| Followers | 27 |

| Posts | 1104 |

| Boards Moderated | 1 |

| Alias Born | 07/15/2009 |

Wednesday, July 11, 2012 1:38:16 AM

Some history of where your money went, if you invested in Quasar Aerospace. If you don't know the history of QASP, how can you feel comfortable with the future?

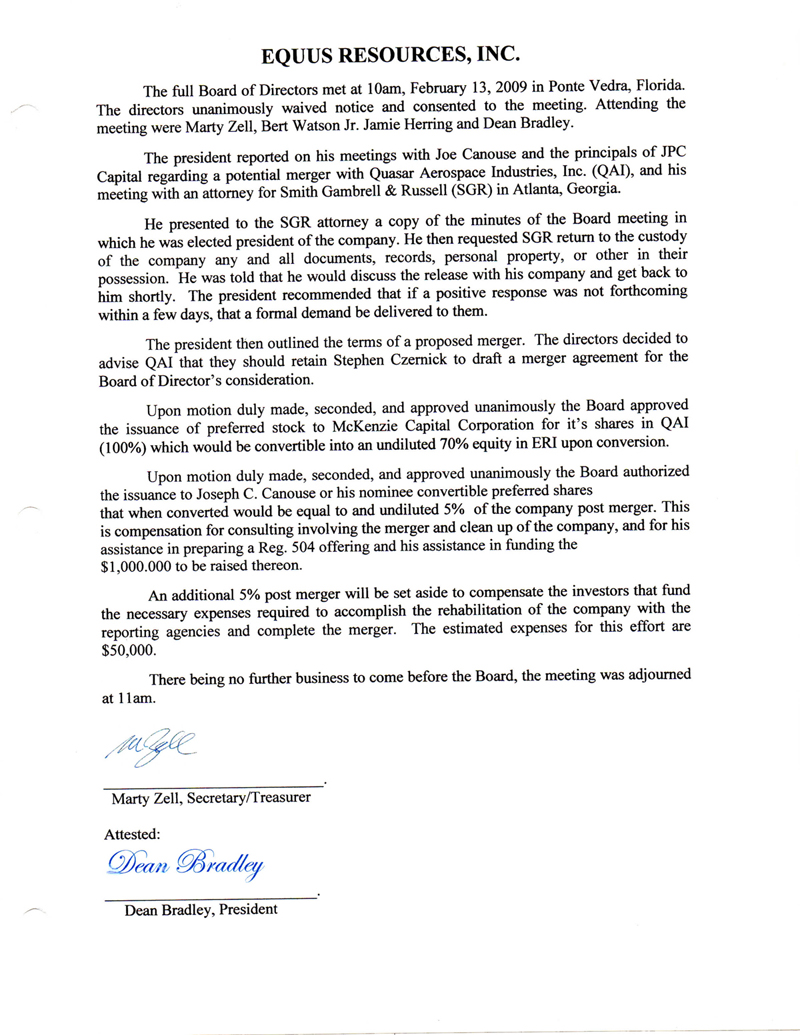

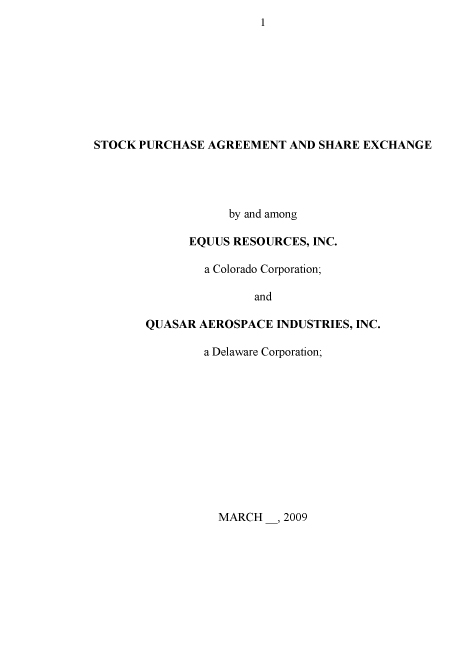

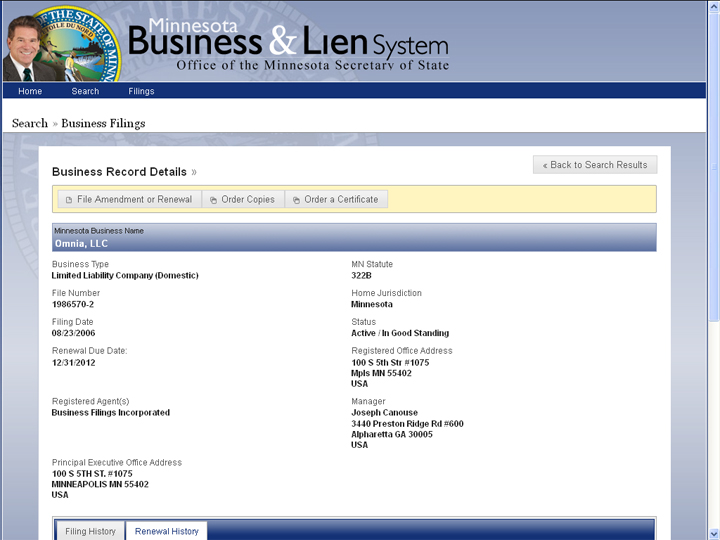

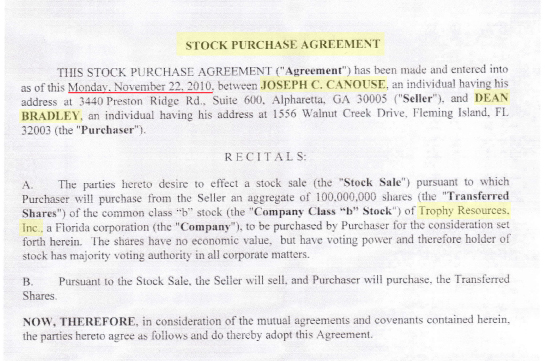

If you look at the 6th paragraph of this document, it appears that Joe Canouse got 5% of the company (Post Merger) for the clean-up of the company, along with his friend Stephan Czarnick. Czarnick is the lawyer for another company of Canouse's; Trophy Resources Inc (TRSI)... http://www.otcmarkets.com/stock/TRSI/company-info

You should also look at this court document where you see Joey's buddy Stephan Czarnick has a history of "clean-ups" and the misleading of shareholders, which is what was perpetrated in this scam called Quasar. http://www.sec.gov/litigation/complaints/2010/comp21401.pdf

Czarnik served an essential role in these illegal offerings. He churned out bogus opinion letters predicated on the Promoters' alleged representations to him that they are buy-and hold investors. In fact, Czarnik knew that they had no intention of holding the stock, but that they intended to nationally advertise the stock and quickly dump their shares into the public market for millions of dollars. Czarnik knew or was severely reckless in not knowing that the Promoters intended to distribute the stock to the public and that the transfer agent would rely on his letters and issue stock certificates without restrictive legends.

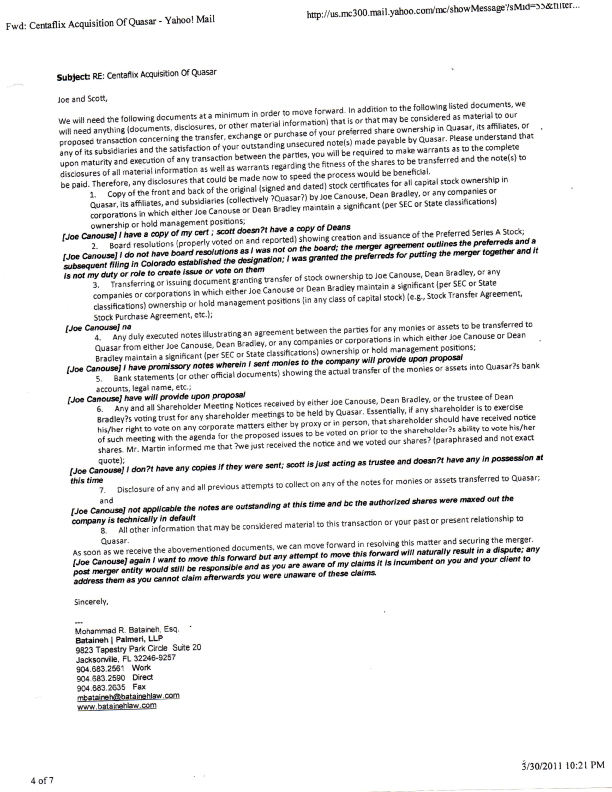

Saying that, Joey would have to have known about every aspect and detail in order to do this. How is it that Joe can say that he didn't know about any aged debt with this company prior to all the 504s, especially if Joe Canouse put the merger together?

As you can read in this e-mail in Item 2 Joe Canouse states: "I was granted the preferreds for putting the merger together...."

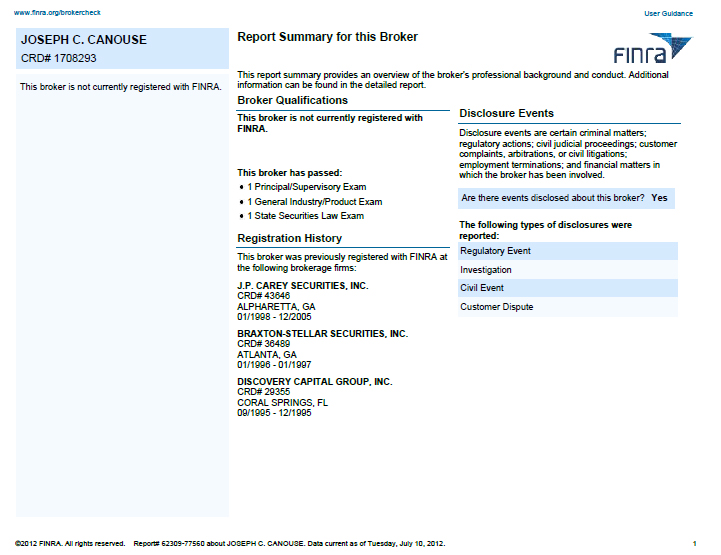

How did Joseph C. Canouse broker this deal (put the merger together) when he didn't have a Brokers Licence since December of 2005. You Can see Canouse's detailed report here (It's worth a read)... http://brokercheck.finra.org/Support/ReportViewer.aspx?SearchGroup=Individual&FirmKey=-1&BrokerKey=1708293

Not to mention that his wife Aron (Brooks) Canouse uploaded all the documents to Pink Sheets and is still a Quasar Company Officer. http://www.otcmarkets.com/stock/QASP/company-info

This is a real story in itself...you can really get to see how the Canouse Playbook and Canouse Play-makers were run for this Multimillion=Dollar SCAM!!! Here is the link to Pink Sheets for QASP Initial Company Information and Disclosure Statement

http://www.otcmarkets.com/financialReportViewer?symbol=QASP&id=21264 . This is what Aron Canouse uploaded, on March 19, 2009, for all investors and potential investors to read in order to complete their Due Diligence.

Let's break-down a few pages:

Aron Canouse Uploaded Page One: (Notice you can see that the date is missing!)

The REAL Page One Document: (Notice you can see that the date is not Missing and you can see that the page is initialized by Dean Bradley and Dated 3/17/09)

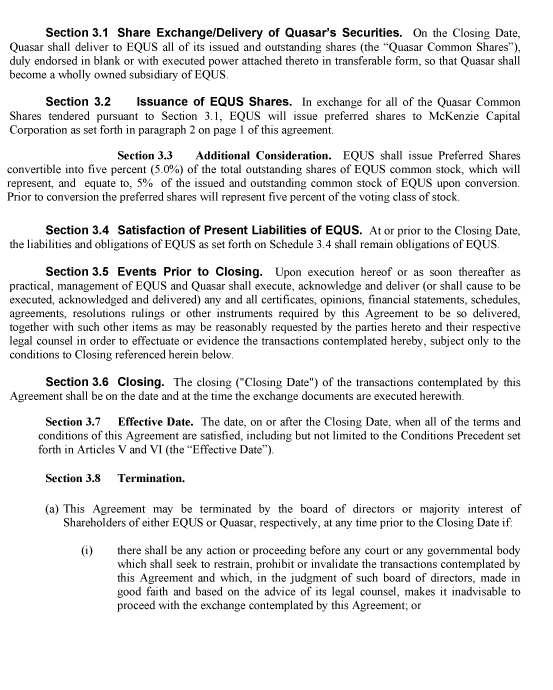

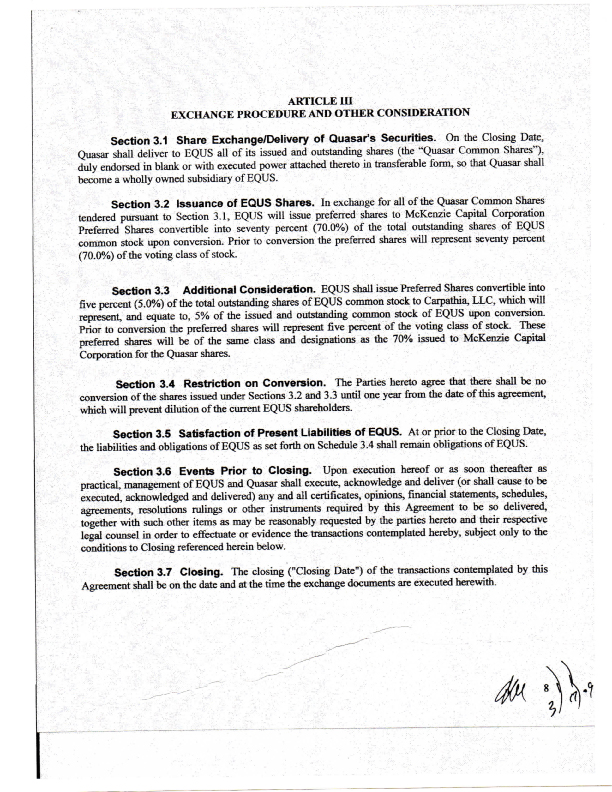

Aron Canouse Uploaded Page Nine: (Pay attention to Section 3.3 and 3.4)

The REAL Page Nine Document: (Notice in Section 3.3 that "Carpathia, LLC" removed from the page!!! We know that Carpathia, LLC IS Joe Canouse and husband of Aron (Brooks) Canouse who uploaded this to Pink Sheets!!! Section 3.4 was removed all together from the agreement that was uploaded to Pink Sheets!!! RESTRICTION ON CONVERSION Note: the document is initialized and dated at the bottom.)

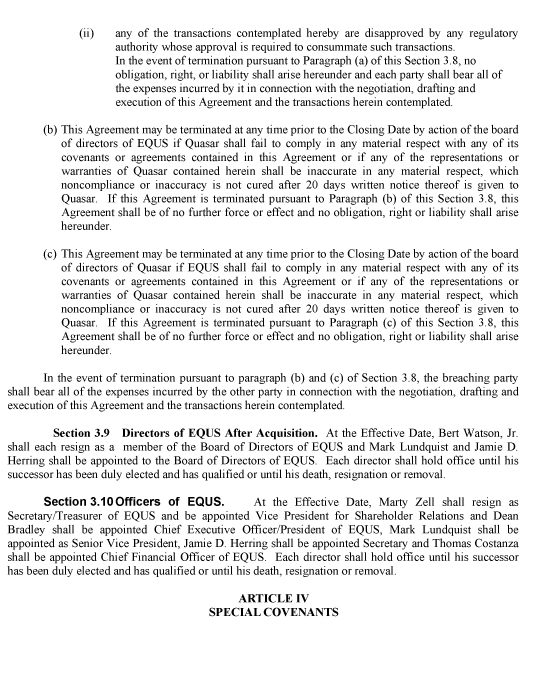

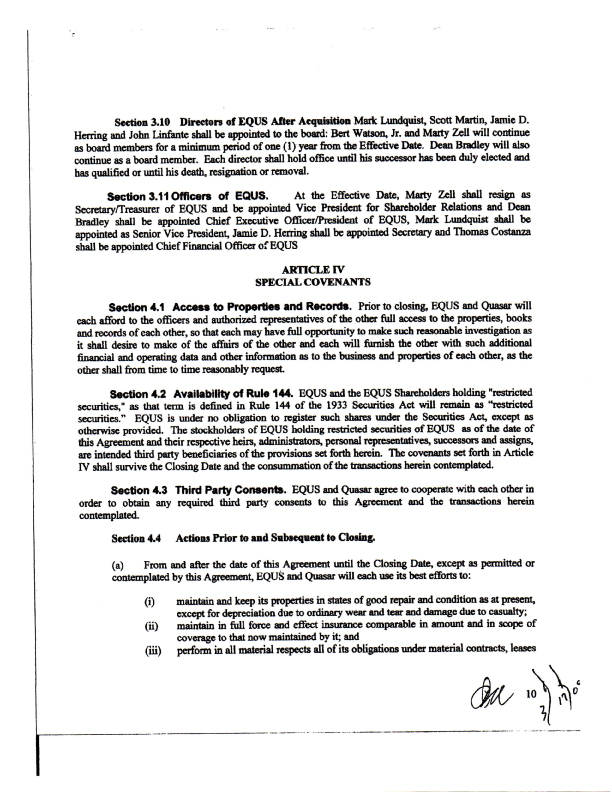

Aron Canouse Uploaded Page Ten: (Note Section 3.10)

The REAL Page: (Notice that name of Scott Martin, who is Joe Canouse's Brother-in-law was removed from the uploaded version to Pink Sheets!!! Once again, you can see that the page is initialized by Dean Bradley and Dated 3/17/09)

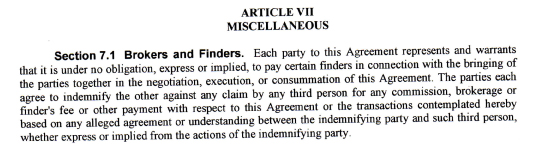

Joe Canouse got Paid to Broker the Deal/Be a Consultant (Whatever he wants us to believe now) but Carpathia, LLC was ommitted from the Pink Sheets uploaded document...why? The simple reason is that it would be in violation of Section 7.1

What was Aron (Brooks) Canouse doing? Was this a rogue individual changing and posting false information to Pink Sheets for investors to complete their Due Diligence on? Did Aron Canouse march on her husband's (Joe) orders? Did she march on Scott Martin's orders?

People want to put this mess on Jeff DiGenova's shoulders, but in fact, he did not post anything regarding Quasar until August 2009 but if you dig you will see that the Conductor of Orchestra, the Wizard of QASP, the Man With the Iron Mask, the one who is really "Your Daddy", is none other than JOE CANOUSE!!!

Since we know that Scott Martin was part of it all, from the start...you can bet he made out handsomely on this deal...

We do know a couple of things about Scotty:

1. He is the current Quasar CEO's (Joe Canouse) Brother-in-law

2. He was Investor Relations for Quasar Aerospace and Director for EQUS after Aquistion.

Definition of 'Investor Relations - IR'

A department, present in most medium to large public companies, that provides investors with an accurate account of the company's affairs. This helps investors to make informed buy or sell decisions.

Do you think he was this type of IR?

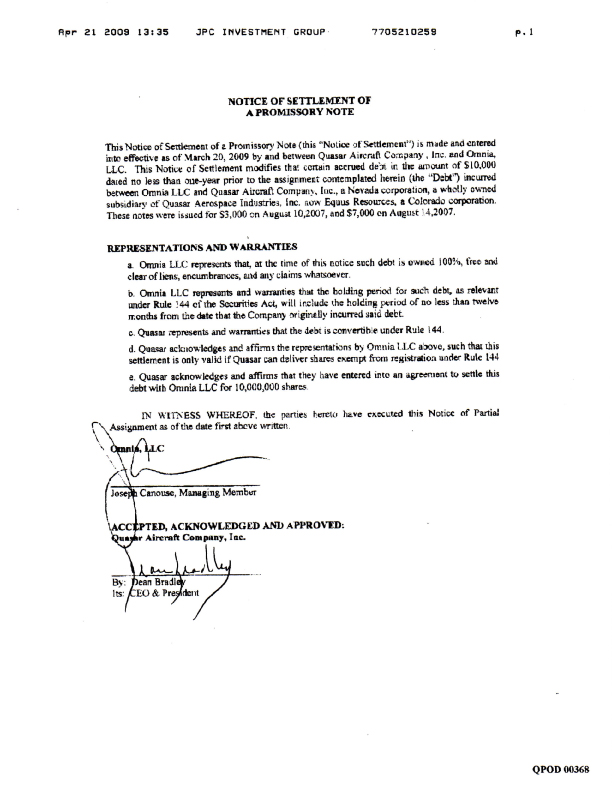

Here is an e-mail from Scott Martin, performing his duties as "Investor Relations"...by telling Dean to "deliver 10,000,000 unrestricted shares to Omnia LLC.

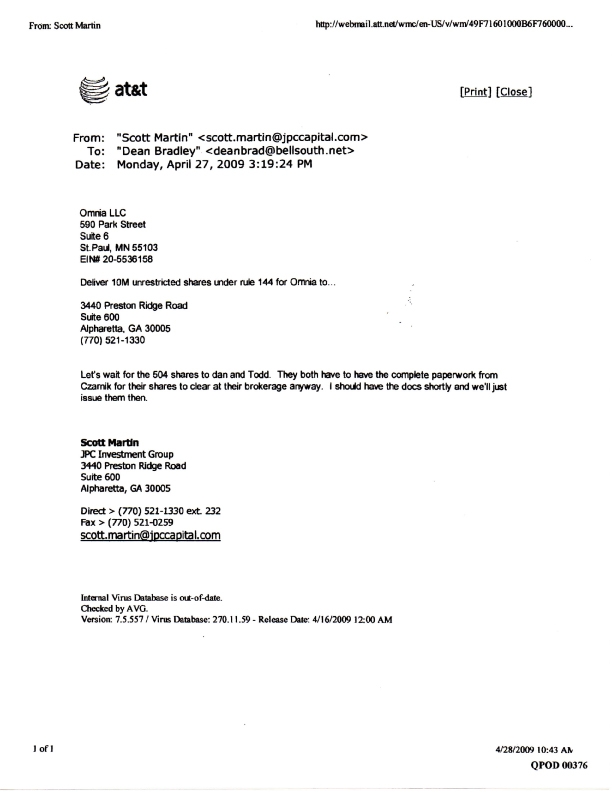

Now who is Omnia, LLC located in the great state of Minnesota?...Look down if you dare!!!!

Now, everybody is probably are wondering what kind of deal Omnia, LLC made for 10,000,000 shares...would you believe me that is was a GOOD DEAL? (For Joe, that is...)

Ten thousand bucks ($10,000) for 10,000,000 shares is .001!!! Now at the time these shares were issued, what was QASP trading at...between 1 cent and 6 cents...how much did Joe Canouse make?

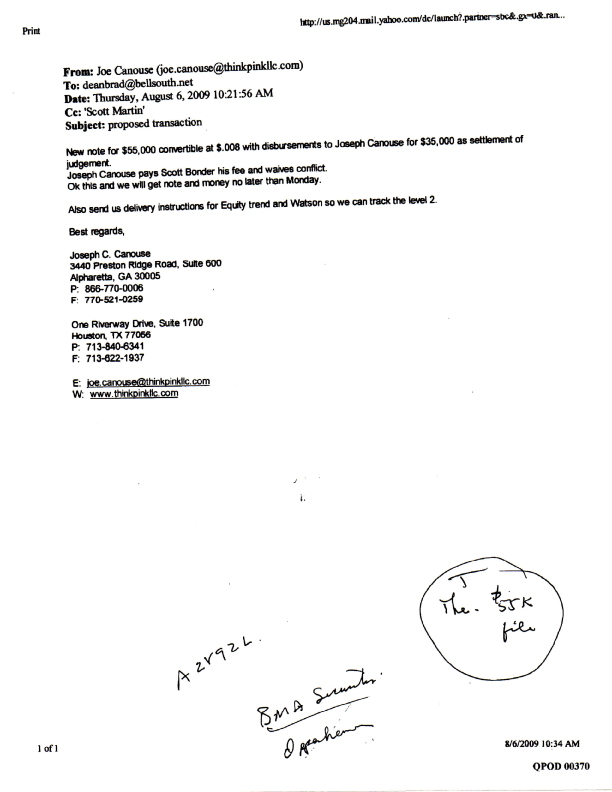

Looks like ole' Dean Bradley, was just the puppet in this scam...Joe and company had Dean jumping through hoops, at his age! Here is “The $55K File”....why did Joe, tell Dean to send delivery instructions for Equity Trend and Watson, to himself and Scott, so it can be tracked on Level 2....why would they need to worry about that? Unless, so they could make sure not too much was being dumped at one time so the stock wouldn't tank and they could all get out at an orderly fashion....

Here is an e-mail from Harold Mittleman, who we all know was the Host/Emcee for Quasar's Conference Call...

Let's all be clear...I don't for one second think Dean Bradley is not guilty of scamming people out of their hard earned money...mine included!!! Dean was learning from the best..."Canouse and Company" on how to do things as you can see by some of these preceding docs. You have the company IR (Scott Martin) man TELLING Dean who to issue shares to and when...you have Joe Canouse asking when other had their shares issued to them so they could "track it on Level 2"...you have them discussing how to keep massaging the shareholders in order to keep them all excited about QASP so they don't all start selling off their shares....

Can you imagine the round table meeting they had between these characters...you have Harold and Scott building a scale model of the new hanger out of Popsicle sticks while Joe is combing his hair in "The Magic Mirror of Deniability" ...this is a movie-no doubt about it!!!

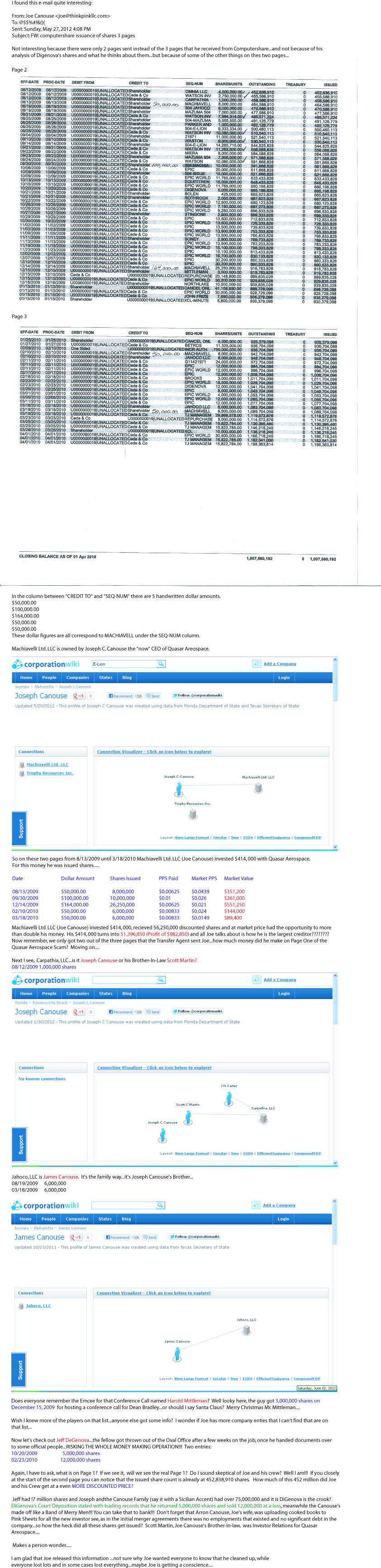

We can't forget the Joe Canouse sent us two pages of Computershare Documents through his 'back-door' email system...Canouse never did send out Page One...which is a little suspect....

After-all Joe Canouse is a "Distressed Debt Specialist" which he really did to all the shareholders of Quasar Aerospace.

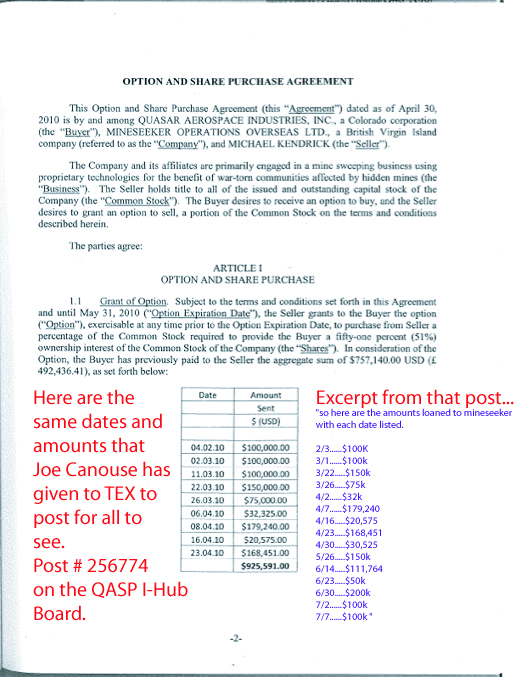

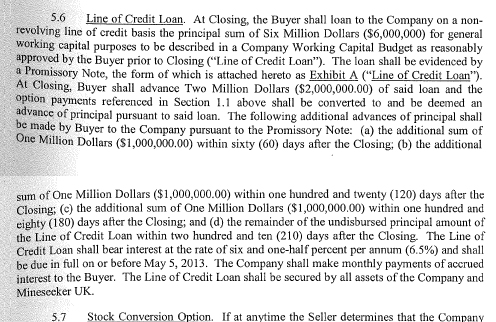

Joe Canouse is now claiming, as the NEW CEO of Quasar, that Minseeker was loaned 1.7mm dollars and must pay it back to Quasar.

This was posted June 1, 2012 (Post #256774), I guess he got another "document" from Joe...did anyone see this document? I would love to see this one!!!

Quote:

the document says total mineseeker and a amount

next line says total loan receivables

so here are the amounts loaned to mineseeker with each date listed.

2/3......$100K

3/1......$100k

3/22.....$150k

3/26.....$75k

4/2......$32k

4/7......$179,240

4/16.....$20,575

4/23.....$168,451

4/30.....$30,525

5/26.....$150k

6/14.....$111,764

6/23.....$50k

6/30.....$200k

7/2......$100k

7/7......$100k

total loan receivables $1,567,880.00 that went to minseeker

jmho

tex

Tex says, "the document says total mineseeker and a amount

next line says total loan receivables". Okay lets see...is this document something that Dean created on Microsoft Word or something from his accounting program? Either way Dean and his partners could call the Headings/Titles anything thing that they pleased!!! They just filled in the blanks... For instance, if Dean paid monies to the IRS and he created an accounting entry as "Total IRS" and the next line says "Total Loan Receivables" does that mean Joe can sue the IRS for that amount? I'm sure he would try....

Okay Joe, through Tex, says that these amounts were paid to Mineseeker...there was an agreement between Quasar and Mineseeker....

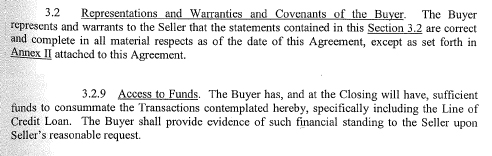

If you look at TEX's numbers that he provides in his post as fact, you see that the numbers do line up on the agreement between the two parties...The agreement states, "In consideration of the Option, the Buyer (Quasar) has previously paid to the Seller (MS) the aggregate sum..."

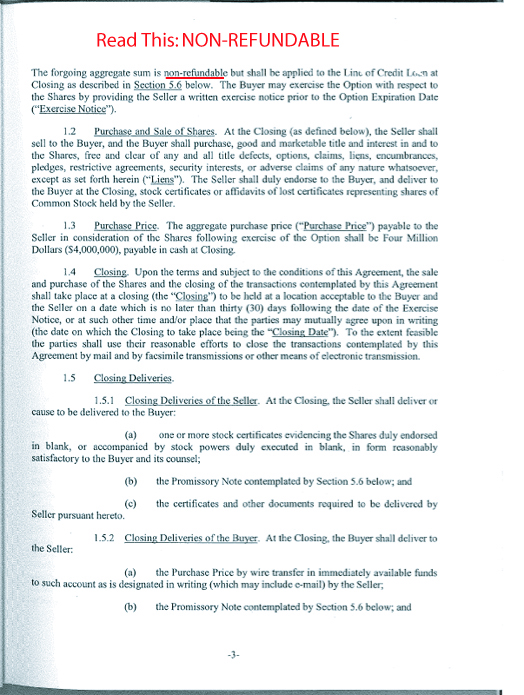

Page 3 of the agreement states, "The forgoing aggregate sum is non-refundable..."

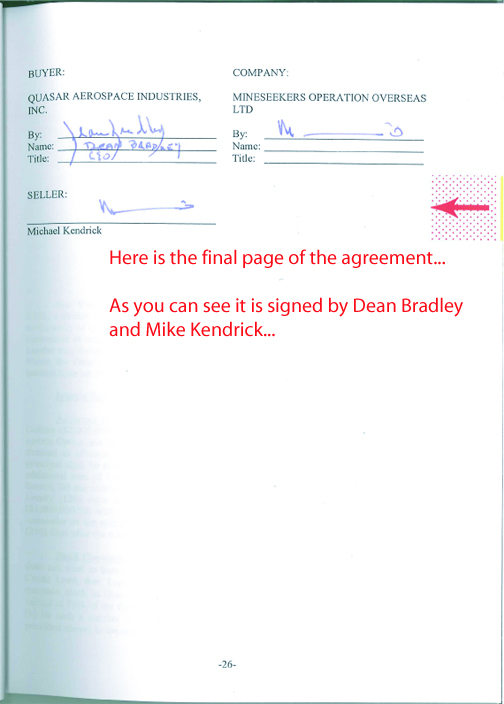

As you can all see...BOTH DEAN BRADLEY AND MIKE KENDRICK SIGNED THE AGREEMENT ----> THE AGREEMENT THAT QUASAR DID NOT FULFILL, WHICH MEANS THEY FORFEITED THE MONIES THAT THEY PAID...the same as the monies that were paid to the IRS...gone and you cannot get them back because you want to...

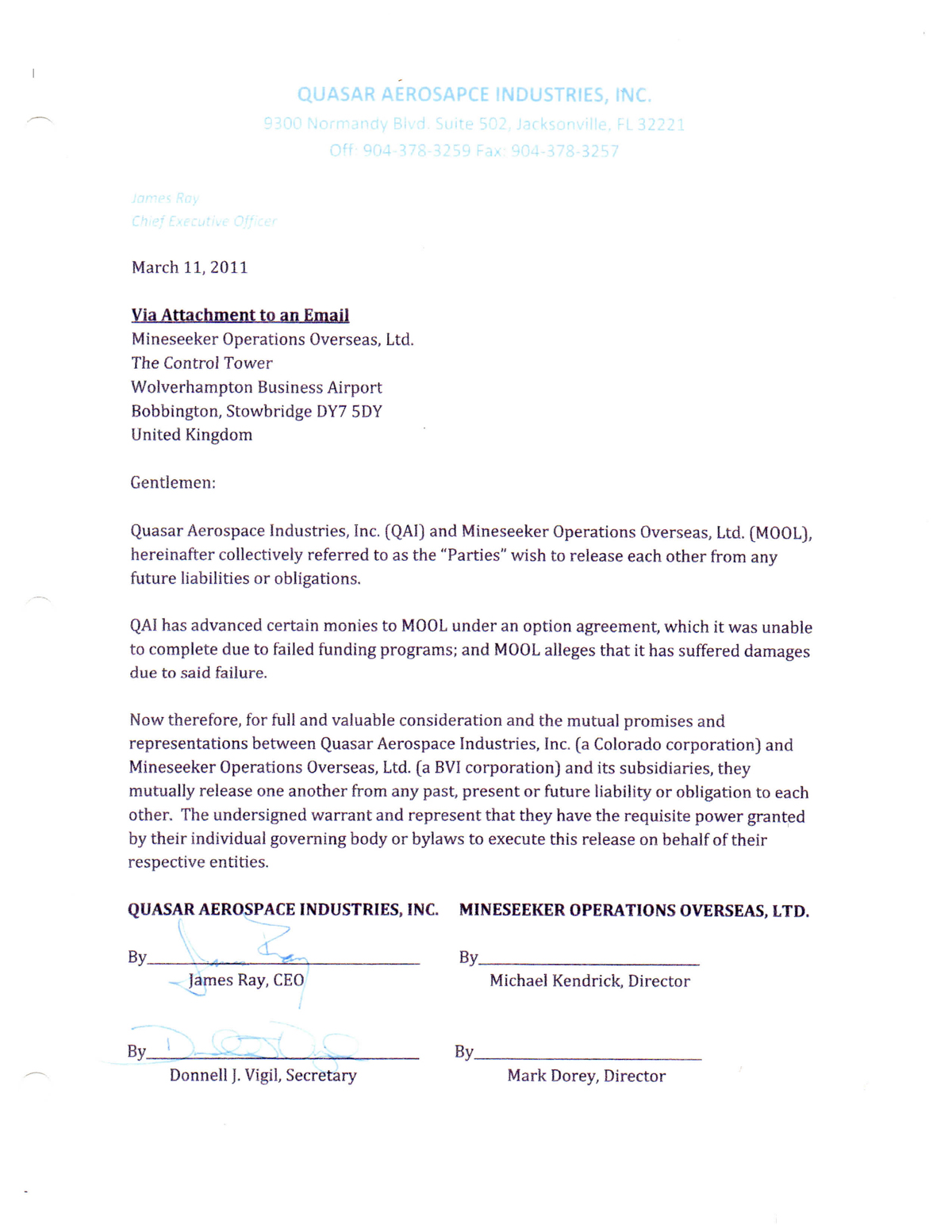

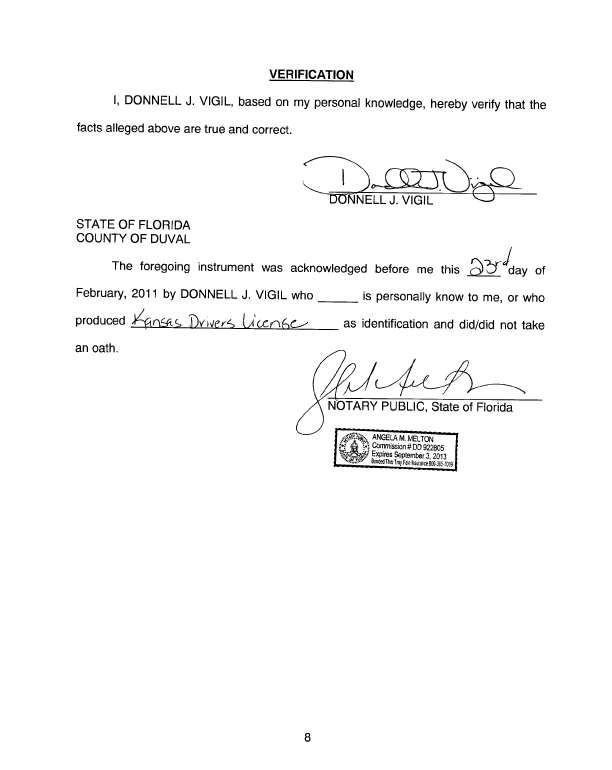

On March 11, 2011, on Quasar Aerospace letterhead, a release was sent to Minseseeker by CEO James Ray and SECRETARY Donnell J. Vigil. There is some questions posed about James Ray in this mess...but Donnell Vigil was the corporate Secretary then and to this day IS STILL Quasar Aerospace's Corporate Secretary, under the regime of Joseph Canouse....

Here is Donnell's signature, signed in front of a notary public on Feb. 23, 2011...compare the signature with her signature on the release below...

If the Option and Share Purchase Agreement was not valid, why would Quasar Aerospace try to get Minseeker to sign a RELEASE?

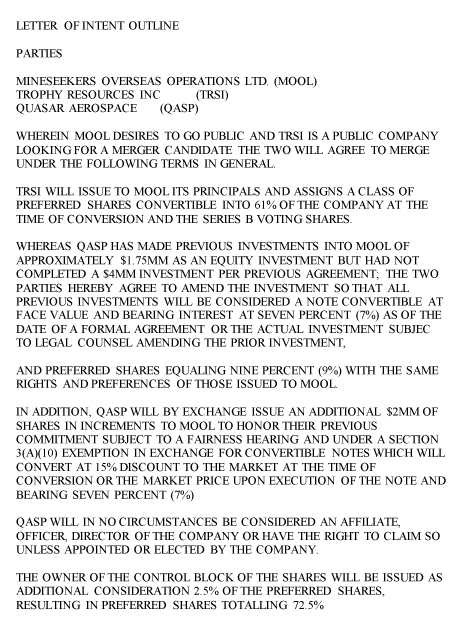

Joe and Dean met with Minseeker in Florida, and they tried to roll Minseeker into Trophy Resources Inc. (yep, the same TRSI from the beginning of this story!!!)

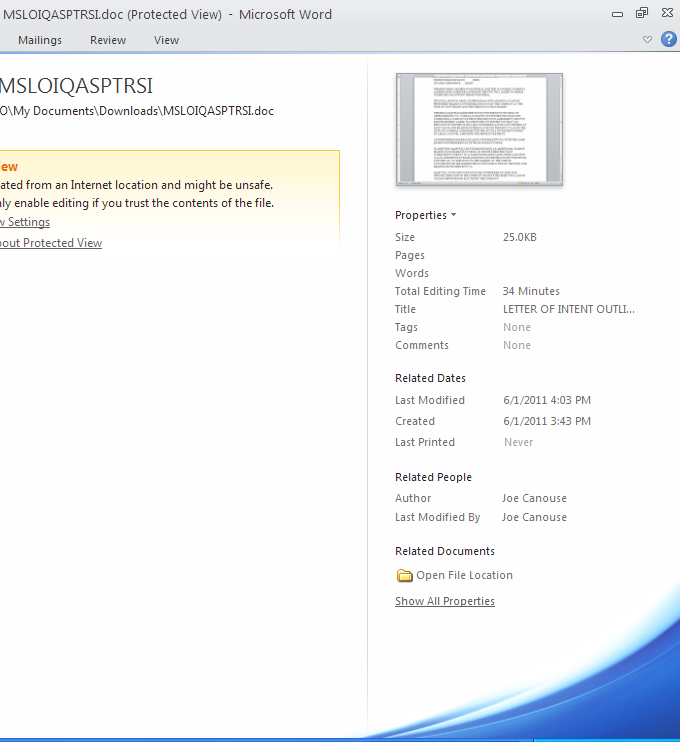

If the Option and Share Purchase Agreement was not valid...why would Joe Canouse send Minseeker a "Letter of Intent", on June 1, 2011, stating “WHEREAS QASP HAS MADE PREVIOUS INVESTMENTS INTO MOOL OF APPROXIMATELY $1.75MM AS AN EQUITY INVESTMENT BUT HAD NOT COMPLETED A $4MM INVESTMENT PER PREVIOUS AGREEMENT”

Why would Joe Canouse the CEO of Quasar mention the agreement if it had no validity?

Mike Kendrick sent out this e-mail after that meeting with Canouse and Bradley, where Minseeker made an in good faith offer to QASP, via Joe on the above described 4% of common stock. Joe Canouse turned down this offer....

From:

Mike Kendrick <MKendrick@mineseeker.com>

Add to Contacts

To: xxx xxx<xxx.xxx@xxx.xxx>

Hi xxx, please forgive me for not fully replying but rather attaching a copy of a not to two other QASP shareholders. I hope this is OK . If you have any further question, feel free to ask.

Disclaimer - June 27, 2011

This email and any files transmitted with it are confidential and intended solely for xxx. If you are not the named addressee you should not disseminate, distribute, copy or alter this email. Any views or opinions presented in this email are solely those of the author and might not represent those of . Warning: Although has taken reasonable precautions to ensure no viruses are present in this email, the company cannot accept responsibility for any loss or damage arising from the use of this email or attachments.

From: Mike Kendrick

Sent: 27 June 2011 17:28

To: 'xxx'

Cc: 'xxx'

Subject: Update

Hi xxx, I have given some thought to your predicament and felt it about time you had an explanation. I have also copied this to xxx, given his email to me of today.

Regards,

Dear xxx,

Thank you for the reply. I do understand your position and I have tried to help and accommodate the QASP shareholders.

Let me explain how.

Firstly, you must understand that we were let down very badly by QASP. They stopped the agreed funding, suddenly and without notice, at a critical time in our programme. This caused enormous damage to our progress – right in the middle of our Croatia demonstration.

On top of that disappointment, some of the QASP shareholders were making libellous claims against us on a public forum. Others were contacting the Croatian authorities to check on our bonifides and not believing we were even in Croatia. One contacted the company of our partner, who passed away suddenly on the basis that we may have made up that story. Incredibly distasteful and unprofessional.

So, at that point, I think you will understand why we wanted nothing to do with QASP. We were being slandered and QASP had reneged on the deal. The contract states quite clearly that the payments were non returnable options.

It then became apparent that Joe Canouse may sue Mineseeker for the $1.7 million that QASP had paid to Mineseeker. In fairness to Joe, he told us he had not seen the agreements and knew of no non-returnable options. We sent Joe copies of the documents two weeks ago and on the 17th of June he acknowledged that he had not seen them before and that they ‘ shed light on your perspective’. Joe's claims were further complicated by Dean Bradley who has written to the Mineseeker stating that much of the cash advanced, came from him personally, not from QASP. The stated that the QASP books did not show any money due from Mineseeker and that we owned him the money. The statement that no debt by Mineseeker was in the books came at a time when Dean was, undisputedly ( I think) the president of QASP.

However, Jeff DiGenova, argued long and hard for the QASP shareholders, stating that many had lost money – some their life savings- and some had only invested as they believed in Mineseeker. This persuaded me that we should take another look at this situation and I offered QASP 4% of common stock in our public entity.

The sequence of events was as follows;

We received several offers to merge with Trophy, from Dean Bradley who explained that he and Joe Canuse owned the company (Trophy) and they would like to work with us.

We met Joe Canuse, Dean Bradley and Donna Virgil during our most recent visit to Jacksonville. I agreed to this meeting on the basis that QASP would not be discussed. We were only listening to an offer from Trophy. We took the details of this offer to our legal counsel who, like ourselves, questioned the legality and ethics of the proposed arrangement. Joe wrote to us formally with this offer which we rejected. We were surprised that these confidential conversations and proposed agreements were emailed to other parties. The details of that breach are being held for future action, if and when necessary.

We made an in good faith offer to QASP, via Joe on the above described 4% of common stock. I assume Joe put this to the QASP shareholders. He did not reply to us formally, although he informed by telephone that it was of no interest. We wrote back to him informing him that the offer was open until 21st of June. We received no response and the offer lapsed.

It seems to me that a section of QASP shareholders are determined, at all cost, to spoil any attempt by NHSH to make a deal with Mineseeker, although, the arrangement would obviously be to the advantage of most . Now, an attack on Dan DiGenova, a young man making his way in life, is subjected to vicious rumours and attacks on his personal integrity. I can tell you that we consider Dan to be a fine young man and our DD would have quickly picked up any questionable behaviour on his part. We have received the shareholders registry related documents and will have warrants to support them. The accusation is obviously false and is simply designed to cause damage to the main body of QASP shareholders, while benefiting one or two.

As far as the accusations against Mineseeker and me personally, we are in the process of subpoenaing a website, Investors Hub, to identify the perpetrators of many false and malicious statements.

I am not in the habit of writing long diatribes but felt this story should be set on record.

Please feel free to post this anywhere you wish. I would be happy to respond to any sensible questions.

Mike Kendrick

Founder.

The Mineseeker Foundation.

The Control Tower. Wolverhampton Business Airport.

Bobbington. Stourbridge. DY7 5DY

T. 01384 904020.

M. 07802 395969

www.mineseeker.org. www.mineseeker.com. www.thesoleofarica.za.org

www.thesoleofarica.za.org

Jeff DiGenova was CEO for a short while, and while he was in this position discovered some of the wrong-doings of Dean Bradley and Joe Canouse and his gang. Jeff went to the authorities with evidence that he discovered and he was quickly removed as CEO of Quasar because of the super-voting rights that came along with the Preferreds A's that Dean Bradley, Joe Canouse and Scott Martin held.

Joe commenced a lawsuit against Jeff DiGenvoa, through Quasar so the common shareholder cold pick up the legal bill but he would still remain as the largest creditor of the company.....even after pocketing millions of dollars, Joe Canouse is still owed!!!

Joe raised share structure and then applied a 1000:1 Reverse Split in order to remove all common shareholders from the past.

How did he do this R/S? Read this string of e-mails below:

From: Joe Canouse [mailto:joe@thinkpinkllc.com]

Sent: Friday, October 14, 2011 9:41 AM

To: ' Craig Huffman '

Cc: 'Donnell Vigil'

Subject: Legal Opinion

Dear Craig

Thank you for agreeing to write the legal opinion required from Computershare. I have copied Donnell Vigil who is our corporate secretary and will be sending you everything you need.

If you can do it by Monday that would be great.

best regards,

Joseph C. Canouse

joe@thinkpinkllc.com

P: 866-770-0006

P2: 770-521-1330

F: 770-521-0259

From: Craig Huffman <craig@dslgpa.com>

To: ' Joe Canouse ' <joe@thinkpinkllc.com>

Cc: 'Donnell Vigil' <donnell_vigil@yahoo.com>; ' Craig A. Huffman ' <Craig@securuslawgroup.com>

Sent: Friday, October 14, 2011 8:01 PM

Subject: QASP Reverse

Joe,

I saw when I received the paperwork that QASP is a Colorado Company. As such you fall under Colorado Business Corporation Act. Specifically, to effect a reverse stock division it is governed by Section 7-106-105. Under that section, which I have copied below, you must obtain shareholder approval, with notice to all common stock class members, and approval from a shareholder meeting.

I reviewed the QASR Articles of Incorporation, including the latest changes, and there is nothing that allows this to be done without shareholder approval. I am sorry, but I don't see how this is done, unless you have a shareholder meeting/vote first. Let me know what you want to do.

7-106-105. Reverse stock split. (1) Unless otherwise provided in the articles of incorporation, the outstanding shares of a class or series may be reduced to a lesser number of shares by a reverse split made on the terms set forth in this section.

(2) To effect the reverse split , each outstanding share of the class or series shall be divided by the same divisor as is every other such share.

(3) Each share of the class or series shall have, after the reverse split , such par value, if any, as may be stated in the articles of incorporation.

(4) If the articles of incorporation are to be amended in connection with the reverse split, whether to change the number of authorized shares of such class or series or the par value, if any, of the shares of such class or series or for any other reason, such amendment shall be effected pursuant to article 110 of this title.

(5) In lieu of issuing fractional shares upon such reverse split , the corporation may take any of the actions provided for in section 7-106-104.

(6) For the reverse split to be effected:

(a) The board of directors shall recommend the reverse split to the holders of shares of the class or series that is to be reverse split and to each other voting group that is entitled, by reason of any provision in the articles of incorporation, to vote on the reverse split, unless the board of directors determines that, because of conflict of interest or other special circumstances, it should make no recommendation and communicates the basis for its determination to the shareholders with the submission of the reverse split; and

(b) The holders of shares of the class or series that is to be reverse split , and each other voting group that is entitled, by reason of any provision in the articles of incorporation, to vote on the reverse split , shall approve the reverse split .

(7) The board of directors may condition the effectiveness of the reverse split on any basis.

(8) The corporation shall give notice, in accordance with section 7-107-105, to each shareholder entitled to vote on the reverse split , of the shareholders' meeting at which the reverse split will be voted upon. The notice of the meeting shall state that the purpose, or one of the purposes, of the meeting is to consider the reverse split , and the notice shall contain or be accompanied by a copy or a summary of the reverse split .

(9) Unless articles 101 to 117 of this title, the articles of incorporation, bylaws adopted by the shareholders, or the proposing board of directors require a greater vote, the reverse split shall be approved by the votes required by sections 7-107-206 and 7-107-207 by every voting group entitled to vote on the reverse split.

Craig A. Huffman

Securus Law Group, P.A.

13046 Racetrack Road #243

Tampa, Florida 33626

Phone: (888) 914-4144

Fax: (888) 783-4712

e-mail: craig@securuslawgroup.com

From: Donnell Vigil [mailto:donnell_vigil@yahoo.com]

Sent: Monday, October 17, 2011 11:47 AM

To: Craig Huffman ; ' Joe Canouse '

Cc: ' Craig A. Huffman '; Donnell_Vigil@yahoo.com

Subject: Re: QASP Reverse

Craig:

Please find attached a copy of the Amended and Restated Articles of Incorporation that Quasar is filing today with the Colorado Secretary of State. This amendment incorporates the following language which conforms with Quasar's corporate Bylaws.

"Except as may otherwise be provided by the Colorado Business Corporation Act, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power; provided that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written consents is required. In no instance where action is authorized by written consent need a meeting of stockholders be called or noticed." Article I, p. 1

Quasar's Bylaws were published to the public on May 19, 2009 (see www.otcmarkets.com/stock/QASP/financials). The foregoing language was omitted in error in our previous filing and in order to conform to our Bylaws we will amended our articles to comply.

In accordance with Quasar's Bylaws and our newly Amended Articles of Incorporation, Quasar should have the right to conduct a reverse split with a written consent thereto signed by stockholders with majority of the voting power without needing a meeting.

Please let me know your thoughts.

Thanks,

Donnell J. Vigil

Corporate Secretary & Director

Quasar Aerospace Industries, Inc.

9300 Normandy Blvd., Suite 502

Jacksonville, FL 32221

(904) 589-1894 - cell

(904) 378-3259 - office

From: Craig Huffman [mailto:craig@dslgpa.com]

Sent: Monday, October 17, 2011 9:07 PM

To: 'Donnell Vigil'; ' Joe Canouse '

Cc: ' Craig A. Huffman '

Subject: RE: QASP Reverse

Joe and Donnell,

This is proving complicated, however you got over the shareholder approval hurdle. Can someone send me the resolution for the reverse. I seem to have everything else but that. It was not on file with Colorado that I saw.

Minor detail ... Please send so I can finish this by tomorrow.

Joe, you and I need to talk tomorrow about this please.

Craig A. Huffman

Securus Law Group, P.A.

13046 Racetrack Road #243

Tampa, Florida 33626

Phone: (888) 914-4144

Fax: (888) 783-4712

e-mail: craig@securuslawgroup.com

From: Joe Canouse [mailto:joe@thinkpinkllc.com]

Sent: Monday, October 17, 2011 9:20 PM

To: ' Craig Huffman '; 'Donnell Vigil'

Cc: ' Craig A. Huffman '

Subject: RE: QASP Reverse

Ok will call...donnell pls forward the resolution

Joseph C. Canouse

joe@thinkpinkllc.com

P: 866-770-0006

P2: 770-521-1330

F: 770-521-0259

From: Craig Huffman [mailto:craig@dslgpa.com]

Sent: Tuesday, October 18, 2011 9:03 PM

To: ' Joe Canouse '; 'Donnell Vigil'

Cc: ' Craig A. Huffman '

Subject: QASP Opinion

Joe and Donnell,

Attached is the opinion for the reverse division for Computershare. Joe , I would still like to talk to you. I tried your office today but didnt get through. Too many choices were Canouses that were not you on the phone menu.

Craig A. Huffman

Securus Law Group, P.A.

13046 Racetrack Road #243

Tampa, Florida 33626

Phone: (888) 914-4144

Fax: (888) 783-4712

e-mail: craig@securuslawgroup.com

From: Joe Canouse [mailto:joe@thinkpinkllc.com]

Sent: Tuesday, October 18, 2011 9:05 PM

To: ' Craig Huffman '

Subject: RE: QASP Opinion

Sorry I will figure out my direct number

The extension is 222

The cell is 404-444-7855

I will call you in the morning unless you have a better time to suggest

Joseph C. Canouse

joe@thinkpinkllc.com

P: 866-770-0006

P2: 770-521-1330

F: 770-521-0259

From: Craig Huffman [mailto:craig@dslgpa.com]

Sent: Sunday, October 23, 2011 7:13 PM

To: ' Joe Canouse '

Cc: ' Craig A. Huffman '

Subject: Invoice for QASP Opinion

Jose,

Attached is the invoice for the reverse division opinion for the Quasar corporate action for Computershare. The amount of the initial quote was really small compared to all that went into this and the extensive litigation. Normally this type of fee would be $3k plus given all at hand. I only increased the quote by $500. Let me know what else is needed. Anything for Pinksheets I will have my associate do it quickly.

Craig A. Huffman

Securus Law Group, P.A.

13046 Racetrack Road #243

Tampa, Florida 33626

Phone: (888) 914-4144

Fax: (888) 783-4712

e-mail: craig@securuslawgroup.com

From: Joe Canouse [mailto:joe@thinkpinkllc.com]

Sent: Friday, May 25, 2012 2:31 PM

To: ' Craig Huffman '

Cc: ' Craig A. Huffman '; 'Donnell Vigil'; ' Ken Tomchin '; tomfavata03=40aol.com@pi8ip6be6-3cf5icqf.r-v5.readnotify.com; tomchin@tomchinandodom.com

Subject: RE: Invoice for QASP Opinion

CRAIG PLEASE CALL ME ON MY MOBILE PHONE AS AN INDIVIDUAL ATTACHED, MR. TOM FARTVALTA, IS MAKING CLAIMS THAT HE AND A GENTLEMAN NAMED MARREK OZGOODWA HAVE ENGAGED YOU TO SUE ME.

AS YOU KNOW YOU AND I HAVE SPOKEN ABOUT A SIMILAR SUIT ON MY BEHALF AS WELL AS MR. JAMES OWENS AND YOU HAVE BEEN ENGAGED BY QUASAR AS WELL WHICH I AM THE CEO OF

PLEASE CALL TO DISCUSS AT 404-444-7855

BEST REGARDS,

Joseph C. Canouse

joe@thinkpinkllc.com

P: 866-770-0006

P2: 770-521-1330

F: 770-521-0259

From: Craig Huffman [mailto:craig@dslgpa.com]

Sent: Friday, May 25, 2012 7:15 PM

To: ' Joe Canouse '

Cc: ' Craig A. Huffman '; 'Donnell Vigil'; ' Ken Tomchin '; tomfavata03=40aol.com@pi8ip6be6-3cf5icqf.r-v5.readnotify.com; tomchin@tomchinandodom.com; ' Craig A. Huffman '

Subject: RE: Invoice for QASP Opinion

Joe,

For the record I have not been retained, nor my firm for any such lawsuit. That is incorrect and such representations should not be made by any party.

Craig A. Huffman

Securus Law Group, P.A.

13046 Racetrack Road #243

Tampa, Florida 33626

Phone: (888) 914-4144

Fax: (888) 783-4712

e-mail: craig@securuslawgroup.com

A promotion on Quasar was started and then the share structure was reduced... Coincidence? NO!!!! Just another tool used to massage potential shareholders into buying this stock.

Stay tuned as this isn't over yet by any means. Invest Wisely!!! Do your Homework!!! Say your Prayers and Good Luck, because the same players are still involved with Quasar!!!!

GeneO

CBD Life Sciences Inc. (CBDL) Launches High-Demand Mushroom Gummy Line for Targeted Wellness Needs, Tapping into a Booming $20 Billion Market • CBDL • Oct 31, 2024 8:00 AM

Nerds On Site Announces Q1 Growth and New Initiatives for the Remainder of 2024 • NOSUF • Oct 31, 2024 7:01 AM

Innovation Beverage Group Receives Largest Shipment of its Top-Selling Bitters to Date in the U.S.-Ready to Meet Growing Demand from Expanding Distribution Network • IBG • Oct 30, 2024 12:22 PM

Element79 Gold Corp to Update Investors on the Emerging Growth Conference on October 31, 2024 • ELMGF • Oct 30, 2024 9:08 AM

CBD Life Sciences Inc. (CBDL) Announces Grand View Research Report Findings on High - Growth CBD Equine Market, Aiming to Drive Unprecedented Shareholder Value • CBDL • Oct 29, 2024 10:19 AM

Integrated Ventures Announces Partnership And Lease Agreement with Driptide Wellness - Leading Health and Wellness Provider. • INTV • Oct 29, 2024 8:45 AM