Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Where they're building the plant and the address? That's all in past PR's and radio interviews. You'd know if you read them or did DD :)

Lets face it. We know you don't.. you like others to spoon feed you.

can u give us something beside company's PR with empty promises to dump shares?

who is giving them money? names? where they gonna build the plant? address? something more than words? some proof? I dont think so!

Yes, the only info I can find there is fluff PRs - no facts - no tech - just RAH RAH posts on the board.

YouTubes are not DD.

I follow GESI for a while now and I have seen that with every PR, only positive, share price drops(except the last one).

if you look at the last quarterly report

http://www.otcmarkets.com/financialReportViewer?symbol=GESI&id=88043

you can see that in

dec 31,2011 they had 115,210,899 issued shares

and after 6 months in jun 30,2012 they have 192,506,353 issued shares.

this is the only real thing about GESI the rest only questionable PR's.

on GESI board you can’t post something like this because the moderators over there delete your messages.

Got a link? I was going by their web page.

Please start posting concrete DD - your posts are off topic without it.

You're behind on your DD. Technology has been decided. Money from escrow has been released for funding to be transferred and tech to be purchased.

The lawyers and accountants also have no role in company management or executive decisions. They're just lawyers & accountants.. That's all.

GESI - It's crooked lawyers and accountants that keep these shells circulating.

They haven't even decided on a technology yet?

From their home page:

Green Energy Solution Industries, Inc., (GESI) is an Alberta Canada based Corporation which is a publicly traded on the OTC Markets Pinksheets currently as GESI.

GESI was incorporated in 2007 and has undertaken project development in Alberta Canada for the creation of a waste wood to energy project. GESI began the project development through years of wood waste potential for energy creation in Western Canada.

The vastly available supply of wood waste as a feed stock for fuel in Western Canada, was narrowed down by GESI to be to utilize waste railway ties (WRT), which is abundant on a yearly basis through ongoing replacement of ties by railroads and servicers.

GESI was recently awarded a grant by Alberta Energy for the development of a feasibility study for the use of waste wood, including rail ties, for the creation of electricity or bio-fuels. GESI has completed significant parts of such study, while at the same time GESI was able to secure strategic relations and contracts to make the project a reality.

GESI now has the backing of a solid feasibility study, identified and secured long term WRT supply, strategically located project site, and is currently taking proposals for bids for the best technology for the project. In sum, GESI has realized from feasibility to current implementation of what it was charged with at the beginning. Namely to create economic stimulation, creation of jobs, removal of toxic waste, creation of energy, and add to Canada’s ever increasing renewable energy sources.

Gordon MacKay, CEO

Gordon MacKay has worked in the renewable green energy sector for the last 7 years; raising capital for bio-fuels projects. He is currently working with Global Tech Environmental Pty. Ltd. securing funding for green energy projects worldwide. Mr. MacKay is a shareholder and consultant with Columbia Basin Bio-Fuels who currently have projects in the United States and he has been instrumental in advising public companies and raising capital for a multitude of ventures and was the co-founder of 3-D Shopping. Mr. MacKay was responsible for raising the seed capital required and instrumental in taking the company public in on the OTC.BB. Mr. MacKay raised $15 million taking 3-D Shopping to the American Stock Exchange where the company reached a market cap of over $100 million.

Through mid 2005, Mr. MacKay served as Managing Director of Inter Capital Group, LLC; a merchant banking boutique. Throughout his career, Mr. MacKay has assisted in raising over $300 million in capital for his clients in over 50 transactions. With over 20 years experience in finance and investment banking, Mr. MacKay has been the key force in identifying and executing fund raising and merger activity for many companies.

Chris Whitworth, Managing Partner

Chris has been involved in start-up companies for the past 20 years ranging from contracts for the cleanup of the Exxon Valdez oil spill, to contracts with the Environmental Protection Agency (EPA) for environmental remediation sites in Washington State and Montana. He has been active in the construction industry as a construction manager and has worked extensively in contract negotiations with suppliers, sub contractors, contract bidding and project development and project completion.

Mr. Whitworth has also worked with governmental agencies such as the Corp. of Engineers, Department of Fish and Wildlife, and other city and state of Washington governmental agencies in permit acquisitions. Chris has acquired permits and contracts in Mexico with the State of Baja Sur to certify water quality and fishing rights for the exportation of seafood products. Chris will be responsible for all governmental correspondence, liaison and communications during the project feasibility study and during the construction build out of the plant.

Wrong. Those aren't the people running the company. Those are the accountants, lawyers, and TA. In other words, not management.

Again, completely different company and has nothing to do with SATM.

The accountant and lawyer have dozens of clients. I guess they all must be SATM too, right? lol

The TA has hundreds of clients. I guess they must also be SATM too.

I guess that means if I start a business and use the same lawyers and accountants as McDonalds, then my company must be run by McDonalds too.

Your rebuttal is a weak argument.

I can't believe I have to tell someone that accountants and lawyers aren't CEO's.

They are involved - if you'd read the next post as I asked you to you'd realize that.

Parties in bold below are involved with two prior companies and they are listed in the link you just gave me. GESI is just SATM in a new package IMO.

There is no way that you could make the claim that this is "completely different management".

My original DD to find this took less than 10 minutes. This shell was recycled so quickly that the paint didn't even have time to dry.

Wednesday, December 14, 2011 5:09:46 PM

Re: samsamsamiam post# 19404

Post # of 29806

Yes GOHG is a mirror of SATM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67579332

Here is a list of similarities:

1) Investor Relations - IR for GOHG is Stock Logic IQ (Robert Adams) and Investor Development Group (Ian Reed aka Nikko Reed)

2) David Chalela - until recently was legal counsel for GOHG and until recently was CEO of SATM

3) Bert Matthews, CPA - accountant for both GOHG and SATM

4) Alex R. Stavrou - legal counsel for both GOHG and SATM

5) Cleartrust, LLC - TA for both GOGH and SATM

6) Recent change in management through some kind of merger/acquisition

7) Lots of similarities in the filings (see above link)

8) The author of the PDF SATM initial disclosure statement for period ending june 30th 2011 is listed as Real Time Interest

The author of the very recent GOHG PDF is also Real Time Interest

10K out on STTN, and it's a bad one again.

They're not involved. If you did DD, you'd realize that.

http://www.otcmarkets.com/stock/GESI/company-info

Are you familiar with what reverse mergers are? SATM was a shell.

Read my next post - are those people involved?

Please support your claim of "completely different management".

Looks like the same management to me...

Please support claims made on this board with facts - otherwise off topic.

Don't know and don't care. Completely different company with completely different management. Has nothing to do with GESI.

GESI - is Bruce Pollack still involved?

Bruce Pollack is registered agent for Real Time Investment,Inc > company showing same address and phone number as SATM/GESI,Inc

Bruce Pollack is currently involved with many different corporations.

http://www.corporationwiki.com/Texas/Houston/bruce-pollock/34668405.aspx

Bruce Pollack > Stock promoter out of Houston, TX named in fraud suit by SEC inolving Aimsi Technologies Inc.

Quote:The SEC names four defendants besides Mr. Ballow: Reginald Hall, a 45-year-old from Tennessee involved in developing ALARM; Bruce Pollock, a 40-year-old promoter from Houston; Winfred Fields, a 39-year-old stock tout from Houston; and Everett Bassie, 52, also a resident of Houston.

The SEC says this crew pumped Aimsi over 13 days in late 2004 from $1.85 per share to a $3.60 high with misleading news releases and the tout sheets.

"From November 17 through November 30, 2004, when Aimsi issued nine press releases and the Promoter Defendants were actively disseminating fax tout sheets and internet postings, Aimsi's stock price rose from $1.85 per share to $3.60 per share with daily trading volume reaching as high as 645,163 shares," the SEC claims.

http://www.stockwatch.com/swnet/newsit/newsit_newsit.aspx?bid=B-459288-C:RDM

Is this the same Bruce Pollack that's tied to Martha Pollack and Real Time Investment, Inc. who is showing same address and phone number as SATM/GESI,Inc?

GESI - Lots of questions raised -

Is this crew out? Is GESI's process in R&D or is it up and running?

nodummy Member Profile nodummy Member Level

Wednesday, December 14, 2011 5:09:46 PM

Re: samsamsamiam post# 19404

Post # of 29806

Yes GOHG is a mirror of SATM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67579332

Here is a list of similarities:

1) Investor Relations - IR for GOHG is Stock Logic IQ (Robert Adams) and Investor Development Group (Ian Reed aka Nikko Reed)

2) David Chalela - until recently was legal counsel for GOHG and until recently was CEO of SATM

3) Bert Matthews, CPA - accountant for both GOHG and SATM

4) Alex R. Stavrou - legal counsel for both GOHG and SATM

5) Cleartrust, LLC - TA for both GOGH and SATM

6) Recent change in management through some kind of merger/acquisition

7) Lots of similarities in the filings (see above link)

8) The author of the PDF SATM initial disclosure statement for period ending june 30th 2011 is listed as Real Time Interest

The author of the very recent GOHG PDF is also Real Time Interest

More on Real Time Interest:

Real Time Interest shares the same address as SATM

Real Time Interest = Bruce Pollack

See these two posts for information about Bruce Pollack and his connections to both SATM and GOHG:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69850941

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69933562

See these posts for more information about some of the other insiders of SATM (group of attorneys from Florida with interesting histories):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68623095

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68109529

Both SATM and GOHG seem very very dirty.

So what happened to SatMax that was doing so well in Dec. 2010?

Business Development

As I am sure you are all aware, we have experienced what has become known as one of

the worst financial crises in United States history, with capital formation for developing

businesses presenting a specifically difficult challenge. SatMAX, fortunately, is

weathering the storm. During 2010, we signed on two new equipment resellers, we

expanded our growing brand recognition, and we added 3 new members - ITT Corp., the

U. S. Navy, and Lockheed Martin Corp. – to our existing marquis line of Fortune 100

customers

Moreover, thanks to our August alliance with McDonald Technologies International, Inc.

for engineering, manufacturing and support services, SatMAX now has access to worldclass

RF engineering and manufacturing capabilities, allowing us to more quickly scale

our business. McDonald has already completed an engineering package for our Alpha

EMS Portable repeater. This alliance has also had an immediate impact by providing

testing facilities for customer demonstrations, which were used when an aircraft industry

customer recently commissioned an independent engineering analysis of our satellite

repeater technology. We are happy to report that our SatMAX unit’s performance

exceeded its published specifications.

Moderator XenaLives allow me to post some DD on your board about Green Energy Solution Industries, INC. (GESI) ...

Thank you sir.

Following PR was released on 06/08/2012... "" GESI Enters Second Phase With Two $45M Funders for 200 Ton Per Day Waste Energy Project "" ~ http://ih.advfn.com/p.php?pid=nmona&article=52705847

On 08/16/2012 a PR was released saying that the company received the formal irrevocable funding commitment from the lender of the financing ~ http://ih.advfn.com/p.php?pid=nmona&article=53848124

.

.

.

GESI received the formal irrevocable $45,000,000 million (up to $50 million) funding commitment from the lender of the financing.......irrevocable = not able to be annulled, appealed or revoked.

For now we're just waiting for the first draw (within weeks) to hit GESI's banc account... some say it's $10,000,000 (guesses, rumours, birdie etc...). Up to $50,000,000 in total.

That will make the present pps EXTREMELY undervalued...

10,000,000 (first draw) divided by 192,506,353 O/S = 0.05 pps(when the firs draw hits) ~ just a simple calculation.

There's also no dilution going on as stated in the CEO Gordons interview.

Share Structure

Market Value $3,368,861 a/o Aug 15, 2012

Shares Outstanding 192,506,353 a/o Jun 30, 2012

Float 96,652,498 a/o Jun 30, 2012

Authorized Shares 490,000,000 a/o Mar 31, 2012

http://www.otcmarkets.com/stock/GESI/company-info

GESI developed business plans, contracts and agreements with resource providers, land owners, waste sources, technology providers, and government entities for the placement of renewable energy projects. Feedstock of the thermal gasification power plant will include railway ties, bridge timbers, poles and lumber treated with creosote etc. and turns them into electricity.

company's website: http://gesienergy.com/

GESI CEO Interview on STT Radio 07/12/2012 can be heard here:

Well this is either a "hit" post or "strike 3". $GESI

How to build a 45 million dollar company

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76358513

Latest interview

Folks - rote repetition of PR's and company promo is not DD.

Please post the information that you feel is most important here, or a summary with links.

We are trying to build a community of trusted informed investors, so it is your perspective that we would like to hear, not just a referral to another board. Please support your posts with links as much as possible.

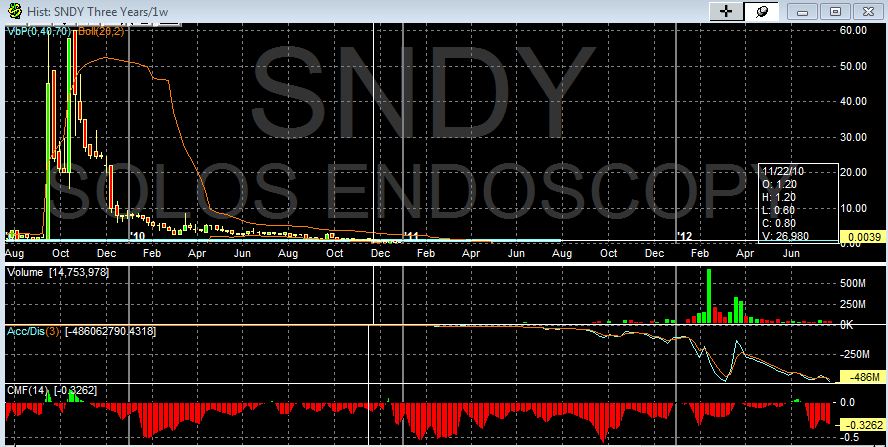

SNDY - I'll be looking at it some more, but my biggest concern is that Boost Marketing is their IR, and Boost is being run by a Big Apple insider.

Big Apple Consulting is currently being sued by the SEC

Today the Securities and Exchange Commission ("Commission") filed a civil action in the U.S. District Court for the Middle District of Florida, alleging that investor relations firm Big Apple Consulting USA, Inc. ("Big Apple"), its wholly-owned subsidiary MJMM Investments, LLC ("MJMM"), and four of its executives-CEO Marc Jablon, vice president Matthew Maguire, MJMM president Mark Kaley, and Keith Jablon, vice president of another Big Apple subsidiary-made public misrepresentations and material omissions about the financial state of CyberKey Solutions, Inc., ("CyberKey") while the two entities sold hundreds of millions of CyberKey shares. These CyberKey shares were sold under no registration statement and no legitimate exemption from registration. The SEC also charged Big Apple and MJMM with acting as unregistered broker-dealers, and Marc Jablon, Maguire, and Kaley with aiding and abetting the two entities' violations in that respect.

Big Apple Consulting = Boost Marketing

Boost Marketing LLC = Jason Takacs and Roy Meadows

Florida Business Entity formed on 10/12/2010

2101 WEST STATE ROAD 434 SUITE 100

LONGWOOD FL 32779 US

(407)389-5900

http://sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=M10000004513&inq_came_from=NAMFWD&cor_web_names_seq_number=0000&names_name_ind=N&names_cor_number=&names_name_seq=&names_name_ind=&names_comp_name=BOOSTMARKETING&names_filing_type=

http://www.boostmarketingnow.com/

Domain Name: BOOSTMARKETINGNOW.COM

Registrant:

John Neff

2101 West State Road 434

Suite 100

Longwood, Florida 32779

United States

Created on: 04-May-10

Expires on: 04-May-11

Last Updated on: 06-Oct-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

2101 West State Road 434

Suite 100

Longwood, Florida 32779

United States

(407) 389-5900

BIG APPLE CONSULTING USA, INC

2101 WEST STATE ROAD 434 SUITE 100

LONGWOOD FL 32779 US

(407)389-5900

ABLON, MARC

2101 WEST STATE ROAD 434, STE 100

LONGWOOD FL 32779

MAGUIRE, MATTHEW

534 ALOKEE CT.

LAKE MARY FL 32746

KALEY, MARK

14924 GAULBERRY RUN

WINTER GARDEN FL 34787

PETERSEIM, WILLIAM

1235 CRANE CREST WAY

ORLANDO FL 32825

2101 WEST STATE ROAD 434 STE. 100

LONGWOOD FL 32779 US

(407)389-5900 (used to be)

NEFF, JOHN

175 CROWN POINT CIR.

LONGWOOD FL 32779 US

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=F03000001156&inq_came_from=NAMFWD&cor_web_names_seq_number=0000&names_name_ind=N&names_cor_number=&names_name_seq=&names_name_ind=&names_comp_name=BIGAPPLECONSULTING&names_filing_type=

http://www.bigappleconsulting.com/management.htm

Domain Name: BIGAPPLECONSULTING.COM

Registrant: Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 03-Feb-03

Expires on: 03-Feb-12

Last Updated on: 07-Dec-09

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

EZ NEWSWIRE, INC.

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

NEFF, JOHN

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

TAKACS, JASON

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

NICOLETTI, M

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=P10000032201&inq_came_from=OFFFWD&cor_web_names_seq_number=0002&names_name_ind=P&ret_names_cor_number=512859&ret_cor_web_names_seq_number=&ret_names_name_ind=&ret_names_comp_name=&ret_names_filing_type=&ret_cor_web_princ_seq=0001&ret_princ_comp_name=TAKACSJACQUELINEM&ret_princ_type=P

http://eznewswire.com/

Domain Name: EZNEWSWIRE.COM

Registrant: Big Apple Consulting USA, Inc

1025 Old Country Road

Suite 200

Westbury, New York 11590

United States

Created on: 31-Jan-07

Expires on: 31-Jan-17

Last Updated on:

Administrative Contact:

Speciale, Thomas tspeciale@bigappleconsulting.com

Network Newwire Inc.

255 S. Orange Ave Suite 1201

Orlando, Florida 32801

United States

(407) 581-3978 Fax -- (407) 425-0032

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 21305 / November 18, 2009

Securities and Exchange Commission v. Big Apple Consulting USA, Inc., MJMM Investments, LLC, Marc Jablon, Matthew Maguire, Mark C. Kaley, and Keith Jablon, Civ. Action No. 09-cv-1963 (M.D. Fla.) (JA)

SEC Charges Investor Relations Firm and its Executives with Fraud, Registration Violations, and Acting as an Unregistered Broker-Dealer

http://www.sec.gov/litigation/litreleases/2009/lr21305.htm

http://www.sec.gov/litigation/complaints/2009/comp21305.pdf

MJMM INVESTMENTS, LLC

http://www.bigappleconsulting.com/mjmm_investments.html

http://www.mjmminvestments.com/

T: 281.305.2634

F: 877.471.0535

E: info@mjminvestments.com

W: mjminvestments.com

MJM Trust Fund

3200 South West Fwy 33rd Floor

Houston Tx 77027

Domain Name: MJMMINVESTMENTS.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 10-Jun-09

Expires on: 10-Jun-12

Last Updated on: 29-Mar-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

https://www.corporations.state.pa.us/corp/soskb/Corp.asp?2115911

MARC JABLON

Title: President

Address: 280 WEKIVA SPRINGS RD SUITE 2030

LONGWOOD FL 32779

DOUBLE DIAMOND INVESTMENTS, INC.

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=1w0lBOspXQIgkCUJQCkBsA%253d%253d&nt7=0

President - MARK C KALEY

http://www.doublediamondinv.com/

Domain Name: DOUBLEDIAMONDINV.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 24-Sep-08

Expires on: 24-Sep-12

Last Updated on: 24-Sep-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

Big Apple Travel

http://www.bigappletravel.com/

407.389.5900

Domain Name: BIGAPPLETRAVEL.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 30-Oct-02

Expires on: 30-Oct-11

Last Updated on: 25-Oct-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

Twin Equities, LLC

http://www.twinequities.com/

2101 W S.R. 434 Ste 100

Longwood, FL 32779

Ph: (407) 389-5900

Domain Name: TWINEQUITIES.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 19-May-06

Expires on: 19-May-12

Last Updated on: 29-Mar-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

SNDY - This is interesting:

Dated June 28,2011

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8031898

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a) Aggregate Number and Percentage of Securities

According to the most recently available information, there are

64,957,710 shares of Issuer common stock outstanding. Richard

Tuch is the record owner of 5,500,000 shares of Issuer common

stock and Dr. Tuch beneficially owns 5,500,000 shares of Issuer

common stock or 8.5% of the outstanding shares.

(b) Power to Vote and Dispose

Dr. Tuch has sole power to vote, or to direct the voting of, and

the sole power to dispose or to direct the disposition of the

5,000,000 shares of the Issuer common stock owned directly by

Richard Tuch, M.D., A Professional Corporation Profit Sharing Plan

(401K).

(c) Transactions within the Past 60 Days

The following lots of shares has been purchased in the last 60

days:

DATE #SHARES PURCHASED PURCHASE PRICE/SHARE BROKERAGE

ACCT.

1a.6/30/2011 500,000 .0065 Merril Lynch

1b. 6/21/11 400,000 shares .0085 Charles Schwab

2. 6/19/11 350,000 shares .0135 Merrill Lynch

3. 6/14/11 850,000 shares .0054 Merrill Lynch

------------------------------------------------------------------------------

-------------------------------------------------

3. 6/20/11 50,000 shares .0095 Charles Schwab

4. 6/17/11 49,900 shares .0148 Charles Schwab

5. 6/16/11 30,000 shares .0155 Charles Schwab

35,712 shares .0155 Charles Schwab

100 shares .018 Charles Schwab

34,288 shares .018 Charles Schwab

6. 6/14/11 500,000 shares .0028 Charles Schwab

7. 6/3/11 300,000 shares .0022 Charles Schwab

------------------------------------------------------------------------------

-------------------------------------------------

8. 5/10/11 50,000 shares .004 Charles Schwab

100,000 .0045 Charles Schwab

9. 5/4/11 150,000 .0055 Charles Schwab

100,000 .005 Charles Schwab

------------------------------------------------------------------------------

-------------------------------------------------

TOTAL 3,500,000

(d) Certain Rights of Other Persons

Not applicable.

(e) Not applicable.

ITEM 6. CONTRACT, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT

TO SECURITIES OF THE ISSUER

Not applicable

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Not applicable

SCHEDULE 13D

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and

correct.

July 7, 2011

------------------------------------

----------------------------

(Date)

Richard Tuch, M.D. A Professional

Corporation Profit Sharing Plan

(401K)

SNDY - RM stock associated with Big Apple affiliates.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77911059

My initial response was negative, but someone accused me of "lazy DD" so I'll take another look.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77959982

When a company is associated with a Big Apple affiliate and it has a shell history like that I really don't do much additional DD.

I can look at the other filings for more information, but if I believe it might be legit (and I'll assume that is a possibility because of what you just brought to my attention) the next think I'd do is look at the charts.

I always look at charts in multiple time frames.

The first chart shows a wild spike at the beginning of trading and then constant price deterioration. I've seen that in another legitmate company that did NOT come from a shell so that could be just a function of the manipulation done on pennies.

It's interesting that the A/D didn't start to fail until June of 2011.

What I would really like to explain is what happened to the volume in 2011 - dilution??? Toxic financing??

Here's the yearly chart smoothed by a five day period - it looks like there may be some validity here just because it held part of the gain from the pump and may have set a new floor.

I'd say December 2010 would be the time frame to investigate.

ACGX 8,5 mil.company with strong financials and no diluition plan.

ACGX 8,5 mil.company with strong financials and no diluition plan.

TDCP - I was intrigued by the idea and my basic DD didn't turn up anything negative - but I feel like my DD has come to a dead end.

No discussion of how the tech works on the website ( in general layman's terms of course, no secrets revealed). I also googled this and didn't find any documentation or peer reviewed papers.

I posted on the board and asked for links to info on HOW the tech worked, got nothing.

Patents don't mean anything if they're for something that can't be produced.

I will monitor the board from time to time but wouldn't consider investing without a common sense level understanding of the tech.

Debt free. OU University owns 8% of company shares. OU owns the patents. possible RS , but we dont think they will as price is to low for what they want to accomplish. Only 1 week left for a possible RS of 1/10 to 1/35. Last year they voted on RS but never executed it. Not sure what all is going on .

Reading recent posts on the board now. What is their cash status like? Will they have to sell much more stock before they poduce revenues?

Annual burn rate?

OK, done a bit of DD on my own, it sounds intriguing, but the website was frustrating. Still don't have a clue as to how they're doing what they're doing and where they are in their business plan.

TDCP - I backed the chart out to nine years. Volume really picked up in 2009. Dilution indicated, but that isn't necessarily a bad thing if they sold stock and invested the money in the business.

Charts do look intriguing.. I will probably look into this some more. This can be a good place to discuss the fundamentals and history of a stock without a lot of extra "noise", if you know what I mean.

TDCP - Ok - I checked their oldest filings. No RM... That's good.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=4827749

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholder. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we have received $125,000 in connection with the issuance of the $1.25 million convertible debenture to the selling stockholder, and expect to receive the balance of $1.125 million following effectiveness of the registration statement. We have used the $125,000 for the general working capital purposes and the payment of professional fees. We expect to use the additional proceeds for general working capital purposes.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the Pink Sheets under the symbol "TDCP". For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

Quarter Ended

High ($)

Low ($)

December 31, 2006 (through November 20, 2006)

1.36

0.75

September 30, 2006

1.73

0.90

June 30, 2006

3.27

0.56

March 31, 2006

0.86

0.14

December 31, 2005

0.33

0.014

September 30, 2005

0.03

0.008

June 30, 2005

0.045

0.009

March 31, 2005

0.18

0.031

December 31, 2004

0.40

0.04

September 30, 2004

0.64

0.15

June 30, 2004

0.64

0.03

March 31, 2004

0.21

0.04

Holders

As of November 15, 2006, we had approximately 395 active holders of our common stock. The number of active record holders was determined from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies. The transfer agent of our common stock is Executive Registrar & Transfer, Inc., 315 South Huron Street, Suite 104, Englewood, CO 80110.

TDCP - looked at the IBOX. University affiliation looks good.

I was surprised by the share structure though...

SHARE STRUCTURE - As of Nov 15, 2011

Authorized Shares: 1,500,000,000

Outstanding Shares: 1,189,361,632

Float: 593,982,650(approximate)

Shares held by Insiders

Martin and Judith Keating 82,215,474

Victor Keen 158,859,668

John O'Connor 47,761,911

OU 63,264,707

3DIcon TDCP is a developer of groundbreaking 3D projection and display technologies that are being designed to produce full color, 360 degree volumetric images. The company's mission is to surpass current 3D technologies by creating true-to-life 3D images that occupy a 3D space and appear solid as viewed from any angle without any special viewing aids. The commercial applications for 3D imaging technologies are projected to approach a market size of well over $1 billion by 2011.

The company just hired a new CEO with a lot more experience and the previous CEO is now on the board. The goal is for the prototype to be finished in about 6 months before they can get comericialization and contracts.

JBI on Discovery Channel.ca... Try this link... you have to get through about a minute of "promo" messages for the channel & show:

http://watch.discoverychannel.ca/daily-planet/march-2012/daily-planet---march-20-2012/#clip641572

Borders is done but blockbuster is currently doing business as a wholly owned subsidiary of dish network.

Link for PBA's post:

http://www.themediationroom1.com/tdgi-penny-stock-looks-promising.html

TDGI has many avenues in which they distribute there movies, walmart being a big one along with target,best buy and online retailers such as amazon.com and streaming via netflix. There are many others this is just a small sampling.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73506824

TDGI - can we have a link to the source of that last post?

Borders and BlockBuster went belly-up so they aren't going to be a source of revenue.

Have you researched the history of the shell? I haven't had time to, but that really is the Achilles heel of every RM stock on the pinks.

TDGI is a true rarity in the land of pinks......transparent and shareholder friendly. With the cusip change complete the transition to HHSE is eminent. If you haven't done any DD on TDGi then I would definitely tell you it is worth a look. This company is really making a name for itself and with a CEO with the contacts and deal making ability he has shown, well, the sky could be the limit. Here's a copy of a recent article.........

"TDGI Penny Stock Looks Promising

Target Development Group, Inc. (PINK: TDGI), which is in the process of rebranding itself as Hannover House, is engaged in the acquisition, production and release of movies and videos across multiple entertainment media platforms in the North American market. Hannover House enjoys direct marketing relationships with the leading theater circuits in North America.

It has a direct dealing with almost all the premier video wholesalers and retailers that cover nearly 95 percent of the home video market in the United States. TDGI penny stock is likely to arouse considerable investor interest in 2012, considering its aggressive plans for this year. It may be a prudent idea to keep a close watch on TDGI quote in the coming months.

Hannover House

Hannover House is a well known full service media firm that specializes in the production and distribution of movies in the DVD and Blu-ray formats. The company was established in 1993 with an initial focus on the book publishing industry. In 2003, the company ventured into the DVD distribution business. With more than 70 DVD titles currently in active distribution, the company has risen rapidly to assume a leading role as an independent DVD distributor in the country. It has achieved significant success in placing its DVD titles across mass merchandisers and key chain stores.

Several thousands of independently owned and run retail video stores and book stores carry Hannover House products. Some of the leading names include Barnes & Noble, Blockbuster Video, Best Buy, Fred Meyer Group, Borders Group, Sam’s Club, Hastings, Wal-Mart, and Transworld Group, apart from many of the leading online retailers. With a consistent growth in the DVD business, Hannover House extended its role by entering the theatrical distribution business in 2007, with an interesting slew of movies that has grown year after year. Book publishing also continues to remain an important part of the Hannover House business strategy.

Growth and Diversification in 2012

Hannover House has developed a comprehensive growth and revenue diversity plan for 2012. The plan includes an acceleration of the company’s home video and theatrical release activities. This growth will be financed through an off balance sheet private fund. The company is also identifying new opportunities to expand the retail distribution of its products in 2012 through existing customers of non-entertainment products. The company has announced that its performance in 2011 has been productive and profitable. It growth plans for 2012 are likely to improve its sales revenues and profits substantially over 2011.

Eric Parkinson, the CEO of Hannover House has said: ‘Our position in the U.S. marketplace as a recognized independent film distributor is now well established. To maximize our growth, profitability and shareholder value, we are looking at new financing opportunities that will enable the company to expand on our successes with entertainment products as well as the pursuit of complementary new ventures.’

Parkinson is excited about the new opportunities presented before the company in 2012. He says: ‘We’re now being offered major feature titles for acquisition. Most of the licensors are no longer requesting significant advances, but are instead requiring theatrical releasing commitments that often exceed our ability to finance internally from our cash flow and existing, vendor credit lines. The establishment of an off-balance-sheet fund will provide us with access to capital to pursue these higher-profile titles, and to grow the company’s revenues while preserving existing resources.’

TDGI Penny Stock in Near Future

Investors and traders in penny stocks may benefit by keeping a track of TDGI quoteover the next few months. If the company’s exciting plans for 2012 begin to show some results, the demand for the stock may start rising."

Why is the history of a shell important?

Here's a great exmple:

Allegiant (APRO) is just about dead, but when you go back to the old filings, the writing is on the wall:

http://www.otcmarkets.com/stock/APRO/financials

Set the documents at 50 and look for the earliest filing.

When you start reading the SB-2 filed on July 17,2006 lists Tiffany Miller. Authorized shares are 5 million.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=4537510#TSHOW_SB2_HTM_M312006

On page 34 of the filing below, Sept. 30 2006, she had 53% of the shares:

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=4883421

The above filing also says they have spent $64,000 out of $68,000 in working capital and have $1000 in inventory.

In addition there are 5 million preferred shares and 70 million authorized.

I the filing below David Goldberg takes over as CEO:

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=5585423

As of December 3, 2007, our authorized capital stock consists of 980,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share. Immediately prior to Closing, TPI had 45,500,000 shares of common stock issued and outstanding. Pursuant to the Plan of Reorganization, certain shareholders of TPI agreed to cancel 23,275,000 shares of TPI common stock and TPI agreed to issue an additional 79,000,000 shares of common stock to entities designated by FV-Delaware. As of December 3, 2007 and immediately after Closing, an aggregate of 101,225,000 shares of Common Stock were outstanding, including shares issued pursuant to the Closing.

Pursuant to the acquisition of Focus Views in 2008, the Company intends to continue to work to develop its internet portal and develop the financial services websites, including OTC Views, Focus500, Stock Detective and ProView.

To the extent the Company is successful in developing its websites and increasing its visitor base, the Company expects to realize cash that will be sufficient to continue operations during the next 12 months. The Company’s opinion concerning its liquidity is based on current information. If this information proves to be inaccurate, or if circumstances change, the Company may not be able to meet its liquidity needs.

Over the course of the next few years, the Company intends to grow and expand its internet presence and become a main provider of OTCBB financial information to investors. The Company expects to develop and maintain a complete internet portal that consists of a variety of websites designed to provide the visitor with information regarding companies trading on the OTC Bulletin Board.

Prepaid workers compensation premium

4,683,137

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS.

Effective March 14, 2008, the board of directors increased the size of our board of directors from one to three directors by appointing Brian Bonar and John Capezzuto to fill the vacancies on the board of directors. These new directors have not yet been appointed to any committees of our board of directors.

In addition, David Goldberg, the Company’s Chief Executive Officer, Chief Financial Officer and Corporate Secretary resigned as the Corporate Secretary as of March 14, 2008. Brian Bonar was elected President and John Capezzuto was elected as the Secretary Protem to replace David Goldberg. Mr. Goldberg’s resignation as the Corporate Secretary was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

ITEM 2.01 Acquisition of Assets

Effective April 1, 2008 Tradeshow Products Inc. (“Buyer”) acquired from Employment Systems, Inc. (”Seller”) certain client contracts including related obligations and certain office equipment leases. The consideration paid was $100,000 plus 3% of the gross payroll each month, for as long the clients remain with the seller, or $15,000 per month for sixty (60) months, whichever is greater. Ten thousand dollars ($10,000) monthly of the purchase price shall be paid by the Buyer to the appropriate tax collection authority to pay down an existing ESI tax lien. The remaining amount of the monthly purchase price will be used to discharge the Seller’s debt obligations to the Buyer.

What is the history of the shell? Who did they buy the shell from? It's been my observation that a tainted shell can bring a good company down.

Great DD and summary of TDGI

I've been accumulating for close to two years now.....this company is transparent and goes out of it's way to accomodate shareholders...nearly unheard of in the pink world. Definitely worth a look for those interested in undervalued pink stocks with explosive potential.

TDGI -- Q4 Financials and Annual Report:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73110087

Here is a listing of some of the current and soon to be revenue streams for TDGI:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73139616

Good evening all, TDGI was a shell that Hannover House reverse merged into back in dec of 2009. Hannover House(TDGI) is a full service media distributor that distributes movies theatrically as well as dvd and VOD. Hannover also distributes books. One thing in particular that separates TDGI from its competitors is they have merchant accounts with all the major retailers as not all of their competition does and certain retailers(walmart for example) are no longer accepting new vendors. For instance Summit Entertainment the(theatrical)distributor of the movie twilight had to use universal for the distribution of their dvd/blu rays of twilight which if i recall the sales were in the hundreds of millions of dollars where as Hannover House could perform the theatrical release as well as distribute it directly to walmart or any of the numerous other retailers without sharing the revenues with a 3rd party. Currently TDGI is undergoing a rebranding of the company which includes a symbol change to HHSE. All paperwork has been submitted to FINRA and we are just waiting as it could come anyday now. An audit is currently being performed for 2010 and 2011 so an eventual uplist can occur. They have many DVD's currently on the market and their next theatrical release Toys in the Attic is scheduled for April 6,2012. There are many other positive ongoings with the company and i invite you to come by the TDGI soon to be HHSE board and look at the Ibox or ask any questions you might have as there are many posters there willing to help. I hope this gives you a little overview of what the company is about and have a great evening!

http://www.toysfilm.com/Welcome_To_Toys_In_The_Attic/toys.html

http://investorshub.advfn.com/boards/board.aspx?board_id=5223

http://www.hannoverhouse.com/

http://www.otcmarkets.com/stock/TDGI/quote

But the purpose of this board is for people to share their personal perspective on the company. It's not a "tip" board or a "pump" board it's a "share DD" board.

TDGI Sales increased year to year 2010 to 2011 by 374%, I don't think they have any management issues. Check out TDGI on Ihub, tons of information about company on board.

Could you give a personal perspective on TDGI? What does it make or do, what advantages does it have over competitors? It seems to have management problems, how was this corrected?

|

Followers

|

33

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1419

|

|

Created

|

02/03/11

|

Type

|

Free

|

| Moderator XenaLives | |||

| Assistants fourkids_9pets GWMAN Justice37 | |||

This board is only for confirmed Due Diligence on Over the Counter and Pink sheet stocks.

Information must be factual in nature. Please avoid the expression of pure opinion or speculation.

All opinions and conclusions expressed should clearly state the facts upon which they are based.

Those facts should be documented in PR's, news reports, the known history of a stock, or trading activity.

If it is history of a stock please back it up with dates and facts (such as splits, dilution, events, etc).

Generalized statements not backed up with fact will be considered opinion.

Please refrain from opinion only or speculative posts, they will be considered off topic.

Charts are factual and on topic but you must give specific indicators and reasons if a positive or negative opinion is expressed based on that chart.

Since this board is for multiple stocks please begin each post with the ticker and then continue your post.

Bolding the ticker seems to make it easier to skim for a stock visually.

You can do this by highlighting the ticker and the clicking on the Bold Button at left.

Please do not use colors in the header as we are trying to inform, not pump.

I know some of you work very hard in your due dilligence.

I created the board with the thought that there should be a place to feature that hard work so it doesn't get buried in board chat.

The board has started very nicely. Thank you all for participating.

|

Posts Today

|

0

|

|

Posts (Total)

|

1419

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |