Tuesday, October 18, 2022 1:08:36 AM

Share selling scam exposed (IGEX, MEDH, SAPX, CNNA)

On September 26, 2022, a Complaint was filed in the United States District Court for the Northern District of Illinois by David Goulding, Howard Salamon, Robyn Goulding, and John O'Shea (the "Plaintiffs") against Mark Miller.

https://drive.google.com/file/d/1v4JwIUH5UQ_jKB3NTKVCv4OXR6fX9jpJ/view?usp=sharing

According to the Complaint, on August 5, 2016, an entity named Capitol Capital Corp ("CCC") entered into a series of transactions involving Indo Global Exchanges Pte Ltd ("IGEX"), as follows:

1) CCC acquired an outstanding debt of $38,006 previously owned by Dermot Monaghan for an undisclosed amount of money, which was convertible into IGEX common stock at an undisclosed conversion rate.

2) In exchange for $25,000 and undisclosed services rendered, CCC received a $100,000 convertible debt note, convertible into IGEX common stock at 40% of the closing price (a 60% discount)

According to the Complaint, on July 17, 2019, CCC exercised its option to convert both the Monaghan Note and the $100,000 Note in return for 680,000,000 shares of IGEX.

According to the Complaint, each of the Plaintiffs and Miller had executed an Agreement to split the proceeds from the sale of the 680,000,000 shares, with the Plaintiffs receiving 75% of the proceeds.

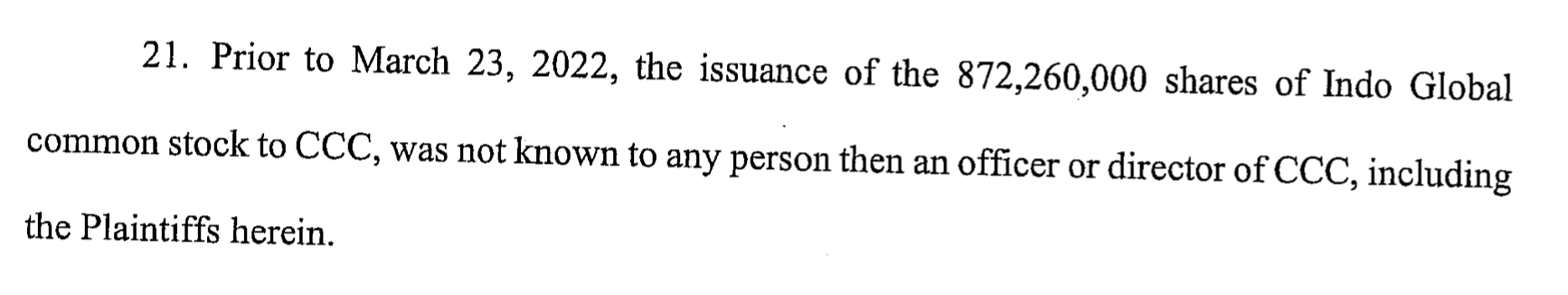

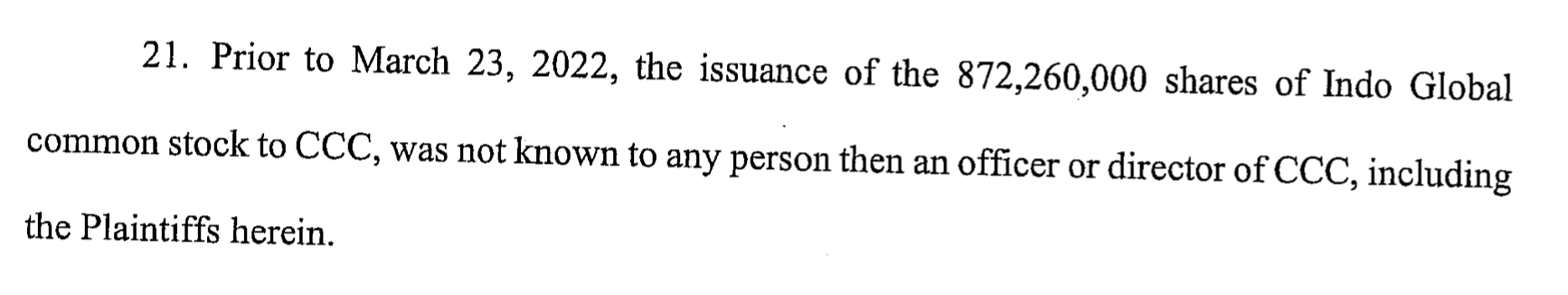

The Plaintiffs claim that between October 2019 and December 2019, Action Stock Transfer (Justeene Blankenship) allowed Miller to convert the Notes into 872,260,000 shares (as detailed below) without the knowledge of any officer or director of CCC, which Miller sold, keeping all the proceeds for himself.

i) 136,130,000 shares on October 17, 2019, which were quickly sold into the market

ii) 136,130,000 shares on October 31, 2019, which were quickly sold into the market

iii) 180,000,000 shares on December 3, 2019, which were quickly sold into the market

iv) 210,000,000 shares on December 10, 2019, which were quickly sold into the market

v) 210,000,000 shares on December 16, 2019, which were quickly sold into the market

The Plaintiffs claim they learned about the stock sales on or about March 31, 2022.

And now, the Plaintiffs are now seeking 75% of the sales proceeds.

Based on the average share price during the selling period, they estimate their 75% of proceeds to be approximately $830,000.

A copy of the $38,006 Monaghan Note, dated May 15, 2015, that CCC allegedly purchased can be found at this link:

https://drive.google.com/file/d/1aXFh4ZvokqOt4cNpZB9ReEfwf_lv6rqX/view?usp=sharing

So far, it just sounds like a funny situation where one dirty penny stock player screwed over some other dirty penny stock players, but if you take a deeper look, there are crimes a plenty going on here.

-----------------------------------------------------------------------------------------------------------

The players:

David Goulding - David Goulding was named in an SEC Complaint in 2009, along with his father, Randall Goulding, for engaging fraud and deceit with their clients and prospective clients, misappropriating client assets, and misrepresenting the value of fifteen investment pools while acting as investment advisors through their company, The Nutmeg Group LLC.

https://www.sec.gov/litigation/complaints/2009/comp20972.pdf

A final judgment was entered in February 2020

https://www.sec.gov/litigation/litreleases/2020/lr24736.htm

While those proceedings were ongoing, the Goulding family became major players in Potnetwork Holdings, Inc (POTN), which saw several of its insiders Indicted for participating in a share selling scheme (Charles Vaccaro, Eli Taieb and Dror Svoria)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=150208911

A superseded Indictment added Dennis Ruggeri, Kevin Hagen, and Josef Biton as defendants.

More info on the POTN pump&dump here

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=138041101

And the related CLCI pump&dump here

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=145766280

Randall Goulding - Randall Goulding (the father of David Goulding) spent time in prison after being charged for mail and tax fraud in the mid-1990s.

https://www.casemine.com/judgement/us/62c90471b50db97b28b6c1b6

See above for his involvement in Nutmeg Group and POTN.

Besides POTN, the Randall Goulding was involved in the hijacking of a couple of abandoned tickers (GRPS and RSHN)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=142477852

Randall, who is also an attorney, is currently fighting a suspension from appearing or practicing before the SEC

https://www.sec.gov/litigation/opinions/2020/34-88718.pdf

Robyn Goulding - based on information and belief, Robyn Goulding is the wife of Randall Goulding and the mother of David Goulding.

John O'Shea - According to public filings, John O'Shea was the CEO of IGEX from July 17, 2013 to May 16, 2019.

Jason Black - According to public filings, Jason Black was the CEO of IGEX from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021.

Jason Black was recently named as a relief defendant in an elaborate scheme involving Richard Tang (an associate of Mark Miller), offshore money laundering groups, and hacked brokerage accounts used to manipulate the stock prices of Lotus Bio-Technology Development Corp (LBTD) and Good Gaming Inc (GMER)

https://www.securitieslawyer101.com/2022/sec-charges-glenn-b-laken-davies-wong-richard-tang-and-15-other-defendants-and-names-jason-black-as-a-relief-defendant-in-international-scheme-to-manipulate-stocks-using-hacked-us-brokerage-accounts/

https://www.sec.gov/litigation/complaints/2022/comp-pr2022-145.pdf

https://www.sec.gov/news/press-release/2022-145

Mark Miller - I exposed Miller for his involvement in hijacking several abandoned entities then using fake information to manipulate the stock prices and run pump&dumps and for his roles in LEAS and BBDA

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=143235663

https://docs.google.com/document/d/1pLhwugWDhBuqwjhGFoZ4qWb3b1o8aSj1zHUZ48fMeSc/edit

He was charged by the SEC for those actions on June 20, 2021

https://investorshub.advfn.com/boards/replies.aspx?msg=164478208

https://www.sec.gov/litigation/complaints/2021/comp25118.pdf

https://www.sec.gov/litigation/complaints/2021/comp25253.pdf

-----------------------------------------------------------------------------------------------------------

Capitol Capital Corp

Capitol Capital Corp was originally registered in Wyoming in 2012 by David Goulding

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=085004133199106207034083174173045069251028209082

That entity went delinquent in 2015 and was revoked by the Wyoming SOS by 2016.

A new Capitol Capital Corp was created on October 6, 2019 by Mark Miller and David Goulding with Mark Miller, David Goulding, and Randall Goulding each as 1/3 owners.

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=081070131144060165007084120014057120194168078124

https://drive.google.com/file/d/1CNfmQROrmWVvbdjwOXEIR0nLNgj_3aq9/view?usp=sharing

Since 2019, Capitol Capital Corp has been involved in several public companies holding debt and shares. The ones that can be confirmed are the following:

Indo Global Exchanges Pte Ltd (IGEX)

MedX Holdings, Inc (MEDH)

CBD Life Sciences Inc (CBDL)

Seven Arts Entertainment, Inc (SAPX)

Cann American Corp (CNNA)

There is likely other public companies besides these.

-----------------------------------------------------------------------------------------------------------

Now The Good Stuff

Bogus Note / Intentionally Misleading the Public

The Complaint claims that the Monaghan Note was acquired on August 5, 2016.

First, it should be noted that no documentation was filed with the Complaint showing that the Note was purchased from Monaghan on August 6, 2016.

Second, there is reason to believe it was ever actually purchased, or at least, not on the date they claimed it was.

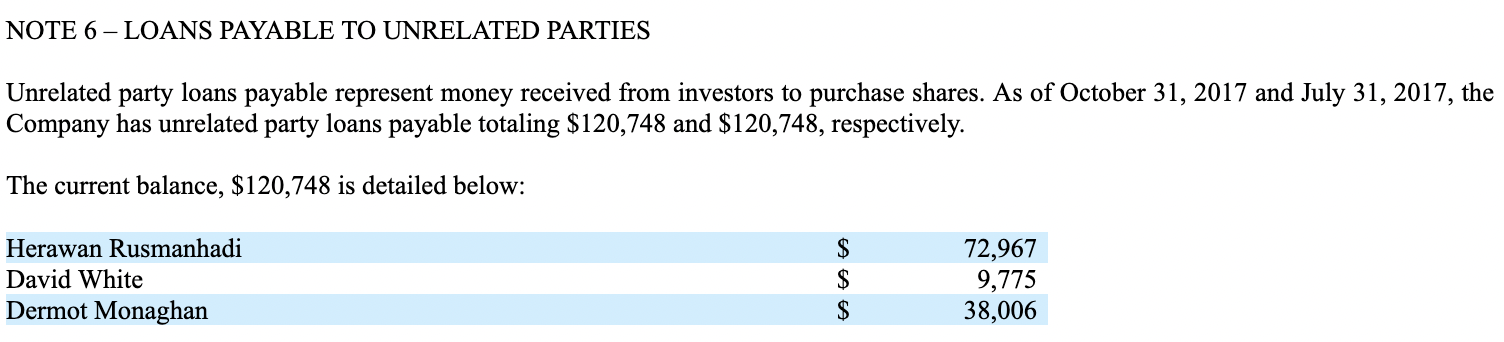

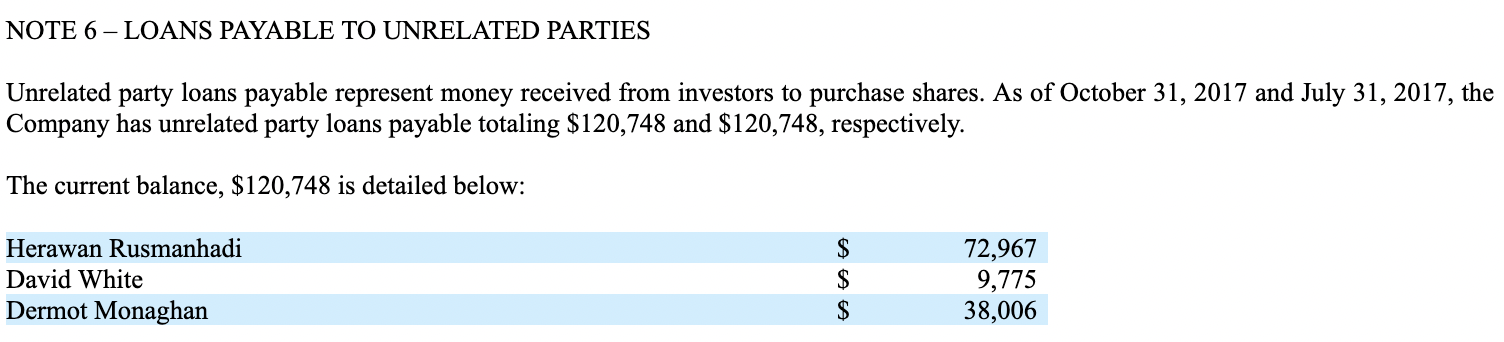

According to SEC filings, Monaghan was owed $38,006 on July 31, 2016

https://www.otcmarkets.com/filing/html?id=15876280&guid=bhR-k6dk9qi-B3h

But According to subsequent SEC filings, Monaghan was still owed $38,006 on October 31, 2017 (the last period covered by the SEC filings)

https://www.otcmarkets.com/filing/html?id=15878374&guid=bhR-k6dk9qi-B3h

If the Note was actually purchased on August 5, 2016, then why do the SEC filings say that the Note still belonged to Monaghan at least through October 31, 2017?

The OTC filings done by IGEN starting in July 2019 fail to even acknowledge that there is any note owned by Monaghan or Capitol Capital Corp. It's not mentioned one single time. All indications are that by July 2019, this group knew they were going to use the Note for some kind of illegal share selling scheme and intentionally chose to not disclose the Note to the public.

https://www.otcmarkets.com/stock/IGEX/disclosure

The following image if from the Annual report for the period ending July 31, 2019 (not a single note on the books):

https://www.otcmarkets.com/otcapi/company/financial-report/227233/content

Was the $100,000 Note bogus too?

The $100,000 Note was allegedly issued on August 5, 2016, but none of the SEC filings covering the periods between October 31, 2016 and October 31, 2017 and none of the OTC filings mention the $100,000 Note (again see the image above - not a Note on the books).

https://www.otcmarkets.com/stock/IGEX/disclosure

The Note was either bogus, or the Goulding/Black/Miller group intentionally misled the public into thinking it didn't exist.

-----------------------------------------------------------------------------------------------------------

Kickback Scheme?

So who was in on the share selling scheme?

Amazingly, the Complaint filed on September 26, 2022 included an exhibit for the alleged profit sharing agreement dated July 19, 2019:

https://drive.google.com/file/d/1rZqQDBYld4Ijxv3dSpObr95obbwyx7Uv/view?usp=sharing

The agreement was between:

John O'Shea, the CEO of IGEX from 2013 - 2019

Robyn Goulding

David Goulding, Randall Goulding, and Harold Salamon (representing Capitol Capital Corporation)

Randall Goulding (representing Securities Counselors Inc)

Jason Black, the CEO of IGEX from 2019 - 2021 (representing Market Cap Concepts LLC)

Mark Miller

According to the Agreement, the group agreed that the $38,006 Monaghan Note and $100,000 CCC Note, would be converted into 680,000,000 shares of IGEX. And the 680,000,000 would be sold into the market with the group splitting the proceeds as follows:

The first $128,102.23 would be split 15.4% each to John O'Shea, Howard Salamon, David Goulding and Randall Goulding, 38.57% to Securities Counselors Inc, and 12.5% each to Mark Miller and Jason Black.

After that, John O'Shea would get 37.5%, and Howard Salamon, David Goulding, Randall Goulding, Mark Miller, and Jason Black would each get 12.5%

Jason Black and Mark Miller would provide services to IGEX by seeking private companies for IGEX to acquire to earn their share of the proceeds.

Capitol Capital Corp (Harold Salamon, Randall Goulding, and David Goulding) provided the $25,000 cash used to create the $100,000 CCC Note to earn its share.

Securities Counselors Inc I assume was to provide the legal opinions to remove the restrictive legends from the 680,000,000 shares to earn its shares.

Now keep in mind that Jason Black was the CEO of IGEX from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021, which means that his payment amounts to a kickback to him for supporting the share selling scheme.

And John O'Shea was the CEO of IGEX when all of this was being put together, so since he provided no cash or services to earn his share of the proceeds, it appears it was yet another kickback for his role as an executive facilitating the scheme.

The odd thing is that the agreement was dated July 17, 2017 (if you look at the opening paragraph) but was executed on July 19, 2019. According to the lawsuit, the July 17, 2017 date was an error:

The July 17, 2017 doesn't seen to be a coincidence though. When IGEX started making public disclosures in June of 2019 (after being dark for more approximately 18 months), John O'Shea claimed that on that very same date, July 17, 2017, he temporarily resigned as the CEO and president, letting a relative, Tom Shea, temporarily take over as the president and CEO from July 17, 2017 until January 30, 2018:

https://www.otcmarkets.com/filing/html?id=13507459&guid=bhR-k6dk9qi-B3h

But even that appears to be yet another lie.

John O'Shea signed as the president of IGEX on January 25, 2018 when IGEX filed a Form 15 to suspend its reporting requirements with the SEC

https://www.otcmarkets.com/filing/html?id=12494212&guid=bhR-k6dk9qi-B3h

I'll let you make your own conclusions about that.

What Else Did They Hide?

So far we have this group hiding the debt Notes from the public and hiding the owners of the Note from the public.

But surely when Miller was doing all those conversion from October 2019 - December 2019, it was disclosed in the filings, right?

Nope.

IGEX actually provided the public with a OTC reports showing a starting balance of 1,777,171,024 shares and an ending balance of 3,007,261,731 (an increase of 1,230,090,706 shares), but only showed transactions for -49,669,193 shares (that's negative 49,669,193 shares). That means that 1,279,759,899 new shares were issued during the period from October 2019 - January 2020 without being disclosed.

https://www.otcmarkets.com/otcapi/company/financial-report/285663/content

Now we know who got 872,260,000 shares, but who got the other 407,499,899 shares that were hidden from the IGEX filings?

It appears that there was a second share selling scheme taking place at the same time as the first one.

-----------------------------------------------------------------------------------------------------------

So Who Really Knew?

The Plaintiffs in the lawsuit claim that they didn't find out that any shares were issued to Mark Miller by the Transfer Agent until March 23, 2022.

But in the very same complaint, they contradict this statement more than once.

The Complaint claims that on October 13, 2019, before the first shares were issued to Miller, they knew Miller was under investigation by the SEC and asked him to put in writing that he didn't do anything illegal.

Which Miller did sign:

https://drive.google.com/file/d/1Ha0BGeHoIPNnWVRpLy7y3BD2mlE6xC88/view?usp=sharing

The Complaint says that Randall Goulding knew that 680,000,000 shares were issued to Miller in October 2019, and that Miller told Randall Goulding that he was unable to sell the shares because his broker, Pershing, told him that because of the Shell Risk Designation on the OTC Markets page for IGEX, the transaction might get declined.

And in the very same complaint, David Goulding admits that he knew that Miller had the 680,000,000 shares in January 20, 2020, when he asked Miller in an email if he had sold the shares yet.

Those paragraphs in the Complaint tell me that they wanted Miller to sell the shares and trusted him to split the proceeds with them as agreed upon. If that's the case, then they can't say that they didn't know.

And keep in mind that no Transfer Agent would ever execute a debt conversion without getting the Company to approve the transaction. So that means all of the Miller transactions had to be known by the Company and it's officer and directors.

So who were the officers/directors of IGEX from October 2019 to December 2019?

According to the IGEX filings, Jason Black was the president and CEO from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021, so he was obviously aware that Miller was converting the debt and selling stock.

If Jason Black knew about the sales, why didn't he inform the rest of the group? Perhaps Jason Black got his cut of the proceeds and more. It would explain why he isn't included as a Plaintiff in the lawsuit, but it does make you wonder why he isn't included as a defendant. Perhaps his name will show up in discovery or some other way later if the lawsuit progresses. Or better yet in future SEC litigation.

Jason Black does seem extremely loyal to Mark Miller. Of the other entities with proven transactions with Capitol Capital Corp (listed earlier in the post), four of the five involved Jason Black:

Indo Global Exchanges Pte Ltd (IGEX)

MedX Holdings, Inc (MEDH)

Cann American Corp (CNNA)

Seven Arts Entertainment, Inc (SAPX)

And what about the attorney who did the Legal Opinion for IGEX for OTC Markets, Joel Steven Mills.

Mr. Mills said he reviewed the shareholder records and the OTC reports, but yet he didn't happen to notice that Mark Miller was selling stock and that those shares weren't being disclosed in the OTC reports, and neither were the Notes used to create the shares?

https://www.otcmarkets.com/otcapi/company/financial-report/287469/content

It appears that IGEX wasn't the only stock that Mr. Mills was doing faulty Legal Opinions for. OTC Markets banned him on August 23, 2021

https://www.otcmarkets.com/learn/prohibited-service-providers

-----------------------------------------------------------------------------------------------------------

So Let's Review

1) We have a possibly bogus $38,006 debt note issued to Capitol Capital Corp

2) We have a possibly bogus $100,000 debt note issued to Capitol Capital Corp

3) IGEX hid both of these notes from the public

4) IGEX hid that the notes were converted into free trading stock and sold into the market

5) Jason Black and John O'Shea agreed to receive proceeds from the sale of the shares issued for the notes, which amounts to illegal kickbacks since Black was a current officer/director and Shea was an officer/director while the scheme was being constructed

-----------------------------------------------------------------------------------------------------------

Was Capitol Capital Corp hijacked?

In the Complaint, the Plaintiffs claim that the new Capitol Capital Corp created on October 6, 2019 was done without the knowledge of the Plaintiffs, and that Miller used their names in the filings fraudulently.

But the original Capitol Capital Corp became revoked in by 2016 and had no license to conduct any business. If they had kept the business entity in good standing it would have been impossible to create a new entity by the same name.

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=085004133199106207034083174173045069251028209082

Again, the paragraphs referenced in the previous section show that the Gouldings were well aware that Miller would be getting the Capitol Capital Corp shares in October 2019, and so, would they really be unaware that they were listed as incorporators with Miller when Capitol Capital Corp was registered as a business entity in Wyoming again on October 6, 2019?

https://drive.google.com/file/d/1CNfmQROrmWVvbdjwOXEIR0nLNgj_3aq9/view?usp=sharing

Possibly. It is very fishy how Miller claimed in the incorporation filing that Howard Salamon resigned and transferred his 25.3% ownership to Miller and appointed Miller as the new Chairman of the Board for the company.

It becomes even more fishy when on December 11, 2019, Miller moved Capitol Capital Corp to Colorado and claimed that David Goulding and Randall Goulding resigned in that same filing and transferred all their ownership to Miller, giving him full power of Capitol Capital Corp

https://drive.google.com/file/d/1NGHH9Qk1gGvW16RvKRSVn2UQt6IQUT2s/view?usp=sharing

Miller's response to the lawsuit will be interesting. So far, he has only really argued that Illinois isn't the proper jurisdiction.

https://drive.google.com/file/d/18xwpFMiPFY2bzsWKzpdrdFx9Cj-LWPCA/view?usp=sharing

-----------------------------------------------------------------------------------------------------------

The Other CCC Stocks

Now that we know that Capitol Capital Corp was involved in an illegal share selling/kickback scheme with IGEX, it stands to reason that they might have been running similar schemes with other companies.

MedX Holdings Inc (MEDH)

According to OTC filings, Mark Miller transferred his control block of MEDH stock to Jason Black on December 20, 2019, in exchange for MEDH owing Mark Miller $70,000 in the form of a convertible debt note, convertible at $.001/share.

Then on January 3, 2020, MEDH issued Capitol Capital Corp a $7,500 Note convertible at $.001/share. At the time, despite Harold Salamon allegedly resigning in October 2019, Salamon was listed in the MEDH filings as the control person for Capital Capital Corp.

Somehow after issuing Capitol Capital Corp 5,000,000 shares to pay off $5,000 in debt on June 30, 2020 and 5,000,000 shares to pay off $5,000 in debt on July 27, 2020 (before the Note had even matured), the Note still had a balance of $7,500 because it was earning interest so quickly.

Based on the market price of the stock on those days, that was $128,000 worth of stock towards just interest on a $7,500 Note.

The June 30, 2020 and July 27, 2020 Capitol Capital Corp conversions were later changed in the filings to shares issued to Richard Kilchelsky (Northwoods Elite LLC).

Richard Kilchelsky lives in Breezy Point, Minnesota (the same town as Mark Miller), and I've been told that he is Mark Miller's brother-in-law. Miller used the Kilchelsky brothers as officers in UITA when he hijacked that shell.

https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=86516778-7cda-e911-9184-00155d01b4fc

https://www.otcmarkets.com/filing/html?id=12638952&guid=6VR-kWjo5tLaKch

Kilchelsky would also get another 265,000,000 MEDH shares at $.0001/share in 2020 and 2021, worth around $1.5 million for a $18,500 debt note that Jason Black added to the MEDH balance sheet right after he took control.

The remaining balance of the Capitol Capital Corp note was converted into 292,000,000 free trading shares at $.0001/share paid to Mark Miller according to the MEDH filings.

https://www.otcmarkets.com/otcapi/company/financial-report/330087/content

Those 292,000,000 shares would have carried a value of roughly $1,000,000.

Jason Black didn't stick around long - he left as the CEO of MEDH in June 2020 after the enrichment scheme was set up.

The big question is - did he also receive a percentage of the proceeds as a kickback from the Capital Capital Corp Note and Kilchelsky Note?

Cann American Corp (CNNA)

Under Jason Black's direction as the CEO of CNNA, CNNA issued not one, but two large debt Notes to Capitol Capital Corp (Mark Miller) in 2020.

A $90,125 Note on September 1, 2020, convertible at $.0001/share, and a $70,830 Note on December 2, 2020, convertible at $.001/share.

At $.0001/share, $90,125 is 901,250,000 shares, and at $.001/share, $70,830 is 70,830,000 shares.

But Jason Black hides Mark Miller's involvement by saying that Capitol Capital Corp is controlled by Howard Salamon.

So far, Capitol Capital Corp has received 60,000,000 shares for $6,000 of debt in September and October of 2021. Based on the market price during that time, the stock was worth around $900,000.

https://www.otcmarkets.com/otcapi/company/financial-report/348802/content

I can't help but wonder if Jason Black has any kind of proceed sharing/kickback arrangement with Capitol Capital Corp in CNNA as well.

Currently, the Notes carry outstanding balances of $98,180 convertible into 981,800,000 shares and $75,000 convertible into 75,000,000 shares. Those 1,056,800,000 shares are currently worth $2,853,360 based on the current share price of $.0027.

Seven Arts Entertainment, Inc (SAPX)

When Jason Black took over the dormant SAPX shell in July 2021, it had no debt notes.

https://www.otcmarkets.com/otcapi/company/financial-report/296945/content

By August 1, 2021, it had a $51,135 Note owed to Capitol Capital Corp (Mark Miller) convertible at $.001/share. It was as if that was the whole point of taking over control of the shell was to use it for yet another share selling scheme involving Capitol Capital Corp (Mark Miller).

But again, Black hides Mark Miller's involvement by saying that Howard Salamon controls Capitol Capital Corp.

As of June 30, 2022, the CCC Note had a balance of $55,334 because of interest. It became due on August 2, 2022. And since August 2, 2022, SAPX has seen its float grow by exactly 55,000,000 shares.

Since the Capitol Capital Corp Note is the only thing that new free trading shares could be issued towards, it seems this share selling scheme is also now under way.

55,000,000 shares at $.001/share would be $55,000 worth of debt (basically covering the entire August 1, 2021 Note). Based on the market price during August, when the stock was likely being sold, the 55,000,000 shares were worth around $125,000.

Besides the August 1, 2021 Note, SAPX announced a line of credit arrangement with Capitol Capital Corp, to provide up to $1,500,000 on a revolving line of credit over six months with an interest rate of 9% per annum, starting on September 2, 2021. The Agreement was Amended on April 1, 2022 to a a one year term, with advances convertible into shares of common stock at par value of $0.0001.

According to the most recent report, Capitol Capital Corp has advanced $164,254 to the company so far. (Note 8 in the financial section)

https://www.otcmarkets.com/otcapi/company/financial-report/344105/content

At $.0001/share, $164,254 converts into 1,642,640,000 shares in the future.

That's a great deal considering the stock currently trades at $.0013/share, making the stock worth $2,135,432 before any future pump and dump action.

The big question again is if Jason Black has any kind of proceed sharing arrangement with Capitol Capital Corp.

What can't be denied is how closely Jason Black likes to work with Mark Miller.

One final note: SAPX, MEDH, and CNNA all use the same legal counsel, Anthony F Newton. Newton was also the legal counsel for LEAS, which hid Mark Miller's involvement while Newton was signing Attorney Letters for the Issuer.

-----------------------------------------------------------------------------------------------------------

Will Mark Miller and Jason Black get busted again?

I'm pretty sure the SEC would be very interested to learn that Mark Miller has been making all this money through these share selling schemes while being charged by the SEC for his previous scams and to learn just how closely Jason Black (already named once as a relief defendant in an SEC action) has been working with Mark Miller through it all.

On September 26, 2022, a Complaint was filed in the United States District Court for the Northern District of Illinois by David Goulding, Howard Salamon, Robyn Goulding, and John O'Shea (the "Plaintiffs") against Mark Miller.

https://drive.google.com/file/d/1v4JwIUH5UQ_jKB3NTKVCv4OXR6fX9jpJ/view?usp=sharing

According to the Complaint, on August 5, 2016, an entity named Capitol Capital Corp ("CCC") entered into a series of transactions involving Indo Global Exchanges Pte Ltd ("IGEX"), as follows:

1) CCC acquired an outstanding debt of $38,006 previously owned by Dermot Monaghan for an undisclosed amount of money, which was convertible into IGEX common stock at an undisclosed conversion rate.

2) In exchange for $25,000 and undisclosed services rendered, CCC received a $100,000 convertible debt note, convertible into IGEX common stock at 40% of the closing price (a 60% discount)

According to the Complaint, on July 17, 2019, CCC exercised its option to convert both the Monaghan Note and the $100,000 Note in return for 680,000,000 shares of IGEX.

According to the Complaint, each of the Plaintiffs and Miller had executed an Agreement to split the proceeds from the sale of the 680,000,000 shares, with the Plaintiffs receiving 75% of the proceeds.

The Plaintiffs claim that between October 2019 and December 2019, Action Stock Transfer (Justeene Blankenship) allowed Miller to convert the Notes into 872,260,000 shares (as detailed below) without the knowledge of any officer or director of CCC, which Miller sold, keeping all the proceeds for himself.

i) 136,130,000 shares on October 17, 2019, which were quickly sold into the market

ii) 136,130,000 shares on October 31, 2019, which were quickly sold into the market

iii) 180,000,000 shares on December 3, 2019, which were quickly sold into the market

iv) 210,000,000 shares on December 10, 2019, which were quickly sold into the market

v) 210,000,000 shares on December 16, 2019, which were quickly sold into the market

The Plaintiffs claim they learned about the stock sales on or about March 31, 2022.

And now, the Plaintiffs are now seeking 75% of the sales proceeds.

Based on the average share price during the selling period, they estimate their 75% of proceeds to be approximately $830,000.

A copy of the $38,006 Monaghan Note, dated May 15, 2015, that CCC allegedly purchased can be found at this link:

https://drive.google.com/file/d/1aXFh4ZvokqOt4cNpZB9ReEfwf_lv6rqX/view?usp=sharing

So far, it just sounds like a funny situation where one dirty penny stock player screwed over some other dirty penny stock players, but if you take a deeper look, there are crimes a plenty going on here.

-----------------------------------------------------------------------------------------------------------

The players:

David Goulding - David Goulding was named in an SEC Complaint in 2009, along with his father, Randall Goulding, for engaging fraud and deceit with their clients and prospective clients, misappropriating client assets, and misrepresenting the value of fifteen investment pools while acting as investment advisors through their company, The Nutmeg Group LLC.

https://www.sec.gov/litigation/complaints/2009/comp20972.pdf

A final judgment was entered in February 2020

https://www.sec.gov/litigation/litreleases/2020/lr24736.htm

While those proceedings were ongoing, the Goulding family became major players in Potnetwork Holdings, Inc (POTN), which saw several of its insiders Indicted for participating in a share selling scheme (Charles Vaccaro, Eli Taieb and Dror Svoria)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=150208911

A superseded Indictment added Dennis Ruggeri, Kevin Hagen, and Josef Biton as defendants.

More info on the POTN pump&dump here

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=138041101

And the related CLCI pump&dump here

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=145766280

Randall Goulding - Randall Goulding (the father of David Goulding) spent time in prison after being charged for mail and tax fraud in the mid-1990s.

https://www.casemine.com/judgement/us/62c90471b50db97b28b6c1b6

See above for his involvement in Nutmeg Group and POTN.

Besides POTN, the Randall Goulding was involved in the hijacking of a couple of abandoned tickers (GRPS and RSHN)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=142477852

Randall, who is also an attorney, is currently fighting a suspension from appearing or practicing before the SEC

https://www.sec.gov/litigation/opinions/2020/34-88718.pdf

Robyn Goulding - based on information and belief, Robyn Goulding is the wife of Randall Goulding and the mother of David Goulding.

John O'Shea - According to public filings, John O'Shea was the CEO of IGEX from July 17, 2013 to May 16, 2019.

Jason Black - According to public filings, Jason Black was the CEO of IGEX from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021.

Jason Black was recently named as a relief defendant in an elaborate scheme involving Richard Tang (an associate of Mark Miller), offshore money laundering groups, and hacked brokerage accounts used to manipulate the stock prices of Lotus Bio-Technology Development Corp (LBTD) and Good Gaming Inc (GMER)

https://www.securitieslawyer101.com/2022/sec-charges-glenn-b-laken-davies-wong-richard-tang-and-15-other-defendants-and-names-jason-black-as-a-relief-defendant-in-international-scheme-to-manipulate-stocks-using-hacked-us-brokerage-accounts/

https://www.sec.gov/litigation/complaints/2022/comp-pr2022-145.pdf

https://www.sec.gov/news/press-release/2022-145

Mark Miller - I exposed Miller for his involvement in hijacking several abandoned entities then using fake information to manipulate the stock prices and run pump&dumps and for his roles in LEAS and BBDA

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=143235663

https://docs.google.com/document/d/1pLhwugWDhBuqwjhGFoZ4qWb3b1o8aSj1zHUZ48fMeSc/edit

He was charged by the SEC for those actions on June 20, 2021

https://investorshub.advfn.com/boards/replies.aspx?msg=164478208

https://www.sec.gov/litigation/complaints/2021/comp25118.pdf

https://www.sec.gov/litigation/complaints/2021/comp25253.pdf

-----------------------------------------------------------------------------------------------------------

Capitol Capital Corp

Capitol Capital Corp was originally registered in Wyoming in 2012 by David Goulding

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=085004133199106207034083174173045069251028209082

That entity went delinquent in 2015 and was revoked by the Wyoming SOS by 2016.

A new Capitol Capital Corp was created on October 6, 2019 by Mark Miller and David Goulding with Mark Miller, David Goulding, and Randall Goulding each as 1/3 owners.

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=081070131144060165007084120014057120194168078124

https://drive.google.com/file/d/1CNfmQROrmWVvbdjwOXEIR0nLNgj_3aq9/view?usp=sharing

Since 2019, Capitol Capital Corp has been involved in several public companies holding debt and shares. The ones that can be confirmed are the following:

Indo Global Exchanges Pte Ltd (IGEX)

MedX Holdings, Inc (MEDH)

CBD Life Sciences Inc (CBDL)

Seven Arts Entertainment, Inc (SAPX)

Cann American Corp (CNNA)

There is likely other public companies besides these.

-----------------------------------------------------------------------------------------------------------

Now The Good Stuff

Bogus Note / Intentionally Misleading the Public

The Complaint claims that the Monaghan Note was acquired on August 5, 2016.

First, it should be noted that no documentation was filed with the Complaint showing that the Note was purchased from Monaghan on August 6, 2016.

Second, there is reason to believe it was ever actually purchased, or at least, not on the date they claimed it was.

According to SEC filings, Monaghan was owed $38,006 on July 31, 2016

https://www.otcmarkets.com/filing/html?id=15876280&guid=bhR-k6dk9qi-B3h

But According to subsequent SEC filings, Monaghan was still owed $38,006 on October 31, 2017 (the last period covered by the SEC filings)

https://www.otcmarkets.com/filing/html?id=15878374&guid=bhR-k6dk9qi-B3h

If the Note was actually purchased on August 5, 2016, then why do the SEC filings say that the Note still belonged to Monaghan at least through October 31, 2017?

The OTC filings done by IGEN starting in July 2019 fail to even acknowledge that there is any note owned by Monaghan or Capitol Capital Corp. It's not mentioned one single time. All indications are that by July 2019, this group knew they were going to use the Note for some kind of illegal share selling scheme and intentionally chose to not disclose the Note to the public.

https://www.otcmarkets.com/stock/IGEX/disclosure

The following image if from the Annual report for the period ending July 31, 2019 (not a single note on the books):

https://www.otcmarkets.com/otcapi/company/financial-report/227233/content

Was the $100,000 Note bogus too?

The $100,000 Note was allegedly issued on August 5, 2016, but none of the SEC filings covering the periods between October 31, 2016 and October 31, 2017 and none of the OTC filings mention the $100,000 Note (again see the image above - not a Note on the books).

https://www.otcmarkets.com/stock/IGEX/disclosure

The Note was either bogus, or the Goulding/Black/Miller group intentionally misled the public into thinking it didn't exist.

-----------------------------------------------------------------------------------------------------------

Kickback Scheme?

So who was in on the share selling scheme?

Amazingly, the Complaint filed on September 26, 2022 included an exhibit for the alleged profit sharing agreement dated July 19, 2019:

https://drive.google.com/file/d/1rZqQDBYld4Ijxv3dSpObr95obbwyx7Uv/view?usp=sharing

The agreement was between:

John O'Shea, the CEO of IGEX from 2013 - 2019

Robyn Goulding

David Goulding, Randall Goulding, and Harold Salamon (representing Capitol Capital Corporation)

Randall Goulding (representing Securities Counselors Inc)

Jason Black, the CEO of IGEX from 2019 - 2021 (representing Market Cap Concepts LLC)

Mark Miller

According to the Agreement, the group agreed that the $38,006 Monaghan Note and $100,000 CCC Note, would be converted into 680,000,000 shares of IGEX. And the 680,000,000 would be sold into the market with the group splitting the proceeds as follows:

The first $128,102.23 would be split 15.4% each to John O'Shea, Howard Salamon, David Goulding and Randall Goulding, 38.57% to Securities Counselors Inc, and 12.5% each to Mark Miller and Jason Black.

After that, John O'Shea would get 37.5%, and Howard Salamon, David Goulding, Randall Goulding, Mark Miller, and Jason Black would each get 12.5%

Jason Black and Mark Miller would provide services to IGEX by seeking private companies for IGEX to acquire to earn their share of the proceeds.

Capitol Capital Corp (Harold Salamon, Randall Goulding, and David Goulding) provided the $25,000 cash used to create the $100,000 CCC Note to earn its share.

Securities Counselors Inc I assume was to provide the legal opinions to remove the restrictive legends from the 680,000,000 shares to earn its shares.

Now keep in mind that Jason Black was the CEO of IGEX from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021, which means that his payment amounts to a kickback to him for supporting the share selling scheme.

And John O'Shea was the CEO of IGEX when all of this was being put together, so since he provided no cash or services to earn his share of the proceeds, it appears it was yet another kickback for his role as an executive facilitating the scheme.

The odd thing is that the agreement was dated July 17, 2017 (if you look at the opening paragraph) but was executed on July 19, 2019. According to the lawsuit, the July 17, 2017 date was an error:

The July 17, 2017 doesn't seen to be a coincidence though. When IGEX started making public disclosures in June of 2019 (after being dark for more approximately 18 months), John O'Shea claimed that on that very same date, July 17, 2017, he temporarily resigned as the CEO and president, letting a relative, Tom Shea, temporarily take over as the president and CEO from July 17, 2017 until January 30, 2018:

https://www.otcmarkets.com/filing/html?id=13507459&guid=bhR-k6dk9qi-B3h

But even that appears to be yet another lie.

John O'Shea signed as the president of IGEX on January 25, 2018 when IGEX filed a Form 15 to suspend its reporting requirements with the SEC

https://www.otcmarkets.com/filing/html?id=12494212&guid=bhR-k6dk9qi-B3h

I'll let you make your own conclusions about that.

What Else Did They Hide?

So far we have this group hiding the debt Notes from the public and hiding the owners of the Note from the public.

But surely when Miller was doing all those conversion from October 2019 - December 2019, it was disclosed in the filings, right?

Nope.

IGEX actually provided the public with a OTC reports showing a starting balance of 1,777,171,024 shares and an ending balance of 3,007,261,731 (an increase of 1,230,090,706 shares), but only showed transactions for -49,669,193 shares (that's negative 49,669,193 shares). That means that 1,279,759,899 new shares were issued during the period from October 2019 - January 2020 without being disclosed.

https://www.otcmarkets.com/otcapi/company/financial-report/285663/content

Now we know who got 872,260,000 shares, but who got the other 407,499,899 shares that were hidden from the IGEX filings?

It appears that there was a second share selling scheme taking place at the same time as the first one.

-----------------------------------------------------------------------------------------------------------

So Who Really Knew?

The Plaintiffs in the lawsuit claim that they didn't find out that any shares were issued to Mark Miller by the Transfer Agent until March 23, 2022.

But in the very same complaint, they contradict this statement more than once.

The Complaint claims that on October 13, 2019, before the first shares were issued to Miller, they knew Miller was under investigation by the SEC and asked him to put in writing that he didn't do anything illegal.

Which Miller did sign:

https://drive.google.com/file/d/1Ha0BGeHoIPNnWVRpLy7y3BD2mlE6xC88/view?usp=sharing

The Complaint says that Randall Goulding knew that 680,000,000 shares were issued to Miller in October 2019, and that Miller told Randall Goulding that he was unable to sell the shares because his broker, Pershing, told him that because of the Shell Risk Designation on the OTC Markets page for IGEX, the transaction might get declined.

And in the very same complaint, David Goulding admits that he knew that Miller had the 680,000,000 shares in January 20, 2020, when he asked Miller in an email if he had sold the shares yet.

Those paragraphs in the Complaint tell me that they wanted Miller to sell the shares and trusted him to split the proceeds with them as agreed upon. If that's the case, then they can't say that they didn't know.

And keep in mind that no Transfer Agent would ever execute a debt conversion without getting the Company to approve the transaction. So that means all of the Miller transactions had to be known by the Company and it's officer and directors.

So who were the officers/directors of IGEX from October 2019 to December 2019?

According to the IGEX filings, Jason Black was the president and CEO from May 16, 2019 to August 16, 2019 and from September 4, 2019 to March 9, 2021, so he was obviously aware that Miller was converting the debt and selling stock.

If Jason Black knew about the sales, why didn't he inform the rest of the group? Perhaps Jason Black got his cut of the proceeds and more. It would explain why he isn't included as a Plaintiff in the lawsuit, but it does make you wonder why he isn't included as a defendant. Perhaps his name will show up in discovery or some other way later if the lawsuit progresses. Or better yet in future SEC litigation.

Jason Black does seem extremely loyal to Mark Miller. Of the other entities with proven transactions with Capitol Capital Corp (listed earlier in the post), four of the five involved Jason Black:

Indo Global Exchanges Pte Ltd (IGEX)

MedX Holdings, Inc (MEDH)

Cann American Corp (CNNA)

Seven Arts Entertainment, Inc (SAPX)

And what about the attorney who did the Legal Opinion for IGEX for OTC Markets, Joel Steven Mills.

Mr. Mills said he reviewed the shareholder records and the OTC reports, but yet he didn't happen to notice that Mark Miller was selling stock and that those shares weren't being disclosed in the OTC reports, and neither were the Notes used to create the shares?

https://www.otcmarkets.com/otcapi/company/financial-report/287469/content

It appears that IGEX wasn't the only stock that Mr. Mills was doing faulty Legal Opinions for. OTC Markets banned him on August 23, 2021

https://www.otcmarkets.com/learn/prohibited-service-providers

-----------------------------------------------------------------------------------------------------------

So Let's Review

1) We have a possibly bogus $38,006 debt note issued to Capitol Capital Corp

2) We have a possibly bogus $100,000 debt note issued to Capitol Capital Corp

3) IGEX hid both of these notes from the public

4) IGEX hid that the notes were converted into free trading stock and sold into the market

5) Jason Black and John O'Shea agreed to receive proceeds from the sale of the shares issued for the notes, which amounts to illegal kickbacks since Black was a current officer/director and Shea was an officer/director while the scheme was being constructed

-----------------------------------------------------------------------------------------------------------

Was Capitol Capital Corp hijacked?

In the Complaint, the Plaintiffs claim that the new Capitol Capital Corp created on October 6, 2019 was done without the knowledge of the Plaintiffs, and that Miller used their names in the filings fraudulently.

But the original Capitol Capital Corp became revoked in by 2016 and had no license to conduct any business. If they had kept the business entity in good standing it would have been impossible to create a new entity by the same name.

https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=085004133199106207034083174173045069251028209082

Again, the paragraphs referenced in the previous section show that the Gouldings were well aware that Miller would be getting the Capitol Capital Corp shares in October 2019, and so, would they really be unaware that they were listed as incorporators with Miller when Capitol Capital Corp was registered as a business entity in Wyoming again on October 6, 2019?

https://drive.google.com/file/d/1CNfmQROrmWVvbdjwOXEIR0nLNgj_3aq9/view?usp=sharing

Possibly. It is very fishy how Miller claimed in the incorporation filing that Howard Salamon resigned and transferred his 25.3% ownership to Miller and appointed Miller as the new Chairman of the Board for the company.

It becomes even more fishy when on December 11, 2019, Miller moved Capitol Capital Corp to Colorado and claimed that David Goulding and Randall Goulding resigned in that same filing and transferred all their ownership to Miller, giving him full power of Capitol Capital Corp

https://drive.google.com/file/d/1NGHH9Qk1gGvW16RvKRSVn2UQt6IQUT2s/view?usp=sharing

Miller's response to the lawsuit will be interesting. So far, he has only really argued that Illinois isn't the proper jurisdiction.

https://drive.google.com/file/d/18xwpFMiPFY2bzsWKzpdrdFx9Cj-LWPCA/view?usp=sharing

-----------------------------------------------------------------------------------------------------------

The Other CCC Stocks

Now that we know that Capitol Capital Corp was involved in an illegal share selling/kickback scheme with IGEX, it stands to reason that they might have been running similar schemes with other companies.

MedX Holdings Inc (MEDH)

According to OTC filings, Mark Miller transferred his control block of MEDH stock to Jason Black on December 20, 2019, in exchange for MEDH owing Mark Miller $70,000 in the form of a convertible debt note, convertible at $.001/share.

Then on January 3, 2020, MEDH issued Capitol Capital Corp a $7,500 Note convertible at $.001/share. At the time, despite Harold Salamon allegedly resigning in October 2019, Salamon was listed in the MEDH filings as the control person for Capital Capital Corp.

Somehow after issuing Capitol Capital Corp 5,000,000 shares to pay off $5,000 in debt on June 30, 2020 and 5,000,000 shares to pay off $5,000 in debt on July 27, 2020 (before the Note had even matured), the Note still had a balance of $7,500 because it was earning interest so quickly.

Based on the market price of the stock on those days, that was $128,000 worth of stock towards just interest on a $7,500 Note.

The June 30, 2020 and July 27, 2020 Capitol Capital Corp conversions were later changed in the filings to shares issued to Richard Kilchelsky (Northwoods Elite LLC).

Richard Kilchelsky lives in Breezy Point, Minnesota (the same town as Mark Miller), and I've been told that he is Mark Miller's brother-in-law. Miller used the Kilchelsky brothers as officers in UITA when he hijacked that shell.

https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=86516778-7cda-e911-9184-00155d01b4fc

https://www.otcmarkets.com/filing/html?id=12638952&guid=6VR-kWjo5tLaKch

Kilchelsky would also get another 265,000,000 MEDH shares at $.0001/share in 2020 and 2021, worth around $1.5 million for a $18,500 debt note that Jason Black added to the MEDH balance sheet right after he took control.

The remaining balance of the Capitol Capital Corp note was converted into 292,000,000 free trading shares at $.0001/share paid to Mark Miller according to the MEDH filings.

https://www.otcmarkets.com/otcapi/company/financial-report/330087/content

Those 292,000,000 shares would have carried a value of roughly $1,000,000.

Jason Black didn't stick around long - he left as the CEO of MEDH in June 2020 after the enrichment scheme was set up.

The big question is - did he also receive a percentage of the proceeds as a kickback from the Capital Capital Corp Note and Kilchelsky Note?

Cann American Corp (CNNA)

Under Jason Black's direction as the CEO of CNNA, CNNA issued not one, but two large debt Notes to Capitol Capital Corp (Mark Miller) in 2020.

A $90,125 Note on September 1, 2020, convertible at $.0001/share, and a $70,830 Note on December 2, 2020, convertible at $.001/share.

At $.0001/share, $90,125 is 901,250,000 shares, and at $.001/share, $70,830 is 70,830,000 shares.

But Jason Black hides Mark Miller's involvement by saying that Capitol Capital Corp is controlled by Howard Salamon.

So far, Capitol Capital Corp has received 60,000,000 shares for $6,000 of debt in September and October of 2021. Based on the market price during that time, the stock was worth around $900,000.

https://www.otcmarkets.com/otcapi/company/financial-report/348802/content

I can't help but wonder if Jason Black has any kind of proceed sharing/kickback arrangement with Capitol Capital Corp in CNNA as well.

Currently, the Notes carry outstanding balances of $98,180 convertible into 981,800,000 shares and $75,000 convertible into 75,000,000 shares. Those 1,056,800,000 shares are currently worth $2,853,360 based on the current share price of $.0027.

Seven Arts Entertainment, Inc (SAPX)

When Jason Black took over the dormant SAPX shell in July 2021, it had no debt notes.

https://www.otcmarkets.com/otcapi/company/financial-report/296945/content

By August 1, 2021, it had a $51,135 Note owed to Capitol Capital Corp (Mark Miller) convertible at $.001/share. It was as if that was the whole point of taking over control of the shell was to use it for yet another share selling scheme involving Capitol Capital Corp (Mark Miller).

But again, Black hides Mark Miller's involvement by saying that Howard Salamon controls Capitol Capital Corp.

As of June 30, 2022, the CCC Note had a balance of $55,334 because of interest. It became due on August 2, 2022. And since August 2, 2022, SAPX has seen its float grow by exactly 55,000,000 shares.

Since the Capitol Capital Corp Note is the only thing that new free trading shares could be issued towards, it seems this share selling scheme is also now under way.

55,000,000 shares at $.001/share would be $55,000 worth of debt (basically covering the entire August 1, 2021 Note). Based on the market price during August, when the stock was likely being sold, the 55,000,000 shares were worth around $125,000.

Besides the August 1, 2021 Note, SAPX announced a line of credit arrangement with Capitol Capital Corp, to provide up to $1,500,000 on a revolving line of credit over six months with an interest rate of 9% per annum, starting on September 2, 2021. The Agreement was Amended on April 1, 2022 to a a one year term, with advances convertible into shares of common stock at par value of $0.0001.

According to the most recent report, Capitol Capital Corp has advanced $164,254 to the company so far. (Note 8 in the financial section)

https://www.otcmarkets.com/otcapi/company/financial-report/344105/content

At $.0001/share, $164,254 converts into 1,642,640,000 shares in the future.

That's a great deal considering the stock currently trades at $.0013/share, making the stock worth $2,135,432 before any future pump and dump action.

The big question again is if Jason Black has any kind of proceed sharing arrangement with Capitol Capital Corp.

What can't be denied is how closely Jason Black likes to work with Mark Miller.

One final note: SAPX, MEDH, and CNNA all use the same legal counsel, Anthony F Newton. Newton was also the legal counsel for LEAS, which hid Mark Miller's involvement while Newton was signing Attorney Letters for the Issuer.

-----------------------------------------------------------------------------------------------------------

Will Mark Miller and Jason Black get busted again?

I'm pretty sure the SEC would be very interested to learn that Mark Miller has been making all this money through these share selling schemes while being charged by the SEC for his previous scams and to learn just how closely Jason Black (already named once as a relief defendant in an SEC action) has been working with Mark Miller through it all.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.