Seeking Creative & Innovative Investment Ideas...

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Notice how the security continues trading in "cycles" making higher highs and higher lows, respectfully. The volume tends to be there on key breaks and thus far the market has shown great strength imho.

GSL ~ ($1.58) matching friday's trading session in volume after less than two hours of action...

Germany upbeat on prospects for Opel talks this week.

Mon Aug 3, 2009 7:57am EDT

BERLIN (Reuters) - The German government has seen encouraging signals in recent days in negotiations to take over Opel and has "positive expectations" for talks this week, a government spokesman said on Monday.

Canada's Magna and RHJ International, a Belgium-based financial investor, are locked in a takeover battle for Opel, in which General Motors is relinquishing control in return for state support for the local carmaker.

GM, which holds 35 percent of Opel shares, and Germany, which will provide state aid, must agree on the buyer but so far the two have disagreed. Germany prefers the Magna offer and GM likes RHJ's bid.

"There have been encouraging signals," government spokesman Klaus Vater said of recent negotiations with the two suitors.

"As a result, the government has positive expectations with regard to the talks that are taking place this week," he added at a regular news conference.

Government sources said earlier that government officials and GM representatives will meet Magna and RHJ on Tuesday to work on forging a deal.

An Economy Ministry spokesman confirmed talks were planned for this week but gave no further details.

The "encouraging signals" Vater mentioned relate to contact between the German government and GM, government sources said.

Chancellor Angela Merkel's economics adviser, Jens Weidmann, held talks on Opel in the United States last week that were regarded in the government as constructive, the sources added.

GM's new board meets later on Monday and industry sources have said Opel will likely be discussed.

German Economy Minister Karl-Theodor zu Guttenberg said in a weekend newspaper interview the two suitors must improve their bids to win government backing.

Magna, a Canadian auto parts supplier, wants to expand Opel's full-scale car assembly business and forecasts high growth rates, particularly in Russia, home of its bidding partner, state-controlled bank Sberbank.

RHJ aims to shrink production to return Opel to profit and may be open to selling it back to GM at a later date.

In a blog entry posted on GM Europe's website last Tuesday, chief negotiator John Smith said he still expected a deal to close by the end of September.

The German states that are home to Opel plants and the federal government have expressed a preference for Magna's bid.

(Reporting by Gernot Heller, writing by Paul Carrel; Editing by David Cowell)

IDOI ~ $0.0078 x $0.0079, strength shown with breakout volume early on.

The only true resistances left are intraday highs themselves, that is, with the exception of our key resistance level, $0.01.

AP analysis: Foreclosures stabilize in key states.

Foreclosure rates stabilize in 3 hard-hit states, even while joblessness holds back economy

By Mike Schneider and Christopher S. Rugaber, Associated Press Writers

On Monday August 3, 2009, 9:08 am EDT

Even as Americans suffer rising unemployment, foreclosure rates in three states hit hardest by the housing bust -- California, Arizona and Florida -- stabilized in June, offering hope that the worst of the real estate crisis is over, according to The Associated Press' monthly analysis of economic stress in more than 3,100 U.S. counties.

The latest results of AP's Economic Stress Index show foreclosure and bankruptcy rates held steady from May in some states. Yet mounting unemployment is hampering an economic recovery in some regions, especially the Southeast and industrial Midwest.

The AP calculates a score from 1 to 100 based on each county's unemployment, foreclosure and bankruptcy rates. The higher the score, the higher the economic stress. The average county's Stress score rose to 10.6 in June, up from 10 in May, mainly because of rising unemployment.

In June 2008, the average county's Stress score was 6.7. The pain was lower then because the economy was still expanding. In fact, the second quarter of 2008 was the last time the economy grew.

Under a rough rule of thumb, a county is considered stressed when its score zooms past 11. In June, 41 percent of the counties scored 11 or higher, up from 36 percent in May and 34 percent in April. The latest reading was slightly worse than for February and March, when nearly 40 percent of counties met or exceeded that threshold.

The national economy, meanwhile, shrank at a pace of just 1 percent in the second quarter of the year, according to figures released Friday. It was a better-than-expected showing that provided the strongest signal yet that the recession is finally winding down.

In June, foreclosure rates held steady for Arizona, California and Florida at 4.1 percent, 3.5 percent and 3.4 percent, respectively.

"It's obviously good news to stop the losses," said Jim Diffley, a regional economist at consulting firm IHS Global Insight.

He cautioned, though, that even as foreclosures level out in some states, they're doing so "at very high levels."

Other figures from the past two weeks suggest that the housing market is recovering in many areas.

Nationally, seasonally adjusted home resales in June were up 9 percent from January. New-home sales surged 17 percent in the same period. Construction is up nearly 20 percent since the year began. And prices rose in May for the first time since June 2006.

The housing bust struck first in states such as California, Arizona and Florida, which had seen outsized price increases during the real estate boom.

Now, California's real estate market, for one, is improving by most measures. Sales increased 20.1 percent in June, and prices rose for the third straight month, according to the California Realtors' Association.

"It looks like we're past the peak in foreclosures," said Steve Goddard, president-elect of the realtors' association. "Most bank-owned properties are receiving multiple offers."

Still, foreclosure rates are rising in other states, such as Nevada, Georgia and Utah. Nationwide, Diffley and many other economists say rising unemployment may push foreclosures higher into next year.

Meanwhile, the sharpest year-to-year rise in bankruptcy rates in June occurred in counties in California and Nevada that have been the epicenter of the housing bust, along with areas of Georgia and Tennessee that tend to have high bankruptcy rates.

Among states, Nevada, Michigan and California showed the most economic distress, with Stress scores of 20.41, 18.34 and 15.78, respectively.

In June, Nevada had the nation's highest foreclosure rate (7.3 percent) and the fifth-highest unemployment rate (12 percent). Its counties have absorbed some of the sharpest growth in bankruptcy filings this year.

Michigan had the nation's highest unemployment rate in June (15.2 percent) and the sixth-highest foreclosure rate (2 percent). California also had among the nation's highest unemployment rates (11.6 percent) and foreclosure rates (3.5 percent).

North Dakota, South Dakota and Nebraska showed the least economic distress in June with Stress scores of 5.23, 5.43 and 6.14, respectively.

The states with the biggest year-to-year change for the worse were Nevada, Oregon and Michigan.

For a third straight month, Imperial County, Calif., topped the list of stressed counties of more than 25,000 residents, with a Stress score of 31. Imperial is among the most impoverished U.S. counties.

It was followed by Merced County, Calif. (25.73), Yuma County, Ariz. (24.56), Yuba County, Calif. (23.76) and Lauderdale County, Tenn. (23.46).

"We've had a couple of factory closings which have impacted a lot of our workers -- mainly automotive supply parts and printing," said Leslie Sigman, president of the Bank of Ripley, in western Tennessee's Lauderdale County.

Riley County, Kan., home to the Army's Fort Riley and Kansas State University, had the nation's lowest Stress score in June (4.04) in counties with more than 25,000 residents.

It was followed by Brown County, S.D. (4.07), Brookings County, S.D. (4.12), Ward County, N.D. (4.22) and Burleigh County, N.D. (4.27), home of the state's capital, Bismarck.

These counties are part of an economic "safe zone" stretching from the Plains to Texas that has been largely shielded from the recession because of high energy and crop prices.

Counties with the biggest year-to-year change for the worse were: Howard County, Ind., Williams County, Ohio, Union County, S.C., Chester County, S.C., and Noble County, Ind. At least a third of the jobs in those counties involve manufacturing.

Oil jumps above $70 on optimism demand to recover.

Oil jumps above $70 on investor optimism that manufacturing recovery will fuel demand

By Pan Pylas, AP Business Writer

On Monday August 3, 2009, 9:10 am EDT

LONDON (AP) -- Oil prices leapt above $71 a barrel Monday on mounting investor hopes that a recovering global economy will boost crude demand.

Benchmark crude for September delivery was up $1.86 to $71.31 a barrel by late morning London time in electronic trading on the New York Mercantile Exchange. On Friday, the contract rose $2.51 to settle at $69.45.

Oil prices seesawed last week before surging Thursday and Friday as investors bet that crude demand, which has been tepid this summer, will eventually pick up as the economy improves.

That optimism was fueled by strong manufacturing surveys around the world, which provided a clear hint that the worst of the global recession was over and that growth could be just round the corner. A survey into the U.S. manufacturing sector later is also expected to show that the pace of the contraction has continued to moderate.

If manufacturing recovers around the world, then demand for oil will increase.

Mohammad Ali Khatibi, Iran's governor to the Organization of Petroleum Exporting Countries, said Sunday he expects crude prices to reach $80 a barrel by January, the oil ministry said.

In other Nymex trading, gasoline for August delivery rose 2.93 cents to $2.04 a gallon and heating oil gained 3.23 cents to $1.86. Natural gas for August delivery rose 0.6 cents to $3.71 per 1,000 cubic feet.

In London, Brent prices rose $1.76 to $73.26 a barrel on the ICE Futures exchange.

Manufacturing, banking reports lift stocks.

Stocks push higher as August trading begins amid signs of healing in manufacturing, banking

By Sara Lepro, AP Business Writer

On Monday August 3, 2009, 9:48 am EDT

NEW YORK (AP) -- Fresh signs of healing in the manufacturing and banking industries are giving investors reason to extend a powerful July rally into a second month.

Stocks are rising in early trading Monday as gains in overseas markets fed the recent momentum on Wall Street that gave the market its best July in 20 years. World markets mostly rose as surveys in China and Europe showed manufacturing activity is improving. Investors are hoping that figures on the manufacturing industry in the U.S. released later Monday will reveal a similar trend.

Positive reports from European banks added to the day's upbeat news.

Barclays PLC said its first-half net profit increased 10 percent on stronger earnings from its investment banking division. HSBC Holdings PLC reported a 57 percent decline in its first-half profit, but results were better than anticipated. Still, losses from bad loans rose at both banks as consumers in the U.S. and Britain had trouble repaying debt.

In other signs of investors' growing confidence, safe-haven assets like Treasurys and the U.S. dollar fell, while oil and other commodities prices rose.

The major indicators begin the first trading day of August at their highest levels since the fall. The benchmark Standard & Poor's 500 index is just 7 points shy of the 1,000 level, a point it hasn't closed above since early November.

In the first half hour of trading, the Dow Jones industrial average rose 43.84, or 0.5 percent, to 9,215.45. The Standard & Poor's 500 index rose 6.41, or 0.7 percent, to 993.89, while the Nasdaq composite index rose 13.33, or 0.7 percent, to 1,614.74.

Stocks surged last month, reigniting a spring rally that had fizzled in June amid growing doubts that the economy was on solid footing. Stocks regained momentum as an increasing number of economic and corporate earnings reports suggested investors' bets had been well-founded.

The reports have shown that companies aren't losing money at the rapid pace they were last fall and earlier this year. Though there are concerns that the aggressive cost-cutting measures businesses have undertaken to boost profits are not sustainable, several upbeat outlooks from companies like Intel Corp. and Caterpillar Inc. suggest business conditions are indeed improving.

"At this point through earnings season, patterns have been firmly established," said Lawrence Creatura, portfolio manager at Federated Clover Investment Advisors. "It would take a lot to derail the emerging optimism."

Good Morning to all.

GSL ~ $1.56 x $1.59, showing strength early on in the trading session.

IDOI ~ $0.0073 x $0.0074, very liquid to start Monday's trading session.

NXG ~ new 52-week high ($2.50). The ideal would be a close above $2.47 (previous 52-week high)...

GSL ~ seeking a strong open to Monday's trading session.

IDOI ~ setting up for some gapping action this morning, currently reading $0.0074 x $0.0075.

NXG ~ trading at new 52-week highs premarket...

Excellent, thank you for inquiring.

mrmorsberger, how have you been?

Thanks LP.

Watchlist 08.03.09

GSL, NXG, LEE, USU, IDOI, DSCO, BQI, AHR, ABK.

Emphasized investment opportunity: WLSA ($0.09). Review your notes and research on Wireless Age Communications, Inc.

GSL ~ video chart 07.31.09

Global Shipping Lease, Inc. (GSL) was looking for a reversal signal going into friday's trading session -- and it got just that! Finished up 17.65% on more than twice (2X) it's 10 day average volume. Accordingly, technicals are rounding off a bottom as it closed at it's high on the day ($1.40), another bullish sign.

Link to video chart: http://timelesswealth.net/gsl.html

GSL ~ video chart 07.31.09

Global Shipping Lease, Inc. (GSL) was looking for a reversal signal going into friday's trading session -- and it got just that! Finished up 17.65% on more than twice (2X) it's 10 day average volume. Accordingly, technicals are rounding off a bottom as it closed at it's high on the day ($1.40), another bullish sign.

Link to video chart: http://timelesswealth.net/gsl.html

IDOI ~ video chart 07.31.09

IDO Security Inc. (IDOI.OB) closed strong at it's intraday high ($0.0063) on above average volume. Some key resistance was brought down during the past two trading sessions, including $0.005 & $0.0057, respectfully, which was resistance dating back to early 2009. Ultimately, these levels become support, and key resistance is found at $0.01.

Link to video chart: http://timelesswealth.net/idoi.html

IDOI ~ video chart 07.31.09

IDO Security Inc. (IDOI.OB) closed strong at it's intraday high ($0.0063) on above average volume. Some key resistance was brought down during the past two trading sessions, including $0.005 & $0.0057, respectfully, which was resistance dating back to early 2009. Ultimately, these levels become support, and key resistance is found at $0.01.

Link to video chart: http://timelesswealth.net/idoi.html

Watchlist 08.03.09

GSL, NXG, LEE, USU, IDOI, DSCO, BQI, AHR, ABK.

Emphasized investment opportunity: WLSA ($0.09). Review your notes and research on Wireless Age Communications, Inc.

Thank you for the scan Obi_Trend_Kenobi, much appreciated.

Great work mmmprofit, and excellent timing.

Expect Smooth Sailing for DryShips.

by: The Aft Deck July 31, 2009

As regular readers would know, DryShips (DRYS) has been one of my favorites for some time, as both myself and Paul have published a number of research articles on this one including a report on how DRYS was trading well behind the Baltic Index. DRYS and GE marked our financial services divisions' first "house trades" over the last few months and Buzz Inc has good sized positions in both.

DryShips Inc reported better than expected quarterly earnings, helped by the recent rise in spot charter rates that the Baltic Index indicated 2 months ago. DryShips also seen an increased contribution from its offshore drilling segment.

Charter rates for drybulk ships which carry commodities such as iron ore, coal, and grains have been improving over the last few months. Day rates for capesize ships averaged about $40,000 a day for the second quarter, double the first-quarter average of about $20,000. "The last several months the dry bulk freight markets have recovered to healthy levels led by strong growth in China," Chief Executive George Economou said in a statement. "We are also beginning to see signs of improvement from other regions, with steel mills in Europe, Japan and elsewhere restarting idle capacity," he added.

DryShips claims it now has about 87 percent of its shipdays in 2009 and 2010 fixed, which would by my estimates deliver bumper earnings in the next few quarters.

In the second quarter of 2009, the company reported a net profit of $52.8 million, 24 cents a share, compared with $299.8 million, $6.95 a share, last year.

Excluding items, the drybulk shippers' earnings for the latest quarter was 25 cents a share. Analysts, on average, had expected earnings of 23 cents a share.

Total revenue fell 30 percent to $210.5 million, caused by the crash in charter rates from last year. Analysts had forecast revenue of $202.9 million.

Disclosure: Long DRYS

Source: http://seekingalpha.com/article/152895-expect-smooth-sailing-for-dryships?

Expect Smooth Sailing for DryShips.

by: The Aft Deck July 31, 2009

As regular readers would know, DryShips (DRYS) has been one of my favorites for some time, as both myself and Paul have published a number of research articles on this one including a report on how DRYS was trading well behind the Baltic Index. DRYS and GE marked our financial services divisions' first "house trades" over the last few months and Buzz Inc has good sized positions in both.

DryShips Inc reported better than expected quarterly earnings, helped by the recent rise in spot charter rates that the Baltic Index indicated 2 months ago. DryShips also seen an increased contribution from its offshore drilling segment.

Charter rates for drybulk ships which carry commodities such as iron ore, coal, and grains have been improving over the last few months. Day rates for capesize ships averaged about $40,000 a day for the second quarter, double the first-quarter average of about $20,000. "The last several months the dry bulk freight markets have recovered to healthy levels led by strong growth in China," Chief Executive George Economou said in a statement. "We are also beginning to see signs of improvement from other regions, with steel mills in Europe, Japan and elsewhere restarting idle capacity," he added.

DryShips claims it now has about 87 percent of its shipdays in 2009 and 2010 fixed, which would by my estimates deliver bumper earnings in the next few quarters.

In the second quarter of 2009, the company reported a net profit of $52.8 million, 24 cents a share, compared with $299.8 million, $6.95 a share, last year.

Excluding items, the drybulk shippers' earnings for the latest quarter was 25 cents a share. Analysts, on average, had expected earnings of 23 cents a share.

Total revenue fell 30 percent to $210.5 million, caused by the crash in charter rates from last year. Analysts had forecast revenue of $202.9 million.

Disclosure: Long DRYS

Source: http://seekingalpha.com/article/152895-expect-smooth-sailing-for-dryships?

Will Gold's Mini Rally Hold?

by: GoldCore July 31, 2009

Gold

After falling by nearly $30/oz on Tuesday, to $926/oz, gold experienced a mini rally Wednesday, moving back to $938/oz in early trading. Whether this is a temporary bounce after a significant sell off remains to be seen. Better than expected US jobless figures, a rally in equity markets and strong demand for the 7 year US Treasury Bill issue Wednesday, may detract from gold and a further correction may be imminent. If the metal does not hold above $945/oz then a move to the downside of $905/oz would be more likely. However, this would present an excellent buying opportunity as the longer term view of gold is extremely bullish with $1,033/oz an achievable target in the coming months.

Silver

Whilst silver tends to hang on to the coattails of any short term move in the gold market, technically it is underperforming gold at the moment. If silver does not maintain a hold above $14.20/oz this would post a bearish signal and a move downwards. Possibly mid $12s/oz could be the next stop. However, some analysts believe that the fact that large shorts are not shorting silver as much as gold as seen in the commitment of traders report, could lead to silver decoupling from gold and significantly outperforming gold on the upside in the coming months.

Platinum group metals

Platinum regained some ground Wednesday, moving from $1,169/oz to $1,185/oz boosted by strong buying interest on the Shanghai Gold Exchange. $1,200/oz is still a strong resistance level. Palladium is $256/oz and rhodium is $1,575/$1,675/oz.

Disclosure: No positions

FDA Calendar Updates: Achillion Pharma, Roche, Genzyme, Protalix, Shire.

by: Mike Havrilla July 31, 2009

Below is a summary of updates to the BioMedReports.com FDA Calendar, which includes a database of 293 entries as of 7/31/09. The calendar was originally created by Mike Havrilla to track companies with pending new drug, biological agent, or medical device new product decisions at the FDA. With the launch of BioMedReports.com, the FDA Calendar has expanded to include the following categories: pending new submissions to the FDA (e.g. NDA, BLA, 510k, PMA, sNDA, sBLA filings), pending complete response letter (CRL) re-submissions to the FDA, and pending late-stage clinical trial results.

On 7/30/09, Achillion Pharma (ACHN) stated that it expects shortly to conclude the Company's opt-in discussions with Gilead (GILD) regarding its ability to advance ACH-1095 into the clinic on its own, and assuming the positive outcome of those discussions, ACHN is actively preparing for a pre-IND consultation with the FDA regarding ACH-1095 (a NS4A antagonist for the treatment of hepatitis C virus or HCV). ACHN plans to report the results of its consultation with GILD in the coming months.

On 7/30/09, ACHN announced that late in 2Q09 the Company initiated Phase 1 studies with its hepatitis C virus (HCV) protease inhibitor (ACH-1625) and continues to receive data regarding the drug's safety and tolerability profile that is expected to be announced late this summer. As ACHN continues this study in patients with HCV, the Company expects to have efficacy data during the winter.

On 7/31/09, Roche (RHHBY.PK) announced that the FDA accepted the Company's resubmission for approval of rheumatoid arthritis treatment Actemra (tocilizumab) with a Class II (six-month) review designation for an expected FDA decision in early 2010. In December 2008, the FDA requested additional non-clinical data on Actemra, including a proposed risk evaluation and mitigation strategy (REMS) and non-clinical studies evaluating the effect of Actemra on peri- and post-natal development and fertility. In July 2008, the FDA Arthritis Advisory Committee recommended approval of the drug by a 10-1 vote.

On 7/31/09, Genzyme (GENZ) announced that the FDA will re-inspect the company's Allston Landing manufacturing facility. The re-inspection is a follow-up to an inspection the agency conducted in May 2009 and is intended to verify that all corrective and preventative actions identified in a February warning letter have been implemented. In its letter to GENZ yesterday, the agency indicated that all promised actions had not been either fully or adequately implemented at the time of the May inspection. GENZ will work with the FDA to schedule the re-inspection as soon as possible. The sanitization of the facility is complete and production of Fabrazyme (agalsidase beta) and Cerezyme (imiglucerase for injection) has resumed.

On 7/6/09, Protalix BioTherapeutics (PLX) announced that it was approached by the FDA and asked to consider submitting a treatment protocol for the use of prGCD in patients with Gaucher disease in order to address an expected shortage of the drug Cerezyme, a mammalian cell expressed version of glucocerebrosidase (GCD) and the only enzyme replacement therapy currently approved for Gaucher disease. Gaucher disease is a rare and serious lysosomal storage disorder in humans with severe and debilitating symptoms. prGCD, the Company's lead product candidate, is a proprietary plant-cell expressed recombinant form of glucocerebrosidase and is currently the subject of a Phase 3 clinical trial for the treatment of Gaucher disease.

The FDA indicated to the Company that it believes the Company's development program for prGCD satisfies the regulatory criteria required to supply prGCD for expanded access to patients under a treatment protocol. PLX expects to submit a treatment protocol to the FDA for its review as a supplement to its current Investigational New Drug (IND) application for prGCD. PLX expects to report results of the Phase 3 trial during 2H09 and expects to submit a NDA for prGCD to the FDA and other global regulatory agencies during 4Q09.

On 7/6/09, Shire (SHPGY) announced that, at the request of the FDA, in view of a potential restriction on the availability of the current approved and marketed treatment for Gaucher Disease patients, it has filed a treatment protocol for velaglucerase alfa, its enzyme replacement therapy in development for the treatment of Gaucher Disease. If approved by the FDA, the treatment protocol would allow physicians to treat Gaucher Disease patients with velaglucerase alfa ahead of commercial availability in the U.S. Under the conditions of the treatment protocol, Shire would provide velaglucerase alfa free of charge initially, in order to provide access to patients as quickly as possible. Velaglucerase alfa is made with Shire's proprietary technology, in a human cell line. The enzyme produced has the exact human amino acid sequence and carries a human glycosylation pattern. Shire is working with the FDA to file a NDA for velaglucerase alfa as soon as possible.

Disclosure: No positions

Real Estate: Not Out of the Woods Yet.

by: Andrew Horowitz July 28, 2009

President Obama spoke this morning about the relationship of the U.S. and China. Perhaps it was a simple olive branch as we have strained relationships of late. But, China has been flapping their mighty economic wings as they have shown an amazing amount of effort and success with their recent stimulus package.

A question that needs to be asked is whether President Obama is looking to hop on the China gravy train. It sure seems so as the speech was both an inferred apology to and request of China. If so, we much wonder if the speech was more of pleading for help as both economies are so tightly integrated. We won’t go so far as to say that the U.S. is groveling for a handout (or should we?), but it appears that we are in need of China to help stimulate exports as well as their continued commitment to buying U.S. debt and their support of the dollar.

The latter is probably the greatest fear for the Treasury as we desperately need other countries to help pay for our record level of spending/backstopping.

Treasury Secretary Geithner was also in on the action today as he assured China that the U.S. is “serious” about shrinking the budget deficit. Is it any coincidence that today was one of the largest sales of government paper that we have ever seen?

The Treasury auctions today were said to be well subscribed. At least that was the headline used to make us feel warm and fuzzy about the auction. But here is a little tidbit about the demand that may cast a different light in the subject (Bloomberg):

The U.S. Treasury has raised $1,020.043 billion in new cash this year selling Treasury securities. The Federal Reserve has purchased $219.721 billion in Treasury securities, or 21.5 percent of the new cash raised in 2009 by the Treasury.

Hmmmm. That is interesting, No?

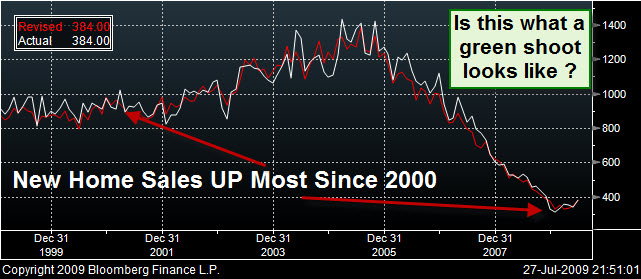

But, the housing data was the topic of the day in terms of economics. There was a high level of optimism that we would see a good number today and by golly, that is what we had. Initially, markets snapped higher on the news after trading lower earlier. On cue, the DJIA, S&P 500, Oil and the NASDAQ broke toward positive returns for the day almost immediately. Then, after the initial 10 minutes of joy wore off of the reactionary investor, we watched the news driven rally fade back below the pre-news levels.

What were the numbers and why the .66% move up and then down for the equity markets? Well, as we know, these days it is buy/sell first and ask questions later.

The numbers: 384k new homes sold in June vs. 346k in May. That amounts to an 11% increase in new homes sales as opposed to a 2.4% increase in May. This is all good even as much of this is due to the low mortgage rates and the first time buyer credit as well a a season that usually brings in buyers.

To take the other side of the discussion for a moment, even with the higher sales, median prices for new homes were down and that this is concerning the markets. Perhaps investors are wondering how sales at rock bottom prices today will affect overall stabilization of home prices into the future. (We will see more detail for this tomorrow as the Case-Shiller housing report will be released at 8:00am.)

As most have come to realize, the diminishing prices continue to push up foreclosures and reduce wealth. Without a rise in housing prices, more people will be pushed to the brink of bankruptcy as their balance sheets continue to tilt toward higher debt. (Of course, I would like to point out that CNBC reported these numbers incorrectly by showing prices on a year over year basis as up 12%, when they were actually down 12%. Cheerleading at its best/worst?)

Higher debt is not in the best interest of the consumer who relies on credit to fund their lives. No, that is not a financial plan that we approve of or suggest since it is precisely what has created the credit mess for which we are now attempting to unwind. Somehow, someone, anyone needs to spend a few minutes re-training the U.S. consumer/saver to understand that the future cannot, and will not be a free ride paid for by the government.

We say this not to stir the pot or to look down on socialized payment systems but to point out the fact that we are on a slippery slope if most believe that their future is secure without personal savings. To their credit though, we are seeing a significant increase in the U.S. savings rate over the past year. This is a good trend that will hopefully continue, as this will be the best path toward personal balance sheet recovery.

Only once the balance sheets are reconstructed through a painful de-leveraging process will we have the resurgent of the consumer. That is not nearly the case yet. No, while we see many retail stocks continuing to move higher, especially electronics and technology based operations; most are doing so by cutting expenses and whittling down inventory in order to benefit the bottom line.

Some would argue that this is a process that can continue for some time as the benefit of technology assisted sales and supply chain management is the next frontier to stabilize net profits. If you recall, we have talked about this in several TDIMG posts and TDI Podcasts of late.

The main takeaway from the above commentary regarding the balance sheets and the price of homes is that we are still not out of the woods with regard to real estate. 8.5 months of inventory is better than it was, but again it is not a good number. Add to that the commercial real estate loans that will be coming due within the next 12 months and we need to realize that the financial system will continue to be under duress for some time.

The one “bright light” in all of this is the fact that every aspect of the financial markets has a partner ready and willing to backstop losses. Remember, the partner is not so silent as they have the ultimate power to create a positive PR campaign. Spreading money to almost every corner of the U.S. business market, our government has become the lender of first and last report.

One item that needs to be addressed again today is the tightening correlation of the global markets. Once again, we saw Asia and Europe up prior to the opening of the U.S markets. German consumer confidence was also up. We also saw a few bank earnings helped to boost European markets. Then, even as European markets were showing gains of 0.6% to 1.4%, losses were quick to follow once the U.S. markets opened.

This is really not a good trend as global herd investing can drive markets higher and just as easily lower. The recent 2-weeks of gains will be under pressure if sentiment changes, even in the face of earnings beats. The herd will either win or lose together. Just as it is in the wild, if the stampeding herd is coming, stand aside so not to get knocked over. Once the herd rests though, look to join in….

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.

Wall Street looks to earnings, jobs to keep rally.

Investors cautiously optimistic this week with steady market rise behind them

By Ieva M. Augstums, AP Business Writer

On Sunday August 2, 2009, 3:16 pm EDT

CHARLOTTE, N.C. (AP) -- After soaring on upbeat corporate earnings and forecasts, Wall Street might be able to stay positive even as there are signs that the economy is still struggling.

Investors enter the week after an extraordinary rally that gave the Dow Jones industrials their best month since October 2002 and their best July in 20 years. All the major indexes gained nearly 1 percent last week and touched their highest levels since last fall.

Dozens of major companies issued better-than-expected second-quarter earnings reports or promising outlooks for the rest of the year. But some traders remain cautious, as shown Tuesday when they received a weaker-than-expected consumer confidence reading and Friday, when they reacted coolly to word from the Commerce Department that that the economy shrank at a slower pace than expected in the April-June quarter.

"We are starting to see a bullish sentiment creep into the market, as we have had a strong run recently," said Michael Sheldon, chief market strategist at RDM Financial Group in Westport, Conn. "A majority of positive earnings news is behind us, so it wouldn't be surprising at all, in fact it might be healthy for the market, to see a brief pullback to refresh and bring new investors back into the market."

July's corporate reports, and the market's own moves, may have given stocks a foundation that will help Wall Street weather bad news. This week, amid the continuing stream of earnings, the market will get reports on employment and how the manufacturing and service sectors fared during July.

"It doesn't matter what they announce nor does it matter about the outcome of the announcement, investors should expect the week to be positive," said David Hefty, CEO of Cornerstone Wealth Management in Auburn, Ind. He said the momentum spurred early last month is enough to keep markets moving for the next few weeks.

The Institute for Supply Management will be issuing its assessment of the health of the manufacturing and service sectors. The ISM manufacturing index, due out Monday, is forecast to have improved to 46.2 in July from 44.8 in June, while the service index, to be issued Wednesday, is expected to have risen to 48.2 from 47. In both reports, a reading below 50 indicates the sectors are still shrinking.

As with earnings reports, the market will want to know what the indexes reveal about the future. If companies report an increase in new orders -- which would mean business is picking up -- stocks could benefit.

On Friday, the Labor Department is expected to report that the unemployment rate rose in July to 9.7 percent, eclipsing June's 26-year high of 9.5 percent. But the market may be able to take an increase in stride because the Federal Reserve has already warned that joblessness is likely to surpass 10 percent this year and stay well above healthy levels for years.

There is keen interest in what the department has to say about the number of jobs lost last month. Economists expect job losses to have slowed, with about 340,000 jobs cut in July. That would be an improvement from June's 467,000 and less than half the 741,000 slashed in January.

Some of the week's earnings reports will give clues about how the housing industry is faring. Homebuilders Centex Corp., Pulte Holmes Inc., D.R. Horton Inc. and Beazer Homes USA are due to report second-quarter results.

The Commerce Department's report on June construction spending and numbers from the National Association of Realtors on pending home sales will provide more insight into housing, which has been showing some signs of recovery recently.

"What we have seen over the last five months has been a steady improvement, stabilization," said Phil Orlando, chief equity market strategist at Federated Investors. "If we can keep that going, we are on our way."

The week's other earnings reports include a key reading on the high-tech industry from Cisco Systems Inc. And companies including Procter & Gamble Co. and Kraft Foods Inc. may provide some insights into how consumers are likely to be spending. The market's concerns about Americans and their willingness to spend grew last week after the Conference Board reported its monthly index of consumer confidence fell in July.

Ford to post 1st monthly sales increase in 2 years.

'Cash for clunkers' program boosts Ford to first year-over-year sales increase since 2007

By Dave Carpenter, AP Personal Finance Writer

On Sunday August 2, 2009, 5:48 pm EDT

CHICAGO (AP) -- Surging demand from the government's "cash for clunkers" program has helped lift Ford Motor Co. to its first monthly increase in two years, the company's top sales analyst said Sunday.

July sales results mark the first year-over-year gain for Ford since November 2007 and apparently the first uptick by any of the six biggest carmakers since last August, George Pipas said.

He declined to disclose a specific total before sales results are officially reported on Monday. Dearborn, Michigan-based Ford sold a total of 161,071 vehicles in July 2008, down 15 percent from a year earlier.

The increase further testifies to the successful reception of the government rebate program, which President Barack Obama signed into law June 24 as part of a broad $106 billion spending bill.

"We were having a good month -- and Ford's been having some good months lately -- but the (clunkers) program really put us over the top for sure," Pipas said in a telephone interview.

The government's Car Allowance Rebate System (CARS) was designed to get old, polluting vehicles off the road and scrapped while helping car dealers emerge from the recession. Owners of gas-guzzlers could receive rebates of $3,500 or $4,500 toward the purchase of a new fuel-efficient car. The program proved wildly popular and led to the sale of 250,000 new vehicles in just days.

Transportation Secretary Ray LaHood said Sunday he expects the current $1 billion pool, which had been expected to last until November, to be exhausted by the end of this weekend. The House on Friday approved an additional $2 billion, shifting funds from a renewable energy loan program, and the Obama administration is pressing the Senate to go along before its summer vacation begins at week's end. If the Senate does not approve the additional funding, the progam will have to be suspended.

Improved sales at Ford and elsewhere may be another sign that the economy has either bottomed out or is nearing a bottom. The government reported Friday that the economy shrank at a pace of just 1 percent in the second quarter, better than analysts anticipated and much better than the 6.4 percent decline seen in the first three months of the year, which marked the steepest slide in nearly 30 years.

Pipas said the July sales increase is "some indication that consumers are getting their feet on the ground again. ... I think it indicates that maybe the worst is behind us, sales-wise."

The July sales also make it the ninth month in the last 10 that Ford has posted a gain in market share, he said.

Pipas said that is evidence of the success of the company's new products -- the Fusion and the Fusion hybrid, the Escape, the redesigned Focus, the Mercury Mariner and the Mercury Milan -- all of them among its most fuel-efficient vehicles.

July auto sales overall are expected to decline about 16 percent year-over-year, according to the automotive Web site Edmunds.com. For the first half of the year, U.S. sales were down 35 percent. But results due out Monday are expected to show that July was 11 percent better than June and the strongest month of the year.

Several analysts are predicting that July sales will exceed an annual rate of 10 million for the first time in 2009, a sign that the economy is starting the modest recovery predicted for the second half of the year.

Earnings Schedule dated ~ 08/03/09 ~

Company Name Symbol Date Time Estimate YrAgo

Administaff Inc ASF 8/3 B 0.25 0.43

Barnes Group Inc B 8/3 B 0.16 0.60

Clean Harbors Inc CLH 8/3 B 0.58 0.70

Clorox Co Del CLX 8/3 B 1.19 1.13

Ducommun Inc Del DCO 8/3 B 0.56 0.55

Ezchip Semiconductor LiEZCH 8/3 B -0.05 -0.01

First Finl Bancorp Oh FFBC 8/3 B 0.07 0.21

Gazprom O A O OGZPF 8/3 B n/a n/a

Geo Group Inc GEO 8/3 B 0.33 0.31

Haemonetics Corp HAE 8/3 B 0.65 0.59

Humana Inc HUM 8/3 B 1.64 1.24

James River Coal Co JRCC 8/3 B 0.78 -0.97

Loews Corp L 8/3 B 0.98 1.00

Lydall Inc Del LDL 8/3 B n/a 0.17

Magellan Midstream HldgMGG 8/3 B 0.29 0.50

Mgm Mirage MGM 8/3 B -0.09 0.40

Nam Tai Electrs Inc NTE 8/3 B -0.01 0.15

Oceanfreight Inc OCNF 8/3 B 0.02 0.78

Oil Co Lukoil LUKOY 8/3 B n/a 4.92

Orbotech Ltd ORBK 8/3 B -0.14 0.16

Portland Gen Elec Co POR 8/3 B 0.37 0.63

Qiao Xing Universal TelXING 8/3 B n/a 0.17

Rrsat Global Comm NtwrkRRST 8/3 B 0.20 0.20

San Miguel Corp SMGBY 8/3 B n/a n/a

Staar Surgical Co STAA 8/3 B -0.03 -0.09

Turkiye Is Bankasi A S TYABY 8/3 B n/a n/a

Tyson Foods Inc TSN 8/3 B 0.21 0.01

United Surgical PartnerUSPI 8/3 B n/a n/a

1st Constitution BancorFCCY 8/3 D 0.09 0.17

Aaon Inc AAON 8/3 D 0.42 0.43

Adstar Inc ADSTE 8/3 D n/a -0.03

Aes Corp AES 8/3 D 0.20 0.17

Affirmative Ins Hldgs IAFFM 8/3 D n/a 0.15

Aftersoft Group Inc ASFG 8/3 D n/a n/a

Alamo Group Inc ALG 8/3 D 0.20 0.56

Aldila Inc ALDA 8/3 D n/a -0.10

Alesco Finl Inc AFN 8/3 D n/a n/a

Alexanders Inc ALX 8/3 D n/a 8.68

Alleghany Corp Del Y 8/3 D 4.05 5.10

Alliance Bankshares CorABVA 8/3 D n/a -0.21

Alliance One Intl Inc AOI 8/3 D n/a 0.16

Allied Cap Corp New ALD 8/3 D 0.14 0.37

Almost Family Inc AFAM 8/3 D 0.67 0.50

Alphatec Holdings Inc ATEC 8/3 D -0.04 -0.08

Altra Holdings Inc AIMC 8/3 D 0.07 0.39

Amdl Inc ADL 8/3 D n/a -0.03

Amerco UHAL 8/3 D 1.15 1.37

American Elec Pwr Inc AEP 8/3 D 0.61 0.70

American Homepatient InAHOM 8/3 D n/a -0.12

American Intl Group IncAIG 8/3 D 1.67 -0.51

Ampal Amern Israel CorpAMPL 8/3 D -0.03 -0.30

Anesiva Inc Com ANSV 8/3 D -0.05 -0.54

Anthracite Cap Inc AHR 8/3 D 0.04 0.23

Apco Oil & Gas InternatAPAGF 8/3 D n/a 0.24

Applied Nanotech HoldinAPNT 8/3 D n/a n/a

Artesian Resources CorpARTNA 8/3 D 0.24 0.21

Atlas Energy Resources ATN 8/3 D 0.31 0.57

Atp Oil & Gas Corp ATPG 8/3 D -0.23 0.86

Atrion Corp ATRI 8/3 D 2.14 2.06

Ats Corp ATCT 8/3 D n/a n/a

Aurizon Mines Ltd AZK 8/3 D 0.08 0.04

Axcelis Technologies InACLS 8/3 D -0.21 -0.16

Banco Bradesco S A BBD 8/3 D 0.27 0.41

Banco De Chile BCH 8/3 D 0.94 0.85

Banctrust Financial Gp BTFG 8/3 D -0.38 0.10

Berkshire Hathaway Inc BRKA 8/3 D 1238.38 1465.00

Biocoral Inc BCRA 8/3 D n/a n/a

Biodel Inc BIOD 8/3 D -0.51 -0.43

Bioject Med Tech Inc BJCT 8/3 D n/a -0.06

Boise Inc BZ 8/3 D 0.04 -0.23

Bovie Medical Corp BVX 8/3 D 0.02 0.08

Bronco Drilling Co Inc BRNC 8/3 D -0.25 0.21

Cadiz Inc CDZI 8/3 D -0.28 -0.31

California First Ntnl BCFNB 8/3 D 0.24 0.14

Callisto PharmaceuticalCLSP 8/3 D n/a -0.06

Camtek Ltd CAMT 8/3 D n/a -0.02

Canyon Bancorp CYBA 8/3 D -0.42 0.02

Carrizo Oil & Co Inc CRZO 8/3 D 0.27 0.62

Cdc Corp CHINA 8/3 D 0.06 0.04

Cell Genesys Inc CEGE 8/3 D n/a -0.03

Centerline Holdings Co CLNH 8/3 D n/a -0.19

Central Vt Pub Svc CorpCV 8/3 D 0.25 0.38

Certicom Corp CIC 8/3 D n/a n/a

Chembio Diagnostics IncCEMI 8/3 D n/a -0.01

Cinemark Holdings Inc CNK 8/3 D 0.23 0.14

Citizens & Northn Corp CZNC 8/3 D -0.09 0.42

Cna Finl Corp CNA 8/3 D 0.68 0.93

Comforce Corp CFS 8/3 D n/a 0.05

Community Central Bank CCBD 8/3 D n/a 0.07

Core Mark Holding Co InCORE 8/3 D 0.21 0.51

Cornerstone Bancshares CSBQ 8/3 D n/a 0.17

Corpbanca BCA 8/3 D n/a 0.62

Cover-All Technologies COVR 8/3 D n/a 0.01

Cubic Corp CUB 8/3 D 0.49 0.32

Cyclacel PharmaceuticalCYCC 8/3 D -0.26 -0.42

Dcb Financial Corp DCBF 8/3 D n/a 0.33

Deltathree Inc DDDC 8/3 D n/a -0.10

Diamond Hill InvestmentDHIL 8/3 D 0.27 0.73

Djo Incorporated DJO 8/3 D n/a n/a

Dominion Res Black WarrDOM 8/3 D n/a 0.72

Doral Finl Corp DRL 8/3 D -0.50 -0.12

Dril-Quip Inc DRQ 8/3 D 0.66 0.68

Drinks Americas Hldgs LDKAM 8/3 D n/a -0.02

Dynavax Technologies CoDVAX 8/3 D 0.05 -0.15

Eagle Rock Energy PartnEROC 8/3 D -0.03 -3.12

Ediets Com Inc DIET 8/3 D -0.09 -0.12

Electro Rent Corp ELRC 8/3 D 0.11 0.20

Emcore Corp EMKR 8/3 D -0.14 -0.04

Empire Resorts Inc NYNY 8/3 D -0.06 -0.08

Endocare Inc ENDO 8/3 D n/a -0.17

Energy Focus Inc EFOI 8/3 D n/a -0.11

Entremed Inc ENMD 8/3 D n/a -0.11

Escalade Inc ESCA 8/3 D 0.02 -0.06

Evans Bancorp Inc EVBN 8/3 D n/a 0.50

Fairpoint CommunicationFRP 8/3 D -0.07 0.26

Federal Home Ln Mtg CorFRE 8/3 D n/a -1.63

Federal Natl Mtg Assn FNM 8/3 D -0.66 1.86

Feldman Mall Pptys Inc FMLPE 8/3 D -0.08 0.04

Fibernet Telecom Grp InFTGX 8/3 D -0.06 -0.09

First Bancorp N C FBNC 8/3 D 2.16 0.32

First Cmnty Bk Corp AmeFCFL 8/3 D n/a 0.04

First Finl Corp Ind THFF 8/3 D 0.38 0.55

First Finl Svc Corp FFKY 8/3 D 0.04 0.45

Firstenergy Corp FE 8/3 D 0.84 0.86

Flotek Inds Inc Del FTK 8/3 D -0.08 0.26

Footstar Inc FTAR 8/3 D n/a n/a

Freightcar Amer Inc RAIL 8/3 D 0.05 -0.08

Fuqi International Inc FUQI 8/3 D 0.31 0.25

Furmanite Corp FRM 8/3 D 0.08 0.21

Furniture Brands Intl IFBN 8/3 D -0.05 -0.49

Gamco Investors Inc GBL 8/3 D 0.38 0.51

General Amern Invs Inc GAM 8/3 D n/a 0.10

General Moly Inc GMO 8/3 D -0.03 -0.05

Gentek Inc GETI 8/3 D n/a 0.76

Gmx Res Inc GMXR 8/3 D -0.02 0.77

Gnc Corp GNC 8/3 D n/a n/a

Gp Strategies Corp GPX 8/3 D 0.11 0.18

Graphon Corp GOJO 8/3 D n/a -0.02

Greatbatch Inc GB 8/3 D 0.40 0.30

Greenlight Capital Re LGLRE 8/3 D 1.99 0.92

Gtsi Corp GTSI 8/3 D n/a -0.44

Guaranty Finl Group IncGFG 8/3 D n/a n/a

Harrington West Finl GrHWFG 8/3 D n/a -0.02

Harvest Natural ResourcHNR 8/3 D 0.10 0.02

Haynes International InHAYN 8/3 D -0.06 1.46

Hearst-Argyle TelevisioHTV 8/3 D 0.02 0.15

Heelys Inc HLYS 8/3 D -0.03 -0.01

Helix Biomedix Inc HXBM 8/3 D n/a -0.06

Hkn Inc HKN 8/3 D n/a 0.23

Horizon Finl Corp Wash HRZB 8/3 D -1.63 0.17

Hrpt Pptys Tr HRP 8/3 D 0.26 0.28

Hsbc Finance Corp HTN 8/3 D n/a n/a

Hudson Technologies IncHDSN 8/3 D n/a 0.15

Idaho First Bank MccallIDFB 8/3 D n/a n/a

Idera Pharmaceuticals IIDRA 8/3 D 0.01 0.05

Ii Vi Inc IIVI 8/3 D 0.15 0.50

Imperial Cap Bancorp InIMP 8/3 D n/a 0.43

India Fd Inc IFN 8/3 D n/a n/a

Ingles Mkts Inc IMKTE 8/3 D 0.61 0.65

Integral Sys Inc Md ISYS 8/3 D 0.08 0.28

International BancshareIBOC 8/3 D 0.27 0.48

Ion Geophysical Corp IO 8/3 D -0.05 0.16

Irwin Finl Corp IFC 8/3 D -0.78 -3.64

Ivax Diagnostics Inc IVD 8/3 D n/a 0.01

Jade Art Group Inc JADAE 8/3 D n/a 0.04

Javelin PharmaceuticalsJAV 8/3 D -0.15 -0.16

Jer Invt Tr Inc JERT 8/3 D 0.00 3.30

King Pharmaceuticals InKG 8/3 D 0.26 0.30

Leucadia Natl Corp LUK 8/3 D n/a 0.76

Lmi Aerospace Inc LMIA 8/3 D 0.35 0.45

M & F Worldwide Corp MFW 8/3 D n/a 0.92

Maguire Pptys Inc MPG 8/3 D 0.05 -1.18

Maine & Maritimes Corp MAM 8/3 D n/a -0.03

Mannkind Corp MNKD 8/3 D -0.56 -0.79

Marathon Oil Corp MRO 8/3 D 0.53 1.20

Martin Midstream PrtnrsMMLP 8/3 D 0.27 0.25

Matrixx Initiatives IncMTXX 8/3 D -0.19 -0.24

Maui Ld & Pineapple IncMLP 8/3 D -0.56 0.03

Mdu Res Group Inc MDU 8/3 D 0.29 0.63

Medallion Finl Corp TAXI 8/3 D 0.16 0.25

Medarex Inc MEDX 8/3 D -0.34 -0.42

Mer Telemanagement SoluMTSL 8/3 D n/a -0.02

Mercury Genl Corp New MCY 8/3 D 0.71 0.86

Meruelo Maddux PropertiMMPIQ 8/3 D -0.05 -0.05

Mid Penn Bancorp Inc MPB 8/3 D n/a 0.30

Middleby Corp MIDD 8/3 D 0.81 0.99

Mobilepro Corp MOBL 8/3 D n/a n/a

Molson Coors Brewing CoTAP 8/3 D 0.99 0.93

Morgans Hotel Group Co MHGC 8/3 D -0.37 -0.02

Nasb Finl Inc NASB 8/3 D 0.53 0.46

Natco Group Inc NTG 8/3 D 0.42 0.47

Nathans Famous Inc New NATH 8/3 D 0.23 0.21

National Health Invs InNHI 8/3 D 0.55 0.60

National Healthcare CorNHC 8/3 D 0.59 0.56

National Retail PropertNNN 8/3 D 0.40 0.50

National Westn Life InsNWLI 8/3 D n/a 5.15

Neurogen Corp NRGN 8/3 D -0.12 -0.28

New Dragon Asia Corp NWD 8/3 D 0.02 0.01

News Corp NWS 8/3 D n/a n/a

Nexmed Inc NEXM 8/3 D n/a -0.02

Nps Pharmaceuticals IncNPSP 8/3 D -0.25 0.03

Nustar Gp Holdings Llc NSH 8/3 D 0.41 0.14

Nymagic Inc NYM 8/3 D 0.33 -0.62

Ocean Shore Hldg Co OSHC 8/3 D 0.14 0.13

Omega Protein Corp OME 8/3 D 0.04 0.36

One Liberty Pptys Inc OLP 8/3 D 0.29 0.55

Opko Health Inc OPK 8/3 D n/a -0.06

Orbit / Fr Inc ORFR 8/3 D n/a -0.18

Origin Agritech LimitedSEED 8/3 D n/a -0.18

Orthologic Corp CAPS 8/3 D n/a -0.07

Osiris Therapeutics IncOSIR 8/3 D 0.11 -0.48

Otter Tail Corp OTTR 8/3 D 0.11 0.11

Pacific State Bancorp CPSBC 8/3 D -0.29 0.15

Parallel Pete Corp Del PLLL 8/3 D 0.02 0.19

Parke Bancorp Inc PKBK 8/3 D 0.33 0.31

Parkway Pptys Inc PKY 8/3 D 0.74 1.03

Parlux Fragrances Inc PARL 8/3 D -0.07 -0.24

Patriot Capital FundingPCAP 8/3 D 0.20 0.31

Patriot Transn Hldg IncPATR 8/3 D n/a 0.89

Peapack-Gladstone Finl PGC 8/3 D 0.29 0.43

Pegasystems Inc PEGA 8/3 D 0.11 0.08

Pennichuck Corp PNNW 8/3 D 0.20 0.19

Phi Inc PHIIK 8/3 D 0.28 0.41

Photomedex Inc PHMDD 8/3 D -0.32 -0.21

Pinnacle Data Sys Inc PNS 8/3 D n/a -0.12

Pomeroy It Solutions InPMRYE 8/3 D n/a 0.12

Presidential Life Corp PLFE 8/3 D 0.18 0.33

Progenics PharmaceuticaPGNX 8/3 D -0.51 -0.08

Protalix BiotherapeuticPLX 8/3 D -0.08 -0.06

Pvf Capital Corp PVFC 8/3 D -0.86 -0.32

Pyramid Oil Co PDO 8/3 D n/a 0.19

Qc Hldgs Inc QCCO 8/3 D 0.14 0.12

Radio One Inc ROIAK 8/3 D -0.02 -0.13

Reading International IRDI 8/3 D 0.02 0.01

Regeneron PharmaceuticaREGN 8/3 D -0.28 -0.23

Reis Inc REIS 8/3 D n/a n/a

Republic First Bancorp FRBK 8/3 D -0.28 0.11

Research Frontiers Inc REFR 8/3 D -0.07 -0.06

Rock Of Ages Corp ROAC 8/3 D n/a 0.10

Rockford Corp ROFO 8/3 D n/a 0.09

Rubios Restaurants Inc RUBO 8/3 D 0.08 0.03

Ryerson Tull Inc New RYI 8/3 D n/a n/a

Sabine Royalty Tr SBR 8/3 D 0.63 1.54

Savient PharmaceuticalsSVNTE 8/3 D -0.40 -0.45

Scolr Pharma Inc DDD 8/3 D -0.04 -0.05

Seaboard Corp SEB 8/3 D n/a 16.85

Senior Hsg Pptys Tr SNH 8/3 D 0.44 0.41

Silver Std Res Inc SSRI 8/3 D -0.05 -0.09

Simcere Pharmaceutical SCR 8/3 D 0.14 0.21

Six Flags Inc SIXF 8/3 D n/a 0.63

Softbrands Inc SBN 8/3 D 0.01 0.01

Southcoast Financial CoSOCB 8/3 D n/a 0.17

Spanish Broadcasting SySBSA 8/3 D n/a -4.09

Spark Networks Inc LOV 8/3 D n/a 0.09

Sports Club Inc SCYL 8/3 D n/a n/a

Standard Mtr Prods Inc SMP 8/3 D 0.08 -0.04

Star Scientific Inc STSI 8/3 D -0.05 -0.07

Stewart W P & Co Ltd WPSLF 8/3 D n/a -0.14

Sulphco Inc SUF 8/3 D n/a -0.11

Summit Financial Group SMMF 8/3 D 0.05 0.35

Sun-Times Media Group ISVN 8/3 D n/a -0.06

Supertel Hospitality InSPPR 8/3 D 0.19 0.26

Symbion Inc Del SMBI 8/3 D n/a n/a

Systemax Inc SYX 8/3 D 0.29 0.36

Tasty Baking Co TSTY 8/3 D 0.06 0.01

Team Inc TISI 8/3 D 0.21 0.47

Tengasco Inc TGC 8/3 D 0.01 0.02

Tfs Finl Corp TFSL 8/3 D 0.02 0.02

Titanium Metals Corp TIE 8/3 D 0.09 0.26

Torreypines TherapeuticTPTX 8/3 D n/a -0.47

Trailer Bridge TRBR 8/3 D 0.00 -0.03

Transportadora De Gas STGS 8/3 D n/a 0.35

Tredegar Corp TG 8/3 D 0.16 0.28

Trimeris Inc TRMS 8/3 D 0.04 0.03

U M H Properties Inc UMH 8/3 D n/a 0.23

Unit Corp UNT 8/3 D 0.47 2.00

United Capital Corp AFP 8/3 D n/a 0.30

United Westn Bancorp InUWBK 8/3 D 5.16 0.43

Unitrin Inc UTR 8/3 D 0.38 0.00

Universal Corp Va UVV 8/3 D n/a 0.64

Universal Display Corp PANL 8/3 D -0.15 -0.15

Univision CommunicationUVN 8/3 D n/a n/a

Us Oncology Inc USON 8/3 D n/a n/a

Usec Inc USU 8/3 D 0.00 0.10

Valuevision Media Inc VVTV 8/3 D -0.27 -0.15

Vanda Pharmaceuticals IVNDA 8/3 D -0.41 -0.51

Verenium Corporation VRNM 8/3 D -0.17 -0.26

Vina Concha Y Toro S A VCO 8/3 D n/a 0.60

Warnaco Group Inc WRC 8/3 D n/a n/a

Web Com Group Inc WWWW 8/3 D 0.16 0.18

Webmediabrands Inc WEBM 8/3 D n/a -0.02

Wesco Finl Corp WSC 8/3 D n/a 3.03

Westwood One Inc WWON 8/3 D n/a 0.07

Whx Corp WXCO 8/3 D n/a 5.30

Wilber Corp GIW 8/3 D 0.11 0.13

Willbros Group Inc Del WG 8/3 D 0.25 0.49

Williams Ctls Inc WMCO 8/3 D -0.05 0.28

Zoltek Cos Inc ZOLT 8/3 D 0.07 0.12

*** A = After market hours B = Before market hours D = During market hours U = Time unknown ***

Earnings Schedule dated ~ 08/03/09 ~

Company Name Symbol Date Time Estimate YrAgo

Administaff Inc ASF 8/3 B 0.25 0.43

Barnes Group Inc B 8/3 B 0.16 0.60

Clean Harbors Inc CLH 8/3 B 0.58 0.70

Clorox Co Del CLX 8/3 B 1.19 1.13

Ducommun Inc Del DCO 8/3 B 0.56 0.55

Ezchip Semiconductor LiEZCH 8/3 B -0.05 -0.01

First Finl Bancorp Oh FFBC 8/3 B 0.07 0.21

Gazprom O A O OGZPF 8/3 B n/a n/a

Geo Group Inc GEO 8/3 B 0.33 0.31

Haemonetics Corp HAE 8/3 B 0.65 0.59

Humana Inc HUM 8/3 B 1.64 1.24

James River Coal Co JRCC 8/3 B 0.78 -0.97

Loews Corp L 8/3 B 0.98 1.00

Lydall Inc Del LDL 8/3 B n/a 0.17

Magellan Midstream HldgMGG 8/3 B 0.29 0.50

Mgm Mirage MGM 8/3 B -0.09 0.40

Nam Tai Electrs Inc NTE 8/3 B -0.01 0.15

Oceanfreight Inc OCNF 8/3 B 0.02 0.78

Oil Co Lukoil LUKOY 8/3 B n/a 4.92

Orbotech Ltd ORBK 8/3 B -0.14 0.16

Portland Gen Elec Co POR 8/3 B 0.37 0.63

Qiao Xing Universal TelXING 8/3 B n/a 0.17

Rrsat Global Comm NtwrkRRST 8/3 B 0.20 0.20

San Miguel Corp SMGBY 8/3 B n/a n/a

Staar Surgical Co STAA 8/3 B -0.03 -0.09

Turkiye Is Bankasi A S TYABY 8/3 B n/a n/a

Tyson Foods Inc TSN 8/3 B 0.21 0.01

United Surgical PartnerUSPI 8/3 B n/a n/a

1st Constitution BancorFCCY 8/3 D 0.09 0.17

Aaon Inc AAON 8/3 D 0.42 0.43

Adstar Inc ADSTE 8/3 D n/a -0.03

Aes Corp AES 8/3 D 0.20 0.17

Affirmative Ins Hldgs IAFFM 8/3 D n/a 0.15

Aftersoft Group Inc ASFG 8/3 D n/a n/a

Alamo Group Inc ALG 8/3 D 0.20 0.56

Aldila Inc ALDA 8/3 D n/a -0.10

Alesco Finl Inc AFN 8/3 D n/a n/a

Alexanders Inc ALX 8/3 D n/a 8.68

Alleghany Corp Del Y 8/3 D 4.05 5.10

Alliance Bankshares CorABVA 8/3 D n/a -0.21

Alliance One Intl Inc AOI 8/3 D n/a 0.16

Allied Cap Corp New ALD 8/3 D 0.14 0.37

Almost Family Inc AFAM 8/3 D 0.67 0.50

Alphatec Holdings Inc ATEC 8/3 D -0.04 -0.08

Altra Holdings Inc AIMC 8/3 D 0.07 0.39

Amdl Inc ADL 8/3 D n/a -0.03

Amerco UHAL 8/3 D 1.15 1.37

American Elec Pwr Inc AEP 8/3 D 0.61 0.70

American Homepatient InAHOM 8/3 D n/a -0.12

American Intl Group IncAIG 8/3 D 1.67 -0.51

Ampal Amern Israel CorpAMPL 8/3 D -0.03 -0.30

Anesiva Inc Com ANSV 8/3 D -0.05 -0.54

Anthracite Cap Inc AHR 8/3 D 0.04 0.23

Apco Oil & Gas InternatAPAGF 8/3 D n/a 0.24

Applied Nanotech HoldinAPNT 8/3 D n/a n/a

Artesian Resources CorpARTNA 8/3 D 0.24 0.21

Atlas Energy Resources ATN 8/3 D 0.31 0.57

Atp Oil & Gas Corp ATPG 8/3 D -0.23 0.86

Atrion Corp ATRI 8/3 D 2.14 2.06

Ats Corp ATCT 8/3 D n/a n/a

Aurizon Mines Ltd AZK 8/3 D 0.08 0.04

Axcelis Technologies InACLS 8/3 D -0.21 -0.16

Banco Bradesco S A BBD 8/3 D 0.27 0.41

Banco De Chile BCH 8/3 D 0.94 0.85

Banctrust Financial Gp BTFG 8/3 D -0.38 0.10

Berkshire Hathaway Inc BRKA 8/3 D 1238.38 1465.00

Biocoral Inc BCRA 8/3 D n/a n/a

Biodel Inc BIOD 8/3 D -0.51 -0.43

Bioject Med Tech Inc BJCT 8/3 D n/a -0.06

Boise Inc BZ 8/3 D 0.04 -0.23

Bovie Medical Corp BVX 8/3 D 0.02 0.08

Bronco Drilling Co Inc BRNC 8/3 D -0.25 0.21

Cadiz Inc CDZI 8/3 D -0.28 -0.31

California First Ntnl BCFNB 8/3 D 0.24 0.14

Callisto PharmaceuticalCLSP 8/3 D n/a -0.06

Camtek Ltd CAMT 8/3 D n/a -0.02

Canyon Bancorp CYBA 8/3 D -0.42 0.02

Carrizo Oil & Co Inc CRZO 8/3 D 0.27 0.62

Cdc Corp CHINA 8/3 D 0.06 0.04

Cell Genesys Inc CEGE 8/3 D n/a -0.03

Centerline Holdings Co CLNH 8/3 D n/a -0.19

Central Vt Pub Svc CorpCV 8/3 D 0.25 0.38

Certicom Corp CIC 8/3 D n/a n/a

Chembio Diagnostics IncCEMI 8/3 D n/a -0.01

Cinemark Holdings Inc CNK 8/3 D 0.23 0.14

Citizens & Northn Corp CZNC 8/3 D -0.09 0.42

Cna Finl Corp CNA 8/3 D 0.68 0.93

Comforce Corp CFS 8/3 D n/a 0.05

Community Central Bank CCBD 8/3 D n/a 0.07

Core Mark Holding Co InCORE 8/3 D 0.21 0.51

Cornerstone Bancshares CSBQ 8/3 D n/a 0.17

Corpbanca BCA 8/3 D n/a 0.62

Cover-All Technologies COVR 8/3 D n/a 0.01

Cubic Corp CUB 8/3 D 0.49 0.32

Cyclacel PharmaceuticalCYCC 8/3 D -0.26 -0.42

Dcb Financial Corp DCBF 8/3 D n/a 0.33

Deltathree Inc DDDC 8/3 D n/a -0.10

Diamond Hill InvestmentDHIL 8/3 D 0.27 0.73

Djo Incorporated DJO 8/3 D n/a n/a

Dominion Res Black WarrDOM 8/3 D n/a 0.72

Doral Finl Corp DRL 8/3 D -0.50 -0.12

Dril-Quip Inc DRQ 8/3 D 0.66 0.68

Drinks Americas Hldgs LDKAM 8/3 D n/a -0.02

Dynavax Technologies CoDVAX 8/3 D 0.05 -0.15

Eagle Rock Energy PartnEROC 8/3 D -0.03 -3.12

Ediets Com Inc DIET 8/3 D -0.09 -0.12

Electro Rent Corp ELRC 8/3 D 0.11 0.20

Emcore Corp EMKR 8/3 D -0.14 -0.04

Empire Resorts Inc NYNY 8/3 D -0.06 -0.08

Endocare Inc ENDO 8/3 D n/a -0.17

Energy Focus Inc EFOI 8/3 D n/a -0.11

Entremed Inc ENMD 8/3 D n/a -0.11

Escalade Inc ESCA 8/3 D 0.02 -0.06

Evans Bancorp Inc EVBN 8/3 D n/a 0.50

Fairpoint CommunicationFRP 8/3 D -0.07 0.26

Federal Home Ln Mtg CorFRE 8/3 D n/a -1.63

Federal Natl Mtg Assn FNM 8/3 D -0.66 1.86

Feldman Mall Pptys Inc FMLPE 8/3 D -0.08 0.04

Fibernet Telecom Grp InFTGX 8/3 D -0.06 -0.09

First Bancorp N C FBNC 8/3 D 2.16 0.32

First Cmnty Bk Corp AmeFCFL 8/3 D n/a 0.04

First Finl Corp Ind THFF 8/3 D 0.38 0.55

First Finl Svc Corp FFKY 8/3 D 0.04 0.45

Firstenergy Corp FE 8/3 D 0.84 0.86

Flotek Inds Inc Del FTK 8/3 D -0.08 0.26

Footstar Inc FTAR 8/3 D n/a n/a

Freightcar Amer Inc RAIL 8/3 D 0.05 -0.08

Fuqi International Inc FUQI 8/3 D 0.31 0.25

Furmanite Corp FRM 8/3 D 0.08 0.21

Furniture Brands Intl IFBN 8/3 D -0.05 -0.49

Gamco Investors Inc GBL 8/3 D 0.38 0.51

General Amern Invs Inc GAM 8/3 D n/a 0.10

General Moly Inc GMO 8/3 D -0.03 -0.05

Gentek Inc GETI 8/3 D n/a 0.76

Gmx Res Inc GMXR 8/3 D -0.02 0.77

Gnc Corp GNC 8/3 D n/a n/a

Gp Strategies Corp GPX 8/3 D 0.11 0.18

Graphon Corp GOJO 8/3 D n/a -0.02

Greatbatch Inc GB 8/3 D 0.40 0.30

Greenlight Capital Re LGLRE 8/3 D 1.99 0.92

Gtsi Corp GTSI 8/3 D n/a -0.44

Guaranty Finl Group IncGFG 8/3 D n/a n/a

Harrington West Finl GrHWFG 8/3 D n/a -0.02

Harvest Natural ResourcHNR 8/3 D 0.10 0.02

Haynes International InHAYN 8/3 D -0.06 1.46

Hearst-Argyle TelevisioHTV 8/3 D 0.02 0.15

Heelys Inc HLYS 8/3 D -0.03 -0.01

Helix Biomedix Inc HXBM 8/3 D n/a -0.06

Hkn Inc HKN 8/3 D n/a 0.23

Horizon Finl Corp Wash HRZB 8/3 D -1.63 0.17

Hrpt Pptys Tr HRP 8/3 D 0.26 0.28

Hsbc Finance Corp HTN 8/3 D n/a n/a

Hudson Technologies IncHDSN 8/3 D n/a 0.15

Idaho First Bank MccallIDFB 8/3 D n/a n/a

Idera Pharmaceuticals IIDRA 8/3 D 0.01 0.05

Ii Vi Inc IIVI 8/3 D 0.15 0.50

Imperial Cap Bancorp InIMP 8/3 D n/a 0.43

India Fd Inc IFN 8/3 D n/a n/a

Ingles Mkts Inc IMKTE 8/3 D 0.61 0.65

Integral Sys Inc Md ISYS 8/3 D 0.08 0.28

International BancshareIBOC 8/3 D 0.27 0.48

Ion Geophysical Corp IO 8/3 D -0.05 0.16

Irwin Finl Corp IFC 8/3 D -0.78 -3.64

Ivax Diagnostics Inc IVD 8/3 D n/a 0.01

Jade Art Group Inc JADAE 8/3 D n/a 0.04

Javelin PharmaceuticalsJAV 8/3 D -0.15 -0.16

Jer Invt Tr Inc JERT 8/3 D 0.00 3.30

King Pharmaceuticals InKG 8/3 D 0.26 0.30

Leucadia Natl Corp LUK 8/3 D n/a 0.76

Lmi Aerospace Inc LMIA 8/3 D 0.35 0.45

M & F Worldwide Corp MFW 8/3 D n/a 0.92

Maguire Pptys Inc MPG 8/3 D 0.05 -1.18

Maine & Maritimes Corp MAM 8/3 D n/a -0.03

Mannkind Corp MNKD 8/3 D -0.56 -0.79

Marathon Oil Corp MRO 8/3 D 0.53 1.20

Martin Midstream PrtnrsMMLP 8/3 D 0.27 0.25

Matrixx Initiatives IncMTXX 8/3 D -0.19 -0.24

Maui Ld & Pineapple IncMLP 8/3 D -0.56 0.03

Mdu Res Group Inc MDU 8/3 D 0.29 0.63

Medallion Finl Corp TAXI 8/3 D 0.16 0.25

Medarex Inc MEDX 8/3 D -0.34 -0.42

Mer Telemanagement SoluMTSL 8/3 D n/a -0.02

Mercury Genl Corp New MCY 8/3 D 0.71 0.86

Meruelo Maddux PropertiMMPIQ 8/3 D -0.05 -0.05

Mid Penn Bancorp Inc MPB 8/3 D n/a 0.30

Middleby Corp MIDD 8/3 D 0.81 0.99

Mobilepro Corp MOBL 8/3 D n/a n/a

Molson Coors Brewing CoTAP 8/3 D 0.99 0.93

Morgans Hotel Group Co MHGC 8/3 D -0.37 -0.02

Nasb Finl Inc NASB 8/3 D 0.53 0.46

Natco Group Inc NTG 8/3 D 0.42 0.47

Nathans Famous Inc New NATH 8/3 D 0.23 0.21

National Health Invs InNHI 8/3 D 0.55 0.60

National Healthcare CorNHC 8/3 D 0.59 0.56

National Retail PropertNNN 8/3 D 0.40 0.50

National Westn Life InsNWLI 8/3 D n/a 5.15

Neurogen Corp NRGN 8/3 D -0.12 -0.28

New Dragon Asia Corp NWD 8/3 D 0.02 0.01

News Corp NWS 8/3 D n/a n/a

Nexmed Inc NEXM 8/3 D n/a -0.02

Nps Pharmaceuticals IncNPSP 8/3 D -0.25 0.03

Nustar Gp Holdings Llc NSH 8/3 D 0.41 0.14

Nymagic Inc NYM 8/3 D 0.33 -0.62

Ocean Shore Hldg Co OSHC 8/3 D 0.14 0.13

Omega Protein Corp OME 8/3 D 0.04 0.36

One Liberty Pptys Inc OLP 8/3 D 0.29 0.55

Opko Health Inc OPK 8/3 D n/a -0.06

Orbit / Fr Inc ORFR 8/3 D n/a -0.18

Origin Agritech LimitedSEED 8/3 D n/a -0.18

Orthologic Corp CAPS 8/3 D n/a -0.07

Osiris Therapeutics IncOSIR 8/3 D 0.11 -0.48

Otter Tail Corp OTTR 8/3 D 0.11 0.11

Pacific State Bancorp CPSBC 8/3 D -0.29 0.15

Parallel Pete Corp Del PLLL 8/3 D 0.02 0.19

Parke Bancorp Inc PKBK 8/3 D 0.33 0.31

Parkway Pptys Inc PKY 8/3 D 0.74 1.03

Parlux Fragrances Inc PARL 8/3 D -0.07 -0.24

Patriot Capital FundingPCAP 8/3 D 0.20 0.31

Patriot Transn Hldg IncPATR 8/3 D n/a 0.89

Peapack-Gladstone Finl PGC 8/3 D 0.29 0.43

Pegasystems Inc PEGA 8/3 D 0.11 0.08

Pennichuck Corp PNNW 8/3 D 0.20 0.19

Phi Inc PHIIK 8/3 D 0.28 0.41

Photomedex Inc PHMDD 8/3 D -0.32 -0.21

Pinnacle Data Sys Inc PNS 8/3 D n/a -0.12

Pomeroy It Solutions InPMRYE 8/3 D n/a 0.12

Presidential Life Corp PLFE 8/3 D 0.18 0.33

Progenics PharmaceuticaPGNX 8/3 D -0.51 -0.08

Protalix BiotherapeuticPLX 8/3 D -0.08 -0.06

Pvf Capital Corp PVFC 8/3 D -0.86 -0.32

Pyramid Oil Co PDO 8/3 D n/a 0.19

Qc Hldgs Inc QCCO 8/3 D 0.14 0.12

Radio One Inc ROIAK 8/3 D -0.02 -0.13

Reading International IRDI 8/3 D 0.02 0.01

Regeneron PharmaceuticaREGN 8/3 D -0.28 -0.23

Reis Inc REIS 8/3 D n/a n/a

Republic First Bancorp FRBK 8/3 D -0.28 0.11

Research Frontiers Inc REFR 8/3 D -0.07 -0.06

Rock Of Ages Corp ROAC 8/3 D n/a 0.10

Rockford Corp ROFO 8/3 D n/a 0.09

Rubios Restaurants Inc RUBO 8/3 D 0.08 0.03

Ryerson Tull Inc New RYI 8/3 D n/a n/a

Sabine Royalty Tr SBR 8/3 D 0.63 1.54

Savient PharmaceuticalsSVNTE 8/3 D -0.40 -0.45

Scolr Pharma Inc DDD 8/3 D -0.04 -0.05

Seaboard Corp SEB 8/3 D n/a 16.85

Senior Hsg Pptys Tr SNH 8/3 D 0.44 0.41

Silver Std Res Inc SSRI 8/3 D -0.05 -0.09

Simcere Pharmaceutical SCR 8/3 D 0.14 0.21

Six Flags Inc SIXF 8/3 D n/a 0.63

Softbrands Inc SBN 8/3 D 0.01 0.01

Southcoast Financial CoSOCB 8/3 D n/a 0.17

Spanish Broadcasting SySBSA 8/3 D n/a -4.09

Spark Networks Inc LOV 8/3 D n/a 0.09

Sports Club Inc SCYL 8/3 D n/a n/a

Standard Mtr Prods Inc SMP 8/3 D 0.08 -0.04

Star Scientific Inc STSI 8/3 D -0.05 -0.07

Stewart W P & Co Ltd WPSLF 8/3 D n/a -0.14

Sulphco Inc SUF 8/3 D n/a -0.11

Summit Financial Group SMMF 8/3 D 0.05 0.35

Sun-Times Media Group ISVN 8/3 D n/a -0.06

Supertel Hospitality InSPPR 8/3 D 0.19 0.26

Symbion Inc Del SMBI 8/3 D n/a n/a

Systemax Inc SYX 8/3 D 0.29 0.36

Tasty Baking Co TSTY 8/3 D 0.06 0.01

Team Inc TISI 8/3 D 0.21 0.47

Tengasco Inc TGC 8/3 D 0.01 0.02

Tfs Finl Corp TFSL 8/3 D 0.02 0.02

Titanium Metals Corp TIE 8/3 D 0.09 0.26

Torreypines TherapeuticTPTX 8/3 D n/a -0.47

Trailer Bridge TRBR 8/3 D 0.00 -0.03

Transportadora De Gas STGS 8/3 D n/a 0.35

Tredegar Corp TG 8/3 D 0.16 0.28

Trimeris Inc TRMS 8/3 D 0.04 0.03

U M H Properties Inc UMH 8/3 D n/a 0.23

Unit Corp UNT 8/3 D 0.47 2.00

United Capital Corp AFP 8/3 D n/a 0.30

United Westn Bancorp InUWBK 8/3 D 5.16 0.43

Unitrin Inc UTR 8/3 D 0.38 0.00

Universal Corp Va UVV 8/3 D n/a 0.64

Universal Display Corp PANL 8/3 D -0.15 -0.15

Univision CommunicationUVN 8/3 D n/a n/a

Us Oncology Inc USON 8/3 D n/a n/a

Usec Inc USU 8/3 D 0.00 0.10

Valuevision Media Inc VVTV 8/3 D -0.27 -0.15

Vanda Pharmaceuticals IVNDA 8/3 D -0.41 -0.51

Verenium Corporation VRNM 8/3 D -0.17 -0.26

Vina Concha Y Toro S A VCO 8/3 D n/a 0.60

Warnaco Group Inc WRC 8/3 D n/a n/a

Web Com Group Inc WWWW 8/3 D 0.16 0.18

Webmediabrands Inc WEBM 8/3 D n/a -0.02

Wesco Finl Corp WSC 8/3 D n/a 3.03

Westwood One Inc WWON 8/3 D n/a 0.07

Whx Corp WXCO 8/3 D n/a 5.30

Wilber Corp GIW 8/3 D 0.11 0.13

Willbros Group Inc Del WG 8/3 D 0.25 0.49

Williams Ctls Inc WMCO 8/3 D -0.05 0.28

Zoltek Cos Inc ZOLT 8/3 D 0.07 0.12

*** A = After market hours B = Before market hours D = During market hours U = Time unknown ***

Great call on that one Orca.

Excellent chart & annotations Ichimoku, thank you.

How is everyone doing here this afternoon? Quite a bit of bullish chatter it seems...

Good Sunday Afternoon to all.

Interesting opinion. Thank you for sharing.