Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

anyone holding sub penny shares, still?

Nice.....Thanks.

Actually, HIVE was early to this trend. Here's their quarterly.

HIVE Announces Quarterly Revenue of $32.2 Million, Adjusted EBITDA1 of $14.9 Million with an Increase in Bitcoin Holdings to 2,496 Bitcoin, 449 Bitcoin Mined and HPC Expansion

Vancouver, Canada – HIVE Digital Technologies Ltd. (TSX.V:HIVE) (Nasdaq:HIVE) (FSE: YO0.F) (the “Company” or “HIVE”) announces its results for the first quarter ended June 30, 2024 (all amounts in US dollars, unless otherwise indicated).

Revenue from digital currency mining was $29.6 million this quarter from mining rewards of 449 Bitcoin, in addition to $2.6 million from the Company’s high-performance computing (HPC) hosting operations, resulting in a gross operating margin of $11.4 million, or a 35% operating margin. The Company’s SG&A for the quarter ended June 30, 2024, was $3.4 million, resulting in a positive corporate margin on a cash basis of $8.0 million. HIVE achieved an Adjusted EBITDA1 of $14.9 million for the quarter and net income of $4.2 million before tax.

The Company grew its Bitcoin mining ASIC hashrate by 4% this quarter, from 4.7 Exahash in March 2024 to 4.9 Exahash in June 2024. HIVE ended the period with 2,496 Bitcoin on the balance sheet as of June 30, 2024, valued at $153.9 million. The Company notes that these Bitcoin are unencumbered, unleveraged and were all mined through HIVE’s green energy focused operations.

HIVE’s production of 449 Bitcoin this quarter compared to 658 Bitcoin in the prior quarter ended March 31, 2024, is mainly a result of the Bitcoin Halving that occurs every four years with the most recent Halving on April 20, 2024. The Halving reduced the Company’s block rewards from 6.25 Bitcoin to 3.125 Bitcoin during the period. The Company prepared for this Halving by upgrading its ASIC miners in the months leading up to and after the Halving, contributing to the positive results for this recent quarter reported.

Frank Holmes, Executive Chairman of HIVE, emphasized, “Our strategy to only source mega chunks of green energy has been a big challenge for rapid growth, but our expansion into Paraguay sourcing 100 MW will more than double our Bitcoin footprint over the next 12 months. Even though we operate in many countries, we have demonstrated a unique ability to keep our operations among the top performers in financial metrics. We believe there is too much political FUD risk to be in one jurisdiction, and despite being a global company, we remain a consistent top performer when measured using various efficiency data metrics. Further, as a Bitcoin mining company, we are consistently among the lowest G&A to mine a Bitcoin and least shareholder dilution per share when compared to peers with over 1 Exahash. I am thrilled that over the past 12 months, even with the difficulty rising to mine Bitcoin and the recent Halving, we made more cash flow than last year.”

Aydin Kilic, President & CEO stated “We are proud to have navigated our second Bitcoin Halving event as a Company, with strategic foresight, producing a gross operating margin1 of $11.4 million this quarter. This comes as a result of our Bitcoin Halving strategy where we procured 7,000 Bitmain S21 AntMiners and 2,500 Bitmain S21 Pro AntMiners, to increase our installed hashrate to 5.5 EH/s with a global fleet efficiency of 24.5 J/TH. Our foresight in navigating this Halving, focusing on upgrading our existing fleet, and being conservative with expansions, comes from years of experience in the crypto-mining sector, with some of our key staff having navigated their 3rd and even 4th Bitcoin Halving events. With an installed hashrate of 5.5 EH/s, we are currently realizing an operational hashrate of 5.2 EH/s, as a result of strategic downclocking of 30 J/TH ASICs to improve overall profitability.”

The Company has identified 30 MW of capacity in its existing Bitcoin mining facilities which it owns and operates, which it is planning to convert to Tier 3 infrastructure for GPU operation, to yield 20 MW of Tier 3 compute. The Company believes these upgrades could be completed in 6-9 months from construction commencement, as power distribution and internet redundancy are in place. The Company believes the value proposition of conversion of existing Bitcoin mining capacity to Tier 3 data center rack space is twofold: a quicker construction timeline of 6-9 months for a retrofit versus a 24-36 month construction timeline for a greenfield, and a construction budget of approximately $5 million to $7 million per MW for a retrofit versus $10 million to $12 million per MW for a new build.

Q1 F2025 Summary – June 30, 2024

Generated digital currency mining revenue of $29.6 million and $2.6 Million of HPC revenue, with a gross operating margin1of $11.4 million

Ending the quarter with over $10 Million of annualized run-rate revenue from our HPC business

Mined 449 Bitcoin during the three-month period ended June 30, 2024

Adjusted EBITDA1 income of $14.9 million for the three-month period

Reported a net income before tax of $4.2 million for the quarter

Working capital increased by $14.2 million during three-month period ended June 30, 2024

Digital currency assets of $153.9 million, as of June 30, 2024

Fiscal 2024 Financial Review

For the three-month period ended June 30, 2024, revenue was $32.2 million, an increase of approximately 37% from the prior comparative period primarily due to the increase in Bitcoin price and includes $2.6 million of revenue from our HPC business segment.

Gross operating margin1 during the three-month period was $11.4 million, or 35% of revenue, compared to $8.0 million, or 34% of revenue, in the same period in the prior year. Gross operating margin1 is directly impacted by digital currency prices and network difficulties as this impacts revenue from mining operations. The Company’s gross operating margin1 is partially dependent on external network factors including mining difficulty, the amount of digital currency rewards and fees it receives for mining, as well as the market price of digital currencies.

The Company achieved a net income for the three-month period ended June 30, 2024, of $3.3 million, or $0.03 basic income per share, compared to a net loss of $16.3 million, or $0.19 basic loss per share, in the prior comparative period.

EBITDA1 and Adjusted EBITDA1

The Company uses EBITDA and Adjusted EBITDA as a metric that is useful for assessing its operating performance on a cash basis before the impact of non-cash items and acquisition related activities.

EBITDA is net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization.

Adjusted EBITDA is EBITDA adjusted for removing other non-cash items, including share-based compensation, non-cash effect of the revaluation of digital currencies and one-time transactions.

The Company emphasizes that “Adjusted EBITDA” is not a GAAP or IFRS measurement and is included only for comparative purposes.

Non-Cash Charges

A non-cash charge is a write-down or accounting expense that does not involve a cash payment. Depreciation, amortization, depletion, stock-based compensation, and asset impairments are common non-cash charges that reduce earnings but not cash flows.

Financial Statements and MD&A

The Company’s Consolidated Financial Statements and Management’s Discussion and Analysis (MD&A) thereon for the three month period ended June 30, 2024 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE’s profile and on the Company’s website at www.HIVEdigitaltechnologies.com.

At-the-Market Offering

On August 17, 2023, the Company entered into an equity distribution agreement (“August 2023 Equity Distribution Agreement”) with Stifel GMP and Canaccord Genuity Corp. Under the August 2023 Equity Distribution Agreement, the Company was able to sell up to $90 million of common shares in the capital of the Company (the “August 2023 ATM Equity Program”).

For the three month period ended June 30, 2024, the Company issued 11,166,160 common shares (the “August 2023 ATM Shares”) pursuant to the August 2023 ATM Equity Program for gross proceeds of C$45.0 million ($32.9 million). The August 2023 ATM Shares were sold at prevailing market prices, for an average price per August 2023 ATM Share of C$4.03. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $1.0 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement.

The Company is using the net proceeds from the August 2023 Equity Distribution Agreement for the purchase of data center equipment, strategic investments including building BTC assets on our balance sheet and general working capital. The August 2023 Equity Distribution Agreement was terminated on July 19, 2024

About HIVE Digital Technologies Ltd.

HIVE Digital Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a focus on sustainable green energy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns and operates state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we endeavour to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

Environmental Sustainability:

Green Energy: By sourcing green renewable energy, HIVE is committed to environmental responsibility, positioning itself as a leader in sustainable cryptocurrency mining.

Competitive Advantage: We believe this environmentally conscious approach sets HIVE apart from competitors and aligns with evolving investor preferences.

Expansion into AI Strategy:

Diversification: HIVE’s diversification into HPC enables us to support artificial intelligence (AI) using Nvidia GPU chips, showcasing our adaptability and innovation beyond traditional Bitcoin mining.

Revenue Streams: This strategic move into HPC broadens HIVE’s revenue streams and places it at the forefront of technological advancements in both cryptocurrency and AI industries.

HIVE’s unique value proposition encompasses efficient operations, a proven agile management team, financial strength, environmental sustainability, and innovative expansion strategies. Beyond Bitcoin mining, HIVE is firmly part of the global boom in data center infrastructure, sourcing primarily green renewable energy.

HIVE presents a unique growth opportunity with over 2,500 Bitcoins on its balance sheet and growing revenue from its suite of Nvidia GPU chips powering data services for the AI revolution.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEdigitaltechnologies.com. Follow @HIVEDigitalTechon Twitter and subscribe to HIVE’s YouTube channel.

I bellieve I read that HIVE is pretty much in synch with this trend

https://dailyhodl.com/2024/08/18/bitcoin-miners-shifting-to-artificial-intelligence-and-high-performance-computing-according-to-vaneck-analysts/

Update: Crypto Miner HIVE Sees 8% Revenue Growth, Expands into AI Computing

HIVE has reported an 8% increase in revenue, demonstrating a significant improvement in its financial performance after a challenging year for digital assets. The company has successfully expanded its mining capacity and diversified into high-performance computing (HPC) to focus on AI.

Key Highlights:

Revenue Growth: 8% increase, showcasing financial resilience.

Expansion: Enhanced mining capacity and a strategic shift towards AI and HPC.

Innovation: Leveraging industrial-grade NVIDIA GPUs for AI computing, positioning HIVE at the forefront of tech advancements.

READ MORE HERE: https://www.financemagnates.com/cryptocurrency/crypto-miner-hive-sees-8-revenue-growth-expands-into-ai-computing/

We encourage you to visit HIVE's YouTube channel to learn more about their latest initiatives and future plans. Check it out here: https://www.youtube.com/channel/UCB12hDmAamGSzoKPJTG0syQ

I just bought another 200 shares of HIVE to add to the 300 I already own. I could not pass up the lowest price in a year.

They are one of the smaller bitcoin miners but their fleet is highly efficient in terms of production per electricity consumption. They rely on Green Energy available on three continents so their cost per bitcoin is low. Also they have thousands of Nvidia GPUs which they are going to deploy for High Performance Computing for Artificial Intelligence. Apparently they have not yet secured their first customer. They are developing a Computing Cloud configuration, I suppose, because their sites are out in the boonies. This will give them a 2nd income stream which could eventually be more lucrative than bitcoin mining.

And finally, they have weekly Call options trading against the stock. This gives me the opportunity to make a little cash profit every month while holding onto the shares for the long haul. I am very happy with the purchase and upside potential.

Good Luck to All Longs.

change of control VIZC 0004s

unrestricted getting up there

change of control has been hot of late

you'll know best

HIVE

Bought 10 June 4 calls at 1.30 today!

BINGO!!! HIVE ain't no Jive!

Yogi the bear.

Yoga Whore Hustle

Yogi likes deep leg stretches.

Yoga pants = best invention ever, except when Chito Lov'n Chicks are wearing them! Cause it ain't easy bein cheesy!

ACTION ----- JACKSON...............................the paints not dry yet

Just got back in, let this win with the hopeful continued rise of BTC

Looks like these mining stocks are going to be worthless. As Bitcoin continues to climb these stocks continue to do nothing but dilute shares and screw share holders

$HIVE Digital Technologies has become a preferred partner for NVIDIA AI, a leading enterprise AI platform, and is launching its GPU compute service through a grant contest for AI developers. Despite a 4.3 per cent YoY drop in HIVE Digital's stock, it has added 45.86 per cent over the past five years..

$HIVE Digital Technologies has become a preferred partner for NVIDIA AI, a leading enterprise AI platform, and is launching its GPU compute service through a grant contest for AI developers. Despite a 4.3 per cent YoY drop in HIVE Digital's stock, it has added 45.86 per cent over the past five years..

HIVE Digital is Now a NVIDIA CSP Partner and Announces GPU Grants for Open-Source AI Developers

https://mailchi.mp/hivedigitaltech.com/hive-digital-is-now-a-nvidia-csp-partner-and-announces-gpu-grants-for-open-source-ai-developers

HIVE is a business that engages in bitcoin mining. The business validates transactions on blockchain networks, offers cryptocurrency mining services, and creates connections between the cryptocurrency and conventional capital markets. The annual earnings growth rate anticipated for HIVE Blockchain is 72.3%. HIVE stock has up 4.9% over the last three months.

HIVE Love this Play Long Term, HODL

OH MY, OH MY, OH MY!!!!!!!!!!!!!! Hardy Har, Har, Har. Franky's Mushrooms still trying to find the daylight. Still under the Reverse Split Price and now Franky's gonna prime the pump for yet another reverse split in a short while!!!!!!!!!!!! You can't make this stuff up!!!!

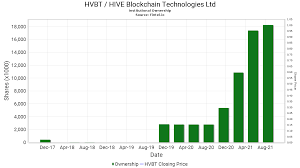

We need to execute a Reverse Split to attract Institutional Investors. And boy, oh boy, didn't those Institutional Investors respond and take the pps to da Mooooooon!!!!!

Now drop your draws, bend over and grab your socks because:

Under the Equity Distribution Agreement, the Company may sell up to US$90 million of common shares of the Company (the “Common Shares”). The Common Shares will be issued by the Company to the public from time to time, through the Agents, at the Company's discretion. The Common Shares sold under the ATM Program, if any, will be sold at the prevailing market price at the time of sale.

I liked Yesterday a lot more than today...

Hive Digital Technologies stock gained 10.4% in trading on Thursday, with the company's share price up 10.4%. The company changed its name from Hive Blockchain Technologies to Hive Digital Technologies, reflecting a shift into offering AI processing services. Investors are excited about the new business direction.

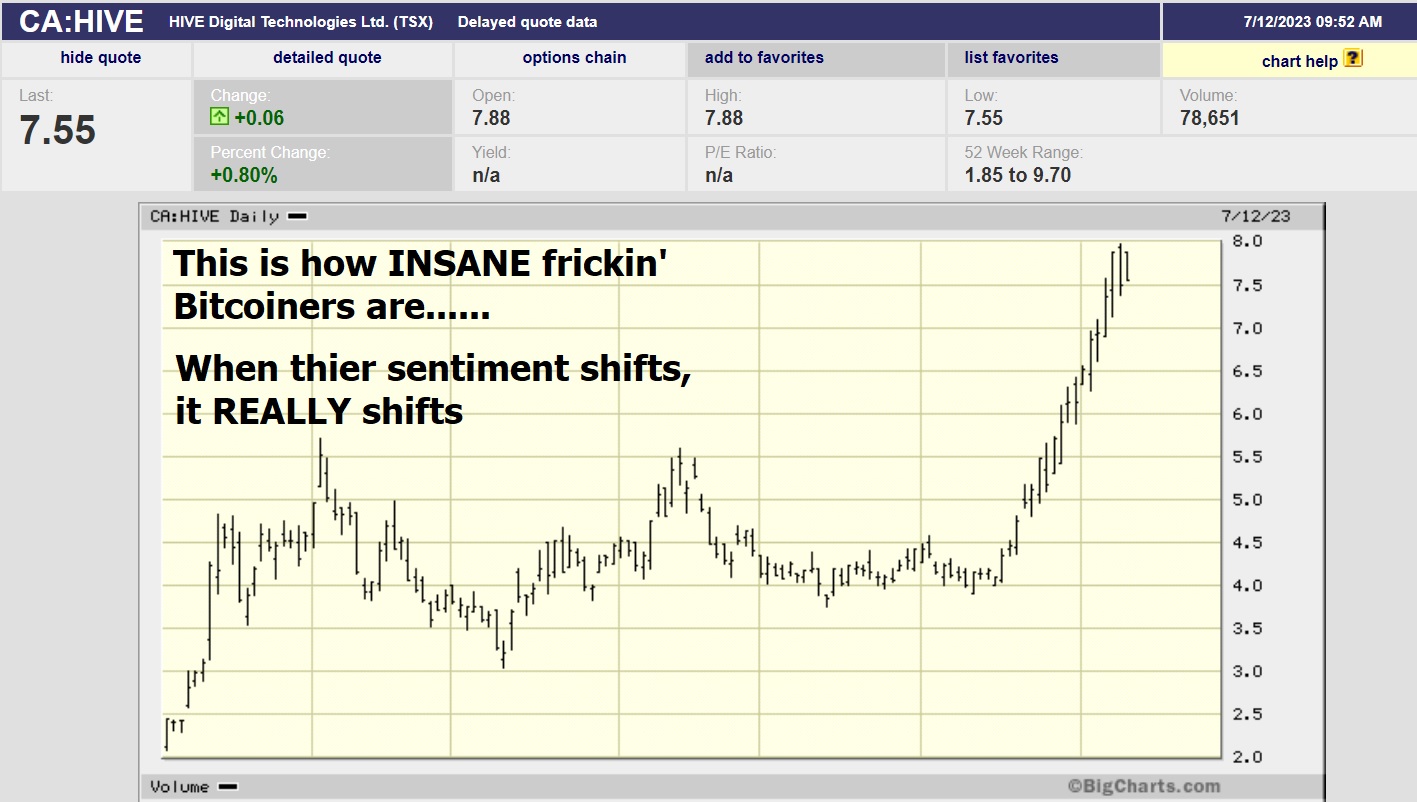

The miners continue.....Yesterday and today......FOMO's bubbling strongly

Next morning (today).....

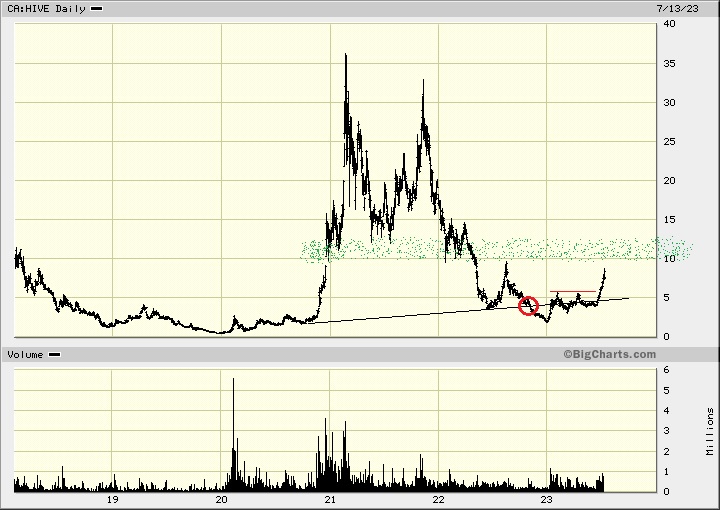

Don't pictures tell a thousand words ?

Feb 2023

What's that look like NOW ?

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=ca%3Ahive&x=54&y=13&time=100&startdate=2%2F4%2F2018&enddate=12%2F29%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=+150+200+21&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

THIS ?

hmmmmmmm.......

.

All good. My turn to post a bunch of words! Don't know if you recall, but I "inherited" HIVE shares via the RM back in 2017 from a shitty gold mining shell I held! 200 shares. I looked into whatever this crazy "crypto stuff" was at that time and kind of went "all in". My proprietary hindsight algorithm says I was a bit early!

I hold shares in 4 accounts. I was able to trade my average "down" to about $6 pps in 2 accounts & booked about $7.5k profit. However, the other 2 accounts hold the bulk of my shares and they are IRA rollover accounts with little equity so not much trading. So once again my hindsight algorithm says I should have dumped other holdings and dove in around $2 pps. Funny how that works.

So even though my total average is around $10 pps now, I am optimistic for the future. HIVE is still doing "ok" with BTC mining and since they were crypto pioneers, I think they have their stuff together with AI. Unlike companies that "said" they were dot.com or weed based to ride the wave, HIVE started shifting for AI early. I think they are in a good position to capitalize on the AI technology while still mining Bitcoin, so my fingers are crossed they will reach the "real ATH" in the not so distant future.

Good luck to us!

ChuckBits, I laughed when I read your comment, pointing out my bone-headed inaccuracy regarding HIVEs ath.

While I didn't like the reverse split, I was in favor of it at the time due to the ugly market circumstances. HIVE needed to keep their head above water and a dollar.

Now, getting SP to $28.75 will take some time. If they succeed, perhaps it will someday make sense to reverse the reverse split.

HIVE entered the US market from Canada with too many shares, at least compared to some newer miners which had 40 to 80 million. HIVE had way more, over 400 million, if memory serves. This might have allowed them to be one of the most liquid and active trading stocks on the Toronto exchange, but it was poison to the OTC, then Nasdaq. I think Frank Holmes made a mistake, thinking, or assuming, that HIVE would maintain such activity when they reached the US market. When this didn't happen, it left HIVE fat and unappetizing to the institutional gorillas. That honor went to MARA and RIOT, with HIVE left to reinvent itself in the brave new world.

Having so many shares made HIVE a difficult and/or confusing company. In my opinion, they misread the American market and should have done the reverse split before they reached the US shores and Nasdaq. Had they gotten here with 60 million, instead of 400 million, things might have unfolded differently.

But that's all assumption vapor. A waste of typing with my thumbs.

I wish Port! The split adjusted ATH (according to my data) is $28.75

PPS hit 5.75 on 2/19/2021, before the 1 for 5.

Only a matter of time, Go AI!

HIVE halted

July 12, 2023

8:55 am ET

*Hive Blockchain Technologies Shares Halted On Code News Pending

Benzinga

1:01 am ET

HIVE Digital Technologies Debuts New Name and Strategic Expansion to Power the Future of Artificial Intelligence with our Nvidia GPU Cards

Newsfile

Standard Chartered Pushes Bitcoin Prediction to $120,000

https://watcher.guru/news/standard-chartered-pushes-bitcoin-prediction-to-120000

HIVE Blockchain had a significant amount of computing power dedicated to mining Bitcoins in June 2023. They were able to mine a total of 259 Bitcoins during the month, with an average of 8.6 Bitcoins per day. Their mining capacity at the end of the month was 3.48 Exahashes per second.

Hey ChuckBits, great hearing from you. Glad we're both alive and kicking. Although, still kicking also means still being kicked. Haha. That part's not as much fun.

Who knew tiny HIVE Bitcoin miner with their messy beginnings would have actually carved out a seat at the table in the future of, well, everything.

Yo Port! I'm still "here"...

Cheers

Hive renames and rebrands. In addition to bitcoin mining, and capitalizing on the Nvidia chip purchase and focusing on the digital needs of the ever expanding use of AI.

https://mailchi.mp/e0b2ddb6ea4d/hive-announces-name-change-to-hive-digital-technologies-ltd-to-reflect-our-hpc-strategy-and-updates-bitcoin-equivalent-for-fiscal-2023?e=6edb7906ab

"... name change to “HIVE Digital Technologies Ltd.” (the “Name Change”) to better reflect the Company's evolving expansion into fast tracking our HPC data centres by utilizing our Nvidia high performance Graphics Processing Unit (“GPU”) chips for the mass adoption trend in Artificial Intelligence (“AI”). HIVE has been a pioneering force in the cryptocurrency mining sector since 2017. The intent of the name change signals a significant strategic expansion to harness the potential of our green energy data centres and of GPU Cloud compute technology, a vital tool in the world of AI, machine learning, and advanced data analysis since the launch of ChatGPT."

Despite the difficulties, analysts predict that the company will do well this year, mainly because of the increasing price of Bitcoin.

Hive Blockchain ($HIVE) stock rose to its highest level since September of last year, as Bitcoin surpassed $31,000. The stock was trading at $5, which was significantly higher than the year's low. This year, it has increased by more than 270%, outperforming the Nasdaq 100 and Dow Jones indices.

HIVE achieved $106 million in annual revenue for the fiscal year ending March 31, 2023.

With 2,332 bitcoin on its balance sheet and $106 million in annual revenue by the end of March 2023, HIVE mines 3,258 bitcoin that year.

HIVE Blockchain Technologies Ltd. lost $7 million in its fiscal fourth quarter, or 8 cents per share. Losses were 5 cents per share after adjusting for one-time gains and costs. HIVE made $18.2 million in revenue.

This is what be of the easiest stocks on the Nasdaq to time the upswing. All you have to do is watch RIO# and MAR#. As soon as they start the upswing then you know Hive will follow. Hive almost always starts it's run last of the three but usually catches up in percentage gains.

All HIVE has to do is announce they are increasing their hash rate by 50% by the end of the year, and the price would be $6.00 USD in a two-week time frame.

Here's Tom at Talkin' Investin, explaining the latest hatefest against BTC. They're going after the miner's, proposing a 30% tax on energy used. The starting gambit is rarely the ending result. This is just a money grab before the negotiating begins.

Do they tax banks? No, they tax individuals. This is just another big shot of "peak FU."

The powers that hate BTC, still love the blockchain. They want the chain but they want to kill us, meaning the miners. Without solid mining, there is no BTC.

It's one reason I like HIVE. While I own other mining companies, I like owning companies outside the US. There may be some extra wriggle room if all companies are not under the thumb of the all and powerful Oz.

Maybe they will do another reverse split to get the price per share above $5, they need more institutions buying and holding..

HIVE is one of the largest publicly traded crypto miners with assets in Canada, Sweden & Iceland. HIVE closed out calendar 2022 on a whimper with the crash in digital currency prices and a huge write-off in mining equipment. Looking forward, HIVE is hyping up a pivot to use its GPU's in 'AI' applications.

|

Followers

|

170

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

6257

|

|

Created

|

09/18/17

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |