Monday, June 04, 2012 10:06:31 PM

Caladay Silver Mine - Third Silver Mine to be reactivated

memo info...

The Company is reviewing available data on

the Caladay property. [1]

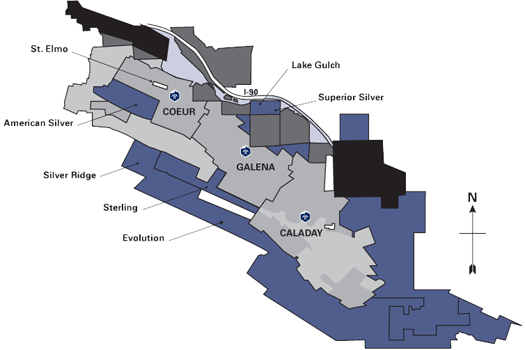

The Caladay adjoins the producing Galena Mine to the east. [2]

In the early 1980's, a joint venture between Day Mines,

Callahan Mining, and ASARCO spent approximately

$32.5 million (about $80.0 million in 2009 dollars) on

the Caladay property -

to construct surface facilities,

a 5,100 foot deep shaft and limited underground workings

to explore the property. [3]

There is a significant historical resource in this zone

based on the

94 drill holes which is not currently 43-101 compliant. [4]

This historical drill program was designed to extend the

"Silver Belt" of the Coeur d'Alene District further east by

delineating the down plunge extensions from

the Galena mine. [5]

As budgets allow, additional drilling will be done to test

the zone of apparent mineralization. [6]

The Caladay facilities benefit the Galena mine operations

through improved ventilation, possible

additional ore and waste hoisting capacity and as a

potential secondary escape way. [7]

The Company has maintained the hoist and with installation of

new hoist ropes, which have been purchased,

the shaft would be fully functional. [8]

Finding costs of new mineralized material have been

$0.13 per ounce of silver. [9]

history often repeat itself -

U.S. Silver Announces Results of Ongoing Diamond Drill

Activities at the Galena Mine and Expanded Geological Team

U.S. Silver Corporation (TSX: USA, OTCQX: USSIF, Frankfurt: QE2)

(“US Silver” or “the Company”) is pleased to announce results

from the previously announced exploration diamond drill program

carried out to date in 2012.

Highlights

Results on the previously recognized Caladay lead zone have

confirmed the existence of a broad mineable resource that

appears to support lower cost bulk mining methods.

Efforts to extend the Silver Vein at depth have produced some

very high grade intercepts including

1,434 Ag opt over 1.6 feet and

and

112.1 Ag opt over 2.8 feet (see below) and

(see below) and

evidence of additional mineralization beyond

current mining levels.

The Silver Vein has been a prolific producer for decades and

the down dip extension of this mineralization is a key target

as deposits elsewhere in

the Silver Valley have demonstrated very high grade at depth.

Dan Hussey has returned to Company as Chief Geologist bringing

decades of experience in the Silver Valley and extensive

experience at the Galena.

http://tmx.quotemedia.com/article.php?newsid=51767554&qm_symbol=USA

2012 Drilling Program Priorities

The results so far in 2012 have defined the direction of the exploration program that we will be pursuing both underground and on surface through the summer drilling months. Specifically the top four priorities are as follows;

1.

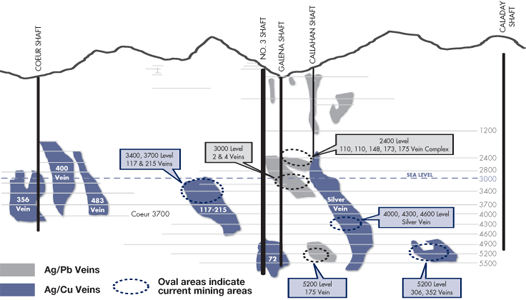

Coeur Mine 3,700 Level - Drilling is scheduled for July at the Coeur Mine to test the down dip potential of known veins in the upper parts of the mine.

2.

Caladay Lead Zone - Drilling at the 4,900, 5,200, 5,500 Levels of the Galena Mine will further refine the extent of the Caladay Lead Zone down dip and along strike. Drilling will continue through mid October to define the potential extent of a large bulk mineable deposit.

3.

Surface Exploration Drilling – Drilling at the Coeur d’Alene Mine will begin in mid June to test the strike extension of known vein systems.

4.

Silver Vein - Drilling to test the up-dip and down dip extensions of the Silver Vein at the Galena Mine will continue throughout the year. Drilling will be completed on the 2,400, 3,700, 4,000, and 5,500 levels.

http://tmx.quotemedia.com/article.php?newsid=51767554&qm_symbol=USA

The Coeur Silver & Copper Mine -

btw..note..

Ag Rich Beauty Producer we get re-commissioned

for fiat$6mil

....would cost fiat>$200mil

to develop from grass-root for an exploration company

if they ever would be lucky to

find anything near as rich very unlikely -

very unlikely -

The Coeur Silver & Copper Mine -

produced from 1969-1998.

The total production was 39 million ounces of silver

and 33 million pounds of copper from 2.4 million tons of ore.

Average ore grades were 16.6 ounces per ton silver

and 0.72% copper.

USSIF $SILVER Chart P&F TA Alert Bullish Price Objective $58.-/oz

http://www.us-silver.com/

God Bless

memo info...

The Company is reviewing available data on

the Caladay property. [1]

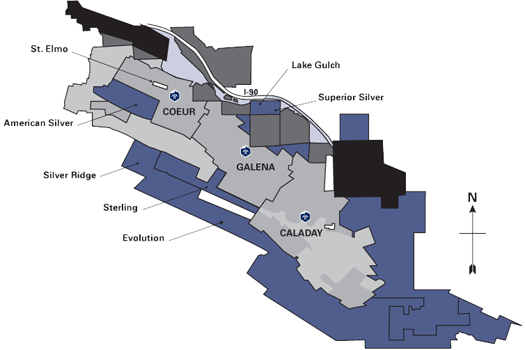

The Caladay adjoins the producing Galena Mine to the east. [2]

In the early 1980's, a joint venture between Day Mines,

Callahan Mining, and ASARCO spent approximately

$32.5 million (about $80.0 million in 2009 dollars) on

the Caladay property -

to construct surface facilities,

a 5,100 foot deep shaft and limited underground workings

to explore the property. [3]

There is a significant historical resource in this zone

based on the

94 drill holes which is not currently 43-101 compliant. [4]

This historical drill program was designed to extend the

"Silver Belt" of the Coeur d'Alene District further east by

delineating the down plunge extensions from

the Galena mine. [5]

As budgets allow, additional drilling will be done to test

the zone of apparent mineralization. [6]

The Caladay facilities benefit the Galena mine operations

through improved ventilation, possible

additional ore and waste hoisting capacity and as a

potential secondary escape way. [7]

The Company has maintained the hoist and with installation of

new hoist ropes, which have been purchased,

the shaft would be fully functional. [8]

Finding costs of new mineralized material have been

$0.13 per ounce of silver. [9]

history often repeat itself -

U.S. Silver Announces Results of Ongoing Diamond Drill

Activities at the Galena Mine and Expanded Geological Team

U.S. Silver Corporation (TSX: USA, OTCQX: USSIF, Frankfurt: QE2)

(“US Silver” or “the Company”) is pleased to announce results

from the previously announced exploration diamond drill program

carried out to date in 2012.

Highlights

Results on the previously recognized Caladay lead zone have

confirmed the existence of a broad mineable resource that

appears to support lower cost bulk mining methods.

Efforts to extend the Silver Vein at depth have produced some

very high grade intercepts including

1,434 Ag opt over 1.6 feet

112.1 Ag opt over 2.8 feet

evidence of additional mineralization beyond

current mining levels.

The Silver Vein has been a prolific producer for decades and

the down dip extension of this mineralization is a key target

as deposits elsewhere in

the Silver Valley have demonstrated very high grade at depth.

Dan Hussey has returned to Company as Chief Geologist bringing

decades of experience in the Silver Valley and extensive

experience at the Galena.

http://tmx.quotemedia.com/article.php?newsid=51767554&qm_symbol=USA

2012 Drilling Program Priorities

The results so far in 2012 have defined the direction of the exploration program that we will be pursuing both underground and on surface through the summer drilling months. Specifically the top four priorities are as follows;

1.

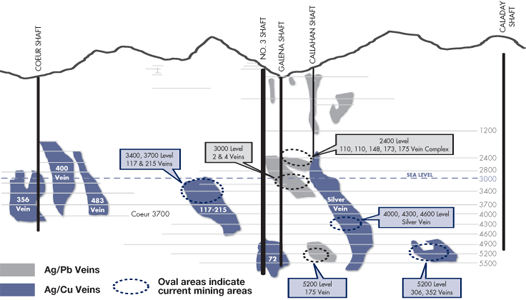

Coeur Mine 3,700 Level - Drilling is scheduled for July at the Coeur Mine to test the down dip potential of known veins in the upper parts of the mine.

2.

Caladay Lead Zone - Drilling at the 4,900, 5,200, 5,500 Levels of the Galena Mine will further refine the extent of the Caladay Lead Zone down dip and along strike. Drilling will continue through mid October to define the potential extent of a large bulk mineable deposit.

3.

Surface Exploration Drilling – Drilling at the Coeur d’Alene Mine will begin in mid June to test the strike extension of known vein systems.

4.

Silver Vein - Drilling to test the up-dip and down dip extensions of the Silver Vein at the Galena Mine will continue throughout the year. Drilling will be completed on the 2,400, 3,700, 4,000, and 5,500 levels.

http://tmx.quotemedia.com/article.php?newsid=51767554&qm_symbol=USA

The Coeur Silver & Copper Mine -

btw..note..

Ag Rich Beauty Producer we get re-commissioned

for fiat$6mil

....would cost fiat>$200mil

to develop from grass-root for an exploration company

if they ever would be lucky to

find anything near as rich

The Coeur Silver & Copper Mine -

produced from 1969-1998.

The total production was 39 million ounces of silver

and 33 million pounds of copper from 2.4 million tons of ore.

Average ore grades were 16.6 ounces per ton silver

and 0.72% copper.

USSIF $SILVER Chart P&F TA Alert Bullish Price Objective $58.-/oz

http://www.us-silver.com/

God Bless

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.