Friday, August 28, 2020 9:11:36 PM

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

GFTX Security Details

Share Structure

Market Value1..........$1,126,116 a/o Aug 27, 2020

Authorized Shares....2,500,000,000 a/o Aug 27, 2020

Outstanding Shares...1,251,239,584 a/o Aug 27, 2020

-Restricted..................16,802,550 a/o Aug 27, 2020

-Unrestricted.............1,234,437,034 a/o Aug 27, 2020

Held at DTC...............1,233,430,438 a/o Aug 27, 2020

Float..............2,329,960 a/o Apr 18, 2019

Par Value

https://www.otcmarkets.com/stock/GFTX/security

________________________________________________________________

How Targets are Calculated

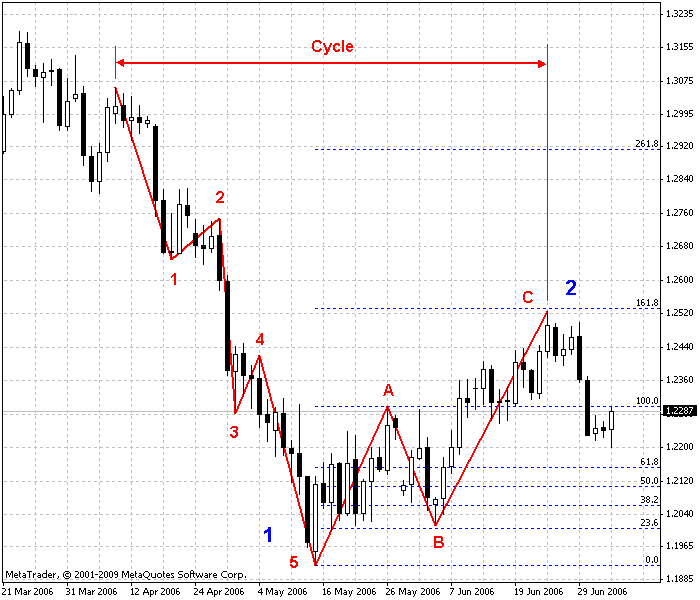

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

Recent AHRO News

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 06/12/2024 09:17:11 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 05/15/2024 02:41:55 PM

- Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • InvestorsHub NewsWire • 04/16/2024 05:30:00 PM

- Maybacks Global Partners with WiseDV in Launching iDreamCTV: A Next-Generation Streaming Platform • InvestorsHub NewsWire • 04/08/2024 12:30:00 PM

- Maybacks Global Signs Agreements with World's Largest Digital Ad Agencies • InvestorsHub NewsWire • 04/04/2024 12:30:00 PM

- Maybacks Global Entertainment Opens 23 More Stations in Important Major Cities • InvestorsHub NewsWire • 03/27/2024 01:00:00 PM

- Former SONY Music SVP of Merchandising Joins Authentic Heroes Team • InvestorsHub NewsWire • 03/20/2024 12:00:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/26/2024 01:00:26 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/21/2024 06:38:13 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/13/2024 06:08:27 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/20/2023 06:34:45 PM

- MAYBACKS AND LOCAL BTV EXPAND AD SHARE AGREEMENT INTO 65 MARKETS • InvestorsHub NewsWire • 08/29/2023 12:00:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/21/2023 09:28:13 PM

- Maybacks Global Entertainment Signs 5 Year Ad Share Agreement with Didja Inc. • InvestorsHub NewsWire • 08/03/2023 12:00:00 PM

Greenlite Ventures Completes Agreement with No Limit Technology • GRNL • Jul 19, 2024 10:00 AM

VAYK Expects Revenue from First Airbnb Property Starting from August • VAYK • Jul 18, 2024 9:00 AM

North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton • NBRI • Jul 18, 2024 9:00 AM

Nightfood Holdings Signs Letter of Intent for All-Stock Acquisition of CarryOutSupplies.com • NGTF • Jul 17, 2024 1:00 PM

Kona Gold Beverages Reaches Out to Largest Debt Holder for Debt Purchase Negotiation • KGKG • Jul 17, 2024 9:00 AM

Avant Technologies Welcomes Back Former CEO with Eye Toward Future Growth and Expansion • AVAI • Jul 17, 2024 8:00 AM