Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$ASKE calling sub's land

$Aske -.0004 Loving it for a run here

$ASKE price Explosion $$$$

$ASKE .0004

Nice $Aske is nice and big in it!!!

$Aske 0.0003 big week coming!!!!

$ASKE 0.0004

$Aske .0003

====ASKE .0003 =====TIME FOR A RUN!!ACCUMULATION STRAIGHT UP MACD CROSSED$$$$ HEADED BACK TO 00'S

$Aske 0.0003 breakout about to happen

$Aske, Up

Dilution 300M

February 2013 R / s

Encouraging people to check in at your business is a great way to engage your audience. Based on check-ins, take a look at the most social cities and their most popular landmarks.

http://www.facebook.com/#!/marketing

4 months diluting

Shares Outstanding is false

The R / S approach

Shares Outstanding are false

100% Scam

Issued shares are confidential

is hibernating

~ASKE huge runner>>>very thin .0002s>>>recent highs.of.0028 ~

$ASKE ~ .0002 Getting Hit Hard!

$ASKE ~ .0002 Getting Hit Hard!

$ASKE uP

$Aske

*$SBRH* Ask getting smaller

Because they preferred to sell to 0002 instead 001? answer: market value of .0001

Facebook IPO: Once Again, Wall Street Wins And Muppets Lose

We warned of a social network tech bubble 2.0 over a year ago due to the hype and overvaluation of Facebook (FB) based on the reported deals by Goldman Sachs and a Russian investment firm--Digital Sky Technologies on the secondary gray market. At that time, the two deals valued Facebook at about $50 billion, with a 100+ price-to-earnings (PE) ratio.

Fast forward to 2012, Facebook actually went IPO on May 18 with a similar lofty vaulation - the $38-per-share IPO price valued Facebook at $104 billion--100+ times historical earnings (the company's profit for 2011 was $1 billion). Facebook stock has since plummeted 27% to $27.72 from its initial $38 a share. Bloomberg estimated the stock would need to sink another 20% to match the average PE ratio for the Nasdaq Internet Index based on estimated earnings in the next 12 months.

The technical glitch on NASDAQ aside, many have blamed the so-called "botched" IPO event on stock misprice or overvaluation. On the surface, it may seem like a simple mispricing by the main underwriting banks and Facebook. However, judging from the sequence of reported events (see timeline below), instead of a "botched" event, the IPO is actually a total success by Wall Street standards, since concerted effort appeared to have been made to ensure an "acceptable" return for the insiders.

May 8: It was reported that Facebook "quietly" added E-Trade as one of the 33 underwriters just two weeks before the actual IPO, "making good on Mark Zuckerberg's desire to give casual [retail] investors the chance to participate", and that "the inclusion of E-Trade on such a high-profile IPO is unusual," although not unprecedented.

May 9: Nine days before the IPO, Facebook filed an amended IPO prospectus with the SEC (Securities and Exchange Commission) expressing caution in its revenue and earnings prospects due to difficulty in monetizing its rapidly growing mobile user base. Facebook officials then personally called its major IPO underwriters to advise them of these negative developments.

Days before the IPO: According to Reuters, Morgan Stanley (MS), Goldman Sachs (GS), JPMorgan Chase (JPM) and Bank of America (BAC) lowered their forecasts for Facebook in response to Facebook's revised SEC filing. The banks then only relayed the downgraded forecasts to "selected clients".

Almost around the same time of the downgrade, Facebook and the underwriters decided to raise the Facebook IPO to $38 a share from a previously projected high of $35, and also increase the number of shares being sold by 25%. Both Reuters and Financial Times quoted different fund managers saying that it is "unusual for analysts at lead underwriters to make such changes so close to an IPO".

May 16: CNBC indicated that Goldman Sachs, one of the underwriters of Facebook IPO, Tiger Global Management and Facebook director Peter Thiel, had more than doubled the volume of shares they planned to sell. (Remember Goldman has accumulated Facebook shares in the gray market prior to the IPO, including the $450 million deal in 2011, so it most likely has more shares to unload than other insiders.)

May 18: Facebook IPO debuted on NASDAQ. Bloomberg reported that Accel Partners planned to offer 49 million shares in the initial sale, while Goldman Sachs aimed to sell 28.7 million. Russian firm Digital Sky Technologies planned to sell 45.7 million shares, and Tiger Global Management planned to sell 23.4 million shares. Bottom line -- insiders are flooding the market to dump their shares.

May 22: CEO Mark Zuckerberg dumped his 30.2 million shares of stock in the company. At $37.58 a share, Zuckerberg will take home a before-taxes total of $1.13 billion, according to Marketwatch. Facebook director Peter Thiel also dumped his 16.8 million shares for a gross total of $633million. The chart below from Business Insider illustrates the extent of insider selling and remaining shares.

Chart Source: Business Insider, May 17, 2012

May 23: Wall Street Journal reported that Morgan Stanley and other underwriters have "oversold" 63 million Facebook shares to mostly individual investors, and made a profit of about $100 million shorting Facebook IPO. That's in addition to the $175 million IPO fees the underwriting banks received.

Law suits are already flying against the underwriters, Facebook as well as NASDAQ over the IPO. Of course, Morgan Stanley, JPMorgan Chase and Goldman Sachs did not pass up the opportunity to want tens and millions from NASDAQ to cover their losses from the exchange's mishandling of trades during the first day of IPO.

The reality is that Wall Street banks / underwriters typically give out IPO shares to preferred big institution clients, such as pension funds and wealthy individuals ("The 1%"). Small, individual investors rarely get a look-see at such offerings. However, since almost all the "smart money" already knew Facebook's growth and profit projection would fall far short of the implied valuation, with so many insiders' shares already from the gray market to unload, the only way every insider goes home happy is to have a large enough pool of "dumb money" from the not-as-sophisticated muppet retail investors into the market.

So there is a reason for Facebook IPO to target individual investors, and when Facebook "quietly" added E-Trade as one of its underwriters, it is most likely not intended so the 99% could share in the good fortune of a supposedly "hot" IPO.

The popularity of Facebook as a social media and IPO pre-marketing pump has generated enough hype to ensure a larger than usual percentage of Facebook shares being held by individuals (most of them probably bought the stock because they have a Facebook page without much further research.) Now, many of these investors who ended up holding Facebook stocks will have more to worry as its IPO lock-up period expires. IPOs typically have a lock-up period of 180 days before insiders may sell their shares. The lock-up period for Facebook, however, is only 90 days.

According to Sci-Tech Today, the first lock-up expiration of Facebook hits in less than three months, when 268 million shares are available for sale, or 1/10 of shares outstanding. In less than six months, 1.7 billion shares will be unlocked. Furthermore, odds are good that Facebook will issue more shares to fund acquisitions such as Instagram to further dilute share price.

Some analysts now put a price tag of under $10 a share as a fair price for Facebook,while some others still give FB a BUY rating. Our view is that until Facebook could prove itself as the next Google (GOOG) or Apple (AAPL) by its actual financial figures, or unless you are the one who sleeps and swims with the Wall Street sharks, it is best to stay away from such an unproven stock.

Regardless, many individual investors who got in on FB at close to its initial $38 a share are unlikely to see that price any time soon. So once again, Wall Street wins, Muppets lose.

The value of facebook is only for your average monthly visits

With over 153 million unique users per month, Nielsen research has named Google the top Internet destination. Facebook, which is the most visited social networking site and second largest Internet destination, received an average number of 137.6 million unique monthly visitors. The combination of the battle to be the top Internet destination, the inevitable Facebook IPO, and the continued growth of the Google+ is sure to intensify the Facebook/Google rivalry in 2012.

Industry analyst Rob Enderle recently told reporters that 2012 is vitally important to Facebook’s survival:

“This is a fight for survival for Facebook — and for relevancy for Google. What happens in 2012 will make the difference between whether there is a Facebook by the end of the decade and whether Google can become truly relevant outside of search.”

While most individuals would argue that Facebook is more likely to be valued at $100 billion in 2012 than have to “fight for survival,” the continued growth of Google+ could easily cut into Facebook’s market share by the end of the year.

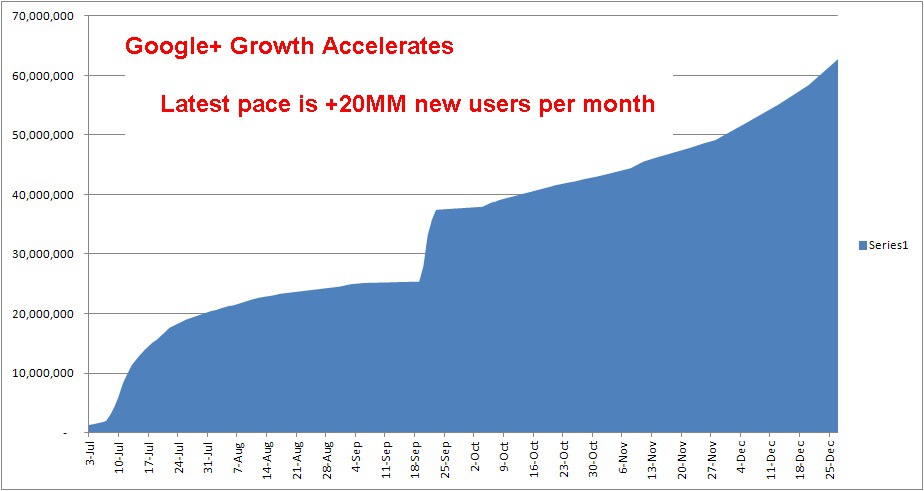

Paul Allen, the founder of Ancestry.com and a trusted tech author who has been closely following Google+ since its beginning, blogged that 24.01% of ALL Google+ users signed up in December. If the December signups rate (equates to 625,000 new users per day) continues, Google+ will reach 100 million users before the end of February and nearly 300 million users by the end of the year. However, Allen is predicting that the Network Effect will power Google+ to a “breakout year” and that the new social network will end the year with over 400 million users.

Whether or not Google+ reaches 400 million users in 2012, the new social network is sure to have impacted Facebook and its long-term strategy. The events of next year are sure to impact the long-term strategy and success of Google, Google+, and Facebook.

Studies show that when used efficiently, Facebook ads yield excellent results. Nutella reported this year that their Facebook ads boost sales far more than their TV ads. Facebook ads can also be used to take advantage of peak sales events and holidays, such as how Zales and 1-800-Flowers utilized ads to engage customers and boost Mother’s Day sales this year. Computer company Acer’s Facebook fan base grew tenfold after creating an integrated marketing and social ad campaign. These are just a few examples of the countless brand success stories from using Facebook ads for pages.

Facebook Users Interact with Brand Content Over Ads

JUNE 1, 2012

Will users click Facebook’s Sponsored Stories?

Facebook is now a public company, and its revenue and advertising plans are under significant scrutiny. However, users are more likely to interact with branded content on the site, not advertising, which may be an obstacle for the social network down the road.

In January 2012, 44% of internet users worldwide said they never clicked on ads or sponsored listings on Facebook, according to the “Search and Social Media Survey (2011-2012)” report from search engine marketing company Greenlight. An additional 31% said they rarely clicked on advertisements.

However, only 17% said they never “liked” brands and companies on Facebook, according to the same study. A quarter of users (26%) said they did so often and 9% said regularly.

“Pick your favorites,” in which users can choose a certain number of items from a list as their favorites, was the most popular type of branded content users shared, at 39%, according to an April 2012 study from Wildfire. An additional 32% shared quizzes, 29% shared trivia contests and 26% shared sweepstakes. Wildfire also found that 82% of users who clicked on a friend’s post about a quiz went on to also take that quiz.

While this interaction and sharing of branded content is good for companies, it doesn’t require them to pay Facebook for the exposure. In February, Facebook reported that each week, only 16% of a company’s fans will see a brand post in either their news feed or on the right-hand side of their homepage. In order to increase that percentage, Facebook launched Reach Generator, which guarantees that 50% of fans will see a branded post each week. Reach Generator is just one way Facebook is encouraging companies to spend money with the site, rather than relying on unpaid brand content reaching users.

Corporate subscribers have access to all eMarketer analyst reports, articles, data and more. Join the over 750 companies already benefiting from eMarketer’s approach

$FB is looking Horizontality Between 28 to 38 for the next few years