Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$GOOG Long-term Alphabet investors have happily paid 17–18x earnings for a decade...

By: TrendSpider | April 15, 2025

🔸 Long-term Alphabet investors have happily paid 17–18x earnings for a decade...

We’re nearing that valuation again right now. $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL - The week ended with a bullish engulfing candle after a 32% drawdown from the February top

By: CyclesFan | April 13, 2025

🔸 $GOOGL - The week ended with a bullish engulfing candle after a 32% drawdown from the February top. The February-March 2020 crash ended with a bullish engulfing candle too after a similar 34% drawdown.

Read Full Story »»»

DiscoverGold

DiscoverGold

Can Alphabet's New AI and Cloud Launches Push the Stock Higher?

By: Zacks Investment Research | April 11, 2025

Alphabet GOOGL shares have lost 19.2% year to date, underperforming the broader Zacks Computer & Technology sector’s decline of 16.4%. The decline can be attributed to challenging macroeconomic conditions post U.S. President Donald Trump’s decision to levy tariffs on trade partners, including China, Mexico, and Canada.

However, GOOGL’s initiatives to infuse AI into its products are a major growth driver. Alphabet made a series of high-impact announcements at the Cloud Next 2025 conference in Las Vegas on Wednesday.

Alphabet unveiled Ironwood, its seventh-generation Tensor Processing Unit (TPU), expected to be available later this year. Ironwood promises 3,600 times better performance compared with Alphabet’s first publicly available TPU and is 29 times more energy efficient.

Google Cloud unveiled its Cloud Wide Area Network (Cloud WAN), giving enterprises access to its private global fiber network. Launching later this month, Cloud WAN delivers more than 40% faster performance while cutting ownership costs by a similar margin.

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Alphabet showcased Willow, its new quantum chip, which overcomes a key challenge in error correction. Willow reduces errors exponentially as more qubits are added, paving the way for scalable quantum computing.

On the AI model front, Alphabet launched Gemini 2.5, its most advanced reasoning model, alongside Gemini 2.5 Flash, a low-latency, cost-efficient version tailored for developers.

Alphabet’s diverse portfolio spanning Google Cloud, Search and YouTube is expected to help the stock ride over the current tumultuous phase. GOOGL’s plan to buy Wiz for a whopping $32 billion in a deal that will enhance Google Cloud’s security offerings. Wiz has a stellar clientele with its cloud security platform currently used by Amazon AMZN, Microsoft and Oracle ORCL.

Alphabet dominates the digital advertising and search business that drives advertising revenues. In fourth-quarter 2024, Google Search revenues increased 13% year over year to $54 billion, led by strength in financial services and retail, while YouTube ads increased 14% year over year to $10.5 billion. Google Cloud revenues surged 30% year over year to $12 billion, driven by core cloud products, AI infrastructure, and generative AI tools like Vertex AI and Gemini. The company is facing stiff competition from Microsoft and Amazon in the cloud domain.

Alphabet Benefits From Expanding Clientele

Alphabet continues to deepen its enterprise partnerships, fuelling growth in AI and cloud. The company recently deployed NVIDIA’s NVDA H200-based platforms to customers and was the first to announce a customer running on the highly anticipated Blackwell platform, reinforcing its strong ties with NVIDIA.

GOOGL also expanded its collaboration with Oracle, announcing an industry-first partner program and the upcoming availability of Oracle Base Database Service on Oracle Database running on Google Cloud. The service now supports Oracle Exadata X11M and offers Oracle Interconnect for U.S. Government Cloud customers. To meet rising customer demand, Oracle and Alphabet plan to expand its availability to 11 new regions over the next 12 months.

GOOGL’s Q1 to Suffer From Unfavourable Forex

Alphabet expects first-quarter 2025 revenues to suffer from unfavourable forex and one less day of revenues compared with the year-ago quarter.

The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $75.63 billion, suggesting a 11.87% increase from the prior-year quarter’s actual.

The consensus mark for first-quarter 2025 earnings is pegged at $2.02 per share, unchanged over the past 30 days. The consensus estimate indicates a year-over-year increase of 6.88%.

Zacks Rank

Alphabet currently carries a Zacks Rank #3 (Hold).

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG at 18.2x while the S&P sits at 24.7x. Might be worth a look.

By: TrendSpider | April 9, 2025

• $GOOG at 18.2x while the S&P sits at 24.7x.

Might be worth a look.

Read Full Story »»»

DiscoverGold

DiscoverGold

Google operates data centers in Hong Kong, $GOOG $GOOGL

Alphabet share price still in mode of Double Bottom Breakdown since 4-Apr-2025. BLTA

$GOOGL - Closed below the 100 week MA. The next natural target is the 200 week MA(137) that is only 5% lower than Friday's close...

By: CyclesFan | April 6, 2025

• $GOOGL - Closed below the 100 week MA. The next natural target is the 200 week MA(137) that is only 5% lower than Friday's close. However, in December 2018 it bottomed right after closing below the 100 week MA, so it remains to be seen if it follows through next week.

Read Full Story »»»

DiscoverGold

DiscoverGold

Double Bottom Breakdown on 4-April-2025. BLTA

$GOOG Large $3 Million OTM Put *Above the Ask*

By: Cheddar Flow | April 3, 2025

• $GOOG Large $3M OTM Put

*Above the Ask*

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG Alphabet flashing hidden bullish divergence into a key horizontal level

By: TrendSpider | April 1, 2025

• Alphabet flashing hidden bullish divergence into a key horizontal level. $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL Monthly secondary retest of prior resistance (support until proven otherwise)

By: Theta Warrior | April 1, 2025

• $GOOGL Monthly secondary retest of prior resistance (support until proven otherwise).

Read Full Story »»»

DiscoverGold

DiscoverGold

In Double Bottom Breakdown mode since 28-Mar-2025.

$GOOGL - Dangerously approaching the September 2024 low at 147...

By: CyclesFan | March 28, 2025

• $GOOGL - Dangerously approaching the September 2024 low at 147. The current area is also the area of the double top from late 2021-early 2022 at 151. If it breaks 147 it could be in a bear market and head significantly lower into 2026. April will be a critical month.

Read Full Story »»»

DiscoverGold

DiscoverGold

The equal-weighted version of the S&P 500 has finally staged a notable turnaround

By:

SentimenTrader | March 25, 2025

• The equal-weighted version of the S&P 500 has finally staged a notable turnaround.

The ratio between the equal-weight versus capitalization-weight versions of the S&P climbed above its long-term average for the first time in over two years.

Except for in 1991, the equal-weight version of the index had trouble holding onto its relative momentum. That was the only time it continued to outperform the cap-weight version over the following three months.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG RSI divergence into channel support? That’s a recipe for a strong reaction

By: TrendSpider | March 25, 2025

• RSI divergence into channel support?

That’s a recipe for a strong reaction. $GOOG.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL has 9 different businesses with over 1 Billion users

By: Cheddar Flow | March 24, 2025

• $GOOGL has 9 different businesses with over 1 Billion users

Google Play Store: 2.5B+ MAUs

Google Workspace: 3B+ users

Google Photos+ 1B+ users

Google Search: 1B+ users

Google Maps: 1B+ MAUs

Android: 2.8B+ MAUs

Chrome: 3.3B+ users

YouTube: 2B+ MAUs

Gmail: 1.8B+ DAUs

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL $2.6 Million Call LEAPS (High Premium)

By: Cheddar Flow | March 24, 2025

• $GOOGL $2.6M Call LEAPS (High Premium)

Both of these orders were bought to open (Vol>OI) with a sizable vol spike today.

Read Full Story »»»

DiscoverGold

DiscoverGold

In Low Pole Reversal mode since 19-Mar-2025. BLTA

$GOOGL - In the last 7 weeks it dropped all the way from the weekly upper BB to the weekly lower BB...

By: CyclesFan | March 23, 2025

• $GOOGL - In the last 7 weeks it dropped all the way from the weekly upper BB to the weekly lower BB. In the last 2 years it made intermediate term lows in February-March, so it probably made one this week. Given its cheap valuation this is likely to be the low for the year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alphabet is facing social media lawsuits claiming YouTube harmed users’ mental health. The lawsuits allege that YouTube deliberately attempts to make its users and content creators become addicted to the platform. Plaintiffs in these lawsuits also claim that YouTube and other social media platforms target minors, with little regard for the emotional well-being of this demographic. If you as a minor or your child have suffered harm following YouTube exposure and addiction, you may be eligible to file a lawsuit. https://www.motleyrice.com/social-media-lawsuits/youtube#:~:text=Case%20Overview&text=The%20lawsuits%20allege%20that%20YouTube,well%2Dbeing%20of%20this%20demographic. $GOOG

$GOOG RSI Divergence loading...

By: TrendSpider | March 21, 2025

• RSI Divergence loading... $GOOG.

Read Full Story »»»

DiscoverGold

DiscoverGold

Google Acquires Wiz

By: TrendSpider | March 20, 2025

Key Takeaways

• Google’s biggest deal: $32B Wiz acquisition surpasses its $12.5B Motorola buy.

• Regulatory-driven offer hike: Google raised its bid by 39%, with a $3.2B breakup fee.

• Cybersecurity push: Wiz’s $700M revenue boosts Google against Microsoft.

Google’s Largest Acquisition: $32 Billion Deal with Wiz

Google (GOOGL) announced its largest acquisition to date, acquiring cloud security startup Wiz for $32 billion in an all-cash deal on Tuesday. The acquisition surpasses Google’s $12.5 billion Motorola Mobility purchase in 2012, reinforcing its cybersecurity position amid rising AI-driven threats.

The deal follows months of negotiations. Google initially offered $23 billion in July 2024, but Wiz considered an IPO. Unfavorable market conditions and shifting U.S. antitrust policies under President Donald Trump’s administration revived discussions. Following Trump’s January 20, 2025, inauguration, the appointment of Andrew Ferguson as FTC Chair and Gail Slater to lead antitrust reviews accelerated talks. Google increased its offer by 39% and raised the breakup fee to $3.2 billion—10% of the deal value, significantly above the 4%-7% industry standard.

Wiz’s Rapid Growth and Market Impact

Founded in 2020, Wiz has rapidly expanded, securing over 50% of Fortune 100 companies as customers. Led by CEO Assaf Rappaport, the company achieved $100 million in annual recurring revenue within 18 months. By May 2024, Wiz reached a $12 billion valuation, maintaining a 70% annual revenue growth rate and generating $700 million in annualized revenue.

Regulatory concerns initially slowed negotiations. The failed $20 billion Adobe-Figma acquisition in 2023, along with Google’s ongoing DOJ lawsuits over search and ad technology dominance, made Wiz’s largest VC backers initially cautious about regulatory risks during acquisition discussions. Former FTC Chair Lina Khan’s aggressive antitrust stance heightened regulatory fears. However, momentum shifted when Fazal Merchant joined Wiz as CFO in January 2025, playing a crucial role in final negotiations with Google Cloud chief Thomas Kurian and other executives.

Expanding Google’s Cybersecurity Investments

The acquisition comes amid a slowdown in venture-backed M&A activity. In 2024, there were 2,066 VC-backed startup exits worth $83.6 billion, but Q1 2025 saw only 382 deals totaling $13.6 billion, according to PitchBook data. The Wall Street Journal first reported on Monday that Google and Wiz were in advanced talks. With this move, Google strengthens its cybersecurity offerings against Microsoft (MSFT), which has been expanding its security portfolio.

Despite the acquisition, Wiz’s products will remain available on Amazon Web Services (AWS), Microsoft Azure, and Oracle Cloud, ensuring a broad customer base. The regulatory strategy remains uncertain. Some firms, like Tempur Sealy, preemptively consult U.S. antitrust regulators before major deals—such as its $4 billion Mattress Firm acquisition in 2023. It is unclear whether Google and Wiz took a similar approach.

With $96 billion in cash reserves, Google’s investment in Wiz signals a long-term commitment to cybersecurity leadership in an evolving digital landscape. Alphabet shares fell ~2% on Tuesday and are now down 15% for the year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Google $GOOGL just confirmed the deal Wiz at $32 Billion is now the largest acquisition in Google’s history

By: Evan | March 18, 2025

• Google $GOOGL just confirmed the deal

Wiz at $32 Billion is now the largest acquisition in Google’s history.

Read Full Story »»»

DiscoverGold

DiscoverGold

BREAKING: The House Judiciary Committee has subpoenaed Google, requesting internal records on alleged collusion with the Biden administration to censor Americans. $GOOG $GOOGL

Alphabet back in talks to buy Israel’s Wiz for over $30 billion, source says

By: Reuters | March 17, 2025

Google-parent Alphabet (NASDAQ:GOOGL) is in advanced negotiations to buy Israeli cybersecurity company Wiz with an offer of more than $30 billion, according to a source familiar with the matter, marking its largest potential acquisition to date.

Alphabet’s latest offer is higher by roughly a third of the $23 billion deal it offered last year, which Wiz called off in July 2024 over concerns it would not clear antitrust hurdles.

Wiz had said in an internal memo at the time that it would focus on an initial public offering. Neither company has publicly acknowledged a deal. They did not immediately reply on Monday to Reuters requests for comment.

The deal hasn’t been signed and could still change, the person familiar with the development said. The Wall Street Journal on Monday first reported the news of the talks between the companies, citing sources.

If the Wiz acquisition goes ahead, it would help Alphabet tap the cybersecurity market and expand its booming cloud infrastructure business, which generated more than $43 billion in revenue last year.

While U.S. President Donald Trump’s administration is widely expected to drop some antitrust policies pursued under the administration of President Joe Biden, a deal that creates a cybersecurity behemoth is still likely to draw scrutiny.

Wall Street had expected a bump in dealmaking after Trump’s election, but the tariffs he has imposed or threatened have roiled global markets and left businesses and investors uncertain about big decisions.

Wiz provides cloud-based cybersecurity solutions powered by artificial intelligence that help companies identify and remove critical risks on cloud platforms.

It works with multiple cloud providers such as Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) and counts companies from Morgan Stanley to DocuSign (NASDAQ:DOCU) among its customers. With 900 employees across the United States, Europe, Asia and Israel, Wiz previously said it planned to add 400 workers globally in 2024.

Interest in the cybersecurity industry has surged since the global CrowdStrike (NASDAQ:CRWD) outage last year, making enterprises more concerned about protecting their digital infrastructures.

Wiz was last valued at $12 billion in a private funding round in May 2024.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG 20x earnings—the same multiple Google hit at the depths of the 2020 sell-off when shares were just $50

By: TrendSpider | March 17, 2025

• 20x earnings—the same multiple Google hit at the depths of the 2020 sell-off when shares were just $50. $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

Alphabet $GOOG is starting to look like a bargain at these levels...

By: TrendSpider | March 14, 2025

• 20x earnings, trading at channel lows...

Alphabet is starting to look like a bargain at these levels. $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

RFK Jr sues ‘state actors’ YouTube and Google for censoring him https://www.independent.co.uk/news/world/americas/us-politics/rfk-jr-sues-google-youtube-b2387644.html $GOOG

Google introduces new AI models for rapidly growing robotics industry

By: Reuters | March 12, 2025

Alphabet (NASDAQ:GOOGL)’s Google launched two new AI models tailored for robotics applications on Wednesday based on its Gemini 2.0 model, as it looks to cater to the rapidly growing robotics industry.

The robotics field has made large strides over the past few years with increasing advancements in AI and improving models, speeding up commercialization of robots largely in industrial settings, according to industry experts.

Google’s launch comes a month after robotics startup Figure AI exited its collaboration agreement with ChatGPT-maker OpenAI after it made an internal breakthrough in AI for robots.

The search engine giant’s Gemini Robotics is an advanced vision-language-action model that will have physical actions as a way to provide output.

The second model, named Gemini Robotics-ER, will enable a robot to have an advanced understanding of the space around it and lets developers run their own programs using reasoning abilities offered by Gemini 2.0.

Google said its models are designed for robots of all form factors including humanoids and other types used in factories and warehouses.

Using robotics-focused AI models developed by the likes of Google and OpenAI can help cash-strapped startups reduce development costs and increase the speed at which they can take their product to market.

Google said it tested the Gemini Robotics model on data from its bi-arm robotics platform, ALOHA 2, but can be specialized for complex use cases such as Apptronik’s Apollo robot.

Apptronik raised $350 million in a funding round last month led by B Capital and Capital Factory, with participation from Google to scale production of AI-powered humanoid robots.

Google had bought robotics pioneer Boston Dynamics in 2013, and sold the company, known for its dog-like and humanoid robots, to SoftBank (TYO:9984) Group Corp about four years later.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG100% Proof of the Firmament! 👀

— vegastar (@vegastarr) July 5, 2024

Explore scientific, photographic, and documentary evidence proving the firmament is real. Discover the truth: Earth is not an infinite plane, concave, or round like a ball, but a non-rotating enclosed circular plane. pic.twitter.com/C4vqdf0gGN

Alphabet (GOOG) Forecast – Major US Stocks Trying to Bounce

By: Christopher Lewis | March 11, 2025

• GOOG Technical Analysis

Google looks like it will open slightly higher than its previous close, with the $165 level acting as a support floor. The 200-day EMA near the $176 level could serve as a reasonable target for a bounce, but it’s unlikely that price action will cut through it easily. Instead, we may see gradual upward pressure as the stock attempts to form a base. A daily close above the 200-day EMA would be a strong bullish signal for Google, likely confirming the continuation of its uptrend.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL TW Pivot buy signal confirmed

By: Theta Warrior | March 5, 2025

• $GOOGL TW Pivot buy signal confirmed.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL - After a big down month it closed the month below the 10 month MA so I expect it to hit the 20 month MA, whether it happens in March or later in Q2...

By: CyclesFan | March 2, 2025

• $GOOGL - After a big down month it closed the month below the 10 month MA so I expect it to hit the 20 month MA, whether it happens in March or later in Q2. The 20 month MA will be around 160 in March.

Read Full Story »»»

DiscoverGold

DiscoverGold

Google dropped over 16% in February—its worst month in nearly three years...

By: TrendSpider | March 1, 2025

• Google dropped over 16% in February—its worst month in nearly three years.

At 22x earnings, it's now the cheapest of the Mag 7...

Bargain or bad omen? $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG pulling back into the weekly discounted range...

By: Peter DiCarlo | February 24, 2025

• $GOOG pulling back into the weekly discounted range.

The weekly Market Bias is normally where we see a bounce to save the trend, but we need confirmation on the daily chart before considering a long position.

Keeping an eye on this over the next few weeks, but no entry for now—patience is key.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG - Millions worth of bullish, short-dated tech prints just flooded the tape

By: Cheddar Flow | February 18, 2025

• Millions worth of bullish, short-dated tech prints just flooded the tape

$INTC, $AAPL, $AMZN, $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

Alphabet share price is in the same breakdown mode since 7-Feb-2025. GLTA

$GOOGL pulling back into the weekly market bias—trading near a discounted range

By: Peter DiCarlo | February 14, 2025

• $GOOGL pulling back into the weekly market bias—trading near a discounted range.

BX Trender on the daily made higher lows yesterday—a sign that short-term buyers are stepping in.

If momentum holds, we could see a push back to $200.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOG Book value is only $25.61 not worth over that

Alphabet $GOOG Total Debt (mrq) $29.29B

$GOOG Can Google continue to hold this area for a S/R flip?

By: TrendSpider | February 10, 2025

• Can Google continue to hold this area for a S/R flip? $GOOG

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL - Closed the week with an outside bearish reversal candle...

By: CyclesFan | February 8, 2025

• $GOOGL - Closed the week with an outside bearish reversal candle. At the last 3 intermediate term lows it bottomed below the 20 week MA. The 20 WMA is at 180 and the 50% retracement of the last uptrend is at 177, so the 1st support range is 177-180. If it doesn't hold, then 170.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alphabet Inc. (GOOGL) Chart to Watch for in February 2025

By: David Keller | February 7, 2025

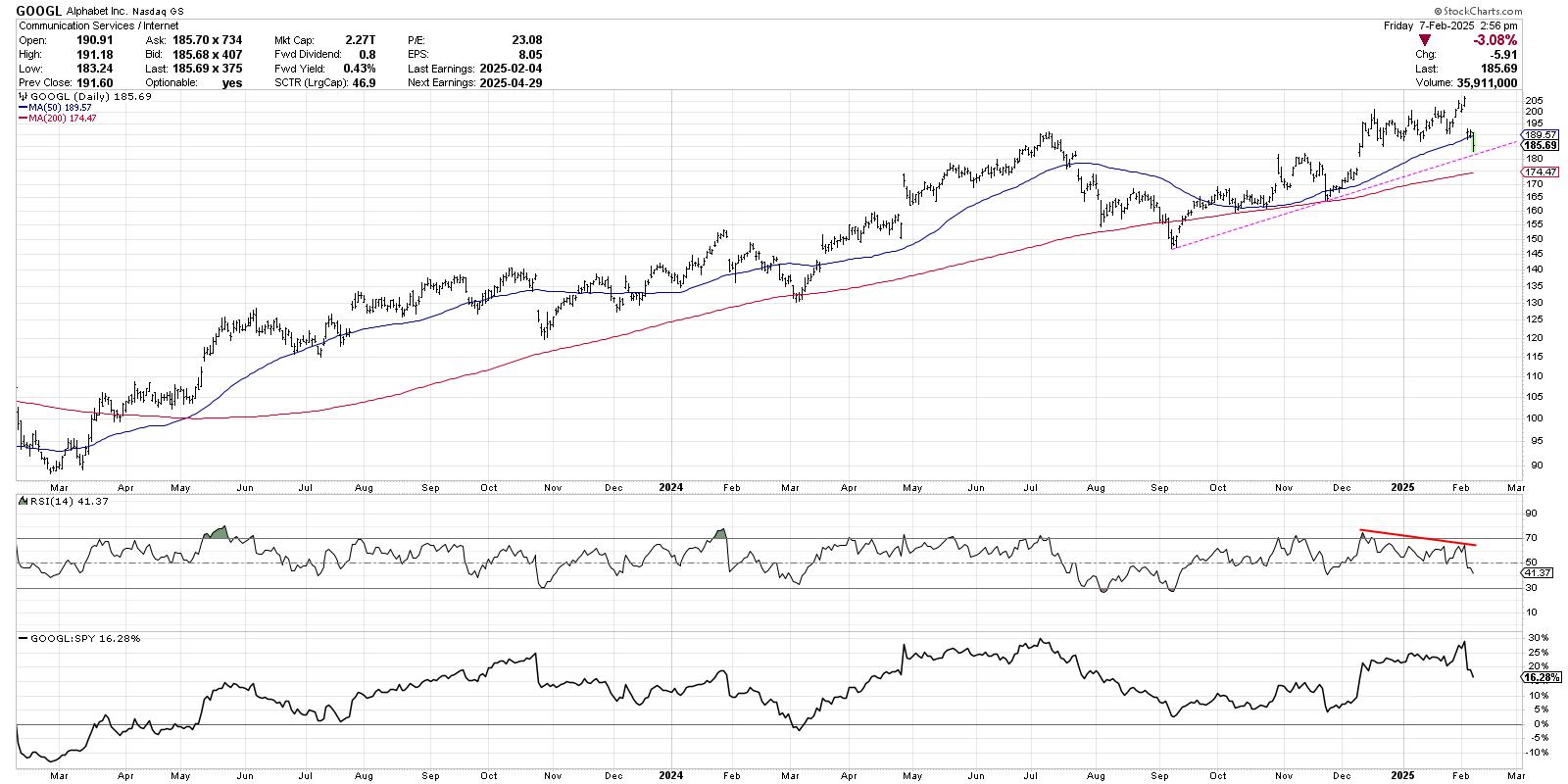

• Our third chart highlights the reality of the Magnificent 7 stocks in early February, with more and more of these previous leadership names beginning to show clear signs of negativity. Earnings season has not been kind to companies like Alphabet, who, despite beating earnings estimates for the quarter, provided a less optimistic forward projection for future earnings growth.

GOOGL gapped lower on Wednesday after making a new all-time high into earnings on Tuesday. After initially finding support at the 50-day moving average, Alphabet broke below the 50-day on Friday's trading session. The gap lower this week also accentuated a bearish momentum divergence, with GOOGL's higher price highs in February marked by a decline in momentum. Higher prices and lower RSI are a common feature of a late stage bull market, when stocks are still moving higher but the momentum behind those gains has begun to wane.

While GOOGL still remains above an upward-sloping 200-day moving average, and still appears to be holding trendline support based on the September and November swing lows, this week's drop on forward guidance certainly has investors wondering where assets could flow if they're no longer supporting mega-cap growth stocks like GOOGL.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GOOGL Short-term, price looks primed for a bounce, potentially testing $207...

By: Peter DiCarlo | February 6, 2025

• $GOOG Post Earnings Update

$GOOGL dropped 10% post-earnings and is now sitting at a liquidity zone around $190.

Short-term, price looks primed for a bounce, potentially testing $207.

However, zooming out to the weekly chart, (image 2) if the BX Trender closes with a lower high, it usually signals a pullback to weekly market bias, which would put our target around $180.

I’m not looking to short this setup—instead, I’ll stay patient and watch for price to return to market bias, where we typically see a bounce.

Read Full Story »»»

DiscoverGold

DiscoverGold

Saying buy me. Sale at discount.

It's an opportunity. A multifaceted high tech giant of an incomparable company.

An amazing money maker. Such times are opportunities to buy or add on, imo.

My average cost now up, at $159.62 Would add below $190 should it go down, anytime.

GLTA

Alphabet (GOOGL) Stock Eyes Worst Day Since 2023 After Earnings

By: Schaeffer's Investment Research | February 5, 2025

• The Big Tech giant reported a fourth-quarter revenue miss

• The company doubled down on its artificial intelligence (AI) investments

Alphabet Inc (NASDAQ:GOOGL) stock is dragging Wall Street after the Big Tech giant reported a fourth-quarter revenue miss as its Google Cloud segment lagged. The company also revealed plans to invest $75 billion in capital expenditures this year to grow its artificial intelligence (AI) offerings, despite Chinese startup DeepSeek claiming it built an AI model at a substantially lower cost.

GOOGL is down 8.3% to trade at $189.36 at last check, pacing for its biggest single-day percentage loss since October 2023 as it pulls back from yesterday's all-time high of $207.05. The equity is testing a floor at the $188 level that has been in place since late December, with added support at its 60-day moving average set to contain additional losses.

No fewer than 11 analysts have cut their price targets, the lowest from Wells Fargo to $184 from $190. Options traders lean overwhelmingly bullish, however, with GOOGL's 50-day call/put ratio of 3.60 back at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) standing higher than 97% of annual readings.

Drilling down to today's options activity, 287,000 calls and 152,000 puts have crossed the tape, which is five times the volume typically seen at this point. The most active contract is the weekly 2/7 195-strike call, where new positions are currently being bought to open.

Read Full Story »»»

DiscoverGold

DiscoverGold

If $190s don't hold then market correction would eventually have it settle at $170

|

Followers

|

245

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

10147

|

|

Created

|

05/02/04

|

Type

|

Free

|

| Moderators DiscoverGold | |||

GOOGLE

GOOGLE GOOGLE

GOOGLE

8-34-200

toned daily pps PPO acuml vol r.s.i.

10 yr. black/daily/200ma 300ma 400ma 500ma 600ma PPS VOLUME

NEW UPDATES COMING /////\\\\\ 08-10-2015

| Volume: | 15,690,785 |

| Day Range: | 157.645 - 162.05 |

| Last Trade Time: | 7:59:58 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |