Wednesday, February 03, 2021 11:37:37 AM

Monument Mining (TSXV:MMY) thanks; RE: Hope that the word

gets out about MMY.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161459448

Ex....

RE: Undervaluation here is difficult to comprehend

ArtieFufkin welcome back;

Monument MIning Limited V.MMY

Alternate Symbol(s): MMTMF

Undervaluation here is difficult to comprehend

RE:

I have only just rediscovered MMY after selling back around the

time of the Mengapur purchase and the hated PP that financed it.

Looks like that purchase has been a millstone round this

company's neck as many predicted it would be.

Now it is gone this company can get back to being what

it should have been all along.

I am utterly amazed at the undervaluation here now,

40 million market cap,

almost 70 million cash and gold on hand,

FCF of maybe 15 million flowing from Selinsing next year.

Murchison which if it was spun out could easily justify a

M/C of 50 million alone based on peers,

20% JV with ODY

currently worth 8 million based on ODY's M/C,

an NSR on Mengapur when it eventually starts producing and no debt.

Incredible position for MMY to be in bearing in mind

what was lost on Mengapur.

Bad sentiment only counts for so much,

not a mispricing of this magnitude,

this needs marketing,

there is nothing out there about MMY

at all and no-one following it..

I only found it because someone spammed another board

with the Mengapur news and it resonated with me

as a former shareholder.

If the company won't do it we need to do it by starting to talk

about it on other forums, get the word out.

Anyway much against my better judgement I am back in,

the under valuation here is too great to ignore.

I am hoping now they have divested Mengapur they can

concentrate properly on Selinsing and Murchison

and become a solid and growing junior gold producer

over the next year or so.

They could also just sell the damn thing

either in one go or piecemeal,

either way it's worth 50 cents a share right now,

more long term if they get it right.

BTW the discussion here

is a level above most other boards,

thanks Nozzpack and others for the DD.

ArtieFufkin welcome back; Thanks for good info I

It like it was listed yesterday and only a few seen it;

Monument MIning Limited V.MMY

Alternate Symbol(s): MMTMF

Monument Mining (TSXV:MMY) Photo Gallery - well they growing;

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is very

undervalued and oversold -

MMY is a profitable Gold Mines producer -

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1): Objective of

Becoming a Mid-Tier Multiple Mines Gold Producer; Interview with Cathy

Zhai, President and CEO

By Allen Alper Jr., President, Metals News Inc.

on 5/14/2019

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is an established

Canadian gold producer that owns and operates the Selinsing Gold Mine

in Malaysia.

The team of proven mine-builders is advancing a portfolio of exploration

and development projects, including the Mengapur Copper-Iron Project,

in Pahang State of Malaysia, and the Murchison Gold Projects in Western

Australia, towards becoming a mid-tier multiple mines gold producer.

At PDAC2019, we learned from Cathy Zhai, President and CEO of Monument

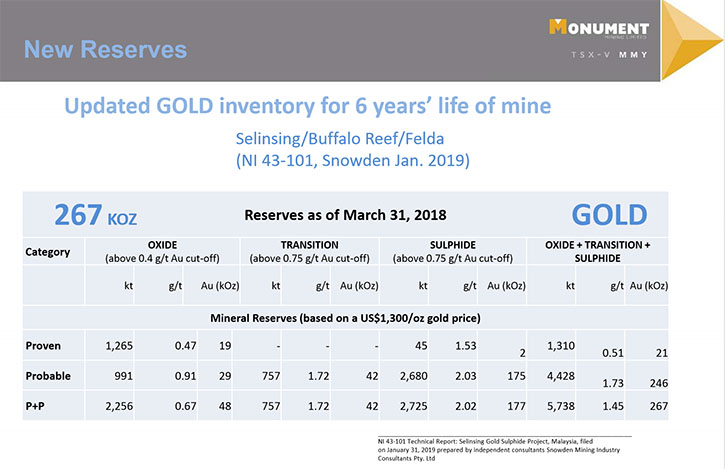

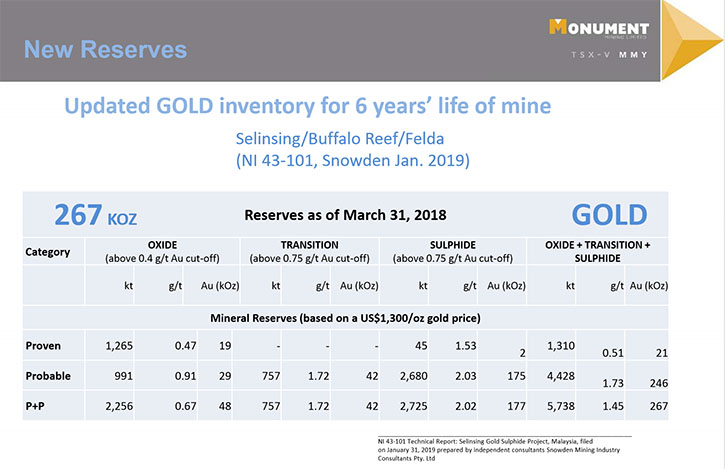

Mining, that the Selinsing Gold Mine has been producing for 10 years,

for a total of about 280,000 ounces for gross revenue of more than

$390 million, with an average low cost of $476 per ounce.

After Monument completes the 53 million plant extension and mine

development work, the mine will have an additional 6 years of mine life

on sulfide materials, which is going to generate another $100 million

cashflow.

Monument Mining Limited

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here

at PDAC 2019, interviewing Cathy Zhai, President and CEO of Monument

Mining Limited.

Could you tell us at Metals News and our readers/investors a little bit

more about yourself?

Cathy Zhai: My background is in accounting. I’ve been with Monument

Mining for more than 10 years, since the beginning. I was a CFO to

support the CEO, President.

Allen Alper Jr: Tell us a bit about Monument and your 10 years there.

Obviously you've stuck with them and grown them, so.

Cathy Zhai: Yes, Monument acquired a Malaysia primary gold asset back in

2007.

We spent two years to complete the mine development, and then we built

out the plant, and put it into production in, I think, October 2009.

Since then, we produced gold for the past 10 years, for a total of about

280,000 ounces for gross revenue, of more than 390 million, with a cost

per ounce, average of $476 dollars per ounce.

Allen Alper Jr: What does the current mine life look like?

Cathy Zhai: Well we pretty much ran out of the oxide materials. Now, we

have just released a full history of what is a related study, with an

additional life of mine, of six years on Sulfide materials.

We should require about 53 million for the additional plant extension,

including mine-development as well. We're expecting to generate a large

cashflow from our operation, about 100 million with NPV 27 million.

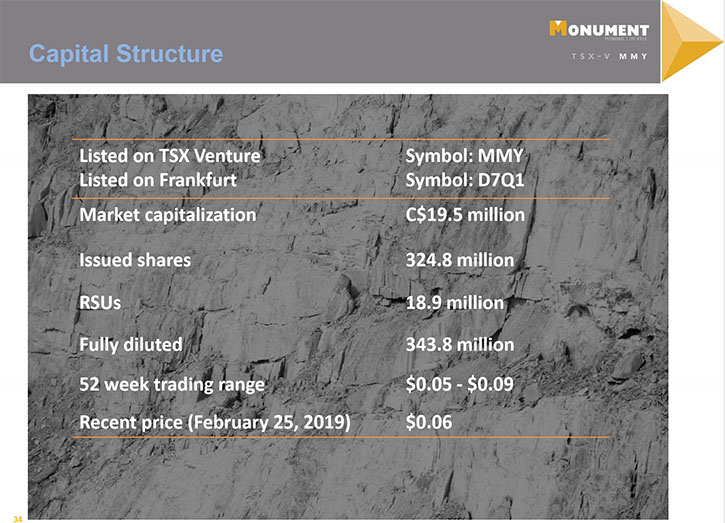

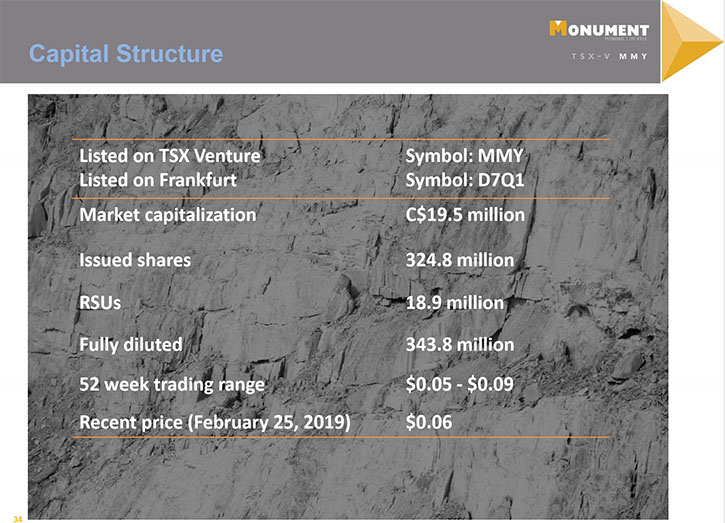

Allen Alper Jr: Tell us a little bit about your share structure and insider investments.

Cathy Zhai: Well, we have a total of about 324 million shares

outstanding.

The majority of them are owned by private shareholders.

We do not have a large institutional and management has

about 5 million shares and 18.9 million in restricted share units.

Allen Alper Jr: What are your next steps now to bring more life to the

mine?

Cathy Zhai: First of all, we want to put Selinsing Sulphide project into

production.

That requires some funding.

Secondly, we have two other projects.

One is in West Australia, our Murchison project.

We have a resource of 380,000 ounces.

It is a very large land position, with very good potential and

underground potential as well.

We're going to do more regional exploration.

Locally, we want to increase our gold inventory.

Then, be able to put it into production, generate a second cashflow.

Another project is our copper and iron project in Malaysia.

We published resources statements last year, in October.

We have about 90 million tons of copper at an average grade of .47.

I think the copper can be a pretty attractive project for

Monument as the next step.

We, most likely, can get a ten year tax holiday from the Malaysia

government for that project.

Allen Alper Jr: Tell us a little bit about your Management team and

their expertise.

Cathy Zhai: Our Management team has been very stable.

We built up a core of people for the past 11 years, and most of them

are still with us, at a senior level.

I think our executives are more strategic and our operation team is

more boots on the ground.

Very good operators.

Over the past 10 years, we have increased our technical capability.

We can do lots of desktop study in-house. We have a pretty strong

management team.

Allen Alper Jr: So, what do you view right now, as your largest

challenge, and what are you doing to address it?

Cathy Zhai: Well, I think the challenge is pretty common in the mining

industry, with the scarcity of a good quality gold inventory and having to mine sulfide materials and, or low-grade materials.

The strength of Monument is our assets, major assets in Malaysia, very,

very low cost compared to Canada and Australia.

Also our team has done lots of research on how to treat the sulfide

materials and our team is quite experienced and able to adapt and carry

on the new technologies.

Allen Alper Jr: Is that going to increase the cost per ounce?

Cathy Zhai: It would increase some cost per ounce, but because Malaysia

is a low cost country, compared to Australia or Canada, the cost is

relatively low, our feasibility study shows the average cost per ounce

is 864 dollars with gold price now about 1300.

I think we’ll made some pretty good profits.

Allen Alper Jr: Now, are you going to need any additional permits for

this?

Cathy Zhai: No. We don't have any permitting issues.

Allen Alper Jr: So, you're fully permitted. What do you think are the

main reasons investors would want to look at Monument?

Cathy Zhai: I think number one is Monument has a very good operating

team and management team, experienced, committed, enthusiastic, think

out of the box.

That's number one.

Number two, our major assets in Malaysia have very low cost and

their tax holidays.

Some, say for the sulfide project, we can get capital tax allowance

against the total investment.

We report 53 million as CAPEX.

So the first profits, up to that amount, are tax-free. Also we have

government support.

We have local support and Malaysia has a very good British law system,

mining law, and I think it's a very established country.

Of course, there is corruption, but I think Malaysia is now moving in

the right direction.

Allen Alper Jr: And, you have a lot of experience dealing in Malaysia.

Cathy Zhai: Yes, I do.

Allen Alper Jr: You have been in Malaysia, with Monument, for ten years.

Cathy Zhai: More than ten years. I started with Monument before it

turned into a mining company in 2001 or 2002.

Then we experienced two reverse takeovers, change of business and

acquisitions, development and other department expansions.

Lots of things happened in the past 11 years.

Allen Alper Jr: And, some people might not be familiar with mining in

Malaysia.

What have you done to make it more mining-friendly?

Cathy Zhai: Well, in general, Monument started from a junior mining

company, but over the past eight years, we have become a leading-edge

gold producer in Malaysia and we have established standards for

Malaysia in the mining industry.

So we're well-known.

We get lots of support.

Allen Alper Jr: You feel you have de-risked anyone else's concerns for

Malaysia?

Cathy Zhai: Well there will always be a risk.

We always tell our investors, "If you are afraid of risk, don't invest

in mining."

Mining has challenges, which we are used to.

But also that opens up opportunities.

Allen Alper Jr: Is there anything else you'd like to add?

Cathy Zhai: Monument, compared to other junior companies, is quite

unique.

Because, we are not an exploration company, and we're not a big, large

gold-producing company. We're in the middle, but we have upside

potential, with exploration, and we also generate cashflow.

We're operators.

Allen Alper Jr: So now, the cashflow that you're producing, are you

putting that back in?

Cathy Zhai: Yes, we generate about 370 or 90 million gross revenue, and with low cost, we re-invest all the money back into our gold portfolio in Australia, and also into copper and iron project in Malaysia. We're looking for sustainable production going forward.

Allen Alper Jr: So, by doing that, you've reduced the dilution of your stock, not having to issue financing in stock. Going forward, how are you planning to finance your next 25 million market cap for the land, without significantly diluting the stocks?

Cathy Zhai: We do not see equity as an option at the moment. We think the debt financing is more attractive to shareholders, without large dilution, but I think after we unlock the value in our assets, hopefully our share price can come up and we can return value to our shareholders.

Allen Alper Jr: Well, thank you very much for an excellent interview. I think this is a good, good company. Very exciting. What's your newsfeed looking like? When will we hear more about your progress? What are the next steps that are coming?

Monument Mining Limited

Cathy Zhai: In summary; we want to bring the Selinsing sulfide project into production as soon as possible. We're ready. The Team is ready. Whenever we get funding we can start immediately. It takes 12 months, a little bit more, than we can start off to generate revenue from the sulfide project.

Allen Alper Jr: So, you're looking at 2020?

Cathy Zhai: Yes, mid-2020, subject to financing. Next, we want to do our regional exploration in Murchison. Murchison has an existing processing plant already, a small one, 260,000 ton per annum. That is designed for processing high-grade gold inventory. In Murchison, we have underground potentials. We're going to do more deep-routing to find if there's a system we should replicate. Also, for the Mengapur, Mengapur used to be a large state-owned economic scale project. We have to divide up the resource, we want to find a finance partner to work together to unlock the value.

Allen Alper Jr: Thank you very much for a very interesting interview. We look forward to seeing you back in production strongly, second half of next year. Sounds very promising.

Cathy Zhai: Thank you, Allen for interviewing us at Monument Mining for Metals News. We appreciate it.

Allen Alper Jr: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.monumentmining.com/

Richard Cushing,

MMY Vancouver

T: +1-604-638-1661 x102

rcushing@monumentmining.com

bigone thanks; RE:Mengapher Copper Porphryry.......Interesting article

These copper/gold /silver porphrys are much more important than i had

realized.

That impression was derived from low grades of these porphrys, but

research on recoveries shows about 90 % copper and about 65 % for gold.

Mengapher has 50.9 million tons of ore , containing 394,000 tons of

copper which is close to 900 million lbs.

It also contains 409,000 ounces of gold plus millions of ounces of

silver.

At 2 million tons per year, its mine life would be about 25 years.

What is also positive is that the overburden is magnetite rich in iron

ore.

Removal of this overburden can be expensive but with lots of magnetite

iron ore in the overburden soils which has been and can be profitably

sold, this process can carry on until the skarn rock is fully exposed,

with progits directed towards paying for the mill.

Mengpaher will need more drilling to upgrade the 43-101 categories to

measured from Indicated, but this too can be paid for by the sale of

magnetite soils.

I dont know what Monument might get for its 100 % owned Mangapher

project.

I would hope at least $40 million US up front and a 2-3 % NSR on future

production.

Contained in this would be 1.2 million tons of stockpiled magnetite

which should convert ,upon concentration and milling,to about 200,000

tons or so of 62 % iron fines valued at about $27 million US at current

iron ore prices.

by nozzpack (519) thanks good info

December 09, 2020 - 08:33 AM

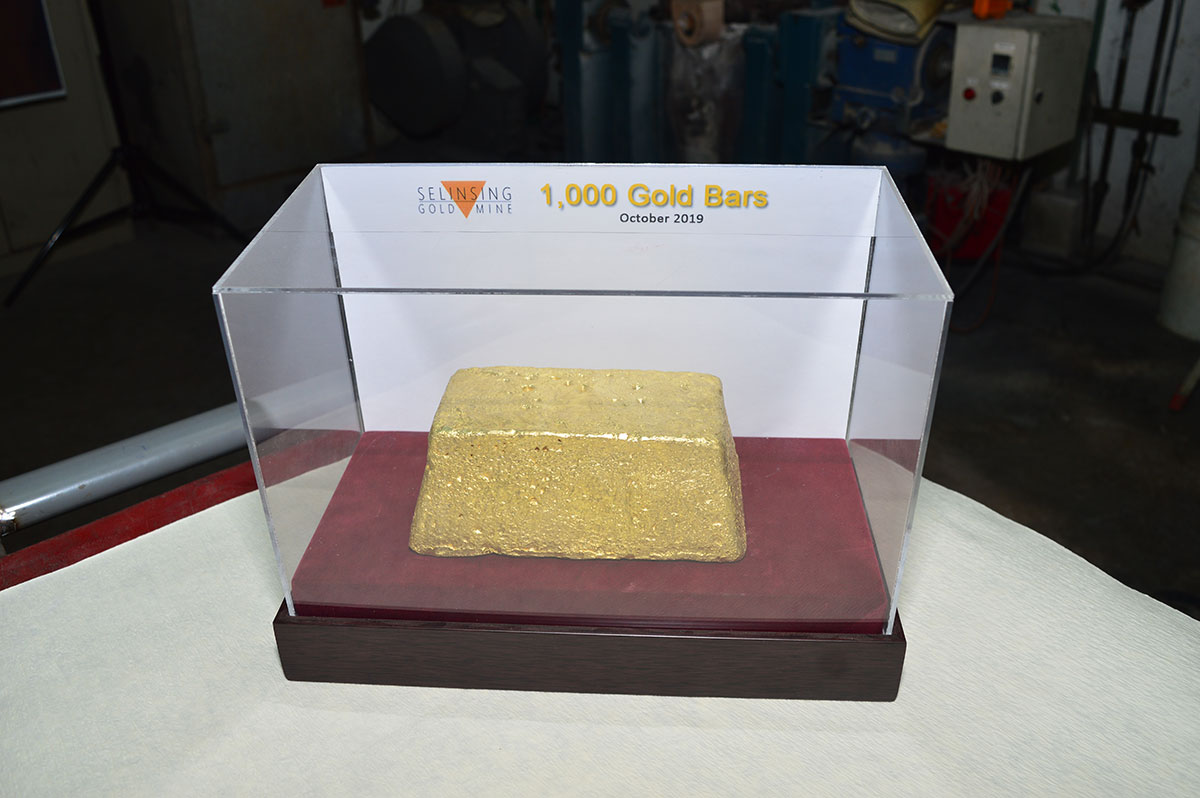

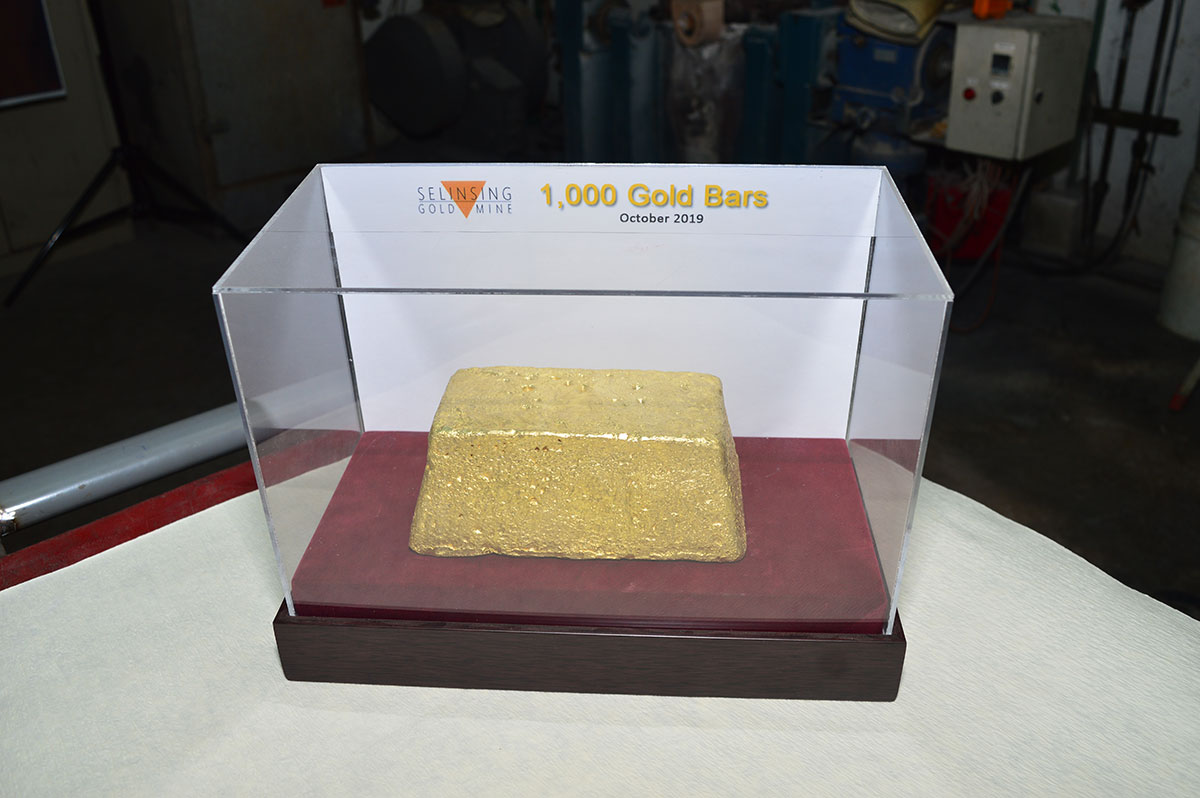

Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future years the weather is good no curtain needed - )

)

1,000th Gold Bar Pour Photo Gallery ) It's a great Mother ore start

) It's a great Mother ore start

https://www.monumentmining.com/news-media/photo-gallery/

Market Cap $30 mil. - No Debt - someone has to be kidding )

)

is it the fact ???

What a Great Gold Mines bargain )

)

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered )

)

Imo!

Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

gets out about MMY.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161459448

Ex....

RE: Undervaluation here is difficult to comprehend

ArtieFufkin welcome back;

Monument MIning Limited V.MMY

Alternate Symbol(s): MMTMF

Undervaluation here is difficult to comprehend

RE:

I have only just rediscovered MMY after selling back around the

time of the Mengapur purchase and the hated PP that financed it.

Looks like that purchase has been a millstone round this

company's neck as many predicted it would be.

Now it is gone this company can get back to being what

it should have been all along.

I am utterly amazed at the undervaluation here now,

40 million market cap,

almost 70 million cash and gold on hand,

FCF of maybe 15 million flowing from Selinsing next year.

Murchison which if it was spun out could easily justify a

M/C of 50 million alone based on peers,

20% JV with ODY

currently worth 8 million based on ODY's M/C,

an NSR on Mengapur when it eventually starts producing and no debt.

Incredible position for MMY to be in bearing in mind

what was lost on Mengapur.

Bad sentiment only counts for so much,

not a mispricing of this magnitude,

this needs marketing,

there is nothing out there about MMY

at all and no-one following it..

I only found it because someone spammed another board

with the Mengapur news and it resonated with me

as a former shareholder.

If the company won't do it we need to do it by starting to talk

about it on other forums, get the word out.

Anyway much against my better judgement I am back in,

the under valuation here is too great to ignore.

I am hoping now they have divested Mengapur they can

concentrate properly on Selinsing and Murchison

and become a solid and growing junior gold producer

over the next year or so.

They could also just sell the damn thing

either in one go or piecemeal,

either way it's worth 50 cents a share right now,

more long term if they get it right.

BTW the discussion here

is a level above most other boards,

thanks Nozzpack and others for the DD.

ArtieFufkin welcome back; Thanks for good info I

It like it was listed yesterday and only a few seen it;

Monument MIning Limited V.MMY

Alternate Symbol(s): MMTMF

Monument Mining (TSXV:MMY) Photo Gallery - well they growing;

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is very

undervalued and oversold -

MMY is a profitable Gold Mines producer -

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1): Objective of

Becoming a Mid-Tier Multiple Mines Gold Producer; Interview with Cathy

Zhai, President and CEO

By Allen Alper Jr., President, Metals News Inc.

on 5/14/2019

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is an established

Canadian gold producer that owns and operates the Selinsing Gold Mine

in Malaysia.

The team of proven mine-builders is advancing a portfolio of exploration

and development projects, including the Mengapur Copper-Iron Project,

in Pahang State of Malaysia, and the Murchison Gold Projects in Western

Australia, towards becoming a mid-tier multiple mines gold producer.

At PDAC2019, we learned from Cathy Zhai, President and CEO of Monument

Mining, that the Selinsing Gold Mine has been producing for 10 years,

for a total of about 280,000 ounces for gross revenue of more than

$390 million, with an average low cost of $476 per ounce.

After Monument completes the 53 million plant extension and mine

development work, the mine will have an additional 6 years of mine life

on sulfide materials, which is going to generate another $100 million

cashflow.

Monument Mining Limited

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here

at PDAC 2019, interviewing Cathy Zhai, President and CEO of Monument

Mining Limited.

Could you tell us at Metals News and our readers/investors a little bit

more about yourself?

Cathy Zhai: My background is in accounting. I’ve been with Monument

Mining for more than 10 years, since the beginning. I was a CFO to

support the CEO, President.

Allen Alper Jr: Tell us a bit about Monument and your 10 years there.

Obviously you've stuck with them and grown them, so.

Cathy Zhai: Yes, Monument acquired a Malaysia primary gold asset back in

2007.

We spent two years to complete the mine development, and then we built

out the plant, and put it into production in, I think, October 2009.

Since then, we produced gold for the past 10 years, for a total of about

280,000 ounces for gross revenue, of more than 390 million, with a cost

per ounce, average of $476 dollars per ounce.

Allen Alper Jr: What does the current mine life look like?

Cathy Zhai: Well we pretty much ran out of the oxide materials. Now, we

have just released a full history of what is a related study, with an

additional life of mine, of six years on Sulfide materials.

We should require about 53 million for the additional plant extension,

including mine-development as well. We're expecting to generate a large

cashflow from our operation, about 100 million with NPV 27 million.

Allen Alper Jr: Tell us a little bit about your share structure and insider investments.

Cathy Zhai: Well, we have a total of about 324 million shares

outstanding.

The majority of them are owned by private shareholders.

We do not have a large institutional and management has

about 5 million shares and 18.9 million in restricted share units.

Allen Alper Jr: What are your next steps now to bring more life to the

mine?

Cathy Zhai: First of all, we want to put Selinsing Sulphide project into

production.

That requires some funding.

Secondly, we have two other projects.

One is in West Australia, our Murchison project.

We have a resource of 380,000 ounces.

It is a very large land position, with very good potential and

underground potential as well.

We're going to do more regional exploration.

Locally, we want to increase our gold inventory.

Then, be able to put it into production, generate a second cashflow.

Another project is our copper and iron project in Malaysia.

We published resources statements last year, in October.

We have about 90 million tons of copper at an average grade of .47.

I think the copper can be a pretty attractive project for

Monument as the next step.

We, most likely, can get a ten year tax holiday from the Malaysia

government for that project.

Allen Alper Jr: Tell us a little bit about your Management team and

their expertise.

Cathy Zhai: Our Management team has been very stable.

We built up a core of people for the past 11 years, and most of them

are still with us, at a senior level.

I think our executives are more strategic and our operation team is

more boots on the ground.

Very good operators.

Over the past 10 years, we have increased our technical capability.

We can do lots of desktop study in-house. We have a pretty strong

management team.

Allen Alper Jr: So, what do you view right now, as your largest

challenge, and what are you doing to address it?

Cathy Zhai: Well, I think the challenge is pretty common in the mining

industry, with the scarcity of a good quality gold inventory and having to mine sulfide materials and, or low-grade materials.

The strength of Monument is our assets, major assets in Malaysia, very,

very low cost compared to Canada and Australia.

Also our team has done lots of research on how to treat the sulfide

materials and our team is quite experienced and able to adapt and carry

on the new technologies.

Allen Alper Jr: Is that going to increase the cost per ounce?

Cathy Zhai: It would increase some cost per ounce, but because Malaysia

is a low cost country, compared to Australia or Canada, the cost is

relatively low, our feasibility study shows the average cost per ounce

is 864 dollars with gold price now about 1300.

I think we’ll made some pretty good profits.

Allen Alper Jr: Now, are you going to need any additional permits for

this?

Cathy Zhai: No. We don't have any permitting issues.

Allen Alper Jr: So, you're fully permitted. What do you think are the

main reasons investors would want to look at Monument?

Cathy Zhai: I think number one is Monument has a very good operating

team and management team, experienced, committed, enthusiastic, think

out of the box.

That's number one.

Number two, our major assets in Malaysia have very low cost and

their tax holidays.

Some, say for the sulfide project, we can get capital tax allowance

against the total investment.

We report 53 million as CAPEX.

So the first profits, up to that amount, are tax-free. Also we have

government support.

We have local support and Malaysia has a very good British law system,

mining law, and I think it's a very established country.

Of course, there is corruption, but I think Malaysia is now moving in

the right direction.

Allen Alper Jr: And, you have a lot of experience dealing in Malaysia.

Cathy Zhai: Yes, I do.

Allen Alper Jr: You have been in Malaysia, with Monument, for ten years.

Cathy Zhai: More than ten years. I started with Monument before it

turned into a mining company in 2001 or 2002.

Then we experienced two reverse takeovers, change of business and

acquisitions, development and other department expansions.

Lots of things happened in the past 11 years.

Allen Alper Jr: And, some people might not be familiar with mining in

Malaysia.

What have you done to make it more mining-friendly?

Cathy Zhai: Well, in general, Monument started from a junior mining

company, but over the past eight years, we have become a leading-edge

gold producer in Malaysia and we have established standards for

Malaysia in the mining industry.

So we're well-known.

We get lots of support.

Allen Alper Jr: You feel you have de-risked anyone else's concerns for

Malaysia?

Cathy Zhai: Well there will always be a risk.

We always tell our investors, "If you are afraid of risk, don't invest

in mining."

Mining has challenges, which we are used to.

But also that opens up opportunities.

Allen Alper Jr: Is there anything else you'd like to add?

Cathy Zhai: Monument, compared to other junior companies, is quite

unique.

Because, we are not an exploration company, and we're not a big, large

gold-producing company. We're in the middle, but we have upside

potential, with exploration, and we also generate cashflow.

We're operators.

Allen Alper Jr: So now, the cashflow that you're producing, are you

putting that back in?

Cathy Zhai: Yes, we generate about 370 or 90 million gross revenue, and with low cost, we re-invest all the money back into our gold portfolio in Australia, and also into copper and iron project in Malaysia. We're looking for sustainable production going forward.

Allen Alper Jr: So, by doing that, you've reduced the dilution of your stock, not having to issue financing in stock. Going forward, how are you planning to finance your next 25 million market cap for the land, without significantly diluting the stocks?

Cathy Zhai: We do not see equity as an option at the moment. We think the debt financing is more attractive to shareholders, without large dilution, but I think after we unlock the value in our assets, hopefully our share price can come up and we can return value to our shareholders.

Allen Alper Jr: Well, thank you very much for an excellent interview. I think this is a good, good company. Very exciting. What's your newsfeed looking like? When will we hear more about your progress? What are the next steps that are coming?

Monument Mining Limited

Cathy Zhai: In summary; we want to bring the Selinsing sulfide project into production as soon as possible. We're ready. The Team is ready. Whenever we get funding we can start immediately. It takes 12 months, a little bit more, than we can start off to generate revenue from the sulfide project.

Allen Alper Jr: So, you're looking at 2020?

Cathy Zhai: Yes, mid-2020, subject to financing. Next, we want to do our regional exploration in Murchison. Murchison has an existing processing plant already, a small one, 260,000 ton per annum. That is designed for processing high-grade gold inventory. In Murchison, we have underground potentials. We're going to do more deep-routing to find if there's a system we should replicate. Also, for the Mengapur, Mengapur used to be a large state-owned economic scale project. We have to divide up the resource, we want to find a finance partner to work together to unlock the value.

Allen Alper Jr: Thank you very much for a very interesting interview. We look forward to seeing you back in production strongly, second half of next year. Sounds very promising.

Cathy Zhai: Thank you, Allen for interviewing us at Monument Mining for Metals News. We appreciate it.

Allen Alper Jr: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.monumentmining.com/

Richard Cushing,

MMY Vancouver

T: +1-604-638-1661 x102

rcushing@monumentmining.com

bigone thanks; RE:Mengapher Copper Porphryry.......Interesting article

These copper/gold /silver porphrys are much more important than i had

realized.

That impression was derived from low grades of these porphrys, but

research on recoveries shows about 90 % copper and about 65 % for gold.

Mengapher has 50.9 million tons of ore , containing 394,000 tons of

copper which is close to 900 million lbs.

It also contains 409,000 ounces of gold plus millions of ounces of

silver.

At 2 million tons per year, its mine life would be about 25 years.

What is also positive is that the overburden is magnetite rich in iron

ore.

Removal of this overburden can be expensive but with lots of magnetite

iron ore in the overburden soils which has been and can be profitably

sold, this process can carry on until the skarn rock is fully exposed,

with progits directed towards paying for the mill.

Mengpaher will need more drilling to upgrade the 43-101 categories to

measured from Indicated, but this too can be paid for by the sale of

magnetite soils.

I dont know what Monument might get for its 100 % owned Mangapher

project.

I would hope at least $40 million US up front and a 2-3 % NSR on future

production.

Contained in this would be 1.2 million tons of stockpiled magnetite

which should convert ,upon concentration and milling,to about 200,000

tons or so of 62 % iron fines valued at about $27 million US at current

iron ore prices.

by nozzpack (519) thanks good info

December 09, 2020 - 08:33 AM

Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future years the weather is good no curtain needed -

1,000th Gold Bar Pour Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

Market Cap $30 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.