www.TheFinancialMarketingGroup.com

| Followers | 58 |

| Posts | 2,197 |

| Boards Moderated | 4 |

| Alias Born | 04/28/2019 |

| Twitter Profile: | Temporarily Unavailable |

| Follow on Twitter: | Follow @ Temporarily Unavailable |

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$FTFT | #FutureFintechGroup On Reversal Watch List

Future FinTech Group, Inc. is a blockchain e-commerce and financial technology company. The company's operations include a blockchain-based online shopping mall platform, Chain Cloud Mall ("CCM"), a cross-border e-commerce platform (NONOGIRL), an incubator for blockchain based application projects, and a digital payment system "DCON". It is also engaged in development of blockchain based e-Commerce technology as well as financial technology. The company was founded on June 29, 1998 and is headquartered in Beijing, China.

$FTFT | #FutureFintechGroup On Reversal Watch List

Future FinTech Group, Inc. is a blockchain e-commerce and financial technology company. The company's operations include a blockchain-based online shopping mall platform, Chain Cloud Mall ("CCM"), a cross-border e-commerce platform (NONOGIRL), an incubator for blockchain based application projects, and a digital payment system "DCON". It is also engaged in development of blockchain based e-Commerce technology as well as financial technology. The company was founded on June 29, 1998 and is headquartered in Beijing, China.

$CLF | #ClevelandCliffs - Bullish Post Acquisition

Potential long entry and trade up to the $7.00 level

Company looks undervalued and may be a benefactor of post election infrastructure spending

Upgrade details

Citi analyst Alexander Hacking views Cleveland-Cliffs' proposed acquisition of ArcelorMittal USA as positive for the company and the industry. Consolidation amongst U.S. integrated mills is "helpful and may help smooth the absorption" of new electric-arc furnace capacity, Hacking tells investors in a research note. Further, the deal secures a future for almost all Cleveland-Cliffs' pellets, "closing out what was a major structural risk before the AKS deal," says the analyst. Hacking keeps a Neutral rating on Cleveland-Cliffs shares.

$CLF | #ClevelandCliffs - Bullish Post Acquisition

Potential long entry and trade up to the $7.00 level

Company looks undervalued and may be a benefactor of post election infrastructure spending

Upgrade details

Citi analyst Alexander Hacking views Cleveland-Cliffs' proposed acquisition of ArcelorMittal USA as positive for the company and the industry. Consolidation amongst U.S. integrated mills is "helpful and may help smooth the absorption" of new electric-arc furnace capacity, Hacking tells investors in a research note. Further, the deal secures a future for almost all Cleveland-Cliffs' pellets, "closing out what was a major structural risk before the AKS deal," says the analyst. Hacking keeps a Neutral rating on Cleveland-Cliffs shares.

$QCOM | #Qualcomm Day Trade Setup

Potential day trade back to previous highs .

Barclays analyst Blayne Curtis raised the firm's price target on Qualcomm to $120 from $110 and keeps an Equal Weight rating on the shares. Handsets are one of a few markets that the analyst expects to see a recovery in 2021. However, Curtis believes his 1.4B handset base case is "generous," and needs to see a higher number in order to be more constructive on Qualcomm shares.

$QCOM | #Qualcomm Day Trade Setup

Potential day trade back to previous highs .

Barclays analyst Blayne Curtis raised the firm's price target on Qualcomm to $120 from $110 and keeps an Equal Weight rating on the shares. Handsets are one of a few markets that the analyst expects to see a recovery in 2021. However, Curtis believes his 1.4B handset base case is "generous," and needs to see a higher number in order to be more constructive on Qualcomm shares.

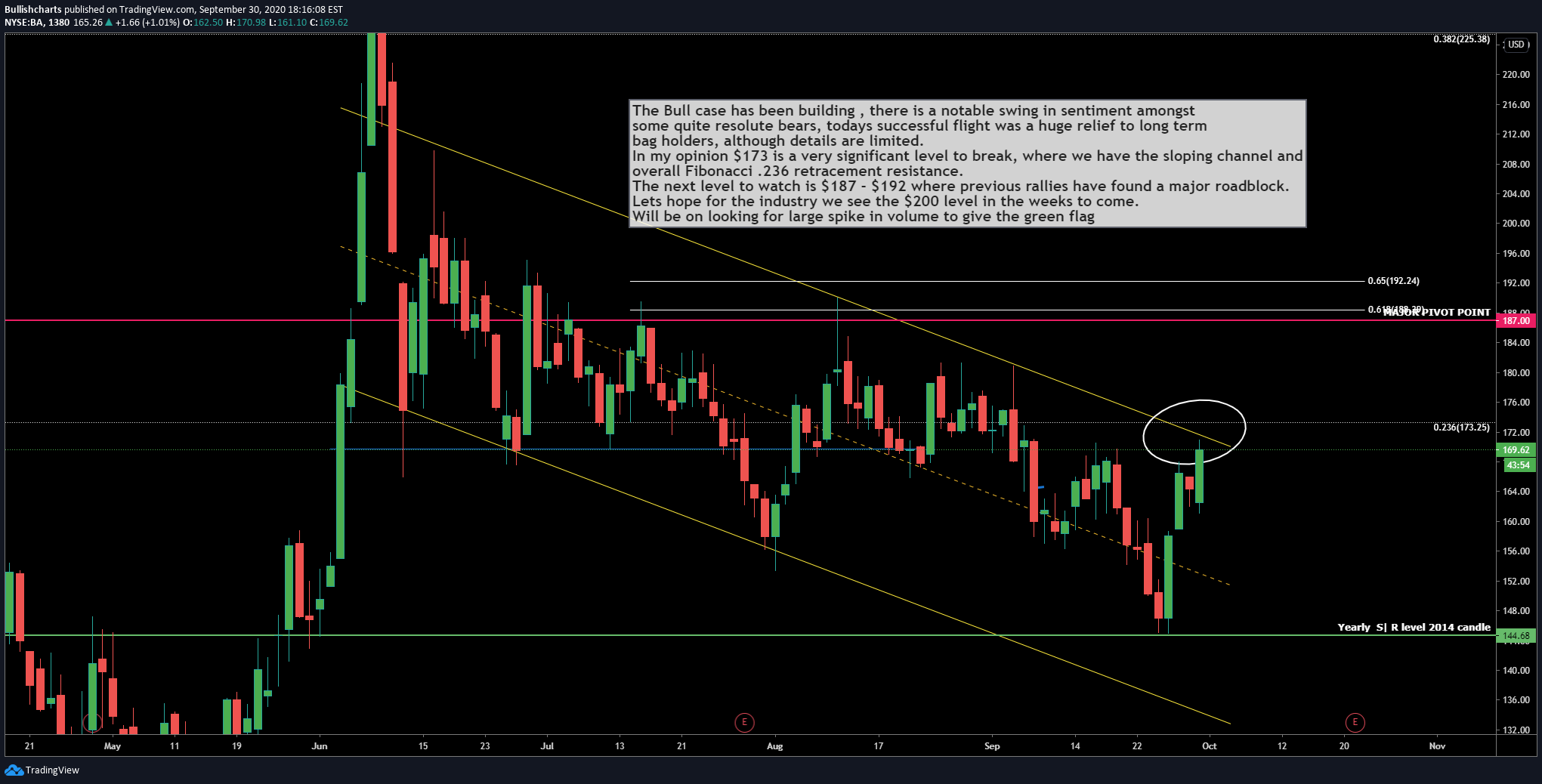

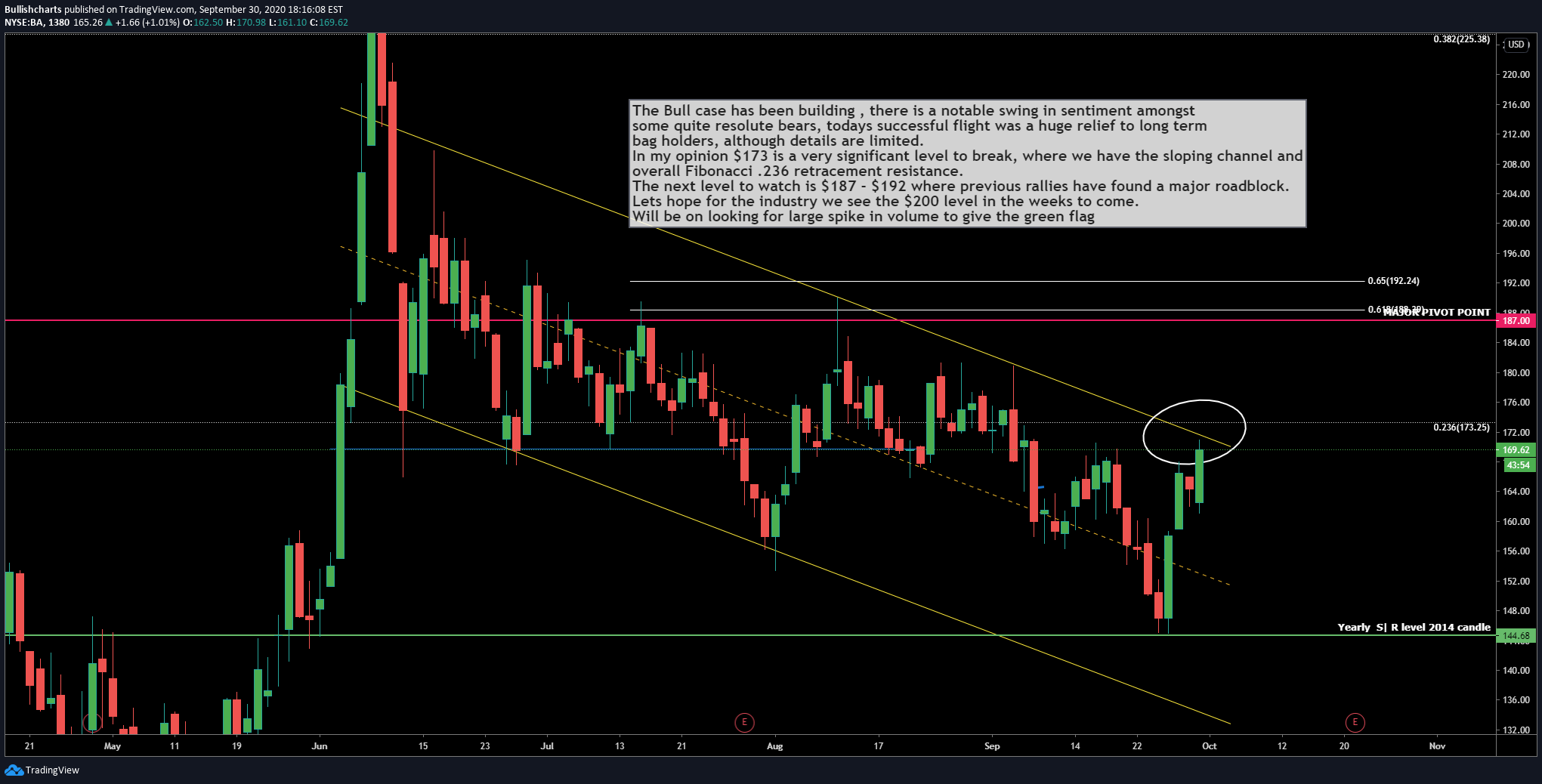

$BA | #Boeing Bears May Need To Jump Soon.

The Bull case has been building , there is a notable swing in sentiment amongst

some quite resolute bears, todays successful flight was a huge relief to long term

bag holders, although details are limited.

In my opinion $173 is a very significant level to break, where we have the sloping channel and

overall Fibonacci .236 retracement resistance.

The next level to watch is $187 - $192 where previous rallies have found a major roadblock.

Lets hope for the industry we see the $200 level in the weeks to come.

Will be on looking for large spike in volume to give the green flag.

$BA | #Boeing Bears May Need To Jump Soon.

The Bull case has been building , there is a notable swing in sentiment amongst

some quite resolute bears, todays successful flight was a huge relief to long term

bag holders, although details are limited.

In my opinion $173 is a very significant level to break, where we have the sloping channel and

overall Fibonacci .236 retracement resistance.

The next level to watch is $187 - $192 where previous rallies have found a major roadblock.

Lets hope for the industry we see the $200 level in the weeks to come.

Will be on looking for large spike in volume to give the green flag.

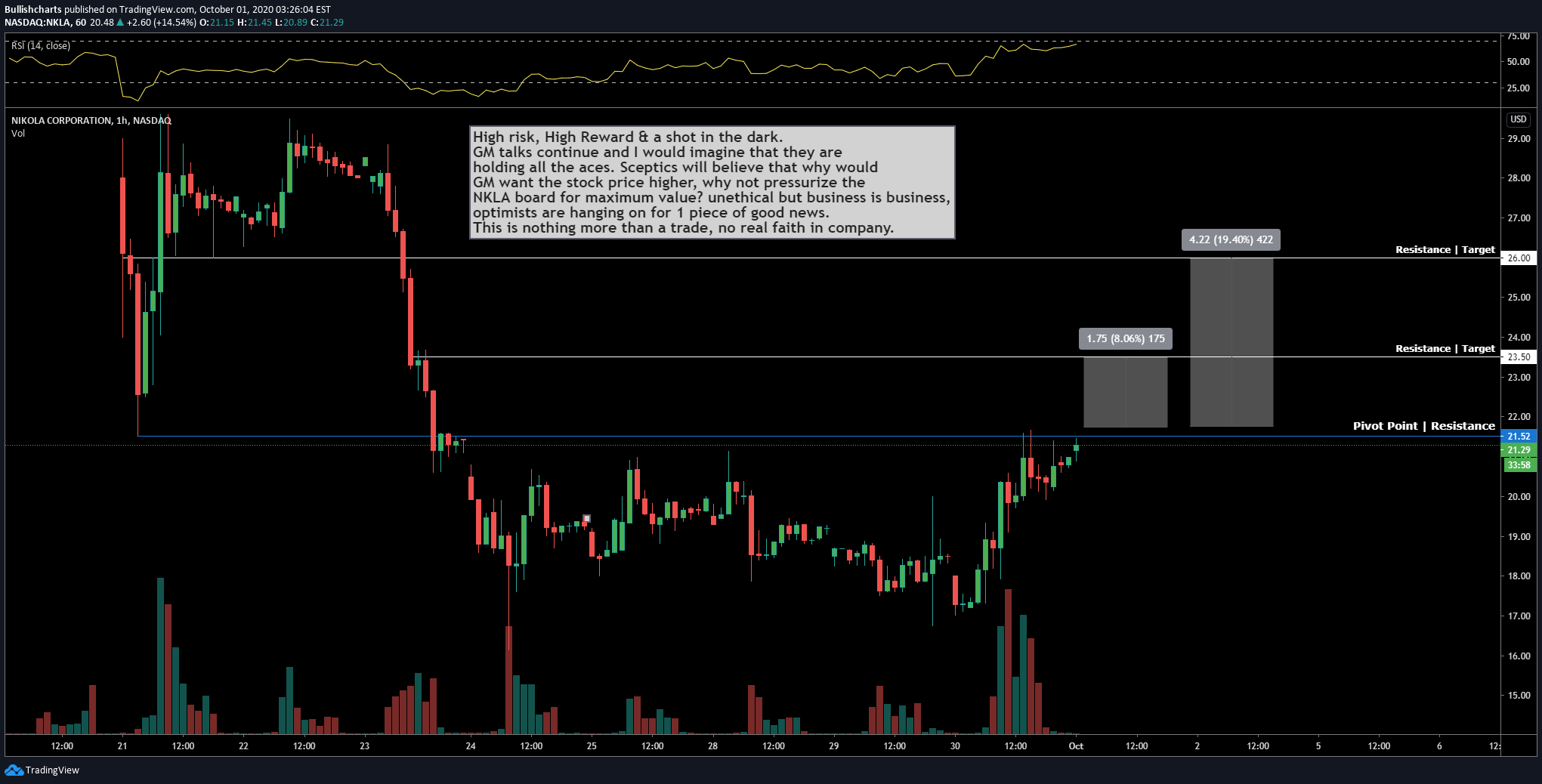

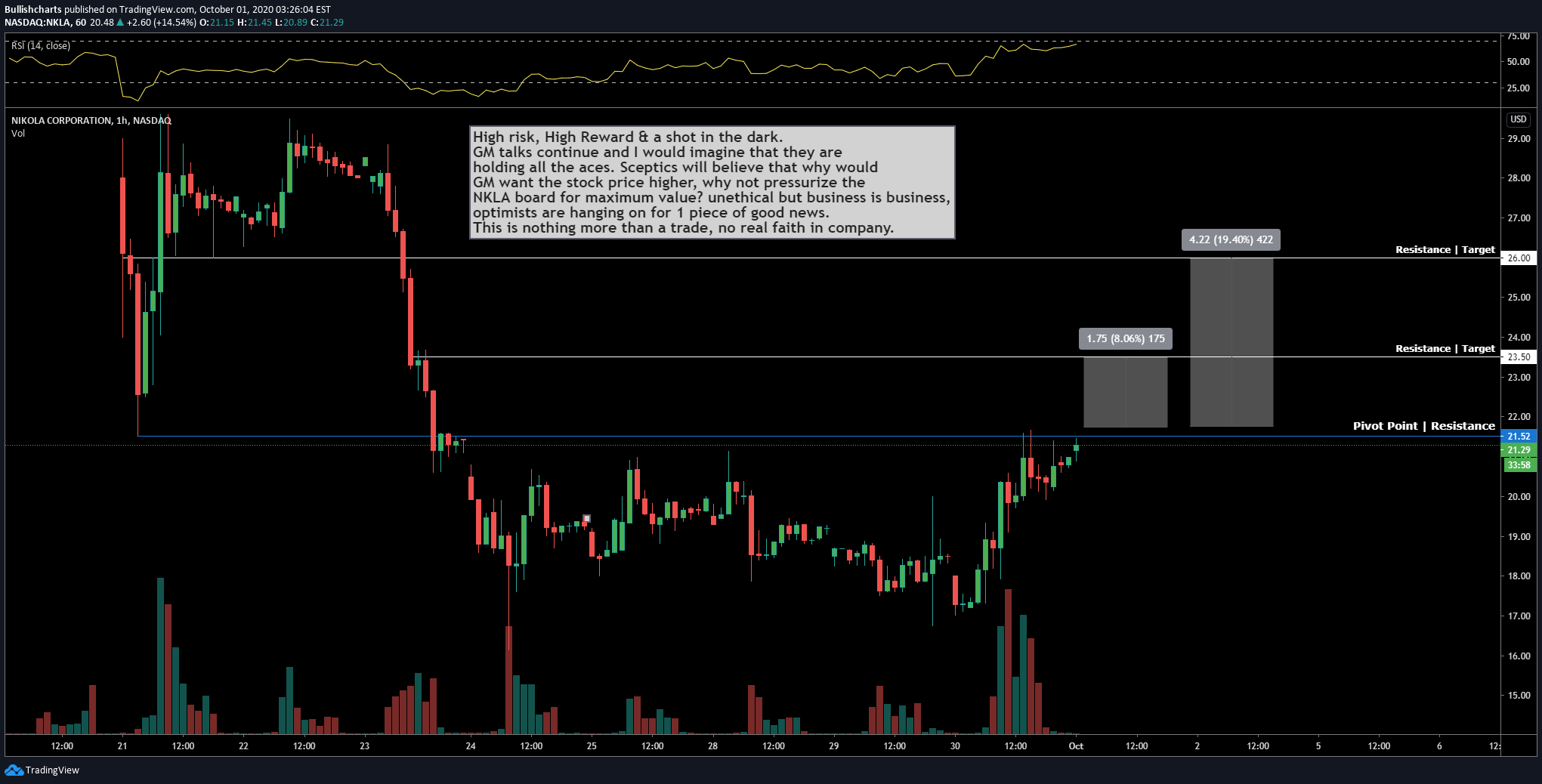

$NKLA - Potential Break Above Pivot #Nikola

High risk, High Reward & a shot in the dark.

GM talks continue and I would imagine that they are

holding all the aces. Sceptics will believe that why would

GM want the stock price higher, why not pressurize the

NKLA board for maximum value? unethical but business is business,

optimists are hanging on for 1 piece of good news.

This is nothing more than a trade, no real faith in company.

$NKLA - Potential Break Above Pivot #Nikola

High risk, High Reward & a shot in the dark.

GM talks continue and I would imagine that they are

holding all the aces. Sceptics will believe that why would

GM want the stock price higher, why not pressurize the

NKLA board for maximum value? unethical but business is business,

optimists are hanging on for 1 piece of good news.

This is nothing more than a trade, no real faith in company.

$FERL - Low Float Bottomed Chart Bounce Play

Fearless Films, Inc. (OTCQB: FERL)

Alert Price: $0.0394

Float: 18.65M

Technical Analysis

Fearless Films, Inc. (OTCQB: FERL) should be at the top of your trading screen!

The company could become a big name in streaming content, and currently the stock is trading at less than 4 cents per share.

FERL is an independent full-service production company is the branchild of award-winning actor/ producer Victor Altomare along with award-winning writer and director Goran Kalezic.

The service scope specializes in short film and feature film production in addition to script writing, copywriting, fulfillment and distribution.

All work created by the company is a unique idea, embodied in the life by talented operators, editors and designers. The company can also realize any task associated with video production.

Movie fans will recognize Victor from the Great Chameleon, Graveyard Story and the Last King. On television you may have seen him in series such as the My Cicco show, Blue murder or documentaries such as Mob Stories, to name a few.

Highlights of Victor's voice talent credits include the acclaimed Resident Evil: Outbreak series, including Resident Evil: Outbreak file # 2.

Streaming is a sector that has been seeing impressive growth due to the coronavirus pandemic. As more people stay at home, the televisions are turned on and many are watching streaming services.

The Bullish Case For FERL

The linear to streaming TV pivot was already happening at a robust pace globally before the novel coronavirus pandemic emerged. This pandemic has just accelerated an already strong trend, which will persist long after the pandemic dies down.

There remains ample room for streaming TV adoption rates to grow. Today, only about 25% of all internet households globally are subscribed to a streaming TV service. By comparison, the U.S. streaming TV household penetration rate is close to 100%. That 75 points of separation implies a huge global growth opportunity for streaming service providers.

Almost 70% of U.S. households still pay for pay-TV. That number will drop to zero over time. As it does, that implies a huge opportunity for incumbent streaming services to raise prices, and new streaming services to gain traction.

Streaming TV services are subscription services, meaning the Covid-19 demand surge doesn’t just equal a one-time boost in one-off sales. It equates to a multi-year boost in annually recurring revenues.

The World Is Streaming More Than Ever Now!

According to a study conducted by OnePoll on behalf of Tubi, which surveyed 2,000 Americans with access to a streaming service, the average person is now streaming eight hours of content per day!

COVID-19 has also helped Netflix sail to over $500 a share and the streaming giant has been reporting record subscriber growth.

Companies like Netflix as well as Amazon and Hulu are spending upwards of $40 billion towards new original content, creating massive opportunities for companies like FERL to meet the demand of these industry powerhouses.

FERL announced at the end of June that it has closed a non-brokered private placement offering of up to 6,666,668 shares priced at $0.15 per common share for gross proceeds of $1M!

The proceeds of the Offering will be used to support the operations of the company, including brand building and film production. FERL plans to begin production on its next film during this year!

CEO Victor Altomare has stated, "The growth of streaming media has created rising demand for quality entertainment properties. Fearless Films was founded with the idea of producing quality entertainment with project budgets under $6 million. The Great Chameleon is an example of this strategy in action. We plan to advance a number of new projects that are promising and designed to meet the needs of new-era film distribution platforms."

It was in April that FERL confirmed its ownership of full rights to The Great Chameleon and it is the first production by Fearless Films. This film forms the cornerstone of the Company's library of intellectual property!

With a stellar rating on IMDB, The Great Chameleon is a bawdy comedy with dramatic overtones in which the FBI secretly releases master of disguise con man Joe Murky (Victor Altomare) from prison to track down his abducted niece.

With the assistance of his long-time cohort and eccentric make-up artist Max; Joe Murky, aka: Great Chameleon will reach into his whole bag of tricks with his off-the-wall style of disguises as he nears his target. All the while, Murky is hampered by the overzealous parole officer Curry, who has a personal vendetta against him. The Great Chameleon is a crime story with plentiful laughs, and a fun-to-watch experience.

The film has streaming distribution through Amazon Video (UK) and is also available for rent or purchase on Amazon Video, along with Google Play, iTunes, YouTube, and Microsoft XBox platforms. Imageworks Entertainment International, the agent for the film, recently obtained US distribution via Amazon US.

The Great Chameleon is now available on a number of streaming platforms. It is available on Amazon US and UK, Google YouTube, Xbox and iTunes.

It was in the fall of 2019 that FERL signed a Letter of Intent with Altomare to acquire the rights to up to twelve movies from a library held by Altomare, who is also the President of Fearless Canada, the Company's operating subsidiary.

Under the terms of the LOI, the acquisition price and consideration for each film will be negotiated separately and payable in cash and shares of the Company, subject to negotiation of the Definitive Agreements and the obtention of mutually satisfactory independent appraisals of the value of each film.

FERL recently completed an agreement to acquire Only Minutes, a significant addition to the company's growing library of media titles!

Only Minutes was written and directed by Goran Kalezic. The movie premiered at the Fort Lauderdale International film festival where it was the winner of the Critic's Choice award. It has also been featured in the Hollywood Film Festival.

Goran Kalezic is a writer and director, known for Only Minutes, The Great Chameleon (2012), The Bartender (2005) Audience Favoured at Indyfest and Bag the Wolf (2000). He is also the author of Dostoevsky's Anarchists: A Screenplay Adaptation of Dostoevsky's Demons (2018).

Only Minutes is a story about a man attempting to exact revenge on his bank. Its cast includes Victoria Snow, known for her work on In The Dark (2019), Incorporated (2016) and Slasher (2016); Lazar Rockwood, known for Witchblade (2000 and 2001) and Antigone (2012); and Peter Schindelhauer, known for his work on X-Men (2000), RoboCop (2014) and X-Men: Dark Phoenix (2019).

The Company has agreed to acquire the film in an all-stock transaction which is expected to close during the third quarter of 2020.

The film will join The Great Chameleon and The Lunatic as part of the Company's growing content library and complements the company's strategy of building an inventory of high-quality films that will be supplemented with new in-house productions.

It was earlier in June that FERL announced that it had completed an agreement to acquire the acclaimed The Lunatic, a film whose rights were held by Mr. Altomare.

The Lunatic was produced by Victor Altomare and directed by Robert Longo. The movie premiered at the Montreal Film festival as an official selection, won the bronze award in Houston Film Festival, and was also awarded at the Yorkton Short Film Video festival.

The Lunatic stars Victor Altomare, who portrays a murderer who feigns insanity in order to avoid electrocution, along with Lazar Rockwood (known for Witchblade and Antigone), Jennifer Dale (received Earle Grey Award recognizing her lifetime achievements in the Canadian entertainment industry), and boxing great George Chuvalo (who twice fought against Muhammad Ali for the heavyweight championship).

FERL also announced recently that it is in discussion with a significant Los Angeles-based film production company to partner on the production of scripts.

This production partnership will be of great benefit in sourcing locations, talent and facilities due to their long experience in film production. These discussions are preliminary and will require formal contracts once agreement has been reached on final details.

Mr. Altomare stated, "Fearless Films was founded with the idea of producing quality entertainment with project budgets under $6 million. Partnering on the development of scripts is a logical next step for the Company as it allows our creative content to reach market sooner than if we had gone it alone."

FERL has additionally announced in June that it has acquired FilmOla.com to add additional revenue and distribution.

FilmOla is an online marketplace where content is showcased and updated instantly to a trusted global community of viewers, reaching new audiences and new markets 24/7.

The platform is also launching an online- social media platform for film and movie junkies to connect. FilmOla earns revenue from advertising and online affiliate programs. FilmOla leverages affiliate marketing to drive revenue to the media channel by connecting viewers interested in film and movie content.

EMarketer forecasts that cord-cutting will grow to 76 million households in 2023 from 46 million in 2019. The company also suggests that pay-TV household numbers will fall from 86.5 million last year to 72.7 million households in 2023.

According to nocable. org , in 2018, there were almost 171 million subscriptions to streaming services, which increased by 6.9% in 2019 to 182.5 million. OTT services such as Netflix , Hulu, Youtube TV and Sling lead the way here and are still expected to headline a list of streaming services that will net a total 191.5 million subscribers in 2020.

How big has the streaming market become? Streaming device maker Roku went bonkers last year and skyrocketed nearly 400%!

There is plenty of interest in online viewing and the proof is in the pudding with Roku's performance in 2019.

More and more people are saying goodbye to their expensive cable bills and are cutting the cord and signing up for streaming services.

The global entertainment market — consisting of theatrical and home entertainment — has surpassed $100 billion in revenues for the first time in history, with earnings reaching $101 billion in 2019, according to a new report released by the Motion Picture Association.

FERL announced that it has negotiated an agreement for the extinguishment of its 2019 Convertible Note from the holder of the Note. The transaction is contingent on the Company delivering shares to the holder. If fully executed, the transaction will extinguish all of the remaining $76,500 in debt related to the Note.

"We negotiated this agreement as a means of reducing future potential dilution from the Convertible Note. We believe that this will provide the Company with the flexibility to raise new equity capital at potentially more beneficial terms, allowing us to continue to support our film production and media library expansion where we believe that shareholder value is ultimately created" stated Victor Altomare, CEO .

FERL also said this month that it will apply to list its share on a stock exchange in Canada, in addition to its current listing on the OTCQB market.

The Company has decided to take this step to access a wider pool of capital as well as to increase liquidity options for its shareholders.

FERL's Recent Developments Could Spark A Bullish Reversal

Acquired the film script Dead Bounty, another significant addition to the company's growing portfolio of films and intellectual property

Announced that it will be applying to list its shares on a stock exchange in Canada, in addition to its current listing on the OTCQB market. The Company has decided to take this step to access a wider pool of capital as well as to increase liquidity options for its shareholders.

Closed a private placement at $0.15, which is about 50% away from where it sits now and a 22% premium to the Company's 20-day volume-weighted average trading price. That’s a strong statement buy the investors behind this money.

Agreed to acquire the award winning film Only Minutes, a significant addition to the company's growing library of media titles in an all-stock transaction. The purchase price was not revealed. The transaction is expected to close during the third quarter of 2020.

Acquired FilmOla.com to add additional revenue and distribution. FilmOla is set to capitalize on the global movie and film industry; the global entertainment market hit $100 billion for the first time in 2019 as streaming kept making huge gains, according to the Motion Picture Association's annual snapshot.

FERL Could See A Nice Bounce From Here

Based on our very own technical analysis , we the potential for a big move from these levels.

Bullish Indicators

Stochastic bottomed and reversal imminent

Momentum remains in strong uptrend

Bullish divergence

The Bottom Line

Streaming is a monstrous arena that gives FERL a massive market to cater to!

The upside is almost too big to ignore!

Start your research on the company right away at: www.fearlessent.com

Millions upon millions of people are streaming and FERL is aiming to capitalize! By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

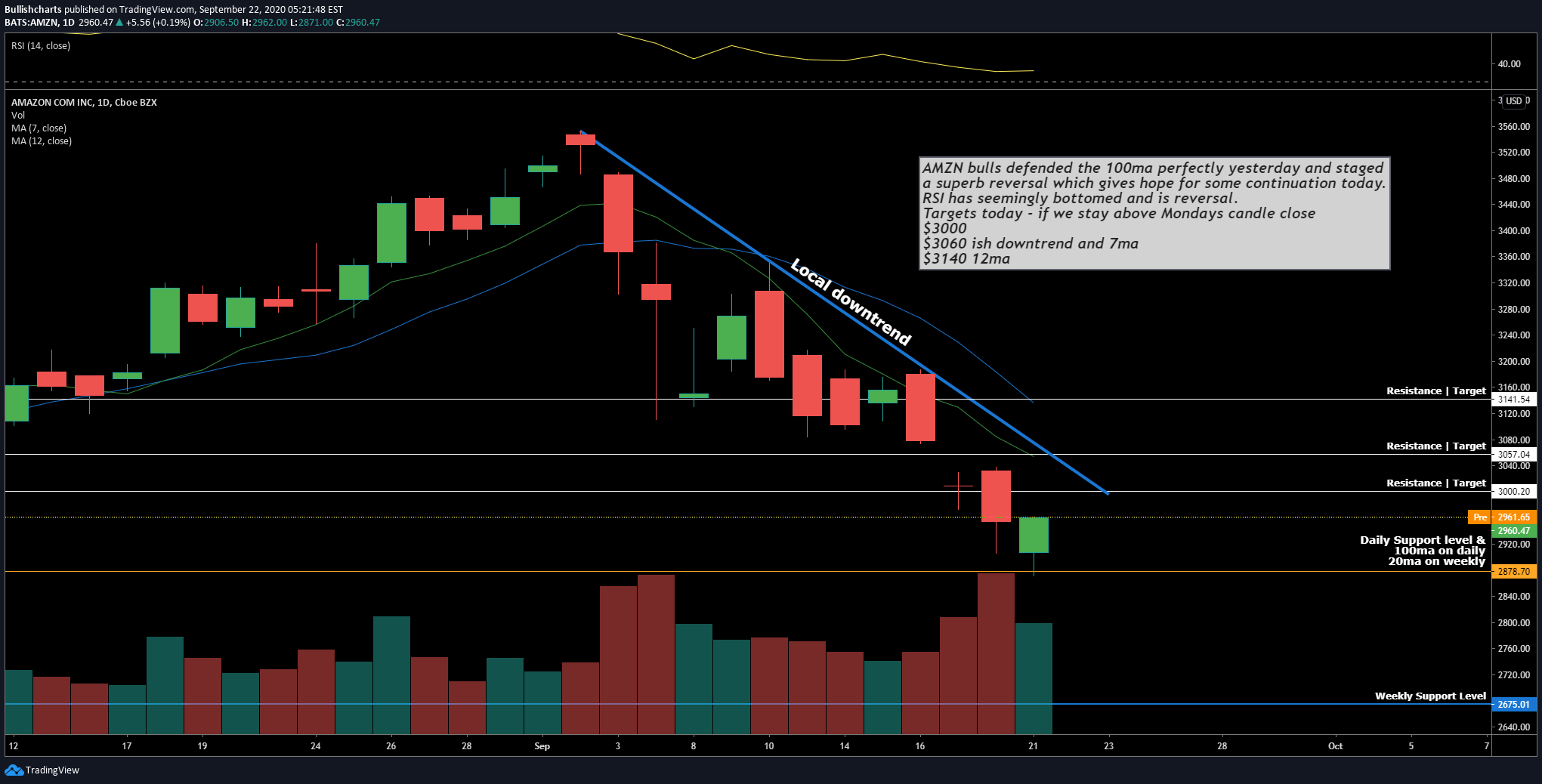

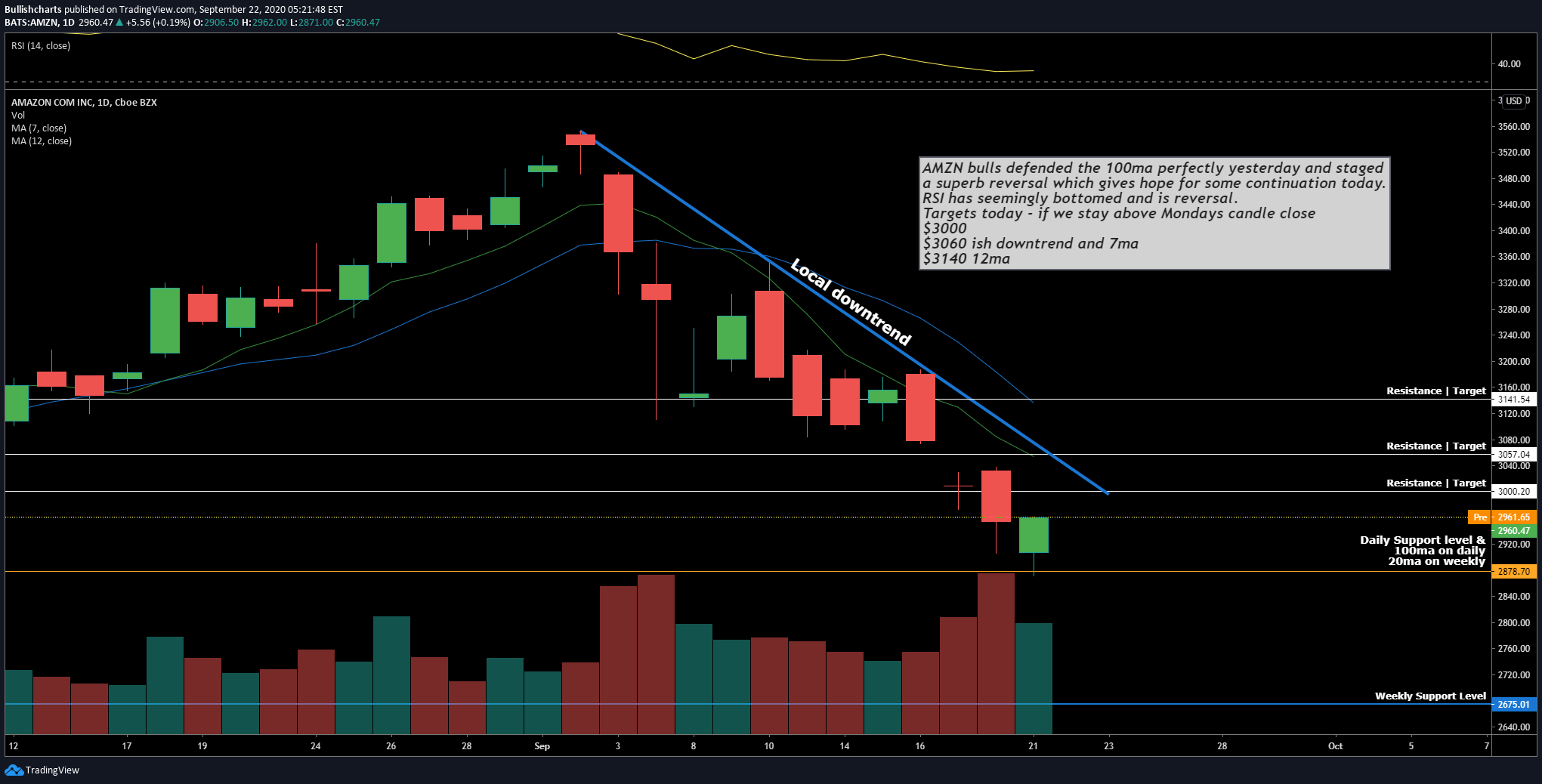

$AMZN | #Amazon Reversal Trade Targets

AMZN bulls defended the 100ma perfectly yesterday and staged

a superb reversal which gives hope for some continuation today.

RSI has seemingly bottomed and is reversal.

Targets today - if we stay above Mondays candle close

$3000

$3060 ish downtrend and 7ma

$3140 12ma

$AMZN | #Amazon Reversal Trade Targets

AMZN bulls defended the 100ma perfectly yesterday and staged

a superb reversal which gives hope for some continuation today.

RSI has seemingly bottomed and is reversal.

Targets today - if we stay above Mondays candle close

$3000

$3060 ish downtrend and 7ma

$3140 12ma

$ROKU Breakout Targets

Shorts once again got caught on the wrong side of the trade on Monday

as the company announced the contract with Comcast.

Still over 7% in short interest can add more fuel as momentum and possible

upgrades in the days to come entice new investors.

It is never plain sailing in this stock so you have to be prepared for considerable pullback.

Targets to consider for continuation.

$200 - Key psychological target| resistance

$208- Fibonacci levels in confluence

$249 - Longer term breakout to Fibonacci resistance

$ROKU Breakout Targets

Shorts once again got caught on the wrong side of the trade on Monday

as the company announced the contract with Comcast.

Still over 7% in short interest can add more fuel as momentum and possible

upgrades in the days to come entice new investors.

It is never plain sailing in this stock so you have to be prepared for considerable pullback.

Targets to consider for continuation.

$200 - Key psychological target| resistance

$208- Fibonacci levels in confluence

$249 - Longer term breakout to Fibonacci resistance

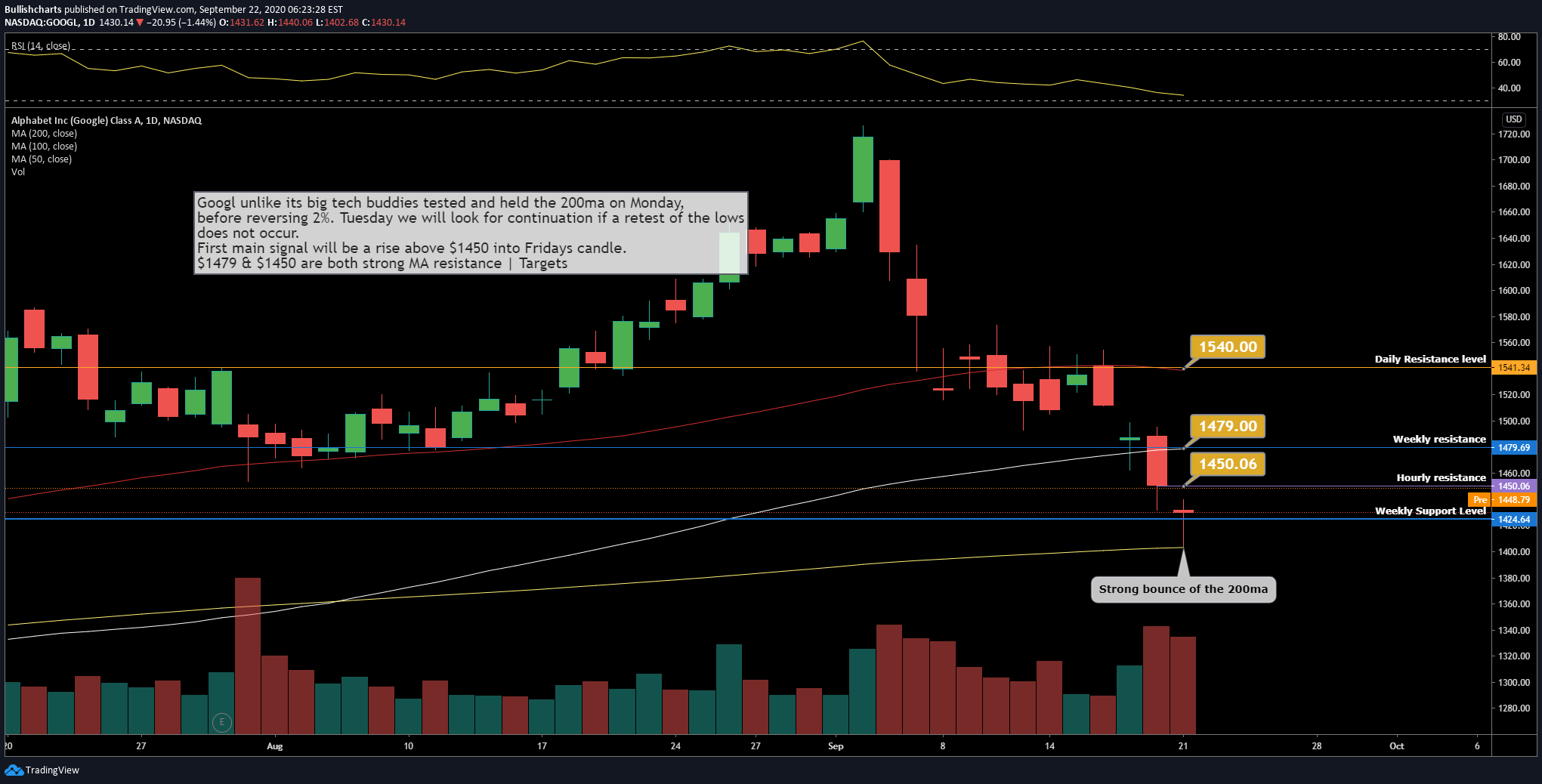

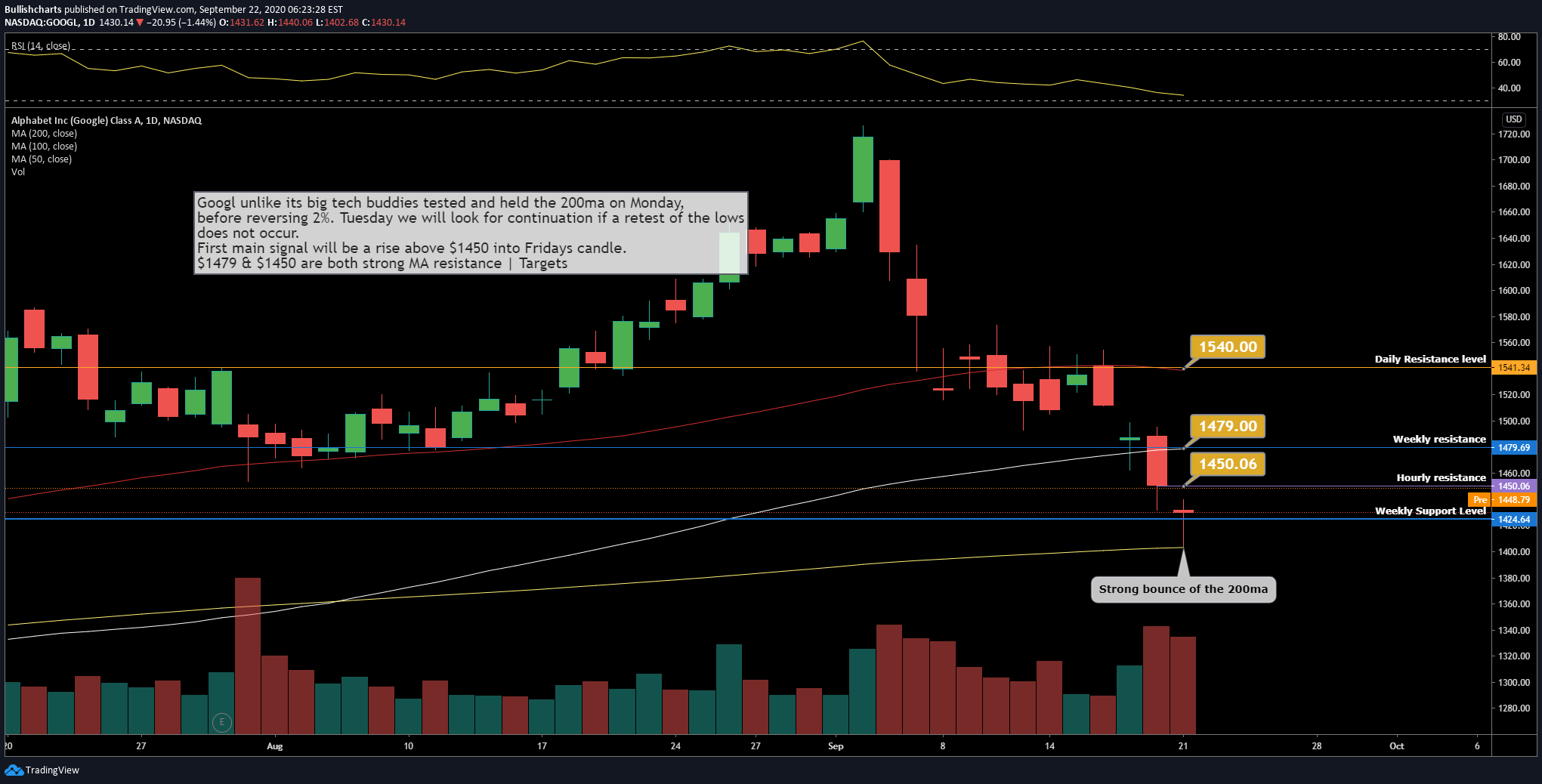

$GOOGL | #Google & Fang Stocks Back in Favor

Googl unlike its big tech buddies tested and held the 200ma on Monday,

before reversing 2%. Tuesday we will look for continuation if a retest of the lows

does not occur.

First main signal will be a rise above $1450 into Fridays candle.

$1479 & $1450 are both strong MA resistance | Targets

$GOOGL | #Google & Fang Stocks Back in Favor

Googl unlike its big tech buddies tested and held the 200ma on Monday,

before reversing 2%. Tuesday we will look for continuation if a retest of the lows

does not occur.

First main signal will be a rise above $1450 into Fridays candle.

$1479 & $1450 are both strong MA resistance | Targets

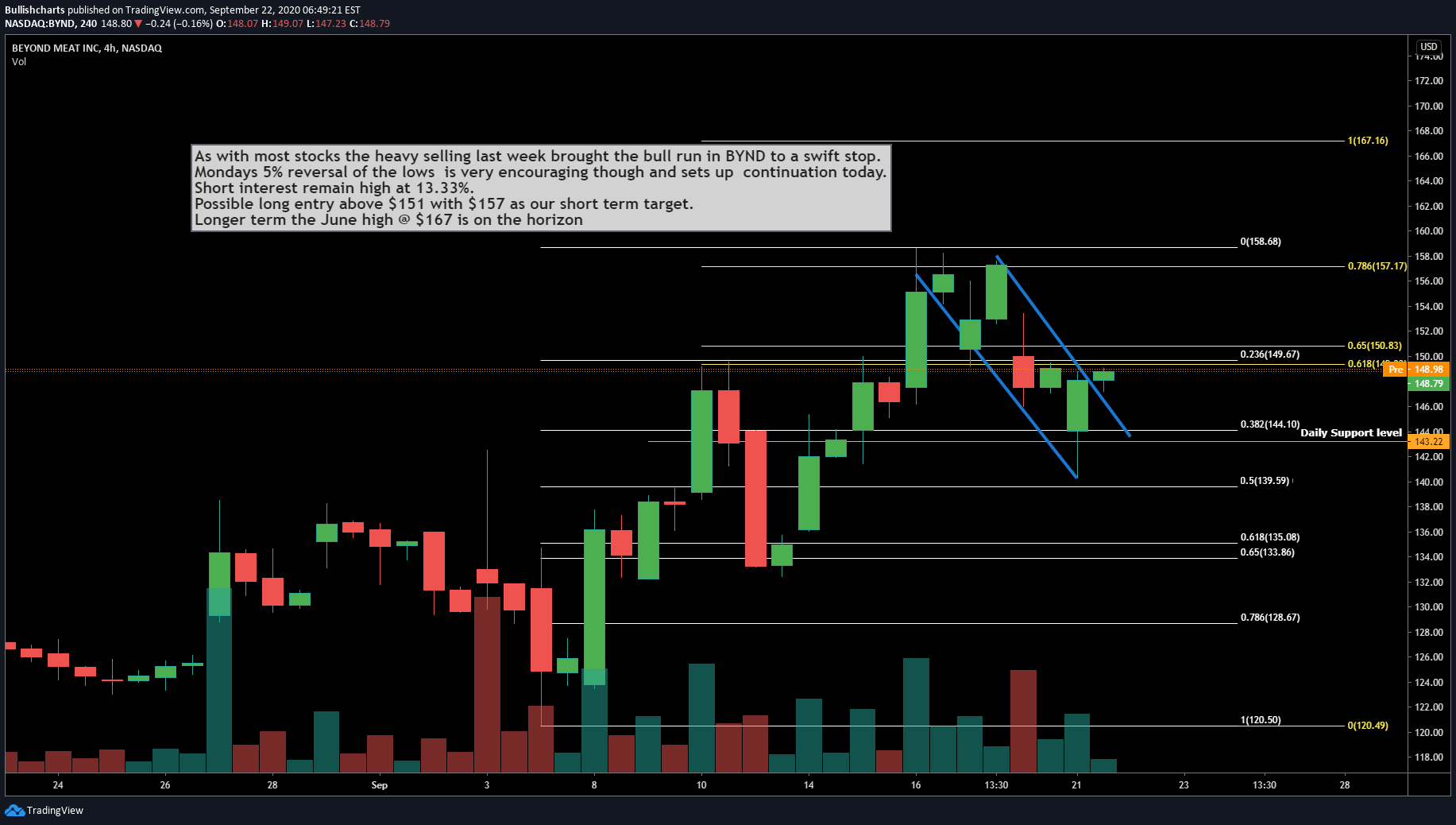

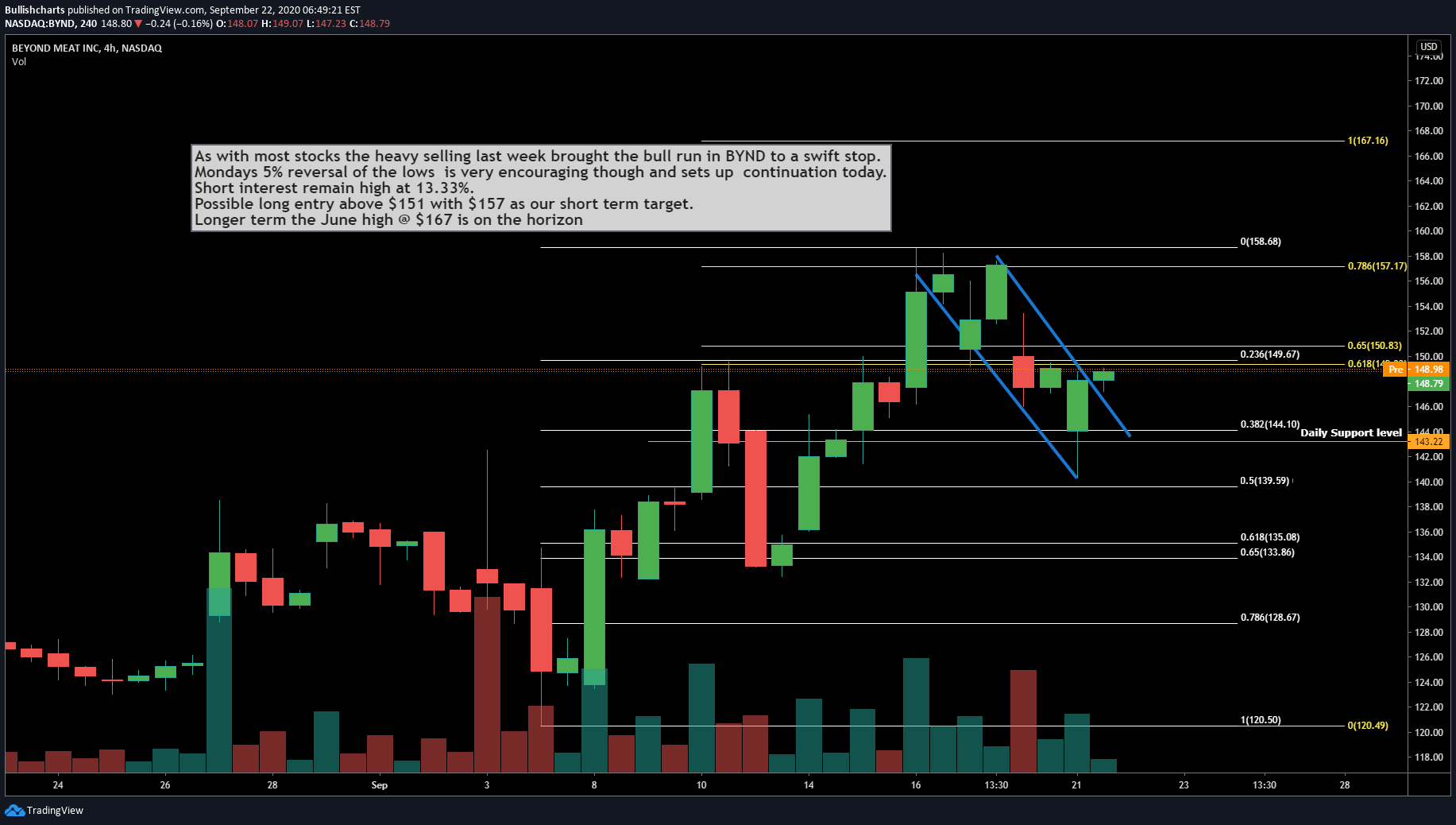

$BYND | Long Above $151 In #BeyondMeat

As with most stocks the heavy selling last week brought the bull run in BYND to a swift stop.

Mondays 5% reversal of the lows is very encouraging though and sets up continuation today.

Short interest remain high at 13.33%.

Possible long entry above $151 with $157 as our short term target.

Longer term the June high @ $167 is on the horizon

$BYND | Long Above $151 In #BeyondMeat

As with most stocks the heavy selling last week brought the bull run in BYND to a swift stop.

Mondays 5% reversal of the lows is very encouraging though and sets up continuation today.

Short interest remain high at 13.33%.

Possible long entry above $151 with $157 as our short term target.

Longer term the June high @ $167 is on the horizon