Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

CAVEAT EMPTOR: GIFA INC NO LONGER EXISTS !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

Discord PUMP CLOWN CONS now peddling lies of "QUIET PERIOD" LMFAO - it's "Quiet" as this ONE MAN CRIMINAL Yusuf Kisa OFF-SHORE SCAM DOES NOT F-ing EXIST Bwwaaa ha ha WTF.....

The PAID DISCORD team here aka Handford and his Canada/UK boy "teams" and paid crew are beyond bad comedy......just plain old gutter lying on this STINKY PINKY Turkish Republic Northern Cyprus crime haven shit hole SCAM SCAM SCAM..........

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

http://www.hri.org/news/cyprus/tcpr/2006/06-05-19.tcpr.html

GIFX CEO Yusuf ONE MAN SCAM Kisa 9mm illegal handgun criminal arrest LOL !!

Kisa arrested 4 times – recent news :

https://yenibakisgazetesi.com/gifa-s-long-awaited-press-release-delayed-due-to-unexpected-circumstances/

https://www.meforum.org/63845/turkish-delight-depravity-in-northern-cyprus

RED ALERT WARNING: GIFA INC aka $GIFX this scam ticker is a ONE MAN SCAM in the shit hole TRNC aka Turkish Republic Northern Cyprus NOT even recognized as a "country" by the USA or the UN - the CEO Yusuf Kisa and side-kick ..."hired hooker model babe" ..female con Aygun Antas aka "company secretary" are muli-time convicted FELON CRIMINAL CONS and there is no "business" known as "GIFA INC" being conducted anywhere on planet earth......

Use Google in English or Turkish and NOTHING will be found as to anything "real" existing as to some public traded "business".....

This is a STINKY PINKY SCAM UN-AUDITED DOG SHIT "Alternative Filing" aka NON SEC FILING OTC gutter scam - same shit as right out of Wolf Of Wall Street.....PINK SHEET HUSTLE CRIME....it was front loaded in 2017 as a shell hijack and pumped and dumped....thee end.....

DO NOT LISTEN TO THE Canadian/UK Discord paid "crew" member non-disclosing promoters here - aka Handord and his boys....they are ONLY "trying" to re-pump this dog shit scam ONE MORE TIME to dump more on the last baggie holders and dupes.....that is the fraud taking place here....THEY created and run the scam Instagram account y.kisa1 and THEY build the latest $100 buck Wordpress shit website and operate it.....nothing else is real.....no "company" will be found anywhere.....NO ONE can prove otherwise.....!!!!

https://web.archive.org/web/20230205044320/https://gifatoken.com/

The criminal “Crypto Token” hustle that put the CEO Yusuf Kisa in the off-shore DUMP known as the TRNC aka Northern Cyprus IN PRISON and was a massive criminal fraud and total scam !!!

You freaking Discord Canadian/UK paid pump-con clown dupes - THERE IS A REASON this POS crime scene is down to "TIGHTLY CROPPED OLD PICS OF ONE ONE ONE MAN CLOWN SHOW Yusuf Kisa" on INSTA-SCAM and literally NOTHING ELSE....because THERE LITERALLY IS NOTHING ELSE...a fugazi SCAM....a STINKY PINKY FRAUD n SCAM.......epic scam.....from clear back to 2017 SCAM SCAM SCAM......INSTAGRAM my ass.....you damn frauds and fools.....!!!

https://www.google.com/maps/@35.2119627,33.3782044,3a,37.5y,198.09h,93.89t/data=!3m7!1e1!3m5!1sAF1QipNtw-hXpm-dmGfupSNrYSJRoublrrGyUV9o1Gln!2e10!3e12!7i5760!8i2880?entry=ttu

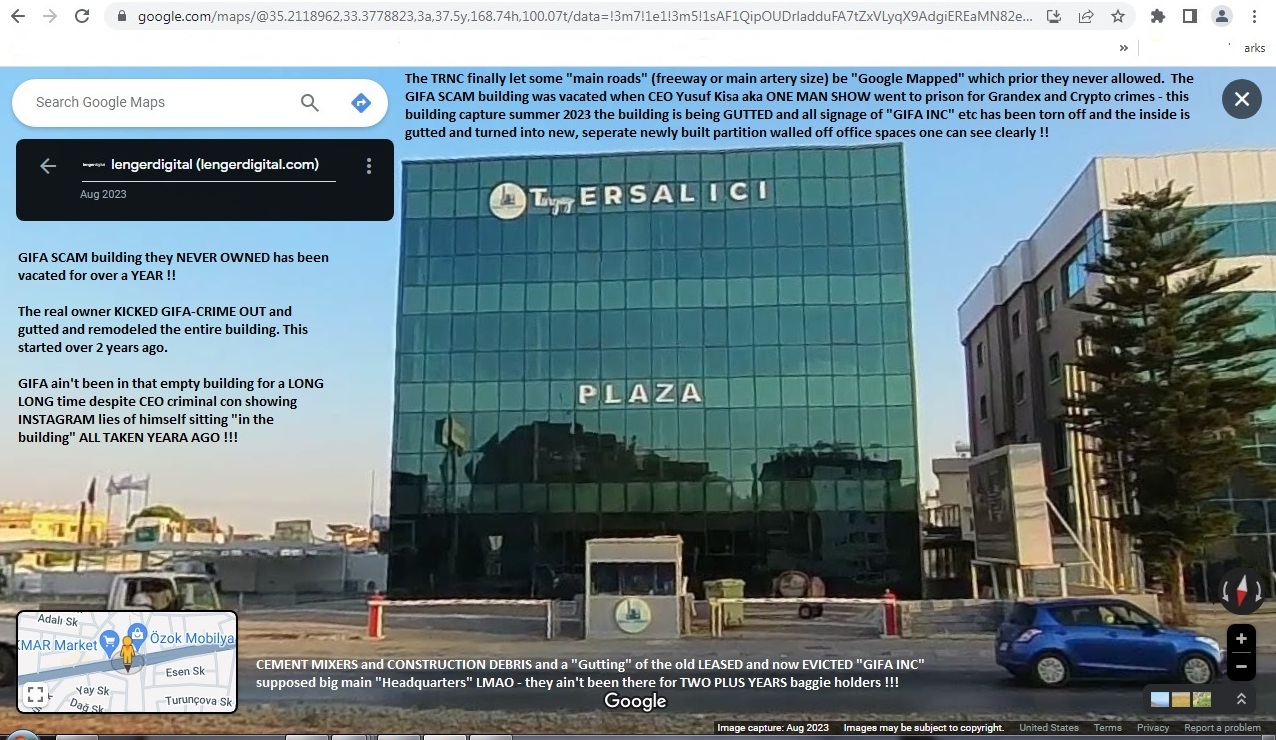

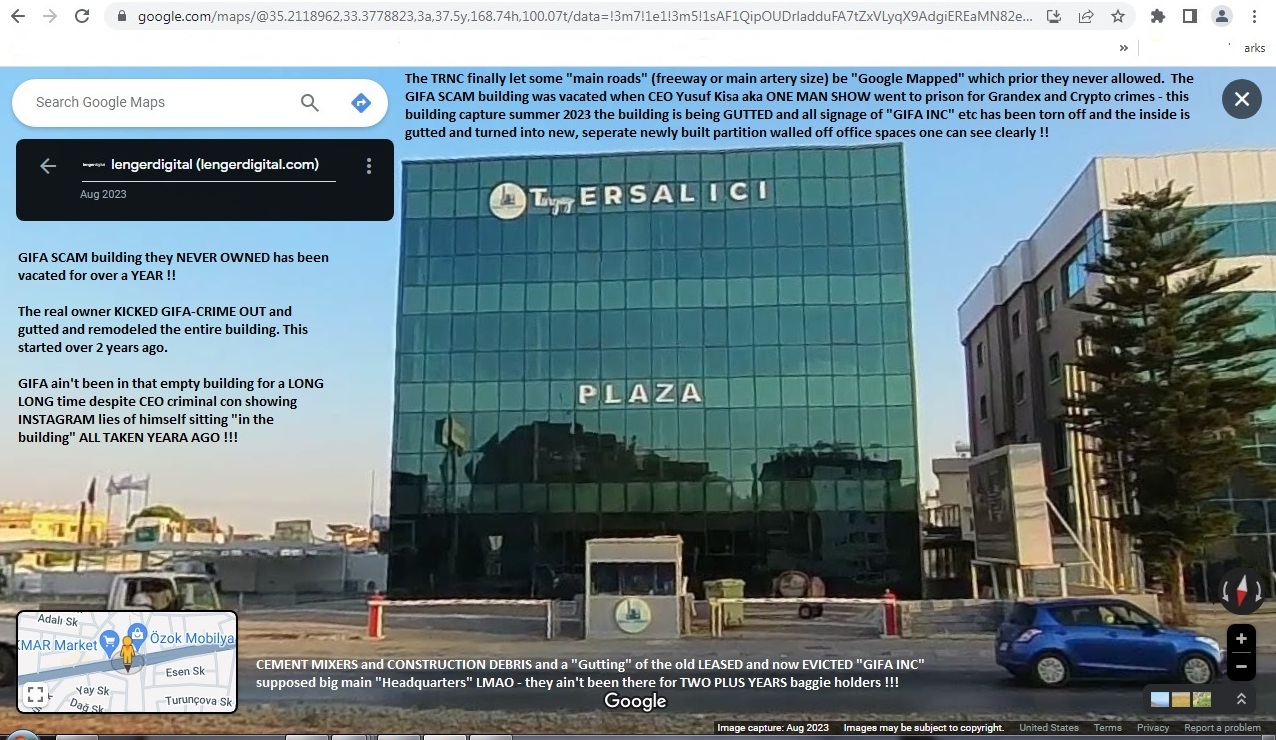

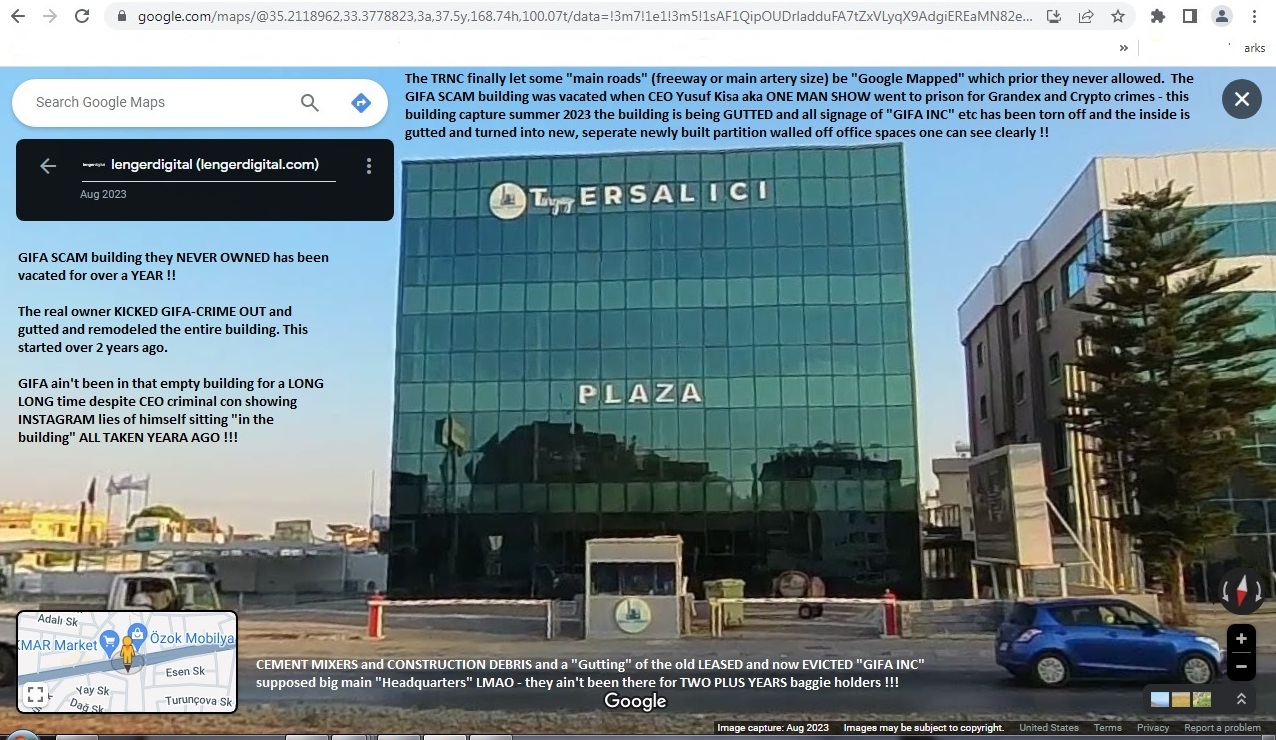

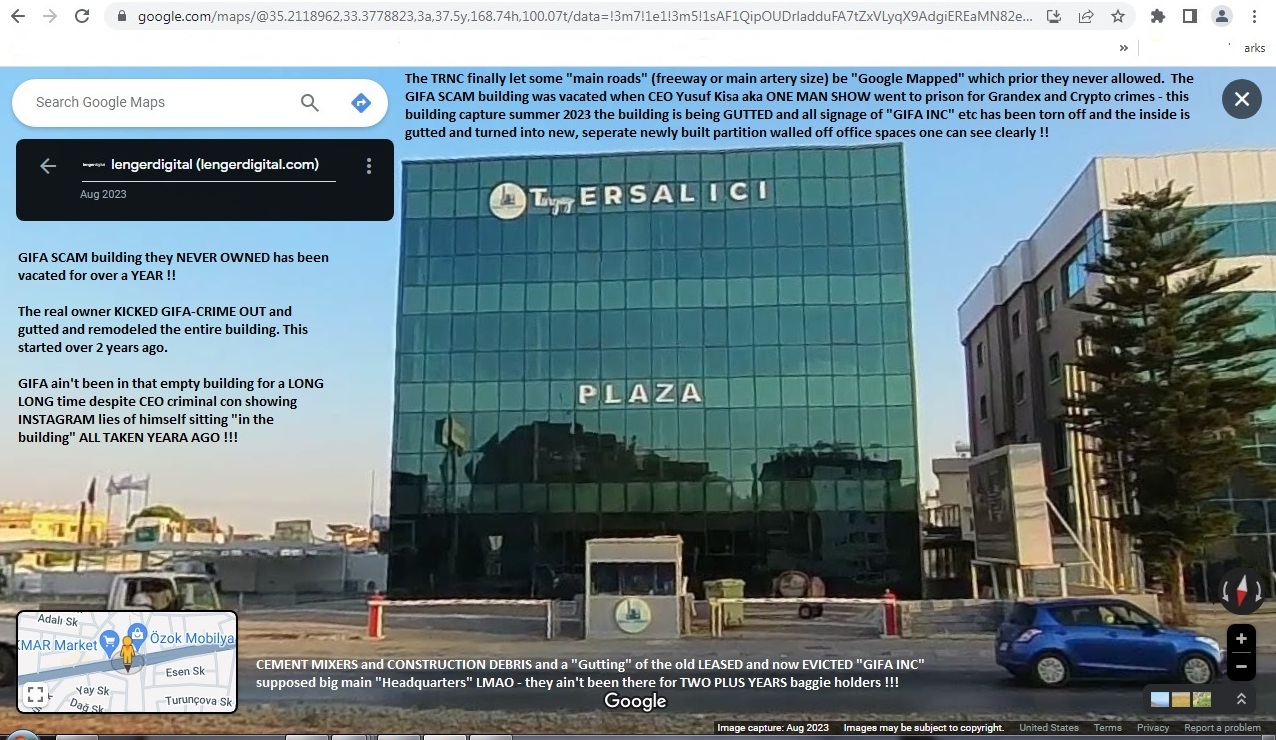

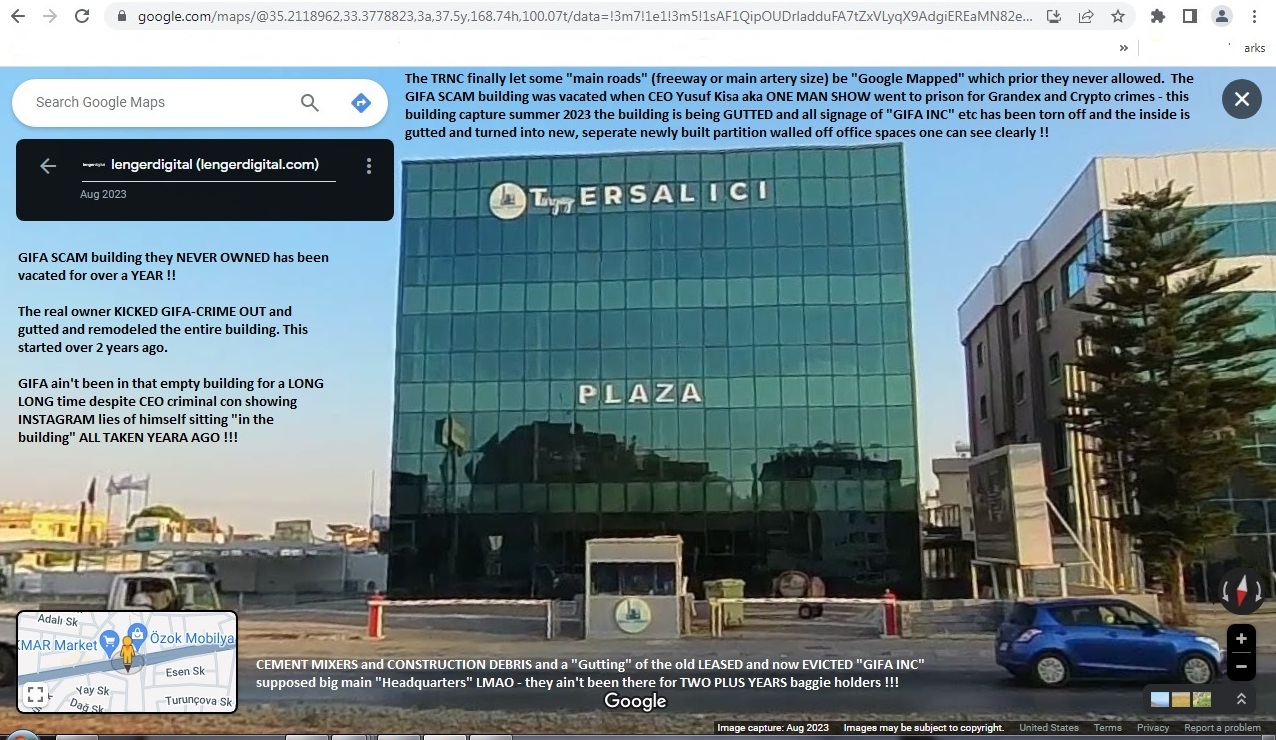

FORMER GIFA – now a USED CAR LOT by the real TRNC businessman and owner of that building Turgay Ersalici.....GIFA-CRIME is a total gonner !!!

https://www.yeniduzen.com/devlet-vergi-konusunda-adaleti-saglamali-119487h.htm

HE OWNS THAT BUILDING and kicked-out GIFA SCAM......and his TOTAL "TAXED EARNINGS REPORTED" is a mere $4 million approx making him ONE OF THE WEALTHIEST TAX PAYERS in the entire TRNC SHIT HOLE you damn freaking fools....LMAO.......$4 mil and he's ONE BIG TIME TOP DOG on that crap hole north island.....

I'm am BLOWING THIS SCAM WIDE WIDE WIDE OPEN for the dirty crime scene that it is.....AND... and expose it ALL ALL ALL.....and NO the Discord paid Canadian/UK clown crew ain't gonna stop STONE COLD FACTS.....

GIFA INC aka GIFA HOLDINGS.....taken over and turned into a USED CAR LOT LMFAO.....by the REAL OWNER who kicked out criminal Kisa off the lease....and sent the ass clown packing.....

https://www.facebook.com/erslc

USED CAR LOT – taken back by the REAL BUILDING OWNER a well known CAR DEALER and actual “business man” in the shit hole TRNC !!!

"ALTERNATIVE FILER" OTC STINKY PINKS - nothing....as in NOT A DAMN THING in those filings is "verified" in ANY WAY, SHAPE OR FORM....READ THE OTC SITE ITSELF...."WE ARE NOT REGULATORS and ONLY A MARKETPLACE and non SEC FILERS RELY ON WHATEVER THEY WRITE IN THEIR OWN FILINGS" and use EXTREME CAUTION IF NOT AUDITED as they are often TOTAL SCAMS and 100% MADE-UP FAKE INFO.....OTC MARKET ITSELF SAYS RIGHT ON THEIR WEBSITE LMAO.....you clowns.....!!!

FIRST HINTS - and I will add narratives and details for WEEKS TO COME as I expose this criminal off-shore TRNC (Turkish Republic Northern Cyprus) ONE MAN CRIME SHOW aka Yusuf The Perp Kisa clown con SCAM SCAM SCAM......

There's a reason this crime scene ain't AUDITED and EVERY WEBSITE (ALL FAKE SCAM PUMPS) EVER EVER EVER ASSOCIATED WITH IT HAVE BEEN SCRUBBED DOWN OUT OF ORWELL AND VANISHED –

Sorry baggies.....start to look at these STONE COLD FACTS....you clown pump frauds days of hyping this clown show are OVER.....it's all coming to an end.....DEAD TICKER SCAM.....nothing but a $50 buck Nevada shit corp with NO bank accounts...no facilities...no daily business operations....no "company" and no "employees" aka NOTHING...nothing but some off-shore ass hat criminal convicted white collar crime perp with a bad INSTAGRAM/INSTA-SCAM account Bwaaa ha ha ha ha !!!!!!

###################################

LOOK CLOWNS - and then WEEP....LMAO.......Kisa got his ass booted out of that building over TWO YEARS AGO and ain't been in it since....:))

###################################

GUTTED - Google Earth and maps.... prior COULD NOT photograph the shit hole TRNC but new laws allowed it .....BUT BUT BUTT I knew these facts for OVER A YEAR as I have a person who went "on the ground" and 100% verified that GIFA IS and ALWAYS WAS A TOTAL SCAM......"rented students" posing as "employees" in a LEASED BUILDING always owned by REAL PERSON Turgay Eralici who who who owns what...CAR DEALERSHIPS and other real businesses in the TRNC....

Criminal Yusuf Kisa besides GOING TO PRISON went after Turgay in the shit show Yeni Bakis and accused the dude...Turgay BOOTED KISA from leasing a few floors of HIS FORMER NISSAN CAR DEALERSHIP BUILDING HE BUILT and that he HAS ALWAYS OWNED and Kisa hasn't posted ANY "recent" as in THREE YEARS OR NEWER (2018 they were BOOTED OUT !!) from that damn building.....them are STONE COLD FACTS......

ALL WEBSITES VANISHED PERFECTLY COINCIDENT WITH WHEN KISA WAS KICKED THE HELL OUT OF THAT BUILDING ANd and and ARRESTED and IMPRISONED.....the dude ain't doing JACK SHIT as far as some fantasy "business" and NEVER HAS.....he ran CRYPTO-CRIMES-a-CON and it got his ass sent to a shit hole prison.....:)))

##########################

GONNER - under construction and turned into a SHOPPING CENTER "PLAZA" over 2 damn damn YEARS AGO LMFAO.....you pump fraud Discord clowns have been had and I knew it all all all along......

GIFA INC is a $50 buck NV empty SHELL CORP....they ain't got $25 bucks in a USA bank account and this crime scene lost EVERY WEBSITE it ever had due to govt of the TRNC intervention due to the crimes CEO Yusuf Kisa committed !!!!

#########################

The SHORT LIST OF EVERY VANISHED CRIMINAL PUMP WEBSITE THIS CRIME SCENE EVER RAN - all all all TOTAL OFF-SHORE STINKY PINKY CAVEAT EMPTOR FRAUD FRAUD FRAUD FRAUD FRAUD........from clear the hell back to 2017 !!!!

This POS CRIME SCENE DOES NOT EVEN HAVE A DAMN WORKING PHONE or DAMN CORP WEBSITE for the faux bullshit crime "global conglomerate" BS pumper con's tall tales -

ALL are DELETED and VANISHED and SCRUBBED "former" CRIME SITES OF THIS POS SCAM:

gifainc.com

GONE

gifainc.net

GONE

grandexfinance.com

GONE and what got Kisa PUT IN PRISON to this damn day !!!

https://gifaholding.com/

GONNER - CRIMES !!

http://grandexfinance.com/

GONNER

http://gifaforex.com/

100% BIG A FRAUD AS THE GIFA TOKEN CRYPTO CRIMES !!

http://www.gifaconsulting.com/about-us.html

DOES NOT EXIST - never existed CRIME SCENE FRAUD !!

http://www.gifafinancialinstruments.com/index.html

GONNER - CRIMINAL FRAUD !!

http://www.gifafinancialinstruments.com/

GONNER - FRAUD !!!

GIFA Green Islands Finance of America (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.greenislandsfinanceofamericaltd.com

GIFA Call Center (FAKE AND "SCRUBBED NEVER EXISTED" !)

http://www.gifacallcenter.com

GIFA Nursing Home (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifahuzurevi.com

GIFA Air Lease (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifaairlease.com

GIFA Duty Free (FAKE AND "SCRUBBED" ONLY RUN AS A FEEDER CON, BUSTED IN THE UK on criminal charges !)

http://www.buyqualitycigarettes.com

Global Visa Limited (FAKE AND "SCRUBBED" TOTAL FRAUD CON - stole people blind and was criminally busted for scamming "immigration" laws !)

http://www.geteasyvisa.net

Yusuf Kifa Biography-CON (FAKE "BIO" by the MONGOL-CLOWN HIMSELF- ALL FAKE, ALL LIES, ALL FABRICATED to pump this dog shit stock and now "SCRUBBED" and gone !)

http://www.yusufkisafinance.com

Gifa Enerji Ürünleri Ticaret (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.nutritionstoreonline.net

GIFA Deniz Ürünleri (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.gifadenizurunleri.com

Yeni Bakis Gazetesi (WORKS "sometimes" and is used as a pump-tool for the LIE-n-FRAUD known as "GIFA INC" aka $GIFX. ALL "OLD" criminal stock pump "articles" and ALL "loans to Iran" articles SCRUBBED AND GONE !!!)

http://www.yenibakisgazetesi.com

Gifa Consulting (FAKE and "SCRUBBED" and NO BULLSHIT about $BILLIONS IN LOANS TO IRAN" WAS LEFT BEHIND - ALL VANISHED ! NO MORE "We're raising our loan targets to $75 BILLION EUROS" blah blah when Aul issued the LIE-n-FRAUD BULLSHIT PR about "the pesky Lira and inflation problem is why we're missing THREE AND A HALF YEARS OF SEC FILINGS and are now re-inventing ourselves as bullshit fraud GIFA PETROLEUM that DOES NOT EXIST EITHER !! ALL A CON !)

http://www.gifaconsulting.com/index.html

Gifa Forex (FAKE and "SCRUBBED" front-company Kisa uses to TRADE HIS OWN SHARES OF GIFX as he's doing RIGHT NOW USING InstaSCAM as the PUMP TOOL)

http://www.gifaforex.com

Gifa Nektar (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifanektar.com

Gifa Insurance (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifainsurance.com/index.html

Gifa Project (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaproject.com

Gifa Rent a Car (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifarentacar.com

Gifa Construction (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaconstruction.com

Gifa Estates (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaestates.com

Gifa Financial Instruments (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifafinancialinstruments.com

GIFA Airways (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON where one can now buy KNOCK-OFF SHOES as in a CRIMINAL FRONT COMPANY USED TO FEED MONIES TO KISA TO BUY HIS OWN GIFX STOCK in P&D "cycles" !!)

http://www.gifaairways.com

GIFA Hotel & Casino (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.scotlandyardnews.com/gifa-chairman-to-build-new-and-deluxe-hotel-casino-in-the-trnc/1108/

GIFALAND (GIANT, ENORMOUS CON-n-FRAUD and FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaland.com/images/fizibilite-raporu-eng.pdf

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaland.com/home.html&prev=search

GIFA Holding (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON as NOTHING EXISTS INSIDE IT when put into "GIFA INC" aka $GIFX THIS EMPTY SHELL DOG SHIT PENNY SCAM and FRAUD !)

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaholding.com/&prev=search

THAT is the "short list" folks- these are SERIAL TRNC OFF-SHORE SHIT HOLE AND CRIME HAVEN.....F-ing.....CRIMINALS and SERIAL CONS operating out of the shit hole "neutral zone" ......TEXTBOOK penny scam as assisted by William Bill Aul long-time penny pump and shell scammer in San Diego.... and numerous others now and a PAID CANADIAN PUMP CREW who also has a few UK "marks" used to wash-trade for P&D crimes.....

Just ANOTHER in the Billy Aul list of garbage "companies" over the years (he and Ralph Amato - a con wanted for IRS fraud now) those two have been "assisting" penny scams for over two decades now- egregious as all hell !!

GIFX WAS...PAST TENSE....now since the TRNC GOVT SHUT IT DOWN and put CEO KISA IN PRISON..it WAS WAS WAS ......A TERRORISM FRONT-COMPANY for washing money via their "Russia division" to aid IRANIAN TERRORISM in violation of U.S. sanctions and embargo laws- that is it.

USED CAR LOT NOW.....REAL BUILDING OWNER CONTROLS IT ALL....kicked out KISA when the ass clown "went after Turgay" in the shit show Yeni Bakis which ALSO got it's scam "TV" web channel bullshit GOVT YANKED...gonner....no more....POOF......GIFA INC is worthless kids....GONNER.....:))

SEC SHUTDOWN AND DOJ INVESTIGATION AND CRIMINAL CHARGES TO FOLLOW :)

PS: The "RUSSIA" organized crime front operation- now at the DOJ level for investigation. Aul is in DEEP, DEEP SHIT !

In early 2020, the company appears to have opened or started a "Russia subsidiary" but William "Bill" Aul has never released any formal PR to explain what the Russia subsidiary does or if it is owned/controlled by GIFA Inc (GIFX this stock) etc?

gifaconsulting.ru

GONE and scrubbed - CRIME !!!

https://www.youtube.com/watch?v=1YSFQfXQEHM

SAME individuals shown in that SCAM FRONT-ORG appear in older "scrubbed" CRIMINAL GIFA HOLDING "ASSISTANCE" VIA LARGE LOANS TO IRAN TERROR GROUPS - total violations of U.S. law(s) !!

THE BIG LIE n CON JOB….. “WE BE IN THE PETROLEUM” biz CRIMINAL FRAUD P&D….NEVER EVER FORGET BAG HOLDERS…..:))

GUN SHELL CASINGS LMFAO !!!!

GIFA-CON aka GIFX…..DOING BIZ WITH TERRORISTS – that be a pic of the Ayatollah Khomeini hanging proudly on the wall – THEE NUMERO UNO SWORN ENEMY OF THESE UNITED STATES……NO WAY the state dept and SEC-DOJ let this POS TRNC crime scene trade given what just happened in the Middle East…..this scam is already BAKED and DONE….and I’ll be sending a note to the key congressman on the US Security Council about these damning criminal facts….:))

BAGGIES RED ALERT - you've been "had" again by criminal con Yusuf Kisa and Aygun Antas Bwwwaaaaaa ha ha ha ha ha dumb assess....!!!!

Aygun Yahi Antas Turkish Republic Northern Cyprus has been moved to "WANTED" status- now the NUMERO TWO "MOST WANTED" as related to GIFA INC criminal stock fraud committed against US citizens....she is on a "EXTRADITE" criminal fraud list now......watch n learn kids....bout to get real good here on this off-shore crime scene...I'm talking more arrests and cons going to a rot gut prison kinda good :))

*******************************************

Aygun Yahi Antas WANTED 💀 ☠️ WANTED 💀 ☠️ WANTED

******************************************

WANTED: SECURITIES FRAUD VIOLATIONS SECURITY ACT 1934 UNITED STATES OF AMERICA

****************************************

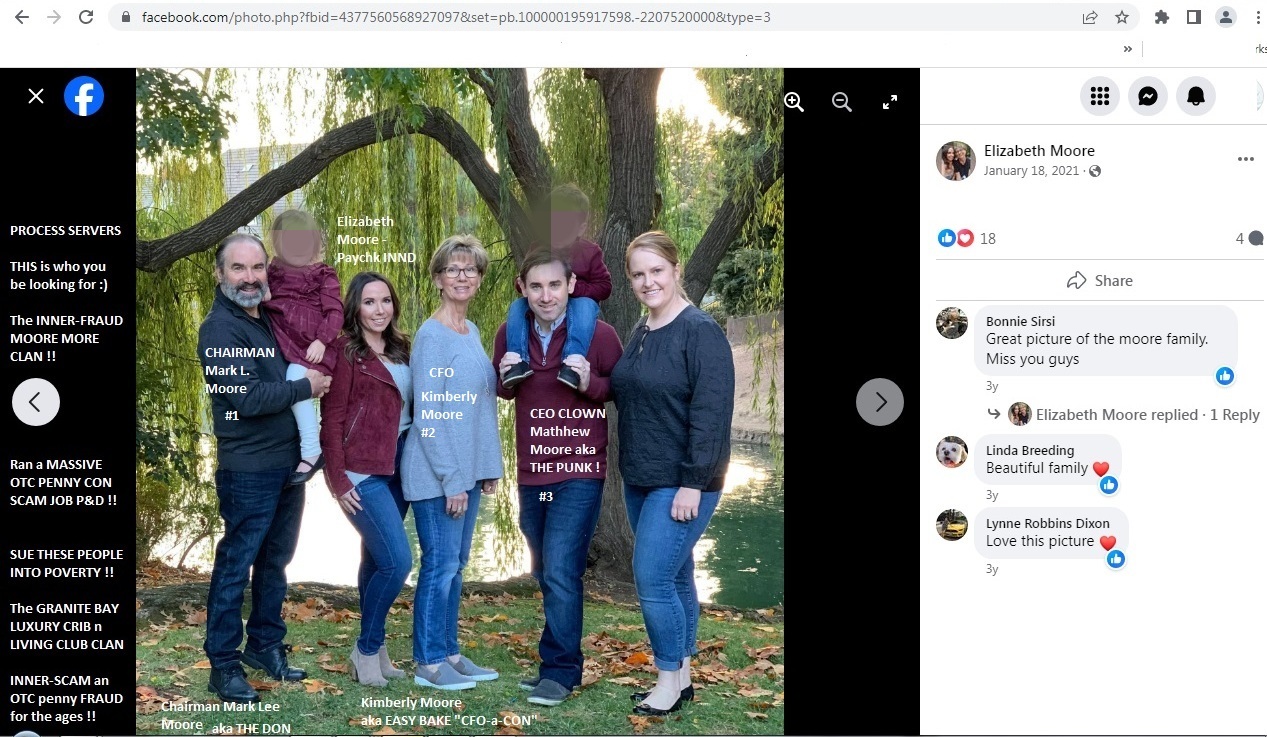

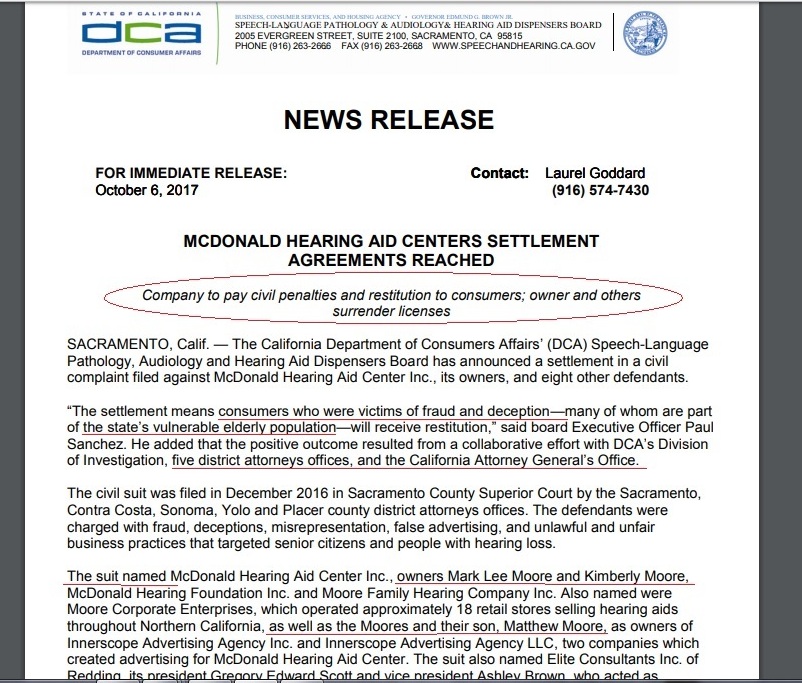

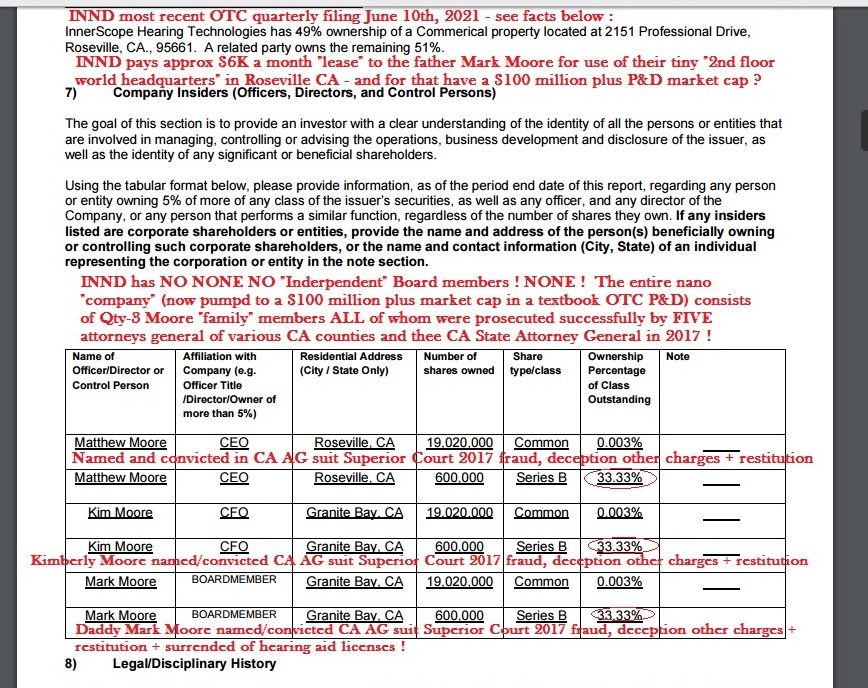

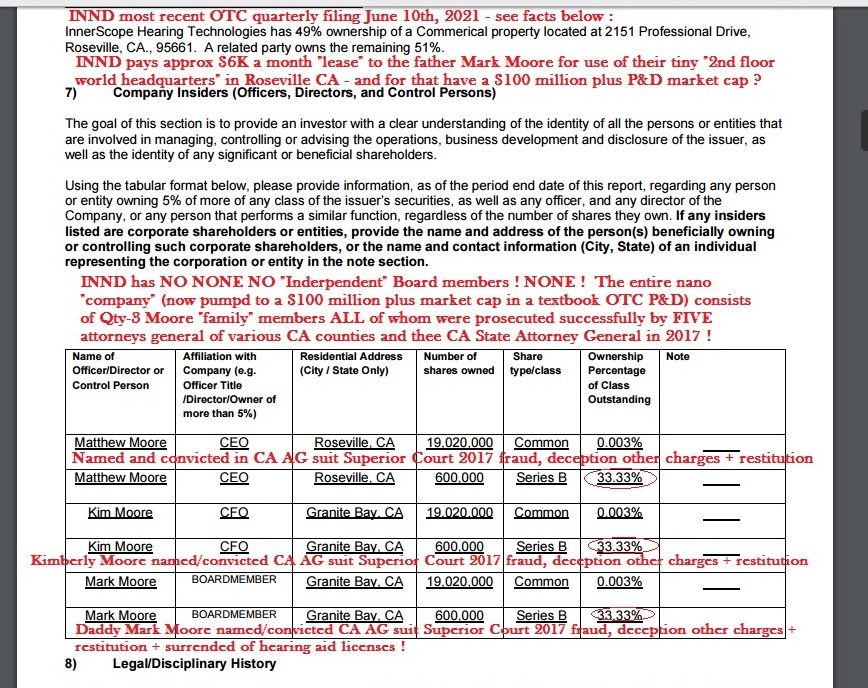

$INND: Q3 ENDS 1 WEEK NO FILINGS !!

YIELD SIGN OTC GUTTER CRIME TRASH:

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

https://www.otcmarkets.com/stock/INNDD/security

The MOORE CRIME CLAN WILL NOT file so much as a Post-It Note for Q3 ending Sept 30 next week......they won't file so much as a scrap of old fish wrap used to line their bird cage at the MILLER HIGH LIFE CRIME CRIB now in foreclosure...not a chance in hell they file now as it SELF INCRIMINATES if if IF if if they file BK which is almost a 100% certainty now......

I "predict" and am "going on the record" that the MOORE CRIME CLAN will file not only a corp INND BK but will file a PERSONAL BK and the likely use of DILUTION via the reverse split was nearly 100% for certain to PAY THEIR BK LAWYER FEES......

Remember kids - the GRANITE BAY COUNTRY CLUB MILLER HIGH LIFE GIG n CRIB WAS "IN DEFAULT/FORECLOSURE" in 2022 and the MOORE CLAN used the PUMP and DUMP GAINS to "buy out their foreclosure" and get their HIGH LIFE back in swing......

They are sociopath criminals....they PAID OFF ALL THEIR BILLS while running a dirty as a road-side gas station toilet seat PUMP and DUMPER OTC GUTTER CRIME and never ever ever "sold hearing aids"...this was a textbook plain jane dirty fraud......

Bwaaa ha ha ha WTF.......MATTY BOY aka CALL SIGN "GERM" aka SOY LATTE aka THE PUNK......

+++++++++++++++++++

+++++++++++++++++++++++++

THE MOORE MORE CRIME CLAN - never ever ever forget THIS WAS A PLANNED and PRE-MEDITATED P&D SCAM SCAM SCAM !!!

++++++++++

https://trellis.law/case/s-cv-0051784/indianapolis-star-vs-innerscope-hearing-technologies-inc-a-nevada-corporation

AND

AND

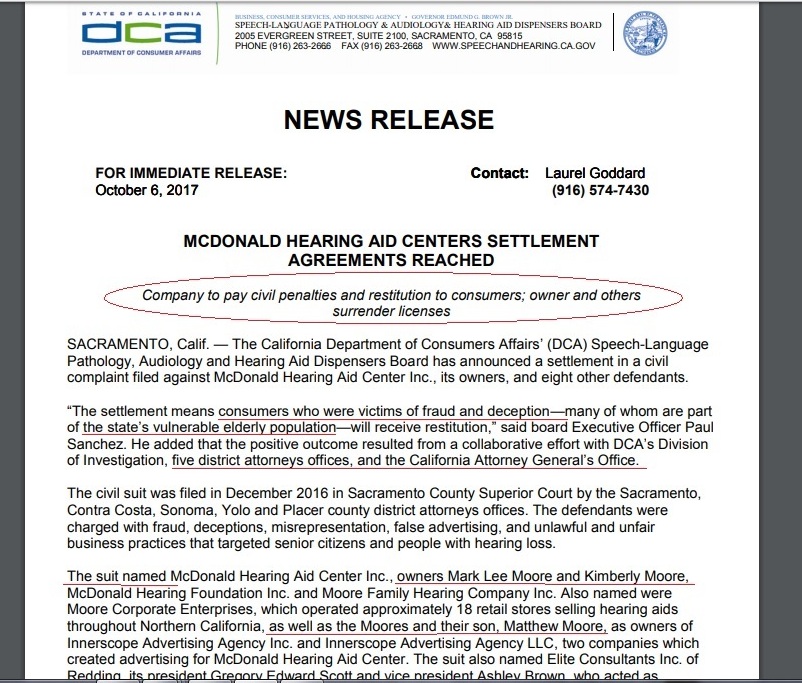

https://www.speechandhearing.ca.gov/forms_pubs/20171006_mcdonald.pdf

https://www.theunion.com/news/local-news/state-settles-suit-against-mcdonald-hearing-aid-centers/article_05558dac-3602-55f1-b9c5-5199716692cb.html

Good luck and good fighting soldiers - time to BRING INNER-CON DOWN FOR GOOD and protect the Sr Citizens and veterans and Catholic nuns of this nation once and for all !!

What's the update work Hessen? Did Matt settle like he did with Adnan?

$INND: BAGGIES PAID FOR THIS WTF !!!

NEVER EVER EVER EVER EVER let people forget WTF the MOORE MORE CRIME CLAN DID and how THEY live the MILLER HIGH LIFE while THEY didn't even pay their own damn employees and THEY lived a life of luxury and NEVER EVER PUT 10 CENTS OF THEIR OWN MONEY INTO THIS CRIME SCENE SCAM !!!!

https://www.invitedclubs.com/clubs/granite-bay-golf-club

https://www.invitedclubs.com/clubs/granite-bay-golf-club/dining

https://www.facebook.com/elizabeth.moore.3152

The fancy-dancy Christmas pic on the Facebook of Elizabeth MOORE MORE aka Ho Ho Jr aka Horse Face....it was taken in front of the giant fireplace at the GRANITE BAY MILLER HIGH LIFE COUNTRY CLUB and lil Ho Ho has a "job history" at age 36 of "Worked at Nordstrom" and then was put on the payroll of INNER-CRIME by Matty Boy and Daddy Mark Lee MOORE MORE aka THE DON.......

Oh....AND....anyone "notice" who ain't in that Christmas "FAMILY" pose w/ the kids and all.....WHERE'S MAGGIE MAY...aka BIG GIRL....has she packed a bag and gotten out of the MOORE MORE CLAN finally....??????

36 freaking long in the tooth yrs old Lizbeth..... ole.... HORSE FACE.... she dunn never married and be shot full of enough botox to clog a industrial sewer system and is ugly as the back end of a beef steer .....

As my hubby and his squadron mates used to say about some 36 yr old never married barbie bimbo chick who dresses like a teen and is broken brick level dumb :

"She's a HANGER QUEEN" .....LMAO !!!

That's what he and the squadron pilots used to call the O-club Ho Ho clingers and chicks always "circulating" at "full dress formal dinner party events" etc.....funniest term I'd ever heard after getting to Merica.....

"HER...that chick..good god....she's a HANGER QUEEN ....baby...stick by my side...I got your wing honey"....she gonna sit parked and rotting till the tires are flat......Bwaaa ha ha ha....

Check out Ho Ho Jr's "RIDING THE PONY" lil pic Bwaaa ha ha ha !!!

Oh yeah - I'm sure she's a "PONY GIRL" taking a look at that badly misshapen Barbie wanna-be 36 yr old living w/ mommy n daddy HANGAR QUEEN.......

THE ENTIRE MOORE MORE CLAN are like some sort of mutant genetic govt experiment gone bad LOL.....ESCAPE FROM THE BIO LAB FROM HELL....the sociopath scam-clan.......and NO DOOR KNOB too boot........

Funny thing is...one of my mates best buddy pilots who at times even flew his right seat or rear seat in combat... was call sign "GERM".....I kid you not....the dude was always worried about getting sick and catching a cold or whatever...took vitamins like a junky......the fellow pilots named his official call sign.... "GERM" .....painted it right on the side of his cockpit....funny as hell....they're ruthless in squadrons....humor and banter keeps um alive and eases all the bullshit they have to put up with from command....:))

As of today....MATTY MOORE aka THE PUNK.....IS NOW OFFICIALLY CALL SIGN...."GERM".....I've christened him....let if be so......:))

INND: GRANITE BAY CRIB "PRE FORECLOSURE" !!!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

RED ALERT.....DEFCON DILUTION MILL RED ALERT....NOT A DRILL....RED ALERT....DUCK AND COVER....!!!!

ANY ANY ANY ANY ANY ANY ANY ANY ANY "QUESTION" NOW boys n girls as to WHY THE MOORE CRIME CLAN REVERSE SPLIT THIS SHIT HEAP AND ARE RE-DILUTING AGAIN.....WTF.....!!!!

This CRIME SCENE IS HEADING TO "NO BID" as Gabe Sayegh has NOTHING left to take and neither do all the LAWSUIT PLAINTIFFS......thee end.....!!

5001 Manchester Ct, Granite Bay CA

Aka THE MOORE CLAN MILLER HIGH LIFE GIG n CRIB......

https://www.zillow.com/homedetails/5001-Manchester-Ct-Granite-Bay-CA-95746/17722256_zpid/

5001 Manchester Ct, Granite Bay, CA 95746

Pre-foreclosure/Auction

This property is scheduled to be sold at a foreclosure auction. The lender initiagted foreclosure proceedings on this property because the owner(s) were in default on their loan obligations. This property is not found on a multiple listing service (MLS).

MATTY's CRIB BIG PRICE CUT AGAIN LMAO !!

https://www.realtor.com/realestateandhomes-detail/1501-Deer-Hollow-Way_Roseville_CA_95661_M18693-66265

$995,000

-$30K

5

bed

4

bath

4,052sqft

4,052 square feet

8,860sqft lot

8,860 square foot lot

1501 Deer Hollow Way, Roseville, CA 95661

Property type

Single family

On Realtor.com

87 days

HOA fees

$50/mo

Price per sqft

Price per square feet

$246

Garage

3 Cars

Year built

2004

TANKS 56.31% in 21 trading days since the MASSIVE 1 for 2500 REVERSE SPLIT. This will continue for the weeks and months to come allllll the way back to 0.0001. 👀

.15 / 2,500 = .00006 TRUE SCAM PRICE !!!

MATTY'S DUMPSTER FIRES R US INC .....CRIME SCENE DEFCON ONE RED ALERT....THIS IS NOT A DRILL......

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

This crime scene and MOORE MORE CLAN HUSTLE are over kids.....there is no actual "business" left and has not been for a YEAR plus now.....

The ONLY reason this shit heap crime scene is still "here" aka incorporated is for the following reasons:

1) TRY and maintain the corp shield to protect the MOORE CRIME CLAN ASSETS and CASH they stole off this stinky pinky hustle scam....

2) To keep a mechanism to DILUTE and pay THE THREE aka MATTHEW ROSS MOORE MORE aka THE PUNK + Daddy Mark Lee Moore more aka THE DON + Kim Kimberly MOORE MORE aka EASY BAKE aka Ho Ho Sr....funding their cribs and MILLER HIGH LIFE LIFESTYLES.....

3) To be able to endlessly DILUTE to PAY THE MOORE CRIME CLAN EVER MOUNTING LEGAL BILLS.....and likely to keep MATTY BOY out of a CLUB FED PRISON and/or "lawyer up" for him to try and cop a plea that minimizes the damage to his sphincter and time in the joint w/ pal and besty boy CROWN KING.......

THAT IS IT.....nothing else exists and no other purpose exists except those stone cold facts right there......

Teed up that dirty gutter reverse split with the ole...BS MOORE CRIME SANDWICH and CRIME-SPEAK from MATTY's sewer hole....the ole.......

Oh...oh..oh..oh.....IN THE COMING DAYS.....like REAL "SOON".....oh...MAYBE A WEEKS OR TWOS....ya knows......NOW IT'S A MONTH PLUS LATER and they ain't filed JACK SHIT and never will file JACK SHIT........

The ole HOOK n BAIT....

"WE BELIEVE" and "WE HOPE" and "PROBABLY MAYBE WE WILL FILE SOON" and "UNICORNS FLEW OUT MY ASS THIS AM" and "PLEASE BUY THESE SHIT SHARES TO PAY OUR LEGAL FEES" and "WE THE MOORE CRIME CLAN ARE LOSING OUR HOUSES SO BUY THESE SHIT SHARES" and "NO INCREASE IN AVAILABLE SHARES" Bwaaaaa ha ha ha ha which is at F-ing 14.7 BILLION and ass-hate boy is telling people "WE DUNN GOOD BY ONLY ONLY ONLY KEEPING THEM 14.7 BILLION TO RE-DILUTE FAST LIKE" blah blah blah....shite-speak right out of Orwell.....

SAME shit of "WE GONNA GET THEM FILINGS OUT SOON" blah blah blah.....SAME lies peddled like 27 F-ing times in the past years since the Greasy Haired Cousin Eddie Ronco VHS Tape Video Series "WE DUNNS GONNA SEC FILE LIKE THIS NEXT WEEKS WE PROMISES" blah blah .....then NEVER SEC FILED AGAIN and then NEVER FILED ANYTHING ever again......

SOCIOPATH ALERT.....RED ALERT.....MOORE CRIME CLAN SOCIOPATHS ON THE LOOSE.....THEY ARE LOSING THEIR CRIBS n GIGS AND NEED YO MONEY......SOCIOPATH ALERT.....NOT A DRILL.....DEFCON ONE CONELRAD RED ALERT........!!!!!

https://x.com/inndstock?lang=en

LOOK AT THAT CRIMINAL FILTHY PSYCHO SHIT - he "pinned" this crime pump post AND he put the NASDAQ looking stock board behind it using fancy graphics WTF WTF !!!!!

GIFX NEWS: CEO CHARGED w/ MORE CRIME LMAO !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

DIRECT FROM THE SHIT HOLE T.R.N.C. aka Turkish Republic Northern Cyprus ....aka.... NOT EVEN A "COUNTRY" per the USA laws and UN laws LMAO !!

https://en.wikipedia.org/wiki/Northern_Cyprus#:~:text=Northern%20Cyprus%2C%20officially%20the%20Turkish,of%20the%20Republic%20of%20Cyprus.

RECENT REAL NEWS folks - another REAL NEWS SOURCE aka Turkish actual "NEWS SOURCE" and not some shit Yusuf Kisa owned lying blog - they are reporting how GIFX CEO Yusuf Kisa is a serial con and IN COURT AGAIN for fraud, stealing money, crimes charged by the equivalent of District Attorneys in US law, slander, civil lawsuits and more......

https://www.dijigazete.net/yasam/yusuf-kisa-karalamalarina-devam-ediyor-h68972.html

The ONLY THING Yusuf Kisa "owns" is his POS "newspaper" little website - ALL ELSE ARE CRIMINAL HUSTLES and this real reporter says so and follows ALL THE COURT CASES BROUGHT AGAINST SERIAL CRIMINAL GIFX CEO Yusuf Kisa.....FINANCIAL CRIMES out the ass.....WTF....baggies you are "had" here...and the Discord group is peddling you a criminal scam....aka Handford and his crime boys club.....!!!

Yusuf Kisa continues his scribbles… Yeni Bakis newspaper owner Yusuf Kisa continues to spend half of the week in the court corridors.

OKU, YORUMLA ve PAYLAS ==> https://www.dijigazete.net/yasam/yusuf-kisa-karalamalarina-devam-ediyor-h68972.html

Yeni Bakis newspaper owner Yusuf Kisa continues to spend half of the week in court. In recent years, Kibris Web News director Izzet Kilic made slanderous publications against him for days, and as a result of the police investigation, Kibris Web News and Mediazet Advertising Agency director Kilic was acquitted and a lawsuit was filed against Kici.

HE COULD N'T DIGEST THE CASE FILED AGAINST HIM. Yusuf Kisa, who couldn't digest the lawsuits filed against him, did what he always does by making a fabricated publication about the Cyprus Web News Director Kiliç in the side column of his newspaper, trying to attribute his own words in court to Mr. Kiliç, writing the exact opposite of what was said and continuing his false statements, will accelerate the manifestation of justice. Many of his publications have been sued and he is known for slandering many people.

Because of these slanderous publications, the Yeni Bakis newspaper, which belongs to Kisa, is described as a hitman in the press community and it is said that its credibility has been lost.

Detained by the Financial Police on July 9, 2022, Gifa Holding Director Yusuf Kisa was brought to court on 4 separate charges of 'obtaining money through fraud ' and 'acting in relation to banks and financial institutions despite not having a license' and was placed on bail.

Source: Kibriswebhaber

OKU, YORUMLA ve PAYLAS ==> https://www.dijigazete.net/yasam/yusuf-kisa-karalamalarina-devam-ediyor-h68972.html

GIFX: Aygun Yahi Antas WANTED SECURITIES FRAUD !!

WARNING: The pretend scammer "Company secretary" for this Yusuf Kisa ONE MAN-SCAM CON SHOW is wanted for aiding and abetting his securities fraud charges - WARNING !!!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

https://www.otcmarkets.com/stock/GIFX/disclosure

https://www.otcmarkets.com/stock/GIFX/profile

Also wanted for Crypto Crimes - SAME as what got her co-conspirator Yusuf Kisa aka ONE MAN SCAM GIFA INC "CEO" and owner tossed into a shit hole TRNC prison cell !!!

Aygun Yahi Yahi Antas Turkish Republic Northern Cyprus....... PER UN-AUDITED SHIT FILINGS "supposedly" owns 40 million COMMON SHARES of off-shore scam GIFA INC aka GIFX yet never did a damn thing to control nearly the entire float of this STINKY PINKY gutter scam....WTF.....she has been put on a WANTED list and is "on the radar" of USA based regulators and federal law enforcement......securities fraud 101 for stupid people style......

https://www.otcmarkets.com/otcapi/company/financial-report/402516/content

PAGE 11 of 14 un-Audited SHIT CRIME FILING:

Names of All

Officers, Directors

and Control

Persons

Affiliation with

Company (e.g.

Officer Title

/Director/Owner of

more than 5%)

Residential Address

(City / State Only)

Number of

shares owned

Share

type/class

Ownership

Percentage of

Class

Outstanding

Names of control

person(s) if a

corporate entity

Yusuf Kisa CEO, Sole

Director,

President,

Principal

Financial Officer

Dr Fazil Kucuk

Boulevard

Hamitkoy

Junction Lefkosa,

Northern Cyprus

Mersin 10,

Turkey 99010

1,000,000 Preferred

Stock

100%

Aygun Antas Secretary Dr Fazil Kucuk

Boulevard

Hamitkoy

Junction Lefkosa,

Northern Cyprus

Mersin 10,

Turkey 99010

40,000,000 Common 24.85%

CAVEAT EMPTOR: GIFA INC NO LONGER EXISTS !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

http://www.hri.org/news/cyprus/tcpr/2006/06-05-19.tcpr.html

GIFX CEO Yusuf ONE MAN SCAM Kisa 9mm illegal handgun criminal arrest LOL !!

Kisa arrested 4 times – recent news :

https://yenibakisgazetesi.com/gifa-s-long-awaited-press-release-delayed-due-to-unexpected-circumstances/

https://www.meforum.org/63845/turkish-delight-depravity-in-northern-cyprus

RED ALERT WARNING: GIFA INC aka $GIFX this scam ticker is a ONE MAN SCAM in the shit hole TRNC aka Turkish Republic Northern Cyprus NOT even recognized as a "country" by the USA or the UN - the CEO Yusuf Kisa and side-kick ..."hired hooker model babe" ..female con Aygun Antas aka "company secretary" are muli-time convicted FELON CRIMINAL CONS and there is no "business" known as "GIFA INC" being conducted anywhere on planet earth......

Use Google in English or Turkish and NOTHING will be found as to anything "real" existing as to some public traded "business".....

This is a STINKY PINKY SCAM UN-AUDITED DOG SHIT "Alternative Filing" aka NON SEC FILING OTC gutter scam - same shit as right out of Wolf Of Wall Street.....PINK SHEET HUSTLE CRIME....it was front loaded in 2017 as a shell hijack and pumped and dumped....thee end.....

DO NOT LISTEN TO THE Canadian/UK Discord paid "crew" member non-disclosing promoters here - aka Handord and his boys....they are ONLY "trying" to re-pump this dog shit scam ONE MORE TIME to dump more on the last baggie holders and dupes.....that is the fraud taking place here....THEY created and run the scam Instagram account y.kisa1 and THEY build the latest $100 buck Wordpress shit website and operate it.....nothing else is real.....no "company" will be found anywhere.....NO ONE can prove otherwise.....!!!!

https://web.archive.org/web/20230205044320/https://gifatoken.com/

The criminal “Crypto Token” hustle that put the CEO Yusuf Kisa in the off-shore DUMP known as the TRNC aka Northern Cyprus IN PRISON and was a massive criminal fraud and total scam !!!

You freaking Discord Canadian/UK paid pump-con clown dupes - THERE IS A REASON this POS crime scene is down to "TIGHTLY CROPPED OLD PICS OF ONE ONE ONE MAN CLOWN SHOW Yusuf Kisa" on INSTA-SCAM and literally NOTHING ELSE....because THERE LITERALLY IS NOTHING ELSE...a fugazi SCAM....a STINKY PINKY FRAUD n SCAM.......epic scam.....from clear back to 2017 SCAM SCAM SCAM......INSTAGRAM my ass.....you damn frauds and fools.....!!!

https://www.google.com/maps/@35.2119627,33.3782044,3a,37.5y,198.09h,93.89t/data=!3m7!1e1!3m5!1sAF1QipNtw-hXpm-dmGfupSNrYSJRoublrrGyUV9o1Gln!2e10!3e12!7i5760!8i2880?entry=ttu

FORMER GIFA – now a USED CAR LOT by the real TRNC businessman and owner of that building Turgay Ersalici.....GIFA-CRIME is a total gonner !!!

https://www.yeniduzen.com/devlet-vergi-konusunda-adaleti-saglamali-119487h.htm

HE OWNS THAT BUILDING and kicked-out GIFA SCAM......and his TOTAL "TAXED EARNINGS REPORTED" is a mere $4 million approx making him ONE OF THE WEALTHIEST TAX PAYERS in the entire TRNC SHIT HOLE you damn freaking fools....LMAO.......$4 mil and he's ONE BIG TIME TOP DOG on that crap hole north island.....

I'm am BLOWING THIS SCAM WIDE WIDE WIDE OPEN for the dirty crime scene that it is.....AND... and expose it ALL ALL ALL.....and NO the Discord paid Canadian/UK clown crew ain't gonna stop STONE COLD FACTS.....

GIFA INC aka GIFA HOLDINGS.....taken over and turned into a USED CAR LOT LMFAO.....by the REAL OWNER who kicked out criminal Kisa off the lease....and sent the ass clown packing.....

https://www.facebook.com/erslc

USED CAR LOT – taken back by the REAL BUILDING OWNER a well known CAR DEALER and actual “business man” in the shit hole TRNC !!!

"ALTERNATIVE FILER" OTC STINKY PINKS - nothing....as in NOT A DAMN THING in those filings is "verified" in ANY WAY, SHAPE OR FORM....READ THE OTC SITE ITSELF...."WE ARE NOT REGULATORS and ONLY A MARKETPLACE and non SEC FILERS RELY ON WHATEVER THEY WRITE IN THEIR OWN FILINGS" and use EXTREME CAUTION IF NOT AUDITED as they are often TOTAL SCAMS and 100% MADE-UP FAKE INFO.....OTC MARKET ITSELF SAYS RIGHT ON THEIR WEBSITE LMAO.....you clowns.....!!!

FIRST HINTS - and I will add narratives and details for WEEKS TO COME as I expose this criminal off-shore TRNC (Turkish Republic Northern Cyprus) ONE MAN CRIME SHOW aka Yusuf The Perp Kisa clown con SCAM SCAM SCAM......

There's a reason this crime scene ain't AUDITED and EVERY WEBSITE (ALL FAKE SCAM PUMPS) EVER EVER EVER ASSOCIATED WITH IT HAVE BEEN SCRUBBED DOWN OUT OF ORWELL AND VANISHED –

Sorry baggies.....start to look at these STONE COLD FACTS....you clown pump frauds days of hyping this clown show are OVER.....it's all coming to an end.....DEAD TICKER SCAM.....nothing but a $50 buck Nevada shit corp with NO bank accounts...no facilities...no daily business operations....no "company" and no "employees" aka NOTHING...nothing but some off-shore ass hat criminal convicted white collar crime perp with a bad INSTAGRAM/INSTA-SCAM account Bwaaa ha ha ha ha !!!!!!

###################################

LOOK CLOWNS - and then WEEP....LMAO.......Kisa got his ass booted out of that building over TWO YEARS AGO and ain't been in it since....:))

###################################

GUTTED - Google Earth and maps.... prior COULD NOT photograph the shit hole TRNC but new laws allowed it .....BUT BUT BUTT I knew these facts for OVER A YEAR as I have a person who went "on the ground" and 100% verified that GIFA IS and ALWAYS WAS A TOTAL SCAM......"rented students" posing as "employees" in a LEASED BUILDING always owned by REAL PERSON Turgay Eralici who who who owns what...CAR DEALERSHIPS and other real businesses in the TRNC....

Criminal Yusuf Kisa besides GOING TO PRISON went after Turgay in the shit show Yeni Bakis and accused the dude...Turgay BOOTED KISA from leasing a few floors of HIS FORMER NISSAN CAR DEALERSHIP BUILDING HE BUILT and that he HAS ALWAYS OWNED and Kisa hasn't posted ANY "recent" as in THREE YEARS OR NEWER (2018 they were BOOTED OUT !!) from that damn building.....them are STONE COLD FACTS......

ALL WEBSITES VANISHED PERFECTLY COINCIDENT WITH WHEN KISA WAS KICKED THE HELL OUT OF THAT BUILDING ANd and and ARRESTED and IMPRISONED.....the dude ain't doing JACK SHIT as far as some fantasy "business" and NEVER HAS.....he ran CRYPTO-CRIMES-a-CON and it got his ass sent to a shit hole prison.....:)))

##########################

GONNER - under construction and turned into a SHOPPING CENTER "PLAZA" over 2 damn damn YEARS AGO LMFAO.....you pump fraud Discord clowns have been had and I knew it all all all along......

GIFA INC is a $50 buck NV empty SHELL CORP....they ain't got $25 bucks in a USA bank account and this crime scene lost EVERY WEBSITE it ever had due to govt of the TRNC intervention due to the crimes CEO Yusuf Kisa committed !!!!

#########################

The SHORT LIST OF EVERY VANISHED CRIMINAL PUMP WEBSITE THIS CRIME SCENE EVER RAN - all all all TOTAL OFF-SHORE STINKY PINKY CAVEAT EMPTOR FRAUD FRAUD FRAUD FRAUD FRAUD........from clear the hell back to 2017 !!!!

This POS CRIME SCENE DOES NOT EVEN HAVE A DAMN WORKING PHONE or DAMN CORP WEBSITE for the faux bullshit crime "global conglomerate" BS pumper con's tall tales -

ALL are DELETED and VANISHED and SCRUBBED "former" CRIME SITES OF THIS POS SCAM:

gifainc.com

GONE

gifainc.net

GONE

grandexfinance.com

GONE and what got Kisa PUT IN PRISON to this damn day !!!

https://gifaholding.com/

GONNER - CRIMES !!

http://grandexfinance.com/

GONNER

http://gifaforex.com/

100% BIG A FRAUD AS THE GIFA TOKEN CRYPTO CRIMES !!

http://www.gifaconsulting.com/about-us.html

DOES NOT EXIST - never existed CRIME SCENE FRAUD !!

http://www.gifafinancialinstruments.com/index.html

GONNER - CRIMINAL FRAUD !!

http://www.gifafinancialinstruments.com/

GONNER - FRAUD !!!

GIFA Green Islands Finance of America (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.greenislandsfinanceofamericaltd.com

GIFA Call Center (FAKE AND "SCRUBBED NEVER EXISTED" !)

http://www.gifacallcenter.com

GIFA Nursing Home (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifahuzurevi.com

GIFA Air Lease (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifaairlease.com

GIFA Duty Free (FAKE AND "SCRUBBED" ONLY RUN AS A FEEDER CON, BUSTED IN THE UK on criminal charges !)

http://www.buyqualitycigarettes.com

Global Visa Limited (FAKE AND "SCRUBBED" TOTAL FRAUD CON - stole people blind and was criminally busted for scamming "immigration" laws !)

http://www.geteasyvisa.net

Yusuf Kifa Biography-CON (FAKE "BIO" by the MONGOL-CLOWN HIMSELF- ALL FAKE, ALL LIES, ALL FABRICATED to pump this dog shit stock and now "SCRUBBED" and gone !)

http://www.yusufkisafinance.com

Gifa Enerji Ürünleri Ticaret (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.nutritionstoreonline.net

GIFA Deniz Ürünleri (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.gifadenizurunleri.com

Yeni Bakis Gazetesi (WORKS "sometimes" and is used as a pump-tool for the LIE-n-FRAUD known as "GIFA INC" aka $GIFX. ALL "OLD" criminal stock pump "articles" and ALL "loans to Iran" articles SCRUBBED AND GONE !!!)

http://www.yenibakisgazetesi.com

Gifa Consulting (FAKE and "SCRUBBED" and NO BULLSHIT about $BILLIONS IN LOANS TO IRAN" WAS LEFT BEHIND - ALL VANISHED ! NO MORE "We're raising our loan targets to $75 BILLION EUROS" blah blah when Aul issued the LIE-n-FRAUD BULLSHIT PR about "the pesky Lira and inflation problem is why we're missing THREE AND A HALF YEARS OF SEC FILINGS and are now re-inventing ourselves as bullshit fraud GIFA PETROLEUM that DOES NOT EXIST EITHER !! ALL A CON !)

http://www.gifaconsulting.com/index.html

Gifa Forex (FAKE and "SCRUBBED" front-company Kisa uses to TRADE HIS OWN SHARES OF GIFX as he's doing RIGHT NOW USING InstaSCAM as the PUMP TOOL)

http://www.gifaforex.com

Gifa Nektar (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifanektar.com

Gifa Insurance (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifainsurance.com/index.html

Gifa Project (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaproject.com

Gifa Rent a Car (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifarentacar.com

Gifa Construction (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaconstruction.com

Gifa Estates (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaestates.com

Gifa Financial Instruments (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifafinancialinstruments.com

GIFA Airways (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON where one can now buy KNOCK-OFF SHOES as in a CRIMINAL FRONT COMPANY USED TO FEED MONIES TO KISA TO BUY HIS OWN GIFX STOCK in P&D "cycles" !!)

http://www.gifaairways.com

GIFA Hotel & Casino (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.scotlandyardnews.com/gifa-chairman-to-build-new-and-deluxe-hotel-casino-in-the-trnc/1108/

GIFALAND (GIANT, ENORMOUS CON-n-FRAUD and FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaland.com/images/fizibilite-raporu-eng.pdf

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaland.com/home.html&prev=search

GIFA Holding (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON as NOTHING EXISTS INSIDE IT when put into "GIFA INC" aka $GIFX THIS EMPTY SHELL DOG SHIT PENNY SCAM and FRAUD !)

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaholding.com/&prev=search

THAT is the "short list" folks- these are SERIAL TRNC OFF-SHORE SHIT HOLE AND CRIME HAVEN.....F-ing.....CRIMINALS and SERIAL CONS operating out of the shit hole "neutral zone" ......TEXTBOOK penny scam as assisted by William Bill Aul long-time penny pump and shell scammer in San Diego.... and numerous others now and a PAID CANADIAN PUMP CREW who also has a few UK "marks" used to wash-trade for P&D crimes.....

Just ANOTHER in the Billy Aul list of garbage "companies" over the years (he and Ralph Amato - a con wanted for IRS fraud now) those two have been "assisting" penny scams for over two decades now- egregious as all hell !!

GIFX WAS...PAST TENSE....now since the TRNC GOVT SHUT IT DOWN and put CEO KISA IN PRISON..it WAS WAS WAS ......A TERRORISM FRONT-COMPANY for washing money via their "Russia division" to aid IRANIAN TERRORISM in violation of U.S. sanctions and embargo laws- that is it.

USED CAR LOT NOW.....REAL BUILDING OWNER CONTROLS IT ALL....kicked out KISA when the ass clown "went after Turgay" in the shit show Yeni Bakis which ALSO got it's scam "TV" web channel bullshit GOVT YANKED...gonner....no more....POOF......GIFA INC is worthless kids....GONNER.....:))

SEC SHUTDOWN AND DOJ INVESTIGATION AND CRIMINAL CHARGES TO FOLLOW :)

PS: The "RUSSIA" organized crime front operation- now at the DOJ level for investigation. Aul is in DEEP, DEEP SHIT !

In early 2020, the company appears to have opened or started a "Russia subsidiary" but William "Bill" Aul has never released any formal PR to explain what the Russia subsidiary does or if it is owned/controlled by GIFA Inc (GIFX this stock) etc?

gifaconsulting.ru

GONE and scrubbed - CRIME !!!

https://www.youtube.com/watch?v=1YSFQfXQEHM

SAME individuals shown in that SCAM FRONT-ORG appear in older "scrubbed" CRIMINAL GIFA HOLDING "ASSISTANCE" VIA LARGE LOANS TO IRAN TERROR GROUPS - total violations of U.S. law(s) !!

THE BIG LIE n CON JOB….. “WE BE IN THE PETROLEUM” biz CRIMINAL FRAUD P&D….NEVER EVER FORGET BAG HOLDERS…..:))

GUN SHELL CASINGS LMFAO !!!!

GIFA-CON aka GIFX…..DOING BIZ WITH TERRORISTS – that be a pic of the Ayatollah Khomeini hanging proudly on the wall – THEE NUMERO UNO SWORN ENEMY OF THESE UNITED STATES……NO WAY the state dept and SEC-DOJ let this POS TRNC crime scene trade given what just happened in the Middle East…..this scam is already BAKED and DONE….and I’ll be sending a note to the key congressman on the US Security Council about these damning criminal facts….:))

BAGGIES RED ALERT - you've been "had" again by criminal con Yusuf Kisa and Aygun Antas Bwwwaaaaaa ha ha ha ha ha dumb assess....!!!!

Aygun Yahi Antas Turkish Republic Northern Cyprus has been moved to "WANTED" status- now the NUMERO TWO "MOST WANTED" as related to GIFA INC criminal stock fraud committed against US citizens....she is on a "EXTRADITE" criminal fraud list now......watch n learn kids....bout to get real good here on this off-shore crime scene...I'm talking more arrests and cons going to a rot gut prison kinda good :))

*******************************************

Aygun Yahi Antas WANTED 💀 ☠️ WANTED 💀 ☠️ WANTED

******************************************

WANTED: SECURITIES FRAUD VIOLATIONS SECURITY ACT 1934 UNITED STATES OF AMERICA

****************************************

__________________________________________________________

$SONG: Momma Regina Noch Liquidating Properties !!

MUST BE NICE - to be able to buy and flip dirt lots for $MILLIONS while "funding" your dumb ass punk shit-for-no-brains KID who is "on the teat" of momma even in his mid twenties....

.30 cents... Jake must be really hurting for cash.

Parcel ID 17260560001 Site Address *Disclaimer 2550 LANTERN LN Google Link Site City NAPLES Site Zone *Note 34102

Name / Address REGINA E NOCH IRREV TRUST

% WILLIAM DEMPSEY

CHEFFY PASSIDOMA PA

2951 CRAYTON RD

City NAPLES State FL Zip 34103

Map No. Strap No. Section Township Range Acres *Estimated

5A16 120700 215A16 16 50 25 0.46

Legal LANTERN LAKE SECT PORT ROYAL LOT 21

Millage Area MillageAreaTable 4 Millage Rates MillageTable *Calculations

Sub./Condo 120700 - PORT ROYAL/LANTERN LAKE School Other Total

Use Code usetable 0 - VACANT RESIDENTIAL 4.3132 5.0523 9.3655

Latest Sales History

(Not all Sales are listed due to Confidentiality)

Date Book-Page Amount

01/20/21 5879-3601 $ 3,800,000

02/28/19 5602-2752 $ 6,250,000

11/09/12 4854-174 $ 4,250,000

02/05/04 3496-3330 $ 1,800,000

04/05/88 1339-722 $ 486,000

03/01/88 1335-1217 $ 0

$INND: MATTY's CRIB PRICE CUT AGAIN LMAO !!!

WELL folks - it's DIRE at the MOORE MORE CRIME CLAN HQ aka GRANITE BAY COUNTRY CLUB MILLER HIGH LIFE CENTRAL as the "family" CLAN "tries" to consolidate and preserve their BIG FAT LIFE STYLES OF THE WEALTHY CORRUPT STUPID AND CRIMINAL CON RUNNERS........

https://www.realtor.com/realestateandhomes-detail/1501-Deer-Hollow-Way_Roseville_CA_95661_M18693-66265

CUT $25K AGAIN after this weekend NO SALE/NO OFFERS.... in less than a few weeks = THE MOORE CRIME CLAN ARE BROKE and need to LEGAL FUNDS or they're going to lose personal wealth and assets and END UP IN A VAN DOWN BY THE RIVER....where they belong.....LOL !!!

The BLEW THROUGH ANOTHER DEAD WEEKEND OF "NO SALE" and NO OFFERS and they can't get THE CASH they need and must have to LAWYER UP and block COLLECTION AGENCIES from eating through not only the PERSONAL assets and ill gotten gains of just MATTY BOY aka THE PUNK and MAGGIE MAY MOORE MORE aka BIG GIRL.....

https://www.redfin.com/CA/Granite-Bay/5001-Manchester-Ct-95746/home/19515544

EVERY foul move the MOORE CLAN MAKES is to preserver THIS CRIB at 5001 Manchester Ct, Granite Bay, CA.... aka home of THE DON aka MARK LEE MOORE MORE + Kim KIMBERLY MOORE MORE aka Ho Ho Sr aka EASY BAKE THE BOOK COOKER.......and to "try" and keep MATTY BOY and THE DON out of a CLUB FED PRISON lockdown....thems the facts kids......

They are FIRE WALLING TO SAVE THE GRANITE BAY COUNTRY CLUB GIG n CRIB and their hidden cash and "other" assets they gained by using the DILUTION MILL SCAM known as INNERSCOPE HEARING.....every move the MOORE CRIME CLAN MAKES including the circus stunt REVERSE SPLIT + NEW DILUTION MILL is for CLAN FUND MONEY.....NOT for any dead entity named "Innerscope"......

HERE IS WHAT THE MOORE CRIME CLAN ARE "FUNDING" and ONLY these items as INNERSCOPE IS DEAD and GONE other than for lawsuit purposes to firewall the MOORE CLAN "personal" assets:

1) Pay the MOORE CLAN LAWYER BILLS

2) Pay LEGAL FEES SEEN and UNSEEN and "new/upcoming" to PROTECT ONLY MATTHEW ROSS MOORE + MARK LEE MOORE + KIM KIMBERLY MOORE and their PERSONAL ASSETS and LEGAL CRIMINAL CHARGES against them ONLY....."Innerscope" does not exist any longer as a "functioning" real, actual "business" and HAS NOT for nearing ONE DEAD YR NOW !!

3) PAY the day-to-day "NEEDS" aka MILLER HIGH LIFES OF THE MOORE CRIME CLAN "THREE" - as in their monthly bills of gourmet food and dining out, pay their new cars, insurance, their kids fancy lifestyles and school bills, buy them their Cadillac medical ins plans and dental AS THEY FAILED TO PAY EMPLOYEES ANYTHING......pay their vacations and property taxes at the GRANITE BAY COUNTRY CLUB...pay golf and country club fees....pay their shopping for luxury goods fees....pay for their on-going vacations and travel fees......and LAWYER MONEY.....etc.....IT'S ALL ABOUT THE MOORE MORE CRIME CLAN and nothing else......ALL MONEY FLOWS TO THEM....period.....nothing else......

4) PRESERVE THE MOORE CLAN bank accounts where they parked their ILL GOTTEN GAINS of the last decade or MOORE MORE - and keep that CASH and investments "protected" and shielded and hide their real estate holdings and anything else they "collected" while running the hearing aid SCAM and hustle known as INNERSCOPE ADVERTISING and then the real sick shit of INNERSCOPE HEARING INC a Nevada Corporation.......

5) There WILL NOT BE and ARE NO NO NO BULLSHIT "FILINGS" aka MATTY BOY's LATEST GUTTER DIRT LIES - he X-Twatted from that sewer pipe he calls a mouth....ALL JUST BAIT and SHIT-SPEAK to fuzzy-up the MASSIVE REVERSE SPLIT OF THIS SHIT HEAP CRIME SCENE ....."IN THE COMING DAYS OR WEEKS" and when the F was that MATTY BOY....yeah....YOU REVERSE SPLIT SHIT BRAIN........liar...fraud...SCAM....serial grifter cons.....the MOORE MORE CLAN......

The MOORE MORE CRIME CLAN ARE IN SURVIVAL MODE and I'm luuuuuuving every second of it......WHEN MATTY BOY and DADDY MARK LEE MOORE MORE get a perp walk we will have a MISSION ACCOMPLISHED PARTY in the style of COUNTRY CLUB GRIFTERS........

https://www.pacermonitor.com/public/case/52733622/Hessenn_Group_LLC_v_InnerScope_Hearing_Technologies,_Inc_et_al

MOORE CLAN ARE "NO SHOWS" at HESSENN v INNERSCOPE and thus this case is DEFAULT WIN TO HESSENN in a matter of days now - the docket is EMPTY of any MOORE CRIME CLAN FILING due over a week ago and the "Lawyer/council" section for INNERSCOPE REMAINS BLANK....they never even "lawyered up".....the scofflaws blew it off like a half dozen other major lawsuits.......

MATTY BOY THOUGHT Sgt ERWIN J. TOOMEY WAS BAD.....now he's just met Drill Instructor Sgt Emil FOLEY........it's over MATTY BOY.....YOU ARE DOR and you don't even know it yet......

$MULN: 1 for 100 REVERSE SEPT 17th LMAO !!!

Baggies - YOU just got MULLENATED AGAIN Bwaaa ha ha ha ha :))

EJECT EJECT EJECT EJECT.....not a drill....EJECT .....DEFCON ONE RED ALERT WARNING.... EJECT.........

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

This crime scene shit heap does NOT make "EV CARS and TRUCKS" LMAO...the ONLY thing this scam "manufactures" is DILUTION MILL PRINTED WORTHLESS SHIT SHARES.......the CEO DAVID DIRTY MICHERY aka MAN BOOBS..... has sucked more $coin out of this scam and into his dirty pocket than the ENTIRE MARKET CAP of the "company'' aka VAPORWARE FUGAZI SCAMS R US INC.....!!!!

Well kids.....DIRTY DAVE aka THE FAT MAN aka THE GREASER just bent the baggies over again - dry, hard, no lube and not even a "kiss or a smoke" lil afterglow when the "dirty deed" is done dirt cheap :))

https://finance.yahoo.com/news/mullen-automotive-inc-announces-reverse-155500061.html#:~:text=The%20Common%20Stock%20will%20continue,Stock%20Split%20will%20be%2062526P505.

BREA, Calif., Sept. 13, 2024 (GLOBE NEWSWIRE) -- via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an electric vehicle (“EV”) manufacturer, announced today that it will effect a 1-for-100 reverse stock split (“Reverse Stock Split”) of its common stock, par value $0.001 per share (“Common Stock”), that will become effective on Sept. 17, 2024, at 12:01 a.m. Eastern Time. The Common Stock will continue to trade on The Nasdaq Capital Market (“Nasdaq”) under the existing symbol MULN and will begin trading on a split-adjusted basis when the market opens on Sept. 17, 2024. The new CUSIP number for the Common Stock following the Reverse Stock Split will be 62526P505.

The Reverse Stock Split is primarily intended to bring the Company into compliance with the $1.00 minimum bid price requirement for maintaining its listing on Nasdaq.

1-for-100 reverse split: Effective Sept 17th 2024 thee end.......

1-for-100 reverse split: Effective December 21, 2023, this split combined 100 shares of common stock into one share. The split was intended to help the company meet the $1 minimum bid price requirement to stay listed on the Nasdaq exchange.

1-for-9 reverse split: This split occurred in August 2023.

1-for-25 reverse split: This split occurred in May 2023.

Just an FYI on @Mullen_USA. In announcing their partnership with Lawrence Hardge, they stated in a PR and SEC filing that "In the late 90s, Lawrence was convicted of a state crime, which was ultimately expunged." Is this true? @hardge_law87778 $MULN #MULN pic.twitter.com/6VdqvCUI0I

— Post Hoc (@PostHoc94107) May 18, 2023

Just an FYI on @Mullen_USA. In announcing their partnership with Lawrence Hardge, they stated in a PR and SEC filing that "In the late 90s, Lawrence was convicted of a state crime, which was ultimately expunged." Is this true? @hardge_law87778 $MULN #MULN pic.twitter.com/6VdqvCUI0I

— Post Hoc (@PostHoc94107) May 18, 2023

$MULN Founder, Chairman and CEO, David Michery led 5 failed penny stock companies prior to Mullen.

— Hindenburg Research (@HindenburgRes) April 6, 2022

Two had their securities registrations revoked by the SEC, two terminated their securities registrations, and the last one merged with a speculative gold mining company. pic.twitter.com/nUcYJJtisR

For its electric SUV, $MULN previously announced it received an order for 10,000 vehicles, representing $500 million in potential revenue. We called the South Florida contractor firm that placed the order. It currently has only around 11 vehicles, none of which are electric. pic.twitter.com/ovfDwCman1

— Hindenburg Research (@HindenburgRes) April 6, 2022

Previously, $MULN had announced purchase orders valued at $60 million for 1,200 Class 2 commercial EV fleet vans. The order came from a small cannabis retailer with only one location, a mailbox drop address & new online store. pic.twitter.com/XIRLAEVwY5

— Hindenburg Research (@HindenburgRes) April 6, 2022

Bingo !!

Well.... That was som'tin... Yeah, Rosen is a lying snake based on his previous shit about OPTI for sure. But this suit by Goerge Sharp is bullshit too. Sharp is a real snake too, no different than Rosen. I get why Rosen was like that. Sharps attorney was being a jerk going around in circles.

Sharp had no business being there. I didn't know a lot about Sharp, but I know all I need to know now. Stay very far away from anything he's involved in. Not sure why he thought it was a good idea to post that all to youtube. Is all that publicly available on PACER or whatever county court that's in??

TOXIC LENDER BRETT ROSEN EXPOSED IN DEPOSITIONS !!

Wow wow wow is all I can say - IF anyone wants a "glimpse" into the real world of TOXIC NOTE GUTTER "FINANCING" of penny scams - then see the videos below aka SIX "depositions" of notorious Brett Rosen aka RB CAPITAL who's run more dirt tickers into the ground than a crash test pilot....it's mind boggling stuff IMO !!

Holy hell - this is MIND BOGGLING STUFF !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

Anyone wanna "glimpse" into the world of TOXIC GUTTER FINANCING aka PENNY SCAM DILUTION MILL CON "CONVERTIBLE DEBT NOTES" - then freaking watch this shit, cause SHIT is what it is WTF !!!

Brett Rosen aka Brett Rosen-SCUM aka RB CAPITAL one of the most notorious gutter lenders in modern times (dirt scam tickers OPTI, ILUS, CYBL - too many to even count !!) getting Deposed "on camera" - this is mind melting stuff :

He had to state his address opening the depo – looks like gutter “financing” pays well for these serial OTC penny gutter hustlers !!

THEN in video 1 he says, “BUT THAT IS JUST MY OFFICE, I DO NOT LIVE THERE” – so this hustler keeps a $MILLION buck San Diego home as a “office” WTF !!

THEN he goes on to say, “MY HOME ADDRESS IS KEPT SECRETE BECAUSE OF WHAT I DO – a lot of people want to come after me” blah blah blah. SOoooo, he has a MULTI $MILLION additional “home” where he really lives but keeps it a secret – all from OTC gutter scam “financing” aka Toxic Dilution Notes R US Inc aka RB Capital gutter loans !

When Rosen-SCUM does his Buffalo Dung Fireside Chat Youboob “PAY TO PUMP HIS DIRT TICKERS” scam “shows” – he’s never in the house he claims is his “office” aka $million plus “home” but he’s in his mega $millions other “house” where he REALLY LIVES THE MILLER HIGH LIFE from running penny P&D scams….all is explained in VIDEO ONE of the deposition ?

https://www.youtube.com/watch?v=MPDzHnG93ik

$ILUS: BRETT ROSEN EXPOSED IN DEPOSITIONS !!

Holy hell - this is MIND BOGGLING STUFF !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

Anyone wanna "glimpse" into the world of TOXIC GUTTER FINANCING aka PENNY SCAM DILUTION MILL CON "CONVERTIBLE DEBT NOTES" - then freaking watch this shit, cause SHIT is what it is WTF !!!

Brett Rosen aka Brett Rosen-SCUM aka RB CAPITAL one of the most notorious gutter lenders in modern times (dirt scam tickers OPTI, ILUS, CYBL - too many to even count !!) getting Deposed "on camera" - this is mind melting stuff :

He had to state his address opening the depo – looks like gutter “financing” pays well for these serial OTC penny gutter hustlers !!

THEN in video 1 he says, “BUT THAT IS JUST MY OFFICE, I DO NOT LIVE THERE” – so this hustler keeps a $MILLION buck San Diego home as a “office” WTF !!

THEN he goes on to say, “MY HOME ADDRESS IS KEPT SECRETE BECAUSE OF WHAT I DO – a lot of people want to come after me” blah blah blah. SOoooo, he has a MULTI $MILLION additional “home” where he really lives but keeps it a secret – all from OTC gutter scam “financing” aka Toxic Dilution Notes R US Inc aka RB Capital gutter loans !

When Rosen-SCUM does his Buffalo Dung Fireside Chat Youboob “PAY TO PUMP HIS DIRT TICKERS” scam “shows” – he’s never in the house he claims is his “office” aka $million plus “home” but he’s in his mega $millions other “house” where he REALLY LIVES THE MILLER HIGH LIFE from running penny P&D scams….all is explained in VIDEO ONE of the deposition ?

https://www.youtube.com/watch?v=MPDzHnG93ik

$OPTI: BRETT ROSEN EXPOSED IN DEPOSITIONS !!

Holy hell - this is MIND BOGGLING STUFF !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

Anyone wanna "glimpse" into the world of TOXIC GUTTER FINANCING aka PENNY SCAM DILUTION MILL CON "CONVERTIBLE DEBT NOTES" - then freaking watch this shit, cause SHIT is what it is WTF !!!

Brett Rosen aka Brett Rosen-SCUM aka RB CAPITAL one of the most notorious gutter lenders in modern times (dirt scam tickers OPTI, ILUS, CYBL - too many to even count !!) getting Deposed "on camera" - this is mind melting stuff :

He had to state his address opening the depo – looks like gutter “financing” pays well for these serial OTC penny gutter hustlers !!

THEN in video 1 he says, “BUT THAT IS JUST MY OFFICE, I DO NOT LIVE THERE” – so this hustler keeps a $MILLION buck San Diego home as a “office” WTF !!

THEN he goes on to say, “MY HOME ADDRESS IS KEPT SECRETE BECAUSE OF WHAT I DO – a lot of people want to come after me” blah blah blah. SOoooo, he has a MULTI $MILLION additional “home” where he really lives but keeps it a secret – all from OTC gutter scam “financing” aka Toxic Dilution Notes R US Inc aka RB Capital gutter loans !

When Rosen-SCUM does his Buffalo Dung Fireside Chat Youboob “PAY TO PUMP HIS DIRT TICKERS” scam “shows” – he’s never in the house he claims is his “office” aka $million plus “home” but he’s in his mega $millions other “house” where he REALLY LIVES THE MILLER HIGH LIFE from running penny P&D scams….all is explained in VIDEO ONE of the deposition ?

https://www.youtube.com/watch?v=MPDzHnG93ik

CAVEAT EMPTOR: GIFA INC NO LONGER EXISTS !!!

💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️ 💀 ☠️

3 CENT shitty collapsing Bid and $GIFX-CON BARELY TRADES and NO TRADES MOST DAYS - this scam is as ill-liquid as dried concrete at a Yusuf Kisa SCAM fake "construction site" on a hot shit hole Northern Cyprus crime pit summer day Bwaaaa ha ha ha ha ha :))

http://www.hri.org/news/cyprus/tcpr/2006/06-05-19.tcpr.html

GIFX CEO Yusuf ONE MAN SCAM Kisa 9mm illegal handgun criminal arrest LOL !!

CEO clown car Yusuf Kisa the serial perp criminal arrested 4 times – recent news :

https://yenibakisgazetesi.com/gifa-s-long-awaited-press-release-delayed-due-to-unexpected-circumstances/

https://www.meforum.org/63845/turkish-delight-depravity-in-northern-cyprus

RED ALERT WARNING: GIFA INC aka $GIFX this scam ticker is a ONE MAN SCAM in the shit hole TRNC aka Turkish Republic Northern Cyprus NOT even recognized as a "country" by the USA or the UN - the CEO Yusuf Kisa and side-kick ..."hired hooker model babe" ..female con Aygun Antas aka "company secretary" are muli-time convicted FELON CRIMINAL CONS and there is no "business" known as "GIFA INC" being conducted anywhere on planet earth......

Use Google in English or Turkish and NOTHING will be found as to anything "real" existing as to some public traded "business".....

This is a STINKY PINKY SCAM UN-AUDITED DOG SHIT "Alternative Filing" aka NON SEC FILING OTC gutter scam - same shit as right out of Wolf Of Wall Street.....PINK SHEET HUSTLE CRIME....it was front loaded in 2017 as a shell hijack and pumped and dumped....thee end.....

DO NOT LISTEN TO THE Canadian/UK Discord paid "crew" member non-disclosing promoters here - aka Handord and his boys....they are ONLY "trying" to re-pump this dog shit scam ONE MORE TIME to dump more on the last baggie holders and dupes.....that is the fraud taking place here....THEY created and run the scam Instagram account y.kisa1 and THEY build the latest $100 buck Wordpress shit website and operate it.....nothing else is real.....no "company" will be found anywhere.....NO ONE can prove otherwise.....!!!!

https://web.archive.org/web/20230205044320/https://gifatoken.com/

The criminal “Crypto Token” hustle that put the CEO Yusuf Kisa in the off-shore DUMP known as the TRNC aka Northern Cyprus IN PRISON and was a massive criminal fraud and total scam !!!

You freaking Discord Canadian/UK paid pump-con clown dupes - THERE IS A REASON this POS crime scene is down to "TIGHTLY CROPPED OLD PICS OF ONE ONE ONE MAN CLOWN SHOW Yusuf Kisa" on INSTA-SCAM and literally NOTHING ELSE....because THERE LITERALLY IS NOTHING ELSE...a fugazi SCAM....a STINKY PINKY FRAUD n SCAM.......epic scam.....from clear back to 2017 SCAM SCAM SCAM......INSTAGRAM my ass.....you damn frauds and fools.....!!!

https://www.google.com/maps/@35.2119627,33.3782044,3a,37.5y,198.09h,93.89t/data=!3m7!1e1!3m5!1sAF1QipNtw-hXpm-dmGfupSNrYSJRoublrrGyUV9o1Gln!2e10!3e12!7i5760!8i2880?entry=ttu

FORMER GIFA – now a USED CAR LOT by the real TRNC businessman and owner of that building Turgay Ersalici.....GIFA-CRIME is a total gonner !!!

https://www.yeniduzen.com/devlet-vergi-konusunda-adaleti-saglamali-119487h.htm

HE OWNS THAT BUILDING and kicked-out GIFA SCAM......and his TOTAL "TAXED EARNINGS REPORTED" is a mere $4 million approx making him ONE OF THE WEALTHIEST TAX PAYERS in the entire TRNC SHIT HOLE you damn freaking fools....LMAO.......$4 mil and he's ONE BIG TIME TOP DOG on that crap hole north island.....

I'm am BLOWING THIS SCAM WIDE WIDE WIDE OPEN for the dirty crime scene that it is.....AND... and expose it ALL ALL ALL.....and NO the Discord paid Canadian/UK clown crew ain't gonna stop STONE COLD FACTS.....

GIFA INC aka GIFA HOLDINGS.....taken over and turned into a USED CAR LOT LMFAO.....by the REAL OWNER who kicked out criminal Kisa off the lease....and sent the ass clown packing.....

https://www.facebook.com/erslc

USED CAR LOT – taken back by the REAL BUILDING OWNER a well known CAR DEALER and actual “business man” in the shit hole TRNC !!!

"ALTERNATIVE FILER" OTC STINKY PINKS - nothing....as in NOT A DAMN THING in those filings is "verified" in ANY WAY, SHAPE OR FORM....READ THE OTC SITE ITSELF...."WE ARE NOT REGULATORS and ONLY A MARKETPLACE and non SEC FILERS RELY ON WHATEVER THEY WRITE IN THEIR OWN FILINGS" and use EXTREME CAUTION IF NOT AUDITED as they are often TOTAL SCAMS and 100% MADE-UP FAKE INFO.....OTC MARKET ITSELF SAYS RIGHT ON THEIR WEBSITE LMAO.....you clowns.....!!!

FIRST HINTS - and I will add narratives and details for WEEKS TO COME as I expose this criminal off-shore TRNC (Turkish Republic Northern Cyprus) ONE MAN CRIME SHOW aka Yusuf The Perp Kisa clown con SCAM SCAM SCAM......

There's a reason this crime scene ain't AUDITED and EVERY WEBSITE (ALL FAKE SCAM PUMPS) EVER EVER EVER ASSOCIATED WITH IT HAVE BEEN SCRUBBED DOWN OUT OF ORWELL AND VANISHED –

Sorry baggies.....start to look at these STONE COLD FACTS....you clown pump frauds days of hyping this clown show are OVER.....it's all coming to an end.....DEAD TICKER SCAM.....nothing but a $50 buck Nevada shit corp with NO bank accounts...no facilities...no daily business operations....no "company" and no "employees" aka NOTHING...nothing but some off-shore ass hat criminal convicted white collar crime perp with a bad INSTAGRAM/INSTA-SCAM account Bwaaa ha ha ha ha !!!!!!

###################################

LOOK CLOWNS - and then WEEP....LMAO.......Kisa got his ass booted out of that building over TWO YEARS AGO and ain't been in it since....:))

###################################

GUTTED - Google Earth and maps.... prior COULD NOT photograph the shit hole TRNC but new laws allowed it .....BUT BUT BUTT I knew these facts for OVER A YEAR as I have a person who went "on the ground" and 100% verified that GIFA IS and ALWAYS WAS A TOTAL SCAM......"rented students" posing as "employees" in a LEASED BUILDING always owned by REAL PERSON Turgay Eralici who who who owns what...CAR DEALERSHIPS and other real businesses in the TRNC....

Criminal Yusuf Kisa besides GOING TO PRISON went after Turgay in the shit show Yeni Bakis and accused the dude...Turgay BOOTED KISA from leasing a few floors of HIS FORMER NISSAN CAR DEALERSHIP BUILDING HE BUILT and that he HAS ALWAYS OWNED and Kisa hasn't posted ANY "recent" as in THREE YEARS OR NEWER (2018 they were BOOTED OUT !!) from that damn building.....them are STONE COLD FACTS......

ALL WEBSITES VANISHED PERFECTLY COINCIDENT WITH WHEN KISA WAS KICKED THE HELL OUT OF THAT BUILDING ANd and and ARRESTED and IMPRISONED.....the dude ain't doing JACK SHIT as far as some fantasy "business" and NEVER HAS.....he ran CRYPTO-CRIMES-a-CON and it got his ass sent to a shit hole prison.....:)))

##########################

GONNER - under construction and turned into a SHOPPING CENTER "PLAZA" over 2 damn damn YEARS AGO LMFAO.....you pump fraud Discord clowns have been had and I knew it all all all along......

GIFA INC is a $50 buck NV empty SHELL CORP....they ain't got $25 bucks in a USA bank account and this crime scene lost EVERY WEBSITE it ever had due to govt of the TRNC intervention due to the crimes CEO Yusuf Kisa committed !!!!

#########################

The SHORT LIST OF EVERY VANISHED CRIMINAL PUMP WEBSITE THIS CRIME SCENE EVER RAN - all all all TOTAL OFF-SHORE STINKY PINKY CAVEAT EMPTOR FRAUD FRAUD FRAUD FRAUD FRAUD........from clear the hell back to 2017 !!!!

This POS CRIME SCENE DOES NOT EVEN HAVE A DAMN WORKING PHONE or DAMN CORP WEBSITE for the faux bullshit crime "global conglomerate" BS pumper con's tall tales -

ALL are DELETED and VANISHED and SCRUBBED "former" CRIME SITES OF THIS POS SCAM:

gifainc.com

GONE

gifainc.net

GONE

grandexfinance.com

GONE and what got Kisa PUT IN PRISON to this damn day !!!

https://gifaholding.com/

GONNER - CRIMES !!

http://grandexfinance.com/

GONNER

http://gifaforex.com/

100% BIG A FRAUD AS THE GIFA TOKEN CRYPTO CRIMES !!

http://www.gifaconsulting.com/about-us.html

DOES NOT EXIST - never existed CRIME SCENE FRAUD !!

http://www.gifafinancialinstruments.com/index.html

GONNER - CRIMINAL FRAUD !!

http://www.gifafinancialinstruments.com/

GONNER - FRAUD !!!

GIFA Green Islands Finance of America (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.greenislandsfinanceofamericaltd.com

GIFA Call Center (FAKE AND "SCRUBBED NEVER EXISTED" !)

http://www.gifacallcenter.com

GIFA Nursing Home (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifahuzurevi.com

GIFA Air Lease (FAKE AND "SCRUBBED" NEVER EXISTED !)

http://www.gifaairlease.com

GIFA Duty Free (FAKE AND "SCRUBBED" ONLY RUN AS A FEEDER CON, BUSTED IN THE UK on criminal charges !)

http://www.buyqualitycigarettes.com

Global Visa Limited (FAKE AND "SCRUBBED" TOTAL FRAUD CON - stole people blind and was criminally busted for scamming "immigration" laws !)

http://www.geteasyvisa.net

Yusuf Kifa Biography-CON (FAKE "BIO" by the MONGOL-CLOWN HIMSELF- ALL FAKE, ALL LIES, ALL FABRICATED to pump this dog shit stock and now "SCRUBBED" and gone !)

http://www.yusufkisafinance.com

Gifa Enerji Ürünleri Ticaret (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.nutritionstoreonline.net

GIFA Deniz Ürünleri (FAKE AND "SCRUBBED" NEVER EXISTED)

http://www.gifadenizurunleri.com

Yeni Bakis Gazetesi (WORKS "sometimes" and is used as a pump-tool for the LIE-n-FRAUD known as "GIFA INC" aka $GIFX. ALL "OLD" criminal stock pump "articles" and ALL "loans to Iran" articles SCRUBBED AND GONE !!!)

http://www.yenibakisgazetesi.com

Gifa Consulting (FAKE and "SCRUBBED" and NO BULLSHIT about $BILLIONS IN LOANS TO IRAN" WAS LEFT BEHIND - ALL VANISHED ! NO MORE "We're raising our loan targets to $75 BILLION EUROS" blah blah when Aul issued the LIE-n-FRAUD BULLSHIT PR about "the pesky Lira and inflation problem is why we're missing THREE AND A HALF YEARS OF SEC FILINGS and are now re-inventing ourselves as bullshit fraud GIFA PETROLEUM that DOES NOT EXIST EITHER !! ALL A CON !)

http://www.gifaconsulting.com/index.html

Gifa Forex (FAKE and "SCRUBBED" front-company Kisa uses to TRADE HIS OWN SHARES OF GIFX as he's doing RIGHT NOW USING InstaSCAM as the PUMP TOOL)

http://www.gifaforex.com

Gifa Nektar (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifanektar.com

Gifa Insurance (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifainsurance.com/index.html

Gifa Project (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaproject.com

Gifa Rent a Car (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifarentacar.com

Gifa Construction (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaconstruction.com

Gifa Estates (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaestates.com

Gifa Financial Instruments (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifafinancialinstruments.com

GIFA Airways (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON where one can now buy KNOCK-OFF SHOES as in a CRIMINAL FRONT COMPANY USED TO FEED MONIES TO KISA TO BUY HIS OWN GIFX STOCK in P&D "cycles" !!)

http://www.gifaairways.com

GIFA Hotel & Casino (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.scotlandyardnews.com/gifa-chairman-to-build-new-and-deluxe-hotel-casino-in-the-trnc/1108/

GIFALAND (GIANT, ENORMOUS CON-n-FRAUD and FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON)

http://www.gifaland.com/images/fizibilite-raporu-eng.pdf

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaland.com/home.html&prev=search

GIFA Holding (FAKE AND "SCRUBBED" AND NEVER EXISTED- just a PUMP CON as NOTHING EXISTS INSIDE IT when put into "GIFA INC" aka $GIFX THIS EMPTY SHELL DOG SHIT PENNY SCAM and FRAUD !)

https://translate.google.com/translate?hl=en&sl=tr&u=http://www.gifaholding.com/&prev=search

THAT is the "short list" folks- these are SERIAL TRNC OFF-SHORE SHIT HOLE AND CRIME HAVEN.....F-ing.....CRIMINALS and SERIAL CONS operating out of the shit hole "neutral zone" ......TEXTBOOK penny scam as assisted by William Bill Aul long-time penny pump and shell scammer in San Diego.... and numerous others now and a PAID CANADIAN PUMP CREW who also has a few UK "marks" used to wash-trade for P&D crimes.....

Just ANOTHER in the Billy Aul list of garbage "companies" over the years (he and Ralph Amato - a con wanted for IRS fraud now) those two have been "assisting" penny scams for over two decades now- egregious as all hell !!

GIFX WAS...PAST TENSE....now since the TRNC GOVT SHUT IT DOWN and put CEO KISA IN PRISON..it WAS WAS WAS ......A TERRORISM FRONT-COMPANY for washing money via their "Russia division" to aid IRANIAN TERRORISM in violation of U.S. sanctions and embargo laws- that is it.

USED CAR LOT NOW.....REAL BUILDING OWNER CONTROLS IT ALL....kicked out KISA when the ass clown "went after Turgay" in the shit show Yeni Bakis which ALSO got it's scam "TV" web channel bullshit GOVT YANKED...gonner....no more....POOF......GIFA INC is worthless kids....GONNER.....:))

SEC SHUTDOWN AND DOJ INVESTIGATION AND CRIMINAL CHARGES TO FOLLOW :)

PS: The "RUSSIA" organized crime front operation- now at the DOJ level for investigation. Aul is in DEEP, DEEP SHIT !

In early 2020, the company appears to have opened or started a "Russia subsidiary" but William "Bill" Aul has never released any formal PR to explain what the Russia subsidiary does or if it is owned/controlled by GIFA Inc (GIFX this stock) etc?

gifaconsulting.ru

GONE and scrubbed - CRIME !!!

https://www.youtube.com/watch?v=1YSFQfXQEHM

SAME individuals shown in that SCAM FRONT-ORG appear in older "scrubbed" CRIMINAL GIFA HOLDING "ASSISTANCE" VIA LARGE LOANS TO IRAN TERROR GROUPS - total violations of U.S. law(s) !!

THE BIG LIE n CON JOB….. “WE BE IN THE PETROLEUM” biz CRIMINAL FRAUD P&D….NEVER EVER FORGET BAG HOLDERS…..:))

GUN SHELL CASINGS LMFAO !!!!

GIFA-CON aka GIFX…..DOING BIZ WITH TERRORISTS – that be a pic of the Ayatollah Khomeini hanging proudly on the wall – THEE NUMERO UNO SWORN ENEMY OF THESE UNITED STATES……NO WAY the state dept and SEC-DOJ let this POS TRNC crime scene trade given what just happened in the Middle East…..this scam is already BAKED and DONE….and I’ll be sending a note to the key congressman on the US Security Council about these damning criminal facts….:))

BAGGIES RED ALERT - you've been "had" again by criminal con Yusuf Kisa and Aygun Antas Bwwwaaaaaa ha ha ha ha ha dumb assess....!!!!

Aygun Yahi Antas Turkish Republic Northern Cyprus has been moved to "WANTED" status- now the NUMERO TWO "MOST WANTED" as related to GIFA INC criminal stock fraud committed against US citizens....she is on a "EXTRADITE" criminal fraud list now......watch n learn kids....bout to get real good here on this off-shore crime scene...I'm talking more arrests and cons going to a rot gut prison kinda good :))

*******************************************

Aygun Yahi Antas WANTED 💀 ☠️ WANTED 💀 ☠️ WANTED

******************************************

WANTED: SECURITIES FRAUD VIOLATIONS SECURITY ACT 1934 UNITED STATES OF AMERICA

****************************************

$INND: MATTY CUTS CRIB PRICE AGAIN LMAO !!!

I tried to TELL THAT STUPID PUNK BOY his crib is sitting UNSOLD aka "WE NEED MO LAWYER MONEY CAUSE WE BE GETTING OUR SORRY ASSES KICKED IN FEDERAL and SUPERIOR COURTS reals dunn bads like"......

Told THE PUNK aka MATTY BOY..... that he better cut the price on that crib to get it sold and cash-it-out to protect the real MOORE MORE CRIME CLAN PRIZE aka THE MILLER HIGH LIFE GRANITE BAY COUNTRY CLUB GIG n CRIB.......aka Momma n Daddy MOORE MORE central......

1501 Deer Hollow Way, Roseville, CA aka MATTY n BIG GIRL MAGGIE MAY PLACE....GETS ANOTHER PRICE CUT - while it sits in a dead market.....

https://www.redfin.com/CA/Roseville/1501-Deer-Hollow-Way-95661/home/19634774

ANOTHER CUT .....this time $25K and this POS IS STILL Waaaay overpriced !!!!

1501 Deer Hollow Way,

Roseville, CA 95661

$1,025,000

Price drop

List price was just lowered by $24K. Tour it before it's gone!

AMAZING GOOD INFO !!!

Shaky Jake, what do you make of this Federal criminal indictment for music royalty fraud?

https://www.ibtimes.com/ai-music-streamed-royalty-fraud-3742230

Keep comin',, ,boyo - JUSTIN(E) COSTELLO needs a cell mate at Lompoc. Hope you like the top bunk and can speak fluent Spanish.