Financial Intelligence is Hard Work. Fundamental and technical analysis is essential towards understanding the game!

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Lots of avoiding answers to direct questions going on...and misdirection. must have struck a nerve! You know the DTCC has a slush fund to settle imbalances when wallstreet has to clean up the mess. It wont activate until litigation or a corp action forces it. Those unworthy governmental agencies won't do it. Many brokers on the hook for a "concentrated" short positions. Alpine is toast! It's only a matter of time. Again, we will shall see what happens.

Doubek and Walsh caused Alpine to declare 545 customer accounts "abandoned" and to transfer approximately $54 million worth of securities out of these "abandoned" accounts and into accounts that Alpine controlled.

That's alot of speculating and nonsense. I see the sport of a last post coming soon. Guess the CRGP board is lighting up today lol.

$13

$CRGP

Those changes in market mechanics are already happening...the stress on borrowing of shares to exposing via DTCC rule changes in margin requirements (T1) to help resolve the fraud associated with inventory imbalances is playing out in the courts. Lots of precedence is already in place to challenge those pesky "unworthy governmental agencies" and their congressional authority to enforce its unconstitutional actions aswell. I don't think immunity will last very much longer!

Have you heard of NSCC v Alpine "concentrated" short positions is under some serious stress? That matter won't be in litigation forever. The DTCC will soon have to engage in buying back all that debt after Alpine gets shuts down. Not to mention CRGP has a high probability of existing concentrated short/debt positions in Alpine via those illegal DWACS. Those broker buy-ins will all have to be "settled" and balanced together. I guess we will find out together when their music stops...

And finally that (T0) initiative with blockchain/upstream pathway. All the major banks are set up for the new monetary system transition.

Please don't spread misinformation... it's just silly! Other investors are still struggling with their education. Don't make it harder for them!

CRGP still trades on Expert (OTC)...not killed...still alive!

Now how about those imbalances, "locates" vs illegal naked shorts?

OTC protocols and/or exemptions do not remove liability!

$13

$CRGP

Yup, that pesky inventory thing keeps coming up...well said!

$13

$CRGP

When this is all over, no more words will be necessary! Price action will tell the main part of this story. The court documents provide enough context for the educated and experienced. They are also key to changing current market mechanics.

I believe anybody holding CRGP shares will have an opportunity of a lifetime when it comes. Been saying it for years because of the matters transpiring in the courts regarding illegal naked short-selling and similar related events of national security in financial markets.

This subject matter is already in progress and is being seriously discussed with Congress.

On another note, whoever is in control of CRGP is "DARK" and it's obvious why it remains so presently!

I believe patience and discipline are key!

The time will come, one way or the other, Wall Street or Congress won't be able to ignore/downplay share imbalances/counterfeiting stock anymore!

$13

$CRGP

The tape shows it went through at 0

Date/Time Price Shares

07/07/2023 9:30:00 EDT 0.00 702

How does that happen?

$13

$CRGP

Well, what do you expect when you dont read the content and want to be spoon fed relevance. Opinions on CRGP become short sighted and easily identified as simple minded or have a lack of critical thinking skills, especially when it comes to important matters relating to trading practices regarding market mechanics.

I still own every share I bought because there is a settlement issue with CRGP and believe it will have to be rectified. Many court cases are addressing this concern because it requires the attention of the courts from a broader perspective.

In order for this settlement issue to be resolved, it would require a counting/audit of shares which addresses the share imbalance (identified in Nebraska Cor Clearing v CRGP case) and the market mechanics of essential participants to enforce it(Issuer/TA/Regulator). It also requires regulatory oversight or corrective actions via the processing of a corporate action. This is very logical. CRGP still trades because their is still value here. And not for nothing, the Nevada State Court would have never overturned and corrected custodianship if fraud on the court was not presented by a well respected and reputable law firm.

This is my position. It has always been my position. I shouldn't have to be harassed, insulted, or recieve defamation for it.

So again, the market mechanics...Who registered, issued, authorized, and/or cleared the shares to trade?

The settlement of trades has always been the issue and requires a resolution.

If you don't believe that then please move onto other matters.

$13

$CRGP

Wrong again, nothing is up in the air. Its all on court dockets. Anybody can find them.

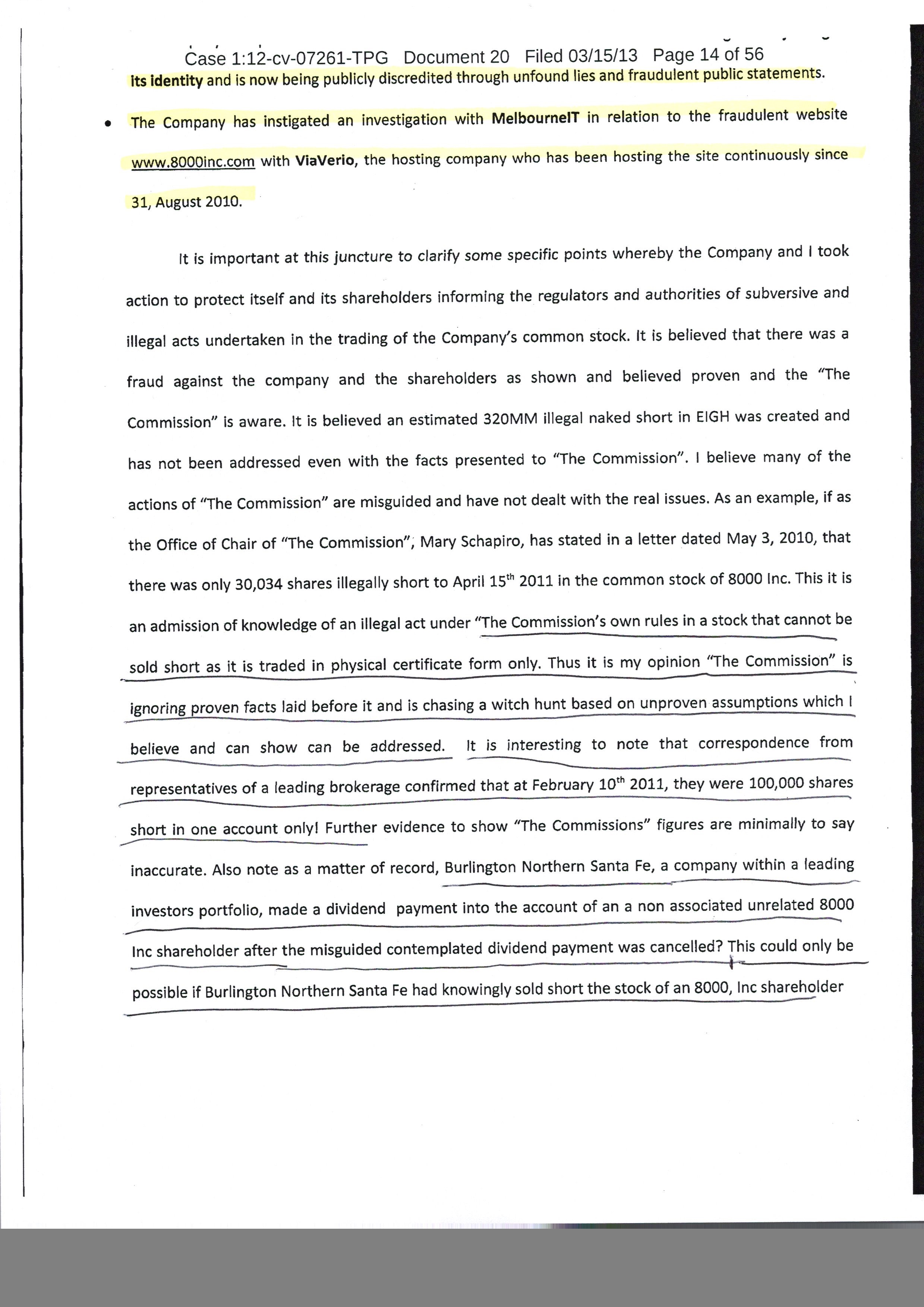

As previously discussed many times, CRGP has a naked short position

Still cant define the Nebraska case? Alpine/Scottdale vs NSCC?, 2016 Supreme Court case on naked shorting?, recent Sabby SEC enforcement actions on naked short selling? 2022 Supreme Court SEC unconstitutional case?, and a few others that will remain nameless...

All the proof is on the dockets.

Still dont know what a locate vs an illegal naked short is huh?

Ohh well I guess investorpedia supercedes litigation filings...lol

Im done with this nonsense!

CRGP shareholders will wait for as long as it takes for the courts and regulatory agencies to resolve this matter among many other tickers aswell.

And if im wrong and an institution is in control of CRGP, I would bet they're paying attention to what is going on too.

$13

$CRGP

Lol, Illegally issued debt is not in the form of shares?

Do you even know what a locate is vs an illegal naked short?

Thanks for the 20 years of catch up research and figuring out how to use a public tool. Welcome to the present reality.

The SEC and Finra are now under legal review for their unconstitutional enforcement procedures via judges. Litigation started in 2022.

This plays a significant role in regards to arbitration clauses via each broker. If each CRGP shareholder took their broker to federal court, each broker would have serious bottom line expenses on their books to address.

Try to stay up to date.

$13

$CRGP

Yes, securities can only register with the SEC unless there is an exemption.

They're 4 exemptions via SEC, Finra, and OTCM which are essentially a form of registration.

15c211 form

Finra 211 form

SEC F6 form

Unsolicited quotation form

All are publicly available to view.

We already know Rule 144 was broken via Alpine/Scottsdale Dwac. And we already know Beaufort and Nobilus were on the hook for imbalances via the dividend.

CRGP has a naked short position! And Finra is protecting the settlement of the imbalance of shares. Approximately 327 million shares were identified in the Nebraska filings.

End of story!

$13

$CRGP

Again, MMTLP and CRGP securities have not settled.

Shareholders for both securities own broker liabilities!

If this was not true than why does Finra hide the bluesheet data?

End of story!

Yes, I believe Finra is absolutely responsible for their actions as an "Unworthy Governmental Agency".

Finra has never given a public statement in regards to CRGP halt. The very definition of the rule classification via U3 is ambiguous and does not clarify direct purpose or relationship in regards to the trading of CRGP when it happened. The only logical reason the halt would take place would be for the reasons identified in a court of law where an imbalance of shares was identified. The DTC could not settle the trades because there was an imbalance.

Finra interfered with a forced settlement of shares.

What brokers or institutions had the "locates" and illegal naked shorts?

I have also identified in the past CRGP has shown up on the Failure to Deliver list post halt.

Combine the prior trading history with its litigation, its not hard to figure out "custodianship", "registration of shares" (including Alpine DWAC's with Scottsdale), and registration for listing via OTC illuminates Finra's lack of responsibility in protecting retail investors. Rather they protected their broker clients and hide behind their "Immunity clause" to not allow for the public viewing of bluesheet data to identify all broker trading activity.

All of this would help towards a final resolution!

Again, this is a pending legal matter and Finra is right in the middle of it now.

The SEC is already under serious questioning by Congress.

Finra reports to the SEC.

Common denominator is the OTC and its exemptions aka loop holes for stock registration that point towards stock counterfeiting by Finra's clients "brokers", and who were the clearing firms involved.

We already know Apex aquired Cor Clearing. And Apex is owned by "..... "

Who cleared and registered CRGP stock?

$13

$CRGP

And wrong, MMTLP is not a company. Its a non tradable preferred security. I have already identified the relationship to CRGP in that regard via its "locates" and the FINRA U3 halt. Its pretty simple to understand when you're actually educated on the matter. The halt took place on both securities because there was a failure to settle trades!

As the Nebraska court filings clearly illustrated an imbalance of shares was determined.

This is not rocket science! All you have to do is read!

$13

$CRGP

Yes, I was referring to the OTCIQ system for said approval for CRGP to trade.

This is a form of registration. I was pointing out the OTC has various exemptions for registration. They're all highly questionable at this point in time.

And for any real shareholder who have access to pacer. All the answers, in regards to an imbalance of CRGP shares, are in Nebraska filings. This has been discussed many times at exhaustion. Its very easy to find for such "willing brains".

$13

$CRGP

Thats correct. The U3 halt on CRGP and MMTLP exposed the stupidity of the brokers. 1 shows an imbalance of shares on the docket, and the other identifies a short position by OTCM itself on social media. Both are official!

This is a legal matter pending resolution!

Fyi, most U3 halts do not trade ever again (domestic) Most U3 halts are foreign and only trade through exemptions usually through ADR protocols on the OTC.

The exemptions are where the problems exist on the OTC.

The CRGP U3 halt and dividend situation exposed an imbalance of shares and MMTLP exposed an issue with OTCIQ system.

Why is FINRA holding CRGP shareholders hostage?

Why is FINRA holding MMTLP (Non DRS elligibale/not tradable via S1) and shareholders hostage?

Was the SEC aware that FINRA executed U3 halts via there was a failure to settle trades because "locates" were not available?

https://www.nasdaq.com/press-release/calissio-completes-its-application-for-their-pink-sheet-current-information-tier-with

All documentation including financial statements and the required legal opinion are completed, and all fees have been paid. Upon allocation by the OTCIQ system, the filing shall immediately be uploaded for its anticipated up-listing approval.

COR Clearing (now Apex = ???) and Alpine are under a significant amount of pressure...

There is a "concentrated short position". FINRA, the DTCC, and the SEC have found their fall guy. Someboody is going to start singing soon! Wallstreet does not like to have fraud on their books. Time to clean it all up soon!

Litigation in progress...

$13

$CRGP

#NakedShortsWar

#SettleAllTheTrades

There is an "imbalance of shares", an SRO, and an OTCM (OTCIQ system) matter that needs to be addressed here. It has not gone away since it appeared on the docket in 2015. Counterfeiting of shares was discovered here and a lot of the legal community far and wide see what's coming!

Synchronization is in progress.

$13

$CRGP

#NakedShortsWar

#SettleAllTheTrades

It is both!

Personal Attack:

The use of personal images, private phone numbers, and location (including personal address or place of work) = doxing. Also can not be used in alias naming conventions, posts, signatures, or any other use of media to display personal information that can be presented to do personal harm to an individual or its affiliates, including family members.

This is illegal.

Seems like a whole lot of continued misleading going on with the CRGP story. I guess time will tell. I will wait patiently for things to come together as they usually do require patience and discipline.

$13

$CRGP

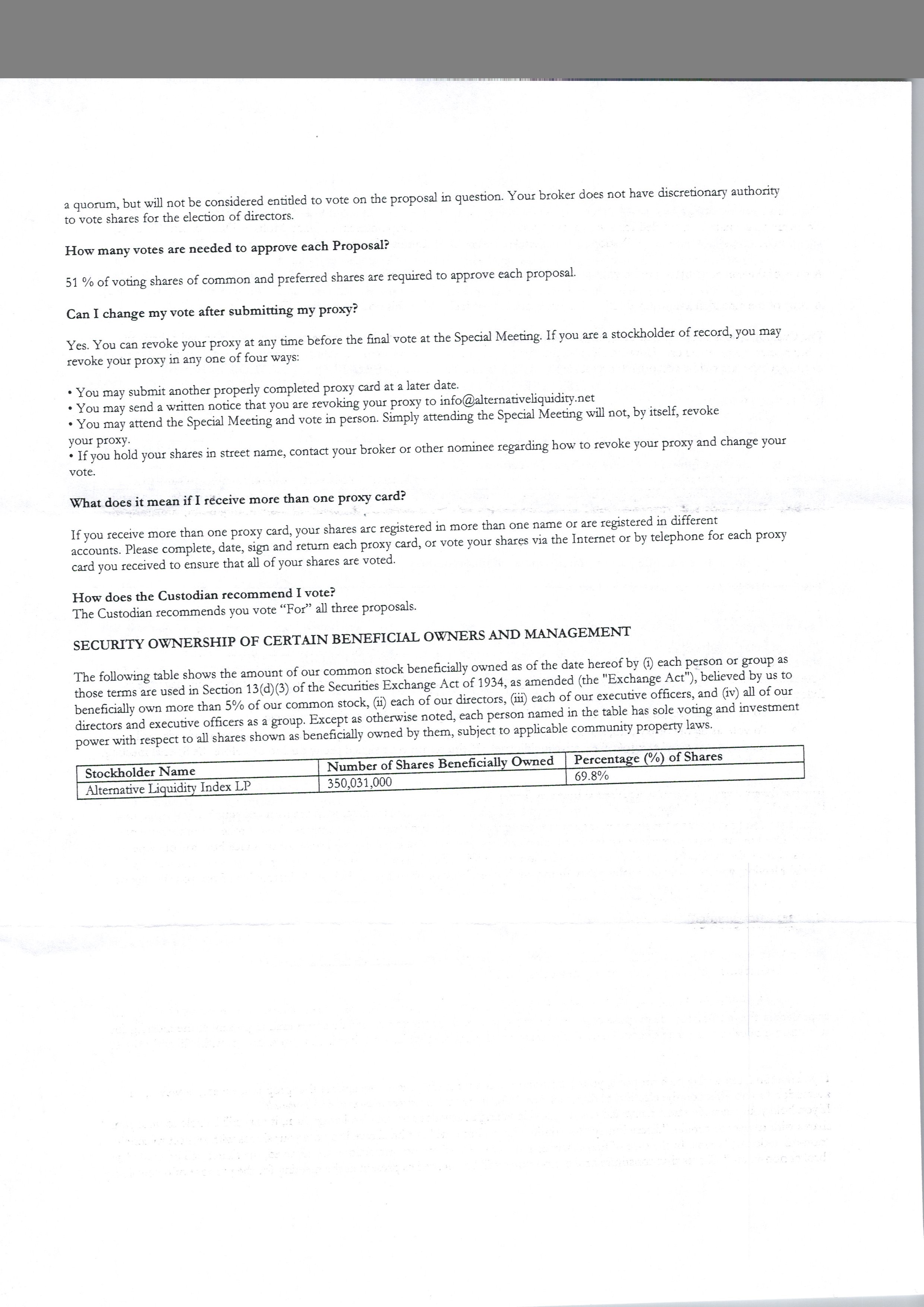

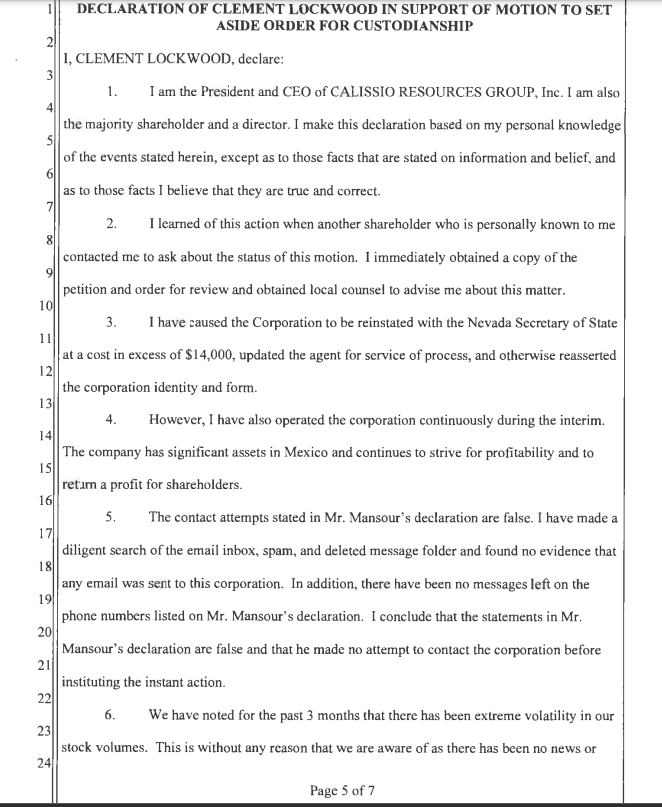

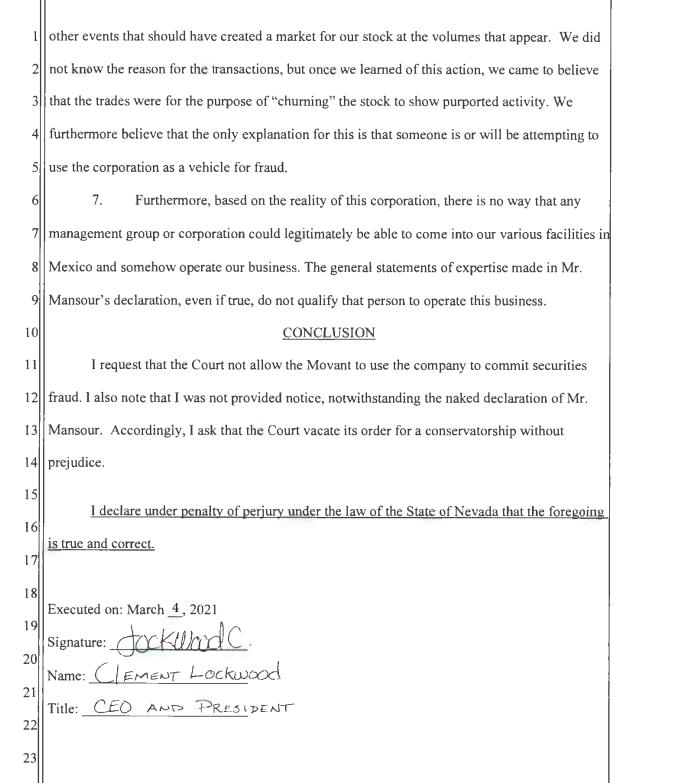

You're wondering how the meeting went? I think its clear how it went. 70% controlling interest.

And this security is not a dog. Its a security going thru a process for as long as it takes!

Yeah, that pesky comma keeps coming up huh

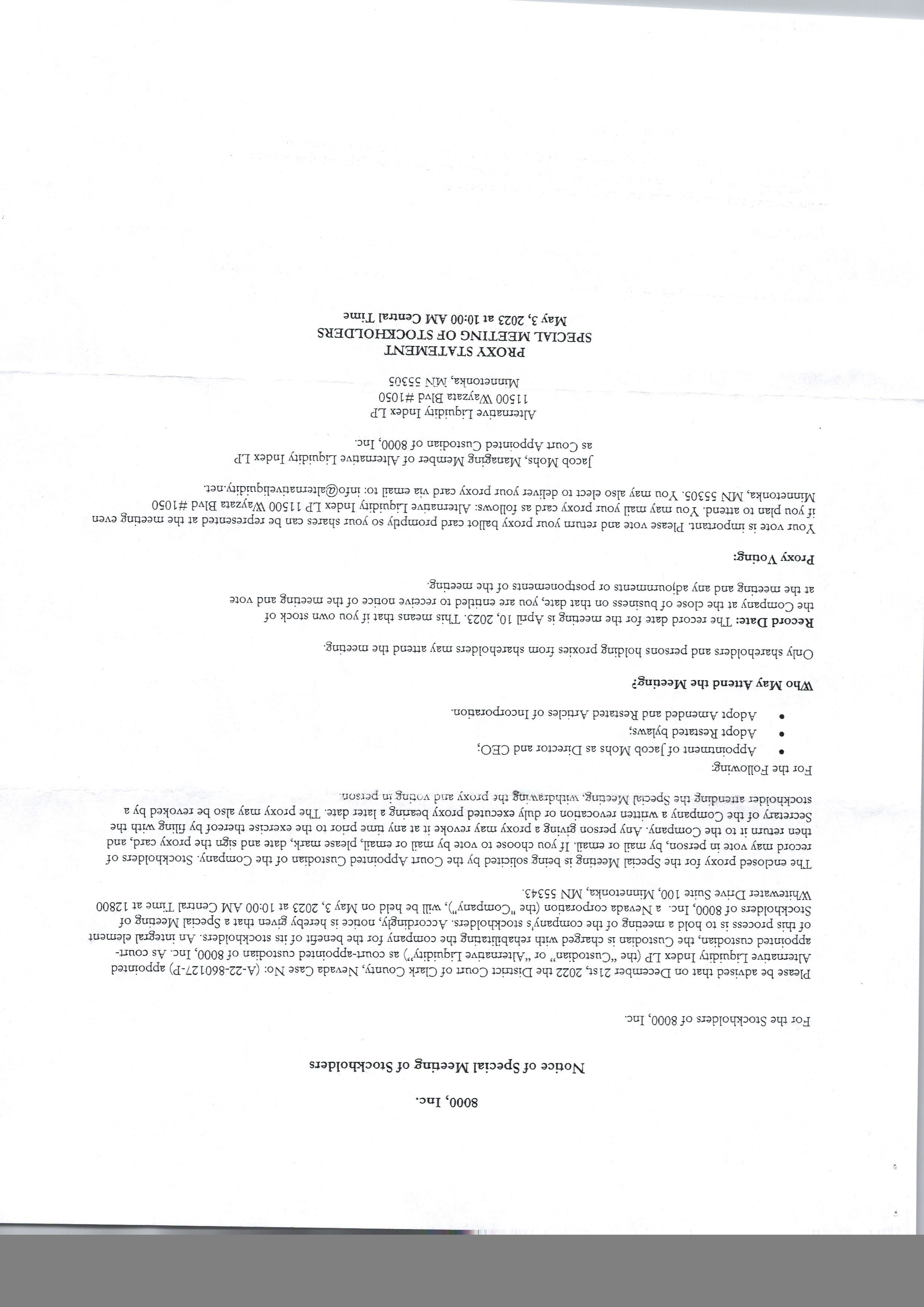

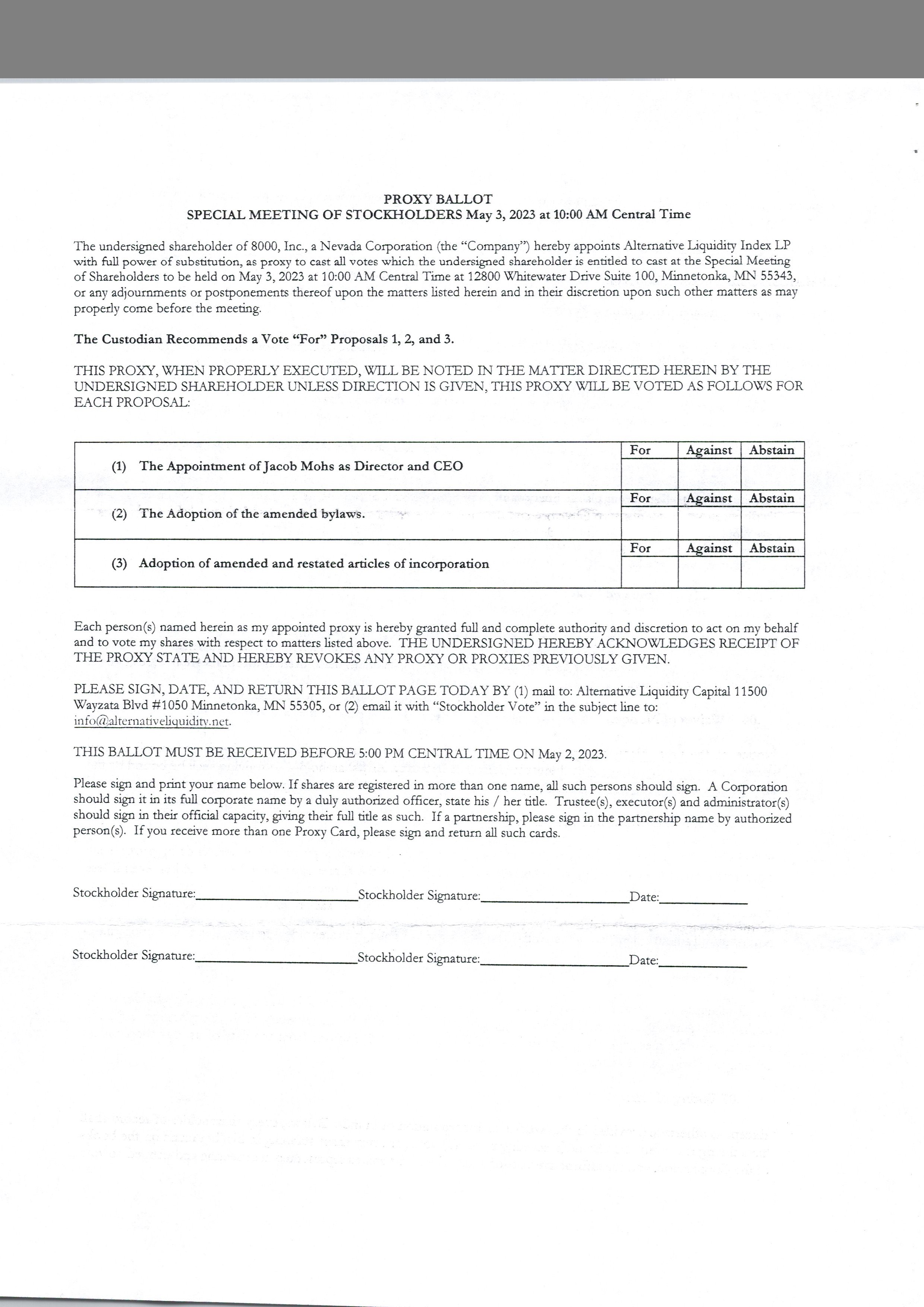

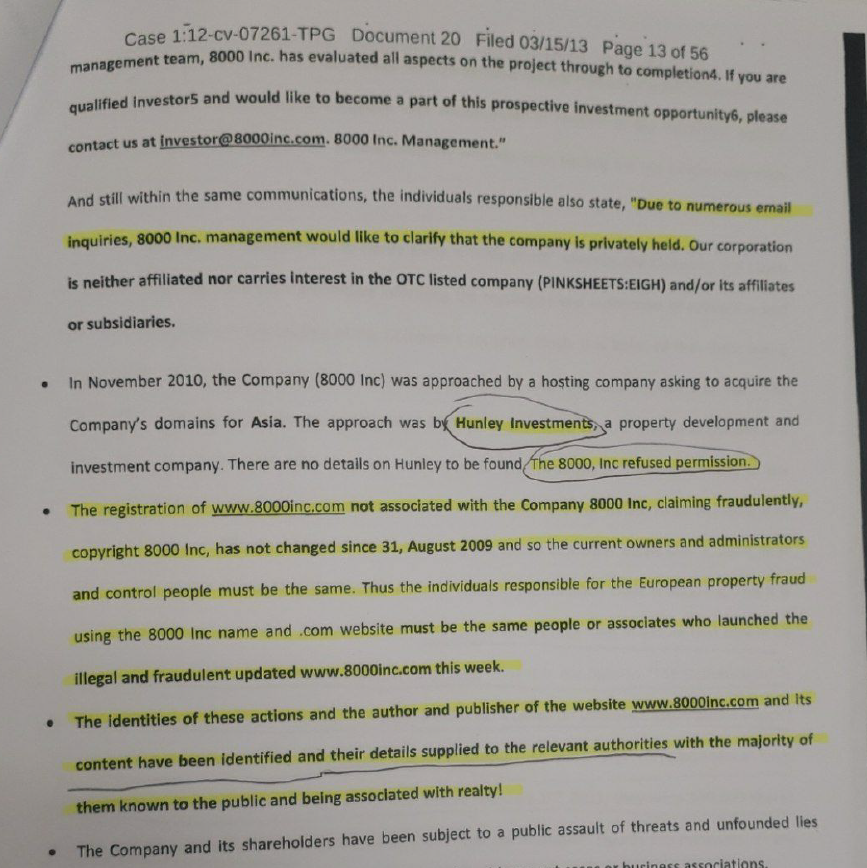

Looks like there was a proxy vote yesterday for 8000, inc. How is this possible given the history of this security?

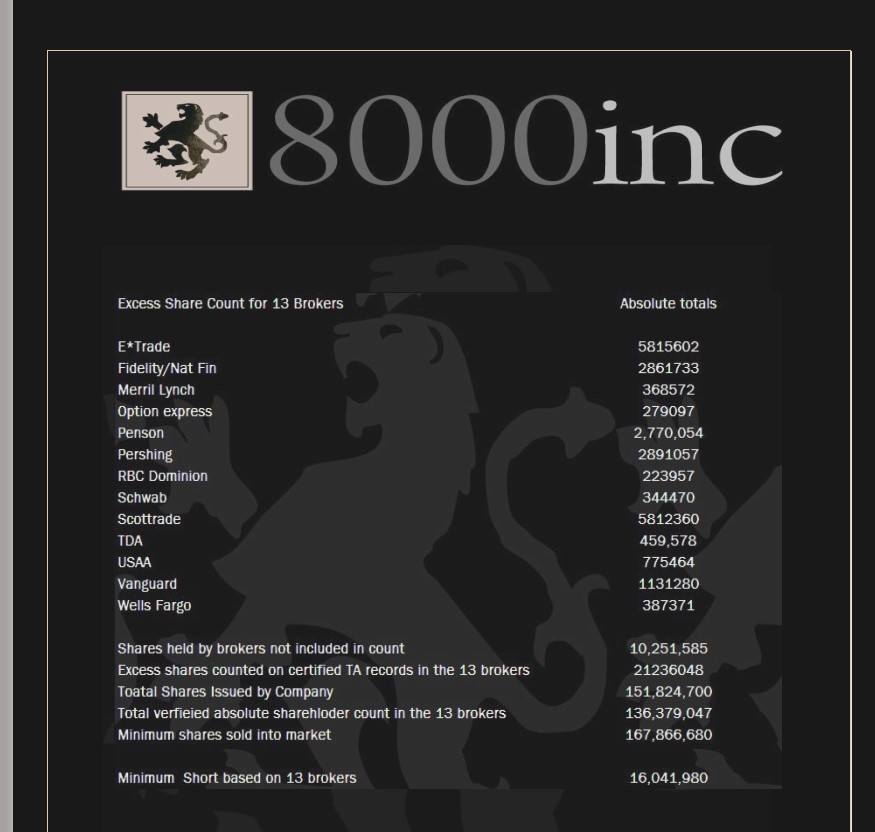

Historical References:

8000 inc Stock Certificate (Real Proof)

.png)

Etrade (Morgan Stanley) Broker Correspondence on EIGH naked short position

Bryant Response to SEC

Did you notice the "Jury Trial Demanded"?

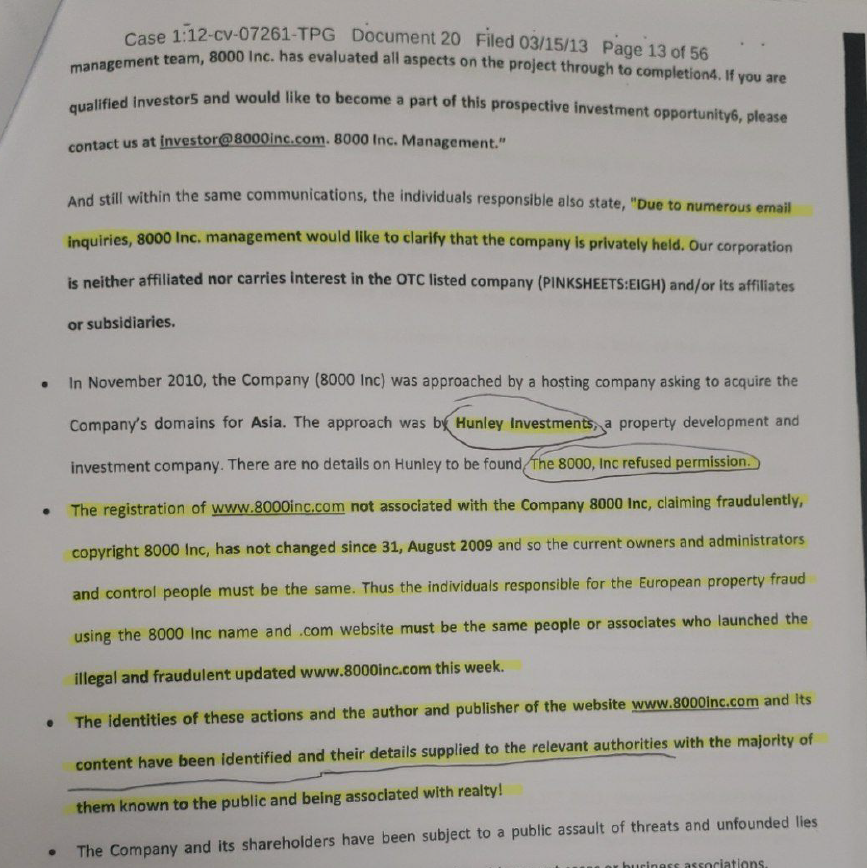

8000 inc is a private entity

Official notice via the SEC court (later found the SEC acted in an unconstitutional manner)

320 million illegal naked short identified

sca

sca

Letter to SEC identifying there is a naked short position asking for SEC/Finra remedy

https://www.otcmarkets.com/otcapi/company/financial-report/55378/content

13 Broker identified with an excess/imbalance of shares

DTCC

Subject: Re: 8000inc ticker EIGH

From: sletzler@dtcc.com

Date: Mon, 26 Sep 2011 15:43:11 -0400

Dear XXXXXXX,

Your email to XXXXXXXXX was forwarded to me for response.

Since 8000Inc is not and has never been eligible for full services at DTC, DTCC is unaware of any restrictions that may be placed on this security by brokers. But in any case, no action that DTCC or DTC would take would have any impact on trading activities, but would only impact the electronic clearing and settlement of securities held at DTC. My suggestion is that you speak directly to your broker to answer any further questions you may have about 8000Inc.

Steve Letzler

Director, Corporate Communications

DTCC

SEC in-house judges violate right to jury trial, appeals court rules

https://www.reuters.com/legal/government/sec-in-house-judges-violate-right-jury-trial-appeals-court-rules-2022-05-18/

Agency powers under threat in U.S. Supreme Court FTC and SEC cases

https://www.reuters.com/legal/agency-powers-under-threat-us-supreme-court-ftc-sec-cases-2022-11-03/

U.S. Supreme Court rules federal courts have jurisdiction to hear challenges of FTC, SEC

https://bankingjournal.aba.com/2023/04/u-s-supreme-court-rules-federal-courts-have-jurisdiction-to-hear-challenges-of-ftc-sec/

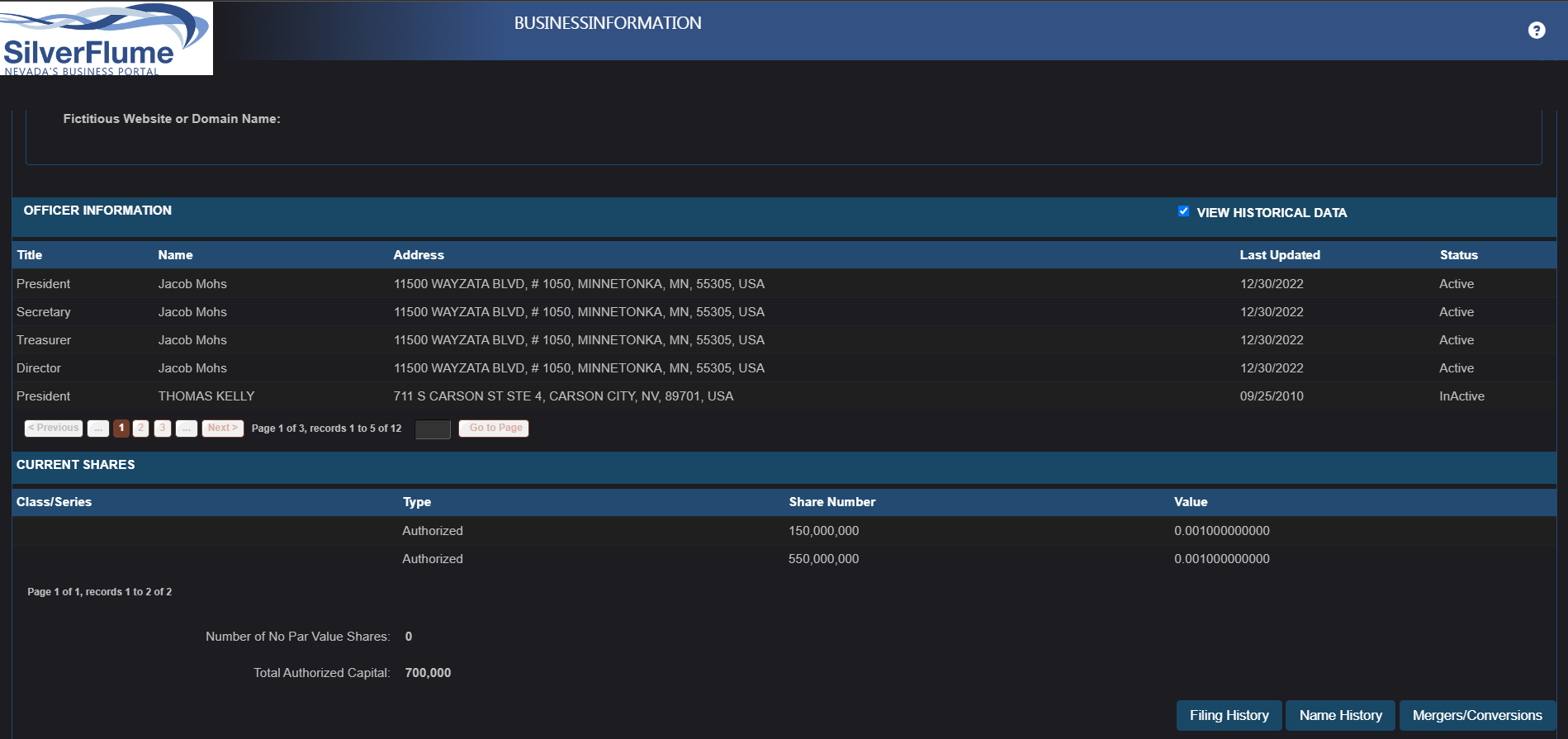

Does anybody want to show Jacob Mohs that he has custody of a security that should not be trading???

Rule 144 violation*

$13

$EIGH

Remember that Rule 144 (DWAC) issue back in the day with CRGP where the DTCC stepped in to protect the special dividends paid to investors because Cor Clearing (now APEX) clients Nobilous and Beaufort got caught with a 327 million share imbalance (due bill).

and

Scottsdale Capital cleared thru Alpine and Macallan Partners LLC was the registered holder.

and Alpine is still dealing with the "Concentrated Short Position" in another ticker

Well, The DTCC just made some changes to the collateral used to support those abused liquidity lifelines that participate via toxic/abusive convertible note lenders on the OTC.

Reducing Risk and Deleveraging Debt Instruments

Changes to DTC Collateral Haircuts

-144A / Reg S ( All Securities - Equity & Debt )

https://www.dtcc.com/-/media/Files/pdf/2023/5..._Final.pdf

and the SEC just put more pressure on these private lenders

SEC Adopts Amendments to Enhance Private Fund Reporting

https://www.sec.gov/news/press-release/2023-86?s=35

I don't think CRGP shareholders will be waiting for a resolution much longer if this activity continues to stress short positions in the stock.

Broker-dealer clients will have to deleverage or face margin call/liquidations if they don't put up the capital required to maintain the margin requirements. The DTCC won't back its Broker Dealer participants that exist with this issue.

$13

$CRGP

volume starting to pick up again

$13

$CRGP

Just called Signature Stock Transfer (SST), who is the Transfer Agent for 8000 Inc. SST confirmed the stock certificates are free trading in certificate form only! Signature Stock Transfer is also aware that 8000, inc was activated in the State of Nevada on December 30th 2022.

He would need the stock certificates to be in the majority. Any electronic volume does not reflect this behavior. Real certs can not trade electronically. Non DTC eligible!!!

To be honest, the EIGH corporate action never went thru in the past. The SEC was notified and did nothing to enforce the settlement rules and regulations of an identified naked short position. Correspondence between brokers even identified fails to deliver in the 8000 Inc disclosure statements. Also, If you remember, there were a few solutions to resolve this private security trading illegally on the OTC. One of them was to cancel all common and transfer to preferred with a new cusip. That cusip was created successfully. So it really boils down to how does a hedge fund take over the custodianship of a private entity that should not be trading electronically in the first place?

Well if the financing is there to support any reporting and handing fees with OTCM and the TA, Signature Stock Transfer, then I guess we shall see how it plays out.

The problem is with the OTCM IDQS system. After all fillings are up to date and fees paid that need to be reviewed and processed, there is no guarantee any enforcement will be made. The 15c211 quotation process is broken. In my opinion, it is no different than CRGP (formerly their TA was Signature Stock Transfer) going private corporate action is stuck in right now. The attempted hijacking over custodianship certainly made things interesting (somehow quotation was granted and it traded for a year, I would assume illegally). All of that didn't change the fact that an imbalance of shares was identified in Nebraska court and was never resolved.

EIGH would be in the same situation where all of its securities trading on the OTC, which essentially are obligations (debt) that is illegal, would be required to be settled.

So is this another attempted hijacking or is this an entity protecting the shareholder's rights to what was perceived as real property when it was sold to them by their brokers?

Another example is the $MMTLP matter. Its was created via a special dividend as a private preffered security that was allowed to illegally trade. There is a pending corporate action in progress. Shareholders are stuck because of a FINRA U3 halt for "extraordinary events"

Seem like all 3 tickers CRGP, MMTLP, and EIGH are private securities by way of slight differences that should not be trading while the SEC, OTCM and FINRA do not know what to do because they got caught in their failures of governance in the financial system.

$EIGH

$CRGP

$MMTLP

Interesting facts on Jacob Mohs the new custodian of EIGH....

https://www.linkedin.com/in/jacobmohs/

https://alternativeliquidity.net/

Some Deals

https://www.marketscreener.com/quote/stock/LOOKSMART-GROUP-INC-120796116/news/Alternative-Liquidity-Index-LP-managed-by-Alternative-Liquidity-Capital-announced-an-offer-to-acqui-41294503/

https://www.marketscreener.com/quote/stock/SYNERGY-CHC-CORP-120795410/news/Alternative-Liquidity-Index-Announces-Offer-to-Purchase-Shares-in-Synergy-CHC-Corp-37726064/

https://www.sfexaminer.com/ap/national/alternative-liquidity-capital-announces-offer-to-purchase-jade-power-trust-cvrs/article_a3c078d2-82e6-5147-bb67-0fbe158672fc.html

https://www.sec.gov/Archives/edgar/data/1091596/000187041222000006/nuo_sc_to_cover_sheet.htm

https://www.benzinga.com/secfilings/22/12/29974560/strategic-realty-trust-inc-formsc-to-t-amended

Look at the address on his purchase and sale agreement

https://alternativeliquidity.net/wp-content/uploads/2022/12/Purchase-and-Sale-Agreement-Fillable.pdf

Why did he choose this space?

Conveniently next to Fidelity

https://www.officespace.com/mn/minnetonka/2145098-11500-wayzata-blvd

https://www.formds.com/issuers/alternative-liquidity-index-lp

Hedge Fund

https://www.sec.gov/Archives/edgar/data/1870412/000187041222000015/xslFormDX01/primary_doc.xml

https://www.sec.gov/Archives/edgar/data/1870412/000187041221000001/xslFormDX01/primary_doc.xml

https://www.prweb.com/releases/alternative_liquidity_index_lp_extends_tender_offer_for_grandview_missouri_tax_increment_revenue_bonds/prweb18288793.htm

As mentioned in the above link

https://westcoaststocktransfer.com/

The PAUSE Program lists entities that falsely claim to be registered, licensed, and/or located in the United States in their solicitation of investors. The PAUSE Program also lists entities that impersonate genuine U.S. registered securities firms as well as fictitious regulators, governmental agencies, or international organizations.

https://www.sec.gov/enforce/public-alerts/impersonators-genuine-firms/west-coast-stock-transfer-inc

Yes, he popped up during the time when SSM Monopoly tried to hijack the custodianship of CRGP. Sagar Raich showed proof to the Nevada State court that it was defrauded and the custodianship ruling was overturned to Clement Lockwood. An affidavit was filed with the court.

Jacob Mohs was attempting to buy private placements after CRGP was heavily shorted from .02. to trips...Just odd timing in my opinion. Not sure if this guy is the real deal or not.

Also during the SEC vs Johnathan Bryant litigation, JB answer to the complaint showed EIGH listed as a private company under 8000 inc, not 8000, inc.

The SEC identified 8000 inc as non-DRS eligible. So what is Jacob Mohs trying to do by taking custodianship over this entity?

$EIGH

#SEC

#OTCM

#FINRA

#Naked

#Short

#Fraud

#finrafraud

$MMAT

$MMTLP

$CRGP

$AMC

$GME

FINRA creates FRAUDULENT COUNTERFEIT shares

new video:

NEW MMTLP News !! Interview w/John Brda, John Tobacco, Cyntax and Jenn V.

Also this happened recently

https://www.thinkadvisor.com/2023/01/24/finra-enforcement-head-to-step-down/

This person is responsible for the governance/review of the 15c211 and regsho data in the financial system for 18 years. Conflict of interest?

$EIGH

#NakedShortWar

Hi LoneGrey,

Its been forever, glad to see you around.

Are you following the mmtlp situation? I believe the illegal naked short practices that we have fought against in the past will finally be resolved.

Both securities are private which traded illegally on the OTC and had the same market makers involved. Both securities involved an issued a special dividend to expose a naked short. Even if EIGH had its dividend frozen, it still exposed it. The disclosure statements are a record reflecting the alleged crimes made against the company and requested the SEC and FINRA to enforce its settlement of transaction rules and regulations in order to protect investors, which it still has not done yet. The request for resolution is still open today.

Nothing happened with EIGH before 2016 because there was nothing to force the issue. All the naked short matters were hiding behind the immunity in the corporate veil of securities laws in the stock borrowing program at the DTCC/NSCC/Obligation Wharehouse.

Well all that changed after the Supreme Court decision allowed/opened the door for jurisdiction and liability to be used against all participants including the DTCC and FINRA.

https://www.crowell.com/NewsEvents/AlertsNewsletters/all/Supreme-Court-Allows-Securities-Related-Claims-to-Proceed-in-State-Court

This law opened the opportunity for all investors to defend their property in a court of law.

The margin requirements have also changed because of the realization of securitized debt obligations is plentiful and unmanageable in the financial system.

Many CEO's are joining efforts for the first time ever to defend their companies against these illegal practices.

CEObloc.com

Fyi in 2022 prior EIGH litigation can be considered unconstitutional by the Supreme Court.

https://www.heritage.org/the-constitution/commentary/secs-house-enforcement-action-ruled-be-unconstitutional

EIGH is still trading illegally with volume until this day.

I believe we have reached new territory here where a final resolution is upon us.

They're many court cases challenging FINRA right now via the mmtlp situation. The matter of naked shorting cannot be ignored anymore.

I believe Congress will have to get involved to force the regulatory agencies to do their functioning purpose in protecting the economy of the United States against the nefarious actions that threaten its stability.

The legal framework is all set for this to be resolved soon in my opinion.

All it takes is one company to expose it legally via "Discovery" and the pin to the grenade in the Obligation Wharehouse blows up and forces a massive settlement of failures to deliver in the system. Thats how I see it.

$EIGH

#NakedShort

CRGP TIME AND SALES 1/24/2023

https://quotes.freerealtime.com/quotes/CRGP/Time%26Sales

"NYSE glitch leads to busted trades, prompts investigation"

$13

$CRGP

![]()

CRGP TIME AND SALES 1/23/2023

https://quotes.freerealtime.com/quotes/CRGP/Time%26Sales

$13

$CRGP

![]()

Battle Plan: From $0.30 to $11.00 in 6 months. Here's my interview with

@johnbrda

where he fought the #NakedShorts, grew his share price 3,600%, raised $183 million and closed a $1.9 billion merger.

Battle Plan: From $0.30 to $11.00 in 6 months. Here's my interview with @johnbrda where he fought the #NakedShorts, grew his share price 3,600%, raised $183 million and closed a $1.9 billion merger. https://t.co/TPhVTALcIg Mindblowing. $GNS $TRCH $MMAT $MMTLP #WeCanWin pic.twitter.com/zCEhWxXc0J

— Roger James Hamilton (@rogerhamilton) January 20, 2023