Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

So folks are supposed to take your "RAH RAH" and the company's statement as DD?

Can't you do any better, we find these pumping pots all over IHUB.

BLVT is one to do some research on. It's a hidden gem which has a low profile. Fully reporting company with the potential of lucrative contracts in the near future.

Bulova Technologies Group, Inc. (OTCQB:BLVT) (the “Company”) announced today the signing of a contract valued at $5.2 million for the sale of commercial ammunition for distribution in the United States. Deliveries will be made to our US customers over the next six month period.

Stephen L. Gurba, President and CEO of Bulova Technologies Group, Inc. stated, “Bulova has used its extensive experience in government and international contracting with suppliers located in NATO/allied nations to seize the opportunity to meet the increased demand for commercial ammunition in the United States. This development is closely related to our long-standing work with the US Government to supply it with non-standard weapons and ammunition. It’s our belief that this contract will lead to further favorable opportunities for commercial ammunition both in the US and NATO countries.”

TREP (formerly STTN) - They are very late on posting their financials and have not filed for an extention or commented. Hmmmm,

$TREP $STTN

Have you had time to check out FITX? It jumped almost 200% on 214 million shares traded today. Hope you caught the train!

SANT - so what? DD isn't just reading a filing or a PR. You want to know about the experience of management, the quality of the product, information that can be confirmed OUTSIDE of the company.

Otherwise you have no way to know that you're not buying into a scam.

Please post some real DD.

SANT had a great 10-k increasing revenue Q after Q and positive net income for an OTC company. EPS of 16 cents. 2012 revenue of 4.3 million. market cap 3.7 million extremely undervalued

FITX - Haven't had time to look at it much -

What do you know about the shell history?

A follow up on the forward split about to happen with FITX.

Still no PR, but the proof and the share structure history are here:

http://nvsos.gov/sosentitysearch/corpActions.aspx?lx8nvq=vV6cbvUb5XlwIiTXwgODhg%253d%253d&CorpName=CREATIVE+EDGE+NUTRITION%2c+INC.

Their last quarter saw revenues of $780k which was a 25% increase QOQ, and is in line with historical growth. Last year they acquired several revenue generating entities in the SPORTS NUTRITION area, and have recently launched their CENERGY line of products. The products are available for purchase at:

www.supplementstogo.com

www.a-z-nutrition.com

www.fitnessone.com

www.worldclassnutrition.com

The supplementstogo website is also wholly owned by FITX as well as their distribution and warehousing infrastructure. The company is also close to selling their products to GNC, one of the largest sports nutrition retailers in the US.

Is this what you wanted to see Xena?

Please read the top stick - we're looking for YOUR DD, not regurgitation of company PR's etc.

FITX is SPAM - NO DD.

Geez - you don't even know what business they are in.

How about posting the history of the shell?

The track record of management?

You know real FACTS that prove this isn't just a pump and dump?

FITX has quietly announced a forward split to reward shareholders.

Revenues have been increasing 25% quarter over quarter, but manipulators have been beating the stock back as it advances. New product lines are being released and distributors are lining up to ink deals to sell FITX products.

STOCK SPLIT HAS NOT BEEN OFFICIALLY ANNOUNCED YET. It was discovered by an attentive share holder and discussed on FITX ihub board. The paper work is in and was confirmed via company CEO!

FITX is a long term growth and profit play, a forward split play, and a Mother of All Short Squeeze play (MOASS).

Support has been solid on the 50 day MA, so buy wisely!

RENU is off topic - unfortunately I missed it and the poster was intent on spamming the board, sorry folks.

RENU was uplisted to current info status on OTC Markets after posting revenues of 565K with a net income of 96K for 2012...any type of buying pressure will make this thing pop

Xena,

Smart-tek's 10Q is out, and its more of the same.

http://secfilings.com/searchresultswide.aspx?link=2&filingid=8929999

DUSS is primarily a spec play - a merger, joint venture or sale of copyrighted products.

DUSS' products are currently sold in 42 stores. Their previous business strategy was focused on high-end retail materials, which resulted in a massive upswing in sales when the company first launched a few years ago - but ran into faltering "head winds" of the economy.

Value in the DUSS Brand.

There is considerable value in the DUSS trademark brand – the 3-year sales trend prior to the market downturn indicates significant sales potential.

3-year trend Sales/Revenue

2007: 102,945

2008: 544,783

2009: 610,923

2-seasons of marketing under Dussault, Inc. broadcasting = increased value.

In the right hands – a company with more focus on quantity (vs. high pricing) = higher value.

DUSS Nothing unique here -just another retail hype.

One of the stickies on the board said all of their assets were up for sale.

Please post solid DD on the company, the business plan, etc. I can't see anything there I'd be interested in and the board is all trade talk.

DUSS looks good in pink...

A quick little recap on DUSS:

O/S = 267M shares

Up = 67% Gain this week

Low Float = Three 100%+ runs the past 90 days

Golden Cross = Extended GC forming, major breakout imminent

65% Increase in volume = 78.1M shares traded this week; 100MA Volume: 20.22M

Eyes On = 3-weeks ago Avg Volume 16.5M, increase to 20.22M

Confirmed shares = 267,458,407 shares of common stock issued and outstanding as of September 11, 2012. ih.advfn.com/p.php?pid=nmona&article=54493598

Merger Candidate = “On October 4, 2012, the Corporation’s remaining director consented to act as Chief Executive Officer, President, Secretary and Treasurer in addition to her role as a director until such time as a replacement for the respective officer positions can be found.”

New CEO Appointment = Natalie Bannister, renown Merger & Acquisition expert, appointed CEO October 4, 2012.

Quote:Ms. Bannister has been a director of the Corporation since July 11, 2012. Ms. Bannister has a long history in the brokerage and financial advisory business, having held a number of positions in the industry. Ms. Bannister is currently the owner and President of Natalie Bannister Consulting, having formed the company in October, 1997. Natalie Bannister Consulting is a firm offering services related to the public reporting markets, including a full range of domestic and international Investor Relations and Public Relations services, merger and acquisition consulting and she also provides reference services to securities counsel and accountants for clients in the OTC markets.

Further DD on DUSS:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80289567

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79667407

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80302790

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80299342

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80368180

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80450392

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80508116

Where they're building the plant and the address? That's all in past PR's and radio interviews. You'd know if you read them or did DD :)

Lets face it. We know you don't.. you like others to spoon feed you.

can u give us something beside company's PR with empty promises to dump shares?

who is giving them money? names? where they gonna build the plant? address? something more than words? some proof? I dont think so!

Yes, the only info I can find there is fluff PRs - no facts - no tech - just RAH RAH posts on the board.

YouTubes are not DD.

I follow GESI for a while now and I have seen that with every PR, only positive, share price drops(except the last one).

if you look at the last quarterly report

http://www.otcmarkets.com/financialReportViewer?symbol=GESI&id=88043

you can see that in

dec 31,2011 they had 115,210,899 issued shares

and after 6 months in jun 30,2012 they have 192,506,353 issued shares.

this is the only real thing about GESI the rest only questionable PR's.

on GESI board you can’t post something like this because the moderators over there delete your messages.

Got a link? I was going by their web page.

Please start posting concrete DD - your posts are off topic without it.

You're behind on your DD. Technology has been decided. Money from escrow has been released for funding to be transferred and tech to be purchased.

The lawyers and accountants also have no role in company management or executive decisions. They're just lawyers & accountants.. That's all.

GESI - It's crooked lawyers and accountants that keep these shells circulating.

They haven't even decided on a technology yet?

From their home page:

Green Energy Solution Industries, Inc., (GESI) is an Alberta Canada based Corporation which is a publicly traded on the OTC Markets Pinksheets currently as GESI.

GESI was incorporated in 2007 and has undertaken project development in Alberta Canada for the creation of a waste wood to energy project. GESI began the project development through years of wood waste potential for energy creation in Western Canada.

The vastly available supply of wood waste as a feed stock for fuel in Western Canada, was narrowed down by GESI to be to utilize waste railway ties (WRT), which is abundant on a yearly basis through ongoing replacement of ties by railroads and servicers.

GESI was recently awarded a grant by Alberta Energy for the development of a feasibility study for the use of waste wood, including rail ties, for the creation of electricity or bio-fuels. GESI has completed significant parts of such study, while at the same time GESI was able to secure strategic relations and contracts to make the project a reality.

GESI now has the backing of a solid feasibility study, identified and secured long term WRT supply, strategically located project site, and is currently taking proposals for bids for the best technology for the project. In sum, GESI has realized from feasibility to current implementation of what it was charged with at the beginning. Namely to create economic stimulation, creation of jobs, removal of toxic waste, creation of energy, and add to Canada’s ever increasing renewable energy sources.

Gordon MacKay, CEO

Gordon MacKay has worked in the renewable green energy sector for the last 7 years; raising capital for bio-fuels projects. He is currently working with Global Tech Environmental Pty. Ltd. securing funding for green energy projects worldwide. Mr. MacKay is a shareholder and consultant with Columbia Basin Bio-Fuels who currently have projects in the United States and he has been instrumental in advising public companies and raising capital for a multitude of ventures and was the co-founder of 3-D Shopping. Mr. MacKay was responsible for raising the seed capital required and instrumental in taking the company public in on the OTC.BB. Mr. MacKay raised $15 million taking 3-D Shopping to the American Stock Exchange where the company reached a market cap of over $100 million.

Through mid 2005, Mr. MacKay served as Managing Director of Inter Capital Group, LLC; a merchant banking boutique. Throughout his career, Mr. MacKay has assisted in raising over $300 million in capital for his clients in over 50 transactions. With over 20 years experience in finance and investment banking, Mr. MacKay has been the key force in identifying and executing fund raising and merger activity for many companies.

Chris Whitworth, Managing Partner

Chris has been involved in start-up companies for the past 20 years ranging from contracts for the cleanup of the Exxon Valdez oil spill, to contracts with the Environmental Protection Agency (EPA) for environmental remediation sites in Washington State and Montana. He has been active in the construction industry as a construction manager and has worked extensively in contract negotiations with suppliers, sub contractors, contract bidding and project development and project completion.

Mr. Whitworth has also worked with governmental agencies such as the Corp. of Engineers, Department of Fish and Wildlife, and other city and state of Washington governmental agencies in permit acquisitions. Chris has acquired permits and contracts in Mexico with the State of Baja Sur to certify water quality and fishing rights for the exportation of seafood products. Chris will be responsible for all governmental correspondence, liaison and communications during the project feasibility study and during the construction build out of the plant.

Wrong. Those aren't the people running the company. Those are the accountants, lawyers, and TA. In other words, not management.

Again, completely different company and has nothing to do with SATM.

The accountant and lawyer have dozens of clients. I guess they all must be SATM too, right? lol

The TA has hundreds of clients. I guess they must also be SATM too.

I guess that means if I start a business and use the same lawyers and accountants as McDonalds, then my company must be run by McDonalds too.

Your rebuttal is a weak argument.

I can't believe I have to tell someone that accountants and lawyers aren't CEO's.

They are involved - if you'd read the next post as I asked you to you'd realize that.

Parties in bold below are involved with two prior companies and they are listed in the link you just gave me. GESI is just SATM in a new package IMO.

There is no way that you could make the claim that this is "completely different management".

My original DD to find this took less than 10 minutes. This shell was recycled so quickly that the paint didn't even have time to dry.

Wednesday, December 14, 2011 5:09:46 PM

Re: samsamsamiam post# 19404

Post # of 29806

Yes GOHG is a mirror of SATM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67579332

Here is a list of similarities:

1) Investor Relations - IR for GOHG is Stock Logic IQ (Robert Adams) and Investor Development Group (Ian Reed aka Nikko Reed)

2) David Chalela - until recently was legal counsel for GOHG and until recently was CEO of SATM

3) Bert Matthews, CPA - accountant for both GOHG and SATM

4) Alex R. Stavrou - legal counsel for both GOHG and SATM

5) Cleartrust, LLC - TA for both GOGH and SATM

6) Recent change in management through some kind of merger/acquisition

7) Lots of similarities in the filings (see above link)

8) The author of the PDF SATM initial disclosure statement for period ending june 30th 2011 is listed as Real Time Interest

The author of the very recent GOHG PDF is also Real Time Interest

10K out on STTN, and it's a bad one again.

They're not involved. If you did DD, you'd realize that.

http://www.otcmarkets.com/stock/GESI/company-info

Are you familiar with what reverse mergers are? SATM was a shell.

Read my next post - are those people involved?

Please support your claim of "completely different management".

Looks like the same management to me...

Please support claims made on this board with facts - otherwise off topic.

Don't know and don't care. Completely different company with completely different management. Has nothing to do with GESI.

GESI - is Bruce Pollack still involved?

Bruce Pollack is registered agent for Real Time Investment,Inc > company showing same address and phone number as SATM/GESI,Inc

Bruce Pollack is currently involved with many different corporations.

http://www.corporationwiki.com/Texas/Houston/bruce-pollock/34668405.aspx

Bruce Pollack > Stock promoter out of Houston, TX named in fraud suit by SEC inolving Aimsi Technologies Inc.

Quote:The SEC names four defendants besides Mr. Ballow: Reginald Hall, a 45-year-old from Tennessee involved in developing ALARM; Bruce Pollock, a 40-year-old promoter from Houston; Winfred Fields, a 39-year-old stock tout from Houston; and Everett Bassie, 52, also a resident of Houston.

The SEC says this crew pumped Aimsi over 13 days in late 2004 from $1.85 per share to a $3.60 high with misleading news releases and the tout sheets.

"From November 17 through November 30, 2004, when Aimsi issued nine press releases and the Promoter Defendants were actively disseminating fax tout sheets and internet postings, Aimsi's stock price rose from $1.85 per share to $3.60 per share with daily trading volume reaching as high as 645,163 shares," the SEC claims.

http://www.stockwatch.com/swnet/newsit/newsit_newsit.aspx?bid=B-459288-C:RDM

Is this the same Bruce Pollack that's tied to Martha Pollack and Real Time Investment, Inc. who is showing same address and phone number as SATM/GESI,Inc?

GESI - Lots of questions raised -

Is this crew out? Is GESI's process in R&D or is it up and running?

nodummy Member Profile nodummy Member Level

Wednesday, December 14, 2011 5:09:46 PM

Re: samsamsamiam post# 19404

Post # of 29806

Yes GOHG is a mirror of SATM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67579332

Here is a list of similarities:

1) Investor Relations - IR for GOHG is Stock Logic IQ (Robert Adams) and Investor Development Group (Ian Reed aka Nikko Reed)

2) David Chalela - until recently was legal counsel for GOHG and until recently was CEO of SATM

3) Bert Matthews, CPA - accountant for both GOHG and SATM

4) Alex R. Stavrou - legal counsel for both GOHG and SATM

5) Cleartrust, LLC - TA for both GOGH and SATM

6) Recent change in management through some kind of merger/acquisition

7) Lots of similarities in the filings (see above link)

8) The author of the PDF SATM initial disclosure statement for period ending june 30th 2011 is listed as Real Time Interest

The author of the very recent GOHG PDF is also Real Time Interest

More on Real Time Interest:

Real Time Interest shares the same address as SATM

Real Time Interest = Bruce Pollack

See these two posts for information about Bruce Pollack and his connections to both SATM and GOHG:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69850941

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69933562

See these posts for more information about some of the other insiders of SATM (group of attorneys from Florida with interesting histories):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68623095

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68109529

Both SATM and GOHG seem very very dirty.

So what happened to SatMax that was doing so well in Dec. 2010?

Business Development

As I am sure you are all aware, we have experienced what has become known as one of

the worst financial crises in United States history, with capital formation for developing

businesses presenting a specifically difficult challenge. SatMAX, fortunately, is

weathering the storm. During 2010, we signed on two new equipment resellers, we

expanded our growing brand recognition, and we added 3 new members - ITT Corp., the

U. S. Navy, and Lockheed Martin Corp. – to our existing marquis line of Fortune 100

customers

Moreover, thanks to our August alliance with McDonald Technologies International, Inc.

for engineering, manufacturing and support services, SatMAX now has access to worldclass

RF engineering and manufacturing capabilities, allowing us to more quickly scale

our business. McDonald has already completed an engineering package for our Alpha

EMS Portable repeater. This alliance has also had an immediate impact by providing

testing facilities for customer demonstrations, which were used when an aircraft industry

customer recently commissioned an independent engineering analysis of our satellite

repeater technology. We are happy to report that our SatMAX unit’s performance

exceeded its published specifications.

Moderator XenaLives allow me to post some DD on your board about Green Energy Solution Industries, INC. (GESI) ...

Thank you sir.

Following PR was released on 06/08/2012... "" GESI Enters Second Phase With Two $45M Funders for 200 Ton Per Day Waste Energy Project "" ~ http://ih.advfn.com/p.php?pid=nmona&article=52705847

On 08/16/2012 a PR was released saying that the company received the formal irrevocable funding commitment from the lender of the financing ~ http://ih.advfn.com/p.php?pid=nmona&article=53848124

.

.

.

GESI received the formal irrevocable $45,000,000 million (up to $50 million) funding commitment from the lender of the financing.......irrevocable = not able to be annulled, appealed or revoked.

For now we're just waiting for the first draw (within weeks) to hit GESI's banc account... some say it's $10,000,000 (guesses, rumours, birdie etc...). Up to $50,000,000 in total.

That will make the present pps EXTREMELY undervalued...

10,000,000 (first draw) divided by 192,506,353 O/S = 0.05 pps(when the firs draw hits) ~ just a simple calculation.

There's also no dilution going on as stated in the CEO Gordons interview.

Share Structure

Market Value $3,368,861 a/o Aug 15, 2012

Shares Outstanding 192,506,353 a/o Jun 30, 2012

Float 96,652,498 a/o Jun 30, 2012

Authorized Shares 490,000,000 a/o Mar 31, 2012

http://www.otcmarkets.com/stock/GESI/company-info

GESI developed business plans, contracts and agreements with resource providers, land owners, waste sources, technology providers, and government entities for the placement of renewable energy projects. Feedstock of the thermal gasification power plant will include railway ties, bridge timbers, poles and lumber treated with creosote etc. and turns them into electricity.

company's website: http://gesienergy.com/

GESI CEO Interview on STT Radio 07/12/2012 can be heard here:

Well this is either a "hit" post or "strike 3". $GESI

How to build a 45 million dollar company

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76358513

Latest interview

Folks - rote repetition of PR's and company promo is not DD.

Please post the information that you feel is most important here, or a summary with links.

We are trying to build a community of trusted informed investors, so it is your perspective that we would like to hear, not just a referral to another board. Please support your posts with links as much as possible.

SNDY - I'll be looking at it some more, but my biggest concern is that Boost Marketing is their IR, and Boost is being run by a Big Apple insider.

Big Apple Consulting is currently being sued by the SEC

Today the Securities and Exchange Commission ("Commission") filed a civil action in the U.S. District Court for the Middle District of Florida, alleging that investor relations firm Big Apple Consulting USA, Inc. ("Big Apple"), its wholly-owned subsidiary MJMM Investments, LLC ("MJMM"), and four of its executives-CEO Marc Jablon, vice president Matthew Maguire, MJMM president Mark Kaley, and Keith Jablon, vice president of another Big Apple subsidiary-made public misrepresentations and material omissions about the financial state of CyberKey Solutions, Inc., ("CyberKey") while the two entities sold hundreds of millions of CyberKey shares. These CyberKey shares were sold under no registration statement and no legitimate exemption from registration. The SEC also charged Big Apple and MJMM with acting as unregistered broker-dealers, and Marc Jablon, Maguire, and Kaley with aiding and abetting the two entities' violations in that respect.

Big Apple Consulting = Boost Marketing

Boost Marketing LLC = Jason Takacs and Roy Meadows

Florida Business Entity formed on 10/12/2010

2101 WEST STATE ROAD 434 SUITE 100

LONGWOOD FL 32779 US

(407)389-5900

http://sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=M10000004513&inq_came_from=NAMFWD&cor_web_names_seq_number=0000&names_name_ind=N&names_cor_number=&names_name_seq=&names_name_ind=&names_comp_name=BOOSTMARKETING&names_filing_type=

http://www.boostmarketingnow.com/

Domain Name: BOOSTMARKETINGNOW.COM

Registrant:

John Neff

2101 West State Road 434

Suite 100

Longwood, Florida 32779

United States

Created on: 04-May-10

Expires on: 04-May-11

Last Updated on: 06-Oct-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

2101 West State Road 434

Suite 100

Longwood, Florida 32779

United States

(407) 389-5900

BIG APPLE CONSULTING USA, INC

2101 WEST STATE ROAD 434 SUITE 100

LONGWOOD FL 32779 US

(407)389-5900

ABLON, MARC

2101 WEST STATE ROAD 434, STE 100

LONGWOOD FL 32779

MAGUIRE, MATTHEW

534 ALOKEE CT.

LAKE MARY FL 32746

KALEY, MARK

14924 GAULBERRY RUN

WINTER GARDEN FL 34787

PETERSEIM, WILLIAM

1235 CRANE CREST WAY

ORLANDO FL 32825

2101 WEST STATE ROAD 434 STE. 100

LONGWOOD FL 32779 US

(407)389-5900 (used to be)

NEFF, JOHN

175 CROWN POINT CIR.

LONGWOOD FL 32779 US

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=F03000001156&inq_came_from=NAMFWD&cor_web_names_seq_number=0000&names_name_ind=N&names_cor_number=&names_name_seq=&names_name_ind=&names_comp_name=BIGAPPLECONSULTING&names_filing_type=

http://www.bigappleconsulting.com/management.htm

Domain Name: BIGAPPLECONSULTING.COM

Registrant: Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 03-Feb-03

Expires on: 03-Feb-12

Last Updated on: 07-Dec-09

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

EZ NEWSWIRE, INC.

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

NEFF, JOHN

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

TAKACS, JASON

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

NICOLETTI, M

2101 WEST SR 434, SUITE 100

LONGWOOD FL 32779

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=P10000032201&inq_came_from=OFFFWD&cor_web_names_seq_number=0002&names_name_ind=P&ret_names_cor_number=512859&ret_cor_web_names_seq_number=&ret_names_name_ind=&ret_names_comp_name=&ret_names_filing_type=&ret_cor_web_princ_seq=0001&ret_princ_comp_name=TAKACSJACQUELINEM&ret_princ_type=P

http://eznewswire.com/

Domain Name: EZNEWSWIRE.COM

Registrant: Big Apple Consulting USA, Inc

1025 Old Country Road

Suite 200

Westbury, New York 11590

United States

Created on: 31-Jan-07

Expires on: 31-Jan-17

Last Updated on:

Administrative Contact:

Speciale, Thomas tspeciale@bigappleconsulting.com

Network Newwire Inc.

255 S. Orange Ave Suite 1201

Orlando, Florida 32801

United States

(407) 581-3978 Fax -- (407) 425-0032

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 21305 / November 18, 2009

Securities and Exchange Commission v. Big Apple Consulting USA, Inc., MJMM Investments, LLC, Marc Jablon, Matthew Maguire, Mark C. Kaley, and Keith Jablon, Civ. Action No. 09-cv-1963 (M.D. Fla.) (JA)

SEC Charges Investor Relations Firm and its Executives with Fraud, Registration Violations, and Acting as an Unregistered Broker-Dealer

http://www.sec.gov/litigation/litreleases/2009/lr21305.htm

http://www.sec.gov/litigation/complaints/2009/comp21305.pdf

MJMM INVESTMENTS, LLC

http://www.bigappleconsulting.com/mjmm_investments.html

http://www.mjmminvestments.com/

T: 281.305.2634

F: 877.471.0535

E: info@mjminvestments.com

W: mjminvestments.com

MJM Trust Fund

3200 South West Fwy 33rd Floor

Houston Tx 77027

Domain Name: MJMMINVESTMENTS.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 10-Jun-09

Expires on: 10-Jun-12

Last Updated on: 29-Mar-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

https://www.corporations.state.pa.us/corp/soskb/Corp.asp?2115911

MARC JABLON

Title: President

Address: 280 WEKIVA SPRINGS RD SUITE 2030

LONGWOOD FL 32779

DOUBLE DIAMOND INVESTMENTS, INC.

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=1w0lBOspXQIgkCUJQCkBsA%253d%253d&nt7=0

President - MARK C KALEY

http://www.doublediamondinv.com/

Domain Name: DOUBLEDIAMONDINV.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 24-Sep-08

Expires on: 24-Sep-12

Last Updated on: 24-Sep-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

Big Apple Travel

http://www.bigappletravel.com/

407.389.5900

Domain Name: BIGAPPLETRAVEL.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 30-Oct-02

Expires on: 30-Oct-11

Last Updated on: 25-Oct-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

Twin Equities, LLC

http://www.twinequities.com/

2101 W S.R. 434 Ste 100

Longwood, FL 32779

Ph: (407) 389-5900

Domain Name: TWINEQUITIES.COM

Registrant:

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

Created on: 19-May-06

Expires on: 19-May-12

Last Updated on: 29-Mar-10

Administrative Contact:

Neff, John tech@bigappleconsulting.com

Big Apple Consulting

2101 SR434

Suite 100

Longwood, Florida 32779

United States

+1.4073895900

SNDY - This is interesting:

Dated June 28,2011

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8031898

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a) Aggregate Number and Percentage of Securities

According to the most recently available information, there are

64,957,710 shares of Issuer common stock outstanding. Richard

Tuch is the record owner of 5,500,000 shares of Issuer common

stock and Dr. Tuch beneficially owns 5,500,000 shares of Issuer

common stock or 8.5% of the outstanding shares.

(b) Power to Vote and Dispose

Dr. Tuch has sole power to vote, or to direct the voting of, and

the sole power to dispose or to direct the disposition of the

5,000,000 shares of the Issuer common stock owned directly by

Richard Tuch, M.D., A Professional Corporation Profit Sharing Plan

(401K).

(c) Transactions within the Past 60 Days

The following lots of shares has been purchased in the last 60

days:

DATE #SHARES PURCHASED PURCHASE PRICE/SHARE BROKERAGE

ACCT.

1a.6/30/2011 500,000 .0065 Merril Lynch

1b. 6/21/11 400,000 shares .0085 Charles Schwab

2. 6/19/11 350,000 shares .0135 Merrill Lynch

3. 6/14/11 850,000 shares .0054 Merrill Lynch

------------------------------------------------------------------------------

-------------------------------------------------

3. 6/20/11 50,000 shares .0095 Charles Schwab

4. 6/17/11 49,900 shares .0148 Charles Schwab

5. 6/16/11 30,000 shares .0155 Charles Schwab

35,712 shares .0155 Charles Schwab

100 shares .018 Charles Schwab

34,288 shares .018 Charles Schwab

6. 6/14/11 500,000 shares .0028 Charles Schwab

7. 6/3/11 300,000 shares .0022 Charles Schwab

------------------------------------------------------------------------------

-------------------------------------------------

8. 5/10/11 50,000 shares .004 Charles Schwab

100,000 .0045 Charles Schwab

9. 5/4/11 150,000 .0055 Charles Schwab

100,000 .005 Charles Schwab

------------------------------------------------------------------------------

-------------------------------------------------

TOTAL 3,500,000

(d) Certain Rights of Other Persons

Not applicable.

(e) Not applicable.

ITEM 6. CONTRACT, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT

TO SECURITIES OF THE ISSUER

Not applicable

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Not applicable

SCHEDULE 13D

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and

correct.

July 7, 2011

------------------------------------

----------------------------

(Date)

Richard Tuch, M.D. A Professional

Corporation Profit Sharing Plan

(401K)

SNDY - RM stock associated with Big Apple affiliates.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77911059

My initial response was negative, but someone accused me of "lazy DD" so I'll take another look.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77959982

When a company is associated with a Big Apple affiliate and it has a shell history like that I really don't do much additional DD.

I can look at the other filings for more information, but if I believe it might be legit (and I'll assume that is a possibility because of what you just brought to my attention) the next think I'd do is look at the charts.

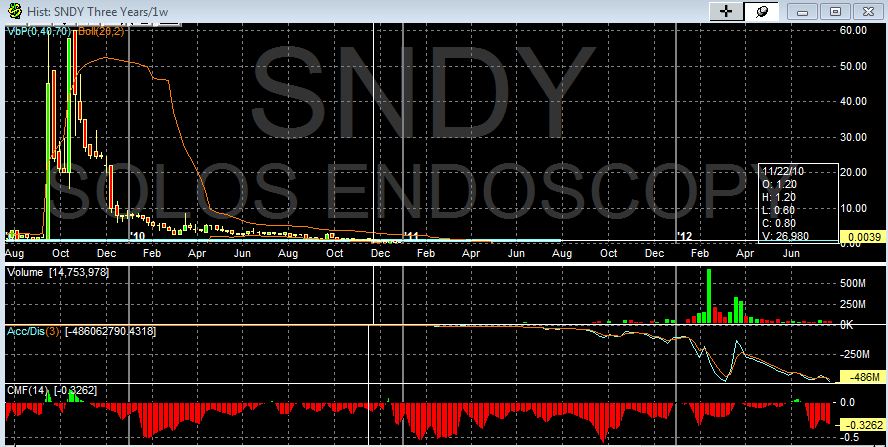

I always look at charts in multiple time frames.

The first chart shows a wild spike at the beginning of trading and then constant price deterioration. I've seen that in another legitmate company that did NOT come from a shell so that could be just a function of the manipulation done on pennies.

It's interesting that the A/D didn't start to fail until June of 2011.

What I would really like to explain is what happened to the volume in 2011 - dilution??? Toxic financing??

Here's the yearly chart smoothed by a five day period - it looks like there may be some validity here just because it held part of the gain from the pump and may have set a new floor.

I'd say December 2010 would be the time frame to investigate.

ACGX 8,5 mil.company with strong financials and no diluition plan.

ACGX 8,5 mil.company with strong financials and no diluition plan.

TDCP - I was intrigued by the idea and my basic DD didn't turn up anything negative - but I feel like my DD has come to a dead end.

No discussion of how the tech works on the website ( in general layman's terms of course, no secrets revealed). I also googled this and didn't find any documentation or peer reviewed papers.

I posted on the board and asked for links to info on HOW the tech worked, got nothing.

Patents don't mean anything if they're for something that can't be produced.

I will monitor the board from time to time but wouldn't consider investing without a common sense level understanding of the tech.

Debt free. OU University owns 8% of company shares. OU owns the patents. possible RS , but we dont think they will as price is to low for what they want to accomplish. Only 1 week left for a possible RS of 1/10 to 1/35. Last year they voted on RS but never executed it. Not sure what all is going on .

Reading recent posts on the board now. What is their cash status like? Will they have to sell much more stock before they poduce revenues?

Annual burn rate?

OK, done a bit of DD on my own, it sounds intriguing, but the website was frustrating. Still don't have a clue as to how they're doing what they're doing and where they are in their business plan.

TDCP - I backed the chart out to nine years. Volume really picked up in 2009. Dilution indicated, but that isn't necessarily a bad thing if they sold stock and invested the money in the business.

Charts do look intriguing.. I will probably look into this some more. This can be a good place to discuss the fundamentals and history of a stock without a lot of extra "noise", if you know what I mean.

TDCP - Ok - I checked their oldest filings. No RM... That's good.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=4827749

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholder. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we have received $125,000 in connection with the issuance of the $1.25 million convertible debenture to the selling stockholder, and expect to receive the balance of $1.125 million following effectiveness of the registration statement. We have used the $125,000 for the general working capital purposes and the payment of professional fees. We expect to use the additional proceeds for general working capital purposes.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the Pink Sheets under the symbol "TDCP". For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

Quarter Ended

High ($)

Low ($)

December 31, 2006 (through November 20, 2006)

1.36

0.75

September 30, 2006

1.73

0.90

June 30, 2006

3.27

0.56

March 31, 2006

0.86

0.14

December 31, 2005

0.33

0.014

September 30, 2005

0.03

0.008

June 30, 2005

0.045

0.009

March 31, 2005

0.18

0.031

December 31, 2004

0.40

0.04

September 30, 2004

0.64

0.15

June 30, 2004

0.64

0.03

March 31, 2004

0.21

0.04

Holders

As of November 15, 2006, we had approximately 395 active holders of our common stock. The number of active record holders was determined from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies. The transfer agent of our common stock is Executive Registrar & Transfer, Inc., 315 South Huron Street, Suite 104, Englewood, CO 80110.

TDCP - looked at the IBOX. University affiliation looks good.

I was surprised by the share structure though...

SHARE STRUCTURE - As of Nov 15, 2011

Authorized Shares: 1,500,000,000

Outstanding Shares: 1,189,361,632

Float: 593,982,650(approximate)

Shares held by Insiders

Martin and Judith Keating 82,215,474

Victor Keen 158,859,668

John O'Connor 47,761,911

OU 63,264,707

|

Followers

|

33

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1419

|

|

Created

|

02/03/11

|

Type

|

Free

|

| Moderator XenaLives | |||

| Assistants fourkids_9pets GWMAN Justice37 | |||

This board is only for confirmed Due Diligence on Over the Counter and Pink sheet stocks.

Information must be factual in nature. Please avoid the expression of pure opinion or speculation.

All opinions and conclusions expressed should clearly state the facts upon which they are based.

Those facts should be documented in PR's, news reports, the known history of a stock, or trading activity.

If it is history of a stock please back it up with dates and facts (such as splits, dilution, events, etc).

Generalized statements not backed up with fact will be considered opinion.

Please refrain from opinion only or speculative posts, they will be considered off topic.

Charts are factual and on topic but you must give specific indicators and reasons if a positive or negative opinion is expressed based on that chart.

Since this board is for multiple stocks please begin each post with the ticker and then continue your post.

Bolding the ticker seems to make it easier to skim for a stock visually.

You can do this by highlighting the ticker and the clicking on the Bold Button at left.

Please do not use colors in the header as we are trying to inform, not pump.

I know some of you work very hard in your due dilligence.

I created the board with the thought that there should be a place to feature that hard work so it doesn't get buried in board chat.

The board has started very nicely. Thank you all for participating.

|

Posts Today

|

0

|

|

Posts (Total)

|

1419

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |