Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$SPX - Micro-Chart Update of the 'Broadening' Plot formed within the lrgr one from yesterdays 5-Min chart. Here shown on a 1-Min...

By: Sahara | May 1, 2024

• $SPX - Micro-Chart Update

An update of the 'Broadening' Plot formed within the lrgr one from yesterdays 5-Min chart. Here shown on a 1-Min...

Read Full Story »»»

DiscoverGold

DiscoverGold

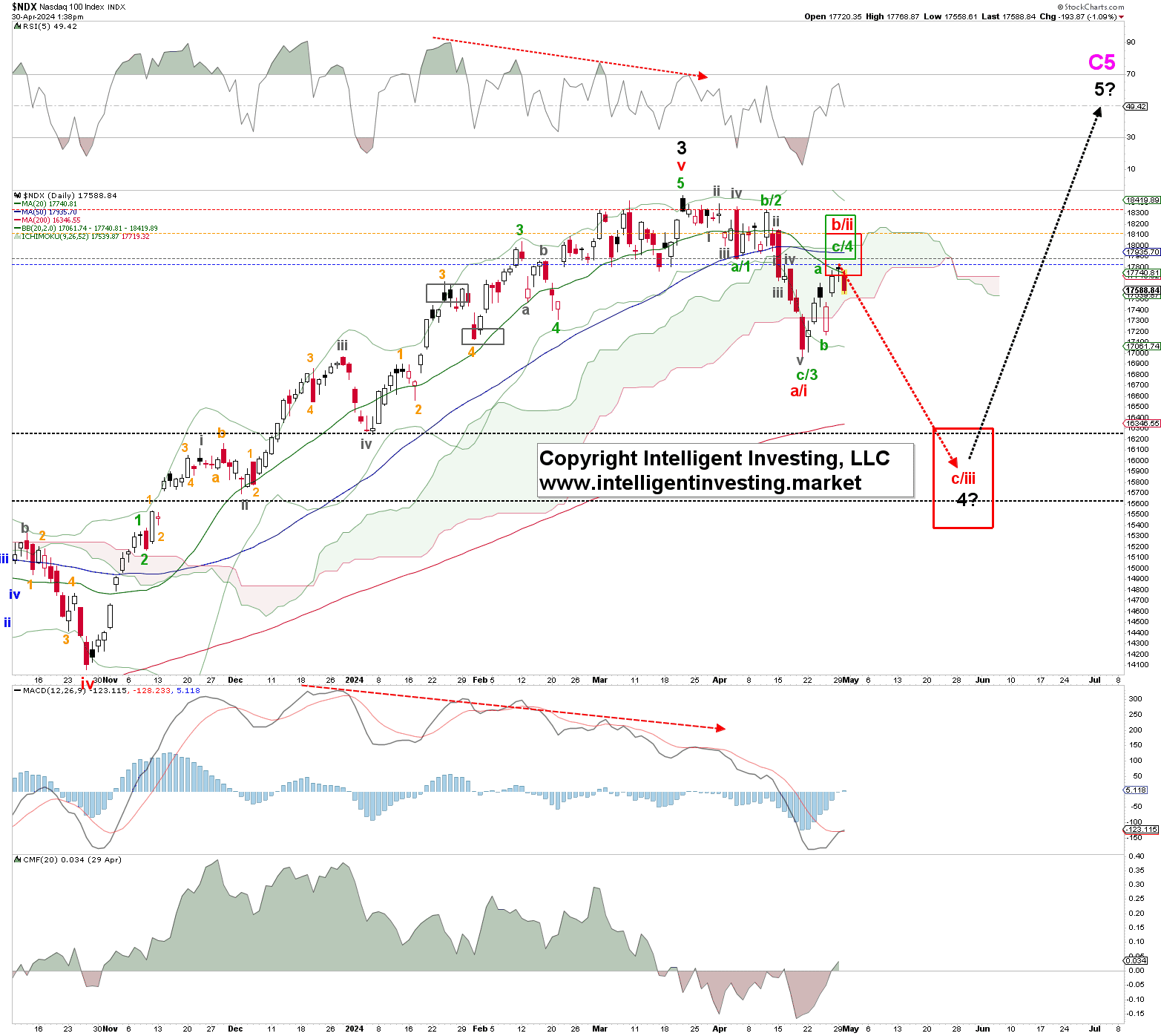

More Pain Ahead for the NASDAQ100?

By: Dr. Arnout Ter Schure | April 30, 2024

• A counter-trend rally has most likely been completed, contingent on holding below at least $18100, and the index should be ready to drop to $15900+/-500.

Was That a Dead Cat Bounce?

In our previous update from early April (see here), we found that the NASDA100 (NDX) had peaked at $18464 on March 21, which was only 0.81% below the ideal target of ~$18615 we had set forth three weeks prior. As such, we concluded:

“…Thus, our preferred [Elliott Wave Principle] (EWP) count is for a larger top to have formed, … and [the Index] is heading for the ideal black W-4? target zone of $15900+/-200.”

Over the next seven trading days, the index lost an additional 5.8%, validating our warning, but it has since staged a 5% rally to yesterday’s $17820 high. Thus, is the correction over, or did we experience a “Dead cat bounce”?

Once again, the EWP can greatly help us. Namely, the rally from the April 19 low has so far been in three (green) waves. See the chart in Figure 1 below. Three-wave rallies are counter-trend rallies, aka “dead cat bounces.”

Thus, our preferred EWP count is for a larger top to have formed yesterday, the red W-b/ii, contingent on holding below the colored warning levels shown in Figure 1 above. The index should now be ready to embark on its red W-c/iii leg lower to ideally $15900+/-500, depending on the Fibonacci extension of this second leg lower.

Our less likely alternative is that yesterday’s high was only a fourth wave and a smaller decline to around $16700+/-100 awaits. The “countertrend rally and the next leg-lower” sequence can commence there.

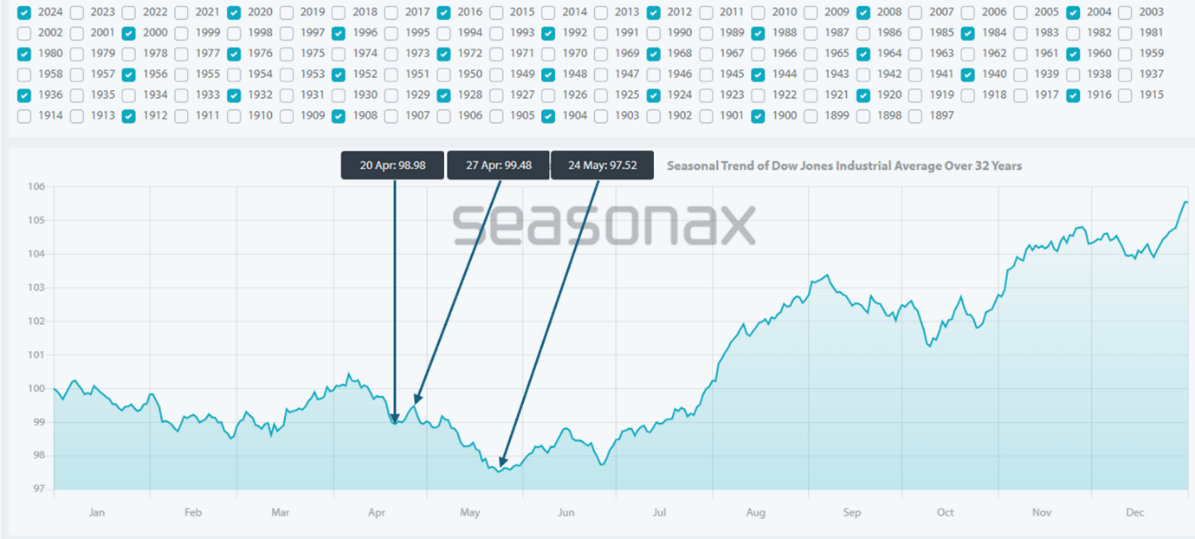

Seasonality and the Anatomy of a Three-wave Rally

However, based on seasonality for an election year, where we look at the Dow Jones because it allows us to have 32 data points vs. only ten if we use the much younger NDX, the recent April 19 low and April 29 high were right on queue. See Figure 2 below. Moreover, as you can see from our X/Twitter profile here, we have accurately forecasted every market high and low since last week using a counter-trend scenario/EWP count. Forecasts like these dramatically help our premium members to stay on the right side of the market.

Figure 2. Dow Jones average seasonality for an election year since 1897, resulting in 32 data points.

Thus, six weeks ago, we found the NDX would likely top at around $18615, and we got $18464. Three weeks ago, we warned that a significant top could have formed and were validated with a 5.8% decline since. The current rally off the recent low counts best as a counter-trend rally and, together with seasonality, suggests the next leg lower to ideally $15900+/-500, is underway, contingent on holding below the warning levels for the Bears outlined in this article. Lastly, please note that a break below the October 2023 low tells us the bull market is over.

Read Full Story »»»

DiscoverGold

DiscoverGold

May’s First Trading Day: S&P 500 and Russell 2000 Higher 69.2% of the Time

By: Almanac Trader | April 30, 2024

The first trading day of May has had a bullish history over the past 26 years. DJIA, S&P 500 and NASDAQ have all averaged around 0.4% on the day. S&P 500 and Russell 2000 have the best track records, up 18 times or 69.2% of the time since 1998. With an average gain of 0.21%, Russell 2000 is slightly weaker. May’s first trading day’s worst loss was in 2020. DJIA and S&P 500 shed over 2.5% while NASDAQ and Russell 2000 dropped over 3%.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX Hello there $145+ Million Calls

By: Cheddar Flow | April 30, 2024

• $SPX Hello there

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX Large $40+ Million ATM Call Roll

By: Cheddar Flow | April 30, 2024

• $SPX Large $40M+ ATM Call Roll

This whale is likely rolling their 4/30's to 5/31 here for end of month rebalancing

Even though both are above the ask, the split, expiration change and timing make it a contract roll

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | April 30, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | April 30, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500: The current reading of 68.37 indicates that the US stock market is not yet overbought, suggesting that there is still upside potential

By: Isabelnet | April 30, 2024

• S&P 500

The current reading of 68.37 indicates that the US stock market is not yet overbought, suggesting that there is still upside potential.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Zweig Breadth Thrust is considered the granddaddy of thrusts, with an excellent record of signaling ends to corrections...

By: SentimenTrader | April 30, 2024

• The Zweig Breadth Thrust is considered the granddaddy of thrusts, with an excellent record of signaling ends to corrections. It got close to triggering this time but fell short.

Even so, its behavior so far is compelling and may be enough of a tailwind for bulls, even if it's far from "official."

Read Full Story »»»

DiscoverGold

DiscoverGold

The S&P 500 Financials triggered a bullish signal when the percentage of stocks trading above their 10-day average surged above 80%, following more than 80% of the issues achieving an oversold condition. This surge from an oversold status occurred within the context of more than 80% of members closing above their 200-day average

By: SentimenTrader | April 29, 2024

• The S&P 500 Financials triggered a bullish signal when the percentage of stocks trading above their 10-day average surged above 80%, following more than 80% of the issues achieving an oversold condition. This surge from an oversold status occurred within the context of more than 80% of members closing above their 200-day average.

Read Full Story »»»

DiscoverGold

DiscoverGold

Markets Monthly Pattern »» Watchlist - Top 10

By: Marty Armstrong | April 30, 2024

• Dow Jones Industrials Index »» Pendulum Swing to Downside

• NASDAQ Composite Index »» ReTesting Support

• NASDAQ 100 Index »» ReTesting Support

• S&P 500 Index »» ReTesting Supportr

• Russell 2000 Index »» New Pattern Forming

• US Dollar Index »» Knee Jerk Low

• CBOE VIX Index »» Temp High

• NY Gold Futures »» Pressing Higher

• NY Silver COMEX Futures »» Possible Sharp Rally

• NY Crude Oil Futures »» New Pattern Forming

DiscoverGold

DiscoverGold

The Market Greed/Fear Index stands at 60.07, which is now far from extreme greed territory, indicating a more neutral sentiment in the market

By: Isabelnet | April 29, 2024

• Sentiment

The Market Greed/Fear Index stands at 60.07, which is now far from extreme greed territory, indicating a more neutral sentiment in the market.

Read Full Story »»»

DiscoverGold

DiscoverGold

In election years, historical data shows that the S&P 500 tends to perform strongly during the months of June, July, and August, as investors gain confidence from the clarity provided by the election process

By: Isabelnet | April 29, 2024

• S&P 500

In election years, historical data shows that the S&P 500 tends to perform strongly during the months of June, July, and August, as investors gain confidence from the clarity provided by the election process.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX - Latest Watching a Pot'l 'Diamond' Plot...

By: Sahara | April 29, 2024

• $SPX - Latest

Watching a Pot'l 'Diamond' Plot...

Read Full Story »»»

DiscoverGold

DiscoverGold

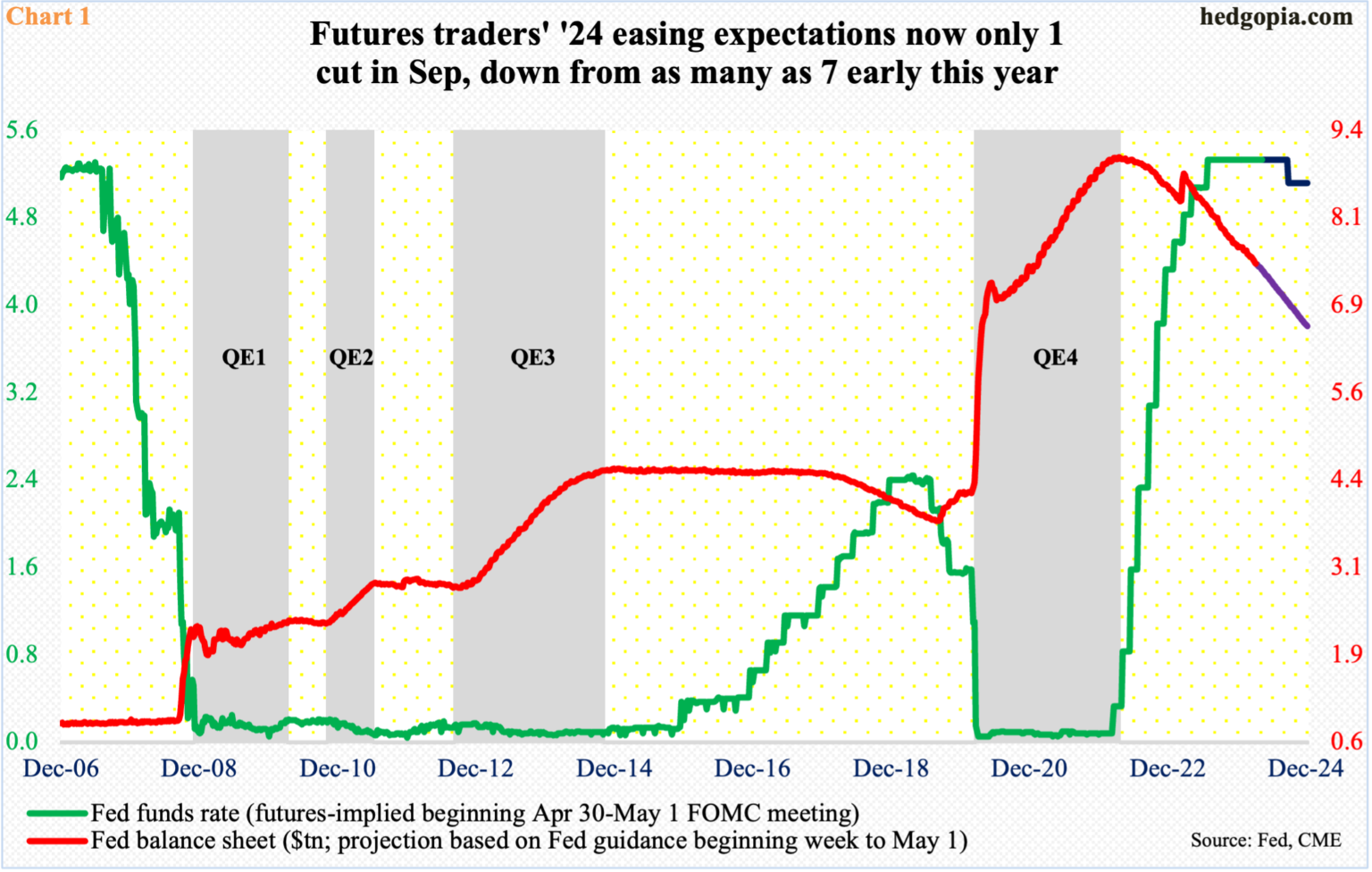

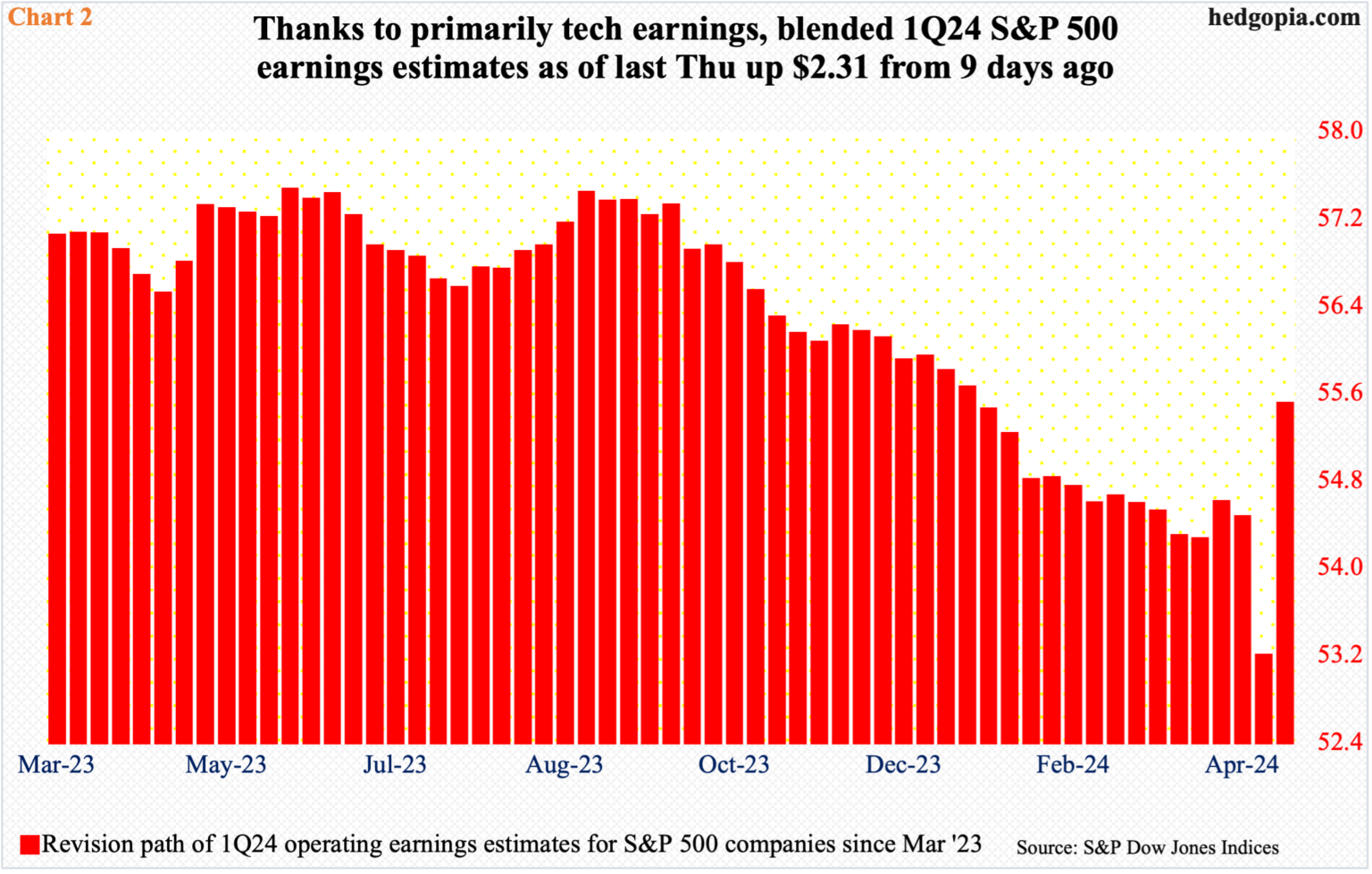

For Equities To Repeat Last Week’s Feat, They Will Need Help From Both FOMC And Tech Earnings This Week

By: Hedgopia | April 29, 2024

In the latter part of last week, tech delivered, helping the major US equity indices rally big. Two issues could make or mar this week. The FOMC meets, and two more tech behemoths report earnings.

The FOMC meets this week, and what comes out of it could prove to be crucial for risk assets.

US stocks bottomed last October and took off post-December 13th FOMC meeting when Chair Jerome Powell made a dovish pivot. Soon, the futures market was consistently betting on as many as six 25-basis-point cuts this year – pricing in even seven at one point. This began to get modeled in analyst forecasts, and risk assets, including equities, shifted into higher gear.

Fast forward to now, futures traders now expect only one cut – in September (Chart 1). Earlier, the Federal Reserve tightened from a range of zero to 25 basis points in March 2022 to between 525 basis points and 550 basis points last July, even as it continues to shrink its still-inflated balance sheet.

Persistent strength in most economic data, including jobs, and sticky inflation has forced even the dovish FOMC members to change their tune and lean hawkish. There are some that are now vouching for no cut to maybe one cut. Until the March meeting, the dot plot expected three cuts this year.

It is possible Powell on Wednesday will lean hawkish outright, or at least not sound as dovish as in December or later. From risk assets’ perspective, the worse is if he openly espouses one cut, let alone talk about the possibility of a hike.

For tech investors, with tech-focused indices such as the Nasdaq 100 having rallied massively from last October’s low on optimism of loads of rate cuts, the interest-rate outlook matters. Thus the importance of this week’s FOMC meeting. Then, there is March-quarter earnings.

Last week, the big ones delivered. Facebook owner Meta (META) bettered the consensus estimates but its outlook came up short and was punished. Microsoft (MSFT) and Google owner Alphabet (GOOG), on the other hand, pleased investors with both their quarterly results and the outlook.

As a matter of fact, thanks primarily to tech earnings, the blended earnings estimates for S&P 500 companies as of last Thursday jumped $2.31 from nine days ago to $55.49, which is the highest since mid-January (Chart 2). This week, Amazon (AMZN) reports on Tuesday and Apple (AAPL) on Thursday. Going into this, AAPL’s estimates are flat to ever so slightly lower from a month ago, while AMZN’s is flat.

If both these events cooperate – FOMC and earnings – there is room for the Nasdaq 100 to continue to push higher.

Last week, the tech-heavy index jumped four percent to 17718. This followed four consecutive down weeks. Earlier, it posted a new intraday high of 18465 on March 21st but struggled to decisively break out of 18300s for seven weeks before sellers took control. By the 19th, the Nasdaq 100 ticked 16974, down 8.1 percent from the high.

Ahead, the 50-day, which is now slightly pointing lower, rests at 17939, with the index under the average for 10 sessions. At 18000 lies trendline resistance from last month’s high (Chart 3). Even in a scenario in which the index rallies, sellers probably will get active at this resistance.

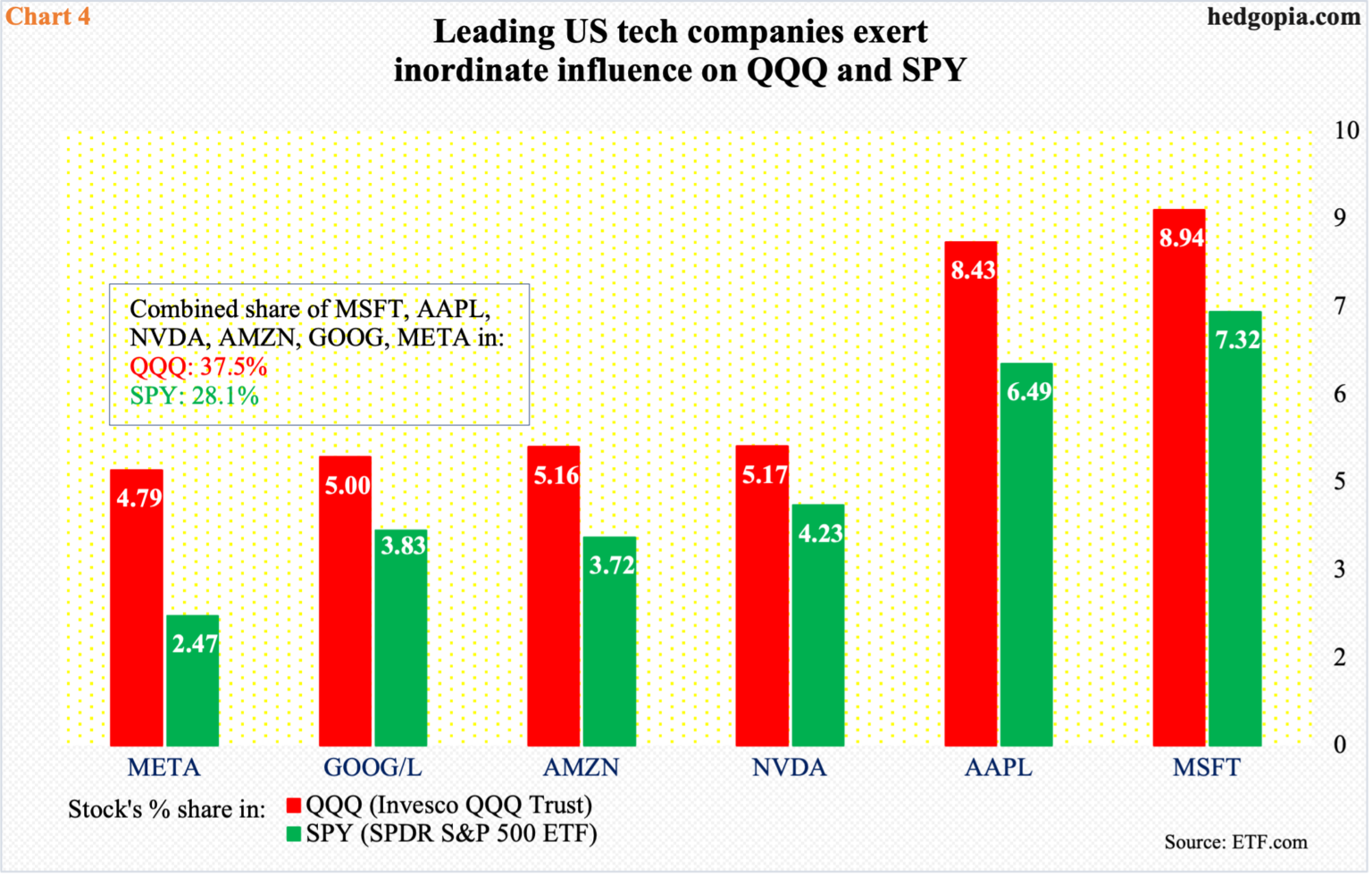

The S&P 500 is the other one to get impacted the most by this. Both these indices are market cap-weighted, and the bigger companies are obviously given bigger weights. The top six – MSFT, AAPL, Nvidia (NVDA), AMZN, GOOG and META – account for 37.5 percent of the Nasdaq 100 and 28.1 percent of the S&P 500 (Chart 4).

This is a massive amount of concentration in just a select a few. This cannot be considered healthy from many respects, but the fact remains that they are also the ones minting a lot of money with healthy margins.

If AAPL and AMZN deliver this week and the stocks rally, the share of the six will only expand.

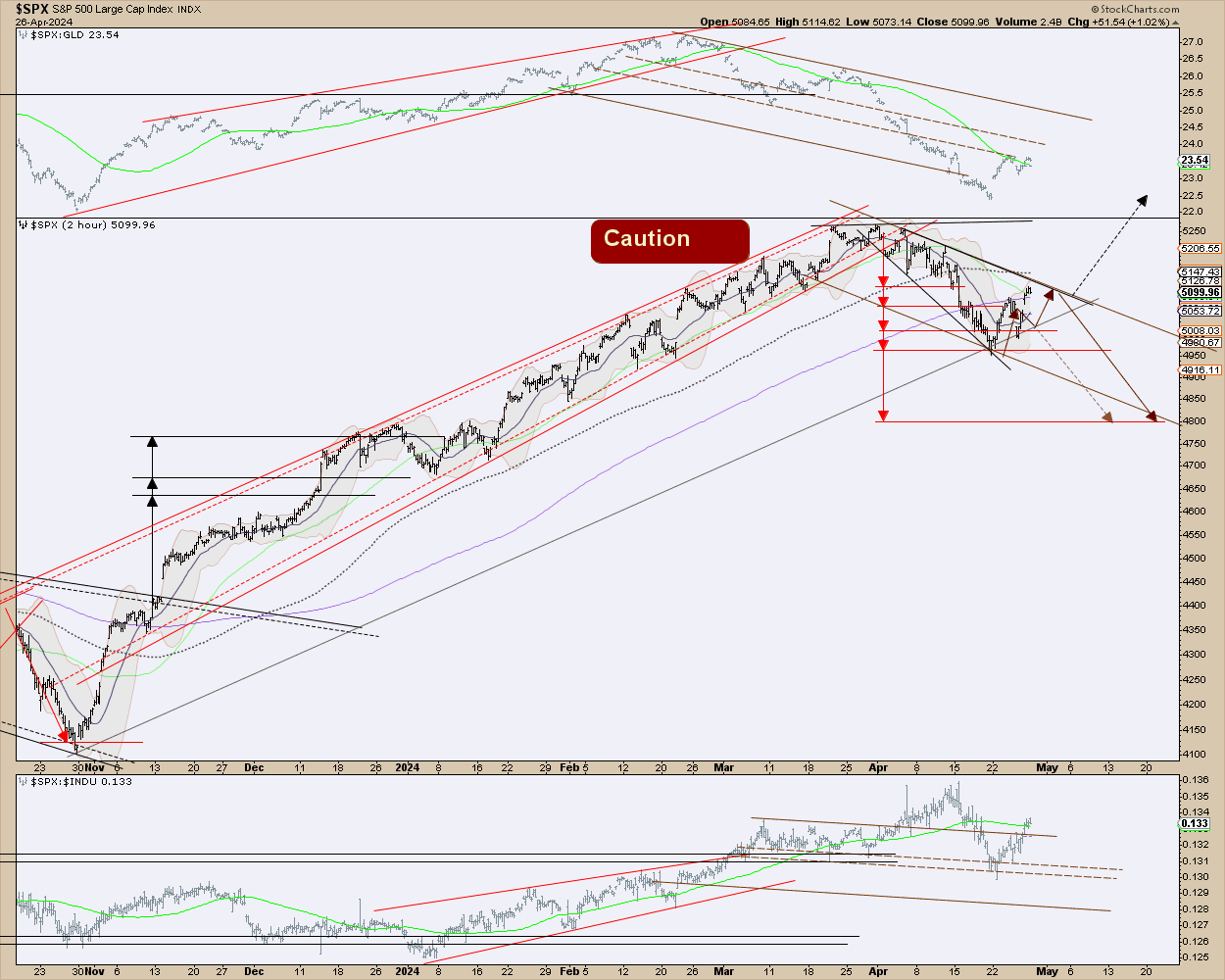

The two are reporting even as the S&P 500 finds itself just under the 50-day. Last week, the large cap index rallied 2.7 percent to 5100, with Friday’s intraday high of 5115 just about testing the average at 5124 (Chart 5).

The index has remained under the average for 10 sessions, having dropped for three weeks in a row before last week’s rally. Earlier, it ticked 5265 on March 28th and turned lower, failing to clear 5260s in three sessions over seven. Bulls put foot down at 4954 on the 19th – for a 5.9-percent drop from high to low.

Importantly, several daily indicators such as the RSI have now risen to the median. This is an opportunity for the bears to force the metric turn down, which will then lead to a reassertion of downward momentum. Bulls put their foot down last week, and they will have to do it again this week. For that, they will need help from both Powell and tech earnings.

Read Full Story »»»

DiscoverGold

DiscoverGold

Market Situation Report: Impending Quantitative Tightening Tapering

By: Hedgeye | April 29, 2024

Quantitative Tightening (QT) was initiated in 2022 with the objective of draining excess reserves from the financial system. However, the extent of liquidity removal thus far has been negligible, and there are indications that the Federal Reserve may announce a tapering of QT operations in the upcoming week.

Despite the Fed's bond holdings decreasing by $1.6 trillion from their peak in mid-2022 due to QT, bank reserves, which represent system liquidity, have remained virtually unchanged. This can be attributed to money market funds effectively neutralizing a significant portion of QT's impact by absorbing a substantial amount of Treasury issuance from Secretary Janet Yellen, thereby preventing the need for private sector banks to do so. Additionally, Yellen has taken steps to mitigate duration risk in the system by disproportionately issuing short-term Treasury bills.

If the Federal Reserve announces a tapering of QT operations, coupled with the Treasury Department utilizing a portion of the current $941 billion balance in the Treasury General Account, it could result in a prolonged period of ample liquidity in financial markets.

Read Full Story »»»

DiscoverGold

DiscoverGold

U.S. Stocks appear to be at an important Short-term/Tactical turning point within an ongoing Intermediate-Term correction

By: Macro Charts | April 27, 2024

U.S. Stocks appear to be at an important Short-term/Tactical turning point within an ongoing Intermediate-Term correction.

Weekly Sell signals remain active – a multi-week/multi-month correction is likely still in progress.

If a bounce develops, it should ultimately fail – an updated chart review suggests key levels to consider adjusting risk exposure.

China remains in a confirmed NEW Bull Market – this week’s price action was a classic continuation Buy signal.

We’ll cover some key Chinese Stocks that continue to hold my attention.

Bond Yields & Volatility remain in an uptrend and have room to move significantly higher.

We’ll cover potential projections & scenarios I’ve been tracking for the past few months.

The Dollar is in an uptrend after launching from a multi-month base.

Precious Metals & Miners may need to pause/consolidate for a while.

SECTION 1:

CORE MODELS & DATA

Core Risk was extremely oversold and turned UP on Monday.

As shared last week, the model plunged since triggering Sell mid/late March – one of the fastest drops in history.

With this turn UP confirmed, look for “a” bottom and potential sharp retracement bounce lasting ideally 1-2 weeks.

It’s possible this was “the” bottom and Stocks will now rally back to the highs – however I consider this a lower-probability scenario, and will present charts as to why.

Further, Weekly Sell signals remain active – a multi-week/multi-month correction is likely still in progress.

Another possibility: the current sequence could play out similar to the Buy signals in the correction that ended last October (see chart below).

Either way: Short-term odds are likely skewed higher.

Later in this report, we’ll cover potential key chart levels to consider adjusting risk exposure.

Read Full Story »»»

DiscoverGold

DiscoverGold

The most overbought stocks in the S&P 500

By: Barchart | April 28, 2024

• Alphabet $GOOGL, Chipotle Mexican Grill $CMG, and Charles Schwab $SCHW are among this week's most overbought stocks in the S&P 500.

Read Full Story »»»

DiscoverGold

DiscoverGold

Here's What You Need To Know About Last Week's Rebound

By: Tom Bowley | April 28, 2024

The Volatility Index ($VIX) is one of my key sentiment indicators and it has a history of accurately predicting corrections and bear markets. We've had neither without the VIX first clearing an important hurdle in the 17-20 range. Bear markets require a huge dose of fear and panic and the VIX acts as our stock market meteorologist - one that predicts major market storms as they're approaching. Throughout this entire secular bull market, the S&P 500's poor periods of performance have been marked by VIX readings above 20. Rather than repeat these results in this article, you can check out a Trading Places article that I wrote in November 2023, "What Are The Chances Of A Market Crash? This Indicator Says ZERO!"

On recent Trading Places Live YouTube shows and in my regular emails to our EB.com members, I've consistently discussed the significant increase in risk that accompanies a VIX close above 20. I do not take it lightly and neither should you. But check out what happened over the past few weeks as the VIX spiked and neared 20:

We had a straight-up move off the October 2023 low and the above chart simply reeks of slowing bullish momentum throughout the second half of Q1. I expected March weakness, but it was delayed into April. That final move lower in October was characterized by the big VIX increase - ultimately with closes on the VIX above 20. Once that VIX returned below 17, the selling and correction was over and the bull market resumed. Hence, the reason for my November article linked above.

When I evaluate a bounce like the one we had last week, I like to see if there's a resumption of the "risk on" market environment. Here are a few ratios that I like to follow and how they responded during the bounce:

These 3 ratios all bounced higher with the S&P 500, but all remain in downtrends that began before the S&P 500 selling did. That tells me that "risk off" still remains in play to some degree and we'll need further confirmation that a short-term bottom is in play. IF we do turn lower again, watch the VIX. If we see fresh new lows on the S&P 500 and the fear dissipates (ie, VIX remains below 20), I'd view that as a positive signal.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX - Zoomed in...

By: Sahara | April 27, 2024

• ... $SPX - Zoomed in...

Read Full Story »»»

DiscoverGold

DiscoverGold

Election year seasonality has been spot on this month with $QQQ pulling back right on cue. Will April showers bring May flowers for the bulls?

By: TrendSpider | April 26, 2024

• Election year seasonality has been spot on this month with $QQQ pulling back right on cue.

Will April showers bring May flowers for the bulls?

Read Full Story »»»

DiscoverGold

DiscoverGold

CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | April 27, 2024

• Following futures positions of non-commercials are as of April 23, 2024.

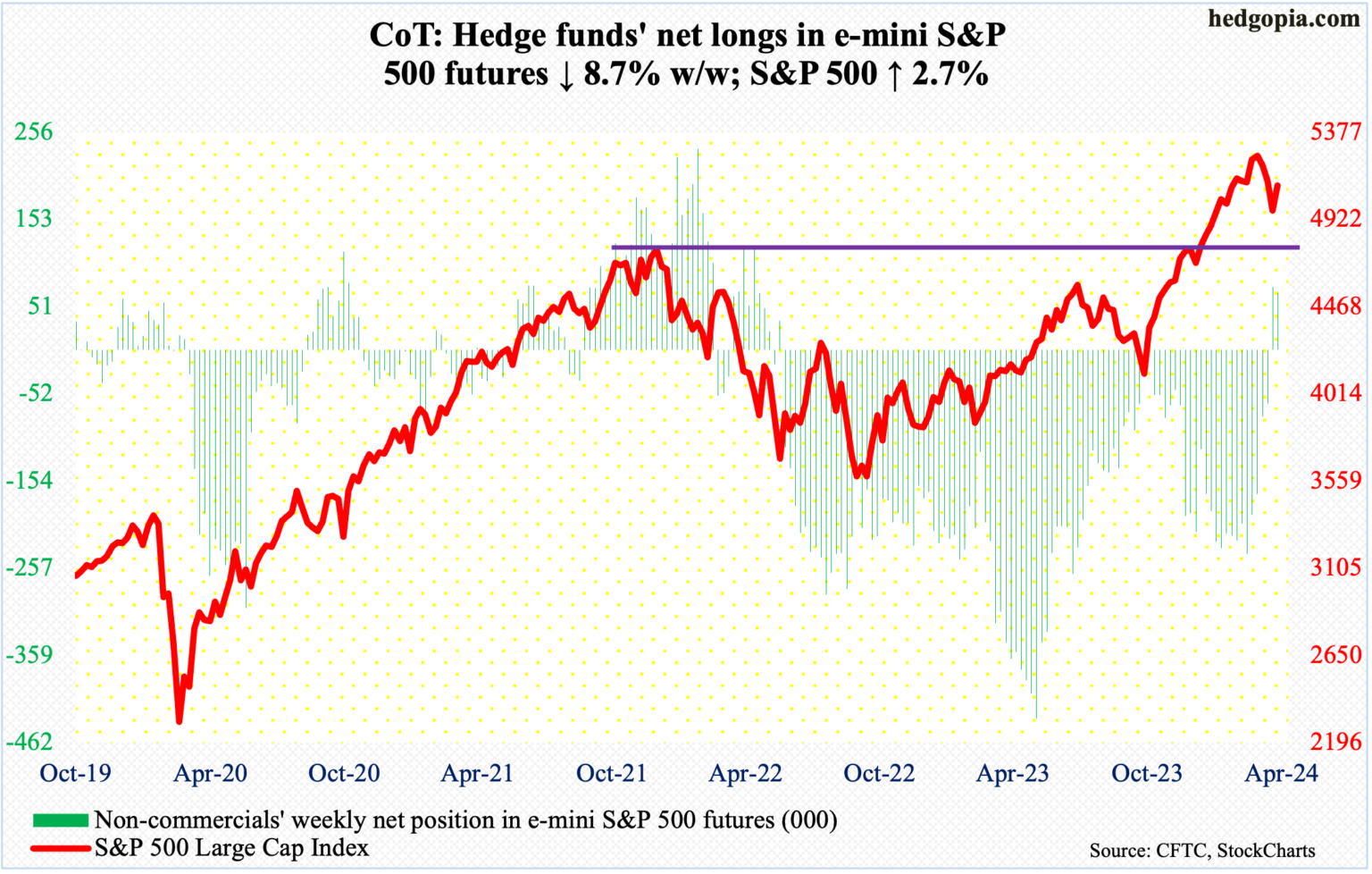

E-mini S&P 500: Currently net long 67.7k, down 6.4k.

Equity bulls’ mettle is being tested and it will only get intense next week. They put their foot down this week after the S&P 500 gave back 5.9 percent intraday from the March 28th high. The large cap index ticked 5265 in that session and turned lower, having tried and failed to clear 5260s in three sessions over seven.

Last Friday, the index tagged 4954. This week, it rallied 2.7 percent to 5100, with Friday’s intraday high of 5115, which just about tested the 50-day at 5124. The S&P 500 has been under the average for 10 sessions now.

Concurrently, several daily indicators such as the RSI have approached the median, and this is a decision time for the bulls – as well as for the bears. If the RSI, for instance, turns back down, then the latter will be eyeing at least last Friday’s low.

In due course, breakout retest at 4819 is just a matter of time. That was the prior high from January 2022 and the S&P 500 waited two years to surpass the old high this January.

Sentiment has taken a hit in recent weeks, but not low enough to signal a durable bottom (more on this here).

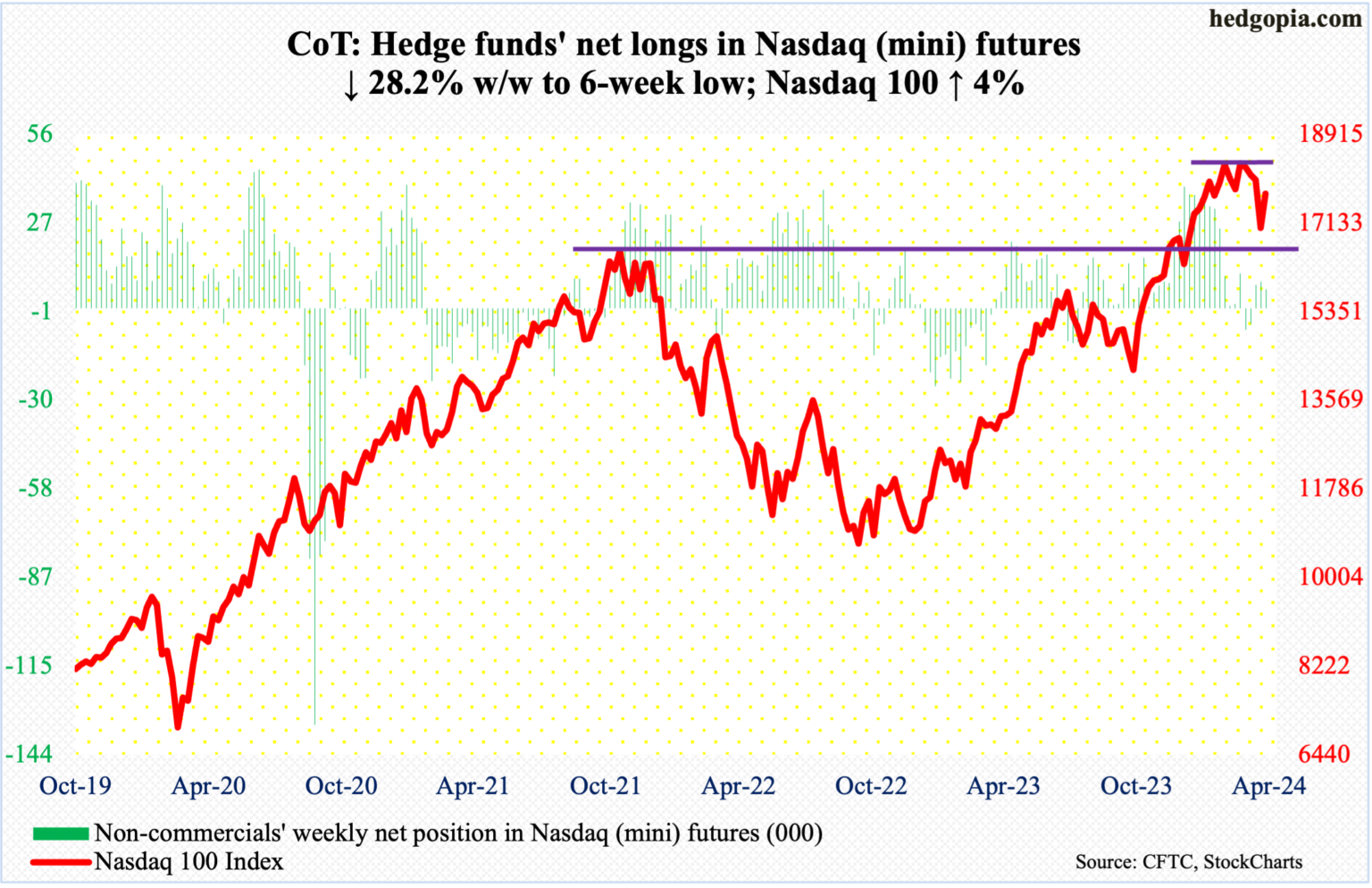

Nasdaq (mini): Currently net long 6.1k, down 2.4k.

The Nasdaq 100 had a topsy-turvy week, with a high of 17773 and a low of 17010. Until Thursday, it touched 17172 intraday; early on it that session, bulls were on the back foot reacting to Meta’s (META) March-quarter results. Then, come Friday, they came roaring back on the back of results from Microsoft (MSFT) and Google owner Alphabet (GOOG). In the end, tech bulls could not have asked for more (more on this here). The tech-heavy index shot up four percent for the week to 17718.

This came after four consecutive down weeks. The Nasdaq 100 posted a new intraday high of 18465 on March 21st but failed to sustainably break out of 18300s for seven weeks before rolling over. By last Friday, it ticked 16974, down 8.1 percent from the high.

Next week, Amazon (AMZN) reports on Tuesday and Apple (AAPL) on Thursday. If these results help and the index continues higher, the 50-day, which was breached 10 sessions ago, is at 17939. After that comes 18200, which is where trendline resistance from the March 21st high, rests.

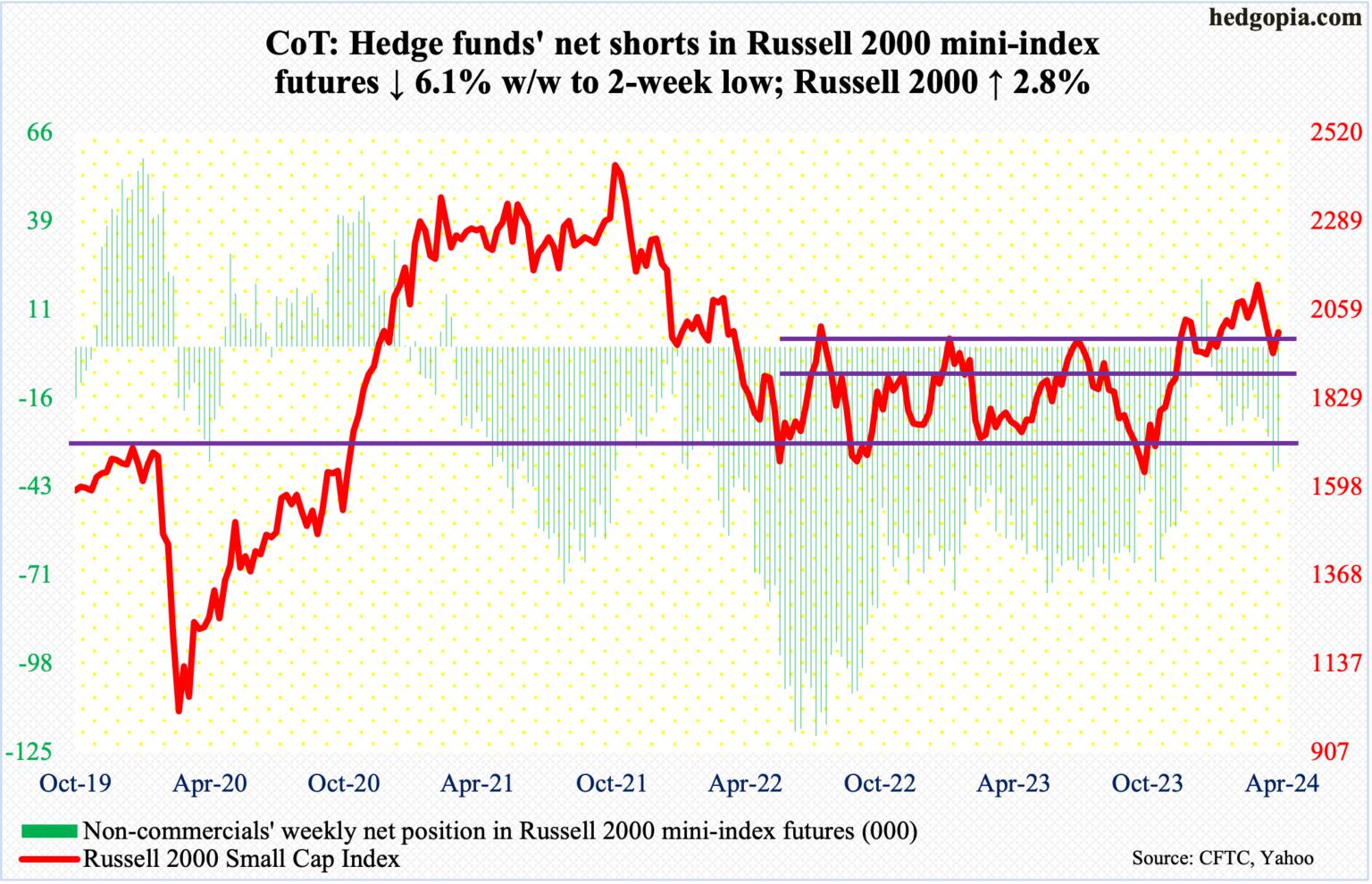

Russell 2000 mini-index: Currently net short 36.1k, down 2.4k.

The Russell 2000 is back at 2000, closing up 2.8 percent this week to 2002; last week, it fell by the same amount from 2003. There is decent support/resistance at 2000. Earlier, after several attempts for a month through early this month, small-cap bulls failed to convincingly break out of 2100. Subsequently, the index dropped to 1932 last Friday.

As things stand, it is a toss-up between the bulls and bears. Inability to push through 2000 eventually opens the door to breakout retest at 1900. On December 13th, the index broke out of a 1700-1900 range in place since January 2022.

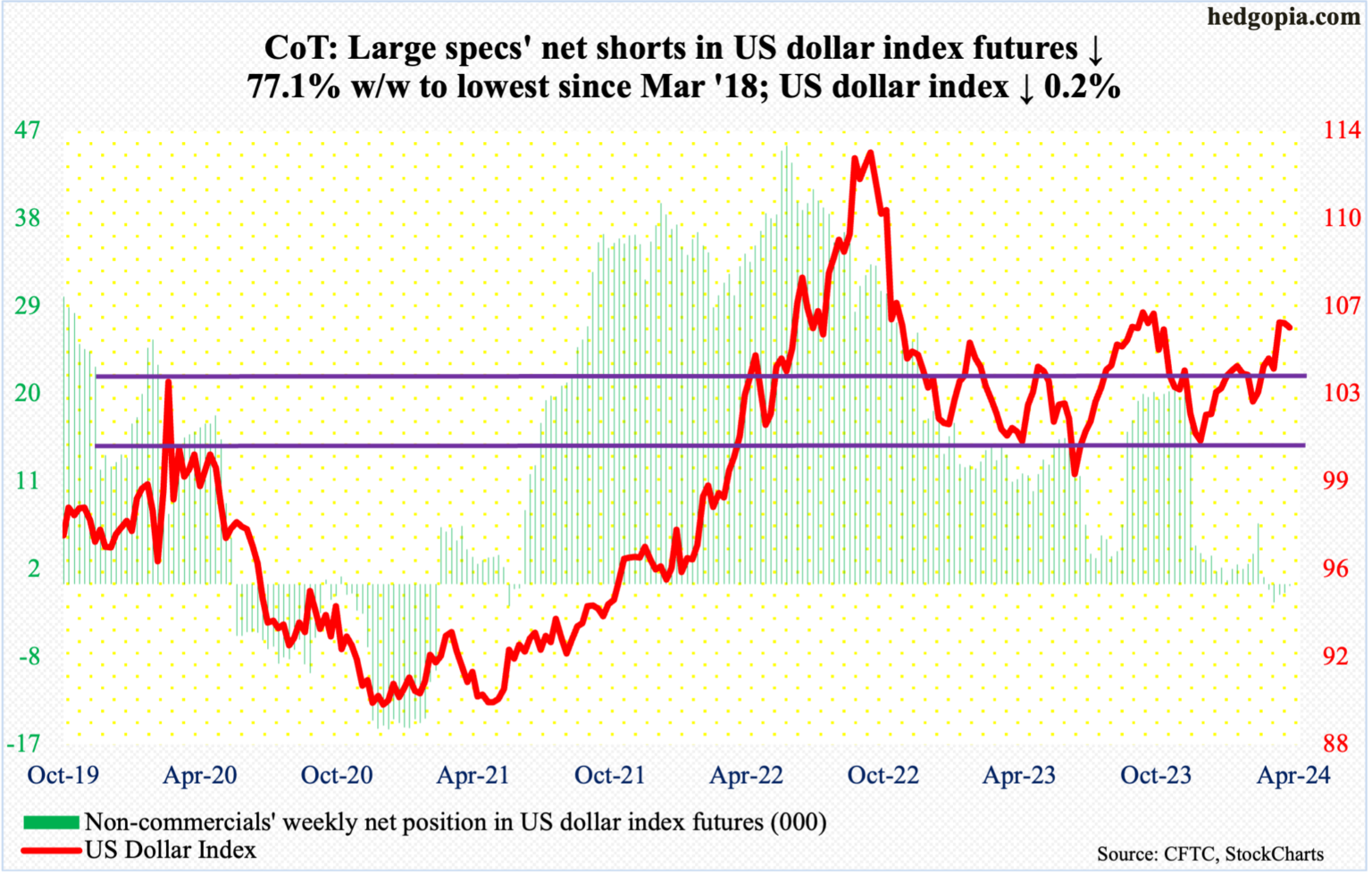

US Dollar Index: Currently net short 213, down 716.

The US dollar index suffered its back-to-back down week, although the decline has been nothing to write home about. This week, it closed at 105.80, versus last week’s close of 105.98 and 106.01 before that.

Dollar bulls were unable to build on a 1.9-percent jump three weeks ago. Selling pressure has picked up just north of 106. Ideally, they would have loved to test 107, which between early October and early November last year rejected rally attempts several times.

Earlier, the index bottomed at 100.32 last December, followed by a takeout three weeks ago of 103-104, which goes back to December 2016.

On the weekly, the path of least resistance is down.

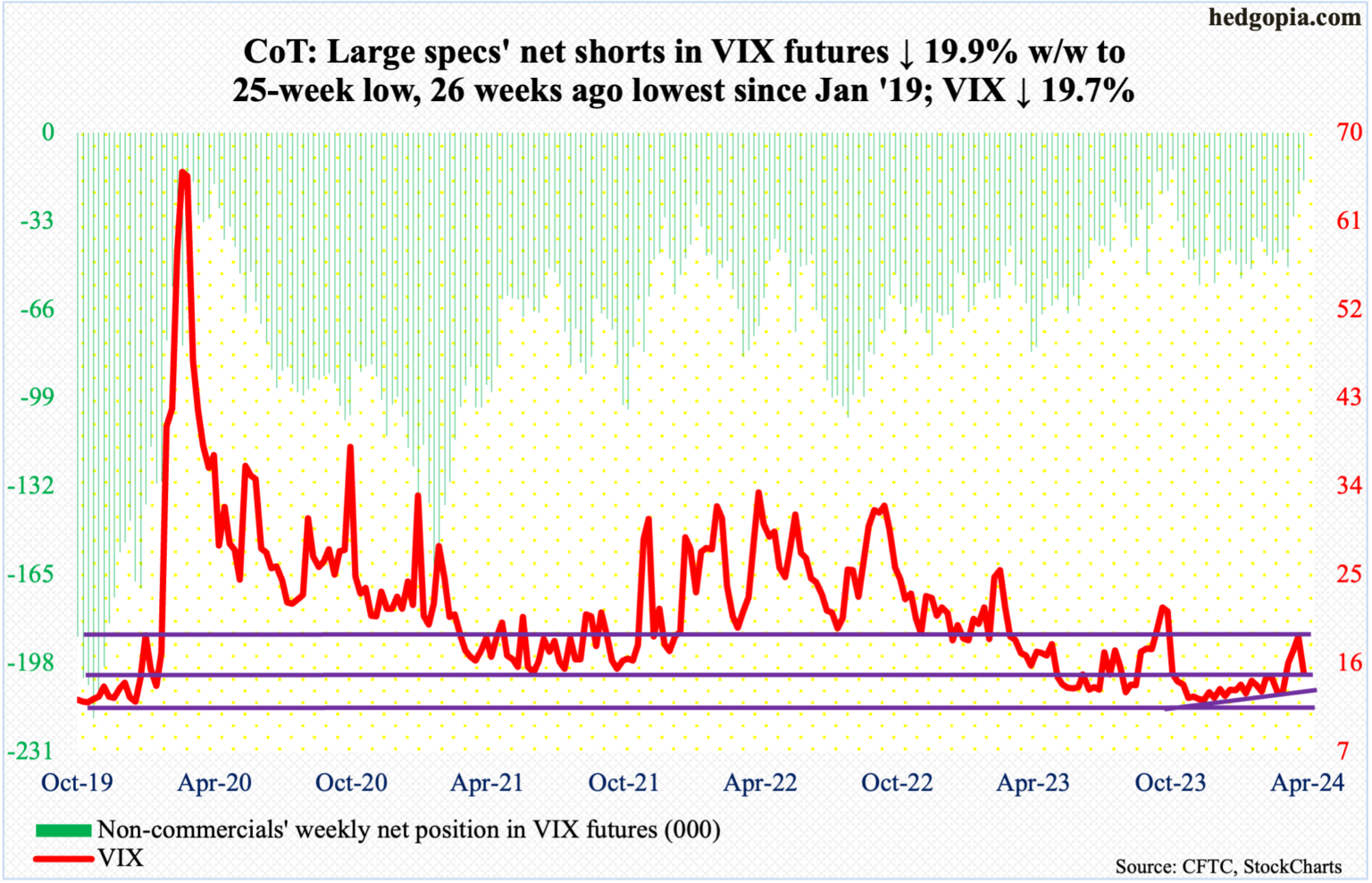

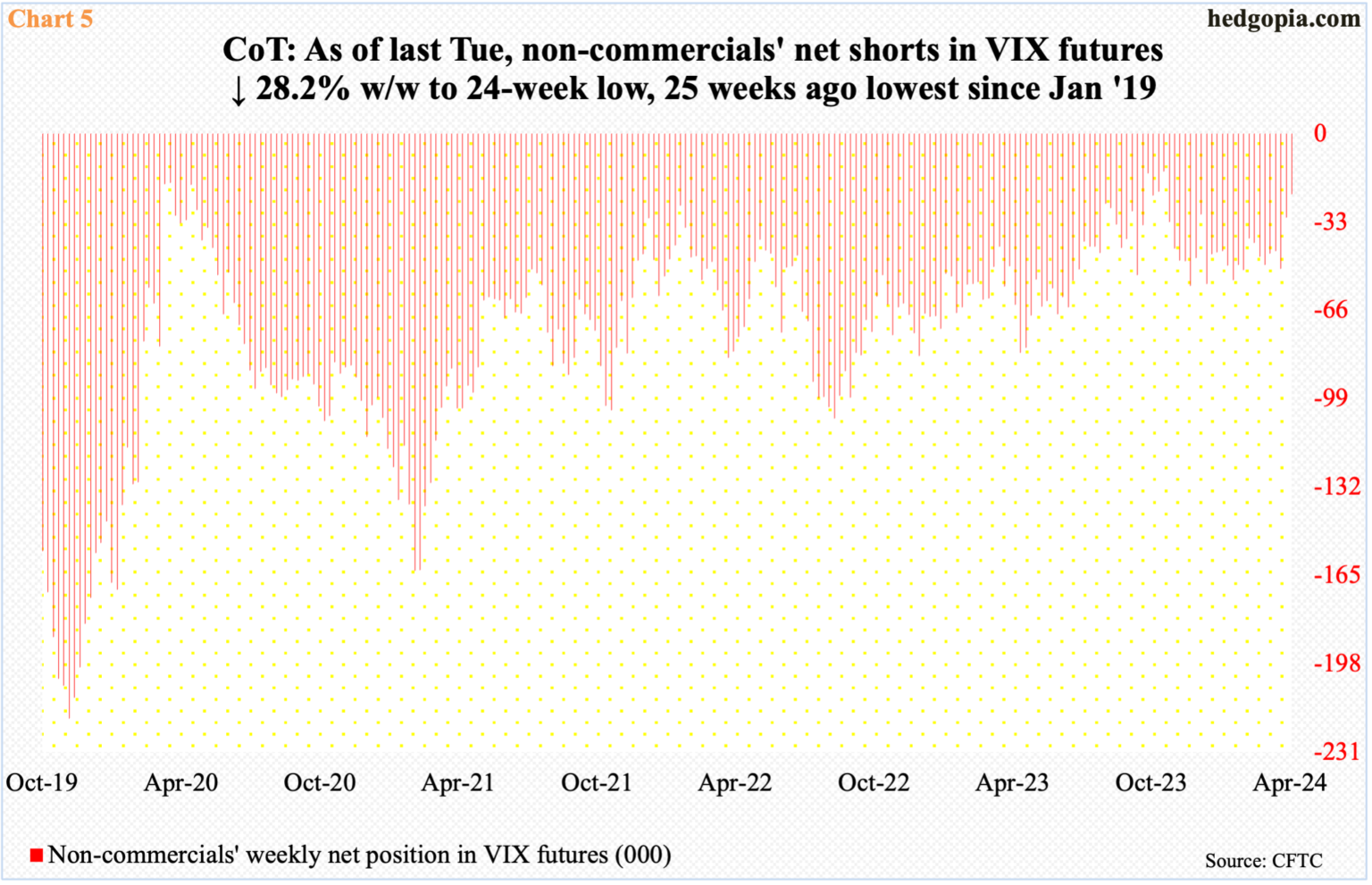

VIX: Currently net short 18k, down 4.5k.

After three up weeks – each of them with long upper wicks – VIX tumbled 3.68 points this week to 15.03. The 50- and 200-day are right underneath – 14.84 and 14.87 respectively. If volatility bulls fail to save these averages, the index could test the 13 handle in no time. Next week is key.

Non-commercials, in the meantime, continued to reduce net shorts in VIX futures. At 18,000 contracts, holdings are at a 25-week low. In the week to October 31st last year, when equities were bottoming, these traders cut net shorts to 13,979 before accumulating again. Historically, VIX has tended to peak as these traders either go net long or get close to doing that.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500 Index (SPX) »» Weekly Summary Analysis

By: Marty Armstrong | April 27, 2024

S&P 500 Cash Index opened above the previous high and closed above it as well warning of a bullish posture right now. It closed today at 509996 and is trading up about 6.92% for the year from last year's settlement of 476983. Up to now, this market has been rising for 5 months going into April suggesting that this has been a bull market trend on the monthly time level which has been confirmed by electing all of our model's long-term Bullish Reversals from the key low. As we stand right now, this market has made a new low breaking beneath the previous month's low reaching thus far 495356 yet it is trading below last month's close of 525435.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in S&P 500 Cash Index, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2009 and 2002. The Last turning point on the ECM cycle high to line up with this market was 2022 and 2007 and 2000.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The S&P 500 Cash Index has continued to make new historical highs over the course of the rally from 1974 moving into 2024. Noticeably, we have elected two Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

From a perspective using the indicating ranges on the Daily level in the S&P 500 Cash Index, this market remains neutral with resistance standing at 514606 and support forming below at 507984. The market is trading closer to the support level at this time.

On the weekly level, the last important high was established the week of March 25th at 526485, which was up 22 weeks from the low made back during the week of October 23rd. We have been generally trading up for the past week from the low of the week of April 15th, which has been a move of 3.251%. When we look deeply into the underlying tone of this immediate market, we see it is currently still in a weak posture.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are rising at this time with the previous low made 2022 while the last high formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2022 warning that this market remains strong at this time on a correlation perspective as it has moved higher with the Momentum Model.

Interestingly, the S&P 500 Cash Index has been in a bullish phase for the past 12 months since the low established back in March 2023.

Critical support still underlies this market at 438504 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading below last month's low warning of weakness at this time.

DiscoverGold

DiscoverGold

Nasdaq Composite Index (COMP) »» Weekly Summary Analysis

By: Marty Armstrong | April 27, 2024

NASDAQ Composite Index Cash opened above the previous high and closed above it as well warning of a bullish posture right now. It closed today at 1592790 and is trading up about 6.10% for the year from last year's settlement of 1501135. Caution is required for this market is starting to suggest it may now decline on the MONTHLY level.

Up to this moment in time, this market has been rising for 5 months going into April suggesting that this has been a bull market trend on the monthly time level which has been confirmed by electing all of our model's long-term Bullish Reversals from the key low. As we stand right now, this market has made a new low breaking beneath the previous month's low reaching thus far 1522278 yet it is trading below last month's close of 1637946.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NASDAQ Composite Index Cash, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2009 and 2002. The Last turning point on the ECM cycle high to line up with this market was 2007 and 2000.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NASDAQ Composite Index Cash has continued to make new historical highs over the course of the rally from 2009 moving into 2024. Clearly, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

The perspective using the indicating ranges on the Daily level in the NASDAQ Composite Index Cash, this market remains neutral with resistance standing at 1596579 and support forming below at 1582202. The market is trading closer to the resistance level at this time.

On the weekly level, the last important high was established the week of March 18th at 1653886, which was up 21 weeks from the low made back during the week of October 23rd. We have been generally trading up for the past week from the low of the week of April 15th, which has been a move of 4.980%. When we look deeply into the underlying tone of this immediate market, we see it is currently still in a weak posture.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are rising at this time with the previous low made 2022 while the last high formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 warning that this market remains strong at this time on a correlation perspective as it has moved higher with the Momentum Model.

Interestingly, the NASDAQ Composite Index Cash has been in a bullish phase for the past 12 months since the low established back in March 2023.

Critical support still underlies this market at 1405840 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading below last month's low warning of weakness at this time.

DiscoverGold

DiscoverGold

$SPX Millions worth of highly unusual put sell orders

By: Cheddar Flow | April 26, 2024

• $SPX Millions worth of highly unusual put sell orders

These were sold to open and the whales are betting that the S&P 500 will stay above 5015-5040 into end of next week

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX A sudden change of scenery

By: Cheddar Flow | April 26, 2024

• $SPX A sudden change of scenery

Read Full Story »»»

DiscoverGold

DiscoverGold

Investor Sentiment Takes Hit, But Yet To Hit Meaningful Low To Signal Durable Bottom

By: Hedgopia | April 26, 2024

After a ferocious rally from last October’s low, US equities gave back some of the gains this month. This has impacted bullish sentiment, but not enough to make a durable bottom in stocks.

The S&P 500 shed 5.9 percent from its March 28th peak before finding a footing this week. Earlier, from the October 27th low of last year, the large cap index shot up 28.3 percent. Big picture, April’s giveback is nothing given the five-month scorching rally.

Between late-March and early-April, bulls began to face difficulty at 5260s, hitting the level three times over seven sessions, including the March 28th all-time high of 5265 (Chart 1). Bears took control right from the beginning this month. The index suffered three weekly declines before recovering. This week, with a session to go, the S&P 500 is up 1.6 percent.

The recent selloff has impacted bullish sentiment.

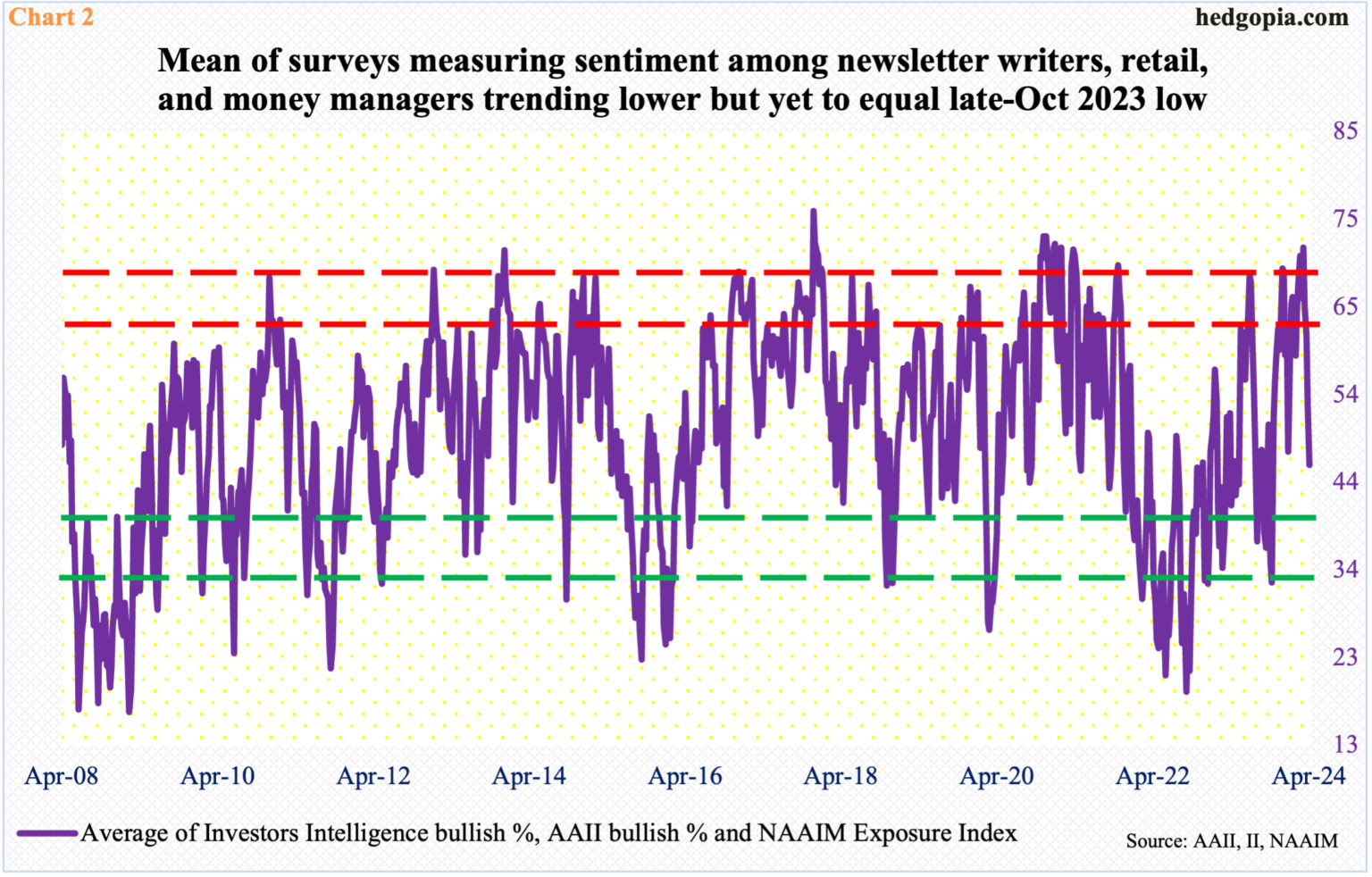

In the week to Tuesday, Investors Intelligence bulls tumbled 10.3 percentage points week-over-week to 46.2 percent. In the week to Wednesday, the NAAIM Exposure Index dropped 3.5 points w/w to 59.5, while American Association of Individual Investors bulls in the week to Thursday declined 6.2 percentage points w/w to 32.1 percent. The three surveys respectively measure sentiment among newsletter writers, money managers, and retail investors. This week’s readings represent a decent drop from the recent highs.

Investors Intelligence bulls hit 62.5 percent in the week to April 2nd. This was the highest reading since April 2021 and the fourth consecutive weekly reading of 60-plus. The NAAIM Exposure Index printed 103.9 in the week to March 27th; two weeks before that, it hit 104.8, which was the highest since November 2021. And AAII bulls hit 50 percent in the week to March 28th; three weeks prior, bulls reached 51.7 percent, which was an 11-week high.

Chart 2 combines the three surveys and takes out an average. A reading of 71.5 in the last week of March was the highest since January 2021. This week, the average dropped to 45.9, which is low but not low enough to even match last October’s low, when it dropped to 32.1, let alone the late-September 2022 trough of 19.3. Equities reached a major low in October 2022.

The bottom line is that investor sentiment has taken a hit but not enough to signal a durable bottom in equities.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | April 26, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | April 26, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bullish sentiment has experienced a significant reversal. Historically, elevated levels of optimism among retail investors and low volatility in financial markets have frequently indicated short-term market peaks

By: Isabelnet | April 26, 2024

• S&P 500

Bullish sentiment has experienced a significant reversal. Historically, elevated levels of optimism among retail investors and low volatility in financial markets have frequently indicated short-term market peaks.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500: The degree of activity in leveraged long vs short US equity ETFs has experienced a substantial decline as sentiment shifts

By: Isabelnet | April 26, 2024

• S&P 500

The degree of activity in leveraged long vs short US equity ETFs has experienced a substantial decline as sentiment shifts.

Read Full Story »»»

DiscoverGold

DiscoverGold

With a median short interest level of 1.8%, which remains relatively low, market participants are positive or cautiously optimistic about the future performance of the S&P 500

By: Isabelnet | April 25, 2024

• S&P 500

With a median short interest level of 1.8%, which remains relatively low, market participants are positive or cautiously optimistic about the future performance of the S&P 500.

Read Full Story »»»

DiscoverGold

DiscoverGold

S&P 500: Active investment managers frequently face criticism for their consistent pattern of selling equities at market bottoms and buying them at market tops

By: Isabelnet | April 25, 2024

• S&P 500

Active investment managers frequently face criticism for their consistent pattern of selling equities at market bottoms and buying them at market tops.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Reality Hits the Markets into May 7th

By: Marty Armstrong | April 25, 2024

The Dow plunged 600 points in the opening, confirming that the bounce was nothing to get all excited about. Yes, the gist of the decline was that the US dropped Thursday morning after the latest GDP report showed that US GDP slowed to just 1.6% in the first quarter of the year, sharply lower than expected but virtually all economic forecasts. In contrast, GDP in the second half of 2023 grew by 4.9% and 3.4% in last year's third and fourth quarters. Economists never foresee a change in direction.

The Dow fell 1.8% and is headed toward its largest drop of the year, while the S&P 500 was down 1.5%, and the Nasdaq Composite plunged by 1.9%. The story is that investors now expect a longer wait for the first rate cut from the Federal Reserve.

This GDP report was the worst of both worlds insofar as economic growth is slowing as we prepare for the turn on May 7th. Yet, as we have been forecasting, inflationary pressures are persisting, confirming that we are heading into Stagflation as the government raises taxes, reducing GDP but raising the cost of production. Insane places like California pushing the minimum wage to $20 as if this will maintain economic growth and not reduce jobs is just an example of the gross incompetence of those running governments. We can see in this report that inflation accelerated in the first three months of this year...

DiscoverGold

DiscoverGold

Money managers Reduced their exposure to the US Equity markets since last week...

DiscoverGold

DiscoverGold

NAAIM Exposure Index

April 25, 2024

The NAAIM Number

59.48

Last Quarter Average

87.84

»»» Read More…

The AAII Investor Sentiment

By: AAII | April 25, 2024

Bullish 32.1%

Neutral 33.9%

Bearish 33.9%

• Historical 1-Year High

Bullish: 52.9%

Neutral: 37.4%

Bearish: 50.3%

Read Full Story »»»

DiscoverGold

DiscoverGold

May Almanac: Historically Poor in Election Years

By: Almanac Trader | April 24, 2024

May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 “flash crash”. It used to be part of what we once called the “May/June disaster area.” From 1965 to 1984 the S&P 500 was down during May fifteen out of twenty times. Then from 1985 through 1997 May was the best month, gaining ground every single year (13 straight gains) on the S&P, up 3.3% on average with the DJIA falling once and NASDAQ suffering two losses.

In the years since 1997, May’s performance has remained erratic; DJIA up fourteen times in the past twenty-six years (four of the years had gains exceeding 4%). NASDAQ suffered five May losses in a row from 1998-2001, down –11.9% in 2000, followed by fourteen sizable gains of 2.5% or better and seven losses, the worst of which was 8.3% in 2010 followed by another substantial loss of 7.9% in 2019.

Since 1950, election-year Mays rank rather poorly, #9 DJIA and S&P 500, #8 NASDAQ and Russell 2000 and #7 Russell 1000. Average performance in election years has also been weak ranging from a 0.4% DJIA loss to a 0.6% gain by Russell 2000. Aside from DJIA, the frequency of gains in election year Mays is bullish, but down Mays have tended to be big losers. In 2012, DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 all declined more than 6%.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPX Bulls are back

By: Cheddar Flow | April 24, 2024

• $SPX Bulls are back.

Read Full Story »»»

DiscoverGold

DiscoverGold

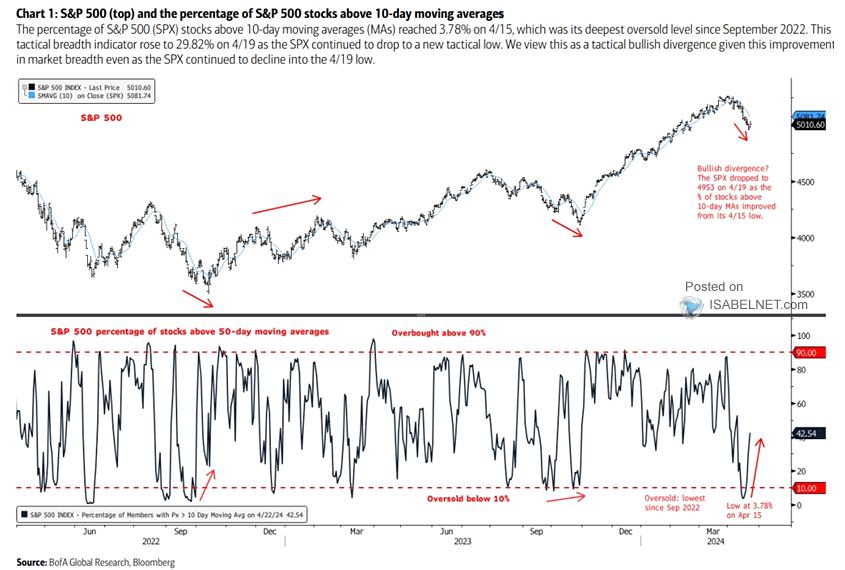

The rise in the percentage of S&P 500 stocks above their 10-day moving averages can be interpreted as a tactical bullish divergence, providing valuable insights into market strength and the potential for a reversal

By: Isabelnet | April 24, 2024

• S&P 500

The rise in the percentage of S&P 500 stocks above their 10-day moving averages can be interpreted as a tactical bullish divergence, providing valuable insights into market strength and the potential for a reversal.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | April 24, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

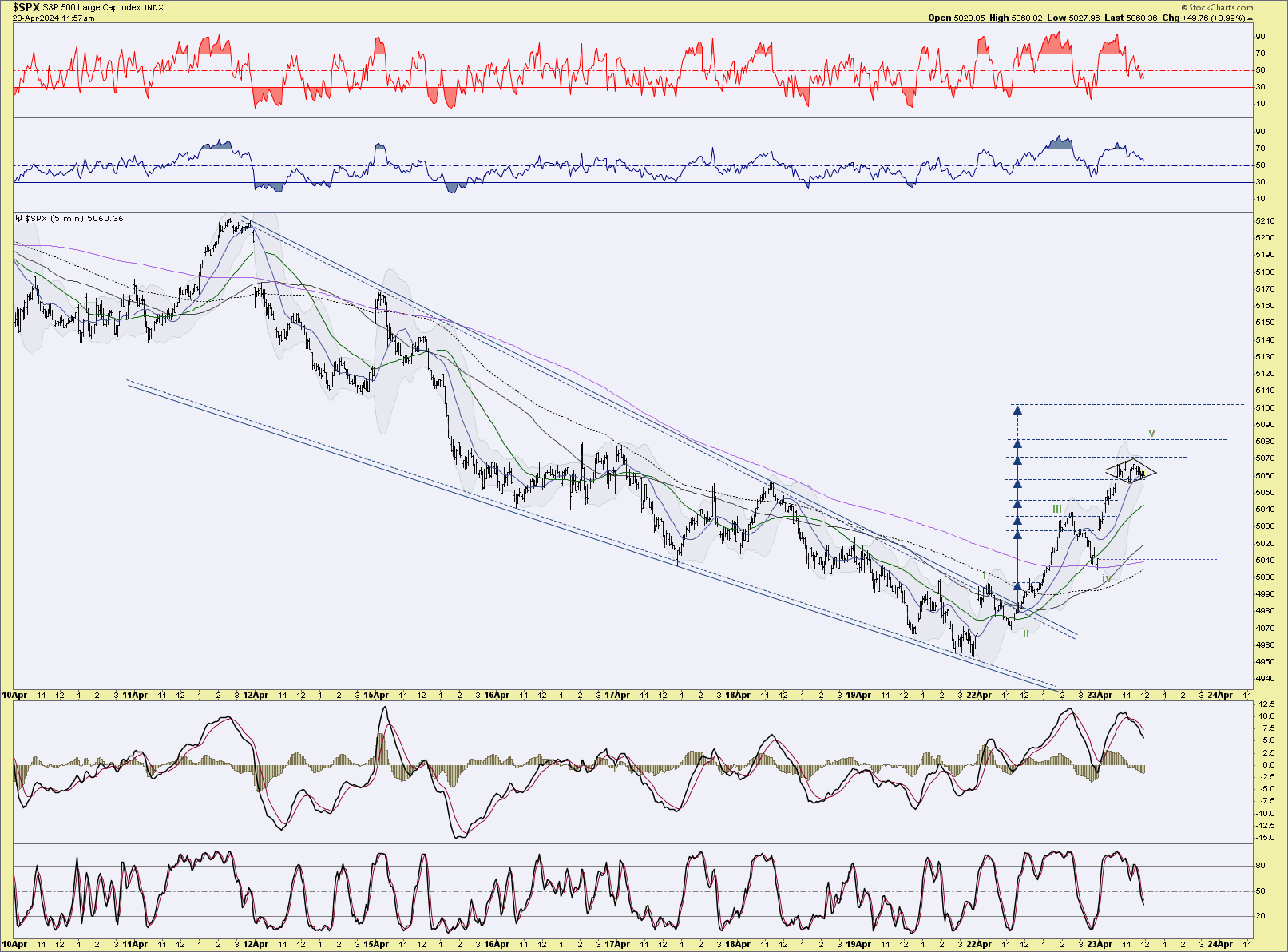

$SPX - Zooming in we can see a clear impulse wave. yet it could be an (a)-(b)-(c) with i-ii being (a) & the 1st target from the Bull 'Wedge' being i of (c)?

By: Sahara | April 23, 2024

• ... $SPX - Zooming in we can see a clear impulse wave. yet it could be an (a)-(b)-(c) with i-ii being (a) & the 1st target from the Bull 'Wedge' being i of (c)?

We should soon know when this move is complete from the ensuing structure whether it being impulsive or corrective...

Read Full Story »»»

DiscoverGold

DiscoverGold

Markets Monthly Pattern »» Watchlist - Top 10

By: Marty Armstrong | April 23, 2024

• Dow Jones Industrials Index »» Pendulum Swing to Downside

• NASDAQ Composite Index »» Entering CRASH MODE

• NASDAQ 100 Index »» Losing Momentum

• S&P 500 Index »» Entering CRASH MODE

• Russell 2000 Index »» Knee Jerk Low

• US Dollar Index »» Pressing Higher

• CBOE VIX Index »» Temp Low In Place Reaction Possible

• NY Gold Futures »» New Pattern Forming

• NY Silver COMEX Futures »» Possible Sharp Rally

• NY Crude Oil Futures »» New Pattern Forming

DiscoverGold

DiscoverGold

S&P 500: With a reading of 55.41, the US stock market is no more overbought, suggesting a potential shift in investor sentiment and a possible opportunity for market participants to reassess their positions and strategies

By: Isabelnet | April 23, 2024

• S&P 500

With a reading of 55.41, the US stock market is no more overbought, suggesting a potential shift in investor sentiment and a possible opportunity for market participants to reassess their positions and strategies.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | April 23, 2024

• Today (8:33 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

Why you shouldn't be too quick to dump your stocks just yet

By: Mark Hulbert | April 23, 2024

Sectors that typically rally at the end of bull markets are lagging

After volatile trading sessions last week, it's worth noting that the U.S. stock market's major trend is still up. The market's sector relative-strength rankings are confirming this, despite the market's gyrations,

I base this bullish assessment on an analysis of which stock-market sectors typically perform the best as bull markets come to an end. Recent market action doesn't fit the historical pattern: Many of the sectors that typically rally at the end of bull markets are lagging, while many of those that usually do the worst have instead been standout performers.

This divergence between recent sector relative-strength and the historical pattern is illustrated in the chart below. While this divergence doesn't guarantee that the bull market is alive and well, it does suggest that investors should not be too quick to give up on it. The S&P 500's SPX rally to start this week suggests that many investors agree, despite the six consecutive session declines through the end of last week.

Twice in the past year I've used the sector relative-strength rankings to grade the market. The first was in early April 2023, when the new bull market was being met with widespread skepticism; I argued that the rankings pointed to an emerging new bull market rather than a correction in a bear market. The S&P 500 on a total-return basis is more than 22% higher since then. The second was in mid-August 2023, when the S&P 500 was - like now - 5% below its recent high; I argued that the weakness did not represent the end of the bull market. The S&P 500 on a total return basis is 15% higher now.

To appreciate how big a divergence exists between the current relative-strength ranking and the historical pattern for bull market endings, consider the rank correlation coefficient between the two. This statistic ranges from a theoretical maximum of 1.0 (when the two rankings are identical) to minus-1.0 (when the rankings are perfectly inverse). This statistic currently stands at minus-0.70, one of the lowest readings in recent decades. Last August, the correlation coefficient stood at minus-0.01, and in April 2023 at plus-0.31. Clearly, the sector relative-strength readings have been moving increasingly further away from the bull-market-ending pattern.

The bottom line? Reports of the bull market's death may be premature.

Read Full Story »»»

DiscoverGold

DiscoverGold

With Equities In 3-4 Weeks Of Selling Pressure And Tech Ready To Report, Bulls Have Opportunity To Put Foot Down For Reprieve N/T

By: Hedgopia | April 22, 2024

Unable to push through resistance, major US equity indices took a drubbing in recent weeks. Mid- to long-term, more downward pressure is probable. Near-term, it is looking like a toss-up between bulls and bears.

The S&P 500 last week suffered its third consecutive down week. From the March 28th peak of 5265, it is now down 5.7 percent, which represents a minor giveback of the gains the bulls have enjoyed since last October. From that low through last month’s high, the large cap index surged north of 28 percent.

The index had difficulty taking out 5260s, which stopped the bulls in three sessions over seven sessions in late March-early April. This was then followed by a breach of a rising trend line from last October’s low (Chart 1). Last week, the 50-day (5118) was compromised, with the index ending down 3.1 percent to 4967.

The daily is beginning to look oversold. The weekly, however, is far from done unwinding the overbought condition it is in. In the event the index continues lower, an important test lies at 4810s. In January 2022, the S&P 500 ticked 4819 – a new high back then – and headed lower, subsequently bottoming at 3492 in October that year. The bulls had to wait until this January before that high was surpassed. A retest is just a matter of time. If the weekly wins out, it will happen sooner than later.

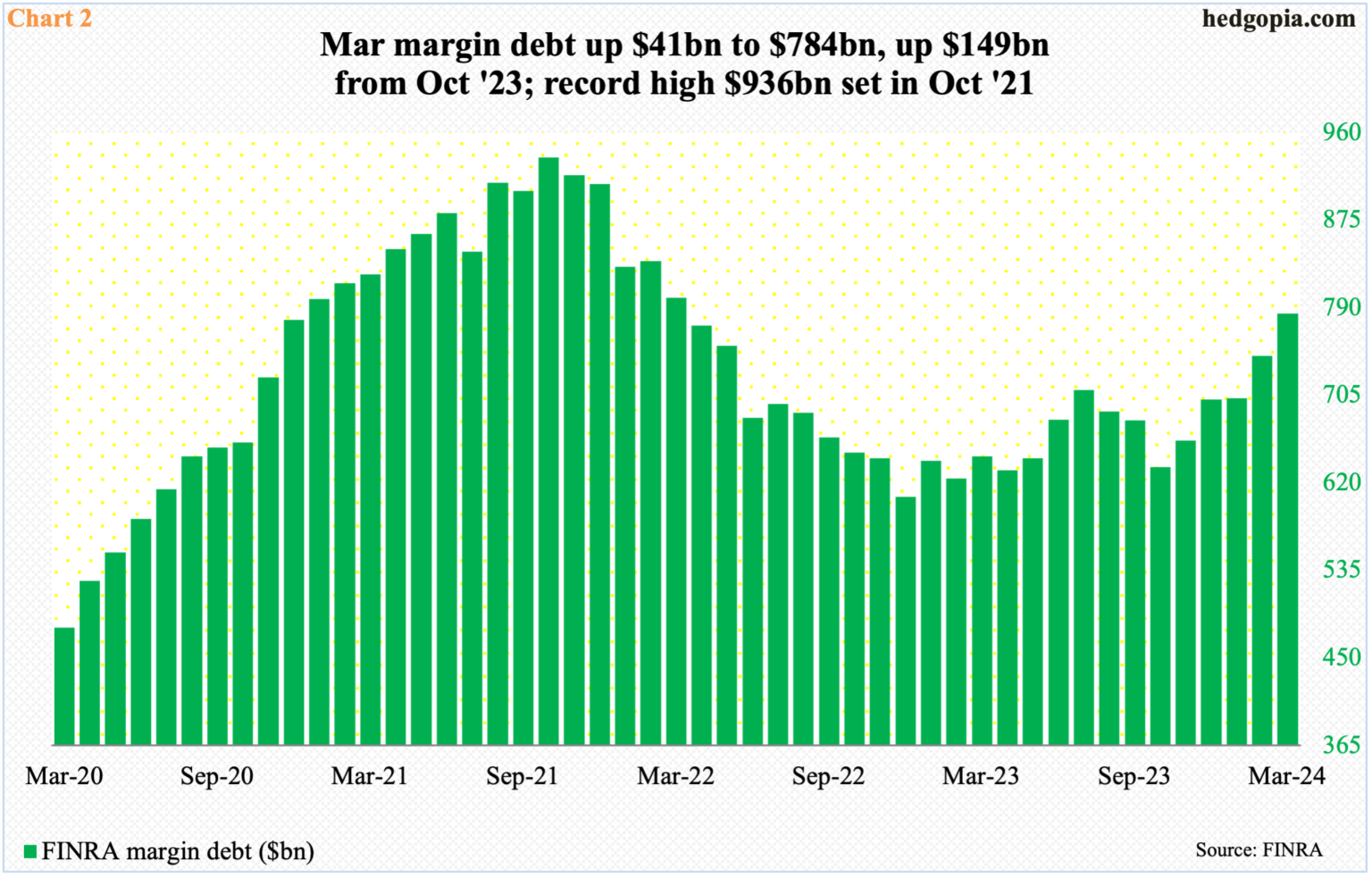

With seven sessions remaining, the S&P 500 is down 5.5 percent month-to-date. If this sticks, this will have come after five up months post-October low. Margin debt played a big role in that.

Last October, FINRA margin debt bottomed at $635 billion, down from $936 billion two years before that (Chart 2). After that peak, margin debt hit $607 billion in December before turning up. But it took time for equity bulls to get comfortable taking on leverage. From last October’s low, it has gone up $149 billion to last month’s $784 billion.

In February and March, margin debt grew $41 billion each; the S&P 500 rallied 5.2 percent and 3.1 percent respectively in those months. How margin debt behaves this month, therefore, will be crucial. Particularly since last October, leverage has paid off. If April’s downward pressure in the S&P 500 leads these risk-takers to lock in gains, then it is unlikely they will come back with vigor right away.

Risk-on is particularly not evident in the Russell 2000, which traditionally is treated as one of the ways to measure investor willingness to take on risk. From this standpoint, risk-on is missing, despite what margin debt is telling us of late.

Unlike its large-cap cousins, the Russell 2000 remains under its prior peak of 2459 reached in November 2021. After that peak, it subsequently bottomed at 1641 in the following June, followed by a successful test of that low in October as the small cap index touched 1642. Those lows were once again tested last October as the index ticked 1634 before reversing higher.

A rally off those lows ended at 2135 on March 28th – still more than 300 points below the November 2021 peak. There was tough resistance at 2100, where horizontal resistance goes back to January 2021. A 61.8-percent Fibonacci retracement of the November 2021-October 2023 drop comes to 2144. The level also represents a measured-move target of a range breakout that took place on December 13th (last year); prior to that, the index played ping pong between 1700 and 1900 going back to January 2022 (Chart 3).

Last week, unable to reclaim 2100, small-cap bulls went on to lose 2000, with the index closing at 1948 with Friday’s intraday low of 1932. If the weekly wins out, breakout retest at 1900 is the path of least resistance; else, bulls may try to once again try their luck at 2000.

Conditions for a rally near term are ripe. It is just that the bulls need to be able to take advantage of the situation.

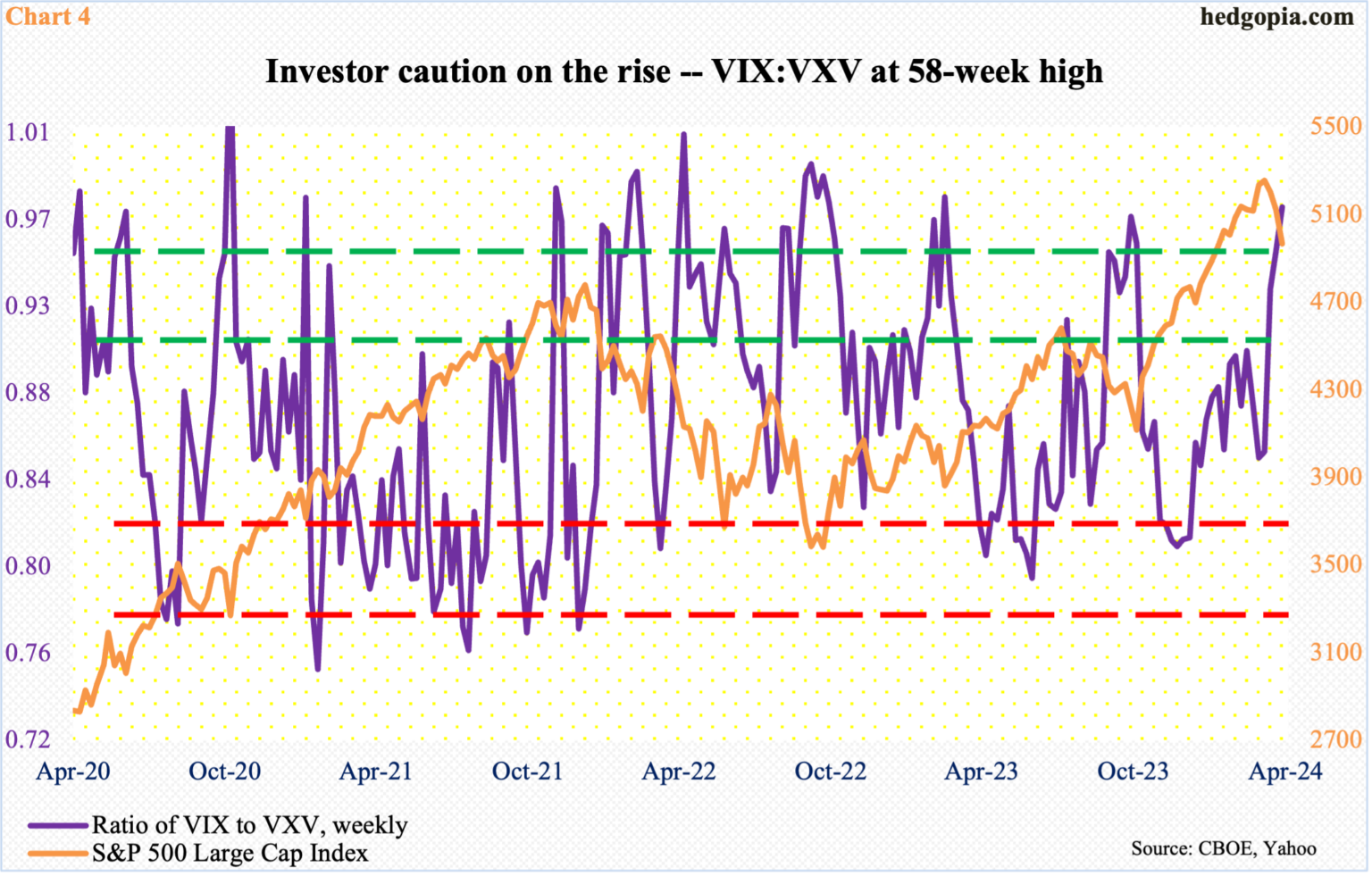

Chart 4 tallies a ratio of VIX to VXV and it has risen enough to begin unwinding the overbought condition.

VIX measures the market’s expectation of 30-day volatility on the S&P 500; VXV does the same, except it goes out to three months. When the investing climate is risk-off, as has been the case in recent weeks, demand for VIX-derived securities is higher than, let us say, VXV. The opposite is true when investor sentiment perks up.

Last week, the ratio of VIX to VXV closed at 0.97 – a 58-week high. The ratio is elevated enough it can reverse lower anytime, in which case VIX drops more than VXV, thus providing a tailwind to the S&P 500.

That said, plenty a time in the past, the ratio has gone on to rally toward unity and higher. Just because it is in the 0.90s does not guarantee a reversal.

There is a similar message coming out of the futures market.

As of last Tuesday, non-commercials cut net shorts in VIX futures to 22,474 contracts – a 24-week low. Just this month alone, they cut their holdings by more than half.

Historically, the volatility index has tended to peak once these traders either go net long or get close to doing that. The last time they were net long was the latter months of 2018 and the first week of 2019. There have been three important lows in the S&P 500 since then – March 2000, October 2022 and October 2023; in each of these instances, equities bottomed with non-commercials still net short VIX futures – respectively 18,377, 52,823 and 13,979.

Thus, the red bars in Chart 5 do not necessarily have to go green before VIX peaks.

In the meantime, the volatility index rallied nicely the last couple of weeks but also reversed slightly with a weekly candle with a long upper wick. Last week, VIX rallied as high as 21.36 intraday Friday but only to end the session at 18.71; in contrast, the S&P 500 fell 0.9 percent in that session, closing near the session low.

If this is an indication of things to come in the sessions ahead, then VIX, after three up weeks in a row, could take a break. Once again, for this to occur, the daily needs to muscle through the weekly.

In the end, it all boils down to how tech fares this week. Several leading outfits report this week and next. Tesla (TSLA) reports on Tuesday, Facebook owner Meta (META) on Wednesday and Microsoft (MSFT) and Google owner Alphabet (GOOG) on Thursday. Apple (AAPL) and Amazon (AMZN) report the week after.

Leading up to this, tech acts weak. The Nasdaq 100 is now down four weeks in a row, with last week’s 5.4-percent tumble most pronounced. On March 21st, the tech-heavy index reached a fresh high of 18465 but faced difficulty at 18300s before and after that. In fact, the rather sideways action lasted seven weeks before the rug-pull happened last week.

The index (17038) is now approaching the November 2021 high of 16765. It will be an important breakout retest. The 50-day has been compromised, as has been trendline support from last October (Chart 6).

In the event the results from the above companies are received well, tech bulls need to recapture 17300s. A lack thereof exposes the index to a drop toward the 200-day (16267). And this will reverberate through the rest of the market – the cap-weighted ones in particular, such as the S&P 500.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SPY $9 Million OTM Calls (Highly Unusual)

By: Cheddar Flow | April 22, 2024

• $SPY $9M OTM Calls (Highly Unusual)

It is rare to see this much premium for a far OTM strike within 3 weeks of expiration

These whales are very bullish

Read Full Story »»»

DiscoverGold

DiscoverGold

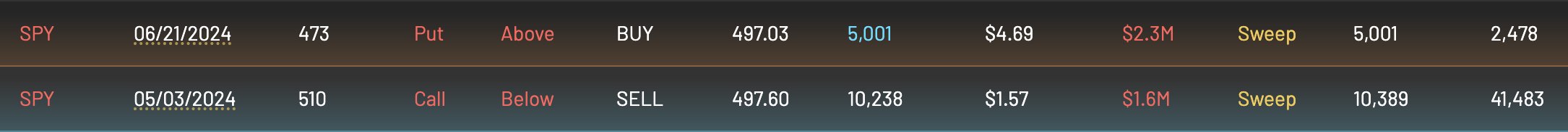

$SPY 2 Large Bearish Orders to Start the Day

By: Cheddar Flow | April 22, 2024

• $SPY 2 Large Bearish Orders to Start the Day

$2.3M OTM Put (Above the Ask)

$1.6M OTM Call Sell Order

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom S&P 500 Index percent net change performers

By: Thom Hartle | April 22, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the S&P 500 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

The 10 Top/Bottom NASDAQ 100 Index percent net change performers

By: Thom Hartle | April 22, 2024

• Today (8:34 CST), the 10 top/bottom percent net change performers in the NASDAQ 100 Index.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

179

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

68618

|

|

Created

|

06/10/03

|

Type

|

Free

|

| Moderators DiscoverGold | |||

:::::::::::: Welcome to S&P 500 & Nasdaq Analysis and Trends :::::::::::::

• The purpose of this board is to help others with Short & Long term S&P 500 & Nasdaq analysis and direction.

• This is strickly an educational board helping traders to learn market direction, swing and bottom trading.

• I ask that everyone respect opinions on the board whether you agree with them or not. We are all here to make money and avoid the

minimum loss we can.

Rules of the Board

Most of this board's WATCHERS are "lurkers" who appreciate info available without the need to sift through tons of "empty" posts.

1. Respect everyone opinions on trades.

2. No Pumping of Stocks.

3. No OTCBB or PINK STOCKS

*********************************************************************************************************

To help us evaluate our performance, please "BoardMark" the board if you find it useful.

To do so, just click on "Add to Favorites" Button at Right just above the Posts Dates.

*Information Posted on this Board is not Meant to Suggest any Specific Action, But to Point Out the Technical Signs That Can Help Our Readers Make Their Own Specific Decisions. Your Due Deligence is a Must.

EXCHANGE TRADED FUNDS~ETFs COMPONENTS~RSI and I/V charts#msg-5495097 COMPONENTSFOR ^NDX / QQQQ ~ I/V charts #msg-9787995

Gold~ Silver~ HUI~ XAU~ US$~ €uro~ Crude #msg-29347660 (thanks,bob)

Cookies/Bandwidth/Security/Privacy #msg-9353921 PIEs/Cookies/Macromedia/Flash #msg-9412363 PerformanceTips for WinXP #msg-9854670

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |