Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This is the kind of thing I am speaking of.

BUENOS AIRES--Pan American Silver Corp. (PAAS, PAA.T) has shelved work on its Navidad silver mine project in Argentina's Chubut province due to the local legislature's failure to pass a regulatory plan for mines and a proposed bill that could sharply raise taxes on the industry.

And of course the Vale deal also.I would think they would eventually get the message.

Fears Ease of a Default by Argentina

April 2013

Argentina's credit-default swaps have made a comeback on expectations that the country will find a way to pay its existing bondholders despite complications posed by a high-stakes court case.

The cost of five-year protection on Argentine debt fell to 2,737 basis points Thursday morning from nearly 3,417 basis points on Monday, a significant decline after days of successive increases amid concerns that the South American country would be forced by court rulings into a technical default.

"The market has started to price in the probability of some good news," said Siobhan Morden, head of Latin American strategy at Jefferies.

She added that the retreat began after Argentina's announcement early Wednesday that it would borrow $2.33 billion from its central bank's foreign-currency reserves to pay its creditors. The measure raised hopes among market participants that Argentina may be working on a backup plan for repaying its existing bondholders, Ms. Morden said.

Argentina's credit-default swaps had risen to successive four-year highs on Monday and Tuesday, after the government late Friday filed a proposal to pay holdout creditors, who haven't accepted earlier debt restructuring deals and who have taken Argentina to court in the U.S. The proposal was widely viewed as a lowball offer that would not likely find favor with either the court or those holders of its defaulted debt.

That raised fears that if Argentina couldn't reach a deal to pay the holdout creditors, it wouldn't be able to make payments on its other bonds under a U.S. District Court ruling requiring Argentina to give equal treatment to all creditors.

But the sharp market reversal Wednesday and early Thursday suggests that such fears have dissipated somewhat.

The U.S. appeals court has given the holdout creditors—who rejected two previous debt exchanges in the years since the country defaulted on almost $100 billion in 2001—until April 22 to file a response to Friday's proposal. That might have come as a relief to some investors as it bought Argentina at least three more weeks in which devise a way to stay current on its other bonds.

Still, even with the latest retreat in the cost of insuring Argentina's debt, both Argentina's bonds and the credit-default swaps remain priced at levels implying significant risks of default over the next five years.

"Investors are still very cautious on Argentina," said Ms. Morden of Jefferies. She added that Argentine bonds see very little trading volume and so are susceptible to distortion from a couple of trades.

http://www.mendozasun.com/business-a-finance/national/2133-fears-ease-of-a-default-by-argentina

Do you have anything more current than this? I am having a hard time finding info.

http://www.bloomberg.com/news/2013-03-20/argentine-president-tightens-foreign-exchange-controls-timeline.html

Your Welcome, Argentina's Stocks, Bonds Rise on Improving Sentiment

http://www.mendozasun.com/business-a-finance/national/2135-argentinas-stocks-bonds-rise-on-improving-sentiment

JD400, thanks. I will look up the easing of restrictions on currency. If that is sufficient, that could ease some of the inflation costs for companies also.

Miners can be successful in Argentina, Peru - gold CEOs

The Minas Conga project is far from dead as Newmont Mining and Buenaventura invest $150 million in construction of reservoirs to hold freshwater to augment local community water supplies.

Author: Dorothy Kosich

Posted: Tuesday , 26 Feb 2013

RENO (Mineweb) -

Gold mining CEOs with operations in Peru and Argentina told the BMO 22nd Global Metals & Mining Conference in Hollywood, Florida, that political risks in both nations can be overcome.

Peruvian gold miner Buenaventura CEO, Roque Benavides, says he is confident the controversial $5 billion Minas Conga copper-gold project will gain local acceptance, and that “we will have surprises from Yanococha in the future.” A joint venture between Newmont Mining and Buenaventura, Yanococha is Peru’s largest gold mine.

During a presentation Monday to the BMO Global Metals & Mining Conference, Benavides recalled a history of opposition to large mining companies investing in Peru in the 1990s.

For instance, Benavides noted the lucrative Yanacocha was Peru’s first major mining project in 24 years due to terrorism activities in the region.

Benavides says a marked contrast in mining attitudes can be found in other operations in which the company is involved, such as the Cerro Verde copper/molybdenum located in Arequipa, which has a more educated population than the poor rural population of Cajamarca in which Minas Conga is located. Poor people in the rural areas of Peru usually want to benefit financially directly from new mining projects, he observed.

Cerro Verde also won social acceptance in Arequipa after the company helped modernize a sewer system, Benavides recalled. He suggested the now underway construction of reservoirs on the mining property could boost local freshwater supplies, which may help gain more community acceptance of the mining project.

Meanwhile, Peter Marrone, CEO of Yamana Gold, told the institutional investors and mining analysts attending the conference that while “Argentina is a poster child for bad public relations," he contends the biggest risk in doing business in the country is inflation, not geopolitical issues.

Marrone said the Argentine government has eased some of the restrictions it imposed on currency exchange last year, which has helped Yamana become “very successful in moving our money.”

He observed that the Kirchner Administration is trying to manage its currency value issues over a longer period of time in order to not discourage further foreign investment. Nevertheless, Marrone stressed inflation still remained the most important risk when doing business in Argentina.

http://www.mineweb.com/mineweb/content/EN/mineweb-gold-news?oid=179388&sn=Detail

JD400, has the attitude of the Argentine Gov improved in the last little while. Those two huge projects that pulled out should have wised them up. I have not been following the situation there in a little while. If they have not yet wised up I am thinking they will soon.

TNR MUX Los Azules Copper project is growing larger with every reported drill hole, new metallurgy tests and expanded copper resources will provide the basis for the new PEA of the project later this year. TNR Gold is talking now about the part of the newly found to the West of the previously known deposit by McEwen Mining - "Potential New Copper Trend" going on the Northern Part of the deposit, which is subject to TNR Gold's Back-in Right. Deeper Copper mineralisation is apparently found as well on TNR Gold's Back-In Right properties.

Update: April 9th, 2013.

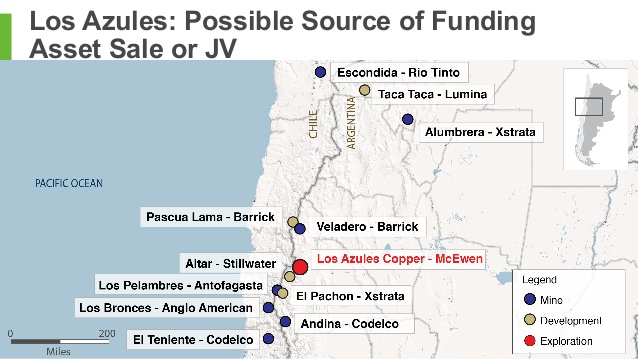

We are very surprised that there is no valuation presented on Los Azules so far by McEwen Mining with BMO hired for the Sale of this asset. New resource estimation by the end of May could be the trigger. For now all interested parties can review the Lumina Copper presentation with Taca Taca Copper deposit and "Comparable Projects & Valuations". Lumina Copper has announced today results of the new PEA on Taca Taca as well.

http://www.stumbleupon.com/su/1e8Xpn/sufiy.blogspot.co.uk/2013/04/tnr-gold-corp-advises-of-mcewen-minings_7.html

TNR,MUX Los Azules 18.4 BILLION POUNDS of Copper, indicated plus inferred. That works out to over 68 Billion dollars worth at today's copper price. With more potential to come as drilling continues

Los Azules is currently estimated to have a 25-year mine life, further exploration will likely extend that. I think it is more likely that a strategic buyer will use the current unrest in Argentina to snatch up a multi-decade project at a discount. Miners already operating in the country may be interested, or allies to Argentina -- like China. In a recent interview Rob McEwen said that they are arranging a trip to view the property with interested parties, but they all have to sign non-disclosure agreements beforehand, so we likely won't hear much about that until a deal is announced.

tag

http://seekingalpha.com/article/1171601-2-3-stocks-well-positioned-for-the-current-risk-on-environment?source=kizur

TNR,MUX World Class Copper Project Continues To Illustrate Growth Potential.

-- Drilling west of the resource has intersected high-grade copper

mineralization in Hole 12114, returning 0.70% copper over 150 meters. This hole was located on the periphery of the resource and continues to extend what is becoming an important new parallel trend.

-- Hole 1297, which was drilled on the western edge of the resource,returned 0.50% copper over 414 meters, including 1.07% over 54 meters. In addition to Hole 12114, this hole helps demonstrate that there is excellent potential to increase the size of the resource.

-- Drilling below the previously known resource successfully extended the depth of the mineralization by over 300 meters in Hole 1295, returning 0.49% copper over 338.5 meters. This result was part of a longer intercept that went through two known zones of mineralization. The overall intercept from this hole was 0.51% copper over 618.5 meters.

-- The Company will incorporate these drill results plus an additional 3 holes not yet released into an updated resource estimate that is expected to be available by the end of May.

"These results continue to illustrate the growth potential of this world class copper asset. Los Azules is both large and high-grade, which makes it unique among the world's undeveloped projects," stated Rob McEwen, Chief Owner.

This updated resource would form the basis of a new Preliminary Economic Assessment (PEA), which is due by the end of the third quarter 2013. Los Azules is one of the largest, highest grade copper-porphyry deposits not owned by a major base metal company.

http://ih.advfn.com/p.php?pid=nmona&article=56945016

TNR Gold CEO interview at PDAC 2013

Company In Good Shape

http://www.commodity-tv.net/c/mid,3434,PDAC_2013/?v=101312

Argentina furious with Brazil over cancelling of 6bn potash development project

The government of President Cristina Fernandez is furious with the Brazil-based Vale mining company for suspending its 6 billion dollars potash development in Mendoza, the largest investment in Argentina in recent years.

======================================================================

“I still remember when last year the CEO of Vale came to visit to celebrate the starting of the project. Plus, we even received information saying that the project would move from 6 to 10 billion dollars”.

======================================================================

Full story here

http://en.mercopress.com/2013/03/14/argentina-furious-with-brazil-over-cancelling-of-6bn-potash-development-project

TNR Gold Investor Acquires 3.75 Million More Shares

2013-03-22 15:22 ET - News Release

Mr. Alexander Listov, an investor, reports

EARLY WARNING REPORT

Alexander Listov has acquired a further 3.75 million common shares in the capital of TNR Gold Corp. at prices ranging from 4.5 cents to seven cents per common share since Mr. Listov's last early warning report dated Oct. 5, 2010, which common shares represent approximately 2.58 per cent of the outstanding common shares of TNR.

Mr. Listov now holds 13,350,500 common shares, and Raymond W. Smith Ltd., a company controlled by Mr. Listov, holds 13,331,500 common shares, totalling 26,682,000 common shares in TNR. As at March 21, 2013, TNR had 147,816,447 common shares outstanding, of which Mr. Listov and Raymond W. Smith together owned, or exercised control or direction over, an 18.05-per-cent interest.

The common shares of TNR were acquired by Mr. Listov for investment purposes. Subject to availability, price, the general state of the capital markets and the financial condition of TNR from time to time, Mr. Listov may purchase or sell securities of TNR.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aTNR-2051701&symbol=TNR®ion=C

TNR Your Time Has Come To Shine

All Your Dreams Are On Their Way.

With the Blessing of Argentina Lately Los Azules may just be the bridge over troubled water.

Enjoying it with friends like you all , Priceless

Sail On TNR

http://www.marketwatch.com/story/vale-suspends-rio-colorado-potash-project-2013-03-11

“disputes with provincial governments” Maybe Argentina will start to realize?

Vale suspending the project may be just what the Argentine Gov needs to bring them off of all of their BS and back to the real world. That is a pretty good hit they will take on that suspension.

JD400, because it is not all Argentina. As a matter of fact Argentina is the freebie. Is reflecting ones true opinion a strike against moderating a board? I will say what I think about a position as long as I have or have had an investment in it. If that causes you duress, so be it.

Sorry for not explaining. I am not overly exuberant about anything in Argentina. N absolutely neg, but definitely not POS

"The Hun is trying to shake me out of my shares. " ???? which shares and why?

Soon Mining's Gastroenteritis Will Be Over and Both TNR and MUX will be Well. For now Banktilla The Hun is trying to shake me out of my shares.

He will have to pry them out of my cold dead fingers before I sell a single share of any of my Mining stocks.

Yes, always a positive indicator.

Now Insiders are buying: CEO and CFO of TNR Gold:

As of 11:59pm ET February 6th, 2013

Filing

Date Transaction

Date Insider Name Ownership

Type Securities Nature of transaction # or value acquired or disposed of Price

Feb 6/13 Feb 6/13 Schellenberg, Gary David Albert Indirect Ownership Common Shares 10 - Acquisition in the public market 60,000 $0.065

Feb 6/13 Feb 6/13 Bella, Jerome Michael Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.070

Feb 6/13 Feb 6/13 Bella, Jerome Michael Direct Ownership Common Shares

http://sufiy.blogspot.com/

Video of yesterdays Q&A With Gary Schellenberg?

TNR Gold Corp. (TSX.V - TNR) CEO Gary Schellenberg sits down for a Q&A interview on the Settlement of the Los Azules Copper Project Lawsuit

Link:

TNR Gold Corp (TNR.V) Finalizes Los Azules Settlement with McEwen Mining

Vancouver B.C., February 05, 2013: TNR Gold Corp. (the "Company" or "TNR") Is pleased to announce that in follow-up to its press release of November 12, 2012, whereby TNR Gold Corp. announced that it and its wholly owned subsidiary, Solitario Argentina S.A. had reached a settlement with McEwen Mining Inc. with respect to the Los Azules Copper Project located in San Juan Province, Argentina, formal documentation and the details pertaining thereto have now been signed and will be filed on SEDAR under TNR's profile at http://sedar.com.

The Company is also pleased to announce that the 1 million shares of McEwen Mining Inc. that form part of the settlement have now been issued (information about McEwen Mining can be found at http://www.mcewenmining.com and on Sedar at http://www.sedar.com). The Company expects that the delivery of the certificates representing such shares will occur upon the transfer of the mineral rights to the Escorpio IV mining tenure to McEwen Mining Inc, which it anticipates will take place later this month. The shares will be subject to the minimum statutory hold period.

About Los Azules

The Company has a 25% back-in right in the northern part of the Los Azules property which is exercisable following the completion of a feasibility study. If the Company elects to back-in for 5% or less or has its interest diluted to 5% or less, TNR will receive a net smelter royalty of 0.6%.

The Los Azules copper deposit is located in the San Juan province of Argentina. McEwen Mining Inc. is the current operator on the Los Azules copper deposit and the Company advises that on January 17, 2013, McEwen Mining Inc. issued a press-release in relation to the deposit. The press release is accessible on Sedar at http://www.sedar.com and on McEwen Mining Inc's website at http://mcewenmining.com.

The press release issued by McEwen Mining Inc. dated January 17, 2013 includes preliminary results from drilling operations on the Los Azules copper deposit for the current exploration season. McEwen Mining Inc.'s press release appears to have been prepared by qualified persons, but no independent qualified person engaged by TNR Gold Corp. has done sufficient work to analyze, interpret, classify or verify McEwen Mining Inc.'s information to determine the accuracy of the current mineral reserve or resource or other information referred to in the press release. Accordingly, the reader is cautioned in placing any reliance on the subject results and estimates.

John Harrop, PGeo, FGS, is a "Qualified Person" as defined under NI 43-101 and has reviewed and approved the technical content of this news release.

About TNR Gold Corp.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's subsidiary, International Lithium Corp. (TSX:ILC.V), demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. Gangeng Lithium Co. Ltd. is a leading China based, multi-product lithium manufacturer, and strategic partner and investor in ILC. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value.

For further details about the Los Azules settlement, please see our 'Question & Answer' release which can be found in the news section of our website at http://www.tnrgoldcorp.com/s/NewsReleases.asp

On behalf of the board,

Gary Schellenberg

TNR Gold Surrounds Shotgun Ridge with Mining Claims

Jan 31, 2013 (ACCESSWIRE-TNW via COMTEX) -- Vancouver B.C.: TNR Gold Corp. (the "Company" or "TNR") expanded their land position at the wholly owned Shotgun Gold project in Alaska. A total of 66 mining claims, each 160 acres, were located over and surrounding the Shotgun Ridge prospect for a total of 10,560 acres (4273.48 hectares). Sixteen of these claims were converted from Traditional Claims to MTRSC Mining Claims (meridian, township, range, section and claim) making the area of new acquisitions equal to 8000 acres (3237.48 hectares).

TNR acquired 100% of the Shotgun Ridge prospect in 2010 following a 50/50 joint venture with Novagold Resources Inc. ("Novagold"). The Traditional Claims were located over the Shotgun Ridge deposit and the Company elected to convert these to MTRSC Mining Claims to simplify administration of the land titles in accordance with Senate Bill 175.

Ground geophysical surveys conducted in 2011 and 2012 by TNR helped to identify structural controls on mineralization at Shotgun Ridge. Drill testing in 2012 confirmed the structural model of mineralization with two drill holes returning mineralized intervals in excess of 200 metres, SR12-56 returned 242 metres averaging 1.25 g/t gold and SR12-57 returned 209 metres averaging 1.02 g/t gold (news release dated 10 October 2012).

Extrapolating the known mineralized structures into the area surrounding Shotgun Ridge, the Company identified additional areas where similar mineralization may be present and as a result acquired the mineral rights to these adjacent targets. A portion of future exploration work will be conducted in these new areas beginning by revisiting previously identified gold showings in respect of the new structural models.

The Company is targeting a large tonnage low-grade porphyry system at Shotgun Ridge. Structural repeats, as interpreted from airborne magnetic data and ground geophysical surveys, provide TNR with encouraging targets for future drill testing.

John Harrop, PGeo, FGS, a Qualified Person for TNR Gold Corp. as defined by NI 43-101 has reviewed the technical information contained in this report.

About TNR Gold Corp.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's subsidiary, International Lithium Corp. , demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. Gangeng Lithium Co. Ltd. Is a leading China based, multi-product lithium manufacturer, and strategic partner and investor in ILC. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value.

For further details on the Shotgun Ridge Project please view the powerpoint presentation at http://www.tnrgoldcorp.com/i/pdf/TNR_Shotgun.pdf

On behalf of the board,

Gary Schellenberg

President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Statements in this press release other than purely historical information, historical estimates should not be relied upon, including statements relating to the Company's future plans and objectives or expected results, are forward-looking statements. News release contains certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company's business, including risks inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Copyright 2013 ACCESSWIRE-TNW

http://www.marketwatch.com/story/tnr-gold-surrounds-shotgun-ridge-with-mining-claims-2013-01-31?mod=wsj_share_tweet

When the insiders get the go ahead to start buying, this will start moving up. Heard rumors on the street that they are held back. That's all I know about this.

GLTU

The tour should be starting at Los Azules and this baby gona sell soon and we all will be fine. Get em low now seems wise to me.

GLTU

I think it is time for me to start loading up with this one!!!

I did sell 12 % of my remaining holdings at .08. I will watch for an opportunity to re enter lower. If it does not happen I will also be happy.

TNR MUX Good Video News

Value Galore

http://www.tnrgoldcorp.com/s/Home.asp#

Los Azules Might Sell Fast McEwen has even set up a special data room and an upcoming walk thru in Jan. ;~)

Because the offering is at .10 it has to stay above that.

.10 is the bottom, Nows the time to Buy

They need to get some news flowing, or we may see them below .06 again. I sold 1/2 at .10 so that will be fine with me if they let it sink. The potential is there, they just have to tap it.

Soon Value Will Catch Up With The PPS

And we will be over .20

Always nice talking to U

I am still around. Just not much to say. Being patient.

Still being minimped at .10 probably so they can get even more cheaper shares. Most SH holding tight

Investors just waiting.

With only 31 million out to play around with anything can happen at this point.

If LA Sold it would bring in TNR around 100 million

just food 4 thought

Things IMHO looking very good here. It will take time to bring it all together though IMHO. 9 followers on the IHUB board? Discovery by investors may be as big a challenge to them as the discovery of mineralization.

TNR Golds 2012 Annual General Meeting Held / Overwhelming Shareholder Support For Management And Board Of Directors

Source: http://bit.ly/QpZdai

Vancouver B.C.: TNR Gold Corp. ("TNR" or the "Company") held its Annual General Meeting on November 16, 2012 and is pleased to announce that all resolutions proposed in the information circular were passed. In addition, all agenda items, as outlined in the circular, were approved and all directors standing for election were re-elected. The Directors for the ensuing year will consist of Mr. Gary Schellenberg, Mr. Kirill Klip, Mr. Paul Chung and Mr. Greg Johnson.

Mr. Gary Schellenberg was reappointed President and Chief Executive Officer. Mr. Kirill Klip was appointed Non Executive Chairman of the Board and will directly support and advise the Chief Executive Officer of the Company. Mr. Paul Chung was reappointed Secretary and Mr. Jerry Bella was reappointed Chief Financial Officer. Mr. John Harrop was reappointed Vice President of Exploration and Mr. Antony Kovacs was appointed Chief Operating Officer.

"Approximately 69 million shares, or 47% of the outstanding shares, were voted with an overwhelming support from the shareholders for the direction Management and the Board of Directors are taking the Company" comments Gary Schellenberg.

The Company also announces 400,000 incentive stock options have been granted to a director of the Company. The options are exercisable at $0.10 per share for a period of five years, subject to regulatory approval. The options are subject to a four month hold period.

ABOUT TNR GOLD CORP.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's recently listed subsidiary, International Lithium Corp. (TSX:ILC.V), demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value

Shotgun is very amiable to open pit IMHO with their showings above 200M. Anything lower than that will have to be proven up via underground with much deeper drilling. In my opinion they are handling this correctly. Prove up the open pit resources first, then prove up the much more expensive underground resources. Some would disagree. IMHO proving up the shallow pit mine able will prove viability. After that one hole hitting high grade will prove up potential. If the intention is to mine that is a positive. If the intention is to sell that is positive. If they decide to mine, they have an open pit to fund the deeper drilling and development of the potential underground. If the drilling does not prove up the underground, they still have the pit. Anyone that does not believe they are amiable for open pit, take a look at the assays (only the beginning) http://www.tnrgoldcorp.com/s/Home.asp

I believe the concentration of investors has been deflected. While I belive the Argentina thing will be good for the company. Take a look at these and consider that the majority is open pit-able. .4GPT on the average seems to be acceptable for open pit. Break even or a small profit. Do your own deduction on what we have there at the shotgun. No guarantees, but it looks good to me. http://www.tnrgoldcorp.com/s/NewsReleases.asp?ReportID=551878 Here is an example.

From

To

Width

Au g/t

Entire intrusive

51.00 From

293.20 to

242.20 width

1.25 GPT

Including (SW-zone)

55.50 FROM

104.35 TO

48.85 WIDTH

1.02 gpt

Including (Mid-zone)

135.00 FROM

159.20 TO

24.20 WIDTH

0.85 gpt

Including (NE-zone)

179.00 FROM

293.22 TO

114.22 WIDTH

1.84 GPT

Including

186.00 From

242.00

68.00

2.05

Including

203.90

226.00

22.10

2.86

And including

264.30

277.45

13.15

3.12

Shotgun Gold Project - Alaska

I bought a few friday. I think this is at or near the bottom. If it goes lower, I will buy some more as I can. I like the prospects of the company, but am still nervous about the Argentine Gov BS, therefore will not jump in with both feet. The other company has the benefit of having current income from other projects and we have basicly none. We do hower have very good prospective property. I would be exploring what MUX would be willing to pay to get rid of the gift they just gave us. My bet is that money would go a long way for us. Argentina is at least in the short term uncertain. JMHO North America is much more stable.

Some Interesting Calculated Totals

Shares Out – 147,816,447

Market Cap – $13.3 million

Latest TNR Presentation

65% Owned by Insiders and Management = 96,080,691 shares*

14% Institutional Holdings ----------------- = 20,694,303 shares*

21% Retail Investors ------------------------ = 31,041,453 shares*

*I calculated the totals and added the Retail Investors share numbers.

From the above, if there is an offer made, or a JV Proposal made, insiders and management control the outcome due to 65% ownership. There will be no hostile take-over of TNR.

---------------------------------------------------------------------------------------------

$.10 Stock Options Available

1) Expire – November 1, 2012 ------ 300,000 shares @ $.10 share

2) Expire – April 9, 2013 --------------- 75,000 shares @ $.10 share

3) Expire – September 2, 2013 --- 1,000,000 shares @ $.10 share

4) Expire – March 19, 2014 ---------- 430,000 shares @ $.10 share

5) Expire – May 20, 2014 ---------- 1,450,000 shares @ $.10 share

A) Expire – January 18, 2013 ------- 1,720,000 shares @ $.25 share

B) Expire – September 10, 2014 ------ 400,000 shares @ $.25 share

C) Expire – January 5, 2015 -------- 2,500,000 shares @ $.30 share

D) Expire – January 7, 2015 ---------- 400,000 shares @ $.25 share

Simplifying the Options issue:

#1) above, date has expired. There may be an additional 300,000 shares Issued & Outstanding, if all 300,000 options were exercised.

#2) above, if share price exceeds $.10 prior to expiration date – Or 1 or 2 weeks before expiration date – options will be exercised. IMO it’s not likely that these options are being exercised now.

#3) to #5) above, same as #2)

#A), #B) & #D) above, if share price exceeds $.25 prior to expiration date – Or 1 or 2 weeks before expiration date – options will be exercised. IMO it’s not likely that these options are being exercised now.

#C) above, if share price exceeds $.30 prior to expiration date – Or 1 or 2 weeks before expiration date – options will be exercised. IMO it’s not likely that these options are being exercised now.

In the event of a sale of Company, (TNR) or a spin-off and/or sale of Los Azules and money received for same results in an increase of share price that exceeds the option price(s), the options could be exercised early.

If, for any reason, the share price grows above the values set in the options, the options could be exercised early.

-------------------------------------------------------------------------------------------------------

There is mention here of MMs, (market makers) being in control. If you are current with the news you should know that HFT, (High Frequency Traders) have supplanted MMs. MMs can’t compete with the speed of the HFTs.

It’s quite possible that HFT programs are attempting, (and sometimes succeeding) in reducing the share price. However, I think the share price may be – Not just by worried investors that are selling and moving on – Some investors are setting close stop losses on their shares, (maybe $.01 below current share price) then they leave for the day, or do whatever. HFTs exploit this practice, they can trigger your stop loss and be gone in a flash – The investor later finds that the share price has dropped,,, and thank goodness his/her stop loss saved him/her from losing more than he/she would accept, not realizing that it was his/her stop loss that was responsible for the drop in share price.

Shorts attacking the stock price? Personally, I have trouble believing that; they would have to have testicles as big as basketballs – Sorry ladies, if you are present, I don’t think a woman would do such a foolish thing – Considering the low number of shares open to trade, (see above) and the presence of the HFTs…. But, I could be wrong.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=31792293&l=0&r=0&s=TNR&t=LIST#8qPTpdJj3rzAbfZS.99

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=31792293&l=0&r=0&s=TNR&t=LIST

When Just Good Is Not Enough TNR MUX

Just let the Legal Dust to Settle. Enjoy the Best and Never Settle for The Rest.

http://sufiy.blogspot.com/2012/11/tnr-gold-and-mcewen-mining-when-just.html

Crazy On TNR

Love this MUX TNR team.

We all know the shorts bet on the wrong side of the stick with these two. Oh well their loss our gain,It's crazy

Easy to spot a good thing when you see it.

TNR Gold retains back-in right to Los Azules property as it settles long-time dispute with McEwen Mining

Mon 3:26 pm by Deborah Bacal

TNR will have a back-in right for up to 25 per cent in certain claims comprising the northern portions of Los Azules. The northern half represents around 62 per cent of the known resource at the property, McEwen noted. TNR will have a back-in right for up to 25 per cent in certain claims comprising the northern portions of Los Azules. The northern half represents around 62 per cent of the known resource at the property, McEwen noted.

TNR Gold Corp (CVE:TNR) and McEwen Mining (NYSE:MUX) (TSE:MUX) have finally agreed to a settlement regarding their ownership dispute on the Los Azules copper project in San Juan province, Argentina.

The deal was reached prior to a trial that was set to begin on November 19 in Vancouver, British Columbia.

TNR Gold and its subsidiary, Solitario Argentina S.A., were previously contesting the ownership to the northern half of the Los Azules copper deposit, seeking to have the court recognize a right to back into the project.

This goal was achieved with the settlement, with TNR retaining its back-in right to the property, as well as receiving 1 million shares of McEwen Mining, which was created back in January of this year from the combination of Minera Andes and U.S. Gold.

McEwen Mining is backed by prolific mining investor, Rob McEwen, who has described the Los Azules project as one of the largest undeveloped copper deposits in the world.

TNR will have a back-in right for up to 25 per cent in certain claims comprising the northern portions of Los Azules. The northern half represents around 62 per cent of the known resource at the property, McEwen noted.

Currently, this means that the 25 per cent interest, when taken in the context of the whole property, would be equivalent to around a 15 per cent stake in the total estimated resources at Los Azules.

The settlement resolves all litigation between the two parties, and gives McEwen title to the Escorpio IV claim, which is situated to the west of the deposit. TNR will transfer to McEwen the contested Escorpio IV claim, which is suited for all processing and administrative facilities of any future mine development, McEwen said.

"I welcome the positive resolution of the Los Azules litigation in the out of court settlement between TNR Gold and McEwen Mining," said non-executive chairman of TNR Gold, Kirill Klip.

"Removing the uncertainty over the rights to Los Azules will allow the project to now achieve its full potential for the benefit of the shareholders of both TNR Gold and McEwen Mining, and I consider our stake in McEwen Mining as a strategic holding for TNR Gold.”

TNR said its back-in right can be used after a bankable feasibilty study is wrapped up, and after it pays two times the expenses attributable to its percentage on the northern portion.

Once it has earned its right, TNR can choose to continue to participate in the Los Azules development, or be diluted down to a 0.6 per cent net smelter returns royalty on the same northern claims.

"This is a very positive development for McEwen Mining, TNR Gold and the Province of San Juan, Argentina," said McEwen.

"It allows us to accelerate and expand the magnitude of our exploration effort. With this legal obstacle behind us, we are now embarking on the largest drill program in the project's history."

Drilling at Los Azules began last month, with a total of seven drills operating, with McEwen believing that the more powerful drills will increase the likelihood of reaching target depths - where high grade mineralization has been found.

Initial results from the drilling are expected in early 2013, with McEwen planning to drill around 15,000 metres this season.

Los Azules is widely credited as one of the world's largest undeveloped copper deposits with a mineral resource of 10.8 billion pounds of copper in the inferred category, and 4.6 billion pounds of copper in the indicated category. Silver and gold resources have also been estimated.

The property encompasses 50,933 acres and surrounds a large alteration zone that contains the resource, which measures roughly 4 kilometres long by 1.5 kilometres wide.

The settlement between TNR and McEwen has been a long time coming, with the resolution "highly significant" to TNR given the magnitude of the claim.

TNR Gold's prime focus, however, is on its Shotgun property in Alaska, from where it recently released the best drill results ever obtained from the property.

Here, TNR has a 100 per cent ownership and is looking for a large, bulk-tonnage gold deposit, similar to what is being developed at the Donlin gold project by NovaGold (TSE:NG) (AMEX:NG) and Barrick Gold (TSE:ABX) (NYSE: ABX).

The property holds an historic (pre NI 43-101) resource of about 1 million ounces so far, and a significant result of this year's program was that it opened the door for discovering a much larger deposit.

In a follow-up to the announced 2012 drill program results from hole SR12-56, which returned 242 metres averaging 1.25 grams per tonne (g/t) gold, the company unveiled further results from the second hole, returning 209 metres averaging 1.02 g/t gold across the full length of the targeted porphyry system.

http://www.proactiveinvestors.com/companies/news/37207/tnr-gold-retains-back-in-right-to-los-azules-property-as-it-settles-long-time-dispute-with-mcewen-mining-37207.html

Lets Bring Some Voltage here with AC/DC

http://sufiy.blogspot.com/

WELCOME TO TNR GOLD CORP.

Exploring for Precious, Base, and Rare Earth Metals in the Americas

International Lithium Corp. trades under symbol ILC:TSXV. TNR holds 25.5% of ILC.v

TNR Gold Corp. (TSX-V: TNR) is a mineral exploration company actively pursuing a portfolio of gold, copper, and Rare Earth Element (REE) containing properties worldwide. Our primary focus is in exploration and development of our key ventures which are the Shotgun gold project in Alaska, TNR iron ore and REE projects in Soules Bay, Canada and our ongoing project generator in Argentina.

TNR's strategy is to strengthen its assets through partnerships with mid-tier and major companies, and establish long-term cash flow through royalty interests and project development.

PROJECTS:

Shotgun TNR currently holds a 100% interest in this property which is located 175 km south of Donlin Creek within the Kuskokwim Gold Belt in Southwestern Alaska. This area is emerging as a world-class gold district hosting more than 40 million ounces of aggregated gold resources. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester.

IIiamna which is also located in Southwestern Alaska, is an early-stage exploration project, divested from BHP Billiton, showing geological similarities to the nearby Pebble Deposit approximately 50km away. Iliamna is a drill ready copper-gold porphyry target with size potential.

Los Azules is an advanced-stage porphyry copper exploration project located in the cordilleran region of San Juan Province, Argentina near the border with Chile. It is ranked as the 6th largest undeveloped copper deposit in the world, with a mineral resource of 10.3 billion pounds of copper (inferred) and 2.2 billion pounds of copper (indicated). To view the current legal status on this project please follow the link to our latest press release: LosAzules_Settlement

Soules Bay Iron Ore is a project located nearly 300 km north of Thunder Bay, Ontario. It is proximal to the Trans-Canada Highway and rail, and has ease of access to power supply. The property contains a 12 km highly magnetic iron strike formation and lies adjacent to a historical reserve of 628 million tonnes grading 23.1% soluble iron.The Property occurs within the eastern Lake St. Joseph Greenstone Belt in the Uchi Subprovince of the Superior Province of the Canadian Shield. The main target area consists of a banded iron formation of considerable extent of which 12kms of strike length is contained within the Property limits. The on-strike extension of the iron formation, partially overlapping, adjacent and to the west of the Property, has witnessed considerable exploration by Steep Rock Iron Mines Ltd. ("Steep Rock") from 1957-1961 reporting a historical indicated reserve* of 628 million tonnes averaging 23.1% soluble iron** yielding a concentrate averaging 67.6% soluble iron signifying an 84.8% recovery at a concentration ratio of 3.4:1; or 29.3 weight percent (Goodwin 1965 and Taylor et al. 1972). The vast majority of the formation within the property has not yet been tested but an extensive exploration program is planned once the Provincial Government of Ontario confirms ownership claims.

In addition to TNR's strong portfolio of projects we have a proven joint venture model that successfully listed a lithium developer International Lithium Corp. with the backing of a large Chinese lithium partner (Ganfeng Lithium). With rising energy demands and increased reliance on lithium ion technology from hybrid and electric vehicles to portable devices, Green Energy is the trend of the future and these acquisitions are the first of many progressive steps for TNR in becoming a prominent Lithium and Rare Earth Elements explorer.

http://www.tnrgoldcorp.com/s/Home.asp#

Party About ready to begin Go TNR !

Junior Miners - Prepare For a Great Bull Run!

http://sufiy.blogspot.co.uk/2012/10/junior-miners-prepare-for-great-bull-run.html

TNR Feasibility Restored

Vancouver B.C.: TNR Gold Corp. ("the Company") is very pleased to announce that TNR Gold Corp. and its wholly owned subsidiary, Solitario Argentina S.A. (together, "TNR") have reached a settlement with McEwen Mining Inc. which resolves the outstanding litigation with respect to the Los Azules Copper Project located in San Juan Province, Argentina ("Los Azules").

The settlement restores a 25% back-in right to TNR which is exercisable following the completion of a feasibility study. The back-in right allows TNR to back-in for 25% of the northern part of the Los Azules property, which McEwen Mining has said contains the largest share of the known resource at Los Azules.

In addition, TNR receives an industry standard Net Smelter Royalty of 0.6% and 1 million shares in McEwen Mining (information about McEwen Mining can be found at http://www.mcewenmining.com and on Sedar at http://www.sedar.com). The Net Smelter Royalty is over the northern portion of the property and is triggered if TNR chooses to back-in for 5% or less or is diluted below 5%. In return, TNR will discontinue its claims and transfer to McEwen Mining the mineral rights to a property called Escorpio IV.

Kirill Klip, Non-Executive Chairman of TNR Gold, stated, "I welcome the positive resolution of the Los Azules litigation in the out of court settlement between TNR Gold and McEwen Mining. I would like personally to thank Rob McEwen as this resolution is a highly beneficial outcome for both our companies. Removing the uncertainty over the rights to Los Azules will allow the project to now achieve its full potential for the benefit of the shareholders of both TNR Gold and McEwen Mining, and I consider our stake in McEwen Mining as a strategic holding for TNR Gold."

Agreed, great song. Good blog too, is it yours?

|

Followers

|

7

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

202

|

|

Created

|

08/05/06

|

Type

|

Free

|

| Moderators | |||

TNR Gold Corp. (TSX-V: TNR) is a mineral exploration company actively pursuing a portfolio of gold and copper containing properties worldwide. Our primary focus is in exploration and development of our Shotgun gold project in Alaska.

TNR's strategy is to strengthen its assets through partnerships with mid-tier and major companies, and establish long-term cash flow through royalty interests and project development.

In addition to TNR's strong portfolio of projects we have a proven joint venture model that successfully listed a lithium developer International Lithium Corp. with the backing of a large Chinese lithium partner (Ganfeng Lithium). With rising energy demands and increased reliance on lithium ion technology from hybrid and electric vehicles to portable devices, Green Energy is the trend of the future and these acquisitions are the first of many progressive steps for TNR in becoming a prominent metal and mineral exploration company.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |