Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

HERE ARE MY OBSERVATIONS AFTER READING THE 10-Q....

1) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

2) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

3) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

4) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

5) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

6) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

7) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

8) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

9) SCOREBOARD...$3.92!!!!!!!!!!!!!!!

10) SCOREBOARD...$3.92!!!!!!!!!!!!!

WHERE IS MY DAILY SHOUT OUT FROM GOOGLE PROTOPUMPER/PROTOPUPPET???

tedpeele, thanks. you're deconstruction of the 10Q cuts right through into the meat of the matter. hope it doesn't take

too much of your time because there are so so many worthier subjects for a good mind like yours than the fortunes of the tiny spec tech

that lwlg is. the big theme of your critical approach is the nature of what and how to conceal what is really going on in order to

gain advantage or even survive. out of necessity a great many kids learn to do it very early in life. this critically

important question applies to individuals as well as larger entities, right up to government and those who govern.

naturally you can expect to get hammered by the usual suspects, but that only serves to validate your approach.

what happens to lwlg in the coming months and years is the one and only way we'll find out the true degree and meaning of lebby's

obfuscation and the reasons behind it.

That makes sense in that we mostly believe NLM is several years behind lwlg. I didn't infer NLM, because NLM is not lwlg's only competitor, or should I say competing tech/materials.

There’s two sets…one comparing EOP to the other technologies and one comparing LWLG to its competitor. Inferred to be NLM…

There were spider charts comparing the various (3 or 4) other tech to Perk on a slide from, maybe a year ago?...not what X just shared. I didn't say PERK didn't look the best in those spider charts, but some were closer than what x shared.

Look again, x's recent post had a spider chart comparing Perk to one competitor. It says "competitor" in the chart, but "competitors" in the legend...yes pdks are continually being tweeked. "Initial" is a confusing term here. We want acceptable for mass production.

That is not what you stated about the pdk. From what Lebby stated the quality was good. I don't have the direct quote.

My understanding of the spider charts is that it compares LWLG to numerous competitors. If you know better parameters from competitors, then post them and challenge Lebby's research. But you won't get better parameters because it's not there, and you know it.

Dan you are incorrect. They continually are working on pdk's. They are not working on initial pdk's.

X's slid was competitors (more than one). If you can show us a chart from a different competitor I would like to see it.

Why can't they produce a 200mm disc without a MASS PRODUCTION PDK? We've seem a 200 mm wafer. True. Do we know the quality of that wafer? How many defects? Is that defect rate acceptable? Does the pdk still need to be tweeked? Unanswered questions, imo.

Everything's as clear as mud.....and that's the way lwlg and many here want it and like it....For me, it seems something is not allowing mass production yet (still working on initial pdks from what I read). Everyone's naming names of potential partners, with or without them being in the "funnel" or list of "push" or "pull" prospects and/or leads from the company slides. X's spider chart from lwlg that everyone liked seems to cherry pick ONE competitor's qualities....

I might be wrong you can be that stupid you did believe what ted wrote.!!!!

You can not be this stupid!!!!! They do not have PDKs.

They would not have been able to produce a 200mm disc full of modulators with out a PDK!!!!!!!!

It is a stated fact!!!!

Excellent analysis. Disappointing to me personally. And I think highly accurate, highly objective and well researched. You are unique in your critical analysis. I am using the word critical in the academic sense. You are removing biases and attempting to be as straightforward as possible with facts and how you read things.

Unfortunately, many hear and read what they want to hear or what confirms their biases. It is clear that Lightwave Logic is not ready. They do not have everything completed. They do not have PDKs. I know the true longs will refute everything you say. That is a result of being blinded by their own desires for it all to be the way Lebby has led us to believe.

Lebby, who is brilliant, will find many ways to put a bright, happy face and a good spin on this reality. I do not trust the true longs who attend the ASM to be able to provide a discerning, clear analysis of the true reality and ground truth of this company.

To a person, each will drink deeply of the spin that the company has prepared for them. They will be delirious in their belief.

The only thing that can make this a different story is a product in the hands of a customer.

The days of lip service and lip service alone are over.

Jesus Christ Superstar is very busy on a saturday saving all investors from loosing money with their investment !!!

Thank you thank you thank you !!!

You saved us all !!! NOT

#thejoker

The sharpest pencil in the box has spoken !!!

I think the you are on the wrong board …

Just for your info !!!

Brrrr I het scared now with all your knowledge you are sharing with us !!!! I have to sell all my shares because Snotana said so …

#thejoker

Tech transfer and foundry partner was to be completed by last year's ASM. Deals closed by end of December.

Lebby keeps saying all is great with scaling , reliability etc but nothing is getting signed.

The only logical explanation is there must be a issue that has no one coming to the table.

Lebby said they want more data. How much data has been collected since last years ASM and the last 5 months since the December miss?? Do they not like tha DATA they are receiving??

Something just seems off.

Fire away with the clown and poop emojis🤡🤡🤡🤡💩💩💩💩 🤣🤣🤣🤣

You seem to have lost your single brain-cell

Almost everybody has you on ignore, but stumbled accidentally over your very intellectual post. My god you are frustrated

On ignore again

HERE ARE MY OBSERVATIONS FROM THIS WEEK'S TRADING...

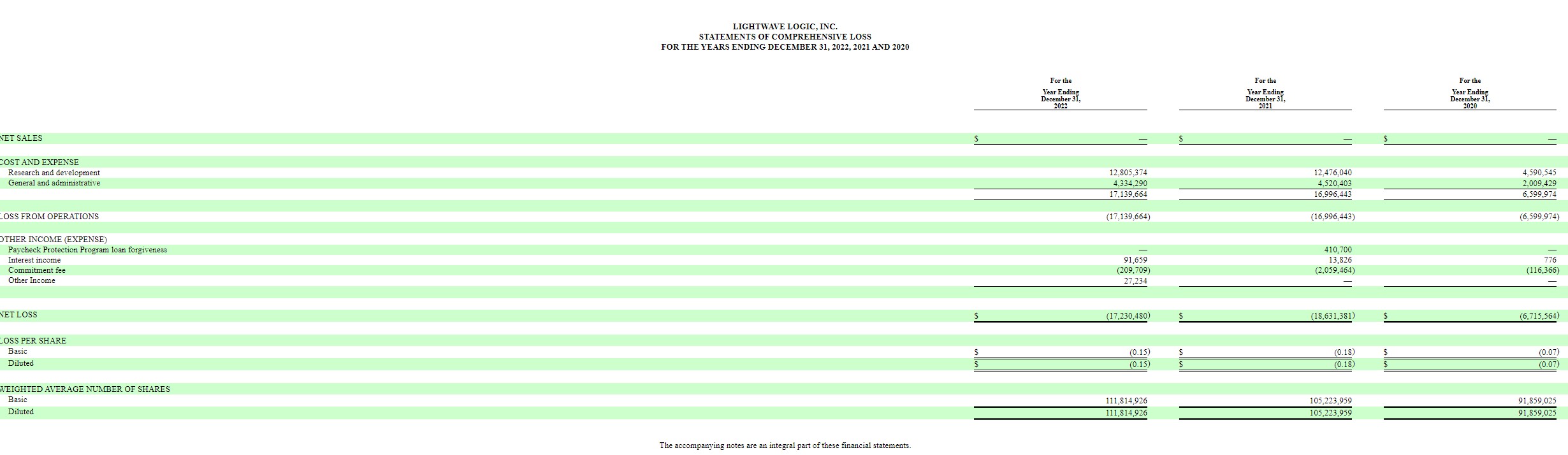

1) THE 10-Q SUCKED!!!!!!!!!!!!!!!!

2) CULT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3) GRIFTER!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

4) NO REVENUE, NO DEALS, NO PARTNERSHIPS

5) PROTOPUMPER/PROTOPUPPET

6) XENAKNOWSNOTHING

7) DISCOUNTEDSHARESX

8) RKFMORON

9) BLAH, BLAH, BLAH, BLAH, BLAH

10) CARROT DANGLER

TIMBER!!!!!!!!!!!!!!!!!!!! SCOREBOARD $3.92

Jeunke and Microchips: I agree with what both of you said. I still believe LWLG polymers and its tech.

Hope LWLG would soon reward us all.

Due to my advancing age I do have plan to reduce my holdings down 50%.

Excellent thanks for the clarification jeunke! And appreciate you emphasizing that when Lebby speaks words, terms and companies, he's a man to take at his word! That's why I really am confident with his Leadership and the proprietary technology they have developed at the right time for Showtime!

PS: In my last post, maybe I was confusing Cenna. cisco for making transceivers, versus switches and routers, so possibly my misunderstanding

Spartex. I took the top 5 by marketshare based on Lebby’s statement ‘ multinational ‘ pluggable transceiver companies. Here is another list with transceiver companies with Cisco included and a number of Chinese companies.

Major Optical Transceiver companies include:

Coherent Corp. (US)

INNOLIGHT (China)

Accelink Technology Co. Ltd. (China)

Cisco Systems, Inc. (US)

Hisense Broadband, Inc. (China)

Lumentum Operations LLC (US)

Sumitomo Electric Industries, Ltd. (Japan)

Broadcom Inc. (US)

Fujitsu Optical Components Limited (Japan)

Intel Corporation (US)

This is what I pulled off the internet. Not sure Lebby wants to conceal anything. If he casually drops names, I normally take him serious. Using names of reputable companies may otherwise lead to legal claims by the companies in question or may even be considered misleading shareholders. So again, I take his information on face value and as serious.

X's bold claim, KCC's latest , 10Q Nuggets and Truth about where things stand:

While I've become increasingly skeptical as the company continues to consistently act like a company that is hiding things that aren't good, I try to remain objective: If there are truly new developments that are exciting I want to know. Antwerp, dinners, winks and smiles mean nothing to me. BUT - the 10Qs and 10Ks - filings and direct public statements DO mean something. So, let's take a look.

X's BOLD CLAIM ABOUT TIER1 FUNDING:

X excitedly resurrected an old narrative that the Tier1s were secretly so supportive of Lightwave that they were funding Lightwave's work with Foundries beginning back in 2021. I thought ECOC 2023 killed that theory for good when the feedback was that Tier1s FINALLY had started to at least pay attention to people like Lightwave for the first time.

But, good ol X tried to revive it yesterday when he said this about the 10Q:

Expenses smoking gun. "Research and development efforts; the rate at which we can, directly or through arrangements with original equipment manufacturers"

X. Wow, I like it and said so, the bulk of development is off the books and being covered by outside forces,, in other words we can not see that. Those are not Lighwave logic direct expenses.

Their engineers and expenses are being covered by the big guys,, the tier 1s.

Our future expenditures and capital requirements will depend on numerous factors, including: the progress of our research and development efforts; the rate at which we can, directly or through arrangements with original equipment manufacturers, introduce and sell products incorporating our polymer materials technology; the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; market acceptance of our products and competing technological developments; and our ability to establish cooperative development, joint venture and licensing arrangements.

Our future expenditures and capital requirements will depend on numerous factors, including: the progress of our research and development efforts; the rate at which we can, directly or through arrangements with original equipment manufacturers, introduce and sell products incorporating our polymer materials technology; the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; market acceptance of our products and competing technological developments; and our ability to establish cooperative development, joint venture and licensing arrangements.

I’m not expecting any major news in the next 2 weeks. I just want an honest accounting of where we stand with the Tier 1s and what the timeframe is.

I’m working on my list. Mostly revolve around device design and manufacturing readiness. The material is ready and there’s no questioning that. I’ll probably keep a couple questions for the Q&A and then save some for the lab tour....When is enough, enough?....My manufacturing readiness questions revolve around yields and process optimization.

I’ve mentioned this previously but my guessthe additional reliability data request is that the end users want to see data across multiple foundry runs. Basically to prove the foundry is capable of providing consistent performance. For example, variations in all sorts of factors like cladding layer thickness, sidewall height/angle, polymer deposition uniformity, electrode spacing, blah blah blah…all can have an effect on performance. This leads to my question on device design. Are the designs “locked-in”? To me, I think so after reading the latest news on the 200G modulators operating at 1v. Hopefully this is a final and optimized design.

Our partnership with silicon-based foundries will allow us to scale commercial volumes of electro-optic polymer modulator devices using large silicon wafers, and we are currently working to have our fabrication processes accepted into foundry PDKs (process development kits). These are the recipes that foundries use to manufacture devices in their fabrication plants.

There’s still time available to optimize processes and improve yields to supply near term SOM, but it won’t be long until there’s no room left for unoptimized manufacturing processes.

At some point (soon, if not already), a transceiver maker would start a sampling process where they take the PICs, engineer them with the electronic components, package them up into a module, and test the modules. That would represent initial orders. Assuming they work as advertised, they start volume production and sales. And going back to your question, due to the advantages of this technology and how ‘easy’ it is to scale compared to competitors…the volumes have potential to scale up very quickly.

We have now received silicon wafers that range up to 200mm in diameter, which aligns well with foundry manufacturing. Using 200mm silicon wafers, we showed packaged polymer modulators operating with open (clean) eye diagrams at 100GBaud PAM4 (or 200Gbps PAM4) at voltage drive levels at 1V at the 2024 Optical Fiber Conference in San Diego, California in March 2024... We also showed polymer modulators with voltage drive levels that were below 1V. Driving voltage levels of around 1V is important as it allows our polymer modulators to be driven directly from CMOS ICs (as opposed to dedicated driver integrated circuit chips). This performance is ideal to enable 4 lanes at 200Gbps per lane pluggable transceivers that can operate at an aggregate data rate of 800Gbps.

Since the invited talk at OFC 2024, a number of Tier 1 pluggable transceiver companies have both reviewed our technical results and viewed operating packaged polymer slot modulators at 200Gbps PAM4 with drive voltages at 1V

Our Long-Term Device Development Goal - Multilane Polymer Photonic Integrated Circuit (P2IC™)

Our P2IC™ platform is positioned to address markets with aggregated data rates of 100 Gbps, 400 Gbps, 800 Gbps and beyond. Our P2IC™ platform will contain several photonic devices that may include, over and above polymer-based modulators, photonic devices such as lasers, multiplexers, demultiplexers, detectors, fiber couplers.

We continue to develop our polymer materials and device designs to optimize additional metrics. We are now optimizing the device parameters for very low voltage operation.

Some of the things needed to achieve the scaling performance of polymers in integrated photonics platforms is within sight today

1. Increased r33 (which leads to very low Vpi in modulator devices) and we are currently optimizing our polymers for this. With Vpi levels of 1V or less will enable direct from associated electronics and potentially save network architects the cost of individual driver ICs.

2. Increase temperature stability so that the polymers can operate at broader temperature ranges effective, where we have made significant progress over the past few years.

3. Low optical loss in waveguides and active/passive devices for improved optical budget metrics which is currently an ongoing development program at our Company.

4. Higher levels of hermeticity for lower cost packaging of optical sub-assemblies within a transceiver module, where our advanced designs are being implemented into polymer-based packages that utilize atomic layer deposition (ALD) that is being developed in-house.

Scalability in terms of cost reduction and high volume manufacturing can be enhanced by:

1. Leverage of commercial silicon photonics manufacturing capacity through the use of silicon-based foundries. Our Polymer Plus™ platform seeks to be additive to standard silicon photonics circuits.

2. Reduction of optical packaging costs by integration at the chip level of multiple modulators and also with other optical devices. Our P2IC™ platform seeks to address device integration.

As we move forward to diligently meet our goals, we continue to work closely with our packaging and foundry partners for 112Gbaud prototypes, and we are advancing our reliability and characterization efforts to support our prototyping.

So X I also have been thinking about this slide. Let me just recap again because there are a lot of posters here who don't seem to want to comment on this.

Out of the 6 key parameters for our chromophores LWLG rate 9-10

The competition rates 10 on 2 parameters and the remaining 4 do not break 4!

That does not seem like competition!

See what CEO’ s of Internet companies are really worried about:

https://www.datacenterdynamics.com/en/news/digitalbridge-ceo-data-centers-will-run-out-of-power-in-two-years/

What's your deal TH? You sold some shares and now you seem to be looking for esoteric alternative options to justify your sales? LWLG polymer is in a lane of its own. It's good to look out for competition, but we don't have to make things up.

Jeunke, thanks for the list. Do you remember in a few of Dr Lebby's presentations he mentions working with companies like Cisco and Ciena (among the Data Center names, etc too)?

Do you think he was just throwing out names that they could be working with just as an example? Keeping the tranceiver partners name(s) under raps for now? Or is there a reason you did not mention cisco or Ciena, for other manufacturing reasons or network gear portfolios They focus on which are not like the 800G Transceivers? Thx!

Update: just saw this Proto post that lists them, csco, ciena, arista....from the Lightwave Funnel slide. Here's Proto''s post for your thoughts. Thx

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174398192

Yes, but light or data still need to go in and out of storage. Lightwave Logic’s 9mm modulators would probably be the best option both as pluggable or on board photonics since they are so miniature and power efficient.

Let me break my promise posting this one before ASM:

Ever heard 3D optical data storage architecture? New technology for 3-dimentional light arrays, Petabit-level capacities are possible on a single disk, energy efficient and much longer data storage system.

It has successfully proven in university labs, if it could be mass produced it would shrink data center size from a football field to a few rooms.

Pb = one million gigabits.

A Picture is worth 1,000 words. Look, think, then look and think again.

Hopefully this will display, if not here is a link.

https://www.sec.gov/Archives/edgar/data/0001325964/000155335024000021/image_033.jpg

That spider chart has it going on baby Oh and for the cherry on top

Oh and that r33 looks to be north of 200 now which was a long-time goal in the way back machine.

https://www.sec.gov/Archives/edgar/data/0001325964/000155335024000021/image_034.jpg

Oh and that R33 looks to be north of 200 now which was a long-time goal from back in the day

On the horizon I see 3 things of interest, the Volume has dropped not good for the shorts, T+1 is coming in 3 Weeks, that may be the reason for the volume as the MM's/Brokers begin to adjust as they will loose 1 day of juggling (not sure), Shareholders meeting is in a week and a half.

X Fab(ulous)

He's a long, Ppastis;

Dead on arrival, name says it all

Just for you, Psoriasis, I’ll try to be more positive.

UPDATED!!! ASM Slide 38 "Multi-Level & Cross Functional Engagements"

most people do NOT understand how deeply embedded Lebby is throughout the entire Photonics Industry Food Chain, what this slide is telling investors that when the "Big Silicon Foundries" LWLG is working with (see SNN interview) there is PULL from the End Users which are the Amazon, Google, etc of the world, and the Packaging partners are likely the large Tier 1 Networkers, so when don't be surprised when the market halts news pending and there are SEVERAL large players involved including Foundries & Tier 1 Networkers

Here are some of the "Big Silicon Foundries" that produce on 200mm wafers:

(the bolded Foundries are the most likely as they have been linked to LWLG already)

GlobalFoundries

Hua Hong Semiconductor

Samsung

SK Hynix

SkyWater Technology

SMIC (Semiconductor Manufacturing International Corporation)

Tower Semiconductor

TSMC (Taiwan Semiconductor Manufacturing Company)

UMC (United Microelectronics Corporation)

Vanguard International Semiconductor

X-Fab

Does anyone care what you say ? What do you think yourself ? Did any of the longs sell 1 share because of what you post ?

And if you reply not about a diaper etc. But a real answer ?

Let's talk about the "Growth Funnel - Internal Roadmap" Slides 38 & 39

Ok, let's start with the list of companies that Lebby has shown investors in the funnel, I don't believe Lebby just dropped random company names into this funnel, I believe Lebby is great at dropping little easter eggs into his presentations and that this list has a good deal of names with purpose to LWLG, ok so from top to bottom we see

Amazon, Meta, Microsoft, Oracle, Cisco, Arista, Samsung, OpenLight, Tower, AWS, Raytheon, Jabil, Google, D.WAVE, Gobal Foundries, Nvidia, Nokia, Xfab, Fujitsu, Ciena

Wow!! That is quite a list!!

Here are my Summary takeaways,

1) It is not surprising to see all of the largest End Users ie. Google, Amazon, Meta, etc on this list

2) It is interesting that Lebby listed these specific Foundries, a) Samsung b) Tower c) Global Foundries d) Xfab e) Fujitsu

3) It is interesting to see Raytheon listed but NOT Lockheed Martin (seeing as how LMT had a LT past relationship with LWLG)

4) It is interesting to see OpenLight, which is a 2022 startup company that provides a new SiP platform being implemented by Tower

5) It is interesting to see these Tier 1 Network builders on this list a) Cisco b) Ciena c) Arista d) Nokia

Note: Ciena had been listed in LWLG's FAQ's list as a potential Customer some time ago, and Lebby has told investors that LWLG must work with the "Switching/Routing" Networkers so as to handle the higher speeds that LWLG will be sending through the "pipes"

6) It is interesting to see one of the largest Contract Manufacturers, Jabil, listed

7) It is interesting to see quantum computing company D.WAVE on this list too

Here are a few comments I have regarding those Summary bullet points above,

1) #2 and #4 are Intel related, the Tower Foundry was listed by Bard AI as the "first" Foundry that LWLG had a deal with, and OpenLight is providing a new SiP platform being implemented by Tower

here's some info on OpenLight >> https://semiconductor-today.com/news_items/2022/jun/openlight-070622.shtml

2) Global Foundries pops up here on the "short list" of Foundries, also considering the number of Foundries listed here I would not be surprised at all that each and every one of these is in "deep" relationship now with LWLG

3) Jabil worked with GIG in the past so they would be a logical fit for Contract Manufacturing needs

4) Raytheon & D.WAVE seem to be such "outliers" to LWLG's stated market disruption plans that they almost certainly have to have working relationships with LWLG currently, this is really cool!

Ok, bottom line takeaways are that LWLG is going to become a HUGE HUGE HUGE company!!!

Does anyone care what you do. Posters are riveted on the possibility of X and his Special Forces team rescuing Khalid from the Russian gulag.

Here is a scientific paper on a possible change from Lithium Niobate with its inherent limitations in fabrication and scaling to Lithium Tantalate. It would seem it would solve some of the scaling issues, but bandwidth remains 40 Ghz and other performance parameters are clearly inferior to Lightwave . .

https://www.nature.com/articles/s41586-024-07369-1

10Q . Recent major events and milestones achieved. If you are reading this you know how all-encompassing the technology is and why patience is so important.

I will never sell 1 share of LWLG!!!

Taking Lightcounting market forecasts as a basis and assuming Lightwave could achieve a 50% marketshare in high speed transceivers ( 800G and up) - which is not ubiquity- and a low 10% marketshare in the incumbent market ( up to 200G) this would translate in a revenue ( assuming packaged modulators are 35% of total transceiver cost) of around 12 Billion times 35% is = $ 4.2 Billion over the next 5 years. Assume an OLED margin of 85% which results in $ 3.6 Billion profit over 5 years or 700 million average per year. Using OLED’ s Price/ Earnings ratio of 40 would than deliver a theoretical market capitalization of $ 28 Billions.

In the 10Q reference is made to the Largest Tier 1 pluggable transceiver companies . Here are the most likely top 5 candidates:

1. Finisar Corporation II-VI

2. NADDOD Pte Ltd

3. Lumentum Holdings Inc.

4. Broadcom Inc.

5. Intel Corporation

Ethernet optical transceiver forecast including an estimate for the contribution of optical connectivity for AI clusters to this market.

Total sales of optical transceivers for applications in AI clusters ( high speed 800G and up) will add up to $17.6 billion over the next 5 years – indeed a very large number, considering that all other applications of Ethernet transceivers combined will generate $28.5 billion over the same period. ( Source: Lightcounting).

The Joker is awake ….

When are you going to write somthinh with value instead of fud and lies ?

When is that day coming ? I know, the same day the commercial is released and all your time, bs and efforts were all for nothing !!! That day is coming closer and closer and closer ….

Bye bye Joker

#thejoker

Agree there are outliers and this racket would probably fall in that category.

Market wide stats are 15-20% so I was giving you the top of the range lol

Honestly it’s not happening. I was making a theoretical statement. They can’t even package a device to needs.

SELL!

#scam

The filing is a confirmation of the fast firm developments of the last months. We are on track and soon commercialisation news will come out. As explained big contracts with big companies needs time. In the mean time the need to make big steps in the need for less energy faster and smaller is putting pressure on the big ones!! Decision time! And above all finances seems solid!

Every single morning you wake up … the first thing you do is make up a negative story and post on this board !!!

Every single day you wake up and think negative !!!

You must have a miserable life !!!

Enjoy your weekend !!

The fiduciary failings in this sad tale are many. Should LWLG tank - as it appears it might - there will be legal accountability for the BOD, which includes JM and ML. This lawsuit will practically write itself. A very sad state of affairs.

HERE ARE MY OBSERVATIONS FROM TODAY'S TRADING....

1) THE 10-Q SUCKED!!!!!!!!!!!!!!!!

2) CULT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3) GRIFTER!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

4) NO REVENUE, NO DEALS, NO PARTNERSHIPS

5) PROTOPUMPER/PROTOPUPPET

6) XENAKNOWSNOTHING

7) DISCOUNTEDSHARESX

8) RKFMORON

9) BLAH, BLAH, BLAH, BLAH, BLAH

10) CARROT DANGLER

SCOREBOARD...$3.92...MONDAY WILL BE A BLOODBATH

THE ASM WILL BE PATHETIC JUST LIKE LAST YEAR

Water. Thank for your reply.

Very few posters seem serious. You seem to the most level headed, serious and intelligent poster. There are very few worthwhile posts to read. The reason I do not post often.

I’m a shareholder since 2010. I’m in the investment profession. So yes, still very interested on LWLG’s progress, holding my shares.

Beat to you and fellow longs.

|

Followers

|

713

|

Posters

|

|

|

Posts (Today)

|

53

|

Posts (Total)

|

205018

|

|

Created

|

01/06/07

|

Type

|

Free

|

| Moderators pochemunyet prototype_101 Pro_v12001 LOVELWLG JLPTNG Lightning_Rod | |||

The need for Lightwave Logic’s proprietary electro-optic polymers is more evident than at any prior point in history, with internet infrastructure coming under increasing strain due to increased online activity. For example, during the recent COVID-19 pandemic, leading platforms such as YouTube prevented high-definition (HD) streaming in Europe due to data throughput issues in existing internet infrastructure.

The Company’s current focus is on the datacom and telecommunications hardware supply chain for the 100 Gbps and 400 Gbps fiber optics communications market, seeking to integrate its proprietary materials into the devices that comprise key components in today’s internet infrastructure. Lightwave Logic’s unique value proposition, including ease of manufacture relative to traditional solutions, has driven several tier-1 and tier-2 potential strategic partners in the data and telecommunications markets to enter into non-disclosure agreements (NDAs) with Lightwave Logic to evaluate its technology for use in their devices, validating the demand for the Company’s solution in the marketplace. The Company expects to introduce its technology into the commercial marketplace in the near future.

Lightwave Logic is a wholly U.S.-based company with in-house materials synthesis, device/package design, wafer fabrication and testing capabilities at its Englewood, Colorado headquarters.

Having the modulator and integrated circuit development in-house has informed the materials development direction and vice versa. This vertically integrated business model enables a superior platform by aligning the design for manufacturability from materials to complex circuits with the following benefits:

Materials are called electro-optic when they enable interactions between applied electric fields and light passing through them. Notably, they change the refractive index seen by the light with minimum loss. The result is an instantaneous and accurate conversion of an electrical signal to an optical signal. Optical signals are better for transmission over distance: an increasingly useful feature as digital signal speeds are now reaching the GHz and THz ranges and the corresponding electrical transmission distances are shrinking to meters and centimeters.

EO polymers are intrinsically superior in speed and sensitivity to electric field to traditional electro-optic materials such as Lithium Niobate, Indium Phosphide and Silicon. They are engineered materials, made by embedding a variety of specially designed electro-optic chromophore molecules into a wide range of standard host polymers.

Chromophores are complex, large molecules, on a scale akin to drug molecules. They are hyperpolarizable, meaning their electron clouds are easily pulled into a different shape by the applied electric field, changing their optical properties such as index of refraction.

The material is poled to become electro-optic by applying a strong electric field along with heat. The hot material is relatively soft, allowing the chromophore molecules suspended in the host polymer to align in the same direction (poling). Cooling the poled material after the molecules are in place traps them in their active state even after the poling field is removed.

Although the electrons in the material respond to any applied electric field, they remain tightly bound to the molecule. The response to an applied signal is almost instantaneous response and recovery– like that of a tight spring– unlike materials that involve much slower macroscopic movement of free electrons.

Another key difference from traditional crystalline materials is the performance of EO polymers continues to improve as chemists explore the almost unlimited design space. Combinations of chromophores and host polymers can be tailored for specific applications.

In addition to innovating the EO polymer materials, Lightwave Logic takes its technology platform to the next level by developing ancillary materials and processes. These elements are brought together and demonstrated in advanced high-speed optical modulators.

The polymer is spun onto silicon wafers and standard microfabrication techniques are used to deposit and pattern metal electrodes and optical waveguides.

One well-known optical modulator device is the Mach-Zehnder interferometer. The light output is changed by changing the relative phase between the two arms. One common trick to double the effect for the same available drive voltage is to drive the two arms in opposite directions (push-pull mode). Polymers have an interesting advantage over most other electro-optic materials which are crystalline. The direction of polymer’s electro-optic activity is entirely determined by the direction of the applied poling field. By poling the two arms of the Mach-Zehnder in opposite directions, the resulting device automatically has push-pull operation with a single applied signal.

Once the modulator chip is made, it is packaged for mechanical protection and also to ensure signal quality for electrical and optical connections.

Below is a polymer optical modulator with >60 GHz bandwidth packaged with high-speed electrical connectors and optical pigtails.

Inspired by the remarkable record of integrated microelectronics, the opto-electronics industry has great interest in developing photonic integrated circuits (PICS). Photonics refers to devices that manipulate photons—that is, light—rather than electrons.

Even the best individual devices can be made more functional by integrating many together. Integration has many benefits, the most notable being dramatic improvements in size and cost. Yet, photonic integration has only recently come into the spotlight. The primary applications for photonics used to require stand-alone, high performance components such as used for long-haul telecom.

Now, photonic integration has suddenly come into the spotlight as electronic interconnects struggle to keep up with speed increases of electronic chips. Photonics is being looked at to replace electronics in already highly integrated applications such as chip interconnect. Co-packaging of electronics integrated circuits (ICs) with photonic interconnect, considered unlikely a few years ago, is now viewed by many as inevitable. However, this requirement poses new challenges that are acknowledged as difficult and that new technologies will be required to meet them.

P2IC™ (Polymer Photonic Integrated Circuits) are ideally positioned to be one of these new technologies. Lightwave Logic’s devices are made using conventional wafer-scale processing such as used for microelectronics and therefore similarly capable of being integrated. In addition, the polymer microfabrication processes are compatible with other materials platforms such as Silicon Photonics and Indium Phosphide which are now starting to become more integrated. In particular, the Silicon Photonics ecosystem has recently accepted that its roadmap will include adding more and more materials, each for their specific benefits. EO polymers’ speed and voltage advantages are attractive additions to this ecosystem.

A fiber link sends data from a transmitter to a receiver through an optical fiber cable. Lightwave Logic’s technology can be used to make a data modulator, a central function of the transmitter.

Datacenters and high-performance computing (HPC) are two market segments that demand the very highest speed optical fiber communications. The datacenter fiber communications segment includes applications ranging from connections inside hyperscale datacenters to fiber links between datacenter campuses.

Optical fiber communication is the infrastructure that supports internet content through its entire lifecycle, between businesses, consumers and datacenters. Behind the scenes, massive amounts of data move between computer processors inside datacenters (or inside supercomputers) as content is generated. In addition to these intra-datacenter links, there are also significant datacenter interconnection links between big datacenters to provide flexible capacity and resilience – all of these represent significant addressable market segments for Lightwave Logic’s technology.

Modulator performance limits the speed of the transmitter, which in turn limits the data-carrying capacity of the entire fiber link. EO polymers have superior speed and sharply reduce the electrical power needed to operate the modulators.

Lightwave Logic estimates that in 2019, the total market for opto-electronic components used in the fiber optics market reached a value of ~$26 billion and is forecasted to grow to approximately $80 billion by 2030.

Above: Market forecasts for photonic (electro-optic) components and transceivers used in optical fiber communications. (Source: Oculi LLC)

The growth in the optical fiber communications market is driven by many factors, primarily:

The historic trend has been a migration from text to graphics, followed by still graphics to increasingly high-definition video. On the accessibility front, the introduction of 5G will enable low-cost mobile internet connections at the same, or higher speeds, as today’s home broadband. This trend continues today as users demand more data at all times.

Recently, particularly since the onset of the COVID-19 pandemic, there has been a sharp increase in reliance on video-conferencing services, often replacing in-person meetings. As video conferencing becomes more commonly used, users will continue to demand faster response times to enable no-lag, real-time communications in full HD.

The benefits of EO polymers, such as low power usage, high speed, increased throughput and lower cost make them ideally suited for markets outside of communications as well, including in consumer, media, augmented reality/virtual reality, medical and industrial applications.

Developing, protecting and commercializing intellectual property is central to Lightwave Logic’s identity as a technology company. Lightwave Logic has over 50 U.S. and international patents and applications that are issued or pending.

These patents provide freedom of manufacture for the company’s electro-optic (EO) polymer materials systems and its optical device technology.

Lightwave Logic’s patent portfolio covers the following areas:

The company continuously seeks to innovate new electro-optic chromophores, designing molecular architectures to meet application needs such as high electro-optic activity and stability. We also design ancillary materials that are useful in conjunction with the EO polymers themselves. Example patents within the materials category include:

| Publication Number | Title |

|---|---|

| US Patent 7,902,322 | Nonlinear optical chromophores with stabilizing substituent and electro-optic devices |

| US Patent 9,535,215 | Fluorinated Sol-Gel Low Refractive Index Hybrid Optical Cladding and Electro-Optic Devices Made Therefrom |

As the company demonstrates its materials in devices, such as modulators, it has engineered ways to enhance device performance by means of device design and optimized control. Example patents within the optical device category include:

| Publication Number | Title |

|---|---|

| US Patent 10,520,673 | Protection layers for polymer modulators/waveguides |

| US Patent 7,738,745 | Method of Biasing and Operating Electr-Optic Polymer Optical Modulators |

Materials innovations are followed by methods in which the Company or its partners can best work with the materials in the fabrication process. Example patents within the fabrication category include:

| Publication Number | Title |

|---|---|

| US Patent Application 20190353843 | Fabrication process of polymer based photonic apparatus and the apparatus |

| US Patent 10,591,755 | Direct-drive polymer modulator methods of fabricating and materials therefor |

Polymers can be used to add functionality to existing semiconductor devices, inclusive of making photonic integrated circuits (ICs). Areas of active innovation include how to get light from one material system into another with minimal losses. Example patents within the semiconductor integration category include:

| Publication Number | Title |

|---|---|

| US Patent 10,527,786 | Polymer modulator and laser integrated on a common platform and method |

| US Patent 10,511,146 | Guide transition device with digital grating deflectors and method |

Challenges for high-speed optical packaging includes maintaining the quality of radio-frequency electrical signals and hermetic/environmental sealing of devices for durability (while still allowing light to go through). Example patents within the packaging category include:

| Publication Number | Title |

|---|---|

| US Patent 10,574,025 | Hermetic capsule and method for a monolithic photonic integrated circuit |

| US Patent 10,162,111 | Multi-fiber/port hermetic capsule sealed by metallization and method |

We cannot assure you that we will meet the conditions of the 2023 Purchase Agreement with Lincoln Park in order to obligate Lincoln Park to purchase our shares of common stock, and we cannot assure you that we will be able to sell any shares under or fully utilize the Roth Sales Agreement. In the event we fail to do so, and other adequate funds are not available to satisfy long-term capital requirements, or if planned revenues are not generated, we may be required to substantially limit our operations. This limitation of operations may include reductions in capital expenditures and reductions in staff and discretionary costs.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |