Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Nonsense. It's not meaningless:

1) Algorithmic information is sourced inside SEC filings

2) Enforcement actions showing Broker Dealer criminal activity using ATS technology.

3) Broker Dealer ATS manuals provide technical details

4) Broker Dealer Operator (BDO) ATS registration requires NMS regulatory compliance.

5) BDO's ATS operates inside the OTC marketplace

6) BDO's ATS have smart order routing (SOR) technology which has to comply with FINRA SIP.

7) FINRA SIP allows BDO Alert messaging and SOR technology to facilitate trades inside TRADING CENTERS

8) FINRA ORF is active in the EXPERT MARKET.

9) FINRA ORF also shows REGSHO activity on the EXPERT MARKET.

10) CRGP is shorted on the EXPERT MARKET by BDO's

Congress, how does FINRA, an SRO under the review of the UNWORTHY GOVERNMENTAL AGENCY via the SEC, be allowed to let an Expert Market security which was also a U3 halted stock, $CRGP, be shorted on the OTC without any accountability?

— Onehundredmph (@onehundredmph) June 28, 2024

This security was also a prime example of a… pic.twitter.com/F5E0cdV9X1

Wallstreet's best kept secret is buried here 👇

— Onehundredmph (@onehundredmph) March 25, 2025

Summary: Smart Order Routing technology inside an ATS can leverage a US asset and interfere with its "place of settlement" by altering or expanding obligation contracts. This is a backdoor activity that provides a broker dealer to… https://t.co/PK3MyBKqJx pic.twitter.com/bein46pKuk

Technology Reference:

— Onehundredmph (@onehundredmph) March 30, 2025

IntelligentCross = FINRA ADF Participate (ATS)

FINRA ORF on OTC Link = APEX

OTC = Virtu MatchIt (ITG) = POSIT alert https://t.co/wqMQrJma55 pic.twitter.com/e6Xzv1IqFP

Part 2: Wallstreet's best kept secret is buried here👇

— Onehundredmph (@onehundredmph) March 27, 2025

(The attack from all sides)

Historical Reference: Phunware Retains https://t.co/F2YZD8nlZR to Surveil Short Sellers and Market Makers

"monitors trading in all US stocks in real time and maintains massive databases of short… pic.twitter.com/CSRsaFdMmQ

Virtu (ITG)

— Onehundredmph (@onehundredmph) March 27, 2025

(Background)

Virtu Financial, Inc. Completes Acquisition of ITGhttps://t.co/X7hRQ6xY0u

Subsidiaries of Virtu Financial, Inc.https://t.co/SGNDQAEnbE

SEC order instituting Admin Cease and Desist on Virtu (MatchIt)https://t.co/q9U68p07Hp

So they rename it...

Virtu… pic.twitter.com/QK3Puz9KFb

Technology Reference:

— Onehundredmph (@onehundredmph) March 30, 2025

IntelligentCross = FINRA ADF Participate (ATS)

FINRA ORF on OTC Link = APEX

OTC = Virtu MatchIt (ITG) = POSIT alert https://t.co/wqMQrJma55 pic.twitter.com/e6Xzv1IqFP

more automation by manual entry?

You understand that is meaningless, right?

more automation by manual entry?

CRGP

Date/Time Price Shares Exch/Mkt

04/01/2025 9:32:05 EDT 0.0004 100 OTCBB

04/01/2025 9:30:05 EDT 0.00 496 OTCBB

Ask was at .0001 yesterday. Missed it. Will pick it up again.

Cheers to a fulfilling career.

I've been an Evil Basher for much longer than CRGP's been around. I just didn't begin to follow it till after the FINRA halt.

I started in 1997. At the time, I was living in Italy. I got online in 1996, and quickly discovered Silicon Investor. There, I made some friends. We were all following normal stocks that were trading on the Nasdaq or the NYSE. But one day, somebody came across a company called Cashco (which quickly became Crashco, naturally) that had an interesting product mix: Y2K remediation software and kitty litter.

So we decided to take a quick look. It was MUCH more interesting than we'd anticipated. The woman who ran it had previously been involved in the Dimples Diapers scandal in British Columbia. Her boyfriend, who was also the company's IR guy, had done prison time for solicitation to commit murder. And so on...

We never looked back.

So how did you get started in the paid basher business? They claim that you are greatest paid basher of all time. Out of all the stocks in the world why did you choose CRGP to bash? How does one start a career in such a thing?

No, I wasn't aware of any of that at the time. I caught up in 2015.

Wow. You’ve been around since AMMG and Mr Carter. 🤣🤣🤣

Here's one thing I've known for 20 years and more: Stories involving Tick Tock Stocks never end well. Never.

Google “delusional disorder.” I think that It applies here. Tik toc.

Agreed.

In the meantime, the CRGP trading bs continues

03/12/2025 9:30:19 EDT 0.0001 2000 OTCBB

Yes, yes tic toc we have seen and heard it all before.

You are confused and it’s evident. You are putting all your faith in these accounts and there is no proof that CRGP is included. You just like to put all your chips on red don’t you.

Translation: Trump has created chaos out of what was once reasonable foreign policy. He's sent Musk and his Muskrats into government agencies to wreck them. They have no idea what they're doing, and by now have done little but fire people at random and screw up the work and institutional memory of decades. None of that deserves approbation.

Thanks to his efforts, our capital markets are crashing. You seem to want that to get worse. And you do not appear to understand that everything Trump says or does is about HIM, and only him. He suffers from a form of main character syndrome that is truly dangerous.

Fraud in goverment agencies being addressed. Ripoffs in global trade being addressed. Stock market fraud and abuse will have its turn.

Echo chamber = 15 posts btw a criminal and a fool. Tic tok. Liquidity is drying up while the judicial process catches up. Whats next wont be pretty for criminals and fools, but all shareholders will love it.

Concentrations in legacy omnibus can not be avoided especially for CRGP.

It hasn't gone to trial yet. I think it's still in the early stages.

Sheesh. This is from December 17 of last year. I really don't think there are any victims...

https://www.justice.gov/criminal/criminal-vns/case/united-states-v-andrew-left

Even the business about him working on the basis of tips from a hedge fund is stupid. Lots of shorts get tips from other market professionals.

The SEC brought a parallel case; there are a few things I haven't read, but not much has happened:

https://www.courtlistener.com/docket/68980520/securities-and-exchange-commission-v-andrew-left/

If anyone's interested, this is the DOJ's indictment:

https://www.justice.gov/usao-cdca/media/1361671/dl?inline

And then last October, Ryan Choi, who worked with Left, and is not named in the criminal indictment, agreed to settle with the SEC. For what? See here:

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26164

And here:

https://www.sec.gov/files/litigation/complaints/2024/comp26164.pdf

No need to go on, but Left did make disclosure. Did he guarantee he was right about what would happen with the stocks in question? Of course not. Was he usually right? I didn't follow all, or even most, of his plays in recent years, but, yes, he was usually right, at least about his short plays.

But all in all, Left should have been more careful about disclosure. And probably it was a big mistake for him to register as an investment adviser in California. He should have stock to mostly writing reports. I don't really think Twitter/X is all that good a venue for presenting complex DD.

If they convicted him for this, then maybe they should go after the people that tweet HODL or diamond hands. Atleast they should be investigated.

They're welcome to try. But it won't work.

It probably has something to do with--or they think it has something to do with--the DOJ investigation of short sellers that began not too long before COVID. It was in large part sparked by that idiot from Columbia, Joshua Mitts. If you've never heard of him, google his name.

But so far, there've only been one or two prosecutions. The second was filed almost a year ago; the defendant is Andrew Left. Pretty much all he's accused of is lying about when he closed short positions. Lying on TWITTER/X, for God's sake. Gee, I thought nobody ever did that. Left doesn't have any clients, so unless the DOJ has stuff that isn't in the court filings yet, it's a weak case.

Left has pled innocent.

All of this is fine. But people claim

That if the information being requested from 2020-2023 shows any fraud or FTD on behalf of the hedge funds, market makers, or brokers this would trigger a larger investigation. Maybe even provide an avenue for similar stocks to request this type of information.

Ohhh. That doesn't actually have anything to do with MMTLP. The MMTLP stock was, of course, Issued by Meta Materials (MMAT). It was intended to be a placeholder for stock in a new private company, Next Bridge. MMTLP would be issued to MMAT shareholders as a placeholder for a preferred dividend in Next Bridge (which at that time didn't exist and hadn't been named), and then six months or so later, the MMAT stock would be exchanged for the Next Bridge divvy. Why was the creation of MMAT necessary? It wasn't. MMAT could, and should, have just issued Next Bridge stock immediately.

That was part of the scam, and the SEC described it in its lawsuit brought by SEC Enforcement against MMAT, John Brda, and George Palikaras:

The SEC’s complaint, filed in U.S. District Court for the Southern District of New York, alleges that Brda and Palikaras planned and conducted the manipulative scheme that included, among other things, issuing a preferred stock dividend immediately before the merger. The complaint alleges that Brda and Palikaras told certain investors and consultants—and hinted via social media—that the dividend would force short sellers to exit their positions and trigger a “short squeeze” that would artificially raise the price of the company’s common stock. The SEC further alleges that Brda and Palikaras also misrepresented the company’s efforts to sell its oil and gas assets and distribute proceeds to preferred stockholders, giving investors a false impression of the value of the dividend. While investors held or bought the company’s common stock to receive the dividend, the complaint alleges, the company was cashing in by selling $137.5 million in an ATM offering at prices that the company, Brda, and Palikaras knew were temporarily inflated by their manipulative scheme. “We have two days,” the complaint alleges Brda told Palikaras after the first day of the ATM offering, “to take advantage of the squeeze...”

... A separate Commission investigation regarding subsequent events related to Meta Materials (MMTLP) remains ongoing. If you are an individual with information related to this investigation or any other related suspected fraud and you wish to contact the SEC staff, please submit a tip at SEC.gov.

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26035

The complaint:

https://www.sec.gov/files/litigation/complaints/2024/comp-pr2024-77.pdf

According to the SEC, "to accomplish his plan, Brda devised a series of transactions intended to create a short squeeze. Those transactions included a merger agreement between Torchlight and another company, along with a dividend—in the form of preferred stock issued to shareholders of record at closing—that Torchlight would not register or make available for immediate trading on any

exchange (“Preferred Dividend”). Shareholders who received the Preferred Dividend would purportedly be entitled to receive the net proceeds of the sale of Torchlight’s oil and gas assets. Brda believed, and intended to lead investors to believe, that the Preferred Dividend would force short sellers to exit their positions and trigger a short squeeze that would inflate the price of

Torchlight’s publicly traded stock."

As you'll see, Brda then went shopping for a company that would be suitable for use in his scheme. One with a CEO willing to play along. And he found MMAT and Palikaras. FINRA shut down MMTLP two days before the stock was scheduled to be cancelled. And that's what the MMTLP crazies are pissed off about, because there was no short squeeze.

MMAT, which was located in Nova Scotia, with other offices in British Columbia, hired a new CEO. A guy in California. MMAT was crazy, too. It'd been expanding without having the means to do so. The building that was its headquarters was huge. But eventually they had to declare bankruptcy. MMAT shareholders will get nothing, because as you see it's Chapter 7.

So to sum up, none of it has any relevance to Calissio.

The Debtor is Meta Materials Inc who is undergoing bankruptcy proceedings under Chapter 7.

The Trustee is Christina Lovato

These are some of the Entities Being Ordered to Produce Records:

Anson Funds USA

Citadel Securities LLC

United States Bankruptcy Court, District of Nevada

Case Number: 24-50792-hlb

Filing Type: Ex Parte Motion and Subpoena for Custodial Records (ECF Nos. 1614, 1615, 1616)

Who are the parties?

The case is in Nevada bankruptcy court. The link is not easily obtainable

lol, and YOU don't have a link either?

But I think Hunny and his friends believe those custodians will somehow turn up bazillions of nekkid shorting in MMTLP stock. (The stock no longer exists, but that doesn't really matter.)

There won't be a gigantic nekkid short, and that'll be the end of it.

Till next time.

The recent ex parte motion in the MMTLP case. Requires custodians of records from TD Ameritrade and Citadel. Granting some type of transparency for retail. Now this is along way from having anything to do with cRGP

If so, it's not worth doing. The MMTLP story was great--deliberate fraud--and the people who dreamt up that fraud are being sued.

He’s most likely referencing MMTLP and is banking on precedent setting. Clutching at straws if you ask me.

Proof is needed if CRGP isn’t documented as part of existing broker obligations, it won’t magically get included. The needs to be PROOF! that CRGP’s stock had been subject to naked short selling, synthetic shares, or settlement failures through omnibus accounts.

The real story here is that iCRGP was simply a penny stock that got diluted, delisted, and abandoned, there are most likely no obligations left to investigate.

Then surely you have a link you can post here! Can't wait!!

Legacy omnibus is in season

Only if they ask nicely and send me a fruit basket.

This post won’t age well. Just another hallucination and delusion. Unverifiable nonsense. 🤣🤣🤣🤣

Some People will say anything. Assuming people can’t fact check the nonsense that they type. A Simple Google search for court records or court hearings is all you need. I assume they will make up another story shortly. A Short Story….. 🤣🤣😂

The internet really has made for change. Not always in a good way.

Fidelity never getting mine back. Holding forever 😂

How could it be an echo chamber with various view points? And one particular view point with out evidence sounds the most unstable.

Looks like the unstables are talking into an echo chamber. Lol

Hallucinating and delusions. The internet allows anyone to have a voice. Even the unstable population.

Reminds me of the scarecrow from the wizard of oz. You couldn’t help but feel sorry for that character.

A deficit of what? Misfortune?

It’s a sin to laugh at the misfortune of others. I realize now that there is a deficit. I’ll pray for all parties involved.

When the orders are granted among other things, it will be crystal clear!

Wow! Court orders AND "other things". Yet no legal action filed that anyone's aware of! I am not getting any "crystal clear" vibes.

I said court orders not hearings.

There are no court orders without hearings. Unless one party in a legal action defaults.

And of course there has to be some kind of legal action in play. There isn't any involving CRGP that I'n aware of,

Self Custody and no counterparty risk.

WTF is "self custody"?? Apart from gibberish.

|

Followers

|

294

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

55428

|

|

Created

|

06/19/12

|

Type

|

Free

|

| Moderators janice shell onehundredmph Cologne9672 | |||

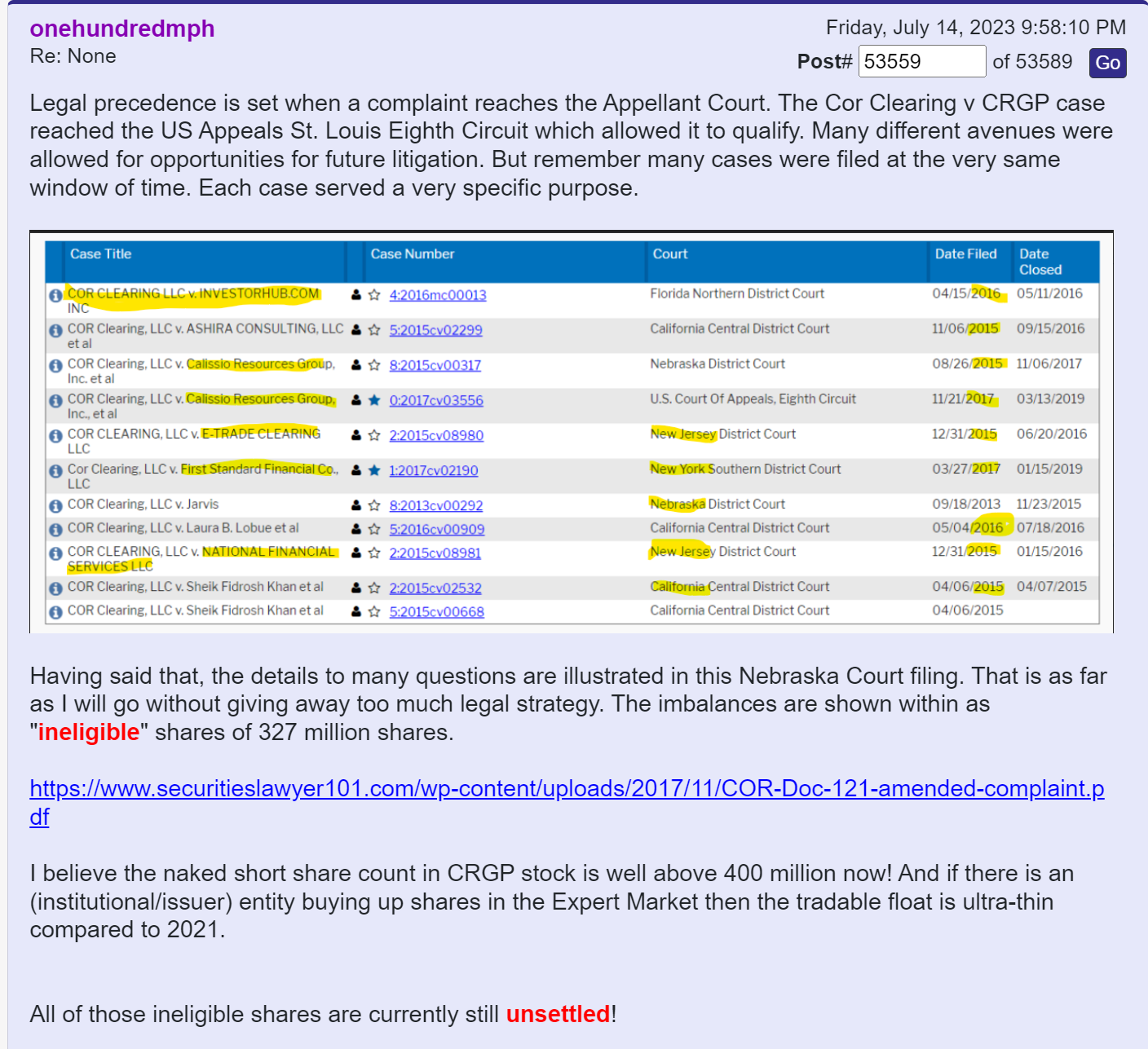

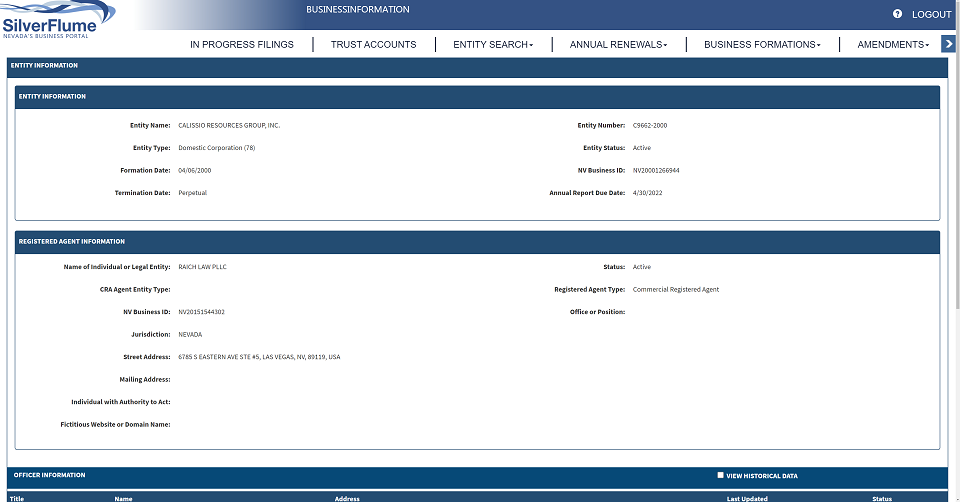

| Certificate of Reistatement - Nevada Department of State |

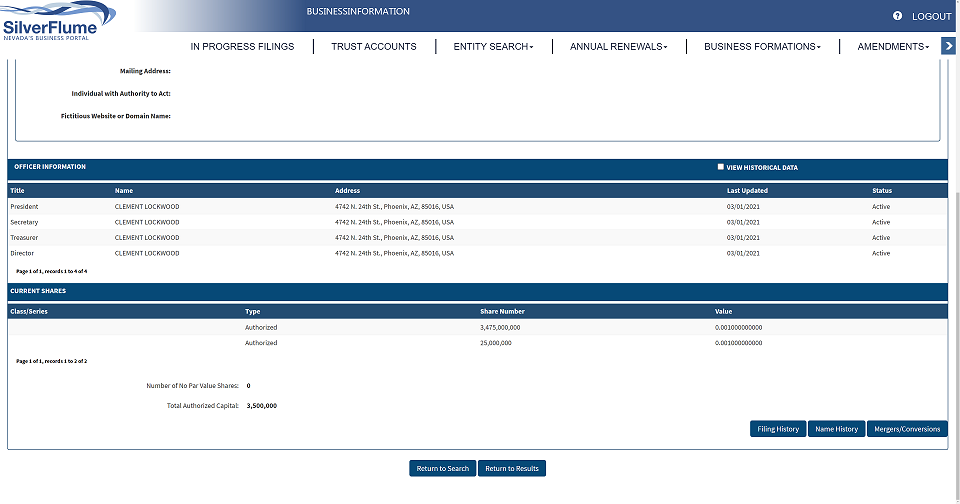

|

| New Director and Reduction from 145B shares to 3.475B in Authorized Shares |

| 03/01/2021 |

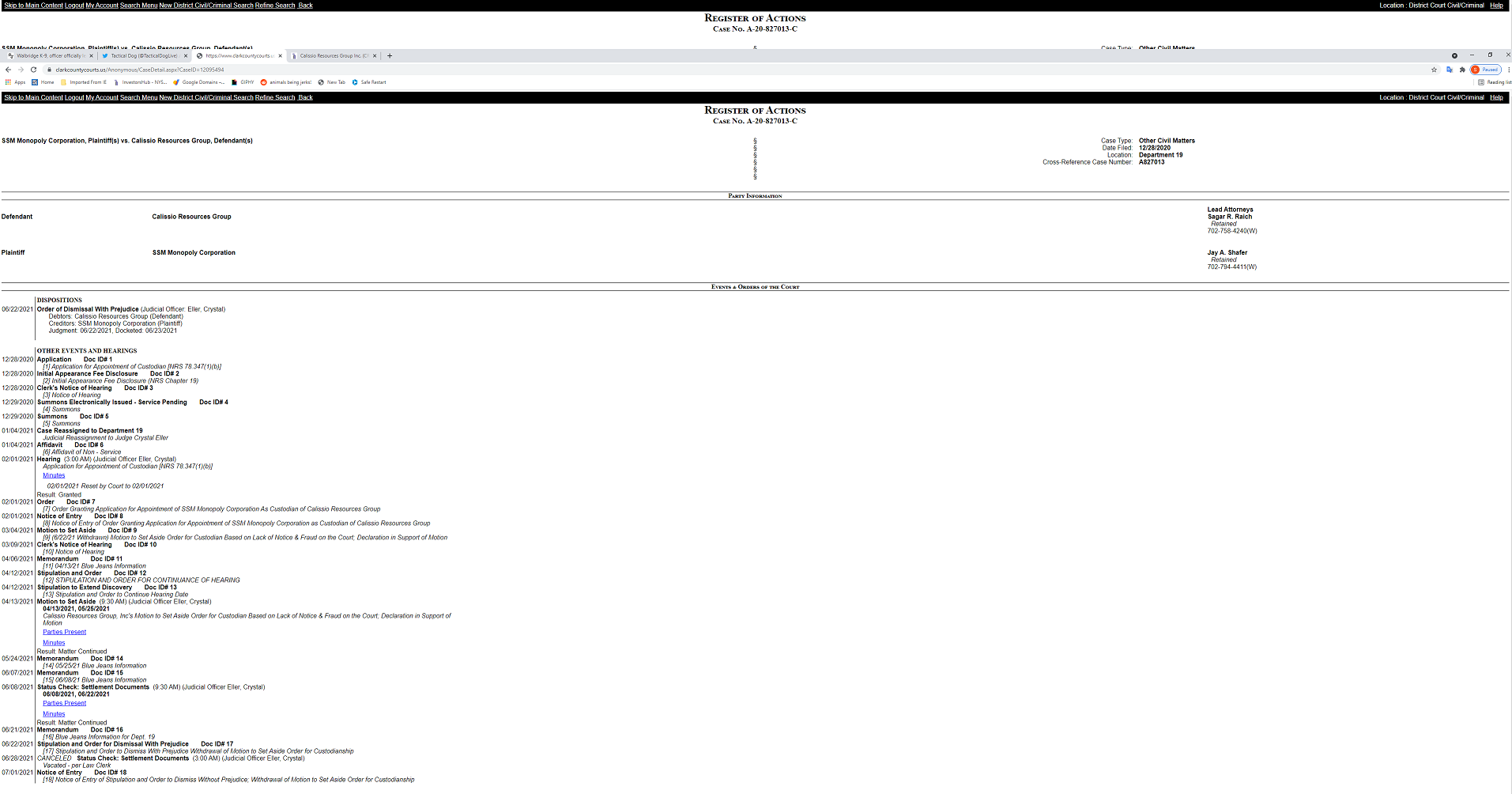

|

| Battle for custodianship in Clark County court |

|

|  |

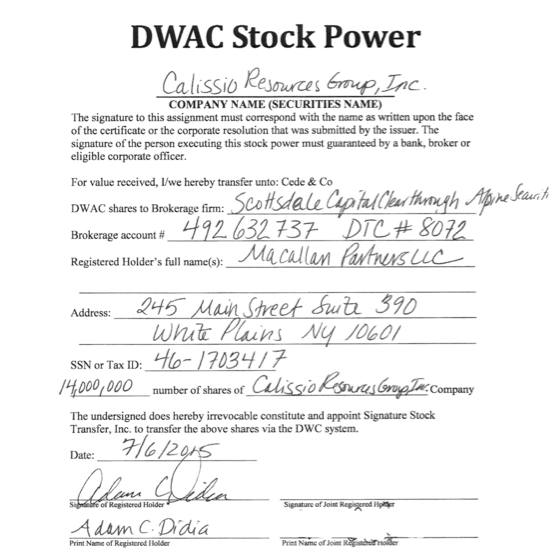

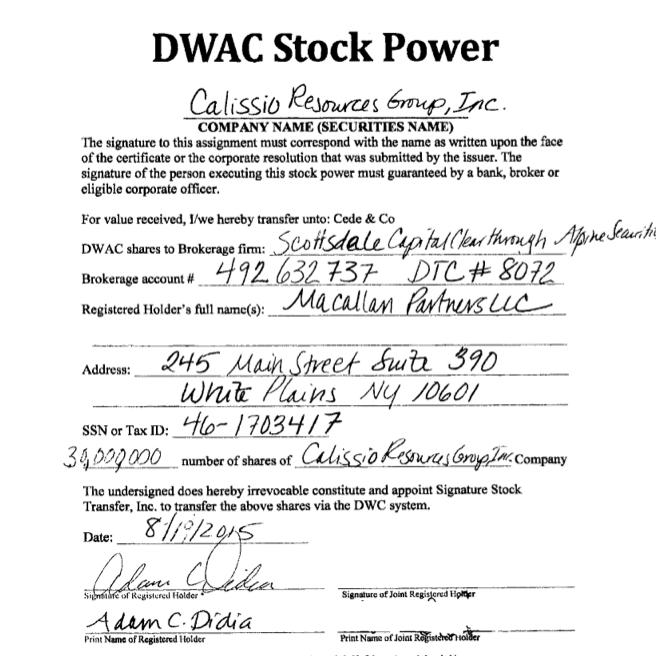

| Fishy Conversions Check: - The "a" in Scottdale, the "3" in 390. - The shifted tail of the 2nd "7" in the account number - The tip of the tail of the "7" can still be seen in the date of the 2nd. document - Portions of the deleted signature covering the same letters in Signature of Holder and Name of Holder. - 2nd. document shows bold letters and lower resolution. Image was scanned and modified. 2nd document is a counterfeit, used to create air shares and dump into the market. Those air shares were not shorted, but behave like shorts. |

| Volume: | - |

| Day Range: | |

| Last Trade Time: |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |