I played last week pretty well through Thursday - closed my AAPL puts for a small profit, wrote AAPL puts for a 100% gain, even closed my NQ short for a gain. I took it on the chin though when I went back into NQ short + AAPL 170p (October this time) shortly after the open on Friday. I didn’t see that big of a move incoming, so holding some bags for the moment. I traded the KRE bounce on Friday for some dinner money.

Technicals - QQQ daily chart remains bullish. It’s just above the middle of the regression channel I drew (see below). Weekly says the trend continues.

Current positions: Short NQ @ 13215, holding AAPL 170p 10/20 @ 10. I’ve got two bets on the banking sector - PFBC 40p Dec’23 @ 3 (lotto ticket), and I held KRE 35c over weekend (likely to regret that)

The Fed has paused, not pivoted. A pivot is delusional without something very big breaking first (nothing has yet). JPow was visibly uncomfortable during his speech. He’s a man torn between the huge risks to the banking sector (despite his statement saying otherwise) and inflation that is about to pick back up again.

Financial conditions are loosening again and CPI is very likely to have a nasty print showing an uptick in headline along with sticky/up core. https://www.chicagofed.org/research/data/nfci/current-data

There’s huge risk to the banking sector. I was actually expecting a rescue plan this weekend, which is why I went long KRE for the weekend. Haven’t seen that yet, so I will look to close out the calls and open up puts - and sit tight and wait for the inevitable.

After CPI print, I’m going to look to close out NQ/QQQ and go long because that’s where the money will flow after more banks go splat - just like it did last time with the preview SVB gave us. At least for now. There’s a reckoning coming on tech, too — can’t keep pushing new highs and show declining growth during inflation — but it looks to get delayed again.

Overall, I remain a bear - but I will trade the channels the market is reliably staying in - for now.

If you missed the Berkshire annual meeting, here’s a great summary:

https://www.cnbc.com/2023/05/06/berkshire-hathaway-annual-meeting-live-updates.html

Too busy yesterday to update my positions, so let's catch up.

I closed out my AAPL Sept 170p for a small profit. I wrote 160p for yesterday, those should be worthless in a few minutes (boom!).

I went long ES overnight, closed out this morning (a bit early).

Fed has effectively paused now. This ends the Fed Trade. We now switch to normal economic conditions where the indicators work normally instead of inversely. I think we're here - maybe one FOMC too early, but we're in transition at least.

Tech - AAPL reported overall decline in revenue. The top should be in for QQQ within a couple months at most. You can't keep pushing new highs with declining revenues in an inflationary environment. Companies are resorting to final straw -- layoffs to hit EPS and buybacks to support stock.

Today I'm looking to short NQ and hold for a week. I think we're going to see rotation out of tech next week. I'll also buy back my AAPL puts for September or later, still 170p.

I'll be looking to go long KRE today (calls). It hit me last night after the close, so already missed the run this morning that is now obvious, but I'm expecting the Fed/FDIC to come up with another rescue operation over weekend which may include short-selling ban (absolutely silly). Let's ride it, though.

NQ up 100 points off that 6pm bottom.

Impressive.

I think this evening all the market heard was "pause"

Good summary of the QA here (scroll down) https://www.cnbc.com/2023/05/03/live-updates-fed-decision-may-2023.html

AAPL hit 163 in after hours (after a 171 high of day in regular session)....

AAPL bulls showed up already and pushing it back to 165, but these puts are going to be looking mighty fine tomorrow.

I am currently short NQ @ 13085 and AAPL 170p (Aug18) @ 12 - and taking a beating on both at the moment. I will get out of JPow’s way no matter what on the NQ short, but I’m looking for a dip ahead of him to close out.

25bps hike as expected by all. Market didn't react much, flat still.

When he takes the mic is when it'll get interesting.

They're saying no issues with banking.

Debt ceiling?

Will he give a wink on pause? They didn't in the statement. I think this will be the trend setter moment. That and saying for the 8th time he's not cutting this year (bulls still don't believe him and pricing in cuts in September)

Bears in the morning, bulls in the afternoons. Almost daily.

Exactly right. At least 25bps is coming....

*LAWMAKERS URGE POWELL TO HALT INTEREST RATE HIKES pic.twitter.com/myBpyDEelc

— Investing.com (@Investingcom) May 2, 2023

I couldn't resist the VWAP fade for one more ride.

Shorted NQ @ 192, closed @ 176.

Done for today.

Only 25 points from the 150 guess for EOD.

Closed out my NQ 13085 short @ 13193 (small loss) before noon. It was a bad entry that got away from me last Wednesday, so I'm happy to close out with a small loss ahead of JPow tomorrow. You do not going into FOMC days with an explosive position (like futures).

I went long at 137 and closed out at 158 for some lunch money. I was playing a run back to VWAP (216). As I'm posting this, it almost went to it, currently at 200. This is one of my favorite trades on the chart. When it's way away from VWAP for the day - like it was today - there's a very high probability it will run back to at least test VWAP - even if it gets faded after tagging it.

VIX woke up from its coma at 15.50 to hit almost 20 today. On its way back down - now at 17.5. No fear in this market.....

I'm still holding my AAPL Aug 170p - and have no plans to let them go.

By the time I finished writing this, NQ went ahead and broke VWAP. Now let's see if it keeps going or gets faded. I don't see any further trades for today. Will probably just watch from the cheap seats. If I were guessing, I'd say we're back around 150 by EOD.

For the last year or so, I've been mostly trading the indices using options or futures, but since they're being held up by a small handful of mega caps while everything else under them cracks, I've missed a lot of opportunities to go short on individual names that are getting the message and being more impacted by the obvious train coming down the track.

I'm going to start pulling out overvalued companies and go short some of those. There's plenty out there still.

I'm overall a bear, but my claws are getting trimmed by the AAPL, MSFT, META, GOOGL, NVDA gang.

Week Ahead: May 2, 2023 - $QQQ 330/315 range

Monday was quiet, but for the rest of the week, we've got a lot of action.

Tuesday - JOLTS, Factory Orders and AMD ER

Wednesday - ADP, FOMC, FOMC Q&A, $QCOM ER

Thursday - $AAPL ER

Friday - Non-Farm Payrolls (Unemployment) + Wage Inflation

Technicals - QQQ is pretty neutral (W), so could easily keep pushing up to 330 this week if JPow doesn’t come in hot. Daily looks very bullish and is staying right in that long-term channel.

I am currently short NQ @ 13085 and AAPL 170p (Aug18) @ 12 - and taking a beating on both at the moment. I will get out of JPow’s way no matter what on the NQ short, but I’m looking for a dip ahead of him to close out.

Then - like everybody else - I’ll be waiting to make a move after he talks.

I don’t see how he cuts anytime soon (or even this year) like CME FedWatch is predicting. The bulls are persisting and holding the line though - impressively. I think we’re looking at August 2022 all over again (see chart below)

$AAPL earnings on Thursday, then NFP on Friday. AAPL will certainly set the tone, but I don’t expect much out of NFP because I’m just not seeing any pain out there yet and the Fed knows that as well.

Good earnings season so far - at least on the headlines.

Inflation is coming back though. That CPI next week is going to upset some bulls, I think, with oil and many other things pushing back up.

The market is in a state of picking and choosing what it wants to move up/down on. It’s quite hard to trade at the moment. Default bias remains long for general market.

|

Followers

|

2

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

28

|

|

Created

|

05/01/23

|

Type

|

Free

|

| Moderator Timmy Picklez | |||

| Assistants Chuckie Finster | |||

|

Posts Today

|

0

|

|

Posts (Total)

|

28

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |