Seeking Creative & Innovative Investment Ideas...

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

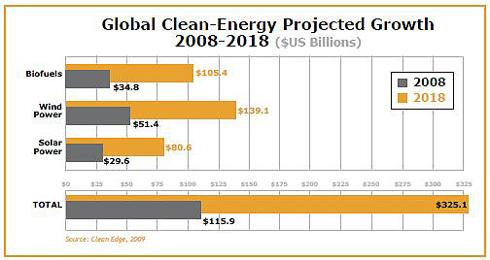

Courtenay, an investment analyst, argues Geothermal Energy 'under-appreciated' as a renewable energy technology. He relates to the sector as being "the same formula that brought us the real estate bubble – they just changed the name to "green power." Regardless of how you view alternative energy, buying these stocks today is like buying real estate in 2002. You'll wish you loaded up once this bubble heats."

He continues stating, "the cap and trade bill will hike electric rates two or three times their current prices. That's what will drive a bubble in alternative energy – low-cost financing, government backing, and huge upside."

http://seekingalpha.com/article/156192-6-ways-to-play-clean-energy?

The principle is that all renewable energy technologies stand to benefit from these government programs. That is not to say these technologies are not in competition against one another. Efficiency, high ROI, and superior environmental performance are critical categories where plasma gasification technology appears 'a cut above the rest'.

The following is a video presentation that overviews an emerging solution to several crisis political and environmental issues: "Discovery Channel features energy from waste, plasma gasification technology."

http://www.timelesswealth.net/video2.html

Market Capitalization, The Quigley Corp.

Assuming market price of $3.00/share, issued and outstanding shares amounting to 12,991,883, market cap totals $38,975,649.

The majority of Quigley Corp.'s revenues have come from the Company's cold remedy segment. Competitors include Matrixx Initiatives Inc. (MTXX), with market capitalization of $52,005,910, China Aoxing Pharmaceutical Co., Inc. (CAXG.OB), with market capitalization of $132,511,288.

Lessons from Central Europe.

by: Edward Hugh August 16, 2009

The non-biblical concept of original sin, as Claus Vistesen notes in this post, when propounded in its standard Obstfeld & Krugman textbook version refers to the situation where many developing economies who are not able to borrow in their own currencies feel forced to denominate large parts of their sovereign and private sector debt in non-domestic currencies in order to attract capital from foreign investors - as evidenced most recently in the countries of Central and Eastern Europe. Well, piling insult upon injury, I'd like to take Claus's point a little further, and do so by drawing on another well tried and tested weapon from the Krugman armory, the idea of the "eternal triangle".

As is evident, the reality which lies behind the current crisis in the EU10 is complex, and has its origin in a variety of causes. But one key factor has undoubtedly been the decisions the various countries took when thinking about their monetary policy and currency regimes. The case of the legendary euro "peggers" - the three Baltic countries and Bulgaria - has been receiving plenty of media attention on late, and two of the remaining six (Slovenia and Slovakia) are now members of the Eurozone, but what of the other four, Romania, Hungary, Poland and The Czech Republic? What can be learnt from the experience of these countries in the present crisis.

Well, one convenient way of thinking about what just happened could be to use Nobel Economist Paul Krugman’s Eternal Triangle” model (see his summary here), which postulates that when it comes to tensions within the strategic trio formed by exchange rate policy, monetary policy, and international liquidity flows, maintaining control over any one implies a loss of control in one of the other two.

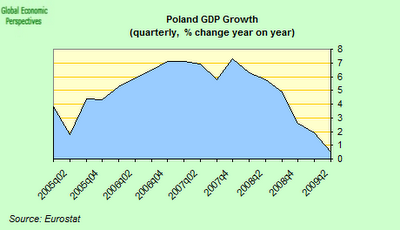

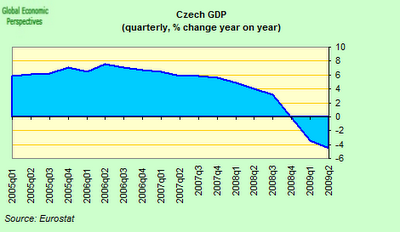

In the case of the Central Europe "four", Poland and the Czech Republic opted for maintaining their grip on monetary policy, thus accepting the need for their currency to "freefloat" and move according to the ebbs and flows of market sentiment. As it turns out this decision has served them remarkably well, since the real appreciation in their currencies which accompanied the good times helped take some of the sting out of inflation, while their ability to rapidly reduce interest rates into the downturn has lead to currency depreciation, helping to sustain exports and avoid deflation related issues.

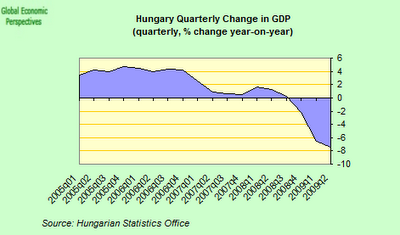

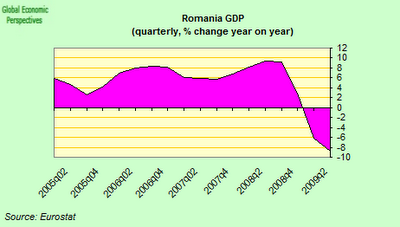

The other two countries (Hungary and Romania), to a greater or lesser degree prioritised currency stability, and as a result had to sacrifice a lot of control over monetary policy, in the process exposing themselves to the risk of much more violent swings in market sentiment when it comes to capital flows. Having been pushed by the logic of their currency decision towards tolerating higher inflation, they have seen the competitiveness of their home industries gradually undermined, and as a consequence found themselves pushed into large current account deficits for just as long the market was prepared to support them, and into sharp domestic contractions once they were no longer disposed so to do.

A second problem which stems from this "initial decision" has been the tendency for households in the latter two countries to overload themselves with unhedged forex loans, a move which stems to some considerable extent from the currency decision, since in order to stabilise the currency, the central banks have had to maintain higher than desirable interest rates, which only reinforced the attractiveness of borrowing in forex, which in turn produced lock-in at the central bank, since it can no longer afford to let the currency slide due to the balance sheet impact on households. Significantly the forex borrowing problem is much less in Poland than it is in Hungary or Romania, and in the Czech Republic it is nearly non-existent.

The third consequence of the decision to loosen control on domestic monetary policy has been the need to tolerate higher than desirable inflation, a necessity which was also accompanied by a predisposition to do so (which had its origin in the erroneous belief that the lions share of the wage differential between West and Eastern Europe is an “unfair” reflection of the region’s earlier history, and essentially a market distortion). The result has been, since 2005, a steady increase in unit wage costs with an accompanying loss of competitiveness, and an increasing dependence on external borrowing to fuel domestic consumption.

So, if we look at the current state of economic play in the four countries, we find two of them (Hungary and Romania) undergoing very severe economic contractions - to such a degree that in both cases the IMF has had to be called in. At the same time both of them are still having to "grin and bear" higher than desirable inflation and interest rates. In the other two countries the contraction is milder, the financial instability less dramatic, and both inflation and domestic interest rates are much lower. Really, looked at in this light, I think there can be little doubt who made the best decision.

Appendix

Here for comparative purposes are charts illustrating the varying degrees of economic contraction, inflation, and interest rates. GDP contraction rates actually present a little problem at the moment, since one of the relevant countries - Poland - still has to report. However Michal Boni, chief adviser to the Prime Minister, told the newspaper Dziennik this week that the economy expanded at an annual rate of between 0.5% and 1% in Q1. So lets take the lower bound as good, it is still an expansion.

The economy in the Czech Republic contracted by an estimated 4.9% year on year in the second quarter.

The Hungarian economy contracted by an estimated 7.4% year on year in Q2.

While the Romanian economy contracted by an estimated 8.8% year on year.

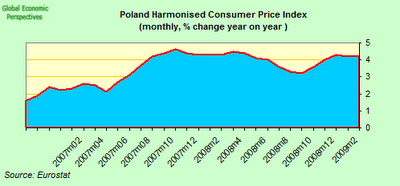

Inflation Rates

Poland's CPI rose by an annual 4.2% in July.

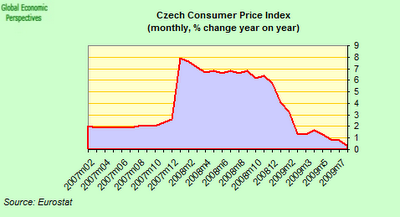

The CPI in the Czech Republic rose by an annual 0.3% in July.

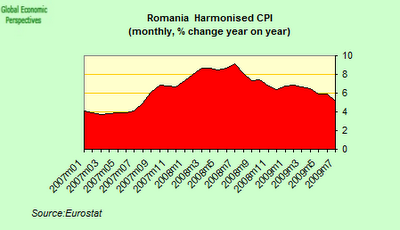

Romania's CPI rose by an annual 5.1% in July.

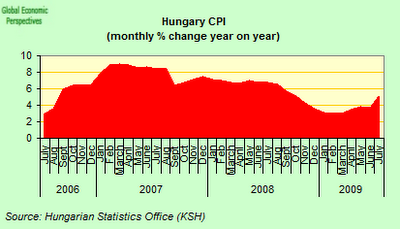

Poland's CPI rose by an annual 5.1% in July.

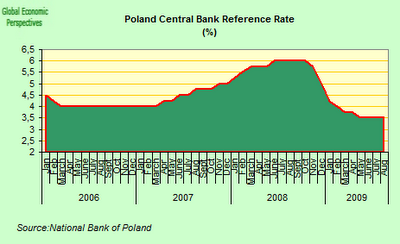

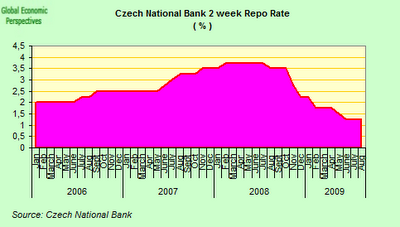

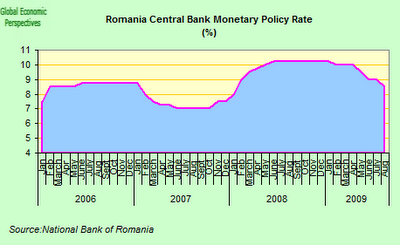

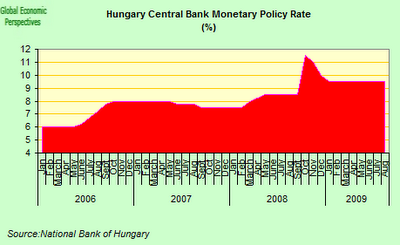

Interest Rates

The benchmark central bank interest rate in Poland is currently 3.5%.

The benchmark central bank interest rate in the Czech Republic is currently 1.25%.

The benchmark central bank interest rate in Romania is currently 8.5%.

The benchmark central bank interest rate in Hungary is currently 9.5%.

Above average volume seemed to have off-set price breakout, imho...

Simmonds commented on Wireless Age Communications' listing status in a peculiar manner, mentioning the Connecticut project(s) could create enough value to qualify Wireless Age Communications, Inc. for listing on a large exchange (emphasis on the American Stock Exchange, NASDAQ). It may be a "long-shot" goal, however, the key is that John Simmonds, Chairman and CEO, carries decades of experience and successful ventures that will translate into significant shareholder value with this company, imho.

I've always emphasized the sharing of overlooked trading and undervalued investment ideas...thank you for your support.

PDL BioPharma: High Dividend Biotech Stock.

by: Double Dividend Stocks August 17, 2009

When measured by its dividend, PDL BioPharma, (PDLI), stands out as one of the best stocks to buy in the biotech field. In fact, it's one of only four dividend paying stocks in this sub-sector.

Biotech is a group which isn't normally favored by income investors, due not only to its lack of high dividend stocks, but also due to its lack of many dividend stocks at all, not to mention its members' earnings and price roller coaster rides.

What makes PDLI different from the rest of the biotechs? They recently spun off their biotech business into a separate stock, Facet Biotech, (FACT), which leaves PDLI functioning as a royalty-collecting operation for its 7 "antibodies" patents, which it licenses to some very large firms, such as Wyeth (WYE), Elan (ELN), and Genentech (DNA).

These patents expire in 2013-2014, which some analysts say makes PDLI akin to a fixed-term 5-year investment. The future income streams from these royalties is over $1.3 billion, well in excess of the current market $1.01 billion market cap, and this estimate doesn't even account for any revenue growth.

PDLI recently upped its 2009 revenue guidance to the $310-$325 million range, and also increased its 2009 net income target by over 7%, ($200-$215 million); and its 2009 cash generation target by over 8%, ($285-$300 million).

PDLI closed at $8.47 Friday, 8/14/09, giving it a current dividend yield of 11.7%, which towers above the other 3 dividend stocks in the biotech group. The current mean analyst EPS estimate for 2009 is $1.21, and $1.33 for 2010, well above PDLI's $1.00/share annual dividend payout. The next semi-annual dividend payment will be $.50/share, payable to shareholders of record as of Sept. 17, 2009.

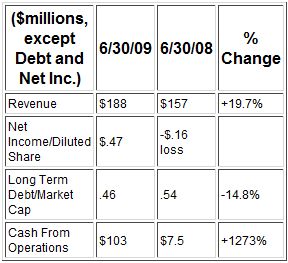

PDLI: 6 months ended 6/30/09 vs. 6/30/08

PDLI vs. Biotech Industry

Negative issues facing PDLI are:

A lawsuit brought by a PDLI customer, MedImmune, who, after paying PDLI royalties for over 10 years, is now suing to try to stop paying royalties. PDLI has settled similar lawsuits in the past, with minimal monetary consequences.

Two $250 convertible notes, the first due in 2012, and the second in 2023. The 2023 holders hold a put option which they may exercise at $8.08 in 2010, which would increase the share count by 25%, which may, in turn, cause the dividend yield to decrease.

In addition to having the highest dividend in biotech, PDLI also has a very low PEG ratio of .27, which supports the argument that investors are getting a strong, uncommon mix of a supportable high dividend, AND cheap growth.

Disclosure: Author is long shares of PDLI

Massive momentum...

Ted Karkas, CEO, The Quigley Corp.

http://finance.yahoo.com/news/Ted-Karkus-Named-CEO-of-The-prnews-1417534334.html?x=0&.v=1

Mr. Karkus has 25 years of Wall Street experience and since 1996 has been providing management consulting services to emerging-growth companies, including the structuring and raising of working capital as well as assisting management in developing operational, marketing and financial strategies. Mr. Karkus was instrumental in assisting the turnaround of ID Biomedical, an influenza vaccine manufacturer, which in 2005 was sold to GalaxoSmithKline for over $1.4 billion.

GlaxoSmithKline buys Vancouver's ID Biomedical for $1.7 billion.

Last Updated: Wednesday, September 7, 2005 | 11:50 AM ET

CBC News

British pharmaceutical giant GlaxoSmithKline PLC announced Wednesday that it is buying ID Biomedical Corp. for $1.7 billion. ID Biomedical is a vaccine company based in Vancouver. It will become a wholly owned subsidiary of GSK. GlaxoSmithKline will pay $35 per share, a 13 per cent premium over its Tuesday closing share price. The London-based company will also assume $77 million US of ID Biomedical's debt.

"GSK's proposed acquisition of ID Biomedical reflects its continuing commitment to address the public health need for increased supply of influenza vaccines," GlaxoSmithKline said in a release. "ID Biomedical is currently in the process of expanding and upgrading its Canadian manufacturing facilities, which are expected, beginning in 2007, to produce around 75 million doses per year of ID Biomedical's Fluviral egg-based influenza vaccine." The transaction is expected to close by the end of 2005 or early 2006.

http://www.cbc.ca/money/story/2005/09/07/glaxo_idbiomedical_20050907.html

Ted Karkas, CEO, The Quigley Corp.

http://finance.yahoo.com/news/Ted-Karkus-Named-CEO-of-The-prnews-1417534334.html?x=0&.v=1

Mr. Karkus has 25 years of Wall Street experience and since 1996 has been providing management consulting services to emerging-growth companies, including the structuring and raising of working capital as well as assisting management in developing operational, marketing and financial strategies. Mr. Karkus was instrumental in assisting the turnaround of ID Biomedical, an influenza vaccine manufacturer, which in 2005 was sold to GalaxoSmithKline for over $1.4 billion.

GlaxoSmithKline buys Vancouver's ID Biomedical for $1.7 billion.

Last Updated: Wednesday, September 7, 2005 | 11:50 AM ET

CBC News

British pharmaceutical giant GlaxoSmithKline PLC announced Wednesday that it is buying ID Biomedical Corp. for $1.7 billion. ID Biomedical is a vaccine company based in Vancouver. It will become a wholly owned subsidiary of GSK. GlaxoSmithKline will pay $35 per share, a 13 per cent premium over its Tuesday closing share price. The London-based company will also assume $77 million US of ID Biomedical's debt.

"GSK's proposed acquisition of ID Biomedical reflects its continuing commitment to address the public health need for increased supply of influenza vaccines," GlaxoSmithKline said in a release. "ID Biomedical is currently in the process of expanding and upgrading its Canadian manufacturing facilities, which are expected, beginning in 2007, to produce around 75 million doses per year of ID Biomedical's Fluviral egg-based influenza vaccine." The transaction is expected to close by the end of 2005 or early 2006.

http://www.cbc.ca/money/story/2005/09/07/glaxo_idbiomedical_20050907.html

How Will We Know When the Economy Is on Solid Footing?

by: Mark Thoma August 16, 2009

One question I am asked fairly often is how we will know when the economy turns the corner and we are on our way to a solid recovery. My answer is that we will be able to detect upticks in the data, though this may come with a bit of a lag, the important but harder task will be to understand why the data are showing improvement.

In order to be convinced that the economy is on solid footing and headed to better times, I will want to see several things. First, though not necessarily foremost, that banks are being recapitalized with private sector funds, and that this is happening without the aid of government guarantees or other such programs that encourage capital infusions (which is hard to determine while the government programs are in place). Second, I will want to see private sector non-residential investment improving, another sign that private sector funds are moving back into circulation. Presently, this hasn't even started heading back upward, though there are signs the decline is slowing.

And there are other important factors too, e.g. consumption rebounding (though not to pre-crisis debt sustained levels), stabilization in housing markets, and so on. The point is that a self-sustaining recovery will require that the private sector be the primary driver of new economic activity, and that is what I will be looking for.

Once the economy does start to recover, the hard but critical part will be to determine how much of the recovery is self-sustaining (as it will be if private sector funds are driving the activity), and how much is being driven by government stimulus programs. If the recovery is self-sustaining, and we are fairly certain of that, then we can begin to carefully wind down the government programs supporting the economy. But if the recovery is mostly due to government stimulus and there is little sign that the financial and real sectors are attracting robust levels of private sector funds, then pulling back on government programs could be disastrous and plunge the economy right back into recession. In fact, in such a case, we may need to provide even more stimulus to fully bridge the gap until the private sector can support the economy on its own.

So, in answer to the question, we will have a pretty good idea when the economy turns the corner, but it will take a while to determine why, and we cannot risk pulling back on government programs until we are sufficiently certain that the private sector can support normal economic activity without the government's help.

Microsoft's First Big Newspaper Partnership.

by: Ken Doctor August 17, 2009

On Monday, Advance Internet is announcing its new partnership with Microsoft (MSFT), an agreement that tells us a few things about the emerging, post-recession marketplace.

Advance Publications, Inc., isn't a well-known name outside the industry. Yet, it's one of the major media companies in the country, encompassing through Conde Nast more than 20 top-drawer magazines (The New Yorker, Wired, Vanity Fair, Gourmet+), the apparently immortal Sunday Parade, the 42-city strong American City Business Journals group and cable interests, in addition to its 30 newspapers. A very private company, Forbes ranks it 41st among private companies in the country, taking in more than $7.5 billion.

So when Advance partners its online newspaper ad business with Microsoft -- when it zags when many of its peers are zigging -- it's worth taking note. The new partnership covers all the Advance newspaper properties, from Newark and Jersey City to Cleveland to Michigan to Portland, Oregon, with many in between. Advance Internet operates as a division, separate from the company's newspapers, but is set up to leverage all those papers' content and sales forces.

The new partnership -- already launched in part -- parallels the Yahoo Newspaper Consortium, but differs from it in one important respect.

What's the same:

Advance Internet's own salespeople, and then the vanguard of its newspaper sales reps, will sell into the Microsoft Media Network, encompassing all the Microsoft sites. So, in essence, Advance will greatly expand what its sales teams can offer local advertisers. The idea and the centerpiece of the deal for Advance: the ability to offer local businesses additional marketing solutions, multiplying Advance's sales.

Advance Internet will use the capabilities of the Microsoft ad technologies -- among them behavioral targeting (BT) and re-messaging (following would-be customers as they move about the web)

The deal connects Advance and Microsoft directly on paid search products. Microsoft will deliver its text ads both through its paid search and contextual-reading ad products. Microsoft paid search ads will replace Google paid search on Advance sites.

The main difference: Advance Internet is maintaining its own ad platform, currently powered by 24/7 RealMedia, and integrating with Microsoft. Yahoo Newspaper Consortium members have fully adopted the Yahoo APT platform for their ad serving businesses, creating a closer, more exclusive relationship. "We wanted flexibility," Peter Weinberger, president of Advance Internet, tells me. Weinberger won't specify what parts of the deal involve exclusivity or the duration of the contract.

So, we can read the move in several ways:

First, Microsoft is really coming back -- to the newspaper world. After Sidewalk, after all kinds of attempted relationships, Microsoft -- soon to be half of the Google/Microsoft search duopoly -- is once again seeing the benefits of the newspaper company local connection. Advance Internet is the first major local news company reselling display ads into the Microsoft Media Network, Peter MacDonald, who is Microsoft's PubCenter Director of Business Development, Advertiser and Publisher solutions, told me. Haven't heard of the Microsoft Media Network? It was formed in February, rolled up from various Microsoft businesses, well-described here by ClickZ. Among the other big media companies named as collaborating on the new underlying PubCenter platform are IAC, Dow Jones Online, The New York Times Co., Time Inc., and Viacom.

With the Advance deal, it gets good local sales potential -- those feet-on-the-street that are the envy of companies that are cubicle-bound and technology-centered. Recall that in the Microsoft/Yahoo deal, Microsoft's Bing and paid search businesses will power not only Yahoo, but apparently all the newspapers sites in the consortium. That will mean that the majority of newspaper sites (with the big exceptions of Gannett, Tribune, the New York Times and the Washington Post, among others) will see critical parts of their business powered by Microsoft.

We all see that the shape of the new battle for local ad dollars. Face it, online newspaper growth has slowed dramatically. We're seeing reading patterns harden in the marketplace, and it's leaving newspaper sites underwhelmed. Yes, they can claim as Advance does -- "according to Media Audit, five of our sites rank in the top 10 of newspaper affiliated sites based on local penetration of adults 18+" -- to be strong locally. But time on site across the news industry is paltry, less than 12 minutes a month in most cities, according to Nielsen data. That means they must sell much more than tired old banners on their own sites. The solutions, here and in the Yahoo consortium: 1) sell more products, in addition to display; and 2) sell Other People's Inventory and networks; in Advance's case, Microsoft's.

As I've noted, this new math is compelling -- many smaller advertisers never could afford print and offer a new business, as the old business has permanently thinned.

Further, this is a market newspaper companies must win if they have any hope of maintaining their already-downsized newsrooms. They're not winning it now. According to Borrell Associates, roughly half of the $14 billion local online ad market is going to the pure plays -- Google, Yahoo, Microsoft, AOL and smaller sites without legacy media businesses. Only a quarter of it is going to newspaper companies. Newspapers' strength is in non-targeted display advertising; they're minor players in the fastest-growing online ad segments of paid search and direct marketing.

If Advance and other newspaper chains see the local opportunity, they aren't alone. Yellow Pages companies, with their own veteran feet, see it, as witnessed by the recent ATT/Yahoo tie-up. (Content Bridges" "5000 New Competitors Just Landed in News Markets." Broadcasters see the new markets opening as well -- all those small businesses that used to be "too small to sell", businesses that have gotten a taste of self-service keyword advertising, but would like some help in putting together better, smarter campaigns. Both YP and broadcast companies are part of the Microsoft reseller program that Advance just joined, in fact. Conversely, Weinberger notes that with the new programs "we can go after broadcast dollars."

It's a coming free-for-all.

So it's a race, a "consultative" sales race. As I talk to newspaper publishers, broadcast execs, YP honchos, all will tell war stories of how hard it is to transform their legacy sales forces. How do you re-train "order-takers" for the new world order of selling targeting, networks and re-messaging? It's a race of turtles to some degree, but it is to those competing turtles that the Yahoo and Microsoft have turned, as ironic as that is in lots of ways.

The new world order of hyper-targeted, sold and serviced both by (self-serve) computers and flexible, innovative human salespeople is certainly not here yet. Whoever gets there first stands to build sizable new businesses. For those of us who care about the news world, we'd hope that these new business builders are somehow connected to local news enterprises, but there is no reason they need to be. Yes, the buy-our-site-plus approach makes sense, and may offer initial advantage, but ultimately, whoever can bring results by best harnessing the diverse marketing environment wins.

What do we make of Advance's zag? Well, as the lone newspaper play for Microsoft, it stands to get some attention, which may help in a business that requires really good execution all around.

Microsoft is though the #3 player in many online ad categories, and that might mean lower pricing, and maybe lower yield, at least for now. In addition, it's always been challenged by ad-based business execution, itself, and still seems plagued by an alphabet soup of names for its ad-related product set. Currently, Microsoft's adCenter counts 90,000 advertisers in the US and elsewhere.

What makes sense to me, conceptually at least, is that Advance is trying to remain at the solid center of its business. Here, it is leveraging Microsoft technology and network assets, but is not bound to its platform.

In a related local sales expansion that began in spring, Advance has been working with four different SEM (search engine marketing) re-sellers, testing out which (WebVisible, Yodle, among them) may optimize results and pricing best. "Paid search is the inroads," says Peter Weinberger. "It's a huge product for us."

Selling local merchants -- that consultative selling, again -- SEM services as well as direct advertising enlarges local media's role in the marketplace. Here, too, numerous newspaper, broadcast and YP companies are re-selling SEM services as well, so the competition grows and becomes more head-to-head.

The Advance principle here -- test partners, partner strongly, maintain the flexibility to change partners -- makes sense in what will continue to be a hyper-changing landscape. As we move into 2010, and look at (public) company earnings, we'll be able to separate out the companies that are truly transforming themselves into digital content-and-sales leaders from the also-rans.

Consider the following...http://investorshub.advfn.com/boards/read_msg.aspx?message_id=40576309

QGLY ~ seeking confirmation to a potential reversal with a strong trading session.

QGLY ~ seeking confirmation to a potential reversal with a strong trading session.

This should be another strong week for Wireless Age Communications, Inc. The upcoming name change and pending Connecticut project announcement, which would create enormous shareholder value, should generate significant interest amongst the investing community imho.

RMBS ~ video chart 08.14.09

Thursday's trading session was the confirmation to a reversal the price was seeking. Breaking past short-term and critical resistance during Friday's trading session, Rambus, Inc. conveyed a bullish price/volume correlation. My thoughts and analysis in video format follow.

Link to video chart: http://timelesswealth.net/rmbsupdate.html

Video chart 08.14.09

Thursday's trading session was the confirmation to a reversal the price was seeking. Breaking past short-term and critical resistance during Friday's trading session, Rambus, Inc. conveyed a bullish price/volume correlation. My thoughts and analysis in video format follow.

Link to video chart: http://timelesswealth.net/rmbsupdate.html

RMBS ~ video chart 08.14.09

Thursday's trading session was the confirmation to a reversal the price was seeking. Breaking past short-term and critical resistance during Friday's trading session, Rambus, Inc. conveyed a bullish price/volume correlation. My thoughts and analysis in video format follow.

Link to video chart: http://timelesswealth.net/rmbsupdate.html

That's correct. I will do my best to make a few adjustments with the audio in the future...

WLSA ~ Power plants exerting heat dates back to an earlier topic of discussion: accommodating greenhouses and vegetation along side the plasma gasification plant. The idea has been and continues to evolve around efficiency.

A glance into the past: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=40057894

Sunbay eyes new property for Port Hope gasification power plant

Energy-from-waste facility still going through approval process

Jun 25, 2009 - 05:10 PM

By Jennifer O'Meara

PORT HOPE -- Sunbay Energy Corporation is eyeing a new site for the proposed energy-from-waste gasification power plant in Ward 2.

The 124-acre site is east of Wesleyville Road, and north of Mail Road, just south of Hwy. 401.

"We feel that is an ideal site - more than we could have expected," Sunbay Energy Corporation President Jordan Oxley told Port Hope council, at its June 23 committee of the whole meeting.

When Sunbay unveiled its plans in April 2008, it planned to build the gasification power plant on a nearby 23-acre site west of Wesleyville Road. The new site is directly off Hwy. 401.

"We thought the other one was great. I can't imagine we'll find one better than this," said Mr. Oxley.

The main facility will be built on the new site and a 43-acre property further south on Wesleyville Road will house greenhouses to take excess heat from the gasification plant.

"That would mean more jobs and a bit more economic activity out there," said Mr. Oxley.

The site is already zoned agricultural and after a preliminary meeting with municipal staff, Mr. Oxley said a greenhouse could be allowed under that zoning.

Around 250 tradespeople are expected to hired for the 18-month construction of the facility, with 40 to 50 jobs created at the plant. Another dozen people could be employed at a visitors centre for officials considering partnering with Sunbay for future gasification power plants in other parts of North America.

The gasification plant will take waste and use plasma gasification at high temperatures to produce a synthetic gas which is then used to produce electricity.

The waste will be recycling and textile residuals from Turtle Island Recycling, one of the largest waste haulers in the Greater Toronto Area. An analysis of the material shows it's ideal for high power output and low emissions.

When up and running, the gasification power plant could produce enough electricity to power 20,000 homes.

Council accepted the new information with only one question - how long until the building starts? Mr. Oxley said he expects the approval process with the provincial and municipal governments to take from six months to a year. Construction could start within a year to 18 months and the plant could open in two years.

"We're probably the ones that want it to go the quickest," said Mr. Oxley. "We're doing everything we can."

http://www.northumberlandnews.com/article/129526

Power plants exerting heat dates back to an earlier topic of discussion: accommodating greenhouses and vegetation along side the plasma gasification plant. The idea has been and continues to evolve around efficiency.

A glance into the past: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=40057894

Sunbay eyes new property for Port Hope gasification power plant

Energy-from-waste facility still going through approval process

Jun 25, 2009 - 05:10 PM

By Jennifer O'Meara

PORT HOPE -- Sunbay Energy Corporation is eyeing a new site for the proposed energy-from-waste gasification power plant in Ward 2.

The 124-acre site is east of Wesleyville Road, and north of Mail Road, just south of Hwy. 401.

"We feel that is an ideal site - more than we could have expected," Sunbay Energy Corporation President Jordan Oxley told Port Hope council, at its June 23 committee of the whole meeting.

When Sunbay unveiled its plans in April 2008, it planned to build the gasification power plant on a nearby 23-acre site west of Wesleyville Road. The new site is directly off Hwy. 401.

"We thought the other one was great. I can't imagine we'll find one better than this," said Mr. Oxley.

The main facility will be built on the new site and a 43-acre property further south on Wesleyville Road will house greenhouses to take excess heat from the gasification plant.

"That would mean more jobs and a bit more economic activity out there," said Mr. Oxley.

The site is already zoned agricultural and after a preliminary meeting with municipal staff, Mr. Oxley said a greenhouse could be allowed under that zoning.

Around 250 tradespeople are expected to hired for the 18-month construction of the facility, with 40 to 50 jobs created at the plant. Another dozen people could be employed at a visitors centre for officials considering partnering with Sunbay for future gasification power plants in other parts of North America.

The gasification plant will take waste and use plasma gasification at high temperatures to produce a synthetic gas which is then used to produce electricity.

The waste will be recycling and textile residuals from Turtle Island Recycling, one of the largest waste haulers in the Greater Toronto Area. An analysis of the material shows it's ideal for high power output and low emissions.

When up and running, the gasification power plant could produce enough electricity to power 20,000 homes.

Council accepted the new information with only one question - how long until the building starts? Mr. Oxley said he expects the approval process with the provincial and municipal governments to take from six months to a year. Construction could start within a year to 18 months and the plant could open in two years.

"We're probably the ones that want it to go the quickest," said Mr. Oxley. "We're doing everything we can."

http://www.northumberlandnews.com/article/129526

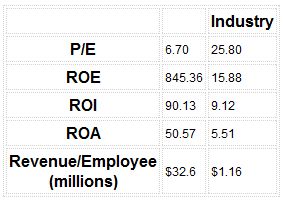

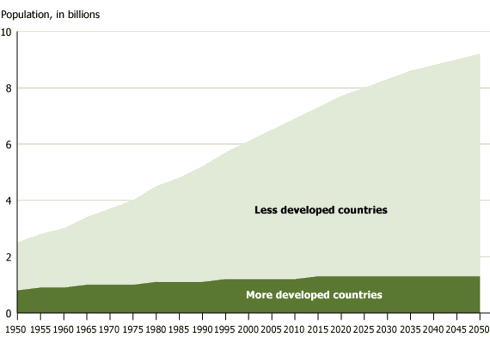

WLSA ~ Global Populations to Accelerate Demands for Fossil Fuels, Renewable Energy.

by: James Rickman August 10, 2009

Today, the United States is addicted to oil consuming over 22% annually of the world’s total oil production or 19 million barrels per day. Yet the U.S. maintains only 4.5% of the world’s population, a minute fraction in comparison.

The sources of energy can be non-renewable fossil fuels including oil, coal, natural gas or renewable energy alternatives such as wind and hydro turbines, PV solar cells, and new bio-fuels such as algae, jatropha or palm oil. Regardless of where energy is derived it always equals economic power for the increasing populations worldwide.

By 2025, the world will add another 1.4 billion people creating an energy hungry workforce of the nearly 700 million new middle class people. China alone represents 350 million with India adding 100 million to the total emerging middle class population. The rapid growth will almost triple worldwide energy demands within the next 15 years.

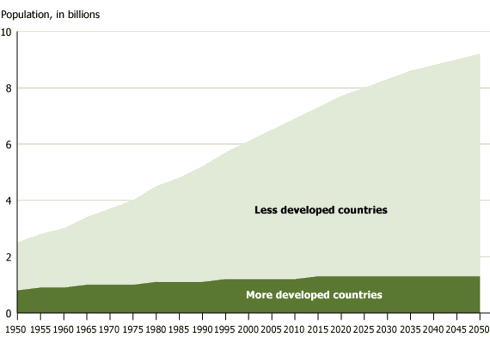

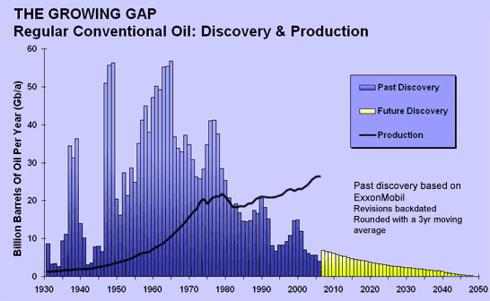

In order to clearly understand the urgency behind the “peak oil” issue it is useful to examine that despite trillions of dollars in debt, currently the United States still imports two-thirds of its oil at a cost that has reached over $400 billion per year. Much of it is from politically unstable regions including South America, Africa and the Middle East; countries that control 55% of world oil supplies.

Let’s also consider the fact that the majority of oil wells today have reached their “peak production”. Already we find examples, as last year Mexican oil producer Cantarell’s production fell about 9.6% every quarter. In the third-quarter, Cantarell produced less than 1 million barrels daily for the first time. As recently as 2005, the Gulf of Mexico field has been producing more than 2 million barrels per day. This declining production due to aging oil wells adds economic stress resulting in less revenue. This threatened 40% of the Mexican government budget. The implications for the U.S. are potentially significant. Mexico once provided on average 1.2 million barrels of oil per day, making it the third-biggest supplier after Canada Athabasca Oil Sands and Saudi Arabia.

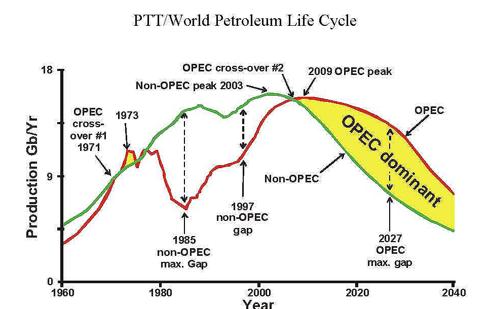

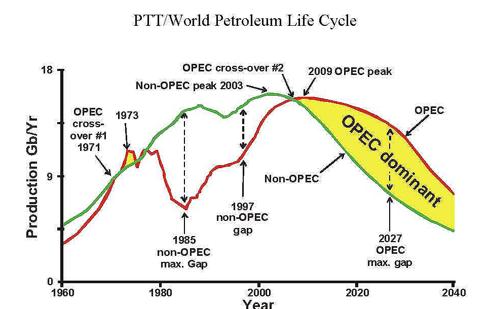

It is relatively straight forward to calculate that from the existing aging oil well data the world petroleum production life cycle by 2011 will have reach “peak oil” with production declining in the following years. Therefore, a steady decline in oil output worldwide will be unable to cost effectively meet the exploding middle class population needs driving up the overall price of energy and commodities.

For example between 2002 to 2035 the major oil producing countries will have seen output declines as follows; Canada (-62%), Mexico (-92%), USA (-90%), Brazil (-64%), Venezuela (-46%), Former Soviet Union (-70%), Iran (-62%), Iraq (-45%), Kuwait (-44%), Oman (-81%), Qatar (-82%), Saudi Arabia (-48%), UAE (-65%), Nigeria (-69%), Libya (-78%), China (-63%) and Indonesia (-71%).

Where do we find enough resources to meet the world’s energy demands?

The answer lies in developing a mix of renewable energy sources including wind, solar, hydro and bio-fuels that also complements sensitive global environmental warming issues requiring less carbon based, cleaner sustainable sources. The challenge now is to manufacture and deliver alternative energy via efficient grid networks or infrastructures at cost competitive prices in comparison with oil, coal, or gas non-renewable sources.

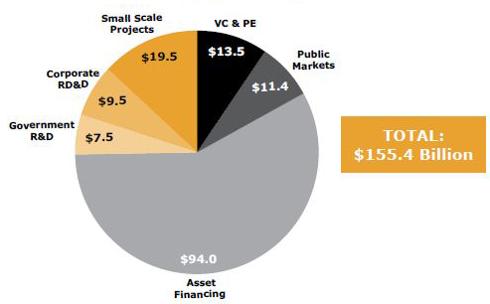

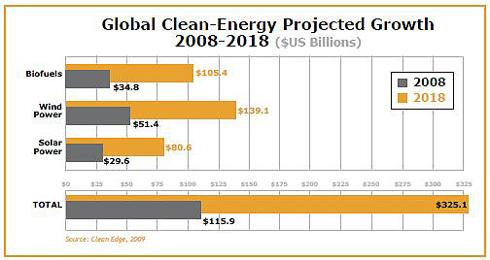

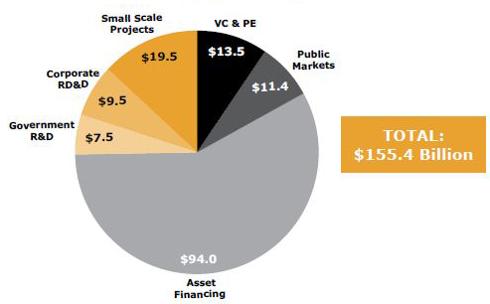

Over the past 12 months, the ability to further develop these clean renewable technologies has attracted over $155 billion of R&D investment capital worldwide. The clean energy market has seen annual growth between 20% - 35% within niche sectors. Particularly wind and hydro turbines, PV solar cell and new bio-fuels such as African palm oil and algae are receiving significant and increasing capital.

For example, China has a $2 trillion surplus and has already launched its stimulus plans to spend $558 billion including a large portion of money targeted in renewable-energy projects. The Chinese goal is 100 GW of wind power by 2020.

China’s wind capacity is expected to grow 200% by 2012. That’s more than twice the estimates for the United States. China’s year-to-year growth average is already over 30% for the wind turbine energy sector. And to top it all off, China is working with German and U.S. manufacturers on 34 new wind farms planned between now and 2014, several are already under construction.

By 2012, China’s solar power capacity is set to increase by 255%, thus achieving 37% annualized growth average. China is already building a 100-megawatt solar power station, the world’s largest. China, U.S. and Germany are now the global leaders in thin photovoltaic solar cell manufacturing. Since 2006, China alone has already spent over $180 billion dollars to develop renewable energy sources.

What’s more is that China’s automobile ownership population is set to grow within 15 years by more than 350 million with India at 100 million new vehicles demanding greater energy. Both countries are already investing billions of dollars in hybrid electric vehicles manufacturing, smart grid networks and battery technologies.

Think about it. The world currently consumes about 85 million barrels of oil per day. By 2025, global energy demand is projected to reach the equivalent of approximately 122 million barrels a day while oil production declines and the need for food supply increases.

Recently, we have seen the acceleration of large cap traditional oil energy companies and governments investing billions of dollars in promising joint bio-fuel manufacturing ventures within sectors such as African palm oil, algae and jatropha much of this capital ending up in emerging countries. Many large cap companies are also expanding their portfolios within the solar manufacturing sector.

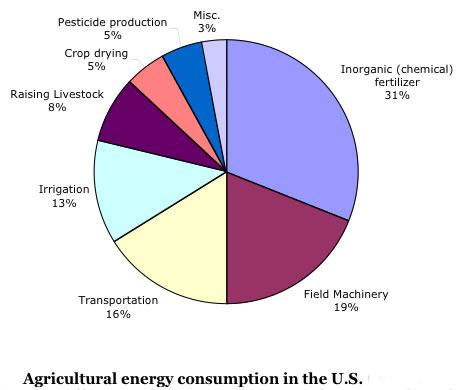

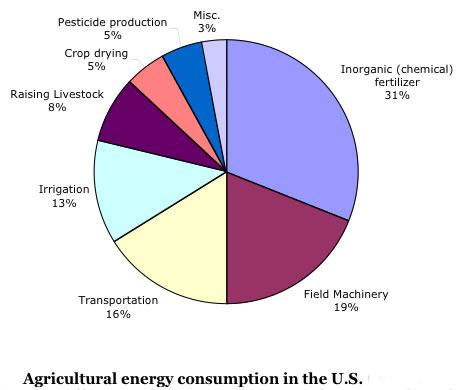

We also find that energy and petrochemicals used for agriculture growing rapidly. Food supply to the increasing population has significantly accelerated its impact on limited non-renewable resources. A huge sucking sound rapidly demanding more energy can already be heard from emerging middle class markets such as Brazil, China, India, Indonesia, Korea, Former Soviet Union, Cambodia, Argentina, Singapore, and Malaysia. These emerging countries coupled with U.S. markets all represent significant growth opportunities within niche alternative energy sectors for both large and small cap companies.

Clearly this research indicates high demand keeping the price of oil and other fossil fuels at a premium. It is also becoming a key driver in the global shift towards increasingly cost competitive alternative energy sources. The combination of increasing global energy demands, coupled with declining peak oil supplies, and emerging industrialized pressures will continue to force prices higher and, in turn, continue to accelerate the development of cost competitive alternative energy sources. As many of the traditional large cap energy companies invest heavily in emerging clean technologies working in partnership with innovative smaller, thinly traded companies; inevitably we will see volatility as the industry shakes out over the next years representing superior growth potential worldwide.

Global Populations to Accelerate Demands for Fossil Fuels, Renewable Energy.

by: James Rickman August 10, 2009

Today, the United States is addicted to oil consuming over 22% annually of the world’s total oil production or 19 million barrels per day. Yet the U.S. maintains only 4.5% of the world’s population, a minute fraction in comparison.

The sources of energy can be non-renewable fossil fuels including oil, coal, natural gas or renewable energy alternatives such as wind and hydro turbines, PV solar cells, and new bio-fuels such as algae, jatropha or palm oil. Regardless of where energy is derived it always equals economic power for the increasing populations worldwide.

By 2025, the world will add another 1.4 billion people creating an energy hungry workforce of the nearly 700 million new middle class people. China alone represents 350 million with India adding 100 million to the total emerging middle class population. The rapid growth will almost triple worldwide energy demands within the next 15 years.

In order to clearly understand the urgency behind the “peak oil” issue it is useful to examine that despite trillions of dollars in debt, currently the United States still imports two-thirds of its oil at a cost that has reached over $400 billion per year. Much of it is from politically unstable regions including South America, Africa and the Middle East; countries that control 55% of world oil supplies.

Let’s also consider the fact that the majority of oil wells today have reached their “peak production”. Already we find examples, as last year Mexican oil producer Cantarell’s production fell about 9.6% every quarter. In the third-quarter, Cantarell produced less than 1 million barrels daily for the first time. As recently as 2005, the Gulf of Mexico field has been producing more than 2 million barrels per day. This declining production due to aging oil wells adds economic stress resulting in less revenue. This threatened 40% of the Mexican government budget. The implications for the U.S. are potentially significant. Mexico once provided on average 1.2 million barrels of oil per day, making it the third-biggest supplier after Canada Athabasca Oil Sands and Saudi Arabia.

It is relatively straight forward to calculate that from the existing aging oil well data the world petroleum production life cycle by 2011 will have reach “peak oil” with production declining in the following years. Therefore, a steady decline in oil output worldwide will be unable to cost effectively meet the exploding middle class population needs driving up the overall price of energy and commodities.

For example between 2002 to 2035 the major oil producing countries will have seen output declines as follows; Canada (-62%), Mexico (-92%), USA (-90%), Brazil (-64%), Venezuela (-46%), Former Soviet Union (-70%), Iran (-62%), Iraq (-45%), Kuwait (-44%), Oman (-81%), Qatar (-82%), Saudi Arabia (-48%), UAE (-65%), Nigeria (-69%), Libya (-78%), China (-63%) and Indonesia (-71%).

Where do we find enough resources to meet the world’s energy demands?

The answer lies in developing a mix of renewable energy sources including wind, solar, hydro and bio-fuels that also complements sensitive global environmental warming issues requiring less carbon based, cleaner sustainable sources. The challenge now is to manufacture and deliver alternative energy via efficient grid networks or infrastructures at cost competitive prices in comparison with oil, coal, or gas non-renewable sources.

Over the past 12 months, the ability to further develop these clean renewable technologies has attracted over $155 billion of R&D investment capital worldwide. The clean energy market has seen annual growth between 20% - 35% within niche sectors. Particularly wind and hydro turbines, PV solar cell and new bio-fuels such as African palm oil and algae are receiving significant and increasing capital.

For example, China has a $2 trillion surplus and has already launched its stimulus plans to spend $558 billion including a large portion of money targeted in renewable-energy projects. The Chinese goal is 100 GW of wind power by 2020.

China’s wind capacity is expected to grow 200% by 2012. That’s more than twice the estimates for the United States. China’s year-to-year growth average is already over 30% for the wind turbine energy sector. And to top it all off, China is working with German and U.S. manufacturers on 34 new wind farms planned between now and 2014, several are already under construction.

By 2012, China’s solar power capacity is set to increase by 255%, thus achieving 37% annualized growth average. China is already building a 100-megawatt solar power station, the world’s largest. China, U.S. and Germany are now the global leaders in thin photovoltaic solar cell manufacturing. Since 2006, China alone has already spent over $180 billion dollars to develop renewable energy sources.

What’s more is that China’s automobile ownership population is set to grow within 15 years by more than 350 million with India at 100 million new vehicles demanding greater energy. Both countries are already investing billions of dollars in hybrid electric vehicles manufacturing, smart grid networks and battery technologies.

Think about it. The world currently consumes about 85 million barrels of oil per day. By 2025, global energy demand is projected to reach the equivalent of approximately 122 million barrels a day while oil production declines and the need for food supply increases.

Recently, we have seen the acceleration of large cap traditional oil energy companies and governments investing billions of dollars in promising joint bio-fuel manufacturing ventures within sectors such as African palm oil, algae and jatropha much of this capital ending up in emerging countries. Many large cap companies are also expanding their portfolios within the solar manufacturing sector.

We also find that energy and petrochemicals used for agriculture growing rapidly. Food supply to the increasing population has significantly accelerated its impact on limited non-renewable resources. A huge sucking sound rapidly demanding more energy can already be heard from emerging middle class markets such as Brazil, China, India, Indonesia, Korea, Former Soviet Union, Cambodia, Argentina, Singapore, and Malaysia. These emerging countries coupled with U.S. markets all represent significant growth opportunities within niche alternative energy sectors for both large and small cap companies.

Clearly this research indicates high demand keeping the price of oil and other fossil fuels at a premium. It is also becoming a key driver in the global shift towards increasingly cost competitive alternative energy sources. The combination of increasing global energy demands, coupled with declining peak oil supplies, and emerging industrialized pressures will continue to force prices higher and, in turn, continue to accelerate the development of cost competitive alternative energy sources. As many of the traditional large cap energy companies invest heavily in emerging clean technologies working in partnership with innovative smaller, thinly traded companies; inevitably we will see volatility as the industry shakes out over the next years representing superior growth potential worldwide.

WLSA ~ Director, Approvals and Regulatory Affairs, Stein Lal, Sunbay Energy Corp.

http://www.sunbayenergy.com/about_us_management.php

Lal, former Deputy Minister of the Environment for Ontario, occupies a fundamental role ensuring grants and approvals are received in a timely manner. The development of renewable energy solutions is extensively encouraged by the recent Green Energy Act of Ontario as well as numerous as other initiatives across North America.

http://www.greenenergyact.ca/Page.asp?PageID=924&ContentID=1114

Stein Lal is documented in numerous sources sharing a valued opinion on a study, conference, or involving himself in a beneficial organization.

The Associations of Municipalities of Ontario appointed Stein Lal to the Waste Diversion Organization. Lal promptly translates the experience to communications between Sunbay Energy Corp., and Turtle Island Recycling, a principle supplier of feedstock. His understanding of the waste management industry is key to partnerships continent-wide.

Associations of Municipalities of Ontario.

December 1, 1999 - FYI 99/015

AMO Confirms Appointees to the Waste Diversion Organization

Issue: The Board of Directors for the New Waste Diversion Organization (WDO) will undertake program design for waste diversion initiatives for the next year and prepare a longer term plan.

Facts:

AMO, along with the Ministry of the Environment, the Recycling Council of Ontario and various industry groups signed a Memorandum of Understanding (MOU) that establishes and sets out the structure and function of the new WDO.

AMO's representatives to the Board of Directors of the WDO are:

Terry Cassidy, Councillor, City of Quinte West, and Chair, Centre and South Hastings Waste Services Board

Joan King, Councillor, City of Toronto, AMO Vice-President, and Chair, AMO's Recycling Task Force

John Jardine, Commissioner of Environmental Services and City Engineer, City of London with corporate responsibility for waste diversion services and involvement in the London-Middlesex Waste Management Planning Study

Peter Partington, Councillor, Region of Niagara, AMO Board of Directors, and Chair, Niagara Region Corporate and Financial Service Committee.

Each municipal representative offers the necessary knowledge and skills to effectively represent the municipal sector, and they will be supported by a technical advisory group that will draw upon municipal staff experts from across the Province.

Other members of the WDO Board of Directors include:

John Hanson, Executive Director, Recycling Council of Ontario

Andy Brandt, Chair and CEO, Liquor Control Board of Ontario

Ron Hoare, VP Corporate Development, Para Paints

John Honderich, Publisher, Toronto Star Newspapers Ltd

Anthony Eames, President and CEO, Coca-Cola Ltd.

Bill McEwan, President and Chief Merchandising Officer, The Great Atlantic and Pacific Company of Canada

William Apted, President, Crown Cork and Seal Canada Inc.

Peter Elwood, President, Lipton

Stein Lal, Deputy Minister, Ministry of the Environment (non-voting status)

Corporations Supporting Recycling (CSR) is providing the administrative support for the WDO during the one-year term of the organization. CSR's address is 26 Wellington Street East, Suite 601, Toronto, M5E 1S2. http://www.amo.on.ca/AM/Template.cfm?Section=19995&TEMPLATE=/CM/ContentDisplay.cfm&CONTENTID=40663

In 2001, Stein Lal retired as Deputy Minister of the Environment, after having served for over a decade. His professional background is in law.

Communications Forum

Perspectives on the Environment

March 28 2002

STEIN LAL, EX-DM MOE, ON GOVERNMENT

Stien Lal joined the public service of Ontario in 1988 as the Deputy Minister in the Ministry of the Solicitor General and since then has held that position in five other ministries retiring from the public service 2001 as the Deputy Minister of the Ministry of the Environment. During this period, Ontario under went unprecedented political change. As a result, Stien Lal has served in the capacity of Deputy Minister under all three governments. He now heads a consulting practice at the national and international level. Stien is a lawyer by profession, having been first called to the bar in England and subsequently in five other jurisdictions in Canada and abroad. He was appointed a Queen's Counsel in 1983.

Notes

Having worked in six ministries in Ontario, he has had the unique opportunity of seeing and appreciating some of the subtle and sometimes not so subtle differences between them. The OPS has its own culture and each Ministry has its own culture driven sometimes by the nature of their business, sometimes by their mandate or whether they are a regulatory or a non-regulatory Ministry...continued.

http://sustainabilitynetwork.ca/Events/Breakfasts/03282002A.htm

Lal involved himself in a environmental research group promoting education of the subject.

Pollution Probe is a Canadian charitable environmental organization that:

Defines environmental problems through research;

Promotes understanding through education; and,

Presses for practical solutions through advocacy.

Pollution Probe is dedicated to achieving positive and tangible environmental change.

The McLal Group Inc.

Stein Lal

Email: stindarlal@rogers.com

http://www.pollutionprobe.org/managing.shared.waters/organizationlist.pdf

National Environmental Law Section: A Return to Environmental Regulation? Another publication that lists Lal's involvement in Environmental movements.

National Environmental Law Section: A Return to Environmental Regulation?

During Deputy Minister Stein Lal’s visit to the

Ontario Section Executive meeting, we received

welcome assurances, particularly regarding the

improvement of lines of communication. One

of our Branch’s goals will be to pursue efforts to

improve communication. We are once again

hopeful that we can finally address this

longstanding concern on the part of the

environmental Bar in Ontario. http://dev.cba.org/cba/Sections/ELS/Eco_Bulletin/ecobul_99-12.pdf

The Ontario Public Service Employees Union facilitated a study in which Stein Lal took part in. The submission was titled, "Public Interests in Water Facilities Operations".

A Submission to the Walkerton Inquiry: Public Interests in Water Facilities Operations.

July 2001

25. Currently, the MOU names various senior public service employees as the Board Members though

there is no need, either in legislation or Management Board Directives, that the Board be drawn

exclusively from the public service. As of March 1, 2000, the Board consisted of:

John Fleming, Deputy Minister, Ministry of Correctional Services;

Stein Lal, Deputy Minister, Ministry of the Environment;

Donald Obonsawin, Deputy Minister, Ministry of Tourism;

Tony Salerno, Vice-Chair and CEO, Ontario Financing Authority;

Ron Vrancart, Deputy Minister, Ministry of Natural Resources. https://ozone.scholarsportal.info/bitstream/1873/8308/1/10295805.pdf

Sunbay Speakers Series is a program that Sunbay Energy Corp. put together in the discussion and introduction of their plasma gasification project in Port Hope, Ontario. Several newspapers documented Stein Lal as a guest speaker of this program.

Sunbay Energy presented guest speaker Stein Lal, former Deputy Minister of the Environment, in their first of a series at their Info centre on Walton St. Mr. Lal hosted a discussion of The Kyoto Protocol, Carbon Emissions and where Ontario fits in. Jordan Oxley, President of Sunbay Energy, completed the evening with a Q & A session and an update on project plans for the Port Hope Gasification Plant. A very informative evening! For more info drop into the Sunbay Info Ctr at 35 Walton St., Port Hope or call 905-885-0050.

http://www.snapnorthumberland.com/?option=com_sngevents&id%5b%5d=78666

Mr. Stein Lal, former Deputy Minister of the Environment reserves an important role in guiding Sunbay Energy Corp., along the path to success. His thoroughness in law and connections to decisive parties in government will be advantageous to the development of Sunbay's projects as renewable energy solutions.

Wireless Age to Acquire Interest in Renewable Energy Projects.

TORONTO, ONTARIO--(Marketwire - Aug. 11, 2009) - Wireless Age Communications, Inc. (PINK SHEETS:WLSA), ("Wireless Age" or "the Company") announced today that it has entered into a definitive agreement with PowerPlay Energy Corp. ("PowerPlay") and Sunbay Energy Corp. ("Sunbay") through a wholly owned subsidiary of the Company to acquire a 60% interest in a newly formed entity that will hold all of the assets and liabilities of a development stage plasma gasification project proposed to be built in Port Hope, Ontario, Canada and the exclusive rights to participate in plasma gasification projects in the United States of America.

Through its subsidiary Sunbay, PowerPlay is a renewable energy developer specializing in gasification projects, and possesses the intellectual property rights, contracts and licenses necessary for the development of plasma gasification and renewable energy projects. Additionally, Sunbay has entered into an exclusive developer agreement with a world-renowned original equipment manufacturer of plasma torches, as well as a designer and operator of plasma gasification facilities.

Formal closing is subject to various conditions precedent, including drafting certain ancillary legal agreements, regulatory and board of directors' approval.

Pursuant to the agreement the Company has agreed to pay the following consideration: two million five hundred thousand (2,500,000) Newlook Industries Corp. ("Newlook") common shares, one hundred sixty seven thousand US dollars (US$167,000) and a one million two hundred fifty thousand Canadian dollar (CAD$1,250,000) senior secured debenture. The debenture pays interest at 8% per annum, will mature one year from the date of closing and may be fully repaid by the Company at any time with the delivery of five million (5,000,000) Newlook common shares. The debenture will be secured by a general security agreement over all of the assets of the Company including the intellectual property rights of the Port Hope project and the Company's interest in future USA projects. As part of the transaction the Company intends to complete a name change to better reflect the future direction of the Company.

The Company confirms that there is no relationship in this transaction involving any non-arms length party and Wireless Age, its insiders and PowerPlay or Sunbay other than a director of a Newlook insider is also a director and officer of PowerPlay and Sunbay.

Newlook is the Company's controlling shareholder currently holding an ownership percentage of approximately 55%.

For more information, please contact:

Wireless Age Communications, Inc.

John G. Simmonds

Chairman & CEO

905-833-2753 ext. 223

Source: http://tinyurl.com/kt4o79

Wireless Age Communications, Inc. (WLSA) has set a important milestone: they have signed a definitive agreement and ensured shareholder value though non-dilutive terms. The letter of intent was a non-binding contract, whereas the definitive agreement they announced this afternoon governs the terms and conditions they have reached in the acquisition.

WLSA ~ Sunbay Energy Corp. President, Jordan Oxley.

http://www.sunbayenergy.com/about_us_management.php

Oxley is an intellectual, with a background in finance, economics, and philosophy. For a lengthy period of time, his occupation was in the banking sector as a venture capitalist, collaborating with seasoned executives. He began his career working closely with the Governor of the Bank of Canada.

Jordan began his career working closely with the Governor of the Bank of Canada helping to modernize the communications of that institution. He continued on to senior executive positions with technology, publishing, and consumer product companies, alongside intense pursuits as a venture capitalist and entrepreneur. A pioneer of high-tech socio-political messaging, Jordan has spoken at the annual conference of the Public Affairs Association of Canada and in many other forums.

Jordan has held the position of Fellow, International Institute for Public Ethics; Counselor, Canadian Institute of International Affairs; Treasurer, Dialogue Canada; Treasurer and Official Spokesperson, Unity Link / Unilien Society; Riding Treasurer, Liberal Party of Canada; Vice President, Association for Non-Resident Voting Rights; and has been an active member of Transparency International and the Mensa Society.

He holds degrees in Philosophy, Economics, and International Relations, studying at Queen's University, the University of Edinburgh, and the London School of Economics.

http://www.ekartingnews.com/news_info.php?n=3313

Oxley’s experience in the business and financial sector is well documented in numerous sources. Previously occupying a position at Bank of Canada, he helped modernize the communications of that institution.

http://www.bankofcanada.ca/en/res/wp/2000/participants2000.pdf

Oxley is also credited with numerous institutional publications on economics.

http://mil.sagepub.com/cgi/content/citation/27/1/158

http://www.thefreelibrary.com/Insuring+Canada's+exports:+the+case+for+reform+at+export+development...-a0172831282

Book Review: John Madeley, Trade and the Poor: The Impact of International Trade on Developing Countries (London: Intermediate Technology Publications, 1996, 210 pp., £ 11.95 pbk.)Millennium - Journal of International Studies 1997 26: 937-939.

http://mil.sagepub.com/content/vol26/issue3/

Oxley took part in the Transparency International Canada Inc. conference, as an active and regular member of the organization.

"TI-Canada held a seminar in Vancouver, February 4-5, entitled “Corruption and Bribery in Foreign Business Transactions: New Global and Canadian Standards,” in cooperation with the International Centre for

Criminal Law Reform and Criminal Justice Policy.

http://www.transparency.ca/Reports/Newsletters/TIN0301.PDF

BUSINESS ETHICS OFFICE ROOM 200F SCHULICH SCHOOL OF BUSINESS YORK UNIVERSITY 4700 KEELE ST. TORONTO, ONTARIO CANADA M3J 1P3 TEL: (416) 488-3939/736-5809 FAX: (416) 483-5128/736-5762 E-MAIL: TI-CAN@BUS.YORKU.CA

www.transparency.yorku.ca

In numerous sources, Oxley is associated with institutions/universities. They relate his past involvement and continued self-education. http://www.metroputnam.com/news/200807080517

Sun Energy Group, LLC: Oxley is credited with co-founding this renewable energy company with D’Juan Hernandez, a former executive of NRG Energy, Inc., the nation’s leading Independent Power Producer. Exelon Corp. on Tuesday delivered on its promise to scrap its hostile $9 billion stock offer to buy NRG Energy after shareholders at the smaller firm rejected its slate of directors.

http://www.marketwatch.com/story/exelon-scraps-bid-after-nrg-holders-vote?

The Lousiana Gasification facility listed under the presentation will be built under plasma gasification technology, that is, waste to energy. Oxley is no stranger having many years experience with this technology.

Location Metro New Orleans Region, Louisiana (Specific Sites Under Review) System Integrated Gasification Combined Cycle (IGCC) Net Capacity 138 Megawatts (MW) Annual Output 1.1 Million Megawatt Hours (MWh) Feedstock Input 2500 Tons per Day; 821,000 Tons per Year.

SUN ENERGY GROUP, LLC: LOUISIANA GASIFICATION FACILITY (LGF) presentation: http://www.labrownfields.org/downloads/presentations/LSWA-D'Juan%20Hernandez%20SG.pdf

Sun Energy Group: http://www.sunenergygrp.com/index.shtml

Oxley boasts as a former Investment Banker with Strategy Energy, Inc., a Canadian Investment Banking firm, specializing in energy debt and equity placements. Oxley's eMail address is listed as Jordan.Oxley@strategyenergy.com under his membership to the Canadian Wind Energy Association. http://www.canwea.ca/images/uploads/File/Members_only/Committees/Small_Wind/Small_Wind_Committee_Member_November.pdf

Video interview will Jordan Oxley. Note: Video is poor quality but the audio is well worth listening to.

Part 1: http://www.youtube.com/watch?v=QMR36NsAdr0

Part 2: http://www.youtube.com/watch?v=FV4CEL9t11k

Part 3: http://www.youtube.com/watch?v=OrCAzklGYME

Part 4: http://www.youtube.com/watch?v=_Hmm3h5YOSQ

Jordan Oxley, Sunbay Energy Corp. President.

Interview with Mr. Jordan Oxley:

Part 1:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838085

Part 2:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838421

Part 3:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838872

Part 4:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39839348

Part 5:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39839662

Part 6:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39840360

Jordan Oxley is an individual who carries over a decade of experience in the financial sector. His connections and communication skills are vital in closing deals and partnerships with multi-million/multi-billion dollar enterprises. His background in economics allows him to visualize projects realistically and apply his experience in finding a solution to a given problem or issue in society. He has continually built strong management teams to guide companies along specific projects and/or tasks.

Wireless Age to Acquire Interest in Renewable Energy Projects.

TORONTO, ONTARIO--(Marketwire - Aug. 11, 2009) - Wireless Age Communications, Inc. (PINK SHEETS:WLSA), ("Wireless Age" or "the Company") announced today that it has entered into a definitive agreement with PowerPlay Energy Corp. ("PowerPlay") and Sunbay Energy Corp. ("Sunbay") through a wholly owned subsidiary of the Company to acquire a 60% interest in a newly formed entity that will hold all of the assets and liabilities of a development stage plasma gasification project proposed to be built in Port Hope, Ontario, Canada and the exclusive rights to participate in plasma gasification projects in the United States of America.

Through its subsidiary Sunbay, PowerPlay is a renewable energy developer specializing in gasification projects, and possesses the intellectual property rights, contracts and licenses necessary for the development of plasma gasification and renewable energy projects. Additionally, Sunbay has entered into an exclusive developer agreement with a world-renowned original equipment manufacturer of plasma torches, as well as a designer and operator of plasma gasification facilities.

Formal closing is subject to various conditions precedent, including drafting certain ancillary legal agreements, regulatory and board of directors' approval.

Pursuant to the agreement the Company has agreed to pay the following consideration: two million five hundred thousand (2,500,000) Newlook Industries Corp. ("Newlook") common shares, one hundred sixty seven thousand US dollars (US$167,000) and a one million two hundred fifty thousand Canadian dollar (CAD$1,250,000) senior secured debenture. The debenture pays interest at 8% per annum, will mature one year from the date of closing and may be fully repaid by the Company at any time with the delivery of five million (5,000,000) Newlook common shares. The debenture will be secured by a general security agreement over all of the assets of the Company including the intellectual property rights of the Port Hope project and the Company's interest in future USA projects. As part of the transaction the Company intends to complete a name change to better reflect the future direction of the Company.

The Company confirms that there is no relationship in this transaction involving any non-arms length party and Wireless Age, its insiders and PowerPlay or Sunbay other than a director of a Newlook insider is also a director and officer of PowerPlay and Sunbay.

Newlook is the Company's controlling shareholder currently holding an ownership percentage of approximately 55%.

For more information, please contact:

Wireless Age Communications, Inc.

John G. Simmonds

Chairman & CEO

905-833-2753 ext. 223

Source: http://tinyurl.com/kt4o79

Wireless Age Communications, Inc. (WLSA) has set a important milestone: they have signed a definitive agreement and ensured shareholder value though non-dilutive terms. The letter of intent was a non-binding contract, whereas the definitive agreement they announced this afternoon governs the terms and conditions they have reached in the acquisition.

WLSA ~ Sunbay Energy Corp. President, Jordan Oxley.

http://www.sunbayenergy.com/about_us_management.php

Oxley is an intellectual, with a background in finance, economics, and philosophy. For a lengthy period of time, his occupation was in the banking sector as a venture capitalist, collaborating with seasoned executives. He began his career working closely with the Governor of the Bank of Canada.

Jordan began his career working closely with the Governor of the Bank of Canada helping to modernize the communications of that institution. He continued on to senior executive positions with technology, publishing, and consumer product companies, alongside intense pursuits as a venture capitalist and entrepreneur. A pioneer of high-tech socio-political messaging, Jordan has spoken at the annual conference of the Public Affairs Association of Canada and in many other forums.

Jordan has held the position of Fellow, International Institute for Public Ethics; Counselor, Canadian Institute of International Affairs; Treasurer, Dialogue Canada; Treasurer and Official Spokesperson, Unity Link / Unilien Society; Riding Treasurer, Liberal Party of Canada; Vice President, Association for Non-Resident Voting Rights; and has been an active member of Transparency International and the Mensa Society.

He holds degrees in Philosophy, Economics, and International Relations, studying at Queen's University, the University of Edinburgh, and the London School of Economics.

http://www.ekartingnews.com/news_info.php?n=3313

Oxley’s experience in the business and financial sector is well documented in numerous sources. Previously occupying a position at Bank of Canada, he helped modernize the communications of that institution.

http://www.bankofcanada.ca/en/res/wp/2000/participants2000.pdf

Oxley is also credited with numerous institutional publications on economics.

http://mil.sagepub.com/cgi/content/citation/27/1/158

http://www.thefreelibrary.com/Insuring+Canada's+exports:+the+case+for+reform+at+export+development...-a0172831282

Book Review: John Madeley, Trade and the Poor: The Impact of International Trade on Developing Countries (London: Intermediate Technology Publications, 1996, 210 pp., £ 11.95 pbk.)Millennium - Journal of International Studies 1997 26: 937-939.

http://mil.sagepub.com/content/vol26/issue3/

Oxley took part in the Transparency International Canada Inc. conference, as an active and regular member of the organization.

"TI-Canada held a seminar in Vancouver, February 4-5, entitled “Corruption and Bribery in Foreign Business Transactions: New Global and Canadian Standards,” in cooperation with the International Centre for

Criminal Law Reform and Criminal Justice Policy.

http://www.transparency.ca/Reports/Newsletters/TIN0301.PDF

BUSINESS ETHICS OFFICE ROOM 200F SCHULICH SCHOOL OF BUSINESS YORK UNIVERSITY 4700 KEELE ST. TORONTO, ONTARIO CANADA M3J 1P3 TEL: (416) 488-3939/736-5809 FAX: (416) 483-5128/736-5762 E-MAIL: TI-CAN@BUS.YORKU.CA

www.transparency.yorku.ca

In numerous sources, Oxley is associated with institutions/universities. They relate his past involvement and continued self-education. http://www.metroputnam.com/news/200807080517

Sun Energy Group, LLC: Oxley is credited with co-founding this renewable energy company with D’Juan Hernandez, a former executive of NRG Energy, Inc., the nation’s leading Independent Power Producer. Exelon Corp. on Tuesday delivered on its promise to scrap its hostile $9 billion stock offer to buy NRG Energy after shareholders at the smaller firm rejected its slate of directors.

http://www.marketwatch.com/story/exelon-scraps-bid-after-nrg-holders-vote?

The Lousiana Gasification facility listed under the presentation will be built under plasma gasification technology, that is, waste to energy. Oxley is no stranger having many years experience with this technology.

Location Metro New Orleans Region, Louisiana (Specific Sites Under Review) System Integrated Gasification Combined Cycle (IGCC) Net Capacity 138 Megawatts (MW) Annual Output 1.1 Million Megawatt Hours (MWh) Feedstock Input 2500 Tons per Day; 821,000 Tons per Year.

SUN ENERGY GROUP, LLC: LOUISIANA GASIFICATION FACILITY (LGF) presentation: http://www.labrownfields.org/downloads/presentations/LSWA-D'Juan%20Hernandez%20SG.pdf

Sun Energy Group: http://www.sunenergygrp.com/index.shtml

Oxley boasts as a former Investment Banker with Strategy Energy, Inc., a Canadian Investment Banking firm, specializing in energy debt and equity placements. Oxley's eMail address is listed as Jordan.Oxley@strategyenergy.com under his membership to the Canadian Wind Energy Association. http://www.canwea.ca/images/uploads/File/Members_only/Committees/Small_Wind/Small_Wind_Committee_Member_November.pdf

Video interview will Jordan Oxley. Note: Video is poor quality but the audio is well worth listening to.

Part 1: http://www.youtube.com/watch?v=QMR36NsAdr0

Part 2: http://www.youtube.com/watch?v=FV4CEL9t11k

Part 3: http://www.youtube.com/watch?v=OrCAzklGYME

Part 4: http://www.youtube.com/watch?v=_Hmm3h5YOSQ

Jordan Oxley, Sunbay Energy Corp. President.

Interview with Mr. Jordan Oxley:

Part 1:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838085

Part 2:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838421

Part 3:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39838872

Part 4:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39839348

Part 5:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39839662

Part 6:http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39840360

Jordan Oxley is an individual who carries over a decade of experience in the financial sector. His connections and communication skills are vital in closing deals and partnerships with multi-million/multi-billion dollar enterprises. His background in economics allows him to visualize projects realistically and apply his experience in finding a solution to a given problem or issue in society. He has continually built strong management teams to guide companies along specific projects and/or tasks.

Wireless Age to Acquire Interest in Renewable Energy Projects.

TORONTO, ONTARIO--(Marketwire - Aug. 11, 2009) - Wireless Age Communications, Inc. (PINK SHEETS:WLSA), ("Wireless Age" or "the Company") announced today that it has entered into a definitive agreement with PowerPlay Energy Corp. ("PowerPlay") and Sunbay Energy Corp. ("Sunbay") through a wholly owned subsidiary of the Company to acquire a 60% interest in a newly formed entity that will hold all of the assets and liabilities of a development stage plasma gasification project proposed to be built in Port Hope, Ontario, Canada and the exclusive rights to participate in plasma gasification projects in the United States of America.

Through its subsidiary Sunbay, PowerPlay is a renewable energy developer specializing in gasification projects, and possesses the intellectual property rights, contracts and licenses necessary for the development of plasma gasification and renewable energy projects. Additionally, Sunbay has entered into an exclusive developer agreement with a world-renowned original equipment manufacturer of plasma torches, as well as a designer and operator of plasma gasification facilities.

Formal closing is subject to various conditions precedent, including drafting certain ancillary legal agreements, regulatory and board of directors' approval.