Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Price-to-Indicator-Divergence is a powerful tool ...

It shows on charts before many reversals...long term and short term...

Take advantage of what is presented -- Price-Action Fundamentals and Divergence and Patterns

Medved Trader software is terrific - it's fast!

It uses very little computer resources and is extremely customizable.

It was created by Jerry Medved ... Remember QuoteTracker?

This combines all of QT's good stuff but is far better.

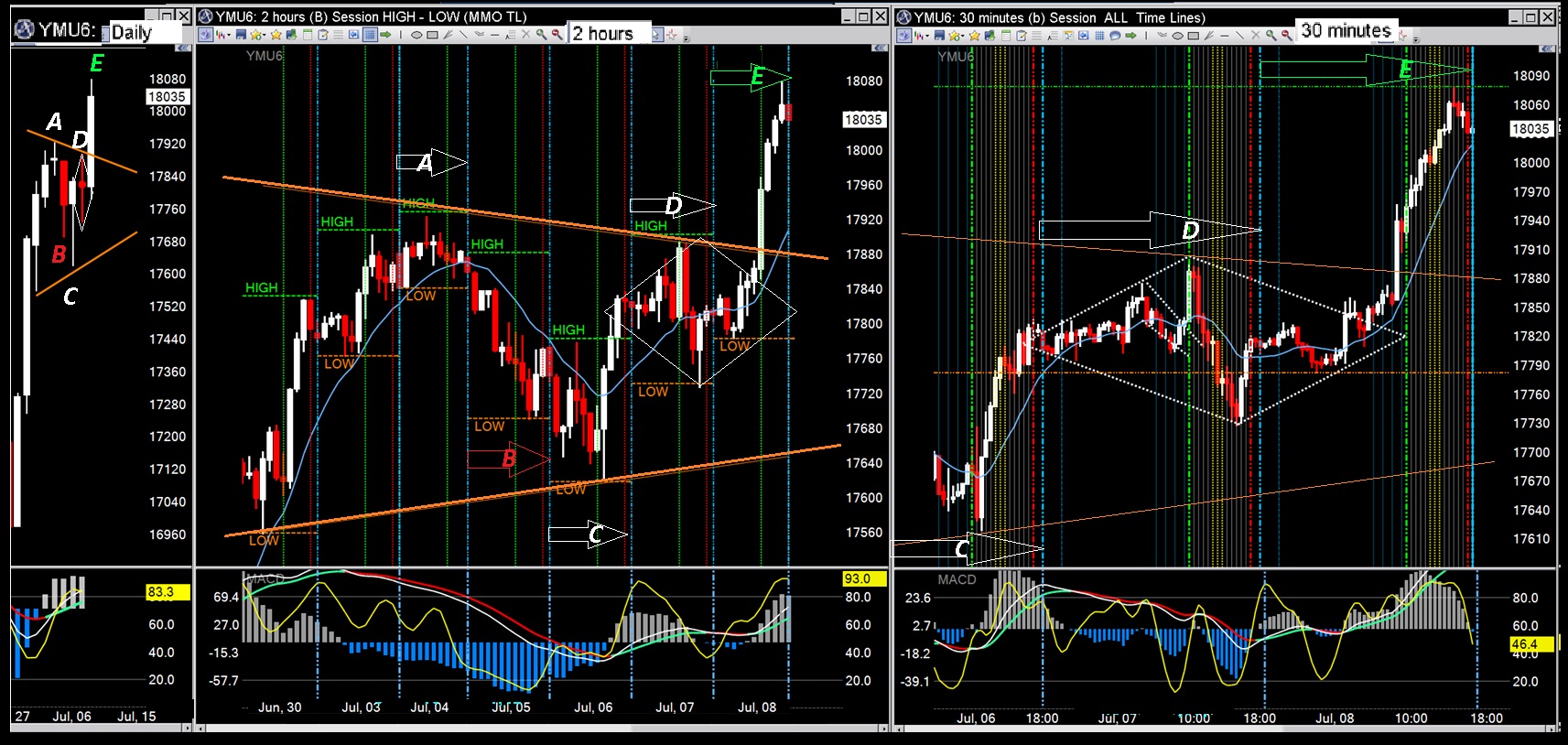

Here are some time based charts:

Here are some tick based:

...and a relatively short term tick chart

$NIO Just Remember One of Teslas biggest investors took 11.4% stake in rival $Nio https://techcrunch.com/2018/10/09/one-of-teslas-biggest-investors-took-an-11-4-stake-in-rival-nio/

Financials flagging ... bullish breakouts

StockCharts.com ChartWatchers Newsletter

...chart set excerpted from Arthur Hill | August 06, 2016

Doji, triangle and diamond patterns can go either-way.

(A) The triangle is defined by the doji top on Monday July 4th...

(B) followed by a wide range sell-off Tuesday...

(C) then a hammer reversal on Wednesday...

(D) To top it all off, a long tailed doji formed a nice indecisive diamond pattern on Thursday...

Shoula known - "It was the old triangular and diamond doji consolidation patterns trick..."

(a rare but well known 5 day continuation pattern)

Typical price action of triangle consolidation patterns.

They do not infer a probable direction before they resolve.

Price is bounded by sloping upper and lower lines as it approaches the apex of the triange.

A 3 or 5 wave pattern most often can be ID'ed.

A breakout of either side will usually be re-tested before price continues

to move in the breakout direction...Use the re-test to anticipate a trade.

In general they will be very similar but there can be significant differences because the e-minis do expire every 3 months and get rolled over to the next 3-month period...prices get "adjusted" each time they roll-over...

Futures quotes also include the 24-hour prices - - of course the regular indices mostly close at 4 PM EST.

Also, when getting futures quotes from BigCharts, StochCharts, Yahoo etc they are "continuous contract" symbols (that are never actually traded).

These quotes will vary further away from the actual prices shown for the indices.

But, ALL quotes for the indices or for futures are adjusted by those who have the registered trade marks...they own the data but they let financial firms use the quotes and of course the trade mark owners get compensated by the users...brokers, financial firms, news firms as well as individual traders/investors all pay for data in some form or another.

Quite surprising how much the Futures ruler-lines differ from the.....regulars.....

*Noticed that last week

Oh wait.....

And yet, hmmm, maybe there IS quite a difference.....

Wonder why :

How come it's trading quite a bit below my line, but is not doing so in yours' ?....

.

Should one place more faith in the lines of Futures traders ?

Seein' as they might be a bit more experienced ?

.

Static and Dynamic charts with BigCharts

By dynamic I assume you mean charts that update automatically without needing to refresh your browser.

Don't know if BigCharts has that available...I think StockCharts.com does but you have to pay a minor yearly membership fee to get "real-time".

Medved Trader (the new QuoteTracker chart program)

Download if here "http://forums.medvedtrader.com/forum/2-support/

It's free and you can use free yahoofinance for the live data fee, including automatic back-fill each time you start it - or you can just leave MT running all day...

You can configure MT's charts to look exactly like BigChart's if you want.

The only probelm is yahoofinances does not provide a live feed for most of the indices you follow.

IQfeed is a pay-fo-feed provider that works with MT and has the indices you use...

Here's a U-tube video on Medved Trader -

But, how to create both Static and Dynamic charts ?.....

For, that'd be great thing to know how to do !

D'ya know if it can be done using Bigcharts' charts ?

'Cause those're generally all I use.

All the best !

Quite the day today here huh ? ---- INDU up 362 (2.07 %) midday

Just like ya' say : "It's like yesterday never happened".

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

196

|

|

Created

|

02/15/12

|

Type

|

Free

|

| Moderator sharpshorts | |||

| Assistants | |||

|

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |