Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Back on 4/09/18 I posted what was going to happen with VERB then FUSZ and in the following days I said I was going to sell my shares to the nearest bagholder at $3, which I did. It topped at $3.05 which is equal to $1410 adjusted for all the splits. Verb turb has dropped from $1400 to .16. Lol Uncle Roy has screwed all his shareholders that bought and held this dilution turd. Lol. Heres a look back into successful stock trading.

05/11/20 12:40 AM

Post #197 on Bagholders Anonymous

VERBFUSZ Bagholder JR since still stuck in 2018 lets look at the post #46422 OSB responded to

dude iligence Monday, 04/09/18 09:57:58 AM

Re: ALL-IN888 post# 46412 0

Post #

46422

of 164325

Rory didnt buy shares from the float he printed some. He used imaginary money of his over inflated back salary he pays himself to make a transaction to put on a Form 4 to get the Newbies and future BH's all excited. There's a big difference in using your hard earned money and buying shares from the float vs what Ole Rory Boy Mr 12% Convertible Note did.

Lets look at some of the response to my posts

pearsby09 Monday, 04/09/18 10:10:49 AM

Re: dude iligence post# 46422 0

Post #

46441

of 164325

Your correct. Rory will make MORE money on his 1.43 pps shares than his salary. Not a bad move! Perhaps that is why he sold a company and became a Multi Millionaire! Perhaps that's why he sees his 1.43 shares out performing his salary by 3 fold in the relative near term. Perhaps you should follow this proven Multi Millionaire lead. He is silver spooning it to you..take it!

-----

Those $1.43 shares are now worth .09 Persby09 went on to leave $1.6 mil in gains on the table which turned into a few $100k in losses.

Here is my repsonse to OSB

dude iligence Monday, 04/09/18 10:07:42 AM

Re: OSB post# 46427 0

Post #

46436

of 164325

OSB I just so happen to be as long in this stock as you are, doesnt mean I will buy into all the BS. This is a momentum play which has at least 2 waves left in it. I've made money on some of the biggest garbage plays around and I will make money on this as well. I will even tell you when the top is in and sell you my shares. Then give it a good kick as it fall on its face. I'm not going to lie. Its a dilution machine with Mr Convertible at the wheel. lol

dude iligence Monday, 04/09/18 10:20:24 AM

Re: pearsby09 post# 46441 0

Post #

46450

of 164325

pearsby09 that was all show, why buy shares at $1.4s when you can take the 12% interest on the convertibles in conversions as lows as .07. The $1.4s Form 4 is like a magician hand faster than the eye. He got the Newbies and future BH's to focus on it and not the convertibles. I've seen versions of this before with form 4 buying, it only works for a little while. I figure 2 waves before its a worn out tired bloated carcass. I'm going to make money on riding this bus while the whole time I pt out all the bad shxx and bad mouth it. It wont matter BH's will be BH's you cant stop them just like you cant stop stupid. Its a disease they cant help themselves. Just like gamblers that lose everything in a Casino they cant stop. They will literally piss and crap their pants before they get up and leave a slot machine. Some wear diapers. Same thing applies here.

Get sum FUSZ this babys going to Da Moon.

------

I then went on to tell you guys where to expect the top based on previous chart resistance level at $3.

dude iligence Monday, 04/09/18 10:39:29 AM

Re: Ziptrader0 post# 46453 0

Post #

46460

of 164325

The problem with putting out estimates on highs is you only help create a top when it may have gone higher yet. I dont want to be a buzzkill, but the $2.1 high it hit last month is a top of a gap from 08/05/15 when it gapped from $1.99 to $2.1 then went to $3. All this on very low volume. So if Fusz gets above $2.1 then next resistance is $3. There is no history above that just Blue skys limited by momentum volume and Good Ole Rory Mr Convertible. Skys the limit if they can stay out of the diution cookie jar.

What a concept to be able to buy a stock that you know what the share structure is because the TA isnt locked and there no dilution. Would anyone be interested in a debt free low float stock like that? You wouldnt have to worry about someone dumping shares on you and all the other shareholders. You could buy and hold knowing someone is not going to sneak around you while you take a nap and crap out a few millions shares.

-----

He still didnt understand so I explained it again

dude iligence Monday, 04/09/18 11:04:52 AM

Re: CG03 post# 46464 0

Post #

46472

of 164325

CGO3 I said $3 after $2.1. As you can see from the chart only 750 traded above $2.1. Its Blue skys above $3 its all up to momentum vol and dilution at that pt. If Ole Rory Boy Mr. Convertible decides to get into the dilution cookie jar or who knows how many other shares are still out there. The unknown factor of dilution is as destructive as the actual shares hitting the float. Dont get upset with me take it up with Mr Converitble during one of your late night email sessions. Its not a good idea to say the pps is going to $3 or $5 or $10 you only help to create a top. Lets just say its going to Da Moon and get off somewhere on the way. Dont be like the guys crapping in diapers while they play the slots. Take your profit then go to the strip club and celebrate.

----------

This is the part you forgot, refused to do, TAKE YOUR PROFIT.

----------

You and your clan of knuckleheads still didnt believe it so I spelled it out in terms that even the Dullest of Bagholders could understand.

dude iligence Tuesday, 04/10/18 11:34:07 AM

Re: CG03 post# 47139 0

Post #

47174

of 164325

CG03 Ole Rory Boy Mr. Up To 12% Convertible with conversions as low as .07, get this thing above $2.1 and its headed for $3. You can dilute after I take my profits. So much BS on this stock its just great cause so many clueless newbies buying into to the bs. Theres a new bagholder born every minute.

Theres she goes $2.14 breaking out.

Comon Rory Keep promising to make millionaires out of all the future BH's

dude iligence Wednesday, 04/11/18 10:04:34 AM

Re: Alpert post# 47666 0

Post #

47674

of 164325

Apert they dont care its all bs and they know it. We just give these things a pass when they are making money for us. This is a momentum and hype play. Its been a good one and eventually it will run out of steam. Just hurry upa and start pumping harder guys. Get some more Newbie fools and future BHs on board I want to sell them my shares at $3. Go Team FUSZ Long N Strong (until I sell to the nearest fool)

From the chart you can see I was pretty much right on target. The stock had two waves then hit resistance at $3 topping briefly at $3.05. divide all price on chart by 15 for RS adjustment. I did what I said I was going to do and sold all my shares to the nearest bagholder as it approached $3. This demonstrates exactly why it is so important to not buy into the BS of the small OTC companies that are dilution machines. Always know your exit and take your profits while you have them or end up like JR30 2 years later holding a bag of shxx.

------------------------

I can't believe verbs not back on otc yet. Roy your the greatest! Rah go team!

Time for the next 4-6 bagger?

threewheeler

Member Level

Re: Awl416 post# 10425

Tuesday, August 31, 2021 10:07:16 AM

Post#

10431

of 10452

HSCC SECURITY DETAILS

Share Structure

Market Cap Market Cap

2,677,851

08/30/2021

Authorized Shares

250,000,000

08/30/2021

Outstanding Shares

191,275,065

08/30/2021

Restricted

131,001,438

08/30/2021

Unrestricted

60,273,627

08/30/2021

Held at DTC

58,070,875

08/30/2021

Float

60,273,627

08/16/2021

check OTC markets float numbers and you see

Float

58,938,655

02/10/2022

Float is the only number to accurately track dilution. For anyone that doesn't know Transfer agent verified means its updated daily by the transfer agent.

This corresponds to the number of free trading shares 1,334,972 owned by insider CEO.

The number of shares with voting rights was reduced by from 191 mil to 180 mil with todays news by converting 11 mil to treasury shares.

ABML $1.23 +11% Float (unrestricted shares) 480,192,379 03/11/2022 up 10 mil since Oct 27 2021. 5 months is 2 mil shares per month average of 500k shares of dilution per week 100k shares of dilution per day everyday. stock has been rallying had a triple top breakout up 11% should make it above the 200ma @$1.31

Wednesday, October 27, 2021 1:03:01 AM

Re: dude iligence post# 6404

Post#

6534

of 6714

FLOAT 470 MIL today, [Transfer agent verified unrestricted (flöat) 437mil 8/13/21.]

33mil increase in aprox 50 trading day works out to roughly 660k Brand spanking new dilution shares per day.

no Rory has alway been true to his skin. The shareholders were just too stupid to see it. They lost their ass because they are gullible clueless niave, inexperienced and in some cases not very intelligent. I perfectly fine with Uncle Rory screwing his shareholders.

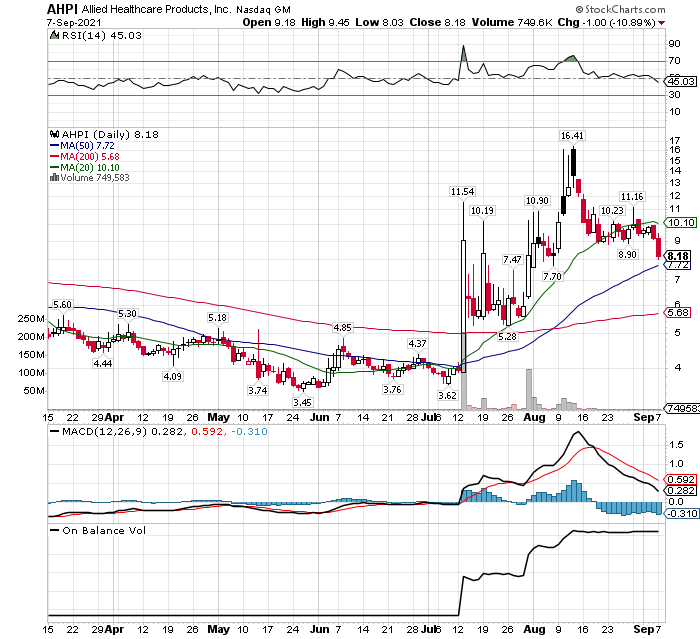

sold andr stopped out of ahpi today. Market looking ugly not positive catalyst under the current administration.

Bought AHPI $4.21-$4.22 this morning

AHPI $4.8 Extremely low float 3 mil possible bounce play coming. With any significant buy volume AHPI will be up 50-200%

https://stockcharts.com/h-sc/ui?s=ahpi

Hows the bat recycling plant coming? Up n running yet? Like the CEO promised a year or two ago?

AMLM .5s well above 200ma (.36) headed back to $land to retest $1.75 high from last winter. Float still 40mil but less of it available due to Flippers that made money last winter and bought back twice as many shares or more and the herd is coming the herd that missed the rally last winter. More buying pressure could drive pps well into mulidollar land. Like $10

PPSI $6 low low 3..79 mil float of which about 25% is owned by institutions and insiders got no where to go but up when the buy volume hits. todays ev news along with the optimism of passing infrastructure bill that pumps a lot of money into the sector. Who knows how high PPSI can go. Last winter it made it to $11. This time around there will be more lunacy as the herd that missed last winter is in town for the rally. Holy crap over $7now this is going to fun. I have so many irons in the NGD sector from wind, solar, zero carbon fuel, lithium, EVs, Batteries etc. They are all going up in leaps and bounds.

FLOAT 470 MIL today, [Transfer agent verified unrestricted (flöat) 437mil 8/13/21.]

33mil increase in aprox 50 trading day works out to roughly 660k Brand spanking new dilution shares per day.

AMKM.234+.022+10% Lithium rare earth NGD stocks moving higher on anticipation of dems passing reduced price NGD bill. If when that happens should see big sector rally. AMTX had a huge run in Jan 2021 from about current level to $1.75. Float and share structure numbers the same.

From Feb 2020

Authorized Shares

75,000,000

02/04/2021

Outstanding Shares

68,717,592

02/04/2021

Restricted

23,826,852

02/04/2021

Unrestricted

44,890,740

02/04/2021

Same exact numbers today TA Verified

10/20/2021

Float 40,540,740 07/12/2021

Float is restricted minus any insider unrestricted shares. AMLM has no dilution it will run hard with any significant increase in buy volume. The Biggest volume day during the run to $1.75 1/25/21 Was a mere 8.1mil shares

BWEN $3.5 +40% Big move above the 50ma after months of drifting lower and bottoming a few weeks ago in what looked like capitulation selling. Start of a new uptrend thanks to latest news.. BWEN float 17.73 mil 50% of all shares owned by institutions and insiders. Tradable float likely 7-8 mil. BWEN has huge upside potential.

https://apnews.com/article/business-gulf-of-mexico-wind-power-environment-and-nature-e91e930df8b002390da02e524e7f6441

New wind farms would dot US coastlines under Biden plan

WASHINGTON (AP) — Seven major offshore wind farms would be developed on the East and West coasts and in the Gulf of Mexico under a plan announced Wednesday by the Biden administration.

The projects are part of President Joe Biden’s plan to deploy 30 gigawatts of offshore wind energy by 2030, generating enough electricity to power more than 10 million homes.

Interior Secretary Deb Haaland said her department hopes to hold lease sales by 2025 off the coasts of Maine, New York and the mid-Atlantic, as well as the Carolinas, California, Oregon and the Gulf of Mexico. The projects are part of Biden’s plan to address global warming and could avoid about 78 million metric tons of planet-warming carbon dioxide emissions, while creating up to 77,000 jobs, officials said.

“The Interior Department is laying out an ambitious road map as we advance the administration’s plans to confront climate change, create good-paying jobs and accelerate the nation’s transition to a cleaner energy future,” Haaland said. “We have big goals to achieve a clean energy economy and Interior is meeting the moment.”

AMTX$19+$2.7+16% will provide Delta Airlines 250 mil gallons sustainable jet fuel. Worth over $1 billion

Whats the expiration date on the next share lockup period. Is it sometime this week?

AHPI $8 .18 -$1 -10% breakdown Dems and main media unable to change the crisis narrative back to Covid. Afghanistan debacle is still an issue thats not likely to go away. 109k maskless fans packed into college football stadium chanting F Joe Biden speaks loudly. Covid fear aint happening AHPI fell out of $9 support today after the trend started late last week. Could punch 50ma tomorrow, bounce op may be in the making.

Sept 2020 big promises led to big run. None of this stuff came to fruition. So just make more bigger and better promises.

https://www.ktvn.com/story/42663059/battery-recycling-plant-coming-to-fernley

johnnygman the play on ABML was a year ago fall 2020 into early 2021 when it ran from mid teens to $4.9 on the promise of an up and running bat recycling plant producing $2 bil in revenue within a yr. It was a great momentum mania play. I made a few hundred k on ABML. Here it is a yr later and they are working on permits. But they have done $mils of dilution. I would not be surprised if they never build a bat recycling plant. It is far easier to promise than it is to deliver on the promise. Ive been trading for over 35 yrs and I know a dilution machine when I see on. ABML is in the business of selling stock. Management doesnt really want a bat recycling plant cause that means hard work. If you want to believe the dream go ahead but you need to understand the float is increasing at an alarming rate of over a mil shares per trading day. The AS is 1.2 bil if I remember correctly and when the OS and float gets that bloated a reverse split and a big one will be in order. The shareholders are on the dilution shxxslide and it always ends the same way. They get fxxxed at the drivethru by management. Dont stop believing.

How convenient of an excuse. My brother is Manager of large construction firm they. Rarely if ever have problms obtaining permits

Did u factor the nonstop dilution into ur analysis? Dilution has a way of undermining positive chart projections. The question remains is the bat recycling plant up n running? CEO said himself $2 bil market cap is based on fully operational bat recycling plant producing $2 bil revenue per yr. Given that $500mil market cap plant should be producing $500mil revenue per yr. How much revenue is the. Current Real or imagined bat recycling plant producing in 2021?

Right now the world is focused on Afghanistan. Once that wanes the media and Dems will get back to work on fanning the Corona Crisis embers into a big bon fire.

Chart

moving lower toward the gap and test the previous highs. Currently underway I consider it in the target zone to re enter. I reloaded the shares I sold around $16 at ave of $9.6.

Chart needs some support built into it at current level while the 20ma catches up, similar to mid to late July. Now is the perfect time with two weeks of Afghanistan evacuations ahead of us which will remain the main focus of Dems/media. In the meantime short loan is paying about $18-$19 per day per 1k shares in interest. Making money on both sides of the trade. 2.99 float AHPI The Perfect Trade On Steroids

Amtx 11.7 breaking out this morning. See if it can hold. Float has doubled since I started trading this. Massive pile of dilution planned $300 mil I believe was the number I read. Any explosive rallies are likely to be muzzled by new shares hitting float. If I don't Sound excited its cause im not. Im not even going to take the time to post the chart. Diluted POS

Likely they read post 6404 and said damn he's on to US we better knock off the dumping for a few days and let it bounce (up to an ever descending ema). The dilution slide will resume how else will the make money?

Float reported on otcmarkets by company as 348mil on 2/18/21. Transfer agent verified unrestricted (flöat) 437mil 8/13/21. Basically 90 mil shares of dilution in the last 6 months and their still working on grading permit. Post 6358 from 7/16/21 float was 406mil just a month ago about 30 mil per month over a mil everyday.. easy to see why pps is on steady decline forming ckassic. dilution shxxslide chart. At some point a rs is inevitable. Do I need to explain anymore than that?

Typical AHPI trading would close the gap. Gap closed today big 83% retracement to $9.35 of the last run from $7.7-$16.41.

The massive gap up by some eager beavers with a big move up. The rest of the day was lighter volume with pps moving lower toward the gap and test the previous highs. Typical AHPI trading would close the gap but matters not. We have months of growing momentum and mania ahead. This is just getting warmed up.

AHPI 2.99 mil float is tiny compared to GME's 58 mil float.

GME float is 19.3 times larger than AHPI float.

Right now the world is focused on Afghanistan. Once that wanes the media and Dems will get back to work on fanning the Corona Crisis embers into a big bon fire.

Chart

moving lower toward the gap and test the previous highs. Currently underway I consider it in the target zone to re enter. I reloaded the shares I sold around $16 at ave of $9.6.

Chart needs some support built into it at current level while the 20ma catches up, similar to mid to late July. Now is the perfect time with two weeks of Afghanistan evacuations ahead of us which will remain the main focus of Dems/media. In the meantime short loan is paying about $18-$19 per day per 1k shares in interest. Making money on both sides of the trade. 2.99 float AHPI The Perfect Trade On Steroids

![]()

Cost to borrow report update $39 per 1k shares per day up $6 from Last night lending report paying $33.04 per 1k shares per day.. My 50% is $19.5 per day per 1k shares That is the cost to borrow AHPI. Last night The report is based on previous day when interest was 103% and closing pps was $2 less, yesterday it was 115%. My 50/50 split is $16.52 per day per 1k shares up $1.2 from previous day. When 100% or more of the float shorted. Then the Red dit fellows climb on board like a bunch of people packed into a suburban down south. gov will do their part in covid crisis management. The sweet people at news outlets will be there as well. Everyone's working together just like a team. 2020 this was The Perfect Trade. The float is the same the volume has increased 10 fold, there is a large and growing short and the herd is coming. Now its The Perfect Trade On Steroids.

Pull back testing $12 the big gap up from the other morning. AHPI was $6 2 weeks ago. consolidation and base building before the next breakout. Each move has been a double bagger from each pennant. Next move could be mid $20s

![]()

Post 221 I asked that very question 1,704,000 shares of float shorted. That was as of last Friday. I would. Assume that it may be higher today seeing how the pps keeps moving up.

AHPI From iborrow site

Fee Available Updated

103.6 % 500 2021-08-11 09:15:03

If I'm reading this right hard to borrow rate is 103.6% annually. The broker(etrade) takes a 50/50 split with the lending shareholder. This works out to over $15 per 1k shares per day to the shareholder based on the numbers I used earlier $10.75 closing pps. As pps goes up so does the daily amount paid to the shareholder all else equal.

do you have a link to the borrow rates and shares available. I got an update from Etrade on the daily rate and how its calculated

The formula to calculate is closing price of the stock X shares loaned X 102% = contract value

Next, you would take the contract value X daily rate (90.38% for AHPI today) = revenue per year

Finally, revenue per year / 360 = revenue per day.

I came up with $27.15 per day per 1k shares and $1629.06 per day for 60k shares based on $10.75 closing price. $594k per yr for 60k shares loaned if all factors remain the same.

The massive gap up by some eager beavers with a big move up. The rest of the day was lighter volume with pps moving lower toward the gap and test the previous highs. Typical AHPI trading would close the gap but matters not. We have months of growing momentum and mania ahead. This is just getting warmed up.

AHPI 2.99 mil float is tiny compared to GME's 58 mil float.

GME float is 19.3 times larger than AHPI float.

It took GME 5 months to go ballistic patience required. GME $5 Aug 21 2020 to $40 Jan 2021 then next 5 days $40 to $483 (over $500 premarket). AHPI is in the very early stage selling now is like selling GME at $10 except AHPI float is 95% smaller, GME float is 19 times larger than AHPI, AHPI is the Biggest Bang For Your Corona Bucks and the mainstream media is telling everyone were going to die if we don't all get vaccinated. Before you die you get put on a ventilator and AHPI makes those ventilators. The bigger the corona fear factor the bigger the AHPI rally. Its only summer and we have about 5 more months of Corona Fear before it peaks. Let the shorts buy up all the float. All 2.99 mil of it then pack 100 mil share days of buy vol day after day. There is no bad AHPI scenario to the bad senarios described above AHPI benefits no matter what.

Float is 2.99 mil not 3.4mil. 1.7mil÷2.99=56.98% short. 100k/2.99mil=.0333% If I loan the 100k shares to be shorted then the % of float shorted will increase 3% to 60%. The higher the % of AHPI float shorted the more it looks like the next GME. except gme float at 58mil is 19.3 times larger than AHPI's 2.99 mil. Gme made it to over $500 and gme didn't have the media and dems fanning rally flames. AHPI $8 would look cheap at $100+.

Short statt. I got a call from Etrade today inquiring about AHPI. They want to borrow my shares. One of my accounts has 60k shares AHPI they said if I loan those 60k shares. I will get paid $800 per day 7 days a week at the current price and short %. That works out to about 60% annual return on my money.I forgot to mention the other 40k I own spread thru a few othe accounts. Short numbers are reported twice per month. I asked what the latest report number. 1,704,000 shares of float shorted. Next report comes out around 15th of month. He said the request has been out for my shares since Tuesday. I have been busy had not seen the message. If the price of the stock goes up, the amount I get paid goes up and vice versa if it goes down. 3.4 mil float 31% of 4mil OS owned by insiders and institutions. Etrade said there is no shares available to short right now. I can call the shares back at any time if I want. Lend the shares let someone short them and wait till the stock goes up for a few days then call the shares back forcing a cover or a scramble to find other shares. This could be a win win.

AHPI tiny float is all sucked up today's call from Etrade is proof of that. AHPI 3.4MIL FLOAT has the potential to be bigger than GME 50MIL+ FLOAT. Hang on to your shares don't sell them for pennies and nickel gains. Hold out for mega Dollar gains.

Proof of dilution. Very simple if u know where to look. The filings are full of dilutive financing. How do u track the dilution. In the old days u had to call the Transfer Agent and ask what share structure was including float.. most times the TA was locked a good sign the company was diluting but the current float was still unknown. Now OTC MARKETS has a very Handy feature, Transfer Agent Verified which Updates share structure daily.https://www.otcmarkets.com/stock/ABML/security

AS over a bil is a huge warning sign of adilution machine. Increase in AS and OS don't necessarily mean dilution. Increasing FLOAT is the indicator of dilution. OS-Restricted =unrestricted= float. The reported float is the only number not updated by Transfer Agent. It is reported by the company and has a date in the case of ABML float reported 348mil on 2/18/21. TA reports unrestricted (float) 406mil on 7/16/21 a 58mil share increase in a 6 month period. That is dilution. To determine the monthly rate of dilution divide 58 by 6 about 9 mil shares a month a couple mil per week. How does it affect the shareholders.pps Was low $3 on Feb 18 2021 on July 16, 2021 $1.6s.

Thats ur proof of dilution TA VERIFIED right in front of u if u know how to look.

CEO said himself months ago $2 BILLION market cap is based on a fully operational bat recycling plant producing $2 bil in annual revenue. Is the plantvup n running yet?

AHPI was The Biggest Bang For Your Corona Buck back in Feb 2020. Review the trade of the 3 stocks to own in a pandemic. The fundamentals for AHPI remain the same except better. OS 4 mil Float 3.4mil 31% of shares owned by institutions and insiders. Now we have the added factor that 57% of the float is shorted. Back in Feb 2020 the biggest volume day, the day it traded over 500k shares in premarket hitting premarket high of $67.2 the volume was 11 mil shares. It opened and had a high of $45 then was systematically repeatedly halted bringing the price lower each time it reopened. On July 13 2021 AHPI traded 211 mil shares and spiked to almost $12 from sub $4. That alerted things to come the next couple weeks was a consolidation period with brief pps spikes on buy volume . Shares bought up $5.5-$6.5 further tightened the float. I had 20k share in Feb 2020 i have 5 times as many I bought in the last couple weeks.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=154168117

Lots of positive catalysts

Tiny Tiny float

No Dilution

Repeat NO DILUTION

Political landscape was very important in 2020 and equally so now. The Dems want to control everything and they use fear to make it happen. They are setting the stage for a disastrous school year and many failed businesses in areas that follow the strict guidelines of vaxing and masking. Profit from the madness with AHPI in your portfolio.

We still have more summer to go and AHPI is trading 100mil shares plus today. When school starts and fall coming Corona fears will be increasing along with it will be the pps and volume of AHPI. AHPI has the makings of one of the biggest Momentum Mania stocks in history. The run is just getting started and could last for 2-3 months If you keep cramming 100mil share days into 2 mil tradable float the pps will explode northward. Today was a good day many more ahead.

[img[https://investorshub.advfn.com/uimage/uploads/2021/7/30/rfpjrAhpibreak.jpeg[/img]

[https://investorshub.advfn.com/uimage/uploads/2021/7/30/rfpjrAhpibreak.jpeg

The dems are pushing for more control and they are using fear to get it. The harder they Fan the covid fear fire the bigger the trade volume for AHPI will be. Just look at Fridays vol and Fridays covid news coverage. After AHPI went to $67 it gained a lot of new eyeballs watching it. The herd is here and the float is smaller than 2020. Its sucked upband being held by strong hands. We all saw GME AMC and the other heavily shorted stocks go ballistic a few months ago. Everyone is looking for the next GME. Gme has a float of 50 mil vs AHPI 3MIL. 211 mil 109 mil vol this thing is just getting warmed up. I have full faith THAT AHPI is going to run much higher than most expect. This momentum and mania on steroids.

VERB/fusz progress report 3.21/,21 +28% on 271mil shares traded. Verb still down 93% from high. Still down a few bags from Nasdaq uplist fantasy pricing. Great for traders but l&s still way underwater. Impressive volume by any measure not very impressive % move given the massive volume. One thing that is way up is the float 54.8 mil up 843% from 3/22/19 6.5mil. More likely than not a few mil shares were dumped today. Watch for a change in next few days.

It's too hot they'll need to wait till the fall-winter. In the meantime they can do so.e more dilution to pass the time.

possible support levels to be tested

$1.98 April high

$2

Gap $1.76-$1.84 with $1.8 low from May20 to May 21 gap up

20ma currently $1.74 and climbing

These are logical trader minded areas to be watching for possible consolidation and re entry.