Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks for clearing it up..

( OS ) I meant the TOTAL OUTSTANDING SHARE structure for SCY or SCYYF?

SCYYF is the symbol on the OTCBB.

It is a grey market on the OTCBB because while you can buy/sell it on that exchange, you cannot see bids/offers on the depth of market for Level2. Trades will print and you can see Time & Sales, but no Level 2 depth of market is provided.

Not sure what you meant by "Anyone here know what's the OS of SCY?"

OS = Operating Schedule???

So, is SCY ONLY on TSX?

Q...

Why is OTCmarkets.com has Scandium Mining Corp as GREY market?

Anyone here know what's the OS of SCY?

Tia!

Magnesium-Scandium alloy retains memory - article details new use for Scandium:

http://www.asianscientist.com/2016/07/tech/lightweight-shape-memory-magnesium-scandium-alloy-aerospace/

All quiet on this SCY board for two months - unusual. What's the next milestone?

Here's a blog from Greg Klein remarking on a recent article by John Kaiser from Kaiser Research Online.

Link: http://resourceclips.com/2016/06/09/opportunities-in-adversity/

Opportunities in Adversity

John Kaiser Talks Trump, Turmoil, Gold, Scandium and the Juniors

by Greg Klein

It’s said to be an ancient Chinese curse: “May you live in interesting times.” Much about our own epoch obviously interests and probably fascinates John Kaiser. But he might be accused of ambivalence for the silver linings he sees among the gathering clouds. The analyst and creator of Kaiser Research Online spoke with ResourceClips.com on a range of subjects, but with mineral exploration always in mind.

On Gold’s Rally

This one has a stronger foundation than previous upswings, Kaiser believes. Chinese aggression, Russian expansionism, Middle East volatility, Brazilian instability, the possible Brexit and the chances of a Donald Trump U.S. presidency all mean “we’re looking at an extremely turbulent world,” he says. “There’s good reason to expect gold to go higher as capital starts to hedge against all these gloomy scenarios.”

That could push prices between $1,600 and $2,000 in the next year, he maintains. “And if that’s happening in the absence of any inflation, that really leverages those ounces in the ground that the juniors have and makes operating mines more profitable. Even for exploration companies it lowers the bar for what counts as a new discovery.”

On the Juniors’ Rally

Kaiser attributes this year’s rebound partly to gold, but also to renewed interest in discovery exploration.

“I’m very pleased that the rally that started the third week of January did not succumb to the PDAC curse and slow down,” he says. “By May everything’s usually in the garbage can before the summer doldrums. We’re not seeing these substantial gains continue that we saw from February to April, but we haven’t seen the markets give up the gains either.

“We’re probably not going to see a roaring global economy driving up demand and catching supply off guard like we did during China’s supercycle. However, as this world gets more belligerent, we could see massive disruptions of supply.”

That would bring greater concern about jurisdictional risk for vital commodities. “An opportunity for the juniors would be to seek out existing deposits of these metals. They might not be worth developing now, but they could be treated by the market as leveraged bets on these big-picture geopolitical outcomes.”

On the Donald

A Vancouver native who’s spent 26 years in the U.S., Kaiser’s firmly among those who consider that country’s anti-establishment presidential contender an outrage.

“He’s basically touching on all the latent prejudices and biases of the country,” says Kaiser. “But another reason people will vote for him is he is not an anti-Keynesian. He and Hillary Clinton both understand that to get America cranking again we need fiscal stimulus in the form of infrastructure renewal. The Republicans have blocked anything along those lines….Trump could prove to be a giant wrecking ball for the stalemate that characterizes Washington. That could put him into power.”

But Kaiser wonders if Trump has a hidden motive to his campaign strategy.

“This guy is an extremely smart person and it’s possible that everything he says is just BS designed to manipulate the public. It’s like he’s satirizing everything. And if he ever did get into power, well first he’d have to deal with the limitations that congress imposes, but once he’s in power he might change his tune and discover all these reasons why it’s not practical to do all the stupid things he said he would do.

“The frightening thing is, what if this sub-narrative is wrong, that the man is indeed insane or worse. Or that he ends up being co-opted by the truly insane in the background, who make him the lever on all the insane stuff that he said, because he is just a human being and he has no true power structure. It would be a reverse takeover of Trump.”

Kaiser downplays the possibility of a Trump presidency meeting an extraordinary end—for example assassination, an establishment putsch or a distinctively American court order annulling the election.

But “whether it’s Hillary or Trump, tensions with China and Russia are on an increasing trajectory,” he says. “That would be good for gold and good for the juniors.”

On the Scandium Field of Dreams

“The problem with scandium—and it makes me want to tear out my hair that the market doesn’t get it—is that the uses for scandium have been understood for 30 or 40 years.”

Used for aluminum-scandium alloys and solid oxide fuel cells, the rare earth element also finds its way into ceramics, electronics, lasers, lighting and radioactive isotopes, according to the U.S. Geological Survey. The stuff is widely abundant, but rarely in concentration. As a result it’s mined as a byproduct in China, Kazakhstan, Russia and Ukraine, producing just 10 to 15 tons a year, the USGS states.

But if supply could grow, so would demand, Kaiser says. The aerospace and automotive industries would be prime customers. “The highest-grade deposits have been around 70 or 100 ppm, as in the Zhovti Vody mine in Ukraine, where the Soviets got scandium to build their airforce fleet. But nobody else has been able to produce a very meaningful supply that is scalable.”

That’s changing as two advanced Australian projects lead the way, Scandium International Mining’s (TSX:SCY) 80%-owned Nyngan project and Robert Friedland-backed, ASX-listed CleanTeQ Metals’ Syerston project.

“The difference these discoveries made is their 400-ppm grades are well above the 200 or 250 ppm you need to produce the stuff at $2,000 a kilo,” Kaiser explains. “At $2,000 a kilo it starts making sense to use a scandium-aluminum alloy. By being able to demonstrate that these deposits have long-term supply, they can produce as much scandium as you want if you’re willing to pay $1,500 or $2,000 a kilo. That will coax demand off the sidelines.

“The next few years will be interesting because those companies are going to try producing 35 to 40 tonnes a year. If they can succeed in demonstrating that they’ve got the recoveries figured out, they’ve got the costs figured out, they can scale these things each to about 150 to 200 tonnes of output, that will set the stage for all kinds of plans to utilize it. It’s really a Field of Dreams where if you build it, they will come.

“But you have to understand that there are all these applications for scandium that can’t be commercialized unless there’s a reliable, scalable supply.”

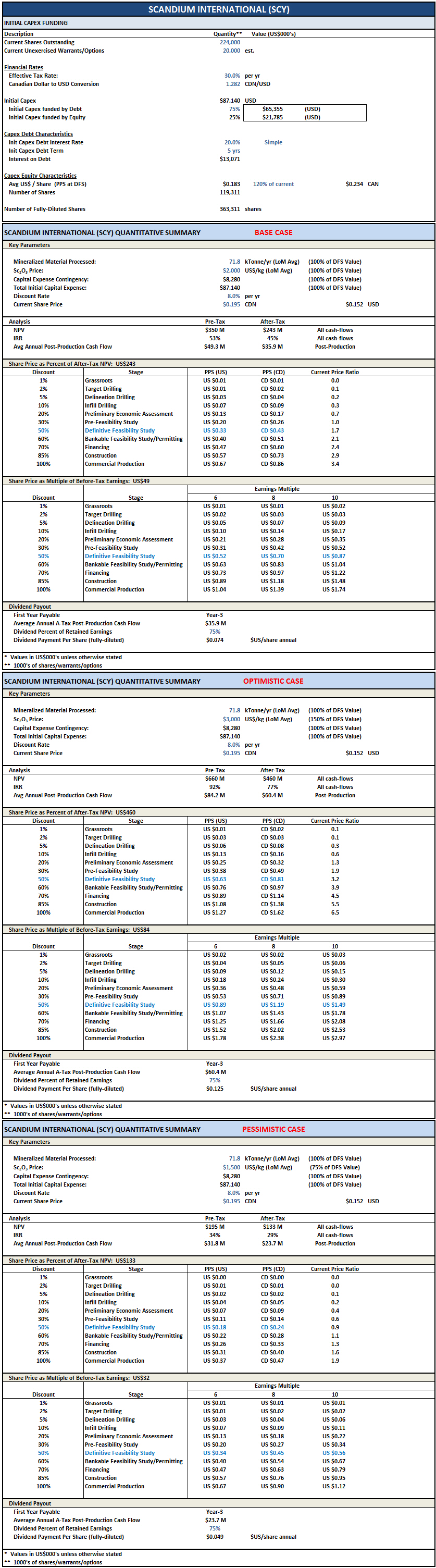

Hey Folks - I prepared some financials using the SCY DFS as a baseline while doing my DD on the stock. I thought the board may find the numbers to be of interest. I've prepared similar financials for Excelsior and NioCorp if you want to search on my handle on those boards.

The financials use three scenarios, Base/Optimistic/Pessimistic, as described below:

1. Base: $2000/kg Sc2O3

2. Optimistic: $3000/kg Sc2O3

3. Pessimistic: $1500/kg Sc2O3

http://investorintel.com/technology-metals-intel/putnam-now-on-fast-track-to-worlds-first-primary-scandium-mine/

P.S. I did not find the arguments from the "be wary" article to be very convincing, the comments at the bottom were interesting though.

Recent articles and reports on the scandium theme:

MiningTechnology.com

"Nyngan Scandium Project, New South Wales, Australia":

http://www.mining-technology.com/projects/nyngan-scandium-project-new-south-wales/

InvestorIntel.com

"Lifton Asks If Scandium Is The New Gold?

http://investorintel.com/technology-metals-intel/lifton-on-scandium-as-the-new-gold/

seekingalpha.com

"Be Very Wary Indeed Of The Coming Excitement About Scandium"

http://seekingalpha.com/article/3968906-wary-indeed-coming-excitement-scandium

sedar.com

FEASIBILITY STUDY - NYNGAN SCANDIUM PROJECT NI 43-101 Technical Report

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00025324

Scrolll down to May 6th to download the 278 page PDF File

rjw/mkc

Old:

PEA HIGHLIGHTS:

Capital cost estimate for the Project is US$77.4 million,

Operating cost estimate for the Project is US$636/kg scandium oxide,

Oxide product volume is 35,975 kg per year,

Project Constant Dollar NPV10% is US$175 million, (NPV8% is US$217 million),

Project Constant Dollar IRR is 40.6%,

Oxide product grades of 97-99% are estimated, and

Scandium recovery estimate is 84.3%.

To the more up to date DFS:

FEASIBILITY STUDY HIGHLIGHTS:

Capital cost estimate for the Project is US$87.1 million,

Operating cost estimate for the Project is US$557/kg scandium oxide,

Oxide product volume averages 37,690 kg per year, over 20 years,

Project Constant Dollar NPV10% is US$177 million, (NPV8% is US$225 million),

Project Constant Dollar IRR is 33.1%,

Oxide product grades of 98-99.9%, as based on customer requirements,

Project resource increases by 40% to 16.9 million tonnes, grading 235ppm Sc, at a 100ppm cut-off in the measured and indicated categories, and

Project Reserve totalling 1.43 million tonnes, grading 409ppm Sc was established on part of the resource.

Looks like a very impressive project. Should be easily financed, conservative 3 year pay back on the low side of production. Super high grade reserves, about $600 million in easy pickings. 400 ppm = $800 per tonne. Scandium bonanza?

http://www.scandiummining.com/s/newsreleases.asp?ReportID=745646

George Putnam, CEO of Scandium International Mining Corp. commented:

"The Company is pleased with this very solid feasibility study result, and with the quality of the development work it represents. We now have a project plan we can execute on, and a considerably more mature development schedule on which to seek additional scandium customers. We also now have what we believe to be a financeable platform with which to engage in construction funding discussions. This accomplishment brings us a significant step closer to building the Nyngan Project and producing scandium for what we know to be numerous waiting markets."

William Harris, Chairman of EMC Metals, commented:

"Delivery of this feasibility study represents an important strategic milestone for the Company in that SCY has the first primary scandium project to complete metallurgical, engineering, and economic investigations and bring a viable feasibility study to the marketplaceSCY has the first primary scandium project to complete metallurgical, engineering, and economic investigations and bring a viable feasibility study to the marketplace, and do so in full view of both scandium investors and future customers."

"Pricing Assumptions

The price assumption in the feasibility study is US$2,000 per kilogram (kg) of scandium oxide product, as an average price covering all product sold, over various product grades. Current market pricing, such as that can be established, is substantially above these levels based on small unit quantities and varying grades. This product pricing benchmark applied in the feasibility study remains the same as was applied in the 2014 Preliminary Economic Assessment ("PEA") on this Project, and for the same reasons. In order to encourage a viable, over-subscribed and vigorous scandium market, across numerous applications, product suppliers will need to provide for adequate supply of quality product, available from trusted jurisdictions, at prices lower than product trades for today.

In addition to limited publically available price quotes for scandium oxide, the feasibility study notes two other reference points on the US$2,000/kg price assumption. The Company has an offtake agreement in place, for 7,500 kg/year (3 years), with pricing being supportive of the pricing assumption in the feasibility study. The customer is a knowledgeable alloy group, with longstanding interest in aluminum-scandium alloys. The feasibility study price assumption is also supported by a recent, independent marketing report that examines the 10 year scandium supply/demand outlook, and includes scenario-based 10 year price forecasts. The details and contents of this market outlook report will remain confidential, but select information will be included in the feasibility study. Both of these reference points support that the scandium value proposition for customers/consumers is valid at this price level."

"CONCLUSIONS AND RECOMMENDATIONS

The production assumptions in the feasibility study are backed by solid independent flow sheet test work on the planned process for scandium recovery. The report consolidates a significant amount of metallurgical test work and prior study on the Project, including important test work results completed since the PEA was generated in 2014. The entire body of work demonstrates a viable, conventional process flow sheet utilizing a continuous-system HPAL leaching process, and good metallurgical recoveries of scandium from the resource. The metallurgical assumptions are supported by various bench and pilot scale independent test work programs that are consistent with known outcomes in other laterite resources. The continuous autoclave configuration, as opposed to batch systems explored in previous flow sheets, is also a more conventional and current design choice.

The level of accuracy established in the feasibility study substantially reduces the uncertainty levels inherent in earlier studies, specifically the PEA. The greater confidence intervals around this Technical Report are achieved by reliance on significant project engineering work, a capital and operating cost estimate supported by detailed requirements and vendor pricing, plus one offtake agreement and an independent marketing assessment, both supportive of the marketing assumptions on the business.

The feasibility study delivers a positive result on the Nyngan Scandium Project, and recommends the Project owners seek finance and proceed to construction. Recommendations are made for additional immediate work, notably to win additional offtake agreements with customers, complete some optimizing flow sheet studies, and to initiate as early as possible detailed engineering required on certain long-lead capital items."

I think the tagline they use repeatedly is that they will be the largest primary scandium mine in the world, so Niocorp isn't even in the running.

Although Nio's scandium is small tonnage relative to their other ops it is a large % of their expected income. I think niobium prices have fallen a lot lately so they will hype their scandium even though it isn't correlated to their niobium geology. Just my quick BoE shows about 225m of niobium and ~200m in scandium. So that is almost 1:1 with the company's namesake.

CLQ and SCY are nearly infinitely scaleable primary scandium mines with giant, super high grade deposits at surface with low development cap ex. Nio has large capex, much lower grades, and a bunch of other hurdles to overcome so it is a matter of ease. SCY and CLQ can produce infinite scandium easily while Niocorp's scandium hopes depend on a much more complex thesis and geology. Nio might even end up the big winner depending on how successful they are at cracking the geology and mining scandium (and potentially avoiding lawsuits). How they operate in an environment of say low Nb high scandium prices would be interesting. A domestic supply for scandium in the US would be critical for defense and advanced industry and there is more than enough demand for all the first movers to produce until their hearts are content. In twenty years there will probably be operating scandium mines on most continents, but like with any mineral the highest grade deposits in the best areas will be exploited first.

Nio might even be able to bill themselves as a zero/low cost producer which is always a huge marketing boon. If scandium pays for the niobium or vice versa. I don't know how this story will end and who will be crowned the ultimate victor but the future is definitely bright for those first few companies to produce at a profit and supply a long sought after commodity to the market.

Here's a March 2016 article in Proactive Investors on NioCorp's Elk City Nebraska project:

http://www.proactiveinvestors.com/companies/news/123149/niocorp-plans-the-usas-biggest-niobium-and-scandium-mine-123149.html

Nothing new to those who follow Nb.

The very small town of Elk City is about 100 miles northwest of Kansas City Missouri - my home.

The article doesn't mention the relative importance of niobium to scandium for the project but from the NioCorp website company estimates ... "anticipated production of 7,490 tonnes per annum (tpa) of Ferroniobium, 97 tpa of Scandium Trioxide, and 23,960 tpa of Titanium Dioxide over its 32-year operating life. Thus very small contribution from the scandium.

Is company on firm ground when saying repeatedly that they'll be the largest Scandium producer in the world?

Shoudln't the BFS be out by now? I'm getting a little impatient

SCY has a booth at PDAC http://www.pdac.ca/convention/programming/investors-exchange?startsWith=s

Someone from the Niocorp board told this. This stock also went up with huge volume but it asumed that this is due to the buying from some folks from Germany where Niocorp was promoted. Most of the people on the other board seem to agree that this inrease in SP was not corrolated.

Why did SCY go up 41%? I see no news. We are getting close to some progress PRs, which should support us. I was very surprised we pulled back as far as we did. These (upcoming) PRs shouldn't have much effect since they are known about a year in advance but the same thing has happened a few times over the years. This stock has such low visibility and a small s-base that the PRs tend to make the price rise more than I would normally expect. 11 cents for this company at this stage of development is madness of the highest order.

DFS with awesome economics coming, along with a positive EIS and more off-take agreements. Anyone selling for less than high 20s or 30s has not been paying attention to the scandium story.

Thanks futrcash for you positive thoughts.

I'm also long on SCY and I look forward to the DFS in March 2016. It's a pity that the company sends out so few news releases, but perhaps this is common in this phase of the project. Your thoughts on this?

There are another things that keep puzzling me. Maybe you can help me with this. I found an interesting article in the Nyngan Observer, dated January 20, 2016 on the meeting held on December 2, 2015.

http://www.nynganobserver.com.au/story/3675726/local-jobs-predicted-from-new-venture/

1. It's just writing down what other people said. Why did it take 7 weeks to publish this article?

2. There's a part where George said: “You can build with it way faster than we can supply it. We have more customers than product". Could it be that there are offtake agreements signed, but because of NDA's (non-disclosure) we don't get to hear about them until they are disclosed in the DFS? Are there examples of this?

GLTA

thanks-

I've had several long conversations with George Putnam over the years,and remain a shareholder.

Unfortunately they had to sell the Nevada tungsten mine,and mill,but having prevailed in the lawsuit over the Australian scandium mine, saved the company,and I believe shareholders here will be rewarded for their patience.

futrcash

Article posted Jan 15, 2016

Scandium International to break scandium supply barrier

In April 2015 the Wall Street Journal reported scandium as hot topic in the mining industry with an annual market worth roughly $50 million from 10-15 tons. - See more at:

http://investorintel.com/technology-metals-intel/scandium-international-mining-corp-tsx-scy-break-scandium-supply-barrier/#sthash.WGDdqW4C.dpuf

Looking good today ![]()

Does anybody have a glue where this momentum is comming from?

Hi longgun, thanks for your analyses and observations! I agree with your final remark. Maybe it's also impatience... @ 0,14 SCY is a nice buying opportunity.

Good luck to the longs.

Clean TeQ's Resin-In-Pulp pilot plant for scandium extraction on Clean TeQ's Syerston ore in action.

As far as I know they would use standard aluminum welding techniques only to a much greater effect. The Sc alloy has greater plasticity and weld strength. I would guess that abundant scandium would make welding aluminum a more common practice since I know it is a finicky metal to work with.

http://www.lincolnelectric.com/en-us/support/welding-how-to/Pages/guide-aluminum-welding-detail.aspx

As for rolling out a large amount of scandium aluminum alloy I doubt they (aluminum manufacturers) need large scale modifications since the machinery I've seen looks really heavy duty. The rollers are huge and the material would only get thinner to meet the same strength requirements.

What type welding or joinery is used with a scandium alloy? Any new or exotic production techniques needed for such material?

The current Gold report talks about Australia's firm on track to open the world's first standalone scandium mine.

http://www.theaureport.com/pub/na/16798?utm_source=delivra&utm_medium=email&utm_campaign=Gold+final+10-22-15

or google for:

"Cleaner Water and Stronger Aluminum Drive Clean TeQ's Future"

Good points. I think competition is far more likely than collusion yet it is a matter of degrees and I can see how they could simultaneously do both. The scandium companies compete for business but if one of them locks down a bunch of deals at a very high price point that might stick as the price for the first few years.

The Australian laterites will be low cost mines and this will drive those prices down in the long term even if there is a scandium cartel. It is obvious that if scandium was cheap enough demand would be tens of thousands of tonnes per year. At 3, 5, 10k/k that gets into the realm of being cost prohibitive and relegated to a niche market like military applications and areas where that cost benefit is still overwhelmingly favourable. Just as a range it seems the market has unlimited demand below a thousand, strong demand demand at 1-2k and then interest (from my own research) seems to fall off dramatically because you can substitute for titanium and other new nano materials and super-alloys like Hf Al and other similar things. There is probably still decent demand at $3-5k, some at 10k and almost none except vanity purchases and science experiments above that.

I think eventually CLQ and SCY will work like similar to high grade gold mines. With efficiencies gained and economies of scale I wouldn't be surprised if they ultimately cut costs in half and lower the price, say mine an oz of gold, er kilo of scandium oxide, for 3-400 and sell it for 11 or $1200. That is a pretty damn good mine with nice margins and all the demand they can handle. If the industry gets to this point the sky is the limit for scandium production and I think it will quickly go to hundreds and then thousand of tonnes of demand within a few years of the first sc hitting the market.

The scandium story continues to heat up. SCY is already nearing 10 bagger status for initial purchases and we haven't even gotten started yet! Smooth sailing to ~.30 and slightly beyond when they release drill results from the high grade center of their pit? I think so. Scyward!

Hi Longgun, I fully agree with your comments on Niocorp.

The discussion on price is somewhat more complicated, I think. It is all about the assumptions made. It starts with the way the supply-and-demand-curve is drawn. If supply remains relatively limited, the usage of scandium maybe restricted to areas where a high price is justified. Where the benefits exceed the added costs of scandium. And how about collusion; price setting by the market leader. With only a handful producers this is a foreseeable scenario.

Yesterday was great for all longs, hope this trend continues...

GLTA

The one thing that infuriates me and every other holder of niocorp, is when posters from SCY and CLQ come onto the board and relentlessly bash the pricing of scandium in our PEA.

Our pricing was done through a third party and has been thoroughly researched.

I have scadium international as well as niocorp too. I bought Niocorp for the niobium resource. The one thing that infuriates me and every other holder of niocorp, is when posters from SCY and CLQ come onto the board and relentlessly bash the pricing of scandium in our PEA. Our pricing was done through a third party and has been thoroughly researched. I am a holder of both stocks as I see historical stability in the pricing of niobium and the emerging markets for scandium is limitless.

New multi year high of 22 cents or 11x its March 2014 low. This was one of the easiest multibaggers I have ever seen and very few people participated. We're still only at 12 board followers while some of the worst stocks on earth have hundreds of followers here on ihub.

It looks like my 25 cent target will be achieved shortly (probably this week) after several false starts. Hard to say exactly where to take profits since I think SCY is worth around 50c-a buck at this moment. At these prices a 3 cent move is a ~50% gain for long holders. I anticipate that there will be some interesting trading action over the next year.

SCYWARD!

Big volume .185 Close high of .19 ask at .20 project advancing rapidly, more ongoing drilling in the high grade pit, cash in the bank, one of the largest and most valuable mineral deposits on earth. Short term 25 cent target holding firm, hopefully everyone got their fill at 8 cents. Great opportunities are not to be squandered!

Scandium International Receives US$2.07M from Royalty Sale on Nyngan and Honeybugle Scandium Projects in Australia

Vancouver, British Columbia (FSCwire) - Scandium International Mining Corp. (TSX:SCY) (“Scandium International” or the “Company”) is pleased to announce that it has received US$2.07M (C$2.7M) from a private investor in return for the granting of a 0.7% royalty on gross mineral sales from both the Nyngan property and the Honeybugle property, in NSW, Australia.

Royalty Highlights:

US$2.07M cash proceeds received from sale of royalty

The royalty consists of a 0.7% gross sales royalty on both the Nyngan and adjacent Honeybugle properties, payable quarterly,

The royalty covers all minerals produced and sold from both properties, with no caps, minimums, term limits or early buyout provisions, and

The Company has retained all rights to commence and operate mining projects on both properties, and adjust land holdings, on a commercial basis as defined by management, consistent with other existing private and State royalties on the properties.

The proceeds from the sale of the royalty will be applied to complete the Definitive Feasibility Study (“DFS”) that was initiated in September 2015 and is currently underway. The DFS is being led by Lycopodium Minerals Pty Ltd, of Brisbane, Australia. The DFS will incorporate considerable metallurgical test work independently prepared for the Company over the previous five years, along with engineering, project design work, environmental work, mine planning, development work, and previous economic estimates. Additional metallurgical test work programs are currently underway now, along with studies and programs required to complete an Environmental Impact Statement scheduled for completion in Q4 of 2015. A small infill drilling program within the high-grade pit featured in the DFS is currently underway at Nyngan now.

George Putnam, CEO of Scandium International Mining Corp. commented:

“The Company is fully focused on working with Lycopodium and a cast of specialist engineering/mining consultants to complete a DFS suitable for funding project construction in 2016. This royalty funding ensures that we have the full resources needed to complete a DFS in a quality form, to meet the project standards set by State and Local requirements, and to bring the Nyngan Scandium Project to a financial investment decision-point next year.”

$2 million for a .7 royalty. The market likes the extra cash buffer. The royalty will probably look pretty good for the buyer in a few years but it is modest enough to not be a burden. Forward, forward, tally-ho, off to be the first primary scandium mine we go.

Scandium International Initiates Definitive Feasibility Study on Nyngan Scandium Project in Australia

Vancouver, B.C. Canada – September 10, 2015 – Scandium International Mining Corp. (TSX:SCY) ("Scandium International" or the "Company") is pleased to announce that it has selected the engineering firm Lycopodium Minerals Pty Ltd, of Brisbane, QLD, Australia, to prepare a Definitive Feasibility Study ("DFS") on the Company's Nyngan Scandium Project in New South Wales (NSW), Australia, expected to be completed in the first quarter of 2016.

Work on the DFS will be completed at Lycopodium's offices, directed by Shane Clark who will be the study manager (Group Manager/Brisbane), along with a team of specialists with experience in hydrometallurgy specifically related to lateritic-type resources, as found at Nyngan and elsewhere in Australia. The DFS will include all elements of project description and design to generate an economic report suitable for seeking project construction financing in 2016. Process engineering and other project study elements will be advanced to a +/-15% accuracy level.

While Lycopodium will coordinate the overall project, significant contributions will be sourced from other engineering groups and consultants who have been a part of previous reports, including Altrius Engineering Services Pty Ltd (Brisbane, QLD), Rangott Mineral Exploration Pty Ltd (Orange, NSW), Mining One Consultants (Melbourne, Victoria) and R.W.Corkery & Co. Pty Limited (Orange, NSW). Knight Piesold Pty Ltd (Brisbane, QLD) will contribute engineering services on tailings dams, geotechnical work, and surface water management.

The DFS will incorporate and be based on considerable metallurgical test work independently prepared for the Company over the previous five years, along with engineering, project design work, environmental work on the property, mine planning and development work, and economic estimates done previously for management use, specifically as incorporated in the Amended Technical Report and Preliminary Economic Assessment on the Nyngan Scandium Project, NSW, Australia, effective date October 10, 2014, amended and restated issue date May 20, 2015.

Work on the Environmental Impact Statement (EIS) is expected to be completed in Q4 of 2015. The Company expects to submit mining license applications (MLAs) to the NSW Department of Trade and Industry also in Q4 of 2015. A small infill drilling program, targeted on the high-grade pit featured in the DFS, will begin as soon as practicable in September.

The Nyngan Scandium Project DFS has been commissioned and will be independently prepared to NI 43-101 compliant Technical Report standards, for filing on SEDAR.

George Putnam, CEO of Scandium International Mining Corp. commented:

"Initiating this DFS means the Company now has the platform to bring five years of test work, business development efforts and commercial understanding on the Nyngan scandium resource to both the investor community and to customers. We intend to demonstrate to all of our stakeholders the viability of our resource, and the game-changing nature of the laterite scandium occurrences in NSW Australia. We intend to bring scandium to waiting world markets with this project in 2017."

Peter De Leo, Managing Director of Lycopodium Minerals Pty Ltd, commented:

"Lycopodium has a long track record in the successful evaluation and delivery of minerals- related projects in Australia and internationally, and we are delighted to be working with Scandium International on the DFS for this new and exciting project. We look forward to assisting the Company to realise their goal of achieving production in 2017."

About Scandium International Mining Corp.

The Company is focused on developing the Nyngan Scandium Project into the world's first scandium-only producing mine. The Company owns an 80% interest in both the Nyngan Scandium Project, and the adjacent Honeybugle Scandium Property, in New South Wales, Australia, and is manager of both projects. Our joint venture partner, Scandium Investments LLC, owns the remaining 20% in both projects, along with an option to convert those direct project interests into SCY common shares, based on market values, prior to construction.

The Company filed a NI 43-101 technical report disclosing Measured and Indicated Resources on the Nyngan Project in March of 2010. The Company also filed an amended NI 43-101 technical report on a preliminary economic assessment of the Nyngan Scandium Project in May of 2015, and has completed extensive metallurgical test work on the resource. The Nyngan Scandium Project PEA is preliminary in nature and should not be considered to be a pre-feasibility or feasibility study, as the economics and technical viability of the project have not been demonstrated at this time. In addition, SCY owns a 100% interest in the Tørdal Scandium/REE property in southern Norway, where we continue our exploration efforts, specifically for scandium and REE minerals.

Qualified Persons

Mr. Willem Duyvesteyn, MSc, AIME, CIM, a director and Chief Technology Officer of Scandium International and a "qualified person" as defined in NI 43-101, has approved the technical information contained in this news release.

For further information, please contact:

George Putnam, President and CEO.

Tel: 928-208-1775

Email: info@scandiummining.com

futr

Thanks Longgun. I'm convinced. Still adding to my postion. SCY is a once in a life time opportunity.

It is obvious SCY trades for a tiny fraction of its intrinsic value. Whether it is measured as ~.1 NPV or by its high IRR or deposit potential it is obviously undervalued and is a unique opportunity. It is impossible to say exactly what the company should be worth but it is definitely in the hundreds of millions of dollars. John Kaiser is way smarter and more experienced than I am - look to him for quality direction and information.

Australia: the emerging scandium powerhouse

Posted on September 8, 2015 by Robin Bromby

Nature has been kind to the Australian state of New South Wales, says George Putnam. Nowhere else on the planet has it bestowed such high grades (over 400 parts per million) of scandium. Putnam heads Scandium International Mining Corp (TSX:SCY) which has the Nyngan project in that state.

Read the article at:

http://investorintel.com/cleantech-intel/australia-the-emerging-scandium-powerhouse/

TMLonggun, you have access to KRO. What's your opinion on John Kaisers new NPV model on SCY? Thanks for your reply.

The fact that Sc is a by product for Niocorp should not be considered a minus.

Sc comes to Niocorp free of charge and they can produce 97 MT of it per year.

I am long on both SCY and NB.

I finally received a reply to my e-mail.

It was quite impersonal and looked like a text which one can use for mostly any request (copy & paste). Attached was the latest news release.

Production starts in 2017.

It would be nice to have an updated corporate presentation which reflects all the good news.

I owned Niocorp (sold on spike earlier in the year.) I like niobium and scandium

If you were say an aircraft or auto supplier that could potentially use 100s of tonnes of scandium oxide why would you go to Niocorp (low production, byproduct) vs a scale-able primary mine? The only reason I can think of is because it is in America. SCY is tied to scandium and Nio(niobium)corp is about niobium. Niobium is already a multi billion industry I`d rather invest in another soon to be multi-billion industry via a basket of scandium juniors.

Say I wanted the best X in the world I dont go to the 3rd or 4rth ranked player.

At this point it probably goes like this for rankings in terms of potential viable long term scandium supply:

CLQ - highest grade, Friedland name, very advanced stage, good promotion.

SCY - most advanced project, offtake in place, deposit is essentially equivalent to Syerston. Arguing which is better when both are awesome and have high grade pockets is sort of irrelevant at this stage with already attractive economics.

Metallica- good deposit, farther back in terms of develop train.

Niocorp- Niobium deposit. Scandium is super low grade byproduct. Niobium is used in steel making and the steel and iron market is collapsing, Niocorp has external market risk and huge capex whereas a pure scandium junior has relatively none.

Nio is also low on the tonnage scale and their niobium is not correlated with scandium in their deposit so the economics might lead them in two different directions.

As a big user it makes sense that you`d pick a leading horse. All this is IMO but seems very logical. The big guys will do their due diligence and might even diversify across suppliers for all we know.

Anyway my last post for a bit, going placer mining. Good luck everyone.

Thank your for your information. I'm learning a lot about this matter.

I want to state that I'm long in Niocorp aswell because I don't want to put all my money on one horse. I initially bought Niocorp shares when scandium didn't play a role in this project. I'm pointing this out because I want to avoid confusion. I have the feeling people in the Niocorp board get quickly suspicious and there is a lot of tension over there. I often think that when I mention to them that I also own SCY they would asume that I try to spread negative posts about NIO.

BTT:

If you were an end user why would you make an off-take agreement with NIO instead of CLQ or SCY?

Nio will do some promotion and trailblazing just the same as CLQ and our own project has.

If you were an end user why would you make an off-take agreement with NIO instead of CLQ or SCY?

Nio will do some promotion and trailblazing just the same as CLQ and our own project has. They all sort of compliment each other and assist in raising awareness. If NIO got someone interested in scandium they would logically be led to SCY and Clean Tech.

Long term the production from Australian laterites will drive the scandium price down. I would be surprised if it didn't ultimately go down to $500 or less a kilo. But of course there is two parts, supply and demand, and I could imagine a scenario where the first couple years of production netted 3-5000 but that might not be in our long term best interest. We need to stimulate as much demand ASAP to that the base is as large as possible to grow for the next couple decades. The lower the price the more we will sell and the more it will drive further sales and stimulate that paralyzed mountain of demand. Best case scenario is a high but stable price that is relatively cheap compared to the benefits provided by the material. We can do fine as a niche metals producer but SCY is unique because they could scale to become a multi billion dollar venture if they nabbed even a tiny, minute % of the aluminum market. Once the world gets a taste then demand for scandium will become insatiable and will easily consume all of the world's production from Australia and the byproduct producers. All of them will need to scale up. There is more than enough demand to go around to supply several primary mines, especially in the early stages. First mover advantage should allow Friedland and SCY to dominate the top of the scandium space - although there will be a host of SCAMdium companies hot on their heals.

Scandium is a bet on humanity, progress, and efficiency. It is inevitable - far too valuable to ignore. Never bet against the rise of humanity.

discussions with 10 parties regarding possible off take agreements.

I think there is an interesting post on stockhouse:

http://www.stockhouse.com/companies/bullboard/t.scy/scandium-international-mining-corp?postid=24053418

With regard to Niocorp... in a new video interview, a company exec talks about discussions with 10 parties regarding possible off take agreements.

I like the economics for SCY more than I do for NB -- CAPEX of only 77 million vs. almost 1 billion and an after tax IRR of 40% vs. the 20s.

Read more at http://www.stockhouse.com/companies/bullboard/t.scy/scandium-international-mining-corp#CCmSJK6wvCmZTmZr.99

Very good news!! I like the part where George says: 'We also intend to pursue additional offtake agreements which will further demonstrate the strong demand for scandium we see from end users in a number of areas and products. The manufacturing sector has been waiting for a dependable scandium supply that is both scalable commercially, and located in a proven, stable mining jurisdiction, and we intend to meet that need.'

This sounds like a promise.

Nice!! Oh man, the worst meltdown in the markets I can remember and both Mexus and SCY surged. Go SCY! Buck the trend!

I still haven't finished going through it all but here is research from Clean Tech. Both it and SCY are leading the scandium pack, I just wish I had easier access to the Australian exchange.

News out

http://www.scandiummining.com/s/newsreleases.asp?ReportID=720306

Key News Items:

Common share private placement raises C$2.16 million,

Equity raise triggers conversion of all existing debt into a 20% Joint Venture interest in our NSW scandium projects-Company now debt-free,

Equity funding enables immediate launch of Nyngan project feasibility study, and

Andrew C. Greig appointed to SCY Board.

Vancouver, B.C. – August 24, 2015 – Scandium International Mining Corp. (TSX:SCY) ("Scandium International" or the "Company") is pleased to announce that it has received C$2,167,118 pursuant to a private placement of common shares, priced at C$0.10 per share. Fees of US$60,000 were paid on the transaction. The proceeds of the private placement permit the Company to proceed immediately with a definitive feasibility study on the Nyngan Scandium Project, in NSW, Australia.

In connection with the equity placement, Scandium Investments LLC, an unrelated private investment company, will, on closing of the private placement, convert the US$2.5 million loan made to the Company into a 20% direct joint venture interest in the Company's Nyngan and Honeybugle scandium projects in NSW, Australia. The conversion of the loan into a joint venture interest will be made pursuant to the terms of the convertible loan agreement entered into in June 2014.

The Company also announces the appointment of Andrew C. Greig as a director to the Company's board of directors. Mr. Greig is a former Executive Director of Bechtel Group Inc., and previously was President of Bechtel's Mining and Metals Global Business Unit, headquartered in Brisbane, Australia.

HIGHLIGHTS:

C$2.16M received from private placement, priced at C$0.10 per common share,

Placement proceeds convert existing US$2.5M loan with lender into a 20% JV interest in the Company's NSW scandium projects,

Company now fully debt-free,

Company immediately to launch a feasibility study on Nyngan Project, and

Andrew C. Greig appointed as director, adds significant Australian expertise and a strong global background in resource project development

Loan Conversion

The Company entered into a US$2.5M convertible loan agreement with Scandium Investments LLC, ("SIL") in June of 2014. The loan terms provide for conversion of the loan into a 20% JV ownership interest in the Nyngan and Honeybugle Scandium Projects at such time as the Company successfully raises US$3.0M in project-related funding. SIL and the Company have agreed that the conversion threshold has now been met, based on previous equity financings (US$1.62M) in June-August 2014, and a further US$1.66M through this latest equity financing. As a result, the loan is extinguished on closing of the private placement and SIL will become a 20% JV share partner in the Company's NSW scandium projects, held by our Australian subsidiary, EMC Metals Australia Pty Ltd. In addition, SIL has agreed to accept outstanding loan interest (C$223,748) in Company common shares at C$0.10 per share, and has further agreed to participate in this latest equity private placement.

Feasibility Study

Scandium International intends to proceed immediately with a definitive feasibility study (DFS) and further supplemental property resource drilling and environmental work for the purpose of reaching a final investment decision on the Nyngan Scandium project in early 2016. The Company also plans to apply for conversion of its exploration licenses on the property into mining licenses, in the same timeframe.

New Board Member

Andrew C. Greig joins the SCY Board with 35 years of experience in the mining and natural resource industry with Bechtel Group Inc., a global engineering, construction and project management company. Mr. Greig has held numerous positions with Bechtel, most recently as SVP and Global Manager of Human Resources. Mr. Greig served on the Bechtel Board as a Director and was President of the Mining and Metals Global Business Unit, centered in Brisbane, Australia for 12 years, prior to his HR role. He brings direct experience in developing minerals, resource, power, refining, and chemical businesses in 20 countries across six continents.

George Putnam, CEO of Scandium International Mining Corp. commented:

"The transactions announced today are significant as we now have the capital and a debt-free balance sheet to advance the Nyngan Scandium Project towards being the world's first significant scale scandium-only producing project, creating value for all stakeholders, from existing shareholders to end users. We will now immediately proceed with a feasibility study, apply our final designs to a scandium mine and on-site processing facility, and complete the necessary project development steps to seek construction financing next year. We also intend to pursue additional offtake agreements which will further demonstrate the strong demand for scandium we see from end users in a number of areas and products. The manufacturing sector has been waiting for a dependable scandium supply that is both scalable commercially, and located in a proven, stable mining jurisdiction, and we intend to meet that need.

We wish to welcome our new 20% joint venture partner, Scandium Investments LLC directly into the NSW projects. This partnership was conceived just over 12 months ago, has developed exactly as envisioned, and brings a strong financial and strategic partner alongside us in development.

We also wish to welcome Andrew (Andy) Greig to the SCY Board. Andy brings invaluable and highly relevant experience to the Company in minerals project development exactly at the right time as we move through this stage of the project. We are truly excited to have his help, advice and participation in building our global scandium business."

About Scandium International Mining Corp.

The Company is focused on developing the Nyngan Scandium Project into the world's first scandium-only producing mine. The Company owns an 80% interest in both the Nyngan Scandium Project, and the adjacent Honeybugle Scandium Property, in New South Wales, Australia, and is manager of both projects. Our joint venture partner, Scandium Investments LLC, owns the remaining 20% in both projects, along with an option to convert those direct project interests into SCY common shares, based on market values, prior to construction.

The Company filed a NI 43-101 technical report disclosing Measured and Indicated Resources on the Nyngan Project in March of 2010. The Company also filed an amended NI 43-101 technical report on a preliminary economic assessment of the Nyngan Scandium Project in May of 2015, and has completed extensive metallurgical test work on the resource. The Nyngan Scandium Project PEA is preliminary in nature and should not be considered to be a pre-feasibility or feasibility study, as the economics and technical viability of the project have not been demonstrated at this time. In addition, SCY owns a 100% interest in the Tørdal Scandium/REE property in southern Norway, where we continue our exploration efforts, specifically for scandium and REE minerals.

The auto industry would consume a lot of Al-Sc alloy. Engine blocks & heads are already used to save weight, they can be made even lighter. Other iron castings could be replaced by the Al-Sc alloys.

Interesting, thank you.

It always seemed strange to me that some industries that would benefit the most from modern technology usually seem the slowest to move and adopt it even when it is in their economic best interest to do so.

On more a scandium related note I have finished reading nearly all of Kaiser's information. Needless to say my confidence has risen from 100%-110% if that is even possible. Just replacing some brake units alone would amount to 3-10,000 mt of scandium demand and would provide immediate fuel savings since they are one of the heaviest components of a ground vehicle. Some calculations I did was getting to around 100,000 mt of scandium oxide demand before I stopped and I still had dozens of industries to go. Our 35 mt is not going to supply the world. Good thing the project is so scale-able because humanity needs scandium will want it as soon as they know it exists.

Okay, here it is.

I work at an insurance company; we sell our products mainly through the independent broker channel. Back in 1999, we were the first to introduce web based systems for quotations and new applications. Brokers were used to working with (stand alone) Windows laptops, which gave them a lot of flexibility. 'Web based' had lots of benefits but mobile internet wasn't as fast and reliable as it is today.

Although everybody did agree that web based systems were the future, it took us far more time than anticipated to get an installed base. In order to work with these new systems, these brokers had to modify their sales processes. For instance, due to slow mobile internet, they had to meet clients at their offices rather than their homes, like they were used to.

Some brokers were early adopters - often small ones - while others waited for more proven technology. When some of your best and biggest brokers are laggards, you can see how challenging the adoption process is.

|

Followers

|

10

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

264

|

|

Created

|

12/06/10

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |