Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Q) - Hi Tom, Would you mind reposting your "Black Swan Rule" for dealing with a stock that has dropped and depleted its cash supply?

Thanks

Adam

A) - Hi Adam, Re: Black Swan Rule......................

I think I first used this idea back during the 2008-09 Financial Crisis. There are times when we do run out of cash in our AIM accounts. The price/share can then move downward or maybe our AIM buying has been solid and the price just seems to stall at that low level. That's never fun when we're AIMing for profits.

The idea is to use our lowest buy price as the base for "black swan" trading. We take that price and divide it by 0.80. That will give us the price target at which we will willingly sell our minimum share allotment. This price may be significantly below what AIM would like for our target. That's okay as AIM will adjust accordingly. It will also be a profitable trade based upon our lowest/last buy price (approx +20% profit).

If/When we get a Sale at that price, we then revert to AIM's next target after that trade is entered. Should the stock price again cycle downward, we'll re-use the last Buy trade price as our buy target. If/When the price drops to trigger that black swan buy, we'll again buy the shares back. We'll again use the 0.80 divisor which should give us a target very close to the previous Black Swan selling price. Rinse, Repeat.

While the stock price is bouncing and bottoming we'll possibly be able to capture some profits with those moves even if the price/share doesn't reach AIM's target for selling. As stated, once the first sale has occurred, we switch AIM back on and use its suggested next sell target price. Once we've worked AIM out of being cash strapped, we just follow AIM's target prices again.

Hope you don't have to use it, but it's nice to have a plan!

Best wishes,

OAG Tom

Buy from the Scared; Sell to the Greedy.....

Q) Hi Tom!

Happy President's Day. :)

I've been backtesting AIM and learning a lot.

1) question for you:

During a severe bear market (2008 scenarios), what do you do when you're running out of cash to buy?

Do you get more cash from other accounts?

Or let it weather the storm and wait for months until it sells and generates cash again?

For example, if I run GOOGL from Nov 2007 to Jan 2010:

The cash portion gets drained quickly and is cash-negative for about 7-13 months.

(Depending on initial cash position of 30% to 50%)

What do you do in the months where AIM wants you to buy, but is out of Cash portion?

2) Also, related to my previous question about running out of cash during bear markets:

You wrote : "I now have a habit of adding 5% to the Buy SAFE each time I buy. That helps to slow the cash burn rate a bit. Then, when selling starts to occur, I reduce the SAFE back to 10% from wherever it was after the buy cycle."

Do you have a cap for Buy Safe %?

And how many sells does it take before you reduce Buy Safe back to 10%?

Thanks!

A:

Hi CCL,

1) Good question! It's painful to run out of cash for AIM users, but far less so than for Mr. Buynhold. Those less than enjoyable times can be improved slightly with a technique I've been able to use a couple of times. I call it the "Black Swan Method."

With the Black Swan method I take the last buy price and divide it by 0.80. That becomes my "next Sell price" for a minimum size trade. This can be quite a bit lower than what AIM would be suggesting as a Sell target price. Should the price rise to this new, lower target I'll sell the minimum shares designated by the percentage of Portfolio Control I've been using. This is even though the price/share is lower than AIM suggests. Once that sale has been made, I then won't sell again until AIM comes back into selling range. If the price/share continues to rise, eventually AIM will sell and start to accumulate cash again.

However, it's possible that the bottoming process of the market will bounce a few times. I use the last Buy Price that drained the cash to zero again as my buy target. If the price drops to that previous price, I'll buy the minimum amount once again. Once more I'll set that same non-AIM target in place for selling a minimum amount of shares. This way, if the bearish period before recovery continues for a long time, at least I'll be able to clip some coupons profitably while low on cash and awaiting the Market Pendulum to swing back toward its mean.

I've not had a lot of these black swan events occur, but this method has worked well when it has occurred.

There is another possibility that I've never used. It's the use of Margin Buying. While I've studied it I've never used it. Most investors are 100% invested at market tops where AIM users are not. Some are using Margin buying even near market tops and are 150% invested (100% stock + another 50% borrowed)! We AIM users buy into the market weakness until our cash is exhausted. By coincidence, many times that will be around the market bottom. If we were to continue buying by borrowing on margin but using AIM as our guide, it looks potentially successful as a way to continue buying. If the market is truly bottoming, then we won't have margin exposure for very long. AIM will get back to selling and back-fill the margin position and then continue selling and rebuilding our cash reserve. Like I said, I've never done this in all the years I've been using AIM even though theoretically it looks like a good plan. Most investors use Margin at the wrong time - near market tops. This theory says AIM's far smarter and would only consider using Margin at or near market bottoms.

You can back test this idea by letting your spreadsheet go to negative cash reserves as AIM continues to buy on Margin. It should shorten the overall recovery time. Proceed with CAUTION!!!

2) As soon as AIM reverts to selling, I reduce the Buy SAFE back to its standard 10% level. I've had a couple of individual stocks take the Buy SAFE as high as 40% with many sequential buys. At each level, I buy only the minimum amount at the suggested price indicated with the higher Buy SAFE.

AIM can and does run out of cash periodically. CASH is the Precious component and lubricant for the AIM engine. AIM CANNOT run out of shares, however. Since we're selling only a portion of the remaining shares, the shares are inexhaustible.

Best wishes,

OAG Tom

So why do I need AIM? Because I never mastered the art of taking profits. I would bet that for most private investors, this is by far the hardest part of the game. AIM offers a rational, systematic approach that forces me to take partial profits as prices rise.

Hi Saul,

I'm glad I could assist. Please feel free to ask questions if you don't find what you need.

Note on our AIM Users page we update our market risk measure, the v-Wave, weekly. It's bearish right now and doesn't show signs of relaxing.

A general rule would be to not start any new investments when the v-Wave is bearish and follow all AIM directed sell suggestions.

When Neutral, start new AIM holdings with the appropriate cash suggested by the v-Wave.

When the v-Wave is Bullish, check seat cushions, penny jars and all other sources of liquidity and plow it into the markets as AIM gives out Buy orders.

Best wishes,

Tom

Hi Tom,

Thanks for the several links and references you sent. They have already been very helpful.

I have fired up my AIM first spreadsheet in many years and am searching for a few stocks to start with. Because I believe the market is overvalued at this time, I have some misgivings about starting any real AIM accounts at this time. It's therefore likely I'll begin with a couple of trial accounts and expand from there.

I do miss the Newport software, but I stopped using it years ago when it ceased to keep up with changes in hardware and operating systems. I don't have an XP machine handy, all Mac now, so I'll be spreadsheet based going forward.

Now I'm off to look for explanations of Split Safe and Vealies in my old AIM notes.

Your assistance is greatly appreciated!

Plexto (Saul)...

Welcome back Saul aka Plexto,

There's some refresher info at the old AIM site that is kept here:

http://web.archive.org/web/20120830055133id_/http://www.aim-users.com/index.html

and there's a freebie spreadsheet done ages ago in Excel here:

http://web.archive.org/web/20120623150522id_/http://www.aim-users.com/aimware.htm

Note on that second page there's the "quick AIM calculator." Current AIM user, TooFuzzy, built the page for us. If you keep track of your Portfolio Control on paper, it will always give you your "next buy/sell" prices quickly and easily.

The Newport software is gone as of the advent of 32 and 64 bit computers. However if you have an operational XP computer, it will run on that. Fellow AIM board attendee, Clive, has made it available and you can read about it here:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=95350611

I hope this helps a bit. Please feel free to ask questions on the main AIM BB as you'll more than likely get a quick reply.

Best wishes and welcome back,

OAG Tom

Hi Tom,

After several years pursuing profits in other investing areas, I have started looking back into AIM. I noticed that the old software programs have disappeared although a website still exists.

I can't get access to my old user name so I have created another to use here at IH. I've spent a little time poking around the message boards to see what specific AIM information is available. It's pretty scattered so I was wondering, aside from Lichello's starter book, if there was a site or set of links that would be useful as an AIM update. A source of reasonably priced pre-built spreadsheets would be rather helpful.

Not sure how to send a message on this board so excuse my Newbie efforts.

Thanks in advance for any help you can give me. It's good to find you still helping folks on the several AIM boards you post on.

Saul Seinberg (Plexto)...

-Q-

Manish from India. Great fan of yours & Mr Lichello & AIM system that is your personal passion.

After using and studying AIM, not able to resolve in my mind of one core question:

is AIM an investment system or trading system at heart?

Also, how many cycles it requires to beat Buy& Hold.

Thanks Sir

-A-

Dear Manish,

Thank you for your note of introduction and AIM comments. Yes, since first reading Mr. Lichello's book back in 1986 I've found AIM to be the ultimate contrary system for long term investors. Your excellent question can only be answered by addressing both ideas:

The fundamental question AIM answers is "How much more or less are you willing to risk today than at a previous point in the equity price cycle?" With that in mind I'd call AIM an investment Risk management system.

AIM can also be considered a profit capture system (trading system?). Many trading systems abhor down trends and will sell out (even at a loss) if the markets move against their positions. AIM's internals don't follow such thinking. It will build a position with more inventory at a nice discount to maintain a pre-determined risk threshold in that investment. (Buy from the Scared) AIM will also not let too much value to build above the current risk threshold before it starts to reduce the amount at risk and capture profits. (Sell to the Greedy)

Seeing as the change in value between AIM's accumulation phase and its distribution phase is around 15% to 30% depending upon AIM settings, the trading isn't high in Frequency. Most "traders" would be bored to tears with AIM. In that sense AIM isn't very close in nature to most other trading systems.

Because of AIM's high amplitude range of profit capture, the trade frequency is pretty low for most diversified investments and even most individual company stock investments. AIM generally will exceed Buy and Hold once AIM has accumulated more shares (or invested value) than the Buy/Hold starting position. So, if one starts with 50% invested (original AIM) in the AIM engine it will take more cycles than if it starts with 80% invested (AIM-High). Once AIM pulls ahead it might trade the lead once or twice over the next price cycles but will then usually pull into the lead and stay there.

Starting with 50% invested if the cycles are deep enough to exhaust the cash reserves, it takes 3 or 4 cycles to pull completely ahead of B&H. Starting with 80% invested, it should take fewer cycles to achieve value in excess of the Buy/Hold investor.

Best wishes,

OAG Tom

Hi Tom.

Ah! Ye-old Lotus-123 charts in that link bring back memories :)

In another post https://investorshub.advfn.com/boards/read_msg.aspx?message_id=155969449 I indicated how since 2000 has been somewhat similar to the 1970's, the era that drove Lichello to devise the original classic 50/50 AIM.

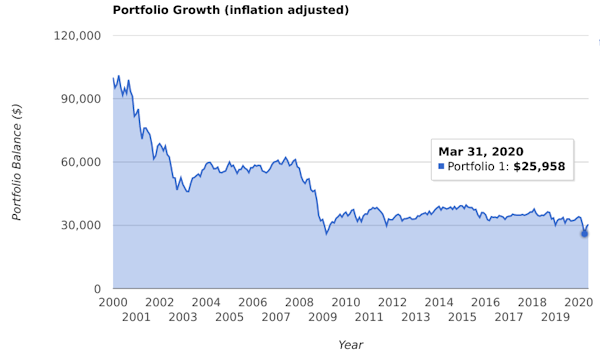

Looking at how a all stock investor who started in 2000, applying a 4% SWR out of total returns ... and in inflation adjusted terms had they persisted with that to present/recent then ...

they'd be sitting on inflation adjusted portfolio value of around 25% of the Jan 2000 start date $100,000 amount. Ouch!

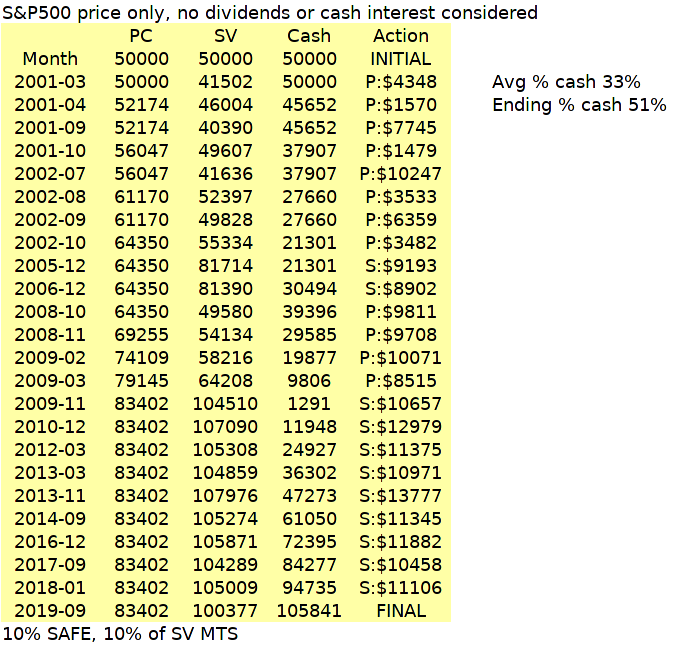

Standard AIM, 50% initial cash, 10% SAFE and Min Trade Size would have seen % cash dip near to perfect timing of the 2009 declines, and have subsequently rebounded back up to 50% % cash levels, averaging 33% cash overall since 2000.

AIM of just stock price (S&P500), no dividends nor cash interest included, would be up in inflation adjusted terms by 35%, but did see dips down to be lagging inflation at times.

Depending on where/how you had cash invested then along with dividends the combined dividends + cash interest from stock + cash holdings might have paid out a average 3.7%/year 'salary' (income) according to my approximation/cash for preferred choice of 'cash' holdings over that period. So pretty much broadly offset inflation + providing a 4% inflation adjusted income type outcome from standard AIM since 2000.

Pretty much adds further to that post suggesting since 2000 being like the 1970's over again observation.

Unlike the 1970's where events/circumstances had high interest rates (low prices) after investors took large hits, we are seeing the complete opposite of very low interest rates/high prices. So whilst investors whose portfolios did get through the 1970's bad times were relatively quickly compensated subsequently (the great 1980's/90's Bull run), we're perhaps unlikely to see such compensation any time soon.

Regards. Clive.

Thank you Clive, Re: Long Term AIM "by the book".................

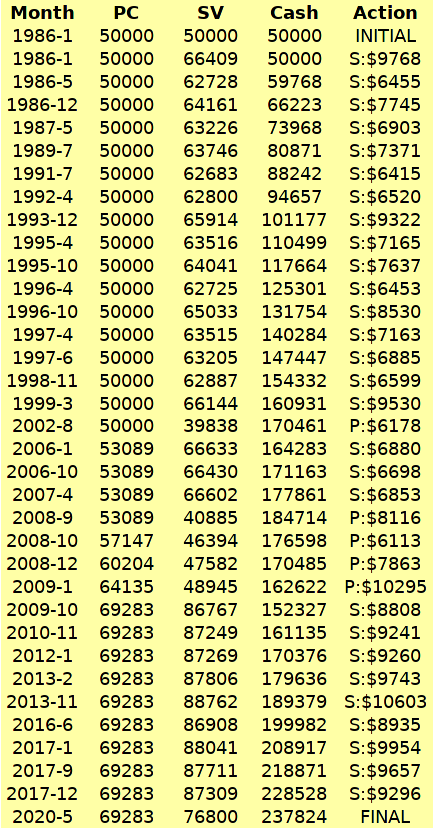

Your example shows how well AIM manages the amount at risk. It also shows that AIM can be used as a cash cow during a primarily bullish period.

Period Cash Change Stock Value Change

'86 to -96 +150% +25%

'96 to '06 +31% + 6%

'06 to '16 +22% +30%

'16 to Date +19% -12%

AIM Cash Accumulation is a feature not a bug.

I use the risk indicators to determine the appropriate maximum level of cash held in reserve. When max'd out I then use a combination of selling and vealies to contain the cash at that max level. If risk goes up, I follow AIM's selling guides to let the cash level rise. If risk goes down, I use more vealies to hold cash steady in dollars but let the percentage fall off to the new lower risk level.

Hi Jim, Re: Twinvest Info..................

In most of the AIM books (Revision 2 and later) look at Chapter 15. It gives the particulars on Twinvest. If you don't have it in your AIM book I can scan the few pages and post them here.

OAG

Tom

I have Lichello's book, but where can I get further on his book and especially Twinvest. Thanks So Much, Jimbo

I use the risk indicators to determine the appropriate maximum level of cash held in reserve. When max'd out I then use a combination of selling and vealies to contain the cash at that max level. If risk goes up, I follow AIM's selling guides to let the cash level rise. If risk goes down, I use more vealies to hold cash steady in dollars but let the percentage fall off to the new lower risk level.

RE Risk indicators

Once I decide what I want to own it just doesn't matter.

I only trade price as guided by Aim.

Toofuzzy

Q:......

Hi Tom, What are the four risk indicators you are using?

Everyone else, are there risk indicators that are different than Tom is using that you find useful?

Me, I'm stumbling around on this as the various ideas I've tried, as well as the ones from various web sites I've looked at are all a jumble with little proven track records although many claim a good history.

Conference Board Leading Economic Index (LEI) is one that Zacks suggests as well as US Department of the Treasury Yield Curve.

The University of Michigan Consumer Confidence numbers is another possibility but I'm not sure I trust it all that much as it is quite subjective. There are other indices that attempt to measure comfort with risk but my perception is that in reality, this kind of indicator relies more on intuition than data.

Thanks, Allen

A:......

Hi Allen, Re: Market Risk data and how it's used............

I use four things that measure the following:

Market Valuation relative to risk free rate of return or CPI

Inflation rate, whichever is larger (Elaine Garzarelli first pointed out

this component with her combination of market P/E + ST Interest Rates)

Speculation as determined by how well the best performing stocks

are doing compared to the worst (My own creation determined from pattern

recognition over many years)

Investor Consensus as measured by a modified version of the

Fosback High/Low Logic Index

IPO Activity as compared to merger/acquisition activity (my own

creation determined from pattern recognition over many years) This one shows a different type of investor speculation.

Generally I used one standard deviation from the median value of each component as a determination of its bullishness or bearishness. Each is smoothed, weighted and summed as a part of the total so that any one component can potentially drive the total to bullish or bearish sentiment.

Interpretation comes with consensus of the components. If just one is bullish or bearish I take note. But if more are also aligning themselves in the same sentiment I pay far deeper attention. For instance, in late January of 2016 I had three of the four components showing a strong Bullish signal which proved to be the right thing to understand. From that date (01/22/2016) with the NASDAQ at 4488 and the S&P 500 at 1880 for the previous week's close we've had a nice run-up.

In 2007 we had a string of bearish signals with the last being on 11/12/2007. At that time the NASDAQ was at 2628 and the S&P 500 was at 1454. A year later the NASDAQ was at 1647 and the S&P was at 931. This again was a pretty good call but had just two components in bearish harmony (valuation and investor consensus).

Going back to 2008, the bullish signals started in late October and continued each week through June of 2009 when the risk indicators finally moved generally back to a neutral status. During that time three of the four components were all bullish. Occasionally all four were bullish.

Of the four, the valuation component has been the most reliable over the years since 1982 (the earliest for which I have data). Investor consensus has been the most erratic and seems to be better at short term forecasting. Speculation has been very good at making bullish calls going 6 to 12 months out. The IPO activity component doesn't give many signals but when it does, they seem to be very good.

I look at, but don't track, Advances vs Declines on a weekly basis. It's better at reflecting the previous week's sentiment than predicting the future. However, it has some value as a short term indicator.

Norman Fosback's book "Stock Market Logic" is a worthy read on learning about dozens of market risk indicators. He reviews each, offers statistics on their effectiveness and then, occasionally, improves on them if possible.

Hope this helps.

Re: Further on Feedback to Portfolio Control from AIM directed Buys.....

Q.........

Thank you so very much for the detailed reply to my query regarding PC incremental increases.

By increasing the PC from 50% to 100% of the system generated buys, would it not slow down the depletion and ballooning of cash or would it be tooo

slowly?

Your comments would be appreciated.

Best regards

A............

Hi Cap, Re: PC Incremental Increase with Buying..............

Several people have experimented with changing the amount of "feedback" to Portfolio Control from the default 50% value suggested by Mr. Lichello as a good compromise. Like many compromises, changes can make the results either better or worse. It depends upon how the history of the stock's price unfolds over time. I guess you could say it then also depends upon the performance of the stock market to a degree depending on the correlation of the investment to the general market. Bigger PC feedback increments in a rising market do very well in general as it helps to postpone selling and encourage buying.

In declining markets larger feedback to PC would accelerate the depletion of cash. A short shallow decline might work out fine but a deep dark ugly grizzly bear that lasted years might leave some scars as one awaits an opportunity finally put some cash back in the register. Smaller feedback would slow the cash decline.

The problem comes in guessing the future. One of AIM's beauties is that it has 20/20 hindsight where guessing the future is usually a 50/50 bet on average. Personally I've chosen to stick with the feedback at 50% of buy increments. I do many other things to control cash buildup and depletion, so fiddling with PC feedback has never been high on my list of endeavors. Some people have even made the feedback percentage an 'automated' thing tied to some A.I. type formulae.

Thanks for asking. I invite others to chime in who have worked with other levels of feedback to the Portfolio Control. Where feedback from an amplified speaker to a microphone is rather annoying, feedback from proper AIM buying to Portfolio Control is, in the long term, quite satisfying. It's to Mr. Lichello's credit that he managed to see this benefit and build it into his overall algorithm. It differentiated AIM from most other systematic investing models.

Re: Feedback to Portfolio Control from AIM directed Buys...........

Q.........

I am new to AIM but I did note that when starting out the PC equal 100 % of shares x price whereas the addition of shares is only 50%. As Shakespeare would have said there seems to be something wrong in Denmark.

Could someone please explain.

A.........

Hi C10 and Welcome, Re: Portfolio Control incremental increases.......

One's initial purchase is, as you said, fully represented with the Portfolio Control value. If your Aunt Lilly were to pass on and leave you a bunch of money and you added it to the existing portfolio, you would add to PC in the exact amount you spent on additional shares. That's all well and good. This is because the new shares are being added as a non-AIM directed purchase.

If you think of AIM as a reward system for good behavior, the incremental bump to PC starts to make sense. The value of your holding has dropped well below the Portfolio Control value and AIM is suggesting that this would be a good time for a prudent investor to add to their position. The reward comes in the fact the entire holding's value needs then to rise to an amount somewhat higher than the initial PC value before any sell signal will be generated.

In accounting terms you might get a sell signal below your initial cost/share (FIFO basis) but it will always be at a profit above your most recent purchase price (LIFO). Without the incremental adjustment to the PC during the buying events, you are essentially "Ladder Trading" - you'll buy and sell at specific prices but the price targets never change. PC upward adjustment after a few buy/sell cycles will allow the overall portfolio to grow in value even if it's range-bound in its price cycle.

So, things may be a bit off in Denmark, but they're fine on Wall Street!

Hi B78, re: finding appropriate settings for an investment......

The very first question here ( http://investorshub.advfn.com/boards/read_msg.aspx?message_id=279368 ) addresses using Zig Zag from Stock Charts to help determine an appropriate Hold Zone size. Then you can divine the SAFE and Min. Trade Size from that.

Generally for diversified mutual funds I've used a total hold zone size of about 20%. For individual stocks I've used 25% up to about 40%.

If one decides 20% is effective, then using 10% total SAFE plus 5% for for each the buy and sell minimum values it would give you an approximate hold zone of 20% (10+5+5).

While the CGNX example doesn't work exactly with the recent trade history, you could plug in another stock or fund and try the same series of Zig Zag points to see if you could find the sweet spot.

Thanks for the replies,

I have been using AIM again for about six months since finding the spreadsheet and re-reading the book. Still had some funds which ended up as Buy&Hold and are now AIMed again.

The min/max share value safe was more or less born out of my question of where to set safe as some funds seem the have a larger swing than others, looks like a larger swing is also better of with a larger safe?

Choosing min and max share value could be done by looking at the history I guess, it doesn't have to be precise, initially it was just meant to ballpark the safe...

Shifting the safe gradually from buy to sell is done by excel so not much emotion in there. I must admit that there is a good chance of draining the cash quickly if the share value drops below the initial min share value...

I did start to get the feeling that I overcooked my stew a bit, probably best to stick with normal AIM and leave this "project" for what it is ;)

Thanks again for your opinions/advice.

Hi Buzz78 and Welcome.

Re: various AIM parameters and testing..............

There are more of us usually reading and responding on the AIM Users BB here on i-Hub.

http://investorshub.advfn.com/AIM-Users-Bulletin-Board-949/

Your concept of a modest increase in the Portfolio Control value once you've reached a target Cash Reserve percentage is very much like the 'vealie' concept. A spreadsheet set to do this should work well.

With that, you will artificially keep cash lower than traditional AIM during long bull markets. Keep in mind that limiting total cash could affect your buying during extended bear markets. I do two things in conjunction with 'vealies': 1) have a higher Buy SAFE than Sell SAFE to help conserve the cash in bear markets, and 2) make no sequential buys in any one security more often than once in thirty days. Both these help to conserve cash for longer periods.

I use different buy and sell SAFE settings for different classes of securities. I also use different minimum order sizes for those classes. So, I treat individual company stocks different from diversified mutual funds, for instance.

As TooFuzzy mentioned, it is best to pick All Weather settings for your investments and then stick with them. Changing AIM's settings in the middle of a market change can work like chasing one's own tail. It's better to Set and Forget.

I hope this helps. Please feel free to ask questions as you gain experience.

I'll answer your last question first.

YES !!!!!!!!

Aim is " good enough "

You can spend the next 50 years finding improvements and never impliment it or you can start using it now.

Regarding changing SAFE at market top and bottom:

If you know when a security was at a top or bottom, first, let

Me know! Second, you would not need Aim.

The whole point of Aim is so you can invest unemotional by gradually selling and buying. If you change the parameters you are making emotional decisions and defeating the whole purpose.

Whatever parameters you pick when you set up an account, you should stay with them.

Not always

Toofuzzy

Hi all,

Still a bit new to this board but have been reading along now for a couple of months. I see my story is similar to quite a few others. Read Lichello's book a long time ago, made an excel sheet based on that in that same period but didn't really get around to putting it in action for some reason. Recently dusted off the old spreadsheet and was curious again but couldn't find my old book anymore luckily it's also available on iBooks so now I have a digital version. Searched a bit on the internet and was surprised to find this board and that it's so actively used still, guess Lichello did something right!

Also very nice to read that over time some improvements have been made, never heard about split Safe or Veallie's before. After dusting off the old spreadsheet I tried to implement some of the improvements in there. At the moment it's raising the PC when cash is equal to the Stock Value with every sell but currently only by 0.25 of the sell, so not really a Veallie but at least braking the cash growth a bit. About (the split) Safe I'm still struggling a bit. Especially with how large safe should be. It seems it's controlling for a large portion how Safe will operate and depends a lot on the volatility of the stock/fund. For now I made it a function of the max and min value of a stock. The bigger the difference between these values the bigger the safe. I was also wondering why 0% sell safe is working, and if it's working for selling especially at the top of the market isn't it than also working for a 0% buy safe at the bottom? Anyone ever tried this? I think I read a post here somewhere saying that you shouldn't do that but can't find it anymore. I tried to put it in my spreadsheet so now safe is variable, very low buy safe and high sell safe at the bottom and high buy safe with a low sell safe at the top. I have added a screenshot of a summary page of one of my spreadsheets showing the results of 4 AIM formula's. The first is standard AIM with 10% safe. Second, the variable safe. Third, variable safe with the raise of PC with each buy connected to the total safe Value (so not the standard 0,5*buy). Fourth, AIM with buy safe only set at 10%....

The column on the left is the input for the share price it's 50/20 which is similar to Lichello's 10/4, probably not very realistic but in this way I could compare it with the book (there are still some different values compared to the book but I guess that's due to rounding of numbers?)

Last thing I was wondering about is didn't I make something nice and simple too complicated...... :(

Hi C, Re: 3 Quarters and review for Funds.....

If it's a managed mutual fund and is actively managed AND moving against the overall market trend, I'd say Yes.

If it's an index or sector fund, I'd say it's the current trend and AIM doesn't mind trend following.

Thank you kind sir for the list.

cklow

Gents,

Thanks for your reply. I am sorry I was unable to reply earlier due to work demands and was in the midst of evicting an errant tenant (they move out tomorrow).

I've read up somewhere after 3 Quarters if the stock is bad, its time for a review. Does it apply to funds then?

Q)

I do plan to get ETFs for AIMING. My father (around Tom's age) was burnt back in the 80s when some of the AIMED stock went into bankruptcy.

My question was- Do you identify those with less than stellar returns and drop them(perhaps trading within bands for a very long time e.g. a year)? What are the Rule of Thumbs that worked for you.

Cheers

CK

A)

Hi C, Re: Stock Picking and Purging for the longer term (necessary for healthy AIM)

If you feel compelled to buy individual company stocks then picking healthy companies is very important. ETFs help reduce "single stock risk" to a manageable level, but AIM still likes the greater frequency and amplitude of price movement from single stocks.

CanRay mentioned one source. There's also the four portfolios offered each week in Value Line. These have a benefit of being pruned and replenished within the guidelines of their stated goals. There are 20 companies in each portfolio strategy. Look in their "Selection and Opinion" each week and you'll find a few pages into it their four portfolio strategies. The Portf #III looks like a good place to find potential AIM stocks (lower turnover, 3-5 year time horizon). Portfolios II and IV also look like they are lower turnover and have the benefit of being oriented toward stability and income.

Remember that AIM is only one ingredient in a healthy portfolio design with the following goals:

1) Price appreciation over time

2) Dividend capture over time

3) Profitable volatility capture over time

AIM is a method of accomplishing #3 but isn't exclusive of the other two. If you want to tilt your portfolio toward growth, you could choose stocks from Portf III, if you want to tilt it toward income, you could choose from Portf VI. Portf II is somewhere in between.

Value Line is available at most larger public libraries.

Portf I:To qualify for purchase in the above portfolio, a stock must have a Timeliness Rank of 1 or 2 and a Financial Strength Rating of at least B+. If a stock’s Timeliness rank falls to 3, or lower, it will be automatically removed. Stocks in the above portfolio are selected and monitored by Michael F. Napoli, Senior Analyst.

Portf II:To qualify for purchase in the above portfolio, a stock must have a yield that is in the top half of the Value Line universe and a Safety Rank of 3 or better. Stocks are selected and monitored by Craig Sirois, Editorial Analyst.

Portf III: To qualify for purchase in the above portfolio, a stock must have above-average 3- to 5-year price-appreciation potential. As the price of a stock in this

Portfolio rises, the computed appreciation potential may fall; it may still be held. This portfolio is most appropriate for investors focused on long-term

capital gains. Stocks in the above portfolio are selected and monitored by Justin Hellman, Editorial Analyst.

Portf IV:To qualify for purchase in the above portfolio, a stock must have a yield that is at least 1% above the median for the Value Line universe, and a Financial

Strength Rating of at least B+. Stocks are selected and monitored by Adam Rosner, Editorial Analyst.

Happy hunting.

Hi cklow,

I agree with toofuzzy, stay with funds, but if you still insist on stocks, Google Altman Z score. Using that number should keep you out of trouble.

Regards,

Ray

Cklow

My "rule of thumb " is to not buy individual stocks and to slap my wrist when I start to think about it saying " do NOT buy individual stocks" .

I think my first reply was clear enough. If you don't buy them, you don't have to worry about dumping them at a loss.

Not Always

Toofuzzy

Hi Toofuzzy,

I do plan to get ETFs for AIMING. My father (around Tom's age) was burnt back in the 80s when some of the AIMED stock went into bankruptcy.

My question was- Do you identify those with less than stellar returns and drop them(perhaps trading within bands for a very long time e.g. a year)? What are the Rule of Thumbs that worked for you.

Cheers

CK

Cklow

While AIM works on individual volatile stocks, you risk them going to ZERO. using AIM. There is no way of avoiding tbat.

If that is what you are worried about, and you should be, only trade funds. Eveen if they go down, they will eventually recover, unless you invest in a fund of a very narrow industry.

Not always

Toofuzzy

Weeding out losers

Given the nature of the stock market, we are bound to pick a few duds. However, I guess we want to get rid of losers fast.

From your personal experience, how long is too long?

What are the signs and how do you decide?

What is AIM is actually working and we mistaken it for a dud?

A penny for your thoughts. :)

Cheers,

cklow

Hi Toof, Re: Reducing the Cash component of AIM...................

In the book Mr. L suggests that if you are reducing the overall size of the AIM engine then you should remove the Stock Value reduction from the Portf. Control value. Cash would be reduced in proportion to the reduction of the Stock side's reduction.

If just removing cash, there is not Portf Control reduction.

HI Tom

When removing significant cash didn't the book recommend reducing PC by some amount, either equal to the amount removed or half.

Or were you to sell half the amount of stock compared to the cash removed?

Toofuzzy

Hi Liam, Re: What to do when removing CASH only from one AIM account or holding.......

The simple answer is "Nothing." There is no direct effect on the AIM engine's internals. It only means there will be less cash in the near future if the markets turn downward.

If you are leaving the AIM account with a significant shortfall of cash you might want to shift some of the SAFE emphasis to the Buy side to slow down any initial buys for a deeper discount. If you had SAFE as 10% for buying and selling, you could shift 5% to the Buy side (or even all of it) so that your initial buy would be below where it is currently. That might help to preserve the cash a bit longer should the markets turn ugly before you sell again.

Doing this also makes the "next sell" target closer, so you'd start to recover cash more quickly if the markets continue upward. The "Lichello Band" or hold zone would remain essentially the same mathematical amount, but would shift toward a Sell bias a bit.

Hope this helps.

Liam00

If you will still have more than 50% cash you might want to ignore it.

I forget wether PC should be reduced by the whole amount or half.

Toofuzzy

Question on taking cash out of an AIM account. I am confused on something I should understand better, but I am a returning 'convert' and I am looking for help!

When I take cash out of an AIM account (to put into a separate AIM startup account), what do I do to the Portfolio Control? I am not selling stock, I don't need to, I just want to pull out some cash to start another AIM account. Thanks!

Hi KT, RE: Frequency of AIM activity.........

Some people only do their calcs once a month. Some more frequently.

Another method that TooFuzzy mentions is to "pre-calculate" the next buy and sell prices and jot those down. Then you can set alarms for those prices and know when AIM needs some activity.

When your price target hits, make your trade and record the trade info in your AIM spreadsheet. Then you calculate your new "next" target prices for buying and selling. Repeat.

That way if a price target hits before a month goes by you don't miss that trade. Several of us delay sequential buys by thirty days. In other words, if you update your AIM engines at the end of each month, but you bought on the 15th, you would ignore any further buy signals until at least the 15th of the next month. That helps to keep from burning through your cash reserve too quickly.

Personally I sell pretty much every time AIM suggests no matter how often the signals come. (I do limit selling if I feel the cash is getting too fat) Buying generally I limit to once in 30 days.

Hi KT, Re: current v-Wave info.........

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124683962

Hope this helps. JDerb reports it on Monday most weeks on the AIM Users BB here on i-Hub..........

Hi KT, Re: v-Wave calculation...............

Here's a post you can read on it.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=38123660

There's also some history on the AIM Users page here at I-Hub. Look in the Intro for that page.

Hi Ktaylor966

Aim monthly. You want there to be time for securities to move. As it is some things will not trade for months anyway because you need a 30% move to go from selling to buying or buying to selling. But only 5% in the same direction. It takes a few market cycles to really see Aim work, dont think it is not doing anything.

Start an account with a minimum of $20,000. $10,000 in stock, otherwise the trades get too small to bother with.

Decide what you want to own the rest of your life before you start. You dont have to invest in them all at once. That might be LARGE, SMALL, FOREIGN, REIT, BOND ( Wait for interest rate spike) Just those 5 could suck up your $100,000. The large caps can later be broken up into sectors.

Yes ETFs are funds.

Funds are MUCH safer than individual stocks, they cant go to zero.

Practice with paper and pencil for awhile to see it work but look for the QUICK AIM CALCULATOR which will figure out your HOLD ZONE so you only need to do the calculations when you know you are going fo have a trade. It is even possible to copy it to your computer.

Toofuzzy

Feel free to message me privately.

I found it! I suppose funds include ETF's. I trade commission free at Merrill Edge so this will work great. My question is, do most people manage AIM on a monthly or quarterly basis?

Thank you. I'll look for it. I'm new to this message board so forgive for asking, what's the link to the weekly stat?

I'm concerned about cash levels as I am starting AIM at $100k and I plan to invest it conservatively as for cash level in the beginning.

Ktaylor966

It is posted weekly on the " AIM Users Bulletin Board " You dont need to calculate it.

It is about 60% cash now. Some people reduce that for funds.

Another thought is to pick what you want to invest in and wait for the 13 day moving average to cross the 30 day ma to the upside. If something is going down the 13 day will be lower and as it starts to go up in price the 13 will cross the 30. You will avoid buying something that goes down just after you buy it.

Toofuzzy

Where do I find the v-wave calculator? I plan to begin a new AIM and I plan to begin cash level at a conservative level, considering stocks indices are at all time highs.

AIM Tax Consequences when starting with existing holdings.........

Q....................

Suggestions sought. When I took back control of my funds I felt that

the markets were overpriced. For that reason, I purposely bought light

with the intent of going a little heavier on any buy orders t ultimately

made to gradually bring my overall portfolio back into balance. This has

worked out fine, but one annoying result is that a number of my sell

points ended up being at or below my average cost now. My question is

how best to fix this? Is it a simple matter of adjusting my portfolio

controls upwards and if so any idea of how big a percentage? I can see

this being an ongoing issue when it comes to rebalancing the overall

portfolio. Any assistance would be appreciated.

M

A....................

Hi M, Re: AIM's lack of concern relative to "average price/share".........

AIM is designed to take profit on the most recent shares purchased, not

on average share cost. So, it is ambivalent about which batch of shares

are being sold or what their costs might be. Generally the gross LIFO

gain is about 20% to 40% depending upon what SAFE values and what

minimum trade size is chosen.

Even with a LIFO gain, the FIFO or average cost could be showing a loss

for a taxable transaction. AIM succeeds by compounding LIFO gains over

time. Eventually with each cycle your average cost/share will be lower

than your average selling price even if you started at a much higher

base cost.

When AIM sells, even at an average or FIFO loss, it will be selling at a

LIFO gain. It is replenishing the cash reserves with profits attached.

Since cash is the seed stock for the next planting, it is important to

recover the cash whenever it is possible regardless of the tax

consequences. If you sell shares at a tax loss, you will be able to use

those losses against any taxable gains you have during the same year.

This will be good for your overall portfolio even if that particular

holding seems to be doing something "wrong."

The best "Fix" is to just follow AIM's directions and sell regardless of

tax base cost when AIM wants a sale to occur.

Other opinions are welcome..............

I probably just put myself in retirement also so will start to need an income stream. Any thoughts.

Own a home, so all 'gross rent' is in effect paid in advance. Roof over your head and the landlord is pleasant.

Enough in safe bonds to cater for 20 years or whatever of living expenses (drawdown).

Rest in growth (stocks) accumulation. Provided enough (typically same amount as initially deposited into bonds) then that's sustainable (longevity/heirs).

If no heirs and 20 years is more than you expect then home+bonds alone would suffice. Spend the bonds and the proceeds of the sale of the home might cover twilight life care.

For bonds I worked a ladder of present day living expenses for each of 20 years, discounting future pension income amounts in later years (as and when those come online) in order to identify a present day amount to be initially invested in bonds (assuming bonds are invested/deposited in a inflation pacing investment). For example if I started today at age 55 and led a $50,000/year living expense lifestyle, had a $15,000/year inflation linked occupational pension payable at age 60, and a $15,000/year state pension payable at age 67 then 5 years x $50,000 to see me through ages 55 to 59, $35,000/year to cover age 60 to 66, $20,000/year to cover age 67 to 74. Which in total $655,000 covers. If invested in safe inflation bonds then 20 years of income is reasonable assured/covered. If the same amount again is available and invested in stocks/accumulation then there's a reasonable chance that after 20 years that stock value might have doubled in real terms (3.5% annualised real) - so overall end 20 years with the same amount as at the start of the 20 years in inflation adjusted terms (longevity/heirs).

For stocks, a low cost tax efficient S&P500 accumulation fund is a simple but effective choice. Well suited to when you might become confused as to what day it is let alone how to manage a portfolio of many assets.

That all assumes you've 'won the game' and have enough (no need to take risk). If not then its a case of dividing what you do have by whatever rock-n-roll party-animal lifestyle you fancy.

Hi Tom

Another issue I would like to address and would like your thoughts.

Other than that I put most of my "cash" in PHDG I am nearing a point that I feel I have enough stock and I am nervous about the market going forward.

For every $100,000 I have invested, I would like to sell $1,000 of stock for every $1,000 rise in my total account. Maybe in $5,000 chunks and buying back after a drop. AIMING is not giving me sales as quickly as my stock account has been going up.

None of my Aim accounts are near sales.

If I arbitrarily sell $5000 worth of stock and then buy it back that is a discount of only 5% or $250 on a $100,000 account or 2.5% on a $200,000 account. It doesnt seem worth it.

It just came to me that I could reduce the SELL SAFE to zero but I am reluctant to change settings as that is an emotional decision. When do I change it back?

I probably just put myself in retirement also so will start to need an income stream.

Any thoughts.

Toofuzzy

Hi Tom

My intention is for the PHDG to be the cash.

I dont presently own long bond funds because I expect them to sink in the near future. After a rate spike I might get in to TLT and then continue to Aim it no matter what rates do.

In any event I set PHDG with standard Aim settings just for the heck of it but wonder what settings might be better to actually Aim even though I expect to trade this to fund other Aim accounts.

Toofuzzy

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |