Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

U.S. Silver & Gold Inc. announces agreement to replace existing debt

08/08/2013

TORONTO, Aug. 8, 2013 /CNW/ -

U.S. Silver & Gold Inc.

(TSX: USA, OTCQX: USGIF) ("U.S. Silver & Gold" or the "Company") has

replaced the previously announced extension on its existing US $7.9

million senior secured credit facility with Hale Capital Partners.

http://www.us-silver.com/News-and-Events/News-Releases/News-Release-Details/2013/US-Silver--Gold-Inc-announces-agreement-to-replace-existing-debt/default.aspx

The Company has signed a credit agreement with Royal Capital Management Corporation as security agent, and certain lenders for the issuance of CDN $8.5 million notes (the "Notes") with a three-year term. The Notes carry a comparable annual interest rate of 12%, payable monthly, and are secured by a first charge on all material assets of the Company. Beginning two years following the date of issue, the Notes will be redeemed in monthly increments of $500,000 with the balance due and payable on maturity. The debt may be repaid at any time during the three-year term, subject to a repayment fee. In connection with closing the transaction, the Company will issue 10,625,000 warrants. Each warrant allows the holder to purchase one of the Company's common shares for a five-year term, and will be issued with an exercise price of $0.68, subject to downward adjustment in certain circumstances.

Unlike the previously announced term sheet with Hale Capital

Partners, this new credit agreement does not require the Company to

pay a net smelter return royalty.

The Company will further update the market on the new credit

agreement during its second quarter conference call on Tuesday,

August 13th, 2013 at 4:30 pm Eastern Standard Time.

http://www.us-silver.com/Investors/Presentations/default.aspx

http://www.us-silver.com/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=90303876

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=90303876

God Bless

Water Powered Car Unveiled: Yes It’s Real -

http://beforeitsnews.com/alternative/2013/07/water-powered-car-unveiled-yes-its-real-2723722.html

JAPANESE COMPANY UNVEILS WATER POWERED CAR

A Japanese company called Genepax unveiled their water powered car

in 2008 in Osaka, Japan(1).

It doesn’t matter if it’s tap, bottled, or lake water, any type of

water can make this car run. An energy generator splits the water

molecules to produce hydrogen and this is used to power the car.

They use a membrane electrode assembly (MEA) to split the Hydrogen

from the Oxygen through a chemical reaction.

The cell needs only water and air, eliminating the need for a

hydrogen reformer and high pressure hydrogen tank.

Genepax

Futuristic Car running on water GenePax -

http://www.youtube.com/watch?v=9JTEUpRdKFY

Lets see $50 on this run...PLEASE

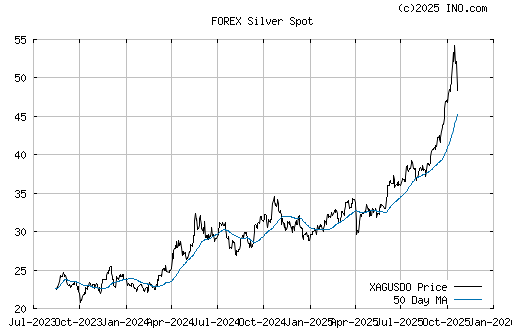

Silver - Continuous Contract Spot Price (EOD

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87867796

rituals of the 666 banksters put the kids to be -

http://www.thedevilsminer.com/index_new.html

God Bless

Silver - Spot Price (EOD) ($SILVER ![]()

Silver - Continuous Contract (EOD -

http://www.biblebelievers.org.au/monie.htm

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87867075

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87366034

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87255432

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86981008

God Bless

Gold & Silver Index Stocks bottom line - Early Oversold Buy Opportunity -

World Changing Events & The Global Run On Gold And Silver

Tuesday, April 30, 2013 17:32

http://beforeitsnews.com/economy/2013/04/world-changing-events-the-global-run-on-gold-and-silver-2515812.html

2 days ago – We also found out that inventories of gold and silver

are dropping ... to some sort of resolution with the potential for

world changing events.

XAU Index to Price of Gold Ratio ($XAU:$SILVER)

HK gold retailers overwhelmed by mainland shoppersUpdated:

2013-05-02 05:00 By Gao Changxin In Hong Kong ( China Daily)

http://www.chinadaily.com.cn/cndy/2013-05/02/content_16466595.htm

World Bank Whistle-blower. Confidence in the Dollar as an

International Currency Is Waning.

The End of Bretton Woods ?

World Bank Whistleblower Karen Hudes

http://nsnbc.me/2013/05/02/world-bank-whistle-blower-bretton-woods-near-collapse-confidence-in-the-dollar-as-an-international-currency-is-waning/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87413351

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87422006

http://www.biblebelievers.org.au/monie.htm

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87366034

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87255432

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86981008

God Bless

Ps.

Germany Facing Another ‘Weimar Republic Meltdown’ – US Ponzi Scheme

Is Being Revealed For The True Fraud That It Is – V’s Latest

Monday, April 29, 2013 11:24

http://beforeitsnews.com/eu/2013/04/germany-facing-another-weimar-republic-meltdown-us-ponzi-scheme-is-being-revealed-for-the-true-fraud-that-it-is-vs-latest-2518814.html

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87366034

Central Banks Grossly Incompetent: Bloomberg -

http://www.bullionbullscanada.com/gold-commentary/26151-bloomberg-central-banks-grossly-incompetent

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87255432

The Dow / Gold chart LT show

the fibonacci LT correction done -

Update to the Update: The Attack on Gold — Paul Craig Roberts -

http://www.paulcraigroberts.org/2013/04/16/update-to-the-update-the-attack-on-gold-paul-craig-roberts/

In extreme market situations created by 666 nwo

against the useless eaters as the nwo 666 call the People -

a small share buy back program for USGIF shares -

would be to some rescue -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84237637

BTW.

when the current playing field not is in level -

only laws against the People enforced -

NO laws against 666 banksters who run the gov. -

are robbing and plunder the People -

shareholders should demand it -

don't listen to the nwo etf pawns who are against it -

if you want a stronger shareholders rights etc.

please, suggest it to your management -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84237637&txt2find=buy|back|program

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86881141

An excerpt from the interview is posted at

the King World News blog here:

http://tinyurl.com/bs866kx

Bull markets come and go - so do bear markets -

These cruel cycles and 666 patterns will end, because

they are inhuman and Island People made an ex....

Iceland Slams Banksters With Harsh 3 Months In Jail -

Canadian Silver Hunter Expands Project Area and Launches New Website

TORONTO, ONTARIO--(Marketwired - April 8, 2013) - Canadian Silver Hunter Inc. (the "Company") (TSX VENTURE:AGH) is pleased to announce the expansion of its exploration area and the launch of its new website: www.candiansilverhunter.ca.

The Company's "South Lorrain Project" includes (i) the Keeley Frontier property, which has been the focus of the Company's exploration program to date; and also includes (ii) the Veinlode claims consisting of 26 patented leases currently held by Veinlode Silver Mines Ltd., covering approximately 444 ha and which are located directly west of and contiguous with the Keeley Frontier property; (iii) the Montreal River Extension consisting of 6 unpatented claims (79 claim units) covering approximately 1300 ha, which are located west of and contiguous with the Veinlode claims; and (iv) the Tooth Lake claim, located south of the Keeley Frontier property.

More information on the South Lorrain Project can be found on the Company's updated website, which was redesigned to provide easy access to the Company's progress and plans. The website will now meet the increasing demands of both retail and institutional shareholders, prospective investors, investment advisors, and financial institutions, by offering simplified navigation of exploration, project, and corporate information.

About Canadian Silver Hunter Inc.

Canadian Silver Hunter Inc. is a Canadian exploration company focused on the exploration of silver-cobalt deposits on its flagship South Lorrain Project (formerly the Keeley Frontier Project). The South Lorrain Project is located within the historic South Lorrain Silver Camp, which along with the historic Cobalt and Gowganda silver camps is part of a world class silver district in the Abitibi Greenstone Belt between Temagami and Kirkland Lake, in northeastern Ontario.

The South Lorrain Project is made up of four properties, centered by two prolific past producing silver-cobalt mines, the Keeley and the Frontier. Combined production from the two mines totaled 19.2 million ounces of silver, and 3.3 million pounds of cobalt, with an average grade of 58 ounces of silver per tonne.

Recent diamond drilling by the Company returned significant silver values between 111.0 and 122.3 metres downhole, including 1517.0 g/tonne over 0.3 metres, 479 g/tonne over 0.4 metres, and 91 g/tonne over 0.3 metres. This zone appears to be related to a new silver bearing structure.

Results from the recent power stripping and channel sampling program returned silver values ranging from 0.4 g/t to 190 g/t, with only 7 of the 77 samples taken assaying below 1.0 g/t Ag.

The company will continue to focus its exploration efforts on the existing targets located on the Keeley-Frontier property portion of the project. For further details about the Company's project and plans please visit the Canadian Silver Hunter Inc. website at www.canadiansilverhunter.ca.

Mr. Gerald Harron, P. Eng., is the "Qualified Person" under NI 43-101 and has reviewed and approved the technical information contained in this news release. Any potential quantities and grades noted herein are conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in any targets being delineated as a mineral resource.

This release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration or project development related to the Company's mineral properties, outcomes of proposed or contemplated acquisitions or other transactions, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact Information:

Canadian Silver Hunter Inc.

Jeffrey Hunter

President and CEO

(647) 348 6966

jhunter@cshi.ca

www.canadiansilverhunter.ca

CDE the situation for the mining industry has been a mess in many

counties in Latin America where the New Left had showed up

(Venezuela, Ecuador, Bolivia)…in some ways, some of their critique

has been correct.. and in deed there has been some grounds to re-

evaluate the cooperation between commodity rich countries and the

mining industry… however the mining industry became a political

scapegoat for the many failures of the domestic & international

actors in these countries.. Morales and Chavez rule today in the

shadow of the constant stream of conspiracy myths in these

countries… however all these perceived outside enemies led

eventually to an overzealous mob atmosphere where it became easy

to take someone else’ property.

The Silver from the 4824 m high Cerro Rico (Rich Mountain) -

once made Potosi the biggest city in the Americas -

and one of the richest in the world -

RICH POTOSI:

The Mountain That Eats Men -

or is it - the el tio ? - 666 - That Eats Men -

Ex.

Cerro Rico: The Mountain that eats men -

All 888 fooled by el tito 666God safety -

Start Telling the Truth -

Demand IT -

ex....

http://removingtheshackles.blogspot.ca/2013/02/times-square-billboards-love-it.html

USGIF Mother Silver very important -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84185429

ex.

every newborn baby need the silver drop in the eyes

to not be blind etc. etc. etc.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84880985

ex.

http://beforeitsnews.com/opinion/2013/02/obamas-astounding-lies-unchallenged-by-the-press-2442756.html

http://www.orlytaitzesq.com/

To All USGIF Long Shareholders, USGIF Very nice info -

Here is something else..to hold the USA / USGIF Ag&AuFORT....

# 1.

USGIF needs to initiate a buy back program of USA / USGIF bargain shares -

Please, send management an email and suggest a buy back of

USGIF share A.S.A.P. -

TIA. -

http://www.us-silver.com/Contact-Us/Contact-Us/default.aspx

or/and

Darren Blasutti

President and CEO

dblasutti@us-silver.com

416-848-9503

http://www.us-silver.com

http://www.us-silver.com/files/WebShow1.pdf

Agenda # 2.

Please, let all who want to be part of USA / USGIF family have

an easy way to right way -

A volunteer program for all mine workers and employees with an

ex.

monthly payment reduction from wages to be for shares of

USA / USGIF and become a Shareholder and part owner of

'U.S. Silver & Gold Inc. (USA / USGIF)

To Shareholder of 'U.S. Silver & Gold Inc. (USA / USGIF) -

NOTE.

The Company should file the NCIB Program to allow for market

purchases of the Company's common shares (the "Shares") under

certain market conditions and subject to the approval of

the Board of Directors.

The Company does not currently intend to purchase Shares on

the market, but may do so from time to time in the future.

Although the Board of Directors and Management of the Company

must believe that the Shares are currently significantly

very extremely undervalued,

ex.

Callahan Mining Corporation 1983 operated by Asarco -

by memo. spent more than $85 million to the shaft construction

development -

($85Mil in 1983 = more than $200Mil in current value)

ex. and more than 195,000 tons mined @ a profit of more than $26 million in 1983

http://www.idahogeology.org/PDF/Technical_Reports_(T)/TR-85-1.pdf

In current market value $85 million on the Callahan shaft

development is more valued than the total market capitalisation

value of U.S. Silver & Gold (USA / USGIF)

@ only

Total Current Market Cap: $121,774,201

In my opinion;

Investors who pay @ $2.-/sh currently pay for Callahan Mine and

get a good bargain for it -

but

rest of the assets of -

USA / USGIF - rest of assets are FREE Load including;

So even a 10hyear old who learned 1 x 20 = USA / USGIF = 20 times higher

in Real Market Value than the bargain give away price @ currently -

USA / USGIF - rest of assets are FREE Load including;

U.S. Silver & Gold Inc.

is a newly formed silver and gold mining company focused on growth

from its existing asset base and the execution of targeted

accretive acquisitions. U.S. Silver & Gold owns and operates the

Galena Mine Complex

in the heart of the Silver Valley/Coeur d'Alene Mining District,

Shoshone County, Idaho and

the Drumlummon Mine Complex in Lewis and Clark County, Montana.

Within the Galena Mine Complex, the Galena Mine produces high-grade

silver and is the second most prolific silver mine in U.S. history,

delivering over 200 million ounces to date,

the Coeur Mine

is under re-development with first production having been achieved

in late 2012 and the Caladay Zone is being evaluated for bulk

mining development.

The Drumlummon Mine currently produces high-grade gold and silver

with historical production of 1 million ounces of gold and 12

million ounces of silver and has never been fully exploited or

explored.

Visit www.us-silver.com.

USA / USGIF has about fiat$30 million + @ current in

working capital -

Please, suggest to management to buy back shares -

The Buy Back Program should again be operational and hopefully

we will see this bolster our share price.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84110312

Best of lucks to all longs!

Also Note.

the Callahan shaft etc. has been repaired -

TORONTO, ONTARIO, Jul 24, 2008 (MARKET WIRE via COMTEX) --

U.S. Silver Coporation

(TSX VENTURE: USA) ("U.S. Silver" or the "Company") is pleased to

announce the beginning of repair activities associated with

bringing

the Caladay mine into production.

The Caladay Shaft lies approximately 1.3 miles southeast of the

Galena Mine No.3 Shaft in Wallace, Idaho. The two mines are already

interconnected on the 4900 foot level of the Galena Mine.

The four-phase program includes:

- The repair of the Placer Creek and Caladay portals and the

installation of new hoist ropes on the Caladay hoist. This includes

upgrades to the timbered sections in the tunnels, repair of the

rail access to the hoist room where necessary, and replacing the

hoist rope that has been in service for more than 30 years.

The repair should be completed by early 4th quarter, 2008.

- Concurrent with the portal repair, additional exploration drilling

in the Caladay mineralized zone between the 4900 and 5200 levels of

the Galena Mine will begin.

This drill program is designed to explore the western zone of the

Caladay mineralized area and will provide information for the test

mining program.

Once drilling is completed, a new resource model will be …

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84146850

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84070858

http://www.biblebelievers.org.au/monie.htm

Ps.

it strange to not see;

all Chinese and India miners etc. from world over to be crawling

on top of each other @ Galena, Wallace to pick up this

strategic super Ag-mine bargain for

$peanutz fiatz counterfeitz for

osama cult pawns has told them that US is open for business!

AGH.V News,

Canadian Silver Hunter Announces a Second New Near-Surface Target at Keeley Frontier Project

Press Release: Canadian Silver Hunter Inc. – Fri, Jan 18, 2013 7:00 AM EST

Email

Recommend0Tweet

Print

RELATED QUOTES

Symbol Price Change

AGH.V 0.05 0.00

TORONTO, ONTARIO--(Marketwire - Jan. 18, 2013) - Canadian Silver Hunter Inc. (the "Company") (TSX VENTURE:AGH) is pleased to release final results of recent sampling at the Keeley Frontier silver project in South Lorrain Township, Ontario. The Company completed a power-stripping and channel sampling program near Gibson Lake on the main Keeley Frontier claim block in November of 2012. As well, one pit was dug by excavator to a depth of 2 metres in a tailings area, with five grab samples taken at various depths in the tailings profile.

Highlights

• Channel line 7 returned composite silver values of 69.3 g/t Ag over the full length of 2.9 metres, including 86.8 g/t Ag over 2.25 metres.

- These samples also include base metal values of 0.91% Pb, 0.65% Zn, 0.28% Cu over 2.25 metres.

- One sample returned a value of 174 g/t Ag and 1.46% Pb over 0.95 metres.

• Channel line 8 returned a composite silver value of 28.0 g/t Ag over 2.05 metres, with 0.58% Pb, and 0.69% Zn. The composite included 70 g/t Ag 1.31% Pb, 1.64% Zn and 0.42% Cu over 0.6 metres.

• Channel line 2 returned a composite silver value of 70.4 g/t Ag over 1.85 metres, including 190 g/t Ag over 0.6 metres.

• Five (5) grab samples of tailings material (sand, silt and clay) exposed at various depths in one location by an excavator at depths ranging from surface to 1.8 metres depth returned silver values of 404 g/t Ag, 191 g/t Ag, 175 g/t Ag, 124 g/tonne and 74.8 g/t Ag.

• The tailings grab samples also assayed up to 0.053% bismuth, 0.33% cobalt, and 0.09% nickel.

A total of 50.45 metres of channel cuts were completed and assayed for silver and trace elements. The average length weighted composite for all 77 channel samples taken is 11.33 g/t Ag, 0.12% Pb, 0.14% Zn and 0.12% Cu. Silver values ranged from 0.4 g/t to 190 g/t, with only seven samples assaying below 1.0 g/t Ag. A similar widespread dispersion of Pb, Zn and Cu values was also noted, with a high correlation to Ag values.

The stripped area consists of one rock type; pillowed mafic volcanics, cut by numerous brittle steeply dipping fractures and faults trending mainly between 310 and 330 degrees. Disseminated pyrite, chalcopyrite, galena, sphalerite, arsenides, native silver and bismuth were visible within and adjacent to many of the fractures. Calcite, and reddish dolomitized volcanics were locally present.

The Gibson Lake structural trend was located by surface prospecting of IP anomalies during the summer of 2012. Historic trenching was exposed using an excavator and high pressure water for approximately 40 metres along strike. Additional caved trenches can be observed along the trend. The width of the mineralized trend is exposed for 10 to 15 metres.

There are no records of previous exploration results in the Gibson Lake area. Silver and cobalt production are known to have occurred 300 metres to the east from the Woods and Watson veins. It is important to note that the current surface stripping is well outside (above by approximately 100 metres) the historic "productive zone" with which the Keeley Frontier high grade silver zones are associated. The "productive zone" follows the shallow dipping Nipissing sill/volcanic rock contact, generally 100 metres above and 50 metres below the sill contact, where most of the high grade silver and cobalt has been found. The top of the "productive zone" could be reached with a 150 metre long drill hole beneath the Gibson stripping.

It is also of interest to note that historic exploration and production in the South Lorrain silver camp focused on underground drifting along narrow high grade structures and there was generally no exploration for wider, lower grade mineralized zones using geophysics, surface drilling or power-stripping. Strong chargeability anomalies from earlier IP surveying completed by the Company suggest the presence of disseminated sulphide/arsenide targets along a northwest trending anomaly 100 metres wide by at least 400 metres long stretching northwest from the Gibson Lake area stripping.

Follow-up work on the Gibson targets will include additional geophysics and power-stripping, with shallow drilling based on additional channel sampling results. Additional power-stripping is also required proximal to hole CSH12-03 (168.22 g/t Ag over 4.2 metres within a zone grading 72.47 g/t Ag over 11.3 metres, see June 19, 2012 press release). Weather conditions this fall did not allow for sufficient power-washing of the site and no channel sampling could be completed. This area is 750 metres south of the Gibson Lake stripping and remains a high priority for surface sampling and diamond drilling.

Sampling along the edge of Little Beaver Lake was done in one location to examine the depth of tailings and distribution of silver and other metals in the tailings profile. Five (5) samples were assayed at Agat Labs and returned silver values between 74.8 g/tonne (2.18 ounces per ton) and 404 g/tonne (11.78 ounces per ton). These silver levels are encouraging and systematic sampling of tailings is being considered as part of the next exploration program.

Project Logistics and QA/QC

All analyses reported in this release are from assay certificates which passed both Canadian Silver Hunter, and AGAT Laboratories QA/QC procedures.

Channel samples were cut with a gas powered saw using a diamond blade, similar to a core cutting saw. Samples were sent for aqua regia digestion and multi-element (including Ag, Co, Ni, Bi, Sb) analysis (ICP-OES finish) at AGAT Laboratories Ltd. in Mississauga, Ontario. The excavating, power-washing and channel cutting program was carried out under contract by Laframboise Drilling Inc. of Earlton, Ontario, managed and supervised by David R. Jamieson, P.Geo and Dean R. Cutting, P.Geo.

AGAT is a fully accredited laboratory and conforms to the requirements of CAN-P-4E (ISO/IEC 17025:2005) and CAN-P-1579 by the Standards Council of Canada. AGAT Laboratories provided pickup of the channel and tailings samples from the Company's core shack in North Cobalt, to the preparation lab in Sudbury, Ontario. Analysis is performed at AGAT facilities in Mississauga, Ontario. QA/QC programs include the use of standard and blank samples inserted into the assay stream, including the tailings samples, by the Company's personnel every 25 samples in addition to the lab's internal QA/QC programs. Samples assaying greater than 100 g/t Ag are fire assayed with a gravimetric finish. QA/QC results indicate that the AGAT aqua regia digestion and multi element analytical procedures used on this program are reliable. Screen metallic assaying may be required to more accurately quantify silver values in higher grade portions of the mineralized zones due to the presence of coarse silver.

Mr. Gerald Harron, P. Eng., is the "Qualified Person" under NI 43-101 and has reviewed and approved the technical information contained in this news release.

About Canadian Silver Hunter Inc.

Canadian Silver Hunter Inc. is a Canadian-based junior precious metals exploration company. The Company's flagship project is Keeley Frontier Project, located near Cobalt, Ontario. The Company's current focus is on exploration of the Keeley Frontier Project for silver, cobalt and nickel deposits.

CAUTIONARY STATEMENT:

This release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration or project development related to the Company's mineral properties, outcomes of proposed or contemplated acquisitions or other transactions, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Contact:

Canadian Silver Hunter Inc.

Jeffrey Hunter

President and CEO

(416) 707-4230

jhunter@cshi.ca

www.canadiansilverhunter.ca

Silver’s annual performances have been erratic in this bull

too as this final chart shows.

Sometimes it is up big, sometimes it is down big.

But even large down years like 2008’s stock panic don’t

prematurely end silver’s secular bull.

It bounces right back as sentiment recovers, something to

remember today in this current environment filled with silver

fear, despair, and bearishness.

Silver’s gains aren’t smooth.

But there is definitely a mean-reversion tendency in

silver’s returns.

Weak years are generally followed by strong years, and

vice versa.

After 2008’s stock panic crushed it,

silver soared 52% in 2009 and 83% in 2010.

And those incredible years led into

the high consolidation of 2011 and 2012,

with their 10% loss and 10% gain.

So if silver’s secular bull is indeed alive and well,

it is certainly due to surge once again in 2013.

And there’s one more thing to note in this real-silver comparison. Today’s secular silver bull, while erratic, is much more consistent than the 1970s one proved. Silver’s gains have been more gradual, the periodic sharp surges as greed waxes excessive haven’t been extreme like the 1974 example. This implies today’s bull has a much larger investor constituency deploying capital more gradually over time.

Thus today’s bull is considerably more robust, it has a stronger foundation than the 1970s one. This supports the thesis that today’s secular silver bull will ultimately prove larger than the last one. The better the foundation, the more investor capital deployed before that crazy popular-speculative-mania phase sets in, the higher silver can potentially rocket when the general public finally comes storming in.

So despite all the silver bearishness out there today spawned by silver’s recent weakness, its secular bull looks far from over. Popular speculative manias cap secular bulls, and though the spring-2011 upleg was strong it was nothing remotely close to mania-caliber. Silver is going to see much higher highs, dwarfing April 2011’s near $50 real, before this secular bull has fully run its course and finally gives up its ghost.

Interestingly, silver is already in a young new upleg that most traders refuse to see because they are blinded by today’s bearishness. While this metal was pounded back down near $30 in December, just under its 200dma, it spent much of last summer languishing around $27. Silver is slow to gather steam, with gradual early-upleg buying slowly building momentum into the exciting large late-upleg surges.

And the Fed’s new QE3 Treasury monetizations that are just starting this month are wildly bullish for silver. This metal has always been a go-to asset in inflationary times. That last mighty upleg that peaked in April 2011 happened to be largely driven by the Fed’s last major inflationary campaign, QE2. So 2013 is shaping up to be an amazing year for silver, and probably even better for the beaten-down silver miners.

When traders are bearish on silver after its slumps, they just abandon the stocks of the companies that bring it to market. The silver stocks plunge to deeply-undervalued levels relative to silver, they are pretty much left for dead. This creates great opportunities to buy low for brave contrarians who understand silver’s bullish fundamentals and aren’t spooked by temporary weakness. The newest persists today.

Most silver stocks are trading as if the bears are right, as if silver is doomed to grind lower from now to the end of time. But in real terms today’s secular silver bull looks far from over, and silver is early in what is likely to prove its next major upleg. So the excessively gloomy psychology plaguing silver stocks today won’t last. Contrarians who understand this have been buying cheap silver stocks in recent months.

It isn’t too late. Last month we published our latest deep-research report on silver juniors, the highest-potential of all silver stocks. We spent 3 long months investigating nearly 100 silver juniors trading in the US and Canada, and gradually whittled them down to our dozen fundamental favorites. Each is profiled in depth in a fascinating new report. One was already bought out at an epic 72% premium, as silver miners realize how dirt-cheap the explorers are. Buy your report today and get deployed before silver runs!

We also publish acclaimed weekly and monthly subscription newsletters for contrarian speculators and investors willing to fight the crowd to buy low and sell high. In them I explain what is going on in the markets, why, and what specific trading opportunities it is creating. Buying low when stocks are deeply out of favor has led to a stellar track record. Since 2001, all 634 stock trades recommended in our letters have averaged annualized realized gains of +34.8%. Subscribe today!

The bottom line is a real comparison shows silver’s current secular bull is far from over. This metal’s latest interim high a couple springs ago was relatively low in real terms, and resulted from an upleg that was nothing like a popular speculative mania. And secular bulls don’t end until the general public falls in love with that asset and starts flooding in. Silver hasn’t seen anything like that for several decades.

The current bearishness is merely a typical psychological response

to silver’s recent weakness.

When prices fall, traders start to believe they will keep falling

indefinitely.

So they look for bearish theories that rationalize their beliefs.

But succumbing to this groupthink is a grave mistake.

Broader perspectives reveal silver’s secular bull is far from

over, creating a great buying opportunity for contrarians today.

by Adam Hamilton, CPA

January 11, 2013

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=83349592

http://maxkeiser.com/

God Bless

Excellon Resources Announces TSX Approval of Normal Course Issuer Bid

Toronto Stock Exchange - EXN

TORONTO, Nov. 29, 2012 /CNW/ -

Excellon Resources Inc.

(TSX: EXN) ("Excellon" or "the Company"), Mexico's highest grade

silver producer, is pleased to announce that the Toronto Stock

Exchange (the "TSX") has approved the notice of its intention to

make a normal course issuer bid (the "NCIB Program").

The Company has filed the NCIB Program to allow for market

purchases of the Company's common shares (the "Shares") under

certain market conditions and subject to the approval of the

Board of Directors.

The Company does not currently intend to purchase Shares on the

market, but may do so from time to time in the future.

Although the Board of Directors and Management of the Company

believe that the Shares are currently significantly undervalued,

the Company's cash flow is best used to fund the ongoing,

aggressive diamond drill program on the Company's new CRD/Source-

style discovery on the La Platosa Property in the state of

Durango, Mexico.

The Company's exploration programs are fully funded from high-

grade silver production at the La Platosa Mine.

Pursuant to the terms of the NCIB Program, Excellon shall be

permitted to purchase Shares for cancellation through the

facilities of the TSX at the prevailing market price of the

Shares.

The Company may purchase a maximum of 26,468,732 Shares (or 10%

of the total public float) pursuant to the NCIB Program.

Purchases will be subject to a daily maximum of 75,060 Shares,

except where such purchases are made in accordance with the

"block purchase" exemption under applicable TSX policy. Excellon

may make purchases from time to time commencing on December 3,

2012 and ending on December 2, 2013.

As at the close of business on November 28, 2012, Excellon had

275,179,467 Shares issued and outstanding.

About Excellon

Excellon's high-grade silver production drives transformative

exploration potential.

The Company's 100%-owned La Platosa Mine in Durango is Mexico's

highest grade silver mine, with lead and zinc by-products making

it one of the lowest cash cost silver mines in the country.

With 41,000 hectares of exploration ground surrounding the mine,

Excellon is focused on discovering the large-tonnage Source of

the high-grade silver mantos currently in production.

Such a discovery has the potential to transform La Platosa into

the next major project in Mexico's prolific CRD/silver belt.

The Toronto Stock Exchange has not reviewed and does not accept

responsibility for the adequacy ----- and is not to be construed

in any way as, an offer to buy or sell securities in the United States.

SOURCE: Excellon Resources Inc.

Excellon Resources Inc.

Joanne C. Jobin, Vice President, Investor Relations

T. (416) 364-1130 E. info@excellonresources.com

W. http://www.excellonresources.com

http://www.excellonresources.com/Investors/Press-Releases.aspx?CnwID=135081

Robert Kiyosaki Advice: Buy Gold & Silver To Hedge Inflation

(In ex. below video -

Banksters Mafiays Huge Silver Delivery Problems Expected: GATA

MARKET RIGGING FRAUD -

by Bill Murphy, Bix Weir, & Andy Hoffman Part 2

U.S. Silver & Gold Inc. (USA:TSE) fiat $2.010 Aug 16, 2012,

Exchange: Toronto Stock Exchange

$2.010 Aug 16, 2012, 8:28 PM EDT

Change: 0.070 +3.61% ![]()

Volume: 109,997

Gold now defends not just liberty but simple reality

Submitted by cpowell on Sat, 2012-03-10 20:02.

Section: Essays

2:57p ET Saturday, March 10, 2012

Dear Friend of GATA and Gold:

GATA can't vouch for the data published in the latest edition of

Alan M. Newman's financial letter, Crosscurrents, which argues

that financial manipulation has become the main pursuit of the

United States economy, but he is far from alone in his

observations.

Commentary about this trend arose around 20 years ago, perhaps

first in The New Republic magazine.

And there is a well-established entry about it at Wikipedia,

the Internet encyclopedia, here:

http://en.wikipedia.org/wiki/Financialization

Newman writes that dollar trading volume (presumably in U.S.

markets) now is more than four times larger than the U.S. gross

domestic product as well as four times larger than total stock

market capitalization.

"The churn continues at the most ferocious pace, making a

mockery of our capital markets," Newman writes.

"The theme of investing for the future is now meaningless as

high-frequency trading distorts price discovery, resulting in

gross pricing inefficiencies."

... Dispatch continues below ...

http://www.gata.org/node/11102

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78609350

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78612626

666 banksters cult -

super red fed fema ussr gulags copycats

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70774248

$SILVER chart P&F TA Ag bullish price bull obj. $58.0/oz -

U.S. Silver Corporation (TSE:USA) fiat$1.550 HAPPY Jul 4, 2012, 3:58 PM EDT to ALL -

Change: $0.070 +4.73%) Volume: 54,929

Day Low

1.460 Day High

1.550

Well, its good strategic position in silver before the coming

accident - to wait until the accident happens -

it may be too late -

http://www.investmentrarities.com/future_price.shtml

in many ways the best thing that could happen to America is

for the government & banksters to go broke which is the

fact & truth - we won’t find many people who share that view.

In fact, you can hardly find anyone who thinks we are in serious

enough trouble that the government can’t fix it.

Most people don’t even think about such things.

That’s the way it was in Greece and Spain etc.

up to a few months ago -

http://www.investmentrarities.com/best_of_jim_cook06-25-12.shtml

dd....

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77115920

God Bless

Exclusive Interview with Eric Sprott Part 1

Wallace Silver GO make Lady Ag Queen happy -

Caladay Silver Mine - Third Silver Mine to be reactivated ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76264616

God Bless

Hi Bob--yes, I read this good news. US Silver needs much higher silver prices, though. Their cost per ounce is too high.

I've been looking at TAHO, which is opening what looks to be a very lucrative silver mine next year. You might want to take a look at it.

USSIF looks mighty cheap here--as do so many others. It's too bad silver has been rigged down the way it has been...

Caladay lead zone have confirmed the existence of a broad

mineable resource that appears to support

lower cost bulk mining methods.

Efforts to extend the Silver Vein at depth have produced some

very high grade intercepts including

1,434 Ag opt over 1.6 feet and

112.1 Ag opt over 2.8 feet (see below) and

evidence of additional mineralization beyond

current mining levels.

The Silver Vein has been a prolific producer for decades and

the down dip extension of this mineralization is a key target

as deposits elsewhere in the Silver Valley have demonstrated

very high grade at depth.

Dan Hussey has returned to Company as Chief Geologist bringing

decades of experience in the Silver Valley and extensive

experience at the Galena.

U.S. Silver Announces Results of Ongoing Diamond Drill Activities

at the Galena Mine and Expanded Geological Team

06/04/2012

http://www.us-silver.com/News-and-Events/News-Releases/News-Release-Details/2012/US-Silver-Announces-Results-of-Ongoing-Diamond-Drill-Activities-at-the-Galena-Mine-and-Expanded-Geological-Team1129700/default.aspx

USSIF $SILVER Chart P&F TA Alert Bullish Price Objective $58.-/oz

http://www.us-silver.com/

USSIF $SILVER Chart P&F TA Alert Bullish Price Objective $58.-/oz

http://www.us-silver.com/

USSIF $SILVER Chart P&F TA Alert Bullish Price Objective $58.-/oz ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73717855

U.S. Silver Focused On Growing its Silver Assets

in 2012 with Goal of Opening A Second Mine

Aggressive Exploration Planned to Develop New Areas for Mining

Company Financially Strong with More than $27 Million Cash on Hand

U.S. SILVER CORPORATION

OTC QX: USSID • TSX: USA

As the second largest primary silver producer in

the United States with annual silver production of

2.4 million ounces from its flagship

Galena Mine, U.S. Silver Corporation’s

(OTC QX: USSID; TSX: USA) --

http://www.us-silver.com --

huge land package of 14,000 acres of under-explored property

provides the company with tremendous future potential reserve

growth in the country’s most prolific silver district –

Idaho’s Silver Valley where more than 1.2 billion ounces of

silver have been produced historically.

This is a company with a strong balance sheet, a stable

operating cash flow, and an increasingly aggressive

exploration program.

Quite simply, U.S. Silver is poised to equal or perform better

than that record in 2012, and could well post annual revenues

of about $100 million.

U.S. Silver Moves to Apply for NYSE Amex Listing, Consolidates

Common Share Structure and Will Buy Back Common Shares

U.S. Silver recently was cleared to apply for a listing on

the NYSE Amex.

The company must also satisfy additional conditions and

confirmations prior to being authorized to list on the U.S.

exchange, including share distribution and satisfaction of

minimum trading price requirements, corporate governance

compliance and filing of a Form 40-F registering the common

shares.

U.S. Silver outstanding common shares were recently

consolidated on the basis of five (5) pre-consolidation common

shares for each one (1) post-consolidation common share.

The consolidation was approved by U.S. Silver shareholders in

June 2011 and took place on January 31, 2012.

As a result, the approximately 309 million pre-consolidation

issued and outstanding common shares were reduced to

approximately 62 million post-consolidation common shares.

Over the next year, U.S. Silver plans to buy back up to about

3 million or 5% of those shares.

Under a recently announced Normal Course Issuer Bid, the share

purchase program will terminate no later than Feb. 20, 2013.

Repurchases will be made by the company on the open market

through the facilities of the TSX in accordance with TSX

requirements, and at the market price at the time of

acquisition.

Daily repurchases will be limited to 22,377 common shares,

other than block purchase exceptions, based on an average daily

trading volume of 89,509 common shares since October 3, 2011,

the date of U.S. Silver’s listing on TSX.

U.S. Silver’s action is based on the belief that the company’s

common shares have not been trading at prices that fully

reflect it’s underlying value, offering an inviting

investment opportunity.

“With a cash balance in excess of our planned needs and an

expected continued strong silver market, we feel that this is

a very prudent investment for the benefit of shareholders at

this time,” says Gordon Pridham, Executive Chairman and

Interim CEO of U.S. Silver.

“We intend to begin repurchasing stock subject to the terms of

this Normal Course Issuer Bid at our earliest opportunity.”

Management Team Strengthened

with Board of Directors Appointment

Tom Ryley, who has a career that spans over 35 years in the

natural resources sector, joined the U.S. Silver Board of

Directors in February 2012.

He leads an advisory firm specializing in business planning and

strategy, new business development and investment analysis.

He spent 25 years with Suncor Energy Inc. in variety of

increasingly senior roles and was executive vice president of

refining and marketing during the last nine years of his career

with the company.

He sits on the boards of several public, private and charitable

organizations.

“We are pleased to add Tom to the Board and look forward to

benefitting from his 35 years of wide ranging experience in

operations management, strategic corporate development and

public company board directorships,” says Pridham.

“His senior corporate blue chip experience and knowledge will

be invaluable to U.S. Silver as it manages its growth

strategy.”

Ryley joins a diversified management team with over 100 years

of mining and business experience.

Pridham has a strong background in investment banking, capital

markets, and corporate banking. COO Steve Long has extensive

experience in mine engineering and management.

CFO Chris J. Hopkins is skilled in financial management,

strategic planning, mergers and acquisitions, corporate finance

and management reporting within the mining sector.

U.S. Silver’s Strong

Financials Support Expansion Plans

“Operational consistency and favorable commodity prices continue

to provide U.S. Silver with improved financial strength and the

ability to pursue our ongoing goal of production growth,”

says Pridham.

The company has a solid revenue stream, substantial receivables

in the form of concentrates on the way to the smelters, no

long-term debt and no royalties.

As a result, U.S. Silver can comfortably self-fund expanding

its silver resource at the Galena and development of its

Coeur and Caladay Mines.

U.S. Silver recently reported $28.3 million in Q3 revenues,

compared to $12.0 million for the same period in 2010.

The company will report its 2011 end-of-year performance

results in March.

U.S. Silver reported net income of $5.2 million in the quarter,

compared to $0.5 million for the same period in 2010.

Cash flow from operating activities totaled $5.4 million in

the quarter, compared to $1.8 million for the same period

in 2010, while cash on hand totaled $27.5 million.

Expanded Exploration Drilling Planned to Increase Resource Base

U.S. Silver’s 2011 exploration program yielded such encouraging

results, the company is significantly expanding both surface

and underground drilling in 2012 to provide even greater

potential for reserve expansion.

From August through December 2011, U.S. Silver drilled 21,433

feet underground at both its flagship

Galena Silver Mine and at its advanced-stage, former producing

Coeur Mine.

Rehabilitation of 140 miles of existing tunnels, many nearly

40 years old, continues.

In 2011 the company spent over $3.3 million on level repairs.

Underground exploration drilling at Galena confirmed additional

resources that will be developed for mining in 2012 and beyond.

Investment Considerations

U.S. Silver’s Galena, Coeur, Caladay and Dayrock silver-lead-

copper mines are part of a 14,000 acre land package in an area

recognized as one of the world’s most prolific silver belts.

The company is a solid silver producer with more than 300

people on its payroll who help to produce 800-1000 tons of ore

per day, five days a week.

A significant 2011 milestone for U.S. Silver was its promotion

to the Toronto Stock Exchange (TSX), the senior Canadian

exchange for mining companies, giving the company greater

accessibility to investors, as well as greater liquidity,

increased market recognition and access to capital.

Listing on the TSX is representative of the significant growth

and strength the company has delivered to its investors.

The TSX is a premier stock exchange for mining companies and

a main board listing will increase our visibility with

investors throughout the world.

Now, U.S. Silver is making a similar move in the U.S. with its

application for listing on the NYSE AMEX to give the company

increased access to and credibility with U.S. investors.

U.S. Silver’s core business plan remains unchanged –

to focus on expanding silver and copper production from

existing operations as well as exploring and developing

its extensive Silver Valley holdings.

The success of that plan is evident – each year

U.S. Silver has more than replaced its mined resources.

“We are confident we will continue to provide additional

reserves for years to come as we explore more aggressively

to prove those reserves on our large land position in the

prolific Silver Valley,” says Pridham.

To date, U.S. Silver has mined 120 different veins at its

flagship Galena Silver Mine, which has been in operation

for almost 60 years.

Incredibly, exploration shows no evidence that the quality

of mineralization is diminishing.

U.S. Silver’s Board of Directors has authorized re-starting

mining operations at its

Coeur Mine, a milestone that will enable the company to

maintain and expand its current production levels

for years to come.

The former producing -

Coeur Mine contains an estimated 5.9 million ounces of silver

equivalent.

The mine has been idle for about 15 years and has aging tunnels

and vertical passageways that must be rehabilitated to provide

miners with at least two safe exit points from all operational

levels.

Currently, there is only the main shaft and a tunnel at one

level connecting to the adjacent Galena mine.

No additional permitting or acquisition costs will be required

to reopen the mine.

Once in operation, the U.S. Silver will have two mills –

one at Galena and the other at Coeur –

capable of processing up to 1,400 tons of ore per day at

recovery rates of 96% for silver-copper and

92% for silver-lead ores.

U.S. Silver forecasts 2012 production levels at about

2.4 million ounces of silver, with by-product production of

lead at about 6.5 million pounds and

copper at about 1.2 million pounds.

“2012 will be a year of continued, enhanced exploration at the

Galena Mine,” says Pridham.

“Our focus is to create more places to mine.

By spending money on infrastructure and development at the

Galena, we are ensuring the mine will provide a stable

platform of growth for U.S. Silver Corporation.”

Contact:

Heather Bailey-Foster, Manager I.R.

P.O. Box 440, Wallace, ID 83873

Phone: 208-556-1535 Ext. 2

Fax: 208-556-1587

Corporate Office:

Christopher Hopkins, CFO

401 Bay Street, Ste 2702

Toronto, ON M5H 2V4

Phone: 416-907-5501

Fax: 647-722-9652

E-Mail: info@us-silver.com

Web Site: http://www.us-silver.com

Shares Outstanding: 61.8 million

52 Week Trading Range:

(as of Feb. 20, 2012)

Canada: Hi: C$4.15 • Low: C$1.95

Given the current environment, we see much greater risk holding

cash in a bank than we do in holding precious metals.”

Furthermore, holding silver instead of cash as a form of

savings allows silver miners to convert their silver into cash

at an opportune time.

When asked about silver specifically, Embry responded,

“Nothing has changed. The supply/demand is powerful....

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/3/21_John_Embry__%2450_Downside_on_Gold_but_%241%2C000s_to_the_Upside.html

$Silver Chart TA alert MACD & slow STO @ the buy zone

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73452172

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73545989

http://www.us-silver.com/Investors/Presentations/default.aspx

http://www.us-silver.com/Operations/Photo-Gallery/default.aspx

http://www.us-silver.com/Operations/Overview/default.aspx

God Bless

Silver Provides Blueprint To Sprott’s Call To Action -

Eric, Wall Street Cheat Sheet | March 21, 2012

Eric Sprott, legendary gold and silver investor and chairman of Sprott Inc.,

famously issued an open letter to 17 of the world’s largest

silver producers last year.

The letter is well-known to the precious metals community

because it challenged the mining industry to limit silver sales

until prices increased.

Unlike an OPEC style cartel, Sprott advocated that miners

simply hold a portion of their cash reserves in the form of

silver, in order to protect themselves and shareholders from

irrational price corrections that take place too often in the

silver market.

Silver mines not only heeded Sprott’s advice, but has already

benefited from it.

Sprott’s “Call to Action” letter suggested, “Instead of selling

all their silver for cash and depositing that cash in a levered

bank, silver miners should seriously consider storing a portion

of their reserves in physical silver outside of the banking

system.

Why take on all the risks of the bank when you can hold hard

cash through the very metal that you mine?

Given the current environment, we see much greater risk holding

cash in a bank than we do in holding precious metals.”

Furthermore, holding silver instead of cash as a form of

savings allows silver miners to convert their silver into cash

at an opportune time.

When asked about silver specifically, Embry responded,

“Nothing has changed. The supply/demand is powerful....

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/3/21_John_Embry__%2450_Downside_on_Gold_but_%241%2C000s_to_the_Upside.html

$Silver Chart TA alert MACD & slow STO @ the buy zone

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73452172

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73545989

Buffalo Bill' Blankfein's Financial Apartheid -

USC Silver Strategy Chart -

Silver's price has been very healthy during this rally -

Instead of correcting to the downside, the price has

only traded slightly lower -

The light declines have come on dropping volume -

The up days this week came on excellent volume -

I'm now looking for the $42-44 target area to be acquired -

the move to that price zone will be accompanied -

by even greater volume -

Silver Bullish Falling Wedge Chart -

Some bullion dealers have been reporting for months that

as much money is going into physical silver as into

physical gold -

With a current gold/silver ratio of 51, about 51 times more

physical silver is being purchased than physical gold -

Silver can be volatile, yet I continue to see silver

as an outstanding long term investment -

The silver mines share price gains has out performmed the physical

silver gains in the past ![]() -

-

the history often repeat itself -

The wedge pattern suggests that silver will now make

its way back to the highs near $50 -

Ag to GO Much HIGHER ![]() -

-

Hold on to the hat Alice -

to the moon soon ![]() -

-

http://www.unitedsilvercorp.com/s/NewsReleases.asp?ReportID=509836

God Bless

United Silver Corporation Announces Four-Year Exploration and Development Plan for the Crescent Mine, Coeur d'Alene Silver Belt, Idaho.

Vancouver, British Columbia, February 28, 2012:

http://www.unitedsilvercorp.com/s/NewsReleases.asp?ReportID=509836

United Silver Corp. -

("United Silver Corp.", the "Company", or "USC": TSX-V; USC: OTCQX; USCZF: Frankfurt: UM8)

is pleased to announce that the Board of Directors has approved

a phased, property-wide, USD$23 million, four-year plan (the

"Plan") to further explore and develop

the Crescent Silver Mine resource.

The objectives of the Plan are to further explore the existing

silver resource, develop the existing resource, and explore

for additional resources at the Company's 80 percent-owned

Crescent Silver Mine.

The Crescent Mine is located on a large, 365 hectare (902 acre)

property in the heart of northern Idaho's Silver Belt, in the

Coeur d'Alene silver-lead-zinc mining district.

The Crescent Mine is situated between the world-class,

previously-mined Sunshine silver mine and the Bunker Hill

silver-lead-zinc mine, with previous district-wide production

estimated to be over 1 billion ounces of silver, making it the

second largest silver district in the world (for details of the

Crescent property, the Idaho silver belt, and figures which

assist in visualizing the details of this press release please

refer to our website at www.unitedsilvercorp.com).

Approximately 25 million ounces of silver at an average grade of

27.3 opt (SRK Consulting 43-101, March 1, 2010) were

historically mined from the Crescent Mine, and known

mineralization has been identified from near surface to

approximately 5,000 feet depth below surface by

the Bunker Hill Mining Company , prior owners of

the Crescent Mine.

We consider this historical information to be reliable.

Silver and base-metals-bearing vein deposits at Sunshine and Bunker Hill, located immediately to the east and west of, and adjoining, the past-producing Crescent Mine, were world-class deposits of silver. The Crescent Mine, which was a much smaller producer than the other two deposits, has never undergone a detailed and aggressive exploration program, despite the fact that the ore-bearing vein systems strike across the large, 365 hectare property, and are known to host high-grade silver-bearing vein deposits. The planned program at the Crescent is designed to aggressively follow up on known mineralization, and to produce silver-bearing concentrates from known mineralized bodies to fund the exploration of the depth and lateral extensions of the known mineralization.

Very significant surface drilling and underground exploration in the form of a spiral ramp and drifting within the known mineralization closest to surface has already been completed. The objective of the current Plan is to restart, aggressively, this partially-completed exploration/development work which began in 2007. Highly-encouraging results from this earlier work form the basis for this aggressive exploration/development plan, which has the goal of unlocking what management believes is a very high potential for the delineation of a significant silver resource.

The initial phase of the Plan will be funded by a recently-announced USD$6.3 million convertible debenture from Hale Capital Partners (see press release dated February 1, 2012) and by a contribution from 20% joint venture partner Gold Finder Explorations Ltd. ("Gold Finder") (TSX-V: GFN) as its share of the program. Ongoing costs of the Company and Gold Finder for the exploration/development plan are projected to be funded by cash flow generated from the milling and refining of silver mineralization mined from known mineralized bodies defined by previous, detailed surface drilling and underground exploration programs.

Previous Work

Subsequent to mining in the early part of the last Century, exploration began again at the Crescent mine in 2007 with drilling carried out by Gold Finder. A total of 31,460 meters were completed, primarily from surface, on the South Vein, resulting in a 43-101 compliant resource estimate of 324,000 tons grading 18.7 ounces per ton (opt) of Indicated and 211,000 tons of Inferred mineralization grading 19.5 opt. This drilling was carried out over an area which accounts for less than 5 percent of the prospective areas of the property. Highlights of the Gold Finder drilling include:

South Vein Intercepts Silver grade

SNS403 10.0 feet @ 56.0 opt

SNS305a 6.8 feet @ 42.1 opt

SNS310 5.6 feet @ 25.3 opt

SNS1006 6.3 feet @ 21.1 opt

SNS307 5.1 feet @ 21.6 opt

SNS1002 7.0 feet @ 17.6 opt

H304 7.8 feet @ 11.0 opt

Alhambra Vein Intercepts

SNS502 6.2 feet @ 41.2 opt

SNS604 6.2 feet @ 16.4 opt

SNS1107 4.9 feet @ 20.6 opt

While the above drilling forms the basis of the current resource calculation (SRK 43-101, March 1, 2010), it was recognized that the silver-hosting veins had a strike continuity across the entire property towards the west and into the adjoining Bunker Hill mine property. In 2011, 11,275 feet of surface drilling in nine holes was completed up to 1500 feet west of the existing resource. The results of the first four Alhambra-targeted holes (see press release dated May 16, 2011) intersected 2.2 feet grading 4.8 opt silver, proving westward continuity of the mineralized system. All five holes drilled into the South Vein structure (, up to 1500 feet west of the known resource) encountered siderite-quartz-pyrite veins, demonstrating continuity of this structure as well as opening a large area for exploration. The highest grade intercept of these five holes returned 2.9 feet grading 4.58 opt silver.

Underground Exploration

The existing Hooper Level tunnel (2725 feet elevation, see website for 3-dimensional view of underground workings) provides an excellent platform to test the down-rake extension of the South Vein resource. The South Vein resource, meanwhile, has been estimated to an elevation of 2940 feet. Therefore, in 2011, a program of 12,000 feet of drilling to test the down-rake extension of the South Vein was proposed, of which only two holes totaling 1,449 feet of drilling were completed due to funding limitations.

These two holes gave highly-encouraging results, indicating that the South Vein resource is open to depth and that further drilling is definitely warranted. The two holes intersected silver mineralization as follows:

DDH From (feet) To (feet) Feet Recovered True Width (Feet) Silver (opt)

H-6 720.20 724.0 3.40 3.11 25.6

Includes 721.40 722.40 0.90 0.82 96.40

H-7 727.00 729.70 2.70 2.21 3.60

Includes 727.00 727.65 0.65 0.50 8.80

A core loss of 6.5 feet between 718 and 728 feet in H-7 may have been from a mineralized, faulted zone within the South Vein. The H-6 intersection is at an elevation of 130 feet below and is 300 feet west of the lowest point of the limit of the calculated South Vein resource, and remains open to depth and along strike, indicating good potential for quickly expanding the known resource by further drilling.

Underground Test Drifting

A decline to facilitate lateral drifting for underground exploration and eventual production activities, called the Countess decline, was collared by the Company in August, 2010 from a surface portal at 4300 foot elevation and progressed for 2400 feet to a point where it intersected the South Vein resource (as defined by SRK in their 43-101) at the 3945 foot elevation.

Test drifting along the South Vein structure at the 3945 foot elevation began in March 2011 and, as of January 2012, a continuous 755 feet of strike length along the drift within the South Vein body yielded 10.4 opt silver over an average width of 9.2 feet. The most significant intervals intercepted by this drift sampling include:

Strike Length (feet) Average Silver Grade (opt) Average Width (feet)

246 14.0 7.3

210 15.6 8.3

88 15.6 9.0

The average grades above were calculated from channel samples collected across the test drift faces and weight-averaged by representative volume and specific gravity. Widths and lengths were measured in the horizontal plane perpendicular to each other. This test drift has yet to cross the entire mineralized body as identified in SRK's 43-101 model of the zone.

The Exploration Plan

Management considers the Crescent to be a property with the potential for the delineation of a world-class silver-mineralized system. Factors on which this opinion is based include:

The property sits between two world-class silver deposits and adjoins them both;

Silver-bearing veins strike from the Sunshine mine, across the large Crescent land package, to the past-producing Bunker Hill mine;

The Crescent deposit is a past-producing silver deposit where only limited exploration has been carried out;

Drilling at Crescent has identified a near-surface resource while past mining at much greater depths indicates the potential for depth continuity;

A small program of wide step-out, surface drilling has shown that silver mineralization continues well away from the known resource;

Underground drilling has shown that known mineralization continues to depth and along strike and is open in both dimensions;

Underground drifting has provided a platform for a much more extensive underground exploration program which has the possibility of identifying additional resources to depth and along strike.

In order to accomplish the goal of aggressively exploring the Crescent prospect and building a much larger silver resource, while minimizing the impact on diluting the Company's share structure, Management has agreed on an exploration plan using cash flow generated from test-mining production of South Vein-hosted, identified silver mineralization. Thus, exploration and development activities will be carried out in parallel.

Exploration activities will include:

continuing the drifting from various underground levels accessed by the Countess decline, concurrent with the establishment of a secondary escapeway and sub-level development

underground drilling to potentially augment the existing resource to greater depths and along strike, with priority given to continuing to drill, from underground, the down-rake continuation of the known, South Vein resource

drilling the Alhambra structure from underground west of the historic Crescent workings, as well as within a 1200 foot "gap" between upper and lower historic workings where good potential exists for continuation of the mineralization, continuing the surface drilling program to identify additional mineralization along the westward projection of the South Vein. An additional 2000 feet of South Vein strike potential exists on the Company's property in addition to the initial 1500 foot step-out drilling program already carried out.

The plan anticipates the completion of approximately 200,000 feet of diamond drilling, consisting of 80,000 feet from the surface and 134,000 feet from underground drill stations.

Development Activities

A spiral ramp system will be developed in the footwall of the South Vein resource area. Ramping down in spirals from the existing Countess decline will proceed, while concurrently a 10 foot by 13 foot incline ramp will be driven from the surface to connect with the Countess spiral. When complete, the second opening to the surface will allow ventilation and serve as a secondary escapeway. The ramp spirals will provide access for test drifting for grade and morphology of mineralization at multiple elevations within the South Vein resource area to determine the continuity, potential for enhancement, and parameters of the mineralization to guide further drilling and drifting.

A paste backfill plant will be constructed near the incline portal.

Test Mining Metal Production to Offset the Cost of Exploration

The Company has a joint venture with the New Jersey Mining Company ("New Jersey"; the "New Jersey Agreement") to secure near-term milling capacity for the Crescent (see press releases dated October 7, 2010 and June 9, 2011). Mill expansion, including equipment installation and fabrication of structures and conveyors is nearing completion. Mine Fabrication and Machine, a business unit of the company's wholly owned subsidiary, United Mine Services, Inc., is performing much of the mill construction. Commissioning is expected to start at the end of March 2011. The joint venture agreement gives the Company an exclusive right to 7,000 tonnes per month of milling capacity, with first rights on additional unused capacity.

The mill is located less than four miles from the Crescent Mine.

The mill will initially process ore from test drifting on the South Vein currently stockpiled at the New Jersey mill. Concentrates produced by the milling of the underground drifting-produced mineralization will be sold to Formation Metals U.S. under an agreement signed in December 2011 (refer to news release dated December 13, 2011). Formation's refinery is less than three miles from the mill, virtually eliminating hauling costs.

The Company expects that the ore from underground test drifting and stoping will provide cash flow to the Company which will offset the cost of exploration development. Projected cash flow will cover the cost of expanding the Crescent deposit and avoid the need for further equity offerings during the period of the Plan.

An Integrated Company

USC CEO Graham Clark states: "The Board of Directors of the Company is excited and extremely optimistic about our plans going forward to explore, and test mine on a modest scale, the materials generated from drifts and stopes within the South Vein area of the Crescent Mine, while at the same time exploring farther afield for the on-strike and down-dip extensions to this potentially extensive silver-bearing system. We are grateful to have secured initial funding from Hale to establish our Plan which, for the next four years, will see aggressive exploration combined with cash flow from mining to finance the exploration and broader understanding of the system. We believe that the cash flow generated from mining will offset the need to go to the financial markets and undertake a public offering during this time, preserving and enhancing value for the shareholders and providing us with first-hand experience mining the deposit.

"USC management is looking forward to our Plan of combined exploration and silver production to be the beginning of the next, and most important period to date, in the evolution of the Crescent deposit".

Lawrence Dick. Ph.D., P. Geo., has approved and is responsible for technical information provided in this news release.

ABOUT UNITED SILVER CORP.

USC is a vertically integrated mining company with operations in Idaho, USA. It has earned, through development and operations, an 80% interest in the Crescent Silver Mine project in Idaho's prolific Silver Belt - directly between two of the world's historically largest silver producing properties, the Sunshine and Bunker Hill mines. USC also offers a full suite of mining services including contract mining and mine machine repair and fabrication services to silver miners in the district. USC's common shares trade on the Toronto Stock Exchange under the symbol "USC". For more information about USC, please visit: www.unitedsilvercorp.com

www.unitedsilvercorp.com

ON BEHALF OF UNITED SILVER CORP.

"Graham Clark"

Chairman and Interim CEO

Cathy Hume

CHF Investor Relations

Tel. (416) 868-1079 x231

Email: cathy@chfir.com

U.S. Silver Corporation (USSID) Chart 2 mon. Performance UP 27% ![]()

management performance often repeat itself -

- may set indication for the rest of the year 2012 ![]() -

-

USSID TA PERF 6 x 27% = 162% gain Ag-bullet>train>arrow-> to Silver Valley ![]()

- all hobo aboard @ comfy chair ![]()

- TI MAD alert Golden Cross ![]()

- CMF TI signal bottom buy zone ![]() -

-

- PPO TI alert cross to buy ![]() -

-

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72479471

God Bless

Eric Sprott - There's No Silver Left - Casey Research -

U S Silver Corp (QX) (USSIF)

0.473 ? 0.021 (4.65%)

Volume: 651,095 @ 3:24:21 PM ET

Bid Ask Day's Range

0.35 0.6893 0.464 - 0.5

USSIF Detailed Quote Wiki

Mining shares have separated from the general equity markets -

GATA e-mail

Submitted by cpowell on 11:27AM ET Friday, September 9, 2011. Section: Daily Dispatches

2:20p ET Friday, September 9, 2011

Dear Friend of GATA and Gold:

Fund manager Eric Sprott today tells King World News that the precious metals mining shares have separated from the general equity markets, going up while the rest are going down, and that the sky is the limit for gold and silver, what with currencies, government debt, and banks causing problem after problem.

An excerpt from the interview is posted at the King World

News blog here:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/9_Eri...

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

USA SILVER chart TA LT Long Term Big Bull Picture -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66601254

God Bless

Great Panther Silver Extends High Grade Silver-Gold

Mineralization and Discovers New Zones at Guanajuato -

http://tmx.quotemedia.com/article.php?newsid=44209917&qm_symbol=GPR

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64279509

God Bless

~SILVER~HDA~17Mo/s~29oz./ton~NI43101~10M+oz.~Q4Production~DD...

Huldra has ALL the money they need to mine with their $10,000,000 credit facility and the $9,000,000 in warrants(2013) that were just placed.

http://www.huldrasilver.com/huldra-silver-inc-announces-closing-of-special-warrant-and-flow-through-special-warrant-offering/