Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Escala I Technical Evaluation, Internal Report -

at -

http://www.franklinmining.com/home.html

The Franklin Mining Escala neighbour property -

ex..

the Escala orebody is a very large orebody with a number

of mineralized targets -

The property has 23 holes drilled by AUSTPAC Gold -

totaling 2,612 meters -

A second round of drilling of 14 holes added another 1,517

meters -

This orebody has also been a property of interest -

since colonial days -

It hosts several very large stockwork deposits -

worthy of significant attention -

The property is polymetallic, however, it also appears

to host a porphyry copper deposit underlying -

the polymetallic stockworks -

It also hosts a gold anomaly containing approximately

30,000 ounces at reasonable grade -

The Escala property has extremely good potential -

but work to date has been more of the geo-chemical nature

and has identified several interesting targets -

APMI plans 8,000 meters of drilling on the property in 2007 -

They also have pick up the Karachipampa Lead/Silver Smelter Project -

The Karachipampa Lead/Silver Smelter is located in Potosi, Bolivia -

It was constructed during the period 1985 thru 1988 -

by Corporacion Minera de Bolivia (COMIBOL) and was never -

fired due to a lack of lead concentrate production -

in Bolivia -

A total of $180 million have been expended on the facility

to date by COMIBOL -

The plant has been on care and maintenance since completion

and is in ‘new condition’ -

It was designed and constructed by Klockner -

a German engineering and construction firm -

with design based on state-of-the-art Russian -

Kivcet technology -

This technology is in common use around the world with

two of the most important users being

the Cominco Trail Smelter in British Columbia

and the Glencore Porto Vesme Smelter

on the island of Sardenia, Italy.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33465020

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33469520

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33439498

God Bless

prisoner thanks for good Ag info -

--

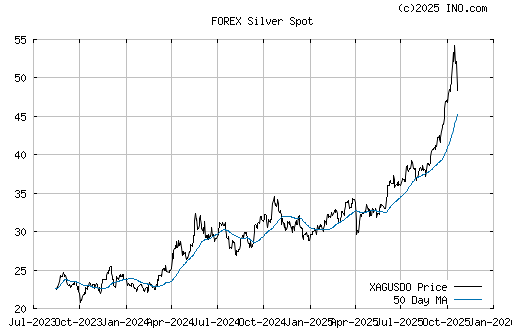

Silvers huge net short postion:

From past experience another move up could be very soon!

imo

Prisoner

--

Ex....

Franklin Mining, Inc. formed a wholly-owned subsidiary, Franklin Mining, Bolivia, S.A, in 2004

The Importance of Franklin Mining, Bolivia, S.A’s

Investment in Bolivia’s Mining Industry

The Cerro Rico de Potosi is universally regarded as

the world’s largest and most productive silver mine.

The modern technologies Franklin Mining, Inc. is prepared

to introduce to its Cerro Rico operations are designed

to significantly increase the volume of silver and all

other minerals that can be exploited.

Under a separate COMIBOL agreement, Franklin is preparing

the Original Escala Mine for its return to full productivity.

The Escala is Bolivia’s second largest mine historic mine.

Franklin’s commitment to multiple Potosi area Cooperativas

is to make every effort possible to increase worker

productivity as well as work to increase worker safety

and security.

Increased worker productivity will result in increased

family earnings within each community and further

increase economic growth and development throughout

the area.

http://tinyurl.com/288dkw

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

God Bless

Cerro Rico, San Bartolome Silver Mine, Potosi -

Ex....

The Silver Mine started production early in 2008

and has been on a steep ramp up curve -

The project advised around one month ago that daily silver

production had steadily increased up to a

level of 15,000 ounces per day,

which was expected to result in

approximately 500,000 ounces of silver production

during the month of September -

Through the end of August, San Bartolome Silver Mine -

produced approximately 390,000 ounces of silver year-to-date -

The operation expects to achieve full capacity in the fourth quarter -

For the year, est. the mine will produce 3.2 million ounces

of silver and that it will achieve its 2009 production

est. of approximately 9 million silver ounces -

Ex....

San Bartolomé Silver Mining Project -

* It will produce positive environmental impacts by cleaning

an important amount of contaminating material

from around the Cerro Rico -

With a good example,

the Project intends to support modern hi-tech new art rational mining,

following industrial security and environmental norms -

The Project will produce the following amount of jobs (approx.) in Potosí:

* 400 good quality direct jobs -

* 1,200 indirect jobs related to goods and services -

* Hundreds of jobs related to silver handcrafting and tourism

thanks to the FUNDESPO

(Sustainable Development Foundation of Potosí)

Many families in Potosi will benefit from good

and decent jobs -

* The Project will invest over $100 million in Potosí

in a period of a year and a half -

* During the Project’s life, $4 to $6 million will be

invested in goods and services each year in Potosí -

* San Bartolomé will contribute to the reactivation

of the local economy by incrementing the economic

activities of the city during the Project’s life -

Commerce, Industry, Mining, Construction,

Transportation, Tourism, and others will benefit -

* The Project will strengthen Potosí institutions,

such as AAPOS, and others -

Income -

* $17 million in Mining Complementing Taxes for Potosí -

* $60 million in national taxes -

* $12 million for COMIBOL -

* $8 million for the Mining Cooperatives -

* Est. numbers -

* The Project will eliminate an important amount of

contaminating material from the surface and surroundings

of the Cerro Rico (pallacos, desmontes, colas, and Plahipo piles) -

These contaminants generate acid water, which contains

arsenic, antimony, cadmium, lead, and others -

These affect Potosinians’ health -

* San Bartolomé will eliminate the risk of a mudslide,

from the pallaco of the Sucumayu (Devil’s) gully,

to city homes -

FMNJ La Cerro Rico ore veins -

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

http://investorshub.advfn.com/boards/board.aspx?board_id=2957

http://www.franklinmining.com/aboutfranklin/ourhistory.html

the Mission - 888children -

http://www.888c.com/

God Bless America

Nice plant we got in La Cerro Rico, Potosi -

basic to clean up the waste first -

to open up -

the Mother - to more than 800 adits into -

La Cerro Rico -

to get the air vents working again -

autom. air conditions for -

FMNJ La Cerro Rico ore veins -

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

http://investorshub.advfn.com/boards/board.aspx?board_id=2957

the Mission - 888children -

http://www.888c.com/

God Bless America

CDN ZINC CORP COM NPV(Toronto: CZN.TO)fiat$0.2450

Trade Time: Oct 31

Change: Up 0.0050 (2.08%)

Prev Close: 0.24

Open: 0.245

Bid: 0.2450

Ask: 0.2500

1y Target Est: N/A

Day's Range: 0.2400 - 0.2500

52wk Range: 0.16 - 0.89

Volume: 124,800

God Bless

Sector Snap: Silver

Associated Press 09.17.08, 3:37 PM ET

WASHINGTON -

Shares of silver mining companies were a bright spot Wednesday as investors sought refuge from the broader market free-fall.

The Dow dropped more than 300 points as anxieties over the financial system rippled through the U.S. market after the government agreed to bail out American International Group Inc. (nyse: AIG - news - people ), the world's largest insurer. Prices for silver, gold and other safe-haven commodities, jumped as investors pulled money out of equities and put it into less volatile assets.

The price for silver on the Comex division of the New York Mercantile Exchange soared $1.158 cents to settle at $11.675 per ounce in afternoon trading.

Silver Standard Resources Inc. (nasdaq: SSRI - news - people ) and Coeur d'Alene Mines (nyse: CDE - news - people ) Corp. led the run-up with each gaining 25 percent and 20 percent, respectively.

Shares of Silver Standard Resources gained $3.40, or 22.6 percent, to $18.44 in late afternoon trading, while Coeur d'Alene shares advanced 30 cents, or 20 percent to $1.73.

Other silver miners including Silver Wheaton Corp. (nyse: SLW - news - people ) added $1, or 11.9 percent, to $9.41, just as Pan American Silver Corp. (nasdaq: PAAS - news - people ) gained $2.86, or 14 percent, to $23.01.

Hecla Mining Co. (nyse: HL - news - people ) picked up 46 cents, or 10 percent, to $4.99.

God Bless

Canadian Zinc Corporation: Memorandum of Understanding Signed With Parks Canada -

Thursday July 31, 7:30 am ET

http://biz.yahoo.com/ccn/080731/200807310477093001.html?.v=1

http://www.canadianzinc.com

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2008) -

Canadian Zinc Corporation -

(TSX:CZN - News; OTCBB:CZICF - News; the "Company" or "Canadian Zinc") is pleased to report that Canadian Zinc and the Parks Canada Agency have entered into a Memorandum of Understanding ("MOU") with regard to the expansion of the Nahanni National Park Reserve and the development of the Prairie Creek Mine.

In the MOU:

- Parks Canada and Canadian Zinc agree to work collaboratively, within their respective areas of responsibility, authority and jurisdiction, to achieve their respective goals of an expanded Nahanni National Park Reserve and an operating Prairie Creek Mine.

- Parks Canada recognizes and respects the right of Canadian Zinc to develop the Prairie Creek Mine and will manage the expansion of Nahanni National Park Reserve so that the expansion does not in its own right negatively affect development of, or reasonable access to and from, the Prairie Creek Mine.

- Canadian Zinc accepts and supports the proposed expansion of the Nahanni National Park Reserve and will manage the development of the Prairie Creek Mine so the mine does not, in its own right, negatively affect the expansion of the Nahanni Park.

The Parties agree to make every reasonable effort to address issues of common interest and build a strong working relationship, including convening a Technical Team which will better identify, define and consider issues of common interest, including, among other things, access to and from the Prairie Creek Mine through the proposed expanded Park and the park boundaries around the Prairie Creek Mine properties.

The Parties have also agreed to share with one another and the Technical Team any existing technical and scientific information relevant to a discussion and analysis of issues of common interest to the Parties.

The MOU, which is valid for three years is intended to cover the period up to the development of the Prairie Creek Mine (Phase I) and may be amended or renewed as agreed by the Parties and may be terminated by either party on not less than three months written notice. It is contemplated that the Phase I MOU will be replaced by a further MOU (Phase II) which will address the operation of the mine and the expanded Park.

The MOU is an expression of the mutual intentions of the parties and is not legally binding or enforceable. The MOU does not create any new powers or duties or alter or affect any rights, powers or duties established by law, including by the Parks Canada Agency Act and the Canada National Parks Act, or result in the Parties relinquishing any right, jurisdiction, power, privilege, prerogative or immunity.

To the extent that the Prairie Creek Mine is subject to regulatory or government processes, including hearings, Parks Canada reserves the right, while recognizing the intent of the MOU, to participate in any such process and take such positions as it sees fit and the MOU does not constrain Parks Canada from doing so, subject only to the understanding that Parks Canada has agreed not to object to or oppose, in principle, the development of the Prairie Creek Mine.

"We are pleased to have signed this cooperation agreement with Parks Canada which will facilitate both parties achieving our mutual objectives." said John F. Kearney, Chairman of Canadian Zinc Corporation.

"The exclusion of the Prairie Creek Mine from the proposed Nahanni National Park expansion area has brought clarity to the land use policy objectives for the region. Canadian Zinc believes that the Prairie Creek Mine and the expanded Nahanni National Park Reserve can co-exist and that, properly planned and managed, the expanded Park will not interfere with the operation of the Prairie Creek Mine and similarly that the operation of the mine will not adversely impact upon the Park or its ecological integrity," Mr. Kearney added.

Nahanni Park Expansion:

The Prairie Creek Mine is located in the Mackenzie Mountains of the Northwest Territories, within the watershed of the South Nahanni River and in proximity to but outside the Nahanni National Park Reserve.

In August 2007 the Prime Minister of Canada visited Fort Simpson to announce the proposed expansion of Nahanni National Park Reserve. The Prime Minister announced that the Government of Canada had approved an Order in Council (PC-2007-1202 July 31, 2007), withdrawing certain lands for the proposed park expansion. The surface lands surrounding the Prairie Creek mine, containing approximately 367 square kilometres, are specifically excluded and exempted from the interim land withdrawal.

Canadian Zinc has been assured by the Government of Canada and by Parks Canada that the final boundaries of the expanded park will not include the Prairie Creek Mine site nor preclude road access to the Prairie Creek mine and that in the proposed expansion of the Nahanni National Park Reserve, the existing mining and access rights of Canadian Zinc to the Prairie Creek mine will be respected and protected.

About Canadian Zinc:

Canadian Zinc's 100% owned Prairie Creek (lead/zinc/silver) Project, located in the Northwest Territories, includes a partially developed underground mine with an existing 1,000 ton per day mill and related infrastructure and equipment. The Prairie Creek Property hosts a major mineral deposit with a Measured and Indicated mineral resource in the Vein and Stratabound deposits of 5.2 million tonnes grading 11.4% Zn, 10.9% Pb, 176 g/t Ag and 0.3% Cu along with an open ended Inferred resource of 5.5 million tonnes of 13.5% Zn, 11.4% Pb, 215 g/t Ag and 0.5% Cu. (Technical Report NI 43-101 - David M. Stone, Minefill Services, Inc., Qualified Person, October 2007 filed on SEDAR).

Cautionary Statement - Forward Looking Information

This press release contains certain forward-looking information. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, the issue of permits, the size and quality of the company's mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company does not currently hold a permit for the operation of the Prairie Creek Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Contact:

John F. Kearney

Canadian Zinc Corporation

Chairman

(416) 362-6686

(416) 368-5344 (FAX)

Alan B. Taylor

Canadian Zinc Corporation

VP Exploration & Chief Operating Officer

(604) 688-2001 or Toll Free: 1-866-688-2001

(604) 688-2043 (FAX)

Email: invest@canadianzinc.com

Website: www.canadianzinc.com

Source: Canadian Zinc Corporation

U.S. Silver Reports June Silver Production Up 37% Over 1st Quarter

Monday July 28, 10:53 am ET

TORONTO, ONTARIO--(MARKET WIRE)--Jul 28, 2008 --

U.S. Silver Corporation -

(CDNX:USA.V - News) ("U.S. Silver" or the "Company") -

is pleased to announce that June silver production was 161,000 ounces which is 37% higher than average monthly production in the 1st quarter 2008 and 61% higher than the average monthly production from 2007. This is an annualized rate of approximately 1.93 million ounces.

Production Rates

The mine averaged 879 tons per day in June, an increase of 260% compared to the 2007 average of 338 tons per day and a 198% increase as compared to 1st quarter 2008 numbers. June's production of 161,000 ounces of silver is the highest monthly production since U.S. Silver acquired the Galena Mine Complex. The mine also produced an additional 33,400 ounces of silver equivalents in the form of lead and copper by-products. Management continues to anticipate silver production levels will increase to over 250,000 ounces of silver per month by the end of 2008.

In the short term, management expects production in July to be similar to the relatively higher levels of May and June. Plans are for production to increase further in the 4th quarter as new production from the 5200 level silver-lead zone begins, and increases from other levels continue.

To view the graph accompanying this release please click the following URL: http://media3.marketwire.com/docs/U.S.%20Silver%20Graph.pdf

The costs at the Galena Mine during June remained in the $12.50 per ounce of silver. Management believes that costs will decline, particularly in the 4th quarter 2008, as the fixed costs of both mining and milling are spread over greater silver production and as grades in both ore types increase as ore production moves from development into regular production where dilution levels will shrink.

Lead Hedges

During the past month, the Company unwound some of its hedges involving lead that had been put in place during the 4th quarter 2007. Originally, the company had contracted to sell over 6 million pounds of lead during 2008 at an average price of over US $1.55 per pound. The Company unwound approximately 4 million pounds of lead hedges by late June 2008 at an average price of approximately US $0.75 per pound. The gain on these transactions will be booked over the remainder of 2008 in the respective months of the original maturity of each contract closed. Remaining lead hedge contracts run from December 2008 through May 2009. As lead production forecasts are refined, additional lead forward sales may be executed. As always, the Company remains totally unhedged with respect to silver production.

U.S. Silver Corp. remains debt free and has cash and investments of over $16 million.

QUALIFIED PERSON

Information of a technical nature in this press release respecting the properties has been prepared and reviewed by Mr. Daniel H. Hussey, Manager of Exploration for U.S. Silver who supervised the drilling and sampling programs, and resource estimation. Mr. Hussey is a "qualified person" within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

ABOUT U.S. SILVER CORPORATION

U.S. Silver, through its wholly-owned subsidiaries, owns and operates the Galena, Coeur, and Caladay silver-lead-copper mines in Shoshone County, Idaho, with the Galena mine being the second most prolific silver producer in U.S. history. Total silver production from U.S. Silver's mining complex has exceeded 210 million ounces of silver production since 1953. U.S. Silver controls a land package now totaling approximately 18,000 acres in the heart of the Coeur d'Alene Mining District. U.S. Silver is focused on expanding its production from existing operations as well as exploring its extensive Silver Valley holdings.

Certain information in this press release may contain forward-looking statements. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. The Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to the Company. Additional information identifying risks and uncertainties is contained in filings by the Company with the Canadian securities regulators, which filings are available at www.sedar.com.

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Contact:

Contacts:

U.S. Silver Corporation

Bruce Reid

Chief Executive Officer

(416) 848-0858

U.S. Silver Corporation

Vance Loeber

Investor Relations

(604) 805-3530

Website: http://www.us-silver.com

Source: U.S. Silver Corporation

Before getting into this missive, I would like to state that other silver commentators make a very strong case for silver being a metal that does well in good, prosperous times.

I absolutely agree. If the world at large were gaining in real wealth and the economy were humming along, we all might be purchasing flat screen TV’s and using even more silver than we do today. Bottom line, silver does not need bad times to do well.

However, I am experienced enough to know two people can look at exactly the same thing and see it differently.

This is what makes the world go round—an exchange of ideas.

In fact, I am on record as stating there is nothing more important in a true free market than the free exchange of ideas.

My worldview is that silver plays a role in the best of times and in the worst of times. Right now there is a huge shift of wealth; wealth is being created in the East and wealth is being diminished in the West. It is and has been my very studied opinion that wealth cannot be printed, and therefore the role of gold and silver at this point in time comes mainly as a means to protect or build wealth.

Fannie Mae (FNM) and Freddie Mac (FNM) were on the verge of collapse, only to be saved by the full faith and credit of the United States. But in reality the Fed did not save them, YOU did. If you are a U.S. citizen, the bailout has your name on it and you don’t even know it, do you?

When a financial institution, bank, broker, hedge fund (Long Term Capital Management) gets bailed out, it is the taxpayer that ultimately pays for it. The Fed “loans” money to the failing institution and rewards mismanagement, but the loan is paid for by collecting taxes from you! How often has your friendly banker asked you to bail out others that have made poor business decisions? The answer is, plenty of times, but those who read the mainstream press never get a clue that the full faith and credit of the United States means simply, the ability of the federal government to tax its citizens. It is just that simple!

The U.S. government is coming to the rescue (through you), but is this “too little, too late”? All of this fear is also being fanned, thanks to statements by Federal Reserve Chairman Bernanke, who told Congress the U.S. economy is faced with "numerous difficulties," such as strains in financial markets, a shaky job market, and ongoing weakness in the housing market. These difficulties are persisting, despite the Fed’s massive interest rate cuts and expanded lending efforts over the past year. Will the Federal Reserve and Treasury be able to save the country from suffering a massive financial collapse?

It depends. It depends upon what you consider a financial collapse, and I tend to look at it from a very realistic point of view. On a case-by-case basis. If you had your entire retirement account with Enron, then you have had a financial collapse. If you are an autoworker for General Motors, then you may be feeling a bit unsure of your future.

The only real way to gain an idea of whether this latest move by the Treasury and the Federal Reserve is going to help is by objectively asking yourself what currency has survived the test of time. The answer is NONE; no piece of (government backed) paper has ever stood the test of time.

However, fear not, because two commodities have stood the test of time and they are gold and silver. These metals have a 5,000-year track record of preserving wealth and at certain times enhancing wealth. You see both of these monetary metals stand outside the entire financial system and yet are money in and of themselves. They are immune to bank or brokerage failure, poor management, or even government intervention. That is the beauty of owning an asset outside the financial system: you have the peace of mind that some of your savings is safe no matter what happens.

Do Even Greater Troubles Lie Ahead?

Thomas Jefferson offered these words at the founding of our country, “Banking establishments are more dangerous than standing armies.” The next few months may prove to be very difficult if the financial crisis spreads throughout the world.

The big “IF” is, if perhaps the worst is behind us, the system will continue and the past errors made by leading financial institutions will be resolved. Certainly, if you are objective, this is a “possibility” but in my view a very remote one. The problem is that if things deteriorate slowly, more people will not wake up in time to really take action.

Which action? The act of buying a metal that reflects the light of truth in good times and bad—SILVER.

July 22, 2008

by David Morgan

God Bless America

Prairie Creek Permitting Update -

Tuesday July 22, 6:00 am ET

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 22, 2008) -

Canadian Zinc Corporation -

(TSX:CZN - News; OTCBB:CZICF - News; the "Company" or "Canadian Zinc") is pleased to announce that it has received a number of approvals to enable continued activities aimed at preparing infrastructure and road access at the Prairie Creek Mine to take place in order to continue advances towards operations.

Roadwork Authorization:

The Company recently received additional authorizations and permits required to proceed with rehabilitation of the winter road immediately to the north of the Prairie Creek Mine. Final authorization from Fisheries and Oceans Canada was issued July 15, 2008, to permit work to proceed adjacent to the Prairie and Funeral creeks. This authorization, coupled with a Class "B" Water Licence issued March 20, 2008, by the Mackenzie Valley Land and Water Board ("MVLWB" or "Board"), and a Quarry Permit, issued February 28, 2008, from Indian and Northern Affairs Canada, will allow the commencement of rehabilitation work on the winter road. Construction crews are being mobilized and work is expected to commence before the end of July.

The existing road, which connects the Prairie Creek Mine with the Liard Highway is approximately 175 kilometres long. The road was first constructed in 1980 and was previously used to transport more than 800 loads of equipment, material and fuel to the Prairie Creek site. Under a Land Use Permit dated April 10, 2007, issued by the MVLWB, the Company was granted a permit to use the road in the winter months for a period of five years until April 10, 2012.

The Company plans to use the rehabilitated road to transport fuel and other necessary supplies to the Prairie Creek Mine site and, upon commencement of operations, to transport the zinc and lead concentrates from the mine site to the rail head.

Applications for Operating Permits:

On May 28, 2008, Canadian Zinc applied to the MVLWB for Land Use Permits and a Class "A" Water Licence to permit the operation of the Prairie Creek Mine (refer to news release dated June 11, 2008). The Company has subsequently responded to a number of requests for additional information from the Board. On July 14, 2008, the MVLWB advised the Company that all applications have now been deemed complete and that the Board is proceeding to the next stage of the regulatory process.

Canadian Zinc's applications for a Type "A" Water Licence and Type "A" Land Use Permit ("LUP") for the operation of the Prairie Creek Mine utilizes the extensive existing infrastructure and facilities that were built in the 1980's, which will be upgraded and enhanced to meet current-day environmental standards. The improvements proposed for specific site facilities will further mitigate any potential impact the Project may have on the environment.

Background:

The Prairie Creek Mine ("Mine" or "Site") is 100% owned by Canadian Zinc Corporation, and is situated in the southern Mackenzie Mountains of the Northwest Territories. The Site presently contains significant infrastructure and facilities constructed in the early 1980's. The Mine received a Water Licence (#N3L3-0932) and Land Use Permit (N80F248) in 1980 for mine operation and the production of lead and zinc concentrates and a silver-bearing copper concentrate. The Mine was within three months from production when the then owner was placed into receivership as a result of the decline in the price of silver.

Cautionary Statement - Forward Looking Information

This press release contains certain forward-looking information. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, the issue of permits, the size and quality of the company's mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company does not currently hold a permit for the operation of the Prairie Creek Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Contact:

John F. Kearney

Canadian Zinc Corporation

Chairman

(416) 362-6686

(416) 368-5344 (FAX)

Alan B. Taylor

Canadian Zinc Corporation

VP Exploration & Chief Operating Officer

(604) 688-2001 or Toll Free: 1-866-688-2001

(604) 688-2043 (FAX)

Email: invest@canadianzinc.com

Website: http://www.canadianzinc.com

Source: Canadian Zinc Corporation

Soros should make a deal with "FMNJ Cerro Rico holdings" before CDE

become the JV-partner? -

FMNJ - Mission -

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

http://biz.yahoo.com/indie/080710/1300_id.html?.v=1

imo. tia.

God Bless America

U.S. Silver Corporation Files New NI 43-101 Technical Report on the Galena Mine

Date : 06/27/2008 @ 6:57PM

Source : MarketWire

Stock : U.S. Silver Corporation (USA)

Quote : 0.39 -0.02 (-4.88%) @ 3:52PM

U.S. Silver Corporation Files New NI 43-101 Technical Report on the Galena Mine

TORONTO, ONTARIO ("U.S. Silver" or the "Company"), is pleased to announce the filing of its updated 43-101 technical report on SEDAR entitled "Galena Mine, Shoshone County, Idaho, Technical Report, June 26, 2008" (the "Technical Report") on SEDAR. The Technical Report follows U.S. Silver's May 12, 2008, press release announcing new estimates for reserves and resources at the Galena Mine as at December 31, 2007. The Technical Report was authored by Daniel H. Hussey, Certified Professional Geologist and Chief Geologist of U.S. Silver-Idaho, Inc. (a wholly-owned subsidiary of United States Silver, Inc., U.S. Silver's wholly-owned subsidiary) and can viewed under U.S. Silver's profile online at www.sedar.com.

Highlights Include

- Proven and probable reserves at its Galena Mine complex near Wallace, Idaho increased to 17,449,400 ounces of silver contained in 981,100 tons of ore at an average grade of 17.79 ounces of silver per ton (oz/t). This represents a 15 percent increase in ounces of silver and a 22 percent increase in tons from the previous technical report on the Galena Mine dated June 4, 2007.

- The proven and probable reserve, silver ounces increased in one year by 60 percent over the December 31, 2006 estimate of 444,003 tons at a grade of 24.5 ounces per ton containing 10,878,797.

-------------------------------------------- Ag Tons Grade Contained % Cu Contained Copper-Silver Ore (oz/t) Ounces Cu Tons -------------------------------------------------------------------------- Proven & Probable Reserves 702,200 21.19 14,878,100 0.68% 4,790 -------------------------------------------- Measured & Indicated Resources 715,900 14.73 10,545,100 0.49% 3,500 -------------------------------------------- Inferred Resource 640,300 18.38 11,765,900 0.57% 3,650 --------------------------------------------------------------------------

-------------------------------------------- Ag Tons Grade Contained % Pb Contained Lead-Silver Ore (oz/t) Ounces Pb Tons -------------------------------------------------------------------------- Proven & Probable Reserves 278,900 9.22 2,571,300 9.85% 27,460 -------------------------------------------- Measured & Indicated Resources 215,600 9.30 2,005,700 9.43% 20,330 -------------------------------------------- Inferred Resource 873,800 7.18 6,275,100 7.72% 67,460 --------------------------------------------------------------------------

The silver-lead portion of the reserve estimate now represents 28 percent of the total reserve tons. Silver ounces contained in silver-lead ore increased by 87 percent, with a 79 percent increase in contained tons of lead. The total reserve tons of silver-lead material increased by 126 percent. Ounces of silver contained in the silver-copper reserve increased by 8 percent over the April 2007 reserve.

The increase in reserves is a result of an exploration and development program undertaken by U.S. Silver since acquiring ownership and operation of the Galena mine in June 2006. During 2007, management placed an increased emphasis on development and diamond drilling of the known silver-lead zones that exist at the Galena mine. Recent exploration demonstrated that the silver-lead zone may be potentially larger than originally indicated. While exploration and development of silver-copper ore continues on a par with silver-lead development, the Company expects the silver-lead resource to grow at an increased rate in the near term. The silver-lead ore is being processed at the Coeur mill while silver-copper ore continues to be processed at the Galena mill.

Reserve and resource grades are based on mine chip and diamond drilling samples. All samples are obtained and assays are reported under a formal quality assurance program.

Mark Hartmann, President and Chief Operating Officer of U.S. Silver, stated, "we are pleased with the effort our work force made during 2007 in exploring and developing new areas for production, that allowed the Company to report an increase in ore reserves, particularly for silver-lead ore. We have made significant improvements since taking over the Galena Mine complex and are excited about the many opportunities ahead of us."

Information of a technical nature in this press release respecting the properties has been prepared and reviewed by Mr. Daniel H. Hussey, Chief Geologist of U. S. Silver, who supervised the drilling and sampling programs, and resource estimation. Mr. Hussey is a "qualified person" within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

ABOUT U.S. SILVER CORPORATION

U.S. Silver, through its wholly-owned subsidiaries, owns and operates the Galena, Coeur, Caladay and Dayrock silver-lead-copper mines in Shoshone County, Idaho, with the Galena mine being the second most prolific silver mine in US history. Total silver production from U.S. Silver's mining complex has exceeded 210 million ounces of silver production since 1953. U.S. Silver controls a land package now totaling approximately 18,000 acres in the heart of the Coeur d'Alene Mining District. U.S. Silver is focused on the production and exploration from existing operations as well as exploring and developing its extensive Silver Valley holdings in the Coeur D'Alene Mining District.

Certain information in this press release may contain forward-looking statements. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. The Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to the Company. Additional information identifying risks and uncertainties is contained in filings by the Company with the Canadian securities regulators, which filings are available at www.sedar.com.

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Contacts:

U.S. Silver Corporation

Bruce Reid

Chief Executive Officer

(416) 848-0858

U.S. Silver Corporation

Vance Loeber

Investor Relations

(604) 805-3530

Website: www.us-silver.com

http://investorshub.advfn.com/boards/board.aspx?board_id=9774

Featured Company: Franklin Mining, Inc. -

Ticker: FMNJ

Interviewee: William Petty Chairman & CEO -

Back to Full Show -

http://tv.wallst.net/3-min-press/3-min-press.php?episode=127&part=592

Bill looking happy and confident -

God Bless America

The Ag mine in Potosi -

with more than 6 million ounces -

of planned silver production this year -

but more than that -

it is a testament to the successful -

cooperation that is possible in the development -

of a resource, which benefits all -

the Potosi old Ag waste piles clean up -

for next 10 yrs -

started -

it has become part of the community by helping -

re-establish cultural institutions -

supporting concerts -

art contests for local artisans -

funding civic beautification projects -

even helping sponsoring a young woman athlete from Potosi -

to the Special Olympics in Beijing, China -

He telling us -

be industrious know material success-

be diligent know earth's secrets wisdom -

the delight of mastery -

to stimulate jaded senses to fresh endeavors -

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

and He will lead -

God Bless America -

Amen

true my brother we asked and prayed for them -

http://tinyurl.com/yj4yp6

He answered -

it's a beauty to me -

thanks the Lord -

the Potosi old Ag waste piles clean up started -

it has become part of the community by helping -

re-establish cultural institutions -

supporting concerts -

art contests for local artisans -

funding civic beautification projects -

even helping sponsoring a young woman athlete from Potosi -

to the Special Olympics in Beijing, China -

He telling us -

be industrious know material success-

be diligent know earth's secrets wisdom -

the delight of mastery -

to stimulate jaded senses to fresh endeavors -

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

true my brother in law has been telling me to buy silver and invest in silver and gold companies for years silver use to be 6 dollars an oz and now its over $16 not that is has gained value but the dollar has lost value

soon it will be $100 i believe and fmnj will be worth a bundle my avg is .0018 and I still have faith that it will be worth a bundle one day!

God Bless America -

Amen

politicians have debased the currency, bankrupted the nation, and robbed the Social Security fund, leaving Baby Boomer's in a perilous position as they approach retirement. But for those who recognize it there is a silver lining on the dark cloud that hangs over the nation. Silver is not only "the poor man's gold," it is potentially the Baby Boomer's salvation! Here is how you can survive and even prosper through the coming economic collapse.

http://www.thenewsurvivalist.com/silver/

God Bless

Sector Snap: Gold, silver stocks climp

Friday June 6, 3:13 pm ET

Shares of gold and silver companies rise as overall market drops

NEW YORK (AP) -- Gold and silver stocks rose Friday against a backdrop of a declining broader market, propelled by a jump in oil prices and a decline in the value of the U.S. dollar.

In afternoon trading, Oil prices shot up more than $10 to a new record above $138 a barrel after a Morgan Stanley analyst predicted prices could hit $150 by July 4.

Additionally, the dollar declined against other major currencies -- a move that makes each barrel of oil more expensive. The Dow Jones industrial average dropped more than 350 points.

The dollar and the price of gold usually move inversely, as each is considered a hedge against the other. In addition, the precious metal is usually seen as a hedge against problems in the economy.

Mining company Goldcorp Inc. posted some of the day's largest gains, rising $2.24, or 5.7 percent, to $41.73 in light afternoon trading.

Kinross Gold Corp. rose 74 cents, or 3.8 percent, to $20.24, Barrick Gold Corp. rose $1.88, or 4.7 percent, to $42.31 and IAMgold Corp. rose 28 cents, or 4.6 percent, to $6.40.

Elsewhere in the sector, Hecla Mining Co. rose 28 cents, or 3.2 percent, to $9.12 and Yamana Gold Inc. rose 47 cents, or 3.2 percent, to $15.40.

http://biz.yahoo.com/ap/080606/metals_sector_snap.html?.v=1

Gold price to rise long term - China c.bank official

Reuters

Reuters - Friday, May 30

SHANGHAI, May 29 - International gold prices are likely to rise further in the long term due to dollar depreciation, rising demand and global political and economic uncertainty, a researcher at China's cental bank said.

http://malaysia.news.yahoo.com/rtrs/20080529/tbs-gold-price-7318940.html

The dollar is a victim of globalization -

http://www.marketwatch.com/news/story/story.aspx?guid={0DB29E93-78B3-4A75-B1D1-6E7F166F5E4A}

God Bless

If only Titan Resources (TNRI) can get themselves into gear. SILVER is where it's at!

GRIFFIN MINING (LSE: GFM.L) 92.00 Up 3.95 (4.49%)

At 11:27AM ET:

http://finance.yahoo.com/q?s=GFM.L

GRIFFIN MINING (LSE: GFM.L) vs. YUKON ZINC CORPORATION (Tier1)

(CDNX: YZC.V) -

http://biz.yahoo.com/ccn/080421/200804210456425001.html?.v=1

http://investorshub.advfn.com/boards/board.asp?board_id=11696

Griffin Mining Limited to Acquire Yukon Zinc Corporation

Monday April 21, 6:11 pm ET

VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 21, 2008) -

Yukon Zinc Corporation -

(TSX VENTURE:YZC - News; "Yukon Zinc") and Griffin Mining Limited (AIM:GFM) ("Griffin") announced today that they have signed an Agreement (the "Agreement") whereby Griffin will acquire all of the issued shares of Yukon Zinc through a court-approved plan of arrangement. The shares of Griffin are traded on the Alternative Investment Market ("AIM") of the London Stock Exchange.

Under the terms of the transaction the shareholders of Yukon Zinc will receive one ordinary share of Griffin for every nine common shares of Yukon Zinc held. This represents a value of C$0.206 per Yukon Zinc share based upon the closing price of the Griffin shares on AIM on April 18, 2008 of 0.9225 of a British Pound Sterling and a Canadian Dollar - British Pound Sterling exchange rate of 0.4984. This represents a premium of 46.9% to the closing price of the Yukon Zinc shares on the TSX-V on April 18, 2008 and 43.0% premium to the 20 day volume weighted average trading price of the Yukon Zinc shares on the TSX-V. After completion of the transaction, the shareholders of Yukon Zinc will hold approximately 16% of the issued Griffin shares, with the current Griffin shareholders holding the remaining 84%. It is expected that the transaction will close by July 31, 2008.

Griffin will have the following attributes after completion of the transaction:

- A strong balance sheet with over C$200 million in cash; No debt;

- 60 percent interest in the low-cost Caijiaying zinc-gold-silver-lead mine in Hebei Province China;

- 100 percent interest in the high grade advanced zinc-silver-copper-gold-lead Wolverine Project located in Yukon Canada;

- When the Wolverine Project achieves full production status, projected annual zinc production in concentrates from Caijiaying and Wolverine will exceed 150 million pounds and annual payable silver production will exceed 4.5 million ounces. There will also be significant quantities of copper, gold and lead production; and

- Exciting exploration and development potential in the vicinity of the Caijiaying mine in China and in the Yukon Zinc's Finlayson District and other exploration properties.

Harlan Meade, President and Chief Executive Officer of Yukon Zinc, said, "The transaction with Griffin will result in the development of the Wolverine deposit, which is projected to become a very low cost producer. Yukon Zinc's properties and exploration expertise will complement the development and financial strengths of Griffin and provide an attractive growth outlook for Yukon Zinc and Griffin shareholders. We believe that this transaction represents an excellent value proposition for our shareholders and provides a bright future."

Mladen Ninkov, Chairman of Griffin, stated, "This transaction fulfills the stringent economic and geological and political criteria the Company has imposed upon itself. Yukon Zinc will add a high grade, profitable mine to Griffin's portfolio and add extensive exploration acreage in one of the most exciting base metals regions in the world. The returns for existing Griffin shareholders and our new Griffin shareholders through Yukon Zinc will be very exciting. We couldn't be more pleased."

Summary of the Transaction

The acquisition of Yukon Zinc by Griffin is to be completed by way of a court-approved Plan of Arrangement whereby each shareholder of Yukon Zinc will receive one-ninth of an ordinary share of Griffin for each common share of Yukon Zinc held (the "Exchange Ratio"). Outstanding warrants and options of Yukon Zinc will be converted into Griffin warrants and options by multiplying the number of warrants and options held by the Exchange Ratio. The exercise price of the warrants and options will be adjusted to a number equal to the current exercise price, divided by the Exchange Ratio. The expiry dates of the warrants and options remain unchanged.

The transaction is subject to a number of conditions that are customary for transactions of this nature, including execution of definitive transaction documents, a favourable vote of at least 66 2/3% of the Yukon Zinc shares voted at a special meeting of the shareholders of Yukon Zinc called to approve the transaction, regulatory and court approvals and completion of due diligence. Yukon Zinc has agreed to pay a break fee to Griffin, under certain circumstances, of C$2.5 million. Yukon Zinc has also provided Griffin with certain other customary rights, including a right to match competing offers.

The Special Committee of the Board of Directors of Yukon Zinc has determined that the transaction is in the best interest of Yukon Zinc shareholders and that the Exchange Ratio is fair to its shareholders. The Board of Directors of Yukon Zinc unanimously recommends that the Yukon Zinc shareholders vote in favour of the transaction. Paradigm Capital Inc. has provided an opinion to the Board of Directors of Yukon Zinc that the Exchange Ratio is fair, from a financial point of view, to the holders of common shares of Yukon Zinc. Senior officers and Directors of Yukon Zinc have agreed to vote in favour of the transaction.

Management Team and Board of Directors

No change to the Board of Directors of Griffin is contemplated. Under the Agreement, Yukon Zinc must use its reasonable best efforts to maintain and preserve its organization, including its current management staff.

Yukon Zinc Advisors and Counsel

Yukon Zinc's legal and financial advisors are Lang Michener LLP and Paradigm Capital Inc. respectively. Griffin legal counsel is Anfield Sujir Kennedy & Durno, Barristers and Solicitors.

About Griffin

Griffin is a Bermuda based mining and investment company listed on the Alternative Investment Market of the London Stock Exchange (symbol GFM). Griffin, through its two Chinese joint ventures has a controlling interest in mining and exploration licenses over 67 square kilometers at Caijiaying in the Hebei Province in the People's Republic of China. Within this area Griffin has successfully commissioned the Caijiaying mine and processing facilities, with a current throughput rate of some 500,000 tonnes of ore per annum to produce a zinc concentrate and a separate lead concentrate containing gold and silver for sale in China. Griffin has a 60% interest in the Caijiaying mine and mineral interests covering the above, but is entitled to 100% of the net cash flows from Caijiaying for the first three years from the commencement of commercial production in July 2005.

Continuing exploration in the area surrounding the mine at Caijiaying and within Griffin's local Chinese joint venture's tenement boundary has shown the area to be highly prospective, indicating significant potential for further economic base and precious metals mineralisation. Considerable progress has been made in defining a separate resource at the Zone II area some 1.5 kilometres to the south of the mine at Caijiaying.

Griffin reported a profit after tax of US$18,010,000 for the six months ended 30th June 2007 and total assets of US$88,926,000 as at 30th June 2007. In August 2007 Griffin completed a placing of 68,181,818 million shares at Pounds Sterling 1.10 per share for total proceeds of Pounds Sterling 75 million (US$152 million) and currently retains cash resources in excess of US$200 million.

About Yukon Zinc

Yukon Zinc is a TSX Venture Exchange listed company based in Vancouver. It is focused on development of its exceptionally silver-rich Wolverine Project in southeast Yukon and its large exploration land holdings in the Finlayson and Rancheria Districts. A bankable feasibility was completed for the Wolverine Project by Wardrop Engineering in January 2007 indicating favourable project economics. The Project has all of its main development permits and enjoys strong support from the Yukon Government and its local First Nations communities.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of applicable Canadian securities laws concerning the business, operations and financial performance and condition of each of Yukon Zinc and Griffin. Forward-looking statements include, but are not limited to, statements with respect to the future price of metals, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Yukon Zinc and Griffin to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the integration of acquisitions; risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities. Although Yukon Zinc and Griffin have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Yukon Zinc and Griffin do not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.

12G: 82-4603

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy of this news release.

Contact:

Dr. Harlan Meade

Yukon Zinc Corporation

President and CEO

(604) 682-5474 or Toll Free: 1-877-682-5474

Shae Dalphond

Yukon Zinc Corporation

Manager, Investor Communications

(604) 682-5474 or Toll Free: 1-877-682-5474

(604) 682-5404 (FAX)

International Toll Free: 1-800-8682-5474

Email: info@yukonzinc.com / Website: www.yukonzinc.com

Source: Yukon Zinc Corporation

http://biz.yahoo.com/ccn/080421/200804210456425001.html?.v=1

http://investorshub.advfn.com/boards/board.asp?board_id=11696

Yukon Zinc Corp. (YZC:CA) $0.165 $0.025 (+17.86%)

Volume: 4.9 m

12:07 PM EDT Apr 22, 2008

http://investorshub.advfn.com/boards/board.asp?board_id=11696

Yukon Zinc Announces Extension of Barclays US$140 Million Senior Debt Facility

Wednesday March 26, 9:28 am ET

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 26, 2008) -

Yukon Zinc Corporation -

(TSX VENTURE:YZC - News) is pleased to announce that Barclays Capital ("Barclays") has extended the current US$140 Million senior debt facility ("the Facility") commitment to June 30, 2008.

This Facility forms the lead portion of project financing for the Wolverine Project located in southeast Yukon, Canada.

The original debt commitment, and the extension of the commitment are subject to standard conditions, including a review of any capital cost changes and loan pricing in the context of the debt markets.

Barclays Capital is the Investment Banking division of Barclays Bank PLC and one of the leading providers of finance to the mining sector.

"The extension of Barclays' commitment in the midst of the current uncertain financial markets again confirms the fundamental merits of the Wolverine Project and confidence in the development team", said Dr. Harlan Meade, Yukon Zinc President and CEO, "meanwhile the Company continues its discussions with industry and other groups interested, directly or indirectly, in providing the required equity to fully finance Wolverine."

Senior Debt Facility

The term sheet for the Facility provides for up to US$140 million that will be available to the Company following completion of loan and security documentation as well as satisfaction of various conditions precedent.

This loan has a term of 7.5 years and will be secured against the assets of the project.

The initial financing commitment followed an extensive due diligence review by Barclays' Independent Engineers, Pincock Allen and Holt, of the Optimized Feasibility Study completed by Wardrop Engineering in early 2007.

This news release contains forward-looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of failure to complete the proposed financing, failure to obtain necessary regulatory or shareholder approvals, and other risk factors beyond its control and actual results may differ materially from the expected results.

12G: 82-4603

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OF THIS NEWS RELEASE.

Contact:

Dr. Harlan Meade

Yukon Zinc Corporation

President and CEO

(604) 682-5474 or Toll Free: 1-877-682-5474

Shae Dalphond

Yukon Zinc Corporation

Manager, Investor Communications

(604) 682-5474 or Toll Free: 1-877-682-5474

(604) 682-5404 (FAX)

International Toll Free: 1-800-8682-5474

Email: info@yukonzinc.com / Website: www.yukonzinc.com

Source: Yukon Zinc Corporation

http://biz.yahoo.com/ccn/080326/200803260450806001.html?.v=1

http://investorshub.advfn.com/boards/board.asp?board_id=11696

Franklin Enters Final Phase of Plan to Bring Escala to Full Production

Wednesday April 16, 10:53 am ET

LAS VEGAS, NV--(MARKET WIRE)--Apr 16, 2008 --

Franklin Mining, Inc. -

(Other OTC:FMNJ.PK - News) (Frankfurt:FMJ.F - News) CEO William Petty has confirmed that Howard Dunn, Vice President for Operations, International Mining, returned to Bolivia to make an assessment of equipment available to complete Phases II and III of the Escala production plan.

Mr. Dunn met with the staff of Franklin Mining, Bolivia on Monday, April 14 in their La Paz, Bolivia offices. On Tuesday, Mr. Dunn and Dr. Jaime Arancibia, Franklin Mining, Bolivia's General Manager, inspected the processing plant acquired in March. Today they are in Potosi where they will inspect and evaluate equipment prior to its relocation to the Escala Mine.

Mr. Dunn will also visit the Escala Mine before returning to Franklin's Santa Cruz, Bolivia office where he will meet with Mr. Petty on Friday, April 18 to review his assessment of equipment available for use in implementing the balance of the Escala production plan.

Comprising three separate mining applications, COMIBOL's Escala Mine concession totals 2,000 hectares located in the Sud Lipez Province, near Bolivia's border with Argentina. Franklin Mining, Bolivia has been awarded a contract to mine 500 hectares within the original concession. Escala II and Escala III mining applications are currently assigned to another company.

The original Escala Mine was established during the Spanish colonial period and has been mined for lead, zinc, gold and silver. In 2007, Franklin Mining, Bolivia negotiated an agreement with COMIBOL, National Mining Company of Bolivia, to resume mining operations within the area of the original concession.

About Franklin Mining, Inc: Franklin Mining, Inc. holds mining and energy interests in the United States and Bolivia as well as energy interests in Argentina. Franklin Mining, Bolivia is a wholly owned subsidiary.

Franklin Mining, Inc. holds 51% ownership in both Franklin Oil & Gas, Bolivia S.A. and Franklin Oil & Gas, Argentina S.A.

DISCLOSURES: "Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements that are subject to risk and uncertainties, including, but not limited to, the impact of competitive products, product demand, market acceptance risks, fluctuations in operating results, political risk and other risks detailed from time to time in Franklin Mining, Inc.'s filings with the Securities and Exchange Commission. These risks could cause Franklin Mining, Inc.'s actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, Franklin Mining, Inc.

For further information, please visit our website (www.FranklinMining.com) or contact our Investor Relations firm, A. S. Austin & Company, 702-386-5379.

Contact:

Contact:

Investor Relations

A. S. Austin & Company

702-386-5379

Source: Franklin Mining, Inc.

http://biz.yahoo.com/iw/080416/0387417.html

http://finance.yahoo.com/q?s=FMNJ.PK

http://messages.finance.yahoo.com/mb/FMNJ.PK

http://investorshub.advfn.com/boards/board.asp?board_id=2957

To 'kiwisteve' on 'SILVER (Ag) PRODUCERS' -

thanks for info....

RE:

so whats with the stock price Bob?

Good LT entry point?

dd....

http://www.marketwatch.com/tools/quotes/snapshot.asp?siteid=bigcharts&dist=bigcharts&symb=CDE&sid=1275&time=20

http://investorshub.advfn.com/boards/board.asp?board_id=5237

so whats with the stock price Bob?

Good entry point?

Coeur's San Bartolome Mine Set to Begin Processing Ore -

Crushing Activities Underway -

First Silver Pour Expected to Take Place before Month’s End -

To Become World’s Largest Pure Silver Mine -

Coeur d’Alene Mines Corporation -

(NYSE:CDE) (TSX:CDM) (ASX:CXC) announced today that

the commissioning of the Company’s new -

San Bartolomé silver mine in Bolivia -

is well underway.

Coeur anticipates processing ore shortly, with the first

doré expected to be poured before month’s end.

The crushing circuit is now fully operational and an

initial stockpile of crushed ore is being generated.

The facility has been connected to the Bolivian national

power grid.

This important milestone allows for the final commissioning

of the grinding, leaching and silver recovery circuits.

Production and plant utilization will steadily increase

with full plant capacity anticipated to be reached

by August, as originally forecast.

The construction efforts at San Bartolomé -

have involved up to 2,100 workers,

almost all of them Bolivians, who constructed

the state-of-the art facility while achieving safety

records that surpassed 4.6 million man hours without

a lost time accident.

Overview of Key Mine Metrics:

* Expected silver production during 2008 of over six million ounces

* Operating cash costs once plant reaches full capacity through the end of the year are expected to be $4.10 per ounce of silver (excluding royalties and production taxes of $2.03 per ounce)

* Over ten million ounces of silver production during the first twelve months of full-scale operations

* 153.0 million ounces of silver mineral reserves and 34.2 million ounces of additional indicated mineral resource

* Estimated mine life of 14 years

Additional photographs of the operation can be accessed through Coeur’s website at www.coeur.com.

About Coeur

Coeur d’Alene Mines Corporation is one of the world’s leading silver companies and also a significant gold producer, with anticipated 2008 production of approximately 16 million ounces of silver, a 40% increase over 2007 levels. Coeur, which has no silver or gold production hedged, is now set to commence production at the world’s largest pure silver mine - San Bartolomé in Bolivia – and is currently another world-leading silver mine – Palmarejo in Mexico. The Company also operates two underground mines in southern Chile and Argentina and one surface mine in Nevada; and owns non-operating interests in two low-cost mines in Australia. The Company also owns a major gold project in Alaska and conducts exploration activities in Argentina, Bolivia, Chile, Mexico and Tanzania. Coeur common shares are traded on the New York Stock Exchange under the symbol CDE, the Toronto Stock Exchange under the symbol CDM, and its CHESS Depositary Interests are traded on the Australian Securities Exchange under symbol CXC.

Cautionary Statement

This press release contains forward-looking statements within the meaning of securities legislation in the United States, Canada, and Australia, including statements regarding anticipated operating results. Such statements are subject to numerous assumptions and uncertainties, many of which are outside the control of Coeur. Operating, exploration and financial data, and other statements in this press release are based on information that Coeur believes is reasonable, but involve significant uncertainties affecting the business of Coeur, including, but not limited to, future gold and silver prices, costs, ore grades, estimation of gold and silver reserves, mining and processing conditions, construction schedules, currency exchange rates, and the completion and/or updating of mining feasibility studies, changes that could result from future acquisitions of new mining properties or businesses, the risks and hazards inherent in the mining business (including environmental hazards, industrial accidents, weather or geologically related conditions), regulatory and permitting matters, risks inherent in the ownership and operation of, or investment in, mining properties or businesses in foreign countries, as well as other uncertainties and risk factors set out in filings made from time to time with the SEC, the Canadian securities regulators, and the Australian Securities Exchange, including, without limitation, Coeur’s reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Donald J. Birak, Coeur’s Senior Vice President of Exploration, is the qualified person responsible for the preparation of the scientific and technical information concerning Coeur’s mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for each of Coeur’s properties as filed on SEDAR at www.sedar.com.

This press release might use the terms “Mineralized Material” or “Measured”, “Indicated” and “Inferred Mineral Resources”, or “Probable Ore Reserves” and “Proved Ore Reserves”. U.S. investors are advised that while such terms are recognized and required by Canadian and Australian regulations, the Securities and Exchange Commission does not recognize them. “Inferred Resources” and “Probable and Proved Ore Reserves” have a great amount of uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of Inferred Resources may not form the basis of a feasibility study. U.S. investors are cautioned not to assume that all or any part of Mineralized Material or Measured, Indicated or Inferred Mineral Resources will ever be converted into reserves. U.S. investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

Coeur d’Alene Mines Corporation

Investor Contact

Director of Investor Relations

Karli Anderson, 208-665-0345

or

Media Inquiries

Director of Corporate Communications

Tony Ebersole, 208-665-0777

Source: Business Wire (April 1, 2008 - 9:35 AM EDT)

To 'kiwisteve' on 'SILVER (Ag) PRODUCERS' -

silver is a future with one of the highest volatility -

used to play it for more than 10 yrs -

but the gov. manipulation going too far -

they now rob IMF of the gold and silver -

it has made a new ST speedbumb -

they cleaned out most 888 central banks -

its about nothing more to rob -

the 666-banksterz have too long fingerz -

btw.

I going for LT positions in the silver producers -

Imo. Tia.

http://www.888c.com/

God Bless America

I wish I was short SILVER!

Silver has just been kicked so hard this time around - tonight at $16.55

My long position got stopped out last night at $18 and I was furious! I shoulda coulda gone short right then and there! Even if it feels like your kicking a good buddy in the head!

I'm too out of cash now to go long on silver and to scared too right now even as I stare at at the 15min doji at $16.75 (Silver May 08 CFD future)

Please let me know where i should set my trigger to go long on this should any one know when and where that is??? (looks like we are going up now - for a bit?

Is this the beginning of the next BULLL RUN! OR Are we going down to 14 bucks?

KIWI

Yukon Zinc Corp. (V.YZC) $0.15 - +$0.01 (+7.14%)

Volume: 447.0 k

3:21 PM EDT Mar 31, 2008

NorthLion good to see you, you're here too! Big potential

here...will take a little while to get the development going

and PM's gold, silver and the base metals zinc, copper

will all make a strong come back -

IMF put out a st speed bumb -

the banksters will rob the last US gold -

after the run to $10K/oz Au moves to moon -

NorthLion keep it up -

its a strategic bargain -

Imo. Tia.

God Bless

http://investorshub.advfn.com/boards/board.asp?board_id=11696

Setback to Bolivian reform plan -

Residents of the resource-rich Bolivian region of Santa Cruz

demonstrate in favour of autonomy in December 2007

The president's constitution plans have split the country -

Bolivian President Evo Morales has suffered a major setback

in his plans to give the country a new constitution -

to favour the indigenous majority.

http://news.bbc.co.uk/2/hi/americas/7284765.stm

http://investorshub.advfn.com/boards/board.asp?board_id=5406

Coeur D'Alene Started At Buy, $7 By Cormark >CDE

Last Update: 3/5/2008 8:30:04 AM

(MORE TO FOLLOW) Dow Jones Newswires

March 05, 2008 08:30 ET (13:30 GMT)

To 'vozmil' on 'SILVER (Ag) PRODUCERS' -

thanks -

FMNJ reporting that Franklin Mining, Bolivia's General Manager,

Dr. Jaime Arancibia, and Mining Engineer, Mr. Javier Leyton,

believe the Escala Mine -

has begun showing signs of a greater than expected

silver content.

Dr. Arancibia and Mr. Leyton have worked in Bolivia's mining

and hydrocarbons industries about twenty years each -

do have the knowledge and want to send bulk samples to

processing to get the accurate info -

ex. large ore bulk samples may often be much more reliable than a

2" drill core etc.

Silver Content at the Escala Showing Signs of Increase -

Franklin Mining, Inc. -

(PINKSHEETS: FMNJ) (FRANKFURT: FMJ) CEO, William Petty

is reporting that Franklin Mining, Bolivia's General Manager,

Dr. Jaime Arancibia, and Mining Engineer, Mr. Javier Leyton,

believe the Escala Mine -

has begun showing signs of a greater than expected

silver content.

SILVER Mar 2008 (NYMEX:SI.H08.E) -

Last trade $19.015 Change +$0.295 (+1.98%)

Dr. Arancibia and Mr. Leyton have worked in Bolivia's mining

and hydrocarbons industries about twenty years each.

Their professional opinion is that the silver -

being recovered from the most recent blast sites at

the Escala is greater than previously estimated.

Using reports prepared by Austpac Gold, NL in 1993-1994

and supplied to Franklin by COMIBOL, the mineral content

in areas where blasting is currently being conducted

was estimated to be 1 Kg per ton of silver and

2 grams per ton of gold as well as economically viable

quantities of lead and zinc and some copper.

Recovery efforts completed over the past several weeks

have produced an estimated 100 tons to be processed.

The actual mineral content recovered from the Escala

will be announced when the processing of this first

month's production is complete.

Additional information on Franklin's -

plans for mining at the Escala -

is available at

www.FranklinMining.com

specifically in multiple Letters from the President

to be posted during February 2008 -

About The Escala Mine:

Comprising three separate mining applications,

COMIBOL's Escala Mine concession totals 2,000 hectares

located in the Sud Lipez Province, near Bolivia's border

with Argentina.

Franklin Mining, Bolivia has been awarded a contract

to mine 500 hectares within the original concession.

Escala II and Escala III mining applications

are currently assigned to another company.

The original Escala Mine -

was established during the Spanish colonial period

and has been mined for lead, zinc, gold and silver.

In 2007, Franklin Mining, Bolivia negotiated an agreement

with COMIBOL, National Mining Company of Bolivia,

to resume mining operations within the area of

the original concession.

About Franklin Mining, Inc:

Franklin Mining, Inc. holds mining and energy interests in

the United States and Bolivia as well as energy interests

in Argentina.

Franklin Mining, Bolivia is a wholly owned subsidiary.

Franklin Mining, Inc. holds 51% ownership in both

Franklin Oil & Gas, Bolivia S.A. and

Franklin Oil & Gas, Argentina S.A.

DISCLOSURES: "Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements that are subject to risk and uncertainties, including, but not limited to, the impact of competitive products, product demand, market acceptance risks, fluctuations in operating results, political risk and other risks detailed from time to time in Franklin Mining, Inc.'s filings with the Securities and Exchange Commission. These risks could cause Franklin Mining, Inc.'s actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, Franklin Mining, Inc.

For further information, please visit our website (www.FranklinMining.com) or contact our Investor Relations firm, A. S. Austin & Company, 1-702-386-5379.

Contact:

Investor Relations

A. S. Austin & Company

1-702-386-5379

Source: Marketwire (February 21, 2008 - 8:30 AM EST)

GOLD Apr 2008 (NYMEX:GC.J08.E) -

fast down - fast UP -

the more volatility the better -

the higher it will jump -

COPPER Mar 2008 (NYMEX:HG.H08) -

God Bless America

Ps.

Judge for yourself and then decide whether you wish

to join the strike.

WE ARE CHANGE!!!

http://tinyurl.com/3d2yhn

Constitution Class taught by

The 2004 Libertarian Presidential Candidate,

Michael Badnarik teaches his famous class about

the Constitution....

http://tinyurl.com/cbg4n

history often repeat itself -

http://tinyurl.com/y824mv

The old bucky falling off the cliff? -

Silver Content at the Escala Showing Signs of Increase -

Franklin Mining, Inc. -

(PINKSHEETS: FMNJ) (FRANKFURT: FMJ) CEO, William Petty

is reporting that Franklin Mining, Bolivia's General Manager,

Dr. Jaime Arancibia, and Mining Engineer, Mr. Javier Leyton,

believe the Escala Mine -

has begun showing signs of a greater than expected

silver content.

SILVER Mar 2008 (NYMEX:SI.H08.E)

Dr. Arancibia and Mr. Leyton have worked in Bolivia's mining

and hydrocarbons industries about twenty years each.

Their professional opinion is that the silver -

being recovered from the most recent blast sites at

the Escala is greater than previously estimated.

Using reports prepared by Austpac Gold, NL in 1993-1994

and supplied to Franklin by COMIBOL, the mineral content

in areas where blasting is currently being conducted

was estimated to be 1 Kg per ton of silver and

2 grams per ton of gold as well as economically viable