Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Y2Kate, we are all over on the Short-Term TA board. If anyone feels more comfortable posting here, please do so, and I will join the conversation!

http://investorshub.advfn.com/boards/board.aspx?board_id=2593

Ted

Hello, just checking in with the Price Team---is anyone around today?

Interesting week, with the trend reversal...what is the next stop on the indices?

Kate

Land, thanks for all your posts. I agree with this Ichimoku

analysis. Accurate, careful observations.

It will take me a while to process the other posts!

Ted

Potential Tweezers Top S&P500 daily Ichimoku charts video -- May 8th 2009

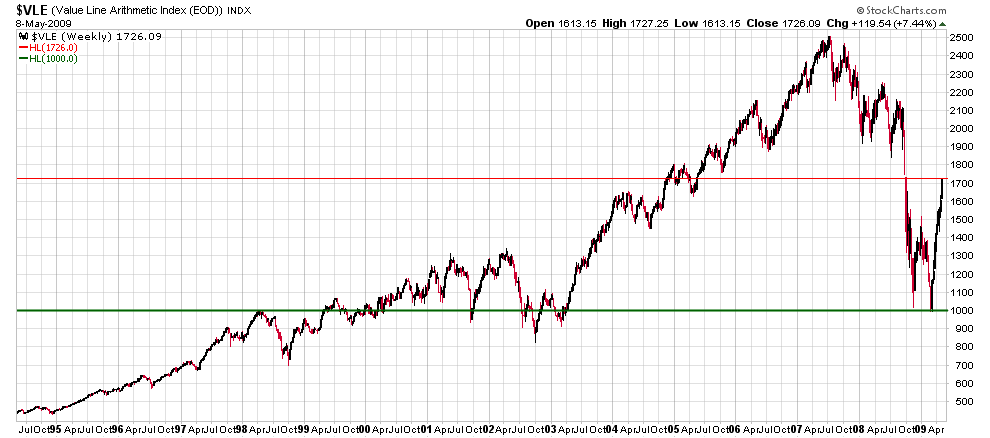

MrNatural: Intriguing Chart! Thnx. Here's a

historical perspective of $VLE:

15-year chart. The brain immediately wants to say CRASH. Experience tells me to reserve judgment and instead expect a mild retreat, another surge, and then a roll down. How far down I can't even guess right now.

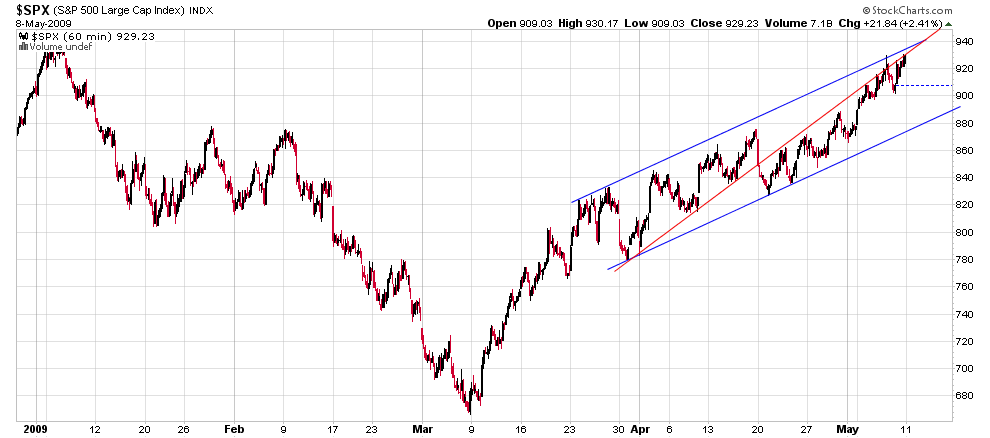

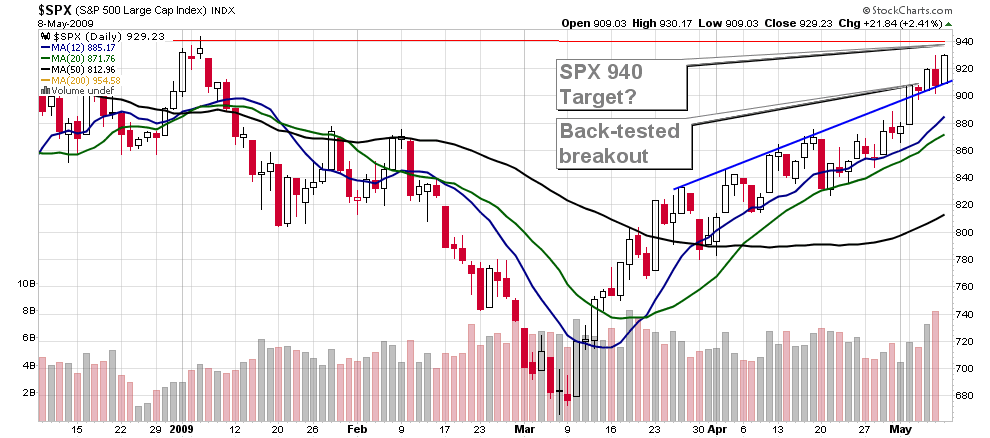

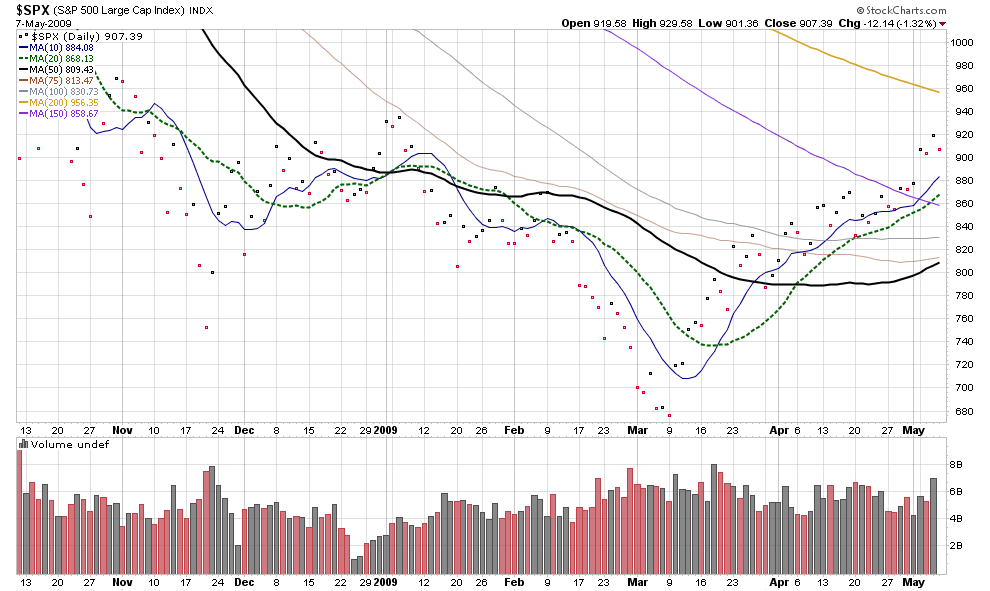

$SPX charts:

While absolutely anything could happen, this chart wants to tap SPX 940 and perhaps even 950 before retreating into Options Expiration on 5/15.

Hi Ted, took the day off today, went on a rode trip to IA. city to get parts for my bike, no BMW dealers out here in the sticks.

I think I have a website in my bookmarks that we can use to back test our theory's, there is a bit of a learning curve so I'll check it out this weekend.

Here is a chart I've been playing around with...

Since posting this, the market has ratcheted up a few points. No panic short-covering yet. Now I'll watch SPX 930 to see if there's a breakout. The market could crawl along that upper edge on low volume (possible headfake signal). It may or may not break above 930. If it does, then expect explosive volume and panic shortcovering.

That's where I see a short-term opportunity to take a short position. Not recommending anything. Just what I see.

Ted

PS

In previous post, said 820 and 815, meant 920, 915.

Overbought can stay Overbought but I see what you're saying

Blowoff top today? Possible if SPX stays above 820 or even 815 on pullbacks. A quick dip to 815 could be the next tease.

Will take short positions only if I see a screaming peak. Otherwise, I'll let this opportunity pass.

Ted

To anyone thinking of going short! See possibility of blowoff top this afternoon. Just a hunch but the setup is building. Once again, the market has been teasing. People have been building short positions, and when the market squeezes the next time, it could be a capitulation run.

So be careful out there!

Ted

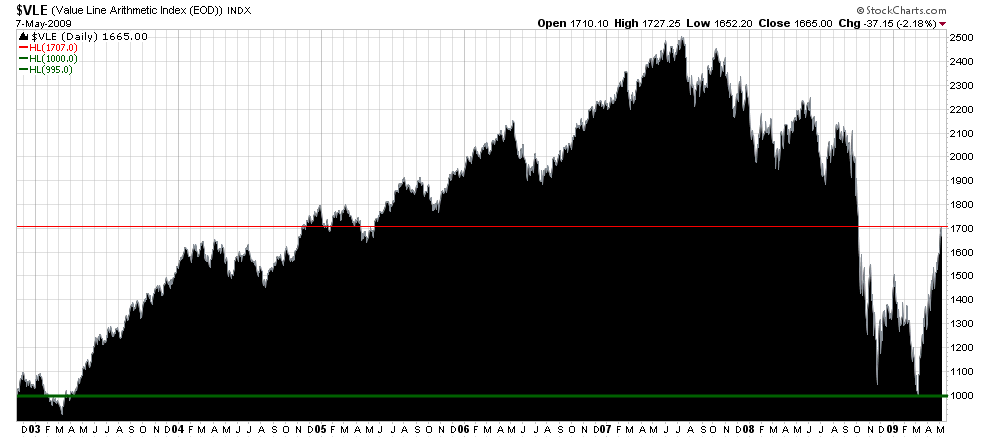

$VLE chart (5/7/09):

This 7-year chart shows the market after yesterday's pullback. Before taking long positions, I want to see this chart settle to 1500. On the way to 1500, I will examine the structure of the daily moving averages to see what I want to own--if anything.

So I posted a lot of info for ya take the weekend to look at it

Everything you're looking at has been looked at before... Everyone's looking for the HOLY GRAIL... But that is r/r risk to reward...." Ya buys the stock in the best formation you can and have a stop in place" "Cause whatever can go wrong will go wrong" So Position size and Risk to reward" So far I like what your posting but lets cut to the chase already Lets post some charts make some money... And so on....

Okay you got some reading to get through Ted

Peace.... Enjoy the posts...

Most traders ignore reward/risk ratios, hoping that luck will save them when things start to go bad.

This is probably the main reason so many of them are destined to fail. It's really dumb when you think about it, because reward/risk is the easiest way to get a definable edge on the market house.

The reward/risk equation builds a safety net around your open positions. It's designed to tell you how much can be won, or lost, on each trade you take. The secondary purpose is to remove emotion so you can focus squarely on the cold, hard numbers.

Let's look at 15 ways that reward/risk will improve your trading performance.

1. Every setup carries a directional probability that reflects a specific pattern. Always execute positions in the highest-odds direction. Exit your trades when a price fails to respond according to your expectations.

2. Every setup has a price level that violates the pattern. Only take trades where price needs to move a short distance to hit this "risk target." Look the other way and find the "reward target" at the next support or resistance level. Trade positions with the highest reward target to risk target ratios.

3. Markets move in trend and countertrend waves. Many traders panic during countertrends and exit good positions out of fear. After every trend in your favor, decide how much you're willing to give back when things turn against you.

4. What you don't see will hurt you. Back up and look for past highs and lows your trade must pass through to get to the reward target. Each price level will present an obstacle that must be overcome.

5. Time impacts reward/risk as efficiently as price. Choose a holding period based on the distance from your entry to the reward target. Then use price and time for stop-loss management. Also use time to exit trades even when price stops haven't been hit.

6. Forgo marginal positions and wait for the best opportunities. Prepare to experience long periods of boredom between frantic surges of concentration. Expect to stand aside, wait and watch when the markets have nothing to offer.

7. Good setups come in various shades of gray. Analyze conflicting information and jump in when enough ducks line up in a row. Often the best thing to do is calculate how much you'll lose if you're wrong, and then take the trade.

8. Careful stock selection controls risk better than any stop-loss system. Realize that standing aside requires as much deliberation as an entry or an exit, and must be considered on every setup.

9. Every trader has a different risk tolerance. Follow your natural tendencies rather than chasing the crowd. If you can't sleep at night, you're trading over your head and need to cut your risk.

10. Never enter a position without knowing the exit. Trading is never a buy-and-hold exercise. Define your exit price in advance, and then stick to it when the stock gets there.

11. Information doesn't equal profit. Charts evolve slowly from one setup to the next. In between, they emit noise in which elements of risk and reward conflict with each other.

12. Don't be fooled by beginner's luck. Trading longevity requires strict self-discipline. It's easy to make money for short periods of time. The markets will take back every penny until you develop a sound risk-management plan.

13. Enter positions at low risk and exit them at high risk. This often parallels to buying at support and selling at resistance, but it can also be used to trade momentum with safety and precision.

14. Look to exit in wild times in order to increase your reward. Wait for price acceleration and feed your position into the hungry hands of other traders just as the price pushes into a high-risk zone.

15. Manage risk on both sides of the trade. Focus on optimizing entry and exit points and specialize in single, direct price waves. Remember that the execution of low-risk entries into bad positions allows more flexibility than high-risk entries into good positions.

http://hardrightedge.com/wheel/hrerisk.htm

Number 1 rule for a trader Never stop learning you stop learning you fade away..

Managing Winning Positions

Diverting from my usually market commentary/analysis as a few recent emails asked how I manage positions and risk. For starters, there are 3 cardinal rules of trading that I ask myself before entering each trade and I suggest you do the same.

(1) Is the trend up or down? Usually identified by a simple trendline, but I also use the 10, 20, 50 and 200-day moving averages.

(2) Am I going to take a trade "with" or "against" the trend? This is the most important question to answer. It defines whether or not you are bottom-picking or picking a top. Counter-trend trades carry more risk since you're betting on a reversal of current momentum. I typically will trade 50% of normal position size on "counter-trend" trades. If you're new to trading, you'll likely want to avoid these types of trades until you feel very comfortable in doing so.

(3) Where's my risk? No trade should ever be entered without knowing where you will take a loss. I typically have a 1.50 pt stop on most trades, depending on volatility in the name and how far price is away from a significant support/resistance.

As for profit-taking, I try to avoid specific targets as much as possible. My personal experience is if you have a target in mind, you'll wind up either failing to take profits because that target is never met or you wind up taking profits too early as price continues well beyond that target. The solution to this problem is focusing on ideal entry points and taking Partial profits. Since I usually risk 1.50 pts, I will typically consider locking in profits when gains fall between 1.50 - 3.00 pts. After a partial is taken, I'll then move the initial stop-loss of 1.50 to the breakeven level. That way if price reverses against my position and comes back to breakeven, I at least got some profits in the bank. If price starts to exceed the 3.00 profit zone, I will then consider trailing the balance stop along the 10-or 20-day ma's, depending on the momentum. Parabolic moves and overnight gaps warrant moving stops to previous lows and highs.

Multicollinearity is a Statistical Term...

For a problem that is common in technical analysis. That is, when one unknowingly uses the same type of information more than once. Analysts need to be careful and not utilize technical indicators that reveal the same type of information:

http://stockcharts.com/education/TradingStrategies/Multicollinearity.html

When people make things more complicated than they need to be. Let me give you an example. One of the leaders in my chat room finally unveiled a new trading system he had developed after more than a year of extensive testing. The system works just as it is. It isn't perfect (no trading system will be 100%), but it is highly profitable.

People's initial reactions were interesting. Instead of saying, "Wow, great. Let me give it a try," a common first response was, "I wonder if it would work even better if we changed this and that, and instead of a 15-day moving average we used a 10-day moving average," and on and on. Before they even tried or understood the system, before ever becoming profitable and successful with it, they immediately set about trying to improve it.

Maybe it's human nature. We love trying to reinvent the wheel. Many of us see trading as a puzzle. If we could just find that solution or formula that no one else has thought of yet, we would be rich and happy. A lot of people think that the more indicators they pile on, the better their trading results will be. So they wind up with analysis paralysis, unprofitable and frustrated, convinced that trading is an unwinnable gamble.

I can't say this enough: What matters is not the system itself, but what you do with the system -- your discipline to use it and keep stops. You won't find a system that always works, so you'd better limit those losses. Two percent of your trades can easily wipe out 98% of your gains if you can't keep stops.

Seven Habits of Ineffective Traders

Friday November 5, 1:03 pm ET

By Ken Wolff, RealMoney.com Contributor

Recently, a couple of people I know packed up and quit trading after struggling for a long time to hold their heads above water. They didn't make it.

This isn't unusual, of course. This profession has a high failure rate. But it frustrated me.

It frustrated me because I could see potential in them. I don't believe you have to be particularly talented or intelligent to be a successful trader, but these people seemed to have a grasp on the market and the love of trading that's necessary.

They had the tools, the knowledge, the time and the funds. It also frustrated me because I could see the pressure they were under that contributed to their failures. Most of all, though, it frustrated me because I could clearly see what they were doing wrong, but they couldn't stop repeating the same mistakes.

This happens a lot. I see a lot of people making the same mistakes. So I thought I'd share my list of the seven most frustrating things that struggling traders do.

1. When people won't do their own homework. Too many people want to make money, but aren't willing to put the time in and do what it takes. I love answering questions, and I have a passion to help people learn, but when I notice someone asking the same questions over and over, and they are basic questions that anyone could Google, and gave it 30 seconds worth of effort, I know that person is lazy and probably won't make it.

You want to know what makes successful traders? People who glue their butts to their chairs. Look at their computer desks and you're likely to see lots of coffee rings and crumbs. You get out of something only what you put into it. If you aren't willing to take notes, take some initiative, keep a journal and spend a lot of time watching stocks, I don't see much hope for you as a trader.

2. When people can't explain their reasoning for a trade. If your reason for entering a trade is something vague like, "I thought I saw buyers, and last week it had news, and I dunno, it just looked good," then you don't belong in that trade! People like this usually have no clearly conceived, written, organized trading strategy because they are lazy. They are doomed to failure.

If you have no solid reason for a trade, you will have no confidence in it. You will wind up mistiming, misjudging, fumbling and losing. Here's a quote from my partner Phil Rosten, who is a brilliant technician:

I think the most important thing to do is to develop a system that you have confidence in. You will get nowhere if you are second-guessing what you are doing. When the market is open, you need to know what you are doing, and why you are doing it, without thinking too much about it. If you start thinking too much about what you are doing or second-guessing yourself, you will quickly get taken out of the game.

Believe it or not, it doesn't matter much what your reason is, as long as you are consistent with that reasoning. But you'd better have a reason.

3. When people make things more complicated than they need to be. Let me give you an example. One of the leaders in my chat room finally unveiled a new trading system he had developed after more than a year of extensive testing. The system works just as it is. It isn't perfect (no trading system will be 100%), but it is highly profitable.

People's initial reactions were interesting. Instead of saying, "Wow, great. Let me give it a try," a common first response was, "I wonder if it would work even better if we changed this and that, and instead of a 15-day moving average we used a 10-day moving average," and on and on. Before they even tried or understood the system, before ever becoming profitable and successful with it, they immediately set about trying to improve it.

Maybe it's human nature. We love trying to reinvent the wheel. Many of us see trading as a puzzle. If we could just find that solution or formula that no one else has thought of yet, we would be rich and happy. A lot of people think that the more indicators they pile on, the better their trading results will be. So they wind up with analysis paralysis, unprofitable and frustrated, convinced that trading is an unwinnable gamble.

I can't say this enough: What matters is not the system itself, but what you do with the system -- your discipline to use it and keep stops. You won't find a system that always works, so you'd better limit those losses. Two percent of your trades can easily wipe out 98% of your gains if you can't keep stops.

4. When people enter a trade for a good reason, then lose their nerve and exit too soon. This is a lot like walking across a log over a river. If you keep focused on your goal, you will get to the other side. You know how to walk a straight line, and you would have no problems if the log was on the ground. But once you are out there, if you start second-guessing yourself and looking down at the rocks below, you will fall. Too often emotions set in and sabotage good trades.

If you have a reason, stick with it. Stay in the trade until your target is reached, you have an exit signal, or the reason for your entry is no longer valid.

5. When people hesitate, or follow others, and enter a trade too late. I understand traders' lack of confidence and I can empathize because I've been there. If they don't get a grip on it, though, it will be their downfall. Calls are great and gurus are great, but if you follow, you will always be late. You need to learn to rely on your own reasoning. Otherwise you will be too slow and you'll become fish bait.

Inexperience is often the reason for this, and that will take care of itself with time. That's why I recommend starting with small shares until you gain confidence in your system and your ability to keep stops. But this problem frequently has to do with deeper emotions, pressures and self-esteem problems that may not go away as easily.

This is hard stuff because it's all about confidence. When you are under pressure from a spouse who disapproves of your trading, or under pressure to pay bills, etc., you are working under an enormous amount of fear and pressure. And that is automatically going to cause hesitation. I know that's a hard situation.

But I tell you, if you don't get that under control and learn to trade like you don't need the money -- with control and a system, leaving out emotion -- you are not going to make it. You must find a way to ease that pressure. Get a part-time job if things are that rough and you still believe trading is the job for you. If you cut back and trade a couple of days a week without the pressure, you'll probably trade better for it and wind up making more money than you did trading five days a week under pressure. I've seen it happen many times.

6. When people will not contemplate the real reasons for their failures. I don't know how many times I have heard this: "The market was tough today. I had one good early trade and then gave it all back in the afternoon in a few bad trades."

Let's be honest here. The market wasn't making you do those stupid later trades. It was you. Don't blame it on the market when in reality you were chasing longs all day when the market was tanking.

Then people will say something like "I need help with risk management," "I need help learning to find good entries," "I need help learning executions" or some other topic not really related to their true mistake. What they need instead is a dose of self-restraint and some personal accountability. They need to stop making trades out of boredom, frustration, regret or any other reason other than "it met my trading criteria." They also need to be honest about these criteria and not stretch things into "well, it kind of meets my criteria -- if I look at it cross-eyed."

I know this is hard. It's tough to sit there all day and stare at these numbers, especially when things are slow and there have been no good trading opportunities that day. It's like fishing. Fishing can be really boring. But if you aren't sitting there waiting with your hook in the water, you won't catch anything when the big fish come by. And it won't help if you jump in the water every time you see a ripple, trying to convince yourself you had a bite.

7. A defeatist attitude, especially in me. The potential in our lives far exceeds what we ordinarily imagine. Too often we put limitations on ourselves with Eeyore-like thinking. We say "I can't do this" or "I am just not smart enough" or "I'm just unlucky." In doing so, we fail to challenge ourselves and develop new potential because we've lost faith in ourselves.

We are like circus elephants tied with small weak chains to a stake, believing we could never get free, unaware of our own strength. We possess tremendous potential, but if we develop the bad habit of convincing ourselves that our potential is limited, we will not actively challenge ourselves and grow. Like the elephant, we will be held captive by our own beliefs.

Powertrend stocks con't.

We want to play earnings blowout stocks

Look for

The angle of ascent---the pace---the velocity

Preferably more than 45 degrees---NOT a straight up spike but an angled ascent

With nice 5 10 20 emas headed up.

We want the stock to be riding that 5 ema

Use the 5 and 13 min charts (a 15 min chart will work if you don’t have 13)

These stocks will push up the upper bb

We want a steep uptrend on both time frames.

We want to see new highs each candle

We want to see the stock move right up to the pivots I post.

A pivot is a decision point---an area of resistance or support. A price where the stock will pause and then decide to go on up or retrace.

Each pivot is a decision point you can enter on any break higher. You can use the previous pivot as support. It can go back and retest the last pivot---it it braks that ---- your stop is there.

Remember---the stock surges to the pivot, then pauses to test it---if no buyers step in, then we retrace. The steeper it gets, the sooner it will find the top. We don’t want huge spike, just surges to the next pivot test then surge

We want new highs.

These methods are for the power trends so we use the pivots as entry/exit points and stops.

We expect new highs. We expect touches back to the 5 ema

The basic power move is over by the time the stock touches the 20 ema

These stocks use the 5ema for support.

Once in a while they will retrace down to the 10 ema after the momentum has waned

We want to play these stocks early if possible. In the first 1 to 1.5 hours when they have the most volume. Touch of the 5ema is a good entry. We do not want to see a candle close below that 5ema. If the other candles going up have been all green the 5 will be the leader—5 min chart---13 min chart will confirm.

This basic formation needs to be recognized—it tells you the stock is trending strongly. The big money is taking these stocks up, they are accumulating these winners, they are buying. There are large orders to buy.

Power Trend Stocks

It's a particular chart formation that tells you that this stock is in play and is trending up strongly. We are looking for stocks that have a reason to move an upgrade, news, blowout earnings these are stocks that offer more than just a quick scalp. we are looking for a trend day up for theseplays regardless what the futs are doing.

Power Trends work in both directions

U must pay attention to after hours earnings announcements. these will be in play the next day

We are looking for a special formation on the chart at the open At the open these plays are typically gapping up at the open because there is a lot of interest in them.

2 most important things we look for volume and velocity

volume tells you their is major interest in this stock

velocity tells you it is moving quickly in price

The chart gives you the velocity by the angle of ascent.

You must put a 5ema 10ema 20ema on each chart and bollinger bands 20ma and 2 sd.

we want a steep angle of ascent these plays are done off a 5min and 13min charts. We want a steep angle of ascent because it shows major urgency to own or sell a short play. Very important concept.

We do not want it straight up vertical Straight up is unsustainable too far too fast Not what we want.

These plays are gonna last all day typically not just a few minutes. Nothing can sustain straight up very long those moves are good only for scalps and u get nailed if you don't have good execution .

The purpose of playing these power trends is to make more than a scalp. You can play lighter shares with less risk and more net results.

For a power trend the 20ema is never flat or horizontal it must be rising steep better than 45 degrees usually this shows power in the stock At the open if the stock gaps p huge then it will be very far above its 5 10 20 emasWhat happens in this case It will form a flag

The stock will hover near the top of that first huge candle and wait for the ema's to catch up.

Or it will retrace slightly down to meet the emas movin up. Under these conditions we wait to see if the stck can take out the hod. Flags can occur on any time frame. I follow the 5min and 13 min for this.

We want the 5 and 13 min looking the same the same power formation steeep angle up using the 5ema for support. The 5min chart can move around more than the 13min so we look to the 13min for guidance. If the 13 min is not in power trend formation not good. We want the charts to look similar in regards to the 5 and 10ema support.

Stocks work in RANGES 10-20 20-30 30-40 40-50 50-60 60-70 70-80 80-90 90-100 between those ranges are pivots for example 50-60 would have key pivots of 50.00 , 60.00 and 55.00 which is the mid piv of the range also if you take 55.00 plus 50.00 and divide by 2 you get another key pivot 52.50

CLUSTERS

support and resistance...

idea of finding CLUSTERS of

support and resistance.

This is a really powerful technique, and one that is too

little used. Of course, many top traders and people on the

trading floors know all about this. But too many of your

average traders just aren't using clusters.

This is the deal - a single support or resistance number is

just that - a single number. It might or might not prove

significant. But when you can find two, three, or four numbers

that are grouped together in a tight area... then you have

something. That is a cluster.

And the more numbers coming together in a cluster, the more

you can take that cluster to the bank.

For instance, say you are trading a stock that is trading

around 32. You find a resistance number at 33.25. Then you

keep looking, maybe on a different time frame or with

different technique, and you find additional resistance at

33.20... and another resistance level at 33.28.

Now you have a CLUSTER of resistance from 33.20 to 33.28.

The general rule of thumb with clusters is that two numbers in

a general area is OK... and a lot more powerful than a single

number standing alone. Three numbers in an area is good. And

four numbers clustered together is great.

So how close do those numbers have to be? Well, that all

depends on what you are trading. That example above of a stock

trading at 32... well, all three of those numbers are

clustered together in a zone of 8 cents. That is a nice tight

zone. However, if you are trading the Dow futures, a cluster

might be a bunch of numbers within a 10 point zone.

In other words, there aren't any cut-and-dried rules about how

tight a cluster needs to be. If you just start looking for and

finding the clusters, you will quickly get a feel for what

type of zones to look for in whatever you are trading.

HOWEVER, there IS one surefire rule. The tighter the zone, the

better... this applies no matter what you are trading.

In other words, start drawing in support and resistance lines

on your charts. Then keep your eyes open for the places where

those lines are grouped together - those are the clusters you

are looking for.

Your trading will be better off for it...

Ted, check these guys they use ma charts and charge a lot for the software...unless of course you're working for them. LOL

Anyway check out their charts...

To anyone just stopping by. I'm inviting you to get real with me. We are not doing here the same old stuff being done everywhere. I am not just handing out some trick you can trade or some mechanical formula. Although there is a mechanical formula here too.

The intent is to engage step by step to see where the stats fall below 70 percent. To focus on the fault and eliminate it. To focus on the signal and to trade it.

The major problem is there is too much market data and especially too much iffy data. The mind buckles, and the stats fall.

Join with me right here and make the commitment to find out what is true. No more mediocre stats. Nothing less than 70 percent accuracy acceptable anymore. Ever.

Engage. Question what I'm saying. Then see the significance. Imagine. Managed price. Now multiply that times the endless opportunities.

What I'm talking about is more significant than the birth of Apple.

What I'm saying--the kernel of it--may have been in the first few chapters of any T/A book. But what I'm saying, it's the dream mathematicians and geniuses such as Hurst have been pursuing for a century. You can know more than they by purposely knowing less, by being absolutely reductive in managing price.

The result could only be a significant revitalization force in our economy. Of that last sentence, I'm not completely sure. That's why I want to talk to some really smart people who may have only a small interest in trading but like thinking about really weird stuff.

Ted

PS

A few people have written to say that I just keep selling. Here's what I need. I need for you to engage with me, to dialog, until we both understand every last detail of what I want to say. I can't do it in the abstract. If you start writing to me, you will see why. Pepper me with questions until there are absolutely NO LEAKS in your thinking or your trading.

MrNatural, now we are talking. Here's why I started this board. I absolutely believe we can go directly to trading and investing with knowledge--meaning with an accuracy rate above 70 percent. Maybe even above 85 percent.

I don't mean to sound so silly when I talk about moving averages. Of course everyone knows *that*.

Over the years I've looked at most everything. What I'm saying, what I'm seeing is that are only a few facts, a few absolutely reliable things we can know about price. What we can know is tied to moving averages. Now let's get in there with razors and scalpels and see exactly what the moving averages can tell us. Let's clean up every last ounce of noise that can be cleaned up and find the signal.

There's going to be noise. We know that. Noise is fine. Let there be noise. Let's find the signal we know is the best possible signal. Half-way signals are not good enough. Fuzzy signals are not good enough. Think signal until you see the signal in your dreams. Think signal until you see only that signal in a chart. So if you're not seeing the signal, you have no desire to trade any more than you have a desire to jump off a cliff.

OK, Ted, how? Strip everything away. Put in one pile those things you know absolutely. Focus on nothing else. Trade only that. See only that. Signal in the noise. Trade the signal.

This is why I started out with the stuff about being a champion. It's wasn't rah-rah stuff. Absolutely for real. I'm writing to myself! To be an Olympic gymnast, you have to know absolutely what you're doing to perform some of those tricks. It takes strength and resolve and experience and knowledge. And when it comes to the performance, focus. Keen focus.

So what I'm asking you to do--and I mean anyone who comes to this board--is help me strip price naked. No noise. Just the signal. Then let's focus on that signal, and trade it. It only.

I made a mistake this week--crossing things up--dipping into my iffy pile of data. The problem there is I'm too smart, and I can out-maneuver the market often--but it isn't worth it. It involves thinking way too much and working way too hard and taking on too much risk.

What I absolutely know is we can accomplish what I'm setting out. Unconditionally believe that. Even more important, the end result is beyond anything we can calculate.

Will you join me in proving or disproving this proposition? This is my invitation. To do this, we have to be absolutely honest. We have say, here's where I get stuck. Here's where I don't execute. What can I do? How can I clean this signal until at the most of execution, I *know* what to do? How can I continue to hold a position when I want to sell it for no good reason?

I'm absolutely serious, and even while I'm serious, I know it could be more fun than we ever dreamed.

Thanks for being there, man.

Ted

PS

Let's prove price is knowable, manageable, a real business, not just a sophisticated gambling game. I love games. What I'm bringing to this business is game strategy. But now I intend on taking that game strategy all the way. I want to apply game theory until there is no game left but only an enterprise to be managed. I need your assistance. I need the dialog. Two minds are better than one.

I don't know, because I lack the discipline to stick with it religiously, I often try to front run the signal when I think its oversold or overbought and at a good S or R level. If I get stopped out then I wait for the signal before trying again.

I also sell too early for fear of the volatility.

These 3X ETF's take some getting used to, but I like them. I rarely look at individual stocks anymore. I'm finding that its better to use the signals generated from the underlying index than The ETF itself.

I need to tape a message on my monitors -"I am not smarter than my charts" LOL

The discipline issue and the trading errors--all of that. I believe the real problem is not discipline but a lack of KNOWLEDGE. And becoming blinded by too much information.

When I know how to drive, I don't push on the accelerator when I mean to hit the brakes. The apparent lack of discipline comes from a weird combination of not knowing what actually works plus tiredness and frustration plus desire, wish and hope (the hail mary stuff).

The tiredness and the not knowing comes from trying to focus on too much iffy information. How could anyone possibly know under those conditions?

What I'm proposing--and this is the revolutionary part--let's strip price down to what we can really know. Then trade *only* what we know.

Now I made a trading error this week because I defaulted (without realizing it) to my iffy pile of information (the cycles plus a few other indicators at extreme readings).

One purpose of this board is to learn what I know and separate that from what I do not know. Then to make commitments to trade only what I know.

That's my commitment, and Landm will hold me to it.

Ted

MrNat. The 7, 14, 7 method you describe. The key question is this: Does it hit a consistent 70+ percent accuracy rate? If yes, it's knowledge!

Thanks!

Ted

Practice Analysis:

Let's look at the right-now of the market on a daily chart.

================================

Price (represented by a dot in this case) is above all the following moving averages: 10, 20, 50, 75, 100, and 150. All are pointing up or are turning up except the 150-day ma. Bullish. Automated message: HOLD. [Note: There may be good reasons to SELL here to collect profits. This is an area for continuous improvement. Not a major issue.]

The 150 is arcing up ever so slightly, being pulled by advancing price. Message: The long-term trend still down because the moving average is still pointing down. The slight upward arc is a bullish hint but not a signal to BUY, HOLD or SELL.

Price is below the 200-day ma, which is down-sloping but arcing slightly up, moved by advancing price. Message: The long-term trend still down because the line is pointing down and price is below the moving average. The slight upward arc is a bullish hint but not a signal to BUY, HOLD or SELL.

================================

The brain examines this chart (even the highly trained ones belonging to professional traders) and they imagine all kinds of unknowable future outcomes. And then based on these imagined futures, they make good decisions and lousy ones. This brings overall stats to under 70 percent.

My computer friend simply sees what is, and makes objective decisions based on the immutable law of price. Now sometimes the market gets choppy and barely worth trading. This is analyzable too--it's knowable. Because the moving average lines reveal the choppiness, it therefore can be automated. Our computer friend will just sit calmly and wait. Then it will strike like lightening when a clear signal fires. The computer never tires.

The tired human brain is the major source of trading error. It is what happened to me on Monday this week. I was tired from setting up this board and a bit distracted. Now one of those trades was a winner and the second may be a winner yet--we shall see. But I'm not happy with it even if it wins.

One more thing: For the last two months, I've been competing this method against the market calls of traders all over Investors Hub. I would look at my chart and get my read in a couple minutes, and then I would shake my head in disbelief at what other traders were saying--and the trades they were making against the flow of the market. That's when I decided I wanted to start publishing this information. It's time to end trading as a gambling endeavor--unless that is your personal choice--to throw money at the market just for the thrill of the possibilities.

The Holistic MA Method of Market Analysis

================================================================

The following is the briefest sketch of the entire method put together. First, let me say, I can't believe it, but occasionally I run out of energy for writing--now that I've started this board. So I'm not going to lay everything out here. This is but an outline.

================================================================

To analyze the market, start with this one law:

A price trends up only when it is above a given moving average while the moving average is pointing up or turning up.

Examine a major index such as the $SPX with the following ma's: 10, 20, 50, 75, 100, 150, 200.

Now examine each moving average one by one (carefully and in detail) and apply the law of price. What does it tell you RIGHT NOW (not what you think might happen tomorrow) about price relative to that one moving average?

Move systematically from the 10 to the 200--or from the 200 to the 10. Watch for any arcing of the line. A down-sloping line that arcs up is sending a possible bullish signal. An up-sloping line that arcs down signals a possible bearish move.

Now integrate all that information seamlessly, and that gives you the most accurate possible reading of the market. Much can be added to this, but this method allows tracking and tracing of the market. It enables efficient, reliable buy and sell signals. It turns trading from risk-taking into wealth engineering.

This tracking and tracing can be automated with a low and manageable inaccuracy rate. All market opinion is rendered virtually useless. Worries about the Wall Street boyz are old-fashioned--out of date--especially if you combine this moving-average method with the methods outlined in the post on how to find winning trades/investments.

The human trader is also fast becoming obsolete, and if you enjoy trading, that's fine. This understanding will lead to your being a better trader.

The problem with the human brain is that it projects an imagined future with desire and fear. It is impatient. A computer can wait forever without any worry or concern.

Ted

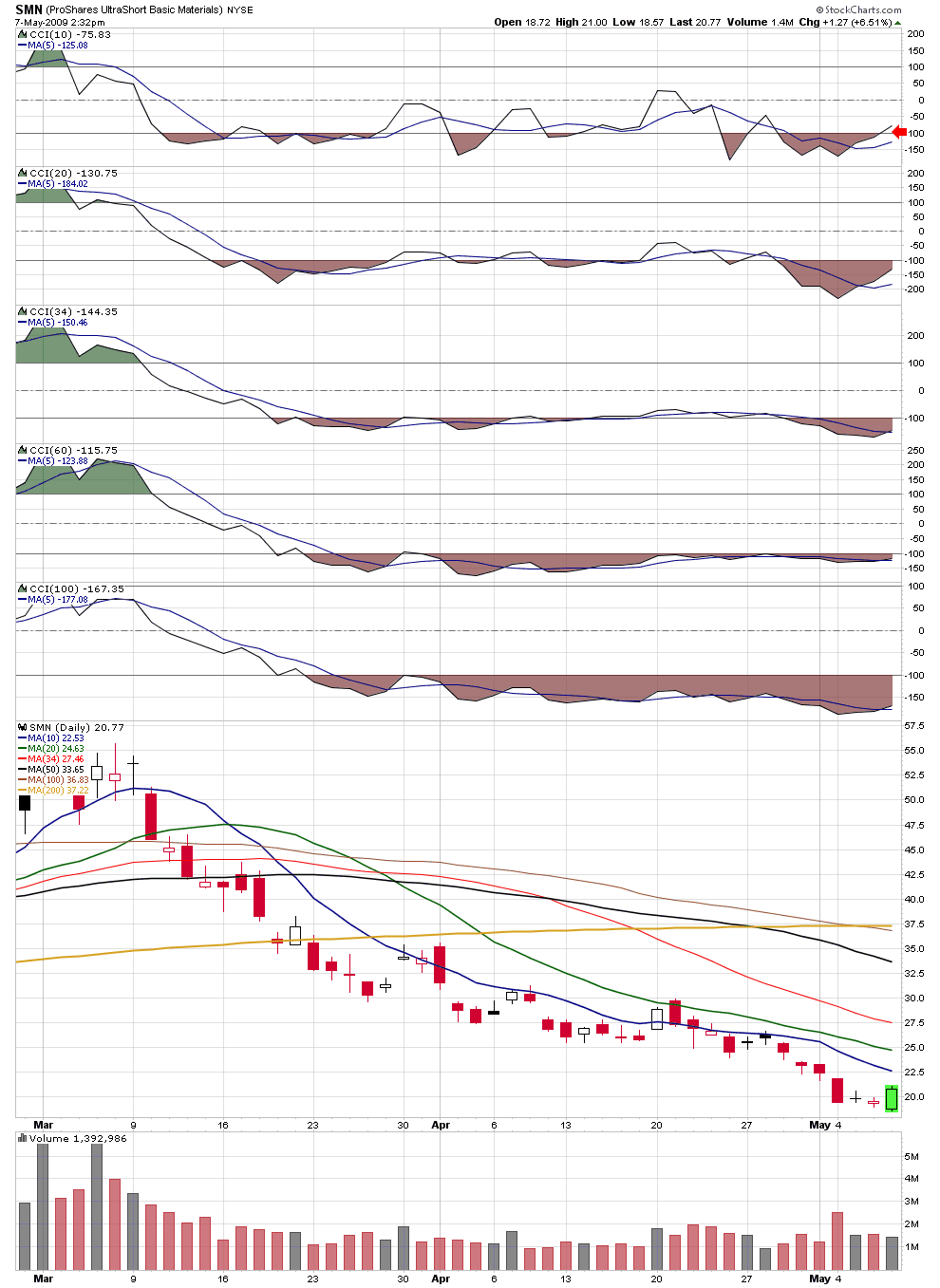

Out SMN @ 20.95, in 19.85. While I believe more is in the trade, I need to dry out some capital for other purposes. It takes 3 days (until next Tuesday--and that's when I anticipate the 10-week low completing).

Another winner with one loser still working. The SMN trade was still a failure because the entry was poor, and it required too much risk and work for too little gain. You can compare my trade with virtually any other bullish one and see it. I love it though when both the longs and the shorts win. Pretty cool that can happen.

Ted

RCKS: Regarding the chop factor. If you will carefully examine the 10-day and 20-day ma method, you will see the chop is largely screened out. There will be false starts and slippage absolutely--but to an acceptable extent. This is my observation anyway so far. A little fine-tuning may be required.

Regarding most successful traders:

1) I've noticed they work really hard paying attention to a lot of iffy information along with the stuff that works.

2) Few are hitting 100 percent returns consistently. There is a strong tendency to make a lot and then lose a lot, or to have good years and bad years. But I guess the truth is, I'm not here to discuss other traders but to discover *only* that information that is truly bankable.

My method is suggesting consistent returns of 100+ percent per year when starting with an amount such as $10,000. If you are trading amounts over $100,000, other issues tend to lower overall returns. For example, it isn't realistic to dump 100% into a trade, sell 100 percent, and then rebuy on the next signal with 100%. Or is it? In any case, you run into difficulties when managing more than $1 million. Distributed trading and/or distributed computing solves that problem when dealing with amounts over $5 million.

I will be putting together the hard facts proving that 100+ percent is a consistent possibility. Will take a couple weeks to get it out there.

Thanks for writing!

Ted

MrNat., yes, I clearly understand what you're saying about the use of MA's not being new. And I think this is why most people are missing what I'm saying.

Nowhere have I seen price behavior stated as a law (see above at the bottom of the Welcome section). If it is indeed a law, it can be applied systematically. If it can be applied systematically, that's what is new. That's what changes everything. If the law is true, then why are we doing anything else but applying it systematically? That's the reason for this board.

Are you now achieving an accuracy rate above 70 percent? Are you now clearly (mechanically) on the path to turning $10,000 into $1 million in 8 years or less? Are you working way too hard for far too little? Do you make money and then lose it?

These are the questions I want to tackle head on! If you're there (being a money machine), then more power to you and we look forward to learning from you!

I have watched traders for 10 years playing around with moving averages. To the best of my ability to see and understand, they have been wildly inconsistent, playing around, gambling.

Airedale was one of the few price scientists, but he worked so hard to get his results, and his method simply could not be automated successfully.

The purpose of this board is to lay out a method where we separate what is true from what is not, and then to focus *exclusively* on what we know works. On that basis, my latest trades were a failure even if they succeed. They were counter-trend--and taking big risks.

If we can prove what I'm saying, we would then have a business plan we could take to a bank. That's what is new here. Utter simplicity focused like a laser beam on one thing: Consistent profitability with high percentage returns over the course of a year. Nothing else matters in the end from a trader's point of view.

The benefits include:

* Greater accuracy of market analysis and trading opportunities

* Higher percentage returns

* Lower risk

* Few tricks, traps, and headaches

* Being forever beyond worries of manipulation

* More free time

* With more free time and rest, you see the market more clearly and it becomes a virtuous cycle when everything just gets better and better.

Ted

FWIW, my 60 min. spx just triggered a sell signal

Ted, the use of ma's for trading is not new, in fact they have been the backbone of T/A analysis for a very long time, pick up any book on T/A and its usually covered in the first few chapters.

The real problem is having the discipline to wait for the signals.

Some are afraid of missing the big move, some feel that they have to be in the market all the time.

Over the years I've settled on the 7ema, 14ma,and then a 7ma moved forward 5 bars/candles, the cross of all 3 gives me my signals. Not a perfect system but when used with a reasonable stop loss discipline it has kept me in the game.

I agree the less oscillators/indicators used the easier it is to trade.

Also visiting these boards can be a source of influence that affects our subconsciousness in ways that can be detrimental to our trading.

PT

I think your concept has a lot of merit. I believe most successful traders are using your methods to a large degree.

Where the system is likely to breakdown is in a non-trending market, where all we have for a few months is chop. Now with discipline money can be made in those markets as well.

Looks like Thurs was reversal day.

The CCI method has generated a signal that SMN will hit the 10-day ma.

If the CCI(10) crosses 0, it will signal the 20-day ma as a target.

The CCI method is NOT connected to my major work on this board. I threw out the idea of the CCI, when Lee Kramer asked about signals or indicators that tell us what is coming in the future. So I'm just paying attention to how this signal system works.

For complete information, see msg. 62 referenced above.

REQUEST: If what I'm proposing has no inherent weaknesses, then we will have done here what mathematicians and the best market analysts have failed to do in 100 years.

No doubt a few traders produce high returns, but what no one has had--until now--is a trading plan you can bank on. A trading plan so specific and real it can be automated and run as an enterprise--like a mining operation.

My request is this: Question my assumptions. Search for the Achilles heel. If we don't find it, please invite the smartest people you know to participate in this discussion. I would love to see this board become a hotbed of the most intelligent and creative trading ideas on the net.

What I have thrown out so far is a crumb. The more you engage, the more I will give--and the more refined my ideas will get. But this isn't about me. I want people on here who are smarter than I am and who see the world from completely different perspectives--and who will see the significance I'm pointing at.

Thanks!

Ted

QUESTIONS:

1) Does everyone see the significance of what I'm proposing?

I've noticed that most of the experienced traders don't get it--or if they do--are pretending the method is of no consequence. Can't see a motive for the latter, so I can only assume they think this is foolishness. If you don't get it, do *not* be afraid to say so, to question what I'm saying! That's the reason for this board.

What I want are questions that focus specifically on how you go about capitalizing on this in a focused and practical way.

2) Can *anyone* find any weakness anywhere in what I'm proposing?

If I'm right and if there are no significant weaknesses and if you practice it consistently, you will almost certainly generate $1 million in less than 8 years if you start with $10,000 in a tax-protected IRA. With continuous improvement (and perhaps automation) you will get there in under 7 years--and perhaps in as few as 5 years.

3) Does the method appear breakthrough to you--in the sense that it can be fully automated? (Few of the major analysis methods can be successfully computerized. I've seen some great attempts but they fail because they focus on iffy clues rather than on knowledge--what we know is always true about price.)

Ted

PS

Let me quickly add, I've only just begun! I've only given the smallest drop of the total strategy. So I'm asking about what I've given so far--the parts highlighted in yellow at the top of the page.

Land, the moving average law of price works with any moving average. So if you look at the 60-minute chart, you will get different answers based on the 8-hour ma or the 50-hour ma.

But to answer your question: Is the 20-hour ma equivalent to the jugular vein of price on a 60-minute chart? I've never thought to look! That's why I appreciate questions so much. And there are about 1,000 more that need answering. So I'm looking right now to see.

Honestly, I'm not ready to commit to the affirmative. Obviously, we are going to get quite a bit of noise on 60-minute charts. The 20-hour ma does give a fairly reliable description of the action.

The method I'm laying out and testing on this board accomplishes everything we need on daily charts. That's why I'm so enthused about it. It's simple, and it will consistently outperform most short-term traders over the course of a year.

I've been a short-term trader, and this analysis has convinced me I need to quit or curtail short-term trading *drastically.* It simply doesn't pay when measured by returns for the investment of time, energy, and risk to capital.

Ted

PS

Regarding my recent short-term counter-trend trade. Half of it is paying (so far) and half is losing (so far). But you can see that trading the holistic method being proposed here produces superior results! So let me be the negative proof--even if my short-term trade goes well.

Land, Holistic Moving Average Price Analysis does not require drawn-in channel lines in most cases. It is a fluid method depending primarily on moving average lines. In a few instances, there may be a need for a more mechanical straight line (for example, the one drawn to maximize profits when price is [> 10] percent above the 20-day ma. This particular method can be written into software with reasonable ease.

The superiority of this method is its deceptive simplicity. It slices and dices price with consistent accuracy based on laws of price.

Here is a major law of price:

===================================

For a price to trend up, it must be above a given moving average while the moving average is pointing up or turning up.

===================================

Practical application: Buy as close to a cross up as possible.

It's fascinating. This law can be used on any line from the 8-day to the 400-day ma. The lower the moving average, the closer you are to the noise of the market and the higher the returns assuming you trade with accuracy.

The practical benefit of this law is that you stop trying to guess what the market is going to do. All you know is that price has crossed up and the moving average is turning up or is sloping up. Then you hold until the signal reverses.

Absolutely simple and something we can automate efficiently. There will be false starts, slippage, and all of that. But it pays and pays and pays.

In one test this week using DDM and DXD over the last 12 months, I hit 167 percent--accounting for false starts and generously allowing for slippage (and without counting any compounding effect). I'm not reporting this number formally just yet. Would like to run a more scientific test.

Ted

So is this computer model going to draw all these lines to??

Does the life of the market line the 20 ma count on the 60's cause that is at 907 and held Not a perma bull here but just going by things you've stated ... " The 20 ma is the life of the Market" and so on...

Welcome to the Price Research and Trading Team

We are dedicated to pooling our best intelligence and understanding of price dynamics to achieve a 70+ percent accuracy rate both in trading and market calls.

This is not a general chat board. This is a business meeting--24 hours a day, 7 days a week, a stream of focused creativity, market analysis, and trading techniques. Because this is a business meeting and a continuous brainstorming session, freedom of communication will be protected even while posts will be managed to a high standard. Meaningful, thoughtful analysis and civil dialog invited. Other things will go poof! To post here, you will need to be a paying member of InvestorsHub. They provide a great service. Please support their work.

While all trading models and methods are welcome, the focus is on the science of price behavior and trading. Be prepared to answer this question repeatedly: Does your TA method produce reliable market calls and trades with an accuracy rate exceeding 70 percent? If it doesn't, the method is probably not a meaningful description of price behavior--or you're not applying what you know with enough consistency to call it a business--a huge issue which will be addressed thoroughly here.

The purpose of PriceTeam is two-fold: 1) To attract individuals and businesses interested in improving trading and investing results. 2) To lay out an understanding of price

that consistently produces market calls and trades with an accuracy rate exceeding 70 percent. Our focus is applied knowledge, knowledge that can be used to engineer wealth without luck or accident. We will capitalize on luck every time it comes along, but the best way to prepare for luck is to *know* what you're doing. ;)

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |