Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi CPT,

We are due...

$RWGI

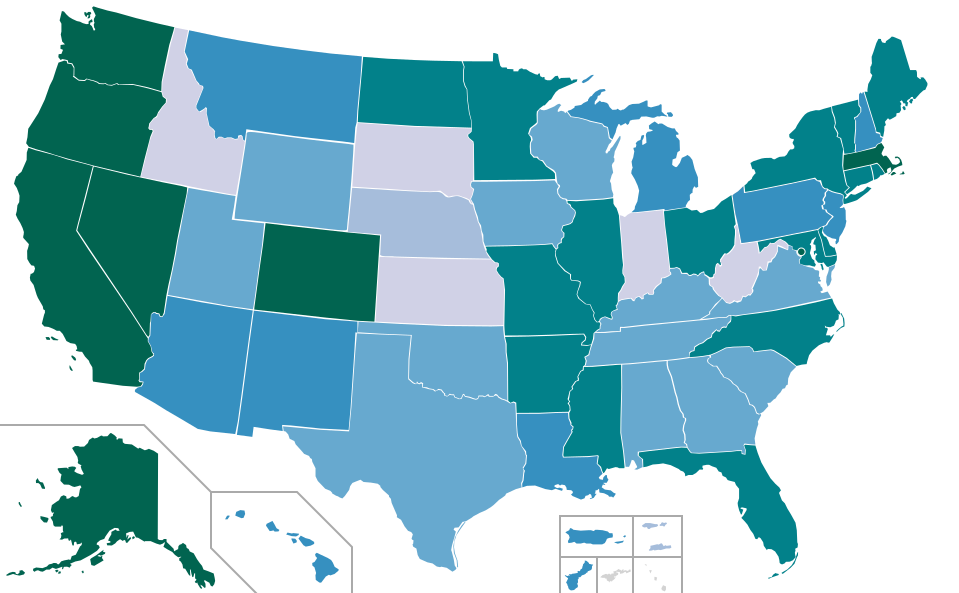

#CANNABIS_NATION: Hey cuckoo... Long time... Florida is voting on Legalization in November...

Could be time to load up on the CANNABIS majors......

https://marijuanastocks.com/top-10-marijuana-stocks-for-your-2022-watchlist/

$CURLF

$TCNNF

$MAPS

In the mean time

$JNUG

$AG

Take advantage of

$SIlVER

$GOLD

Hope things are going well for you...

https://twitter.com/CaptainMonet

#CANNABIS_NATION IS IS WAKING UP.....![]()

The SAFER Banking Act is here according to Schumer. 1,000 time is a charm.

BREAKING:

— Chuck Schumer (@SenSchumer) September 20, 2023

We're introducing the Secure and Fair Enforcement Regulation (SAFER) Banking Act.

This will help make our communities and small businesses safer by giving legal cannabis businesses access to traditional financial institutions. pic.twitter.com/7SEiJEu9nV

Senators Are Reportedly Circulating Revised Marijuana Banking Bill With New Title And Provisions As Committee Prepares To Vote Next Week: A section-by-section summary of the retitled SAFER Banking Act is making its rounds ahead of the committee markup.https://t.co/f2UvgHgDQf

— Marijuana Moment (@MarijuanaMoment) September 19, 2023

Let's hope they get it done this time!!!

Senate Committee To Hold Marijuana Banking Bill Vote Last Week Of September, Senate Source Confirms: The tentative date of the committee vote on the Secure and Fair Enforcement (SAFE) Banking Act is now September 27.https://t.co/vBt5Qu58AS

— Marijuana Moment (@MarijuanaMoment) September 15, 2023

AMMJ over .08! Beautiful!

WoW! AMMJ Up 39% on a low volume day. The MJ sector is just getting warmed up for reclassification. Time to add to those low trading MJ companies.

AMMJ is absolutely going off today .0375! Just a matter of time until DMAN; RWGI: THCBF; SIPC; WDRP hit their stride!

Largest legacy #cannabis co's love this news more than anyone bc news ss not about federalization which could be a green light to is big CPG/pharma/tobacco etc. News is about FCF and balance sheet repair whihc changes overnight for the industry. Solves biggest problem right now https://t.co/HPdKnP7Jwz

— Tim Seymour (@timseymour) August 30, 2023

#CANNABIS_NATION: BRANDON LOOKING FOR SUPPORT....![]()

Hey cuckoo... Summertime loading season for cannabis stocks ends today...!

Just in time for the " LET'S GO BRANDON" TEAM TO PUT OUT THE CARROT ON A STICK...!

https://www.marijuanamoment.net/top-federal-health-agency-says-marijuana-should-be-moved-to-schedule-iii-in-historic-recommendation-to-dea/

Check out $Askh while we wait IMO

Regards

#CANNABIS_NATION: STILL WAITING...![]() HAPPY 2023 SUMMER TIME cuckoo

HAPPY 2023 SUMMER TIME cuckoo

https://dailyreckoning.com/governors-of-the-mind/

Governors of the Mind

The assault on enterprise of the last few years — meaning not the biggest politically connected businesses but smaller ones reflecting vibrant commercial life — has taken very strange forms.

Ever since The New York Times said the way forward was to “go medieval,” the elites have been attempting just that. But this medievalism has not come at the expense of Big Data, Pharma, Ag or Media.

It mainly hits products and services that impact our freedom to buy, trade, travel, associate and otherwise manage our own lives.

What began in lockdowns mutated into a thousand forms. That continues with daily new outrages. Maybe it’s not random.

It was never really about health care. It was about the exercise of power over the whole population by a tiny elite in the name of science.

The government locked down society, and then tried to make us get the shots through hook and crook, an experimental medicine we did not need and which was proven neither safe nor effective.

Since those days, other strange things have been unleashed: the campaign to eat bugs, end fossil fuel, abolish wood-burning pizza ovens, impose all-electric ovens and cars, stop air conditioning, own nothing and be happy with your digital consumption and even block out the sun, while indulging in every farce such as pretending that men can get pregnant.

Many cities are falling apart, abandoned by well-to-do residents and consumed by crime. It’s all madness but maybe there is rhyme to the reasons for all this?

‘We Must Remake Society!’

In August of 2020, Anthony Fauci and his long-time co-author wrote a piece in Cell that called for “radical changes that may take decades to achieve: rebuilding the infrastructures of human existence, from cities to homes to workplaces, to water and sewer systems, to recreational and gatherings venues.”

They wanted social distancing forever but that was only the start of it. They imagined the dismantling of cities, mass social events, the end of international travel and really all travel, no more owning pets, the end of domesticated animals and a strange non-pathogenic world that they imagined existed 12,000 years ago.

We can’t go back, they said, but we can “at least use lessons from those times to bend modernity in a safer direction.”

There we have it. Preserve “essential” services (and people) but get rid of everything else. The lockdowns were merely a test case of a new social system. It’s not capitalism. It’s not socialism as we’ve come to understand it.

It feels like corporatism but with a twist. The big businesses that gain favor are not heavy industry but digital tech designed to live off scraped data and power the world with sunbeams and breezes.

There’s nothing new under the sun. So where did this strange new utopianism come from?

The Counter-Revolution of Science

Three years ago, Matt Kibbe and I recalled that in 1952, F.A. Hayek wrote what became The Counter-Revolution of Science. The idea is that in the late 18th and early 19th centuries, a new conception of science was born, which reversed a previous understanding.

Science was not a process of discovery by research, but a codified end state known and understood only by an elite.

This elite would impose its view on everyone else. Hayek called this “the abuse of reason” because genuine reason defers to uncertainty and discovery while scientism as an ideology is arrogant and imagines it knows what is unknown.

I did not have time to reread the book but Kibbe did. I asked him if Hayek said anything that touched on our current problems. His response: “This book explains everything.”

That’s quite the recommendation. So I dug in. Yes, I had read it years ago but every book from the before times has a different feel and message in the after times.

It is indeed prescient. Hayek explores in great detail the thinkers of the early 19th century — successors to and reversers of the original French Enlightenment — and its origin in the writings and influence of Henri Saint-Simon (1760–1825).

Simply put, Saint-Simon dreamed of a world without privilege of birth or inherited wealth. The aristocracy can be damned for all he cared.

He imagined a world of what he called merit but it was no merit by means of hard work and enterprise as such. It was a world run by geniuses or savants with unusual intellectual gifts. They would comprise the managerial and ruling elite of society.

The Council of 21

His preferred system of government would consist of 21 men: “three mathematicians, three physicians, three chemists, three physiologists, three men of letters, three painters, three musicians.”

The council of 21! I’m sure they would get along great and not be corrupt in the slightest. And they would surely be benevolent!

We would find out who these people are by having votes placed at the grave of Isaac Newton (Saint-Simon’s god of choice) and eventually the consensus concerning the elite council would be chosen.

They would not be a government as such, at least not as traditionally understood, but elite planners who would use intelligence to shape the whole society the same way that scientists understand and shape the natural world.

You see, to his way of thinking, this is far more rational than having an hereditary aristocracy in charge. And these men would in turn deploy their rationality in service of society, which would be enormously inspired by it, just as MSNBC is so enthused for Dr. Fauci and his friends.

Saint-Simon wrote:

Men of genius will then enjoy a reward worthy of them and of you; this reward will place them in the only position which can provide them with the means of giving you all the services they’re capable of; this will become the ambition of the most energetic souls; it will redirect them from things harmful to your tranquility. By this measure, finally, you will give leaders to those who work for the progress of your enlightenment, you will invest these leaders with immense consideration and you will place a great pecuniary power at their disposition.

So there you go: The elite get unlimited power and unlimited money and everyone will aspire to act like these people and this aspiration will improve the whole of society.

It reminds me of the pre-modern system in China in which only the best students could enter into the class of the mandarins, which were the nine levels of high-ranking officials in Imperial China’s government.

Governors of the Mind

Indeed, Saint-Simon invited his followers to “consider yourselves as the governors of the operation of the human mind.”

He imagined “spiritual power in the hands of the savants; temporal power in the hands of the possessors; the power to nominate those called to fulfill the functions of the great heads of humanity, in the hands of everyone.”

Saint-Simon lived a life that oscillated between wealth and poverty, and regretted that condition would befall any man of his genius. So he cobbled together a politics that would protect him and his ilk from the vicissitudes of the market.

He wanted a permanent class of bureaucrats that would be completely insulated from the liberal world that had been celebrated only a quarter century earlier by the likes of Adam Smith.

Here was the core of what Hayek called the counter-revolution of science. It was not science but scientism in which freedom for everyone is a hell, geniuses seizing control was the transition and permanent rule by savants to shape the human mind was heaven on Earth.

The best book I’ve seen that captures the essence of this dream is Thomas Harrington’s The Treason of the Experts. They turn out to be not altruists or competent overseers of society but cowardly sadists who rule with career-driven cruelty and refuse to admit when their “science” produces the opposite of their stated goal.

“Scientism” as an ideology is the reverse of science as traditionally understood. It is not supposed to be the codification and entrenchment of an elite class of social managers but rather a humble exploration of all the fascinating realities that make the world around us work.

It is not about imposition but curiosity, and not about norms and force but facts and an invitation to look more deeply.

Saint-Simon celebrated science but became the anti-Voltaire. Instead of freeing the human mind, he and his followers imagined themselves to be governors of it. Anthony Fauci followed in that tradition.

Their actual goal is to become permanent “governors of the operation of the human mind.”

Weed Stocks Are Booming Again! #SafeBanking

"We see weed in the Senate Banking Committee’s future." @PunchbowlNews #US #Cannabis #SAFEBanking https://t.co/TPqOffiwsc pic.twitter.com/AizQnLD1Eh

— Todd Harrison (@todd_harrison) July 3, 2023

I've never heard such positive MJ sentiment coming from our elected officials. This definitely feels different. Safe Banking 1st, rescheduling next. Exciting times Cap!

$RWGI

Multiple acquisition and JV targets now in the $RWGI pipeline. Chris Swartz, will be addressing the updated initiatives and next steps toward acquisitions for $RWGI Year 1 revenue goal of mininum 5 Million USD. pic.twitter.com/qA6Rd5crG7

— Rodedawg International Industries Inc (@RWGImerger) June 26, 2023

Schumer Is 'Confident' Marijuana Banking Bill Will Pass This Session, According To Cannabis Entrepreneur Who Spoke To Majority Leader: "I am of the opinion that our Democratic leadership believes that this is something we can get done."https://t.co/ad89RZ88Ub

— Marijuana Moment (@MarijuanaMoment) June 21, 2023

Our sincere apologies for the delay in relaying pertinent information. A project of this magnitude, requires some work to say the least. Thank you for your patience.

— Demand Brands (@DemandBrands) June 15, 2023

$RWGI- Positive News for the #cannabisindustry to have #SAFEBanking reform #legislation reviewed before Congress adjourns. #national #LegalizeIt #Cannabis #MarijuanaMovement #stockstowatch #Uplist #growthmindset #RollitwithRodedawg #Uplisting #NASDAQ https://t.co/UUMp0ryaQC

— Rodedawg International Industries Inc (@RWGImerger) June 8, 2023

We are in process of finalizing a few moving pieces within the company. Thank you for your patience.

— Demand Brands (@DemandBrands) June 7, 2023

#CANNABIS_NATION: EXPLAINING "WOKE".....!

#CANNABIS _NATION: Looking forward to something...![]()

In the mean time...

https://i.redd.it/r2kb4py7r30b1.jpg

#JNUG

#AGQ

#NUGT

https://www.marijuanamoment.net/schumer-wants-marijuana-banking-bill-to-get-committee-vote-in-the-near-future-reiterating-plan-to-attach-criminal-justice-provisions/

Schumer Wants Marijuana Banking Bill To Get Committee Vote ‘In The Near Future,’ Reiterating Plan To Attach ‘Criminal Justice Provisions’

The SAFE Act is gaining MEGA Momentum!

https://www.marijuanamoment.net/schumer-says-marijuana-banking-bill-will-go-to-senate-floor-with-expungements-and-social-justice-attached-at-nyc-cannabis-rally/

Senate Majority Leader Chuck Schumer (D-NY) spoke at a marijuana rally in New York City on Saturday, vowing again to pass federal cannabis banking reform legislation as Congress works to end prohibition.

Schumer was among a variety of lawmakers, officials, advocates and entrepreneurs to reflect on the progress of the reform movement at the NYC Cannabis Parade & Rally (NYCCPR), which celebrated its 50th anniversary on Saturday.

This is the third year in a row that the majority leader has participated in the event. He told attendees that there’s ample reason to celebrate, from the rollout of New York’s adult-use market to progress on federal cannabis policy reform on Capitol Hill.

“We struck a real victory here in New York with legalization, which I pushed the legislature to do,” Schumer said. “And while there are definitely real changes in implementation in this state, no one—no one—can take away what legalizing marijuana means as a bellwether in this country. Now Congress has to catch up. I’m working on Congress to catch up to New York.”

He touted the recent scheduling of a Senate Banking Committee hearing on cannabis banking issues and the Secure and Fair Enforcement (SAFE) Banking Act, which will take place on Thursday.

“We will put the bill on the floor—god willing we get the votes in committee—and we will add to it expungement of the records of all of those who suffered from the over criminalization of marijuana,” Schumer said at the event. ” The SAFE Banking Act is a good thing.”

“We need to do social justice and attach it to the SAFE Act and pass it together,” the majority leader said. “So I’m with you all the way. I can’t wait when we’ll come back and celebrate here in Union Square in the near future and say cannabis is legalized in all of the United States of America.”

The last time Schumer spoke at NYCCPR, he focused on legislation he was drafting at the time to end federal marijuana prohibition. While he said at a 4/20 event in the Capitol last month that he plans to refile that bill, the majority leader is making clear that the first major task will be passing the banking measure in a divided Congress.

Prior to the scheduling of the marijuana hearing in the Senate Banking Committee, Chairman Sherrod Brown (D-OH) told reporters that senators planned to “move quickly” on the legislation from Sens. Jeff Merkley (D-OR) and Steve Daines (R-MT).

#CANNABIS_NATON: Sure hope so cuckoo...

Peter Schiff time...![]()

Is 2023 the we get the Safe Banking Act Through Congress?????

https://www.marijuanamoment.net/bipartisan-u-s-house-and-senate-lawmakers-reintroduce-marijuana-banking-bill/

#CANNABIS_NATION: Tucker Carlson BREAKS OUT...![]()

BYE BYE FOX....!

Is it time to reconsider @SIPC? Hmm.

RWGI Looking ready to Spring Forward!

Petro dollar collapse = end to perpetual wars

#CANNABIS_NATION: WAITING FOR $RWGI :TO SURPRISE...![]()

Hey cuckoo : Could happen any time...

The NWO plan is unfolding right before our eyes...!

Six months before they BLOW UP A PIPE LINE...!

https://www.bbc.com/news/world-europe-63297085

Just read the this and weep... They are brain washing the masses...!

https://www.rollingstone.com/tv-movies/tv-movie-features/how-to-blow-up-a-pipeline-hottest-date-movie-of-season-climate-change-environmental-activism-oil-1234710016/

Happy Spring time cuckoo....

$RWGI Shareholders- #Acquisition documents and terms are finalized. Awaiting all signatures for formal #announcement into expanded #industries with existing online and direct channels of #distribution. New division #Manufacturing #healthcare #medicine Thank You for your patience

— Rodedawg International Industries Inc (@RWGImerger) April 6, 2023

MJ is setting up 2 MOVE![]()

$DMAN

$RWGI

$AMMJ

$THCBF

#CANNABIS_NATION: HEY cuckoo WATCH $CNBX...![]() 0.09

0.09

UP 140% YESTERDAY...!

Mandating experimental mRNA vaccines with no long-term safety data was CRIMINAL.

— Dr. Simone Gold (@drsimonegold) March 25, 2023

Those who were complicit should be prosecuted.

pic.twitter.com/QD0L1WkqMV

#CANNABIS_NATION: $DMAN WILL MAKE IT BIG TIME..![]() $0.005

$0.005

BUT FIRST THE BANKING SYSTEM WILL FOLD...!

I'M SURE WE WILL BE THERE WHEN IT HAPPENS..

$JNUG

$NUGT

$AGQ

$AG

#SQQQ: SELL IN MAY AND GO AWAY....![]() $32.23....

$32.23....![]()

The price of even a successful preservation of the banking system is the destruction of fiat currencies, because the bigger picture is still of the greatest credit bubble in history unwinding.

https://www.zerohedge.com/markets/great-credit-unwind-powells-hidden-pivot

https://www.goldmoney.com/research/the-great-credit-unwind-pivot

We are all now aware that the global banking system is extremely fragile. Driving bank failures is contracting credit, which in turn drives interest rates higher. Though it is not generally appreciated, central banks have failed to suppress them.

Some regional banks have failed in the US and the run on Credit Suisse’s deposits has forced the Swiss authorities into forcing a reluctant rescue by UBS. Undoubtedly, as the great credit unwind plays out, there will be more rescues to come.

In this, the earliest stages of a banking crisis, some questions are being answered. We can probably rule out bail-ins in favour of bail outs, and we can assume that nearly all banks will be rescued — they must be in order to prevent systemic contagion.

In this article I quantify the position of the global systemically important banks (the G-SIBs) and point out that the central banks which are meant to backstop them are themselves bankrupt — or rather they would be properly accounted for.

Because even a minor failure in the banking system could undermine the entire global banking system, the much heralded pivot is now here, but not in plain sight. Because central banks have lost control over interest rates, the focus on preserving the financial markets underpinning the banking system has shifted to supressing bond yields. This is why the Fed has introduced its Bank Term Funding Programme, likely to be copied in other jurisdictions.

It is Powell’s hidden pivot — his line in the sand. But it is the last desperate throw of the dice and depends entirely on inflation being transient and interest rates not rising much more.

The price of even a successful preservation of the banking system is the destruction of fiat currencies, because the bigger picture is still of the greatest credit bubble in history unwinding.

And that process has only recently started...

The great unwind accelerates

Now that everyone in finance knows that there is a banking crisis, cynicism prevails. When a central banker or treasury minister tries to reassure the public, it is disbelieved. The risk to an extremely fragile global banking system is that if disbelief in public statements spreads from financial sceptics to the wider public, the system is doomed. All credit is based on confidence and confidence alone.

It is still too early to say that confidence has been irretrievably shaken. But last weekend, UBS was unwillingly forced by the Swiss authorities into taking over Credit Suisse on a share swap, which valued the latter’s shares at about 70 centimes. That put Credit Suisse’s shares on a discount to book value of 94%. Admittedly, this figure is unreliable when deposits are running out of the door and the full value of foreign exchange derivatives are not accounted for. But it does raise a question over the valuations of all the other global systemically important European banks. And why stop there — the G-SIBs have all taken in each other’s laundry, so if one fails so might all the rest. Perhaps they should all be similarly valued.

Presumably, in their groupthink the central bankers represented by the three wise monkeys in the illustration above never thought it would come to this. After all, their regulators have frequently conducted stress tests and all major banks routinely pass them with flying colours. But as Kevin Dowd, Professor of Finance and Economics at Durham University put it in 2016 in one of his several critical reviews of bank regulation,

“The purpose of the stress testing programme should be to highlight the vulnerability of our banking system and the need to rebuild it. Instead, it has achieved the exact opposite, portraying a weak banking system as strong. This is like having a ship radar system that cannot detect an iceberg in plain view.

“As the EU banking system goes into a renewed crisis, the UK banking system is in no fit state to withstand the storm. Once contagion spreads from Italy to Germany and then to the UK, we will have a new banking crisis but on a much grander scale than 2007-08.

“The Bank of England is asleep at the wheel again, and we will be back to beleaguered banksters begging for bailouts – and the taxpayer will be ripped off yet again, but bigger this time."

Unfortunately, it is Professor Dowd’s analysis and conclusion that have stood the test of time. And nothing, repeat nothing, has been done to alter this situation. Only last Monday, the President of the ECB proved this point by releasing the following official statement:

“I welcome the swift action and the decisions taken by the Swiss authorities. They are instrumental for restoring orderly market conditions and ensuring financial stability. The euro area banking sector is resilient, with strong capital and liquidity positions. In any case, our policy toolkit is fully equipped to provide liquidity support to the euro area financial system if needed and to preserve the smooth transmission of monetary policy.” (italics are my emphasis)[ii]

The group-thinking on stress testing is based on commonly agreed parameters between central banks and regulators for constructing stress models, and their desire to be seen discharging their duties rather than the actuality. That being the case, what we have seen in Switzerland which led to Credit Suisse being valued at only 6% of its book value is an important message not just for European bank regulation, but elsewhere as well.

Whatever their mollifying statements, the central bank groupthinkers must now be very worried. But they appear to lack coordination. The Swiss National Bank decided that as part of bailing out Credit Suisse, it would bail in higher ranking bond holders, writing off Sf17bn. That shareholders should get something while senior creditors get nothing is a travesty of company law. Following the market’s reaction, it has been swiftly denounced by regulators in Europe and London, only days after the ECB President issued the formal statement above, extoling the Swiss authorities for their actions.

The consequences of the Swiss National Bank writing off senior creditors are likely not just to impose losses on other banks which are in a fragile state themselves and can ill afford their senior debt to be traduced in this way, but to make future bond financing of banks more difficult. Furthermore, banks, insurance companies, and pension funds will be reassessing their risk exposure to all Swiss franc denominated bonds, even to the extent of impacting UBS, Credit Suisse’s rescuer.

The legal wrangling and rating downgrades probably start here, and no one comes out of it without damage to their reputations. And as already noted above, credit depends entirely on confidence. One can only assume that this will get central banks and their regulators to drop the whole bail-in concept in their attempts to ensure the survival of their commercial banking systems. Perhaps the Swiss should backtrack on their decision to save a paltry Sf17bn. We can understand and accept that Swiss banks get into trouble. But the Swiss authorities’ clumsy handling of the Credit Suisse crisis is risking its national reputation for financial probity and stability.

The broader problem is that confidence in banking is beginning to be publicly undermined. It is not just a matter of identifying the weakest links, but it is becoming a systemic problem of the widest proportions. The illusion of control by central banks is being shattered by the great credit unwind. Consequently, the policy priority is pivoting from the inflation mandate to pure survival. And as we have seen illustrated by the Swiss authorities, the scope for error is chasmic.

The G-SIB mess

Bail-in legislation was not the only G-20 response to the Lehman crisis. The Basel Committee’s third iteration of its regulations, still not fully implemented, was the Bank for International Settlement’s contribution to post-Lehman banking reform. The designation of a new category of bank, the global systemically important bank, or G-SIB, was created. G-SIBs are required to have additional capital buffers to address the systemic risks they are exposed to from international counterparties, relative to domestic regional banks.

Here are some relevant facts. At current exchange rates, total G-SIB balance sheet assets are recorded at $63,978 billion. But this is supported by only $4,444 billions of balance sheet equity, giving a ratio of assets to equity of 14.4 times. But this is not evenly spread, with the Eurozone’s seven G-SIBs averaging 19.7 times, and Japan’s three G-SIBs at 23 times. At the lower end of the scale, the US’s eight G-SIBs average 11.4 times and China’s four banks 12.0 times. All these ratios translate into unacceptable leverage when credit unwinds and interest rates increase, threatening to trigger rapidly rising levels of non-performing loans.

This is at least partially recognised in stock markets, where G-SIB shares commonly stand at significant discounts to book value. Only four out of the twenty-nine listed G-SIBs have price to book ratios greater than one. Based on last Monday’s share prices, the average price to book for Eurozone G-SIBs is a discount of 56%, for Japan 47%, for China 54%, and for the US it is only 7% bolstered by JPMorgan Chase and Morgan Stanley being the only two US banks trading at a reasonable premium to book value. There is considerable variance within these figures, but the message from the markets is clear: whatever the regulators and central banks say and despite their extra capital buffers, G-SIBs are still a risky investment.

These statistics do not tell the whole story. As we saw with the failure of Silicon Valley Bank, it was using widely adopted accounting methods to conceal losses on its bond investments. As of Dec. 31, 2022, SVB had about $120 billion in investments, primarily high quality bonds, such as US Treasuries and agency debt. According to its 10-K filed in February. the bank only had $74 billion of loans to borrowers. Therefore, its investments were significantly larger than its loans. Of the $120 billion in investments, $91 billion were classified as “held to maturity” investments and were not reported at fair value in each reporting period. Instead, they were reported at amortized cost, net of any reserves for credit losses in accordance with accounting convention.

SVB originally bought its bonds when the yield curve was positive. That is to say, the cost of short-term funding was less than the yield on the longer maturities which SVB bought. But when the Fed increased its fund rate from the zero bound, the yield curve turned sharply negative with two consequences for SVB. First, its short-term funding costs began to rise, and secondly the capital value of the bonds began to fall. Its shareholders’ capital on the balance sheet was soon wiped out, and belated attempts to rectify the situation simply broadcast SVB’s problems, leading to its demise.

It is a problem which is not confined to SVB. There will be other regional banks in the US and elsewhere which have fallen into the same trap. And it won’t be a problem restricted to regional banks. One can speculate that the incentive to buy longer maturity bonds than banks normally hold on their balance sheets was stronger in jurisdictions which imposed negative interest rates. A Eurozone or Japanese bank has had a zero or even slightly negative cost of short-term funding in their respective money markets, encouraging them to buy longer-dated government bonds. And like SVB, they will have been whipsawed by sharply rising short-term rates.

This leads us to speculate about how much of similar losses may be hidden in the entire G-SIB system. Like SVB, have they been sufficient to wipe out the notional shareholders’ capital of all the G-SIBs, which we know to be $4.444 trillion?

But this problem is not even the mother of all elephants in the room — that award goes to derivatives. The G-SIBs’ participation in regulated futures and over-the-counter derivatives is valued on their balance sheets at net mark-to-market values, which are very small fractions of their nominal values. Nevertheless, regulated futures are credit commitments for the full amounts, and should be valued as such. Options which have been sold are similarly commitments for their exercisable amounts, though bought options are not. The amounts of open interest involved at end-2022 are assessed by the Bank for International Settlements at $36,630bn for all regulated futures, and a further $43,182bn in options. These are just one side of open interest, the majority of which is bank exposure as market makers, traders, and banks acting as principals for their customers.

In OTC derivatives, foreign exchange and commodity contracts are liabilities for their full amounts, while credit swaps are not. At end-June 2022, foreign exchange contracts amounted to $109,587bn with a further $12,951bn in options. Commodity contracts add a further $2,341bn.[iii] We can exclude the large category of credit default swaps, because their gross values are purely notional. These exposures represent only one side of credit commitments, the other being distributed among non-bank financial institutions, hedgers, speculators, and other banks as well. From the G-SIBs’ collective balance sheet perspective, they should all be included at full value.

Last December, Claudio Borio, Head of the BIS’s Monetary and Economic Department even wrote a paper on this topic. Borio stated that “Foreign exchange swap positions point to over $80 trillion of hidden US dollar debt [part of the $109.587 trillion above], reported off-balance sheet”. And “The volume of daily foreign exchange turnover subject to settlement risk remains stubbornly high despite mechanisms to mitigate such risks”. In effect, Borio confirmed that for a true appreciation of global banking risk, gross OTC values for foreign exchange contracts should be recorded on both sides of bank balance sheets, and not just as net mark-to-market contract values.

Between regulated and unregulated derivatives, we are therefore staring down the barrel of a further $210 trillion of balance sheet liabilities, to be added to the $64 trillion of officially recorded total G-SIB balance sheets, all supported by only $4.444 trillion of shareholder’s funds. And while the US G-SIBs appear to be less leveraged than their opposite numbers in the Eurozone and Japan, it should be noted that as Borio points out the large majority of OTC exposure is in dollar-denominated contracts, for which the US G-SIBs are the counterparties.

If only one G-SIB fails, its counterparty risks could easily undermine all the others. As Borio pointed out, settlement risk remains stubbornly high. It explains why the Fed was ready to come up so swiftly with swap lines for the Swiss National Bank to aid it in its attempt to support Credit Suisse. And it allows us to draw a further conclusion: credit expansion at the central bank level to ensure the global financial system’s survival will place the greatest burden on the dollar, being the currency in which most of these derivative obligations are settled.

Can central banks actually handle a credit crisis?

Having invested in government and other bonds at the top of the market — a top created by them to be far higher than they would otherwise have been — central banks are now demonstrably bankrupt unless they recapitalise themselves. For all of them, excepting the ECB, it is theoretically easy to do but best done before commercial banks need their support.

The simplest way of recapitalising a central bank is by expanding its balance sheet assets in favour of equity instead of other liabilities. Delaying addressing the same problems faced by Silicon Valley Bank on the basis they need not doesn’t serve central banks well. The losses can be assumed to continue to accumulate as commercial bank credit continues to contract, because it is credit contraction which drives up the true level of interest rates. Already, the Bank of Japan has been accumulating financial assets at negative yields, so that even with a small rise on yields, its losses from last year are over four thousand times its balance sheet capital of only 100 million yen. Sooner or later, its credibility is bound to be questioned if it fails to address this issue.

But of all the central banks, the ECB is probably the most difficult to recapitalise. The ECB’s shareholders are not a single state, but the national central banks of the twenty member nations (including Croatia which joined the euro system in January). Unfortunately, with few exceptions the NCBs in the euro system are also all in need of recapitalisation.

Imagine the legislative hurdles. The Bundesbank, let’s say, presents a case to the Bundestag to pass enabling legislation to permit it to recapitalise itself and to subscribe to more capital in the ECB on the basis of its share of the ECB’s equity — the capital key — to restore it to solvency as well. One can imagine finance ministers being persuaded that there is no alternative to the proposal, but then it will be noticed by pedestrian politicians that the Bundesbank is owed over €1.1 trillion through the TARGET2 system. Surely, it will almost certainly be argued, if those liabilities were paid to the Bundesbank, there would be no need for it to recapitalise itself.

If only it were so simple. But clearly, it is not in the Bundesbank’s interest to involve politicians in monetary affairs. The public debate would risk spiralling out of control, with possibly fatal consequences for the entire euro system. It would be a row at the worst possible time. And with twenty NCB shareholders facing similar hurdles, their contributions to refinancing the ECB requires unanimous consent for proportional subscriptions in accordance with their capital keys.

Besides the confusion over bail-ins and bail outs which we can now hope has been settled, there still remains a huge question mark over whether the central banks have the wherewithal to discharge the potentially enormous burden of bail out commitments. In any event, it will need massive quantities of additional central bank credit in all relevant currencies to backstop the system. The destruction to balance sheets at both central and commercial bank levels reinforces the point, that central banks are likely to move their attention away from short-term interest rates over which they have lost control to bond yields which they can still influence. Different versions of the Fed’s Bank Term Funding Programme (more on which follows) are likely to be devised. It is becoming a hidden pivot.

The hidden pivot

In a classic banking crisis, bank balance sheets become overextended and bankers become cautious in their lending, restricting the expansion of credit. The credit shortage leads to higher interest rates for the few borrowers deemed creditworthy and able to pay them. Both producers and consumers are affected. The shortage of credit and higher borrowing costs result in businesses failing, and a slump in economic activity follows. This leads in turn to the problem identified by Irving Fisher, which he described as his debt-deflation theory.[iv] According to Fisher, when the cycle of bank lending turns down and higher interest rates and falling collateral values follow, it forces banks to call in loans, liquidating collateral and driving colateral values down further. The self-feeding nature of this phenomenon deepens the slump and leads to banking failures.

Fisher’s paper was published in the wake of record numbers of bank failures in America between 1930—1933. And it should also be noted that it has informed every state economist ever since. The fear of a slump exacerbated by collateral liquidation is in the back of every mainstream economist’s mind. But so far, there has been not much evidence of credit shortages undermining the non-financial economy. Presumably, the downturns in credit expansion reflected in broad money supply statistics have reflected banks withdrawing from financial activities, so the hit to non-financial activity is yet to come. But the issue of falling collateral values identified by Fisher has resurfaced in problems created by policy makers themselves, because the sudden rise in interest rates has had the same effect.

This is why we are now witnessing central banks pivoting from control of inflation to the preservation of the global commercial banking system. The danger of systemic failure is more hardwired into central bankers’ DNA than that of inflation. And frankly, they have proved pretty clueless on interest rate management anyway. They are set to do “whatever it takes” to preserve both financial market values and the status quo. But things have moved on from Mario Draghi’s famous aphorism. No longer just a finger-wagging threat, whatever it takes is likely to end up undermining the purchasing power of currencies. Whatever it takes is now an open-ended commitment to whatever it costs.

There can be no question that pivoting from fear of inflation to fear of a banking crisis undermines currencies. But central bankers appear to find it difficult to concede it publicly. The Fed’s solution is to offer to take in all US Treasuries, agency debt, mortgage-backed securities, and “other qualifying assets as collateral” at par with no haircut against cash liquidity for one year. Furthermore, with foreigners no longer net buyers of Treasuries, there is a funding problem to address.

The Fed stated that its new bank term funding programme (BTFP)

“…will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy. The Federal Reserve is prepared to address any liquidity pressures that may arise.”

It is a policy that might have been scripted by Irving Fisher’s ghost. The one-year term of the facility shows that the Fed regards this as a temporary problem to be reversed when the situation improves, and inflation returns towards its two per cent target. Yes, all the forecasts are still for inflation to be transient — only it is taking just a little longer than originally thought.

The BTFP is QE by another name, injecting credit into the banks —admitted in the Fed’s statement above. But we have seen that the Fed’s few attempts to reverse QE have always threatened the credit bubble. As soon as bankers realise that because of the history of quantitative tightening, which is what the ending of the facility will amount to, the loan terms can be regarded by them as perpetual. Any bond standing at a discount can be collateralised with the Fed at final redemption value, notwithstanding its current market value at a discount. Already, this has driven the 10-year US Treasury yield below its major moving averages, indicating further falls in yield are to come.

Clearly, this is a facility which is likely to lead to a massive and additional expansion of the Fed’s balance sheet. But by putting a one-year loan term on this facility, the Fed will feel justified in disregarding the automatic loss the BTFP facility creates on the basis that the bonds bought will simply returned to the sellers who will repay the money borrowed. It will be treated like a long-term repurchase agreement.

While we know that realistically this repo will turn out to be perpetual, purchases in the market by banks to benefit from the BTFP facility allows the Fed to reduce its losses on its existing bond holdings as their yields fall further. And importantly, the government’s deficit will continue to be funded.

The banking crisis similarly exists in other jurisdictions, so it is likely that the other major central banks will introduce their own versions of the Fed’s BTFP. All that’s required is an unhealthy dose of group-thinking that the inflation monster will retreat into its cave, and that therefore the outlook for bond yields is for them to fall. Driving this hope is the benefit to central bank balance sheets, which if their assets were properly valued currently puts them all deeply into negative equity.[vi]

If it works, the pressure will diminish on banks with bonds shown as held to maturity and the situation might become manageable. But there is still the ongoing problem of credit contraction, which is not going to go away. Can the Fed suppress bond yields by much when the real cost of borrowing, which is driven by credit contraction, continues to rise? The Fed’s BTFP looks like its final gamble.

The refuge from this credit crisis is only real money — gold.

This article attempts to explain the true state of global credit. Everything appeared to be fine, until the Fed realised it was losing control over interest rates and had to raise them from the zero bound. This was followed by other central banks, with the lone exception of the Bank of Japan. Consequently, the global credit bubble which had been inflating financial asset values over the last forty years, has now burst.

Anyone who dispassionately analyses credit conditions must come to this conclusion. Furthermore, far from being an unexpected shock, we are seeing just the start of a great unwind — a great unwind which will continue to impose mounting strains on the global banking system. Even at the first hurdle, it has become clear that the world’s leading central banks in their dollar-based credit system will do whatever they can to preserve it. This is as expected, but the consequences are that the dollar’s credibility as credit will continue to be undermined as rescue after rescue proceeds.

First it was a banking crisis, and that is just the beginning of it. Now the Fed is acting to save financial asset values, likely to be followed by the other members of the central banking cabal. Then it will be the non-financial economy, as malinvestments and over-extended consumers are exposed, leading to further banking write-offs. And finally, it will be governments themselves, faced with soaring welfare costs and collapsing tax revenues, exacerbated by foreigners no longer buying Treasuries. There is only one probable outcome: being only credit, national currencies will eventually lose their credibility.

The root of credit valuation woes is that one form of credit, being that in the hands of commercial bank creditors, depends for its value on another form of credit, being manifest in bank notes. But unbeknown to most people, a bank note is not money: it is a credit liability of a central bank. An incorporeal form of wealth is wholly dependent upon another. But as we have seen, the rottenness of the credit system is not confined to a few bad apples in the banking system. The entire contents of the credit basket are rotten, from the top down.

For individuals, there is only one escape from the inevitable destruction of the value of credit. And that is to get out of the collapsing credit system altogether. The collapse may appear slow today, but at some indefinable stage in the future, it will become sudden. It won’t be just the sceptics and cynics finding fault in the system, but the general public will lose faith in their currencies. And when they do, the point of no return has been passed.

The corporeal, as opposed to incorporeal form of credit is gold. It is credit without any counterparty. It is credit only in the sense that it is the unspent product of labour and profit. This distinction allows us to define gold as the only stable medium of exchange, or true money. Gold has been money since the end of barter. In today’s monetary system, it has been legal money since Roman coin came into existence, which according to the Roman juror Gaius was at the time of the Duodecim Tabularum, the Twelve Tables ratified by the Centuriate Assembly in 449 BC. Credit comes and goes, but gold is there for ever.

Dman something BIG is unfolding there! I've got an itchy feeling![]()

$DMAN hard at work scouting new local partners to support their nursery and processing operations. Here is a beautiful shot at one of the many sites we visited today! pic.twitter.com/S9ixowYMi5

— Demand Brands (@DemandBrands) March 20, 2023

$DMAN Back In Business! 7.7M shares traded today. The next run has begun!

#CANNABIS_NATION: GOES Cruisin Tikis....![]()

https://youtu.be/j-QlA7Lj3OI?t=10

I agree Cap! Lets stay in touch.

#CANNABIS_NATION: Hey cuckoo....i-hub sure has screwed up it's Web-site....

I no longer post dally ...

It's been a great run all these years..

Let's stay in touch..

https://twitter.com/CaptainMonet

https://www.reddit.com/r/interestingasfuck/comments/11c02jm/southern_california_is_currently_getting_hit_by/

blob:https://www.reddit.com/a4ea4dc7-c8a5-406c-9fe2-07f84ea2ab3d

https://www.reddit.com/a4ea4dc7-c8a5-406c-9fe2-07f84ea2ab3d">https://www.reddit.com/a4ea4dc7-c8a5-406c-9fe2-07f84ea2ab3d" />

Must've been another case of climate change..

#CANNABIS_NATION: CHECK THIS OUT...DIED SUDDENLY...!

https://pirate-bays.net/search?q=DIED+SUDENLLY

MIN. 45....!

$DMAN 4M+ shares traded so far today! Penny Plus incoming..

|

Followers

|

100

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3331

|

|

Created

|

11/11/16

|

Type

|

Free

|

| Moderator Captainandy | |||

| Assistants CrazyKar123 cuckoo 4 cocoa puffs | |||

Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci Retracements are 61.8% and 38.2%. Note that 38.2% is often rounded to 38% and 61.8 is rounded to 62%. After an advance, chartists apply Fibonacci ratios to define retracement levels and forecast the extent of a correction or pullback. Fibonacci Retracements can also be applied after a decline to forecast the length of a counter trend bounce. These retracements can be combined with other indicators and price patterns to create an overall strategy.

This article is not designed to delve too deep into the mathematical properties behind the Fibonacci sequence and Golden Ratio. There are plenty of other sources for this detail. A few basics, however, will provide the necessary background for the most popular numbers. Leonardo Pisano Bogollo (1170-1250), an Italian mathematician from Pisa, is credited with introducing the Fibonacci sequence to the West. It is as follows:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610……

The sequence extends to infinity and contains many unique mathematical properties.

1.618 refers to the Golden Ratio or Golden Mean, also called Phi. The inverse of 1.618 is .618. These ratios can be found throughout nature, architecture, art and biology. In his book, Elliott Wave Principle, Robert Prechter quotes William Hoffer from the December 1975 issue of Smithsonian Magazine:

….the proportion of .618034 to 1 is the mathematical basis for the shape of playing cards and the Parthenon, sunflowers and snail shells, Greek vases and the spiral galaxies of outer space. The Greeks based much of their art and architecture upon this proportion. They called it the golden mean.

Retracement levels alert traders or investors of a potential trend reversal, resistance area or support area. Retracements are based on the prior move. A bounce is expected to retrace a portion of the prior decline, while a correction is expected to retrace a portion of the prior advance. Once a pullback starts, chartists can identify specific Fibonacci retracement levels for monitoring. As the correction approaches these retracements, chartists should become more alert for a potential bullish reversal. Chart 1 shows Home Depot retracing around 50% of its prior advance.

The Fibonacci Retracements Tool at StockCharts shows four common retracements: 23.6%, 38.2%, 50% and 61.8%. From the Fibonacci section above, it is clear that 23.6%, 38.2% and 61.8% stem from ratios found within the Fibonacci sequence. The 50% retracement is not based on a Fibonacci number. Instead, this number stems from Dow Theory's assertion that the Averages often retrace half their prior move.

Based on depth, we can consider a 23.6% retracement to be relatively shallow. Such retracements would be appropriate for flags or short pullbacks. Retracements in the 38.2%-50% range would be considered moderate. Even though deeper, the 61.8% retracement can be referred to as the golden retracement. It is, after all, based on the Golden Ratio.

Shallow retracements occur, but catching these requires a closer watch and quicker trigger finger. The examples below use daily charts covering 3-9 months. Focus will be on moderate retracements (38.2-50%) and golden retracements (61.8%). In addition, these examples will show how to combine retracements with other indicators to confirm a reversal.

Chart 3 shows Target (TGT) with a correction that retraced 38% of the prior advance. This decline also formed a falling wedge, which is typical for corrective moves. The combination raised the reversal alert. Chaikin Money Flow turned positive as the stock surged in late June, but this first reversal attempt failed. Yes, there will be failures. The second reversal in mid July was successful. Notice that TGT gapped up, broke the wedge trend line and Chaikin Money Flow turned positive (green line).

Chart 4 shows Petsmart (PETM) with a moderate 38% retracement and other signals coming together. After declining in September-October, the stock bounced back to around 28 in November. In addition to the 38% retracement, notice that broken support turned into resistance in this area. The combination served as an alert for a potential reversal. William %R was trading above -20% and overbought as well. Subsequent signals affirmed the reversal. First, Williams %R moved back below -20%. Second, PETM formed a rising flag and broke flag support with a sharp decline the second week of December.

Chart 4 shows Pfizer (PFE) bottoming near the 62% retracement level. Prior to this successful bounce, there was a failed bounce near the 50% retracement. The successful reversal occurred with a hammer on high volume and follow through with a breakout a few days later.

Chart 5 shows JP Morgan (JPM) topping near the 62% retracement level. The surge to the 62% retracement was quite strong, but resistance suddenly appeared with a reversal confirmation coming from MACD (5,35,5). The red candlestick and gap down affirmed resistance near the 62% retracement. There was a two day bounce back above 44.5, but this bounce quickly failed as MACD moved below its signal line (red dotted line).

Fibonacci retracements are often used to identify the end of a correction or a counter-trend bounce. Corrections and counter-trend bounces often retrace a portion of the prior move. While short 23.6% retracements do occur, the 38.2-61.8% covers the more possibilities (with 50% in the middle). This zone may seem big, but it is just a reversal alert zone. Other technical signals are needed to confirm a reversal. Reversals can be confirmed with candlesticks, momentum indicators, volume or chart patterns. In fact, the more confirming factors the more robust the signal.

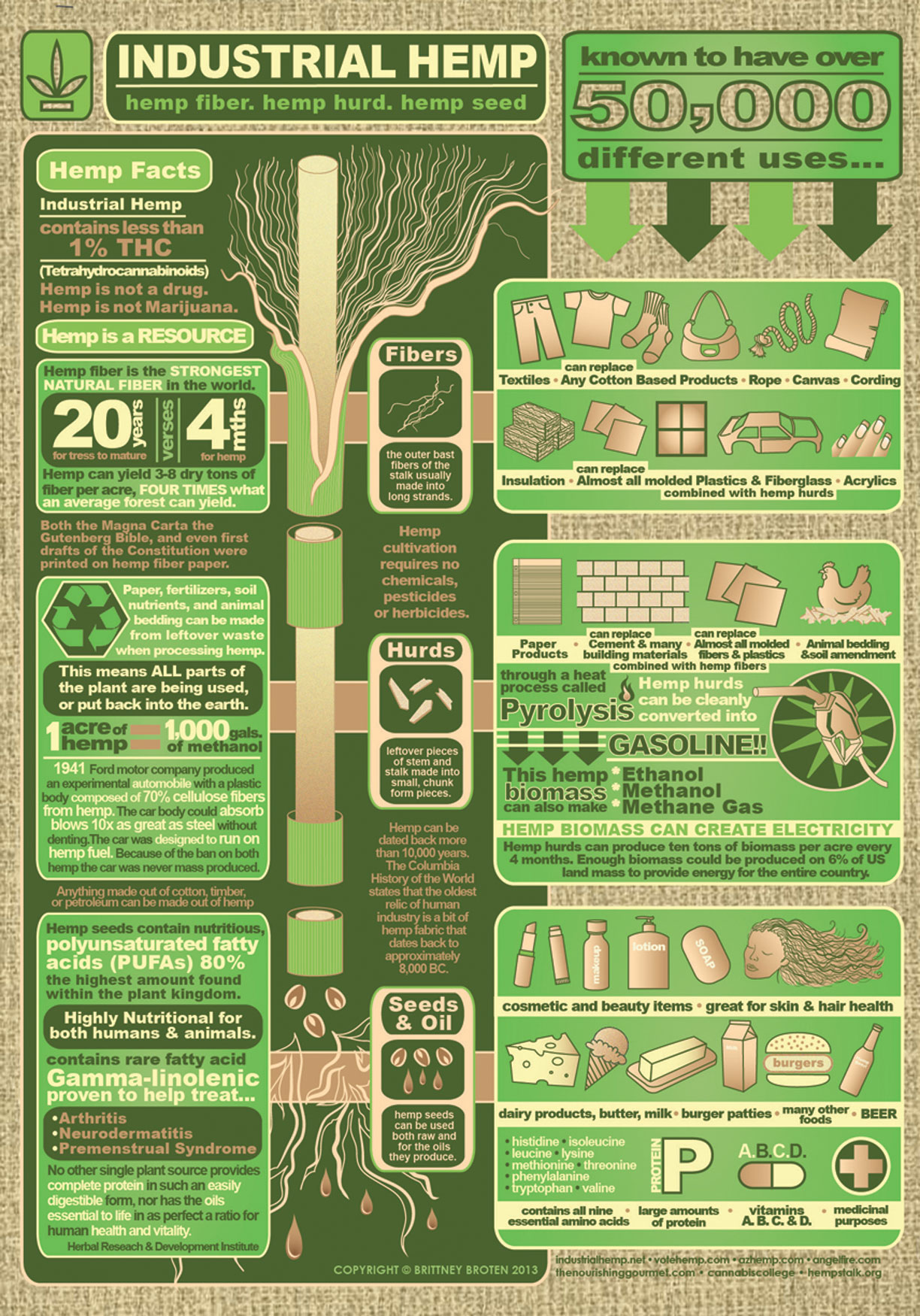

| Ailment | Strains to Investigate |

| Acid Reflux | See Gastrointestinal below. |

| ADD / ADHD | Blue Dragon (Sour Diesel x Blueberry), Blue Dream, Bubba Kush, Shiva X, Double Dutch, G13, Purple Haze, NYC Diesel, White Rhino, Trainwreck, OG Kush, Orange Bud, Northern Lights x Big Bud, Northern Lights x Haze, Gorilla Grape, Raspberry Kush, |

| AIDS / HIV | Blueberry, OG Kush, Casey Jones, Purple Haze, Maui, Triple Diesel, Snoop's Church, Blue Dragon, Blue Haze, |

| Alzheimer's | 4-Way (aka four way), 303, Acapulco Gold, Optimus Prime, Northern Lights x Haze, Y2K, Willie Nelson, Pure Power Plant (PPP), Panama Red, Gorilla Grape, Eldorado, |

| Anorexia | Orange Crush, Orange Kush, OG 18, Oasis, Northern Lights, Papaya (aka Mango), XXXtra Skunk, Ozzy, Raspberry Kush, |

| Anxiety | Northern Lights, Purple Kush, Cherry Kola, Orange Kush, C2, Big Cheese, Master Kush, Kashmir, Blue Dream, Maui Waui, |

| Arthritis | OG Kush, Blue Dragon, Jack the Ripper, White Diesel, Lemon Skunk, The Black, Afghan, |

| Asthma | 15% THC or better recommended. Orange Crush, Cali Gold, Belladonna, Master Kush, Sour Diesel, Big Cheese, Casey Jones, Jacks Cleaner, Kush, Blue Dragon, Big Cheese, Master Kush, Vortex, Gorilla Grape, |

| ASD / Asperger's Syndrome | See Autism below. |

| Autism | High sativa content strains are recommended; LA Confidential is one to try. Blue Haze, |

| Bipolar Disorder | 20% Sativa - 80% Indica hybrids. 4-Way, Blackberry Kush, Dutch Treat, Skunk #1, Lemon Skunk, Pakalolo, Eldorado, Raspberry Kush, |

| Brain Damage | Banana OG, Cannatonic, Panama Red, Kali Mist, Aurora Indica, |

| Cancers | Please see here. Phoenix Tears (oil), Also investigate Joshua Stanley and the Stanley brothers. Blue Dragon, |

| Cerebral Palsy | Tessa, Death Star, Blackberry Kush, Cali Gold, Purple Urkle, |

| Chronic Pain | Indica hybrids (Indica x Sativa) for pain symptoms. Grand Daddy Purple, God's Gift, Cali Hash Plant, C2, OG Kush, Master Kush, Vortex, Pineapple Express, Kashmir, Maui Waui, Sour Diesel, Blue Cheese, Northern Lights/Haze, Afghan, Shiva, |

| COPD | Indica dominant hybrids. |

| Crohns Disease | OG Kush, Blue Dragon, Purple Pheno, Ultimate Trainwreck, |

| Diabetes | Jack Herer, Sour Diesel, Hemp Oil, Gorilla Grape, Five-O, |

| Depression | Blue Dragon, Big Cheese, Vortex, Lemon Diesel, Pineapple Express, Blue Cheese, Kashmir, AK-47, Blue Dream, Cherry Cough Syrup, Maui Waui, Tangerine Dream, God's Gift, Grand Daddy Purple, Y2K, Willie Nelson, |

| Epilepsy | Master Kush, OG Kush, Pure Power Plant (PPP), Blue Dragon, Shaman, Eldorado, |

| Fibromyalgia | OG Kush, Master Kush, Blue Dragon, |

| Gastrointestinal | OG Kush, Master Kush, Blue Dragon, Willie Nelson, God Bud, Shoreline, |

| Glaucoma | Cherry Kola, Maui Waui, Willie D, Zombie Virus, Remus, |

| Heartburn | See Gastrointestinal |

| Indigestion | See Gastrointestinal |

| Inflammation | See Arthritis |

| Insomnia | Blue Cheese, Cherry Kola, Cali Hash Plant, Orange Kush, Big Cheese, Master Kush, Chem Dog, Kashmir, AK-47, God's Gift, Sour Diesel, NYC Diesel, God Bud, |

| Leukemia | Visit phoenixtears.ca for cannabis oil knowledge. Also investigate Joshua Stanley and the Stanley brothers. |

| Loss of Appetite | Northern Lights, Blue Cheese, OG Kush, Orange Crush, Big Cheese, Master Kush, AK-47, Tangerine Dream, |

| Menstrual | Lemon Diesel, |

| Migraine Headaches | Critical Mass and XJ-13 (Indica dominant or 100% pure Indica), Purple Kush, Big Bud, Blue Dragon, Kush, Master Kush, AK-47, Grand Daddy Purple, Wonder Woman, |

| Multiple Sclerosis | Master Kush, OG Kush, Cherry Cough Syrup, Northern Pride, Northern Lights x Shiva, Wonderberry, Willie Nelson, Pure Power Plant (PPP), Purple Haze, Ozzy, Five-O, Raspberry Kush, |

| Muscle Spasms | OG Kush, AK-47, Mater Kush, Hindu Kush, Hollands Hope, Gorilla Grape, Sensi Star, |

| Nausea | Sour Diesel, Big Bud, OG Kush, Blue Dragon, Orange Crush, Cherry Cough Syrup, Pure Kush, Remus, |

| OCD - Obsessive Compulsive Disorder | Kush Wreck, Kia Kush, Kahuna, Himalayan Gold, Great White Shark, Shoreline, Shiva Skunk, Silver Afghani, |

| Pain | Sour Diesel, C2, OG Kush, Kush, Pineapple Express, Kashmir, Maui Waui, Grand Daddy Purple, Zombie Virus, Shiva, Also see Chronic Pain. |

| Parkinson's Disease | 303, Pure Power Plant (PPP), Purple Dragon (Apalala), Super Haze, Eldorado, |

| PTSD | Start here. Master Kush, OG Kush, Blue Dragon, |

| Recurring Polio | Sativa hybrids, (Sativa x Indica), (60:40) for all other symptoms. |

| Relaxation | Big Cheese, Orange Crush, Master Kush, |

| Rheumatism | See Arthritis |

| RLS - Restless Leg Syndrome | Power Kush, |

| Scoliosis | See Chronic Pain |

| Skin Cancers | See here. Phoenix Tears (Oil), Also investigate Joshua Stanley and the Stanley brothers. |

| Stress | Northern Lights, Cherry Kola, Big Bud, Orange Crush, Big Cheese, AK-47, God's Gift, Zombie Virus, Wonder Woman, Afghan, Power Kush, Ozzy, |

| Tourette's | Island Bud, Jack Flash, Isis, Honeymoon, Hells Angel, Gorilla Grape, Grenadine, Green Devil, Grapefruit Haze, Grapefruit Kush, Shiva, |

Is life so dear, or peace so sweet, as to be purchased at the price of chains and slavery? Forbid it, Almighty God! I know not what course others may take; but as for me, give me liberty, or give me death!

Patrick Henry - March 23, 1775

The horned man in question is none other than 32-year-old Jake Angeli, a familiar face at pro-Trump rallies and a purported QAnon conspiracy theorist sometimes referred to as the “QAnon Shaman,” according to the Arizona Republic’s website.

|

Posts Today

|

0

|

|

Posts (Total)

|

3331

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |