Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

why release it than?

$25+ :)

i would be more interested why he wasn't allowed to ask his valid questions?

is there no more free speech in the USA?

we had this kind of behaviour ~65 years ago in my country!

(Germany)

LOL awesome :D

i'm sure a pinkie CEO can handle those calls ;)

the float is 9 million... ( or was ;) )

FORT LAUDERDALE, Fla., Jul 27, 2007 (BUSINESS WIRE) -- Rapid Fitness, Inc., (Pink Sheets:RPDI) issued a statement today discussing the Company's share structure. Management stated that the current issued and outstanding total of shares of the Company's common stock is 27,307,129, of which 18,217,980 are restricted shares; the public float consists of 9,089,149 shares.

only a couple? ;)

unbelievable... is this how things are handled in the states?

reminds me of the past of my country :(

i just posted the article from the blog, it's not me :)

looks like a real company, i like the CMF on the chart...

put it on my watch :)

way to go!!!

it's always the same with these kind of stocks that get heavily promoted on the german exchanges...

dilution?

no no no i'm a bagholder there!!! :D

to da moon ;)

why?

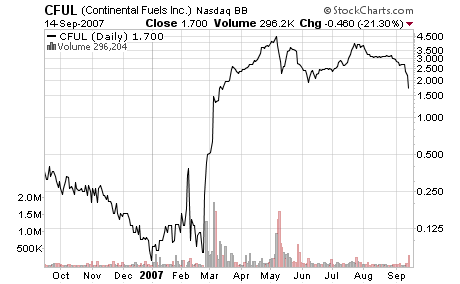

Continental Fuels: The Most Overvalued Penny Stock I Have Ever Seen

posted on: September 18, 2007

It is Not Fraud if There are No Lies

Dictionary.com defines fraud as “deceit, trickery, sharp practice, or breach of confidence, perpetrated for profit or to gain some unfair or dishonest advantage.” It has been more succinctly defined as “implicit theft” by Murray Rothbard, among others.

The key to fraud is that deception leads to the deceiver gaining economically in a direct transaction with the deceived. Many unlisted penny stocks toe the line on fraud. Management, getting paid large salaries (and tons of stock options) despite crummy financial performance, hypes up the stock, always offering overoptimistic predictions of future performance.

Often times management pays ‘independent’ analysts large sums to cover the company. This leads to gullible investors paying out large sums for the stock. When management’s glowing predictions are later belied by stark reality, the investors lose their socks and the executives live happily ever after.

What would happen if management of a worthless penny stock were completely honest about how worthless the company truly was? In that case, there would be no fraud, but anyone buying the stock would be an utter fool. I found a company like this: Continental Fuels OTC BB: (CFUL.OB).

As of August 13, the company had 571.6 million fully diluted shares outstanding. That gives the company a market cap of $972 million. What do investors get for that $972 million? Not much. They get total assets of $3.8 million, a stockholder’s deficit of $1.1 million, and for the most recent quarter, sales of $5.7 million and an operating loss of $560k. (See the 10Q for the quarter ended June 30, 2007 for details.)

First, I should detail the shares outstanding–this is a tricky computation given all that the company has done with its shares. To save space I will only discuss the origins of 500 million (88%) of the shares. There is convertible preferred voting stock that is convertible into 500 million shares. This was issued to UNIVERSAL PROPERTY DEVELOPMENT AND ACQUISITION CORPORATION [OTC BB: UPDA.ob] in payment for some assets. From the 10Q:

On April 23, 2007, the Company closed a business combination transaction pursuant to a Stock Purchase Agreement dated April 20, 2007, by and among the Company and Universal Property Development and Acquisition Corporation (“UPDA”), a publicly held Nevada corporation (the “SPA”). Pursuant to the SPA, the Company acquired one hundred percent (100%) of the capital stock of US Petroleum Depot, Inc. and Continental Trading Enterprizes, Inc. f/k/a UPDA Texas Trading (the “Subsidiaries”), two private Nevada Corporations and wholly-owned subsidiaries of UPDA. The consideration paid by the Company for the Subsidiaries consisted of $2,500,000 in cash, payable within 30 days of the Effective Date, and 50,000 shares of our Series A Convertible Preferred Stock valued at $5,000,000 (the “Preferred Stock”). The Preferred Stock is currently convertible into 500,000,000 shares of our common stock and UPDA has the right to vote the shares of Preferred Stock on an “as converted” basis in any matters for which the holders of our common stock are entitled to vote.

Valuation

Now comes the fun part. Continental Fuels, its 88% owner UPDA, and major shareholders of the two companies have repeatedly said that the stock is not worth 1% of its current market value. Following are the statements and transactions that show this:

1. The acquisition of a majority of CFUL stock by UPDA. The preferred stock (representing at that time 77% of the total stock of Continental Fuels) was in payment of a debt of $5 million incurred when CFUL bought some assets from UPDA. By this metric, Continental Fuels is rightly worth $6.5 million. This puts the value of its stock at $0.011 per share.

From a recent recent 8k filing regarding the merger:

The consideration received by us from CFI for the Subsidiary Shares consisted of $2,500,000 in cash, payable within 30 days of the Effective Date, and 50,000 shares of CFI’s Series A Convertible Preferred Stock valued at $5,000,000 (the “Preferred Stock”).

The Preferred Stock is currently convertible into 500,000,000 shares of CFI common stock and the Registrant has the right to vote the shares of Preferred Stock on an “as converted” basis in any matters for which the holders of CFI’s common stock are entitled to vote. Based on the number of shares of CFI common stock currently outstanding, as of the Effective Date the Registrant controlled seventy-seven percent (77%) of the voting stock of CFI.

2. A large shareholder recently sold 100 million shares of CFUL to UPDA in exchange for 10,000 shares of UPDA Series preferred stock. That preferred stock is convertible into 200 million shares of UPDA stock, which at a recent market price of $.042 per share values the preferred stock at $8.4 million. Why would someone sell stock valued at $170 million for stock in a different company, worth $8.4 million? The simple reason is that CFUL is way overvalued, and Ms. Sandhu was rightly afraid that by the time she could sell her stock (it was restricted until February 2008) the stock would have tanked. If Ms. Sandhu gained nothing from this transaction, then this stock swap values CFUL at $48 million and each share at $.084.

From UPDA’s most recent 10Q::

On August 13, 2007, Ms. Karen Sandhu sold 100,000,000 shares out of 141,000,000 shares of Continental’s outstanding $.001 par value common stock held by her to UPDA for 10,000 shares of UPDA Series B Preferred Stock. UPDA made the purchase on behalf of Continental as treasury stock and was retired on the same day.

also from the 10Q:

In July of 2007, certain holders of Series B preferred shares converted 3,520 Series B preferred shares into 70,400,000 common shares.

3. Those shares (plus 40 million others) of CFUL that were sold by Karen Sandhu were acquired by her in a private placement in exchange for $200,000 on February 6, 2007.

From CFUL’s 10Q:

On February 6, 2007, Company completed the sale of 141,000,000 restricted shares of its post-2007 Reverse Split common stock to Ms. Karen Sandhu for $200,000 cash. Company used the proceeds from this offering to pay outstanding debts and liabilities.

4. Continental’s 88% owner, UPDA, has a market cap of $33 million. If Continental Fuels was worth its current implied market cap, UPDA would be not only greatly undervalued but it would be the best investment of all time.

5. On August 17, 2007, Continental Fuels issued 12.6 million restricted shares to pay off a $100,000 debt, valuing those shares at $0.008 per share. Assuming a modest discount (20%) for the restricted shares, the company so much as said that it is worth $0.01 per share or $5.7 million.

From the 8k:

On August 17, 2007, the board of directors of the Registrant approved the conversion of an aggregate of one hundred thousand dollars ($100,000) of outstanding notes of the Registrant (the “Notes”) into shares of the Registrant’s common stock. Based upon the current assets and capitalization of the Registrant, the conversion price of the shares of common stock to be issued upon conversion of the Notes was valued at $0.008 per share by the Registrant’s board of directors. The conversion of the Notes to shares of the Registrant’s common stock is at the discretion of the Note holders. However, convertibility of the Notes is subject to certain limitations based on the number of shares of the Registrant’s common stock then outstanding. Upon the eventual full conversion of the Notes to common shares, the approved conversion of the Notes to common stock will result in the issuance by the Registrant of an aggregate of 12,615,326 restricted shares of its common stock.

6. A similar transaction to #5 above took place back in April, valuing the company’s stock at $0.012 per share.

from the 8k dated 23 April 2007:

On April 25, 2007, the board of directors of the Registrant approved the conversion of an aggregate of one hundred thousand dollars ($100,000) of outstanding notes of the Registrant (the “Notes”) into shares of the Registrant’s common stock. Based upon the current assets and capitalization of the Registrant, the conversion price of the shares of common stock to be issued upon conversion of the Notes was valued at $0.012 per share by the Registrant’s board of directors. The conversion of the Notes to shares of the Registrant’s common stock is at the discretion of the Note holders. The eventual full conversion of the $100,000 in Notes to common stock will result in the issuance of an aggregate of 8,326,115 restricted shares of our common stock.

When Will Sanity Return?

I have proven my case that Continental Fuels is incredibly overvalued. When should its valuation return to a realistic level? I am not sure, for it is never possible to predict stock price changes. However, it is a worthwhile exercise to examine a couple of factors that will influence the price of the company’s stock.

1. UPDA has begun to convert its preferred shares to common shares of Continental Fuels. Consequently, it has decided to spinoff a number of these shares to its shareholders. A total of 787 million shares were outstanding as of the record date, and one share of CFUL will be distributed for each 50 shares of UPDA. This means that 16.7 million more shares of CFUL will hit the market, although not until August 1, 2008, because these shares are restricted from trading for one year.

With only about 2 million shares trading currently (according to Yahoo Finance and verified by me from the company’s SEC filings), selling of a large chunk of those 16 million shares next August as the shares lose their restrictions will quickly depress the price.

From the press release on CFUL’s website:

According to the Board Resolution, one share of CFUL common stock will be distributed to UPDA’s common stockholders for every 50 shares of UPDA common stock held. Every UPDA common stockholder will receive at least one CFUL share in this distribution and fractional shares will be rounded up to the nearest whole number. The date of the distribution will be August 1, 2007 to UPDA’s common stockholders of record on July 11, 2007. Although the distributed shares will be restricted from transfer for one year pursuant to SEC Rule 144, UPDA has obtained an opinion that the shares will have no tax consequence to the recipient until they are sold or transferred.

2. Every month since April the number of shares of CFUL sold short has increased dramatically. Currently (as of August 2007), 417,000 shares are sold short (see here and search for CFUL for updated numbers). Increased selling is inevitable as more short sellers (and stockholders) become aware of the company’s extreme overvaluation.

Conclusions

The absurd valuation of Continental Fuels despite highlights several problems with capital markets in the United States. In a future post I will address these problems and ways that financial market regulation can change this.

http://seekingalpha.com/article/47442-continental-fuels-the-most-overvalued-penny-stock-i-have-ever-...

you want to believe it... ok

no need to discuss it by me

GLTY

yep finally there will be no more NSS BS rumors on pinksheet stocks!!! i wonder what the con artists come up with after that...

on stinky pinkies? when??

LOL

no his buddy took over and sold the company without the shareholders and the debt to himself... ;)

that's a myth told by con artists like pawson!

IMHO/FWIW

tried to warn ppl month ago...

i don't believe the bull about naked shorts on pinksheet stocks...

Short Interest for August 15 2007: 788,211 shares...

i added a few today, so no i don't wanna hear it ;)

maybe tomorrow?

uWink to Present at Merriman Curhan Ford & Co.'s Investor Summit 2007 on September 18th

no, not at all ;)

no, no idea...

just received my MRHD (MERH) roundup shares (interactive brokers)

no, i just sold my ZIPL :(

the merger is off, what do ppl do if smthg doesn't work out?

they sell...

IMHO

i'm out now, maybe i'll buy back lower...

yup could be another R/M in the works, but that could be month/years away... i guess ZIPL will tank hard now!

:(

looks to me that there'll be no RM...

you were proven wrong...

i tend to believe the California Department of Justice Firearm Safety Device Test more than the so called DD of a guy who lost his shirt on a pinkie scam like CKYS...

and as i told you some weeks ago, i don't care what the BioVault is made of, what about i care is.. does it sell?

are you also on the MCD board and bashing there because the food could not be that healthy??

give it a rest...

never imho

not on daily list yet...

i like whackers, bought some from them ;)

GLTA :)