Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

You’re so delusional that you believe your own lies. That article is on the NICE website. How can anyone take anything you post seriously?

There is no such thing as an NWBO pumper.

Duopoly is not a bad situation if you can’t have a monopoly, I seem to remember.

New poll!

🚨 $NWBO $IGPK $SPZI 🚨

— MIKE KNOWS RUNNERS (@MikeKnowsRunner) May 13, 2024

WHICH WILL GO 100% FIRST FROM CURRENT PPS? LOVING ALL 3 🚀

meirluc,

This is far too conservative. Recall what happened to Roche's FDA filing for SC Tecentriq last year. The filing was rejected because of technicality issue. One week before PDUFA, FDA notified that Roche needed to change their filing package to meet the new CMC criteria. How could a simple technical issue take such a long time? Now Roche had the approval from UK and EU. The revenue will start coming. According to Roche 1st quarter report, the SC Tecentriq has PUDFA set on September 15 if I am not mistaken. What happened to Merck's SC keytruda? I don't recall TLD from the p3 trial has been released yet. Would Merck like Roche to take the thunder?

https://assets.roche.com/f/176343/x/cbba56da34/irp240424-a.pdf

From the publication of the Nature paper and the news post from Oncovir, can we sense the positive correlation between the two company? From my understanding about the following article, it seems like good things are going to happen to Oncovir soon. Likewise NWBO.

https://gritdaily.com/cancer-therapy-oncovirs-hiltonol/

We can also estimate the approval from another angle. The following is the ADC trial which has AZN, Merck, and Daiichi involved. IMO, the results are lackluster in comparison of those from Seagen. After the ASCO presentation in June last year which had the data about 132 patients (the target is 145 patients), both the primary completion date and study completion one were moved to June 1, 2025 (conveniently IMO). I suspect the reason is simple. The lackluster data from the Daiichi's ADC in combination with keytruda would make Merck investors question if the deal between Merck and Daiichi was highly overpriced and shake their confidence on whether Merck can circumvent the patent cliff. Merck must have something exciting to lessen their investor's worries about patent cliff. It has to be something happening soon.

But as someone mocked me before, I could be in La La Land. Take my post just for fun.

https://classic.clinicaltrials.gov/ct2/show/NCT04526691

https://www.onclive.com/view/datopotamab-deruxtecan-plus-pembrolizumab-displays-efficacy-in-advanced-nsclc-with-or-without-chemotherapy

You two morons can be a good pair for a duet. Just so you know, you usually don't argue with fools. But you two really make me laugh.

Hmm everything I ask a pumper who talks about their shares or average to post a picture of their position. They somehow can't produce any evidence.

Go look at my other posts. I am using a UK government site not a company projections. Big difference. And yes there are hard limits go Google it like you did this article.

Thr point is the UK isn't the market where you are going to get reimbursement and subsequent real profitability. It is a nice secondary market. US,Japan, EU are where you should hit first if profit is truly a motivation.

Dilution for the unforeseeable future is the bottomline

“The company estimates that just over 450 people in England will be eligible to receive this new treatment.”

What happened to your 100 hard cap?

Approval as late as the Spring of 2025 is completely unrealistic.

1. The 150 fast track started with the MAA submission on 12/20/23 and

Spring 2025 would consume at least an additional 10 months.

Even before 2024, MHRA decisions were not rendered more than

a year from submission.

2. I am guessing that of the 86 trial sites perhaps 10-20 (a representative sample))

were inspected so as to make sure that the trial records represented the

required procedures. I am quite certain that most of those sites have

already been inspected and that the remaining inspections will be

conducted within the next few weeks because I very much doubt that in

the absence of approval by sometime in early June, the ASM would

have been scheduled for no later than late June.

Makes sense to me.

Marty, just ignore him he is not worth the effort to get upset over

While I agree with that, I'd actually do a Phase 4 where all uses of the vaccine, and all newly approved products, are tracked until the FDA is completely satisfied with their safety, and efficacy. Perhaps more importantly, Drs. would be asked to discuss successes in which they tried new therapeutic combinations and protocols that could assist others.

I believe that very few products are limited in use to only the protocol used in the clinical trials. Dr. Liau, beyond any doubt, is trying new ideas to increase the effectiveness of DCVax-L and that's why Poly-ICLC, etc. has been added. Her goal is curing all with brain cancer, so she'll keep working to improve on the gains she's already reached.

Hopefully all the regulators will begin to work together more, and do things more dynamically. New products shouldn't take one to two decades or more from genesis to approval, but they do. DCVax-Direct is clearly the victim of insufficient funding and it's sad that some agencies didn't offer NWBO a means to keep it in the clinic.

Gary

total of 318 people received treatment through the CDF between December 2018 and October 2021 in England

I know you wouldn't know it, but we can tell.

LOL get clear on the concept . . .

Thanks Doc for your measured response, but that still tells me that we may not see any type of disposition until at the very earliest spring of 2025.

https://www.nice.org.uk/news/article/more-than-400-people-set-to-benefit-after-nice-approves-ground-breaking-car-t-therapy-to-treat-aggressive-form-of-blood-cancer

I won’t even bother responding to the rest of your post….

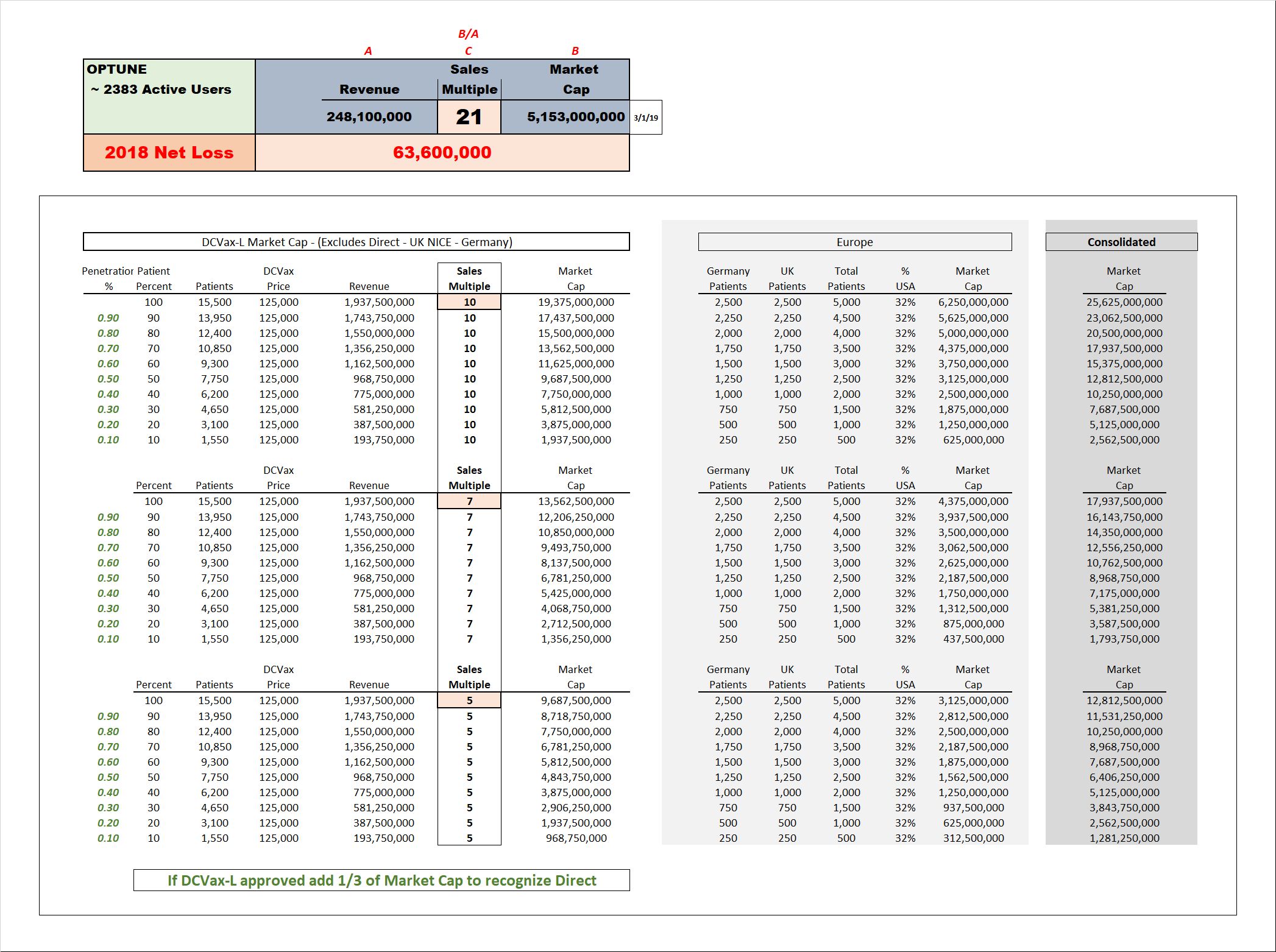

What is the path to profitability here? Do we know what revenue split there is with advent?

Let me tell you, there is no path to commercialization or profitability. And most definitely not in the UK where NICE is stingy on expensive autologous treatments. See the CAR-T max authorizations per year they allow, and those are in the max of 100 per year....i repeat per year. Patients aren't going to be there without reimbursement. And hiring at advent is not going to help NWBO commercialize.....

Don't let these pumpers fool you with their ridiculous UK projections.

Really you plan on selling nothing, what about if it goes to $10 r u still selling nothing? I will sell some at stages if it hits $5 maybe $8 and upwards.

Of course we all could be wrong about how long it will take for off label use covered by insurance if the data from off label use in the compassionate use in the UK were released and made many oncologists realize that they should be using DCVax-L now with their patient with a variety of solid cancers. I don't know if such data will ever be released, and what it will show if it is,

DrugRunner says these are his scans but not sure what he's claiming??

https://www.thetransmitter.org/spectrum/new-atlases-chart-early-brain-growth-monkeys/

I certainly hope you're right Hank, my experience is that trials move slowly especially if annual costs are being held down. If a partner came in with billions, and the trials were run at hundreds of sites, perhaps 5 years or less is possible, especially if the goal of treatment duration of 3 years or less was possible. I really don't know how low you can take the treatment duration and satisfy the regulators, 5 years for GBM certainly made the point as it's one of the deadliest, it would be likewise true for the likes of pancreatic, but others nearly as deadly kill slower, so I really don't know how quickly such a trial could be done. With hundreds of trials sites it may be possible to recruit hundreds of patients in one to two years time, if they want 5 years survival to examine, you can see where I'm going.

It's my believe that off label treatment can proceed approval by many years. With peeks at the trial authorized at a few occasions, sufficient information may be out in 3 to 5 years to get a great deal of off label treatment authorized by insurance years in advance of actual approvals. We've all learned that even after the trial ends it takes substantial time to create the documentation to file for approval. No doubt greater funding can expedite this, but without dynamic work from the regulators, all these things take time. I wish the regulators could make dynamic approvals by observing what's happening in trials, but barring that it just takes lots of time to gain official approvals.

Of course we all could be wrong about how long it will take for off label use covered by insurance if the data from off label use in the compassionate use in the UK were released and made many oncologists realize that they should be using DCVax-L now with their patient with a variety of solid cancers. I don't know if such data will ever be released, and what it will show if it is, but I suspect that DCVax-L may have worked miracles in patients with certain solid cancers. Solid anecdotal data can be all that's needed for the insurance companies to authorize DCVax-L.

Gary

Even he claimed as a well-known author, I suspect it is not against law. But impersonating as a former soldier or a former government employee with the intent to deceive is a crime in both UK and the US. Of course, using other people's medical records without consent to deceive is no doubt a crime too.

Wrong again LC .. ADVENT in the UK will produce all we need initially

Your lame attempts at diversion again !!!

lol ..a BASHER spending your Mother’s Day on a penny stock board instead of with family !!

Congrats LC IC EX …and the others I have blocked

Just proves who u are !!!

it could easily take a decade or longer,

learningcurve2020,

While validation of Flaskworks plays out the process is considered experimental and third parties can make money with manufacturing true, but that also allows that third party to hire more employees to ramp up for commercial scale output which must be achieved before final inspection and approval. So… trying to turn good news into bad again?; ). Best wishes.

DS, great synopsis but you forget ‘former soldier’ & soon to be ‘author.’

JTORENCE,

No, not all sites are physically inspected. They do random sampling of a few based on what I read. That’s why they don’t know exactly when or where but must be ready. Best wishes.

No. Retail has a non-U.S. "Facility" leased from the Chinese with all the manpower and technical knowhow provided by your CEO CFO Chair's private CDMO company. In return retail receives a lousy rent fee while paying office-warehousing lease costs to the Chinese along with taking some depreciation on equipment.

We have spent the better part of the last five years preparing for an approval. We have the infrastructure in place with production capabilities to treat thousands of patients initially that’s just in comparison to the old SOC ..

drugrunner,

“If you build it they will come”. -Field of Dreams

Best wishes.

You’ve been telling the same lies over 100 times yourself IC

you caught me, i'm a short now 4 years. No exit plan? LOL I plan on giving my kids cash while I'm alive so they can enjoy it and they can buy me expensive gifts. As for profit, lets see some first, then we'll talk. As for mngmt diluting shares, according to captain obvoius someones been creating them every week. Let me guess, you're still counting on the billions from the lawsuit...Now who was it that said "take profits"...

I agree.

If someone needs the money that is one thing but if they are just selling NWBO to put it in a different investment there is no better investment than NWBO.

DCVAX-L for GBM is relatively low risk for approval assuming that the big money rat bastards don't have their hooks into the regulatory agencies.

That will get the stock price back in the range it should and also provide windfall revenue to NWBO to branch out into other areas.

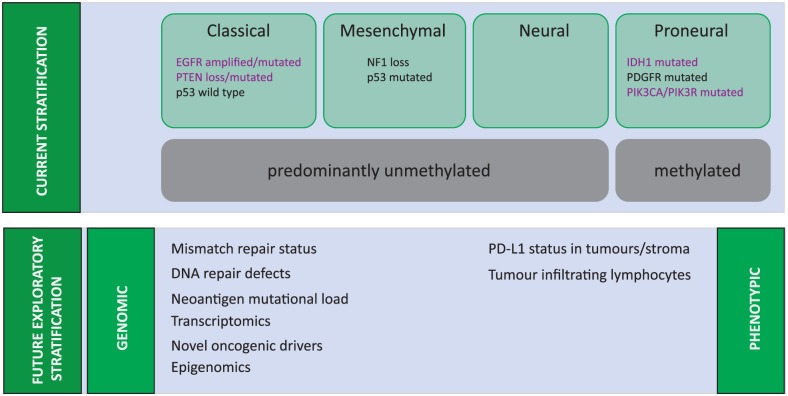

DCVAX-L for other solid tumors

DCVAX-Direct for inoperable solid tumors.

This is an industry disruptive technology that will provide what is effectively a cure for a significant portion of the patients even for cancers that really have not effective treatment today.

If NWBO does not sell they will be the cornerstone for pretty much all future solid tumor cancer treatments which will start with cancer antigen sensitized dendritic cells.

Big pharma will start with that and then add specialized co-treatments like Poly-ICLC or checkpoint inhibitor like Keytruda

Unfortunately, we don’t own any of Linda Liao’s data and the majority of it anyway is not powered for anything beyond proof of concept. Of course her data does lead us down the exact path we need to go. We just need big Pharma or whoever that partner might be to finance it.

You are too funny mate 🤣😂

I’m actually beginning to like you, yer bloody lunatic 😜

You must be scared. According to the deleted post, your IP is not from Georgia. Where is your UK IP address?

Did you impersonate as a former government officer or former veteran with intent to deceive? This type of act is a crime in both UK and the US.

18 U.S. Code § 912 - Officer or employee of the United States

Whoever falsely assumes or pretends to be an officer or employee acting under the authority of the United States or any department, agency or officer thereof, and acts as such, or in such pretended character demands or obtains any money, paper, document, or thing of value, shall be fined under this title or imprisoned not more than three years, or both.

Impersonation of designated officer etc

23 (1)

A person commits an offence if, with intent to deceive—

(a) the person impersonates a designated officer,

(b) the person makes any statement or does any act calculated falsely to suggest that the person is a designated officer, or

(c) the person makes any statement or does any act calculated falsely to suggest that the person has powers as a designated officer that exceed the powers the person actually has.

That reminder of a diligent and on top of their game student. Or that lawyer who is always ready for rebuttal. $NWBO is 10 steps ahead of everyone. The science, politics, and even the regulatory bodies. The 3L's, our 2 Lindas and Laura, are playing 3D chess. Always ahead! 😎👍🏽 pic.twitter.com/OryHHnkiLJ

— RIP_GOP (@RIP_GOP1234) May 12, 2024

Answer the question: Is the medical record yours? or Did you use someone's medical record without their consent?

Would anyone here really care if the company in order to do the trials needed, and perhaps take in equity partners, raised the authorized shares to 3 or even 4 billions if during the time they did so the DCVax's were approved to be part of the SOC for most solid cancers. I don't see a problem with such dilution provided the gains are being achieved.

This won't happen overnight, it could easily take a decade or longer, but where would we be when it happened. I suspect that our market cap could be as big, or bigger than todays largest BP's, but of course they too would have grown, and some may be our partners. I doubt if we'd come close to the market cap of Apple, they have over 15 billion shares outstanding, but we might have half their market cap, which is a trillion dollar number.

We're doing things very differently than the likes of Apple, Tesla, etc. They drove up the price dramatically, then they did splits to take up the share count. We've issued many shares, now it's time to make those shares worth a lot more money so we can rightfully issued more as needed to support growth and/or achieve equity partners.

We have an Annual Meeting coming up in June. As long as we have UK approval before it would not surprise me at all if we're once again asked to raise the authorized shares. The question is, do they just go to 2 billion, or is it 2.5 or 3 billion. It may be premature to bring in an equity partner, but if we do at some point, many shares well be needed for that alone unless a large part of it comes from shareholders tindering shares. I prefer a partner bringing a lot of money into the company over buying a lot of shareholders shares at a nice premium. The share price should rise to very nearly the price a partner is paying for the shares.

Gary

Looks like his scan - and a dead worm or two.

Answer the question: Is the medical record yours? or Did you use someone's medical record without their consent?

I see that you have chopped out all your BS from this 4th repost of your own fall back comment.

There’s a good boy. ☝️🥹

Looks like his scan - and a dead worm or two.

Jesster, I have no exit plan. I'm planning to hold shares until I die and pass them on to my grandkids. And when I talk about selling shares, its only on a spike and I'll probably buy back every one of them. Finally, I don't understand why you're talking about management diluting shares when we'll be making money and turning a profit for the first time. I expect we'll be makiing money hand over fist by this time next year.

Sounds like you're pushing a short narrative.

Is LP a mother?

This management crew runs things tighter than Los Alamos.

|

Followers

|

1621

|

Posters

|

|

|

Posts (Today)

|

8

|

Posts (Total)

|

690942

|

|

Created

|

02/02/05

|

Type

|

Free

|

| Moderators XenaLives sentiment_stocks CaptainObvious Poor Man - Doc logic JerryCampbell | |||

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

~ Winston Churchill

Stylized Dendritic Cell featured on NWBO board since 2015

- Dr. Linda Liau, PhD, MBA, Professor and Chair, Department of Neurosurgery, David Geffen School of Medicine at UCLA

Clinical Trials

DCVax®-L to Treat Newly Diagnosed GBM Brain Cancer (NCT00045968) - Phase III (Double Blind)

UK (MHRA): DCVax-L to Treat Newly Diagnosed GBM Brain Cancer (EudraCT#) 2011-001977-13

DE (Germany - PEI): DCVax-L to Treat Newly Diagnosed GBM Brain Cancer (EudraCT#) 2011-001977-13

Expanded Access Protocol for GBM Patients with Already Manufactured DCVax®-L Who Have Screen-Failed Protocol 020221 (NCT02146066) (Expanded Access)

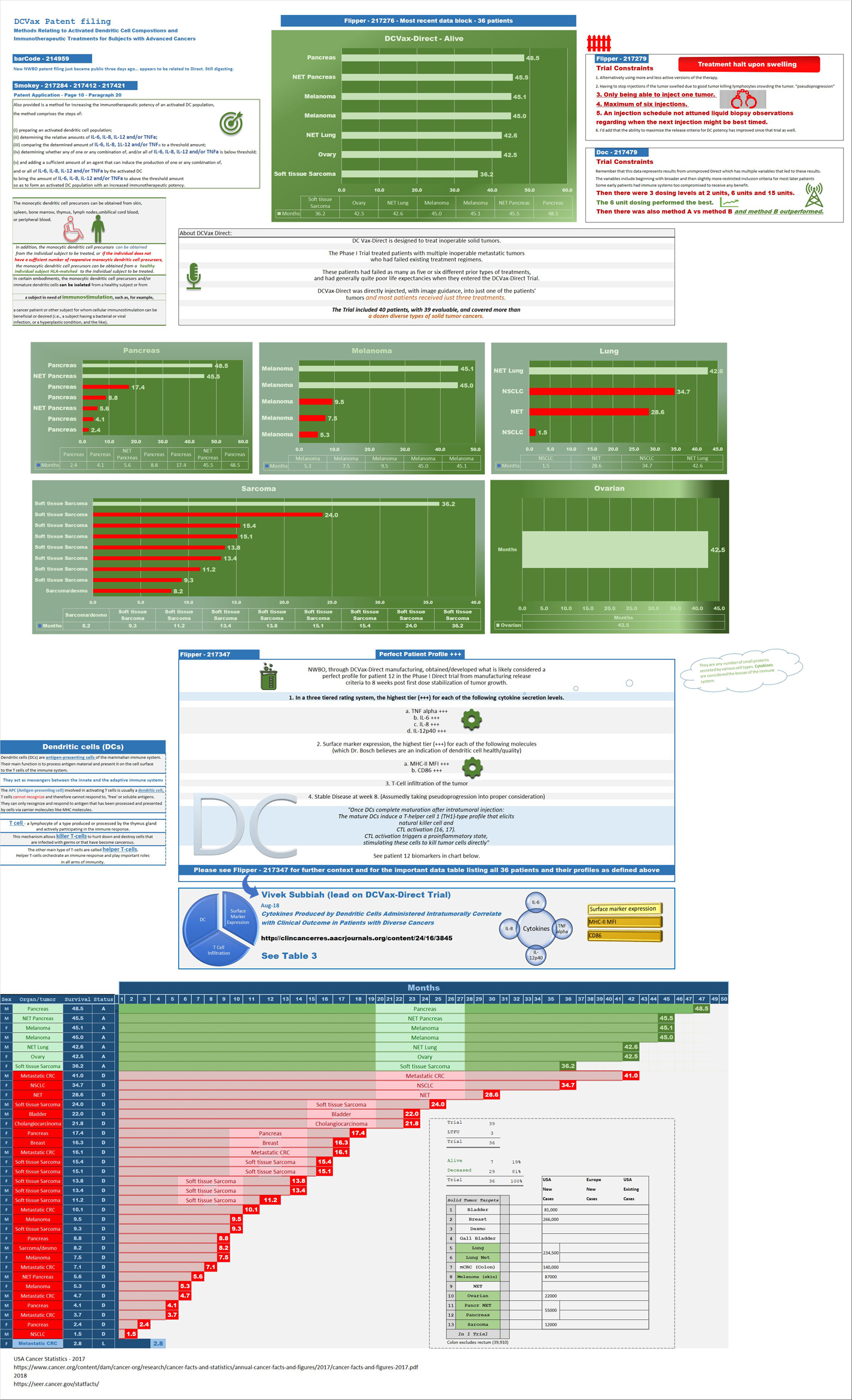

Safety and Efficacy Study of DCVax-Direct in Solid Tumors (NCT01882946) - Phase I/Phase II (Open Label)

UK Clinical Trials - Study of a Drug (DCVax®-L) to Treat Newly Diagnosed GBM Brain Cancer

EU Clinical Trials for DCVax-L - Phase III

Dendritic Cell Vaccine for Patients with Brain Tumors (NCT01204684) - Phase II - at UCLA - Randomized (Open Label) testing DCVaccine with Resiquimod and DC Vaccination with Adjuvant polyICLC

Pembrolizumab and a Vaccine (ATL-DC) for the treatment of Surgically Accessible Recurrent Glioblastoma - Phase 1 (NCT04201873)

Dendritic Cell-Autologous Lung Tumor Vaccine (DCVax-L) and Nivolumab in Treating Patients with Recurrent Glioblastoma - Phase 2 (NCT03014804)

Dendritic Cell Therapy for Brain Metastases From Breast or Lung Cancer (NCT0368765) - Phase 1 - Collaborator: Mayo Clinic

Announcement of DCVax-L and Anti-PD-1 Monoclonal Antibody (Pembrolizumab) for Patients with Liver Metastases of Primary Colorectal Carcinoma Phase 2 Trial - November 17, 2016 - University Medical Center (UMC) of the Johannes Gutenberg University of Mainz

Cognate Bioservices - Owned by Charles River Labs

Website

Company Contact Info

Investor Relations:

Les Goldman (Company) (202) 841-7909 lgoldman@nwbio.com

Sign up for Northwest email list here (hit the subscribe to email list button in the lower right)

Company Headquarters

4800 Montgomery Lane, Suite 800, Bethesda, MD 20814 (240) 497-9024

NW Bio is developing cancer vaccines designed to treat a broad range of solid tumor cancers more effectively than current treatments, and without the side effects of chemotherapy drugs. NW Bio’s proprietary manufacturing technology enables them to produce its personalized vaccine in an efficient, cost-effective manner. NW Bio has a broad platform technology for DCVax dendritic cell-based vaccines.

Their lead product, DCVax-L, is currently in a 331-patient Phase III trial for patients with newly diagnosed Glioblastoma multiforme (GBM), the most aggressive and lethal brain cancer. This trial is currently underway at 69 locations thoughout the United States, Germany and the United Kingdom. NW Bio has also conducted a Phase I/II trial with DCVax-L for late stage ovarian cancer together with the University of Pennsylvania.

Their second product, DCVax-Direct, is currently in a 60-patient Phase I/II trial for direct injection into all types of inoperable solid tumor cancers, with trials currently being conducted at both MD Anderson Cancer Center in Texas, as well as Orlando Health in Florida.

They previously received clearance from the FDA for a 612-patient Phase III trial with its third product, DCVax-Prostate, for late stage prostate cancer.

DCVAX Survival Stories & Testimonials

Alice - Metastic Merkel Cell patient from Florida - ASCO 2018

Brad Silver - GBM patient from Huntington Beach, California - ASCO 2018

Sarah Rigby - GBM patient from Hong Kong - ASCO 2018

Kristyn Power - daughter of GBM patient from Canada - ASCO 2018

Kat Charles - GBM patients from UK - ASCO 2018 - as related by her husband Jason (Kat's Cure)

Prospective patients may contact NW Bio at patients@nwbio.com

UCLA Jamil Newirth DCVax-Patient Video - 2015

Allan Butler Video - National Geographic Vice President - DCVax-Direct patient from Phase 1 Trial with Pancreatic Cancer

NWBO - Patients Sunday Dennis and Jami Newirth - Enrolled at UCLA - Vimeo, Uploaded approx. May 2015

NWBO - Vaccine Helps Keep Brain Cancer Patient Alive (Jennifer Sugioka) - NBC Channel 4, Southern California, February 24, 2015

NWBO - National Geographic's Allan Butler Stage IV Pancreatic Patient using DCVax-Direct at MD Anderson

NWBO GBM Brain Cancer Survival Story of Mark Pace

Presentations

UCLA Agreements

Prostrate

DCVax-Phase II

DCVax-Booster

Upcoming Events

Videos

Linda M. Liau, MD, PhD, MBA - April 24, 2019 at University of Washington, Neurosciences Institute

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |