Friday, January 12, 2024 8:19:36 AM

nodummy Re: nodummy post# 11543

Thursday, December 01, 2011 3:50:24 AM

Post#

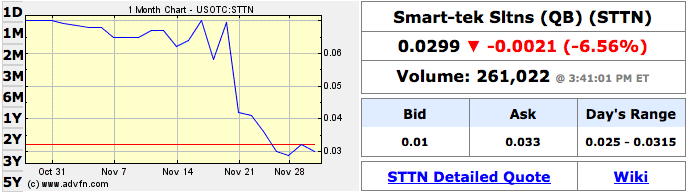

18772 of 218318 STTN some research inspired by the filing of the last 10Q on November 21, 2011

The stock started to plummet the day before the 10Q filing (maybe some insiders with advanced knowledge that the 10Q was going to be brutal decided they better start getting out early?)

-----

So what was in this 10Q?

Before we get to that a quick rundown on the events that have happened over the past few months:

-----

Starting shortly after the former Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer and founder of the company, Perry Law, tendered his resignation from his last remaining position of Director effective immediately on June 3, 2011 things have taken a very bad turn for the worse.

-----

On June 9, 2011, Brian Bonar signed a toxic financing agreement with La Jolla which included a $500,000 debenture agreement and the right for La Jolla to purchase up to $5,000,000 worth of stock at 80% below the market price. To date this agreement has not been executed.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7997447

On June 15, 2011, Brian Bonar issued himself 21,897,999 shares at no cost. According to the recently filed 10Q those shares were issued for $218,979 in compensation owed. On June 15, 2011, STTN closed at $.071/share making the actual value of those shares $1,554,757.93.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002630/xslF345X03/form4a.xml

On June 17, 2011, Brian Bonar issued to his Director, Owen Naccarato, 3,000,000 shares at no cost for $225,000 in compensation owed.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002672/xslF345X03/form4.xml

On July 29, 2011, Brian Bonar and Owen Naccarato met at the Rancho Bernardo Inn and used their 24,897,999 shares to elect themselves as the new Directors for the STTN shell.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8069037

On October 17, 2011, Brian Bonar brought his son, Colin Niven Bonar (aka C. Niven Bonar aka C N Bonar), into the picture by purchasing a group of companies which were all wholly owned subsidiaries of American Marine LLC, a company controlled by both Brian Bonar and C. Niven Bonar, for $50,000 and a $500,000 debt Note.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8194094

Solvis Medical Group consists of three revoked Nevada entities

Solvis Medical Inc and Solvis Medical Staffing Inc and Solvis Physical Therapy Inc all with Eric Gaer and Robert Dietrich listed as officers.

Former chairman of the Solvis Medical Group is Brian Bonar.

American Marine LLC is controlled by both Brian Bonar and C. Niven Bonar

http://www.corporationwiki.com/California/Escondido/american-marine-llc/47532519.aspx

Owen Naccarato (STTN Director) served as the legal counsel for the signed agreement between father and son.

C. Niven Bonar and Brian Bonar were previously linked with Dalrada Financial Corp (DFCO). Both C. Niven Bonar and Brian Bonar's daughter, Pauline Bonar, were initial shareholders in Dalrada Financial Corp back in 1999 while Brian Bonar was the CEO. Not so coincidentally Owen Naccarato was and still is the legal counsel for Bonar linked Delrada Financial Corp.

http://www.otcmarkets.com/stock/DFCO/company-info

The Bonar, Bonar, Naccarato connections don't end there.

The three can be linked to Allegiant Professional Business Services, Inc. (APRO)

Where daddy Bonar served as a Director and president, son Bonar served as the COO, and Naccarato once against served as legal counsel:

http://www.otcmarkets.com/stock/APRO/company-info

http://investing.businessweek.com/research/stocks/people/people.asp?ticker=APRO:US

APRO was (I used past tense because that company is basically dead now) a PEO company just like STTN is now.

APRO even uses the same address as STTN

11838 Bernardo Plaza Ct.

Suite 240

San Diego, CA 92128

Which is in shouting distance from American Marine LLC

11838 Bernardo Plaza Ct

Suite 210

San Diego, CA 92128

And is within walking distance from Dalada Financial Corp

11956 Bernardo Plaza Drive

#516

San Diego, CA 92128

John Capezzuto who works with Brian Bonar with APRO also worked with Brian Bonar with scam company Warning Management Services Inc. (WNMI) which was revoked by the SEC on May 22, 2009

http://www.sec.gov/litigation/admin/2009/34-59968.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64388493

Legal counsel for scam company WNMI was Owen Naccarato.

Are you beginning to wonder if Brian Bonar always uses Owen Naccarato for a reason?

Here is a list of companies for which Owen Naccarato currently provides legal services:

http://www.otcmarkets.com/service-provider/Naccarato-&-Associates?id=2062&b=n&filterOn=3

Allegiant Professional Business Services, Inc. (APRO)

Com-Guard.com, Inc. (CGUD)

Dalrada Financial Corp. (DFCO)

Diverse Media Group, Inc. (DVME)

DPOLLUTION International Inc. (RMGX)

eMamba International Corp. (EMBA)

Family Room Entertainment Corp. (FMYR)

Genco Corp. (GNCC)

Global Digital Solutions, Inc. (GDSI)

Icon Media Holdings, Inc. (ICNM)

ITonis, Inc. (ITNS)

Lexico Resources International, Inc. (LXXI)

Markray Corp. (RVBR)

Quad Energy Corp (CDID)

Ree International, Inc. (REEI)

Smart-Tek Solutions, Inc. (STTN)

South Shore Resources, Inc. (SSHO)

TapSlide, Inc. (TSLI)

Velocity Energy Inc. (VCYE)

This link draws some interesting past connections between Corey Ribotsky and many companies that used Owen Naccarato as legal counsel

http://www.offshorealert.com/WorkArea/threadeddisc/print_thread.aspx?id=60&g=posts&t=37726

---------------------

I got side tracked though back to the 10Q

Then on November 21, 2011, the STTN 10Q for the 3rd quarter came out and it was ugly.

Cash on September 30, 2011 - $270,048

Cash on June 30, 2011 - $882,069

STTN lost $612,021 in cash during the 3rd quarter

Accounts payable and accrued liabilities on September 30, 2011 - $8,384,307

Accounts payable and accrued liabilities on June 30, 2011 - $3,256,689

STTN added $5,127,619 in accounts payable and accrued liabilities during the 3rd quarter

The accounts payable and accrued liabilities for the 2nd quarter was only $82,477

$5,127,619 is $2,129,070 more than STTN had in accounts payable and accrued liabilities for its entire existence from 1995 - through the 2nd quarter of 2011.

Why the $5,127,619 in accounts payable and accrued liabilities all in just a 3 month period? Who is all that money owed to?

Gross profit on September 30, 2011 (for 3rd quarter) - negative $155,177

Gross profit on June 30, 2011 (for 2nd quarter) - $1,685,183

STTN went from a profitable business to a company with a failing business. The cost of revenue for the 3rd quarter of 2011 was higher than the revenues themselves. They would have been better off not doing business in the 3rd quarter.

Subtract away the operation costs/expenses and

Overall operating loss on September 30, 2011 (for 3rd quarter) - $2,963,852

Overall operating loss on June 30, 2011 (for 2nd quarter) - $599,161

STTN's operating losses increased by $2,364,691.

During the 1st quarter of 2011 (the period ending March 31, 2011), STTN didn't have an operation loss. They had an operating gain of $363,354 after subtracting away all the costs of operations from the revenues for the quarter. It is obvious the direction that STTN is headed, and it is not good.

A further break down of the Selling, general and administrative expenses helps partially explain why STTN is headed down the toilet.

Salaries & Related Expense

1st quarter - $311,430

2nd quarter - $582,969

3rd quarter - $553,404

Consulting

1st quarter - $220,366

2nd quarter - $158,823

3rd quarter - $353,624

Commissions

1st quarter - $177,223

2nd quarter - $269,583

3rd quarter - $633,742

Outside Services

1st quarter - $31,688

2nd quarter - $62,403

3rd quarter - $211,287

Overall Selling, General, and Administrative Expenses

1st quarter - $1,272,515

2nd quarter - $1,685,183

3rd quarter - $1,997,439

Since revenues dropped by 28% from the 2nd quarter to the 3rd quarter why did commissions increase by 235% during that same stretch?

----------------

The most disturbing parts of the recent STTN filings:

#1) Brian Bonar paying himself $1,554,757.93 in shares for a $218,979 balance that was owed to him then writing off the payment in the books as a $218,979 stock expense.

#2) Brian Bonar issuing himself and his son a $500,000 debt Note for a group of revoked business entities.

#3) The $5,127,619 in accounts payable accrued during the 3rd quarter alone. Who is all that money owed to?

#4) STTN went from a positive balance sheet at the end of the 1st quarter to a failing business whose revenues cost more than what they make.

#5) The past connections and histories of the main players involved in STTN.

| Volume: | - |

| Day Range: | |

| Bid: | |

| Ask: | |

| Last Trade Time: | |

| Total Trades: |

FEATURED Cannabix Technologies to Attend U.S. National Drug and Alcohol Conference to Market Marijuana Breath Test • Apr 1, 2025 8:35 AM

FEATURED NUBURU Advances Joint Development Agreement to Innovate Laser Applications in Defense Sector • Apr 1, 2025 8:30 AM

Glidelogic Corp. Unveils ResearchMind - Pioneering AI-Driven Research Innovation for a Global Academic Community • GDLG • Apr 1, 2025 2:10 PM

Fifty 1 Labs, Inc. Celebrates Groundbreaking SpaceX, NASA, and ISS Yeast Experiment by Subsidiary Genetic Networks • FITY • Apr 1, 2025 9:30 AM

North Bay Resources Announces Discovery of Mass Tonnage Gold Deposit up to 149m (489 feet) Grading 0.95 g/t Au, Fran Gold Project, British Columbia • NBRI • Apr 1, 2025 9:00 AM

Nightfood Acquires Skytech to Expand Leadership in AI-Driven Hotel Automation • NGTF • Apr 1, 2025 8:30 AM